Harry Callahan Chicago 1947

“At the same time it is warning of a consumer credit bubble, the BoE has just increased its programme of lending to banks at preferential rates to increase bank lending in things like, yes you’ve guessed it, consumer credit!”

• Albert Edwards: The Bank Of England’s ‘Monetary Schizophrenia’ (CW)

After last month admitting he was becoming tired of central bank bashing – a feeling many of his readers may relate to – Albert Edwards has launched another scathing attack. The Bank of England (BoE) was in the line of fire this time, with the SocGen strategist claiming Mark Carney’s team was leading the way when it comes to ‘monetary schizophrenia’. Edwards finds it remarkable how similar the US and UK macro situations often are. ‘This was most evident in the run-up to the 2008 global financial crisis with both the Federal Reserve and Bank of England (BoE) asleep at the wheel, building a most precarious pyramid of prosperity upon the shifting sands of rampant credit growth and illusory housing wealth,’ he said. ‘These of all the major central banks were the most culpable in their incompetence and most prepared with disingenuous excuses. And 10 years on, not much has changed.

‘The Fed and BoE are once again presiding over a credit bubble, with the BoE in particular suffering a painful episode of cognitive dissonance in an effort to shift the blame elsewhere. The credit bubble is everyone’s fault but theirs.’ Edwards sees unsecured credit at the heart of the problem, where growth has shot up by more than 10% in both the UK and US. Edwards accepts the debt time-bomb is specific to the UK. ‘We are in a QE, zero interest rate world, where central banks are effectively force-feeding debt down borrowers’ throats. They did it in 2003-2007 and they are doing it again,’ he highlights. ‘Most of the liquidity merely swirls around financial markets, but there is certainly compelling evidence now of a consumer credit bubble in both the UK and US (as well as a corporate credit bubble in the US).’

However, he finds the reaction of the BoE most ‘bizarre’, with Carney darkly warning banks of lessons of the past while recently increasing bank capital requirements on consumer loans. The perplexed Edwards points out: ‘At the same time it is warning of a consumer credit bubble, the BoE has just increased its programme of lending to banks at preferential rates to increase bank lending in things like, yes you’ve guessed it, consumer credit!

“It may not ‘feel’ like the mania of the late 1990s to early 2000, but in terms of actually measurable data, the overall bullish consensus seems to be even greater than it was back then.”

• 4-Warnings For The Bull Market (Roberts)

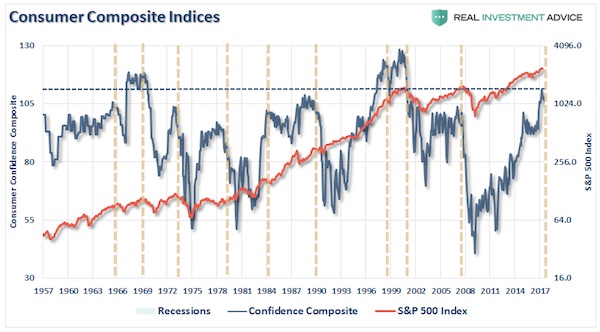

As I have discussed many times previously, the stock market rise has NOT lifted all boats equally. More importantly, the surge in confidence is a coincident indicator and more suggestive, historically, of market peaks as opposed to further advances. As David Rosenberg, the chief economist at Gluskin Sheff noted: ‘For an investment community that typically lives in the moment and extrapolates the most recent experience into the future, it would only fall on deaf ears to suggest that peak confidence like this and peak market pricing tend to coincide with each other.” He is absolutely correct. As shown below in the consumer composite confidence index (an average of the Census Bureau and University Of Michigan surveys), previous peaks in confidence have been generally associated with peaks in the market.

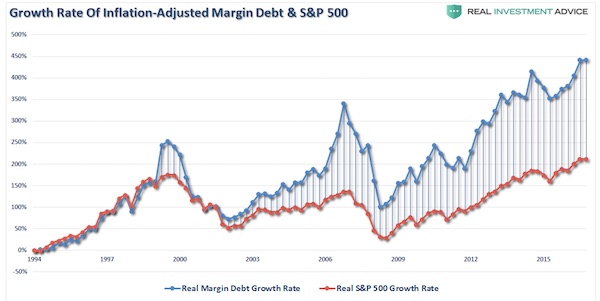

For those of you unfamiliar with Texas sayings, “all hat, no cattle” means that someone is acting the part without having the “stuff” to back it up. Just wearing a “cowboy hat,” doesn’t make you a “cowboy.” I agree with the premise that leverage alone is not a problem for stocks in the short-term. In fact, it is the increase in leverage which pushes stock prices higher. As shown in the chart below, there is a direct correlation between stock price and margin debt growth. But, margin debt is NOT a benign contributor. As I discussed previously in “The Passive Indexing Trap:” “At some point, that reversion process will take hold. It is then investor ‘psychology’ will collide with ‘margin debt’ and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.”

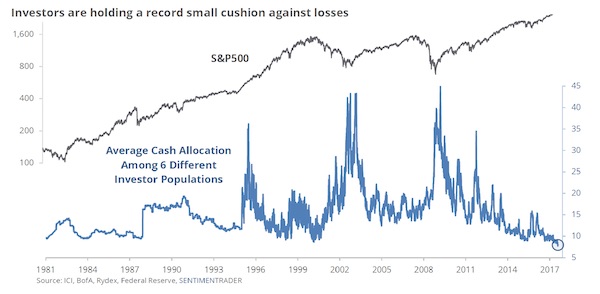

Not surprisingly, the expansion of leverage to record levels coincides with the drop in investor cash levels to record lows. As noted by Pater Tenebrarum via Acting-Man blog: “Sentiment has become even more lopsided lately, with the general public joining the party. It may not ‘feel’ like the mania of the late 1990s to early 2000, but in terms of actually measurable data, the overall bullish consensus seems to be even greater than it was back then. Along similar lines, here is a recent chart that aggregates the relative cash reserves of several groups of market participants (including individual investors, mutual fund managers, fund timers, pension fund managers, institutional portfolio managers, retail mom-and-pop type investors). It shows that there is simply no fear of a downturn:”

So much for the “cash on the sidelines” theory. When investors believe the market can’t possibly go down, it is generally time to start worrying. As Pater concludes: “As a rule, such extremes in complacency precede crashes and major bear markets, but they cannot tell us when precisely the denouement will begin.”

“The Fed has essentially trapped itself into a state of perpetual manipulation.” All major central banks have.

• QT1 Will Lead to QE4 Rickards)

There are only three members of the Board of Governors who matter: Janet Yellen, Stan Fischer and Lael Brainard. There is only one Regional Reserve Bank President who matters: Bill Dudley of New York. Yellen, Fischer, Brainard and Dudley are the “Big Four.” They are the only ones worth listening to. They call the shots. The don’t like dots. Everything else is noise. Here’s the model the Big Four actually use: 1. Raise rates 0.25% every March, June, September and December until rates reach 3.0% in late 2019. 2. Take a “pause” on rate hikes if one of three pause factors apply: disorderly asset price declines, jobs growth below 75,000 per month, or persistent disinflation. 3. Put balance sheet normalization on auto-pilot and let it run “on background.” Don’t use it as a policy tool.

[..] Here’s what the Fed wants you to believe… The Fed wants you to think that QT will not have any impact. Fed leadership speaks in code and has a word for this which you’ll hear called “background.” The Fed wants this to run on background. Think of running on background like someone using a computer to access email while downloading something on background. This is complete nonsense. They’ve spent eight years saying that quantitative easing was stimulative. Now they want the public to believe that a change to quantitative tightening is not going to slow the economy. They continue to push that conditions are sustainable when printing money, but when they make money disappear, it will not have any impact. This approach falls down on its face — and it will have a big impact.

Markets continue to not be fully discounted because they don’t have enough information. Contradictions coming from the Fed’s happy talk wants us to believe that QT is not a contractionary policy, but it is. My estimate is that every $500 billion of quantitative tightening could be equivalent to one .25 basis point rate hike. The Fed is about to embark on a policy to let the balance sheet run down. The plan is to reduce the balance sheet $30 billion in the fourth quarter of 2017, then increase the quarterly tempo by an additional $30 billion per quarter until hitting a level of $150 billion per quarter by October 1, 2018. Under that estimate, the balance sheet reduction would be about $600 billion by the end of 2018, and another $600 billion by the end of 2019. That would be the equivalent of half a .25 basis point rate hike in each of the next two years in addition to any actual rate hikes.

While they might attempt to say that this method is just going to “run on background,” don’t believe it. The decision by the Fed to not purchase new bonds will be just as detrimental to the growth of the economy as raising interest rates. The Fed’s QT policy that aims to tighten monetary conditions, reduce the money supply and increase interest rates will cause the economy to hit a wall, if it hasn’t already. The economy is slowing. Even without any action, retail sales, real incomes, auto sales and even labor force participation are all declining. Every important economic indicator shows that the U.S. economy is slowing right now. When you add in QT, we may very well be in a recession very soon. Because they’re getting ready for a potential recession where they’ll have to cut rates yet again. Then it’s back to QE. You could call that QE4 or QE1 part 2. The Fed has essentially trapped itself into a state of perpetual manipulation.

Hong Kong dollar is pegged to USD.

• S&P Strips Hong Kong of AAA Rating A Day After China Downgrade (BBG)

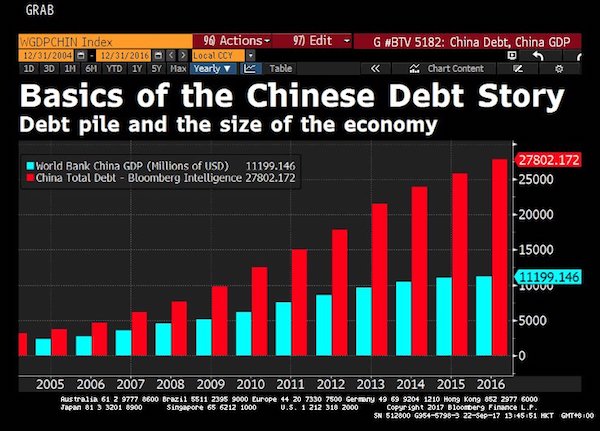

S&P Global Ratings cut Hong Kong’s credit rating a day after it downgraded China for the first time since 1999, a move that reflects the “strong institutional and political linkages” between the special administrative region and the mainland, the ratings firm said. The financial hub’s long-term issuer credit rating was lowered to AA+ from AAA, S&P said in a statement Friday. The agency lowered China’s sovereign rating Thursday to A+ from AA-, citing the risks from soaring debt, and revised its outlook to stable from negative. “We are lowering the rating on Hong Kong to reflect potential spillover risks to the SAR should deleveraging in China prove to be more disruptive than we currently expect,” S&P said in a statement, referring to the Hong Kong special administrative region.

It’s the second time this year Hong Kong’s rating has been cut in response to a China downgrade. Moody’s Investors Service in May lowered the finance hub’s rating and changed the outlook to stable from negative after it cut China for the first time since 1989. “Downgrading Hong Kong after China is a natural step,” said Mark McFarland, chief Asia economist at Union Bancaire Privee. “It has been widely anticipated that S&P would eventually follow the others and that Hong Kong would be dropped a notch too.” While S&P said Hong Kong’s credit metrics remain “very strong” based on the strength of the central government in Beijing, it faces a slew of challenges from surging property prices to the Federal Reserve’s plans to raise interest rates. Because the former British colony’s currency is pegged to the dollar, it effectively imports U.S. monetary policy.

The only thing they can do. But claiming that China is ‘so different’ from developed nations is not terribly encouraging.

• China Hits Back At S&P’s ‘Mistaken’ Credit Downgrade (AFP)

China on Friday lashed out at the decision by Standard & Poor’s to downgrade the country’s credit rating, calling the warning against ballooning debt “mistaken” and based on “cliches” about its economy. The agency slashed China from AA-minus to A-plus on Thursday, a move that followed a similar decision in May by Moody’s stemming from concerns that the world’s second largest economy is increasingly overleveraged. “Standard & Poor’s downgrade of China’s sovereign credit rating is a mistaken decision,” the finance ministry said in a statement, adding that the move was “perplexing.” It went on to scold the company for making a decision based on “cliches” about China’s economy. The rating “ignores the unique characteristics of the capital raising structure of China’s financial markets”, it said.

“Most unfortunately, this is inertial thinking that international ratings agencies have held for a long time and is a misreading of China’s economy based on the experiences of developed countries,” the ministry said. “This misreading also overlooks the good fundamentals and development potential of China’s economy.” S&P followed the move on Friday by cutting the top-notch credit rating of Hong Kong citing the city’s close links the the mainland economy. Debt-fuelled investment in infrastructure and property has underpinned China’s rapid growth, but there are widespread concerns that years of freewheeling credit could lead to a financial crisis with global implications. Beijing has been clamping down on bank lending and property purchases, but those efforts are complicated by the government’s determination to meet its full-year growth target of around 6.5%. That compares with last year’s pace of 6.7%, which was the slowest in more than a quarter of a century.

JPMorgan trading in what its CEO calls a fraud demands some answers.

• Jamie Dimon Faces Market Abuse Claim Over Bitcoin Comments (ZH)

A week after Jamie Dimon made headlines by proclaiming Bitcoin a “fraud” and anyone who owns it as “stupid,” the JPMorgan CEO faces a market abuse claim for “spreading false and misleading information” about bitcoin. Unless you have been living under a rock for the past week, you will be well aware of JPMorgan CEO Jamie Dimon’s panicked outburst with regard the ‘fraud’ that Bitcoin’s ‘tulip-like’ bubble is. To paraphrase: “It’s a fraud. It’s making stupid people, such as my daughter, feel like they’re geniuses. It’s going to get somebody killed. I’ll fire anyone who touches it.” One week later, an algorithmic liquidity provider called Blockswater has filed a market abuse report against Jamie Dimon for “spreading false and misleading information” about bitcoin. The firm filed the report with the Swedish Financial Supervisory Authority against JPMorgan Chase and Dimon, the company’s chief executive.

Blockswater said Dimon violated Article 12 of the EU Market Abuse Regulation (MAR) by declaring that cryptocurrency bitcoin was “a fraud”. The complaint said Dimon’s statement negatively impacted “the cryptocurrency’s price and reputation”. It also said Dimon “knew, or ought to have known, that the information he disseminated was false and misleading”. “Jamie Dimon’s public assertions did not only affect the reputation of bitcoin, they harmed the interests of some of his own clients and many young businesses that are working hard to create a better financial system,” said Florian Schweitzer, managing partner at Blockswater. Blockswater said JPMorgan traded bitcoin derivatives for their clients on Stockholm-based exchange Nasdaq Nordic before and after Dimon’s statements, which Schweitzer said “smells like market manipulation”.

Democracy 2017.

• Spain’s Attack On Catalonia Spills Over To 100,000 Domain Names (IN)

The offices of the .cat registry were raided by Spanish police this morning. The Guardia Civil officers entered the .cat registry’s offices around 9am local time this morning and have seized all computers in the domain registry’s offices in downtown Barcelona. The move comes a couple of days after a Spanish court ordered the domain registry to take down all .cat domain names being used by the upcoming Catalan referendum. The .cat domain registry currently has over 100 thousand active domain names and in light of the actions taken by the Spanish government it’s unclear how the registry will continue to operate if their offices are effectively shutdown by the Spanish authorities. The seizure won’t impact live domain names or general day to day operations by registrars, as the registry backend is run by CORE and leverages global DNS infrastructure. However it is deeply worrying that the Spanish government’s actions would spill over onto an entire namespace.

Why do you think the Catalans want out? Spain is answering that.

• Spain Hires Cruise Liner to House Police in Rebel Catalonia (BBG)

Spain has discreetly hired ferries to be moored in the Port of Barcelona as temporary housing for possibly thousands of police specially deployed to keep order in rebel Catalonia and help suppress an illegal independence referendum. The country’s interior ministry asked Catalan port authorities to provide a berth for one ship until Oct. 3 – two days after the planned vote – saying it was a matter of state, a spokeswoman for the port said by phone Wednesday. The vessel, known as “Rhapsody,” docked in the city about 9:30 a.m. Thursday, she said. The aim is to amass more than 16,000 riot police and other security officers by the Oct. 1 referendum, El Correo newspaper reported on its website. That would exceed the number of Catalan police, the Mossos d’Esquadra, who serve both the Catalan and central governments.

Spain is putting more boots on the ground in the northeastern region as it arrests local officials, raids regional-government offices and takes control of payroll administration in the run-up to the referendum. The ballot initiative, passed by the Catalan Parliament and declared illegal by the country’s highest court, has escalated a years-long stand-off between pro-independence campaigners and Spain’s central administration in Madrid. As well as the “Rhapsody,” with capacity for 2,448 people, the ministry also hired another vessel to dock in Barcelona with a third headed for the port of Tarragona, 100 kilometers (60 miles) west along the coast, El Confidencial website reported. The “Rhapsody” is operated by the Italian shipping company Grandi Navi Veloci SpA, the port spokeswoman said.

Without debt relief all streets are dead ends.

• Greece Will Remain Under Strict Supervision For Years, EWG Chief Says (K.)

The Greek economy will remain under close supervision for years after the completion of the third bailout deal, the president of the Euro Working Group (EWG), Thomas Wieser told insider.gr in an interview published on Wednesday. Even though he is confident the cash-strapped country will be able to recover, Wieser says that a lot of work needs to be done first, starting with the timely completion of the third bailout review. He also suggests that additional measures may be needed in 2019 and 2020 depending on the course of the budget next year. Asked whether he believes this will be Greece’s last memorandum, the Austrian-American economist says “three programs have already been implemented in the space of eight years and the political desire for yet another is zero. The rest of the eurozone also wants the third program to be the last one.”

Wieser adds that Greece’s ability to tap international lending markets by the end of the program in August 2018 will be a “decisive factor for the Greek government to push ahead with reforms.” “In other words, knowing that the program is ending in a few months is a huge incentive to get the reforms done,” he says, adding that a successful completion of the program is within reach given the government’s limited fiscal obligations. Wieser appears confident that Greece will successfully wrap up the upcoming review within the fall even though the government needs to push through 95 so-called prior actions, saying the majority has already been legislated. However, he adds, Greece may need additional measures after August 2018 depending on whose scenario plays out: the IMF’s pessimistic outlook, or the upbeat projects of the European institutions and the Greek government.

Greece will also remain under supervision – as have Spain, Ireland, Portugal and Cyprus – until 75% of its debts are paid off, and this will be much stricter “in the first few years at least, than, say, it was for Ireland,” Wieser adds. Regarding debt relief, Wieser tells insider.gr that “an analysis will be conducted in the summer of 2018 and a decision taken upon the completion of the program.”

Freedom exists because there are limits and boundaries. Living forever is not freedom.

• Life Unlikely Beyond 115 Year Mark Despite Medical Advances (DT)

Researchers claim to have discovered the maximum age ‘ceiling’ for human lifespan. Despite growing life expectancy because of better nutrition, living conditions and medical care, Dutch scientists say our longevity cannot keep extending forever. Women can only live to a maximum of 115.7 years, they said, while men can only hope for 114.1 years at the most. The research by statisticians at Tilburg and Rotterdam’s Erasmus universities said, however, there were still some people who had bent the norm. The research by statisticians at Tilburg and Rotterdam’s Erasmus universities said women could live to a maximum of 115.7 years, while men could only hope for 114.1 years at the most. However, they did concede that there were exceptions, like Jeanne Calment, the French woman who died in 1997 at the age of 122 years and 164 days old – the longest life ever recorded.

Lifespan is the term used to describe how long an individual lives, while life expectancy is the average duration of life that individuals in an age group can expect to have – a measure of societal wellbeing. The team mined data over 30 years from some 75,000 Dutch people whose exact ages were recorded at the time of death. “On average, people live longer, but the very oldest among us have not gotten older over the last thirty years,” Prof John Einmahl said. “There is certainly some kind of a wall here. Of course the average life expectancy has increased,” he said, pointing out the number of people turning 95 in the Netherlands had almost tripled. “Nevertheless, the maximum ceiling itself hasn’t changed,” he said.

The Dutch findings, to be published next month, come in the wake of those by US-based researchers who last year claimed a similar age ceiling. However, that study by Albert Einstein College of Medicine in New York found that exceptionally long-lived individuals were not getting as old as before. Einmahl and his researchers disputed that, saying their conclusions deduced by using a statistical brand called ‘Extreme Value Theory’, showed almost no fluctuation in maximum lifespan.

Home › Forums › Debt Rattle September 22 2017