Pablo Picasso Jacqueline in Turkish costume 1955

Inflation is arguably the Fed’s no. 1 concern left. Yellen admits they don’t know what it is or does, though. Still, decisions concerning billions and trillions are taken. No direction home.

• Yellen Brushes Aside Inflation ‘Mystery’ While Fed Eyes Rate Hike (BBG)

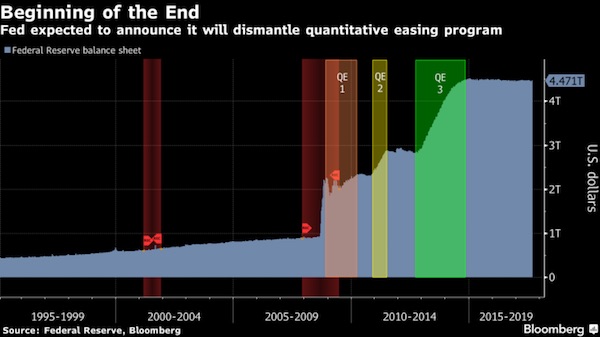

Federal Reserve Chair Janet Yellen acknowledged that the fall in inflation this year was a bit of a “mystery” but suggested that the central bank was on course to raise interest rates again in 2017 nonetheless. She told reporters on Wednesday that the economy was robust enough to withstand further rate increases and an imminent reduction in the Fed’s $4.5 trillion balance sheet, as it exits from a crisis-era policy a decade after the onset of the Great Recession.“We continue to expect that the ongoing strength of the economy will warrant gradual increases” in rates, she told a press conference after the Federal Open Market Committee announced that it will slowly begin to pare its bond holdings next month. As expected, the target range for the federal funds rate was held at 1% to 1.25%. The central bank’s intention to press ahead with another rate hike this year and three more in 2018 caught investors by surprise, sending bond yields and the dollar higher.

The strategy represents a bit of a gamble because it risks cementing inflation permanently below the Fed’s 2% target. As measured by the personal consumption expenditures price index, inflation has ebbed this year even as the economy and the labor market have continued to improve. After briefly poking above 2% earlier this year, it fell to 1.4% in June and July. “I will not say that the committee clearly understands what the causes are of that,” Yellen, 71, said. While transitory forces such as a one-time cut in mobile-phone service charges were part of the story, they did not fully explain the shortfall, she said. The Fed chief though argued that the ongoing strength of the economy and the labor market would ultimately help lift inflation, while she kept open the possibility the central bank would alter course if that proved not to be the case.

The Fed doesn’t serve the people. Never forget.

• Federal Reserve Will Continue Cutting Economic Life Support (Smith)

First, let’s be clear, historically the Fed’s predictable behavior has been to skip major policy actions in September and then startle markets with renewed and aggressive actions in December. People placing bets on a Fed rate hike in September would look at this pattern and say “no way.” However, the narrative I see building in Fed rhetoric and in the mainstream media is that stock markets have become “unruly children” and that the Fed must become a “stern parent,” reigning them in before they are crushed under the weight of their own naive enthusiasm. In my view, the Fed will continue to do what it says it is going to do — raise interest rates and reduce and remove stimulus, and that the mainstream narrative will soon be adjusted to suggest that this is “necessary;” that stock markets need a bit of tough love.

If the Fed means to follow through with its stated plans for “financial stability” in markets, then the only measure that would be effective in shell-shocking stocks back to reality would be a surprise hike, a surprise announcement of balance sheet reduction or both at the same time If the Fed intends to continue cutting off life support to equities and bonds in preparation for a controlled demolition of the U.S. economy, then there is a high probability at the very least of a balance sheet reduction announcement this week with strong language indicating another rate hike in December. I also would not completely rule out a surprise rate hike even though September is usually a no-action month for central banks. This would fit the trend of central banks around the globe strategically distancing themselves from artificial support for the financial structure.

Last week, the Bank of England surprised investors with an open indication that they may begin raising interest rates “in the coming months.” The Bank Of Canada surprised some economists with yet another rate hike this month and mentions of “more to come.” The European Central Bank has paved the way for a tapering of stimulus measures according to comments made during its latest meeting early this month. And, the Bank of Japan initiated taper measures in July. Even Forbes is admitting that there appears to be a “coordinated tightening of monetary policy” coming far sooner than the mainstream expects. If you understand how the Bank for International Settlements controls policy initiatives of national central bank members, then you should not be surprised that central banks all over the world are pursuing the same actions and the same rhetoric. The only difference between any of them is the pace they have chosen in taking the punch bowl away from the party.

Psychology and obesity. Gee, thanks Bob! Feel much more confident now.

• What Shiller Says Is Preventing A 1929-Like Stock Market Crash (CNBC)

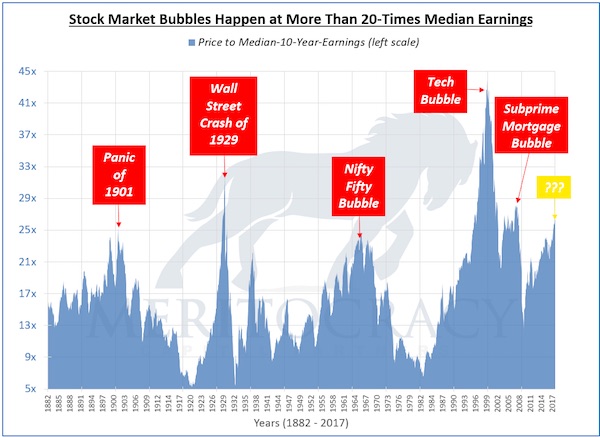

It’s a comparison no one wants to hear — that this stock market bears striking similarities to that of 1929. The observation is coming from Nobel Prize-winning economist Robert Shiller, who’s been arguing valuations are extremely expensive. But instead of predicting an epic stock market crash, he’s finding reasons to be optimistic. “The market is about as highly priced as it was in 1929,” said Shiller on Tuesday’s “Trading Nation.” “In 1929 from the peak to the bottom, it was 80% down. And the market really wasn’t much higher than it is now in terms of my CAPE [cyclically adjusted price-to-earnings] ratio. So, you give pause when you notice that.” In his first interview since penning an op-ed on Sept. 15 in The New York Times, the Yale University economics professor reiterated to CNBC that there’s one vital characteristic protecting investors from losing their nest eggs: Market psychology.

“It’s not just a matter of low interest rates, it’s something about the American atmosphere. It’s partly the Trump atmosphere. Investors love this. I can’t exactly explain – maybe it has something to do with prospective tax cuts. But I don’t think it’s just that. It’s something deeper, and it’s pushing the American market up,” he added. Unlike 1929, Shiller points out there’s not much talk about people borrowing exorbitant amounts of money to buy stocks. Plus, he notes there’s now more regulation. But don’t mistake the Yale University economics professor for a bull. “I don’t want to encourage people too much to put a lot into the most expensive market in the world,” said Shiller. “The U.S. has the highest CAPE ratio of 26 countries. We are number one.”

[..] Shiller may see red flags, but he isn’t ruling out a market that continues to churn out fresh records for months, if not years. “I wouldn’t call it healthy, I’d call it obese. But you know, some of these obese people live to be 100 years, so you never know,” said Shiller.

Still feeling good, Shiller?

• Stock Market Bubbles in Perspective (Ma)

A better type of average would be the median. It literally represents the middle of a sequence of ranked numbers. In most cases, it is not influenced by outliers. By using median (instead of mean) earnings, I refer to this valuation approach as the CAPME ratio. It currently shows the S&P Composite is not the second or third most expensive stock market cycle. This finding supports those who criticize the traditional CAPE ratio of overstating the valuation of the S&P Composite Index. The problem for critics though is using the CAPME ratio still shows the U.S. stock market is very expensive right now. In fact, it is the fourth most expensive, behind the stock market cycle that occurred during the Subprime Mortgage Bubble. Based on the data Professor Shiller uses, you can see this in the graph below that looks back 135 years.

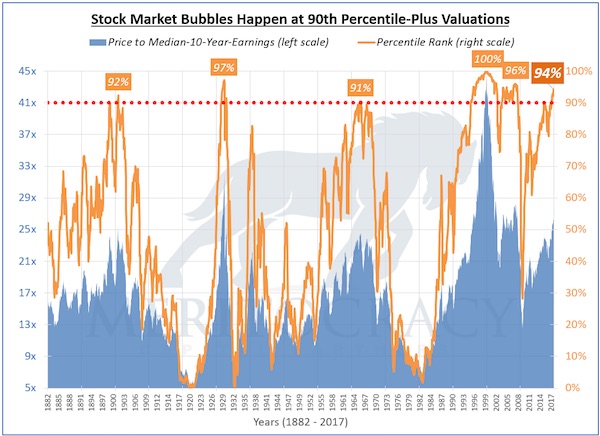

You will notice in the graph above that the past 5 stock market bubbles were all valued at one point at more than 20-times median, annual, inflation-adjusted earnings. The valuation range of those peaks is wide though given the Tech Bubble was valued at more than 40-times at its peak. This makes the Tech Bubble potentially an outlier. Furthermore, all 5 stock market bubbles did not last long. They were fleeting. To put this all into perspective, consider these valuations by their percentile ranks. You can see this from the orange lines in the graph below. [It] shows the aforementioned 5 stock market cycles turned into bubbles when their CAPME valuation ratios reached a very high level of roughly the 90th percentile (red dotted line). In other words, these bubbles formed when their valuations were near or at the most expensive decile.

Investors beware: the valuation of the S&P Composite Index is currently ranked at the 94th percentile. This puts the U.S. stock market smack-dab at the heart of bubble territory. It has been argued lots that the high stock market valuation is justified by low interest rates. This argument does not work for me. Let me tell you why. Yields on 10-year U.S. treasury bonds in early-1941 were lower than they are now. Despite lower interest rates in early-1941, the stock market CAPME valuation ratio was quite low at that time ranking at around the 30th percentile. Furthermore, the amount of debt provided by stock brokers used to fuel the current stock market cycle is at a record level. This could prove problematic given bubbles driven by financial leverage are particularly dangerous.

The aforementioned 5 stock market cycles turned into bubbles when their CAPME valuation ratios reached the 90th percentile. The U.S. stock market is back there again. Its valuation is squarely in the middle of that very expensive decile looking back 135 years. The 5 previous instances of stock market bubbles suggest this will not end well. Bubbles never do, particularly ones driven by financial leverage.

Whcih goes to show how easily markets are manipulated.

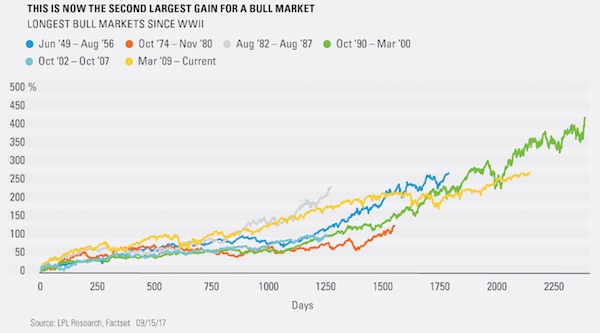

• We’re Officially In The 2nd-Largest Bull Market Since World War II (BI)

We’re officially in the second-largest bull market since World War II. A week ago Monday, the S&P 500 index’s bull market became the second-best performing in the modern economic era. Stocks have climbed by about 270% from their March 2009 low over the past eight years, according to data from LPL Financial. Today’s bull market has eclipsed the 267% gain seen from June 1949 to August 1956. But the bull market from October 1990 to March 2000 remains in the top spot. “The logical question we continue to receive is: how much further can it go? We have an old bull market and an old expansion. When will the music stop?” Ryan Detrick, the senior market strategist for LPL Financial, wrote in commentary. “The current bull market is officially 101 months old, which might sound old (and it is), but remember that bull markets don’t die of old age, they die of excesses.”

“The central bankers of the world have dumped $30 trillion into the global economy over the last eight years and we’ve got 2% growth and change..”

• Who’s Pulling The Strings? (Ren.)

Feierstein cited the Resolution Trust debacle as an example of what should have happened. The Trust was declared insolvent as a consequence of the 1980s Savings and Loans Crisis and up to 300 bankers were jailed. “This is what should have happened this time around, instead of taking hundreds of trillions of dollars taxpayer’s money and placing the taxpayer at incredible peril and just added liquidity to the markets,” he said. “Giving more money to an insolvent institution is not the solution. You cannot pay your way out of debt with borrowed money. It’s not going to cure the underlying problem of insolvency.” This is why Feierstein refers to the entire global economy as a Ponzi scheme. “The amount of debt in the global financial system is a Ponzi scheme because the United States government has over $240 trillion in debt which is more than three times global GDP.

That’s the sum of all goods and services produced with zero consumption for three years. We’ll never pay out the debt that’s owed.” Feierstein says the government has tried to replace consumer demand with debt and printed money and consumers haven’t come back into the market. “That’s why we’ve got a huge government that thinks they can control everything and price action manipulating volatility to unrealistically low levels,” he said. “They think the consumer will eventually come back but they won’t because the jobs have disappeared and the unemployment rate which we’ve spoken about before is a lie. It’s not 4.3%, it’s closer to 20% because you’ve got people who aren’t participating in the workforce. And that’s probably over 100 million people in America.” Financial times journalist, Rana Foroohar says consumers are all tapped out.

“Credit is what we do to sort of keep middle class voters happy,” she said. “We’re tapped out.” The good news and the bad news is that when the next financial crisis comes the US government will not have as much firepower to throw at it. “The central bankers of the world have dumped $30 trillion into the global economy over the last eight years and we’ve got 2% growth and change,” she said. “It’s pathetic.” Feierstein said it is important to highlight how derivative products have contributed massively to this problem. “When I say there is too much leverage, basically derivative products allows financial institutions and investors to create 100 to 1 leverage. You put up $1 to control $100, or $500 dollars in assets. Think about that on a big scale. If you take $1 million you can control something worth $100 million, or even $500 million depending upon how you gear the leverage ratio.

Art Cashin tells a story.

• 144 Years Ago A Panic Shut Down The Stock Market For The First Time (Cashin)

“[O]n Saturday, September 20, 1873, for the first time in its history, the NYSE closed in response to a panic. (The word circuit breaker had not been invented yet….er…..neither had circuits.) A week or more before, one of the most renowned firms in American finance and especially U.S. Treasury auctions came under a cloud of suspicion. The firm was Jay Cooke & Company. And, on most continents, it was seen as a key player. After all, its aggressive style had made it the key underwriter for the billions of Treasury bonds issued during and after the Civil War. (Contemporary competitors had shied back fearing that deficit spending had gotten out of control.) Anyway, the concern about in this key brokerage firm only confused the market at first. But as this day approached, there were hints that the problems would spread to other brokers. On the 18th, liquidation of equities showed up at the ‘first call.’

For most of its first century of existence, the NYSE was a ‘call market.’ The chairman, or other senior officer, would call out the name of one of the listed issues. Brokers who had an interest in that ‘issue’ would arise from their ‘seats’ and begin to bargain with any other brokers arisen from their ‘seats’. When transactions ended in that issue (assuming they were not all buyers), brokers returned to their ‘seats’ and the chairman called the next issue on the roll. When the last issue was called, the session officially ended. There were two sessions each day. […] So, here they were. Rumors surfaced that, perhaps some other brokers were involved and the first call on the 18th turned soft. The second call turned soggy. Prices were down and with no on-going after market; all you could do (as the banks did) is await the next call.

The morning call on the 19th was messy and the afternoon call was just a disaster. Outside, in a heavy rain, crowds gathered on Wall Street to withdraw securities and money from brokers. By the morning of the 20th anyone who was in the phone book (if there had been one at the time) was rumored to have been impacted by the problem. So, naturally the morning call on Saturday the 20th was a disaster. So much so that the Exchange opted to close until the crisis calmed (skipping the P.M. call). Close they did and for a lot more than one ‘call.’ But, but perhaps because banks and investors naturally needed some means of evaluating holdings, they reopened about ten days later. However, the rumors would not go away and liquidations and defaults continued. The history books call it the Panic of 1873. And, it put the American economy in a tailspin for years. (Nearly 10,000 businesses failed.)”

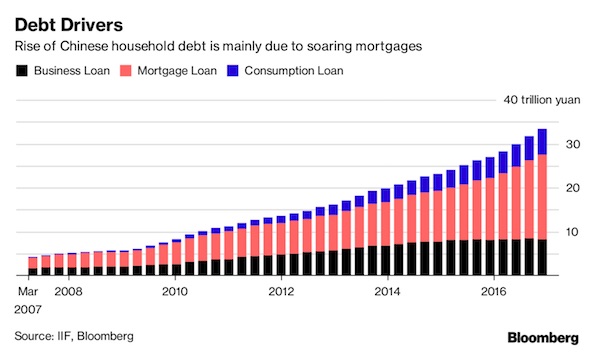

Until recently, Chinese hardly borrowed at all. Now, debt is the only way to keep up.

• China’s Dangerous House Price Boom Is Spreading (BBG)

Hefty mortgages have pushed up Chinese household debt, reducing their room for maneuver should income growth stall, according to recent research by Gene Ma, chief China economist at the Institute of International Finance in Washington. In general, it’s debt that’s the warning sign. As developers and households become more leveraged, the risk is that a price downturn doesn’t remain contained within the property market. “The high leverage will amplify the damage to the economy if a property bust happens,” said Bloomberg Intelligence economist Fielding Chen. “The shock wave will be passed onto the entire financial system, and losses will be greater,” he said. Once home prices tumble, about 40% of Chinese banks will be hit hard, according to a recent research note from Ping An Securities.

Analysts have argued that the debt load in the Chinese property market is far from a carbon copy of the situation in Japan’s bubble era before its bust in the 1990s, nor is it similar to the sub-prime crisis in the U.S. a decade ago. With down payment requirements of at least 20% for first purchases and as much as 70% for second homes, China’s household mortgages still stand at relatively safe levels, said Wang Qiufeng, an analyst at China Chengxin International in Beijing. Ping An Securities also argues that the odds of a property crash happening in the near term are very small. But as household debt-to-income ratios have risen almost to levels seen in advanced economies, the potential impact on the economy of a popping bubble would be considerable.

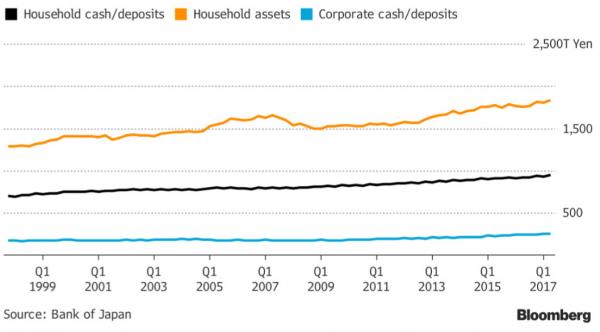

Abenomics is (was) an attempt to force people into spending. That scares them into not spending. It doesn’t come any simpler.

• Japan’s “Deflationary Mindset” Grows (ZH)

After being force-fed more stimulus than John Belushi, and endless rounds of buying any and every asset that dares to expose any cracks in the potemkin village of fiat folly, Japan remains stuck firmly in what Abe feared so many years ago – a “deflationary mindset.” As Bloomberg reports, cash and deposits held by Japanese households rose for 42nd straight quarter at the end of June as the nation’s consumers continued to favor saving over spending. The “deflationary mindset” that the Bank of Japan is battling to overcome was also evident in the money laying idle in corporate coffers, which stayed near an all-time high, according to quarterly flow of funds data released by the BOJ on Wednesday. Still, as Bloomberg optimistically notes, with the economy expanding much faster than its potential growth rate, greater inflationary pressures could be on the way, which may prompt a shift in behavior by consumers and companies… or not!

Musical chairs.

• Greece Considers Bond Swap As It Looks To Bailout Exit (R.)

Greece is considering swapping 20 small bond issues for four or five new ones, government sources said, as it prepares to exit its international bailout and resume normal financing operations. The country has been surviving on rescue funds since 2010 and is anxious to draw a line under its bailout phase next year. The government is considering a swap that would consolidate the secondary market into a few benchmark issues, replacing 20 separate bonds with a face value of around 32 billion euros, said officials familiar with the proposal. “We are planning to proceed with some debt management actions … to improve liquidity and tradeability,” one senior government official said. Officials said the move was still under discussion and did not say when it might happen, adding that bondholders had yet to be sounded out.

The 20 bonds were issued in 2012 in a voluntary scheme whereby private bondholders took a 53.5% haircut on their investments. It was the world’s biggest debt restructuring involving bonds with a total face value of 206 billion euros. Major holders included banks and pensions funds in Greece and abroad. Two years later in 2014, Greece made two forays as part of a plan to regain full bond market access. This time the plan is more modest but would represent a major step toward for bigger debt issues. Greece issued a five-year bond in July, and investors that bought the new bond are already making a profit of about 1.5% since the beginning of the year. Greece’s borrowing costs have fallen sharply this year back to pre-crisis levels, as investors see the prospect further bailouts diminishing as well as signs of economic improvement.

Wouldn’t that be something.

• Abbas Says Trump May Have Mideast ‘On the Verge’ of Peace Deal

Palestinian Authority President Mahmoud Abbas said Wednesday that President Donald Trump’s diplomatic efforts in the Mideast give him confidence that the region is “on the verge” of peace. Abbas said his government has met with U.S. diplomats more than 20 times since Trump took office in January. “If this is an indication of anything, it indicates how serious you are about peace in the Middle East,” Abbas said through a translator at a meeting with the U.S. president during the United Nations General Assembly in New York. “I think we have a pretty good shot, maybe the best shot ever,” Trump said. “I certainly will devote everything within my heart and within my soul to get that deal made.” “Who knows, stranger things have happened,” he added. “No promises, obviously.”

Trump met with Abbas two days after a similar meeting with Israeli Prime Minister Benjamin Netanyahu, where the U.S. president said he was hopeful Israelis and Palestinians would be able to come to a peace agreement during his presidency. The president recently dispatched his son-in-law and senior adviser, Jared Kushner, to the region in a bid to restart peace talks. Kushner was joined by Jason Greenblatt, the president’s envoy for Israeli-Palestinian peace, and deputy national security adviser Dina Powell. The White House is trying to take advantage of a period of relative calm following violent clashes earlier this summer over Israeli security arrangements at the Jerusalem shrine known to Jews as Temple Mount and to Muslims as Haram al-Sharif, said a senior administration official who requested anonymity to discuss the negotiations.

Trump has said he’s hopeful Kushner can help restart a peace process that has made little headway over the past 25 years. He made addressing the Israeli-Palestinian conflict an early priority, hosting both Abbas and Netanyahu at the White House during the opening months of his presidency and visiting Israel during his first international trip as president. The last round of U.S.-led talks, a pet project of former Secretary of State John Kerry, broke down three years ago amid mutual recriminations.

How does a country, state, territory survive without power for half a year?

• 4-6 Months To Restore Puerto Rico Electricity After Hurricane Maria (NBC)

Hurricane Maria is likely to have “destroyed” Puerto Rico, the island’s emergency director said Wednesday after the monster storm smashed ripped roofs off buildings and flooded homes across the economically strained U.S. territory. Intense flooding was reported across the territory, particularly in San Juan, the capital, where many residential streets looked like rivers. The National Weather Service issued a flash flood warning for the entire island shortly after 12:30 a.m. ET. Yennifer Álvarez Jaimes, Gov. Ricardo Rosselló’s press secretary, told NBC News that all power across the island was knocked out. “Once we’re able to go outside, we’re going to find our island destroyed,” Emergency Management Director Abner Gómez Cortés said at a news briefing. [..] Maria, the strongest storm to hit Puerto Rico since 1928, had maximum sustained winds of 155 mph when it made landfall as a Category 4 storm near the town of Yabucoa just after 6 a.m. ET.

But it “appears to have taken quite a hit from the high mountains of the island,” and at 11 p.m. ET, it had weakened significantly to a Category 2 storm, moving away from Puerto Rico with maximum sustained winds of 110 mph, the agency said. [..] “Extreme rainfall flooding may prompt numerous evacuations and rescues,” the agency said. “Rivers and tributaries may overwhelmingly overflow their banks in many places with deep moving water.” San Juan San Juan Mayor Carmen Yulín Cruz told MSNBC that the devastation in the capital was unlike any she had ever seen. “The San Juan that we knew yesterday is no longer there,” Yulín said, adding: “We’re looking at four to six months without electricity” in Puerto Rico, home to nearly 3.5 million people. “I’m just concerned that we may not get to everybody in time, and that is a great weight on my shoulders,” she said.

Nice math, but many questions.

• Global Mass Extinction Set To Begin By 2100 (Ind.)

Planet Earth appears to be on course for the start of a sixth mass extinction of life by about 2100 because of the amount of carbon being pumped into the atmosphere, according to a mathematical study of the five previous events in the last 540 million years. Professor Daniel Rothman, co-director of MIT’s Lorenz Centre, theorised that disturbances in the natural cycle of carbon through the atmosphere, oceans, plant and animal life played a role in mass die-offs of animals and plants. So he studied 31 times when there had been such changes and found four out of the five previous mass extinctions took place when the disruption crossed a “threshold of catastrophic change”. The worst mass extinction of all – the so-called Great Dying some 248 million years ago when 96 per cent of species died out – breached one of these thresholds by the greatest margin.

Based on his analysis of these mass extinctions, Professor Rothman developed a mathematical formula to help predict how much extra carbon could be added to the oceans – which absorb vast amounts from the atmosphere – before triggering a sixth one. The answer was alarming. For the figure of 310 gigatons is just 10 gigatons above the figure expected to be emitted by 2100 under the best-case scenario forecast by the IPCC. The worst-case scenario would result in more than 500 gigatons. Some scientists argue that the sixth mass extinction has already effectively begun. While the total number of species that have disappeared from the planet comes nowhere near the most apocalyptic events of the past, the rate of species loss is comparable. Professor Rothman stressed that mass extinctions did not necessarily involve dramatic changes to the carbon cycle – as shown by the absence of this during the Late Devonian extinction more than 360 million years ago.

Home › Forums › Debt Rattle September 21 2017