Edward S. Curtis A smoky day at the Sugar Bowl—Hupa c. 1923

is this where it’ll all blow up?

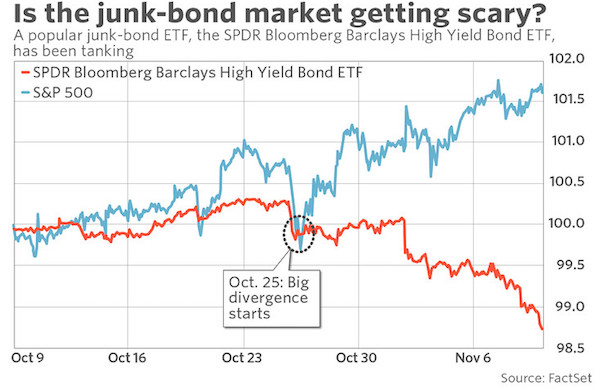

• Stock-Market Investors Are Starting To Freak Out About Junk Bonds (MW)

Wall Street bears are sounding alarms about a recent drop in non-investment-grade bonds, popularly referred to as junk bonds. The SPDR Bloomberg Barclays High Yield Bond ETF, an exchange-traded fund that tracks junk bonds, is on track to finished at its lowest level since March 24. Another well known junk-bond ETF, the iShares iBoxx $ High Yield Corporate Bond ETF also carved out late-March nadir, according to FactSet data. Both ETFs fell below their 200-day moving averages early this month, signaling that momentum in fixed-income products is bearish. Technical analysts tend to follow short- and long-term averages in an asset to help determine bullish and bearish trends. The moves for JNK and HYG, referencing their widely used tickers, come as the S&P 500 index and the Dow Jones Industrial Average have been testing fresh highs.

Normally, junk bonds and stocks are positively correlated, or move in the same direction, because junk bonds are considered a proxy for risk appetite in the market. Junk bonds had been drawing interest, particularly in an environment of ultralow bonds, with the 10-year Treasury and the 30-year Treasury bond offering yields below their historic averages, even as the Federal Reserve embarks upon efforts to lift interest rates from crisis-era levels. Bonds with the highest yields tend to be the riskiest and therefore offer a commensurate compensation in exchange for that perceived risk. Bond prices and yields move in opposition. However, a recent divergence between junk bonds and stocks, taking hold in late October, has raised eyebrows among Wall Street investors.

This cannot end well.

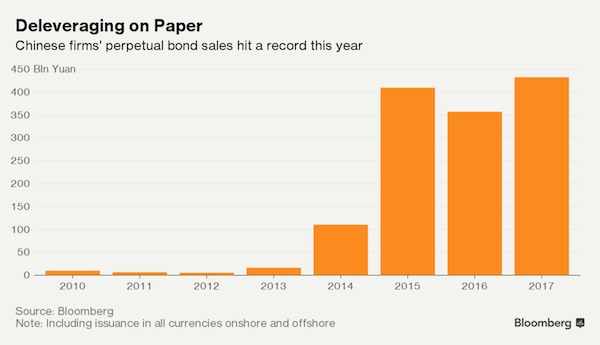

• China’s New Way To Hide Debt: Call It Equity (ZH)

The legacy of the soon-to-retire PBoC governor, Zhou Xiochuan, will be that in sharp contrast to his western brethren, he warned that China’s credit bubble would burst before the fact. Two weeks ago, Zhou warned during the Party Congress that China’s financial system could be heading for a “Minsky moment” due to high levels of corporate debt and rapidly rising household debt. “If we are too optimistic when things go smoothly, tensions build up, which could lead to a sharp correction, what we call a ‘Minsky moment’. That’s what we should particularly defend against.” Perhaps sensing that nobody in the Middle Kingdom was paying attention, we noted two days ago his lengthy essay published on the PBoC website. It contained another warning that latent risks are accumulating in the Chinese system, including some that are “hidden, complex, contagious and hazardous.”

He also highlighted “debt finance disguised as equity” as a concern. Talking of which, there’s a new growth market in the gargantuan Chinese corporate debt market – we are referring to perpetual notes. Are you ready for the clever part about perpetual notes – they are debt but it’s permissible under Chinese accounting regulations to classify them as “equity” – et voila, corporate gearing has fallen. Under pressure to trim borrowings, China’s companies have found a way to reduce their lofty debt burdens – even if some of the risk remains. Sales of perpetual notes – long-dated securities that can be listed as equity rather than debt on balance sheets given that in theory they could never mature – have soared to a record this year as Beijing zeros in on leverage and the threat it poses to the financial system.

The bonds are so popular that issuance by non-bank firms has jumped to the equivalent of 433 billion yuan ($65 billion), more than seven times sales by companies in the U.S. “Chinese issuers love perpetual bonds because they are under great pressure to deleverage,” said Wang Ying, a senior director at Fitch Ratings in Shanghai. “Sophisticated investors should do their homework and shouldn’t be misled by the numbers in accounting books.

China signals it needs money, badly.

• China To Remove Foreign Ownership Limit In Chinese Banks, Brokers (BBG)

China took a major step toward the long-awaited opening of its financial system, removing foreign ownership limits on its banks and asset-management companies, and allowing overseas firms to take majority stakes in local securities ventures and insurers. Regulators are drafting detailed rules, which will be released soon, Vice Finance Minister Zhu Guangyao said at a briefing in Beijing on Friday. Foreign firms will be allowed to own up to 51% in securities ventures and life-insurance companies, caps that will be removed gradually over time, he said. China’s steps look poised to end years of frustration for foreign banks, who have long been marginal players in Asia’s largest economy. The announcement could be seen as a major win for U.S. President Donald Trump, whose first official visit to China was followed by a string of Sino-U.S. deals.

“This is a milestone in China’s progress of opening up its economy,” said Larry Hu at Macquarie in Hong Kong. Announcing this during Trump’s visit shows the world that “China and the U.S. are in a business and trade cooperation rather than confrontation,” Hu said. On Thursday, China’s Foreign Ministry foreshadowed the latest moves, with a statement saying that entry barriers to sectors such as banking, insurance, securities and funds will be “substantially” eased. Those comments came following a meeting between Trump and his counterpart Xi Jinping. The moves would be encouraging to foreign banks, asset managers and insurers, who have long been kept on the margins in China, the world’s second-largest economy, by various barriers. Global banks are currently limited to owning 49% of local securities joint ventures, frustrating their attempts to compete effectively with Chinese rivals.

“This is their democracy today. We just happen to live in it.”

• Why Have We Built A Paradise For Offshore Billionaires? (Thomas Frank)

It’s not enough to say, in response to the Paradise Papers revelations, that we already knew that rich people parked their money in offshore tax havens, where their piles accumulate far from the scrutiny of our government. Nor is it enough to say that we were already aware that we live in a time of “inequality.” What we have learned this week is the clinical definition of the word. What we have learned is how much the rich and the virtuous have been hiding away and where they’re hiding it. Yes, there are sinister-looking Russian capitalists involved. But there’s also our favorite actors and singers. Our beloved alma mater, supposedly a charitable institution. Everyone with money seems to be in on it. We’re also learning that maybe we’ve had it backwards all along.

Tax havens on some tropical island aren’t some sideshow to western capitalism; they are a central reality. Those hidden billions are like an unseen planet whose gravity is pulling our politics and our economy always in a certain direction. And this week we finally began to understand what that uncharted planet looks like; we started to grasp its mass and its power. Think about it like this. For decades Americans have been erupting in anger at what they can see happening to their beloved middle-class world. We think we know what the culprit is; we can see it vaguely through a darkened glass. It’s “elitism.” It’s a “rigged system.” It’s people who think they’re better than us. And for decades we have lashed out. At the immigrant next door. At Jews. At Muslims. At school teachers. At public workers who are still paid a decent wage. Our fury, unrelenting, grows and grows.

We revolt, but it turns out we have chosen the wrong political leader. We revolt again: this time, the leader is even worse. This week we are coming face to face with a big part of the right answer: it’s that the celebrities and business leaders we have raised up above ourselves would like to have nothing to do with us. Yes, they are grateful for the protection of our laws. Yes, they like having the police and the Marine Corps on hand to defend their property. Yes, they eat our food and breathe our air and expect us to keep these pure and healthy; they demand that we get educated before we may come and work for them, and for that purpose they expect us to pay for a vast system of public schools. They also expect us to watch their movies, to buy their products, to use their software. They expect our (slowly declining) middle class to be their loyal customers.

[..] Our leaders raised up a tiny class of otherworldly individuals and built a paradise for them, made their lives supremely delicious. Today they hold unimaginable and unaccountable power. We endure potholes and live in fear of collapsing highway bridges because our leaders wanted these very special people to have an even larger second yacht. Our kids sit in overcrowded classrooms in underfunded schools so that a handful of exalted individuals can relax on their own private beach. Today it is these same golden figures with their offshore billions who host the fundraisers, hire the lobbyists, bankroll the think tanks and subsidize the artists and intellectuals. This is their democracy today. We just happen to live in it.

“So the only way we can really stop it – is by forgetting about taxing them with income. Income tax works for workers – it doesn’t work for a corporation; it doesn’t work for the wealthy.”

• We Should Tax Them On Transactions – Steve Keen (RT)

Steve Keen, Professor of Economics at Kingston University says the findings of the so-called Paradise Papers haven’t been surprising as “Tax evasion by the wealthy has been going on for decades, and we’ll never stop it. “We simply have to find a way to bring tax revenue back into the government that they can’t evade. And it will always manage to evade income tax,” he told RT. Keen adds though that it won’t be easy to stop this thing from happening. Partly that’s “because we don’t understand how taxation actually works.” “We think taxation is necessary to finance government spending. In fact, the government can spend regardless of taxation – the taxation simply takes large amounts of the money out of the system that government has spent into it because if we didn’t tax, we would have a risk of inflation.”

“Once you look at it that way, what the rich are actually doing – are siphoning off money that has been created by the government, accumulating it in offshore accounts and hanging onto the wealth, which should be recycled back into the economy. So the only way we can really stop it – is by forgetting about taxing them with income. Income tax works for workers – it doesn’t work for a corporation; it doesn’t work for the wealthy. We should tax them on transactions, and then they can’t evade unless they stop having transactions. If they stop having transactions, they will stop being wealthy,” he said. RT: What are the chances of that happening? SK: It just takes politicians to understand how money is created. So I think it is almost virtually impossible. They continue spreading this myth that they have got to tax us to be able to spend, running austerity, which is unnecessary. All this fits in to actually loading the pockets of the rich. Maybe there is a connection…

Part 2 of the article above.

• Kleptocrat-Owned Media Pick Out ‘Incrimination’ To Target Russia – Keiser (RT)

Let’s talk about some numbers there. To put this into a broader context, the Tax Justice Network did a study a couple of years ago. They determined that between $21 and $31 trillion is held offshore. This means that hundreds of billions of dollars of taxes go uncollected. It means those who are paying tax are paying for the entire tax burden for various countries infrastructures, military, etc. You end up with what I would call apartheid, where you have got approximately 200,000 people in the world, who pay no tax and are able to invest without paying any tax. So they are compounding money at 20-22% a year without paying tax. So the billionaire class is escalating, we know this.

Meanwhile, the poverty levels are continuing to rise because people are being ripped off by these corrupt countries in cahoots with these billionaires, who are placing the entire cost of running a society on those who can least afford it. And into the mix comes the social uprising – more violence, because naturally, if you have everything stolen from you, you have nothing to lose, so you become violent. Now, to specifically answer your question about Russia being targeted by selectively picking out … here’s an elegant phrase – you’re trying to pick a fly poop from the pepper. So they look at this big scattershot of information, and with little tweezers, they try to pick out what they perceive to be incriminating data points.

Then they build a scenario, and then the corporations that are owned by the same people that are hiding the wealth… There are only approximately six major media companies in America. Those are owned by the same kleptocrats that are hiding all these billions of dollars. They then put that story out there to deflect and confuse the average mainstream media watcher that “oh my Gosh, Russia is involved in this scandal! Russia is involved in Black Lives Matter! Russia is involved with Hillary losing the election because she is completely inept. Russia, Russia, Russia…”

Confidence.

• ‘$300 Million In Cryptocurrency’ Accidentally Lost Forever Due To Bug (G.)

More than $300m of cryptocurrency has been lost after a series of bugs in a popular digital wallet service led one curious developer to accidentally take control of and then lock up the funds, according to reports. Unlike most cryptocurrency hacks, however, the money wasn’t deliberately taken: it was effectively destroyed by accident. The lost money was in the form of Ether, the tradable currency that fuels the Ethereum distributed app platform, and was kept in digital multi-signature wallets built by a developer called Parity. These wallets require more than one user to enter their key before funds can be transferred. On Tuesday Parity revealed that, while fixing a bug that let hackers steal $32m out of few multi-signature wallets, it had inadvertently left a second flaw in its systems that allowed one user to become the sole owner of every single multi-signature wallet.

The user, “devops199”, triggered the flaw apparently by accident. When they realised what they had done, they attempted to undo the damage by deleting the code which had transferred ownership of the funds. Rather than returning the money, however, that simply locked all the funds in those multisignature wallets permanently, with no way to access them. “This means that currently no funds can be moved out of the multi-sig wallets,” Parity says in a security advisory. Effectively, a user accidentally stole hundreds of wallets simultaneously, and then set them on fire in a panic while trying to give them back. Some are pushing for a “hard fork” of Ethereum, which would undo the damage by effectively asking 51% of the currency’s users to agree to pretend that it had never happened in the first place.

That would require a change to the code that controls ethereum, and then that change to be adopted by the majority of the user base. The risk is that some of the community refuses to accept the change, resulting in a split into two parallel groups. Such an act isn’t unheard of: another hack, two years ago, of an Ethereum app called the DAO resulted in $150m being stolen. The hard fork was successful then, but the money stolen represented a much larger portion of the entire Ethereum market than the $300m lost to Parity. The lost $300m follows the discovery of bug in July that led to the theft of $32m in ether from just three multisignature wallets. A marathon coding and hacking effort was required to secure another $208m against theft. Patching that bug led to the flaw in Parity’s system that devops199 triggered by accident.

Lawsuit after lawsuit after lawsuit. At what point will we say it’s enough?

• Monsanto Sued By Brazilian Soybean Farmers Over GMO Seed (RT)

Growers in Brazil’s largest soybean producing state Mato Grosso have asked a court to cancel Monsanto’s Intacta GMO seed patent. They claim irregularities, including the company’s alleged failure to prove it brings de facto technological innovation. The Mato Grosso branch of Aprosoja, the association representing the growers, has filed a lawsuit in a federal court in Brasilia. The growers claim Monsanto’s Intacta RR2 PRO patent “does not fully reveal the invention so as to allow, at the end of the exclusivity period, for any person to freely have access to it.” That requirement “avoids that a company controls a technology for an undetermined period of time,” Aprosoja said, adding Intacta’s patent protection extends through October 2022. It cited data from consultancy Agroconsult, saying that about 53% of Brazil’s soy area was planted with Intacta technology in the 2016/17 crop cycle.

Around 40% of the crop is grown with Monsanto’s Roundup Ready seed technology (Intacta’s predecessor), and only seven% is non-GM. Brazilian farmers have been continually urging the replacement of genetically modified soybeans with non-GM seeds. Recently they asked Monsanto and other producers of pest-resistant corn seeds to reimburse them for money spent on additional pesticides when the bugs killed the crops instead of dying. Several years ago five million Brazilian soybean farmers sued Monsanto, claiming the genetic-engineering company was collecting royalties on crops it unfairly claims as its own. In 2012, the Brazilian court ruled in favor of the Brazilian farmers, saying Monsanto owes them at least $2 billion since 2004. After the legal disputes, Monsanto stopped collecting royalties linked to its first-generation Roundup Ready technology, and some farmers agreed to get a discount rate to use Intacta seeds.

How is Monsanto not a criminal enterprise?

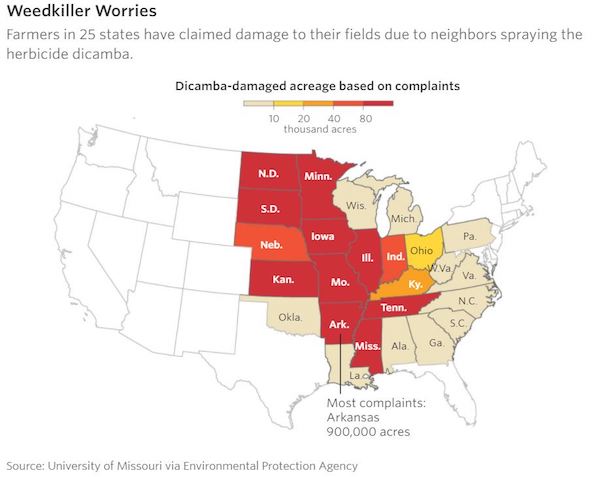

• Monsanto In Court Again: New Herbicide Kills 3.6 Million Acres Of Crops (ZH)

[..] as the Wall Street Journal points out today, after allegedly wiping out millions of acres of farm ground across the Midwest, Monsanto once again finds itself in a familiar spot: the courtroom. Monsanto’s new version of the herbicide called dicamba is part of a more than $1 billion investment that pairs it with new genetically engineered seeds that are resistant to the spray. But some farmers say their nonresistant crops suffered after neighbors’ dicamba drifted onto their land. The agricultural giant in October sued the Arkansas State Plant Board following the board’s decision to bar Monsanto’s new herbicide and propose tougher restrictions on similar weed killers ahead of the 2018 growing season. Monsanto claims its herbicide is being held to an unfair standard.

Arkansas has been a flashpoint in the dispute: About 900,000 acres of crops were reported damaged there, more than in any other state. About 300 farmers, crop scientists and other attendees gathered in Little Rock on Wednesday for a hearing on Arkansas’s proposed stiffer dicamba controls, which Monsanto and some farmers are fighting. The proposed restrictions are subject to the approval of a subcommittee of state legislators.

As we pointed out previously, the EPA has reported that farmers in 25 states submitted more than 2,700 claims to state agricultural agencies that neighbors’ dicamba spraying shriveled 3.6 million acres of soybeans. The herbicide is also blamed for damaging other crops, such as cantaloupe and pumpkins. The massive crop damage prompted Arkansas’s Plant Board to propose the idea of prohibiting dicamba use from mid-April through the end of October to safeguard growing plants. The state has also refused to approve Monsanto’s dicamba product for use in Arkansas, saying it needs further analysis by University of Arkansas researchers.

Of course, delays didn’t sit well with Monsanto which stands to make some $350 million a year in dicamba and related seed sales according to Jonas Oxgaard, an analyst with Bernstein who described the products as “their big moneymaker.” Meanwhile, farmers are exploring their own legal options with some joining a class-action lawsuit against Monsanto and BASF, seeking compensation for damaged crops.

Follow the money: ..the kingdom owes Hariri’s “Oger” company as much as $9bn..

• Lebanon PM’s Resignation Is Not All It Seems (Fisk)

When Saad Hariri’s jet touched down at Riyadh on the evening of 3 November, the first thing he saw was a group of Saudi policemen surrounding the plane. When they came aboard, they confiscated his mobile phone and those of his bodyguards. Thus was Lebanon’s prime minister silenced. It was a dramatic moment in tune with the soap-box drama played out across Saudi Arabia this past week: the house arrest of 11 princes – including the immensely wealthy Alwaleed bin Talal – and four ministers and scores of other former government lackeys, not to mention the freezing of up to 1,700 bank accounts. Crown Prince Mohamed bin Salman’s “Night of the Long Knives” did indeed begin at night, only hours after Hariri’s arrival in Riyadh. So what on earth is the crown prince up to?

Put bluntly, he is clawing down all his rivals and – so the Lebanese fear – trying to destroy the government in Beirut, force the Shia Hezbollah out of the cabinet and restart a civil war in Lebanon. It won’t work, for the Lebanese – while not as rich – are a lot smarter than the Saudis. Every political group in the country, including Hezbollah, are demanding one thing only: Hariri must come back. As for Saudi Arabia, those who said that the Arab revolution will one day reach Riyadh – not with a minority Shia rising, but with a war inside the Sunni Wahhabi royal family – are watching the events of the past week with both shock and awe. But back to Hariri. On Friday 3 November, he was in a cabinet meeting in Beirut. Then he received a call, asking him to see King Salman of Saudi Arabia.

Hariri, who like his assassinated father Rafiq, holds Saudi as well as Lebanese citizenship, set off at once. You do not turn down a king, even if you saw him a few days’ earlier, as Hariri had. And especially when the kingdom owes Hariri’s “Oger” company as much as $9bn, for such is the commonly rumoured state of affairs in what we now call “cash-strapped Saudi Arabia”. But more extraordinary matters were to come. Out of the blue and to the total shock of Lebanese ministers, Hariri, reading from a written text, announced on Saturday on the Arabia television channel – readers can guess which Gulf kingdom owns it – that he was resigning as prime minister of Lebanon. There were threats against his life, he said – though this was news to the security services in Beirut – and Hezbollah should be disarmed and wherever Iran interfered in the Middle East, there was chaos.

[..] Of course, the real story is just what is going on in Saudi Arabia itself, for the crown prince has broken forever the great compromise that exists in the kingdom: between the royal family and the clergy, and between the tribes. This was always the bedrock upon which the country stood or fell. And Mohamed bin Salman has now broken this apart. He is liquidating his enemies – the arrests, needless to say, are supposedly part of an “anti-corruption drive”, a device which Arab dictators have always used when destroying their political opponents.

Our friends.

• Saudi Arabia Is Blocking Aid To The World’s Worst Humanitarian Crisis

Saudi Arabia is stopping food and aid from getting into Yemen, in a move that the United Nations said will be “catastrophic” for a country already facing world’s worst humanitarian crisis. Saudi Arabia shut down all access points to Yemen by air, land, and sea over the weekend, in what they say is an attempt to to curb arms trafficking from Iran to Houthi rebels after an intercepted missile landed on the outskirts Riyadh. “The Coalition Forces Command decided to temporarily close all Yemeni air, sea and land ports,” the coalition said in a statement on the Saudi state news outlet SPA. The Kingdom’s lock down means critical humanitarian aid like medical supplies, food, and water, are not getting into the country. Aid workers decried the decision, warning of “dire” consequences for a country where millions of people rely on humanitarian aid to stay alive.

“Humanitarian supply lines to Yemen must remain open,” urged Robert Mardini, the International Committee of the Red Cross’s regional director for the Near and Middle East. “Food, medicine and other essential supplies are critical for the survival of 27 million Yemenis already weakened by a conflict now in its third year.” Mardini said that shipments of chlorine tablets, used to tackle the spread of cholera, were stopped at the country’s northern border. “That lifeline has to be kept open and it is absolutely essential that the operation of the United Nations Humanitarian Air Service (UNHAS) be allowed to continue unhindered,”Jens Laerke, a spokesperson for the UN Office for the Coordination of Humanitarian Affairs (OCHA) told reporters Tuesday.

It’s a wonder there’s any ice left.

• Antarctica Is Being Rapidly Melted From Below (Ind.)

There is something mysterious and hot lurking beneath the surface of the Antarctic ice. Now Nasa says that it might have found the source of that strange heating – a “mantle plume” – or upwelling of abnormally hot rock, that lies deep beneath the surface. The heat is causing the surface of the ice to melt and crack, resulting in rivers and other disruption to Antarctica. Around 30 years ago, a scientist at the University of Colorado Denver said that there might be a mantle plume under a region of the continent known as Marie Byrd Land. That hypothesis helped explain some strange features seen on the ice, like volcanic activity and a dome. Mantle plumes are narrow streams through which hot rock rises up from the Earth’s mantle, and then spreads out under the crust. Because the material itself is hot and buoyant, it makes the crust bulge upwards.

They explain how some places – like Hawaii and Yellowstone – have huge amounts of geothermal activity despite being far from the edge of a tectonic plate. But it was also an idea that was hard to believe, since the ice above the plume is still there. “I thought it was crazy,” said Helene Seroussi of Nasa’s Jet Propulsion Laboratory, who helped the lead work. “I didn’t see how we could have that amount of heat and still have ice on top of it.” Now scientists have used the latest techniques to support the idea. The team developed a mantle plume numerical model to look at how much geothermal heat would be needed to explain what is seen at Marie Byrd Land, including the dome and the giant subsurface rivers and lakes present on Antarctica’s bedrock.

Further guaranteeing the further demise of the country.

• Next Round Of Greek Pension Cuts To Reach Up To 18% In 2019 (K.)

The recalculation of pensions paid out to people who have already retired will likely lead to major cuts for pensioners of the former Traders’ Fund (TEBE/OAEE) and the civil servants’ fund, as well as those who used to work at banks and state firms. According to data presented to the country’s creditors by the Labor Ministry, three-quarters of the recalculations have been completed, while the process is expected to finish by year-end. The cuts will be implemented from January 1, 2019, but the country’s 2.6 million pensioners should learn by how much their income will suffer by the middle of next year, as Athens has told the creditors it will inform all pensioners by June 2018.

Legally, the cuts cannot exceed 18%, even if the pensioner’s so-called personal difference – i.e. the margin between the pension they secured in the past and the amount a new pensioner would receive – is greater. The law also provides for the abolition of allowances for spouses and children, which a large share of pensioners receive. Kathimerini understands the recalculation results will lead to major cuts mainly for pensioners who had high salaries but few years of service, as well as widows.

is there anyone is the EU left with a conscience?

• EU Parliamentarians Warn Refugees May Die on Greek Islands (GR)

The EU Council and the European Commission must work urgently with Greece to prevent a humanitarian crisis this winter, according to the he Progressive Alliance of Socialists and Democrats (S&D) Group in the European Parliament. The group called for a debate in the parliament’s plenary session next week in Strasbourg. “Thousands of people seeking asylum on the Greek islands still do not have adequate protection for the coming cold months,” said S&D Group President Gianni Pittella.

“Many are still sleeping in light tents designed for summer weather, without sleeping bags, on thin mats or even on the ground. EU governments need to immediately stop sending back refugees to Greece under the Dublin mechanism; which is creating further strain on the Greek asylum system. If we do not act and refugees die from the cold, as they did last year, then their blood will be on our hands.” Pittella was also quick to stress that all EU member states must fulfill their obligations to relocate refugees from Greece. “A legal decision has been taken by the EU, and this must be fully respected. Relocation is the only way of taking these people out of limbo and allowing them to get on with rebuilding their lives.”

‘We’ll get you eventually.”

• Facebook: God Only Knows What It’s Doing To Our Children’s Brains (Axios)

Sean Parker, the founding president of Facebook, gave me a candid insider’s look at how social networks purposely hook and potentially hurt our brains. Be smart: Parker’s I-was-there account provides priceless perspective in the rising debate about the power and effects of the social networks, which now have scale and reach unknown in human history. He’s worried enough that he’s sounding the alarm. Parker, 38, now founder and chair of the Parker Institute for Cancer Immunotherapy, spoke yesterday at an Axios event at the National Constitution Center in Philadelphia, about accelerating cancer innovation. In the green room, Parker mentioned that he has become “something of a conscientious objector” on social media. By the time he left the stage, he jokingly said Mark Zuckerberg will probably block his account after reading this:

“When Facebook was getting going, I had these people who would come up to me and they would say, ‘I’m not on social media.’ And I would say, ‘OK. You know, you will be.’ And then they would say, ‘No, no, no. I value my real-life interactions. I value the moment. I value presence. I value intimacy.’ And I would say, … ‘We’ll get you eventually.'”

“I don’t know if I really understood the consequences of what I was saying, because [of] the unintended consequences of a network when it grows to a billion or 2 billion people and … it literally changes your relationship with society, with each other … It probably interferes with productivity in weird ways. God only knows what it’s doing to our children’s brains.”

“The thought process that went into building these applications, Facebook being the first of them, … was all about: ‘How do we consume as much of your time and conscious attention as possible?'” “And that means that we need to sort of give you a little dopamine hit every once in a while, because someone liked or commented on a photo or a post or whatever. And that’s going to get you to contribute more content, and that’s going to get you … more likes and comments.”

“It’s a social-validation feedback loop … exactly the kind of thing that a hacker like myself would come up with, because you’re exploiting a vulnerability in human psychology.”

“The inventors, creators — it’s me, it’s Mark [Zuckerberg], it’s Kevin Systrom on Instagram, it’s all of these people — understood this consciously. And we did it anyway.”

Home › Forums › Debt Rattle November 10 2017