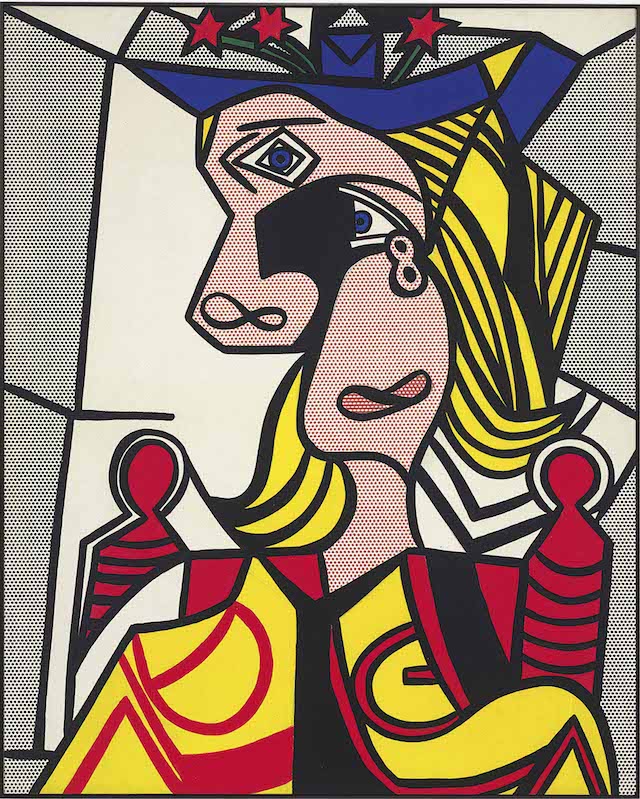

Roy Lichtenstein Woman With Flowered Hat 1963

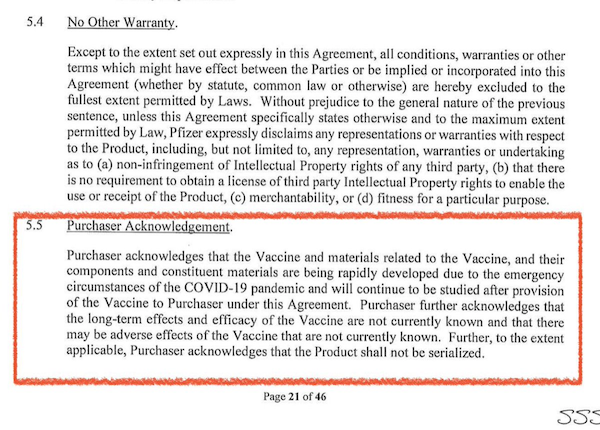

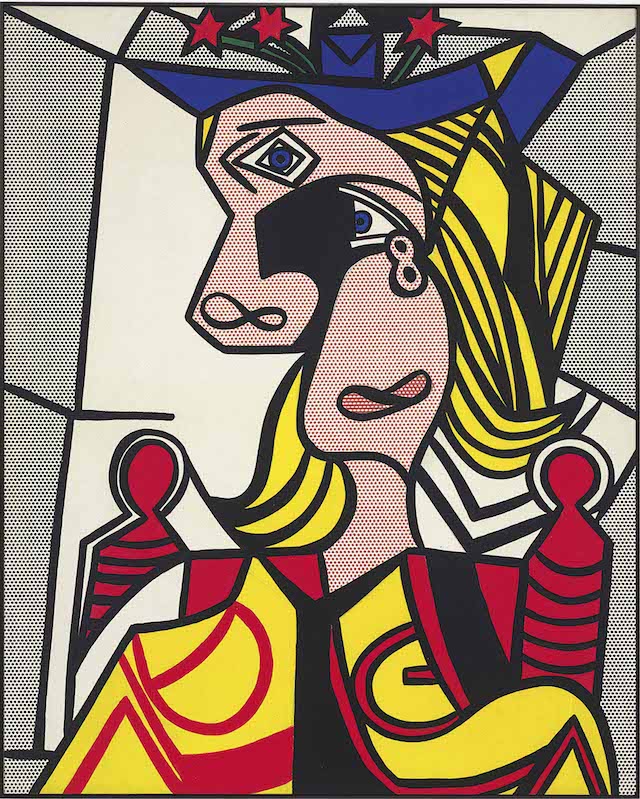

South Africa’s vaccine purchase agreement with Pfizer.

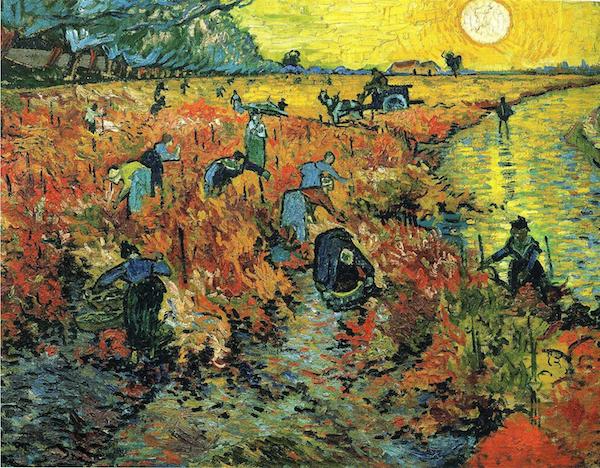

Churchill

Biden Serbia

Mike Johnson is the next designee for Speaker of the House

The Head of the Snake: Democide – Top Swiss banker Pascal Najadi

COVID VACCINES DO NOT SAVE LIVES. THEY HAVE CAUSED 17 MILLION DEATHS

“..many of whom have had only a few weeks of training in the maneuvers and coordination required for the invasion..”

• Israel Considers Flooding Hamas Tunnels Before Ground Operation – Hersh (Sp.)

Israel is looking into flooding Hamas’ tunnel system before starting its ground operation in the Gaza Strip, US investigative journalist Seymour Hersh said, citing sources. “A well-informed American official told me that the Israeli leadership is known to be considering flooding Hamas’s vast tunnel system before sending in its troops, many of whom have had only a few weeks of training in the maneuvers and coordination required for the invasion,” Hersh said in his column published on Substack. Hersh said Israel is in the process of turning Gaza City into rubble, via constant bombing, and is also planning to begin the ground invasion soon. Flooding the tunnels could mean that Israel was ready to “write off the hostages still in jeopardy,” Hersh said.

“Where the estimated 200-plus hostages are is an open question. Israel is only talking about the end of the Hamas regime and Hamas has so far released four hostages,” Hersh said.”The American official told me that the Israel leadership expects more to come soon.” Earlier on Tuesday, Israel’s Deputy Director General for Public Diplomacy Emmanuel Nahshon said that Israel is delaying the start of the ground invasion in Gaza due to possible “deadly traps.” The Israeli military is taking its time as it needs to prepare its soldiers for this unique situation, Nahshon added. Hersh further indicated the al-Aqsa Martyrs brigade joined the Qassam brigades – the military wing of Hamas – in the attack on Israeli kibbutzim and villages on October 7.

On the day of the attack on Israel, the Qassam brigades were not alone and were actually joined by al-Aqsa Martyrs brigades, a coalition of Palestinian armed groups that has been designated as a terrorist organization by the United States, Israel, the European Union and others, the article said on Tuesday, citing a US official. “We know,” Hersch cited the official as saying, “that the al-Aqsa Martyrs Brigade participated.” The participation of outside groups on Hamas’ side in the attack on Israel was likely one of the reasons why secret talks about a larger release of Israeli hostages were never successful, according to Hersh.

Read more …

“The notion that somehow peace is nefarious, that China is being unprincipled in that it’s trying to work for peace..”

• US Opposes Chinese Peace Mission in the Middle East (Tweedie)

The US has unmasked its true nature by blocking efforts by China and other nations to bring peace to the Middle East, says a peace activist. Chinese special envoy to the Middle East Zhai Jun said on Monday he had already visited Qatar and Egypt and would now travel to the United Arab Emirates, Saudi Arabia, Jordan and other countries in the region “to further strengthen coordination with relevant parties to promote ceasefire, end violence and mitigate the situation.” More than 5,700 civilians have been killed and some 18,000 injured in the besieged Gaza Strip by Israeli Defence Forces bombing since the armed wing of the Hamas movement launched a surprise attack into southern Israel on October 7. The victims include 2,360 children, almost 1,300 women and 300 elderly people.

Last week the US blocked UN Security Council motions moved by Russia and Brazil calling for an immediate ceasefire between Israel and the Palestinian territories and for civilians to be protected. Washington has also sent two US Navy aircraft carrier strike groups and a seaborne assault flotilla to the region to back up Israel. Peace campaigner KJ Noh told Sputnik that Washington was directly opposed to Beijing’s attempts to broker a peace deal between Israel, Hamas and other states and movements in the region. “China is using its good offices, scrambling to do shuttle diplomacy to try and de-escalate and find a peaceful resolution,” Noh said. “And the United States is saying: ‘Don’t even dare talk about de-escalation. Nobody mention a ceasefire’.”

“It only wants to make sure that whatever Israel does, it does it with a minimum of PR blowback,” he added. “And so it’s trying to mitigate the PR damage rather than prevent the horrific war crimes and atrocities that are sure to happen and that are already happening.” The writer said this was a “mask-off moment” when the West’s true nature was exposed to the nations of the global south. “The US could plausibly mystify many countries by pretending to be something that it was not,” Noh argued. “But when it came out all in favor of Israel’s violence and was ignoring the ground realities as well as international law, then at that point you can’t keep up the pretence any more.”

“Even the quisling leaders of US allies have had to make a conscientious statement because the outrage on the street, the outrage globally is so extraordinary that they cannot but speak up against what the US and Israel are doing,” he stressed. Western media has tried to dismiss China’s peace initiatives as an attempt to position itself as a geopolitical rival to the US — a narrative which Noh called “extraordinary”. “The notion that somehow peace is nefarious, that China is being unprincipled in that it’s trying to work for peace — China is on the side of peace. That much is clear because that it stands to gain from peace,” he said. “Everybody benefits from peace. It just is because China’s model is win-win cooperation,” Noh said. “On the other hand, the empire benefits from war. The US is built on more genocide, primitive accumulation and geopolitical oppression and bullying.”

Read more …

Peace is bad.

• Israel Unhappy With Russian Stance On Gaza War (RT)

The Israeli Foreign Ministry has conveyed to Russian diplomats their “displeasure” with Moscow’s position on the conflict with Hamas in Gaza, the public broadcaster Kan reported on Tuesday citing anonymous sources. “Russia’s conduct and the remarks against Israel don’t correspond with the severity of the situation Israel is in, which is a state of war,” Israeli diplomats reportedly told their Russian counterparts. West Jerusalem also expressed “displeasure with the role Russia is playing” in the war against Hamas and hope that Moscow will take “more balanced” positions, another ministry official told the Times of Israel newspaper. Moscow’s proposed resolution in the UN Security Council did not include “an explicit condemnation” of Hamas, and did not match President Vladimir Putin’s endorsement of Israel’s right to self-defense, according to the ministry.

Israel was subjected “to an attack that was unprecedented in its brutality, and it certainly has the right for defense, to ensure its peaceful existence,” the Russian leader said on October 13, just days after the Hamas incursion that resulted in more than 1,300 Israeli deaths. However, on the same occasion Putin noted that true peace can only be achieved when the Palestinians have a state of their own. He advised Israel not to react with “brutality,” noting that Gaza was home to around two million civilians, not all of whom supported Hamas, and argued that the proposed “total blockade” of the territory would be just as unacceptable as the siege of his home city during World War II. Russian Foreign Minister Sergey Lavrov has advocated for the immediate stop to the conflict, urging all parties to “respect international humanitarian law, prevent any terrorist actions and indiscriminate use of force.” He also called for the implementation of the UN-endorsed two-state solution to the conflict.

On Tuesday, Israeli diplomats called for the resignation of UN Secretary-General Antonio Guterres, after he told the Security Council that the Hamas attack “did not happen in a vacuum” and noted that the Palestinians had been “subjected to 56 years of suffocating occupation.” Israel’s ambassador to the UN, Gilad Erdan, accused Guterres of expressing “an understanding for terrorism and murder” and “compassion for the most terrible atrocities committed against the citizens of Israel and the Jewish people.” Israeli Foreign Minister Eli Cohen announced he would boycott meetings with Guterres again, adding that “after October 7th there is no room for a balanced approach. Hamas must be wiped out from the world!”

Read more …

“I cannot praise Xi Jinping because it would be as if I’m praising myself & that would be an embarrassing thing to do.”

• The Palestinian Tragedy: Cui Bono? (Pepe Escobar)

By now it’s fully established who is profiting from the ghastly Palestine tragedy. As it stands we have 3 wins for the Hegemon and 1 win for its aircraft carrier nation in West Asia. First winner is the War Party Inc., a massive bilateral scam. The White House’s $106 billion supplemental request to Congress for “assistance” especially to Ukraine and Israel is manna from Heaven to the weaponizing tentacles of the MICIMATT (military-industrial-congressional-intelligence-media-academia-think tank complex, in the legendary definition by Ray McGovern). The laundromat will be on a roll, including $61.4 billion for Ukraine (more weapons and replenishing of U.S. stocks) and $14.3 for Israel (mostly air and missile defense “support”).

Second winner is The Democratic Party engineering the unavoidable change of narrative from the spectacularly failing Project Ukraine; yet that will only postpone the upcoming humiliation of NATO in 2024, which will reduce the Afghan humiliation to the status of sandbox child playing. Third winner is setting West Asia on fire: the Straussian neocon psycho “strategy” conceived as a response to the upcoming BRICS 11, and everything in terms of Eurasia integration that was advanced at the Belt and Road Forum in Beijing last week (including nearly $100 billion in new infrastructure/development projects). Then there’s the vertiginous acceleration of the project sponsored by genocidal Zionist maniacs: a Final Solution to the Palestinian question, mixing razing Gaza to the ground; forcing an exodus to Egypt; the West Bank turned into a cage; and, at the most extreme, a “Judaification of Al-Aqsa” , complete with an eschatological destruction of the third holiest place in Islam, to be replaced by rebuilding the Third Jewish Temple.

Everything is of course interlinked. Vast swathes of the U.S. Deep State in tandem with the neocon-run “Biden” combo can ride the new bonanza side by side with the Israeli Deep State – their bubble protected by a massive propaganda barrage demonizing all forms of support for the Palestinian plight. Yet there’s a problem. This “alliance” has just lost – perhaps irretrievably – the overwhelming majority of the Global South/Global Majority, which is viscerally Palestinian. Very well-educated Palestinians living in Gaza and suffering throughout the Unspeakable, fiercely denounce the ambiguous roles of Egypt, Jordan and the UAE while praising Russia, Iran and among Arab nations, Qatar, Algeria and Yemen. All of the above spells out a stark continuity since the end of the USSR. Washington refused to dissolve NATO in 1990 to protect the immense profits of the weaponized tentacles of the MICIMATT.

The logical consequence has been the Hegemon and NATO as a Global Robocop, in tandem, killing at least 4.5 million people in West Asia while displacing over 40 million, then killing, by proxy, at least half a million in Ukraine and displacing over 10 million. And counting. In sharp contrast to the Empire of Chaos, Lies and Plunder, the Global South/Global Majority see the emergence of what a sophisticated Chinese scholar delightfully described as an “aristocratic bromance” at the center of the “present nexus of Universal History”. Exhibit A is provided by Vladimir Putin commenting, “I cannot praise Xi Jinping because it would be as if I’m praising myself & that would be an embarrassing thing to do.”

Read more …

“..any judge who heard a corruption case against Ben Netanyahu, who allowed it to go forward would be subjected to impeachment, removal. It makes Benjamin Netanyahu literally above the law.”

• Israel Failing in Global PR Campaign to Demonize Hamas – Scott Ritter (Sp.)

The latest claim to emerge about Hamas’ deadly border raid on October 7, which killed more than 1,300 Israeli civilians in several towns near the Gaza Strip, is that the Hamas militants were carrying plans for chemical weapons during the attack. In a broadcast on Sunday, Israeli President Isaac Herzog held up a document he claimed had been found in one of the settlements, across the front of which it says Al-Qaeda in bold white lettering. However, social media users quickly dissected Herzog’s claim, pointing out that the document he is holding is a biography of Ramzi Youssef, an Al-Qaeda member who carried out the 1993 World Trade Center bombing that killed six people, which was published by Al-Qaeda.

A former Al-Qaeda operative who turned coat and became a spy for MI6 told British media that one of the documents Herzog held up was a diagram of a simple bomb that was posted online by Al-Qaeda in 2009 and widely downloaded, but wasn’t instructions on how to make such a weapon. However, the Youssef biography doesn’t contain the image in question. Herzog’s claims follow rhetorical attempts by Israeli officials to link Hamas with terrorist groups like Al-Qaeda* and Daesh**, calling the October 7 attacks “Israel’s 9/11” and saying that if the US was justified in pursuing its War on Terror, then so is Israel justified in launching its all-out war on Gaza, which has killed more than 5,000 Palestinians as of Tuesday.

Former UN weapons inspector and weapons of mass destruction whistleblower Scott Ritter told Radio Sputnik’s The Backstory that in attempting to destroy Hamas, Israel has asked a question it is still unwilling to answer: “what is the ultimate cause of the violence on October 7?” Israel’s trying to undermine any claim to legitimacy that Hamas might have regarding why they carried out these attacks,’ Ritter said. “You know, Israel is not winning the PR campaign globally, primarily because of the heavy-handed manner in which they’ve responded to the attacks. And people, when they dig into the attacks, are trying to make the claim that you can’t cite self-defense when you’re the occupier. The occupier cannot ever claim a right of self-defense from the occupied. And there’s a larger debate going on right now about the history of Gaza, the history of the Israeli occupation, the history of abuse that’s transpired, etc.”

“So what they’re trying to do, the Israelis right now, is create a new aspect to this conversation, which is: Hamas is an extension of Al-Qaeda, because I believe the documents in question were Al-Qaeda documents, they weren’t original Hamas documents, but rather from an Al-Qaeda playbook. And so, again, as has happened before, they’re trying to make a nexus between – the United States did this – where we tried to link Al-Qaeda with [former Iraqi President] Saddam Hussein unsuccessfully because that was a lie. And now we have Israel tried to link Al-Qaeda and ISIS** with Hamas so that it will help, from their perspective, muddy the waters or anybody trying to say that Hamas had a legitimate right to attack Israel on October 7,” he explained. “Then, of course, the chemical weapons, let’s just be straight up on this here: anybody who knows anything about chemical weapons will tell you that somebody carrying a piece of paper from a handbook written by another agency in their pocket does not a chemical weapon make.”

“Remember, Benjamin Netanyahu, the prime minister of Israel, was teetering on the brink of political collapse prior to the Hamas action of October 7,” Ritter recalled. “He is a man who is under the shadow of some very serious corruption charges, charges which, again, you’re innocent until proven guilty in a court of law, but if there was a court of law of relevant jurisdiction who heard the case, he probably be found guilty – and he knows it, which is why he is collaborating with his party in the Knesset, the Israeli parliament, to change the Israeli Basic Law so that there is no longer a separate-but-equal branch of government called the judiciary, but rather a judiciary that is subordinated to the Israeli parliament. And the Israeli parliament can basically veto any judge that they disagree with. They can impeach at will. So any judge who heard a corruption case against Ben Netanyahu, who allowed it to go forward would be subjected to impeachment, removal. It makes Benjamin Netanyahu literally above the law.”

Read more …

X thread

• The Shit Show That Is The Israeli Army (Narwani)

Meanwhile in Israel, they’re like headless chickens running around. Here is retired General Yitzhak Brick on the shit show that is the Israeli army: “The current situation of the land forces is tragic, they are not ready for war. Emergency supplies are not available, exercises have stopped and the battalions have not trained in years. There is also no weapons training and education, and the army is not capable of carrying out an attack.” “We have lost the ability to field an effective army and have become a one-dimensional aerial power that cannot win a war on its own.”

“I know the army on the ground better than anyone. I have seen soldiers who do not take care of their weapons before leaving the base. No army in the world behaves like this. The soldiers carry their smartphones with them everywhere. Commands are sent via WhatsApp groups. These phones are being tracked by the enemy.” “Our system has lost all control. Have we gone crazy? I cannot sleep at night. Our ground forces and armored corps are not ready for war.”

Read more …

Lukewarm air is what it means.

• What Biden’s ‘New World Order’ Really Means (RT)

We all have that one friend who can’t stop arranging things – whether it’s matchmaking, dinner parties, or vacation itineraries programmed down to the minute. They just can’t kick back and take things in stride. The world has to revolve around them, on their time and terms. The US has been that guy for the world for the past several decades. Everyone’s tired of it. But now it has a new invitation – to a new world order. “I think we have an opportunity to do things, if we’re bold enough and have enough confidence in ourselves, to unite the world in ways that it never has been,” US President Joe Biden said at a fundraiser this month. Washington’s boldness and confidence has led to unilateral regime-change bombings, the arming of jihadist proxies in Afghanistan against the Soviets and in Syria against President Bashar Assad, and Azov neo-Nazis in Ukraine. None of that has made the world a better place – just more chaotic. It’s not like any of these places end up better off as a result.

“We were in a post-war period for 50 years where it worked out pretty damn well, but that sort of run out of steam. It needs a new world order in a sense,” Biden said. “Worked out pretty damn well” for whom? Surely not for Latin America, subjected to constant intervention by Washington in its own interests. Same with the Middle East for all those decades when it served primarily as America’s gas station. Or even for the European Union, much of which has gone from being a collection of independent-minded allies to mostly a monolithic vassal for US interests at the expense of its own. The same could even be said of my native Canada, whose economic interests were hindered by Biden himself when he unilaterally cancelled a critical $9 billion pipeline project (Keystone XL) upon election. That should have been the very last time that Canada banked its economic interests on American good faith. It won’t be, though.

The EU had its own critical pipeline of Russian gas (Nord Stream) blown up just a few months after Biden said, right in front of German Chancellor Olaf Scholz, that he’d find a way to “end” it if the Ukraine conflict popped off. Then, after Biden’s promises to help his European partners wean themselves off Russian cooperation in exchange for backing Washington’s strategy in Ukraine, reality is setting in for EU leaders that their own blind trust is going to cost them. Not only do they now suffer from an overdependence on American fuel that’s helping to drive inflation, but they’re also stuck with Biden’s Inflation Reduction Act that even further disadvantages European industrial exports, already suffering from high energy costs, to the benefit of US manufacturers. And not even a pleading visit by French President Emmanuel Macron to the White House and Congress has managed to move the dial.

Read more …

Then why continue to support them?

• Entire Global Arms Production ‘Not Enough’ For Ukraine – Minister (RT)

Western nations must be prepared to support Kiev against Moscow “for decades” and should build up their arms production accordingly, a Ukrainian minister has said, claiming that worldwide industrial capacity at its current levels was not sufficient. “The free world should be producing enough to protect itself,” Strategic Industries Minister Aleksandr Kamyshin told Politico on Monday, ahead of a planned announcement this week of a German-Ukrainian joint arms production deal. “If you get together all the worldwide capacities for weapons production, for ammunition production, that will be not enough for this war,” he added. Kamyshin was appointed to his job in March, as Kiev sought to secure the continued supply of arms and munitions to sustain its war effort.

At the time it was gearing up for a summer counteroffensive, for which the US and its allies provided tanks, armored vehicles and other military hardware. The push against Russian defensive lines has failed to produce any significant territorial gains, an outcome that some media have warned could undermine Kiev’s chances of receiving future assistance. With Israel now embroiled in a war with the Palestinian militant movement Hamas, competition for the dwindling reserves of Western arms has intensified. According to German media, Berlin intends to prioritize supplies to Israel over those meant for Ukraine. “What happens in Israel now shows and proves that the defense industry globally is a destination for investments for decades,” the Ukrainian minister argued. Kiev wants Western defense firms to open production lines on Ukrainian soil to ensure Ukrainian “self-sufficiency,” and has secured pledges from Germany and the UK to do so.

Moscow has warned that foreign-funded weapons factories in Ukraine would be considered legitimate targets for Russian missile strikes. Speaking in an interview in July, Ukrainian President Vladimir Zelensky claimed that no amount of aid would be “enough” for his nation, “as long as the war continues.” Moscow has described the conflict as a US-led proxy war against Russia, in which Ukrainians are used as “cannon fodder”. Last week, Russian President Vladimir Putin estimated Ukrainian materiel losses since early June as standing at “hundreds of tanks”and “almost 1,500 armored vehicles”. While the US government has pledged to keep arming Kiev, there is growing resistance against the policy in the opposition Republican party. Skeptics have cited the cost of the aid, as well as the lack of proper oversight, despite endemic corruption in Ukraine.

Read more …

What a difference.

• Russia’s External Debt-to-GDP Ratio at a Historic Low (Sp.)

Recent economic studies have revealed that Russia’s gross public debt to GDP ratio is currently at its lowest level in the nation’s history. According to Sputnik calculations, based on the figures provided by the Central Bank of the Russian Federation (Bank of Russia), the second quarter of 2023 saw Russia’s foreign debt-to-GDP dip below 15%. The indicator has been on a steady decline in recent years. It fell to 31% in 2020, 26.2% at the end of 2021, and just 16.6% last year. The first quarter of 2023 saw a modest decline to 15.45%. “In the second quarter of 2023, debt obligations continued to decline, reaching a total of 14.96%,” the calculations show. At the end of June 2023, gross external financial debt, both government and corporate, was estimated at $343.4 billion. Bank of Russia has also published data on external debt per capita in the second quarter of 2023. According to estimates, the figure decreased by 4% down to $2,300. This is the best indicator since 2006, when it was $2,200.

Read more …

Rose colored glasses?

• OPEC-Russia’s Share in Oil Supply to Exceed 50% by 2050 – IEA (Sp.)

Russia and OPEC petroleum exporting countries will continue to account for up to 48% of global oil supply until 2030 and exceed 50% by 2050, when Saudi Arabia boosts production, the International Energy Agency (IEA) said on Tuesday. “OPEC and Russia’s combined share of global oil supply remains between 45–48% to 2030 but it rises above 50% by 2050 as Saudi Arabia increases production,” the IEA said in a fresh World Energy Outlook. Total oil production by OPEC members is set to increase by 1 million barrels per day by 2030, given a decrease of about 1.5 million barrels per day by OPEC producers in Africa.

Russia’s output is projected to drop by 3.5 million barrels per day between 2022 and 2050, according to the report. OPEC+, the global alliance of oil producers led by Saudi Arabia and Russia, has been aggressively cutting crude supplies on the global market in recent months, citing uncertainties about demand. The Saudis have pledged to cut 1 million barrels per day until the end of the year, while Russia has said it will reduce daily supply by 300,000 barrels.

Read more …

She did go pretty crazy, along with Lin Wood. But is Trump to blame for having bad legal advice?

• Sidney Powell’s Plea Bargain Sets Up Trump for Conviction (PCR)

[..] one of President Trump’s attorneys, Sidney Powell, “pleaded guilty to six misdemeanor counts of conspiring to interfere with election duties and accepted a sentence of six years’ probation and a $6,000 fine. She must also write a letter of apology to the state and its residents and testify against her co-defendants, including her former client.” I will explain to you what this means. Sidney Powell found herself at risk at the hands of a black prosecutor and a black jury in Atlanta, Georgia in a jury trial. Powell already knew that the prosecutor was biased against her and reasoned the same from the black jury. Plea bargaining, which is what Sidney Powell has done, arose because prosecutors are more interested in their conviction rate than they are in innocence or guilt, and judges are more interested in clearing their dockets than in trials.

To aid their conviction rate, prosecutors have gained the power to withhold exculpatory evidence from the defendant and to bribe other defendants with reduced sentences or with money to testify falsely against the target defendant. This is what Sidney Powell has done. What this means for Trump is that one of his own attorneys has admitted guilt rather than to undergo the ordeal and risks of trial and has agreed in exchange to testify against Trump. So Trump’s own lawyer provides the black prosecutor and black jury (or white Democrat) with evidence to convict Trump. As I explained in my book, The Tyranny of Good Intentions in 2000, in a plea bargain a fictional crime is created and it serves as a substitute for the alleged crime. The fictional crime is a lessor one compared to the indictment crime.

The defense attorney tells the defendant to accept the plea deal he has negotiated and not risk a jury trial that will annoy both the prosecutor and judge, with a corresponding higher punishment if found guilty. Plea bargaining results in defendants admitting to what did not happen in order to avoid the more severe charges in the indictment, often orchestrated in order to coerce a plea. Cleary, plea bargaining permits prosecutors to build cases on speculation rather than on evidence. As I wrote in 2000: “It is only a short step from creating a fictional crime out of a real one to creating a fictional crime out of thin air. The step isn’t taken all at once. When he option of plea bargaining first surfaces, it is considered by everyone involved as a way of meting out punishment in a timely way. But with the passage of time, several things happen. ”

As Plea Bargaining takes over from jury trials, as it has, the investigative work that is the basis for the indictment is not tested by judge and jury. This permits prosecutors to bring charges for which they have little or no evidence. The public presumes that the prosecutor has a case, and the prosecutor uses the media to create a presumption of guilt. Newspaper and television reports from anonymous leaks from the prosecutor’s office, preceded by the phrase “according to sources familiar with the investigation,” create a presumption of guilt, reducing the defendant’s chance of an objective jury. It would be unusual for a jury to find innocent a person already convicted in the media.

Read more …

“It is not clear if she would tie Trump to a conspiracy or racketeering.”

• Jenna Ellis Admits to Criminal False Statements, Ominous for Trump (Turley)

The image most of us had of former Trump attorney Jenna Ellis was a remarkably cheerful mugshot after her arrest in the RICO case brought by Fulton County District Attorney Fani Willis. Ellis made a very different appearance today in state court as she pleaded guilty to intentionally interfering in the election process in the state of Georgia. While the impact of earlier pleas by figures like Sidney Powell is hard to judge at this stage, this plea has more ominous implications for the former president. Ellis offered a sobbing apology for her role in challenging the 2020 election and stated that

“as an attorney who is also a Christian, I take my responsibilities as a lawyer very seriously and I endeavor to be a person of sound moral and ethical character in all my dealings. … In the wake of the 2020 presidential election, I believed that challenging the results on behalf of President Trump should be pursued in a just and legal way. I endeavored to represent my client to the best of my ability…What I did not do, but I should, was make sure the facts that the other lawyers alleged to be true were in fact true. In the frenetic pace of attempting to raise challenges to the election in several states, including Georgia, I failed to do my due diligence.”

As with the other former Trump counsel, she will not face jail time and was charged with one charge of aiding and abetting false statements in writing. As part of the plea deal, Ellis will have to serve five years probation and pay $5,000 in restitution to the Georgia Secretary of State within 30 days. She will also have to complete 100 hours of community service, write an apology letter to voters in the state of Georgia and testify truthfully in future hearings regarding ongoing cases. Ellis is the type of plea that tends to concentrate the mind. Powell pleaded to relatively minor charges involving unauthorized access to voting machines and areas. Those charges tend to be easy to prove. It is not clear if she would tie Trump to a conspiracy or racketeering.

Ellis pleaded guilty to false statements that could conceivably implicate the President if she claims that he was aware of the falsity and facilitated the crime. Moreover, Ellis recently broke with Trump. She called him a “malignant narcissist” who cannot admit mistakes — and said that she would never vote for him again. The question is now whether Ellis will implicate Trump in this conspiracy. What is clear is that her plea will hold particular interest of Special Counsel Jack Smith in his parallel federal prosecution.

Read more …

“Countries like Brazil or India still want to transact with Russia. They can’t do it with dollars, so we’ve forced them to de-dollarize their transactions..”

• US Went ‘Overboard’ In Weaponizing Dollar – Musk (RT)

The United States has “overplayed” its hand in “weaponizing” the dollar with sanctions, pushing more countries around the world to slash transactions using the currency, Elon Mask has warned. “You’re now seeing a lot of countries de-dollar their transactions because we’ve forced it. And this goes beyond even Russia, China, and Iran,” the owner of X (formerly Twitter) said during a Twitter Spaces session hosted by American entrepreneur David Sachs on Monday. Musk highlighted a shift to trade in national currencies, especially among the BRICS nations, adding that it was not a choice made by these countries, but rather a necessity forced upon them by Ukraine-related Western sanctions against Moscow.

“Countries like Brazil or India still want to transact with Russia. They can’t do it with dollars, so we’ve forced them to de-dollarize their transactions, thus weakening the strength of the dollar in the world,” he explained. The weaponization of the greenback has pushed many nations to look for alternatives, after sanctions effectively cut Russia off from the Western financial system. A large number of prominent economists have repeatedly warned that the dominance of dollar-based financial institutions and aggressive US economic policy would prompt more nations around the world to abandon dollar transactions and move to local currencies in trade.

Read more …

1986

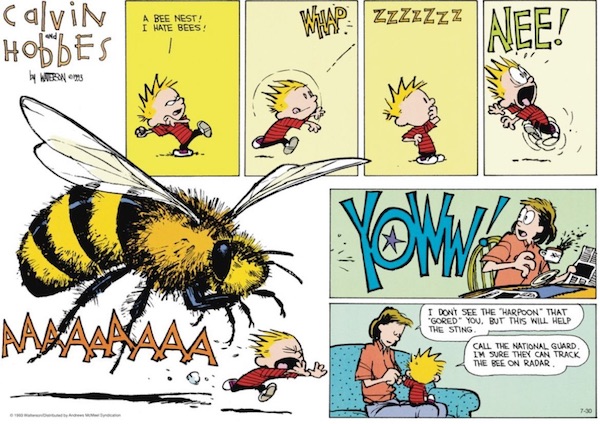

Eyes of the tiger

Goat?

https://twitter.com/i/status/1717046487882887349

Squid

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.