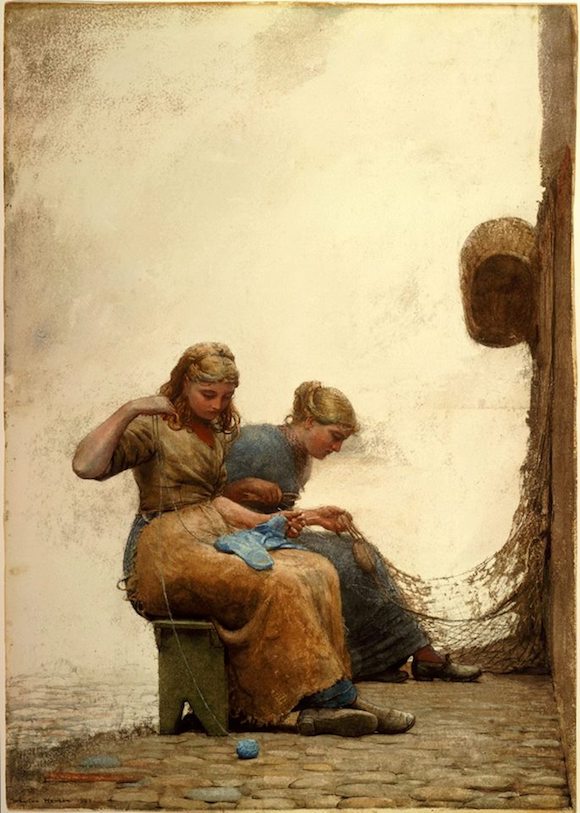

Winslow Homer Mending the nets 1881

Yes, it’s 10 years ago today, on January 22 2008, that Nicole Foss and I published our first article on the Automatic Earth (the first few years on Blogger). And, well, obviously, a lot has happened in those 10 years.

For ourselves, we went from living in Ottawa, Canada to doing a lot of touring starting in 2009, to support Nicole’s DVDs and video downloads. We visited Sweden, Slovakia, Czech Republic, Germany, Switzerland, Italy, Spain, Austria, Denmark, US of course, with prolonged stays in France, Britain, New Zealand, Australia, times that I miss a lot here and there, to now with Nicole settled in New Zealand and my time divided between Athens, Greece and the Netherlands.

We met so many people both online and in the flesh in all these countries it’s impossible to remember everyone of them, and every town we found ourselves in. Overall, it was a humbling experience to have so many people share their views and secrets, especially since we never stayed at hotels (or very rarely), we were always invited to stay with our readers. Thank you so much for that.

Since we started publishing 8 months before the fall of Bear Stearns, and we very much predicted the crisis that followed (we had been doing that before as well, since 2005 at the Oil Drum), we were the first warning sign for many people that things were going off the rails.

There are still to this day people expressing their gratitude for that. Others, though, not so much. And that has to do with the fact that governments, media and central banks came together to create the illusion of an economic recovery, something many if not most people still believe in. Just read the headlines and the numbers, on housing markets, stocks, GDP, jobs. Unfortunately, it was an illusion then and it still is now.

To get back to 10 years ago: Nicole and I decided to leave the Oil Drum because they didn’t want us to write about finance. Given what happened with Lehman while we were leaving, and as said with Bear Stearns later, it would appear that finance was indeed the hot issue back then, more than peak oil or associated themes.

The main reason we wanted to focus on finance was that we realized it was the most imminent of all the crises mankind faced and still faces. Energy and environmental issues are real and threaten our way of life, but before they hit us, the mother of all financial crises will.

What has changed, and increased, a lot over the past decade is the media. They have moved, more than before, into a kind of la la land where narratives are invented and presented with the express intention of keeping people feeling good about themselves in the face of all the distortion and disasters they face.

The big move in energy is not so much peak oil, but a meme of moving away from oil. ‘Renewable energy’ is all the fad, and it works, because it holds the promise that we can maintain our levels of energy consumption, and our lifestyles in general, pretty much up to some undefined moment in the future. For all you know, a seamless transition.

It’s a nonsense narrative, which originates not just in wishful thinking, but much more than that in widespread ignorance about what energy actually is and does, and what qualities oil and gas bring to the table that no other energy source can.

We must have written a hundred articles about such themes as energy return on energy invested (EROEI), and that the EROEI on renewables doesn’t allow for our present complex societies to continue as they are. Renewables are not useless by any means, but switching to them from oil will mean a huge simplification from our present lives. More than anything, probably, we have to ask if that would be such a bad thing.

But that is a question we avoid at all costs, because it is a threatening one. It implies we may have to do with less, and that’s not what we’re hardwired to do. Like any other species, we always want more. This is so ingrained in our world that our economies depend squarely on a perpetual need to strive for more tomorrow than we have today. Not as individuals, perhaps, but certainly as a group.

More trinkets, more gadgets, more energy. And for a -relatively- long time, more people. Relatively, because population growth is a recent phenomenon. It started at the very moment we began to have sources of ‘free’ or ‘surplus’ energy. Give any species a source of ‘surplus’ energy, and it will use it up as fast as it can, and proliferate to achieve that, until the surplus is gone. We are no different.

Of course, as the 2nd Law of Thermodynamics holds, the use of energy produces waste. More energy use produces more waste. One source may be slightly less polluting than another, but it’s thermodynamics that dictates the limits here. No energy source is fully renewable, and clean energy is just an advertizing term. And with an energy return too low to run complex societies on, those are hard limits. The only way out is to use less energy, but our economic models are geared towards the opposite, as are our brains.

Meanwhile, we’re saddling our children with the consequences of our prolific use of energy. Species extinction runs a hundred or a thousand times faster than is ‘natural’, ever more of our arable land is too polluted or wasted to produce food, and the grand mass of plastics in our oceans exceeds that of the living creatures that fed us for a very long time, taking the numbers of these creatures down so fast our grandchildren will have to eat jellyfish.

Ironically (and there’s lots of irony in the story of our tragic species), we produce more food per capita today than ever before, but its distribution is so warped that one group of us throw away more than we consume, while another goes hungry. And to top it off, much of what we eat lacks nutrition, and is often even downright toxic for us; it makes us fat and it makes us sick.

Then again, our entire environment is also fast becoming toxic. We’re a bloated, obese, asthmatic, allergic and cancer-riddled species, and yet we call ourselves a success. It’s all about the narrative.

But as Nicole and I said 10 years ago, and still do, it’s finance that will be the first crisis to hit. It will hit so hard it’ll make any other crises, environment and energy, feel like an afterthought. Pension plans across the board will prove to be a Ponzi, housing will collapse, shares will crumble, scores of people will lose all their savings and their jobs, their homes.

This is because, in an ostensible effort to ‘save’ our societies and economies, our -central- bankers and politicians decided to put everything on red, and loaded another $20 trillion into the upper shelf of the financial world, the very shelf that was most rotten to begin with in more than one sense of the word. And they’re not the ones paying the heftiest price for this stupidest bet of all times, you are.

All in all, the only possible conclusion we can draw is that in the past 10 years, things have indeed changed. Thing is, they have changed for the worse. Much worse. And the recovery narrative can’t and won’t hold. Question is who realizes this, and what they are planning to do with the knowledge.

Friend of the Automatic Earth Nomi Prins said recently that in her view, the Fed is scared to death of causing a global financial crash. I think they may have recognized the inevitability of that crash quite a while ago, and they’re working to minimize the impact on themselves and their buddies and masters.

A global central bank tightening looks an easy sale now that people have swallowed the recovery myth whole. The crash that will lead to might take long enough to develop for them to deny any responsibility.

And then we’re all on our own. The political ramifications will be gigantic. Because the incompetence and corruptness of incumbent politicians will be exposed, and governments overthrown.

Nothing we couldn’t have, and didn’t, see coming in January 2008. Best advice today, as it was back then: get out of debt.

And thank you so much for 10 years of reactions, responses, comments, your hospitality, and all other forms of support -including financial of course.

Home › Forums › 10 Years Automatic Earth