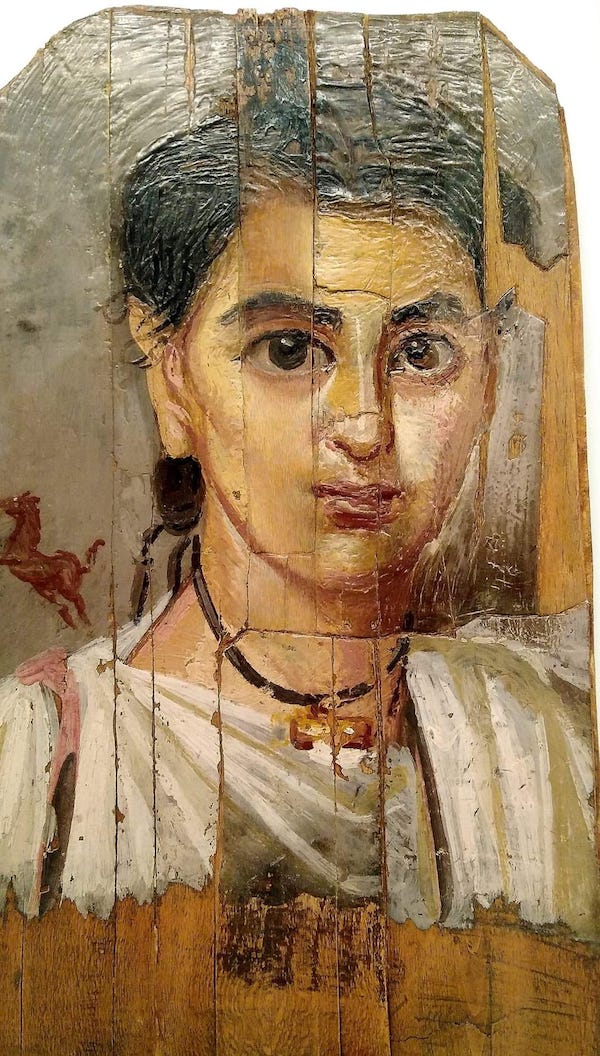

Fayum mummy. Portrait of a boy, with a golden pendant. between 50 BCE and 250 CE

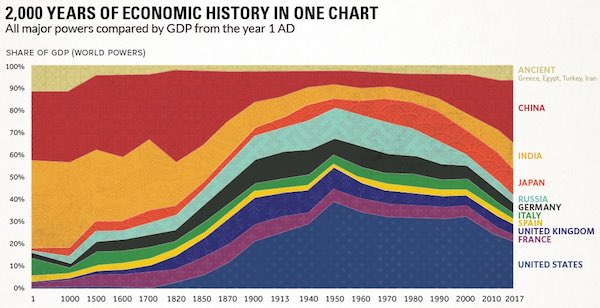

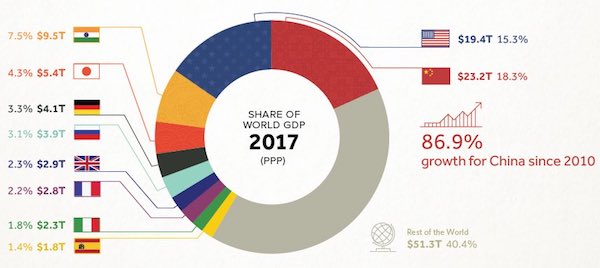

Macgregor China

https://twitter.com/i/status/1651690488502665216

Dunham Biden

https://twitter.com/i/status/1652003123479625732

Megyn Kelly Tucker

Former Top Fox News host and insider Megyn Kelly reveals Tucker not actually FIRED from Fox yet— This is what's REALLY happening…

— Benny Johnson (@bennyjohnson) April 27, 2023

Putin Russian jews

Can any Russians confirm this?#UkraineRussiaWar️ pic.twitter.com/ChddyvEdpg

— Lucas Gage (@Lucas_Gage_) April 27, 2023

RFK climate

Robert F. Kennedy Jr Clarifies His Position on Climate Change & Pollution

"Climate issues and pollution issues are being exploited by the World Economic Forum and Bill Gates and all of these mega-billionaires the same way that COVID was exploited – to use it as an excuse to… pic.twitter.com/xcQkCQcG52

— Chief Nerd (@TheChiefNerd) April 28, 2023

“Russian T-14 “armata” tanks that were sent to the zone of special military operations in Ukraine are equipped with modern weapons and can be invisible to the enemy, writes the British newspaper “The Sun”. “Russian experts have produced special camouflage coverings ‘mantles’ for T-14 tanks, which absorb radar waves and at the same time repel and disperse them,” the article states.”

“Let’s hope Europe does not become again the slaughterhouse it was in the last century.”

• On War and Wars (James Howard Kunstler)

Ukraine is the last in a string of hapless military adventures that has exhausted America’s credibility in the world, especially as regards our military superiority. (Think: Russia’s Kinzhal hypersonic missile.) There will be many unexpected consequences of that failure. One will be the crack-up of NATO, which has only been a false front for American military power. Germany couldn’t fight its way out of a duffle bag with what it’s got, and it is supposedly Europe’s leading economic power. The sad truth is that it will stop being any kind of power without the cheap Russian Natgas it was running on, and later this year Germany will be in a panic to try and restore its horribly damaged trade relations with Russia to get that natgas. Since NATO’s essential mission is to oppose Russia on everything, that will be the end of NATO. Europe will return to what it has always been: a region of squabbling national interests. Let’s hope Europe does not become again the slaughterhouse it was in the last century.

The failure of the Ukraine project could easily stimulate a collapse in Europe’s banking system, which would instantly spread to America’s banking system as obligations dissolve and payments stop. The net effect of all that will be the vanishing of a whole lot of capital, including the money in bank accounts, the money invested in stocks and bonds, the money lodged in pension plans, and the money controlled by insurance companies. As I’ve mentioned before — it’s worth repeating — you can go broke two ways: you can have no money, or you can have money that’s worthless. We’ve been steadily following the latter path through the “Joe Biden” years, but we’re close to simply not having money at all. Being broke will get Americans’ attention. And the first place they’ll look is the party in power.

\Multiple scandals have finally caught up to “Joe Biden” and are escaping the formidable suppression apparatus erected by the Deep State’s legal department. Attorney General Merrick Garland himself is now directly implicated in obstruction of justice by an IRS whistleblower. The allegation is that Mr. Garland interfered in the case against Hunter Biden in the Delaware US attorney’s office and lied about it to Congress. On top of that comes a new allegation, with hard documentary evidence (testimony by former Acting CIA Director Mike Morell), that Secretary of State Antony Blinken and National Security Advisor Jake Sullivan arranged, as “Biden” campaign officials in 2020, for fifty-one intel officers, including five retired CIA directors, to sign a phony letter denouncing the Hunter laptop as a Russian disinfo project, knowing it to be untrue. A case can be made for that amounting to election interference.

“We are not going to crawl under the covers with them. But we’re not going to follow their rules either.”

• Russia Won’t Play By ‘Rules’ Invented By Anyone – Putin (RT)

Moscow will not abide by the “so-called rules” invented and imposed by “certain countries,” Russian President Vladimir Putin said on Friday, as he delivered a speech at a meeting of Russia’s Council of Legislators in St. Petersburg. Russia is currently enduring “economic aggression” from the collective West, Putin stated, urging the legislators, as well as other branches of the country’s authority, to work proactively rather than try to “wait out” this difficult period. The ultimate goal is creating a “basis for the long-term, independent, and successful development of our country,” he emphasized. The international diplomacy system has eroded greatly as of late, with “certain countries” imposing their own “rules” instead, Putin noted. “Our partners, or, one might say, already former partners, in some countries are maniacally destroying the legal framework and channels of communication, trying to impose their views and so-called rules on everyone. What are the rules? … Nobody saw them,” he stated.

“They’re writing something under the covers and they themselves are doing something with that under the covers. We are not going to crawl under the covers with them. But we’re not going to follow their rules either.” At the same time, Russia does not want to go into “self-isolation” and remains ready to cooperate fairly with “friendly countries,” Putin explained. “We will expand pragmatic, equal, mutually beneficial, exclusively partnership relations with friendly countries in Eurasia, Africa, and Latin America.” He noted that Russia has “many like-minded people” in the countries of the collective West, including the US. “Yet, the elites behave differently. But you and I know that the elites of these countries do not always pursue a policy aimed at the best interests of their own people. This will come around to haunt them,” he warned.

“..some 85% of the world’s population are reluctant to pull the chestnuts out of the fire for former colonial powers..”

• Lavrov Points To Failed US-led Attempts To Isolate Russia (TASS)

Efforts by Washington and its satellites to isolate Moscow are failing completely, with the global majority being unwilling ‘to pull the chestnuts out of the fire’ for former colonial powers, said Russian Foreign Minister Sergey Lavrov. Addressing the online Global Conference on Multipolarity on Saturday, Russia’s top diplomat said, “It seems only natural that efforts by Washington and its satellites to reverse the course of history and force the international community to live up to a ‘rules-based world order’ have failed. I will only mention the completely failed course toward isolating Russia that the Westerners have been pursuing.”

“The majority of countries inhabited by some 85% of the world’s population are reluctant to pull the chestnuts out of the fire for former colonial powers,” he added. Ahead of the conference, the Russian Foreign Ministry pointed out that the event would once again make it possible to heed politicians, public dignitaries, journalists, and academic and cultural figures from around the world, who stand up for multipolarity, and for fairer and more democratic inter-state relations.

“The Russian people are getting killed with targeting done by the US, money [provided] by the US, weapons [supplied] by the US, and by the hands of a regime that was brought to power by the US ..”

• US Helping To ‘Kill Russians’ – Zakharova (RT)

The US is directly contributing to the deaths of Russians by providing military and financial aid to Ukraine, Russian Foreign Ministry spokeswoman Maria Zakharova claimed on Friday. She was reacting to a Kommersant interview with Lynne Tracy, the US ambassador to Moscow, who stated that Washington “does not view Russians as enemies.” “The Russian people are getting killed with targeting done by the US, money [provided] by the US, weapons [supplied] by the US, and by the hands of a regime that was brought to power by the US as a result of a coup orchestrated by the US,” Zakharova wrote on Telegram, referring to the Western-backed 2014 uprising in Kiev that ousted the democratically elected president, Viktor Yanukovich.

In an interview published in Russian newspaper Kommersant on Thursday, Tracy said she supports informal contacts between Americans and Russians, and that the US “does not want to ‘cancel’ the Russian people in any way.” “No matter what differences we, the United States, have with the Russian government, they are not differences with the people of Russia,” she said. The Foreign Ministry later issued a statement criticizing the ambassador’s interview, in which it accused Tracy of cherry-picking and fabricating facts about Ukraine’s recent history. The US diplomat claimed that “a situation in which a leader who lost support and got scared of his own people takes a decision to flee” could not be called a coup.

“Madam Ambassador probably does not know and was not informed by her aides that this simple puzzle… lacks the truth and correct sequence of events,” the ministry said. The statement went on to explain that the protests in Kiev were infiltrated by violent extremists supported by US officials, and ended with a power-sharing agreement that the opposition forces immediately broke. Tracy’s failure to acknowledge the nature of the events in Kiev can be explained by either amnesia or ignorance, while her description has nothing to do with reality, the Russian ministry added. The statement included a screenshot of the interview with a large red ‘FAKE’ stamp on it.

Washington imposed sweeping sanctions on Moscow shortly after Russia launched its military operation in Ukraine in February 2022. The US and many other NATO countries have since supplied Kiev with heavy weapons, including tanks and artillery systems, and shared intelligence with Ukraine. The State Department said in January that it was up to Kiev to determine how to use foreign arms. Russia has warned that the military aid makes the US and NATO de facto direct participants in the conflict. Moscow also repeatedly accused Ukraine of using US-made weapons, such as HIMARS multiple rocket launchers and M777 howitzers, to kill civilians. On April 13, Ukrainian troops used HIMARS launchers to shell a hospital in the Donbass city of Svatovo, local officials said. On Thursday, several areas in the Donetsk People’s Republic were hit with rockets and artillery rounds, leaving one woman dead and eight people, including four children, injured, according to the authorities.

“We lost our best people – those who died and those who were taken out of the fight because of injuries..”

• Western Arms May Not Be Enough, Ukrainian Troops Tell NYT (RT)

Ukrainian troops on the frontline are concerned that even with all the military assistance from the US and its allies, their Russian opponents still have an advantage, The New York Times has reported. “I don’t know where the Russians are getting so much artillery,” a 43-year-old private named Pavel, who is deployed near the Donbass city of Ugledar, told the US newspaper. “And there are also tanks, helicopters, and jets. The guys can’t get in and out of their positions, the firing is so heavy,” he complained. “We can’t go up against them with rifles. We need heavy equipment on the ground and support in the air.” Kiev is expected to launch a counteroffensive against Russia within weeks, utilizing tanks, armored vehicles, and other heavy weapons provided by Western nations.

Ukrainian Defense Minister Aleksey Reznikov said on Friday that his troops were ready to push forward when the order comes from the military leadership. A company commander, who uses the callsign Dolphin, told NYT that his men had high morale and wanted to go on the offensive, despite the numbers not being in their favor. “We lost our best people – those who died and those who were taken out of the fight because of injuries,” he said of the unit’s recent action against Russian forces. “But there is one but,” he added. “There are more of them, but we’re stronger.”

Another fighter, a 23-year-old sergeant by the name Michael, described a lack of training in operating Western weapons. He is the only one in his company who knows how to properly use a US-made Mk-19 grenade launcher, the article said. “At the time it entered into service with the Ukrainian armed forces, there were no instructors who could explain how to work it,” he said. “The manuals were only in English and in the Ukrainian military few speak English.” Michael, according to NYT, has five years of experience with grenade launchers and is sharing it with others. Moscow cited the creeping expansion of NATO into Ukraine and a growing threat to Russian national security stemming from it, as one of the key reasons for launching its military operation in February 2022.

The Institute for the Study of War is this war’s go-to think tank in media all over. They should really be called the Institute for the Promotion of War.

• ISW: Ukraine Can Expel Russian Troops From Country With Counteroffensives (Az.)

Enabling further successful Ukrainian counteroffensives will deny the Kremlin a breather to replenish its resources, will further deplete Russia’s offensive potential, and eventually enable Ukrainian forces to expel Russia from Ukraine, said the US Institute for the Study of War (ISW), Report informs. According to ISW, the Kremlin’s plan for a quick war has failed: “The Kremlin’s ability to sustain a long war in Ukraine is not a given — it disproportionately depends on whether Russia gets the time and space to rebuild its capabilities. Russia’s ability to reconstitute its military capability is currently constrained. The Kremlin invaded Ukraine with insufficient resources which it has further exhausted to secure only limited gains. The Kremlin is trying to replenish its resources but is still pursuing half-measures below full national mobilization to regenerate its forces and mobilize its defense industrial base.”

The ISW noted that Russia may be weakened but the Kremlin’s intent regarding the US and NATO remains the same: “Russia not only seeks to eradicate Ukrainian statehood, but also to control other states in the region, such as Belarus and Moldova, and eventually link Russian military gains across the former Soviet Union. Putin still seeks to neutralize NATO and undermine the US. The Kremlin is rallying Russian society for a long fight against the West.

Resnikov is minister of Defense.

• Reznikov: If Russia Capitulates, Ukraine Is Ready To Start Negotiations (Az.)

Oleksii Reznikov: If Russia agrees to capitulation, Ukraine is ready to start negotiations, Defense Minister Oleksii Reznikov said at a press conference, Report informs via UNIAN. According to him, the partners do not discuss the issue of peace: “Because they know very well that Ukraine will not talk to the current Russian leadership. However, negotiations on the capitulation of Russia and the payment of reparations are possible.”

Bakhmut

Civilians evacuated from #Bakhmut tell about the war crimes committed by the Ukrainian Army:

– That is, everything that was shown and told about Mariupol, the same thing happened with us.

– As for us, they called us… What did they call us?

“Waiters”. And they said: waiting… pic.twitter.com/QUHMpReGhH— Mats Nilsson (@mazzenilsson) April 28, 2023

“The goal of the US and its allies is to undermine the emerging multipolar world and preserve their dominance..”

• US Blackmails Nations Into Fighting Moscow And Beijing – Shoigu (RT )

Washington resorts to various forms of coercion as it pushes to create regional alliances aimed against its geopolitical rivals, including Moscow and Beijing, Russian Defense Minister Sergey Shoigu has said. He was speaking to his counterparts representing other members of the Shanghai Cooperation Organization (SCO) at a meeting in New Delhi. “Unprecedented pressure is being applied to independent nations through the use of open blackmail, threats, ‘color revolutions,’ coups, and dissemination of blatant disinformation. All those tools long ago became the Western calling card,” the minister said on Friday. The goal of the US and its allies is to undermine the emerging multipolar world and preserve their dominance, according to Shoigu.

Washington chose to dismantle the system of global security in pursuit of its ambition and withdrew from multiple treaties with Russia, the minister told his audience. Shoigu said that Moscow had attempted to defuse tensions with NATO through diplomacy in 2021, but its proposals were rejected by the West, proving that it is unwilling to have a partnership of equals with Russia. “Today, Washington and its accomplices are executing a strategic plan to provoke other nations into military confrontation with the states they don’t like, primarily Russia and China.” The minister interpreted the Ukraine conflict as a vivid example of American “criminal policy.” The US goal in it is to “inflict a strategic defeat on Russia, create a threat to China and preserve its [hegemonic] position,” said Shoigu.

The official blasted Western supplies of weapons to Kiev, stating that they only prolong hostilities and create additional risks to Europe and the entire world. He said the arms “make their way to the black market and further into the hands of terrorist organizations.” The SCO, a Eurasian intergovernmental organization, includes China, India, Kazakhstan, Kyrgyzstan, Pakistan, Russia, Tajikistan and Uzbekistan among its members.

https://twitter.com/i/status/1651888112916922370

“Serbia will painstakingly maintain its military neutrality and defend its freedom on its own. This is our choice..”

• Serbian President Vucic Vows Country Will Not Join NATO (TASS)

Serbia’s President Aleksandar Vucic has promised the Serbs that the country will not join NATO as long as he remains the head of state. “Serbia today is one of the few countries with its own policies. It’s independent and free-thinking,” Vucic said while addressing a crowd of local residents in Sokobanja on Friday. “As long as I am president, and this will [last] another four years, and as the commander-in-chief, I guarantee you that Serbia will not join NATO or any other military bloc.” “Serbia will painstakingly maintain its military neutrality and defend its freedom on its own. This is our choice,” Vucic concluded. Earlier, Vucic stressed that Western representatives in their calls on Serbia to join NATO were referring to a global threat from Russia. Vucic stated separately that his country could not join the alliance because “NATO threatened” Belgrade. In particular, he added that it was representatives of the West that “intruded into Serbia’s territory” and were killing its people.

Don’t underestimate Orban

https://twitter.com/i/status/1651971665973108740

“US Customs and Border Patrol warned in a memo that “Ukrainian nationalist groups including the Azo[v] Movement are actively recruiting racially or ethnically motivated violent extremist-white supremacists to join various neo-Nazi volunteer battalions.”

• UK Allegedly Censored Report On British Neo-nazis Fighting In Ukraine (RT)

A British intelligence report on the global threat of right-wing terrorism includes a completely redacted section on ‘returning foreign fighters’ from an unnamed European country, highly likely to be Ukraine. Published last July, the Intelligence and Security Committee of Parliament’s report on ‘Extreme Right-Wing Terrorism’ gave British lawmakers an overview of the threat posed by right-wing radicals at home and abroad. Drawn from material provided by Britain’s multiple intelligence agencies, including MI5 and MI6, the report totals 130 pages and includes detailed sections on right-wing violence in northern Europe and North America. However, one section that follows those on northern Europe and the US and Canada is entirely redacted, its six paragraphs replaced by asterisks.

A semi-redacted paragraph beneath offers some further context. It states that British intelligence officers are concerned that “There is no process in place to monitor those ‘G***’ individuals who have travelled overseas for Extreme Right-Wing Terrorism-related purposes and have returned to the UK. It notes that “there is a strong possibility that these returning foreign fighters, some of whom may have fought ***, will have been further radicalised” while in the unnamed country, and will have “developed connections with others who share their Extreme Right-Wing ideology.” “There is little doubt that for *** we are talking about interesting details of the situation in one of the countries of Eastern Europe,” Russian journalist and Kremlin critic Max Solopov wrote on Telegram on Thursday.

“Especially considering that the UK is the most involved country in the Ukrainian conflict after Russia.” Extremist ideology in Ukraine was covered extensively by the Western media before the start of Russia’s military operation last February. White supremacists from Germany, the US, UK, Scandinavia, and elsewhere traveled to Ukraine from 2014 onwards to join the neo-Nazi Azov militia, which would go on to be formally integrated into the Ukrainian military. When the trickle of foreign fighters into Ukraine increased to a deluge last year, US Customs and Border Patrol warned in a memo that “Ukrainian nationalist groups including the Azo[v] Movement are actively recruiting racially or ethnically motivated violent extremist-white supremacists to join various neo-Nazi volunteer battalions.”

“What kind of training are foreign fighters receiving in Ukraine that they could possibly proliferate in US based militia and white nationalist groups?” the document asked, noting that this was an “intelligence gap” faced by US law enforcement at the time. Shortly before Russia’s military operation began, UK counterterrorism police were deployed to British airports to question people traveling to Ukraine. According to The Guardian, officers were looking to identify “far-right extremists” seeking weapons training and military experience. Such reports have since vanished from the Western media, replaced by stories sympathetic to foreign volunteers and articles downplaying the Azov Regiment’s neo-Nazi roots.

“a partisan political ploy” that endangers the national security of the US, its allies in Europe, and “the courageous Ukrainian people.”

• US Pushed To Disclose Number Of Troops In Ukraine (RT)

A resolution demanding President Joe Biden and the Defense Department inform Congress of troop deployments in Ukraine and plans for future military aid was approved on Friday by the Foreign Affairs Committee of the US House of Representatives. The committee voted along party lines, 22-20, in favor of the proposal by Congressman Matt Gaetz, a Florida Republican. Gaetz called the vote a “big win for accountability” and accused Democrats of being afraid of “truth and transparency on aid to Ukraine.” Under the terms of his privileged resolution, the White House and the Pentagon would have 14 days to send the House “copies of all documents indicating any plans for current or future military assistance to Ukraine and documents indicating whether any US Armed Forces, including special operations forces, are currently deployed in Ukraine.”

During the debate on the resolution, earlier this week, members of Biden’s party accused Gaetz of serving the interests of Russian President Vladimir Putin, “amplifying Russian propaganda” and threatening the bipartisan consensus in Congress that support for Ukraine must be “unwavering and indefinite.” Congresswoman Kathy Manning, a North Carolina Democrat, called the resolution “divisive and ill-advised” as well as “a partisan political ploy” that endangers the national security of the US, its allies in Europe, and “the courageous Ukrainian people.” Her colleague Gerry Connolly of Virginia accused Gaetz of wanting to force a peace on Kiev, and argued that there might be a time for oversight, “but now is not that time.”

Florida Republican Cory Mills, a military veteran, countered that the resolution was not against supporting Ukraine, but ensuring there is no “mission creep” like with Afghanistan or Iraq, where he spent a total of ten years and got “blown up twice.” Proposing the resolution earlier this month, Gaetz pointed to the leaked Pentagon documents to accuse Biden of “misleading the world on the state of the war in Ukraine” and demanding “total transparency” when it came to risking “war with a nuclear adversary.” The resolution now goes to the House floor, where Republicans have a slim majority. However, a significant faction within the party agrees with the Democrats and the White House on unconditional support for Kiev.

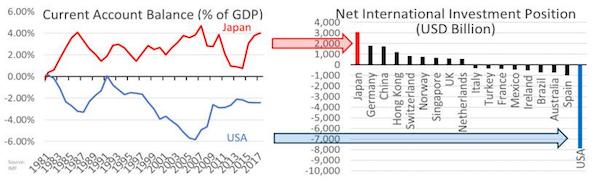

“Perhaps the current changes are the most significant in the last few hundred years.”

• Increasingly Frenetic Diplomatic Maneuvering Reshapes World Order (Bordachev)

There is no doubt that the world is undergoing a major transformation. Perhaps the current changes are the most significant in the last few hundred years. This is all the more so, because never before in the history of international politics has it involved so many actors with different historical and cultural backgrounds. This means that we are not talking about another redistribution of power within a limited circle of states, but about a much broader phenomenon. In practice, however, these sweeping changes have led to a highly paradoxical situation: Diplomacy is heavily influenced by tactical maneuvering rather than strategic considerations. This is particularly evident in Western behavior, but most others are no exception. Even the actions of powers such as China or Russia, which in many ways are genuine examples of diplomatic conservatism, show signs of contextual concerns.

But what about small and medium-sized countries, especially those that have become known for their skillful tactics in making the most of ambiguous international situations? In other words, it is not only the leading states, which are really the ones who will determine the composition of the new world order, but also the smaller opportunists who are now in a constant state of maneuvering. In popular analysis, the capacity for continuous jostling for position is now generally regarded as an attribute of medium-sized states occupying an intermediate geopolitical position, but it is the large countries that are the true masters of this genre. Western Europe, despite its long-term commitment to transatlantic relations, is certainly in the lead. The major powers of the European Union, acting in their personal capacity or under the guise of submissive European institutions, are in a state of permanent maneuvering: In relations with China, Russia or the rest of the so-called world majority, in addition to constant bargaining in relations with their powerful patron, the US.

For the rest of the world, it creates the illusion that the EU can one day break away from Washington and sail on relatively independently. And for the Americans, it creates few additional concerns, but nothing that threatens their monopoly on power. French President Emmanuel Macron’s visit to Beijing in the first half of April was certainly an example of such posturing. The French leader sought in every way to reinforce the perception among his Chinese counterparts that continental Europe could act, at least tactically, as more than just a territorial base for US interests. This was partly due to the economic opportunities that make cooperation with the Western Europeans beneficial for Beijing and the Chinese economy. It is also due to the persistent Chinese belief that Germany and France are acting so hardline towards Russia precisely because they do not believe that a conflict with Moscow would have dramatic consequences.

A confrontation with China, which the EU states are being gently nudged towards by the UK and the US, would indeed be a suicidal economic decision for the bloc. Especially in the current not-so-pleasant state of the socio-economic systems of most of “old Europe.” The reluctance of EU members to give up the benefits of cooperation with China was evident to all in Beijing during an earlier visit by German Chancellor Olaf Scholz. Moreover, Beijing quite rationally believes that the conflict between the West and Russia is more fundamental for the EU than the confrontation between the US and China. Our Chinese friends are well aware of the history of relations between Russia and Western Europe, and they know that hostility is rooted in European bloc capitals. Despite some positive experiences with Russia in an era of its comparatively EU-friendly behavior, the major countries of the bloc have their grievances with Moscow, perhaps even more seriously than those of Japan, another American ally.

Russia will not pay this, the EU will.

• Ukraine Looking To Grab More Of Russia’s Oil Revenues – Kommersant (RT)

Kiev is preparing to significantly increase tariffs for transporting Russian crude oil to the EU through its territory via the Druzhba pipeline, business daily Kommersant reported on Friday. According to the report from the Russian outlet, which cites the consultancy Argus and market sources, Ukrainian pipeline operator Ukrtransnafta has applied for a two-step increase in transit prices, by 25% from the current $14.90 per ton to $18.70 on June 1, and by an additional 23.5% to $23 on August 1. Transneft, Russia’s state pipeline transport company, confirmed to Kommersant having received notification from Ukrtransnafta of the tariff hike but said that it was not conducting negotiations with Kiev on the matter.

According to Kommersant’s sources, Ukraine is currently negotiating the hike directly with buyers in Slovakia, Hungary, and the Czech Republic. However, any arrangements with them will have to be formalized with the Russian Energy Ministry and Transneft, experts say. The latter traditionally pays in advance for the transit of Russian oil through Ukrainian territory. The transit cost is included in the price of oil deliveries, and Russian oil companies, having received payment from buyers, reimburse Transneft for the transit. The planned hike in transit costs will be the second this year, after Kiev raised the tariff by €2.10 per ton (18.3%) on January 1. Prior to that, the tariff was hiked twice last year.

Experts warn that overly frequent tariff hikes may bring oil transport via Druzhba to a halt, as buyers, despite not having many alternatives to Russian oil, may find the costs too high. According to Igor Yushkov, a professor at the Financial University under the Government of the Russian Federation, this scenario would hurt Ukraine, which relies on the transit fees. Druzhba carries crude some 4,000km from Russia to refineries in the Czech Republic, Germany, Hungary, Poland, and Slovakia. Supplies via the route were not targeted by the EU embargo on Russian crude that was introduced late last year.

Propaganda or endocrine disruptors?

• Fewer Heterosexual Teens Than Ever – CDC (RT)

A new report by the Centers for Disease Control and Prevention (CDC) has found that a quarter of US high school students identify as homosexual, bisexual, or ‘questioning’, a figure that has more than doubled since 2015. Based on data collected in 2021 and released on Thursday, the CDC’s report found that 72.4% of high schoolers identify as heterosexual, down from almost 90% in 2015; 3.2% identify as gay or lesbian, 12% identify as bisexual, and 9% as ‘other’ or ‘questioning’. Girls were more likely than boys to place themselves in all three categories, with five times as many female students considering themselves bisexual (20% vs. 4%), and four times as many (13.7% vs. 3.7%) listing themselves in the ‘other’ category.

The CDC noted that the increase “might be a result of changes in question wording,” explaining that answers like “I am not sure about my sexual identity” or “I describe my sexual identity in some other way” were not included in its previous questionnaires. Just over 7% of the US adult population identifies as LGBTQ, according to a Gallup poll published in February. This figure has risen with each passing generation, with 20% of Generation Z (those born between 1997 and 2004) identifying as LGBTQ, compared to 11.2% of Millennials, 3.3% of Generation X, 2.7% of Baby Boomers, and 1.7% of those born before the end of World War II. The number of transgender Americans, which the CDC survey did not measure, has exploded. Fewer than 0.05% of the Silent Generation (born between 1928 and 1945) identified as transgender in the Gallup survey, compared to 1.9% of Generation Z, an almost forty-fold increase.

Some commentators argue that increased acceptance of alternative sexualities has made each successive generation more comfortable with coming out as LGBTQ. Others claim that “social contagion” – in which young people embrace LGBTQ identities in order to fit in with their peers – is responsible. A study published earlier this month found that adolescent girls with transgender friends were more likely to come out as transgender themselves. The study also linked heavy social media use to transgender identification. Although more and more high school students are embracing alternative sexualities, fewer and fewer are sexually active. According to CDC data, the number of students who have ever had sex has fallen from 47% in 2011 to 30% in 2021, while the number who said they were currently sexually active fell from 34% to 21% in that same period.

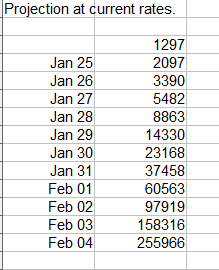

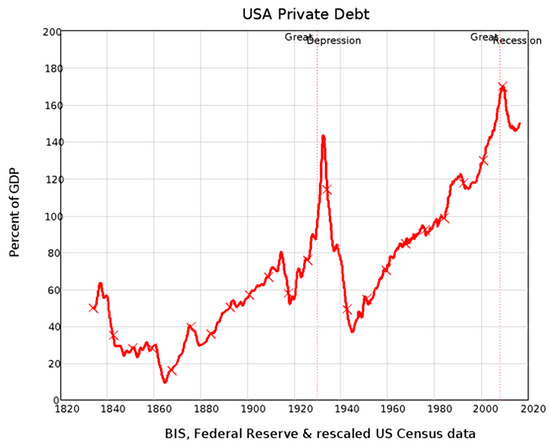

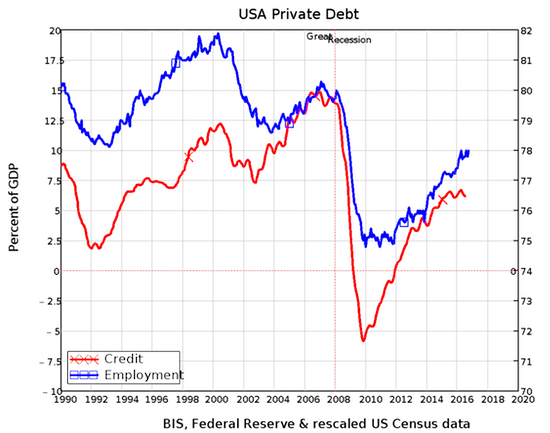

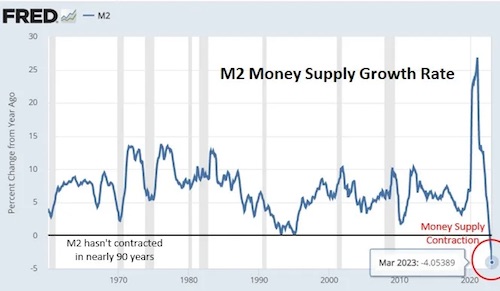

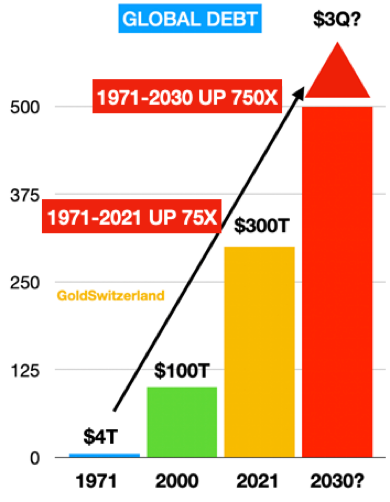

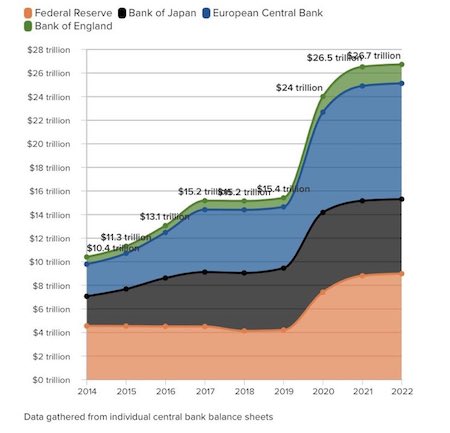

“..during the entire fiat currency era, M2 has never before gone down. This means some debts won’t be paid..”

• You Can’t Taper A Ponzi Scheme (John Rubino)

In a normal fiat currency system, the central bank simply creates the needed currency out of thin air, everyone gets paid, and the resulting decline in the value of the currency is small enough that few are bothered. But that’s not what’s happening today. As the above obligations come due, the amount of available money is … shrinking. The following chart of the M2 money supply growth rate shows a massive spike from all the covid lockdown stimmy checks (which partially accounts for last year’s surge in consumer prices) and a correspondingly dramatic plunge this year. Note that during the entire fiat currency era, M2 has never before gone down. This means some debts won’t be paid. Creditors thus stiffed will fail to pay their debts and so on until sectors start blowing up. Think back to last month’s local and regional bank near-death experience for a relatively benign example of what this unraveling will look like.

To sum up, the current global financial system is a Ponzi scheme and the new money spigot has been turned off. Excitement is about to ensue. During the pandemic, central banks discovered how easy it is to flood an economy with newly-conjured cash. The US, for instance, simply mailed checks to citizens and gifted “loans” to small businesses while tossing trillions in loan guarantees and direct aid at favored large corporations. Easy peasy. When today’s Ponzi scheme starts to unravel, those same governments will be faced with a choice between letting virtually everything grind to a halt as trouble at the collapsing periphery starts heading for the core (that is, as small players die in ways that threaten JP Morgan Chase), or restarting the stimmy check machine, but on a much bigger scale and with a major twist:

Instead of sending out paper or electronic checks to individual bank accounts, the Fed will roll out its much-discussed central bank digital currency and fund “free” account balances for everyone who it deems worthy of such a gift. The vast majority, traumatized by the disappearance of their jobs and stock portfolios, will willingly accept the free money. And just like that, the next financial system is born. Which, as always, takes us back to gold and silver. History says the first phase of this process will feature an equities bear market that takes precious metals down for the ride. But in the second phase (i.e., the CBDC introduction), people who prefer not to own “programable” currency that’s monitored 24/7 by the NSA will convert their Fed bucks to real assets. Shortages of gold and silver will ensue and prices will respond accordingly.

A carefully crafted campaign.

• Government Vaccine Mandate Efforts Were Secretly Funded by Pfizer (Slay)

Pharmaceutical giant Pfizer was secretly funding pressure groups that pushed governments to introduce draconian vaccine mandates and passports, according to a bombshell new report. The report, from investigative journalist Lee Fang, reveals that Pfizer silently funded several groups advocating for vaccine mandates and passports. Pfizer’s COVID-19 shot is one of the most widely used vaccines in the world. Under vaccine mandates, people around the world the forced to take the jabs or face losing their jobs. In August 2021, the president of the Chicago Urban League, Karen Freeman-Wilson, in an interview on TV, argued that vaccine mandates would not disproportionately harm the black community. “The health and safety factor here far outweighs the concern about shutting people out or creating a barrier,” Freeman-Wilson said at the time.

Earlier that year, the Chicago Urban League had received $100,000 from Pfizer. The money was supposedly for a project to advance the promotion of “vaccine safety and effectiveness.” Part of this “promotion” involved lobbying governments to introduce tyrannical vaccine mandates. The organization did not list Pfizer as a donor or partner on its website. Freeman-Wilson did not mention the funding during the interview, either. The Chicago Urban League grant is one of many Pfizer-awarded groups to promote and encourage vaccine mandates. The pharmaceutical giant awarded grants to public health organizations, civil rights groups, as well as consumer, medical, and doctors’ groups. Most of these groups did not disclose the funding from Pfizer. The lack of transparency regarding the grants allowed Pfizer to secretly fund efforts to force the public into using their products.

In August 2021, the corporate watchdog group the National Consumers League announced support for “government and employer mandates” requiring Covid vaccination. The announcement came at around the same time the organization received a $75,000 grant from Pfizer for “vaccine policy efforts.” Houston-based public health organization the Immunization Partnership publicly lobbied against bills introduced in Texas aimed at banning vaccine passports and vaccine mandates. The organization did not disclose that Pfizer gave it $35,000 earlier that year for “legislative advocacy.”

Japan Pfizer

New finding from Japan:

The Pfizer's vaccine has a staggering problem. The DNA read from the Pfizer vaccine contains the SV40 sequence which allows the DNA to easily enter the human nucleus, and functions as a promoter of the cancer viruses.

Pfizer maliciously retained the SV40… https://t.co/wk2PJimksu pic.twitter.com/cqLbqSv3hL— You (@You3_JP) April 28, 2023

1.27259146ºC

https://twitter.com/i/status/1651852516554932224

This is the Centennial Light, the world’s longest-lasting light bulb, burning since 1901. It is at 4550 East Avenue, Livermore, California and due to its longevity, the bulb has been noted by The Guinness Book of World Records

Gecko

Mossy leaf-tailed geckos are nocturnal and arboreal. These geckos rely on their impressive camouflage as they dwell among the trees.

[read more: https://t.co/8Pd0vJ2fYW]

[source: https://t.co/l95cVhLjv9]pic.twitter.com/4mMmX96C4Z— Massimo (@Rainmaker1973) April 28, 2023

Blue tit singing on a cold early morning you can see its song in the air

Armadillo

Armadillos collect leaf litter they use to build nests in their burrows. Because of the specific armadillo's body shape, the animal opts for bunching a pile of leaves up against their abdomens and hopping backwards toward their nestpic.twitter.com/oRZkPHlB27

— Massimo (@Rainmaker1973) April 28, 2023

DogTwist

https://twitter.com/i/status/1652035202171146241

Logging

https://twitter.com/i/status/1651949402335084545

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.