Leonardo da Vinci First anatomical studies c1515

They don’t want peace. No neutrality for Ukraine.

“France and the UK in particular, are urging the Ukrainians against compromise until Russian troops withdraw from the country.”

• EU Warns Ukrainians Against Compromise (ZH)

On Friday Russian Foreign Minister Sergei Lavrov said Moscow is preparing a response to Ukraine’s prior proposals issued in Istanbul early this week on reaching a ceasefire, as the next round of dialogue is currently underway via remote link. His statements were generally in a positive direction, saying that in light of Ukraine of late showing “more understanding” as to the Crimea and Donbas issues, Moscow stands ready to engage on Kiev’s proposals on neutral and non-nuclear status for the country, according to Bloomberg. However, France and the UK in particular, are urging the Ukrainians against compromise until Russian troops withdraw from the country.

Following days of outside speculation in the West over just how “constructive” toward a potential breakthrough the talks in Istanbul were, France – which has been closely involved in pushing a diplomatic resolution hard, particularly through repeat Macron-Putin phone calls – has weighed in pouring cold water on any optimism. “I don’t see any signs indicating a real and long-term change in Russia’s position,” Foreign Minister Jean-Yves Le Drian told a French newspaper Thursday. “Even though its troops are moving slower than the Kremlin expected, I don’t currently see any significant retreat or a ceasefire,” Le Drian said. “The so-called regime of silence that Russia announced for a few hours in Mariupol yesterday was clearly not enough,” he added, in reference to the announced humanitarian evacuation corridor opened Friday at French and German request.

The city has been in Russian hands since early this week, but Ukrainian civilians still remain. “Around 2,000 civilians are on evacuation buses heading from the coastal city of Berdyansk to the Ukrainian government-held city of Zaporizhzhia, carrying civilians evacuating from the besieged city of Mariupol,” CNN reports. “The evacuation convoy left Berdyansk for Zaporizhzhia,” the city of Mariupol announced on Telegram via its council. “Many private vehicles have joined the 42 buses escorted by Red Cross and SES (State Emergency Service) vehicles. Today we expect the arrival of a record number of Mariupol residents.”

Le Drian also acknowledged that Kiev’s Western backers (France among them) are pushing hard for Ukraine’s negotiators to hold a tough line, even as it’s the Ukrainian people under the bombs: “We have a very clear objective, to not give up anything and to intensify our efforts until a total ceasefire across the whole of Ukraine’s territory and real negotiations,” the French top diplomat said. He further repeated by now familiar calls for Europe to boycott Russian hydrocarbons. “While we don’t all have the same dependence on Russian hydrocarbons, we will have the same interest in exiting them (in Europe),” he said.

Read more …

“Most of Russia’s military intervention in Ukraine is focused on clearing Ukrainian and neo-Nazi forces out of Donbass. This is the reason for Putin’s go-slow war that rules out heavy weapons use on civilian areas. The civilians are Russians, and, as Putin said, “we went in to liberate these people, not to kill them.”

• Ukrainian Update #9 (Paul Craig Roberts)

Just as everything you were told about Covid by the media and health and government officials was false, so is everything you have been told by the same propagandistic liars about Ukraine. Americans have had nothing but lies since the assassination of US President John F. Kennedy, of his brother, US Senator Robert Kennedy President-in-Waiting, Martin Luther King, the Vietnam war, 9/11, Saddam Hussian’s nonexistent “weapons of mass destruction,” Assad’s “use of chemical weapons,” Iranian nukes, the extraordinary lies about Kaddafi, Covid pandemic, Russian invasions. The entire Western World lives in The Mattrix, a world created by propaganda. The vast majority of people in the West have no idea of the reality in which they live. This makes them impotent and completely unable to protect their freedom. They are sitting ducks for tyranny which is fast enclosing around them.

Take the Ukraine narrative, for example. The story as presented to the public by the Western media has no relationship to reality. The Ukraine narrative has collapsed as completely as the Covid narrative. There will be no going back to it. The narrative will simply be dropped as the next crisis–inflation perhaps or a newly released pathogen–takes the front page. There was never a Russian invasion of Ukraine. Russian military focus was on the Donbass region in east and south Ukraine. Inhabited by Russians and part of Russia herself until Soviet leaders transferred it, like Crimea, into Ukraine for their reasons. When the US overthrew the democratically elected Ukrainian government in 2014 and took control over Ukraine, the Crimean and Donbass Russians voted overwhelmingly to be reunited with Russia. The Kremlin accepted Crimea but not Donbass.

This was a strategic blunder demonstrating a lack of awareness on the part of the Russian government. Immediately the neo-Nazi remnants in west Ukraine, whose forebears had fought for Hitler against Russia in WW II, began abusing the Russian population in the Donbass region in the east. The American puppet government in Kiev followed up by banning the use of the Russian language. To protect themselves, the Donbass Russians declared their independence in the form of two republics, the Donetsk and Luhansk Republics. Ukrainian troops and neo-Nazi militias began attacking these “breakaway republics.” They have been shelling with artillery Donbass villages, towns, and cities for 8 years, killing thousands of civilians, and the Ukrainian forces, although twice defeated by hastily assembled forces in the Donbass, managed to gain control over large areas of the breakaway republics.

It was the deployment of a 100,000 or more Ukrainian force on the shrunken borders of Donbass for an invasion to reconquer the territory that provoked the Russian intervention. Washington’s refusal to give the Kremlin a security guarantee was a second reason for the Russian military intervention. Russia told Washington in completely clear language that Russia would not permit Ukraine to be a member of NATO. Nevertheless, Washington persisted in its provocation. Most of Russia’s military intervention in Ukraine is focused on clearing Ukrainian and neo-Nazi forces out of Donbass. This is the reason for Putin’s go-slow war that rules out heavy weapons use on civilian areas. The civilians are Russians, and, as Putin said, “we went in to liberate these people, not to kill them.”

Read more …

“Charging a man with murder in this place was like handing out speeding tickets at the Indy 500.”

• Russia, Ukraine and the Law of War: War Crimes (Ritter)

“Based on information currently available,” Blinken said, “the U.S. government assesses that members of Russia’s forces have committed war crimes in Ukraine. “Our assessment,” Blinken added, “is based on a careful review of available information from public and intelligence sources.” According to Blinken, “Russia’s forces have destroyed apartment buildings, schools, hospitals, critical infrastructure, civilian vehicles, shopping centers, and ambulances, leaving thousands of innocent civilians killed or wounded. Many of the sites Russia’s forces have hit have been clearly identifiable as in-use by civilians.” Blinken declared that this category “includes the Mariupol maternity hospital” as well as “a strike that hit a Mariupol theater, clearly marked with the Russian word for ‘children’ — in huge letters visible from the sky.”

Blinken’s accusations echo those made by the Ukrainian government and organizations such as Amnesty International. Karim Khan, the lead prosecutor for the International Criminal Court, has announced that his office will begin investigating allegations of Russian war crimes committed during its ongoing military operation in Ukraine. The narrative that paints Russia and the Russian military as perpetrators of war crimes, however, runs afoul of actual international humanitarian law and the laws of war. The issue of jus in bello (the law governing conduct during the use of force) set forth a framework of legal concepts which, when allied to specific actions, help determine whether an actual violation of the law of war has occurred.

Jus in bello is derived from treaties, agreements, and customary international law. Two sets of international agreements, the Hague Conventions of 1899 and 1907, and the four Geneva Conventions of 1949, serve as the foundation for the modern understanding of jus in bello, regulating, respectively, what is permissible in the execution of war, and the protections provided to non-combatants, including civilians and prisoners of war. “Grave breaches” of jus in bello can be prosecuted in courts of relevant jurisdiction as war crimes. Starting from the proposition that war is little more than organized murder, the issue of how to define what constitutes murder sufficient to be categorized a being of a criminal nature is far more difficult that one might think. Michael Herr gave voice to this reality in his book, Dispatches, about America’s war in Vietnam, when he observed that, “Charging a man with murder in this place was like handing out speeding tickets at the Indy 500.”

Read more …

Their euros don’t buy oil. They buy rubles. Twist it any way you want it. Which means Russia banks stay open, and dollars and euros keep pouring in.

• Germany Says Putin Agreed To Keep Payments For Gas In Euros (DW)

Germany’s government said on Wednesday it has received assurances from Russia that Europe would not have to pay for Russian gas supplies in rubles. Olaf Scholz’s office said Russian President Vladimir Putin told the German Chancellor that European companies could continue paying in euros or dollars. In a phone call with Scholz, Putin said the money would be paid into Gazprom Bank and then transferred in rubles to Russia, a German statement said. The bank is not currently subject to sanctions. “Scholz did not agree to this procedure in the conversation, but asked for written information to better understand the procedure,” the statement added.

Putin said last week that Moscow would only accept rubles as payment for gas deliveries to “unfriendly” countries, including European Union nations. According to a Kremlin statement, Putin told Scholz that “the decision taken should not lead to worsening of contractual terms for European importer companies.” He also sought to justify Russia’s demands for ruble payments, saying that “in violation of the norms of international law, the foreign exchange reserves of the Bank of Russia were frozen by the member states of the European Union.” The Kremlin said the two leaders agreed that experts from each country would hold further discussions on the matter.

Read more …

Very good in Vanity Fair. “..genomic sequences mentioned in a published paper from China had somehow vanished without a trace”

• The Virus-Hunting Nonprofit at the Center of the Lab-Leak Controversy (VF)

Bloom’s paper was the product of detective work he’d undertaken after noticing that a number of early SARS-CoV-2 genomic sequences mentioned in a published paper from China had somehow vanished without a trace. The sequences, which map the nucleotides that give a virus its unique genetic identity, are key to tracking when the virus emerged and how it might have evolved. In Bloom’s view, their disappearance raised the possibility that the Chinese government might be trying to hide evidence about the pandemic’s early spread. Piecing together clues, Bloom established that the NIH itself had deleted the sequences from its own archive at the request of researchers in Wuhan. Now, he was hoping Fauci and his boss, NIH director Francis Collins, could help him identify other deleted sequences that might shed light on the mystery.

Bloom had submitted the paper to a preprint server, a public repository of scientific papers awaiting peer review, on the same day that he’d sent a copy to Fauci and Collins. It now existed in a kind of twilight zone: not published, and not yet public, but almost certain to appear online soon. Collins immediately organized a Zoom meeting for Sunday, June 20. He invited two outside scientists, evolutionary biologist Kristian Andersen and virologist Robert Garry, and allowed Bloom to do the same. Bloom chose Pond and Rasmus Nielsen, a genetic biologist. That it was shaping up like an old-fashioned duel with seconds in attendance did not cross Bloom’s mind at the time. But six months after that meeting, he remained so troubled by what transpired that he wrote a detailed account, which Vanity Fair obtained.

After Bloom described his research, the Zoom meeting became “extremely contentious,” he wrote. Andersen leapt in, saying he found the preprint “deeply troubling.” If the Chinese scientists wanted to delete their sequences from the database, which NIH policy entitled them to do, it was unethical for Bloom to analyze them further, he claimed. And there was nothing unusual about the early genomic sequences in Wuhan. Instantly, Nielsen and Andersen were “yelling at each other,” Bloom wrote, with Nielsen insisting that the early Wuhan sequences were “extremely puzzling and unusual.” Andersen—who’d had some of his emails with Fauci from early in the pandemic publicly released through FOIA requests—leveled a third objection.

Andersen, Bloom wrote, “needed security outside his house, and my pre-print would fuel conspiratorial notions that China was hiding data and thereby lead to more criticism of scientists such as himself.” Fauci then weighed in, objecting to the preprint’s description of Chinese scientists “surreptitiously” deleting the sequences. The word was loaded, said Fauci, and the reason they’d asked for the deletions was unknown. That’s when Andersen made a suggestion that surprised Bloom. He said he was a screener at the preprint server, which gave him access to papers that weren’t yet public. He then offered to either entirely delete the preprint or revise it “in a way that would leave no record that this had been done.” Bloom refused, saying that he doubted either option was appropriate, “given the contentious nature of the meeting.”

Read more …

We must declare the end of Pfizer.

• Ioannidis: ‘We Must Declare the End of the Pandemic’ (RCS)

Ioannidis is sure to court more controversy with a new commentary published to the European Journal of Clinicial Investigation in which he argues that it’s time to declare the end of the COVID-19 pandemic. “This does not mean that the problem is inappropriately minimized or forgotten, but that our communities move on with life,” he writes. “Pandemic preparedness should be carefully thought and pre-organized, but should not disrupt life.” While Ioannidis recognizes that there are no quantitative definitions for the end of a pandemic like COVID-19, he contends that the amount of immunity now present worldwide exceeds the threshold needed to declare SARS-CoV-2, the virus that causes COVID-19, endemic – constantly present but not a public health emergency.

“By end 2021, probably 73-81% of the global population had been vaccinated, infected or both,” he says. Pockets of low immunity, such as in places that pursued zero-COVID policies and/or with limited access to effective vaccines, may persist, causing regional outbreaks, but we will likely never see COVID-19 again trigger a global emergency. Declaring the pandemic phase of COVID-19 to be concluded means understanding and accepting a new “normal”. “A decrease of COVID-19 deaths back to typical seasonal influenza levels may not necessarily happen in 2022 or even beyond,” Ioannidis cautions. “With an increasingly aging global population, “normal” may still correspond to higher death counts… This should not be mistaken as a continued pandemic phase.”

Easing out of the pandemic requires a widespread mental shift, as well. This means focusing more on indicators like hospital intensive care admissions to guide policy rather than just infections. “If perception of risk focuses on number of documented cases, the spurious perception of emergency situations may be difficult to quell,” Ioannidis writes. Exiting the pandemic also means reducing fearmongering coverage of COVID-19 in the popular media, the propagation of which undoubtedly contributed to the public’s warped perception of COVID’s risks throughout the pandemic. On average, Americans believed in early 2021 that 8% of deaths had occurred in people under the age of 24. The actual percentage as of today is 0.3%. Moreover, a third of the population has consistently believed that COVID leads to hospitalization in over half of infections. During the most recent Omicron wave, the proportion was 3% or lower.

Read more …

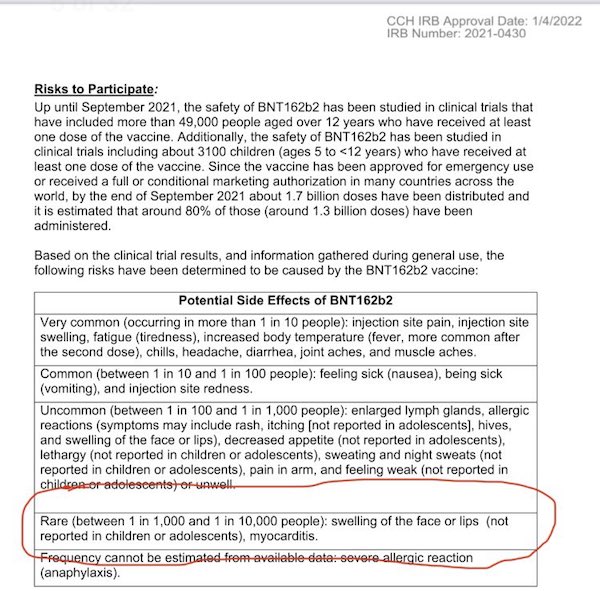

1 in 1,000 is not rare. That’s 200,000 US cases of myocarditis.

• Heart Damage Found in Teens Months After Second Pfizer Shot (CHD)

A new peer-reviewed study shows more than two-thirds of adolescents with COVID-19 vaccine-related myopericarditis had persistent heart abnormalities months after their initial diagnosis, raising concerns for potential long-term effects. The findings, published March 25 in the Journal of Pediatrics, challenge the position of U.S. health agencies, including the Centers for Disease Control and Prevention (CDC), which claim heart inflammation associated with the Pfizer and Moderna mRNA vaccines is “mild.” Researchers at Seattle Children’s Hospital reviewed cases of patients younger than 18 years old who presented to the hospital with chest pain and an elevated serum troponin level between April 1, 2021, and Jan. 7, 2022, within one week of receiving a second dose of Pfizer’s vaccine.

While 35 patients fit the criteria, 19 were excluded for various reasons. Cardiac magnetic resonance imaging (MRI) of the remaining 16 patients was performed three to eight months after they were first examined. The MRIs showed 11 had persistent late gadolinium enhancement (LGE), although levels were lower than in previous months. According to the study, “The presence of LGE is an indicator of cardiac injury and fibrosis and has been strongly associated with worse prognosis in patients with classical acute myocarditis.” In a meta-analysis of eight studies, LGE was found to be a predictor of all-cause death, cardiovascular death, cardiac transplant, rehospitalization, recurrent acute myocarditis and requirement for mechanical circulatory support.

Similarly, an 11-study meta-analysis found the “presence and extent of LGE to be a significant predictor of adverse cardiac outcomes.” Researchers said that while symptoms “were transient and most patients appeared to respond to treatment,” the analysis showed a “persistence of abnormal findings.” The results “rais[e] concerns for potential longer-term effects,” researchers wrote, adding that they plan to repeat imaging at one year after the vaccine to assess whether abnormalities have resolved. “The paper provides more evidence that myocarditis in adolescents that result from COVID-19 vaccines is very serious,” said Dr. Madhava Setty, senior science editor for The Defender.

Read more …

Tons of stories of people with $20 Berlin-Athens return tickets. Hard to deter that.

• War, Disease, Surging Gas Prices Will Probably Not Deter Hospitality (Bisnow)

Already grappling with long-term pandemic-fueled troubles, the travel and hospitality industry finds itself confronting yet another adversary: surging fuel prices. The sector had managed to claw its way back to a tolerable recovery in 2021 — and 2022 was shaping to look a little more like the days before the coronavirus. Summer vacations to the beach and further afield were anticipated. Business travel was ticking back up with conferences and in-person meetings on the rise. For a while, things were looking up. Then Russia invaded Ukraine. Oil prices are now spiking beyond $100 a barrel, driving sharp increases for gas at the pump and for pricy jet fuel — which, if conventional wisdom holds true, will inevitably mean higher costs for U.S. travelers this spring and summer.

So, less travel and another big knock on the hospitality industry? Maybe not. Travel and hospitality experts told Bisnow this week that they remain optimistic for 2022, citing the fact that bookings are still strong — apparently because last year didn’t satisfy Americans’ demand for travel. Travelers might adjust their plans a bit this year, but mass cancellations don’t seem to be in the cards — yet. “As concerns around omicron subside, we see very strong demand for leisure travel in the second quarter this year and beyond, and are expecting the travel market to continue to recover,” said Hayley Berg, head of price intelligence at Hopper, a booking service for airlines and hotels.

Bookings are still strong now despite gas prices that are about 70 cents higher than in mid-February, at an average of $4.26 a gallon, according to AAA, and $1.37 higher per gallon than a year ago. The price of airline tickets is up as well, with Berg expecting airfare to climb to an average of $360 per round-trip through May, a 10% increase from current prices, though rates will taper off some by the end of the summer, as they do every year. The spike in gas prices has certainly caused pain for many millions of people. That was already the case late last year when gas prices crept up slowly but steadily. Low-income Americans or those on fixed incomes, as well as small businesses that use a lot of transport, are all suffering.

Read more …

“.. the odor around Mr. Garland’s department will be so pungent that prosecutors will have to work the Hunter case wearing industrial-strength, full-face, carbon-filtered respirators.”

• “Jettison the Animals!” (Kunstler)

The fabled Hard-drive-from Hell apparently contains evidence of felonious misdeeds other than tax evasion ranging from treason, bribery, and wire fraud, to child sex-trafficking and the use of Air Force Two in the commission of crimes. That leaves AG Mr. Garland on a hot spot of dreadful discomfiture. Does he call off the dogs on that vast bone-pile of perfidy and just “laser focus” on some rinky-dink tax charge — and then face the wrath in ten months of a sure-to-be Republican majority House and Senate capable not just of impeaching his ass, but making criminal referrals on it? Or is compelling evidence of high crimes going to be spewed all over the land by those aforesaid private-sector sleuths poring over Hunter’s hard-drive, in a way that the AG can only ignore at the risk of his own reputation… or maybe even a year in some federal slammer for obstruction of justice?

Kinda depends a little bit on what sort of commotion special counsel Mr. John Durham stirs up if-and-when he gets around to indicting any of the superstars of RussiaGate — many of them former and current DOJ and FBI personnel — because when that happens, the odor around Mr. Garland’s department will be so pungent that prosecutors will have to work the Hunter case wearing industrial-strength, full-face, carbon-filtered respirators.

In short, is the dear Deep State fixing to throw “Joe Biden” overboard in a play for its own legitimacy, as if it is actually looking after the nation’s interests? At some point, even ghouls and spooks have a certain survival instinct. And all that might kinda depend on whether President Vlad Putin of Russia happens to disclose what exactly his soldiers found when they captured the numerous “bio-research” labs that ringed Ukraine’s former eastern provinces near the Russian border. Hunter Biden’s companies had an ownership position in those labs, which were actually run by the US Department of Defense jointly with (who else?) the CIA. The wildest stories are circulating about the labs — like, they were developing horrific designer plagues targeted specifically at genetically Slavic people… to be spread by loosing infected migratory birds into the Eurasian skies… say, what…? When, exactly, did American foreign policy turn into something out of a Marvel Comic?

Read more …

Not the worst things that happened, but surely a symbol of the worst. Until now, only Franco and Hitler banned art.

• The Cancellation of Tchaikovsky (BI)

I have an old LP on the turntable now, a 1985 Berlin Philharmonic performance of Tchaikovsky‘s 1812 Overture. Recorded almost 40 years before the Russian invasion of Ukraine, almost 40 years after Germany‘s siege of Leningrad, the Berlin Wall still standing, no end in sight, at the height of the Cold War. Great Russian music, composed to the memory of yet another war between East and West, performed by a renowned West German orchestra; the old foes, and by then foes still, but united through art. A few weeks ago, the Cardiff Philharmonic Orchestra canceled a Tchaikovsky concert, calling it “inappropriate at this time.” Throughout Western Europe, Russian artists have had their engagements canceled and some have even been fired from their jobs.

In a 1984 Granta article, “A Kidnapped West or Culture Bows Out,” Milan Kundera defined European culture as characterized by “the authority of the thinking, doubting individual and on an artistic creation which expressed his uniqueness.“ In contrast “nothing could be more foreign to Central Europe and its passion for variety than Russia: uniform, standardizing, centralizing, determined to transform every nation of its empire … into a single Russian people … on the Eastern border of the West – more than anywhere else – Russia is seen not just as one more European power but as a singular civilization, another civilization.“ The article sparked a debate between Kundera and Russian poet and dissident Joseph Brodsky, who vigorously opposed Kundera‘s views.

The essence of European civilization, according to Brodsky, is not modern Western individualism, a culture which to him has lost the relationship with its roots, but Christianity. The true fight is “between faith and the utilitarian approach to existence.“ We now see this controversy revived; just look at the recent debate between Bernard-Henri Lévy and Aleksandr Dugin. It is the same tension between opposite worldviews and there is little doubt it will grow stronger. For the world is now changing, as we live in interesting times once more. And surely Brodsky‘s view will gain more ground, not without reason; we have seen it too clearly during the past two years how easily the thinking doubting individual, the foundation of free Western society, is replaced by the frightened obeying mass.

Read more …

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.