Vincent van Gogh Le moulin de blute fin 1886

Good points from Russell Napier. Also says Turkey will default, impose capital controls.

• The Fed Is Destroying Dollars (Napier)

Too much debt and not enough money remain a diagnosis for deflation and not inflation. In particular, we need to discuss why fears of inflation persist in a world where the US central bank and the US commercial banking system are now both destroying money. When both these key engines of the reserve currency creation act to destroy money, there will ultimately be a contraction in broad money growth, the first since the 1930s, if nothing changes. This analyst thinks that matters, but few, if any, agree. At this stage the interesting evidence is that this dramatic tightening of monetary policy seems to matter more outside the USA than within.

From its peak in November 2017 the level of US bank credit, when we adjust for the systems acquisition of non-banks, has posted no growth. When a commercial banking system posts no growth in bank credit over four months, it creates no money over that period. It just so happens that this is the same four months during which the Federal Reserve has been contracting its balance sheet. Sticking to the Policy Normalisation Principles (PNP) and their addendum of June 2017, the Fed has been destroying money by shrinking its balance sheet. In the period from August 2017 to February 2018 there has been a shrinkage of US$105.2bn in commercial bank reserve balances: the high-powered money. Based on the PNP, a further US$20bn will have been destroyed in March 2018.

So with a commercial banking system creating no money, and a central bank destroying money, we are looking at one of the tightest monetary policies ever pursued by a central bank. To disagree with that statement is to believe that monetary policy is judged solely by the price of money, without reference to the quantity of money. Such was the belief that led to the Great Depression. At this stage the distress associated with this policy seems to be falling primarily upon non-US companies that have borrowed USD. This has huge consequences for investors.

EU is winner takes all.

• What Trump Gets Right About Europe’s Trade Problem (Pol.)

Donald Trump may prove to be the catalyst for change the eurozone has long been looking for. The protectionist U.S. president is forcing Europeans to face the unsettling problem of their massive current account surplus, which has been the best indicator of everything that’s wrong in the monetary union in the last five years. Forget Trump’s own economic analysis or lack thereof, and forget the attention-grabbing headlines on coming trade wars that may or may not happen. The U.S. president’s attacks on German exports — his Exhibit A that the Europeans aren’t playing a fair trade game — have helped throw a harsh light on the eurozone’s No. 1 problem.

Far from being a sign of economic well-being, the eurozone’s surplus — $380 billion last year or about 3% of the region’s GDP — reflects the monetary union’s deep structural flaws, worsened by the way it addressed its long crisis. [..] For a monetary union’s economy to be balanced, it has to take into account the differences between its respective nations’ different political, economic, and social systems. What happened instead when the euro crisis took everyone by surprise in 2009 was that each member country was told to become more like Germany. But for the system to work, if everyone must become like Germany, then Germany must also become a little bit less German. Surprise — this is not what happened. Countries in trouble were told to cut costs, boost competitiveness and implement austerity policies.

It worked: Imports fell and exports rose. Spain and Italy are now showing significant surpluses. In each of these countries, the balance has improved (from deficit to surplus) by roughly $100 billion since 2009 — the same as Germany’s accounts, which went from a $200 billion to $300 billion surplus. [..]According to European rules that are even less enforced than the more talked-about ones on fiscal deficits, a member country cannot run a surplus higher than 6% of its GDP. Germany’s surplus amounted to 8% of GDP last year, while the Netherlands’ was 8.5%. As long as the narrative of the eurozone crisis keeps making a surplus the moralistic sign of economic virtue, Europeans are unlikely to dare to take steps to tackle a problem that is now the world’s. Here’s hoping that the brutality of Trump’s attack on free trade will force them to spring into action.

Something will have to happen. But nothing has so far, so why the loud voices?

• “When You’re Already $500 Billion Down, You Can’t Lose!” (G.)

Fears that Donald Trump is embroiling America in a global trade war intensified on Wednesday after China imposed on the US and stock markets plunged. The Dow Jones industrial average dropped and then rallied after markets fell in Europe and Asia on worries of an intensifying trade conflict between the world’s two biggest economies – the latest example of Trump taking his appetite for disruption to the global stage. After Washington unveiled plans to impose tariffs on $50bn in Chinese imports Tuesday, China hit back with plans to tax a matching $50bn of US products, including beef, cars, planes, soybeans and whiskey.

The US president has worn stock market success as a badge of honour and proof that, despite myriad controversies, the economy is booming under his presidency. But there are concerns that his aggressive tariffs and “America first” instincts could undermine confidence and cause a slowdown. Trump claimed last month that “trade wars are good, and easy to win”. China is the biggest market for US soy. The American Soybean Association, a lobbying group representing 21,000 producers, warned that China’s proposed 25% tariff on soybeans would be “devastating” to American farmers. It estimated that farmers lost an estimated $1.72bn on Wednesday morning alone as soybean futures tumbled.

John Heisdorffer, an Iowa farmer and the president of the association, said: “That’s real money lost for farmers, and it is entirely preventable.” He called on the White House to scrap its proposed tariffs. The car makers Ford and General Motors also issued statements calling for continued dialogue to resolve the escalating trade tensions. On Wednesday, Trump moved to play down concerns over a damaging trade war. He protested on Twitter: “We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the U.S. Now we have a Trade Deficit of $500 Billion a year, with Intellectual Property Theft of another $300 Billion. We cannot let this continue!” The president added: “When you’re already $500 Billion DOWN, you can’t lose!”

Did anyone tell the soybeans?

• Kudlow Says Trump’s China Tariffs Are Just Proposals Right Now (BBG)

White House economic adviser Larry Kudlow stressed U.S. tariffs announced on Chinese goods are still only proposals that might never take effect as the Trump administration sought to tamp down fears of a trade war. “None of the tariffs have been put in place yet, these are all proposals,” Kudlow said in an interview Wednesday with Bloomberg News. “We’re putting it out for comment. There’s at least two months before any actions are taken.” Administration officials throughout the day emphasized the U.S. is willing to negotiate with China, helping to ease concerns among investors about a tit-for-tat trade conflict. The Dow Jones Industrial Average, after falling more than 2% at the market’s open, finished the day up almost 1%.

Commerce Secretary Wilbur Ross said China’s response isn’t expected to disrupt the U.S. economy. In an interview on CNBC on Wednesday, he said China’s announcement of retaliatory tariffs against the U.S. “shouldn’t surprise anyone.” He said the U.S. isn’t entering “World War III” and left the door open for a negotiated solution. “Even shooting wars end with negotiations,” Ross said. Earlier Wednesday, China said it would impose an additional 25% levy on about $50 billion of U.S. imports including soybeans, automobiles, chemicals and aircraft. The move matched the scale of proposed U.S. tariffs announced the previous day. The U.S. is allowing 60 days for public feedback and hasn’t specified when the tariffs would take effect, leaving a window open for talks. Chinese Ambassador to the U.S. Cui Tiankai said Wednesday his country is ready to negotiate.

Keep that number growing. And when will the press acknowledge this is not about Cambridge Analytica?

• Up To 87 Million Facebook Users’ Data Shared With Cambridge Analytica (Ind.)

Up to 87 million people may have had their Facebook data improperly passed to a third-party political firm – and most users’ public profile information could have been collected, the social media company has revealed. Initial accounts estimated the number of people affected at around 50m. But Facebook updated that number to say information from as many as 37m additional users could been shared with Cambridge Analytica. And it warned in a blog post that a now-discarded feature meant “most people on Facebook” could have had their public data scraped by “malicious actors”.

The revelations expanded the scope of a privacy scandal besieging the company just days ahead of CEO Mark Zuckerberg’s hotly anticipated appearance before Congress. It had already been revealed that researcher harvested information encompassing a vast number of Facebook users and then passed it on to Cambridge Analytica, a company that went on to work for Donald Trump’s presidential campaign. The news has sent the company’s stock plunging and stoked a political outcry on both sides of the Atlantic. Facebook said it would inform users if their information had been funnelled to Cambridge Analytica. It said roughly 70 million of those users were in the United States.

And in seeking to reassure users that it was moving to safeguard their personal information, the company made an extraordinary disclosure: chief technology officer Mike Schroepfer said the majority of its users were vulnerable to abuse of a now-disabled feature allowing people to search for other users with phone numbers and email addresses. “Given the scale and sophistication of the activity we’ve seen, we believe most people on Facebook could have had their public profile scraped in this way”, Mr Schroepfer said in the blog post.

Insane. Will he get some serious questions on Capitol Hill, or can he get away with this sort of thing?

• Zuckerberg Says Most Facebook Users Will Only Get Privacy ‘In Spirit’ (Ind.)

Facebook CEO Mark Zuckerberg has said that new data privacy laws will only apply “in spirit” to more than three quarters of the company’s users. Europe’s General Data Protection Regulation (GDPR) will force the social network to comply with strict rules about the privacy of its European users. But Mr Zuckerberg failed to commit to rolling out the protections globally. “We’re still nailing down details on this, but it should directionally be, in spirit, the whole thing,” Mr Zuckerberg said on Tuesday. With only 17 per cent of its 2.2 billion users residing within Europe, the vast majority of Facebook’s users will not benefit from the new rules.

Facebook has faced pressure in recent weeks to better protect its users’ data following revelations that the data analytics firm Cambridge Analytica harvested personal information from more than 50 million Facebook accounts in the build up to the 2016 US elections. On Monday, New York City Comptroller Scott Stringer called for Mr Zuckerberg to resign from his role as chairman of Facebook, adding that data privacy issues represented “a risk to our democracy.” The new data protection law – set to come into effect on May 25 – will give people more control over how companies store and use their personal data.

Are you kidding? They all are. Stop working there.

• We Work For Google. Our Employer Shouldn’t Be In The Business Of War (G.)

Dear Sundar,

We believe that Google should not be in the business of war. Therefore we ask that Project Maven be cancelled and that Google draft, publicize and enforce a clear policy stating that neither Google nor its contractors will ever build warfare technology. Google is implementing Project Maven, a customized AI surveillance engine that uses “wide area motion imagery” data captured by US government drones to detect vehicles and other objects, track their motions and provide results to the Department of Defense. Recently, Googlers voiced concerns about Maven internally. Diane Greene responded, assuring them that the technology will not “operate or fly drones” and “will not be used to launch weapons”.

While this eliminates a narrow set of direct applications, the technology is being built for the military, and once it’s delivered it could easily be used to assist in these tasks. This plan will irreparably damage Google’s brand and its ability to compete for talent. Amid growing fears of biased and weaponized AI, Google is already struggling to keep the public’s trust. By entering into this contract, Google will join the ranks of companies like Palantir, Raytheon and General Dynamics. The argument that other firms, like Microsoft and Amazon, are also participating doesn’t make this any less risky for Google. Google’s unique history, its motto “don’t be evil”, and its direct reach into the lives of billions of users set it apart.

We cannot outsource the moral responsibility of our technologies to third parties. Google’s stated values make this clear: every one of our users is trusting us. Never jeopardize that. Ever. This contract puts Google’s reputation at risk and stands in direct opposition to our core values. Building this technology to assist the US government in military surveillance – and potentially lethal outcomes – is not acceptable. Recognizing Google’s moral and ethical responsibility, and the threat to Google’s reputation, we request that you: 1. Cancel this project immediately. 2. Draft, publicize and enforce a clear policy stating that neither Google nor its contractors will ever build warfare technology.

Falciani was assisting the Spanish government, and now they sold him out to get to two Catalonia separatists.

• World’s Most Wanted Bank Whistleblower Arrested for Worst Possible Reason (DQ)

Hervé Falciani, the French-Italian former HSBC employee who blew the whistle on HSBC and 130,000 global tax evaders in 2008, has been arrested in Madrid on Tuesday in response to an arrest warrant issued by Switzerland for breaking the country’s bank secrecy laws. He lives in France, which rarely extradites its own citizens. But when Spanish authorities learned that he was in town to speak at a conference ominously titled, “When Telling the Truth is Heroic,” they made their move. If he is extradited to Switzerland he could face up to five years in prison. Falciani worked as a computer technician for HSBC’s Swiss subsidiary. One day in 2008, he left the office with five computer disks containing what would eventually become one of the largest leaks of banking data in history.

According to Swiss authorities, Falciani stole and then attempted to sell a trove of confidential data. Falciani says he was a whistleblower who wanted to expose a “broken” banking system, “which encouraged tax evasion.” When much of the stolen data was leaked to the press in 2015, it revealed, among other sordid things, that HSBC’s Swiss subsidiary routinely allowed clients to withdraw “bricks of cash,” often in foreign currencies of little use in Switzerland. It also colluded with clients to conceal undeclared “black” accounts from their domestic tax authorities and provided services to international criminals, corrupt businessmen, shady dictators and murky arms dealers.

As Falciani would soon find out, snitching on one of the world’s biggest banks and 130,000 of its richest clients does not make you a popular person in a country famed for its banking secrecy. In 2014 he was indicted in absentia by the Swiss federal government for violating the country’s bank secrecy laws and for industrial espionage. A year later he was sentenced by Switzerland’s federal court to five years in prison – the “longest sentence ever demanded by the confederation’s public ministry in a case of banking data theft.”

All these bubbles will burst.

• Toronto’s Epic Housing Bubble Turns to Bust (WS)

After having ballooned for 18 years with barely a dip during the Financial Crisis, Toronto’s housing market, Canada’s largest, and among the most inflated in the world, is heading south with a vengeance, both in terms of sales volume and prices, particularly at the high end. Home sales in the Greater Toronto Area (GTA) plunged 39.5% in March compared to a year ago, to 7,228 homes, according to the Toronto Real Estate Board (TREB), the local real estate lobbying group. This was spread across all types of homes, even the formerly red-hot condo sector: • Detached houses -46.3% • Semi-detached houses -30.6% • Townhouses -34.2% • Condos -32.7%.

While new listings of homes for sale fell 12.4% year-over-year, at 14,866, they’d surged 41% from the prior month, and added to the listings of homes already on the market. The total number of active listings – new listings plus the listings from prior months that hadn’t sold or been pulled without having sold – more than doubled year-over-year to 15,971 homes, and were up 20% from February. At the current sales rate, total listings pencil out to a supply of 2.1 months. The average days-on-the-market before the home is sold or the listing is pulled without having sold doubled year-over-year to 20 days. Both data points show that the market is cooling from its red-hot phase, that potential sellers aren’t panicking just yet, and that potential buyers are taking their time and getting more reluctant, or losing their appetite altogether, with the fear of missing out (FOMO) having evaporated.

Sales volume has been plunging for months while listings of homes for sale have also surged for months. Prices follow volume, and prices have been backing off, but in February they actually fell on a year-over-year basis, the first since the Financial Crisis, and in March, they fell more steeply. This is what the report called a “change in market conditions.” The average price for the Greater Toronto Area (GTA) plunged 14.3% year-over-year to C$784,588. In other words, the average buyer in March a year ago is now about C$130,000 in the hole.

Better check this out if this is you.

• Tax Trouble For -Certain- Bitcoin Traders (F.)

What do you do, come April 17, if you made a ton of money trading crypto last year and have since lost most of it? Panic, probably. A lot of last year’s winners are in deep porridge now. They owe tax on 2017 profits. They’re losing money now, so it’s not easy to come up with the cash to pay off the IRS. As for using today’s losses to offset last year’s gains, these tax naïfs are discovering, too late, that capital loss carryovers run forwards but not backwards. Suppose speculator Bob turned $200,000 into $1 million in last year’s feverish market, trading all the way—in and out of Bitcoin and Ethereum and Ripple and back in again. Now Bob has $800,000 in short-term capital gain to report on Schedule D. The state and federal tax bill is going to be upwards of $300,000.

The 2018 crash has shrunk Bob’s account value, let us suppose, to $300,000. If Bob sells out to pay the tax, he will have a $700,000 capital loss to claim. But he can claim the loss only against future capital gains, not past ones. Small consolation: Bob can use the $700,000 against up to $3,000 a year of ordinary income. If he throws in the towel on cryptocurrencies and goes back to his day job delivering pizzas, it will take him 234 years to catch even. Tyson Cross, an attorney in Reno, Nev. who has built up a specialty in crypto taxation, has been hearing many a sad tale recently. “Some alt coins are down to a tenth or less of their peak value,” he says. “The taxpayers are distraught. They don’t have any way to pay [the tax bill]. There’s only so much we can do.”

There were no laws. Heroin was candy.

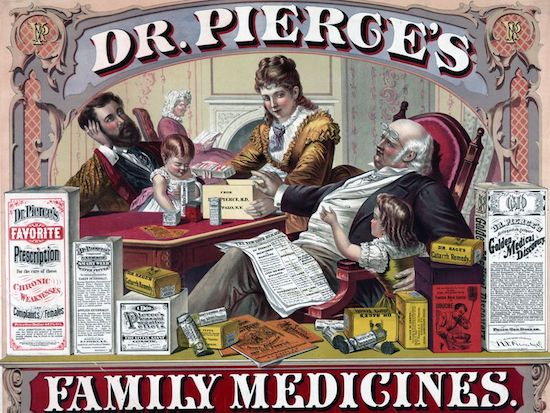

• How Advertising Shaped the First Opioid Epidemic (Smithsonian)

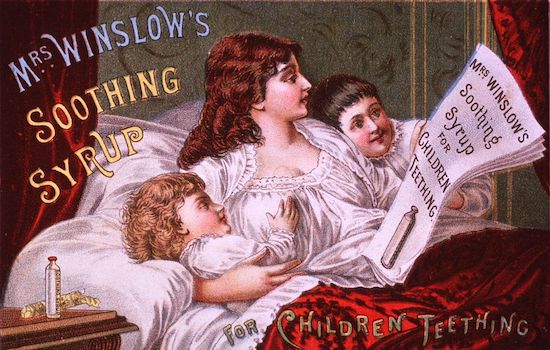

When historians trace back the roots of today’s opioid epidemic, they often find themselves returning to the wave of addiction that swept the U.S. in the late 19th century. That was when physicians first got their hands on morphine: a truly effective treatment for pain, delivered first by tablet and then by the newly invented hypodermic syringe. With no criminal regulations on morphine, opium or heroin, many of these drugs became the “secret ingredient” in readily available, dubiously effective medicines. In the 19th century, after all, there was no Food and Drug Administration (FDA) to regulate the advertising claims of health products. In such a climate, a popular so-called “patent medicine” market flourished.

Manufacturers of these nostrums often made misleading claims and kept their full ingredients list and formulas proprietary, though we now know they often contained cocaine, opium, morphine, alcohol and other intoxicants or toxins. Products like heroin cough drops and cocaine-laced toothache medicine were sold openly and freely over the counter, using colorful advertisements that can be downright shocking to modern eyes. Take this 1885 print ad for Mrs. Winslow’s Soothing Syrup for Teething Children, for instance, showing a mother and her two children looking suspiciously beatific. The morphine content may have helped. Yet while it’s easy to blame patent medicines and American negligence for the start of the first opioid epidemic, the real story is more complicated.

First, it would be a mistake to assume that Victorian era Americans were just hunky dory with giving infants morphine syrup. The problem was, they just didn’t know. It took the work of muckraking journalists such as Samuel Hopkins Adams, whose exposé series, “The Great American Fraud” appeared in Colliers from 1905 to 1906, to pull back the curtain. But more than that, widespread opiate use in Victorian America didn’t start with the patent medicines. It started with doctors.

Home › Forums › Debt Rattle April 5 2018