Theodor Horydczak U.S. Supreme Court interiors, Washington DC 1931

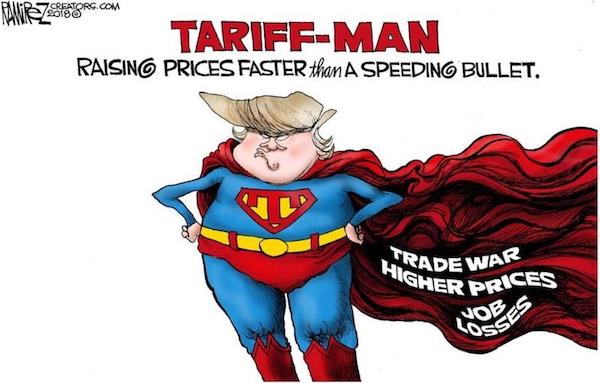

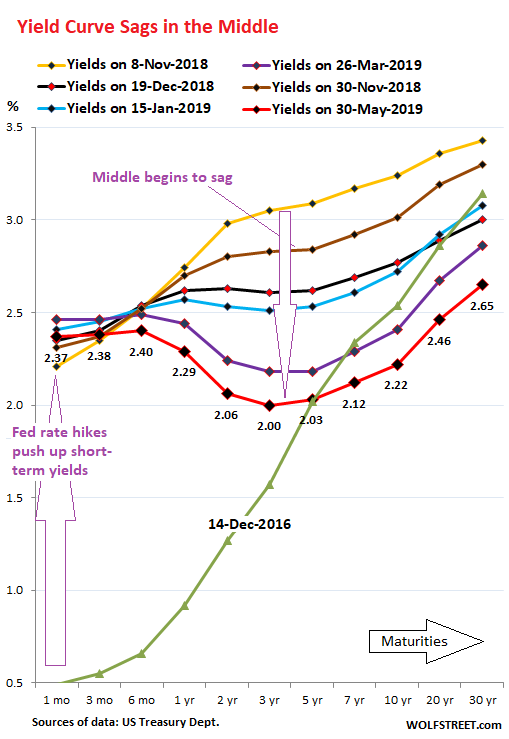

There is one issue underlying all the talks at this point: China is running out of dollars.

• China Suspends Planned Tariffs Scheduled For Dec. 15 On Some US Goods (R.)

China has suspended additional tariffs on some U.S. goods that were meant to be implemented on Dec. 15, the State Council’s customs tariff commission said on Sunday, after the world’s two largest economies agreed a “phase one” trade deal on Friday. The deal, rumors and leaks over which have gyrated world markets for months, reduces some U.S. tariffs in exchange for what U.S. officials said would be a big jump in Chinese purchases of American farm products and other goods. China’s retaliatory tariffs, which were due to take effect on Dec. 15, were meant to target goods ranging from corn and wheat to U.S. made vehicles and auto parts.

Other Chinese tariffs that had already been implemented on U.S. goods would be left in place, the commission said in a statement issued on the websites of government departments including China’s finance ministry. “China hopes, on the basis of equality and mutual respect, to work with the United States, to properly resolve each other’s core concerns and promote the stable development of U.S.-China economic and trade relations,” it added. Beijing has agreed to import at least $200 billion in additional U.S. goods and services over the next two years on top of the amount it purchased in 2017, the top U.S. trade negotiator said Friday.

Christopher Balding taught in China for a long time; he knows the country. This is his lenghty analysis of the trade deal.

• Unpacking The No Deal Not a Trade War Trade War Deal (Balding)

Having been subjected to such a barrage of horrendous trade war analysis that seems more like literary therapy for the politically frustrated than actual deal analysis, I have opted to write my own analysis of the deal. I will as studiously as possible try to avoid or limit any political opinionating, and stick strictly to the analyzing the deal points within the USTR Fact Sheet and providing what are the likely trade offs, risks, and perspective about each points. Let’s get started.

This deal is about a lot more than agriculture.I’m leading with this one only because it is arguably the most common myth and repeated like the 10 Ten Commandments and divine truth even though it is clearly false on numerous levels. The USTR specifically lists IP protection, tech transfer, agriculture, financial services, currency, expanding trade, and dispute resolution as the major areas. One report in the news quoted a source as saying there were 9 chapters which would come close to matching these general areas. Even within the broader trade purchase aspect, agriculture is not even the main area. Let us please kill once and for all, this deal is just about agriculture.

Intellectual Property and Technology Transfer The two paragraphs on IP and tech transfer in the USTR statement provide scant detail but use relatively ambitious language with regards to Chinese commitments. In IP, China will “address long standing concerns”. In tech transfer, the language is even more ambitious saying China “agreed to end its long-standing practice of forcing or pressuring foreign companies to transfer their technology to Chinese companies as a condition for obtaining market access, administrative approvals, or receiving advantages from the government” and “commits to provide transparency, fairness, and due process in administrative proceedings and to have technology transfer and licensing take place on market terms” and “commits to refrain from directing or supporting outbound investments aimed at acquiring foreign technology pursuant to industrial plans that create distortion.”

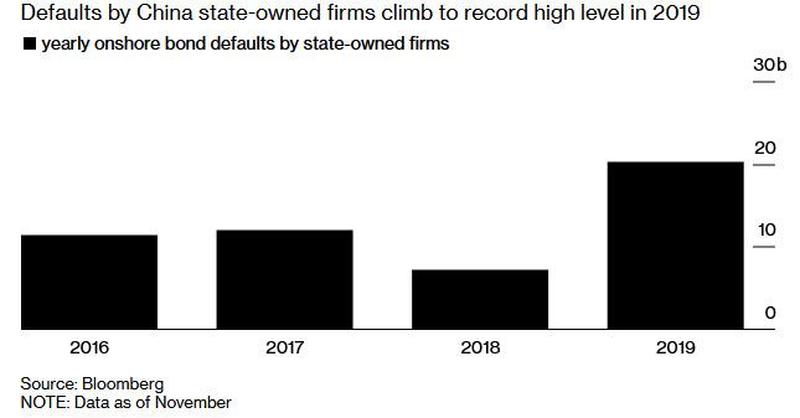

Borrowed in dollars, can’t pay back in dollars.

• Giant China SEO Announces Largest Dollar Bond Default In Two Decades (ZH)

Two weeks ago we previewed what we said would soon be a D-Day for China’s bond market, as a massive commodities trader and Global 500 state-owned enterprise was set for an “unprecedented” bond default. As of last week, this historic default is now in the history books after Tewoo, the closely watched Chinese commodities trader, became the biggest dollar bond defaulter among the nation’s state-owned companies in two decades, in what Bloomberg called a “moment of reckoning” for Beijing as China struggles to contain credit risk in a weakening economy, as bond defaults hit an all time high and are set to keep rising in the coming years.

Last Wednesday, Tewoo Group announced results of its “unprecedented” debt restructuring, which saw a majority of its investors accepting heavy losses, and which according to rating agencies qualifies as an event of default. As a result of the default, until recently seen as virtually impossible for a state-owned company, investors’ perceptions are undergoing a dramatic U-turn about government-owned borrowers whose state-ownership had for years offered an ironclad sense of security. No more: The fact that a state-owned enterprise such as Tewoo has now defaulted on repaying its dollar bonds in full, confirms that Beijing will no longer bail out troubled SOEs, let alone private firms, perhaps due to the strains imposed by the economy which while growing at just below 6%, is slowing the most in three decades.

It also raises concerns over the Chinese province of Tianjin, where Tewoo is based, following a series of rating downgrades and financing difficulties suffered by some of the city’s state-run firms. The metropolis near Beijing also has the highest ratio of local government financing vehicle bonds to GDP in China. As a reminder, Tewoo ranked 132 in 2018’s Fortune Global 500 list, higher than many other conglomerates including service carrier China Telecommunications Corp. and financial titan Citic Group Corp. It had an annual revenue of $66.6 billion, profits of about $122 million, assets worth $38.3 billion, and more than 17,000 employees as of 2017, according to Fortune’s website.

Glenn Greenwald has dug deep.

• IG Report Reveals Scandal of Historic Magnitude for the FBI and US Media (GG)

Just as was true when the Mueller investigation closed without a single American being charged with criminally conspiring with Russia over the 2016 election, Wednesday’s issuance of the long-waited report from the Department of Justice’s Inspector General reveals that years of major claims and narratives from the U.S. media were utter frauds. Before evaluating the media component of this scandal, the FBI’s gross abuse of its power – its serial deceit – is so grave and manifest that it requires little effort to demonstrate it. In sum, the IG Report documents multiple instances in which the FBI – in order to convince a FISA court to allow it spy on former Trump campaign operative Carter Page during the 2016 election – manipulated documents, concealed crucial exonerating evidence, and touted what it knew were unreliable if not outright false claims.

If you don’t consider FBI lying, concealment of evidence, and manipulation of documents in order to spy on a U.S. citizen in the middle of a presidential campaign to be a major scandal, what is? [..] They are out-of-control, virtually unlimited police state factions that lie, abuse their spying and law enforcement powers, and subvert democracy and civic and political freedoms as a matter of course. In this case, no rational person should allow standard partisan bickering to distort or hide this severe FBI corruption. The IG Report leaves no doubt about it.

[..] It’s long been the case that CIA, FBI and NSA operatives tried to infiltrate and shape domestic news, but they at least had the decency to do it clandestinely. In 2008, the New York Times’ David Barstow won the Pulitzer Prize for exposing a secret Pentagon program in which retired Generals and other security state agents would get hired as commentators and analysts and then – unbeknownst to their networks – coordinate their messaging to ensure that domestic news was being shaped by the propaganda of the military and intelligence communities.

But now it’s all out in the open. It’s virtually impossible to turn on MSNBC or CNN without being bombarded with former Generals, CIA operatives, FBI agents and NSA officials who now work for those networks as commentators and, increasingly, as reporters. [..] The past three years of “Russiagate” reporting – for which U.S. journalists have lavished themselves with Pulitzers and other prizes despite a multitude of embarrassing and dangerous errors about the Grave Russian Threat – has relied almost exclusively on anonymous, uncorroborated claims from Deep State operatives (and yes, that’s a term that fully applies to the U.S.). The few exceptions are when these networks feature former high-level security state operatives on camera to spread their false propaganda,

Tulsi to the rescue.

• The Bloated Pentagon Budget Should Be Spent on Human Needs (Nation)

Even as our nation fails to allocate adequate resources to feed the hungry, house the homeless, care for the sick and protect our planet, the coffers of war profiteers continue to grow. This is why we joined with 102 faith leaders and groups to call upon those who are vying to become our next president to embrace significant reallocations away from the bloated Pentagon budget toward major reinvestments in the needs of our communities. The Pentagon is on track to receive $738 billion next year, despite its inability to account for the money it already has. This includes taxpayer dollars that are redirected to corporate war profiteers, such as a staggering $34 billion contract announced in October for Lockheed Martin’s costly and fault-plagued F-35 fighter jet.

Congress has increased the Pentagon’s budget by $20 billion compared to last year. To put this in perspective, that’s double the amount of the Environmental Protection Agency’s entire budget and one-third of all the money spent on international diplomacy and development. It’s a stark and appalling contrast to the lived reality in our communities. As just a few examples, there are 140 million poor and low-income people living in the United States; about 40 million people in this country face food insecurity; salaries for our nation’s teachers plummeted by more than 4.5 percent over the last decade; we are losing veterans to suicide and drug overdose at alarming rates; and our national infrastructure is crumbling beneath our feet.

Why, then, would our elected officials agree to pump more money into weapon systems that don’t work, endless wars that don’t make us safe, and a refurbishment of our nuclear weapons arsenal that, if employed, can only end in apocalyptic destruction? It’s not just bad policy. We find it immoral. President Eisenhower said more than half a century ago: “Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone. It is spending the sweat of its laborers, the genius of its scientists, the hopes of its children.”

Note: Bellingcat is a crucial provider of “evidence” in the MH17 trial that starts in February. It has no credibility left.

• The Art of Doublespeak: Bellingcat and Mind Control (Curtin)

In the 1920s, the influential American intellectual Walter Lippman argued that the average person was incapable of seeing or understanding the world clearly and needed to be guided by experts behind the social curtain. In a number of books he laid out the theoretical foundations for the practical work of Edward Bernays, who developed “public relations” (aka propaganda) to carry out this task for the ruling elites. Bernays had honed his skills while working as a propagandist for the United States during World War I, and after the war he set himself up as a public relations counselor in New York City. There is a fascinating exchange at the beginning of Adam Curtis’s documentary, The Century of Self (above), where Bernays, then nearly 100 years old but still very sharp, reveals his manipulative mindset and that of so many of those who have followed in his wake.

He says the reason he couldn’t call his new business “propaganda” was because the Germans had given propaganda a “bad name,” and so he came up with the euphemism “public relations.” He then adds that “if you could use it [i.e. propaganda] for war, you certainly could use it for peace.” Of course, he never used PR for peace but just to manipulate public opinion (he helped engineer the CIA coup against the democratically elected Arbenz government in Guatemala in 1954 with fake news broadcasts). He says “the Germans gave propaganda a bad name,” not Bernays and the United States with their vast campaign of lies, mainly aimed at the American people to get their support for going to a war they opposed (think weapons of mass destruction).

He sounds proud of his war propaganda work that resounded to his credit since it led to support for the “war to end all wars” and subsequently to a hit movie about WWI, Yankee Doodle Dandy, made in 1942 to promote another war, since the first one somehow didn’t achieve its lofty goal. As Bernays has said, “The American motion picture is the greatest unconscious carrier of propaganda in the world today.”

[..] There is a notorious propaganda outfit called Bellingcat, started by an unemployed Englishman named Eliot Higgins, that is funded by The Atlantic Council (a think-tank with deep ties to the U.S. government, NATO, war manufacturers, and their allies), and the National Endowment for Democracy (NED) (another infamous U.S. front organization heavily involved in so-called color revolution regime change operations all around the world), that has just won the International Emmy Award for best documentary. The film with the Orwellian title, Bellingcat: Truth in a Post-Truth World, received its Emmy at a recent ceremony in New York City.

Bellingcat is an alleged group of amateur on-line researchers who have spent years shilling for the U.S. instigated war against the Syrian government, blaming the Douma chemical attack and others on the Assad government, and for the anti-Russian propaganda connected to, among other things, the Skripal poisoning case in England, and the downing of flight MH17 plane in Ukraine. It has been lauded by the corporate mainstream media in the west. Its support for the equally fraudulent White Helmets (also funded by the US and the UK) in Syria has also been praised by the western corporate media while being dissected as propaganda by many excellent independent journalists such as Eva Bartlett, Vanessa Beeley, Catte Black, among others.

It’s had its work skewered by the likes of Seymour Hersh and MIT professor Theodore Postol, and its US government connections pointed out by many others, including Ben Norton and Max Blumenthal at The Gray Zone. And now we have the mainstream media’s wall of silence on the leaks from the OPCW concerning the Douma chemical attack and the doctoring of their report that led to the illegal US bombing of Syria in the spring of 2018. Bellingcat was at the forefront of providing justification for such bombing, and now the journalists Peter Hitchens, Tareq Harrad (who recently resigned from Newsweek after accusing the publication of suppressing his revelations about the OPCW scandal) and others are fighting an uphill battle to get the truth out.

Yet Bellingcat: Truth in a Post-Truth World won the Emmy, fulfilling Bernays’ point about films being the greatest unconscious carriers of propaganda in the world today. Who presented the Emmy Award to the filmmakers, but none other than the rebel journalist Chris Hedges.

Dismantling the OPCW is the only possible way forward.

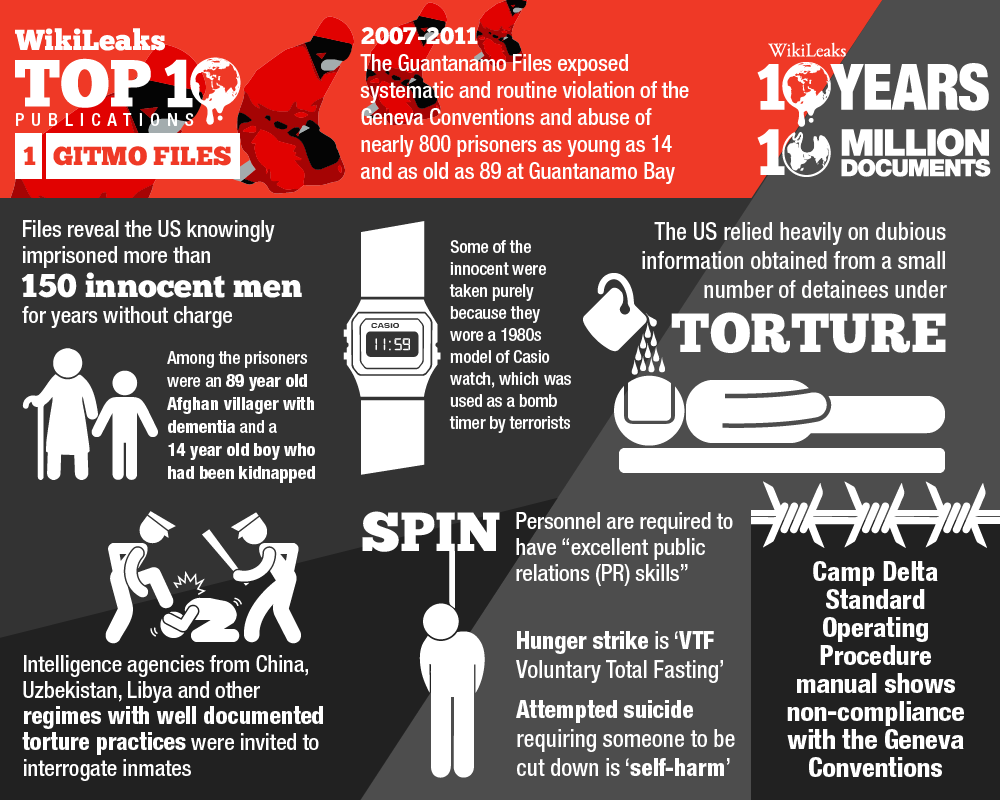

• WikiLeaks: 20 OPCW Inspectors Dissent From Syria Chemical Attack Narrative (ZH)

Late Saturday WikiLeaks released more documents which contradict the US narrative on Assad’s use of chemical weapons, specifically related to the April 7, 2018 Douma incident, which resulted in a major US and allied tomahawk missile and air strike campaign on dozens of targets in Damascus.

The leaked documents, including internal emails of the Organization for the Prohibition of Chemical Weapons (OPCW) — which investigated the Douma site — reveal mass dissent within the UN-authorized chemical weapons watchdog organization’s ranks over conclusions previously reached by the international body which pointed to Syrian government culpability. It’s part of a growing avalanche of dissent memos and documents casting the West’s push for war in Syria in doubt (which had resulted in two major US and allied attacks on Syria). This newly released batch, WikiLeaks reports, includes a memo stating 20 inspectors feel that the officially released version of the OPCW’s report on Douma “did not reflect the views of the team members that deployed to [Syria]”.

This comes amid widespread allegations US officials brought immense pressure to bear on the organization. The Daily Mail’s Peter Hitchens, who saw the leaked documents just prior to WikiLeaks going public with them had this to say: Sources stress that the scientists involved are ‘non-political, utterly uninterested in any strategic implications of what they reveal’. They just ‘feel that the OPCW has a duty to be true to its own science, and not to be influenced by political considerations as they fear it has been’. An internal memo seen by The Mail on Sunday suggests that as many 20 OPCW staff have expressed private doubts about the suppression of information or the manipulation of evidence.

This is about 1988. 25 years later, in 2013, Hunter was discharged from the U.S. Navy after testing positive for cocaine. One year after, he landed his job with Burisma. Two years after that, a 2016 police report said that Hunter Biden returned a rental car in Arizona that contained a cocaine pipe and “a small ziplock bag with a white powdery substance inside all sitting on the passenger seat.”

• Hunter Biden Drugs Charge Kept Under Wraps As Joe Led Drug War From Senate (WE)

Joe Biden’s son Hunter was arrested on Jersey Shore drug charges in 1988 and had his record expunged at a time when his father was pushing for the incarceration of drug offenders drawn disproportionately from minority groups. Congressional records reveal that Hunter Biden, now 49, was arrested in Stone Harbor, New Jersey, where the Biden family has often holidayed over the years, in June 1988. Hunter Biden, then 18, had just graduated from the prestigious Archmere Academy prep school, which his father had also attended. The former vice president and his wife Jill have often been spotted on trips to Stone Harbor.

The arrest has not previously been reported. Republicans have recently highlighted Hunter Biden’s drug abuse, questioning why it was not taken into account when the lobbyist was appointed to a $50,000-a-month post on the board of the Ukraine oil company Burisma in 2014, when his father, as vice president, was the Obama administration’s lead official on Ukraine. A year after the arrest, Joe Biden gave a speech in which he said the federal government needed to “hold every drug user accountable” because, “If there were no drug users, there would be no appetite for drugs, there would be no market for them.” He neglected to mention the drug use in his own family.

[..] Five months after his son escaped a sentence and had his possession charge kept secret, Biden voted for the Anti-Drug Abuse Act of 1988, which made crack cocaine, often used by poor, black offenders, the only drug with a mandatory minimum penalty for a first offense of simple possession. But while many minorities were imprisoned for minor drug offenses, the wealthy, white Hunter Biden was allowed to participate in a state diversionary program called pretrial intervention. The program allowed first offenders to “avoid a trial and having the stigma accompanying a guilty verdict,” according to the Rubinstein Law Firm in New Jersey.

Advice on how to deal with it, not a statement about how ridiculous this is.

• One-Third Of Credit Card Debt Is Caused By Medical Expenses (CNBC)

For millions of Americans, unexpected bills can be summed up in two words: medical debt. Surprise health-care costs have affected about 137.1 million adults in the past year, according to recent research. And many Americans are turning to credit cards to help manage those debt burdens, according to CompareCards.com. The website found that 33% of cardholders are in debt because of medical bills. And nearly 60% said they used a card because they had no other way to pay. If you’re saddled with this debt, you need to take action.

First, start by making sure that you’re getting the best interest rates for your balances. If you have debt sitting on a high-interest card, consider transferring the balance to a 0% credit card. You may also use a medical credit card for out-of-pocket expenses not covered by your insurance. These cards, which are offered by companies like CareCredit, have special financing you may not get on other cards. They’re interest-free for a few months as long as you make your monthly payments on time. After that period, though, be sure to pay the balance off in full to avoid deferred interest that will charged from the original date of purchase.

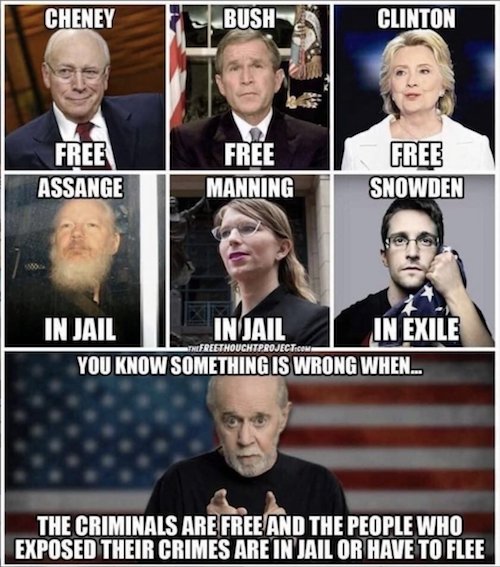

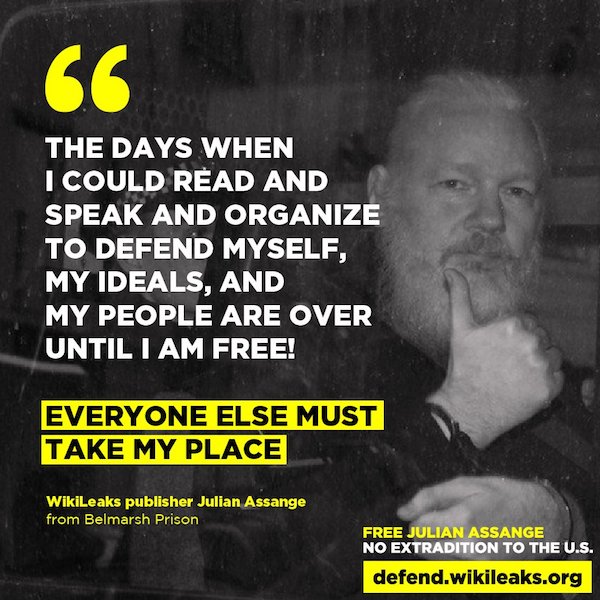

Obama revived the Espionage Act. But he didn’t have the guts to use it against journalists.

• Edward Snowden Speaks Out for Julian Assange and Chelsea Manning (RPI)

Last week, Edward Snowden, a whistleblower who has since 2013 escaped similar silencing via retaining sanctuary in Russia, spoke up in strong advocacy for Assange and Manning’s freedom. He did so in an interview with Democracy Now host Amy Goodman. Snowden points out in the interview that the US cases against Assange, Manning, and himself all derive from the Espionage Act, the same Espionage Act that he notes was used against Daniel Ellsberg in the 1970s after Ellsberg leaked the Pentagon Papers to media. Pointing as an example to Ellsberg being prevented from even telling a jury at trial why he leaked the Pentagon Papers that revealed the hidden truth about US actions in the Vietnam War, Snowden emphasizes that the Espionage Act “is a special law that absolutely rules out any kind of fair trial.”

Continuing, Snowden discusses in the interview Manning’s revelations of “torture and war crimes, indefinite detention on the part of the United States government in places like Iraq and Afghanistan and Guantanamo Bay in Cuba” and Snowden’s own “involvement in the revelation of global mass surveillance” as being part of activities by a “new generation” of whistleblowers. Like Ellsberg, Snowden relates that he and Manning were confronted with the Espionage Act “that forbids the jury to consider” if the leaking activity at issue “was something that did more good for the public to know than it did harm to the government in terms of inconvenience or theoretical risks of investigative journalism in a free society.” And Snowden makes sure to emphasizes that the victims of this type of persecution over the last few years extend beyond Manning and himself.

Indeed, the charging of Julian Assange under the Espionage Act Snowden sees as particularly threatening. States Snowden: “We moved from an individual and exceptional case that was not repeated for decades and decades in the Ellsberg instance to something that under the Obama administration he charged more sources of journalism using this special law than all other presidents in the history of the United States combined. And now, under the Trump administration, we have taken one more step. We have gone from the United States government’s war on whistleblowers to, now, a war on journalism with the indictment of Julian Assange for what even the government itself admits was work related to journalism. And this I think is a dangerous, dangerous thing — not just for us, not just for Julian Assange, but for the world and the future.”

“December 20 is an important day..”

• Assange Lawyer Discloses Conditions For British Justice TO RETHINK His Extradition (RT)

A Spanish judge will question Julian Assange on a Spain-based security firm thought to have spied on him in the Ecuadorian Embassy in London. His lawyer hopes it may help thwart the WikiLeaks founder’s extradition to the US. Set for next week, the questioning is part of a criminal inquiry the Spanish High Court is carrying out into UC Global, a private security company suspected of gathering surveillance on Assange and passing it further to US intelligence services. “December 20 is an important day,” Aitor Martinez, a lawyer in charge of defending Assange in Spain, told Russia’s RIA Novosti news agency. The Spanish judge will go to Westminster Magistrates Court “to receive a video conference testimony from Mr Assange as a victim of the alleged spy plot,” he revealed.

The firm’s name surfaced this summer when El Pais newspaper reported that it was eavesdropping on Assange during his exile at the Ecuadorian diplomatic mission in London. Citing recordings it has had access to, the paper alleged that the firm – tasked to guard the embassy – specifically focused on Assange’s legal matters discussions. Now, Assange’s input is invaluable as it can pave the way to shooting down US efforts to try the publisher on their soil, Martinez explained. “Obviously, once Spanish justice receives such testimonies from Mr. Assange … the British justice should rethink the usefulness of his extradition [to the US],” he argued. As the inquiry progressed, the Spanish High Court arrested the company’s owner David Morales, a former member of the Spanish military, believed to have liaised with the US side.

He was released on bail, but his company’s premises were searched and his bank accounts frozen. As the story unfolded, it emerged that UC Global operatives also monitored Russian and American visitors to Assange, handing their profiles to US intelligence. Morales himself didn’t try to hide his ties to the “American friends.” According to Germany’s NDR broadcaster, which filed a complaint against UC Global for having targeted one of its journalists who visited Assange, Morales allegedly told one of his employees: “From now on, we play in the first league… We are now working for the dark side.” He is said to have traveled up to twice a month to the US to deliver intelligence taken from the Ecuadorian Embassy.

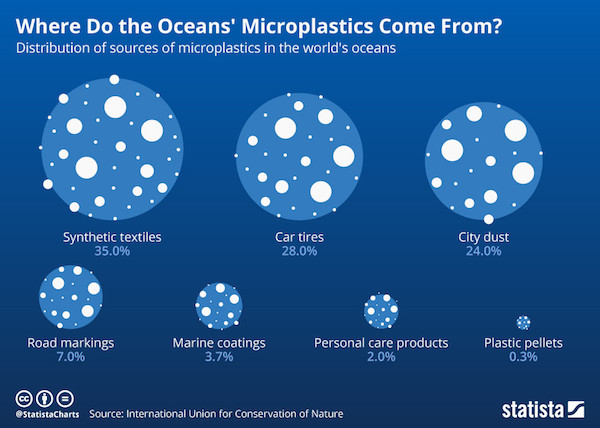

And in our own bodies too, if not now then soon.

• A Million Times More Microplastic In The Oceans Than We Thought (Wef)

There could be a million times more microplastics floating around our oceans than previously thought, according to new research suggesting existing studies could have seriously underestimated the problem. Some microplastics – defined as fragments measuring less than 5 mm – are too small to be caught in the nets traditionally used to collect samples, making them go unnoticed. But researchers say a new technique has enabled more accurate measurements, capturing pieces smaller than the width of a human hair. The study, led by biological oceanographer Jennifer Brandon of Scripps Institution of Oceanography, published in the science journal Limnology and Oceanography Letters, found the concentration of tiny plastic pieces could be five to seven orders of magnitude greater than previously thought.

These fragments make their way into the world’s waterways and end up in our oceans. More than one-third of microplastics in the ocean come from synthetic fabrics, such as polyester or nylon. Car tyres are the second-leading source, releasing plastic particles as they erode. To more accurately record the level of microplastic pollution in ocean waters, the researchers analysed seawater salps, which are tiny, barrel-shaped filter feeders. These invertebrates inhabit ocean waters to depths of around 2 kilometres. Salps pump salt water through their bodies as they perform a pulsing movement both to feed and to move through the ocean. Filter-feeding in the ocean depths makes them a likely place to find microplastics, the researchers say.

All of the salp samples taken from three different ocean zones had mini-microplastic particles in their stomachs. Since food passes through the creature’s digestive system in two to seven hours, it was an alarming find. “The thing that truly surprised me the most was that every salp, regardless of year collected, species, life stage, or part of the ocean collected, had plastic in its stomach,” Brandon explained to Earther. “A species having 100% ingestion rates is quite extraordinary, and devastating for the food web that eats salps.”

Please put the Automatic Earth on your Christmas charity list. Support us on Paypal and Patreon.

Top of the page, left and right sidebars. Thank you.