Pieter Bruegel the Elder� The Triumph of Death �1562

Finally financial ‘markets’ go through a substantial dip, which Steve Mnuchin claims is just temporary and Donald Trump says is caused by the fact that the Fed is ‘loco’. Mnuchin may well be right, but it won’t be because he knows something you don’t.

And Trump is certainly right, but in reality the Fed has been loco for many years, so why be surprised if it acts crazy now? The reason Mnuchin and a million other ‘experts’ may be right without realizing it is that the Fed has been crazy enough to kill the financial markets.

Or at least killed what made the markets functional, and beneficial to society. And that may well be exactly what Jay Powell is trying to repair, but he may well not be aware of that either. Looked at from a ‘benign’ angle, Powell is perhaps raising rates so people can regain insight into what they’re buying.

The pre-Powell Fed pushed up asset prices (don’t let’s say ‘values’) to such heights nobody has any insight anymore into what anything is truly worth. And in what was formerly known as the financial markets that was not important, because what were formerly known as investors were making heaps of money regardless.

Surely they must all have known that this wouldn’t continue?! That it’s just a matter of timing, of knowing when it would end? Oh, but that’s not really possible, is it, without the very price discovery process the Fed successfully strangulated?

Still, there must also be tons of people left thinking the Fed can kick that can six times to the moon and back, or sixty. If only because they’ve never bothered to think about price discovery, and what role it plays in the very ‘markets’ they volunteer to spend their money in.

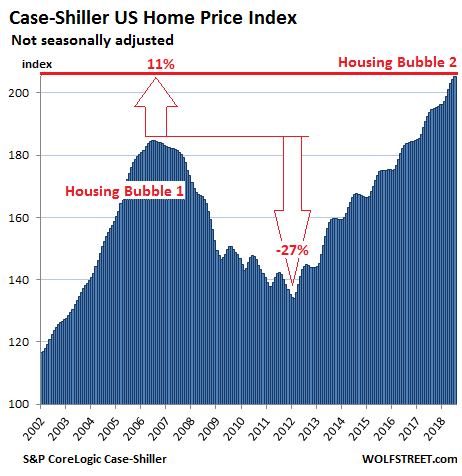

And along those same lines, many acknowledge housing bubbles in Sydney and Vancouver but think the US has learned its lesson a decade ago. And the loco Fed plays its role there too: mortgage rates have been ultra-low, enticing the last left batch of greater fools not mortally wounded by the last fire to jump in this time. Wolf Richter’s Case-Shiller graph says plenty in that regard:

But of course things tend back to normalcy, and it doesn’t take all the overleveraged stock- and home buyers longing for price discovery; it takes just a few to get the engine started. And then everyone will be along for the ride. So from that angle Jay Powell looks anything but crazy raising rates, we just can’t be sure if he knows what the consequences will be.

Not that it matters all that much what he does or does not know. What was formerly the market is like a pendulum swung so far out of balance that it costs ever more effort and money to keep it from moving towards equilibrium, and that process has only one possible outcome.

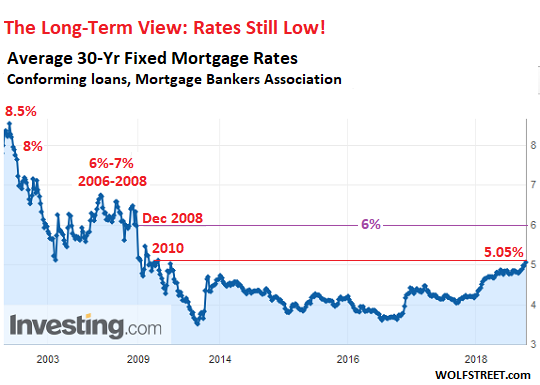

For mortgage rates, it looks something like this, and to make anyone able to buy any home at all higher rates will of necessity mean lower prices. You can’t, nobody can, not the Fed or the government can, keep that pendulum away from its tendency towards equilibrium forever.

For stocks it looks much the same. So why try, you’d think?! To prevent incumbents and ruling classes from being exposed as swimming naked, that’s why. They invented a way to make the entire nation swim naked, thinking they’d never be found out because the water levels were so high.

Whether yesterday’s 831-point Dow dip is temporary or not is of little interest. Much more important is that the entire asset prices situation is temporary. It doesn’t matter if the Fed pumps $1, $10, or $100 trillion into what once were markets, in the end it all comes down to how many people can pay how much money for the assets.

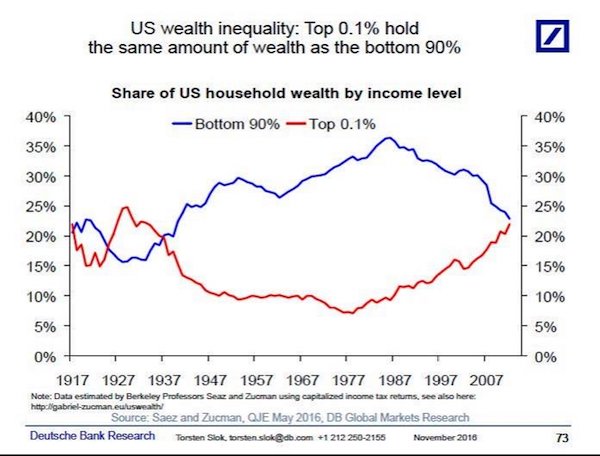

And since there is never an unending supply of greater fools, we know where this is going. The easy money and low rates and asset purchases at central banks and stock buybacks by companies can and will result only in more profits and more wealth for a few, and sheer endlessly less for the many.

Inequality in the US has now reached such extremities that the country’s AAA rating threatens to be taken away –as Moody’s indicated-; the government has so many people it must support financially (or let perish) that its financial position comes under pressure. Which is, again, negative for the many, for the few; they don’t care about that rating.

Yes, too many people are on some form of welfare in America. And Washington would love to throw many of them off of it. The many have no representation on Capitol Hill anymore. Just about any senator and congress(wo)man is a millionaire or certainly well-off.

How can the country get its rating back, or at least not lose it due to its increasing inequality? There seem to be two ways: let the 80 million now on welfare die by the side of the road, or provide them with jobs that allow them a fruitful life. That may sound like socialism or something, but it’s really the exact opposite.

It’s not the government’s role to give people jobs, but it is its role to make sure conditions are in place for the private sector to provide them. Trump’s ‘trade wars’ look crazy to many, but the intent is to get jobs back to the US. But there is much more.

America was once prosperous. What changed?

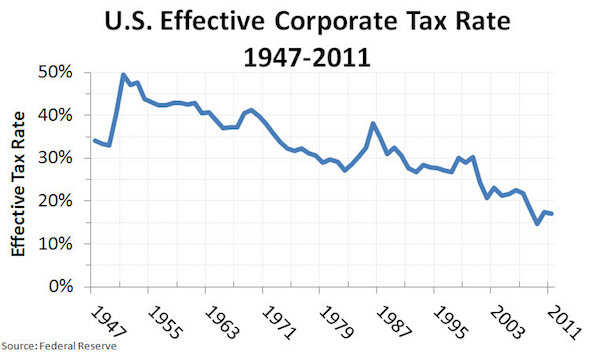

Here’s one thing: In what was -arguably?- America’s wealthiest time as a nation, the post-World War II period, income taxes for the richest were as high as 90% (1952: 92%); they were slowly brought down towards 70%. Only when Ronald Reagan took over in 1980 did they really fall (1982: 50%). This was ‘justified’ by lowering the highest income bracket (1982: $85,600, it had been between $200,000 and $400,000 for years).

In 1988, the top rate plunged to 28%, and the highest bracket to $29,750. Today, the top rate is 39.6% and the high bracket $400,000. In a graph, the consequences look like this:

The corporate tax rate, meanwhile, pulled this one, and don’t get started on tax havens etc.:

And that situation has led to a huge financial crisis, to the Fed going crazy and handing out trillions to the exact wrong part of society, those who already have a lot of money, and the result has been an absolute disaster, at least for the country; not so much for its elites.

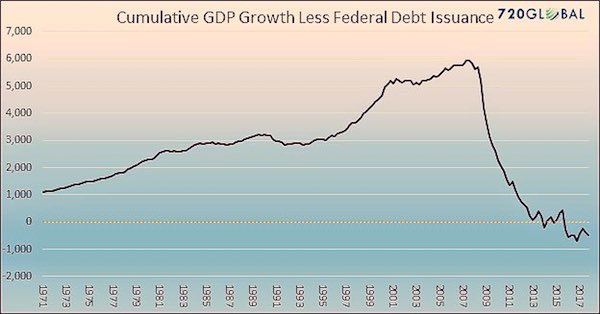

But as even Moody’s now recognizes, you can’t run an AAA-rated country on elites alone. Despite the crazy Fed trillions, the US has achieved negative growth (imagine where it would be without):

Something must be done. Problem is, with only those millionaires in charge in the House and Senate, the likelihood of boosting income tax levels up to where they were when America was most prosperous is extremely low. And Trump’s tariffs are not on their own going to bring back the jobs; they can’t rebuild the lost infrastructure, for one thing.

Something must be done, and it’s entirely unclear what, or rather, who’s going to do it. The Democrats have nothing, or nothing but frustrated millionaires and Bernie Sanders. The GOP has only Trump. None of these people are going to vote to double their income taxes.

Much of what needs to be done will be classified as socialism, ridiculed and thrown out the window, even if the country was anything but socialist under Eisenhower and Kennedy, during its -at least economic- Golden Age.

It’s a nice puzzle, isn’t it? Well, maybe not so nice after all.

Home › Forums › Of Course The Fed Is Crazy