James McNeill Whistler Harmony in Blue and Silver: Trouville 1865

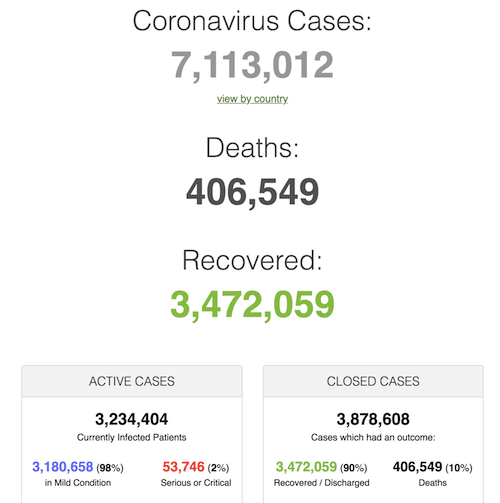

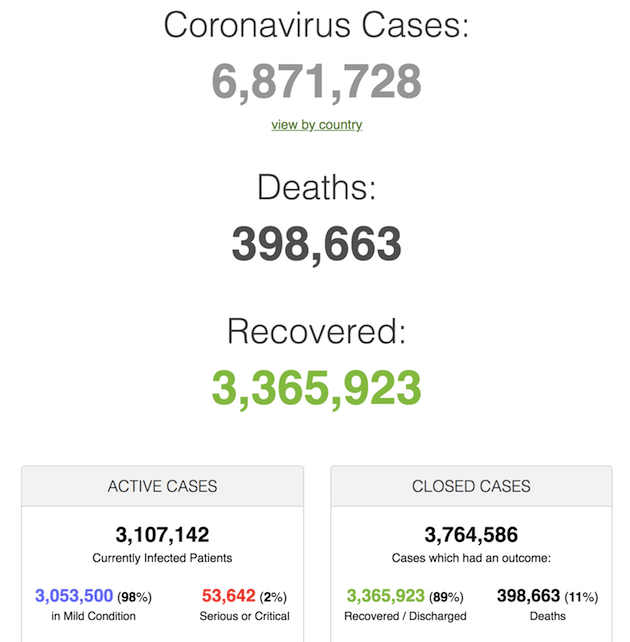

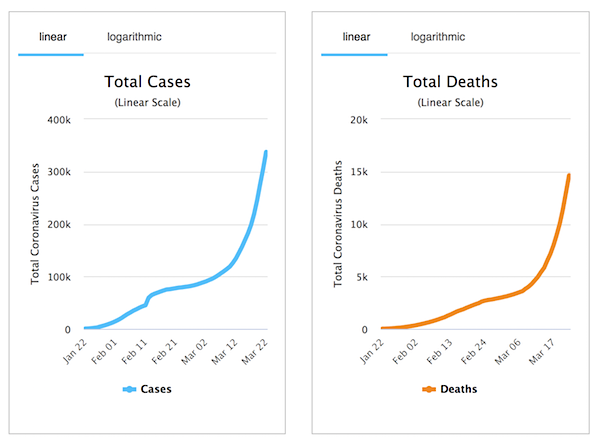

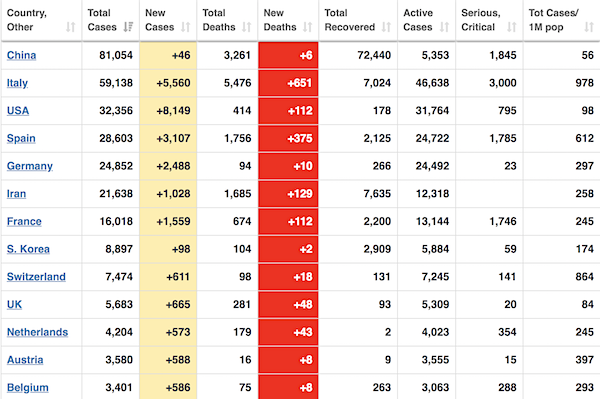

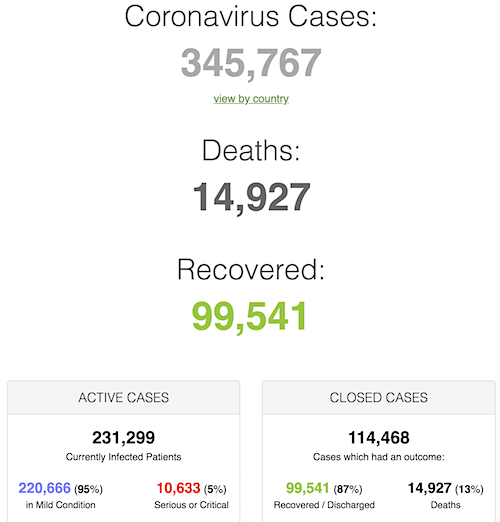

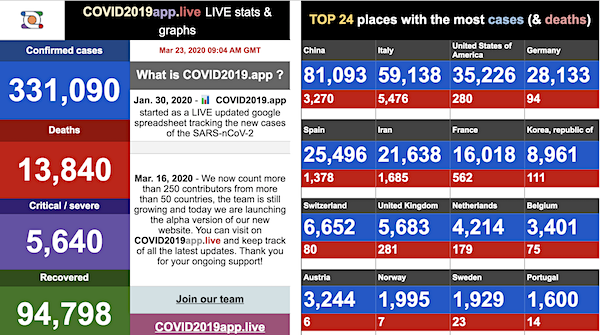

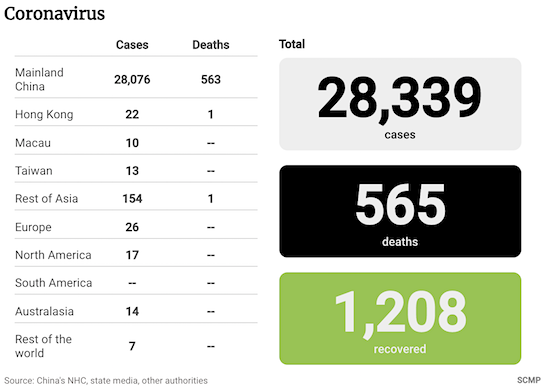

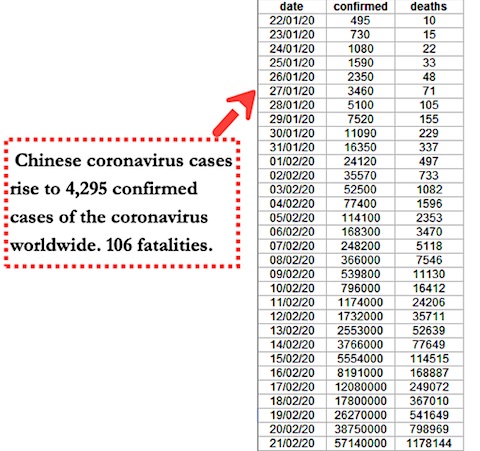

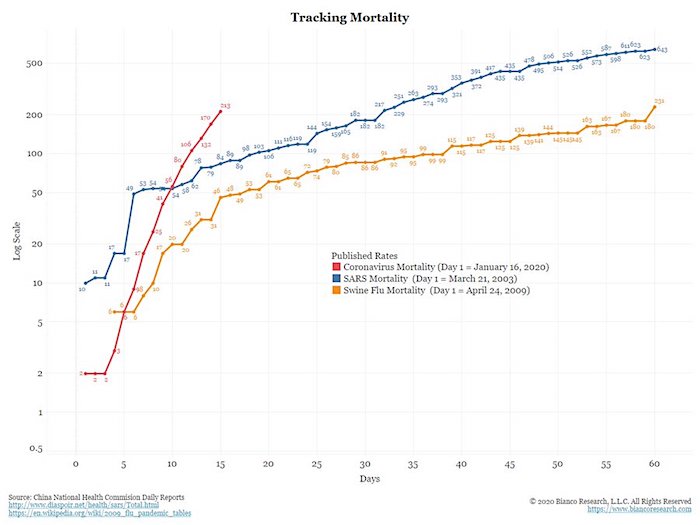

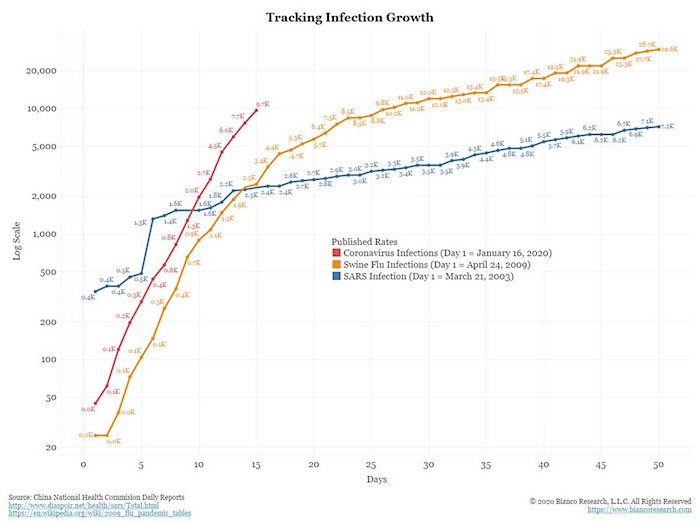

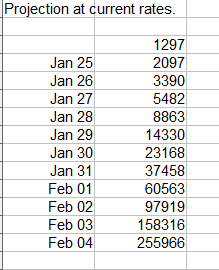

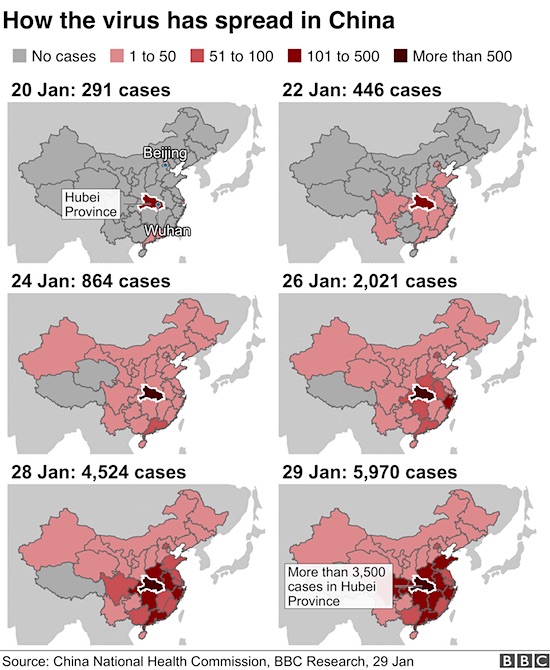

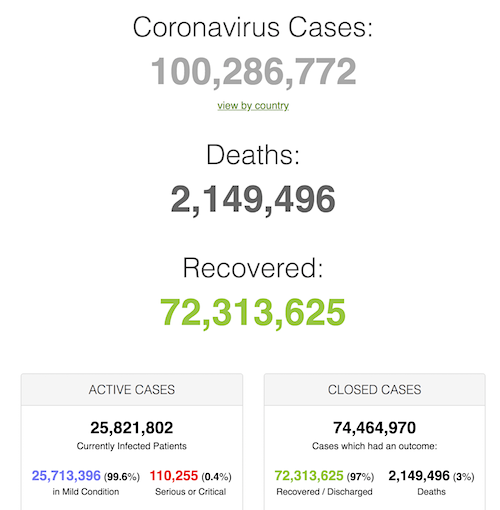

We passed 100 million cases overnight.

And off to the bullfight we go. Still not a word on HCQ, ivermectin or even vitamin D. Is it really just incompetence?

• EU Threatens To Block Covid Vaccine Exports Amid Astrazeneca Shortfall (G.)

The EU has threatened to block exports of coronavirus vaccines to countries outside the bloc such as Britain, after AstraZeneca was accused of failing to give a satisfactory explanation for a huge shortfall of promised doses to member states. The pharmaceutical company’s new distribution plans were said to be “unacceptable” after it “surprisingly” informed the European commission on Friday that there would be significant shortfalls on the original schedule. The EU has been due to receive 100m doses in the first quarter of this year. But it is feared that the bloc will only receive half of that despite making large advance purchases ahead of authorisation of the vaccine by the European medicines agency.

In a heated call with AstraZeneca’s chief executive, Pascal Soriot, on Monday, the European commission president, Ursula von der Leyen, said the company must live up to its contractual obligations. The EMA is expected to authorise the vaccine by the end of this week. Von der Leyen’s spokesperson said: “She made it clear that she expects AstraZeneca to deliver on the contractual arrangements foreseen in the advance purchasing agreement. “She reminded Mr Soriot that the EU has invested significant amounts in the company up front precisely to ensure that production is ramped up even before the conditional market authorisation is delivered by the European Medicines Agency. “Of course, production issues can appear with the complex vaccine, but we expect the company to find solutions and to exploit all possible flexibilities to deliver swiftly.”

The EU’s health commissioner, Stella Kyriakides, made a televised statement to express her frustration at the company’s behaviour, warning that the answers so far provided had not been satisfactory. Late on Monday evening following discussions with executives representing the pharmaceutical company, Kyriakides tweeted: “Discussions with AstraZeneca today resulted in dissatisfaction with the lack of clarity and insufficient explanations. “EU member states are united: vaccine developers have societal and contractual responsibilities they need to uphold. “With our member states, we have requested from [Astrazeneca] a detailed planning of vaccine deliveries and when distribution will take place to member states. Another meeting will be convened on Wednesday to discuss the matter further.”

On the bright side, at least we know where those trillions are. Safely in the hands of Bezos, Musk et al.

• COVID19 Has Cost Global Workers $3.7 Trillion In Lost Earnings – ILO (G.)

The economic blow from Covid-19 has cost workers around the world $3.7tn (£2.7tn) in lost earnings, after the pandemic wiped out four times the number of working hours lost in the 2008 financial crisis, according to the UN’s labour body. The International Labour Organization (ILO) said women and younger workers had borne the brunt of job losses and reductions in hours, and warned that people in sectors hardest-hit by the crisis – such as hospitality and retail – risked being left behind when the economy recovers. Sounding the alarm that entrenched levels of inequality risked becoming a defining feature of the economic rebound from Covid-19, the Geneva-based agency said that governments around the world needed to take urgent action to support those at the heart of the storm.

In its annual analysis of the global jobs market, it said 8.8% of working hours were lost in 2020 relative to the end of 2019, equivalent to 255m full-time jobs. This is approximately four times bigger than the damage suffered by workers as a consequence of the 2008-9 financial crisis. These “massive losses” resulted in an 8.3% decline in global labour income, before government support measures are included, according to the ILO, equivalent to $3.7tn in earnings – about 4.4% of global GDP. Women have been more affected than men by the disruption to the jobs market, with female workers more likely to drop out of work altogether and stop looking for a new job. Younger workers have also been particularly hard hit, either losing jobs, dropping out of the labour force or delaying the search for a first job.

The ILO said there were some encouraging signs of recovery at the start of 2021 as the Covid-19 vaccine is gradually deployed around the world. However, it still estimated the continuing economic fallout would lead to a 3% loss of working hours globally in 2021 compared with the end of 2019, equivalent to 90m full-time jobs. In a pessimistic scenario, which assumes slow progress on vaccination, working hours would fall by 4.6% this year, while on an optimistic path the world economy would still lose 1.3% of working hours.

They’re so hungry for blood they can’t see how ridiculous they look.

• House Delivers Impeachment Article To Senate (ZH)

The House delivered its single impeachment article against former President Donald Trump to the Senate on Monday, setting the stage for a February 8 trial. Just three Senate Republicans were present during the formal delivery of the article; Mitch McConnell, Mitt Romney and Roger Marshall. Senators will get sworn in as jurors on Tuesday, according to a previous statement by Senate Majority Leader Chuck Schumer (D-NY), while both the impeachment managers who will argue the House Democrats’ case, and Trump’s defense team, will have time to draft and file legal briefs, according to CNBC. “The managers, headed by lead manager Rep. Jamie Raskin, D-Md., carried the article across the Capitol to the Senate on Monday in masked pairs as part of a formal procession. As Raskin read the charge against Trump, a smattering of senators wearing face coverings looked on from within the chamber.” -CNBC

Ironically, Trump – the only president to be impeached twice by the House – is unlikely to be convicted according to none other than President Biden, who told CNN he believed the outcome would be different if Trump had six months left in office – but that he doubts the required 17 GOP senators will vote to convict. Which begs the question if the entire exercise is moot, then why do it as it will only further polarize the already deeply divided US society and certainly not help the “unity” that Biden is allegedly striving to achieve. Trump was charged by the House with incitement of insurrection at the US Capitol on Jan. 6 by, as House Democrats claim, ‘falsely claiming that widespread election fraud cost him the 2020 election,’ and then encouraging his supporters to show up and challenge the electoral college count.

According to the article, Trump “threatened the integrity of the democratic system, interfered with the peaceful transition of power, and imperiled a coequal branch of Government,” and “thereby betrayed his trust as President, to the manifest injury of the people of the United States.”

Twitter comment:

“DC will stay under military occupation while the opposition leader is put on trial..”

• Joe Biden On Donald Trump’s Impeachment Trial: ‘It Has To Happen’ (G.)

The impeachment trial of Donald Trump “has to happen”, Joe Biden told CNN on Monday. While acknowledging the effect it could have on his agenda, the president said there would be “a worse effect if it didn’t happen”. Biden said he didn’t think enough Republican senators would vote for impeachment to convict, though he also said the outcome might well have been different if Trump had had six months left in his term. “The Senate has changed since I was there, but it hasn’t changed that much,” Biden said. The US House on Monday delivered its article of impeachment against Trump to the Senate, setting the stage for Trump’s second impeachment trial and the first ever Senate trial of a former US president.

Trump has been charged with inciting the attack on the US Capitol on 6 January, when an assault by a violent pro-Trump mob lead to the deaths of five people. Monday’s delivery and formal reading of the charge marks the opening of the trial, although arguments are set to start the week of 8 February. Republicans and Democrats last week agreed to a two-week delay to the start of the proceedings to allow both sides to prepare arguments and give senators a fortnight to negotiate vital legislation to mitigate the impact of the coronavirus and consider Biden’s cabinet appointments. Following Trump’s impeachment in the House on 13 January, Biden had said he hoped senators would “deal with their constitutional responsibilities on impeachment while also working on the other urgent business of this nation”.

Judge, jury and henchman. Where’s the impartiality? Isn’t that required in a trial?

• Sen. Leahy To Preside Over Trump’s Second Impeachment Trial (JTN)

Vermont Democratic Sen. Patrick Leahy is presiding over the upcoming impeachment trial of former President Trump in the Democratic-led Senate, the lawmakers announced in a statement on Monday. Chief Justice John Roberts presided over the first impeachment trial against Trump, which centered on his phone conversation with Volodymyr Zelensky, the president of Ukraine, in which he brought up Hunter Biden’s work with a Ukrainian gas company while his father, Joe Biden, was U.S. vice president. Leahy, the new Senate president pro tempore, voted in favor of convicting Trump on both articles of impeachment during the first trial against Trump in February 2020. Trump was ultimately acquitted by the Republican-led Senate.

“The president pro tempore has historically presided over Senate impeachment trials of non-presidents. When presiding over an impeachment trial, the president pro tempore takes an additional special oath to do impartial justice according to the Constitution and the laws,” Leahy said in a statement on Monday. “It is an oath that I take extraordinarily seriously.” Leahy also said he considers holding the president pro tempore position “one of the highest honors and most serious responsibilities” of his political career. “When I preside over the impeachment trial of former President Donald Trump, I will not waver from my constitutional and sworn obligations to administer the trial with fairness, in accordance with the Constitution and the laws,” he said.

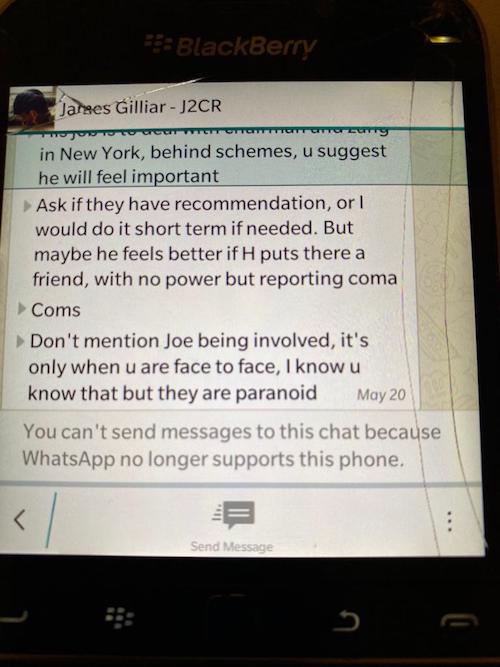

“Mark Zuckerberg alone poured $419 million into this scheme.”

• Democrats Have Released A Roadmap To One-Party Rule (RCP)

The Democrats appear intent on instituting one-party rule in the United States. They’re trying to use the U.S. Capitol riots as an excuse to criminalize dissent and banish conservative voices from the public sphere, and at the same time they’re hoping to use their temporary, razor-thin majority in Congress to rewrite the rules governing our elections in a way designed to keep the Democratic Party entrenched in power for decades to come. In the House, Democrats have revived sweeping election reform legislation that died in the Senate during the previous session, perhaps hoping they can browbeat enough Republicans into going along with them. If that happens, the “Grand Old Party” of Abraham Lincoln might as well disband, because Republicans would never have any hope of regaining a congressional majority or controlling the White House under the rules that HR 1 would put in place.

Although the Constitution explicitly places state legislatures in charge of managing federal elections, HR 1 seeks to use the power of the purse to bludgeon the states into conforming to a centralized system pioneered in California and other deep-blue states. Congress can’t technically compel the states to change their voting laws, but seasoned politicians know that the states have become dependent on federal money to run their elections, and can’t afford to pick up the tab themselves. To make matters worse, HR 1 declares that Congress possesses “ultimate supervisory power over Federal elections” — an extraordinary usurpation of governmental authority that the Founders specifically assigned to the states. The 2020 election witnessed private interests dictating the manner in which the election was conducted in the nation’s urban cores.

Mark Zuckerberg alone poured $419 million into this scheme. The goal of centralizing power in the hands of the federal government has long been at the heart of liberal politics, and this legislation demonstrates why. HR 1 would codify the very practices — many of them currently illegal in most states — that created widespread irregularities in the 2020 elections and contributed greatly to public mistrust of the electoral process. In 2020, state and local officials used the COVID-19 pandemic as justification to ignore or deliberately violate state election laws. If HR 1 is enacted, they won’t need any such excuse in 2022 because the states will have no choice but to implement policies such as legalized ballot harvesting, early voting, and universal mail-in voting, as well as repeal of voter ID laws, signature-matching laws, and other ballot security measures.

Democrats’ wet dream.

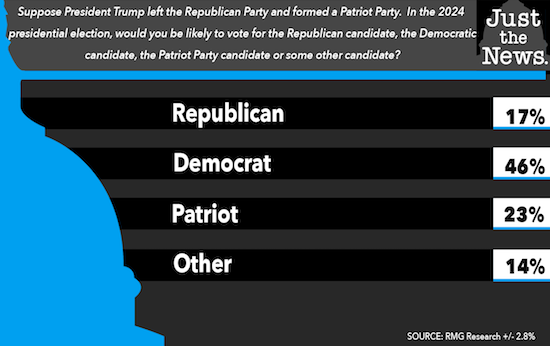

• Poll: Trump ‘Patriot Party’ Would Win 23% Of Voters, Drop GOP To Third (JTN)

A hypothetical “Patriot Party” led by former President Donald Trump would win the support of almost a quarter — 23% — of the electorate, bumping the GOP down to third place with just 17%, according to a new Just the News poll with Scott Rasmussen. The startling survey result comes amid reports that Senate Republican support for convicting Trump in an impeachment trial is fast eroding. A Trump third party could provoke a pivotal realignment in American politics. With the support of 46% of registered voters in the new poll, Democrats would reap the benefits of a fractured opposition and entrench themselves as the nation’s dominant party — even without majority support.

Among “very conservative” voters — who make up a disproportionately large bloc within the Republican primary electorate — a Trump Patriot Party crushes the GOP 55%-24%. Should Trump remain in the GOP, his wide lead among these highly motivated voters affords him great leverage to influence the direction of the party by wielding the threat of conservative primary challenges against establishment Republicans ill at ease with the former president’s combative brew of conservatism infused with populism and nationalism. Despite Trump’s outperformance in 2020 of recent GOP presidential candidates among minorities, African-American and Hispanic voters effectively split evenly between the GOP and a Patriot Party in the the new poll.

Move the goalposts.

• Democrat Sens. Manchin, Sinema Won’t Back Elimination Of The Filibuster (JTN)

Democratic Sens. Joe Manchin and Kyrsten Sinema will not back the elimination of the filibuster. “I do not support doing away with the filibuster under any condition. It’s not who I am,” West Virginia’s Manchin said on Monday, according to The Hill. “If I haven’t said it very plain, maybe Sen. McConnell hasn’t understood, I want to basically say it for you. That I will not vote in this Congress, that’s two years, right? I will not vote” to alter the filibuster, the senator said in an interview on Monday, according to Politico. Sinema of Arizona is also unwilling to support nixing the filibuster. According to the Washington Post, a Sinema spokesperson said that the lawmaker is “against eliminating the filibuster, and she is not open to changing her mind about eliminating the filibuster.” “The Senate filibuster has evolved over the course of its history into a de facto supermajority requirement, necessitating 60 votes to end debate and advance legislation,” according to the Post.

Vicious circles: as Fed president, she lowered interest rates, which as Treasury Secretary she can now use to excuse “acting big”.

• Janet Yellen Confirmed As Treasury Secretary (Axios)

The Senate voted 84-15 to confirm Janet Yellen as Treasury secretary on Monday. Yellen is the first woman to serve as Treasury secretary, a Cabinet position that will be crucial in helping steer the country out of the pandemic-induced economic crisis. Yellen previously served as the first female chair of the Council of Economic Advisers under President Clinton and the first female chair of the Federal Reserve under President Obama. Her confirmation as Treasury secretary makes her the first person to have held all three economic power positions in the federal government. Yellen told senators during her confirmation hearings that her immediate focus would be pandemic relief. With her confirmation, she can immediately start negotiating and working with Congress to pass President Biden’s $1.9 trillion coronavirus relief proposal.

“The damage has been sweeping, and as the President-elect said last Thursday, our response must be, too,” Yellen said last week. Yellen also endorsed Biden’s tax reform plan in her testimony, but she said the administration’s top legislative priority would be economic stimulus, with infrastructure not too far behind. “The focus right now is on providing relief and on helping families keep a roof over their heads and food on the table, and not on raising taxes.” “Neither the president-elect nor I propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big.”

Big Bird is watching you.

• Twitter Launches Birdwatch, A Wikipedia-Style Approach To Fight Misinformation (F.)

In a significant attempt to overhaul how it moderates content, Twitter on Monday unveiled Birdwatch, a pilot program to crowdsource fact-checks to combat misinformation. Birdwatch will allow regular users, called “Birdwatchers,” to identify tweets they think have misinformation and write notes with more information and context, which is similar to Wikipedia, where registered volunteers write, update and edit articles for accuracy. Anyone can apply to be a Birdwatcher, and the only requirements are a valid phone number, email and no recent violations of Twitter’s rules. Birdwatch notes will appear beneath a tweet, and in an effort to prevent people from gaming the system, Birdwatchers will be able to rate the effectiveness of each note, impacting the note’s ranking.

The program is currently a pilot, and is only available via a separate website, but eventually the company wants to expand Birdwatch to the rest of Twitter. During the pilot, Twitter said it wants to focus on making Birdwatch “resistant to manipulation attempts and ensure “it isn’t dominated by a simple majority or biased based on its distribution of contributors.” “We believe this approach has the potential to respond quickly when misleading information spreads, adding context that people trust and find valuable. Eventually we aim to make notes visible directly on Tweets for the global Twitter audience, when there is consensus from a broad and diverse set of contributors,” Twitter Vice President Keith Coleman said in a blog post.

Twitter has long been under pressure to prevent misinformation from spreading on its platform. But it wasn’t until this year that the company took more aggressive action. Twitter fact-checked tweets from former president Donald Trump and other politicians about Covid-19, mail-in voting and the election results. Those labels linked to news organizations or other institutions offering credible information. The social network eventually banned Trump entirely, citing tweets that could incite more violence following the Capitol riot. The intention of Birdwatch, though, is to expand those efforts beyond “circumstances where something breaks our rules or receives widespread public attention,” Coleman said.

Gitmo in Manhattan.

“Schulte has been in solitary confinement and not been outdoors in over two years..”

“Schulte’s filthy cell, the size of a parking space, is infested with rodents, rodent droppings, cockroaches and mold and there is no heating, air conditioning or functioning plumbing..”

• Ex-CIA Engineer Tells Judge He’s Incarcerated Like An Animal (Ind.)

A former CIA software engineer charged with leaking government secrets to WikiLeaks says it’s cruel and unusual punishment that he’s awaiting trial in solitary confinement, housed in a vermin-infested cell of a jail unit where inmates are treated like “caged animals ” Joshua Schulte, 32, has asked a Manhattan federal judge to force the federal Bureau of Prisons to improve conditions at the Metropolitan Correction Center, where he has been held for over two years under highly restrictive conditions usually reserved for terrorism defendants. In court papers Tuesday, Schulte maintained he is held in conditions “below that of impoverished persons living in third world countries.” “It is barbaric and inhumane to lock human beings into boxes for years and years — it is a punishment worse than death,” the court filing said.

Last year, a jury deadlocked on espionage charges alleging that Schulte stole a massive trove of the agency’s hacking tools and gave it to the organization that publishes news leaks. He was convicted of lesser charges of contempt of court and making false statements. He is scheduled for another trial on espionage charges in June in what was said to be the largest leak in CIA history involving classified information. Afterward, he faces a separate trial on child pornography charges. He has pleaded not guilty to all charges. In his 20s, Schulte, originally from Lubbock, Texas, worked as a coder at the CIA’s headquarters in Langley, Virginia, where digital sleuths design computer code to spy on foreign adversaries.

The so-called Vault 7 leak published in March 2017 by WikiLeaks revealed how the CIA hacked Apple and Android smartphones in overseas spying operations and efforts to turn internet-connected televisions into listening devices. After a yearlong probe, investigators blamed Schulte, who had already left the agency after falling out with colleagues and supervisors and moved to New York City to work at a news agency. At trial, a prosecutor called the leaks “devastating to national security.” A defense lawyer said the materials could have been accessed and stolen by hundreds of people. Juror Alexis Anthony said she never thought the evidence was strong enough to convict Schulte of espionage-related charges.

According to the court papers, Schulte has been in solitary confinement and not been outdoors in over two years under special administrative measures designed to severely restrict an inmate’s communications and interactions with others. Prosecutors say the measures are necessary after Schulte tried to leak even more classified information using a contraband cellphone that had been smuggled into the jail. They said he declared an “information war” and was “prepared to burn down the United States government.” Schulte’s filthy cell, the size of a parking space, is infested with rodents, rodent droppings, cockroaches and mold and there is no heating, air conditioning or functioning plumbing, the court papers said, while sunlight is blocked by a blacked out window. Television access is permitted for one hour per week.

“Black paid Epstein a stunning $158 million in fees for services..”

• Leon Black To Step Down From Apollo Global After Epstein Investigation (F.)

Leon Black, the billionaire co-founder of private equity giant Apollo Global Management, will be stepping down from his role as CEO of the $433 billion in assets firm. Black, who will remain as chairman, will be replaced by co-founder Marc Rowan by mid-year. The announcement of changed leadership came on Monday evening as Apollo released findings of an investigation directed by its board of directors into Black’s relationship with Jeffrey Epstein, the deceased financier who was criminally charged with human trafficking in 2019. Apollo said its investigation, conducted by law firm Dechert, found “no evidence that Mr. Black was involved in any way with Mr. Epstein’s criminal activities at any time.”

However, the report did show that Black paid Epstein a stunning $158 million in fees for services, loaned him over $30 million in loans and made a $10 million donation to Epstein’s charity, all figures that are multiples of what was previously reported. While the changing of guard atop one of the world’s largest private equity firms was characterized as part of its succession planning—Black is turning 70 this year and has been one of Wall Street’s most feared dealmakers for decades—it is also a maneuver by Apollo to move past well over a year of Epstein-related questions, which have slowed the firm’s growth, sunk its stock at times, and been a troubling mystery for its investors.

Black is the most prominent Wall Street A-lister connected to Epstein, a disgraced financier who was convicted and jailed for sex trafficking charges in 2008. After a Miami Herald investigation into Epstein in 2018, it was revealed that his trafficking operation was far greater than the public had known due to a sweetheart deal he cut with Florida prosecutors. The Herald found Epstein’s alleged trafficking was international and included numerous victims who came forward with allegations. The investigation, which won reporter Julia K. Brown a Pulitzer prize, caused prosecutors to reopen their investigations of Epstein, and exposed deep ties between Epstein, Wall Street power players like Black and well connected politicians and heads of state.

“There will be plenty of work for former professors of Intersectionality in the sorghum fields.”

Growing food and getting it to markets is the most critical activity. Poor Bill Gates, addled by his fortune, has bought up something like a quarter-million acres of farmland. His grandiosity prompts him to believe he can organize farming on the super-giant scale — Walmart for corn and turnips. Nothing could be further from the real coming trend: a reduction of scale and scope of farming and of the distribution supply lines that serve it. Poor Bill doesn’t seem to realize that the oil-and-gas-based “inputs” (fertilizers, pesticides) won’t be there for him, nor will the million-dollar diesel-powered combines. Nor the trucking industry. He could do more good for mankind getting into the mule business. (He won’t. Lacks razzle-dazzle.)

The transition between the old giant agri-biz model of farming and the emergent system of small-scaled farms based on human and animal labor will be arduous and disorderly in the early going. A lot of people will miss a lot of meals, and you know what that means. Working on a farm will be one way to make sure you get enough to eat. But also consider all the businesses that have to be created from scratch on the local level to serve the logistics of farming. You are already seeing many food products unavailable in the supermarkets. That will become more distressingly obvious in the disorders of 2021. When food deliveries to the supermarkets get really spotty, the farmers’ markets will not just be for schmoozing over lattes and almond croissants.

For those perhaps not paying attention, Covid-19 has destroyed what remains of education, especially the public school system. It was already moribund, waiting to crash, reduced to a pension racket for teachers. Going forward, the money won’t be there to operate these giant centralized schools and their yellow buses (while paying out pensions). The virus has kick-started exactly the kind of home-schooling pod system (several families combining) that can be reorganized into small-scale schooling for people who want it. People who don’t want it can move into their future without knowing how to read or do arithmetic. We’ll finally get a good test of the noble savage hypothesis. As for the colleges and universities, their business models are toast. They’ll be downscaling and shuttering as far ahead as the eye can see. Whatever remains will be more like finishing schools for neo-medieval ladies and gentlemen — and, by the way, the distinction between men and women will be reestablished. Why? Because reality insists on it. There will be plenty of work for former professors of Intersectionality in the sorghum fields.

“..when they began being built were not seen as running for more than 40 years because of radioactivity embrittling metal parts and otherwise causing safety problems..”

• Let Nuke Plants Run for 100 Years? (CP)

The U.S. Nuclear Regulatory Commission held a “public meeting” last week on what it titled “Development of Guidance Documents To Support License Renewal For 100 Years Of Plant Operation.” Comments from the “public” were strongly opposed to the NRC’s desire for it to let nuclear power plants run for a century. “I request you pause and consider before you go ahead on this reckless path,” testified Michel Lee, chairman of the New York-based Council on Energy & Conservation Policy. “Our position and that of our constituents is a resounding no,” declared Paul Gunter, director of the Reactor Oversight Project at the national organization Beyond Nuclear.

“It’s time to stop this whole nuke con job,” said Erica Grey, nuclear issues chair of the Virginia Sierra Club. There is “no solution” to dealing with nuclear waste, she said. It is “unethical to continue to make the most toxic waste known to mankind.” And, “renewable energy” with solar and wind “can power the world.” Jan Boudart, a board member of the Chicago-based Nuclear Energy Information Service, spoke, too, of the lack of consideration of nuclear waste. Cited was the higher likelihood of accidents with plants permitted to run for 100 years. Whether the NRC—often called the Nuclear Rubberstamp Commission—listens is highly unlikely considering its record of rubberstamping whatever has been sought by other nuclear promoters in government and the nuclear industry.

Nuclear power plants when they began being built were not seen as running for more than 40 years because of radioactivity embrittling metal parts and otherwise causing safety problems. So operating licenses were limited to 40 years. But with the major decline of nuclear power—the U.S. is down to 94 plants from a high of 129 and only two are now under construction—the nuclear promoters in the U.S. government and nuclear industry are pushing to let nuclear power plants run for 100 years to somehow keep nuclear power going.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.