Vincent van Gogh Pink peach trees (Souvenir de mauve) 1888

Giant iceberg.

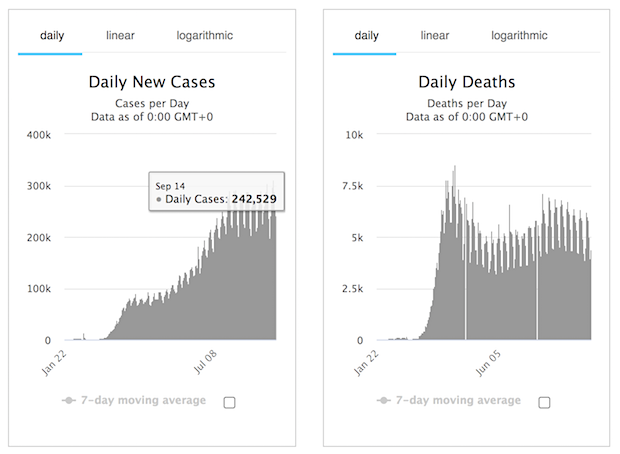

I know I wrote a year ago that lockdowns work. But obviously, that was not about year-long ones. A few weeks when nothing is clear about a virus makes sense. What happens now does not.

“The lockdowns are trickle down epidemiology.”

• Lockdowns the ‘Biggest Public Health Mistake We’ve Ever Made’ (NW)

Dr. Jay Bhattacharya, a professor at Stanford University Medical School, recently said that COVID-19 lockdowns are the “biggest public health mistake we’ve ever made…The harm to people is catastrophic.” Several U.S. states have started to ease their COVID-19 restrictions over the past few weeks. Bhattacharya, who made the comments during an interview with the Daily Clout, co-authored the Great Barrington Declaration, a petition that calls for the end of COVID-19 lockdowns, claiming that they are “producing devastating effects on short and long-term public health.” As of Monday, the Great Barrington Declaration has received signatures from over 13,000 medical and public health scientists, more than 41,000 medical practitioners and at least 754,399 “concerned citizens.”

During the interview last month, Bhattacharya said that the declaration comes from “two basic facts.” “One is that people who are older have a much higher risk from dying from COVID than people who are younger…and that’s a really important fact because we know who his most vulnerable, it’s people that are older. So the first plank of the Great Barrington Declaration: let’s protect the vulnerable,” Bhattacharya said. “The other idea is that the lockdowns themselves impose great harm on people. Lockdowns are not a natural normal way to live.” He continued, “it’s also not very equal. People who are poor face much more hardship from the lockdowns than people who are rich.”

In an email sent to Newsweek, Bhattacharya wrote: “I stand behind my comment that the lockdowns are the single worst public health mistake in the last 100 years. We will be counting the catastrophic health and psychological harms, imposed on nearly every poor person on the face of the earth, for a generation. At the same time, they have not served to control the epidemic in the places where they have been most vigorously imposed. In the US, they have – at best – protected the “non-essential” class from COVID, while exposing the essential working class to the disease. The lockdowns are trickle down epidemiology.”

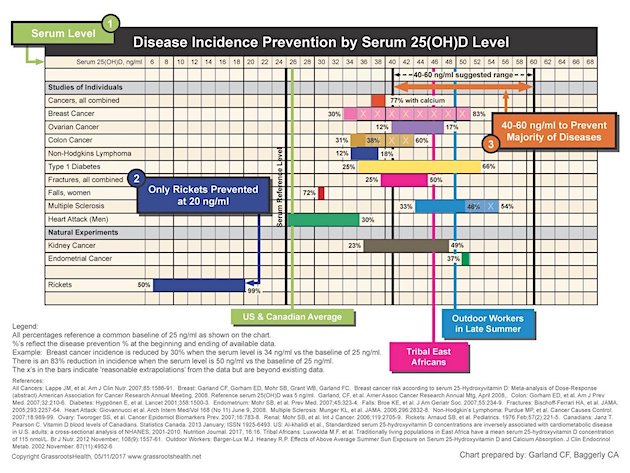

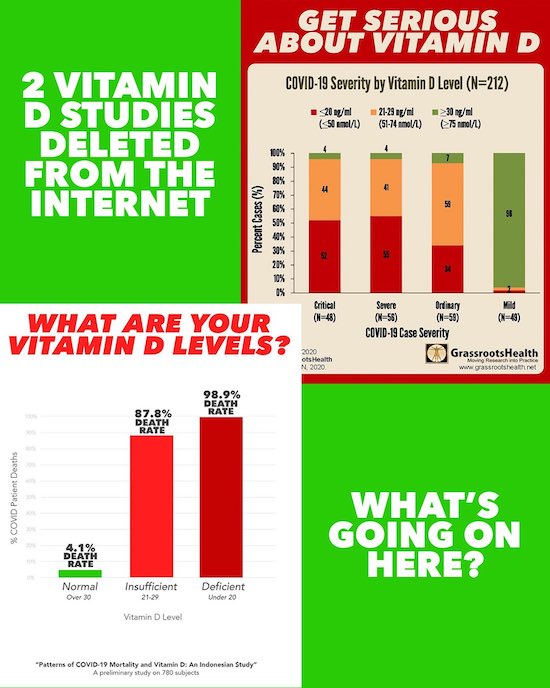

Get healthy. Now.

• Coronavirus Variants To Evolve, Escape Current Generation Of Vaccines (RT)

A new study examining the efficacy of current generation of vaccines against the UK and South Africa variants of SARS-CoV-2 makes for sobering reading, and raises the specter of widespread reinfection. The study, published in Nature on March 8, warns that the current generation of vaccines and monoclonal antibody treatments may lose the arms race against the coronavirus, raising the daunting, open-ended possibility of reinfection unless vaccine rollout is greatly expedited worldwide to prevent further mutations. The study’s findings are currently being borne out amid the latest results concerning the Novavax vaccine, which reported a 90 percent efficacy rate against the UK variant but only 49.4 percent efficacy in combating the South African variant.

“Our study and the new clinical trial data show that the virus is traveling in a direction that is causing it to escape from our current vaccines and therapies that are directed against the viral spike,” says the study’s lead author, David Ho. Ho warned that, with continuing “rampant spread” of the virus in certain areas of the globe, humanity “may be condemned to chasing after the evolving SARS-CoV-2 continually, as we have long done for influenza virus.” He called for redoubled mitigation efforts in concert with expedited vaccine rollouts, arguing that time is of the essence when it comes to eradicating the threat posed by the coronavirus permanently, rather than allowing it to mutate and linger indefinitely.

Ho and his team found that antibodies in recipients of either the Pfizer-BioNTech or Moderna vaccines were less effective at neutralizing the UK and South African variants, with a two-fold drop in efficacy in the case of the former, and up to an 8.5-fold drop in neutralizing activity with the latter. “The drop in neutralizing activity against the South Africa variant is appreciable, and we’re now seeing, based on the Novavax results, that this is causing a reduction in protective efficacy,” Ho says.

“As we come out of our lockdowns blinking in the light of our empty and boarded up town centres, global civil unrest seems inevitable.”

• Growing Covid Inequality Virus To Fuel Popular Rebellions Across The World (RT)

As the gap between rich and poor rapidly worsens during the pandemic, you can detect a surge in support for revolutions and remedies. But instead of truly tackling the underlying problems, governments will react with repression. There’s a sense of some relief in the UK that the Covid-19 year of lockdowns, illness and industrial-scale death tolls that have seen our health care services overwhelmed may finally be coming to an end. Even a Tory-hating cynic like me has to grudgingly admit that the country’s vaccination programme has been a success. The sheer numbers of people getting the jab – 20m-plus as of the start of this week – has been impressive. It has started to open debates about possible summer holidays, travelling to see family, even going to festivals and gigs – a welcome silver lining. But the rhetoric coming from the government that better times are on the way is just political BS. The hope of a brighter future is misplaced.

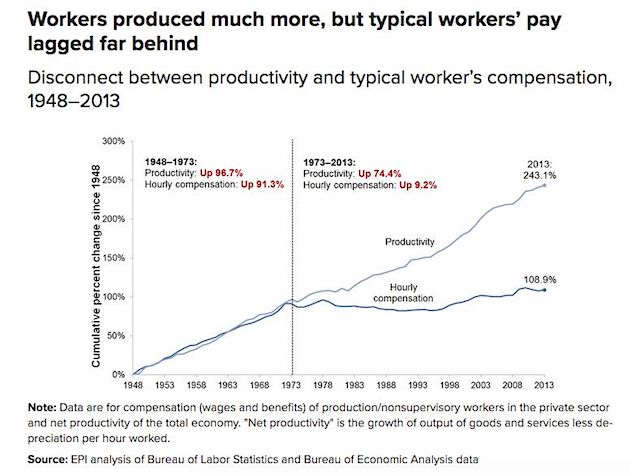

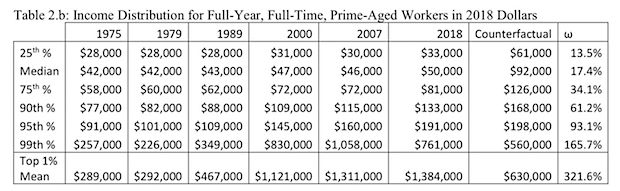

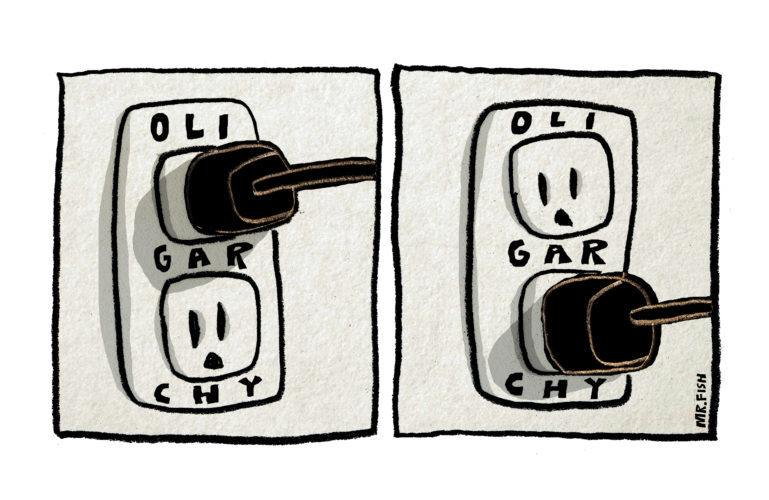

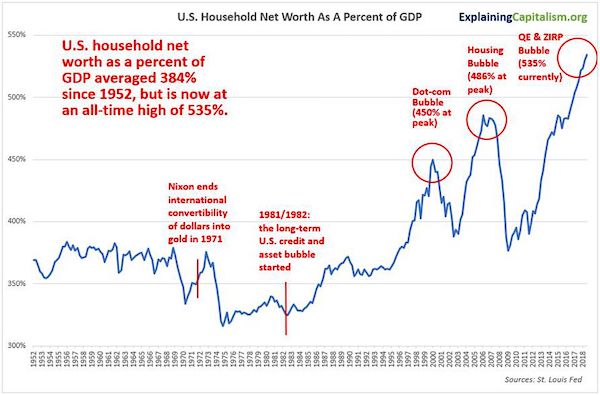

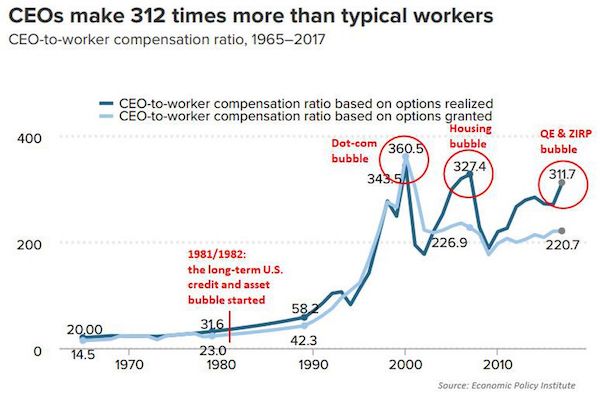

There are some dark storm clouds of reality moving in at a fast pace that may well be more deadly that the virus: the spectres of growing global inequality, of widespread poverty and mass unemployment, and of the vast majority of us being under the control of an emboldened elite that through the pandemic has increased its wealth, power and political influence. Research shows that those who were already rich have increased that wealth exponentially, while those who were at the bottom have sunk even lower. An Oxfam report earlier this year showed not only that wealth inequality was deepening and becoming more entrenched, but also that policies enacted by governments around the world have resulted in giving even more billions to the super-rich while denuding the poorest.

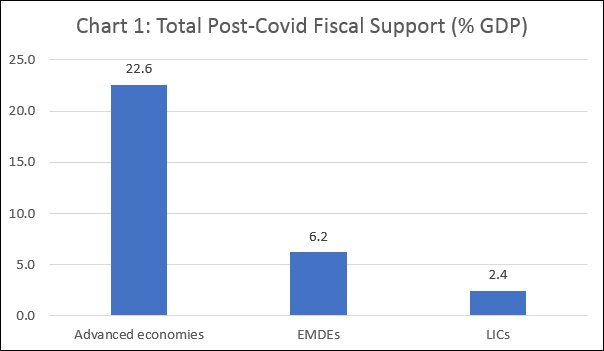

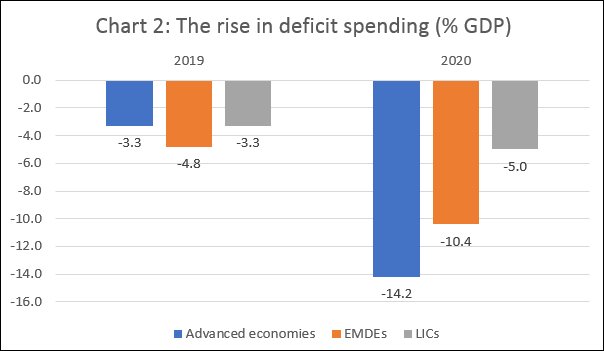

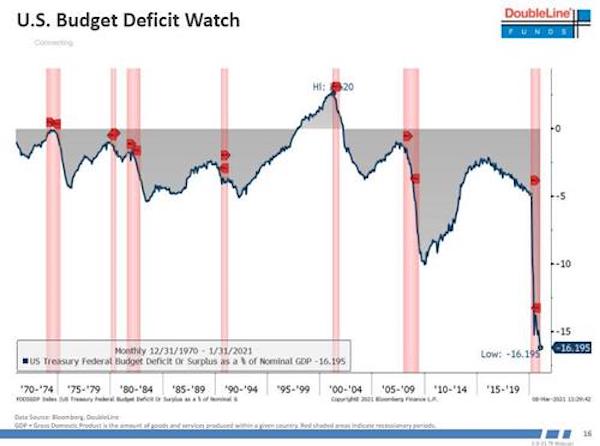

[..] As we come out of our lockdowns blinking in the light of our empty and boarded up town centres, global civil unrest seems inevitable. Studies have shown that when inequality worsens, revolutionary fervour grows and states become unstable and unsafe. We can see the first rumblings, from anger in Poland, riots in the Netherlands, to protests in Denmark, Belgium and France and sporadic demonstrations in other countries. How far will it go lies in the hands of governments. In past times of hardship, governments have used the welfare state as a prop to keep their populations from the edge of starvation and away from full-blown insurrection. But most are running out of road this time. They’ve hugely increased borrowing to keep a semblance of their economies going during the shutdowns, and have little room for maneuver.

After the banking crash of 2008, most governments slashed and burned their welfare states to bail out the bankers and now do not have that crutch. Governments all over the globe are going to have to make tough choices. Are they going to genuinely confront the growing wealth inequality, which they know destabilizes democracies as the social contract is compromised and broken?

“..the name of the laboratory was familiar. Its research on bat viruses had already drawn the attention of U.S. diplomats and officials at the Beijing Embassy in late 2017..”

• In 2018, Diplomats Warned of Coronavirus Experiments in a Wuhan Lab (Pol.)

On January 15, in its last days, President Donald Trump’s State Department put out a statement with serious claims about the origins of the Covid-19 pandemic. The statement said the U.S. intelligence community had evidence that several researchers at the Wuhan Institute of Virology laboratory were sick with Covid-like symptoms in autumn 2019—implying the Chinese government had hidden crucial information about the outbreak for months—and that the WIV lab, despite “presenting itself as a civilian institution,” was conducting secret research projects with the Chinese military. The State Department alleged a Chinese government cover-up and asserted that “Beijing continues today to withhold vital information that scientists need to protect the world from this deadly virus, and the next one.”

The exact origin of the new coronavirus remains a mystery to this day, but the search for answers is not just about assigning blame. Unless the source is located, the true path of the virus can’t be traced, and scientists can’t properly study the best ways to prevent future outbreaks. The original Chinese government story, that the pandemic spread from a seafood market in Wuhan, was the first and therefore most widely accepted theory. But cracks in that theory slowly emerged throughout the late winter and spring of 2020. The first known case of Covid-19 in Wuhan, it was revealed in February, had no connection to the market. The Chinese government closed the market in January and sanitized it before proper samples could be taken. It wouldn’t be until May that the Chinese Centers for Disease Control disavowed the market theory, admitting it had no idea how the outbreak began, but by then it had become the story of record, in China and internationally.

In the spring of 2020, inside the U.S. government, some officials began to see and collect evidence of a different, perhaps more troubling theory—that the outbreak had a connection to one of the laboratories in Wuhan, among them the WIV, a world leading center of research on bat coronaviruses. To some inside the government, the name of the laboratory was familiar. Its research on bat viruses had already drawn the attention of U.S. diplomats and officials at the Beijing Embassy in late 2017, prompting them to alert Washington that the lab’s own scientists had reported “a serious shortage of appropriately trained technicians and investigators needed to safely operate this high-containment laboratory.” But their cables to Washington were ignored.

When I published the warnings from these cables in April 2020, they added fuel to a debate that had already gone from a scientific and forensic question to a hot-button political issue, as the previously internal U.S. government debate over the lab’s possible connection spilled into public view. The next day, Trump said he was “investigating,” and Secretary of State Mike Pompeo called on Beijing to “come clean” about the origin of the outbreak. Two weeks later, Pompeo said there was “enormous evidence” pointing to the lab, but he didn’t provide any of said evidence. As Trump and Chinese President Xi Jinping’s relationship unraveled and administration officials openly blamed the Wuhan lab, the U.S.-China relationship only went further downhill.

“..he was paid €600,000 for lobbying a mask supplier..”

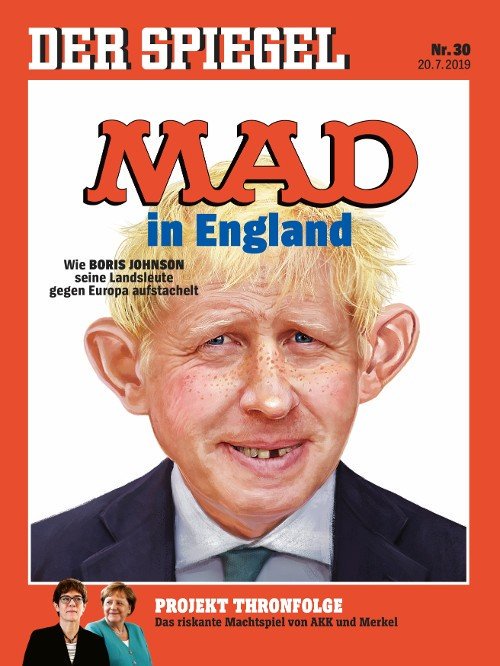

• Incompetence and Corruption Allegations Blight Germany’s Handling Of Covid (RT)

Allegations of German politicians at the highest level of Chancellor Angela Merkel’s government profiteering from the pandemic have rocked a nation sick of lockdown restrictions, struggling with a stubborn Covid-19 infection rate and a shambolic vaccine rollout. A leading figure in Germany’s largest opposition party, Alternative für Deutschland (AfD), Euro MP Gunnar Beck, fears the corruption could go deeper, telling me, “While two of Mrs. Merkel’s allies have been found out and resigned from their parties so far, the odds are there are significantly more involved in this corrupt behaviour.”

German magazine Der Spiegel is reporting that up to a dozen MPs might be involved in the face-masks-for-kickbacks scandal where two key MPs were allegedly paid hundreds of thousands of euros in exchange for facilitating lucrative government contracts. Beck said the environment for corruption became apparent at the outset of the coronavirus outbreak. “There was an acute shortage of face masks and other relevant equipment in Germany and predominantly foreign companies were looking to shift production and take advantage of that situation,” he said. “They were looking for quick and smooth access to government deals and it appears that some MPs provided such access in return for significant financial gain that was straightforwardly unlawful.

“So not only do we have incompetence that led to a shortage of protective equipment in the first place, it seems we have incontrovertible evidence of widespread corruption. Incompetent and corrupt; those are the two adjectives that characterise the German government’s whole approach to the coronavirus crisis.” The two politicians embroiled in the scandal have quit not only their parliamentary posts but their political parties as well, with the Christian Democrats’ (CDU) Nikolas Loebel, 34, announcing that he was to quit politics altogether, leaving his parliamentary seat, a post on the Foreign Affairs Committee and his party with immediate effect.

Resigning, Loebel said: “I take responsibility for my actions and draw the necessary political consequences.” He had admitted that a firm he ran earned €250,000 commission from face mask sales. Georg Nuesslein, a 51-year-old MP with Christian Socialist Union (CSU) the sister party of Merkel’s CDU has denied charges stemming from an inquiry into alleged bribery after accusations were made that he was paid €600,000 for lobbying a mask supplier during the first wave of the pandemic.

This we will see all over the world. Local governments have lost far too much revenue.

• Covid Has Exposed Dire Position Of England’s Local Councils (G.)

The pandemic has a habit of bringing hidden social crises into the open. Now it reveals the precarious position of local government, the provider of vital services from care homes to public health and bin collection, which has helped keep the show on the road in the UK’s biggest national emergency since the second world war. The National Audit Office (NAO) account of the near implosion of England’s local councils during Covid is sobering: only by the government’s swift, if grudging, injection of billions of pounds of emergency cash into council coffers over recent months did ministers avert what the auditors call “system-wide financial failure”.

The watchdog rightly praises ministers for this: the consequences of scores of local authorities having to declare bankruptcy in the middle of lockdown are frightening. But it makes two other points: first, that 10 years of austerity made municipal finances structurally fragile; and second, that councils’ budget crisis isn’t over. It makes clear successive Tory governments not only dismantled the town hall roof but failed to fix it by the time hurricane Covid blew in. Council spending was cut by a third, rising demand for social care was ignored and council budgets made reliant on the whims of local income, whether council tax or car parking charges.

Grand, longstanding government plans to reform local government and social care funding failed to materialise. For years, councils patched up their threadbare budgets by using up financial reserves and cutting frontline services. The more ambitious borrowed billions to spend on risky office and retail investments. So when Covid arrived, council spending rocketed, income crashed and many found they had little in the way of rainy-day cash reserves. As the NAO puts it: “Funding reductions … means that authorities’ finances were potentially more vulnerable to the impact of the pandemic that they would have been otherwise.”

… is to own a bank. Greensill is a pretty unbelievable story.

• The Best Way to Rob a Bank (Ben Hunt)

Is this a Madoff Moment for the unicorn market? Honestly, if you had asked me a few weeks ago, I would have told you that a Madoff Moment was impossible in our narrative-consumed, speak-no-evil market world of 2021. Now I’m not sure. We’ll see, but I think this has legs. By all rights, Greensill – the eponymously named investment bank started by former Citigroup and Morgan Stanley banker Lex Greensill in 2011 – should have been shot between the eyes in 2019. That’s when their “supply-chain finance” loans, in this case to the steel and energy companies of the UK’s “Savior of Steel”, Sanjeev Gupta, blew up Swiss asset manager GAM’s $11 billion flagship fund, the Absolute Return Bond Fund (ARBF).

It’s a story as old as capital markets … Greensill lent Gupta a lot of money, Greensill wined and dined and private jetted ARBF portfolio manager Tim Haywood, and so naturally Haywood bought as much of the Greensill-originated loans as humanly possible, topping out at 12% of ARBF NAV. LOL. The loans, of course, were not as they seem, Gupta’s companies were nowhere near as solid as they were represented, and GAM ended up firing Haywood and seeing their stock price crater. The GAM CEO got fired, lots of people lost lots of money … end of the road for Greensill, right? Nope. Enter Masayoshi Son, CEO of Softbank, who ended up putting $1.5 billion into Greensill in 2019 through Softbank and then another $1.5 billion into Greensill through the Vision Fund, becoming Greensill’s largest investor and diluting the prior largest investor – General Atlantic – from a 15% to a 7% position. And then the fun begins.

Since that 2019 rescue, Greensill has lent billions of dollars to Softbank and General Atlantic affiliates (mostly Softbank, but GA looks plenty stinky here), loans that were then bought by Credit Suisse funds and laundered by Greensill’s German bank subsidiary. Now when I say ‘laundered’, I don’t mean that metaphorically. The German banking and markets regulator, BaFin, has suspended Greensill’s banking license and referred the case for criminal prosecution.

Here’s an example of how the scam worked. Again, it’s a story as old as capital markets. In early 2020, Greensill lent Softbank portfolio company Katerra $435 million. The company ran into … errr … operational difficulties, and Softbank ponied up $200 million in additional capital last December. For its part, Greensill wrote off the $435 million loan in exchange for … again, wait for it … 5% of common equity. LOL. The $9 billion valuation for Katerra (I am not making this up) was determined by Softbank, of course, and so the Greensill German bank subsidiary reported on its balance sheet that all was well. A $435 million senior loan, secured by trade receivables, was exchanged for a 5% equity position in a bankrupt company, with no loss reported. Seems fair! As always, the best way to rob a bank is to own a bank.

This doesn’t smell right.

• European Parliament Lifts Immunity Of Catalonia MEPs (RT)

The European Parliament has voted to strip MEPs Carles Puigdemont, Toni Comin and Clara Ponsati of immunity, paving the way for their extradition to Spain over their roles in the outlawed 2017 Catalonia independence referendum. The three politicians were elected to the European Parliament in 2019, after having fled Spain two years earlier to avoid arrest warrants for sedition, after they helped to organize and run the 2017 independence referendum in Catalonia, despite it being banned by Spain’s central government. Spain had asked the European Parliament to vote to strip the three politicians of immunity last year but that vote had been postponed due to the coronavirus pandemic.

Puigdemont lost his immunity in a 400-248 vote, while Comin and Ponsati lost their protection in a 404 to 247 ballot, confirming a recommendation that was made by a European parliament committee last month. The committee’s report had laid out how the three individuals should lose their protection against the charges filed by Spain, as the crimes they are accused of committing occurred before they took office and was unrelated to their work as MEPs. The three individuals will now be at risk of being extradited back to Spain to face charges, with the countries they are currently seeking refuge in left to decide whether to fulfil the judicial request from Spain. Puigdemont, the former president of Catalonia, and Comin, the region’s former education minister, both reside in Belgium, while Ponsati, the ex-health minister, is currently living in Scotland.

Drip.

• Cuomo Gave Bond Deals To His Wall Street Donors (IBT)

New York Gov. Andrew Cuomo has since 2012 taken in more than $131,000 in campaign contributions from three major financial firms that were then tapped by his administration to manage state bond work, according to an International Business Times review of campaign finance documents and state bond prospectuses. The Democratic governor accepted the money — and his officials handed out the government business without competitive bids — despite federal rules that bar campaign contributors from receiving taxpayer-financed state bond work. Last week, Cuomo officials designated the three banks that contributed the campaign funds — JPMorgan Chase, Citigroup and Bank of America — as the dealers for a $33 million bond issue, enabling the firms to reap lucrative fees.

That came on top of the Cuomo administration assigning the firms to manage a $68 million bond issue last fall, even as federal law enforcement officials were investigating allegations that New York lawmakers were doing favors for political donors. Federal rules bar states from awarding bond work to parties who have donated to gubernatorial campaigns within the last two years (more than $86,000 of the campaign cash from the firms flowed to Cuomo in the last two years). The rules aim to prevent financial firms from gaining influence over officials who have the power to select which firms receive the lucrative bond business. The rules explicitly seek to stop financial companies from circumventing those strictures: They prohibit firms from channeling contributions to bond overseers through PACs, which are giant pools of money distributed to multiple campaign war chests.

“The pay-to-play rules are very clear,” said Craig Holman, an ethics expert at the watchdog group Public Citizen. “If Andrew Cuomo’s receiving any money from a PAC controlled by a municipal dealer, he’d be in violation of pay-to-play rules.”

Split it up into baby Twiiters.

Twitter has filed a lawsuit against Texas Attorney General Ken Paxton, claiming that he used his office to retaliate against the social media giant for banning former President Donald Trump following the Jan. 6 riot at the US Capitol, according to the Associated Press. Following Trump’s banishment by several left-leaning companies, Paxton announced that his office was investigating Twitter, Apple, Google and Amazon for what he called “the seemingly coordinated de-platforming of the President.” He made several document requests related to their content moderation policies, as well as internal communications. Twitter demands that the court effectively halt Paxton’s investigation.

“Paxton made clear that he will use the full weight of his office, including his expansive investigatory powers, to retaliate against Twitter for having made editorial decisions with which he disagrees,” wrote Twitter’s lawyers in the suit filed in a Northern California court. Twitter’s counterpunch comes as states, in addition to federal lawmakers and governments outside the U.S., are cracking down on tech companies they see as having amassed too much power in the past decade. This includes antitrust and anti-monopoly regulation, internet privacy laws as well as attempts to regulate how platforms like Twitter, Facebook and others moderate their sites.

In December, Paxton led 10 Republican attorneys general in suing Google for allegedly running an illegal digital-advertising monopoly in cahoots with Facebook. GOP politicians in roughly two dozen states have also introduced bills that would allow for civil lawsuits against platforms for what they call the “censorship” of posts. Almost always, this means what they view as the censorship of conservative or Christian religious viewpoints. -Associated Press Paxton cited the First Amendment while launching his investigation, claiming that tech companies’ deplatforming of Trump “chills free speech” and “wholly silences” his detractors.

Bellingcat.

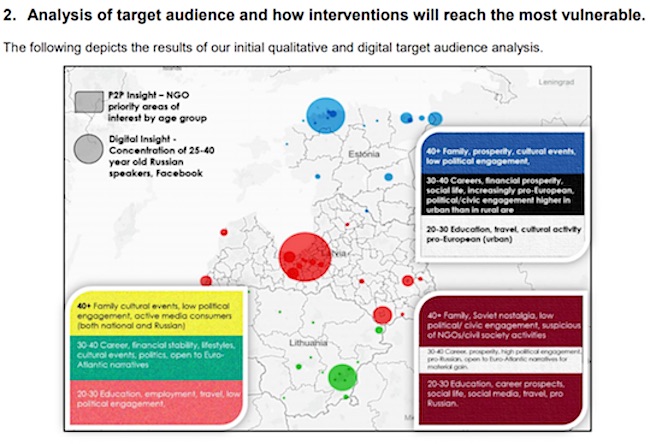

• Massive Secret UK Propaganda Campaign in Former Soviet Republics (MPN)

Standing against the scorching blue backdrop at the EU podium in late 2017, then British Prime Minister Theresa May mendaciously promised to “counter [Russian] disinformation” in all the former Soviet republics of Eastern Europe, Eurasia and the Baltics by pledging €110 Million ($130 Million) over five years to fight the Kremlin’s influence in the region. A massive data leak published by the Anonymous hacktivist group this past February has revealed how some of that money was used to create and disseminate disinformation, alternate narratives and effectuate the outright manipulation of media by the UK’s Foreign, Commonwealth & Development Office (FCDO) through a number of partnerships with stalwart disinformation outfits like Bellingcat, established information warfare specialist firms like the Zinc Network among dozens more that were working in secret with the governmental entity responsible for promoting British interests around the world.

Several different operations dedicated to a specific region or country have been discovered so far, as reporters sift through the trove of documents. Highly sophisticated and disturbingly insidious propaganda campaigns to influence society, mold perceptions about Russia, and affect political outcomes were carried out by teams of Western media organizations, consultants, paid assets, and operatives from the Baltics to the shores of the Mediterranean. The Open Information Partnership (OIP), as one of these far-reaching operations is named, received funding from the FCDO, according to RT, of at least £10 Million and was comprised of 44 partners, among which the aforementioned Bellingcat and Zinc, were joined by the Atlantic Council’s DFRLab and London-based NGO Media Diversity Institute and others.

Billed as a “diverse network of organisations and individuals united in our determination to expose and counter disinformation,” OIP’s partners had their agents strewn across Central and Eastern Europe to deliver on the scope of work delineated in its contracts with the FCDO, which would determine what locations to target at any given moment. North Macedonia was selected early on and Zinc initiated the operation by identifying the largest media outlet in the country, MOST Network. The information warfare outfit and OIP partners approached DFRLab and Bellingcat to offer a two-week course on “cyber security training, mentoring on digital forensics, open source investigation and media ethics.”

Although the documents don’t provide specific dates, it is inferred that the 2019 election in North Macedonia was what moved the FCDO to prioritize it at that time, given the choice between pro-EU and pro-Russia candidates. A recent RT exposé revealed disinformation efforts by the UK that predate May’s speech by at least a year, targeting ethnic Russians in Estonia, Latvia, and Lithuania. A 2016 request for proposal issued by the FCDO seeks contractors to “provide overt innovative soft power interventions that will foster better links between the United Kingdom and individuals in the Baltic States whose primary language is Russian.”

“.. if illegal crossing attempts continue at the rate they’ve been going in the last four months, the final tally by the end of this fiscal year will surpass 2018, 2019, and 2020 combined.”

• White House Won’t Admit Biden’s Dealing With A Border Crisis (RT)

The fruits of Joe Biden’s border policies are already apparent: a tripling of children detained at the border, and crossings set to hit record levels. Yet the administration refuses to acknowledge it has a crisis on its hands. The number of unaccompanied migrant children detained along the southern US border has tripled in the last two weeks to more than 3,250, the New York Times reported on Tuesday. These children are filling the same Customs and Border Patrol facilities that Biden himself called “inhumane” during his 2020 campaign, and the “overflow shelters” opened by the Biden administration are nearing capacity. On top of the surge in child arrivals, agents encountered 78,000 migrants attempting to cross the border in January, the highest number for that month in more than a decade.

John Modlin, the interim chief in charge of the Border Patrol’s Tucson, Arizona sector, told Sinclair reporter Sharyl Attkisson on Sunday that if illegal crossing attempts continue at the rate they’ve been going in the last four months, the final tally by the end of this fiscal year will surpass 2018, 2019, and 2020 combined. This uptick in illegal immigration has been directly linked to Biden’s near-total reversal of former president Donald Trump’s tougher border policies. Trump’s ‘Remain in Mexico’ policy was eliminated by executive order, and migrants awaiting their asylum claims in Mexico have now begun heading north to the US. Biden has also modified Trump’s policy of turning back all border crossers during the Covid-19 pandemic, carving out an exception for under-18s, hence the surge in unaccompanied minors highlighted by the New York Times.

Among his flurry of executive orders overturning Trump’s border policies, Biden resurrected the so-called ‘Catch and Release’ program, an Obama-era policy suspended by Trump, under which migrants apprehended at the border would be released in the US, on the condition that they later show up for an immigration court hearing. Unsurprisingly, few ever do, and even those who play by the rules face a wait time of up to 689 days. Critics claim that ‘Catch and Release’ effectively invites migrants to make the journey to the US, and Biden has faced criticism even from within his own party for reinstating the policy. “I don’t think, quite frankly, the Biden administration was aware of what’s happening on the ground here,” Texas State Senator Juan Hinojosa told The Hill on Sunday. “The Border Patrol is overwhelmed, they’re throwing their hands up because they don’t know what to do.”

Psaki

REPORTER: "The number of migrants detained has tripled… Is that accurate?"

PSAKI: "Those numbers are tracked by DHS. I'm just suggesting that you talk to them…"

REPORTER: "We talked to them… They won't confirm the numbers."

PSAKI: "Ask them again… It's not our program" pic.twitter.com/4MQy2X9RgX

— Daily Caller (@DailyCaller) March 9, 2021

“My training kicked in and I leapt into action. I’m just happy I was able to make a difference.”

• Secret Service Agent Saves Biden As Reporter Tries To Ask A Question (BBee)

In an extraordinary act of bravery and heroism, a Secret Service agent dove in front of Biden to block a question from a pesky reporter. As Biden slowly stepped out of his vehicle, a nosy reporter rudely attempted to ask him intrusive questions about things that were none of her business. “Nooooooooooo!” said agent James Carter as the CBS reporter raised her hand to ask a completely inappropriate question– possibly about the Middle East, or executive orders. Carter ran up to the president, arms outstretched, and dove through the air to shield the president from the incoming query.

“It’s like everything went into slow motion,” said Agent Carter. “My training kicked in and I leapt into action. I’m just happy I was able to make a difference.” Carter took the entire force of the blow from the incoming question before collapsing to the ground. “Hey– lookie there, they fly now!” said President Biden. “Hey there young man, would you mind not flying in front of me while I exit my vehicle? I have to get to the Oval Office in time for Matlock.” The Secret Service agent sustained minor injuries but is grateful to have saved the president from a reporter’s unwelcome question. “Just doing my job,” he said.

Moar.

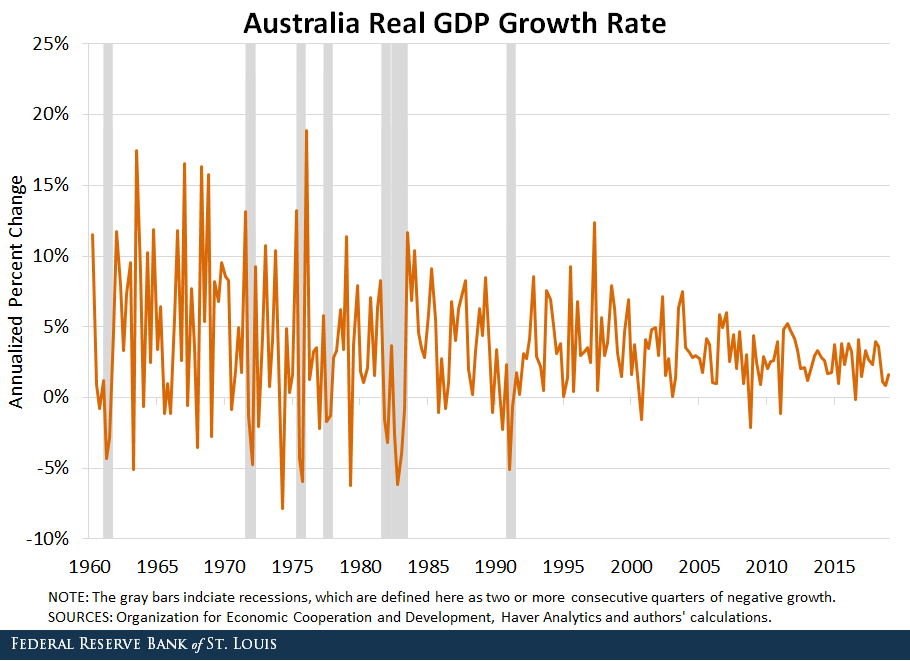

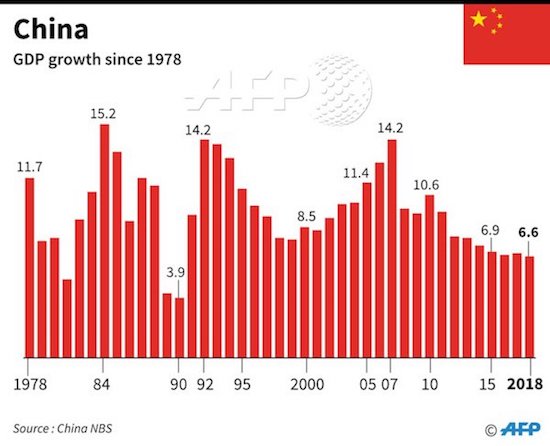

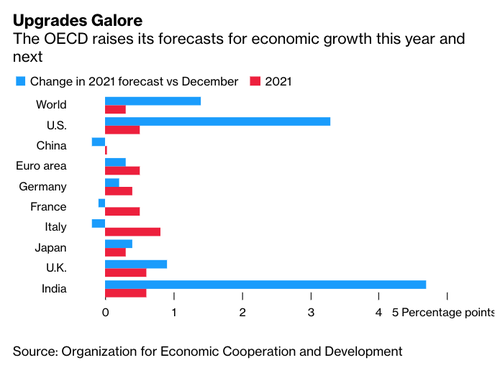

• OECD Believes Biden Stimulus Will Boost World GDP (ZH)

A global economic recovery is coming in hotter and faster than previously anticipated by the OECD as President Biden’s $1.9 trillion stimulus program will boost not just the domestic economy but the world. The Paris-based organization upgraded its outlook for global growth on Tuesday in a note titled “The need for speed: faster vaccine rollout critical to stronger recovery,” where it explains global output could surge above pre-pandemic levels by the second half of 2021 as vaccine rollouts and stimulus aid the recovery but warned of unevenness. In Europe, measures to boost output will result in slower growth, with the OECD lowering France and Italy’s outlook this year. It also warned accommodative policies should not be prematurely tightened.

OECD estimates global GDP growth will print around 5.6% this year, an upward revision of more than one percentage point since its December 2020 report. Laurence Boone, the OECD’s chief economist, told the Financial Times that the stimulus bill – known as the American Rescue Plan – will add one percentage point to global economic growth in 2021. There are consequences to governments and monetary authorities across the planet printing like there was no tomorrow – that is – a sharp rise in inflation expectations are putting pressure on central banks to adopt some form of the yield curve control to cap the long end of the curve. It has also added to a violent shift from growth to value, where the once favored tech stocks have lost their luster, such as TSLA, NFLX, and AMZN, as investors pivot to value companies like XOM.

Boone doesn’t believe the stimulus package will increase domestic inflation to dangerous levels because “there is a lot of slack in US labor markets,” she said. “The amazing fiscal support everywhere means that we have preserved the economic fabric across OECD countries. Even in emerging markets, we’ve seen amazing policy support,” Boone said.

Babylon Bee outdone by Politico. “A sales job”. Indeed.

• The Biden Blitz Is Coming (Pol.)

President Joe Biden spent the first months of his presidency hunkered down as he worked on getting more vaccines into people’s arms and a massive bill to deal with the pandemic to his desk. With that $1.9 trillion legislation set to clear Congress and the pace of vaccinations picking up, the White House is preparing to embark on a new, far more public-facing phase. Biden is scheduled to deliver his first prime-time address as president Thursday, which will focus on the Covid crisis. Later this month, he’ll hold the first press conference of his young presidency. He’s committed to making a still-unscheduled address to Congress. And officials are busy preparing for a sprawling sales campaign designed to draw attention to the benefits of the Covid-relief package. Biden, first lady Jill Biden, Vice President Kamala Harris and others will hit the road to tout, among other things: the $1,400 checks, how billions of dollars in the bill will reopen schools, and the investments being made in increasing the numbers of vaccinations.

“There are a lot of people who use the term ‘victory lap’ in a derogatory way. I’ve already heard people saying that Biden is about to take a victory lap. Well, that’s a lot of crap,” said House Majority Whip Jim Clyburn (D-S.C.), a close Biden ally. “One of the—if not the biggest—mistakes that Obama made, in my opinion, was getting the Recovery Act done and not explaining to people what he had done.” Biden and top administration officials acknowledged they’ll have to do more to ensure the benefits of their package sink into the public’s consciousness. And they’ve spent weeks carefully planning how best to begin their efforts while much of the country remains consumed by the pandemic. White House press secretary Jen Psaki said Tuesday that once the American Rescue Plan is signed, “We will need to do some work and use our best voices.”

Part of the White House strategy before the Covid package passed was aimed at avoiding the kinds of storyline distractions that Biden can sometimes create in less guarded moments. That’s one reason the White House so far has avoided putting Biden in front of reporters for more in-depth questioning. The upcoming sales job will require Biden to assume a new posture: fewer scripted events and private dealings with lawmakers, more interactions with the press and appearances before the public. That will give the president opportunities to make more emotional appeals, such as highlighting older family members finally being able to get together with their grandchildren.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.