John William Waterhouse Hylas and the Nymphs 1896

This is a carefully planned attack by Warmongers “R” Us.

• Russian Ambassador To US Summoned Back To Moscow For Consultations (RT)

Russia’s ambassador to the US, Anatoly Antonov, has been recalled to Moscow for in-person discussions on the country’s ongoing relations with Washington and Joe Biden’s administration, the Foreign Ministry has said.

In a statement announcing the envoy’s recall on Wednesday night, Russian Foreign Ministry spokeswoman Maria Zakharova said the ambassador was needed in Moscow for “consultations to analyze what to do and where to head in the context of the relations with the US.” Representatives of the Foreign Ministry and other relevant agencies will participate in the discussions with Antonov about US relations going forward, she added.With the Biden team in power for almost two months, it was a good time to analyze “where it succeeds and where it fails,” she added.

For us, it’s important to determine possible ways of straightening out Russian-American relations, which remain in harsh conditions after being effectively led into a dead end by Washington in recent years. Moscow is “interested in avoiding the irreversible degradation” of its ties with Washington, Zakharova said, expressing the hope that Biden’s officials also understood the risks of such a scenario. The news of the ambassador’s recall came hours after the US Department of Commerce on Wednesday announced the expansion of Washington’s sanctions on exports to Russia. The fresh restrictions were imposed over Moscow’s alleged involvement in the poisoning of opposition figure Alexey Navalny – an allegation that Kremlin officials have repeatedly denied. Deputy Foreign Minister Sergey Ryabkov said Moscow was “calm” about the new sanctions, as such measures had already been taken many times before. However, he pointed out that such moves by Washington reduced the chances of a “normalization of relations” between the parties.

Bide plays some wise guy strongman role for which he is not suited.

• Biden: Putin Is A Killer (Ind.)

US President Joe Biden said he believes Russian President Vladimir Putin is a “killer” when asked by ABC News host George Stephanopoulos. His question follows a federal investigation into Russian-linked cyber attacks and an intelligence report linking the Kremlin to election-related online interference that promoted Donald Trump and right-wing conspiracy theories in an attempt to discredit Mr Biden. Asked whether he believes Mr Putin is a “killer” in a pre-taped interview that aired on Wednesday, the president responded: “I do.” “The price he’s going to pay, you’ll see shortly,” he said. Mr Biden recalled meeting Mr Putin, during which he reportedly told him that he doesn’t “have a soul”: “I wasn’t being a wise guy.”

“He looked back at me and said, ‘We understand each other’,” Mr Biden said. A report released on Tuesday from the Office of the Director of National Intelligence assessed that Russia sought to interfere with the 2020 presidential election with an expansive social media and online influence campaign similar to an operation from 2016. The newly declassified report also said that a network of Ukraine-linked individuals connected to Russian intelligence relied on “prominent US persons and media conduits to launder their narratives” alleging “corrupt ties” among members of Mr Biden’s family with Ukraine.

That 2020 misinformation campaign was aimed at “denigrating President Biden’s candidacy and the Democratic Party, supporting former President Trump, undermining public confidence in the electoral process, and exacerbating sociopolitical divisions in the US,” according to the report. Mr Biden said he had warned his Russian counterpart about a potential response from the US during a call in January. “He will pay a price,” Mr Biden said. “We had a long talk … and the conversation started off, I said, ‘I know you and you know me. If I establish this occurred, then be prepared.’”

Biden has no idea what the vaccine does.

• Biden Talks Cuomo, Putin, Migrants, Vaccine (ABC)

President Joe Biden sat down with ABC News’ George Stephanopoulos for a wide-ranging interview Tuesday in which he said his message to migrants was to not come to the border and that New York Gov. Andrew Cuomo should resign if allegations he committed sexual harassment are confirmed. Biden also told Stephanopoulos that he agreed Russian President Vladimir Putin was a “killer” and would “pay a price” for interfering in U.S. elections. And he said it would be “tough” to withdraw all American troops from Afghanistan by May 1, a deadline set out in a deal former President Donald Trump’s administration made with the Taliban.

Biden told Stephanopoulos he was surprised that COVID-19 vaccinations were still so politicized. “How do you get the politics out of this vaccine talk?” Stephanopoulos asked. “I honest to God thought we had it out,” Biden said. “I honest to God thought that, once we guaranteed we had enough vaccine for everybody, things would start to calm down. Well, they have calmed down a great deal. But I don’t quite understand – you know – I just don’t understand this sort of macho thing about, ‘I’m not gonna get the vaccine. I have a right as an American, my freedom to not do it.’ Well, why don’t you be a patriot? Protect other people.” Biden said getting vaccinated himself has let him to show Americans doing so is safe – and has changed his life “because I can hug my grandkids now.” “They come over to the house,” the president said. “I can see them. I’m able to be with them.”

“Even former president Donald Trump, he claimed, “despite the decisions that were being made on sanctions, maintained rhetoric appropriate to the level of head of state.”

• Joe Biden’s ‘Putin Is A Killer’ Claim A ‘Tantrum Of Powerlessness’ – MP (RT)

Explosive comments made by US President Joe Biden, in which he suggested his Russian counterpart is “a killer,” have ignited a diplomatic row, as Moscow’s chief parliamentarian said the remarks constitute an attack on the country. In a statement posted to Telegram, the speaker of the State Duma, Vyacheslav Volodin, said that “Biden has insulted the citizens of our country with his statement” about Vladimir Putin. “This is a tantrum that comes from powerlessness. Putin is our president, attacking him is an attack on our country,” he added. Volodin contrasted the tone of the criticism to that of previous US presidents, who, despite often overseeing tense relations with Russia, and the USSR before it, maintained mutual respect.

Even former president Donald Trump, he claimed, “despite the decisions that were being made on sanctions, maintained rhetoric appropriate to the level of head of state.” However, he argued, “Biden’s statement today is beyond common sense. This is no way for the leader of a country that claims to be a bearer of democratic principles and morality to behave.“ The American president made the remarks in an interview on Wednesday with the ABC news channel. He was asked by chief anchor George Stephanopoulos whether he believed Russian President Vladimir Putin was “a killer.”“Mmm-hmm, I do,” Biden replied. Biden said he had warned Putin earlier this year that he would take action if evidence was found of Russian interference in the 2020 US election. “He will pay a price,” Biden said.

How to sell a “vaccine”.

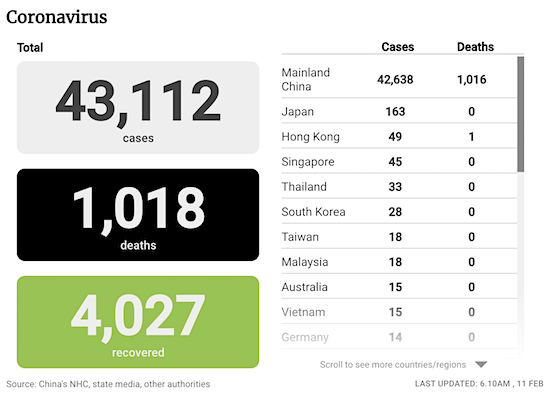

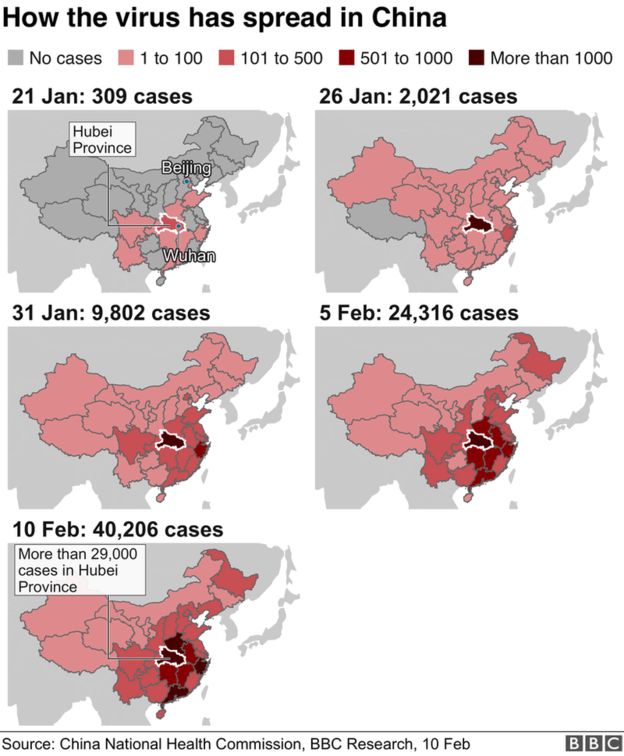

• Past Covid Infections Don’t Confer Strong Enough Immunity (F.)

Most people who catch Covid-19 are unlikely to get sick from the disease again, but reinfection is more common than previously thought and older people face an especially high risk, according to a study Wednesday that researchers cast as proof that vaccines are the best form of protection against the coronavirus — even for people who have already been infected. The study, published in the Lancet medical journal, looked at millions of people who took PCR coronavirus tests through Denmark’s nationwide mass-testing initiative last year. Just 0.65% of those who tested positive for the virus during Denmark’s spring surge showed a positive result during the country’s second wave in the fall, suggesting a protection rate against reinfection of 80.5% according to a team of researchers from Statens Serum Institut in Copenhagen.

Among people 65 and over, the protection rate was just 47.1%. Both are higher reinfections rate than other studies have found, a commentary published by Lancet noted.The study’s authors say elderly people could face a higher risk of reinfection from the coronavirus because their immune systems are less effective, a dire problem because the elderly are most vulnerable to severe illness and death from Covid-19.The researchers said this study shows vaccines are important for those who have already contracted the coronavirus, especially if they’re elderly, because “natural protection cannot be relied on.” The coronavirus vaccines that have been authorized so far vary in efficacy, but most appear to offer more protection than natural immunity.

“These data are all confirmation, if it were needed, that for SARS-CoV-2 the hope of protective immunity through natural infections might not be within our reach, and a global vaccination programme with high efficacy vaccines is the enduring solution,” the Lancet said in a commentary released alongside the study.

How not to sell a vaccine.

• Why Vaccine Safety Experts Put The Brakes On AstraZeneca’s Vaccine (ScienceM)

The decision this week by more than 20 European countries to temporarily stop using AstraZeneca’s COVID-19 vaccine has opened a rift between vaccine safety experts, who say the cases of serious clotting and bleeding that triggered the pause are alarming and unusual, and public health officials concerned that the immunization pause on a continent in the grip of the pandemic’s third wave could take a heavy toll. “The harm caused by depriving people of access to a vaccine will likely vastly outweigh even the worst case scenario if any link to the clotting disorders is eventually found,” University of Leeds virologist Stephen Griffin told the United Kingdom’s Science Media Centre. The European Medicines Agency (EMA) and the World Health Organization have recommended that countries continue immunizations while they investigate the reports.

Scientists don’t know whether the vaccine causes the syndrome, and if so, what the mechanism is. “Everyone’s scratching their heads: Is this a real signal?” says Robert Brodsky, a hematologist at Johns Hopkins University. But vaccine safety officials say they did not take the decision lightly, and that symptoms seen in at least 13 patients, all between ages 20 and 50 and previously healthy, in at least five countries are more frequent than would be expected by chance. The patients, at least seven of whom have died, suffer from widespread blood clots, low platelet counts, and internal bleeding—not typical strokes or blood clots. “It’s a very special picture” of symptoms, says Steinar Madsen, medical director of the Norwegian Medicines Agency. “Our leading hematologist said he had never seen anything quite like it.”

A somewhat similar blood disorder, called immune thrombocytopenia (ITP), has been seen in at least 36 people in the United States who had received the Pfizer and Moderna vaccines against COVID-19, The New York Times recently reported. The U.S. Food and Drug Administration said it was investigating these cases, but also said the syndrome did not appear to be more common in vaccinated people, and immunizations in the United States have continued. But Madsen says the cases seen in Europe in recent weeks are distinct from ITP, which lacks the widespread blood clots seen in the European patients. The United Kingdom, which has administered the AstraZeneca vaccine to more than 10 million people, has so far not reported similar clusters of unusual clotting or bleeding disorders.

In Europe, a 49-year-old intensive care nurse in Austria was one of the first cases. She died last week from what officials called “clotting disorders” that culminated in internal bleeding. (A colleague at the same hospital who received the vaccine developed lung embolisms, but was expected to recover.) A similar constellation of symptoms has been identified in four patients in Norway, two of whom have died, Madsen says.

Imagine living in one and then reading this.

• Blanket ‘Do Not Resuscitate’ Orders Imposed On English Care Homes (G.)

Blanket orders not to resuscitate some care home residents at the start of the Covid pandemic have been identified in a report by England’s care regulator. A report published by the Care Quality Commission (CQC) found disturbing variations in people’s experiences of do not attempt cardiopulmonary resuscitation (DNACPR) decisions during the pandemic. Best practice is for proper discussions to be held with the person involved and/or their relatives. While examples of good practice were identified, some people were not properly involved in decisions or were unaware that such an important decision about their care had been made. Poor record-keeping, and a lack of oversight and scrutiny of the decisions being made, was identified.

The report, Protect, respect, connect – decisions about living and dying well during Covid-19, calls for a ministerial oversight group – working with partners in health and social care, local government and the voluntary sector – to take responsibility for delivering improvements in this area. The report surveyed a range of individuals and organisations, including care providers and members of the public, and identified: • Serious concerns about breaches of some individuals’ human rights • Significant increase in DNACPRs put in place in care homes at the beginning of the pandemic, from 16,876 to 26,555 • 119 adult social care providers felt they had been subjected to blanket DNACPR decisions since the start of the pandemic • A GP sent DNACPR letters to care homes asking them to put blanket DNACPRs in place • In one care home a blanket DNACPR was applied to everyone over 80 with dementia.

Healthcare professionals emphasise that resuscitation is both invasive and traumatic with only a 15-20% survival rate when performed in hospitals and a 5-10% success rate when performed outside hospitals. However, concerns have been raised about both blanket DNACPR orders being put in place and such instructions being recorded on patients’ records without discussion or informed consent being given.

“..his record as state senator and congressman, authoring legislation to increase the criminalization and incarceration of Black and brown Californians..”

“Here in California, we know him as someone who was, in many ways, one of the chief architects of mass incarceration..”

He sounds just like Kamala.

• Will Adam Schiff Be California’s Next Top Cop? (G.)

As the lead prosecutor in Donald Trump’s first impeachment trial, Adam Schiff, the representative from southern California, became a household name, an icon of the anti-Trump resistance, and a rising star in the Democratic party. A year on, the congressman looks increasingly well positioned to be appointed as California’s next attorney general. But in Schiff’s home district, criminal justice and immigrant rights advocates say that his record as state senator and congressman, authoring legislation to increase the criminalization and incarceration of Black and brown Californians, should disqualify him from holding the position. “There’s this real disconnect,” said Jody Armour, a University of Southern California law professor who studies the intersection of race and legal decision making.

“The country knows Schiff as sort of an icon. Here in California, we know him as someone who was, in many ways, one of the chief architects of mass incarceration.” Schiff has reportedly been lobbying governor Gavin Newsom for the attorney general spot that will open up if the US Senate confirms Xavier Becerra as the Health and Human Services secretary later this week. House speaker Nancy Pelosi has given her blessings, and reportedly even a personal endorsement. Schiff, 60, began his career at a US district court in California, first as a law clerk and eventually as an assistant US attorney, rising to prominence for prosecuting the case against a former FBI agent convicted of spying for the Soviet Union.

He was elected to the California state senate in 1996, and four years later moved to the US House of Representatives. There, he served as the chair of the powerful Intelligence Committee, becoming one of Pelosi’s closest confidants. As the lead impeachment manager pursuing Trump for abuse of power and obstruction of Congress, Schiff’s fiery speeches gained him lavish praise from liberals, begrudging recognition from conservatives and $41m in campaign funds last election cycle. Schiff’s star power, his powerful allies in the Democratic party and fundraising prowess have set him up as a top contender for attorney general.

“The language, slipped into the legislation at the last minute by Senate Majority Leader Chuck Schumer, is designed to prevent federal money from subsidizing new tax cuts..”

Q: what’s the difference between Anti-Tax Zealotry and Anti-Vax Zealotry?

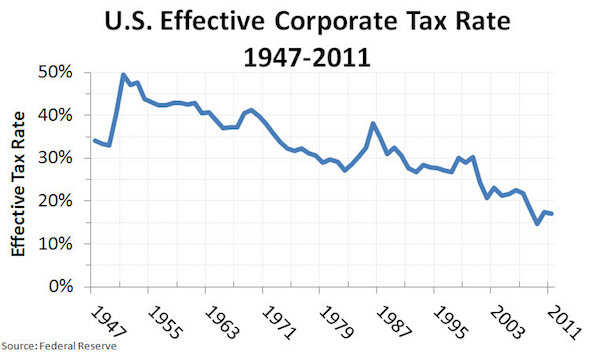

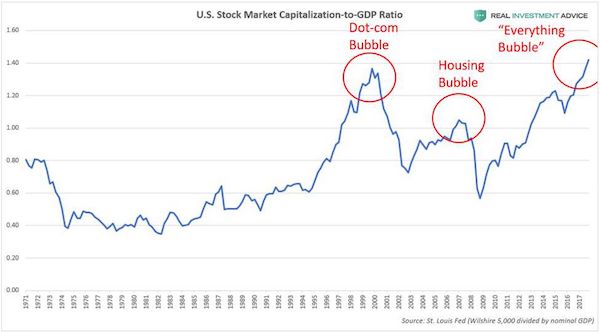

• A Big Win Against Anti-Tax Zealotry (DP)

The American Rescue Plan’s $1.9 trillion of spending represents a significant and long overdue break with the budget-cutting, deficit-obsessed austerity ideology that has held sway since the Reagan Era. But that’s not all it does. A provision tucked into the final bill also aims to halt the anti-tax movement that has drained state and local coffers of resources to fund infrastructure, public education, and other basic social services. The language, slipped into the legislation at the last minute by Senate Majority Leader Chuck Schumer, is designed to prevent federal money from subsidizing new tax cuts at a moment when some Republican-led states have been considering them.

“Money from COVID relief needs to go to helping every day Americans get through the pandemic, not paying for tax cuts for the rich,” Schumer said in a statement to The Daily Poster. “The American Rescue Plan explicitly prohibits states from using emergency COVID relief dollars to fund frivolous tax cuts. Governors should use this money to maintain public health and social assistance programs to fight the pandemic, and keep millions of other essential employees on the job and working for our communities.” The provision, coupled with Biden’s upcoming plan to raise taxes on the wealthy, represents the first significant effort to explicitly combat the anti-tax movement that has dominated American politics for the last half century.

Such efforts suggest Democrats have learned a valuable lesson since their 2009 economic stimulus bill about the importance of prioritizing public aid for local and state governments — and keeping that aid from being waylaid by Republicans’ anti-tax zealotry.

Washington wants more power.

• Ohio AG Sues Biden Administration Over Pandemic Bill (Hill)

Ohio’s attorney general filed a lawsuit against the Biden administration on Wednesday over a provision of the recently signed pandemic relief bill. In a complaint filed in federal district court in Ohio, Ohio Attorney General Dave Yost (R) challenged a provision in the legislation that forbids state and local government from using pandemic aid to offset tax cuts. “Ohio seeks to enjoin federal officials from enforcing the unconstitutional Tax Mandate, and seeks declaratory relief establishing that the State of Ohio, under the Tenth Amendment to the U.S. Constitution, retains the freedom to manage its own tax policy,” the lawsuit reads. The lawsuit was filed against Treasury Secretary Janet Yellen and the Treasury Department. Neither the White House nor the Treasury Department immediately responded when asked for comment.

President Biden signed the bill last week, authorizing aid including direct payments for individuals and $195.3 billion for states and Washington, D.C. — including about $5.5 billion for Ohio, according to the lawsuit. The aid is largely distributed based on each state’s number of unemployed workers. Yost argues in his lawsuit that Congress violated constitutional restraints in seeking to control how states set their tax policies. “By accepting that money, the State must sacrifice its sovereign authority to set tax policy as it sees fit, because changes to tax policy that reduce revenues violate the Tax Mandate,” the lawsuit reads. “Such violations could be used to force the State to return funding received through the Act.” [..] Carl Davis, the research director for the left-leaning Institute on Taxation and Economic Policy, said that the rhetoric from the conservative attorneys general has been overblown.

“There’s a lot of potential very positive uses for this money that states and localities could find in this moment,” Davis told The Hill. “It’s not intended to be a way to help states to go ahead and cut taxes, particularly for folks at the top, which is really what we’re talking about in a lot of these states that are objecting most loudly to the provision.” “So I think if a state believes that its budget is so strong, and it can afford to actually cut taxes and it’s not going to be doing those kinds of investments, dealing with the economic situation of the hardship we’re seeing right now, it would forego an equivalent amount of aid,” he added. Daniel Hemel, a tax law professor at the University of Chicago law school, agrees that the rhetoric from the attorneys general has been overblown but says that the tax provision in the relief bill is not “Congress’s best work.”

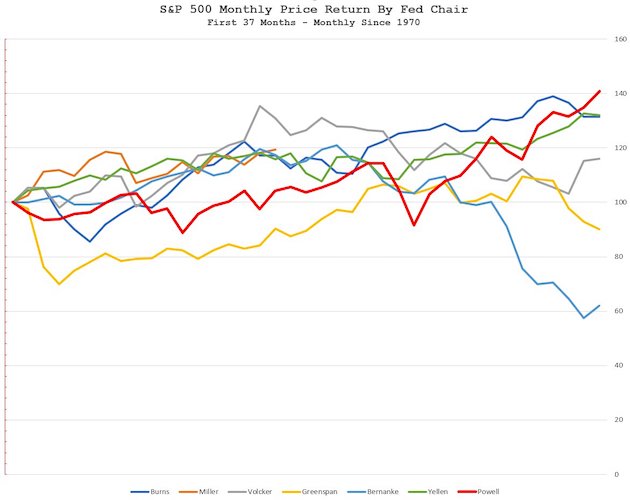

Stop talking about markets, there’s only the Fed.

• Fed Expects Growth Surge, Inflation Jump In 2021 But No Rate Hike (R.)

The U.S. economy is heading for its strongest growth in nearly 40 years, the Federal Reserve said on Wednesday, and central bank policymakers are pledging to keep their foot on the gas despite an expected surge of inflation. “Strong data are ahead of us,” a confident Fed Chair Jerome Powell said after a two-day policy meeting, ticking off the list of forces Fed officials expect will produce 6.5% GDP growth this year – from massive federal fiscal stimulus to optimism around the success of coronavirus vaccines.“The (stimulus) checks are going out … COVID cases are coming down. Vaccination is moving quickly,” Powell said, marking a moment in which a body of top U.S. economic officials expect growth in the United States to rival that of China this year, not to mention surging quickly beyond that of Europe and Japan.

Fed officials, in fact, expect economic growth to remain above trend for at least two years to come, at 3.3% in 2022 and 2.2% in 2023, compared to estimated long-term potential growth of just 1.8%. While inflation is expected to jump to 2.4% this year, above the central bank’s 2% target, Powell said that is viewed as a temporary surge that will not change the Fed’s pledge to keep its benchmark overnight interest rate near zero as part of an effort to ensure the economic wounds from the pandemic are fully healed. [..] in overlooking the expected jump in inflation this year without a policy response, the Fed held true to its new framework and a pledge not to overreact at the first hint of rising prices, a reaction that has in the past been felt to nip off periods of growth before workers felt the full benefits.

Michael Hudson and Paul Craig Roberts.

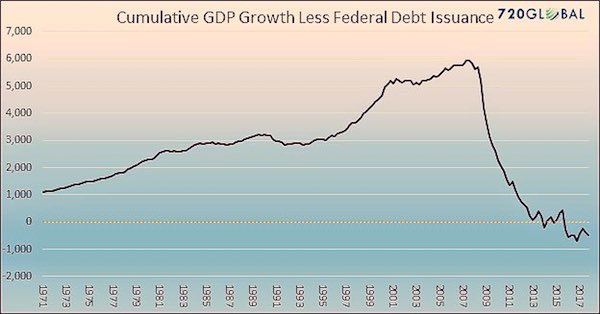

• It Is Time To Remove The Debt Barrier To Economic Growth (Hudson/PCR)

Out of habit, American economists worry about federal debt. But federal debt can be redeemed by the Federal Reserve printing the money with which to retire the bonds. The debt problem rests with individuals, companies, and state and local governments. They have no printing press. We have explained that the indebtedness of the population means there is little discretionary income with which to drive the economy. The offshoring of middle class jobs lowered incomes, and after paying debt service—mortgage interest, car payments, credit card interest, student loan debt—Americans’ pockets are empty. This situation has been worsened by Covid lockdowns. In the US the federal government has sent out a few Covid payments to help keep people’s heads above water as they face expenses without income.

The financial press refers to these Covid checks as “fiscal stimulus,” but there is no stimulus. The Covid checks do not come close to replacing the missing wages, salaries and business profits from lockdowns. Corporations have indebted themselves and impaired their capitalization by borrowing money with which to repurchase their stock. This has built up their debt in the face of stagnant or declining consumer discretionary income. We propose to deal with the debt crisis by forgiving debts as was done in ancient times. Our basic premise is that debts that cannot be paid won’t be. Widespread foreclosures and evictions would further worsen the distribution of income and wealth and further contrain the ability of the economy to grow. Writing debt down to levels that can be serviced would clear the decks tor a real recovery.

Income that would be siphoned off in debt service would instead be available to purchase new goods and services. A few economists muttered that we were overlooking the “moral hazzard” of absolving people of their debts. But leaving the economy stagnated in debt is also a moral hazzard. Policymakers did not endorse our proposal, but, in effect, policymakers adopted our policy. However, instead of forgiving the debt itself, they forgave payment of the debt service. Individuals and businesses who cannot pay their landlords or lenders cannot be evicted or foreclosed until June. This doesn’t hurt the lenders or banks, because the loans are not in default, and their balance sheet is not impaired. The banks add the unpaid payments to their assets, and their balance sheets remain sound.

When June arrives, the prohibition against eviction and foreclosure will have to be extended as the accrued debt service cannot be paid. Extending the moratorium on foreclosures and evictions will just build up arrears. Is the implication a perpetual moratorium? The question is: If policymakers are willing to forgive debt service, why not just forgive the debt. The latter is neater and clears the decks for an economic renewal.

Solid discussion. Welcome.

• Bitcoin Bros Rediscovering Our Monetary Past (AIER)

All eyes on bitcoin, it seems, as the price hits new all-time-highs, its proponents celebrate, and the economists who have long pronounced it dead and useless scratch their head in confusion (any “bubble” pronouncements as of late?)“The discomforting reality for the early idealists,” wrote Izabella Kaminska, a long-time critic of cryptocurrencies, before the price explosion in recent months, “is that 12 years on, the bitcoin ecosystem has more in common with the incumbent one it was hoping to displace than that original utopian vision.” She’s more right than she knows. In one sense, we should probably celebrate this as it means that bitcoin is approaching the monetary commodity dream it always harbored: it is running into some eternal troubles common to all monetary systems.

Even better, we should take the opportunity to teach some monetary history, as those in the crypto world have never been particularly well-versed in our monetary past. The audience they cater to is even less informed and so the “bitcoin heroes” – Saifedean Ammous, Robert Breedlove etc – are celebrated for their wisdom, no matter how rudimentary or inaccurate. It’s easy to discard an entire field of centuries-long academic inquiries, especially if you’ve never been exposed to it, or only investigated a caricature. Some humility is recommended since, as Denis Patrick O’Brien writes in his collection of scholarly articles The Development of Monetary Economics, “Monetary economics has attracted some of the very best people to have written about economic problems.”

In contrast to Bitcoin’s money supply mechanism, set in stone since its origin, many of bitcoin’s rivals – “alt-coins” or “sh**coins” – want to set their own monetary policy, laid down arcane rules in fancy white papers that only the insiders have the discretion to change. This dispute over rules and discretion about who runs the printing press is about three centuries old if not more, and was thoroughly investigated by the likes of Adam Smith, Benjamin Franklin, Thomas Tooke, Horsley Palmer, Walter Bagehot, John Clapham and others. Some of the seemingly novel features of many cryptocurrency innovations are not so novel, and quickly run into precisely the problems that plagued past economies; these were promptly examined and argued over by monetary economists long since dead and forgotten.

When Bitcoin was small and insignificant, the dollar-cost of sending value across the network was minuscule. For the first few years of the cryptocurrency’s existence, this was among the best reasons to use it: you could send any amount, to anyone in the world, much cheaper and much faster than the legacy banking system of the 2000s. That was roughly correct. Legacy systems were slow and expensive, and doing international banking only 15-20 years ago caused headaches to plenty more people than money launderers.

The Internet, effective competition, and the rise of fintechs changed all that – but the most vocal bitcoiners remained in the past that the legacy system had long left behind, thinking that their magnificent invention still trumped the system against which bitcoin was created. For most uses it doesn’t: unless you’re living under authoritarian regimes or are trying to do business in the legal grey (two very important, yet comparatively small, market segments), using bitcoin for its initial transactional purposes isn’t that great.

“Experts say that Markle may be the most qualified presidential candidate to ever run for office since she is a Democrat woman of color and has a ton of useful experience as a princess.”

• Woman Who Thought Being A Princess Was Too Hard, To Run For President (BBee)

The former Duchess of Sussex, who left the royal family after realizing how hard it was to be a princess, is now eyeing a presidential run. According to sources, Meghan Markle is networking with Democratic leaders for a possible shot at becoming America’s first female president. “Being a princess was, like, the absolute worst,” said Markle to some trusted political consultants. “There were so many things to do, and so many annoying obligations I had to fulfill. I think being President of the United States will be much easier. Let’s do that instead!” Experts say that Markle may be the most qualified presidential candidate to ever run for office since she is a Democrat woman of color and has a ton of useful experience as a princess.

“Meghan Markle may be the one to finally save America and get all those migrant kids out of cages,” said local Meghan Markle enthusiast Camy Fumbertook. “Obama was a letdown, and Biden was a letdown, but I think Markle will be totally different due to her womanness and person-of-colorness.” In a statement, Biden announced support of Markle’s future run. “Don’t worry, sweetie,” he said as he descended his basement stairs for another nap. “The presidency is way easier than being a princess.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

International trash-talk:

5. You are a potato with the face of a guinea pig (French)

4. Your brain is like two walnuts in a bag (Arabic)

3. My foot is in your butt’s destiny (Urdu)

2. You’re the son of a gender-neutral dog (Bengali)

1. Your gran masturbates standing up (German)

You are neither here nor there,

A hurry through which known and strange things pass

And catch the heart off guard and blow it open.

Lá fhéile pádraig

Seamus Heaney

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.