Office of War Information Watching D Day news line on New York Times building June 6, 1944

Much ado about nothing. That about sums up the real story behind the heated headlines on the “historic” decision by the ECB to lower its deposit rate into negative territory, from 0% to -0.1%. Because without any actual deposits, the move is empty, meaningless, showmanship, sleight of hand. There was a time when it made sense for banks to park reserves at the central bank, but that time is long gone, since banks don’t have to be afraid of each other’s hidden debts anymore. Not because those debts have disappeared , but because governments and central banks are now on the hook for them.

First, in November 2011, the Financial Stability Board published its initial official list of SIFIs or “Systemically Important Financial Institutions”, another way of saying Too Big To Fail. Being on the list may come with a few requirements, reserve ratios etc., but much more importantly it cemented the coup by the banking world in the wake of the financial crisis. Other than those few requirements, they could now act with impunity: any losses would be covered first by the people of the countries the banks had their headquarters in, but in the case of Europe also by other EU citizens.

What risks remained in the system, such as smaller banks and peripheral bonds, were taken away on July 26 2012 by Mario Draghi’s infamous “whatever it takes” speech. From there on in it’s been smooth sailing. For the banks that is, not for the various economies. To wit: yields on PIIGS bonds are now about on par with US Treasuries, even as Spanish, Italian and Greek unemployment numbers have stayed absurdly high for years now. That’s the kind of distortion you can only get through the promise of unlimited spending from central banks.

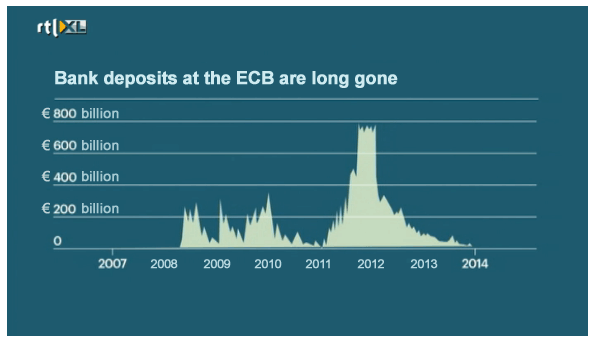

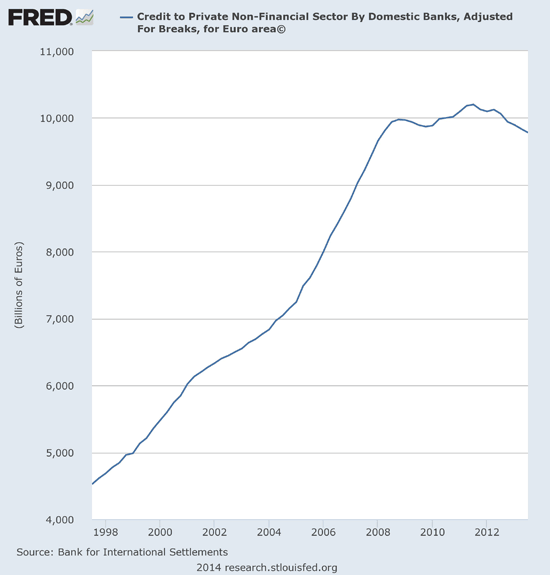

I picked up the graph below from Dutch business channel RTLZ and adapted it a little. It needs precious few further comments. From the $800 billion in deposits in early 2012, perhaps $10 billion or so is left. Chump change. The negative deposit rate has neither meaning nor impact. The Systemically Important Financial Institutions are in full control of the game. And that cannot bode well for the man and woman in the street.

• Banks Are Digging Into China Metal-Backed Loans (WSJ)

As many as a half-dozen banks are trying to determine whether the collateral for loans they made to commodities traders was used fraudulently by a third party to obtain other loans, according to people with knowledge of the matter. The banks, including Citigroup and Standard Chartered, provided loans to trading firms that were backed by metals such as copper and aluminum stored at one of China’s biggest ports, the people said. The trading firms hold the deed to the metal, which can be used to secure financing, but the metal stays in a warehouse. Banks fear a private Chinese company may have used the metal as collateral to get multiple loans, potentially defrauding the lenders and trading firms. Two of the people with knowledge of the matter estimated the value of the loans and collateral at several hundred million dollars.

The banks are frustrated because they haven’t been able to get access to the collateral, the people said. The metals are stored at Qingdao Port, which administers the warehouses. An executive at one of the banks said the title documents from the warehouses may have been photocopied and used to secure the loans. Police in Qingdao, a city of nearly nine million people in eastern Shandong province, are scrutinizing paperwork between a domestic company and the port, according to another person familiar with the matter. In one suspected instance, five receipts involving one stockpile were found, even as the port claimed to have only issued one, this person said. [..]

The potential fraud raises questions about the integrity of commodities warehouses in China, one of the world’s largest users of commodities, and how trading is financed. There has been concern among policy makers that commodities in China are being used to get financing for cash-strapped companies. As credit tightens and the nation’s economy slows, some investors worry that the commodities will be dumped onto the market as banks seize collateral, potentially knocking down prices. There is also concern that demand in China will collapse because so much of the metal had been stockpiled in warehouses.

Maybe the courts can do what regulators won’t. But that’s still a big maybe.

• US Exchanges Face Class Action Suit Over High-Frequency Trading (Guardian)

The American lawyer who orchestrated a successful class action suit against the tobacco industry 20 years ago has turned his sights on the stock exchanges caught up in the controversy over high-frequency trading. HFT is the process by which professional traders are able to put orders in to the stock market more quickly than the majority of investors. Putting in these earlier bets on the market, it is alleged, allows professionals to make quick profits at the expense of savers and investors in pension funds. The practice is being tested in a class action suit filed in a New York court last month by a number of US legal firms including Michael Lewis, the lawyer who led a class action suit brought by the state of Mississippi in 1994. The team of lawyers he assembled at that time led to $368.5 billion being paid out by 13 tobacco companies to cover the cost of treating illnesses related to smoking in almost 40 US states.

In an interview in Weekend magazine, Lewis – who is not related to the author of the same name whose book Flash Boys exposed high-frequency trading to the public – describes his court action as “a small skirmish against the larger backdrop of the vast accumulation of wealth and political power”. The case in the Southern District of New York is filed against 13 stock exchanges and subsidiaries on behalf of Harold Lanier “individually, and on behalf of all others similarly situated”. “This is a case about broken promises,” the 40-page document begins. It is signed by eight legal firms. In the interview, Lewis says that the information being provided by exchanges “was not timely or accurate, and wasn’t fairly distributed”, and alleges that they were in breach of contract. “The illusory market – the market that the investor sees when he looks at his monitor – is anywhere from 1,500 to 900 milliseconds old. That doesn’t sound like much, because the blink of an eye is 300 milliseconds. But that’s a long, long time in the world of HFT.”

Interesting way to look at the numbers.

• BLS Employment Surveys Diverge (Alhambra)

It’s payroll day again, which means we get to watch the straight-line march of the Establishment Survey “confirm” whatever the observer wishes to infer because a straight line is both uninteresting and mostly not useful. This happens, of course, regardless of what other parts of the survey or other surveys show. The most prominent disagreement continues to be with the Household Survey, diverging conspicuously in October 2012. We can also add the labor force, which flattened out also in October 2012, as well as one other data point. The headline numbers were all exactly in line with previous months, which should stand out as something askew more than act in confirmation. The economy certainly doesn’t move in a straight line so it stands to reason there should be more than a little lumpiness to payroll changes even including adjustments. Ever since the start of 2013, the Establishment Survey has become more of a straight line than at any time in its history.

Going back a few months before, it was there that the Household Survey began to “undercount” employment, at least by comparison. While the mainstream position places far greater faith (which is what it is) in the more quoted Establishment Survey, the other parts of the payroll report disagree – and some vehemently. As I have shown in previous months, prior divergences between the two surveys were typically small and never endured for very long. The last 20 months have been highly unusual to say the least. However, the somewhat healthy increases in the official labor force flattened out right around that same month. In fact, the labor force in October 2012 was 155.5 million, and is estimated to be 155.6 million in today’s release. Measuring from January 2013, when the Establishment Survey’s straight line grew straighter, the labor force is actually 86k fewer in number.

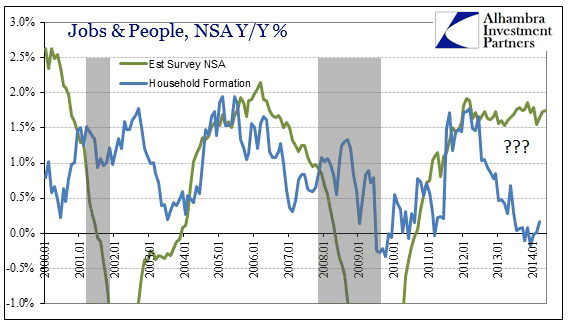

This is highly irregular as well except during periods of open contraction. It is not just the labor force that shows this trend, either, as I noted earlier this week household formation has dropped significantly in the past year or so. Adding that data point to the mix reinforces this interpretation, particularly as the change in trend dates once again to about October 2012. This is beyond random coincidence and mere population characteristics. How can it be related to population when the Household Survey, an alternate measure of employment, picked up the same exact inflection at the same exact time? The only way to tie these factors together and maintain logical consistency is to look to the macro economy as something other than what the mainstream indication is being used for. Putting household formation together with the unadjusted Establishment Survey shows this divergence perhaps even clearer.

As forests disappear, so do languages. Let’s all switch to Mandarin, shall we?

• Loss Of Biodiversity Linked To Loss Of Human Diversity (Guardian)

New Guinea has around 1,000 languages, but as the politics change and deforestation accelerates, the natural barriers that once allowed so many languages to develop there in isolation are broken down. This is part of a process that has seen languages decline as biodiversity decreases. Researchers have established a correlation between changes in local environments – including the extinction of species – and the disappearance of languages spoken by communities who had inhabited them. “The forests are being cut down. Many languages are being lost. Migrants come and people leave to find work in the lowlands and cities. The Indonesian government stops us speaking our languages in schools,” says Wenda.

According to a report by researchers Jonathan Loh at the Zoological Society of London and David Harmon at the George Wright Society, the steep declines in both languages and nature mirror each other. One in four of the world’s 7,000 languages are now threatened with extinction, and linguistic diversity is declining as fast as biodiversity – about 30% since 1970, they say. While around 21% of all mammals, 13% of birds, 15% of reptiles and 30% of amphibians are threatened, around 400 languages are thought to have become extinct in the same time. New Guinea, the second-largest island in the world, is not just the world’s most linguistically diverse place, it is also one of the most biologically abundant, with tree-climbing kangaroos, birds of paradise, carnivorous mice, giant pigeons, rats bigger than domestic cats and more orchid species than any other place on the planet.

A timely warning. Complacency is never a good driver.

• A Hawk Stirs as Weber’s UBS Sees U.S. Inflation Set to Take Off (Bloomberg)

Leave it to Axel Weber to sound the inflation alarm while most of the world is focused on the threat of deflation. A stalwart advocate of tight money at the European Central Bank, where he helped to set interest rates from 2004 to 2011, Weber says U.S. price gains and the subsequent response of the Federal Reserve will outpace investor expectations. “I see more potential ahead for nervousness in the market,” Weber, chairman of UBS since 2012, told a London conference of the Institute of International Finance yesterday. “The whole driver is going to be the inflation rate by the end of the year in the U.S.” The boss’s concerns are shared inside Switzerland’s largest bank.

In a May 27 study, New York-based economist Maury Harris and colleagues outlined what they called a non-consensus view that the personal consumption expenditures price index excluding fuel and food will reach 2% by the end of this year. It rose 1.4% in April. The Fed’s benchmark rate will jump to 1.25% by the end of next year and 3.25 by the end of 2016, UBS predicts. By contrast, the median estimate of economists in a May survey was for a 0.75% rate by the end of next year. The UBS analysis points to tightening labor and rental markets, a less-disinflationary impact from imports and price gains at the factory gate. Such an environment sets the stage for a surge in bond yields by the end of the year, forcing the Fed to retreat from its low-interest rate commitment, in UBS’s view.

The 10-year Treasury yield will rise to 3.25% in December from 2.57% today and touch 4% by the end of 2015, it says. That would surprise many, with the median forecast of analysts in another Bloomberg poll suggesting the yield will be 3.14 percent in the fourth quarter of this year. A year since emerging markets were roiled by the fear the U.S. central bank was readying to withdraw stimulus, Weber now says investors worldwide must brace themselves anew for international fallout from the Fed. “Every U.S. tightening cycle has been associated with repercussions in the global economy,” he said. “I don’t have the hope it will be different this time around.”

The US government may be facing a credibility problem.

• The Two Key Numbers That Shadow The Jobs Numbers (WaPo)

The monthly jobs report is comprised of two numbers, calculated using two different methods. In May, the economy added an estimated 217,000 jobs and the unemployment rate stayed at 6.3%. But looking at those two numbers outside of the context of two other numbers means you’re not seeing the full picture.

Jobs numbers and population Earlier, we noted that the economy hit a post-recession milestone: The number of people employed in the United States has finally passed the level of January 2008, the previous peak. (There are a number of footnotes that could be applied to “number of people employed,” but we’re going to skip those for now.) Thanks to those 217,000 more jobs, there are about 98,000 more people employed than in that month. But you can’t look at those job gains without looking at another number: population. Below is a graph of the number of people employed in the economy relative to January 2008 (“JOBS”) with another set of data, the noninstitutional population of the country relative to the same month (“POPULATION”).That’s the shadow. And it shows that job additions since 2010 have essentially kept pace with the growth of the number of people in that same time period.

Unemployment rate and participation Likewise, you can’t just look at the unemployment rate by itself. The unemployment rate is a simple fraction: the number of people employed divided by the number of people in the workforce. If a million people are in the workforce and 800,000 are employed, 80% of them are employed and the unemployment rate is 20%. Simple enough. But the size of the workforce fluctuates. People retire, people graduate from college, people go on disability, people just give up on finding work. So if the workforce suddenly drops to 900,000 in our previous example, eight out of nine people are working, instead of eight out of 10. The unemployment rate goes from 20% to 11% in a snap, with no one getting a job. The government counts the percentage of people participating in the workforce, too. And it tracks neatly with the unemployment rate, as you can see in the graph below, which shows the change in percentage rate since January 2008. Participation is the unemployment rate’s shadow.

” … go easy on the hallelujahs”

• Most US Workers “Running Up The Down Escalator” (AP)

The U.S. economy has finally regained the jobs lost to the Great Recession. But go easy on the hallelujahs. The comeback is far from complete. Friday’s report from the government revealed an economy healing yet marked by deep and lasting scars. The downturn that began 6Ω years ago accelerated wrenching changes that have left many Americans feeling worse off than they did the last time the economy had roughly the same number of jobs it does now. Employers added 217,000 workers in May, more than enough to surpass the 138.4 million jobs that existed when the recession began in December 2007. But even as the unemployment rate has slipped to 6.3% from 10% at the depth of the recession, the economy still lacks its former firepower.

To many economists, the job figures are both proof of the sustained recovery and evidence of a painful transformation in how Americans earn a living. “The labor market recovery has been disappointing,” said Stuart Hoffman, chief economist at PNC Financial Services. “Even with the new peak, there is still a great deal of slack.” There are still 1.49 million construction jobs missing. Factories have 1.65 million fewer workers. Many of these jobs have been permanently replaced by new technologies: robots, software and advanced equipment that speeds productivity and requires less manpower, said Patrick O’Keefe, director of economic research for the advisory and consulting firm CohnReznick. “When heavy things need to be moved, we now have machines to do it,” O’Keefe said. “It is unlikely in the manufacturing sector that we recover much of the losses.”

Government payrolls have shrunk, taking middle class pay with them. Local school districts have 255,400 fewer employees. The U.S. Postal Service has shed 194,700 employees. And during the economic recovery, more people have left the job market than entered it. Just 58.9% of working-age Americans have jobs, down from 62.7% at the start of the recession. Some of that decline comes from an aging country in which more people are retiring. But the share of working adults among the overall population is “still bouncing around at the bottom where it was during the worst of the recession” evidence that meaningful wage gains across the economy are unlikely, O’Keefe said.

The recovery hasn’t kept up with the expanding U.S. population. Researchers at the liberal Economic Policy Institute estimate that 7 million more jobs would have been needed to keep up with population growth. The pain has been concentrated largely among lower- and middle-income workers, according to an analysis by the institute. For the bottom 30% of earners, wages, when adjusted for inflation, have fallen over the past 14 years. For the next 40% of earners, pay basically flatlined. Most U.S. workers are “running up the down escalator,” said Larry Mishel, the institute’s president.

if nobody believes the unemployment numbers anymore, why keep publishing them?

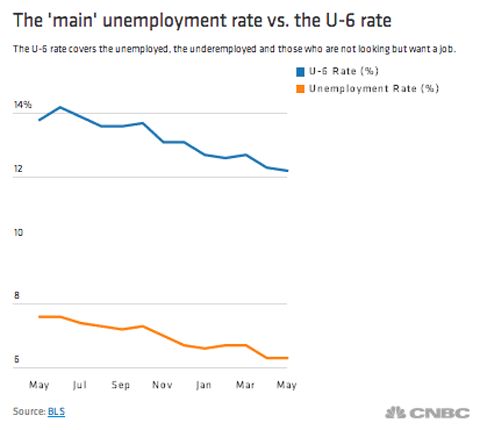

• What’s The Real Unemployment Rate? (CNBC)

The U.S. Labor Department said Friday that the unemployment rate was 6.3% in May—but does that rate tell the real story? A number of economists look past the “main” unemployment rate to a different figure the Bureau of Labor Statistics calls “U-6,” which it defines as “total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a% of all civilian labor force plus all marginally attached workers.” In other words, the unemployed, the underemployed and the discouraged—a rate that still remains high. The U-6 rate fell slightly in May to 12.2%. While it is down 160 basis points over the last year, the trend has been somewhat more volatile than in the main unemployment rate, which steadily declined. Over the last 18 months, the U-6 rate has changed by at least four-tenths of a point from month to month five times.

• The Fed Won’t Let the Economy Heal (Mises Inst.)

Most commentators are of the view that the massive monetary pumping of the Fed during 2008 prevented a major economic disaster. The yearly rate of growth of the Fed’s balance sheet jumped from 3.9% in January 2008 to 150.9% by December of that year. The federal funds rate target was lowered from 3% in January 2008 to 0.25% by December of that year. According to popular thinking, the Fed’s actions have bought time to allow the US economy to heal — much like keeping a coma patient on life support. Consequently, popular thinkers are harshly criticizing commentators that advocate allowing economic recession to take its course. Contrary to popular thinking, economic recessions or economic busts are not about the end of the world but about the removal of various non-productive activities, also labeled as bubble activities brought about by previous loose monetary policies of the central bank.

Observe that by means of loose monetary policy wealth is diverted from wealth generators to non-wealth generating activities. The stronger the pace of monetary pumping the stronger is the divergence of wealth. (Bubble activities, which don’t generate wealth, cannot exist without this divergence.) Obviously then the longer the divergence of wealth takes place the weaker wealth generators become. Note that once the ability of wealth generators to generate wealth comes under pressure the so-called economy follows suit. After all it is the increase in wealth that supports overall economic activity. It is increases in wealth that fund increases in productive and non-productive activities. So how then can aggressive monetary pumping by the Fed during 2008 have allowed the economy to buy time and to heal?

We suggest that the massive monetary pumping of 2008 has bought time for non-productive bubble activities. However, as we have seen, such activities undermine wealth generators thereby weakening the economy as a whole. If loose monetary policy is enforced over a prolonged period of time it runs the risk of severely weakening the process of wealth generation. A situation can then emerge where the pool of wealth becomes stagnant or starts to decline. Once this happens the economy plunges into a severe slump since there is now less funding available to support both productive and non-productive activities. In such a case, what is required to heal the economy is the fast removal of bubble activities. This will leave a larger amount of necessary funding in the hands of wealth generators thereby strengthening the process of wealth generation — the key for economic recovery.

It’s clear whose side Draghi is on.

• Draghi Faces Off With Regulators Over $2 Trillion In Tricky Debt (Bloomberg)

Mario Draghi is on a collision course with regulators as he seeks to revive Europe’s asset-backed debt market to boost lending to businesses. The European Central Bank president said yesterday regulators are holding back the market he wants to use to spur economic growth. Policy makers are frustrated by the Basel Committee on Banking Supervision’s demands that investors increase the capital they hold to absorb losses on the debt. “We are working on the ABS, but you know that there are also other actors,” Draghi said at a press conference in Frankfurt. “There has to be a revisitation of the regulation that had been introduced in the past few years about ABS to eliminate some of the undue discriminations.”

Europe’s $2 trillion ABS market contracted 32% since 2009 as regulators cracked down on the debt they blamed for deepening the financial crisis. The securities package individual loans such as mortgages, auto credit or credit-card debt and sell them on to investors, allowing banks to share the risk of default and encouraging them to offer more credit. Regulators have been wary of the securities as the complicated structure of some products can obscure the true riskiness of the underlying assets. That happened with securities backed by the U.S. sub-prime mortgage market, which imploded in 2007. Lenders from London-based Barclays Plc to Deutsche Bank AG in Frankfurt say the rules are becoming so onerous they may shun some of the debt, prompting the ECB to join with the Bank of England to seek to ensure the market isn’t unnecessarily impaired.

The ECB is promoting bonds backed by loans to small- and medium-sized enterprises in a bid to increase funding to the businesses that employ about 70% of the European Union’s private-sector workers. Draghi said the plan to revive the market includes buying “simple and transparent” notes that are backed by non-financial private sector debt. That may prove to be a challenge, according to New York-based Citigroup Inc., because there are only about 13 billion euros ($18 billion) of public bonds outstanding. “They may well succeed in reviving the market, but only in encouraging exactly the sort of credit-intensive growth and associated bubbles in asset prices which got us into trouble in the first place,” Citigroup analysts led by Matt King said in a note to clients yesterday before Draghi spoke.

• Draghi’s Big Fat Monetary Zero (Detlev Schlichter)

Before the ECB’s latest move, eurozone banks could get regular funds from the ECB at 0.25%, emergency funds at 0.7%, and they could deposit money at the ECB at 0%. After the ECB’s move, they can borrow regular funds at 0.15%, emergency funds at 0.40%, and they now get charged 0.1% for anything they keep at the ECB. What will the impact of all of this be? Pretty much nothing, I believe. It is sometimes stated that the –0.1% on deposits at the ECB is a fine for “parking” cash at the ECB and that it will encourage banks to do other things with the money. I think that this description is inaccurate. It gives the impression that banks could lend this money to corporations and households. But banks cannot do this.

Deposits at the central bank are bank reserves. They cannot be transferred and cannot be lent to non-banks because non-banks do not have an account at the central bank. Banks can lend these balances to other banks but the banking sector in aggregate cannot get rid of them. This means that at the new negative deposit rate the banking industry will pay about €220 million to the ECB every year and they can do precious little about it (but not to worry, this is small change in the big scheme of things). How can this potentially be stimulating? Individual banks that sit on large reserves may try and reduce their balances at the ECB by creating extra loans. When banks extend new loans they also create extra deposits (new money). Some of these deposits may flow to other banks, which means reserves also flow to other banks, that is, the balances at the ECB of the first bank (the credit and money creating bank) shrink. (Again, this does not lower balances at the ECB in aggregate.)

How many new and risky loans to small and medium sized companies banks will create to avoid the 0.1% “fine” at the ECB I do not know. My guess is it won’t be many. The extra money injections from September onwards seem equally ridiculous to me. Banks are not lending because of some shortage of reserves or lack of interbank liquidity but out of concern for their own balance sheets and the risks inherent in extending new loans to their shaky debtors. There also appears to be limited demand for loans.

By caving in to its critics rather than vigorously defending its previously passive but reasonable policy position, the ECB nurtures the foolish belief that various monetary shenanigans could play a meaningful role in improving the European economy. These policies will not solve anything but wet the appetite for more monetary interventions down the road. The advocates of “easy money” will not be appeased for long. For these people money is always too tight, interest rates are always too high and budget deficits always too small. There is always too little “stimulus”. Paul Krugman is a case in point.

• Draghi’s Horrible Threat: “Are We Finished? The Answer is No” ! (Stockman)

Taken at face value yesterday’s action by the ECB amounted to a monetary farce. How could any adult believe that a benchmark rate cut of 10 bps from an already microscopic level of 25 bps would move the needle in an economic zone that is already groaning under of the weight of $60 trillion in public and private credit market debt? Similarly, what exactly is the point of negative rates on excess bank funds deposited at the ECB when there will never be any takers? After all, Euro banks do have alternative parking lots for idle cash. Likewise, how does inventing a grand new acronym called TLTRO hide the fact that its essentially a free toaster program for clever loan book managers? As instructed by this swell new ECB writ, they will presently shuffle some funds out of mortgages, sovereign debt or other speculative purposes yet to be defined and into approved “productive” loans.

And then they will pass “go”, collect some cheap TLTRO funding from the ECB and collect their own performance bonus for all the bother. All of this silly kidstuff, in fact, is the work of Keynesian desperados in Frankfurt who embrace two propositions that are unequivocally and provably wrong. Namely, that the Euro area economy is floundering due to a tiny decline in non-financial credit and that “low-flation” is the great roadblock that prevents the wheels of credit and commerce from turning at a more satisfactory pace.

In truth, the Euro zone has had an explosion of bank credit growth to the private non-financial sector. Outstanding bank loans grew at a 7.5% CAGR during the 10-years ending at the eve of the financial crisis in early 2008. During those halcyon days there was obviously nothing wrong with the bank credit machinery—especially given the fact the euro zone money GDP grew during the same decade at only a 4.4% CAGR. Expressed in absolute dollar terms, the gain borders on a borrowing frenzy. During that decade, non-financial debt outstanding in the euro zone grew by the equivalent of $7 trillion—which is to say, by an amount equal to the entire loan book of the US banking system on the eve of the crisis.

Home › Forums › Debt Rattle Jun 8 2014: The ECB Negative Rate Is A Dud