Harris&Ewing National Capital digs out after storm Jan 14 1939

I’d just written down as a comment on one of the other articles: “Beware French banks, and Santander et al. It’s far too quiet on that front.” And then I see this flash by at the last minute.

• Europe Stocks Head for Worst Drop Since August as SocGen Plunges (BBG)

The relief rally of Wednesday stopped short, with European stocks falling for the eighth time in nine days, heading for their lowest levels since September 2013. Financial results missing projections at Societe Generale, Rio Tinto and Zurich Insurance are adding to growing concerns that the global economy is slowing down. Energy producers deepened their slide as oil fell further. The Stoxx Europe 600 Index lost 3.9% at 9:26 a.m. in London, with more than 580 of its shares slumping. Federal Reserve Chair Janet Yellen yesterday said the turbulence had “significantly” tightened financial conditions and that the central bank might delay planned interest-rate increases. That failed to halt a slide in U.S. stocks, which by the end of the day had erased all of their gains.

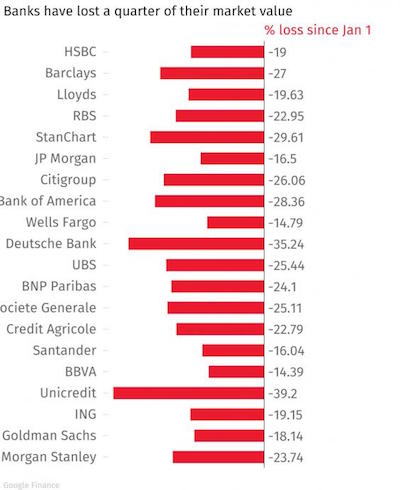

European shares have dropped 17% this year and reached their lowest levels since October 2013 on Feb. 9, before rebounding on Wednesday 1.9%. This week alone, the Stoxx 600 is heading for a 6.9% plunge, its worst since August 2011. With a valuation of 13.4 times estimated profits, the gauge is near a more than one-year low relative to the Standard & Poor’s 500 Index. At least four of the 10 worst-performing equity gauges among the 93 that Bloomberg tracks are from western Europe, with Germany’s DAX Index down 19% in 2016 and Italy’s FTSE MIB Index sinking 26%. While all industry groups have been suffering, banks have borne the brunt of the selloff – they’ve plunged 28% this year amid disappointing earnings results and worries over bad loans and creditworthiness. They extended their losses on Thursday, plunging 6% as a group.

European lenders are heading for their lowest levels since the beginning of August 2012 – right when they started to rally after European Central Bank President Mario Draghi pledged to save the euro. Now even speculation that he’ll step up support as soon as next month is doing little to calm the market. A measure of volatility expectations for the region’s stocks jumped 17% on Thursday, heading for its highest level since August. Societe Generale tumbled 12%, the most since 2011, after reporting that quarterly profit missed estimates as earnings at the investment bank fell and it set aside provisions for potential legal costs. While Italian and Greek lenders tumbled the most, Deutsche Bank, Credit Suisse and Standard Chartered were among the biggest decliners, down more than 6.5% each. They’re trading at their lowest prices since at least 1998.

Beijing will need to move before the Monday Shanghai opening.

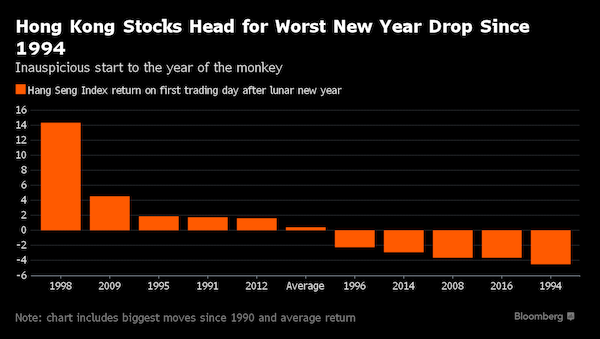

• Hong Kong Stocks Fall 4% in Worst Start to Lunar New Year Since ’94 (BBG)

Hong Kong stocks headed for their worst start to a lunar new year since 1994 as a global equity rout deepened amid concern over the strength of the world economy. The Hang Seng Index slumped 3.9% as of 1:13 p.m. in Hong Kong as markets reopened following a three-day trading closure, during which the MSCI All-Country World Index dropped 2.1%. The last time the gauge fell so much on the first day of the lunar new year, investors were worried about the health of former Chinese leader Deng Xiaoping. Lenovo and energy producers led declines after crude slumped 11% during the holidays, while jeweler Chow Sang Sang slid after riots in the Mong Kok district. Hong Kong’s benchmark equity gauge tumbled 12% this year through Friday amid concern that capital outflows, a slumping property market and China’s economic slowdown will hurt earnings.

Tuesday’s violence in the shopping district of Mong Kok threatens to deter mainland visitors and worsen a drop in retail sales, according to UOB Kay Hian. “You can’t avoid a drop because everywhere has come down so much during this time and the same concerns are still there – oil price, global recession,” said Steven Leung at UOB Kay Hian. “The image of Hong Kong as a metropolitan city has been hurt quite seriously” by the rioting, he said. PetroChina tumbled 5.7%, while Cnooc, China’s largest offshore oil company, dropped 6.4%. HSBC slid 5.2%, heading for a six-year low. The Hang Seng China Enterprises Index retreated 4.8%, poised for its biggest loss since August. Mainland financial markets remain closed for holidays until Monday. Plunges in crude and concerns over the perceived creditworthiness of European banks has fueled uncertainty over the strength of the world economy this week. Oil fell below $27 a barrel in New York, compared with $31.72 a barrel at the close on Feb. 4.

Hollow: “..we certainly recognize that global market developments bear close watching,..

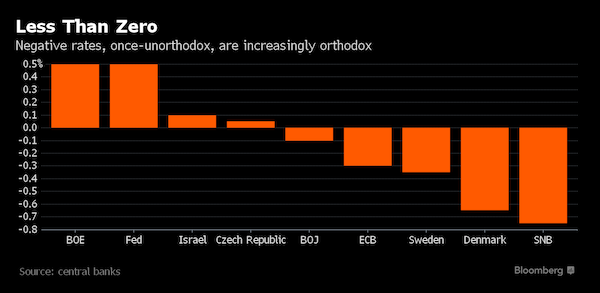

• Yellen: Not Sure We Can -Legally- Do Negative Rate (CNBC)

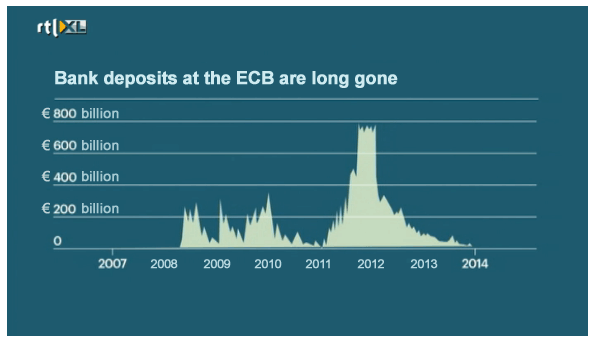

As whispers mount that the Fed could implement negative interest rates as a way to goose economic activity, Chair Janet Yellen said Wednesday the central bank has not completely researched whether that would be legal. During her semiannual congressional testimony, Yellen said the Federal Open Market Committee discussed charging banks to hold excess reserves at the Fed but never fully researched the issue. “We didn’t fully look at the legal issues around that,” she said. “I would say that remains a question that we still would need to investigate more thoroughly.” Asked whether she foresees the Fed cutting rates after just hiking its interest rate target in December, Yellen said she did not expect that to happen anytime soon as she considers the risk of recession low.

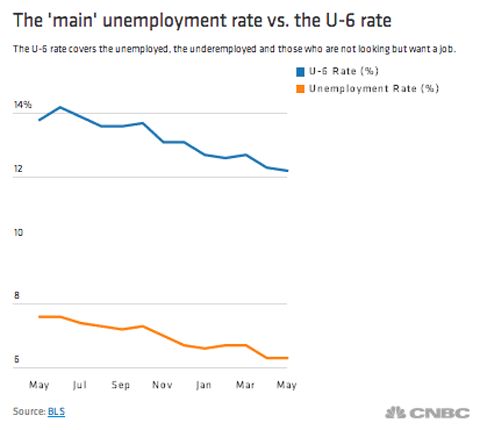

“There would seem to be increased fears of recession risks that is resulting in rising in risk premia. We’ve not yet seen a sharp drop-off in growth, either globally or in the United States, but we certainly recognize that global market developments bear close watching,” she told the House Financial Services Committee. Her testimony comes as speculation grows that the Fed might consider implementing negative rates on what it pays on excess reserves. That would be one option the Fed would have should the current bout of economic softness intensify. “I do not expect the FOMC is going to be soon in the situation where it’s necessary to cut rates,” she said. “Let’s not forget, the labor market is continuing to perform well, to improve. I continue to think many of the factors holding down inflation are transitory. … We want to be careful not to jump to a premature conclusion about what’s in store for the U.S. economy.”

No, this is no new normal, it’s still beyond crazy.

• How Low Can Central Banks Go? JPMorgan Reckons Way, Way Lower (BBG)

There are “no limits” to how far central banks can ease monetary policy. That’s a recent declaration of both ECB President Mario Draghi and Bank of Japan Governor Haruhiko Kuroda, who have joined their counterparts in Denmark, Sweden and Switzerland in embracing interest rates of less than zero. In September 2014, when the ECB’s deposit rate was minus 0.2%, Draghi was saying “now we are at the lower bound.” As recently as December, Kuroda said “we don’t think we should institute” negative rates. The rethink is global, even in places where rates are still positive.

Bank of England Governor Mark Carney conceded in November that his benchmark could fall below the current 0.5% if needed, while Federal Reserve Vice Chair Stanley Fischer said last week that negative rates were “working more than I can say that I expected in 2012.” Citigroup Inc. economist Willem Buiter says even China could shift below zero next year. The worry had been that probing below zero risked hurting the profitability of lenders, forcing them to pass on the cost to borrowers. Other fears included bank and currency runs, the hoarding of cash or gridlocked money markets. Rather than spurring lending and spending as intended, subzero rates would become more a problem than solution. Such a concern could still flare up anew given the recent selloff in global bank stocks and fretting over financial titans such as Deutsche Bank.

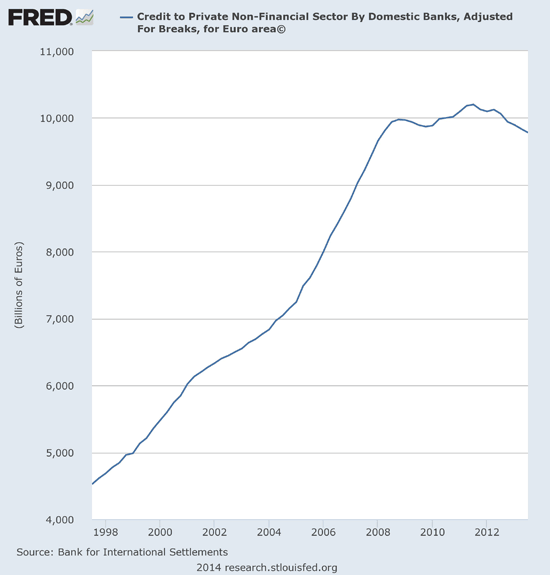

As I’ve repeatedly said: “The nation’s expanding shadow banking system [..] is where the first credit problems are emerging.”

• Kyle Bass Says China Bank Losses May Top 400% of Subprime Crisis (BBG)

Kyle Bass, the hedge fund manager who successfully bet against mortgages during the subprime crisis, said China’s banking system may see losses of more than four times those suffered by U.S. banks during the last crisis. Should the Chinese banking system lose 10% of its assets because of nonperforming loans, the nation’s banks will see about $3.5 trillion in equity vanish, Bass, the founder of Hayman Capital Management, wrote in a letter to investors obtained by Bloomberg. The world’s second-biggest economy may end up having to print more than $10 trillion of yuan to recapitalize banks, pressuring the currency to devalue in excess of 30% against the dollar, according to Bass. Bass, 46, scored big after betting against mortgages in 2007, racking up gains as the world’s largest banks wrote off more than $80 billion in subprime losses.

All his calls haven’t been as prescient. He revealed wagering on a collapse in Japan’s government-bond market in 2010, a short position that Bass later acknowledged that other bond investors had nicknamed “the widow maker.” “What we are witnessing is the resetting of the largest macro imbalance the world has ever seen,” he wrote in the letter. “Credit in China has reached its near-term limit, and the Chinese banking system will experience a loss cycle that will have profound implications for the rest of the world.” Bass said his hedge fund has sold most of its riskier assets since the middle of last year to position itself for 18 months of “various events that are likely to transpire along this long road to a Chinese credit and currency reset.” In an e-mail, he said about 85% of his portfolio is invested in China-related trades.

“The problems China faces have no precedent,” Bass wrote in the letter. “They are so large that it will take every ounce of commitment by the Chinese government to rectify the imbalances. Risk assets will not be the place to be while all of this is happening.” [..] Bass estimates the Chinese economy actually expanded last year at a slower pace than reported, about 3.6%, according to the letter. He estimates that of China’s $3.2 trillion in foreign-exchange reserves, about $2.2 trillion are liquid. The banking system, which he estimates swelled 10-fold in assets over the last decade to more than $34.5 trillion, is fraught with risky products used by financial companies to skirt regulations, wrote Bass. The nation’s expanding shadow banking system – which he says has grown almost 600% in the last three years, citing UBS data – “is where the first credit problems are emerging.”

A few more details.

• Bass: China Banks May Lose 5 Times US Banks’ Subprime Losses (CNBC)

“China’s [banking] system is even more precarious when we realize that, even at the biggest banks, loans are not made to borrowers based on their ability to repay,” he wrote. “Instead, load decisions are political decisions made by the state.” Add to this the danger posed by China’s shadow banking system – made up of instruments Bass claimed the country’s banks used to subvert restrictions on lending – and the upshot was there were “ticking time bombs” in China’s banking system, the hedge fund manager explained. “Chinese banks will lose approximately $3.5 trillion of equity if China’s banking system loses 10% of assets,” Bass wrote. “Historically, China has lost far in excess of 10% of assets during a non-performing loan cycle.”

He noted that U.S. banks lost about $650 billion of their equity throughout the global financial crisis. The letter said that the Bank for International Settlements (BIS) estimated that Chinese banking system losses from the 1998-2001 non-performing loan cycle exceeded 30% of GDP. “We expect losses in this cycle to exceed prior cycles. Remember, 30% of Chinese GDP approaches $3.6 trillion today,” he warned. Bass wrote that he expected the massive losses to force Beijing to recapitalize Chinese banks and sharply devalue the yuan. “China will likely have to print in excess of $10 trillion worth of yuan to recapitalize its banking system,” he said. “By the time the loss cycle has peaked, we believe the renminbi will have depreciated in excess of 30% versus the U.S. dollar.”

Is you have the likes of VW and Deutsche listed….

• Germany’s DAX Is One Of The World’s Worst-Performing Stock Markets (BBG)

A one-day rebound in German shares is doing little to extinguish concerns in what has become one of the world’s worst-performing stock markets. The DAX Index has tumbled 16% this year through Wednesday, posting a loss that exceeds declines in France, the U.K. and Switzerland by as much as seven %age points. It plunged another 3.1% at 9:40 a.m. in Frankfurt. Investors are taking money out of an exchange-traded fund tracking German shares at the fastest pace since August. Fears about Deutsche Bank’s creditworthiness this week added to growing worries over a slowing global economy. Because of Germany’s close ties to China, its biggest trade partner outside of Europe, the nation stands to lose more than others in the region.

Carmakers such as BMW, Volkswagen and Daimler have already tumbled more than 23% this year on weakening demand there. “Oil and China are still on fire and a cause for concern, but we’ve got other, more broad-based fires to be watching now, and Deutsche Bank is just one of them,” said Alex Neil, EFG Bank’s head of equity and derivatives trading in Geneva. “Whichever way you look at the global economy in the next few months, there are more attractive markets than Germany.” While only about a dozen out of 93 equity gauges tracked by Bloomberg have risen this year, Germany stands out for the extent of its losses. After being some of investor’s favorites in 2015, none of the 30 DAX shares rose this year. The gauge closed 27% below its April peak on Wednesday.

Or a shareholder. A pension fund that holds ‘secure’ stocks.

• It’s A Bad Time To Be A Bank (Ind.)

It’s a bad time to be a bank. Banking stocks have lost around a quarter of their value since the start of the year. Some are now trading around lows not seen since the financial crisis. Shares in Deutsche Bank and Unicredit have been particularly hard hit as investors have lost confidence. It took reports that Deutsche Bank was considering buying back some of its own bonds on Wednesday to scrape its share price off the floor. But the extent of the losses suggests that something much bigger than a loss of confidence in one or two banks is going on.

Beware French banks, and Santander et al. It’s far too quiet on that front.

• European Banks Face More Energy Problems (CNBC)

European banks appear to face greater long-term exposure to problems in the energy sector compared to U.S. banks, many of which have already shored up capital reserves for half of their energy debt portfolio. Numerous European banks have not yet seen their borrowers draw down much of the credit that has been allotted for them, or, even more perplexing to analysts and investors, aren’t saying what their exposure to commodity-sensitive credit is, or what has already been committed. At the Credit Suisse Financial Services Conference this week in Florida, several bank executives highlighted the total exposure of their balance sheets to energy debt, but also explained what%age of that exposure is made up of outstanding paper.

Wells Fargo CFO John Shrewsberry highlighted the bank’s $42 billion in total oil and gas credit in his presentation at the conference; 41% ($17.4 billion) is already outstanding. The lender already has prepared for losses in outstanding paper by setting aside $1.2 billion to offset credit losses. The difference between Wells’ energy exposure and many of its competitors is that much of the California-based bank’s paper is non-investment grade. But the finance chief doesn’t sound like he’s sweating it. “This is not new for Wells Fargo,” Shrewsberry said at the event, and he noted “most of these loans are senior secured credit facilities.” However, European banks may have an even greater need to shore up capital. Many have billions in energy credit still waiting to be drawn down, which in turn could impact how much reserves must be set aside to bolster against defaults.

Credit Suisse CEO Tidjane Thiam spoke at the conference run by his bank Wednesday, and explained that while the company’s total energy exposure represents $9.1 billion, only $2.4 billion (about a quarter) of that had been drawn down by borrowers. In a JPMorgan report, analysts highlighted energy exposure for banks including Barclays, Standard Chartered, Royal Bank of Scotland and BNP Paribas. All told, the banks’ commodity exposure represented nearly $150 billion, much of which is yet to be drawn down, according to the report. Deutsche Bank didn’t quantify what its full energy exposure is in its fourth-quarter results, although, according to S&P Global Market Intelligence analyst Julien Jarmoszko, the lender has a lower exposure than its bigger competitors.

Chesapeake looks done.

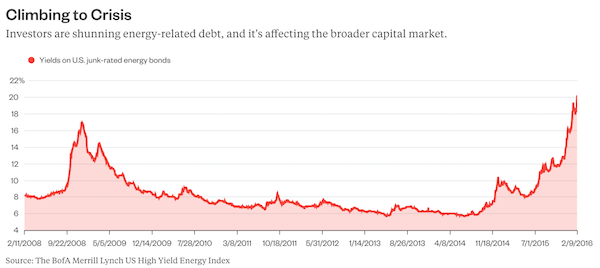

• Energy Debt Fuels Broader Malaise (BBG)

This will most likely go down as the year of the Great Energy Debt Crisis, a spiral that exacerbated an economic funk that roiled the world. Companies are starting to go bankrupt. Banks are preparing for losses tied to oil and gas loans. And bond markets have all but closed to energy companies, especially the lowest-ranked ones. Borrowing costs for U.S. junk-rated energy companies have soared to records, with yields on their bonds surging past 20% for the first time, exceeding the past peak of about 17% in 2008, Bank of America Merrill Lynch index data show. Moody’s expects the U.S. default rate to reach the highest in six years in 2016, and a growing pool of investment-grade energy debt will most likely be downgraded to junk in the near future.

Chesapeake Energy is fast heading toward default, with Standard & Poor’s calling its debt “unsustainable.” Bonds of California Resources, Linn Energy, Energy XXI, Chesapeake and EP Energy have all lost more than 75% since the end of July. Without a doubt, the relentless carnage in energy debt is spilling over into the broader market, especially as prices continue to plunge, with Goldman Sachs seeing the possibility of crude prices dropping below $20 a barrel after rising as high as $107 in 2014.An estimated $75.7 billion in value has been eliminated from the pool of U.S. energy-related junk bonds since the end of June. Those losses are reverberating through mutual funds and hedge funds, which enabled an unprecedented borrowing spree by these companies just years earlier and are now suffering the consequences.

Financial innovation.

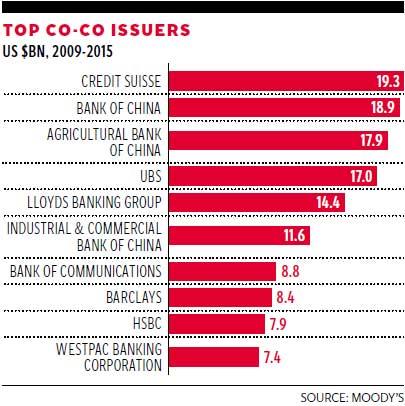

• Is The Market In European Coco Bonds About To Pop? (Ind.)

In May last year Martin Taylor, the former chief executive of Barclays Bank, addressed a crowd of high-powered financiers in the ballroom of the InterContinental Park Lane hotel in London. Mr Taylor, an adviser to the Bank of England’s Financial Policy Committee and an influential voice on market risk, spoke darkly about his fears for Coco bonds, a quirky-sounding debt instrument launched in the wake of the financial crisis. “I talk to a group like this about credit matters with the greatest timidity. I am sure you are good citizens and desire to exercise exemplary scrutiny. But I wonder whether you will flip – like the holders of European sovereign bonds before 2010 – from believing all issuers equally safe to thinking many equally precarious when the sky next darkens,” he said.

Skies have not only darkened this week, but Mr Taylor’s words have a prophetic rings: investors have indeed flipped out with concern about Cocos after the German lender Deutsche Bank was forced to reassure investors it could meet interest, or coupon, payments on its Coco bonds. The move has stoked fears that something is rotten at the heart of the European banking sector and led many to question why Cocos – considered a silver bullet solution – have melted like their chocolate breakfast cereal namesake in the face of market turmoil. Cocos, formally known as contingent convertible bonds, were born out of the 2008 financial crisis as a solution for stricken banks without the need for a state bail-out.

They work quite simply on the surface: banks issue them to finance their business like normal bonds but they morph into equity if a bank’s capital falls below a certain threshold. This automatically reduces a bank’s debt and boosts its capital buffers at a time when external investors could be reluctant to inject new money. The flexibility removes some of the risk inherent in loading up bank balance sheets with debt. But herein lies the rub: how can a bank be flexible on debt obligations without spooking the market into thinking it is in trouble?

Long overdue.

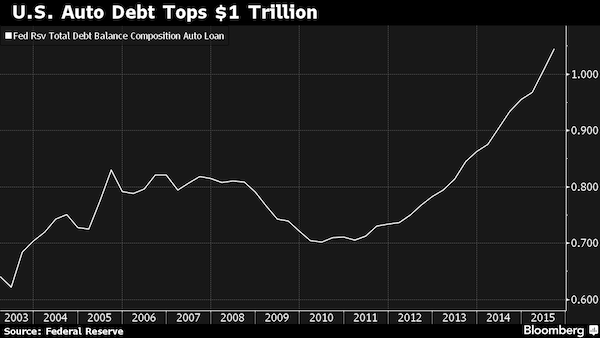

• Some Hedge Funds Want to Make Subprime Auto Loans Next Big Short (BBG)

A group of hedge funds, convinced they have found the next Big Short, are looking to bet against bonds backed by subprime auto loans. Good luck finding a bank willing to do the trade. Money managers have looked at betting that subprime auto securities will tank for many of the same reasons that investors wagered against risky mortgage bonds in the run-up to the financial crisis: Loan volume has mushroomed in the last few years, lending terms have become looser and delinquencies are ticking higher. Mary Kane, an asset-backed securities analyst at Citigroup Inc., wrote in a note late last month that the bank has received “an explosion of calls” in recent weeks, after the movie “The Big Short” portrayed a group of traders that wagered against subprime bonds.

The demand now is coming from hedge funds that trade everything from stocks to bonds, analysts said. But many banks, including Bank of America and Morgan Stanley, are not interested in making the bet happen for clients, according to representatives of the firms. Some said they fear that helping clients wager against car loans would be bad for their reputation, and that new capital rules and other post-crisis regulations would make the transactions difficult or even impossible to put together. “Most trading desks just don’t take that kind of risk now,” said Mike Edman, a former Morgan Stanley executive who helped invent credit derivatives that helped Wall Street banks bet against subprime mortgage bonds.

At least one trading desk has done this sort of trade. Etai Friedman, who runs hedge fund Crestwood Advisors, said he was able to work with a salesman he had known for years to buy an option that performed well if a custom-made index of subprime auto bonds fell. Friedman declined to identify the bank that did the trade, on which he earned a 36% return, but said finding a dealer was hard. “A trade like this is just taboo now,” Friedman said. Banks’ reluctance to help investors bet against subprime auto loans signals that may be paying more attention to how their trades will play with regulators and in the media, after having been criticized for crisis-era transactions.

They’re all still thinking in terms of short term cycles only.

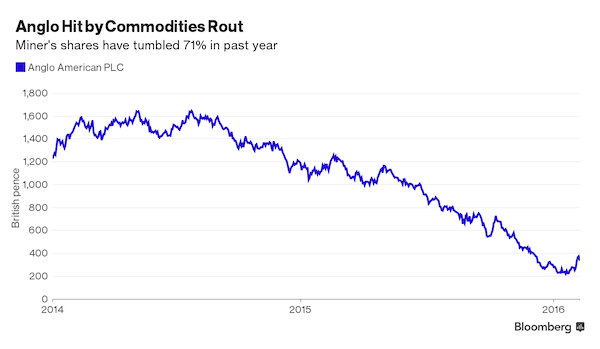

• The Mining Industry Makes Oil Giants Look Great (BBG)

When you find yourself in a hole, the saying goes, stop digging. A simple lesson that arguably has bypassed a mining industry that’s wiped out more than $1.4 trillion of shareholder value by digging too many holes around the globe. The industry’s 73% plunge from a 2011 peak is far beyond the oil industry’s 49% loss during the same time. Just how long it will take for the world to erode bulging stockpiles of metals, coal and iron ore was the central debate at the mining industry’s biggest investment conference in Cape Town this week, which attracted more than 6,000 top executives, bankers, brokers, analysts, miners and reporters. This year may be the worst yet with prices trending lower for longer, according to Anglo American CEO Mark Cutifani, who says his company should be better prepared “for the winter that inevitably comes after the summer.”

Because it sees it as its duty to harass its citizens.

• Why Does the US Government Pursue Student Debtors in Prison? (BBG)

For Cecily McMillan, getting mail while incarcerated was a complex project. Any letter that was sent to her went through a metal detector and was opened by correctional officers before landing in the mailroom, where she had a two-hour window to collect it on a good day, she said. McMillan was living in the Rikers Island facility, a city-run jail complex in Queens, N.Y., but that did not stop the clock on her student loan payments. McMillan was serving a 58-day stint for assaulting a police officer, who tried to remove her from Zuccotti Park on the night of March 17, 2012, when people had assembled to mark the Occupy Wall Street protests. Eight months after she was released, McMillan realized she had missed a letter from a government debt collector warning that one of her federal student loans was coming due.

She ended up defaulting on her loan, leading that debt to balloon 35% to more than $7,600. In all, she had more than $100,000 in student debt. Her experience helps to illustrate the persistence of student loans—the only form of consumer debt that can almost never be erased, even if you declare bankruptcy. While collectors for other types of loans also pursue debtors behind bars, federal student loans are different because the government is the collector, which means taxpayer money is spent trying to reach borrowers who cannot easily communicate with the outside world and have few opportunities to earn money to repay the debt. McMillan, for example, said she was making less than a dollar per hour at her job as a suicide-prevention aid worker at Rikers. The average federal prison worker makes about 92 cents per hour, according to the Economic Policy Institute.

“..whoever occupies the White House in 2017 will preside over a financial debacle like unto nothing in scale that the world has ever seen before..”

• Notes from the Locked Ward (Jim Kunstler)

Beyond all the political histrionics, is there not some broad recognition that whoever occupies the White House in 2017 will preside over a financial debacle like unto nothing in scale that the world has ever seen before? With all the reverberating side effects imaginable among the traumatized nations? Something wicked has been creeping through the stock markets since the year began. The velocity and damage are amping up. Credit default swap spreads are yawning like fault lines in a ‘quake. Bankers are watching their share prices collapse. It’s a wonder that panic has not already broken out.

This is not just about Wall Street and its counterparts in London, Shanghai, Tokyo, and Frankfurt. This is the financial world (and underworld) catching up with the Economy of Actual Stuff. In the USA, that economy has bled out like a hapless bystander with a sucking chest wound for the last eight years. Despite all the patriotic sanctimony on view at the Superbowl, the nation appears to be visibly cracking up, along with the fantasy of a permanent global economy. None of the desperate work-arounds since 2008 have worked around the predicaments of our time. Politics will not abide a rational journey out of our fatal hyper-complexity to something simpler and more consistent with the realities at hand. Expect more and greater craziness as the year lurches on.

I can tell you when: when the economy deteriorates sharply. How does 2016 sound?

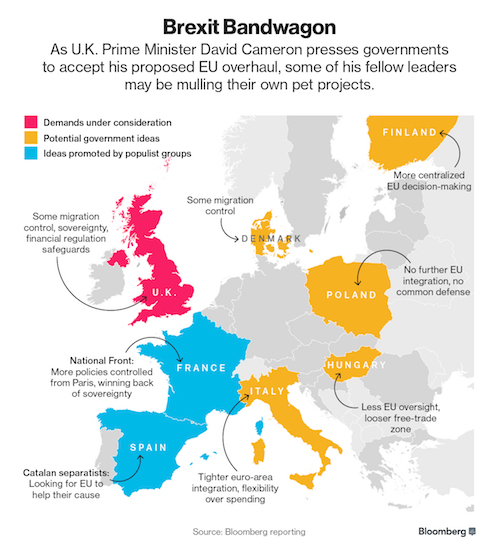

• When Will the Rest of Europe Want Its Own ‘Brexit’? (BBG)

If David Cameron leaves next week’s European Union summit with a deal to overhaul the terms of Britain’s membership, many of his counterparts will breathe a sigh of relief – and dig out their own wishlists. As populist and anti-EU forces surge across the region, the prime minister’s ultimately successful strategy of issuing demands for change and threatening to leave if they’re not met has left an impression on his fellow leaders, two senior EU officials said. Some see his approach as a template for pushing their own causes, the officials said, asking not to be named because the discussions were private. “The fact David Cameron raised a number of concerns and these concerns have all been addressed is creating a political precedent,” said Vincenzo Scarpetta, policy analyst at the London-based Open Europe think tank.

“The British renegotiation has to be seen as a longer-term path – Cameron has raised existential questions about the future of the EU.” Europe’s economic foundations were fractured by the debt crisis and now over a million refugees are pulling at its social fabric, bolstering populist movements from Madrid to Helsinki and fanning anti-EU feeling in former Soviet-bloc nations. That ensures when Cameron pushes for an accord at the Feb. 18-19 summit diminishing some of the bloc’s influence over the U.K., the shockwaves could resonate far beyond the English Channel. “All eyes are on France,” said John Springford, senior research fellow at London’s Centre for European Reform. EU officials are keen on “sending signals” to National Front leader Marine Le Pen and the wider French electorate “that this trick won’t work,” because “if France goes euro-skeptic, the project is toast.”

“..it would lead to “downright apocalyptic scenarios”: Greece would collapse within a few weeks..”

• Will Greece Become a Refugee Bottleneck? (Spiegel)

At five o’clock in the morning last Tuesday: Macedonia has once again closed its border, and just a few hours later, chaos reigns. Eighty buses with 4,000 refugees have been stopped by the Greek police 20 kilometers from the frontier and they are now waiting in a gas-station parking lot. Bus drivers argue, refugees jostle on the overfilled lot and overwhelmed police officers yell orders. “Macedonia, Macedonia,” the people waiting scream, “open the border!” But today, the border remains closed to most people. And if it were up to Brussels and the Germans, it would remain that way – that is, to anyone not from Syria, Iraq or Afghanistan. Since mid-November, Macedonia has tightened its border controls and whoever isn’t from one these three countries is turned away. Now, many people’s dreams of Europe come to an end here, in Idomene.

For it has recently become clear that Turkey is both unable and unwilling to stop the flow of refugees. As a result, the EU is placing its bets on Macedonia, with a plan that has the support of European Commission President Jean-Claude Juncker. Last year, the majority of the over 850,000 refugees traveling along the Balkan route went through Macedonia. If authorities have their way, that will come to an end. “Macedonia is our second line of defense,” says a high-ranking EU official. Several EU states have approved the deployment of 82 officers in Macedonia with the task of improving border protection. Financial support is to follow. If Macedonia reduces the number of people it allows into the country, it will lessen the pressure on Germany and Austria. It will also mean that more people will stay in Greece – and, Brussels hopes, place additional pressure on Greece to better protect its borders.

Idomene is a case study of what would happen were Europe to seal its borders and shut down the Balkan Route, the path most migrants take on their way to Germany and the rest of Europe. The result would be a massive backup of hundreds of thousands of refugees in Greece. And this in a country that is in a deep recession, and where every fourth citizen is unemployed. It is a country where angry farmers, teachers, doctors, lawyers, taxi drivers and ferry workers — actually everyone — is opposed to the government’s austerity measures. And it is a country that is once again in danger of sliding into its next big political crisis. The country will face big problems if Prime Minister Alexis Tsipras can’t find a compromise with the country’s international creditors, who are pushing for tough reforms. Or if Greece is made to bear the burden of the refugee crisis.

[..] According to a report by the Gemeinsames Analyse- und Strategiezentrum illegale Migration (Joint Analysis and Strategy Center on Illegal Immigration), many refugees in Greece live on the streets, even children and neo-nazis periodically hunt them down. The conditions for many refugees in Greece are described by the German authorities as “inhumane.” And still, the country is potentially being turned into a giant refugee camp. According to a confidential memo from the German Foreign Office, a backup of refugees would “inevitably lead to uncontrollable humanitarian conditions and security problems within days.” Migration researcher Franck Düvell from Oxford University warns that it would lead to “downright apocalyptic scenarios”: Greece would collapse within a few weeks, he believes.