Astor Theater, Times Square NYC 1945

Financial cycles appear to have grown in amplitude and length. Next move could be really wild.

• Monetary Policy In The Grip Of A Pincer Movement (BIS)

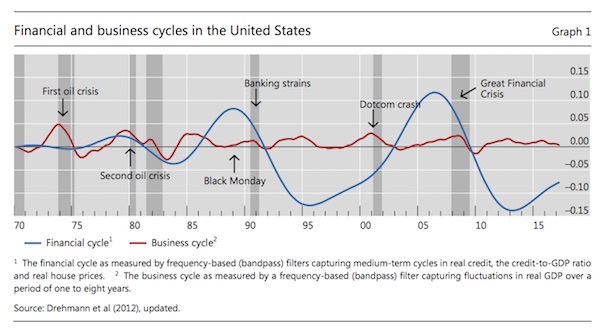

The emergence of disruptive financial cycles and the limited sensitivity of inflation to domestic slack may at first sight seem to be unrelated. In fact, there may be a common thread: the behaviour of monetary policy. Consider each in turn. The first major development is that, since around the early 1980s, financial cycles appear to have grown in amplitude and length. There is no unique definition of the financial cycle. A useful one refers to the self-reinforcing processes between funding conditions, asset prices and risk-taking that generate expansions followed by contractions. These processes operate at different frequencies. But if one is especially interested in those that cause major macroeconomic costs and banking crises, probably the most parsimonious description is in terms of credit and property prices.

Graph 1 illustrates the phenomenon for the United States using some simple statistical filters, although the picture would not be that different for many other countries or using other techniques (eg peak-trough analysis). The graph shows that the amplitude and length of the fluctuations has been increasing, that the length of the financial cycle is considerably longer than that of the traditional business cycle (blue versus red line) and that banking crises, or serious banking strains, tend to occur close to the peak of financial cycle. Another key feature of financial cycles is that the bust phase tends to generate deeper recessions. Indeed, if the bust coincides with a banking crisis, it causes very long-lasting damage to the economy.

There is evidence of permanent output losses, so that output may regain its pre-crisis long-term growth trend while evolving along a lower path. There is also evidence that recoveries are slower and more protracted. And in some cases, growth itself may also be seriously damaged for a long time. Some recent work with colleagues sheds further light on some of the possible mechanisms at work. Drawing on a sample of over 40 countries spanning over 40 years, we find that credit booms misallocate resources towards lower-productivity growth sectors, notably construction, and that the impact of the misallocations that occur during the boom is twice as large in the wake of a subsequent banking crisis.

“.. I continue to expect the S&P 500 to lose about two-thirds of its value over the completion of the current market cycle…”

• The Arithmetic of Risk (John Hussman)

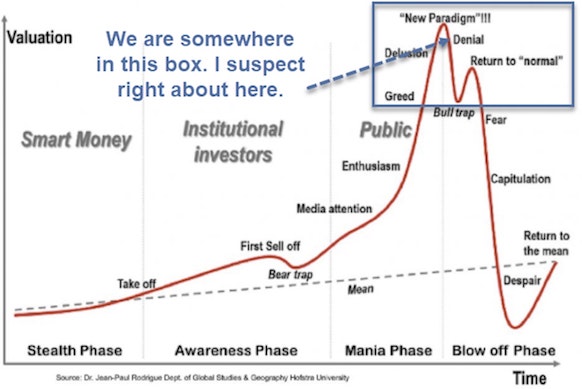

At present, I view the market as a “broken parabola” – much the same as we observed for the Nikkei in 1990, the Nasdaq in 2000, or for those wishing a more recent example, Bitcoin since January. Two features of the initial break from speculative bubbles are worth noting. First, the collapse of major bubbles is often preceded by the collapse of smaller bubbles representing “fringe” speculations. Those early wipeouts are canaries in the coalmine. In July 2007, two Bear Stearns hedge funds heavily invested in sub-prime loans suddenly became nearly worthless. Yet that was nearly three months before the S&P 500 peaked in October, followed by a collapse that would take it down by more than 55%.

Observing the sudden collapses of fringe bubbles today, including inverse volatility funds and Bitcoin, my impression is that we’re actually seeing the early signs of risk-aversion and selectivity among investors. The speculation in Bitcoin, despite issues of scalability and breathtaking inefficiency, was striking enough. But the willingness of investors to short market volatility even at 9% was mathematically disturbing. See, volatility is measured by the “standard deviation” of returns, which describes the spread of a bell curve, and can never become negative. Moreover, standard deviation is annualized by multiplying by the square root of time. An annual volatility of 9% implies a daily volatilty of about 0.6%, which is like saying that a 2% market decline should occur in fewer than 1 in 2000 trading sessions, when in fact they’ve historically occurred about 1 in 50.

The spectacle of investors eagerly shorting a volatility index (VIX) of 9, in expectation that it would go lower, wasn’t just a sideshow in some esoteric security. It was the sign of a market that had come to believe that stock prices could do nothing but advance, and could be expected to do so in an uncorrected diagonal line. I continue to expect the S&P 500 to lose about two-thirds of its value over the completion of the current market cycle. With market internals now unfavorable, following the most offensive “overvalued, overbought, overbullish” combination of market conditions on record, our market outlook has shifted to hard-negative. Rather than forecasting how long present conditions may persist, I believe it’s enough to align ourselves with prevailing market conditions, and shift our outlook as those conditions shift.

Annotation in blue by Mish

Perhaps this is truly a coordinated effort. The BIS could be doing the coordination.

• BOJ’s Kuroda Joins Queue of Central Banks Looking Toward Exit (BBG)

The end of the easy money era which spanned the global economy for the last decade came into even sharper focus as the Bank of Japan gave fresh insight into when it might slow its stimulus program. Governor Haruhiko Kuroda’s remarks on Friday that the central bank will start thinking about how to complete its unprecedented easing around the fiscal year starting April 2019 was the clearest signal yet that a conclusion might be in sight to emergency support for the Japanese economy. While Kuroda’s statement in response to questions from lawmakers was in some ways stating the obvious – the BOJ forecasts inflation to reach its 2% target in fiscal 2019 – the significance is that he’s put down a marker in public that he can be held to.

“It’s notable how over the past few weeks Kuroda has been forced into talking more specifically about the exit,” said Izumi Devalier, head of Japan economics at BofAML. “A year and a half ago he would have shut down the discussion altogether with the blanket ‘it’s too early to talk about it’ statement.” That means the last of the big central banks is finally thinking out loud about policy normalization or how to begin the process of unwinding years of asset purchases and ultra-low interest rates that were used to stoke growth after the 2008 financial crisis sparked the worst global recession in decades. The Fed, Bank of Canada and Bank of England have already raised interest rates and may do so again soon, while the ECB is debating how soon to end its own bond-buying. China’s central bank is sticking to what it describes as neutral policy settings and is ratcheting up money market rates to cool the pace of borrowing.

Peters is never boring.

• Trump’s Trade War Is For The Forgotten People (Eric Peters)

“The import restrictions announced by the US President are likely to cause damage not only outside the US, but also to the US economy itself, including to its manufacturing and construction sectors, which are major users of aluminum and steel,” warned the IMF, their army of nerds in full sweat. Panic. Just 200k Americans work in steel, aluminum and iron. 5.5mm of our 154mm workers are employed by businesses that use steel. “How could the Americans make such an idiotic mistake?” howled the nerds. But of course, they entirely miss the point. “If the EU wants to further increase their already massive tariffs and barriers on US companies doing business there, we will simply apply a Tax on their Cars which freely pour into the US. They make it impossible for our cars (and more) to sell there. Big trade imbalance!” tweeted Trump.

The US currently imposes a 2.5% tariff on EU auto imports. The EU imposes a 10% tariff on US auto imports. Germany exports $25bln of autos to America annually. “US auto prices will rise,” warned the Washington Post. But of course, they entirely miss the point. “Trade wars are good, easy to win,” tweeted Trump, knowing the statement would trigger every nerd with a college degree. Some worried about their jobs. But not terribly. Because their unemployment rate is just 2%, their labor force participation is 74%. They’re as well off as they’ve ever been. Particularly when set against those who never went to college, 5% of whom are unemployed, and 50% don’t even participate in the labor force. They’ve given up. These trade policies are for these forgotten people. To hell with the consequences. That’s the point.

More for forgotten people. Beppe got them where he wanted; largest party by a huge margin. Merkel and Macron’s “More Europe” plans can be shelved. But first, expect more tricks to keep the old guard in power.

• Italy Faces Political Gridlock After 5-Star Surges (R.)

Italy faces a prolonged period of political instability after voters delivered a hung parliament on Sunday, spurning traditional parties and flocking to anti-establishment and far-right groups in record numbers. With votes counted from more than 75% of polling stations, it looked almost certain that none of the three main factions would be able to govern alone and there was little prospect of a return to mainstream government, creating a dilemma for the EU. A rightist alliance including former prime minister Silvio Berlusconi’s Forza Italia (Go Italy!) held the biggest bloc of votes. In a bitter personal defeat that appeared unlikely last week, the billionaire media magnate’s party looked almost certain to be overtaken by its ally, the far-right League, which campaigned on a fiercely anti-migrant ticket.

But the anti-establishment 5-Star Movement saw its support soar to become Italy’s largest single party by far, and one of its senior officials said on Monday that forming a coalition without it would be impossible. The League’s economics chief on Monday raised the possibility of an alliance with 5-Star. Any government based on that combination would be euro-skeptic, likely to challenge EU budget restrictions and be little interested in further European integration. The full result is not due until later on Monday and, with the centre-right coalition on course for 37% of the vote and 5-Star for 31%, swift new elections to try to break the deadlock are another plausible scenario.

Despite overseeing a modest economic recovery, the ruling centre-left coalition trailed a distant third on 22%, hit by widespread anger over persistent poverty, high unemployment and an influx of more than 600,000 migrants over the past four years.

Plus huge cuts to steel production. China is hurting.

• China Sets 2018 GDP Target at About 6.5%, Turns Fiscal Screws (BBG)

China stepped up its push to curb financial risk, cutting its budget deficit target for the first time since 2012 and setting a growth goal of around 6.5% that omitted last year’s aim for a faster pace if possible. The deficit target – released Monday as Premier Li Keqiang delivered his annual report to the National People’s Congress in Beijing – was lowered to 2.6% of GDP from 3% in the past two years. The 6.5% goal is consistent with President Xi Jinping’s promise to deliver a “moderately prosperous” society by 2020. Policy makers dropped a target for M2 money supply growth, saying it’s expected to expand at similar pace to last year. Authorities reiterated prior language saying prudent monetary policy will remain neutral this year and that they’ll ensure liquidity at a reasonable and stable level.

Xi has ratcheted up his drive to curb debt risk, pollution and poverty at a time when the world’s second-largest economy is on a long-term growth slowdown. His efforts to rein in spending contrast with an historic expansion of U.S. borrowing under Donald Trump during a period of economic expansion. The 2018 targets “suggest slower growth and a fiscal drag,” said Callum Henderson, a managing director for Asia-Pacific at Eurasia Group in Singapore. “This makes sense for China in the context of the new focus on financial de-risking, poverty alleviation and environmental clean-up, but is less good news at the margin for those economies that have high export exposure to China.”

Is it too late to close the gap in a peaceful manner?

• Tax the Wealth of Older Britons to Help the Young, Report Argues (BBG)

Britain should impose higher wealth taxes on the older generation to ease the growing burden on young people, according to the Resolution Foundation. In a speech Monday, Executive Chair David Willetts will warn that welfare spending is set to rise by the equivalent today of 60 billion pounds ($83 billion) by 2040 as aging “baby boomers” drive up the cost of health care. “The time has come when we Boomers are going to have reach into our own pockets,” he will say. “The alternative could be an extra 15 pence on the basic rate of tax, paid largely by our kids. Is that kind of tax really the legacy we – a generation who own half the nation’s wealth – want to bequeath our children and grandchildren?”

Willetts, a former minister in the ruling Conservative Party, will make the case for reform of council tax – a property-based levy that helps fund local services – and of inheritance tax. Failure to act could fuel a sense of grievance among young people who are already struggling to match to the living standards enjoyed by older generations, he will say.

“..deficits aren’t only not bad, they’re necessary…”

• Eliminate The Deficit? Eliminate Economic Hope, More Like (McDuff)

Congratulations, everyone! We did it! The deficit has been eliminated! George Osborne, the architect of austerity, emerged from one of his non-jobs as the editor of the London Evening Standard to tell us all it was a “remarkable national effort” on Twitter, as if he’d ever broken a sweat over it. David Cameron, who will go down as arguably the worst prime minister in history thanks to the gigantic power move of doing a Brexit and running away, simply added: “It was the right thing to do” – safe in the knowledge that he was now out of the line of fire from tough questions.

That will all be cold comfort to the thousands of homeless people struggling to cope with sub-zero temperatures, or those having to choose between keeping the heating on, or risk going into rent arrears and losing their home entirely; to public sector workers in the NHS or local government, trying to keep the wheels from falling off as they deliver vital services in the face of budget cuts; and to disabled and unemployed people, bearing the brunt of the government’s spending cuts and facing harassment from the authorities. Forget all that. We’ve eliminated the deficit, and all we had to do was attack the poor and vulnerable with a relentless fury, create a new generation of young people for whom the concept of pensions or even steady wages is a fantasy, and undermine public services to such a grotesque extent that it will take years to rebuild what we’ve lost. Hooray!

[..] As Richard Murphy of Tax Research UK points out: “A growing economy requires general price increases, or inflation. Except under unusual circumstances, a general increase in prices requires an increasing money supply. A fiscal deficit is the only way in which money can be injected into an economy continuously. It follows that governments must run a near perpetual deficit or face the risk of creating a liquidity crisis due to a shortage in the money supply, which would then create a risk of deflation.” In other words, deficits aren’t only not bad, they’re necessary. Without them we get deflation, an over-indebted household sector, and an explosion in inequality.

The government is not like your household. It does not “run out of money,” because its job is to match the quantity of money to the desired economic activity. Its “debts” are not like your debts – they’re your savings and your pension funds. Osborne’s “remarkable national effort” was always and only to ensure that the government sector took more money out of the economy than it put into it. His great legacy is that we’re now at the stage where for every pound the government spends in day-to-day services, it taxes, and therefore destroys, more than a pound somewhere else. And we put people on the streets to freeze to achieve it. Go us.

Thatcher-inflicted pain continues.

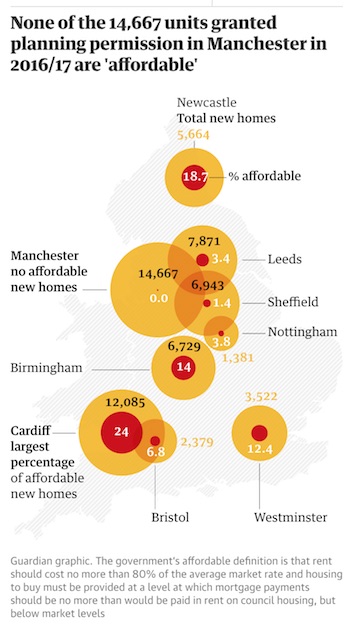

• 15,000 New Manchester Homes And Not A Single One ‘Affordable’ (G.)

Some of the UK’s biggest cities are allowing developers to plan huge new residential developments containing little or no affordable housing. In Manchester, none of the 14,667 homes in big developments granted planning permission in the last two years are set to be “affordable”, planning documents show – in direct contravention of its own rules, and leading to worries that London’s affordable housing crisis is spreading. In Sheffield – where house prices grew faster last year than in any other UK city, according to property portal Zoopla – just 97 homes out of 6,943 (1.4%) approved by planners in 2016 and 2017 met the government’s affordable definition. That says homes must either be offered for social rent (often known as council housing), or rented at no more than 80% of the local market rate.

In Nottingham, where the council aims for 20% of new housing to be affordable, just 3.8% of units given the green light by council planners meet the definition, Guardian research found. In Manchester, named by Deloitte earlier this month as one of Europe’s fastest growing cities and where property now sells three times as quickly as in London, planners have routinely waved through huge new developments – some containing swimming pools, tennis courts and more than 1,000 flats. Not one of the swanky apartments meets the national definition of “affordable” – leading critics to accuse the council of social cleansing. Others worry the city could become like London, where people on average salaries can no longer afford to live anywhere central.

Aka the terror of social media.

• The Tyranny of Algorithms (G.)

For the past couple of years a big story about the future of China has been the focus of both fascination and horror. It is all about what the authorities in Beijing call “social credit”, and the kind of surveillance that is now within governments’ grasp. The official rhetoric is poetic. According to the documents, what is being developed will “allow the trustworthy to roam everywhere under heaven while making it hard for the discredited to take a single step”. As China moves into the newly solidified President Xi Jinping era, the basic plan is intended to be in place by 2020. Some of it will apply to businesses and officials, so as to address corruption and tackle such high-profile issues as poor food hygiene.

But other elements will be focused on ordinary individuals, so that transgressions such as dodging transport fares and not caring sufficiently for your parents will mean penalties, while living the life of a good citizen will bring benefits and opportunities. Online behaviour will inevitably be a big part of what is monitored, and algorithms will be key to everything, though there remain doubts about whether something so ambitious will ever come to full fruition. One of the scheme’s basic aims is to use a vast amount of data to create individual ratings, which will decide people’s access – or lack of it – to everything from travel to jobs. The Chinese notion of credit – or xinyong – has a cultural meaning that relates to moral ideas of honesty and trust.

There are up to 30 local social credit pilots run by local authorities, in huge cities such as Shanghai and Hangzhou and much smaller towns. Meanwhile, eight ostensibly private companies have been trialling a different set of rating systems, which seem to chime with the government’s controlling objectives. The most high-profile system is Sesame Credit – created by Ant Financial, an offshoot of the Chinese online retail giant Alibaba. Superficially, it reflects the western definition of credit, and looks like a version of the credit scores used all over the world, invented to belatedly allow Chinese consumers the pleasures of buying things on tick, and manage the transition to an economy in which huge numbers of people pay via smartphones. But its reach runs wider.

What does Washington have to say?

• US Embassy In Turkey Closed Due To Security Threat (R.)

The U.S. embassy in Turkey’s capital Ankara will be closed to the public on Monday due to a security threat and only emergency services will be provided, it said in a statement on Sunday. The embassy advised U.S. citizens in Turkey to avoid large crowds and the embassy building and to be aware of their own security when visiting popular tourist sites and crowded places. It did not specify what the security threat was that prompted the closure. Additional security measures were taken after intelligence from U.S. sources suggested there might be an attack targeting the U.S. embassy or places U.S. citizens were staying, the Ankara governor’s office said in a statement. Visa interviews and other routine services would be canceled on Monday, the embassy said, adding that it would make an announcement when it was ready to reopen.

Same guy said if Greeks set foot on -their own- Imia islets, it will basically mean war.

• Erdogan Advisor Says Ankara Ready To ‘Strike’ In Eastern Med (K.)

A close advisor of Turkish President Recep Tayyip Erdogan has warned of a “strike” in the eastern Mediterranean if any attempt to explore or drill for hydrocarbons goes ahead without Ankara’s approval. Yigit Bulut, who is known for his incendiary remarks, was quoted by the Cyprus News Agency as telling Turkish state broadcaster TRT that Erdogan is prepared to call a “strike” at any “attempt at provocation.” “Have no doubt about it,” he said. Ankara has vowed to prevent any exploration for oil or gas around Cyprus and last month was accused to threatening to use force against a drillship chartered by Italy’s Eni to explore Block 3 of Cyprus’s exclusive economic zone.

3 million hectares to be lost over 15 years.

• Australia: Global Deforestation Hotspot (G.)

Australia is in the midst of a full-blown land-clearing crisis. Projections suggest that in the two decades to 2030, 3m hectares of untouched forest will have been bulldozed in eastern Australia. The crisis is driven primarily by a booming livestock industry but is ushered in by governments that fail to introduce restrictions and refuse to apply existing restrictions. And more than just trees are at stake. Australia has a rich biodiversity, with nearly 8% of all Earth’s plant and animal species finding a home on the continent. About 85% of the country’s plants, 84% of its mammals and 45% of its birds are found nowhere else. But land clearing is putting that at risk. About three-quarters of Australia’s 1,640 plants and animals listed by the government as threatened have habitat loss listed as one of their main threats.

Much of the land clearing in Queensland – which accounts for the majority in Australia – drives pollution into rivers that drain on to the Great Barrier Reef, adding to the pressures on it. And of course land clearing is exacerbating climate change. In 1990, before short-lived land-clearing controls came into place, a quarter of Australia’s total greenhouse gas emissions were caused by deforestation. Emissions from land clearing dropped after 2010 but are rising sharply again. “It has gotten so bad that WWF International put it on the list of global deforestation fronts, the only one in the developed world on that list,” says Martin Taylor, the protected areas and conservation science manager at WWF Australia. In Queensland, where there is both the most clearing and the best data on clearing, trees are being bulldozed at a phenomenal rate.

And more deforestation. Sometimes you wonder what will be left of Europe in 100 years. Or 50.

• Europe Tree Loss Pushes Beetles To The Brink (BBC)

The loss of trees across Europe is pushing beetles to the brink of extinction, according to a new report. The International Union for the Conservation of Nature assessed the status of 700 European beetles that live in old and hollowed wood. Almost a fifth (18%) are at risk of extinction due to the decline of ancient trees, the European Red List of Saproxylic Beetles report found. This puts them among the most threatened insect groups in Europe. Saproxylic beetles play a role in natural processes, such as decomposition and the recycling of nutrients. They also provide an important food source for birds and mammals and some are involved in pollination.

“Some beetle species require old trees that need hundreds of years to grow, so conservation efforts need to focus on long-term strategies to protect old trees across different landscapes in Europe, to ensure that the vital ecosystem services provided by these beetles continue,” said Jane Smart, director of the IUCN Global Species Programme. Logging, tree loss and wood harvesting all contribute to the loss of habitat for the beetles, said the IUCN. Other major threats include urbanisation and tourism development, and an increase in wildfires in the Mediterranean region. Conservation efforts need to focus on long-term strategies to protect old trees and deadwood across forests, pastureland, orchards and urban areas, the report recommended.