Vincent van Gogh Pink peach trees (Souvenir de mauve) 1888

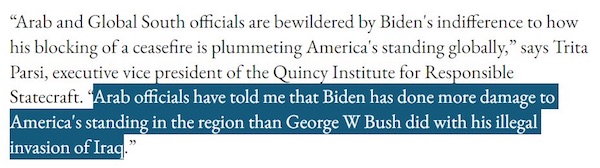

Orf

“Ukraine will win.” pic.twitter.com/QxH8wBl8a3

— Matt Orfalea (@0rf) February 24, 2024

KSP

The easiest job in the US pic.twitter.com/wDx4ZQVgfo

— Russian Market (@runews) February 25, 2024

Mike Benz 3 minutes

https://twitter.com/i/status/1758743460025389427

AI Tucker Carlson narrating The Lord of the Rings

As promised,

Here’s an AI Tucker Carlson narrating The Lord of the Rings@MiddleearthMixr @TuckerCarlson pic.twitter.com/eiXtR0m2qz

— Dr. Maverick Alexander (@MaverickDarby) February 25, 2024

Excellent from Tom Luongo. Who, interestingly, seems to put power relations on their head. With the demise of EU industry, we think the US is in charge. But:

“..Europe wants the US to be a vassal after spending itself to death fighting the phantom menace of Putin. Eurobonds are the real story. The rest is just noise..”

• Why War Bonds Are Returning in Europe (Luongo)

The fate of these SURE bonds and all future EC bond issuances hangs in the balance here. In fact, the future of the EU itself hangs in the balance. And that’s why I was contacted by Sputnik News yesterday to give my thoughts on this subject. “Eurobonds are the Holy Grail for European integration,” Tom Luongo, financial and geopolitical analyst, told Sputnik. “PM Kallas is telling you what the plan is. The EU’s Achilles’ heel is the euro itself and its lack of central taxing authority.” “Eurobonds, issued through the European Commission, of this type are another way of handing that authority to Brussels, bypassing member state central banks and legislatures,” he added. “If one was cynical, which I am, one would suspect that the EU’s support for the war in Ukraine was mostly driven by this desire to centralize power in Brussels,” Luongo argued. “You start a war in Ukraine by purposefully crossing Russia’s red lines, drive inflation up locally, and empty the military coffers of all the post-WWII weapons and ammunition that is now outdated. (…)

If you are losing, as you are now, you play up the threat of Russia not stopping at Ukraine to justify shifting your domestic spending to a military build-up, issuing Eurobonds to pay for it.” This plan for war bonds was shepherded by the usual suspects for EU militarization, French President Emmanuel Macron and EU President Charles Michel. And I want to stress here that nothing about this project is economic. It is purely political. They will expend whatever political capital they must to force this outcome on the people of Europe. To folks like Macron, Michel, Ursula Von der Leyen and their bosses, European bourgeoisie and proletariats alike are just tax cattle. No wonder they are so against them eating beef. So, let’s connect another couple of dots. Because now it should be obvious that this is why they threatened Hungary’s Viktor Orban with economic devastation for holding up their $50 billion aid package for Ukraine.

They need to keep Ukraine going to justify now spending another $100+ billion to launder into failing French and German banks sitting on massive losses from all the debt they bought during the NIRP (Negative Interest Rate Policy) period. This is just the beginning of their plans for transferring sovereignty out of the hands of the member states and handing it to Brussels. But to sell this to global investors they have to prove to the world they have all the wayward voices under control. Sovereign debt is secured through taxation and the productive capacity of the population. At this point the EU has neither. Now when I think about what all the principle players have been harping about for the past couple of weeks the common theme was NATO uber alles. This was echoed by everyone from President Biden at his latest press conference and Vice President Harris at Munich, to Hillary Clinton, clearly on more than a proof of life tour.

We had Alexei Navalny’s death used to raise money for war. Reports of Russia shooting US satellites out of orbit. Locusts! It never stops with these people. There’s always a convenient Russian or Chinese bogeyman lurking behind every headline. But the underlying theme is to keep the money flowing into NATO. Trump’s comments on standing aside if Putin attacked a NATO country that didn’t pay its way were used by all of them to breathlessly support MOAR NATO. But, in the end, this is just about the exercise of raw power against domestic populations. Putin and his army are no more a threat to Berlin than they are a threat to Kiev at this point. NATO, and the plans to morph it into a global police force under UN control, is the reason for all of this. Europe wants the US to be a vassal after spending itself to death fighting the phantom menace of Putin. Eurobonds are the real story. The rest is just noise.

“..Those who are using nuclear blackmail against us should know that the wind rose can turn around.”

• Surge of “Little Green Men,” and Metal is Poised to Strike (Trader Stef)

Yesterday, NATO’s Secretary General Stoltenberg interviewed with Radio Free Europe and noted in the context of discussing F-16s that Ukraine has the right to self-defense, including “striking legitimate Russian military targets outside Ukraine.” It’s not a coincidence that Stoltenberg expressed that point of view after Ukraine experienced the sudden collapse of Avdiivka that I covered in the “Surge of ‘Little Green Men,’ and Metal is Poised to Strike” Part XVIII and its Twitter thread. Russia has repeatedly expressed that existing international law grants the right to militarily strike a third party or nation state’s infrastructure that provides weapons and/or logistical support to an enemy during war. In the context of the NATO’s proxy war with Russia in Ukraine, that includes striking U.S., NATO members, and allied territory.

It was also made clear that any weapon systems delivered by third parties through Ukraine would be targeted upon identification, which already occurred on numerous occasions using conventional weaponry and hypersonic missiles armed with non-nuclear warheads. Don’t you think the U.S. striking Iran-backed proxies and supply lines in the Middle East that supported Hamas in its war against Israel validates Russia’s legal authority to strike NATO territory? Putin has been exceptionally restrained based on circumstances surrounding the war in Ukraine and the proliferation of legacy media narratives. “Medvedev predicts Apocalypse in event of Russia-NATO war… “Leaders should tell the bitter truth to their voters instead of treating them as brainless idiots. They should explain to them what will really happen instead of repeating the deceitful mantra about readiness for a war with Russia.” – Security Council Deputy Chairman Dmitry Medvedev, Feb. 2024”

The issue with Ukraine utilizing F-16s to strike Russian troop positions or target inside Russia proper is it no longer has a sovereign airbase capable of supporting F-16s (Col. Douglas Macgregor’s Aug. 2023 analyses). It also lacks the integrated space-based and land-based communications technology required to execute sorties that must be supported by NATO or U.S. AWACS, miscellaneous functions and intelligence from NATO members, and spare parts and supplies support from the U.S. If an attempt is made to buildout a new or existing airfield, Russia will incinerate that location in the same way it already disabled Ukraine’s airbases and air force. That leaves a distinct possibility of F-16s entering the battlespace via a third-party nation. The moment any fighter jets are detected within Ukraine, in its airspace, or approaching the battlefield frontline they will be targeted and destroyed.

That scenario immediately raises the possibility of NATO activating its Article 5 provision for war against Russia, then war will be declared on the collective West by Russia and its strategic allies. Putin openly admits that Russia cannot match NATO’s combined conventional military strength despite its own superior manufacturing base and logistical advantages, so any attack by NATO would be considered an “existential threat.” That opens the door to tactical nuclear weapons being used to blunt the enemy on a battlefield. Where it goes from there depends on the collective West’s response, which will be answered in kind by Russia.

“I would like to remind those who make such statements regarding Russia that our country has different types of weapons as well, and some of them are more modern than the weapons NATO countries have. In the event of a threat to the territorial integrity of our country and to defend Russia and our people, we will certainly make use of all weapon systems available to us. This is not a bluff. The citizens of Russia can rest assured that the territorial integrity of our Motherland, our independence and freedom will be defended – I repeat – by all the systems available to us. Those who are using nuclear blackmail against us should know that the wind rose can turn around.” – Putin, Sep. 2023

Guys like Col. Macgregor and Scott Ritter insist it’s at least 10 times that.

Big Serge on X: “Obviously Zelensky’s new claim that total Ukrainian losses are only 31,000 would seem to be starkly at odds with their December statement that the AFU needs 20,000 replacements per month to keep up with burn.”

• Ukraine War: Zelensky Says 31,000 Troops Killed (BBC)

Ukraine’s president says 31,000 soldiers have been killed since Russia’s full-scale invasion began. Volodymyr Zelensky said he would not give the number of wounded as that would help Russian military planning. Typically, Ukrainian officials do not make public the numbers of servicepeople killed in the war. It comes after the defence minister said half of all Western aid for Ukraine has been delayed, costing lives and territory. “At the moment, commitment does not constitute delivery,” Rustam Umerov said in a televised address on Sunday. Ukraine is currently experiencing a variety of setbacks in its mission to drive Russia from its territory. Mr Umerov said that the lack of supplies put Ukraine at a further disadvantage “in the mathematics of war”. “We do everything possible and impossible but without timely supply it harms us,” he said.

German Defence Minister Boris Pistorius warned in November that plans to deliver a million artillery shells by March would not be met. In January, the European Union (EU) said just over half of these would reach Ukraine by the deadline and that the full promised amount would not be there until the end of 2024. The EU’s foreign policy chief, Josep Borrell, blamed a lack of production capacity but Nato Secretary General Jens Stoltenberg said allies had been stepping this up. Ukrainian forces have often complained of shortages in their war with Russia. President Volodymyr Zelensky said one of the reasons Ukraine’s highly anticipated counter-offensive did not start earlier last year was the lack of weapons. That counter-offensive largely failed – one of a number of setbacks Kyiv has faced after some early successes in repelling Russia after it invaded in February 2022.

Last week, it was announced that troops had withdrawn from the key eastern town of Avdiivka – Moscow’s biggest win in months. Mr Zelensky also blamed this partly on faltering Western weapon supplies. The Biden administration, meanwhile, has said the hold-up in Congress of a $60bn aid package for Ukraine led to the fall of the town. Despite the delay, Ukraine’s prime minister sounded an optimistic note. “We are deeply convinced that the United States will not abandon Ukraine in terms of both financial support and military, armed support,” Denys Shmyal said on Sunday. His comments come after Mr Zelensky pressed members of the G7 – the world’s richest democracies – to increase their “vital support” in order for his country to win the war. “You know perfectly well that we need all this in time, and we count on you,” he said at a virtual meeting.

When you let a piano playing penis overrule and replace your popular top general…

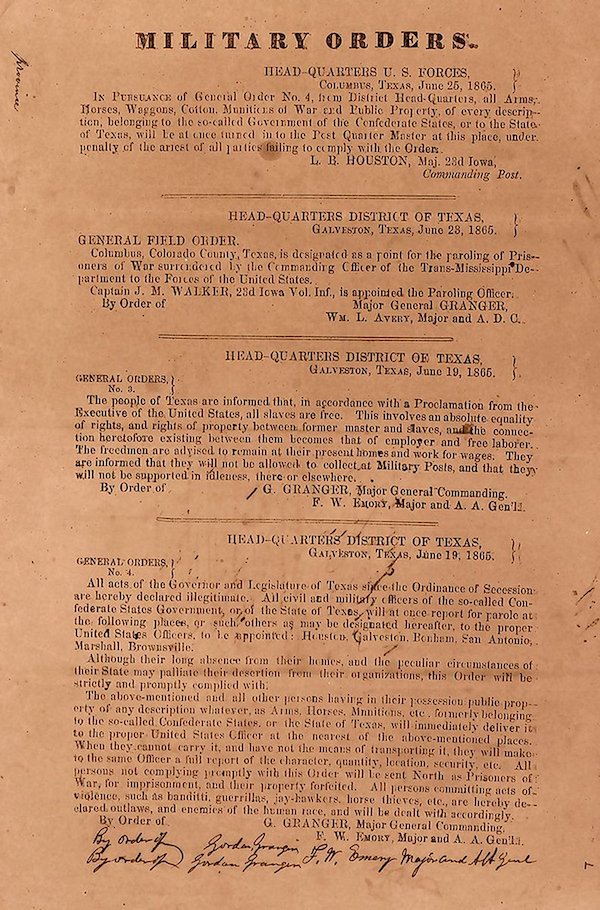

• Kiev Demanded Victory Plan From Military With No Resources – Zaluzhny Aid (RT)

The Ukrainian government wanted the military to figure out how Kiev could defeat Russia but failed to provide data on what resources it had to achieve that goal, an adviser to former Ukrainian commander-in-chief Valery Zaluzhny has said. In an interview with The New York Times published on Saturday, General Viktor Nazarov offered a glimpse into one of the reasons for the rift between the country’s military and civilian authorities last year. He noted that army officials were troubled by demands from the government in Kiev, which wanted them to draw “a road map for victory without telling them the amount of men, ammunition and reserves they would have to execute any plan.” The general lamented that this was one of the factors the civilian authorities “did not understand or did not want to understand” when they asked the military without any strategic reserves to come up with strategic plans.

Nazarov’s comments echoed the remarks of his ex-boss prior to his sacking. In an opinion piece for CNN earlier this month, Zaluzhny blasted “imperfections of the regulatory framework,” as well as the partial monopolization of the national defense industry, which he said resulted in production bottlenecks and exacerbated dependence on foreign arms shipments. In his November article for the Economist, the ex-top commander also suggested that the conflict was now at “a stalemate,” with both sides having the technological capability to know what the other one is doing, making any advances on the battlefield problematic. Zelensky fired Zaluzhny, who oversaw Ukraine’s botched counteroffensive last year, as well as several other top commanders earlier this month. The Ukrainian president has described the decision as “a reboot,” noting that “some things were not changing over the recent period of time.”

Some media reports, however, suggested that Zelensky wanted to get rid of Zaluzhny as a potential political rival who was popular with the rank and file. Zaluzhny was replaced by General Aleksandr Syrsky, whom Politico described as a “butcher” unpopular with the troops who supposedly resented his willingness to throw them into “fruitless assaults.” Even before Ukraine’s chaotic retreat from the strategic Donbass city of Avdeevka, Syrsky admitted that Kiev was in a “difficult” frontline situation. He has also said that Ukraine has now “transitioned” from offensive actions to strategic defense. However, commenting on the top brass reshuffle, Kremlin spokesman Dmitry Peskov noted that Moscow did not expect it to have any significant impact on the battlefield.

The CIA had control of the Kremlin under Yeltsin. They thought they had it made. Then they themselves selected Putin.

• Putin Defeated US Plan For Russia – Nuland (RT)

Vladimir Putin’s Russia is “not the Russia that we wanted,” Acting US Deputy Secretary of State Victoria Nuland has told CNN. Nuland explained that Washington wanted a compliant leader in the Kremlin who would “westernize” the country. “It’s not the Russia that, frankly, we wanted,” Nuland told CNN’s Christiane Amanpour on Thursday. “We wanted a partner that was going to be westernizing, that was going to be European. But that’s not what Putin has done.” Putin’s predecessor, Boris Yeltsin, enjoyed Washington’s support as he oversaw the rushed privatization of the Russian economy in the 1990s. Yeltsin’s reforms saw the rise of the so-called ‘oligarchs’, who amassed huge fortunes selling Russia’s natural resources to Western buyers, while the majority of the population dealt with declining life expectancy, soaring crime and homicide rates, and the collapse of the ruble.

Putin, who first took office in 2000, is widely credited with taming the oligarchs, imposing public order, and reversing the economic and social decline of the 1990s. Putin initially sought friendly relations with the West, telling American journalist Tucker Carlson earlier this month that he asked then-US President Bill Clinton whether Russia could one day join NATO, only to be rejected. Putin nevertheless reached out to Clinton’s successor, George W. Bush, with a proposal that the US, Russia, and Europe jointly create a missile defense system. While Bush’s team initially expressed interest, Putin said that “in the end they just told us to get lost.”

A combination of NATO expansion, American support for jihadist groups in the Caucuses, and Nuland’s orchestration of the coup d’etat in Ukraine in 2014 made it clear that the US and its allies were not interested in cooperation, Putin told Carlson. Nuland told Amanpour that Putin has “destroyed his own country” by intervening in Ukraine, and that the US will “continue to tighten the noose on him,” presumably by supplying Kiev with weapons and imposing additional economic sanctions on Moscow.

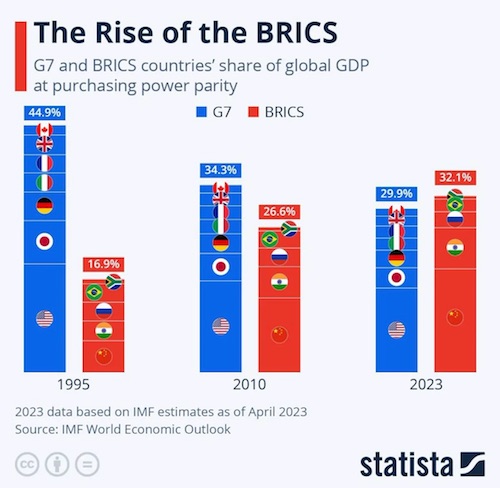

However, successive rounds of sanctions have failed to “crater” the Russian economy, as US President Joe Biden predicted they would in 2022. Instead, the International Monetary Fund predicts that Russia’s economy will grow by 2.6% in 2024, while the US’ will expand by 2.1%. Likewise, the unprecedented influx of Western arms failed to rescue Ukraine’s summer counteroffensive from failure. The operation fizzled out in the autumn after Kiev lost around 160,000 men and failed to retake any of its lost territory, according to the Russian Defense Ministry. Russian officials have repeatedly said that they are ready to negotiate an end to the conflict, but that Ukraine must accept the loss of its former territories and commit to neutrality.

How to grow your economy on top of dead bodies..

• Most Ukraine Aid ‘Goes Right Back’ To US – Nuland (RT)

Washington spends most of the money allocated as aid for Ukraine on weapons production at home, Acting US Deputy Secretary of State Victoria Nuland said in an interview with CNN this week. Commenting on the pending aid package which Congress failed to approve before going on winter recess, Nuland said she has “strong confidence” that it will pass, as it addresses America’s own interests. “We have to remember that the bulk of this money is going right back into the US economy, to make weapons, including good-paying jobs in some forty states across the US,” she stated, adding that support for Ukraine in America “is still strong.” Lawmakers in the House of Representatives blocked a bill requested by US President Joe Biden for an aid package for Kiev worth $60 billion, most of which is earmarked for weapons, earlier this month.

They are expected to restart discussions on the package after they reconvene on February 28. US Secretary of State Antony Blinken also recently said that roughly 90% of the financial assistance for Ukraine is spent on domestic production of weapons and equipment. At a press conference on December 20, he said additional tranches would “benefit American business, local communities, and strengthen the US defense industrial base.” According to Germany’s Kiel Institute, which tracks international support for Kiev, Washington allocated nearly €68 billion ($73.7 billion) in aid for Ukraine between January 24, 2022 and January 15, 2024, including roughly €43 billion ($46.6 billion) in military aid. However, Kiev has been increasingly demanding more aid from its Western backers.

Several days ago, Ukrainian President Vladimir Zelensky warned visiting American legislators that Kiev would “lose the war” against Russia without Washington’s assistance, according to US Senate Majority Leader Chuck Schumer. Russia has criticized the US and other Western states for their military support for Kiev, arguing that it is only dragging out the conflict. According to a recent survey from the Harris Poll and the Quincy Institute, a growing number of Americans do not support US military aid to Kiev unless it is tied to peace talks. Only 22% of respondents said Washington should continue ‘unconditionally’ providing Ukraine with financial assistance, while 48% said new funding must be conditioned on progress toward a diplomatic solution. Around 30% said the US should halt all aid.

Everything new about Zaluzhny is now censored and silenced.

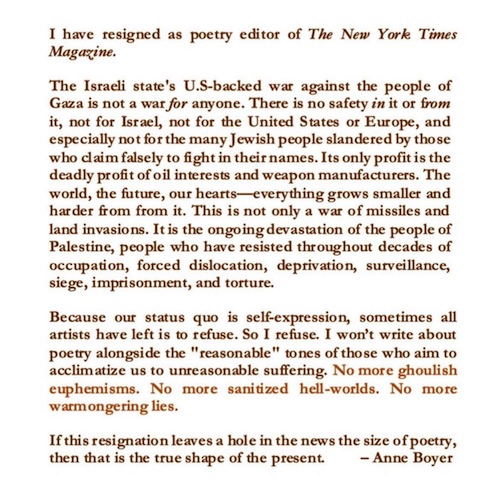

• The Untold Half of the Zaluzhny Story (Snider)

There were probably many reasons why Ukraine’s President Volodymyr Zelensky fired Ukraine’s popular commander in chief of the armed forces, Valerii Zaluzhny, on February 8, but one of the biggest seems to have been a disagreement over how to go forward in a war that seemed to have overwhelmingly turned against them. Zelensky spoke of a need for “the same vision of the war,” and Zaluzhny said “a decision was made about the need to change approaches and strategy.” When the war began, Zelensky said that Ukraine “will definitely win” but stressed life over land. “Our land is important, yes, but ultimately it’s just territory.” He said that “Victory is being able to save as many lives as possible. Yes, to save as many lives as possible, because without this nothing would make sense.” But actions speak louder than words. Zelensky began to define victory as the reclamation, not only of land lost during the war, but of Crimea and all of Ukraine’s pre-2014 territory.

Zelensky insisted that Ukraine stay on the offensive. He insisted on moving forward, “Whether it’s by a kilometer or 500 meters, but forward every day.” Zaluzhny saw Zelensky’s strategy of fighting for Bakhmut and Avdiivka at any cost as a strategic disaster that was costing Ukraine too much in weapons and in lives. Zaluzhny argued for preserving lives over forfeitable territory, lest Ukraine lose its land and its army. In General Oleksandr Syrsky, Zelensky found the commander who would execute his vision and carry out his orders. Syrsky fought the Battle of Bakhmut. His performance there, and in other battles, gave him the reputation of a commander who is willing to give orders that lead to little real gain and lots of real loss of life. “Some soldiers say his orders are unreasonable, at times sending men to their obvious deaths,” The Washington Post reports. According to The Economist, he “has a reputation for being willing to engage the enemy, even if the cost in men and machines is high.”

His reported willingness to put “his men in danger to reach his military goals” has earned him the nicknames “Butcher” and General 200, 200 being the code for a soldier’s corpse. Syrsky is also seen as being a commander who is close to Zelensky and who will not question his orders. The replacement of Zaluzhny by Syrsky signals Zelensky’s intent to push ahead with the suicidal war of attrition and fight for every inch of land despite the cost in lives. Aware of the optics of the choice in the public and, perhaps especially in the armed forces, Kiev assuaged the perception of Syrsky as “being indifferent to military casualties.” In his first statement as commander in chief, Syrsky said, “The lives and well-being of our servicemen have always been and remain the main asset of the Ukrainian army.”

But, again, actions speak louder than words. General Syrsky’s first words were about protecting the lives of his men, but his first actions were about fighting for every inch of territory. On February 11, just three days after the change in command, Syrsky ordered the reinforcement and defence of Avdiivka, a strategic town that faced imminent loss to the Russian army and enormous loss of Ukrainian lives. Zaluzhny would have withdrawn his troops, preserved lives and moved the front to more defensible positions. Syrsky deployed the 3rd Separate Assault Brigade, one of the best armed and trained and most successful brigades in the Ukrainian Armed Forces. It did not go well. It went exactly as Zaluzhny said it would, and Syrsky was forced to respond exactly as Zaluzhny had said they should. But now the response was carried out in disarray instead of in an orderly, planned fashion. Perhaps Zelensky should have stuck with Zaluzhny.

In sending in reinforcements instead of retreating, Syrsky said the “goal of our operation is to exhaust the enemy, inflict maximum losses on him.” The opposite happened. Less than a week later, on February 17, Syrsky announced the withdrawal of Ukrainian troops from Avdiivka. “Based on the operational situation around Avdiyivka, in order to avoid encirclement and preserve the lives and health of servicemen,” he said, “I decided to withdraw our units from the city and move to defense on more favorable lines…The life of military personnel is the highest value.” That’s exactly what Zaluzhny advised Zelensky to do. But the situation was worse than at first reported. Zaluzhny would have preplanned the retreat and executed it according to a plan. Zelensky and Skysky’s stubbornness turned the already costly loss into a disaster.

I doubt the NYT piece told Russia anything they didn’t already know.

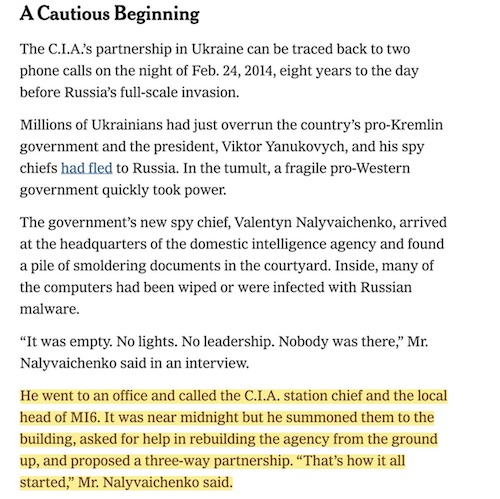

• CIA Built “12 Secret Spy Bases” In Ukraine – NYT (ZH)

On Sunday The New York Times published an explosive and very belated full admission that US intelligence has not only been instrumental in Ukraine wartime decision-making, but has established and financed high tech command-and-control spy centers, and was doing so long prior to the Feb. 24 Russian invasion of two years ago. Among the biggest revelations is that the program was established a decade ago and spans three different American presidents. The Times says the CIA program to modernize Ukraine’s intelligence services has “transformed” the former Soviet state and its capabilities into “Washington’s most important intelligence partners against the Kremlin today.” This has included the agency having secretly trained and equipped Ukrainian intelligence officers spanning back to just after the 2014 Maidan coup events, as well constructing a network of 12 secret bases along the Russian border—work which began eight years ago.

These intelligence bases, from which Russian commanders’ communications can be swept up and Russian spy satellites monitored, are being used launch and track cross-border drone and missile attacks on Russian territory. This means that with the disclosure of the longtime “closely guarded secret” the world just got a big step closer to WW3, given it means the CIA is largely responsible for the effectiveness of the recent spate of attacks which have included direct drone hits on key oil refineries and energy infrastructure. “Without them [the CIA and elite commandoes it’s trained], there would have been no way for us to resist the Russians, or to beat them,” according to Ivan Bakanov, former head of the SBU, which is Ukraine’s domestic intelligence agency.

A main source of the NYT revelations—disclosures which might come as no surprise to those never willing to so easily swallow the mainstream ‘official’ narrative of events—is identified as a top intelligence commander named Gen. Serhii Dvoretskiy. Clearly, Kiev and Washington now want world to know of the deep intelligence relationship they tried to conceal for over the past decade. It is perhaps a kind of warning to Moscow at a moment Ukraine’s forces are in retreat: the US is fighting hand in glove with the Ukrainians. And yet the revelations contained in the NY Times report also confirm what President Putin has precisely accused Washington of all along.

[..] Among the most interesting and curious moments of the NYT report is a description of the CIA program’s expanse under the Trump administration. The report suggests that the true scope may have even been hidden from Trump. The Russian hawks in his administration quietly did the ‘dirty work’, we are told: “The election of Trump in November 2016 put the Ukrainians and their CIA partners on edge. Trump praised Putin and dismissed Russia’s role in election interference. He was suspicious of Ukraine and later tried to pressure its president, Volodymyr Zelenskyy, to investigate his Democratic rival, Biden, resulting in Trump’s first impeachment.”

The report then emphasizes, “But whatever Trump said and did, his administration often went in the other direction. This is because Trump had put Russia hawks in key positions, including Mike Pompeo as CIA director and John Bolton as national security adviser.” And further, “They visited Kyiv to underline their full support for the secret partnership, which expanded to include more specialized training programs and the building of additional secret bases.” Given the attempt to place Trump in a negative light (he had to be ‘tiptoed around’…), it will be interesting to see how he and his campaign respond to the report. But more consequential will be the reaction of Putin and the Kremlin in the coming days.

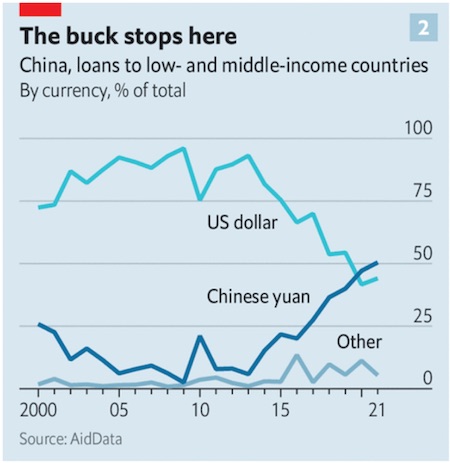

“..Xi Jinping deliberately set about changing the structure of China’s economy in order to end a growth boom based solely on real estate and debt..”

• Xi Isn’t Destroying China’s Economy – He’s Changing It (Fomenko)

If there’s one thoroughly unoriginal strand of thought on China present in the mainstream media today, it is the idea that China’s economy has been wrecked, and that Xi Jinping’s policies are to blame. Such commentary, pushed by every major mainstream outlet on a weekly basis, frequently promotes a narrative of the “end” of China’s rise, often talks about “decline” and squarely places responsibility on Xi Jinping, who supposedly ended the dynamic of an open and prosperous China for increasingly centralized, authoritarian rule and a return to communist fundamentals. Such an article was pushed this week by the editorial board of the Washington Post, in a piece titled “Xi is tanking China’s economy. That’s bad for the US”. The article was hardly original in its premise, stating the above argument pretty much word for word.

When this argument is pushed, it always conveniently ignores the broader context that the world economy is in dire straits, and moreover the more pressing elephant in the room, that American foreign policy has been deliberately detrimental if not outright antagonistic to global economic prospects as a whole. The idea of this narrative is to push the psychological warfare aspect that China is failing in order to dampen the optimism of businesses, undermine the Chinese economy and therefore push US foreign policy goals. This deliberately paints over the geopolitical, economic, and domestic considerations which have all driven a change in China’s own strategy and position. It is easy to denounce the “tyrannical rule of Xi Jinping” in a cliché and blame him for everything that has apparently gone wrong, but more difficult to paint an assessment as to why China’s internal and external environment today is not the same as it was ten years ago.

First, what is always, always ignored is that Xi Jinping deliberately set about changing the structure of China’s economy in order to end a growth boom based solely on real estate and debt. The newspapers love to waffle on about the “real estate crisis” and Evergrande, but can you imagine how big the problem would have been had previous policies been continued and China pushed for obscene 10% growth targets based on an explosion of debt? Xi Jinping ended this and initiated a process of deleveraging which deliberately slowed down China’s economic growth to around 6% when he came to power. Why? Because debt is not a sustainable mechanism and his policy has been literally to push the real estate industry into a managed recession, even if that has short-term repercussions.

Secondly, Xi Jinping’s policy has been to reinvent China’s economy to meet upcoming challenges by transforming it from a low end, export, real estate boom economy, into a high-end technological powerhouse. Instead of investing aimlessly in local government real estate booms, China has redirected state money to building up high-value industries including renewable energy, computing, semiconductors, automobiles, aviation, among other things. It is primarily this bid to become the global technological leader (by default of size) that has triggered the backlash from the US on an economic level and thus the bid to try and cripple China’s technological advance through export controls, which in fact show little evidence of working.

In addition to that, the global economic environment China operates in, has changed. The US has terminated its longstanding policy of open economic integration in favor of protectionism, bloc alignment, and the geopoliticization of supply chains. It has, in turn, created geopolitical conflicts with Russia and China and demanded its allies cut or reduce economic ties to the targeted countries. In doing so, the US has also attacked Beijing on a number of fronts using issues such as Xinjiang, Tibet, Taiwan and Hong Kong as weapons to smear China’s image, implement sanctions, and of course an all-embracing campaign of negative publicity to create uncertainty and destroy the optimism of China’s rise.

These policies inevitably have consequences on Beijing, which makes the country feel less secure, more suspicious, and therefore less open to the outside world. That isn’t as much a possible indictment of Xi Jinping as it is a structural reality of politics. The CIA for example, is relentless in trying to strengthen its presence in China, but if China arrests someone or links them to spying, the media will respond by calling Beijing paranoid, insecure and coercive, showing how the narrative will skewer the country no matter what. However, the point still remains that it is more challenging for China to grow in this environment than it was before. New challenges create new policies, and when the mainstream media pretend that Xi is the instigator of all the change and “spoiling” China’s chances, they are simply lying on multiple levels. It is a multifaceted psychological warfare campaign which opts for simple explanations rather than telling you the bigger picture of why China changed.

“Draghi stressed the necessity to channel European private savings, because “public money will never be enough..”

• EU Must Find ‘Enormous Amount’ Of Money To Face Global Challenges – Draghi

The European Union needs to invest an “enormous amount of money in a relatively short time” to deal with the deep challenges the bloc is facing, former European Central Bank President Mario Draghi said on Saturday. Draghi, who has been tasked with producing a high-level report on the EU’s competitiveness, met with EU ministers on Saturday in Ghent, Belgium, to discuss the best way to come up with the needed funds. He presented EU governments with his diagnosis: The three pillars the EU has relied on — energy from Russia, exports from China, and the U.S. defense apparatus — are no longer as solid as before, and on the green and digital transitions alone the EU would have to spend €500 billion a year.

The funding gap between Europe and the United States in terms of investment is equivalent to half a trillion euros a year, and a third of that would be public money, Draghi told the ministers, according to his assistant. All the participants appeared to agree on what needs to change to boost EU competitiveness, from lowering energy prices to reducing regulatory burdens, but divisions emerged when talking about public money. “They made clear that a lot of discussions would be needed in the months to come,” the Draghi aide said, adding that Draghi called for “bold action” on the matter of investments. Draghi stressed the necessity to channel European private savings, because “public money will never be enough,” but he also put on the table options to find funds at the EU level, according to the aide.

The EU could create a new common cash facility, such as debt or loans, or use private partnerships where the European Investment Bank would have a role to play. French President Emmanuel Macron and others support the idea of new common debt. EU Commissioner Paolo Gentiloni has pitched many times the idea of a sort of second Next Generation EU fund, but the proposal has not generated enthusiasm among all countries. Asked about the need for new common funds earlier this month, Germany’s Economy Secretary Sven Giegold told POLITICO: “It’s well known” that the German government is in favor of “increasing the spending path into research and development, climate, innovation and so on, which is certainly needed in global competition. But as you know, at the moment, about 70 percent of the EU budget does not go into these future-oriented sectors.”

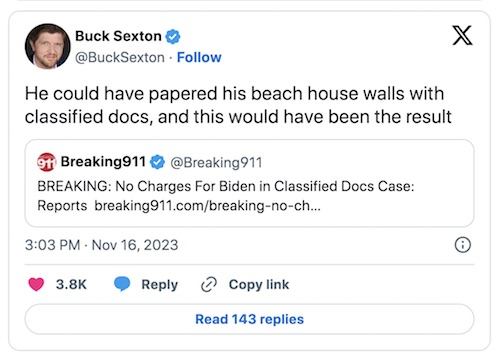

Trump the dictator has become a prominent narrative..

• 10 Ways A Second Trump Term Could Be More Extreme Than The First (Pol.)

Trump’s campaign has repeatedly dismissed media reports about his potential second-term agenda, saying in a statement in November that policy recommendations from his conservative allies “are certainly appreciated and can be enormously helpful” but “are just that — recommendations.” “Unless a second term priority is articulated by President Trump himself, or is officially communicated by the campaign, it is not authorized in any way,” the statement from campaign advisers Susie Wiles and Chris LaCivita said. But both supporters and critics of the ex-president predict that a reelected Trump would wage a more focused and aggressive attack on the status quo. This time, they say, he would be far more knowledgeable about the mechanics of wielding executive power. Having placed so many conservatives in federal judgeships, he would face less resistance from the courts. And he would be more determined to place loyalists, not rules-obsessed traditionalists, in senior roles.

Trump’s second term would be “dramatically more comprehensive and more aggressive and more determined to profoundly change the establishment,” said former Republican House Speaker Newt Gingrich, who wrote a 2017 book called “Understanding Trump.” The outside proposals drawing so much attention “are worth being aware of,” he said, “because they give you a sense of what it would mean to put Trumpism into effect.” President Joe Biden’s campaign said voters need to be informed about proposals that would “undermine democracy, rip away rights and freedoms, and make Americans’ lives as miserable as humanly possible if Trump is reelected.” “Americans should know the stakes of this election,” Biden campaign spokesperson Seth Schuster said in a statement to POLITICO, “and Trump has made them as clear as day.”

These are among the policy changes that both fans and foes of the former president say people can expect if Trump wins in November: As a candidate, Trump has both claimed credit for the demise of Roe v. Wade and cast himself as a moderate on abortion rights — and he has frustrated anti-abortion groups by refusing to openly embrace or rule out a national ban. Yet those same groups, in collaboration with veterans of Trump’s previous administration, are drafting plans for a sprawling anti-abortion agenda that would all but outlaw the procedure from coast to coast, including in states whose laws or constitutions guarantee reproductive rights. The proposals would go far beyond his first-term anti-abortion policies — which Biden has since lifted — and would lean heavily on executive branch actions, bypassing a stymied Congress.

The prospect terrifies abortion rights supporters, who see a second Trump administration as a threat to all the work they’ve done during the last two years to restore and defend abortion access at the state level. Their reasons for worry grew after The New York Times reported this month that Trump has privately told aides and supporters that he could support a national abortion ban after the 16th week of pregnancy. “We cannot ballot initiative our way out of this fundamental crisis of rights,” said Deirdre Schifeling, chief political and advocacy officer for the American Civil Liberties Union, one of many groups bracing for Trump and a Republican Congress to attempt to override state abortion protections. “I have no doubt that they would try to impose a federal abortion ban, restrict birth control, and do lots of things that are way out of step with what people in this country want.”

From what I understand the system is far more precise than she lets on. It doesn’t place you somewhere in the neighborhood, but at an exact location.

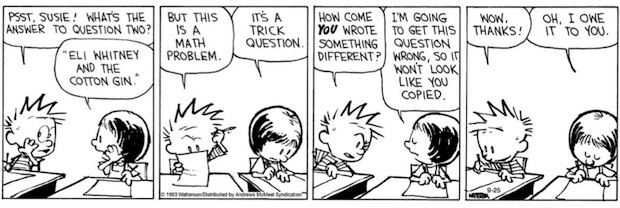

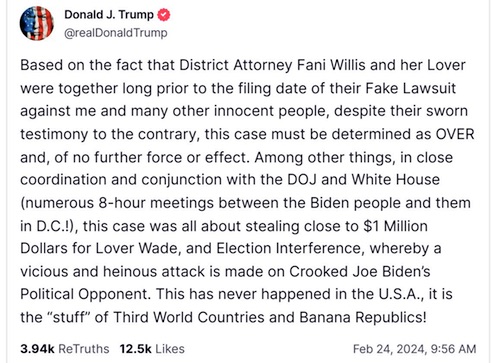

• Fani Willis Demands Judge Reject Cellphone Evidence (ZH)

Fulton County DA Fani Willis is reeling after evidence was submitted to the court suggesting that she and special prosecutor Nathan Wade lied about when their romantic relationship began. To recap, Wade and Willis claimed that their relationship began sometime in early 2022 – after Willis hired Wade to help her go after Trump in the Georgia election interference case. Wade’s cell phone records disprove their official story, however. As The Reactionary notes, “Trump’s attorneys were able to obtain, by subpoena to AT&T, Wade’s cell phone records from 1/1/2021 through 11/30/2021. Wade’s location data was analyzed by an investigator hired by the attorneys – an analytical tool which generated geolocation data that pinpointed Wade’s presence at DA Willis’s South Fulton Condo during that time period.

Here are the highlights: • Wade and Willis exchanged “over 2000 voice calls and just under 12,000 texts messages” from January 1, 2021 through November 30, 2021. • Geolocation data indicates Wade was at DA Willis’s condo “at least 35 occasions”. The data revealed he was “stationary” at the condo “and not in transit.” • Wade’s visits to DA Willis’s condo were corroborated by texts and phone calls. According to the report: On November 29, 2021, “following a call from Ms. Willis at 11:32 PM, while the call continued, [Wade’s] phone left the East Cobb area just after midnight and arrived within the geofence located on the Dogwood address [the condo] at 12:43 AM on November 30, 2021. The phone remained there until 4:55 AM.” • On September 11, 2021, Wade arrived at the condo address at approximately 10:45 PM. He left the address at 3:28 AM and arrived at his Marietta residence at 4:05 AM. He then texted DA Willis at 4:20 AM.”

Now, Fani wants the evidence tossed – claiming that some of the data is inadmissible for technical or procedural reasons. Willis argued in a response that the cell phone data fails to “prove anything relevant,” and should be tossed because it contains “both telephone records that have not been admitted into evidence and an affidavit and other documents containing unqualified opinion evidence.” Because of this, Willis argues that the court should exclude the new information, or at least consider her “rebuttal evidence that demonstrates the unreliability of the unqualified opinion evidence improperly introduced by Defendant Trump.” She also claims that the new evidence is inadmissible because the defense counsel provided no written notice of its introduction, no summary of the expert’s testimony, and no information as to the expert’s qualifications. And even if he’s legit, the phone records don’t prove anything.

“The records do nothing more than demonstrate that Special Prosecutor Wade’s telephone was located somewhere within a densely populated multiple-mile radius where various residences, restaurants, bars, nightclubs, and other businesses are located,” she wrote, adding that the records may have even been obtained illegally. In a Saturday post to Truth Social, Trump argued that the new evidence shows that Willis is full of shit and should be disqualified. “Based on the fact that District Attorney Fani Willis and her Lover were together long prior to the filing date of their Fake Lawsuit against me and many other innocent people, despite their sworn testimony to the contrary, this case must be determined as OVER and, of no further force or effect,” he wrote. “Among other things, in close coordination and conjunction with the DOJ and White House (numerous 8-hour meetings between the Biden people and them in D.C.!), this case was all about stealing close to $1 Million Dollars for Lover Wade, and Election Interference, whereby a vicious and heinous attack is made on Crooked Joe Biden’s Political Opponent.”

Judge Kaplan

https://twitter.com/i/status/1761760801957044394

Placing Assange in the tradition of Ellsberg and Seymour Hersh.

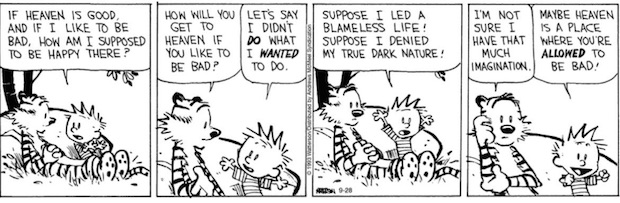

• The Show Trial against Julian Assange (Scheidler)

The revelations of whistleblowers such as Edward Snowden and Chelsea Manning and journalists such as Julian Assange have shown that in the shadow of the so-called war on terror, a vast parallel universe has emerged in recent decades that is obsessed with the illegal spying on its own citizens and the arbitrary imprisonment, torture and killing of political opponents. This world is largely beyond democratic control, indeed it is undermining the democratic order from within. However, this development is not entirely new. In 1971, leaks revealed a secret FBI program for spying on, infiltrating and disrupting civil rights and anti-war movements, which became known as COINTELPRO. In the same year, the New York Times published the Pentagon Papers leaked by whistleblower Daniel Ellsberg, which showed that four successive US administrations had systematically lied to their citizens about the extent and motives of the Vietnam War and the massive war crimes committed by the US military.

In 1974, Seymour Hersh revealed the CIA’s secret programs to assassinate foreign heads of state and the covert operation to spy on hundreds of thousands of opponents of the war, which ran under the code name “Operation CHAOS”. Driven by these reports, the US Congress convened in 1975 the Church Committee, which carried out a comprehensive review of the secret operations and led to greater parliamentary control of the services. Julian Assange is part of this venerable journalistic tradition and has made a decisive contribution to its renewed flourishing. However, there is one important difference to the 1970s: Today, the most important investigative journalist of his generation is openly persecuted, criminalized and deprived of his freedom. When states declare the investigation of crimes to be a crime itself, society enters a dangerous downward spiral, at the end of which new forms of totalitarian rule can emerge. As early as 2012, Assange remarked, at the time with regard to the increasingly comprehensive surveillance technologies: “We have all the ingredients for a turnkey totalitarian state”.

If the US authorities succeed in convicting a journalist for exposing war crimes, this would have another serious consequence. In the future, it would become even more difficult and dangerous to expose the sordid reality of wars, especially those wars that Western governments like to sell as civilizing missions with the help of embedded journalists. If we do not learn the truth about these wars, it becomes much easier to wage them. Truth is the most important instrument of peace. Julian Assange has not yet been extradited and sentenced. Over the years, a remarkable international movement has formed for his release and the defense of press freedom. Many parliamentarians around the world are also raising their voices. The Australian parliament, for example, supported by Prime Minister Anthony Albanese, passed a resolution by a large majority calling for Assange’s release. A group of over 80 members of the German parliament have joined in.

However, the German government is still refusing to exert any serious pressure on Joe Biden’s government, which continues to persecute Assange. German Foreign Minister Annalena Baerbock, who as the Green Party’s candidate for chancellor had spoken out in favor of freeing Assange, has persistently avoided questions on the subject since joining the government. Her ministry has left questions from MPs about the case unanswered for months, only to then make elusive rhetorical excuses. The leading politicians of the governing German coalition, who like to loudly present themselves as the guardians of democracy and the rule of law, must finally take action in this case of political justice and unequivocally demand the release of Julian Assange before it is too late. However, this would require overcoming the cowering attitude towards the godfather in Washington and actually standing up for the much-vaunted values of democracy.

“This is America. We can’t let this happen..”

• If We Don’t Keep Sending Billions To Ukraine, The War Might End (BBee)

Congress issued a dire warning to the American people Friday, sternly reminding voters that if they do not keep sending billions of tax dollars to Ukraine, the war might end. “This is America. We can’t let this happen,” said Senator Chuck Schumer in a press conference. “Our donors at Lockheed Martin, General Dynamic, Teledyne, Raytheon, Boeing, Northrop Grumman, and Burisma are running out of patience. If we don’t inject their weapon supply chains with fresh cash immediately, Ukraine and Russia might be forced to broker a peace deal.” “I shudder at the thought.”

Foreign policy experts concurred that essential defense contractors and Ukrainian shell companies will run out of money to launder within a few weeks, which might force the hands of Russian and Ukrainian leaders to sign a peace treaty and stop slaughtering each other. “I don’t want to imagine a world where people on the other side of the globe aren’t killing each other with American weapons,” said Secretary of State Blinken. “I urge Congress to put aside their differences and support this endless war. For America.” At publishing time, Republicans had shown willingness to send more funding to Ukraine in exchange for a promise of future conversations to plan potential negotiations to secure the southern border maybe someday.

Crow

Crows are excellent problem solvers, and scientists claim their intelligence is like that of a seven-year-old humans pic.twitter.com/x3Or6oRf5V

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 25, 2024

Bus

Interesting bus prototype.pic.twitter.com/XD3DqeHq5d

— Figen (@TheFigen_) February 25, 2024

Prince

If socially awkward was a person pic.twitter.com/0VMHJUBFRe

— Historic Vids (@historyinmemes) February 25, 2024

Cat bottle

— Why you should have a cat (@ShouldHaveCat) February 25, 2024

Monitor

Feeding fish and a water monitor arrives

pic.twitter.com/l5CN8oVfye— Science girl (@gunsnrosesgirl3) February 26, 2024

KIndness

Kindness won! pic.twitter.com/qoNtG2As1I

— Figen (@TheFigen_) February 25, 2024

This intrigues me

This method of food preservation in Afghanistan, where grapes are kept substantially fresh for 6 months using a mud-straw container known as kangina,

pic.twitter.com/xZZvyrmWae— Science girl (@gunsnrosesgirl3) February 25, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.