Claude Monet Water lilies 1904

Seems like a risky gamble.

• Fed Discards Flattening Yield Curve as Recession Indicator (WS)

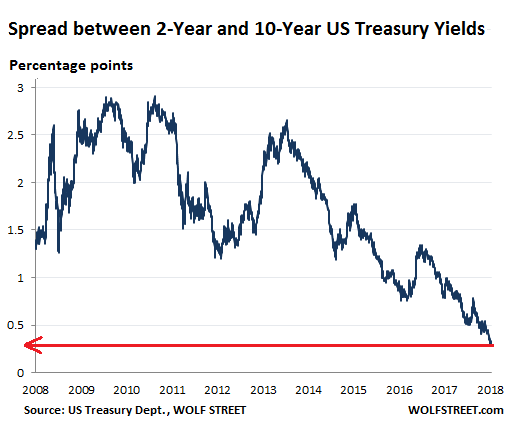

In the minutes of the FOMC meeting on June 12 and 13, released this afternoon, there was a doozie, obscured somewhat by the dynamics of the rate hike plus the indication that there would be two more rate hikes this year, for a total of four, up from three at the prior meeting, with more hikes to come in 2019, along with other changes [..] But the doozie in the minutes was about the flattening “yield curve.” The yield curve is formed by Treasury yields of different maturities: normally, the two-year yield is quite a bit lower than the 10-year yield. Over the last several decades, each time the yield curve “inverted” – when the two-year yield ended up higher than the 10-year yield – a recession followed. The last time, the Financial Crisis followed.

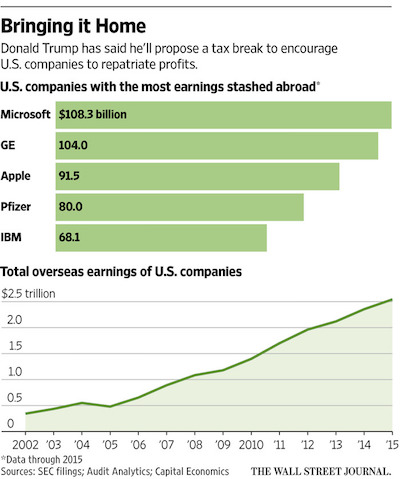

So this has become a popular recession indicator that has cropped up a lot in the discussions of various Fed governors since last year. Today, the two-year yield closed at 2.55% and the 10-year yield at 2.84%. The spread between them was just 29 basis points, the lowest since before the Financial Crisis. The chart below shows the yield curves on December 14, 2016, when the Fed got serious about raising rates (black line); and today (red line). Note how the red line has “flattened” between the two-year and the 10-year markers, and how the spread has narrowed to just 29 basis points:

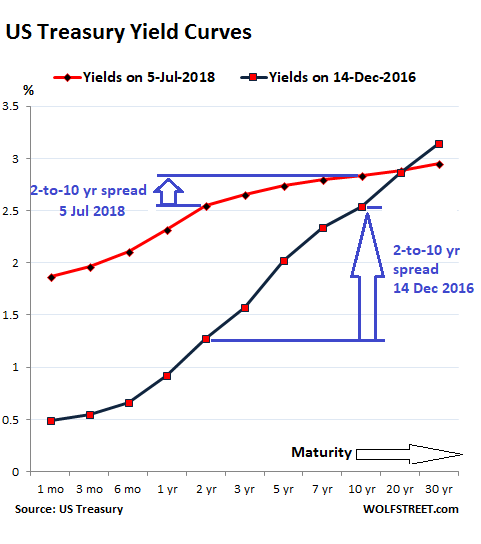

The chart below shows the two-year yield (black) and the 10-year yield (red) going back to 1992. Note how the spread has been narrowing in recent months.

The chart below tracks this spread for every day back to 2008. Today, the spread, at just 29 basis points, is the lowest since before the Financial Crisis:

There has been a lot of handwringing about this being an indicator that the next recession is nearing and that the Fed should back off with its rate hikes. But this Fed is getting seriously hawkish: In the minutes today, it revealed that instead of thinking about backing off with its rate hikes, it’s throwing out the flattening yield curve.

She’s threatened to fire them. But Brexit looks less likely to happen by the day.

• Theresa May Secures Approval From Cabinet To Negotiate Soft Brexit (G.)

Theresa May has secured approval to negotiate a soft Brexit deal with the European Union, signing up her fractious cabinet at a Chequers awayday to a controversial plan to match EU standards on food and goods. The prime minister released a statement following the critical afternoon session of the long-awaited summit that alarmed Tory hard Brexiters, in which she confirmed she had won over the cabinet to new customs arrangements ending political deadlock on the issue. May said the cabinet had “agreed our collective position for the future of our negotiations with the EU”. That included a proposal to “create a UK-EU free trade area which establishes a common rule book for industrial goods and agricultural products” after Brexit.

Tory Brexiters voiced concern at the agreement, while soft Brexiters expressed relief. Andrea Jenkyns, a hardline MP, complained that “British businesses will continue to be a rule taker from the EU” and said she would “pray” that the detail was not as bad as she feared. Heidi Allen, a moderate, said she was “pleased to report Theresa May has secured cabinet agreement for a sensible, soft Brexit”. On Thursday, when the common rule book proposal was first leaked, hardline Brexiter cabinet ministers and Conservative MPs voiced alarm that it could prevent the UK striking a trade deal with the US, which has different standards in goods and foods, such as allowing chickens to be washed in chlorine.

But May was able to release the text of a three-page agreed statement before cabinet, following a relatively undramatic day of discussions, sat down for dinner to listen to No 10 communications chiefs make a presentation on how to sell the new proposals. Michel Barnier, the EU’s chief Brexit negotiator, appeared to react warmly to the proposals, noting in a tweet that the “Chequers discussion on future to be welcomed. I look forward to white paper. We will assess proposals to see if they are workable and realistic”. The prime minister made clear that she expected ministers would be sacked if they did not remain in line with her soft Brexit blueprint.

She wrote to Tory MPs to explain her plans and included a clear warning about discipline: “As we developed our policy on Brexit, I have allowed cabinet colleagues to express their individual views. Agreement on this proposal marks the point where that is no longer the case and collective responsibility is now fully restored.”

It doesn’t matter one bit unless the EU agrees.

• Boris Johnson’s Gang Outgunned By Theresa May At Chequers (G.)

Theresa May has won the battle with her Brexiter rebels in the cabinet, but the war will be a long one. She gambled that the Brexit purists – those who gathered on the eve of the Chequers summit at the Foreign Office with Boris Johnson – would be outgunned at Chequers when the full cabinet was assembled. The choreography was impressive – May locked her ministers inside the Buckinghamshire retreat without their phones or special advisers. The final agreement – sent out on behalf of “HM government” came to journalists an hour before advisers had even seen it – and before they could get in contact with their ministers to know what concessions had been made. Within the hour, out came a letter to Conservative MPs warning the days of debate over the government’s Brexit position were over.

“Collective responsibility is now fully restored,” May warned. The deal clinched with her most difficult members of her cabinet, architects of the leave campaign such as Johnson and Michael Gove, gave May the leverage to demand similarly hardline MPs get in line. Downing Street has been briefing in a strident tone, practically daring hard Brexiter ministers to give it all up to walk down the Chequers drive. The numbers that will matter now are those in her parliamentary party. Some will express predictable fury, though in the hours since the deal was reached, Jacob Rees-Mogg was telling MPs to keep their powder dry. Key will be whether this is a deal that can win over mainstream backbenchers.

In recent weeks, a number of Conservative MPs had begun to express frustration that the prime minister was not prepared to face down one side of her party and lead. [..] On Monday, the prime minister will address the 1922 committee of backbenchers, though the timing of the summit means angry MPs will have the weekend to either cool off or come to the boil. “I’ll wait to see if this collective responsibility lasts the weekend,” another MP said. Perhaps just as crucially there are still some concerns about the future deal for UK services, around 80% of the UK economy. The agreement states the UK would “strike different arrangements for services, where it is in our interests to have regulatory flexibility, recognising the UK and the EU will not have current levels of access to each other’s markets”.

And that’s the whole point.

• UK Government Has No Clue How To Execute Brexit Without Harm – Airbus CEO (G.)

The chief executive of Airbus has accused the government of having “no clue” on how to leave the EU without harming the economy, as the prime minister aimed at uniting the cabinet behind a Brexit plan. The criticism from the aerospace firm, which employs 14,000 people in the UK, is the strongest intervention yet from the business community on the risk of a hard Brexit and came in the same week that Jaguar Land Rover, Britain’s largest carmaker, warned its were under threat. Speaking at a briefing in London before the Farnborough air show later this month, the Airbus chief executive, Tom Enders, said: “The sun is shining brightly on the UK, the English team is progressing towards the [World Cup] final, the RAF is preparing to celebrate its centenary and Her Majesty’s government still has no clue, no consensus on how to execute Brexit without severe harm.”

Enders said Airbus, a Franco-German group that supports a further 100,000 UK jobs in its supply chain, was wary of all types of Brexit, including a worst-case no-deal scenario. “Rest assured that we are taking first preparations as we speak in order to mitigate consequences from whatever Brexit scenario may follow,” he said. “Brexit in whatever form, soft or hard, light or clean, whatever you call it, will be damaging for industry, for our industry and damaging for the UK, whatever the outcome will be.”

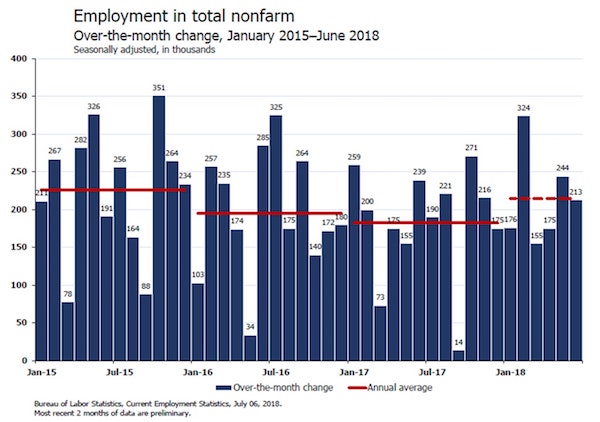

600,000 more looking for a job. Out of 95 million not in labor force. All new jobs are part-time. Full-time jobs fell.

• Despite 213K Jobs Gain, Unemployment Up by 499K (Mish)

Today’s establishment survey shows jobs rose by 213,000. Revisions were positive. The unemployment rate rose from 3.8% to 4.0% as the labor force rose by 601,000. More people are starting to look for jobs but employment only rose by 102,000. Nonfarm wage growth was +0.2% vs an Econoday consensus of +0.3%. The Phillips’ curve is a joke, but it’s still widely believed. The change in total nonfarm payroll employment for April was revised up from +159,000 to +175,000, and the change for May was revised up from +223,000 to +244,000. With these revisions, employment gains in April and May combined were 37,000 more than previously reported

Putin meets Trump in 9 days.

• Russia Hikes Duties On US Imports, Pledges More Retaliation (R.)

Russia said on Friday it was imposing additional import duties on some U.S. industrial goods after the United States slapped tariffs on steel and aluminum imports, and warned that more retaliatory steps could be in the pipeline. The economy ministry said Russia would impose extra tariffs on some goods from the United States for which there are Russian-made substitutes.The extra duties of 25 to 40 percent will apply to imports of fiber optics and equipment for road construction, the oil and gas industries and metal processing and mining.

The ministry said the measures, signed by Russian Prime Minister Dmitry Medvedev, were intended to compensate for $87.6 million of damage suffered by Russian export-focused companies as a result of the U.S. metals tariffs. The U.S. tariff hike will cost an overall $537.6 million and Russia has the right to impose more compensatory measures in the future, the economy ministry said.

Feels like Python.

• US Border Agents Stop Canadian Fishermen In Disputed Waters Off Maine (G.)

Canada’s government is investigating reports that US border patrol officers have intercepted and questioned crew members on more than 20 Canadian vessels in disputed waters off the coast of Maine. The reports have thrust a longstanding territorial dispute between the two countries into the spotlight; since the late 1700s tensions have simmered over a pair of tiny, treeless islands that sit between Maine and the Canadian province of New Brunswick. Primarily inhabited by nesting puffins, the islands of North Rock and Machias Seal remain the only disputed lands between US and Canada, with both claiming sovereign jurisdiction over the islands and their surrounding waters.

As a result, the area has long hosted lobster fisherman from both sides of the border. The question of jurisdiction flared up recently after the Grand Manan Fishermen’s Association said a Canadian vessel had been stopped by US border patrol while fishing in the waters near Machias Seal Island in late June. “He informed them he was a Canadian vessel legally fishing in Canadian waters,” wrote Laurence Cook of the association on Facebook. He said he was “not surprised to see the Americans trying to push people around”, describing them as “typical American bullies.”

In ways we didn’t yet know.

• More Ways Your Phone Is Spying On You (ZH)

For years, conspiracy theories about smart phones listening to users without their permission to show them advertisements have abounded. While some researchers have shown this could happen, a first of its kind study just found something far more insidious. Academics at Northeastern University have just proven that your phone is recording your screen – as in taking video – and uploading it to third parties. For the last year, Elleen Pan, Jingjing Ren, Martina Lindorfer, Christo Wilson, and David Choffnes ran an experiment involving more than 17,000 of the most popular Android apps using ten different phones. Their findings were alarming, to say the least.

As Gizmodo points out, during the study, the researchers started to see that screenshots and video recordings of what people were doing in apps were being sent to third-party domains. For example, when one of the phones used an app from GoPuff, a delivery start-up for people who have sudden cravings for junk food, the interaction with the app was recorded and sent to a domain affiliated with Appsee, a mobile analytics company. The video included a screen where you could enter personal information – in this case, their zip code.

GoPuff did not disclose in its terms of use that its app was recording users screens and uploading this data to a third party. What’s more, when they were contacted by the researchers GoPuff merely added a disclosure to their policy acknowledging that “ApSee” might receive users PII. The fact that these apps can record your screen without you knowing and use this data is chilling. It illustrates how easy it would be for a malicious actor to be able to look at your private messages, personal information, passwords, photos, and videos. None of this is stopped by your phone’s security either as it is a function built into the apps and you don’t have an option to disallow it.

“Mr. Mueller will come up with someone to indict on something, even if it’s ninety-seven ham sandwiches.”

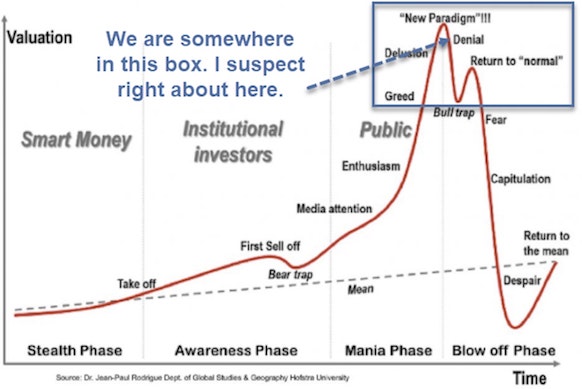

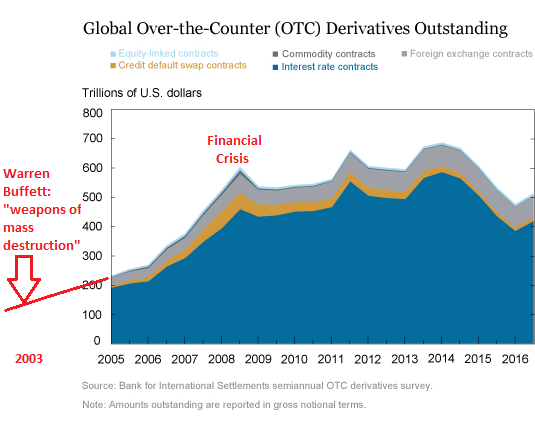

• Summer of Tough Love (Jim Kunstler)

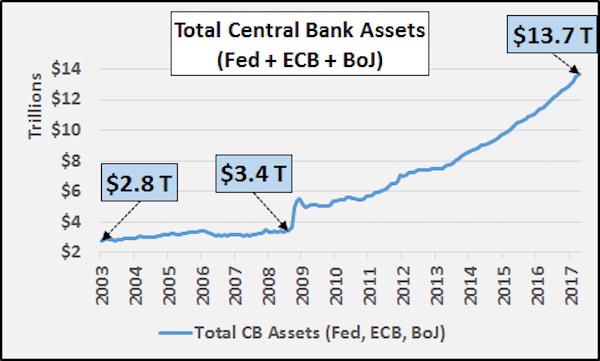

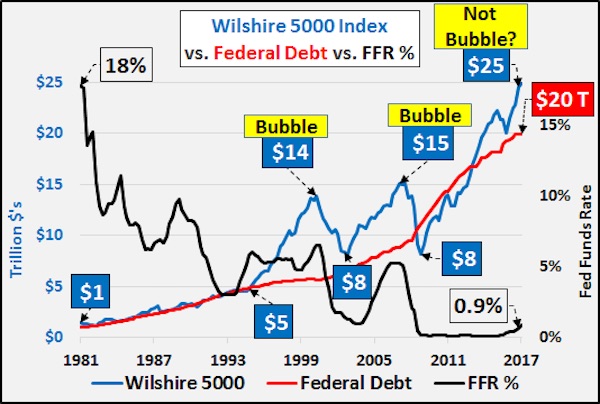

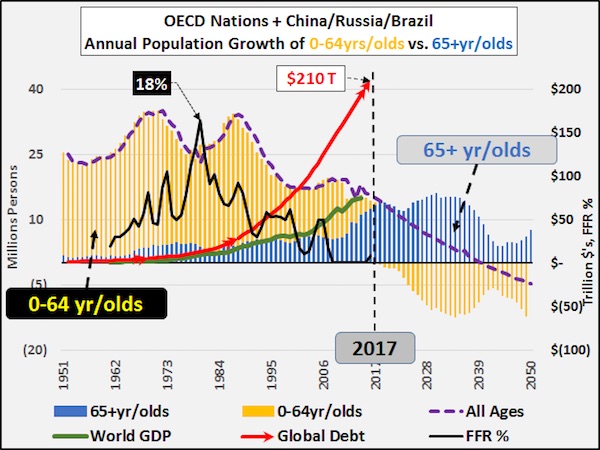

The blowup of the bond and stock markets later this year will put to a gloomy rest the ludicrous notion that America has been enjoying a great economic boom. It’s actually been an engineered hallucination, thanks to the global monetary authorities applying the magic of limitless credit to a bad habit of credulous speculation. The central banks have launched a program of so-called “quantitative tightening (QT)” — an idiotic phrase meant to counterpoise the equally fatuous “quantitative easing (QE),” PhD economist-speak for grotesque interference in the bond markets — that will choke down the credit supply at exactly the moment that governments and giant corporations need new loans to pay the interest on old loans. The trajectory there is obvious.

The big question, of course — hardly ever asked in the public arena — is what that will do to currencies, i.e., money. It can really only go two ways: either make money very scarce, in which case a lot of people and enterprises go broke, or, if the monetary authorities respond to the predicament by enabling a return to bottomless credit issuance, the money will become worthless — they’ll be plenty of it, but it won’t buy much. Such a turn of events will make an already-unhinged nation fly apart. [..] Oh, yes, there is also that Hieronymus Bosch Garden of Earthly Delights known as the Mueller Investigation, with its dreary outposts in the executive suite of the FBI, and all the tangled mysteries entailed there.

Mr. Mueller will come up with someone to indict on something, even if it’s ninety-seven ham sandwiches. I suspect Mr. Trump will manage to dump Attorney General Jeff Sessions and Deputy AG Rod Rosenstein. And then the pardons will fly, like so many winged demons flapping from the mouth of Hades. Constitutional crisis may be too mild a word for what ensues. By holiday time in early winter, much will clarified about the actual direction of the country. By then, the “Walk Away” movement may even include the obdurate shills at CNN and The New York Times, and the Intellectual-Yet-Idiots on the college campuses. And the Golden Golem of Greatness will lie upended in the swamp that he just didn’t try hard enough to drain.

How many fake accounts do they have?

• Twitter Suspends Over 70 Million Accounts In Two Months (R.)

Twitter Inc suspended more than one million accounts a day in recent months to reduce the flow of misinformation on the platform, the Washington Post reported. Twitter and other social media platforms such as Facebook Inc have been under scrutiny by U.S. lawmakers and international regulators for doing too little to prevent the spread of false content. The companies have been taking steps such as deleting user accounts, introducing updates and actively monitoring content to help users avoid being a victim to fake content. Twitter suspended more than 70 million accounts in May and June, and the pace has continued in July, the Post reported on Friday, citing data it obtained.

“It’s hard to believe that 70 million accounts were affected when Twitter has only 336 million monthly active users (MAU),” Wedbush analyst Michael Pachter said. Twitter’s MAU is expected to grow nearly 3 percent to 337.06 in the second quarter, according to Thomson Reuters I/B/E/S. “My guess is that a large number of these suspended accounts were dormant … it should have little impact on the company,” Pachter told Reuters. If the 70 million were mostly active accounts, the affected accounts would have been “screaming bloody murder”, added the analyst.

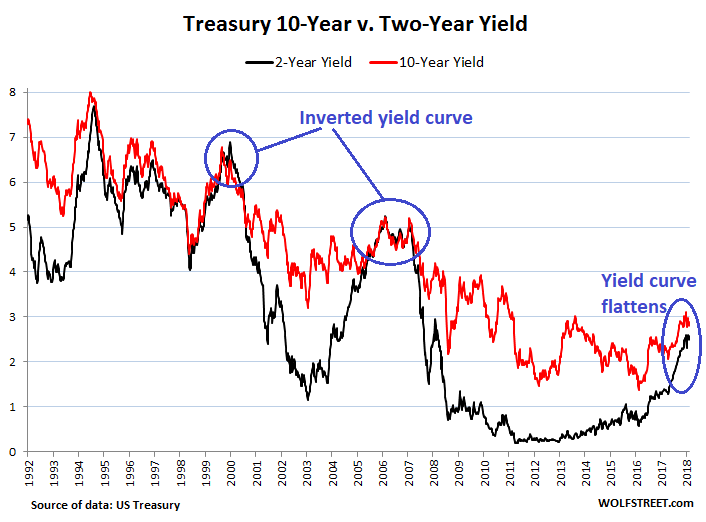

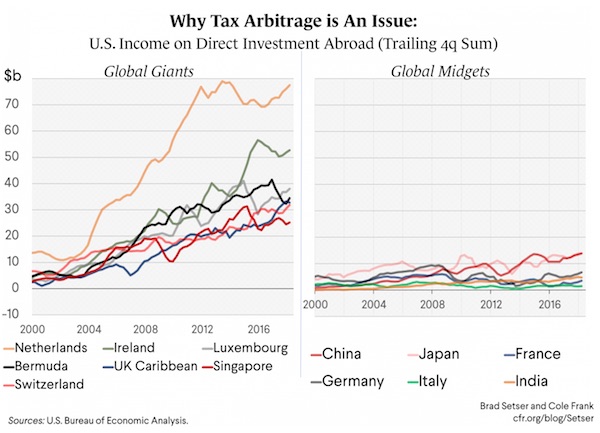

Tax havens.

• Tax Arbitrage Is An Issue (Setser)

The impact of the U.S. tax reform on the U.S. trade balance was a hot item of debate last December. There was an argument that reducing the headline tax rate—and creating an even lower tax for the export of intangibles—would reduce the incentive for firms to book profits abroad in offshore tax centers. Booking those profits at home would raise U.S. services exports—while the service “exports” of countries like Ireland and Luxembourg (really re-exports of intellectual property created in the U.S) would fall. This would have no overall effect on the balance of payments. The rise in the recorded exports of intellectual property from the U.S. would be offset by a fall in the offshore income of U.S. firms.

For example, Google (U.S.) would show a bigger profit as offshore sales would be booked as exports of IP held in the U.S. (a service export) while Google (Bermuda) would show a smaller profit —and that would translate both into a smaller trade deficit and a smaller surplus on foreign direct investment income.* But shifting paper profits around would bring down the measured trade deficit—a potential win for Trump. It is obviously too soon to assess the full impact of the tax reform. But it isn’t too soon to start looking for some clues. The q1 balance of payments data doesn’t suggest that firms have lost their appetite for booking profits abroad, or their appetite for booking the bulk of their offshore profits in low tax jurisdictions. This shouldn’t be a surprise—the lowest rate in the new U.S. tax code is the new global minimum rate on intangibles.

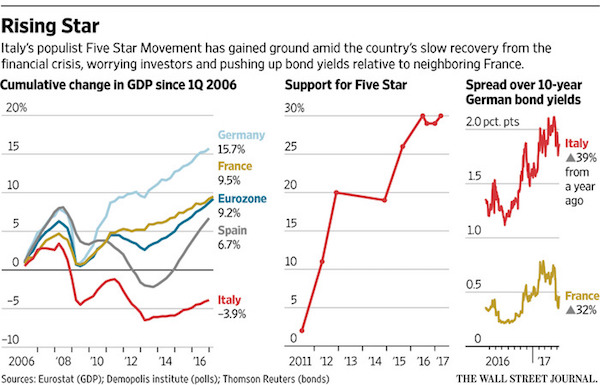

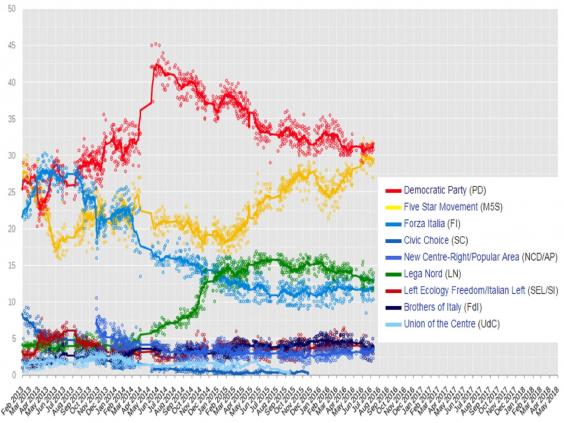

The existing “ideologies have outlived their usefulness,” Grillo said. “There are just good and bad ideas..”

• Mainstream Politicians Short-Sighted, Don’t See World Changing – Grillo (RT)

Mainstream political parties have outlived their purpose as they cannot adapt to the changes in the political system and are out of step with the voters, Beppe Grillo, the founder of the Italian Five Star Movement (M5S), said. “The world of the old politics and old political parties,” which expect the people to trust them with defending the public interests, is “slowly dying out,” Grillo, a former Italian satirist and activist, told Ex-Ecuador President Rafael Correa during the “Conversations with Correa” show on RT Spanish. People are no more willing to just blindly follow some political forces, they are much more informed now, they seek for information in the internet and want to form their own opinions, he explained.

“The world is changing at a fantastic speed. However, the current generation of politicians does not feel these changes. They just do not see it,” Grillo said, adding that the politicians are oriented “on a short-term horizon.” Meanwhile, the society, particularly the young people, is no longer attracted by the ideas propagated by the mainstream parties. The existing “ideologies have outlived their usefulness,” Grillo said. “There are just good and bad ideas,” he added, explaining that “they are not divided into ‘right’ and ‘left’ anymore.” The self-described anti-establishment activist then criticized the mainstream politicians for hiding their own inability to adapt behind the warnings about the perceived threat of populism.

As for the populism, I am proud to be a populist, if the word ‘populus’ (the people) is still of some importance,” Grillo told Correa. “Our goal is to reach out to people, to encourage them to think for themselves, to give them instruments to fulfill their own ideas,” he added. He agreed with Correa’s statement that the so-called “anti-populism” is what really poses a threat to the modern society as it seeks to keep the system unchanged. He particularly agreed that “anti-populism” is in fact a “means of attack” as it sees everything that challenges the system as populism and seeks to clamp it down.

It’s going to be so annoying people will stop flying.

• Number Of Planes In The Sky To More Than Double In Next 20 Years (Ind.)

The number of aircraft in the skies will more than double by 2037, according to the latest Global Market Forecast by Airbus. The Toulouse-based plane maker says half the present 21,450 aircraft flying will still be aloft in 20 years. With 37,390 new planes predicted to take off, the world’s total will increase by 123 per cent to 47,990. The expected total number of aircraft is 11.3 per cent higher than it was in the last big forecast by Airbus, a year ago. The vast majority of the new planes will be smaller, narrow-bodied jets. More than three-quarters of deliveries will be from the Airbus A320 and Boeing 737 families, or aircraft of a similar scale from other manufacturers.

Assuming the 737 is still being made in 2037, it will be the most enduring aircraft in aviation history, having first flown 70-years earlier. Of the 28,550 predicted new narrow-bodied planes, one of Airbus’s leading hopes is the A321 NEO, a re-engined version of an aircraft that attracted little attention when it was launched as a stretched A320 in the early 1990s. The latest version can hold up to 244 passengers, and the long-range variant can fly 4,600 miles – the distance from Manchester to Seattle. The economics of the A321 are very tempting to 21st-century airlines, particularly for “long, thin” routes.

[..] Last month, Eamonn Brennan, director general of the air-traffic provider, Eurocontrol, warned: “On our most likely scenario, there won’t be enough capacity for approximately 1.5 million flights or 160 million passengers in 2040. “Many airports will become much busier, with higher delays. By 2040, 16 airports will be highly congested operating at close to capacity for much of the day, up from six airports today. “As a result of this congestion the number of passengers delayed by between one and two hours will grow from around 50,000 each day now to around 470,000 a day in 2040.”

You’re going to need a lot tougher words than that.

• Pope Warns Earth Turning Into Vast Pile Of ‘Rubble, Deserts And Refuse’ (AP)

Pope Francis urged governments on Friday to make good on their commitments to curb global warming, warning that climate change, continued unsustainable development and rampant consumption threatens to turn the Earth into a vast pile of “rubble, deserts and refuse”. Francis made the appeal at a Vatican conference marking the third anniversary of his landmark environmental encyclical “Praise Be.” The document, meant to spur action at the 2015 Paris climate conference, called for a paradigm shift in humanity’s relationship with Mother Nature. In his remarks, Francis urged governments to honor their Paris commitments and said institutions such as the IMF and World Bank had important roles to play in encouraging reforms promoting sustainable development.

“There is a real danger that we will leave future generations only rubble, deserts and refuse,” he warned. The Paris accord, reached by 195 countries, seeks to avoid some of the worst effects of climate change by curbing global greenhouse gas emissions via individual, non-binding national plans. President Donald Trump has said the US will pull out of the accord negotiated by his predecessor unless he can get a better deal. Friday’s conference was the latest in a series of Vatican initiatives meant to impress a sense of urgency about global warming and the threat it poses in particular to the world’s poorest and most marginalised people. Recently, Francis invited oil executives and investors to the Vatican for a closed-door conference where he urged them to find alternatives to fossil fuels. He warned climate change was a challenge of “epochal proportions”.