Paul Gauguin By the stream, autumn 1885

George Webb’s predictions are quite specific. A Kissinger initiated peace conferece will start – in about 10 days. After all the lights go out in Ukraine, and after Russia detonates a small neutron bomb -tennis ball size- along with some plutonium, deep underneath a steel plant like Azovstal. The west will pay well over $300 billion for its reconstruction.

When the lights and heat go out in Kiev, we will get a Peace Deal in Ukraine. Now, Trump calling for Peace Deal. We said Kissinger would do Eleven Days of escalation bombing as in Operation Linebacker, then de-escalate to Peace Deal. I am counting this as Day 2. pic.twitter.com/7gkll0MUL8

— George Webb – Investigative Journalist (@RealGeorgeWebb1) October 10, 2022

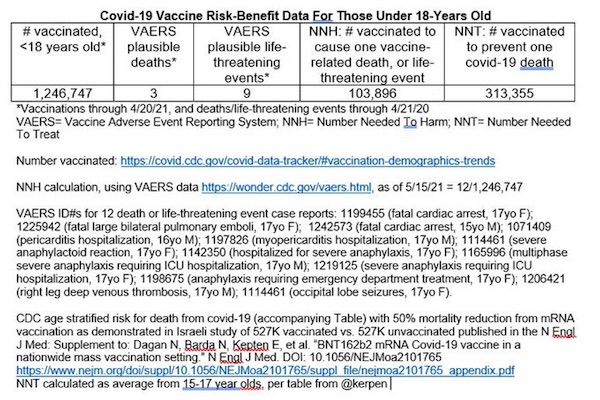

Ladapo

Florida's Surgeon General Dr. Joseph Ladapo:"This body of tech and other forces that come in and silence people, they don't think human beings have the right to have free access to information that they don't want them to have access to."

Source: https://t.co/pOiAQfYRJ3 pic.twitter.com/uYdirlrepG— Wittgenstein (@backtolife_2023) October 10, 2022

Florida Surgeon General Joseph Ladapo:

"If it had been known two years ago or so, that this vaccine would increase cardiac deaths in young men by 84%, would they have approved it? The obvious answer is no." pic.twitter.com/Rnn7gl2Wb5

— Townhall.com (@townhallcom) October 11, 2022

Lassalle

https://twitter.com/i/status/1579567313082544129

“Message: if you think we’re fucking around, consider this an attitude adjustment opportunity.”

• You Can Always Dream (Jim Kunstler)

Forgive me for repeating what I’ve written more than once before: Russia will not benefit from having a broken, failed state on its doorstep. Such a situation would clearly just invite more international hugger-mugger. Rather, Russia will benefit hugely from having a neutral, functioning Ukraine next door, a state with ample agricultural resources that could plausibly feed its people and live in peace, perhaps even enjoy special trade privileges with its bigger neighbor to the east… a Ukraine that would be a geographical buffer between Russia and what is apt to be a very disorderly and distressed Western Europe on the other side. The Ukrainian leader, Mr. Zelenskyy, capped off the weeks of sabotage by appealing to the US and NATO to conduct “preemptive nuclear strikes” against Russia proper.

That’ll work in Ukraine’s favor, I’m sure. He promised to call German Chancellor Olaf Scholz and make the pitch for NATO jumping into the action on the ground. (And with whose army would that be?) Such cheek from this desperado! Going mad-dog is probably not a sign of confidence. As of Monday, October 10, Russia began delivering some disciplinary actions against Mr. Zelenskyy’s insolent regime. Russia sent missiles into at least 10 Ukrainian cities, targeting electric power generation, water, central heating, and other “key services” in Kiev and elsewhere. Message: if you think we’re fucking around, consider this an attitude adjustment opportunity.

The action is an overture to a strategic shift. Russia aims to speed up the game clock, consolidate its ownership of the Donbas provinces, destroy Ukraine’s remaining military capability, bust up enough stuff to perhaps prompt the Ukrainian people to ask whether continuing to follow Mr. Zelenskyy’s gang is a good idea, and leave no alternative to talks that will leave Ukraine neutralized. Mr. Putin is calling “Joe Biden’s” bluff. All of this could have been avoided, of course, if the maniacs of America’s deep state had simply abided by the promise made thirty years ago to not expand NATO. What part of that deal didn’t we understand? Apparently, all of it. On purpose. Because we have acted with conscious and arrogant dishonor.

Of course, our “president” could commence that nuclear war he affects to be so avid for. It would be a fitting career-capper for the Ol’ Dawg. The show-runner behind all this needless mayhem, former President Barack Obama, reminded us a while back: “Don’t underestimate Joe’s ability to fuck things up.” Roger that, BHO! Which gets back to that dream I had of the headline: BIDEN ARRESTED. It was good, but not enough. How about : BIDEN, OBAMA, AND 639 FEDERAL OFFICIALS IN NINE AGENCIES ARRESTED. What a strange moment in our long and steadfast history as an orderly Republic that would be. And yet, what a perfect ending to these years of perfidy and travail.

No nukes, no NATO, no nazis.

• Ukraine’s ‘Nazi Regime’ Must Be Dismantled – Medvedev (RT)

Former Russian President Dmitry Medvedev on Monday called for a “complete dismantling” of Ukraine’s “political regime.” Writing on Telegram, Medvedev, who now serves as deputy head of the Security Council, shared his “personal opinion,” claiming that the current “Nazi political regime” in Kiev will represent “a constant, direct and clear threat to Russia.” “Therefore, in addition to protecting our people and protecting the borders of the country, our future actions, in my opinion, should be aimed at a complete dismantling of the political regime of Ukraine,” Medvedev said. Commenting on the numerous missile strikes carried out across Ukraine on Monday morning, the former Russian leader said that that was a “first episode” and that “there will be others.”

Russian President Vladimir Putin earlier on Monday confirmed that the major operation against Ukrainian infrastructure was in response to the October 8 attack on the Crimean Bridge. Moscow considers it an act of terrorism organized by the Ukrainian security services. Claiming that “the Kiev regime has been using terrorist methods for a very long time,” Putin warned Ukraine against further attacks on Russian soil. Otherwise, Kiev will face a response “on a scale corresponding to the threats created against Russia,” the president said. Meanwhile, Ukraine has not claimed responsibility for the attack on the Crimean Bridge, despite the country’s top officials openly celebrating the deadly explosion.

The EU condemned Monday’s shelling of Ukrainian cities by Moscow, with the bloc’s top diplomat Josep Borrell pledging to provide more military assistance to Kiev in response. The Russian Defense Ministry confirmed that its forces had carried out multiple strikes “on objects of military command and control systems, communications and energy of Ukraine.” Kiev, Lviv, Kharkov, Odessa and other cities were targeted, according to the local authorities, while regions across Ukraine are facing blackouts and rotating power cuts.

“..there was no land connecting Crimea to the rest of Russia; but now that Kherson and Donetsk are again part of Russia, traffic from Simferopol to Rostov can be sent around the northern shore of Sea of Azov..”

• A Nice Bridge You Got There… (Dmitry Orlov)

A truck bomb exploded on the bridge that links Crimea with Krasnodar, shutting it down for almost a whole day. Oh, and before we forget, Krasny Liman, a railroad junction in Donetsk was temporarily surrendered to the relentlessly attacking Ukrainians (mostly Polish mercenaries, actually) who drenched it in their blood and festooned it with their billowing entrails in the process. These and other less significant events have caused some small but noisy part of Russian social media to explode in consternation, baying for revenge and generally acting dissatisfied with the progress made since the Special Operation was declared on February 22, 2022. Sure enough, plenty of these hysterical voices are actually paid Ukrainian agents tasked with spreading fear, uncertainty and doubt and, sure enough, the Special Operation will proceed regardless, so this is all just a temporary annoyance.

But I will comment on it because I feel that I have to, and then move on to more important things. The bridge across the Kerch Strait was under discussion for many decades. It was in the planning stages even while Crimea was still an autonomy within the constitutionally intact Ukraine, prior to the US-instigated violent coup of 2014. After Crimea rejoined Russia, it became extremely important to create a ground transportation link between it and the mainland, and the bridge was built in record time. It was a massive undertaking and is a high-prestige item for the Russian government. But there have also been some organizational issues. As it stands, yesterday a large tractor-trailer packed with explosives was detonated on the highway portion of the bridge just as a cargo train with cisterns of diesel was passing through.

The resulting explosion demolished two reinforced concrete highway spans and sooted up the rail bed. All train traffic and half of the road traffic were restarted that very day. There is equipment to X-ray all cargo passing through, but it wasn’t being used because of certain bureaucratic inadequacies; these, I am sure, will now be remedied. The reason the bridge was extremely important was because there was no land connecting Crimea to the rest of Russia; but now that Kherson and Donetsk are again part of Russia, traffic from Simferopol to Rostov can be sent around the northern shore of Sea of Azov (which is now an entirely Russian body of water); the difference is between 690km and 730km. The bridge is by means superfluous because the distance to Krasnodar, another regional hub, is 1030km by land and just 460km via the bridge. But the new land route from Moscow to Simferopol is 350km shorter.

“.. the West’s “redirection” towards terrorism is an admission of military, economic and political defeat.”

• West Has Now Set A Course On Total Terrorist Warfare (Saker)

From what I have read, a truck filled with explosives blew up, killing three people in a car nearby, and then the flames took over a train also crossing the bridge. That train was full of fuel. It is only thanks to the amazing speed at which the bridge crews reacted that the damage was limited to only 9 wagons and, therefore, to a much shorter segment of the rail tracks. Looking at the video, one would imagine that the bridge is in ruins. In fact, traffic was reestablished on both rail tracks and the road in less than 24 hours (with the exception of heavy trucks). In other words, this is yet another case of “it is humiliating, but not dangerous” But that is an increasingly mistaken notion: this time is also VERY dangerous.

It is self-evident that the Kiev regime would never have had the means, technical and political, to execute such an attack without being told to do so by its masters in the West. Such an attack, right on the heels of the attacks on of NS1/NS2 shows beyond any doubt that West has now set a course on total terrorist warfare. This makes sense, since for all the so-called “victories” of the NATO forces in the Ukraine, the reality is that they reconquered a few villages and towns while Russia liberated and then incorporated entire regions. And Russia did that while always being at a numerical disadvantage. And while inflicting 10:1 KIA ratios. In other words the West’s “redirection” towards terrorism is an admission of military, economic and political defeat.

While this is hardly a surprise, the West *always* uses terrorism against sovereign governments, this is still a very negative development for Russia. Simply put, there are always more targets than cops/guards. Furthermore, terrorists can always chose the time and location of their attacks. So far, the Ukronazi efforts in Russia yielded very little tangible benefits: the murder of Dugina made her into a martyr, the attack on NS1/NS2 really only hurt Germany and the EU, while the explosion on Crimean Bridge has proven that this is a very hard target which will be extremely hard to destroy short of using a tactical nuke.

“The lightning strike de facto metastasizing of SMO into CTO means that the regime in Kiev and those supporting it are now considered as legitimate targets..”

• Terror On Crimea Bridge Forces Russia To Unleash Shock’n Awe (Escobar)

So we had, in sequence, Ukrainian terrorists blowing up Darya Dugina’s car in a Moscow suburb (they admitted it); US/UK special forces (partially) blowing Nord Stream and Nord Stream 2 (they admitted and then retracted); and the terror attack on Krymsky Most (once again: admitted then retracted). Not to mention the shelling of Russian villages in Belgorod, NATO supplying long-range weapons to Kiev, and the routine execution of Russian soldiers. Darya Dugina, Nord Streams and Crimea Bridge make it an Act of War trifecta. So this time the response was inevitable – not even waiting for the first meeting since February of the Russian Security Council scheduled for the afternoon of 10 October.

Moscow launched the first wave of a Russian Shock’n Awe without even changing the status of the Special Military Operation (SMO) to Counter-Terrorist Operation (CTO), with all its serious military/legal implications. After all, even before the UN Security Council meeting, Russian public opinion was massively behind taking the gloves off. Putin had not even scheduled bilateral meetings with any of the members. Diplomatic sources hint that the decision to let the hammer come down had already been taken over the weekend. Shock’n Awe did not wait for the announcement of an ultimatum to Ukraine (that may come in a few days); an official declaration of war (not necessary); or even announcing which ‘”decision-making centers” in Ukraine would be hit.

The lightning strike de facto metastasizing of SMO into CTO means that the regime in Kiev and those supporting it are now considered as legitimate targets, just like ISIS and Jabhat al-Nusra during the Anti-Terror Operation (ATO) in Syria. And the change of status – now this is a real war on terror – means that terminating all strands of terrorism, physical, cultural, ideological, are the absolute priority, and not the safety of Ukrainian civilians. During the SMO, safety of civilians was paramount. Even the UN has been forced to admit that in over seven months of SMO the number of civilian casualties in Ukraine has been relatively low.

‘The entry of the four provinces into Russia is not the last’.

• All Quiet on the Eastern Front? Not At All, Atlantis (Batiushka)

We are still having our minds blown by President Putin’s Speech over a week ago. How many times we have listened to it and watched it. If I may say something personal, I can say that I have not even dared dream for over 40 years that a Russian leader would make such a speech. I thought I would die long before it would happen, even if it did happen. I was waiting for the end of the world and now hope has been given us. The President said it all, summing up an evil millennium of Western history, starting with its worldwide plunder and ending in its shameful Woke ideologies, the denial and destruction of Spiritual Reality, National Sovereignty and Family Life. Yes, this is Satanism against any sort of Spiritual Tradition. And only Russia has dared to oppose this Satanism. Needless to say, we stand behind the Russian Federation 100%. As the President, our President, said: ‘Nothing will be as before’.

The results from the referenda on returning to Russia in four Russian-speaking Ukrainian provinces came in nearly two weeks ago: Donetsk: 99% Lugansk: 98% Zaporozhie: 93% Kherson: 87%. Thus, on 30 September these four provinces, the size of four Belgiums, duly joined the Russian Federation, following the example of the Crimea over eight years ago. The results were interesting, as they showed how popularity for the move ‘declines’ as you move westwards, with Kherson at ‘only’ 87%. However, nobody should be surprised that Russian-speaking areas overwhelmingly, even if ‘only’ 87%, wanted to return to Russia, which is where they belonged until 1922. The voting, ethnicity, linguistic and religious patterns are clear from, for example, the maps and analysis of the Eurasian Research Institute.

Nobody should be surprised, unless of course they have no common sense, or else their common sense has been blinded by their ‘West is Best’ ideology, which is in fact the essence of Nazism. Nearly 10,000,000 people, nearly one quarter of the population of the Crimea-less Ukraine (pre-War population) (more people than those in Estonia, Latvia, Lithuania and Georgia combined), some 20% of the landmass of the Crimea-less Ukraine, an area nearly the size of England, joined the Russian Federation. Out of 25 provinces in the Ukraine before the violent, US-organised overthrow of the democratically-elected Ukrainian government (cost to the US taxpayer: $5 billion) in February 2014, 20 are now left. Who leaves next? As the head of the Republic of the Crimea, Sergei Aksjonov, said on 1 October: ‘The entry of the four provinces into Russia is not the last’.

“The goal of the strike has been achieved. All designated objects have been hit..”

• Russian MOD Comments On Results Of Strikes In Ukraine (RT)

A rocket barrage that targeted Ukrainian military objects and infrastructure has accomplished its goal, the Russian Defense Ministry claimed on Monday. The attack came after Moscow accused Kiev of orchestrating a deadly explosion on the strategic Crimean Bridge. Speaking at a regular briefing, Lieutenant General Igor Konashenkov noted that Russia had used high-precision and long-range weapons to hit objects on Ukrainian territory, including “military command facilities, communications and energy systems.”“The goal of the strike has been achieved. All designated objects have been hit,” he noted.

His comments came hours after Russia struck multiple targets in Kiev, with the city’s Mayor Vitaly Klitschko claiming that “critical infrastructure” had been affected. The attack also apparently hit Vladimirskaya Street, where the main office of the Security Service of Ukraine (SBU) is based, according to Anton Gerashchenko, an adviser to the interior minister. Apart from Kiev, several other Ukrainian cities were targeted, including Dnepr in east of the country, and Lviv in the west. Following the strikes, Ukrainian authorities reported blackouts in Lviv, Poltava, Sumy, Kharkov and Ternopol Regions, adding that in other parts of the country power supply had been partially disrupted.

On Monday, President Vladimir Putin warned Ukraine that if it orchestrates any new terrorist attacks on Russia, it “will respond firmly and on a scale corresponding to the threats created against” it. The attacks follow a powerful explosion that rocked the Crimean Bridge on Saturday, killing three and causing the partial collapse of the road section, as well as a blaze on the parallel railway span. While Ukrainian officials did not directly assume responsibility for the explosion, on Sunday Putin claimed that it was the Ukrainian intelligence service that had orchestrated the blast.

“The cynicism is that the entire supply chain has been hit..” “It’s both electricity distribution systems and generation.”

• Ukraine Halts Electricity Exports To EU (RT)

Damage to energy infrastructure caused by Moscow’s air strikes has forced Ukraine’s government to cut off electricity exports to the European Union, taking away a supply source that Kiev claims helped its partners reduce their reliance on power generated with Russian natural gas. “Today’s missile strikes, which hit the thermal generation and electrical substations, forced Ukraine to suspend electricity exports from October 11, 2022, to stabilize its own energy system,” the Ukrainian energy ministry said on Monday in a statement. The ministry noted that even after losing control of the Zaporozhye nuclear power plant to Russian forces in March, Kiev had been able to meet its export commitments to European partners, but Monday’s attacks were the largest of the entire conflict.

“The cynicism is that the entire supply chain has been hit,” Energy Minister German Galushchenko said. “It’s both electricity distribution systems and generation. The enemy’s goal is to make it difficult to reconnect electricity supplies from other sources.” Russian President Vladimir Putin said Monday’s air strikes on Kiev and other major Ukrainian cities – targeting military, energy and communications infrastructure – came in response to Ukraine’s attack on the strategic Crimean Bridge on Saturday. “If there are further attempts to conduct terrorist attacks on our soil, Russia will respond firmly and on a scale corresponding to the threats created against Russia,” Putin announced. Galushchenko, however, accused Moscow of waging “energy terror” in retaliation for Kiev helping other countries reduce their dependence on Russia.

After joining European energy system ENTSO-E back in June, Kiev said it expected to earn some €1.5 billion from electricity exports to the EU by the end of the year. “That is why Russia is destroying our energy system, killing the very possibility of exporting electricity from Ukraine,”the energy minister claimed. Ukrenergo, the national power grid operator, claimed its specialists have been “engaging backup supply schemes” and repaired some of the damage by Monday night. In the meantime the ministry urged “all citizens of Ukraine to unite” and minimize their energy use during the peak demand hours, arguing that not only Ukraine is implementing measures to reduce power consumption, but the “whole of Europe is doing this now.”

“..if you, ladies and gentlemen, support beyond that point the Government of Ukraine, either in word or deed you support the backing and outright commission of terrorism.”

• Dancing In The Streets…. (Denninger)

Who remembers those that danced in the streets and cheered when 9/11 happened? You’re old enough to remember that, right? It wasn’t that long ago. I remember it quite well and the level of revulsion I had for those who participated was visceral and permanent; it remains even today. The detonation on the land bridge to Crimea at first looked like perhaps part of an act of War; special forces or something like that who managed to infiltrate into the area and blow it up. That happens during wars. Except… a closer look discloses that this was clearly not such a thing at all. Indeed it appears to be a simple truck bomb and it was primarily aimed at civilians and civilian infrastructure. In other words exactly as was Oklahoma City or the first attempt at the World Trade Center in the case of a truck bomb, and exactly as were two airliners aimed at the Twin Towers.

Those were all…… terrorism. Do recall that after 9/11 some of the cheerleading was done by government actors in certain other nations. Well, the government of Ukraine has officially endorsed the truck bombing that, near as we can tell, killed only civilians. According to the NY Times, it would appear, they not only endorsed it they orchestrated it. In other words Zelinskyy is reasonably compared against Bin Laden, the Blind Sheikh or Timothy McVeigh. So if you, ladies and gentlemen, support beyond that point the Government of Ukraine, either in word or deed you support the backing and outright commission of terrorism. I find your actions equally revolting — and I will forevermore — exactly as I found those who danced when the towers came down. And that’s a fact.

“..the next one “will be even more difficult.”

• Hard Winter Ahead For Europe – Erdogan (RT)

European countries are about to face significant difficulties this winter amid limited deliveries of Russian natural gas, Türkiye’s President Recep Tayyip Erdogan said on Sunday. Speaking at the TUGVA youth forum, Türkiye’s leader noted that the whole continent “is on fire now.” “The entire Europe is wondering: ‘How will this winter go?’” he said. Meanwhile, according to Erdogan, his country will have no issues with energy resources in the coming months. “Thank God, we have made all our preparations… we have prepared everything for our nation, both natural gas and coal,” he stated. He also noted that the main issue for the nation is “how to deliver natural gas to our citizens at more affordable prices,” adding that Ankara is doing its best to achieve this goal. Erdogan went on to explain that Ankara is acting as a leading mediator between Ukraine and Russia, which have been locked in conflict since late February.

Several months ago, Ankara and the UN brokered a deal between Moscow and Kiev that unblocked Ukrainian grain exports via the Black Sea. Erdogan has also repeatedly urged the two parties to strike a peace deal. His comments come as Europe is reeling from an energy crisis fueled by skyrocketing gas prices due to sanctions the West has imposed on Russia over the conflict. While EU authorities have taken measures to cut energy consumption in a bid to alleviate the situation, various officials and public figures have warned of the desperate situation the continent may find itself. Earlier this month, Microsoft founder Bill Gates claimed that in a few months Europe may face a “very scary situation” as many could be unable to heat their homes. In late September, EU Energy Commissioner Kadri Simson also predicted that this winter “will not be easy,” adding that the next one “will be even more difficult.”

“..the Kiev regime, by its actions, has actually put itself on the same level as international terrorist groups, and with the most odious of those. It is simply no longer possible to leave crimes of this kind without retaliation.”

• Putin Meeting With Permanent Members Of The Russian Security Council (Saker)

The President held a briefing session with permanent members of the Security Council, via videoconference. “Colleagues, good afternoon, You know that yesterday Chairman of the Investigative Committee Alexander Bastrykin reported to me on the first results of the investigation into the act of sabotage on the Crimean Bridge. The forensic and other expert data, as well as operational information, show that the October 8 explosion was an act of terrorism aimed at destroying Russia’s civilian and critical infrastructure. It is also clear that the Ukrainian special services were the organisers and perpetrators of the attack. The Kiev regime has long been using terrorist methods, including murders of public figures, journalists and scientists, both in Ukraine and in Russia.

And terrorist attacks on towns in Donbass, which have been going on for more than eight years. And also acts of nuclear terrorism, by which I mean missile and artillery strikes on the Zaporozhye Nuclear Power Plant. This is not the whole story: Ukraine’s special services have also carried out three terrorist acts against Russia’s Kursk Nuclear Power Plant, repeatedly blowing up the plant’s high-voltage lines. The third such terrorist attack damaged three of those lines at once. The damage was repaired in the shortest possible time and there were no serious consequences. However, there have been a number of other terrorist attacks and attempts to commit similar crimes against electricity generation and gas transportation infrastructure facilities in our country, including an attempt to blow up a section of the TurkStream gas pipeline system.

All this has been proven by objective data, including the testimony of the detained perpetrators. It is well known that Russian representatives are not allowed to take part in the investigation into the causes of explosions at and the destruction of international gas pipelines running under the Baltic Sea. But we all know who ultimately benefits from this crime. Thus, the Kiev regime, by its actions, has actually put itself on the same level as international terrorist groups, and with the most odious of those. It is simply no longer possible to leave crimes of this kind without retaliation.”

Putin

❗️Putin: This morning, Russia launched massive missile strikes from the air, sea, and land against Ukrainian energy, military command, and communications facilities. pic.twitter.com/Xh1kvh8TYv

— Putin Direct (@PutinDirect) October 10, 2022

“..Britain’s evident interest in planning such an attack underscores the deep involvement of NATO powers in the Ukraine proxy war..”

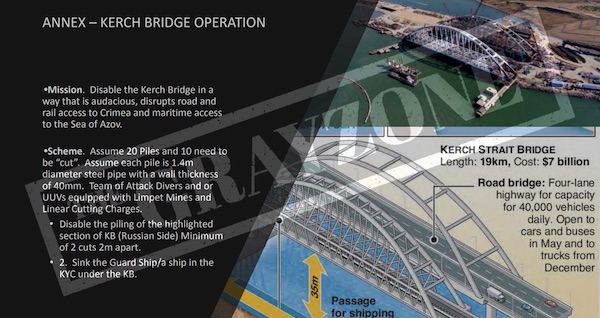

• Before Ukraine Blew Up Kerch Bridge, British Spies Plotted It (GZ)

The secret British intelligence plot to blow up Crimea’s Kerch Bridge is revealed in internal documents and correspondence obtained exclusively by The Grayzone. The Grayzone has obtained an April 2022 presentation drawn up for senior British intelligence officers hashing out an elaborate scheme to blow up Crimea’s Kerch Bridge with the involvement of specially trained Ukrainian soldiers. Almost six months after the plan was circulated, Kerch Bridge was attacked in an October 8th suicide bombing apparently overseen by Ukraine’s SBU intelligence services. Detailed proposals for providing “audacious” support to Kiev’s “maritime raiding operations” were drafted at the request of Chris Donnelly, a senior British Army intelligence operative and veteran high ranking NATO advisor. The wide-ranging plan’s core component was “destruction of the bridge over the Kerch Strait.”

Documents and correspondence plotting the operation were provided to The Grayzone by an anonymous source. The truck bombing of the Kerch Bridge differed operationally from the plot sketched therein. Yet, Britain’s evident interest in planning such an attack underscores the deep involvement of NATO powers in the Ukraine proxy war. At almost precisely the time that London reportedly sabotaged peace talks between Kiev and Moscow in April this year, British military intelligence operatives were drawing up blueprints to destroy a major Russian bridge crossed by thousands of civilians per day. The roadmap was produced by Hugh Ward, a British military veteran. A number of strategies for helping Ukraine “pose a threat to Russian naval forces” in the Black Sea are outlined.

The overriding objectives are stated as aiming to “degrade” Russia’s ability to blockade Kiev, “erode” Moscow’s “warfighting capability”, and isolate Russian land and maritime forces in Crimea by “denying resupply by sea and overland via Kerch bridge.” In an email, Ward asked Donnelly to “please protect this document,” and it’s easy to see why. Of these assorted plans, only the “Kerch Bridge Raid CONOPS [concept of operation]” is subject to a dedicated annex at the conclusion of Ward’s report, underlining its significance. The content amounts to direct, detailed advocacy for the commission of what could constitute a grave war crime. Markedly, in plotting ways to destroy a major passenger bridge, there is no reference to avoiding civilian casualties.

Across three separate pages, alongside diagrams, the author spells out the terms of the “mission” – “[disabling] the Kerch Bridge in a way that is audacious, disrupts road and rail access to Crimea and maritime access to the Sea of Azov.” Ward suggests that destroying the bridge “would require a cruise missile battery to hit the two concrete pillars either side of the central steel arch, which will cause a complete structural failure,” and “prevent any road re-supply from the Russian mainland to Crimea and temporally [sic] disrupt the shipping lane.”

4 pillars.

• Global Pandemic Response was a House of Cards (McCullough)

The last and longest hearing occurred on January 24, 2022, the day after the Defeat the Mandates Rally in Washington where tens of thousands of Americans gathered to hear about the unjust mandates from doctors, nurses, scientists, religious leaders, employment groups, and entertainers and journalists. The January 24, 2022, hearing was co-moderated by Dr. McCullough and this time had dozens of doctors, nurses, patients, attorneys, and press in attendance. In a roundtable presentations were given, and questions were answered on the “Four Pillars of Pandemic Response.” These principles of how a nation should use its public health and clinical resources to respond to a novel infectious outbreak were presented and published by Dr. McCullough in the fall of 2020: 1) contagion control, 2) early ambulatory treatment, 3) late treatment in the hospital, 4) vaccination.

The reason why McCullough’s four pillars are so important is that a balanced approach would have provided the most immediate relief and care to those who are ill at the moment to reduce hospitalizations and deaths while developing a longer-run strategy. The four pillars should have been the framework for monthly updates from the White House Task Force and the CDC/NIH/FDA with input from teams of practicing doctors and experts on each of the pillars. So when doing an evaluation of how America and the world performed in the COVID-19 crisis, the four pillars of pandemic response is a vital framework upon which to craft the exercise.

This structure can also apply to any local community, hospital, health system or other jurisdiction. Every single organization who acted in a capacity of making decisions during the pandemic and took responsibility on policy decisions should take the time and effort to do a post-mortem evaluation using the four pillars—it is likely they will quickly see their imbalanced set of errors—largely ones of omission on the pillars of early and late treatment cost hundreds of thousands of lives and millions of avoidable hospitalizations. Without the four pillars, global pandemic response was a house of cards.

“But almost as bad, crooked Hillary deleted 33,000 emails under congressional subpoena. She acid-washed them. … [It’s a] very expensive process. That’s why nobody does it.”

• Trump Shreds Four Former Presidents, Hillary Clinton (CB)

Former President Donald Trump tore into three former presidents and President Joe Biden’s Department of Justice at his most recent rally. The former president was in Nevada on Saturday when he insisted that the raid on Mar-a-Lago and the way he has been treated would not have happened to any other president, and he claimed to have proof. “This is a new hoax: the document hoax. Just look at how every other president has been treated when they left office. Very interesting. They’ve been given all the time needed [to return documents] — because you’re supposed to have as much time as you need — and complete deference when it came to their documents and their papers. ‘Take as much as you need,’” he said.

“Barack Hussein Obama moved more than 20 truckloads, over 33 million pages of documents, both classified and unclassified, to a poorly built and unsafe former furniture store located in a bad neighborhood in Chicago. With no security, by the way,” he said. He then went on to former President George W. Bush. “George W. Bush stored 68 million pages in a warehouse in Texas and lost 22 million emails. Can you imagine if I lost two emails? They’d say, ‘This is terrible. It must have been nuclear in those two.’ … He lost 22 million. Can you believe that we’re talking about millions of pages and they’re coming after me? But they’re still looking for them. They’re still looking for those pages,” he said before going for former President Bill Clinton.

“Bill Clinton took millions of documents from the White House to a former car dealership in Arkansas … and kept classified recordings in his sock drawer. In fact, he supposedly put the information from the White House into his socks and left the White House with the information, so we call it the sock case,” the former president said. “If I did that, there’d be major trouble and NARA — you know NARA, the National Archives and Records Administration — ‘lost’ an entire hard drive full of information from the Clinton White House. They lost it. They can’t find it,” he said. He then hit his favorite target, former Secretary of State Hillary Clinton, his opponent in the 2016 presidential election. “But almost as bad, crooked Hillary deleted 33,000 emails under congressional subpoena. She acid-washed them. … [It’s a] very expensive process. That’s why nobody does it. And then pounded her phones with hammers, making them totally unrecognizable to the naked eye. So she took those phones and she pounded the hell out of them,” the former president said.

He then went as far back as the late former President George H.W. Bush. “Meanwhile, George H.W bush took millions of documents to a former bowling alley and a former Chinese restaurant. … By contrast, I had a small number of boxes and storage at Mar-A-Lago — very small, relatively — guarded by the great Secret Service. And yet the FBI, with many people, raided my house. It’s in violation, by the way, of the Fourth Amendment, and many other things also,” he said. “The radical left thinks by doing all these sinister and venomous things, they’re making us weaker, but actually they are making us stronger and much more unified than ever before. I really believe that. I believe that,” the former president said.

“Americans today are more likely to believe in witches, ghosts, and astrology than to trust the federal government.”

• Julian Assange and Our Impunity Democracy (Bovard)

When the federal indictment against Assange was announced in 2019, a New York Times editorial declared that it was “aimed straight at the heart of the First Amendment” and would have a “chilling effect on American journalism as it has been practiced for generations.” Unfortunately, Americans and foreigners continue to suffer because of the perennial cover-ups of U.S. foreign interventions. After Britain arrested Assange on behalf of the U.S. government in 2019, Sen. Joe Manchin (D-WV) whooped that Assange “is our property and we can get the facts and the truth from him.” But Manchin had no recommendations on how Americans can “get the facts and the truth” from the federal government. Biden has ramped up U.S. bombings in Somalia: who exactly are we killing? It is a secret. Which Syrian terrorist groups are the U.S. government still bankrolling? It’s a secret. Why is the U.S. continuing to assist Saudi atrocities against Yemeni civilians? It’s a secret.

And then there’s the biggest and most dangerous secret operation on the horizon right now – the U.S. intervention in the Russia-Ukraine war. Folks can condemn Russia and support Ukraine without believing that Washington policymakers deserve a blank check to potentially drag America into a nuclear war. Are CIA analysts or Pentagon officials issuing warnings about U.S. government actions in this conflict could lead to a spiral that ends in catastrophe? Unfortunately, Americans won’t learn of any such memos until damage has been done. And if a disaster occurs, then we’ll see the same sham that occurred after the Iraq War – some Senate Committee blathering that no one is to blame because everyone in Washington was a victim of “group think.”

Federal prosecutors stress that Assange leaked “classified” information. But federal agencies are creating trillions of pages of new “classified’ secrets each year. Yet, any information which is classified is treated like a political holy relic that cannot be exposed without cursing the nation. Pervasive secrecy helps explain the collapse of trust in Washington. Americans today are more likely to believe in witches, ghosts, and astrology than to trust the federal government. Adding Assange’s scalp to the Justice Department’s trophy wall will do nothing to end the mistrust of the political ruling class that has dragged America into so many debacles. Assange is guilty of lese-majeste – embarrassing the government by exposing their follies, frauds, and crimes. Assange declared years ago, “If wars can be started by lies, they can be stopped by truth.” Dropping the charges against Assange is the best way for the Biden administration to prove it is serious about ending excessive secrecy.

Stossel

Trust the science? Why should we?

Biden’s co-head of “scientific integrity” @JaneLubchenco46 just got caught breaking rules.

“An egregious violation,” @AndrewCFollett tells me.

This is what she did: pic.twitter.com/YHDkEZLEXy

— John Stossel (@JohnStossel) October 9, 2022

Athens 1959

https://twitter.com/i/status/1579440770939228160

In 2015, photographer Atif Saeed captured this intense photograph of a male lion moments before it launched an attack on him. He narrowly escaped with this incredible shot of a face-to-face with a lion about to kill.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.