Marcel Duchamp About young sister 1911

What Putin tells Netanyahu, he also tells Trump at the same moment. A red line in the sand. This is the new world order.

• Israeli Attacks On Syria Halted After Russian Threat To Shoot Down Jets (ZH)

According to reports in both Israeli and Arabic regional media, Israel this past week was preparing to expand major airstrikes against “Iran-backed” targets in Syria, but Moscow imposed its red line. The Independent has published a story describing that Russia’s military in Syria threatened to shoot down any invading Israeli warplanes using fighter jets or their S-400 system. The Jerusalem Post, citing sources in the UK Independent (Arabia), writes just after the latest meeting in Sochi between Prime Minister Benjamin Netanyahu and Russian President Vladimir Putin: “According to the report, Moscow has prevented three Israeli airstrikes on three Syrian outposts recently, and even threatened that any jets attempting such a thing would be shot down, either by Russian jets or by the S400 Anti-aircraft missiles.

The source cited in the report claims a similar situation has happened twice, and that during August, Moscow stopped an airstrike on a Syrian outpost in Qasioun, where a S300 missile battery is placed.” Netanyahu’s hasty trip to meet with Putin on Thursday – even in the final days before Tuesday’s key election – was reportedly with a goal to press the Russian president on essentially ignoring Israel’s attacks in Syria. Citing further sources in the British-Arabic Independent Arabia, The Jerusalem Post continues: According to the Russian source, Putin let Netanyahu know that his country will not allow any damage to be done to the Syrian regime’s army, or any of the weapons being given to it… Israel sources cited by the Arabic newspaper described Netanyahu’s attempts to persuade Putin as “a failure”. This in spite of Netanyahu telling reporters after the meeting that his relations with Moscow were stronger than ever.

Israel is going to defend the US?

• US, Israel Talk About Mutual Defense Treaty – Trump (RT)

The US and Israel are discussing a mutual defense treaty that would further cement the already “tremendous” alliance between the two countries, President Donald Trump has revealed. “I had a call today with Prime Minister Netanyahu to discuss the possibility of moving forward with a Mutual Defense Treaty, between the United States and Israel, that would further anchor the tremendous alliance between our two countries,” Trump tweeted. Trump voiced not-that-veiled support for Benjamin Netanyahu ahead of the upcoming parliamentary elections in Israel. “I look forward to continuing those discussions after the Israeli Elections when we meet at the United Nations later this month!” Trump wrote.

The support surely comes in handy, as Netanyahu’s backing appears to be quite shaky. The September 17 polls are the second snap legislative elections this year after Netanyahu failed to form the government back in April. The outcome of the upcoming vote is hard to predict, as Netanyahu’s party, Likud, has almost equal support as their main opponent the Blue and White led by Benny Gantz, opinion polls show. Netanyahu was quick to respond to Trump’s announcement, lauding the prospects of the alliance and managing to call the US president a “friend” twice in a single tweet.

Netanyahu wanted to bomb Syria to support himself in the Sep 17 Knesset elections. Putin said we’ll shoot down your jets.

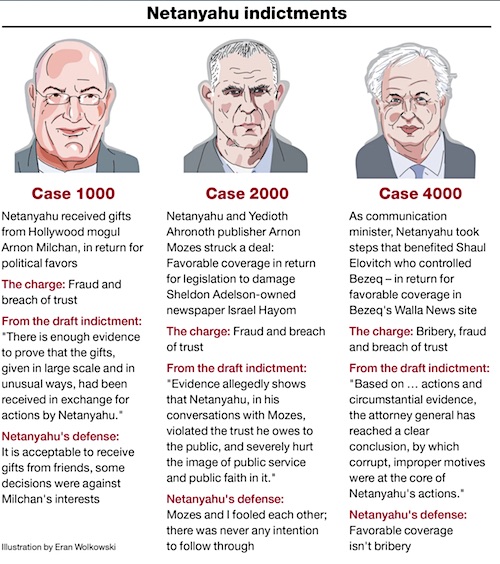

Netanyahu needs victory in the election to keep himself out of jail. He may be indicted by mid-October. Trump might want to reconsider who he’s friends with.

• Netanyahu’s Plan to Escape Trial (Haaretz)

Immediately after the last election, Prime Minister Benjamin Netanyahu outlined to members of his inner circle a plan to extract him from facing trial. The plan was based on obtaining immunity from the Knesset and passing legislation to prevent the High Court of Justice from removing that immunity. If his bloc wins 61 Knesset seats next week, Netanyahu will presumably resort to this rescue plan. For him it will be the Day of Judgment. “Stop being frightened. It’s time for them to be frightened,” Netanyahu told his confidants, referring to justice officials, headed by Attorney General Avichai Mendelblit and State Prosecutor Shai Nitzan, who have decided to indict him in three cases, subject to a hearing.

Netanyahu told his confidants why he insisted on his destructive plan, telling them he had lost all confidence in the legal system on all levels – the attorney general’s office, the state prosecutor and the court system. “They want me in prison,” he told one of his cronies, noting that if he were indicted that would indeed be the result – not because he had crossed a red line, but merely due to the jurists’ collective hostility toward him and his ideology. Netanyahu appears to wholeheartedly believe himself to be a victim, framed by prosecutors and that Mendelblit, who is weak, doesn’t believe in them at all, but couldn’t withstand the pressure.

In his interviews with the police Netanyahu acted like a hunted man. “It’s a wacky conception,” he told national fraud squad chief Koresh Bar-Nur in January 2017. Bar-Nur came to Netanyahu’s residence with a team of investigators to question him under caution on Case 2000, involving a bribery deal Netanyahu allegedly negotiated with Yedioth Ahronoth publisher Arnon “Noni” Mozes.

Trump was talking about lifting sanctions on Iran and then this happens?! That smells like Assad attacking his own people with chlorine just as things were getting better.

• US Blames Saudi Oil Strikes On Iran, Not Houthis (BBC)

US Secretary of State Mike Pompeo has blamed Iran for Saturday’s drone attacks on Saudi oil facilities. He dismissed a claim by Yemeni Houthi rebels that they had attacked the two facilities, run by state-owned company Aramco. Saudi Arabia’s energy minister said the strikes had reduced crude oil production by 5.7 million barrels a day – about half the kingdom’s output. Correspondents say they could have a significant impact on world oil prices. TV footage showed a huge blaze at Abqaiq, site of Aramco’s largest oil processing plant, while a second drone attack started fires in the Khurais oilfield. The Saudis lead a Western-backed military coalition supporting Yemen’s government, while Iran backs the Houthi rebels.

If the rebels were responsible for the attacks, their drones would have had to fly hundreds of miles from Yemen into central Saudi Arabia. Meanwhile experts are investigating whether the attacks could have been carried out from the north – either by Iran or its Shia allies in Iraq – using cruise missiles rather than drones, the Wall Street Journal reports. Tensions between the US and Iran have escalated in recent months. since US President Donald Trump abandoned a deal limiting Iran’s nuclear activities last year and reinstated sanctions. In a tweet, Mr Pompeo said there was “no evidence” the drones came from Yemen. He described the attack as “an unprecedented attack on the world’s energy supply”.

The US and Saudi Aramco (its IPO is near) stand to gain most if oil prices shoot up.

• Global Spare Oil Capacity In US Hands After Saudi Outage (R.)

An attack on Saudi oil facilities on Saturday is believed to have disrupted half the country’s production capacity, making the United States the only real holder of the global supply cushion via its ability to raise own output or to soften sanctions against other major oil producers. Saudi Arabia has yet to comment on the extent of damage on its oil production but industry sources have said some 5-6 million barrels per day (bpd) or 5-6% of global supply have been affected. Saudi Arabia, the Organization of the Petroleum Exporting Countries’ de-facto leader and largest producer, has been long seen as the custodian of the world’s spare oil capacity.

Spare capacity is the extra oil a producing country can bring onstream and sustain at short notice, providing global markets with a cushion in the event of natural disaster, conflict or any other cause of an unplanned supply outage. Industry sources have said Saudi Arabia will be able to restore supply within days. A prolonged supply outage will have a major bullish impact on oil prices, which in turn will spur further gains in U.S. shale production. The United States has briefly overtaken Saudi Arabia as the world largest crude exporter this year, only a few years after removing a ban on oil exports because of large needs at home as the world’s largest oil consumer.

Analysts have repeatedly underestimated U.S. output growth gains with the country now producing around 15% of global supply. Besides the United States, the only countries which have significant spare capacity are Iran and Venezuela.

Only to replace it with much more expensive oil?

• US Stands Ready To Tap Emergency Oil Reserve After Saudi Attacks (R.)

The Trump administration is prepared to tap U.S. emergency oil reserves if necessary after drone attacks shut oil output in Saudi Arabia, the world’s largest crude exporter, a Department of Energy spokeswoman said. Energy Secretary Rick Perry “stands ready to deploy resources from the Strategic Petroleum Oil Reserves if necessary to offset any disruptions to oil markets as a result of this act of aggression,” spokeswoman Shaylyn Hynes said. Yemen’s Iran-aligned Houthi group claimed credit for Saturday’s attacks on two plants at the heart of Saudi Arabia’s oil industry, including the world’s biggest petroleum processing facility Abqaiq.

Perry directed department leaders to work with the Paris-based International Energy Agency (IEA) “on potential available options for collective global action if needed,” Hynes said. The IEA said on Twitter earlier in the day that it was in contact with Saudi authorities and other major oil-producing nations, and that markets for now are well-supplied. The United States has occasionally coordinated with the IEA on collective draw downs of oil from international reserves. The SPR, held in heavily-guarded underground storage caverns on the Texas and Louisiana coasts, currently holds nearly 645 million barrels, or about the amount the United States consumes in a month.

Where are the British people protesting this?

• London Upper Tribunal Rejects La Repubblica’s Assange Docs Appeal (Maurizi)

The press does not have the right to access the full set of documents on the Julian Assange case. That is what judge Edward Mitchell finally ruled in an appeal taken to the London Upper Tribunal by la Repubblica, after we have spent the last four years trying to access the full documentation to investigate the Assange case and factually reconstruct it.

In an extremely technical judgement just made public and which the judge himself characterises as “unusually long”, Mitchell rejects our legal arguments and states that he believed public knowledge of Mr Assange’s case would not have increased if it was known that the CPS held information from the US State Department or Department of Justice. A rather incredible argument considering that the entire Assange case revolves around the role of the United States authorities, who want to get their hands on the WikiLeaks founder, extradite him to the US and jail him for life: establishing whether the British and US authorities discussed this possibility from the very beginning is crucial.

[..]Our attempt to access the documents has been hindered and hugely delayed in every jurisdiction. However, the very few documents we have obtained so far have allowed us to unearth crucial information. They provide indisputable evidence of the UK’s role in helping to create the legal and diplomatic quagmire which kept Julian Assange arbitrarily detained since 2010, as established by the United Nations Working Group on Arbitrary Detention (UNWGAD). In fact, it was the UK Crown Prosecution Service which advised the Swedish prosecutors against the only judicial strategy that could have brought the Swedish rape investigation to a quick closure: questioning Assange in London, rather than trying to extradite him to Stockholm. It was the Crown Prosecution Service which tried to dissuade the Swedish prosecutors from dropping the case in 2013. Finally, it was the Crown Prosecution Service that wrote to its Swedish counterpart: “Please do not think that the case is being dealt with as just another extradition request” and destroyed crucial documents, even though the case is still ongoing and very controversial.

When we tried to shed light on these facts, to understand why the British authorities acted this way and why the Assange case was not “just another extradition request”, we ran up against a true rubber wall, so much so that we were forced to sue the Crown Prosecution Service. Our first appeal to the London First-tier Tribunal was rejected: the judge established that the press has no right to access the documentation, because the need for the British authorities to protect the confidentiality of the extradition process outweighs the public interest of the press to know. Today, Judge Edward Mitchell has rejected our appeal to the Upper Tribunal. At this point it is not clear who will be able to introduce some transparency and oversight in the Assange case, considering that the press is not allowed to do so.

Selling a book.

• Johnson Is A Liar Who Only Backed Leave To Help His Career – Cameron (G.)

Boris Johnson is a liar who only backed the Leave campaign to help his career and Michael Gove was a “foam-flecked Faragist” whose “one quality” was disloyalty, David Cameron writes in his memoirs. The former prime minister poured vituperation on both his former colleagues Priti Patel, the current home secretary, and Dominic Cummings, the No 10 adviser, in extracts from the book published on Sunday. In what may be Cameron’s most explosive allegation yet, he effectively accused Boris Johnson of mounting a racist election campaign by focusing on Turkey and its possible accession to the EU. “It didn’t take long to figure out Leave’s obsession,” he writes. “Why focus on a country that wasn’t an EU member?

“The answer was that it was a Muslim country, which piqued fears about Islamism, mass migration and the transformation of communities. It was blatant.” Then Cameron echoes the explicitly racist Conservative campaign slogan used in Smethwick in 1964: “They might as well have said: ‘If you want a Muslim for a neighbour, vote “remain”.’” In Smethwick, Peter Griffiths had been elected as Conservative MP on the slogan “If you want a n**** for a neighbour, vote Labour.” Cameron writes that Johnson’s claims of concerns about British sovereignty were “secondary to another concern for Boris: what was the best outcome for him?”

Get ready for more fun.

• US To Hit EU With Billions In Tariffs After Victory In Airbus Case (Pol.eu)

The United States has gotten the green light to impose billions of euros in punitive tariffs on EU products in retaliation for illegal subsidies granted to European aerospace giant Airbus. Four EU officials told POLITICO that the World Trade Organization ruled in favor of the U.S. in the long-running transatlantic dispute and sent its confidential decision to Brussels and Washington on Friday. The decision means that U.S. President Donald Trump will almost certainly soon announce tariffs on European products ranging from cheeses to Airbus planes. One official said Trump had won the right to collect a total of between €5 billion and €8 billion. Another said the maximum sum was close to $10 billion.

The decision sets the stage for a showdown between Europe and Washington just as the EU is transitioning to new leadership under incoming Commission President Ursula von der Leyen and Trade Commissioner-designate Phil Hogan. In unveiling her team on Tuesday, von der Leyen signaled a robust approach to transatlantic disputes on trade and other issues with the Trump administration. aWashington has previously announced it would follow through with tariffs if it won the case in Geneva and has prepared a list of EU exports worth a total of $21 billion. The U.S. can choose products from that list and then tax them at different rates in order to claw back the total amount of damage resulting from the EU subsidies.

After EU nations agreed to take the refugees.

• Italy’s New Government Lets Charity Ship Head To Italian Port (R.)

Italy’s new government allowed a French charity ship to bring ashore 82 migrants on Saturday in an apparent reversal of the uncompromising, closed-door policy of the previous administration. However, Foreign Minister Luigi Di Maio, who heads the 5-Star Movement in the governing coalition, said the Ocean Viking was only being given access to the southern island of Lampedusa because other European states had agreed to take in many of those on board. The government formally took office on Tuesday, promising a fresh approach to migration following the hardline clampdown on rescue ships introduced by former interior minister Matteo Salvini, who heads the far-right League.

Prime Minister Giuseppe Conte said on Thursday that “several EU countries” had agreed to take in the Africans aboard the Ocean Viking but did not give further details. The ship is run by French charities SOS Mediterranee and Doctors Without Borders. It picked up the migrants off Libya earlier this week and had asked both Italy and Malta for permission to dock. Recent such requests from other boats had been rejected, leaving migrants stranded at sea for prolonged periods. The center-left Democratic Party (PD), which has replaced the League in the ruling coalition, applauded the announcement that the vessel had been given access to Lampedusa.

As long as it pays more to cut and burn trees than to grow them or just leave them alone, this is inevitable.

• World ‘Losing Battle Against Deforestation’ (BBC)

A historic global agreement aimed at halting deforestation has failed, according to a report. An assessment of the New York Declaration on Forests (NYDF) says it has failed to deliver on key pledges. Launched at the 2014 UN climate summit, it aimed to half deforestation by 2020, and halt it by 2030. Yet deforestation continues at an alarming rate and threatens to prevent the world from preventing dangerous climate change, experts have said. The critique, compiled by the NYDF Assessment Partners (a coalition of 25 organisations), painted a bleak picture of how the world’s forests continue to be felled.

“Since the NYDF was launched five years ago, deforestation has not only continued – it has actually accelerated,” observed Charlotte Streck, co-founder and director of Climate Focus, which co-ordinated the publication of the report. The report says the amount of annual carbon emissions resulting from deforestation around the globe are equivalent to the greenhouse gases produced by the European Union. On average, an area of tree cover the size of the United Kingdom was lost every year between 2014 and 2018. Tropical forest loss accounts for more than 90% of global deforestation, with the hotspot being located in Amazon Basin nations of Bolivia, Brazil, Colombia and Peru.

Your must read for the Sunday. Excellent. You’ll know a lot more about the CIA in Moscow, and in the US elections.

• The Spy Who Failed (Scott Ritter)

Oleg Smolenkov was a controlled asset of the CIA. While he was given certain latitude on what information he could collect, generally speaking Smolenkov worked from an operations order sent to him by his CIA controllers which established priorities for intelligence collection based upon information provided by Smolenkov about what he could reasonably access. Before tasking Smolenkov, his CIA handlers would screen the request from an operational and counterintelligence perspective, conducting a risk-reward analysis that weighed the value of the intelligence being sought with the possibility of compromise. Only then would Smolenkov be cleared to collect the requested information.

It is not publicly known what prompted the report from Smolenkov which Brennan found so alarming. Was it received out of the blue, a target of opportunity which Smolenkov exploited? Was it based upon a specific tasking submitted by Smolenkov’s CIA handlers in response to a tasking from above? Or was it a result of the intervention of the CIA director, who tasked Smolenkov outside normal channels? In any event, once Brennan created his special analytical unit, Smolenkov became his dedicated source. If Smolenko was in this for the money, as appears to be the case, he would have been motivated to come up with the “correct” answer to Brennan’s tasking for information on Putin’s role. By late 2016, Western media had made quite clear what kind of answer Brennan wanted.

Every intelligence report produced by a controlled asset is subjected to a counterintelligence review where it is examined for any evidence of red flags that could be indicative of compromise. One red flag is the issue of abnormal access. Smolenkov did not normally have direct contact with Putin, if ever. His intelligence reports would have been written from the perspective of the distant observer. His report about Putin’s role in interfering in the 2016 election, however, represented a whole new level of access and trust. Under normal circumstances, a report exhibiting such tendency would be pulled aside for additional scrutiny; if the report was alarming enough, the CIA might order the agent to be subjected to a polygraph to ensure he had not been compromised.