Paul Klee Analysis of Various Perversities 1922

Davis is getting upset. He’s offering a free copy of his Trump book to every American at the link.

• The Little Putsch That Could Beget a Great Big Coup (Stockman)

Let’s start with two obvious points about the whole Russia fiasco… Namely, there is no “there, there.” First off, the president has the power to declassify secret documents at will. But in this instance he could also do that without compromising intelligence community (IC) “sources and methods” in the slightest. That’s because after Edward Snowden’s revelations in 2013, the whole world was put on notice — and most especially Washington’s adversaries — that it collects every single electronic digit that passes through the worldwide web and related communications grids. Washington essentially has universal and omniscient SIGINT (signals intelligence). Acknowledging that fact by publishing the Russia-Trump intercepts would provide new knowledge to exactly no one. Nor would it jeopardize the lives of any American spy or agent (HUMINT).

It would just document the unconstitutional interference in the election process that had been committed by the U.S. intelligence agencies and political operatives in the Obama White House. That pales compared to whatever noise comes out of Langley (CIA) and Ft. Meade (NSA). And I do mean noise. Yes, I can hear the boxes on the CNN screen harrumphing that declassifying the “evidence” would amount to obstruction of justice! That is, since Trump’s “crime” is a given (i.e. his occupancy of the Oval Office), anything that gets in the way of his conviction and removal therefrom amounts to “obstruction.” Given that he is up against a Deep State/Democratic/Neoconservative/mainstream media prosecution, the Donald has no chance of survival short of an aggressive offensive of the type I just described. But that’s not happening because the man is clueless about what he is doing in the White House.

And he’s being advised by a cacophonous coterie of amateurs and nincompoops. So he has no action plan except to impulsively reach for his Twitter account. That became more than evident — and more than pathetic, too — when he tweeted out an attack on his own Deputy Attorney General, Rod Rosenstein. At least Nixon fired Elliot Richardson (his Attorney General) and Bill Ruckelshaus (Deputy AG): “I am being investigated for firing the FBI Director by the man who told me to fire the FBI Director! Witch Hunt.” Alone with his Twitter account, clueless advisors and pulsating rage, the Donald is instead laying the groundwork for his own demise. Were this not the White House, this would normally be the point at which they send in the men in white coats with a straight jacket.

[..] Even Senator John Thune, an ostensible Swamp-hating conservative, had nothing but praise for Special Counsel Robert Mueller, that he would fairly and thoroughly get to the bottom of the matter. No he won’t! Mueller is a card-carrying member of the Deep State who was there at the founding of today’s surveillance monster as FBI Director following 9/11. Since the whole $75 billion apparatus that eventually emerged was based on an exaggerated threat of global Islamic terrorism, Russia had to be demonized into order to keep the game going — a transition that Mueller fully subscribed to.

“One thing that I am concerned about – because I’ve seen it happen so often over the years, are false flags.”

• US Should Mind Its Own Business; It Shouldn’t Be In Syria (Ron Paul)

RT: Australia halted its cooperation. How significant is this development? Why did they do it? Ron Paul: I think that is good. Maybe wise enough, I wish we could do the same thing – just come home. It just makes no sense; there’s a mess over there. So many people are involved, the neighborhood ought to take care of it, and we have gone too far away from our home. It has been going on for too long, and it all started when Obama in 2011 said: “Assad has to go.” And now as the conditions deteriorate …it looks like Assad and his allies are winning, and the US don’t want them to take Raqqa. This just goes on and on. I think it is really still the same thing that Obama set up – “Get rid of Assad” and there is a lot of frustration because Assad is still around and now it is getting very dangerous, it is dangerous on both sides.

One thing that I am concerned about – because I’ve seen it happen so often over the years, are false flags. Some accidents happen. Even if it is an honest accident or it is deliberate by one side or the other to blame somebody. And before they stop and think about it, then there is more escalation. When our planes are flying over there and into airspace where we shouldn’t be, and we are setting up boundaries and say “don’t cross these lines or you will be crossing our territory.” We have no right to do this. We should mind our own business; we shouldn’t be over there, when we go over there and decide that we are going to take over, it is an act of aggression, and I am positively opposed to that. And I think most Americans are too if they get all the information they need.

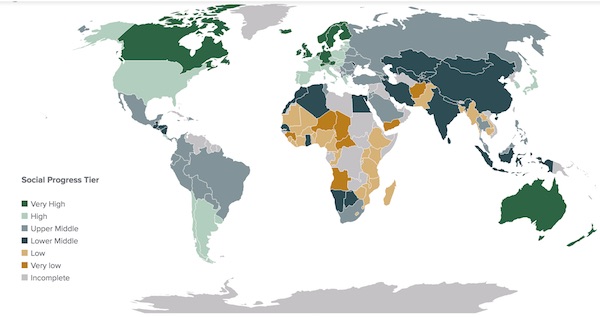

“..the US received its lowest marks in the categories of “tolerance and inclusion” and “health and wellness.“

• US Is A “Second Tier” Country (ZH)

Most Americans’ idea of happiness involves lounging by the water or on a beach somewhere. But it turns out, human happiness can flourish even in freezing climates far from the equator. To wit, the Social Progress Imperative, a US-based nonprofit, released the results of its annual Social Progress Index report, which purports to rank countries based on the overall wellbeing of their citizens. Four Scandinavian countries – Denmark, Finland, Iceland and Norway claimed the top spots, while the US placed 18th out of 128, leaving it in what the SPI defines as the “second-tier” of countries based on citizens’ wellbeing, according to Bloomberg. Luckily, being “second-tier” doesn’t seem that bad, according to a definition found in the report. “Second-tier countries demonstrate “high social progress” on core issues, such as nutrition, water, and sanitation.

However, they lag the first-tier, “very high social progress” nations when it comes to social unity and civic issues. That more or less reflects the U.S. performance. (There are six tiers in the study.)” “We want to measure a country’s health and wellness achieved, not how much effort is expended, nor how much the country spends on healthcare,” the report states. In a nod to the controversy surrounding President Donald Trump’s anti-immigrant rhetoric, as well as his efforts to repeal and replace Obamacare, the report noted that the US received its lowest marks in the categories of “tolerance and inclusion” and “health and wellness.” America’s “tolerance” score has been sliding since 2014, around the time that several high-profile shootings of unarmed black men ignited the “Black Lives Matter” movement, sparking a national conversation about the prevalence of racism in US society.

Just very slowly.

• America Grows Older And More Ethnically Diverse (BBG)

The United States is growing older and more ethnically diverse, a trend that could put strains on government programs from Medicare to education, the Census Bureau reported Thursday. Every ethnic and racial group grew between 2015 and 2016, but the number of whites increased at the slowest rate — less than one hundredth of 1% or 5,000 people, the Census estimate shows. That’s a fraction of the rates of growth for non-white Hispanics, Asians and people who said they are multi-racial, according to the government’s annual estimates of population. President Donald Trump’s core support in the racially divisive 2016 election came from white voters, and polls showed that it was especially strong among those who said they felt left behind in an increasingly racially diverse country.

In fact, the Census Bureau projects whites will remain in the majority in the U.S. until after 2040. “Even then, (whites) will still represent the nation’s largest plurality of people, and even then they will still inherit the structural advantages and legacies that benefit people on the basis of having white skin,” said Justin Gest, author of “The New Minority,” a book about the 2016 election. The Census Bureau reported that the median age of Americans — the age at which half are older and half are younger — rose nationally from just over 35 years to nearly 38 years in the years between 2000 and 2016, driven by the aging of the “baby boom” generation. The number of residents age 65 and older grew from 35 million to 49.2 million during those 16 years, jumping from 12% of the total population to 15%.

That’s a costly leap for taxpayers as those residents move to Medicare, government health care for seniors and younger people with disabilities, which accounted for $1 out of every $7 in federal spending last year, according to the Kaiser Family Foundation. By 2027, it will cost $1 out of every $6 of federal money spent. Net Medicare spending is expected to nearly double over the next decade, from $592 billion to $1.2 trillion, the KFF reported.

Excellent take-down from Yves.

• The Wheels Come Off Uber (Yves Smith)

Not surprisingly, the financial press has been all ago about the drama of Travis Kalanick’s forced departure from Uber’s CEO position yesterday, and has focused on getting salacious insider details of his ouster. That means journalists largely ignored what ought to be the real story, which is whether Uber has any future. I anticipate that Hubert Horan will offer a longer-form treatment of this topic. Hubert had already documented, in considerable detail in his ten-part series, how Uber has no conceivable path to profitability. Its business model has been based on a massive internal contradiction: using a ginormous war chest to try to achieve a near-monopoly position in a low-margin, mature business that is fragmented geographically and locally.

Monopolies and oligopolies are sustainable only when certain factors are operative: the ability to attain a superior cost position through scale economies, which include network effects, or barriers to entry, such as regulations, very high skill levels, or high minimum investment requirements. Neither of these apply in the local car ride business. Even if Uber were able to drive literally every competing cab operator in the world out of business due to its ability to continue its predatory pricing, once Uber raised prices to a level where it achieved profits, new entrants (or revived old entrants) would come in. Uber will thus never be able to charge the premium prices (in excess of the level for a traditional taxi operator to be profitable) for the very long period necessary for Uber to merely be able to recoup the billions of dollars it has burned, mainly in subsidizing the cost of rides, let alone to achieve an adequate return on capital.

And that’s before you get to the fact that systematically much higher prices would mean fewer fares. The developments of the last few months mean Uber’s decay path is sure to accelerate. I’ve been following the business press for over 30 years. I can’t think of a single case where even an established, profitable business with an established franchise has had so many top level positions vacant, and for such bad reasons. As reader vidimi quipped, “With no CEO, CFO, COO, and CIO, uber is coming very close to becoming a self-driving company.” And that’s not even a full list. World-class communications expert Rachel Whetstone, who is recognized as a key force in rebuilding the Tories’ brand in the UK, quit in April.

The heads of engineering departed for failing to disclose a previous sexual investigation; the head of product and growth was forced out over a sexual impropriety at a company function. And in a scandal that will have a much longer tail, Uber’s former head of its Waymo driverless car unit, Anthony Levandowski, has had his case involving alleged theft of intellectual property from Google referred to the Department of Justice. Kalanick was deeply involved in Levandowski sudden exodus. It seems implausible that Kalanick didn’t know Levandowski was making off with Google files. If the case does lead to a criminal prosecution, it is hard to see how Kalanick could escape scrutiny as a potential criminal co-conspirator.

Just in case you were wondering why King Salman named a new crown prince…

• Oil Prices ‘Like A Falling Knife’ (CNBC)

Oil prices could be poised to fall below $40 a barrel before too long, according to an analyst at Energy Aspects, as the commodity appeared set to post its largest price slide in the first half of the year for the past two decades. “This is like a falling knife right now, I genuinely haven’t seen sentiment this bad ever,” Amrita Sen, the co-founder and chief oil analyst at Energy Aspects, told CNBC on Wednesday. “We have had clients emailing saying they have been trading this for 20 or 30 years and they have never seen something like this,” she added. Oil prices have tumbled more than 20% his year, marking its worst performance for the first six months of the year since 1997 and putting the commodity in bear market territory.

The ongoing decline in prices appears to have stemmed from investors discounting evidence of robust compliance by OPEC and non-OPEC producers with a deal to curtail a global supply overhang. Prices took a fresh leg lower in the previous session – dipping 2% – as new signs of rising output from Nigeria and Libya, the two OPEC members exempt from a deal to cut production. Output from the 14-member exporter group ticked higher in May due to rising production in Nigeria, Libya and Iraq, raising concerns about OPEC’s effort to shrink global stockpiles of crude oil. OPEC and other producers have committed to keeping 1.8 million barrels a day off the market through March. Libya’s oil production rose more than 50,000 barrels per day to 885,000 bpd. Meanwhile, exports of Nigeria’s benchmark Bonny Light crude oil are set to rise by 62,000 barrels per day in August.

Absolutely. He’s the War Prince.

• The Rise of a Prince Ends Doubts Over Saudi Arabia’s Direction (BBG)

With the anointment of Prince Mohammed bin Salman as heir to the Saudi throne, any doubts over the continuation of policies that have shaken up the Middle East have gone. Western diplomats already referred to the 31-year-old as “Mr. Everything,” because of his control over most aspects of domestic, foreign and defense affairs. His elevation ends a behind-the-scenes struggle for power and answers the question of what would happen to his plans for Saudi Arabia when King Salman, now 81, dies or steps aside. The most ambitious of these, Vision 2030, seeks to recalibrate the economy to end the country’s near-total dependence on oil revenue. But internationally, there are also ramifications. Last month, the prince again raised the stakes in the regional rivalry with Iran, saying that dialog was “impossible” as they fight a proxy war in Yemen.

He also led a multi-nation effort to isolate neighboring Qatar, causing a rift among fellow members of the Gulf Cooperation Council. That also looks set to turn into another long and potentially fruitless test of wills as Iran and Turkey come to Qatar’s aid. “The switch offers him the legitimacy and consensus of becoming the next king and that will validate his vision, his plans and his policies,” said Sami Nader, head of the Beirut-based Levant Institute for Strategic Affairs. “There were a lot of question marks about the future of Saudi Arabia and the transition. Now this debate has ended.” Widely known as MBS, he was made crown prince just after dawn in Riyadh, displacing his older cousin, Mohammed bin Nayef, who was also stripped of his post as interior minister in charge of domestic security forces and counter-terrorism policy.

The move was neither a shock nor a coup, and it means he could be running the kingdom for decades to come. What’s more, his tough approach to the intractable problems of the Middle East would appear to mesh well with U.S. President Donald Trump, who visited Saudi Arabia last month. Trump called the new crown prince Wednesday to offer congratulations on his elevation, the White House said in a statement. Trump and the prince “committed to close cooperation to advance our shared goals of security, stability, and prosperity across the Middle East and beyond,” according to the statement. The problem is what comes next. On Tuesday, the U.S. Department of State questioned Saudi Arabia’s justification at striking out at Qatar by cutting it off from diplomatic and transport links.

The bombing campaign in Yemen aimed at destroying the rebel Houthi forces that Saudi Arabia sees as proxies for Iran, meanwhile, appears to have no end in sight. Two years later, it has become bogged down, bloody and increasingly unpopular. “On the foreign policy side he’s also embroiled Saudi Arabia in Yemen and Qatar without an exit strategy,” said James Dorsey at Singapore’s Nanyang Technological University. These aren’t changes of direction for Saudi Arabia, but “what he has done is to stretch up a notch and put some very sharp edges on it, and at this point those are backfiring.”

Any Canadian with a substantial mortgage who’s not actively trying to sell right now…..

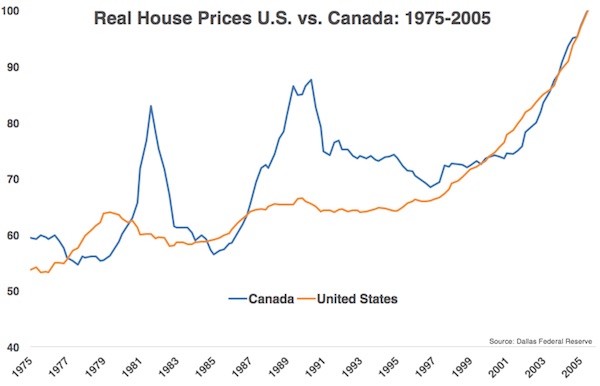

• Canada’s Housing Bubble Will Burst (BBG)

Canadian home sales fell the most in five years last month. That didn’t stop an increase in prices, which were up 18% nationwide from a year earlier. When you consider that most houses are leveraged assets, this represents huge gains for homeowners. While leverage can help boost performance on the way up, it becomes very dangerous on the way down. Leverage can turn even the best investments into poor ones when things go wrong, as losses are amplified. Equity can get wiped out pretty quickly on an overleveraged asset. Canadian real estate has been on fire for years. The housing price data there has made the U.S. real estate market during the boom of the mid-2000s look mild. The Federal Reserve Bank of Dallas puts out a global housing price index for more than 20 countries every quarter. Using this data, I looked at the real house price index data for Canada and compared it with the same data in the U.S. going back to 1975. Here’s this relationship from 1975 through the end of 2005:

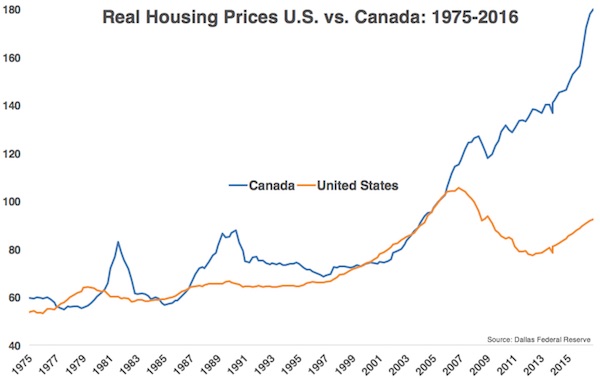

Although there were some divergences in the early and late 1980s, both housing markets essentially ended up in the same place after 30 years. Now let’s add in the most recent data to see how things have unfolded since:

An enormous divergence occurred in 2006, when U.S. housing prices really began to soften, while Canadian price barely skipped a beat. This makes any differences in the past look like blips. The rise in Canadian real estate prices has been relentless. The U.S. housing market peaked in late 2006. Since then, based on this index, U.S. housing prices are still down almost 13% from their peak through the end of 2016. In that same time frame, Canadian housing prices are up 56%. From the 2006 peak, it took until late 2012 for real estate in the U.S. to bottom. We’ve since witnessed a 19% recovery from what was a 27% decline nationwide, on average. While the U.S. real estate downturn lasted almost six years, Canada’s housing market experienced just a 7% drawdown that lasted less than a year. And house prices in Canada reclaimed those losses in about a year and a half. Canadian housing has also outpaced its neighbors to the south since the 2012 bottom in U.S. real estate, with a 30% gain in that time.

You can’t even blame these people. It’s the whole crazy idea of cities and governments blowing housing bubbles on purpose, that’s what’s wrong here.

• Rehousing Of Grenfell Tower Families In Luxury Block Gets Mixed Response (G.)

Two miles south of the charred skeleton of Grenfell Tower is a large complex of sleek new apartments that some of those displaced by last week’s inferno will soon be able to call home. Kensington Row’s manicured lawns, clipped trees and burbling fountains are a haven from the rumbling traffic of two busy London thoroughfares, and its spacious, air-conditioned foyers a relief from June’s oppressive heatwave. Four unfinished blocks house the 68 flats purchased by the Corporation of London for families who lost their homes in Grenfell Tower. Workmen had been instructed not to talk to the media, but one said there was now a rush to complete the building work. “It’s a brilliant idea,” he said of the resettlement plan. Among those exercising dogs and small children, the views were more mixed. “It’s so unfair,” said Maria, who was reading the news in the Evening Standard with two neighbours.

She bought her flat two years ago for a sum she was unwilling to disclose. “We paid a lot of money to live here, and we worked hard for it. Now these people are going to come along, and they won’t even be paying the service charge.” Nick, who pays £2,500 a month rent for a one-bedroom flat in the complex, also expressed doubts about the plan. “Who are the real tenants of Grenfell Tower?” he asked. “It seems as though a lot of flats there were sublet. Now the people whose names are on the tenancies will get rehoused here, and then they’ll rent the flats out on the private market. And the people who were actually living unofficially in the tower at the time of the fire won’t get rehoused. “I’m very sad that people have lost their homes, but there are a lot of people here who have bought flats and will now see the values drop. It will degrade things. And it opens up a can of worms in the housing market.”

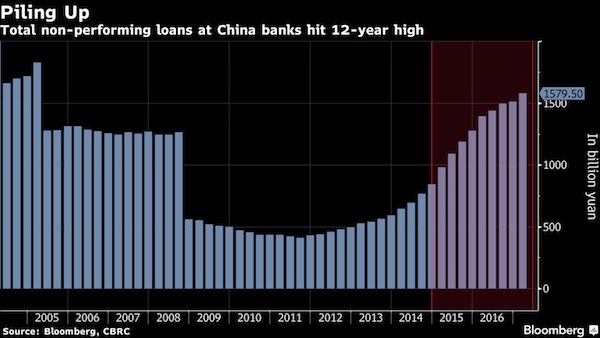

When your bad debt is in a bubble, I guess you got it made?! Or should that be: you should be afraid?

• China NPL Prices Up 30% as New Gold Rush Gets Under Way (BBG)

Bad loans are rapidly becoming the latest hot commodity in China as more domestic and foreign investors rush into the market and bid up prices. Non-performing loan prices have risen more than 30% this year, according to distressed investor Belos Capital Asia. The average selling price of NPLs has climbed to around 50 cents on the dollar in the past two years, from 30 cents, said Victor Jong, a partner in the deals and business recovery services unit of PricewaterhouseCoopers in Shanghai. Such a high level is “very rare” in international markets, Jong said. “There are just too many buyers grabbing a limited supply of NPLs,” said Hanson Wong, CEO of Belos Capital in Hong Kong. “At these prices, it’s pretty hard for these NPLs to be profitable.” Distressed investors are increasing as Chinese authorities encourage market-oriented ways to resolve lenders’ mounting piles of non-performing debt amid slowing economic growth.

A jump in valuations of real estate, which often act as underlying assets for secured loans, has boosted the debt’s recovery prospects. Combined with a surge in money supply, this has lifted bad-loan prices even in some less-developed regions of China, according to domestic distressed debt investor Bald Eagle Asset Management. Foreign investors including Oaktree Capital, Lone Star, Goldman Sachs and PAG have bought China NPLs in the current cycle that began in 2014, according to a March report from PwC. Non-performing loans at the country’s lenders jumped 61% in the past two years to 1.58 trillion yuan ($231 billion) at the end of March. In the previous NPL cleanup in China, between 2001 and 2008, secured debt was typically sold at 20 cents on the dollar, and unsecured creditors got back only 5 cents, said Wang Yingyi, a partner at Bald Eagle in Beijing.

Looks like Greece should try China’s bad debt recipe.

• Strong Interest, Low Price For NPLs of Greece’s Eurobank (K.)

The loans portfolio put up for sale by Eurobank is attracting strong investment interest but low offers as the lender begins the process for the transfer of nonperforming loans. This is a portfolio valued at €2.8 billion which has attracted the interest of about 20 investment funds in the data room, illustrating the strong leverage the NPL market commands, partly due to the banks’ commitment to reducing their bad loans by 40% by the end of 2019. The portfolio that Eurobank is selling includes debt from consumer loans and credit cards that have gone unpaid for years, most for at least a decade – i.e. since before the financial crisis broke.

Eurobank has made all the necessary moves for the collection of part of the €2.8 billion, without getting a great response. Therefore the prices in the market are expected to be particularly low for the portfolio, with estimates speaking of just 5% of the original value. Market professionals note that Eurobank’s effort to recover part of the dues just before the opening of the portfolio’s sale, offering debtors a haircut of up to 95% without any significant results, means that the price will likely drop below 5% too.

Greeks are still stuck in the mindset of being proud to be deemed worthy of being a full member of the EU. So much so that they can’t see they’re not.

• Greeks Skeptical About Benefits, Prospects of EU (K.)

As the European Union’s cohesion faces being sorely test by the upcoming Brexit negotiations and other challenges, Greeks appear increasingly skeptical about the benefits and prospects of the EU, according to a new study by London-based international policy institute Chatham House and research company Kantar. 74% of Greeks are worried about the outlook for the EU, according to the survey which was carried out on a sample of 1,000 people in 10 European countries: Britain, Belgium, Germany, Greece, Spain, France, Italy, Austria, Hungary and Poland.

The Greek figure was almost double the research average of 38%. Greeks were also significantly more downbeat than their counterparts, with 60% declaring themselves to be pessimistic compared to a research average of 40%. An even larger proportion of Greeks, 80%, said they believed more members of the bloc would follow Britain’s lead and decide to break away from the Union in the next 10 years. Predictably, following seven years of belt-tightening imposed by foreign creditors, a significant proportion of Greeks (67%) said that austerity was the EU’s biggest failure. 73% of Greeks believe that the decision of Britain to leave the EU will weaken the Union.

A debt colony AND a tourist colony. With most of the best assets sold off to foreigners.

BTW, both Greeks and tourists would be much better off if Greece had its own currency and could lower daily prices.

• Greek Tourism Minister Says Arrivals Will Top 30 Million This Year (K.)

The tourism sector is showing genuine signs of growth this year that suggest it will be the main driver of the Greek recovery, as it will help state revenues, the private economy, the country’s current accounts and employment. The government is for the first time speaking of 30 million arrivals in 2017. Bank of Greece data show that in the first four months of the year travel receipts increased by 2.4% or 23 million euros year-on-year, reaching 997 million euros. This increase was thanks to the 3.2% rise in arrivals and not average spending per trip, which posted a 0.8% decline. This means the 4.8% drop in travel receipts during the first quarter was offset in April, when arrivals rose 12% and receipts 11.3% annually. This positive picture is expected to have continued in May.

Retail sector representatives are looking forward to cashing in on the increase in arrivals, to offset the losses resulting from Greek households’ ever shrinking disposable incomes. Based on the bookings picture, turnover in retail commerce could rise by up to 5% this year. Addressing a conference organized by the Panhellenic Exporters Federation, Tourism Minister Elena Kountoura said that the data of the first five months point to an increase in arrivals, revenues, nights stayed and occupancy rates. They also show an increase in bookings for the summer ranging between 15 and 70%, depending on area, which led to her conclusion that Greece will have more then 30 million tourists this year after welcoming 28 million in 2016 and 26 million in 2015. The growth in tourism is also reflected in employment and commerce. The number of unemployed registered last month dropped by 56,820 people from April to 913,518, mainly thanks to the rise in seasonal employment in tourism and commerce.