Pablo Picasso Les femmes d’Alger Version 0 1955

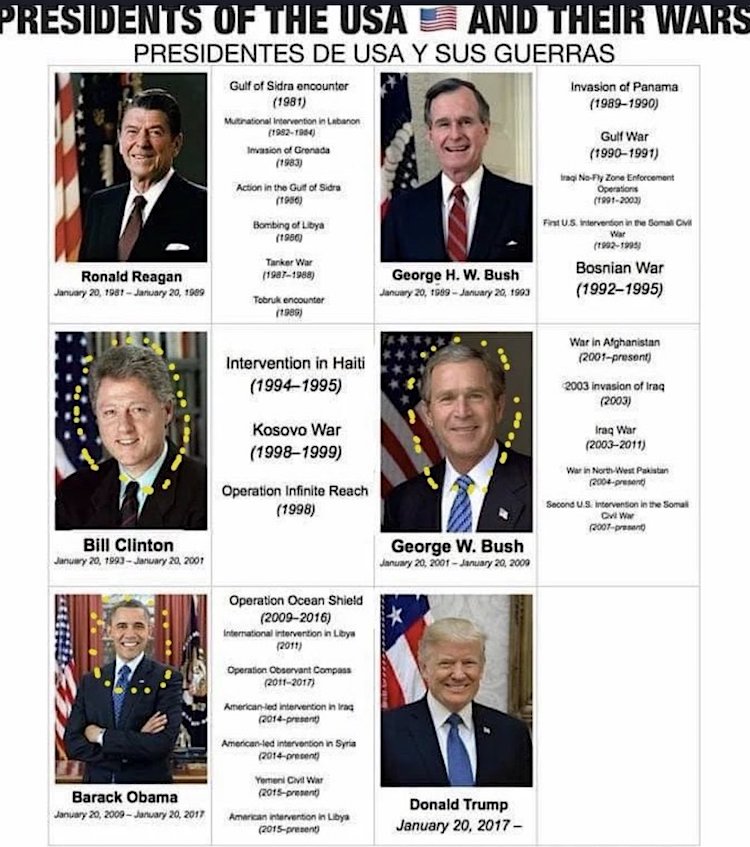

Great War of 2020

https://twitter.com/i/status/1327831816313704448

“We are not a people of perpetual war — it is the antithesis of everything for which we stand and for which our ancestors fought. All wars must end,” the memo reads. “Ending wars requires compromise and partnership. We met the challenge; we gave it our all. Now, it’s time to come home.”

• New US Defense Chief Tells Troops ‘Time To Come Home’ (F24)

Newly appointed Pentagon chief Christopher Miller signaled Saturday that he could accelerate the withdrawal of US troops from Afghanistan and the Middle East, saying, “It’s time to come home.” “All wars must end,” Miller, named acting defense secretary by President Donald Trump on Monday, said in his first message to the US armed services. He said that the US is committed to defeating Al Qaeda, 19 years after the September 11 attacks on the United States, and is “on the verge of defeating” the group. “Many are weary of war — I’m one of them,” he wrote in the message, dated Friday but posted early Saturday on the Defense Department’s website. “But this is the critical phase in which we transition our efforts from a leadership to supporting role,” he said.

“Ending wars requires compromise and partnership. We met the challenge; we gave it our all. Now, it’s time to come home.” Miller did not mention specific US troop deployments, but the reference to Al Qaeda appeared to single out Afghanistan and Iraq, where US troops were deployed after the September 11 attacks. The former US special forces officer and counterterrorism expert was named to lead the Department of Defense after Trump fired Mark Esper. Trump, who lost to Democrat Joe Biden in the November 3 election, has been pressing to pull US forces out of both countries since he came into office four years ago. Any such action would have to come in the 67 days before Biden takes office on January 20.

Esper cut US forces in Afghanistan by nearly two-thirds in the wake of the February 29 US-Taliban peace deal. But, drawing a line, he said he would hold troop numbers at 4,500 after this month until the Taliban, as they negotiate with the government in Kabul, follow through on pledged reductions in violence. Trump, however, has pushed for continued cuts, tweeting that he wants the troops “home by Christmas,” December 25. His national security advisor Robert O’Brien has said the goal is to cut to 2,500 by February.

It’s a long list.

• Biden’s Transition Team: War Profiteers, Beltway Chickenhawks (GZ)

A glance at the Biden-Harris agency review teams should provide a rude awakening to anyone who believed a Biden administration could be “pushed to the left” An eye-popping array of corporate consultants, war profiteers, and national security hawks have been appointed by President-elect Joe Biden to agency review teams that will set the agenda for his administration. A substantial percentage of them worked in the United States government when Barack Obama was president. The appointments should provide a rude awakening to anyone who believed a Biden administration could be pressured to move in a progressive direction, especially on foreign policy. If the agency teams are any indication, Biden will be firmly insulated from any pressure to depart from the neoliberal status quo, which the former vice president has pledged to restore.

Instead, he is likely to be pushed in an opposite direction, towards an interventionist foreign policy dictated by elite Beltway interests and consumed by Cold War fever. A prime example of the interventionist-minded establishment-oriented figures filling the Biden-Harris Defense Department agency team is Lisa Sawyer. She served as director for NATO and European strategic affairs for the National Security Council from 2014 to 2015, and worked for Wall Street’s JPMorgan Chase as a foreign policy adviser. Sawyer was part of the Center for a New American Security’s “Task Force on the Future of US Coercive Economic Statecraft,” which essentially means she participated in meetings that focused on methods of economic warfare that could be used to destabilize countries that refused to bow to American empire.

Sawyer believes the US government is not doing enough to deter Russian “aggression,” US troop levels in Europe should return to the levels they were at in 2012, and offensive weapons shipments to Ukraine should continue and increase in violation of the Minsk Agreements. “Instead of saying we will lift sanctions when Russia decides to comply with the next agreement, say that we will raise them until they do. Instead of kowtowing to Russia’s supposed spears of influence, provide Ukraine the lethal assistance it so desperately needs and increase US support to vulnerable nations in the gray zone,” Sawyer declared when testifying before the Senate Armed Services Committee in 2017.

US assistant secretary of state for African affairs Linda Thomas-Greenfield was appointed leader of the Biden-Harris State Department team. She is a stalwart ally of former US national security adviser Susan Rice, who pushed for war in Libya, supported the invasion of Iraq, and was involved in the decision to remove peacekeepers from the United Nations which enabled Rwanda genocide. As a developer and manager for US policy toward sub-Saharan Africa, she cheered President George W. Bush’s Millennium Challenge Account, a neocolonialist policy designed to privilege US corporations and facilitate the economic exploitation of so-called emerging African economies.

And then there’s more. Enjoy your cabal.

• The Filthy Rich War Hawks That Make up Biden’s New Foreign Policy Team (MPN)

Biden is no stranger to the rich and powerful. He kicked off his presidential campaign last year with a dinner for ultra-rich patrons at a Manhattan hotel, insisting that “nothing would fundamentally change” if he were elected, reassuring them that he would never demonize the rich and that they were not at fault for growing inequality. “I need you very badly,” he concluded. The former vice-president’s team is also looking to be made up of extremely wealthy individuals as well. His transition task squad has been, in his website’s words, crafted to ensure they “reflect the values and priorities of the incoming administration,” and includes executives from Lyft, Amazon, Capital One, Uber, Visa, and JP Morgan.

One name being strongly floated for a cabinet position is former mayor of Chicago Rahm Emanuel, a move being met with vocal opposition from the left. Emanuel’s first tour of duty in the White House came under President Bill Clinton, where he was one of the key architects of the North American Free Trade Agreement (NAFTA), a deal that decimated manufacturing in the Midwest, hobbled union power, and sent well paying blue-collar jobs to Mexico. In 2016, Trump constantly brought up NAFTA as a weapon to attack Hillary Clinton, winning him votes (and states) across the region. Emanuel also pushed through welfare “reform” bills that sharply reduced benefits for the poor and worked with Biden on the now-infamous 1994 Crime Bill, a key accelerator of mass incarceration.

He then left politics to pursue a lucrative career in finance — something that quickly netted him a reported $16 million fortune — before returning and becoming President Obama’s advisor and enforcer. Many of the president-elect’s potential picks for foreign policy positions — including Susan Rice and Michele Flourney — have onlookers worried. “With a Biden administration, we can expect a continuation of the Middle East wars and possible escalations in places like Syria. Biden could be better than Trump on Iran and Yemen, but judging by his potential cabinet picks, that should not be expected without significant pressure from antiwar activists and lobbyists in Washington,” Dave DeCamp, assistant news editor of AntiWar.com told MintPress.

“His administration will likely be more successful than Trump at expanding the empire, with a more diplomatic and coherent approach at building alliances to face Russia and China.” Rice, who was the U.S. ambassador to the United Nations and National Security Advisor under Obama, has amassed a fortune of around $40 million. After leaving office, she was given a spot on the board of Netflix, being paid $366,666 as a base salary. On top of that, she was given $2.3 million worth of the company’s stock. However, it is her husband, former ABC News executive producer Ian O. Cameron (whose father was a super-wealthy industrialist), who is the prime source of her wealth. She was a key driver in U.S. action in Libya, and also successfully lobbied Obama to place harsher sanctions on North Korea and Iran.

Unpossible, that was all Trump, remember?

• Cecilia Muñoz Defended Family Separations Under Obama, Joins Biden Team (DN)

Joe Biden has named President Obama’s former top immigration adviser Cecilia Muñoz to his transition team. During her time in the White House, Muñoz often justified Obama’s harsh immigration enforcement policies, including the administration’s deportation of thousands of Central American children and its decision to kill an executive order that would have halted deportations. In 2011, Muñoz was interviewed by PBS’s Maria Hinojosa. Cecilia Muñoz: “At the end of the day, when you have an immigration law that’s broken and you have a community of 10 million, 11 million people living and working in the United States illegally, some of these things are going to happen, even if the law is executed with perfection. There will be parents separated from their children. We don’t have to like it, but it is a result of having a broken system of laws. And the answer to that problem is reforming the law.”

“Those now bleating about how dangerous his current assertions of election fraud are should remember they were the ones who smashed that particular glass house..”

• Biden Will Fail To Bring Back ‘Normal’ Politics (Cook)

The narrowly averted Trump second term has at least prompted liberal pundits to draw one significant lesson that is being endlessly repeated: Biden must avoid returning to the old “normal”, the one that existed before Trump, because that version of “normal” was exactly what delivered Trump in the first place. These commentators fear that, if Biden doesn’t play his cards wisely, we will end up in 2024 with a Trump 2.0, or even a rerun from Trump himself, reinvigorated after four years of tweet-sniping from the sidelines. They are right to be worried. But their analysis does not properly explain the political drama that is unfolding, or where it heads next. There is a two-fold problem with the “no return to normal” argument.

The first is that the liberal media and political class making this argument are doing so in entirely bad-faith. For four years they have turned US politics and its coverage into a simple-minded, ratings-grabbing horror show. A vile, narcissist businessman, in collusion with an evil Russian mastermind, usurped the title of most powerful person on the planet that should have been bestowed on Hillary Clinton. As Krystal Ball has rightly mocked, even now the media are whipping up fears that the “Orange Mussolini” may stage some kind of cack-handed coup to block the handover to Biden. These stories have been narrated to us by much of the corporate media over and over again – and precisely so that we do not think too hard about why Trump beat Clinton in 2016.

The reality, far too troubling for most liberals to admit, is that Trump proved popular because a lot of the problems he identified were true, even if he raised them in bad faith himself and had no intention of doing anything meaningful to fix them. Trump was right about the need for the US to stop interfering in the affairs of the rest of the world under the pretence of humanitarian concern and a supposed desire to spread democracy at the end of the barrel of a gun. In practice, however, lumbered with that permanent bureaucracy, delegating his authority to the usual war hawks like John Bolton, and eager to please the Christian evangelical and Israel lobbies, Trump did little to stop such destructive meddling. But at least he was correct rhetorically.

Equally, Trump looked all too right in berating the establishment media for promoting “fake news”, especially as coverage of his presidency was dominated by an evidence-free narrative claiming he had colluded with Russia to steal the election. Those now bleating about how dangerous his current assertions of election fraud are should remember they were the ones who smashed that particular glass house with their own volley of stones back in 2016.

Steal? You sure?

• How Pence & GOP Senators Could Try To Steal The Election (DP)

Since Donald Trump lost the election, he and GOP state legislators have suggested that the race was marred by voter fraud, and Trump administration officials have been publicly talking about Trump remaining president. On Friday, Vice President Mike Pence reportedly told a conservative group that there is already a “plan” for a second Trump term. Though Republicans have not produced any evidence to substantiate the fraud claims, they have continued to promote the fraud allegations — which could serve as a rationale for state legislatures, Republican electors and Mike Pence to try to use the Electoral College system to hand Trump a second term.

The unlikely-but-possible scenario revolves around the prospect of competing slates of electors. That situation has only arisen once in the modern era, when in 1960 then-vice president Richard Nixon faced a decision on whether to recognize Hawaii’s Republican or Democratic electors during the joint session of Congress to certify that year’s election results. The mini controversy spotlighted the pivotal role that the vice president can potentially play in the Electoral College system — and according to Harvard University law professor Larry Lessig, it should worry everyone right now.

In an interview with The Daily Poster, Lessig explained how Vice President Mike Pence could try to recognize slates of Republican electors sent to Congress from five Biden states where GOP legislators have started voicing allegations of voter fraud. In that situation, the Republican-controlled U.S. Senate would be in a position to decide on Pence’s move — and if they backed him up, Lessig says they could potentially throw the presidency to Trump. So far, GOP leaders in four of those states are saying they will not try to replace Biden electors with Trump electors in defiance of certified election results. Lessig’s group Equal Citizens is launching a petition on its website that calls on Republican U.S. senators to commit right now to uphold elector slates that represent the will of the popular vote in all states.

“26 out of the 50 state delegations are majority Republican. Assuming they deliver strict party-line votes, Trump would win the contingent election and be constitutionally re-elected..”

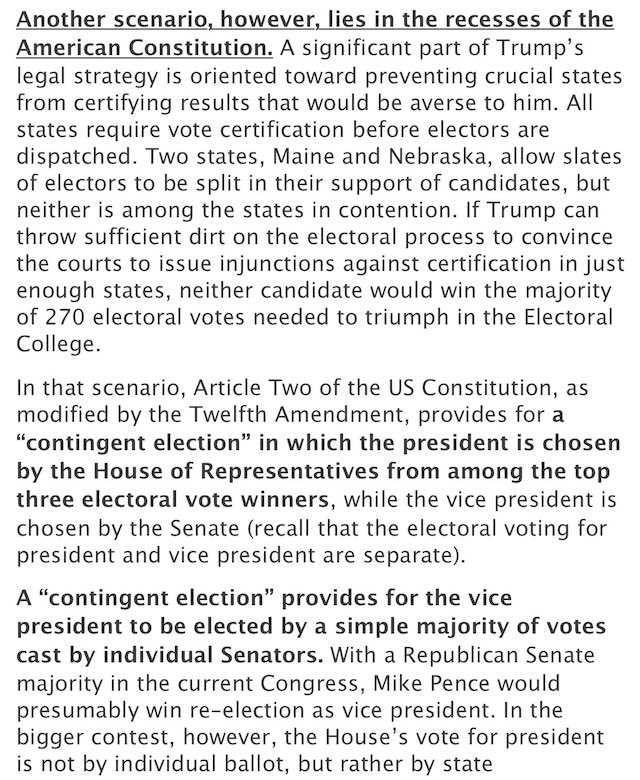

• Donald Trump’s Likeliest Path To Staying In Office (du Quenoy)

So far, the media debate revolves almost entirely around the final tabulation of votes. If enough evidence of fraud surfaces, and if court rulings based on that evidence favour Trump decisively, it is possible that he could win by court decision. Another scenario, however, lies in the recesses of the American Constitution. A significant part of Trump’s legal strategy is oriented toward preventing crucial states from certifying results that would be averse to him. All states require vote certification before electors are dispatched. Two states, Maine and Nebraska, allow slates of electors to be split in their support of candidates, but neither is among the states in contention. If Trump can throw sufficient dirt on the electoral process to convince the courts to issue injunctions against certification in just enough states, neither candidate would win the majority of 270 electoral votes needed to triumph in the Electoral College.

In that scenario, Article Two of the US Constitution, as modified by the Twelfth Amendment, provides for a “contingent election” in which the president is chosen by the House of Representatives from among the top three electoral vote winners, while the vice president is chosen by the Senate (recall that the electoral voting for president and vice president are separate). A “contingent election” provides for the vice president to be elected by a simple majority of votes cast by individual Senators. With a Republican Senate majority in the current Congress, Mike Pence would presumably win re-election as vice president. In the bigger contest, however, the House’s vote for president is not by individual ballot, but rather by state delegation en bloc. That means that all the Representatives from each state would cast one collective vote for president.

In the current Congress, 26 out of the 50 state delegations are majority Republican. Assuming they deliver strict party-line votes, Trump would win the contingent election and be constitutionally re-elected. This procedure is obscure, but not unprecedented in choosing American presidents. Thomas Jefferson was elected president in a contingent election in 1801, when the electoral vote in the previous year’s election resulted in a tie between him and incumbent president John Adams. In 1825, Adams’s son John Quincy Adams also won the presidency in a contingent election, in which four candidates split the Electoral College vote that resulted from the election of 1824. The younger Adams prevailed over Andrew Jackson, who had won large pluralities in both the popular and electoral votes.

“Neither has the guts or the intelligence. They are nowhere men who fear the fate that John Kennedy faced squarely when he turned against the CIA and the war machine.”

• Everybody Knows the Fight was Fixed (Curtin)

At the end of Henrik Ibsen’s classic play, A Doll’s House, Nora, the aggrieved wife, leaves her husband’s house and all the illusions that sustained its marriage of lies. She chooses freedom over fantasy. She will no longer be played with like a doll but will try to become a free woman – a singular one. “There is another task I must undertake first. I must try and educate myself,” she tells her husband Torvald, a man completely incapable of understanding the social programming that has made him society’s slave. When Nora closes the doll’s house door behind her, the sound is like a hammer blow of freedom. For anyone who has seen the play, even when knowing the outcome in advance, that sound is profound. It keeps echoing. It interrogates one’s conscience.

The echo asks: Do you live inside America’s doll house where a vast tapestry of lies, bad faith, and cheap grace keep you caged in comfort, as you repeat the habits that have been drilled into you? In this doll’s house of propaganda into which America has been converted, a great many of our basic assumptions are totally illusory. Americans who voted for either Trump or Biden in the 2020 election are like Torvald clones. They refuse to open that door so they might close it behind them. They live in the doll’s house – all 146+ million of them. Like Torvald, they are comforted. They are programmed and propagandized, embracing the illusion that the electoral system is not structured and controlled to make sure no significant change can occur, no matter who is president. It is a sad reality promoted as democracy.

They will prattle on and give all sorts of reasons why they voted, and for whom, and how if you don’t vote you have no right to bitch, and how it’s this sacred right to vote that makes democracy great, blah blah blah. It’s all sheer nonsense. For the U.S.A. is not a democracy; it is an oligarchy run by the wealthy for the wealthy. This is not a big secret. Everybody knows this is true; knows the electoral system is sheer show business with the presidential extravaganza drawing the big money from corporate lobbyists, investment bankers, credit card companies, lawyers, business and hedge fund executives, Silicon Valley honchos, think tanks, Wall Street gamblers, millionaires, billionaires, et. al. Biden and Trump spent over 3 billion dollars on the election. They are owned by the money people.

Both are old men with long, shameful histories. A quick inquiry will show how the rich have profited immensely from their tenures in office. There is not one hint that they could change and have a miraculous conversion while in future office, like JFK. Neither has the guts or the intelligence. They are nowhere men who fear the fate that John Kennedy faced squarely when he turned against the CIA and the war machine. They join the craven company of Johnson, Ford, Carter, Reagan G.H.W. Bush, Clinton, George W. Bush, and Obama. They all got the message that was sent from the streets of Dallas in 1963: You don’t want to die, do you?

But it’s easy to find the exact opposite view as well.

• Lockdowns Haven’t Brought Down COVID Mortality, But Killed Millions Of Jobs (Mises)

[..] many proponents of lockdowns still contend that every covid infection is a failure of public policy. But this position is largely a luxury of white-collar workers who can afford to work from home. Lockdowns have been described as “the worst assault on the working class in half a century.” Martin Kulldorff, a biostatistician, says, “the blue-collar class is ‘out there working, including high-risk people in their 60s.” Kulldorff’s colleague Jay Bhattacharya notes that one reason “minority populations have had higher mortality in the U.S. from the epidemic is because they don’t often have the option…to stay at home.” In effect, top-down lockdown policies are “regressive” and reflect a “monomania,” says Dr. Bhattacharya. With this in mind, it is easy to see why more affluent Americans tend to view restrictive measures as the appropriate response.

For many Americans, prolonged periods of time without gainful employment, income, or social interaction are not only impossible but potentially deadly. Martin Kulldorff notes that covid-19 restrictions do not consider broader public health issues and create collateral damage; among the collateral damage is a “worsening incidence of cardiovascular disease and cancer and an alarming decline in immunization.” Dr. Bhattacharya correctly notes that society will be “counting the health harms from these lockdowns for a very long time.” Bhattacharya emphasized the politicization of these restrictions: “When Black Lives Matter protests broke out in the spring, ‘1,300 epidemiologists signed a letter saying that the gatherings were consistent with good public health practice,’” while those same epidemiologists argued that “we should essentially quarantine in place.”

Such a contradiction defies logic and undercuts arguments about the lethality of this virus. If this novel virus truly were as devastating to the broader public as advertised, then political leaders supporting mass protests and riots during a pandemic seem to be ill founded. This contradiction has been cited in countless lawsuits challenging the validity and constitutionality of covid-19 restrictions. Separately, these often heavy-handed restrictions have targeted constitutionally protected rights like the freedom of religion. Supreme Court Justice Samuel Alito criticized the Nevada governor’s restrictions saying, “that Nevada would discriminate in favor of the powerful gaming industry and its employees may not come as a surprise…We have a duty to defend the Constitution, and even a public health emergency does not absolve us of that responsibility.” This scathing criticism, however, did not gain the support of the Supreme Court as a 5–4 majority deferred to the governor’s “responsibility to protect the public in a pandemic.”

“We are asking people to take a vaccine that is going to hurt..”

• COVID19 Vaccines May Have Potentially Unpleasant Side Effects (Kaiser)

Pfizer is expected to seek federal permission to release its Covid-19 vaccine by the end of November, a move that holds promise for quelling the pandemic but also sets up a tight time frame to make sure consumers understand what it will mean to get the shots. The vaccine, and likely most others, will require two doses to work, injections that must be given weeks apart, company protocols show. Scientists anticipate that the shots will cause enervating flu-like side effects — including sore arms, muscle aches and fever — that could last days and temporarily sideline some people from work or school. And even if a vaccine proves 90 percent effective, the rate Pfizer touted for its product, 1 in 10 recipients would still be vulnerable. That means, at least in the short term, as population-level immunity grows, people can’t stop social distancing and throw away their masks.

[..] Pfizer and its partner, the German company BioNTech, said Monday that their vaccine appears to protect 9 in 10 people from getting Covid-19, although they didn’t release underlying data. It’s the first of four Covid-19 vaccines in large-scale efficacy tests in the U.S. to have posted results. Data from early trials of several Covid-19 vaccines suggest that consumers will need to be prepared for side effects that, while technically mild, could disrupt daily life. A senior Pfizer executive told the news outlet Stat that side effects from the company’s vaccine appear to be comparable to those of standard adult vaccines but worse than those of the company’s pneumonia vaccine, Prevnar, or typical flu shots.

The two-dose Shingrix vaccine, for instance, which protects older adults against the virus that causes painful shingles, results in sore arms in 78 percent of recipients and muscle pain and fatigue in more than 40 percent of those who take it. Prevnar and common flu shots can cause injection-site pain, aches and fever. “We are asking people to take a vaccine that is going to hurt,” said Dr. William Schaffner, a professor of preventive medicine and health policy at Vanderbilt University Medical Center. “There are lots of sore arms and substantial numbers of people who feel crummy, with headaches and muscle pain, for a day or two.”

For how long?

• Australia Revels In Covid-free Days (G.)

When the premier of Queensland held her regular Covid-19 update on Friday she couldn’t help letting a smile creep across her face. “Now, here’s a good one,” Annastacia Palaszczuk told reporters. “I think all Queenslanders are going to be happy about it.” She went on to announce that Brisbane’s Suncorp stadium would host a capacity 52,500 crowd for the forthcoming State of Origin rugby league decider against New South Wales next week. “The cauldron can be filled to 100% capacity,” she said. In the midst of the pandemic, the idea of responsible leaders encouraging citizens to gather in large crowds to sit or stand shoulder to shoulder with strangers might seem to be a case of extreme recklessness.

But in Australia, where the Covid-19 pandemic has largely been controlled after months of lockdowns, border closures and strict limits on gatherings, moments like these are becoming more and more common. Last month, footage from a packed nightclub in Western Australia went viral, offering a surreal image of pre-Covid normality even as countries in the northern hemisphere began to return to lockdowns amid surging case numbers. In Sydney, about 40,000 fans were present for the rugby league grand final last month. The country has reason to be bullish about its successes. On Friday, Australia recorded no new cases of the virus for the fifth day in a row. In Victoria, where a second-wave spike of the virus forced Melbourne into a months-long lockdown and left hundreds dead, Friday marked the 14th day in a row with no new cases.

Includes Australia, South Korea and New Zealand.

• The Huge New Trade Deal ‘Western’ Media Do Not Like To Talk About (MoA)

Tomorrow a new trade agreement between 15 Asian states will be signed. It will soon be seen as a milestone in the global economic history. But only very few ‘western’ media have taken note of it or of the huge consequences the new agreement will have. The agreement is also a huge victory for China over U.S. hegemony in Asia: Fifteen Asia-Pacific nations including China and Japan plan to sign the world’s biggest free trade deal this weekend. The FTA will cut tariffs, strengthen supply chains with common rules of origin, and codify new e-commerce rules. The Regional Comprehensive Economic Partnership (RCEP) is expected to be announced at the Association of Southeast Asian Nations (ASEAN) Summit, which Vietnam is hosting virtually.

It will involve the ten member states of the ASEAN bloc – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – as well as their trade partners Australia, China, Japan, New Zealand, and South Korea. The new economic bloc will thus represent around a third of the world’s gross domestic product and population. It will become the first-ever free trade agreement to include China, Japan, and South Korea – Asia’s first, second and fourth-largest economies. The economies of the RCEP members are growing faster than the rest of the world. The agreement is likely to accelerate their growth. India is the only country that was invited but is missing in the deal. Its Hindu-fascist Modi regime had bet on the U.S. led anti-Chinese QUAD initiative pressed for by Trump and Pompeo and thereby lost out in trade terms.

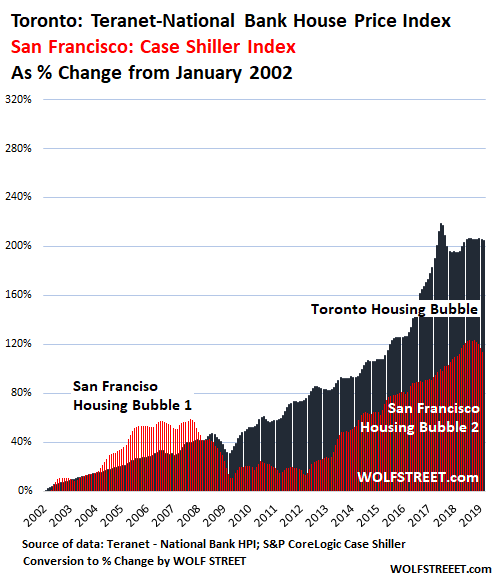

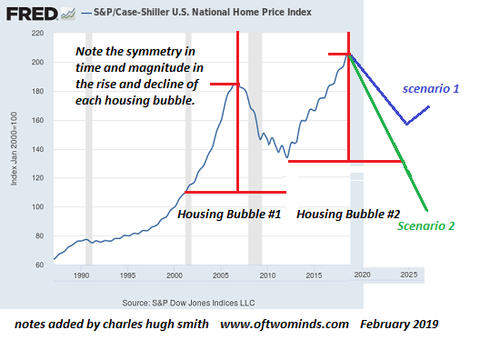

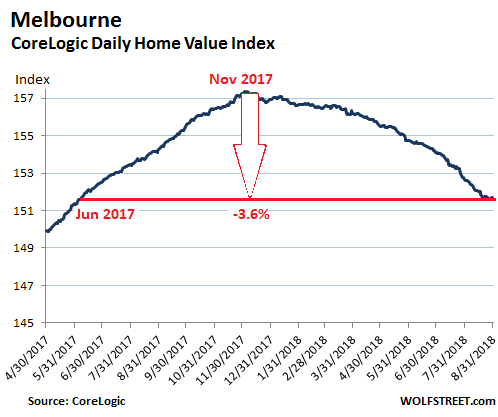

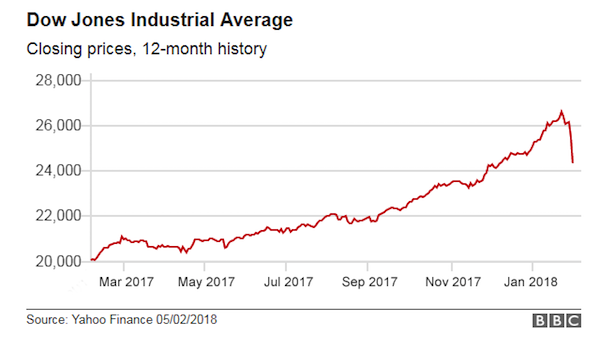

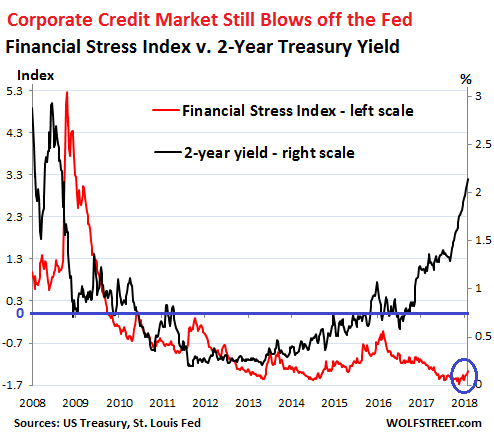

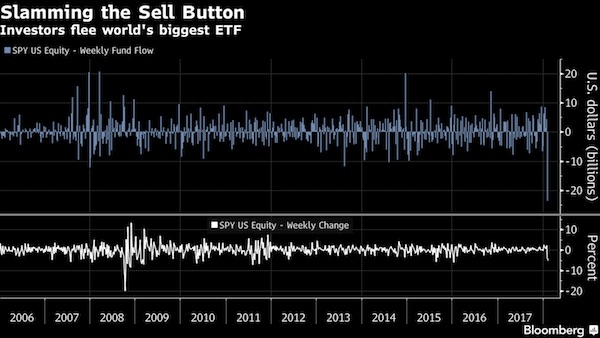

Bubbles “R” The Economy

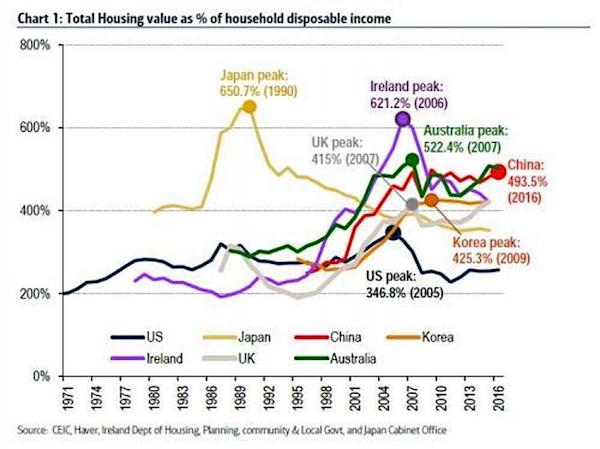

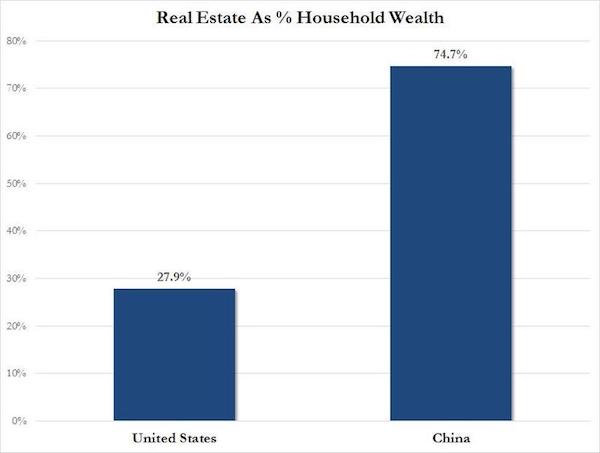

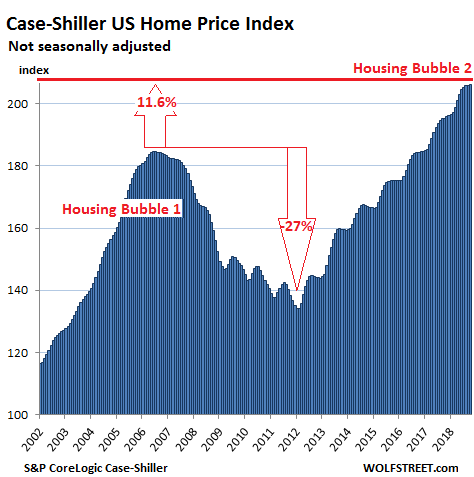

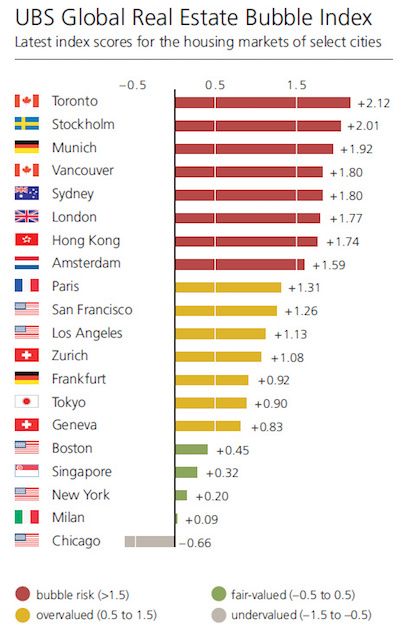

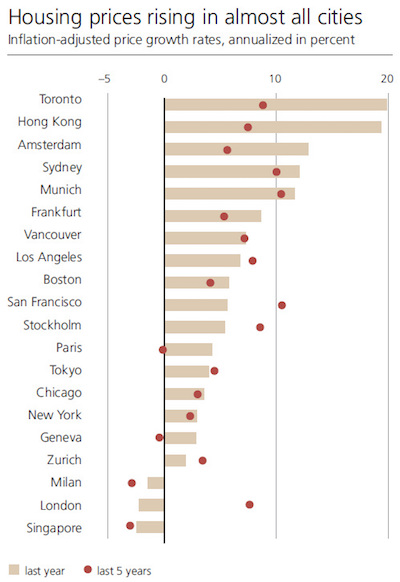

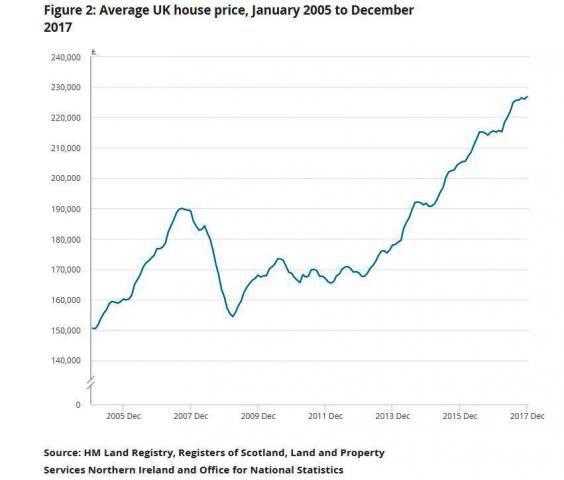

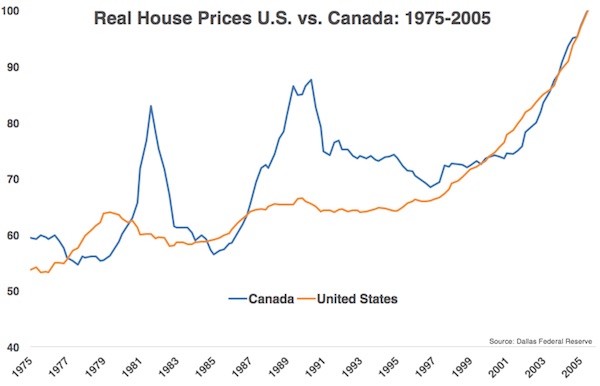

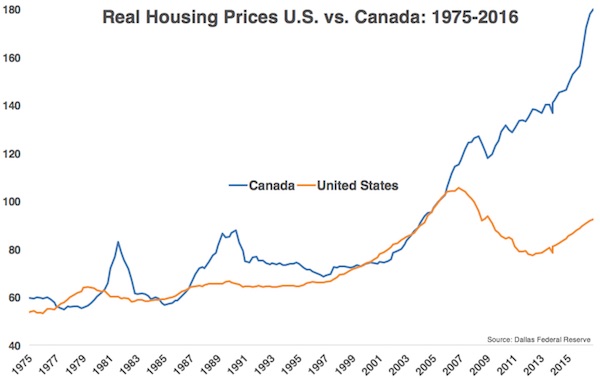

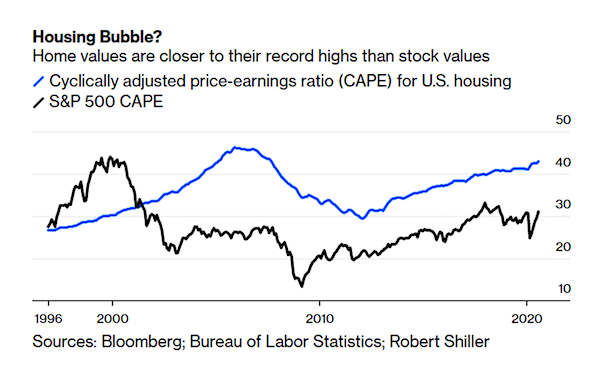

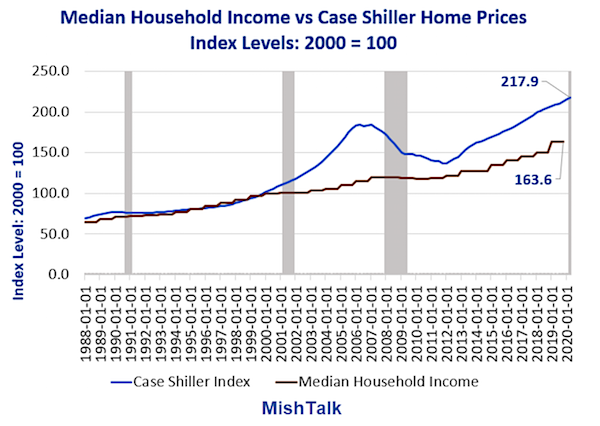

• The Housing Bubble is Even Bigger Than the Stock Market Bubble (Mish)

Stocks may be expensive based on historical measures, but it’s nothing compared to skyrocketing home values says Robert Shiller.

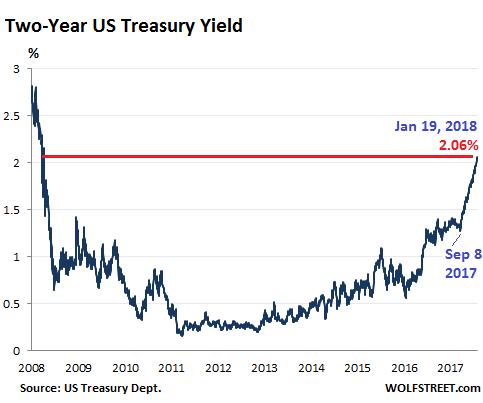

“Consider that the Case-Shiller National Home Price index has gained in excess of 6% per year on average since January 2012, while net rental income has barely kept up with inflation, increasing just less than 2% per year. The result is that home prices seem as overvalued as they were in the spring of 2005, nine months before the peak. One way to measure home valuations is with a cyclically adjusted price to earnings (CAPE) ratio developed by Yale University professor and Nobel Laureate Robert Shiller for stocks. The concept can be applied to a broad swath of assets by dividing the current price of an asset by the average annual inflation-adjusted earnings over the prior 10 years. The chart above shows CAPE for U.S. home prices and the S&P 500 Index since 1996.

The bad news is all previous history came at higher mortgage rates. The average 30-year fixed mortgage rate fell below 3% for the first time in August 2020, and rates are close to the lowest possible levels given the credit risk and costs of writing mortgages. It’s one thing to be a peak valuation, it’s another to be at peak valuation with no discernable upside.” Shiller compared home prices to stocks based on CAPE. To compute the CAPE for housing he used rent. My chart looks at household income vs the Case-Shiller Home Price Index. Both indexes have a base year of 2000. Household income is annual and the latest year available is 2019. I used Case-Shiller quarterly data. Since 2000, median household income is up about 64%. Home prices are up 118%. Robert Shiller calls this a bubble and so do I.

Just lovely.

• The EU Funds Global iPhone And Facebook Surveillance (F.)

Police across the world are getting special training from a little-known European Union agency on how best to snoop on Facebook and Apple iPhones, according to documents obtained by nonprofit Privacy International. The files reveal that CEPOL, the EU’s law enforcement training agency, instructed officers across the globe, from within Europe and in Africa, on how to use malware and other tools to gain access to citizens’ phones and monitor social networks. In some cases, the training was funded by EU aid coffers and went to countries with histories of human rights abuses, Privacy International warned. Furious about the previously secret initiatives that are aiding surveillance rather than protecting people from it, Privacy International and fellow human rights organizations are calling for reform, demanding that aid money going to intelligence training be diverted to more altruistic programs.

The revelations land just days after the EU Parliament announced plans to curb spy tool exports where human rights abuses were possible. “Today’s revelations confirm our worst fears about the diversion and securitization of EU aid,” said Edin Omanovic, advocacy director of Privacy International. “Instead of helping people who face daily threats from unaccountable surveillance agencies, including activists, journalists and people just looking for better lives, this ‘aid’ risks doing the very opposite. “The EU as the world’s largest provider of aid and a powerful force for change must enact urgent reforms to these secretive and unacceptable programmes. Failure to do so is a betrayal not just of the purpose of aid and the people it’s supposed to benefit, but of the EU’s own values.”

Silicon Valley.

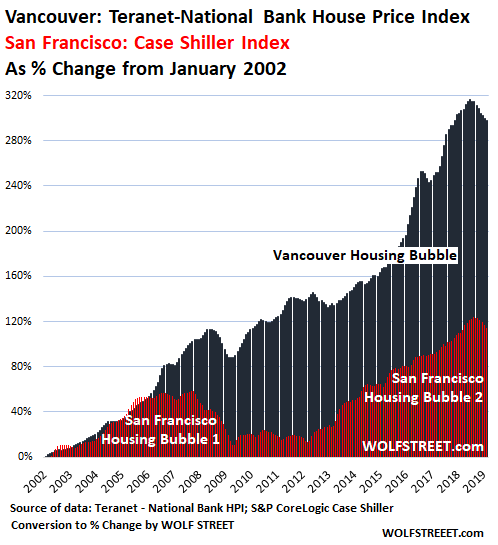

• Bay Area Food Bank Now Serves 500k Working-Poor As Demand “Doubles” (ZH)

The virus pandemic is threatening another lost decade, similar to the Great Recession of 2007-2009, or even the Great Depression of the 1930s, for America’s working poor. Widespread permanent job loss and the collapse of small and medium-sized enterprises have become a severe risk to the broader recovery – as the economic fallout from the virus-induced downturn could linger for years. Case in point, the San Francisco Bay Area has lost 350,000 jobs this year – leaving many households with food and housing insecurity problems ahead of the holiday season. Local news station KQED offers a sobering reminder of the economic devastation left behind from the virus – and one that will likely continue to intensify as virus cases explode to new highs, forcing state officials to reimpose new social distancing restrictions.

KQED said, “food banks are racing to keep up with increased demand for food — and volunteers.” One of the top food banks in the state, called Second Harvest of Silicon Valley, has “literally doubled the amount of food we’re distributing,” said CEO Leslie Bacho. Bacho continued: “We already serving a quarter-million people. Now we’re serving a half million people.” She said many of the folks picking up care packages at food banks across the Bay Area are coming for the first time. “This is a testament to how the pandemic-induced economic crisis is disproportionately impacting low-wage workers,” she added.

“We are seeing so many people who are already just living on the edge, having to then burn through their savings,” Bacho said. “More than half the people we’re serving now have never sought food assistance before.” Someone named “Gabriel” sent Second Harvest of Silicon Valley a donation of around $1,300 – the letter Gabriel received from the food bank outlines the dire situation playing out in the Bay Area.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Only a life lived for others is a life worthwhile.

– Albert Einstein

This is extremely dangerous to our democracy

https://twitter.com/i/status/1327597849849131008

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.