Pablo Picasso Portrait of woman in wheelchair 1936

Giant constrictor snake squeezing Copenhagen citybus as part of a campaign for the city zoo

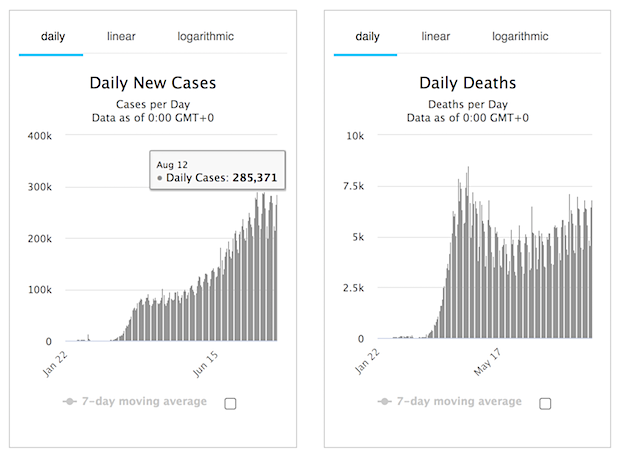

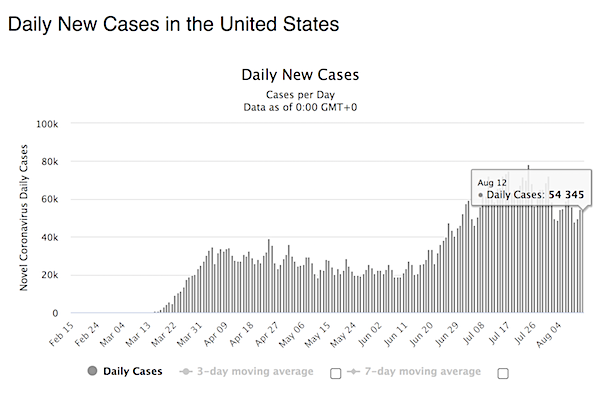

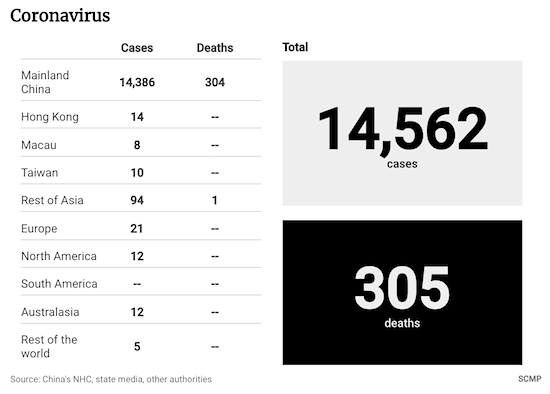

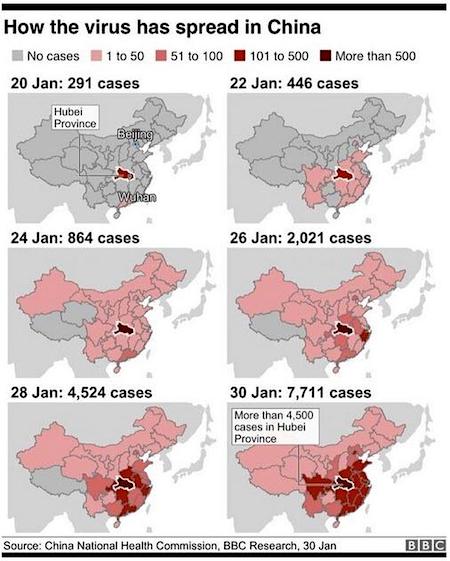

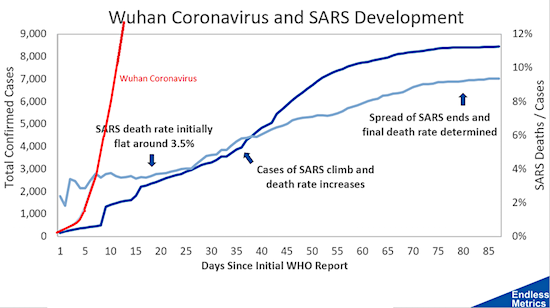

SARs

Did Sen. Ron Johnson just CATCH Joe and Hunter Biden at center of MASSIVE human trafficking operation?! pic.twitter.com/NyqSpRY263

— Benny Johnson (@bennyjohnson) July 11, 2022

Wise man.

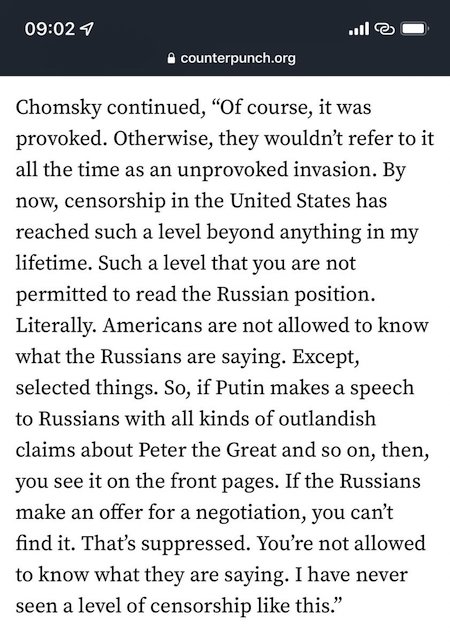

• Defiant Schroeder Will Keep Talking To Putin (RT)

A diplomatic solution to the ongoing conflict in Ukraine is the only thing that can effectively alleviate the suffering of civilians, the former German chancellor, Gerhard Schroeder, has told Germany’s FAZ newspaper, adding that he would continue to use every opportunity to talk to the Russian president Vladimir Putin. The former chancellor, who was earlier forced to leave his position at the board of the Russian oil giant Rosneft amid pressure from the European Parliament lawmakers, is now facing potential expulsion from his Social Democratic Party (SPD) at home. His perceived close relations with Moscow are cited as one of the reasons why the party considers his behavior “damaging” to its image, according to FAZ.

Schroeder himself, however, believes that the idea of isolating Russia politically is flawed. “I will not give up on… opportunities to talk to President [Vladimir] Putin,” Schroeder told FAZ in an interview published on Sunday. Russia is “interested in a negotiated solution,”the former chancellor asserted as he blamed Kiev for the stalled talks with Moscow. Schroeder, who sought to act as a mediator between Kiev and Moscow in early March, said that Ukrainians did not want any commitments “written down.” Such a position made any “serious” talks impossible at that stage of the negotiations, he added. The former chancellor also demonstrated little understanding for the West’s focus on supplying Ukraine with arms. “I don’t believe in a military solution.

The war can only be ended through diplomatic negotiations,” he told FAZ, adding that lives of the military on both sides can be spared and the suffering of the civilian population in Ukraine alleviated only through a diplomatic solution. When asked if he thinks that the western weapons deliveries contribute to a stronger negotiating position for Ukraine, Schroeder reiterated that all the nations, including “those not directly involved in this conflict,” should “work together to find a diplomatic solution”instead. He also criticized Lithuania over restricting the movement of goods to the Russian exclave of Kaliningrad, again saying that “all sides” bear responsibility for ensuring that “this conflict does not escalate further.”

The interview comes ahead of an SPD committee meeting next week that will discuss the former chancellor’s potential expulsion from the party. The politician’s lawyer told FAZ, however, that there is no sufficient legal basis for such a move. In June, Schroeder said he would still remain a Social Democrat, even if kicked out of the SPD.

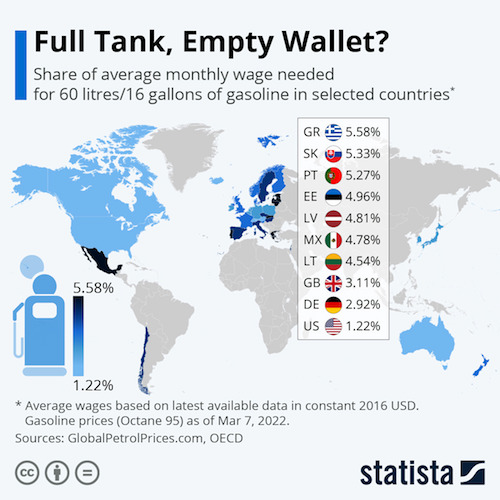

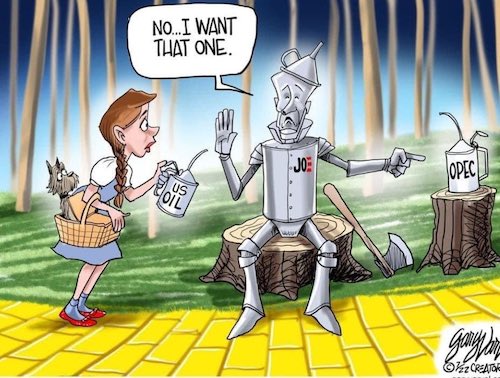

“U.S. oil refineries are operating at 94% capacity..”

• Why Biden Is Putting Us In Danger (Shellenberger)

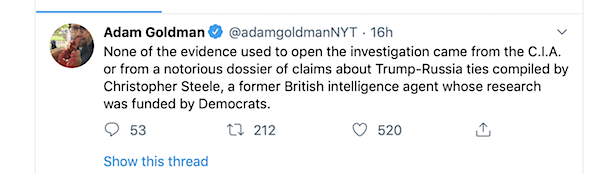

On Friday, White House Press Secretary Karine Jean-Pierre defended the Biden Administration’s policy of sending American oil to China and other nations. “When it comes to the oil, it is something that oil companies decide… The Department of Energy can’t dictate what oil companies do with the oil they purchase or where they ship it to sell.” But the United States Department of Energy (DOE) does decide to whom it will sell oil from the Strategic Petroleum Reserve (SPR). “A total of 16 companies responded to this notice, submitting 126 bids for evaluation,” noted DOE. A dozen won contracts. One was Unipec America, the trading arm of Sinopec, the China Petrochemical Corporation, which is wholly owned by the Chinese government.

There is no evidence that DOE went out of its way to sell American oil to Unipec, and little reason to believe that the U.S. could have refined that oil into gasoline, diesel, and other products had it remained in the U.S. After all, U.S. oil refineries are operating at 94% capacity. The DOE sold the oil to the highest bidders. And it was a coordinated release with international partners, including China, which also released oil from it strategic reserves. Indeed, Bloomberg and others oil market analysts predicted back in November that some U.S. SPR oil would go to China and India. But the reason our refineries are at maximum capacity is because Biden revoked a permit for a massive refinery expansion in the U.S. Virgin Islands in March and halted its operations entirely in May.

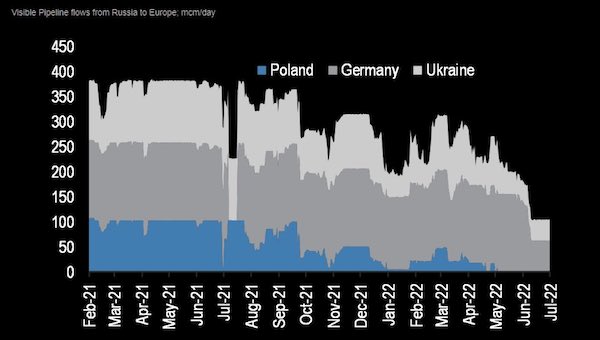

And where the U.S. released 50 million barrels of oil in 2021 and 180 million barrels of oil in 2022 so far, China has only released 7.4 million barrels of oil, which is just a half day’s consumption. Is that because China is oil-poor? No. It has equal-sized petroleum reserves to the U.S. In fact, despite promises in November and again in January to release oil from its reserves, China has instead been increasing its reserves. And there is no evidence that any non-Chinese firms, much less American firms, bought any of its released reserve oil, which undercuts the Biden Administration’s claim that the SPR release was being reciprocated. But the real drama is about to start. Today, Russia cut off all natural gas flowing through the main pipeline to Europe as part of routine maintenance.

Russia is contractually committed to turning the gas back on 10 days later, but many analysts, heads of state, and government officials believe Russian President Vladimir Putin won’t turn the gas back on in 10 days. Why? So he can increase prices, increase Russia’s energy revenues, and pressure Europe to stop supporting Ukraine in its fight against Russia. France’s economy minister yesterday called a complete cut-off “the most likely” scenario. The consequences of a full Russian gas embargo would be devastating. German industries are already “in danger of permanently collapsing,” warned the head of Germany’s trade unions. Britain has warned that, in order to protect its own citizens, it may cut off natural gas supplies to Europe. If Putin cuts off the gas, Europe would be forced to ration energy, and bail-out both electric utilities and energy-intensive companies.

A mess of its own making.

• July Shutdown Of Nord Stream Pipeline Has The EU Worried (ZH)

It’s a dynamic which some in the alternative media have been warning about for months – While the establishment claimed that Russia would be crushed under the weight of NATO sanctions, others have suggested that Russia could hurt the west more (specifically Europe) by implementing sanctions of their own. While mainstream governments and journalists argued about how fast NATO should implement restrictions on Russian oil and gas, none of them seemed to consider the possibility that Putin would cut off energy exports himself. This is the problem with instituting foreign policy and engaging in geopolitics using a “cancel culture” mentality; it leads to childish thinking and a lack of foresight. You can’t “cancel” a nation if you are dependent on them for 40% of your energy needs.

Anyone with moderate industry knowledge in oil and gas could have seen this coming. Europe is now on “high alert” as the Nordtream 1 pipeline to Germany has lost 60% of its natural gas transfers as Russia pressures Canada for the return of a massive turbine being held in Canada for repairs. Canada has lifted sanctions in response and allowed the shipment of the turbine back to Russia, showing that the Kremlin does indeed have economic leverage over NATO countries. Even more concerning is that the pipeline will be undergoing an extended shutdown due to “maintenance” until July 21st. Some officials in Europe believe this shutdown may be a precursor (a beta test) to a total block of Russian gas to the EU, and they are probably right.

Speaking at the economic forum Les Rencontres Économiques, French Minister Bruno Le Maire said: ‘Let’s get ready for a total shutdown of the Russian gas supply…This is the most likely event.’ He added ‘We should not take Vladimir Putin’s threats lightly.’ It’s important to remember that Europe is not only dependent on oil and gas imports for heating, it is also dependent on them for electricity and many other needs. The middle of summer does not seem like the worst time to face heating shortages, but the overall effect of energy loss would drag the EU economy down into panic. Will the gas supply return after July 21? Probably, but this shutdown indicates that the Kremlin may be sending a message that they could end Europe’s economic stability anytime they want. The closer we get to winter, the more pressure will be applied, no doubt.

Visible pipeline flows.

“Breaking China Apart”

• U.S. China Policy Is Heading Towards Disaster (NI)

The unity, territorial integrity, and sovereignty of China are translated into the sanctity of its borders which includes “red lines” like Taiwan, Tibet, Xinjiang, Hong Kong, and the South China Sea (out of fourteen neighbors, China has signed boundary agreements with twelve, barring India and Bhutan). Then, China’s “peaceful rise” is viewed as a natural evolution, even a sense of an historical entitlement, that China has finally “arrived” on the international stage. This was first publicly alluded to by President Xi, during his speech on October 18, 2017, at the 19th CCP Congress. Referring to “the world witnessing once in a century changes,” Xi remarked that China has become “a great power in the world,” playing “an important role in the history of humankind … it is time for us to take center stage in the world.”

Among “core interests” is the primacy of the CCP as China’s center of gravity pivotal to the country’s unity, stability, and prosperity, because, for Xi and his close associates, there is the conviction that anything like Gorbachev’s glasnost would be a recipe for disaster and could even lead to the breakup of China. As the inheritors of the “Middle Kingdom” which built a Great Wall to defend China from foreign intruders, the CCP leadership is well aware that existing fault lines can be susceptible to manipulation to China’s detriment. I was struck by the fact that, unlike Americans, who tend to have short memories and shifting relationships with foreign countries, Chinese take the long view, with a keen sense of history.

A few years ago, during a meeting with a top Chinese “thinking” policy maker, while discussing U.S. “designs against China,” he politely passed on an old op-ed of the New York Times written by Leslie Gelb on November 13, 1991, around the time when the Soviet Union was disintegrating. Interestingly titled, “Breaking China Apart,” Gelb’s piece matter-of-factly discussed the United States resorting to the “ultimate sanction — a threat to the territorial integrity of the Middle Kingdom — if Beijing leaders continue to defy new standards of world behavior…” Alarmingly, Gelb continued in the New York Times, if “Chinese actions go far beyond the pale. Americans and others may take extraordinary measures, including kindling separatism, to stop them. Beijing’s leaders will be making a terrible mistake to think otherwise.” It is thus no accident that China often views unrest in Xinjiang, Tibet, or Hong Kong or talk of Taiwan as some sort of a U.S.-supported state policy of “kindling separatism.”

“It is not a president who governs France but a lobby!”

• Macron Ordered To Resign, Faces Urgent Probe After ‘Betraying France’ (Exp.)

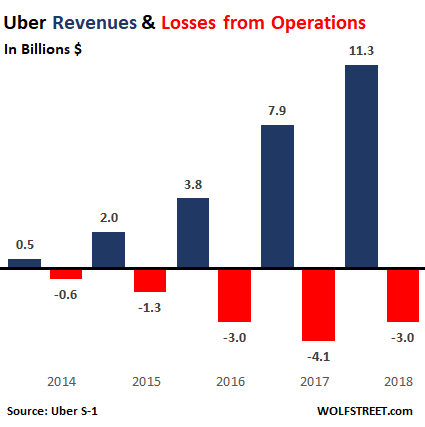

The French President backed the development of Uber in France singing a deal when he was economy minister between 2014 to 2016. The findings, leaked after an investigation based on 124,000 confidential internal Uber documents, prompted calls for Mr Macron to resign. Les Patriotes leader Florian Philippot said: “Macron must resign! He betrays France, its companies, the State, justice, the people! Out!” He added: “If after the #UberFiles the oppositions don’t vote ‘no confidence’ today, I don’t know what they need! “Be responsible and vote it! Put the Macronie down!” Echoing his comments, National Rally MEP Jordan Bardella said: “It was common knowledge, the #UberFiles demonstrate it once again.

“Despite the permanent ‘at the same time’, Emmanuel Macron’s career has a consistency, a common thread: to serve private interests, often foreign, before national interests.” Left MEP Manon Aubry also blasted the French leader. She said: “Revelations on a secret deal between Macron and Uber. “We also better understand the role played by France in blocking any European regulation of platforms! “It is not a president who governs France but a lobby!” Debout La France leader Nicolas Dupont-Aignan echoed: “Emmanuel Macron, loyal supporter of Uber. “Minister of the Economy, he was already betraying France by defending the interests of an American company!”

According to the investigation, the French leader signed a deal with Uber to “make France work for Uber so that Uber can work in and for France”. Mr Macron also promised “a drastic simplification of the legal requirements” to obtain a ride-sharing licence. Uber also secretly lobbied ministers to influence London’s transport policy, it has been reported. Leaked documents show lobbyists for the ride-sharing app company met then-chancellor George Osborne and other ministers, according to the BBC. The “undeclared” meetings took place after Boris Johnson, as Mayor of London, had promised to launch a review that could have limited Uber’s expansion in the capital. The meeting with Mr Osborne took place at a private dinner in the US state of California, where Uber is based.

An internal Uber email stated that this was better than a meeting in London because “this is a much more private affair with no hanger-on officials or staffers”, the BBC reported. Other meetings were held between Uber lobbyists and current or former ministers including Priti Patel, Sajid Javid, Matt Hancock and Michael Gove, according to the corporation. Mr Johnson ultimately abandoned his review, and Uber was able to increase its number of drivers in London.

It’s the Monsanto model.

• Uber Paid Academics Six-figure Sums For Research To Feed To The Media (G.)

Uber paid high-profile academics in Europe and the US hundreds of thousands of dollars to produce reports that could be used as part of the company’s lobbying campaign. The Uber files, a cache of thousands of confidential documents leaked to the Guardian, reveal lucrative deals with several leading academics who were paid to publish research on the benefits of its economic model. The reports were commissioned as Uber wrestled with regulators in key cities around the world. University economists were targeted in France and Germany where enforcement by the authorities was increasingly fierce in 2014-15. One report by a French academic, who asked for a €100,000 consultancy fee, was cited in a 2016 Financial Times report as evidence that Uber was a “route out of the French banlieues”, delighting Uber executives.

Using techniques common in party political campaigns, Uber targeted academics and thinktanks to help it construct a positive narrative, namely that it created well-paid jobs that drivers liked, delivered cheap transport to consumers and boosted productivity. Documents show how its lobbyists planned to use academic research as part of a production line of political ammunition that could be fed to politicians and the media. The aim was to use the research to increase pressure for changing the rules Uber was evading. While Uber’s involvement in reports was mentioned, leaked files expose how it wanted to use academics’ work and their reputations to further its aims, and how much it was prepared to pay them. In France, the €100,000 consultancy arrangement was negotiated with a rising star of university economics, Prof Augustin Landier of the Toulouse School of Economics.

Landier agreed to produce a report that he described in emails to Uber’s policy and communications team as “actionable for direct PR to prove Uber’s positive economic role”. Landier proposed collaborating with David Thesmar, another high-profile professor from France’s top business school, École des Hautes Études Commerciales de Paris (HEC). In discussions in February 2015, Uber executives noted that although the price was high, it was worth it, especially if they worked on the report’s messages “to ensure it’s not presented in a potentially negative light”.

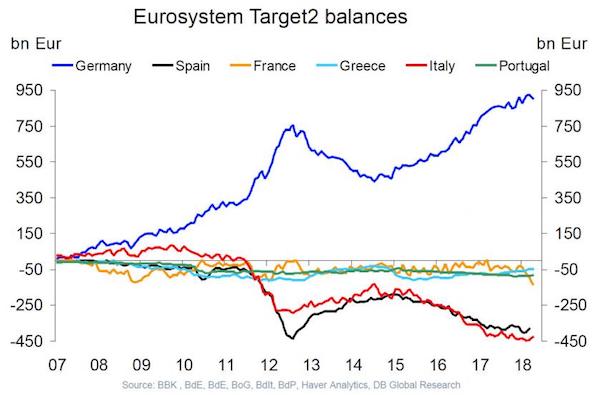

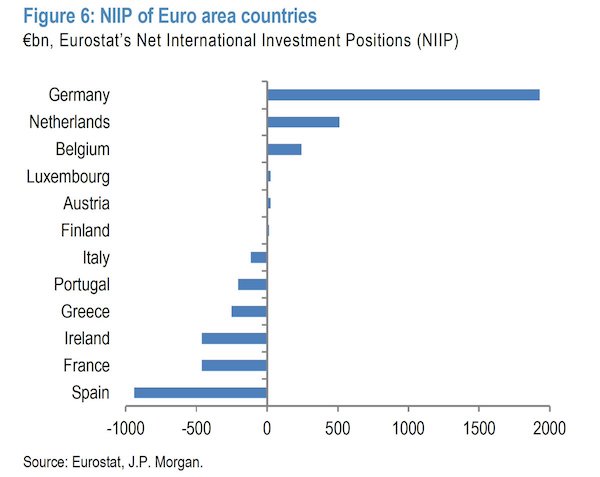

“The balance of the ECB is 69.5% of the GDP of the eurozone, when that of the Federal Reserve is 37% of the GDP of the US and the Bank of England’s is 39% of the UK GDP.”

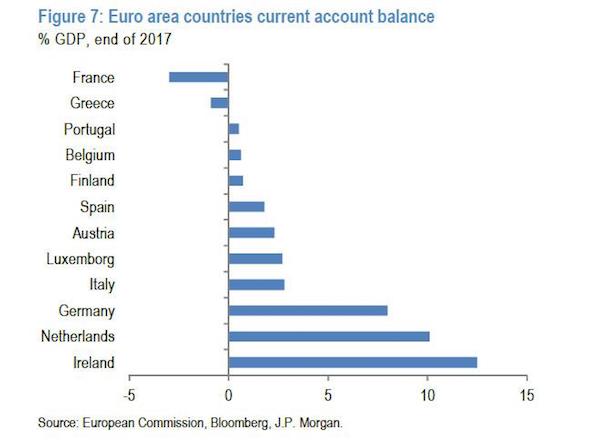

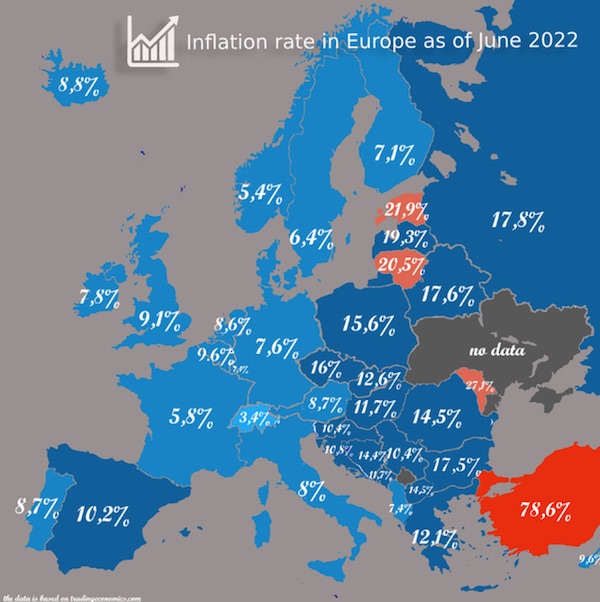

• The ECB Must Follow Its Mandate (Lacalle)

The European Central Bank should be hugely concerned about two pieces of news. The euro is on the verge of parity with the US dollar and has accumulated a drop of 17% since 2021, more than 35% since 2008. On the other hand, inflation in the eurozone reached 8.6% in June, 5% excluding the energy and food components. Inflation in more than six eurozone countries, including Spain, is already in double digits with core CPI at multi-decade highs. Meanwhile, in Switzerland, June inflation was 3.4% with core at 1.9%. Switzerland relies on imports for gas, commodities, and supply chains as much as its neighbors, but it has not engaged in massive printing of its currency.

The euro is the greatest monetary success of the last 150 years, and it cannot be jeopardized by risking the independence of the European Central Bank. It is an elevated risk and those of us who want it to remain a reserve currency and a success are concerned. The balance of the ECB is 69.5% of the GDP of the eurozone, when that of the Federal Reserve is 37% of the GDP of the US and the Bank of England’s is 39% of the UK GDP. However, the euro is not the world’s reserve currency. The US Federal Reserve is the only central bank that pays attention to the global demand for US dollars and despite this, it has also made the enormous mistake of expanding money supply well above demand and, thereby, triggering inflation.

Let us not forget that prices do not go up all at once for the same amount of currency issued. One or two prices may rise for exogenous reasons, but not all rise unless the purchasing power of the currency is destroyed by printing without control. As Frank Shostak reminds, inflation is money supply growth, not prices denominated in money. A weak euro and rising inflation are extremely worrying factors because in June 2021 the increase in broad money supply (M3) in the eurozone was 8.3% annualized, with M1 (currency in circulation and overnight deposits) increasing by 11.8%. In other words, the increase in money supply (M3) was still 16% higher than during the so-called “Draghi bazooka”. In May 2022 it is still growing above 5.6% with GDP rebounding a mere 2.6% (consensus estimates).

“The political fall-out seems to be too high, even if the ‘technical level’ … could defend such a delay..”

• Officials Pressured EU Regulators to Rush Authorization of Pfizer Vax (CHD)

A Nov. 16, 2020, email from Marco Cavaleri, then head of the EMA’s biological health threats and vaccines strategy, stated that “[Alex] Azar and US GOV [sic]” had “pushed hard” to “rush into EUA [Emergency Use Authorization].” Azar at the time was secretary of the U.S. Department of Health and Human Services, which oversees the FDA. In a Nov. 19, 2020, email, Noel Wathion, then deputy executive director of the EMA, referenced a “TC” — shorthand for teleconference — “with the commissioner,” referring to European Commissioner Ursula von der Leyen. During the call, which Wathion described as “rather tense, at times even a bit unpleasant,” von der Leyen warned the EMA what might happen “if the expectations are not being met” to quickly issue a CMA [Conditional Marketing Authorization] for the Pfizer-BioNTech vaccine, “irrespective if such expectations are realistic or not.”

In the same email, Wathion wrote: “The political fall-out seems to be too high, even if the ‘technical level’ … could defend such a delay in order to make the outcome of the scientific review as robust as possible. … “Although we know that whatever we do (speeding up the process to align as much as possible with the ‘approval’ timing by FDA/MHRA [Medicines and Healthcare products Regulatory Agency] versus taking the time needed to have robust assurance in particular as regards CMC [Chemistry, Manufacturing and Controls guidelines] and safety) EMA will have a very big challenge addressing questions and criticism from various parties … in case of a delay of several weeks.” The “various parties” Wathion referenced included the European Commission, the European Parliament, the media and the general public.

Wathion went on to argue that “CMC, responsibility and accountability are certainly elements to be considered in my view.” In a later email, dated Nov. 22, 2020, Wathion further revealed the pressure the agency was facing to issue a CMA for the Pfizer-BioNTech vaccine, writing: “The likelihood that FDA (and also MHRA) will issue an EUA before a CMA is granted is extremely high. So we have to prepare for this.” However, Wathion expressed concerns in the same email that such preparation might come at the expense of a proper scientific assessment of the Pfizer vaccine. “We are speeding up as much as possible but we also need to make sure that our scientific assessment is as robust as possible,” Wathion wrote.

Nuremberg 2.0. A code, not a trial.

• Doctor Files $5M Defamation Lawsuit Against News MedPage Today (AFN)

America’s Frontline Doctors member Dr. Bret Barker, DNP, FNP, RN is suing MedPage Today and its Director of Enterprise & Investigative Reporting Kristina Fiore for defamation after Fiore wrote an article Dr. Barker says is riddled with disinformation. Dr. Barker is author of Sold Out Souls:Sars2-COVID-19, Simple Truths Ignored and CEO of Nuremberg 2.0, an organization dedicated to medical accountability and holding responsible medical professionals who harm the public in the name of COVID-19. In May, Fiore penned an article titled, “Should Doctors Worry About ‘Nuremberg 2.0?’ — It’s a ‘completely misleading application of the concepts of the Nuremberg trials.’”

Fiore first led readers to believe that Nuremberg 2.0 is about the Nuremberg trials and not the Nuremberg Code, which was developed in response to the medical experimentation perpetrated by the Nazis as revealed in the Nuremberg trials. The Code contains 10 tenets dedicated to human safety and dignity, the first of which is that “the voluntary consent of the human subject is absolutely essential.” In fact, Fiore writes about an individual who made a public comment at the California State Assembly against bill AB-2098, which would allow medical professionals to be punished for challenging the COVID-19 narrative. As Fiore wrote: “’I oppose this bill,’ he started, ‘and anybody who supports this bill will be held accountable under Nuremberg codes. Be warned.’”

But despite the outright reference to the Nuremberg Codes, Fiore said the word, which is “thrown around by the right wing,” refers to the Nuremberg trials. “These days, it’s mostly referred to as ‘Nuremberg 2.0,’ to invoke a second coming of the trials,” she wrote. Fiore then shared how one science professor in Canada said “he’s received many threats referencing Nuremberg 2.0” She proceeded to re-invoke the California State Assembly incident and name Dr. Bret Barker, making it seem as though Dr. Barker was the individual who made the public comment, when the doctor was not even there. She wrote that “the speaker at the California State Assembly hearing didn’t identify himself” and then went on to name Dr. Bret Barker as the CEO.

Third, Fiore led readers to believe that Nuremberg 2.0 is a medical terrorist organization “which essentially calls for doctors (and others) to be killed for providing COVID shots and other supposed pandemic crimes.” She also suggested that Nuremberg 2.0 members want to “execute” those who promote the COVID-19 vaccine, like in the Nuremberg trials. The week after Fiore wrote her piece, Dr. Barker filed a lawsuit against both MedPage Today and Fiore herself, seeking compensatory damages of $5 million for “long-term permanent damage to my personal life and reputation,” and punitive damages of $1 million. The complaint also mentions that Fiore did not reach out to Dr. Barker for a statement before publishing the story online and in emails to the publication’s 150,000 subscriber base. The story reached Dr. Barkers colleagues “and those who may have influence on my licensure and ability to work.”

Green ain’t cheap.

• It’s Not Working (Jim Kunstler)

Many people, I’m sure, assume that the more solar units feeding the grid, the better. Strangely, not so. Electric companies work much better when the production and flow of current is absolutely predictable and under their control — like, when they decide to fire up the natgas on generator number three or tune down the hydro turbines. It’s much harder to run the system with little dribs and drabs of electricity trickling in from hither and yon. But alt-energy is good PR for the government, so they do whatever they can to promote or even compel its use. I got a whopping folio of tax breaks and subsidies from the state and federal government when I decided to put solar electric on my house in 2013, though it finally still cost a lot: $35-K.

I had intimations of living through a chaotic period of history, and the decision was consistent with my general theory of history, which is that things happen because they seem like a good idea at the time. Getting a home solar electric rig seemed like a good idea. So, last week, after considerable hassle with my solar company setting up an appointment for a techie to visit and evaluate the problem here, the guy came up (at $150-an-hour) and informed me that my charge controller was shot. The charge controller processes all those chaotic watts coming from the solar panels on the roof into an orderly parade of electrons. He also told me that my back-up batteries — for running critical loads like the well-pump during grid outages — were at the end of their design life. Subtext: you have to get new batteries.

There are four big ones in a cabinet under the blown charge controller and the inverter (for turning direct current into alternating current that is the standard for running things). The techie had some bad news, though. New building codes forbid his company from replacing the kind of batteries I have, which are standard “sealed cell” lead-acid batteries. Some bullshit about off-gassing flammable fumes. Now the government requires lithium batteries, which would cost me sixteen-thousand dollars ($16-K) more to replace than new lead-acid batteries.

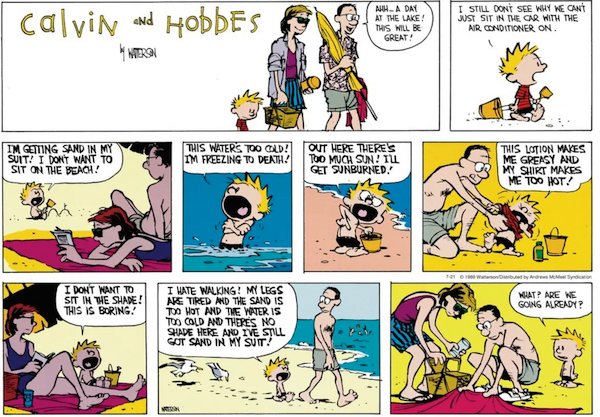

Hunter Gatherer

Wow! pic.twitter.com/K6qNzOjYdm

— Mr. Potato Head (@America1Scotty) July 11, 2022

AliKid

"If my mind can conceive it, if my

heart can believe it-then I can achieve

it.' ~ Muhammad Ali— Tansu YEĞEN (@TansuYegen) July 10, 2022

Gervais

Probably @rickygervais’ greatest joke and most relevant to the world today.

— Daniel (@Clark1995Clark) July 10, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.