Byron On the streets after a New York blizzard 1899

Love the CNN side link: “Related: Rogers wants to buy North Korea.” Jim Rogers is so dead on.

• Central Bankers ‘Don’t Have A Clue’ – Jim Rogers (CNN)

Famed investor Jim Rogers is warning that financial Armageddon is just around the corner, and it’s being fueled by moronic central bankers. “We’re all going to pay a horrible price for the incompetence of these central bankers,” he said Monday in a TV interview with CNNMoney’s Nina dos Santos. “We got a bunch of academics and bureaucrats who don’t have a clue what they’re doing.” The Singapore-based American investor said central bankers are doing everything they can to prop up financial markets, but it’s all for naught. He predicts their unconventional monetary strategies will lead to a stock market rally in the near future, but deep trouble later this year and into 2017. “This is going to be a disaster in the end,” he said. “You should be very worried and you should be prepared.”

Central bankers around the world have been increasingly using negative interest rates to prop up inflation and support their economies, but Rogers said the moves aren’t working. He said they are simply trying to rescue stock markets and help brokers keep their Lamborghinis. “The mistake they’re making is, they’ve got to let the markets sort themselves out,” he said. “It’s been over seven years since we’ve had a decent correction in the American stock market. That’s not normal … Markets are supposed to correct. We’re supposed to have economic slowdowns. That’s the way the world has always worked. But these guys think they’re smarter than the market. They’re not.”

Rogers made his fortune several times over by investing where others feared to tread. He made a name for himself in the 1970s after co-founding a top-performing fund with George Soros. He has also penned a range of investment books and become a fixture on the international speakers’ circuit. Rogers set a Guiness world record between 1999 and 2002 by visiting more than 100 countries by car.

Read more …

“..It is an odd world where the failure of unconventional monetary policies leads to more rather than less of the same. There will be worse to come.”

• There Is Worse To Come As QE Loses Its Impact (FT)

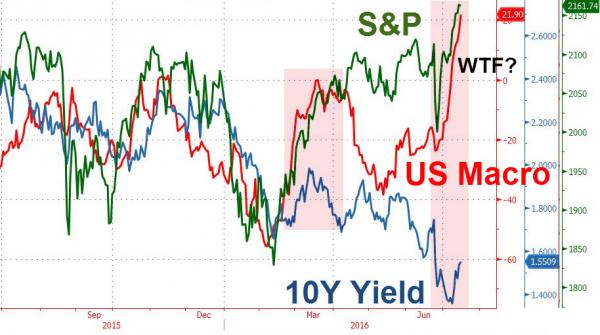

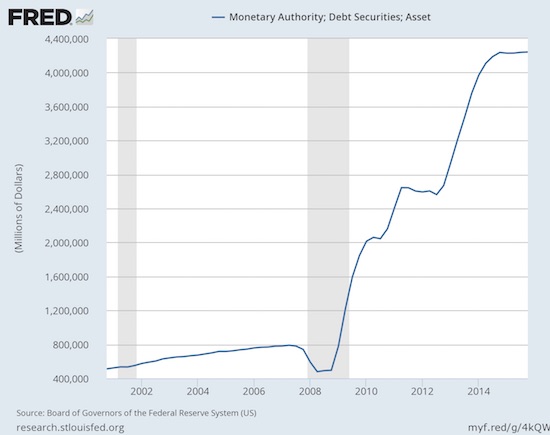

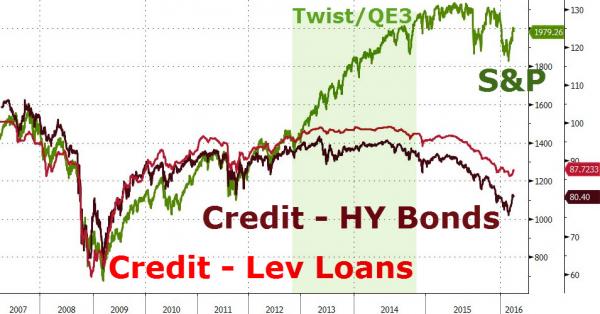

Ahead of a recent appearance in Hong Kong, one minder for Ben Bernanke suggested the former chairman of the Federal Reserve be asked not about the cost of quantitative easing, but about the impact of the policy instead. For years, central bankers have been reluctant to suggest that unconventional monetary policies even had costs. But while developed markets plunge ever deeper into uncharted financial territory as a result of central bank actions, the drawbacks and the limitations of such policies are finally becoming apparent. The negative effects will become even more obvious over time. This will come as asset price inflation — the main consequence of central bank policies — goes into reverse, robbing financial engineering of its efficacy and flattening the yield curve.

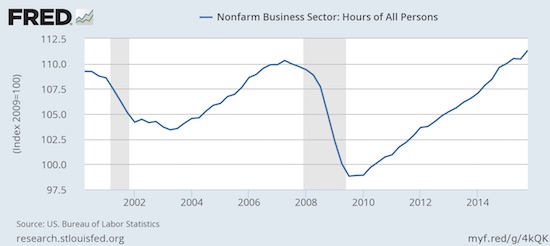

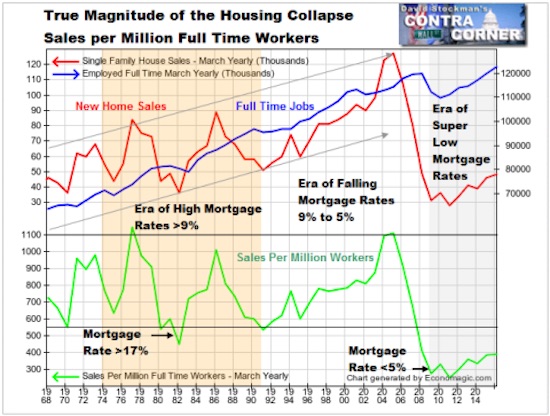

Suddenly, the success of central bankers in lifting financial asset prices through unconventional monetary policies seems to be coming to an end. Those policies did little for the real economy on the way up, as most companies engaged more in share buybacks than in investing in capacity, and economic growth in the US never broke through a range of 2% to 2.5%, falling under 1% in the fourth quarter. The impact on the real economy on the way down will be greater. The Bank of Japan’s embrace of negative rates, dovish coos from New York Fed Chairman William Dudley, and carefully worded statements from Mr Bernanke’s successor, Janet Yellen, last week spooked markets rather than soothed them. The fallout is already being felt in stock and credit markets, and in sectors from the banks to tech companies.

The extent to which quantitative easing is losing effectiveness can be seen best in the drop in the share prices of the private equity firms. In the past few years, it is possible to argue that no single group of investors has been as big a beneficiary of QE as these large alternative investment firms. They could finance their deals with cheap debt, sell down their holdings of portfolio companies in stock markets which kept rising, and mark up the value of their privately held portfolio companies on the basis of their listed peers. Now those perfect conditions are going into reverse. That’s why last week both Apollo Global Management and Carlyle announced that they were planning on some financial engineering by buying back their own shares for the first time ever. They may be too late.

“The share buyback boom has peaked,” notes Christopher Wood, strategist for the CLSA arm of Citic Securities, citing “the dramatic underperformance of the S&P 500 Share Buyback Index relative to the S&P 500 itself. The stock market has been ignoring the clear evidence of deteriorating margins and profitability, a form of deception encouraged by the share buybacks.” Meanwhile, Blackstone’s Steve Schwarzman spent much of his recent earnings call with his investors talking up the dividend yield (11% as of January 28, the day of the call) and value of his firm’s shares. “Right now you’re getting Blackstone on sale,” said the eternal salesman. We are in a world where the yield curve is flattening and there is little demand to borrow other than to engage in financial engineering. Banks’ inability to earn money in that world dominated headlines last week. But it will leave other kinds of financial institutions in even worse shape, especially insurers that sold guaranteed investment contracts. And savers will earn even less on their savings.

In an election year in the US, it seems unlikely that the Fed will return to its previous pattern of purchasing more securities, given the fact that such policies are partly responsible for deepening income inequality. It is even more risky for the Fed to adopt negative interest rates policy (NIRP) as so many other developed nations now have given that the impact on huge money market funds is unknown. “The US is not close to considering NIRP,” concluded JPMorgan economists in a report. “However, if recession risks were realised, the need for substantial additional policy support would likely push the Fed towards NIRP.” However, disconcertingly, the Fed’s latest stress test includes just that scenario, Mr Wood says. Meanwhile, JPMorgan late last week predicted that both the Bank of Japan and the ECB are likely to ease more in coming weeks. It is an odd world where the failure of unconventional monetary policies leads to more rather than less of the same. There will be worse to come.

Read more …

Worshipping idols.

• Markets Putting Faith in QE4? (WSJ)

Since the medieval church clamped down on the sale of indulgences, it has been hard to put a price on religious faith. Not so with central banks. The value of trust in the world’s leading policy makers is calculated second by second, and stood at about $1,209 an ounce on Monday. The gold price is far from a perfect measure of belief—or lack of it—in policy makers. But its 14% rise supports one popular explanation for this year’s tumbling markets: Investors have lost faith that the central bankers know what they are doing. The supporting evidence seems pretty convincing. The most obvious comes from moves in currencies and from banks, which suffer when they cannot pass on negative interest rates to most of their customers.

Currencies haven’t moved as expected. Negative rates ought to weaken a currency by making it less attractive to hold, one reason that central banks in the eurozone, Japan, Switzerland, Sweden and Denmark are so keen on them. But when the Bank of Japan surprised economists by cutting to negative rates for the first time at the end of January, the yen had just one weak day before strengthening back to be worth more than it was before the cut. Against the dollar, it is now worth 4% more than before the cut. Sweden faced the same problem last week, as its central bank, the Riksbank, cut its main policy rate more than expected to minus 0.5%. By the next morning, the krona was in fact stronger than before the action.

Both cases seem to show that investors fear negative rates more than they respect their power to stimulate. Part of this is down to the effect on the banking system, particularly in Europe. Banks haven’t been able to pass on negative rates to customers, hurting their margins even as bondholders worry that corporate defaults are set to rise. If central banks were trusted to boost the economy, higher demand for loans and fewer bad debts should amply offset negative rates’ effects on bank profits. Bank shares suggest otherwise. In Japan, bank shares fell more than 40% in three months, before Monday’s nearly 9% rally. This is their third-worst three-month drop since 1983, behind only the postbubble crash in the early 1990s and the 2008 Lehman Brothers panic.

Read more …

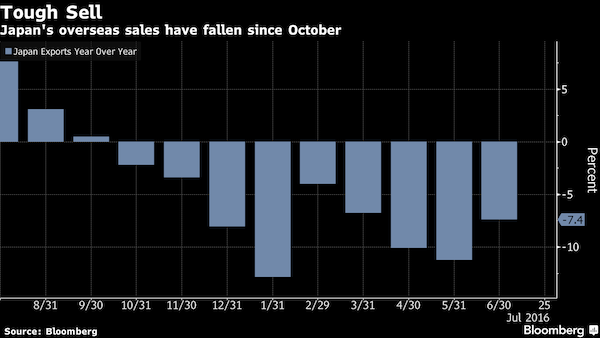

We don’t see nearly enough on Japanese banks. “..Japanese bank shares have slumped by as much as 30%..”

• BOJ Launches Negative Rates, Already Dubbed A Failure By Markets (Reuters)

The Bank of Japan’s negative interest rates came into effect on Tuesday in a radical plan already deemed a failure by financial markets, highlighting Tokyo’s lack of options to spur growth as global markets sputter. The central bank, which announced the shock decision on Jan. 29, will charge banks 0.1% for parking additional reserves with the BOJ to encourage banks to lend and prompt businesses and savers to spend and invest. While the announcement briefly drove down the yen and buoyed Japanese share prices, markets quickly went into reverse. “It’s getting clearer that Abenomics is a paper tiger,” said Seiya Nakajima, chief economist at Office Niwa, a consultancy, referring to Prime Minister Shinzo Abe’s policy mix of monetary easing, spending and reform.

“The impact of monetary easing is similar to currency intervention. The first time they do it, there’s a huge impact. But as they repeat it, the impact will wane,” said Nakajima. Though senior BOJ officials were at pains to say they had calibrated only a minor impact on Japanese banks, their stock prices plunged, contributing to a global market sell-off, particularly in financial shares. The problem was partly bad timing, as global markets were already in a tailspin over concerns about China’s slowdown, U.S. rate hikes and tumbling oil prices. But the reaction leaves BOJ Governor Haruhiko Kuroda’s assertion that his policy is having its intended effects looking increasingly threadbare. “It seems as though the BOJ’s action triggered the market moves,” said Yoshinori Shigemi, global market strategist at JPMorgan Asset Management. “But a better explanation would be that concerns elsewhere overwhelmed the BOJ action.”

In the 11 days since the BOJ board’s announcement, the benchmark Nikkei index has fallen 8.5%, despite a sharp rebound on Monday, while the yen has climbed 6.5% against the dollar. Japanese bank shares have slumped by as much as 30% as they are unlikely to pass on negative rates to savers, who already get negligible interest on their deposits but would baulk at paying to save. Negative rates could push down bank operating profits by 8-15%, Standard and Poor’s said. The 10-year Japanese government bond yield nitially fell below zero on the easing – a first among Group of Seven economies. But it has recovered from minus 0.035% last week to 0.090% above zero, with Japanese markets becoming more unstable as investors are at a loss on how to reckon fair value.

Read more …

“This is the equivalent of drinking whiskey and taking aspirin at the same time..”

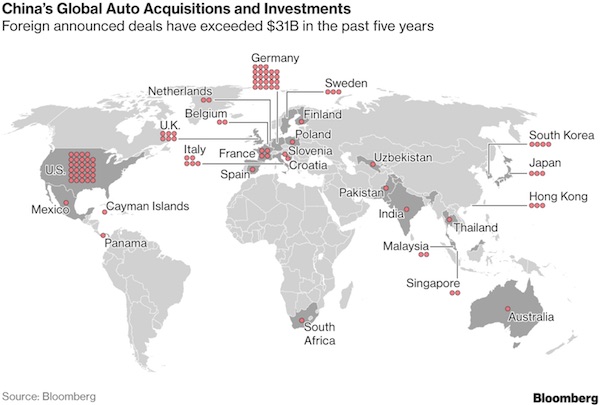

• China’s Problems ‘Just Gargantuan’ (CNBC)

Despite China’s yuan hitting its highest level this year against the U.S. dollar Monday, the country’s fundamental problems are “just gargantuan”, Stewart Paterson, portfolio manager at Tiburon Partners, told CNBC. “They (the Chinese) have deflation, they have a slowing economy,” said Paterson, “To say there is no downward pressure on the RMB (Renminbi) or no fundamental reason for it to weaken, I think is very disingenuous and symptomatic of the fact that the Chinese population themselves are starting to lose confidence in their own currency.” The Chinese authorities are bolstering the yuan, in part, by selling off chunks of their foreign currency reserves and dumping dollars in the market. Nonetheless, the money stock in China is growing about twice the pace of its economy, at about 14% year-on-year.

“If using your foreign exchange reserve is just a way of tightening monetary policy, as you support your own exchange rate… [then] the POBC (People’s Bank of China) are easing monetary policy by handing money out to the monetary market,” said Paterson. “This is the equivalent of drinking whiskey and taking aspirin at the same time… what you’re doing with one hand is counteracting the effects of what you’re doing with the other.” Paterson believes the yuan could devalue by a further 35%. However, economist George Magnus does not believe China will devalue the yuan in ways “that people think it will be forced or choose to.” “Instead, and if pushed by the capital flight that’s bleeding its reserves, China’s basic instinct will be to carry on tightening capital controls, and punishing those that try to breach them,” he wrote in a note on Friday.

And what is happening in China is having repercussions across the world, not least Europe, said Paterson. “If a country could just print as much money as it wanted, and at the same time, preserve the external purchasing power of its currency, clearly there would be no poverty in the world…we would have all done this,” he said. “The failure of Europe to generate nominal GDP (gross domestic product) growth is why the leverage is so damaging. The credit risk is rising in the risk-free sovereigns, which the banks are all up to their eyeballs in … and so a deflationary shock from China that makes nominal GDP growth in Europe an ever more distance prospect , of course that manifests itself in real stress in the European financial system,” he said.

Read more …

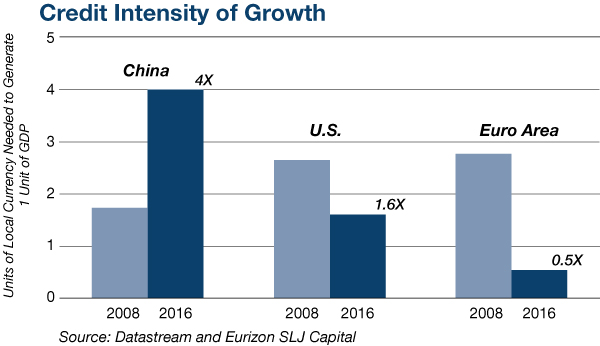

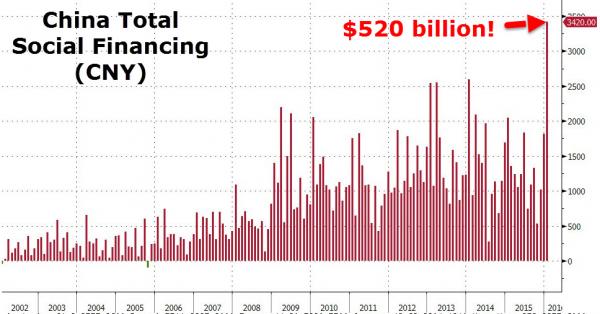

Diminishing returns. [That’s half a QE3 in one month]

• China Created A Record Half A Trillion Dollars Of Debt In January (ZH)

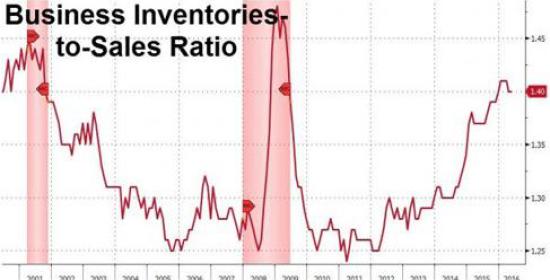

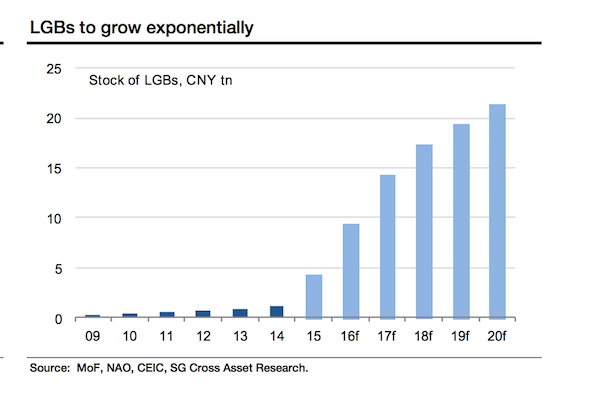

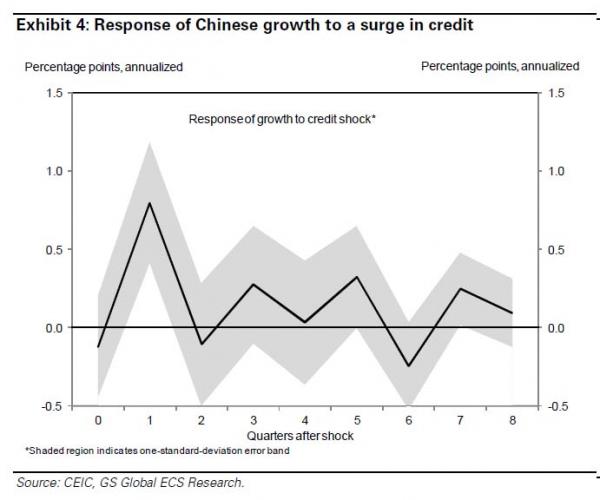

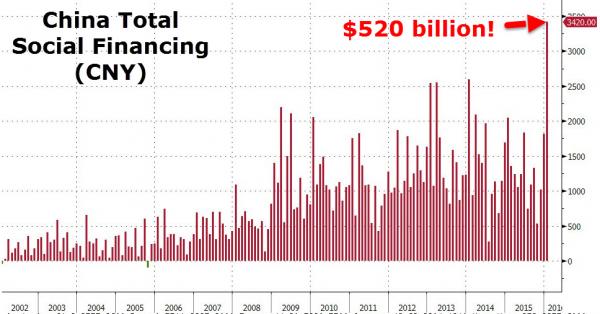

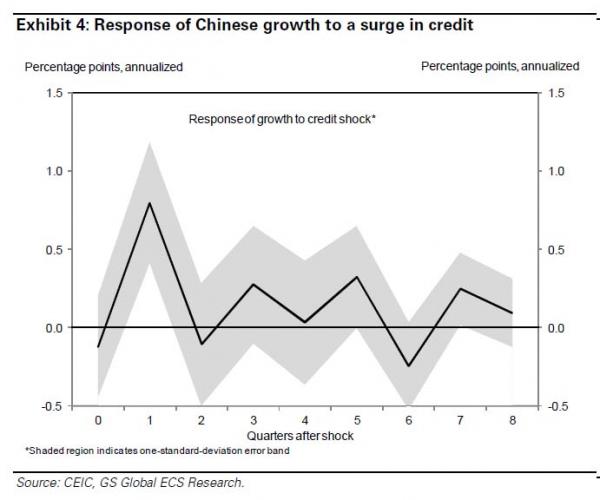

Yes, you read that right. Amid a tumbling stock market, plunging trade data, weakening Yuan, and soaring volatility, China’s aggregate debt (so-called total social financing) rose a stunning CNY3.42 trillion (or an even more insane-sounding $520 billion) in January alone. In fact, since October, China has added over 1 trillion dollars of credit… and has nothing but margin calls, ghost-er cities, and over-supplied commodity-warehouses to show for it… oh and even-record-er debt-to-GDP ratio. This is what the unprecedented addition of half-a-trillion dollars in one month looks like – Hyman Minsky called, he wants his chart back. [That’s half a QE3 in one month]

In the process of this gargantuan debt creation, China has smashed its recently record debt/GDP of 346% pushing it to even more ridiculous levels. Why is China doing this? Because as we showed three years ago, China needs ever greater stimuli to achieve the same effect: This is what else we said back in April 2013 which by now seems painfully (and plainfully) obvious: “What should become obvious is that in order to maintain its unprecedented (if declining) growth rate, China has to inject ever greater amounts of credit into its economy, amounts which will push its total credit pile ever higher into the stratosphere, until one day it pulls a Europe and finds itself in a situation where there are no further encumberable assets (for secured loans), and where ever-deteriorating cash flows are no longer sufficient to satisfy the interest payments on unsecured debt, leading to what the Chinese government has been desperate to avoid: mass corporate defaults.”

This could be the end as the last bubble standing (in China corporate debt) has begun to burst amid the over-supply of credit. What happens next?

Read more …

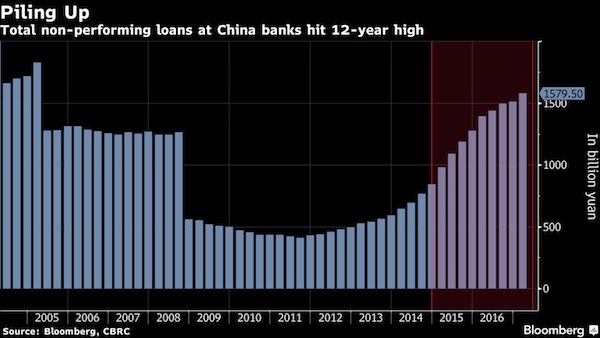

A) They’re lowballing. B) It’s not much use to look at China NPL without including shadow banks.

• China’s Bad Loans Rise to Highest in a Decade (BBG)

Soured loans at Chinese commercial banks rose to the highest level since June 2006 as the nation’s economic expansion slowed to the weakest pace in a quarter century. Nonperforming loans rose 7% from September to 1.27 trillion yuan ($196 billion) by December, the slowest quarterly increase in two years, data from the China Banking Regulatory Commission showed Monday. Including “special-mention” loans, where future repayment is at risk but yet to become nonperforming, the industry’s total troubled loans swelled to 4.2 trillion yuan, representing 5.46% of total advances. Concern over borrowers’ ability to service debt has weighed on Chinese lenders, with shares of the nation’s four largest banks trading at valuations at least 35% below a gauge of their emerging-nation peers. China’s economy grew last year at its slowest pace since 1990.

“The slower quarterly increase in NPLs are likely to be results of stepped-up efforts by banks to recollect loans, more aggressive write-offs, and some relaxation in their bad-loan recognition standards,” said Chen Shujin at DBS Vickers Hong Kong. “We don’t expect to see any turnaround of asset quality until the end of this year.” Separately, the People’s Bank of China reported Tuesday that new credit surged in January to a record 3.42 trillion yuan, almost double the amount in December and exceeding the median forecast of 2.2 trillion yuan in a Bloomberg survey of analysts. The increase was linked to a seasonal binge as banks front-loaded lending and Chinese borrowers refinanced foreign-denominated debt. The CBRC data comes amid speculation that soured loans could be much larger than indicated by official data.

Kyle Bass, a hedge fund manager who successfully bet against mortgages during the subprime collapse, said earlier this month that the Chinese banking system may see losses of more than four times those suffered by U.S. lenders during the 2008 credit crisis. That claim has been disputed by DBS’s Chen and analysts at China International Capital Corp and Macquarie. Should the Chinese banking system lose 10% of its assets because of nonperforming loans, the nation’s banks will see about $3.5 trillion in their equity vanish, Bass, the founder of Dallas-based Hayman Capital Management, wrote this month in a letter to investors obtained by Bloomberg. Larry Hu, a China economist at Macquarie in Hong Kong, said in a research note on Monday that Bass’s estimate could be too large as it implied a true bad-loan ratio for China banks at 28 to 30%.

Read more …

Scapegoats are easy to find in a central control system. But the system at the same time always points upward when it comes to blame.

• Chinese Premier Faults Regulators’ Handling of Stocks, Yuan Rout (BBG)

Chinese Premier Li Keqiang took the nation’s financial regulators to task for the way they handled a rout in stocks and the yuan, making him the most senior official to date to fault the response to the turmoil. Regulators didn’t respond actively to declines and some even have management problems, Li said in a State Council meeting on Monday, according to a Beijing News report carried on the government’s website. Li didn’t specify the regulators at fault and defended the decision to intervene in equity and foreign-exchange markets as necessary to head off systemic risks and “defuse some bombs.” “Looking back, the major responsible departments took inadequate actions and had internal management issues,” Li said.

The China Securities Regulatory Commission has drawn criticism recently over a series of steps such as as the circuit-breaker system that had to be rescinded just four days after it was introduced in January. The CSRC’s chairman, Xiao Gang, blamed factors including incomplete trading rules and an inappropriate regulatory system, and said officials will learn from their mistakes. The benchmark Shanghai Composite Index has tumbled more than 40% since a June high even after state funds spent billions of dollars to prop up equities. The government also tightened capital controls and spent almost $300 billion of its foreign exchange reserves in the last three months to prop up the exchange rate. The yuan posted its biggest advance in more than a decade on Monday in Shanghai after central bank Governor Zhou Xiaochuan voiced his support for the currency.

Read more …

Beijing tries to impress by showing it can raise the yuan. We are not impressed.

• China Favors Flexibility in Managing Yuan (WSJ)

China’s yuan had its biggest jump against the dollar in more than a decade on Monday, as Beijing keeps markets off guard with a shifting approach to managing its currency. The central bank is keeping its options open, swinging between its pledge to attach the yuan’s value to the currencies of its major trading partners and, when that works against it, repegging it to the dollar. Since mid-January, the People’s Bank of China has quietly rehitched the yuan’s value to a weakening dollar, despite vowing just a month earlier to use multiple currencies as the yuan’s reference points. For investors, China’s opportunistic approach sows confusion, which has led to volatile trading. On Monday, the central bank suddenly guided the yuan sharply higher.

Chinese officials and advisers close to the central bank said the move was aimed at shoring up dwindling confidence in the Chinese currency, also known as the renminbi, that has led businesses and individuals to rush to move capital out of the country. Analysts estimate China’s capital outflows ranged between $500 billion and $1 trillion last year. “The central bank wants to be flexible,” one of the officials said. “The goal is to reference the renminbi, instead of strictly pegging it, to the basket.” In published remarks over the weekend, China’s central-bank governor, Zhou Xiaochuan, gave a hint of Beijing’s desire to be opportunistic in remaking its exchange-rate regime. Speaking to Caixin, a prominent Chinese magazine, Mr. Zhou said China would proceed with the reform of referencing the yuan to the currency basket when there is “a window” of opportunity and will be “pragmatic and patient” when there is not.

“The direction is clear, but the path to reform won’t be a straight line,” Mr. Zhou said. Returning to what some analysts call a quasi-dollar peg has helped Beijing at a time when the dollar has weakened sharply against the yen and the euro as expectations for interest-rate increases in the U.S. fade. That has allowed the yuan to ride down with the dollar and discreetly depreciate against the currencies of China’s trading partners. “Things right now are working in the central bank’s favor,” said David Loevinger, a managing director and emerging-market sovereign analyst at TCW Group, with $180.7 billion of assets under management. “For the moment, that’s taken a lot of the pressure from the Chinese yuan. There’s less need for them to have the yuan depreciate against the dollar.” But it isn’t clear how long the favorable winds will blow for China. Monday’s currency movements gave an indication of the complexity of China’s gambit.

Read more …

We are not impressed. “The PBOC might like to flex its muscles by pegging the yuan higher but this has considerable costs if it continues to use up its reserves in the process.”

• Capital Flight Signals Investors Still Bracing For China To Devalue Yuan (MW)

While China’s currency had a strong jump after the lunar new year holidays, it is moves by capital, not moves by policy makers, that investors should pay attention to. At the weekend People’s Bank of China Gov. Zhou Xiaochuan ended his silence to make his first comments in a number of months, reiterating that there was no intention to devalue the yuan, while also ruling out imposing capital controls. He added that the PBOC would be cautious when using resources to fight international speculators, while also saying he supported a more flexible yuan. A slide in the dollar last week likely contributed to this more sanguine tone, with the central bank moving to set the yuan almost 1% stronger at 6.5118 to the dollar on Monday.

But any suggestion the troubled yuan is now at a turning point still looks decidely premature. For one thing, no central banker would decisively flag in advance an intention to move off an effective currency peg as this would be an open invitation to speculators. Indeed, some have commented that this was exactly the problem with the PBOC’s surprise and poorly explained devaluation last August. Further, China is still burning through its foreign reserves at an alarming pace to support the yuan after they fell another $99.47 billion to US$3.23 trillion in January. Hedge funds that have been targeting the yuan are betting that Beijing will eventually tire of intervention if currency outflows persist as it contracts the money supply and piles more pain on the economy.

The PBOC might like to flex its muscles by pegging the yuan higher but this has considerable costs if it continues to use up its reserves in the process. In a recent report, BMI Research explained that using reserves to backstop the onshore yuan market contradicts the policy goal of supporting economic growth and easing credit conditions. The key pain point is the extremely large stock of debt, which is becoming increasingly difficult for local governments and corporates to service as economic growth slows. This underpins their view that the central bank would eventually have to relent and allow the yuan to weaken. Societe Generale is also forecasting a weaker yuan and in a recent report looks at what will happen if Beijing succumbs to a one-off devaluation or moves to a free float by the end of the year.

Read more …

Anything close to China will see fallout.

• A Massive Banking Crisis Is Brewing In Singapore, Says Zulauf (SBR)

The three biggest banks are losing capital. A crisis of staggering proportions is looming in China, and tiny Singapore will be caught right in the middle of the storm once the disaster finally erupts. Speaking at the annual Barron’s roundtable, Swiss billionaire investor Felix Zulauf warned that Singapore’s largest banks are at risk of massive capital outflows if the Chinese economy experiences a hard landing, which he expects will happen this year. “We are in a down cycle that will end with crisis and calamity. China in today’s cycle is what US housing was during the financial crisis in 2008,” Zulauf warned. Zulauf warned that capital outflows in China will continue, prompting regulators to devalue the yuan by as much as 15% to 20% within the year.

When this happens, Asian economies which are heavily dependent on China—particularly Singapore—will suffer because Chinese corporates will cut their imports even more, while indebted Chinese companies will be placed at greater risk of default. “I expect the situation the deteriorate to a point where we will witness a banking crisis in Asia that will hit Singapore and Hong Kong particularly hard,” Zulauf said. “It is conceivable that Singapore, which has attracted a lot of foreign capital over the years because of its image as a strong-currency state, will be extremely exposed to the situation in China. Singapore’s banking-sector loans have grown dramatically in the past five or six years. Singapore is now losing capital, which means the banking industry is losing deposits,” Zulauf said.

He said that such a situation will cause carry trades to go awry, which will result in steep losses for heavily-leveraged traders. “I mentioned the potential for a banking crisis in Singapore. I don’t recommend shorting Singapore bank stocks, but rather the EWS, or iShares MSCI Singapore ETF. In this case, an investor will benefit from both declining local stock prices and a decline in the Singapore dollar against the U.S. dollar,” said the report.

Read more …

“You can’t just miss coupon payments. It’s called insolvency.”

• Keiser: Deutsche Bank ‘Technically Insolvent’, Running A ‘Ponzi Scheme’ (RT)

Max Keiser hit out against Deutsche Bank in the latest episode of his RT program Keiser Report, saying the bank was “technically insolvent” despite assurances from German Finance Minister Wolfgang Schaeuble that he had “no concerns” over his country’s biggest bank. Deutsche Bank shares are down 40% since the beginning of the year, falling below their price at the time of the 2008 financial crisis. The bank suffered record losses of €6.8 billion in 2015. With a balance sheet now eclipsing JP Morgan’s, Keiser warned that the bank will sooner or later have to admit to insolvency and say “we need either a huge bailout or we gotta close up shop.” However, German Finance Minister Wolfgang Schaeuble dismissed concerns over Germany’s biggest lender, telling Bloomberg he was not worried about its future.

Deutsche Bank CEO John Cryan also played down the concerns in a published letter to staff on February 9, describing the bank as “absolutely rock-solid” and “strong”. “On Monday, we took advantage of this strength to reassure the market of our capacity and commitment to pay coupons to investors who hold our Additional Tier 1 capital,” Cryan wrote. “This type of instrument has been the subject of recent market concern. The market also expressed some concern about the adequacy of our legal provisions but I don’t share that concern. We will almost certainly have to add to our legal provisions this year but this is already accounted for in our financial plan.” The bank’s contingent convertible (CoCo) bonds also plunged in value this year. CoCo bonds are designed to be converted to equity when the bank gets into trouble.

They have no maturity date and come with no promise to investors that they will get their money back. Coupon payments on the bond are contingent on the bank’s ability to keep its capital above certain thresholds. If the bank does not make a coupon payment, investors cannot call for a default. Deutsche Bank said last week that they would likely be able to make its coupon payment for 2016, after telling investors last month that it couldn’t make its 2015 payments. Keiser described the move as a ponzi scheme saying, “You can’t just miss coupon payments. It’s called insolvency.”

Read more …

“..European institutions are girding yet again for another round of restructuring. [..] So much so that analysts in London call them “building sites..”

• The Never-Ending Story: Europe’s Banks Face a Frightening Future (BBG)

If you had to pick the moment when European banking reached the point of no return, which would you choose? The July day in 2012 when Bob Diamond resigned as Barclays’s chief executive officer amid the Libor rigging scandal? Or the fall morning later that year when UBS announced it was pulling out of fixed income and firing 10,000 employees? How about Sept. 12, 2010, when Basel III’s raft of costly capital requirements started upending the economics of global finance? All signature events, to be sure. But try May 21, 2015. That’s when Deutsche Bank stockholders filed into the dome-shaped Festhalle arena in Frankfurt to take part in one of the most venerated and, let’s be honest, boring rituals in corporate life: casting a vote on management’s strategy and performance.

It wasn’t dull this time. Almost 40% of the bank’s investors gave co-CEOs Anshu Jain and Jürgen Fitschen a big thumbs down. While winning six out of 10 votes is a landslide in politics, it’s a crushing blow at a publicly traded company. By the end of June, Jain was out and Fitschen had agreed to leave the company by May of this year. Investors are running out of patience with European bank chieftains, and no wonder. Since the fall of Lehman Brothers in September 2008, eight of Europe’s biggest banks have announced layoffs adding up to about 100,000 employees, paid $63 billion in legal penalties, and lost $420 billion in market value. In 2015, Deutsche Bank lost a record €6.8 billion ($7.6 billion).

In mid-February the industry suffered an epic selloff as subzero interest rates, China’s slowdown, the oil crash, and looming regulatory and litigation costs triggered an outbreak of fear not seen since the fall of 2008. Just last year new CEOs took over at Barclays, Credit Suisse, Deutsche Bank, and Standard Chartered. Now they have to find a way to prosper in a marketplace that’s being reshaped simultaneously by strict new capital regulations and myriad financial technology startups that don’t have to abide by them. While American banks appear to have turned the corner since that gut-churning autumn nearly eight years ago, European institutions are girding yet again for another round of restructuring.

So much so that analysts in London call them “building sites,” Bloomberg Markets magazine reports in its forthcoming issue. Credit Suisse’s new CEO, Tidjane Thiam, is “right-sizing” the investment bank and pushing for a 61% jump in pretax income from his international wealth management unit over the next two years. At Barclays, Jes Staley wasted no time cutting 1,200 investment banking jobs and closing offices in Asia and Australia after taking charge in December. Meanwhile, John Cryan, the British executive who replaced the India-born Jain, is pursuing an unprecedented overhaul of Deutsche Bank’s entire information technology infrastructure to shore up shaky risk-management systems.

Read more …

Creatively broke.

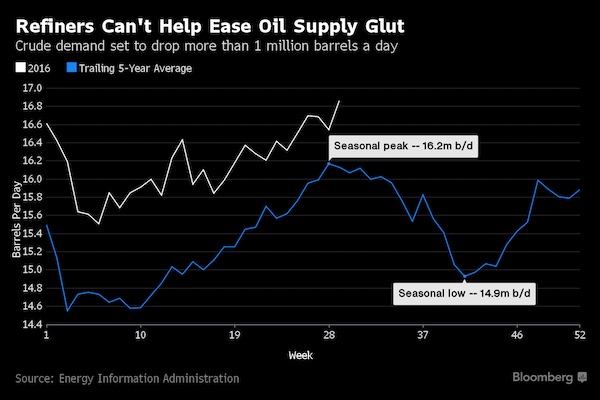

• Low Oil Prices Claim New Victim, an Offshore Driller From Texas (NY Times)

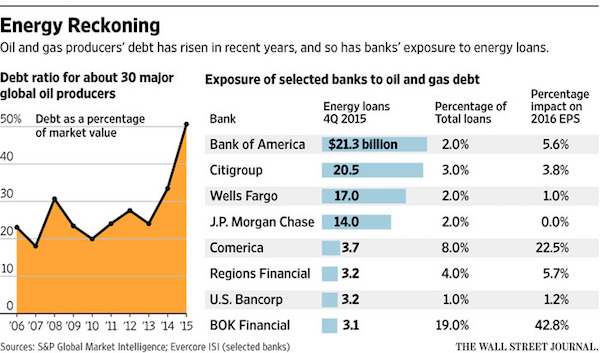

Yet another oil company has filed for bankruptcy, as the energy industry and its lenders brace for a prolonged slump. Paragon Offshore, which operates offshore drilling rigs from the Gulf of Mexico to the North Sea, filed for Chapter 11 bankruptcy protection Sunday evening, the latest filing in a painful shakeout buffeting the oil industry. Over the last 16 months, about 60 oil and gas companies have filed for bankruptcy as commodity prices slide, and that figure is expected to double in the coming months if prices remain low. All told, analysts say as much as a third of the sprawling oil and gas industry in the United States could be consolidated as a result of the downturn. Paragon, based in Houston, was one of the more fortunate companies that has contemplated bankruptcy.

The company was able to negotiate a deal with its lenders — a mix of bondholders and banks — ahead of its bankruptcy filing. The so-called prepackaged bankruptcy agreement sealed last week allowed Paragon to cut its $2.7 billion of debt by about $1.1 billion and to keep operating. For other energy companies, the swift drop in oil prices from $100 a barrel in late 2014 to just around $30 last week has drained cash reserves so quickly they have not been able to agree on an out-of-court debt restructuring, which is likely to lead to a series of drawn-out and messy bankruptcies. Unlike other recent oil restructurings, which have all but wiped out equity holders, Paragon’s existing equity investors will retain 65% of the company.

Paragon, which traces its roots to the Great Depression and now employs about 2,900 people around the world, had not run out of cash when it filed, but company executives determined that it could not hold out forever, said Lee M. Ahlstrom, Paragon’s senior vice president for investor relations, strategy and planning. Paragon’s biggest customers for its drilling services, including the Mexican oil giant Pemex and Petrobras of Brazil, have been cutting back on new projects as the global supply remains high. In the shale oil fields of the United States, there are very few wells that are profitable to drill at current prices. With large producers like Saudi Arabia showing no signs of cutting back production and the global economy slowing, oil executives and investors expect the market to remain in turmoil until 2017.

Read more …

This is going to hurt. NZD=0.66USD

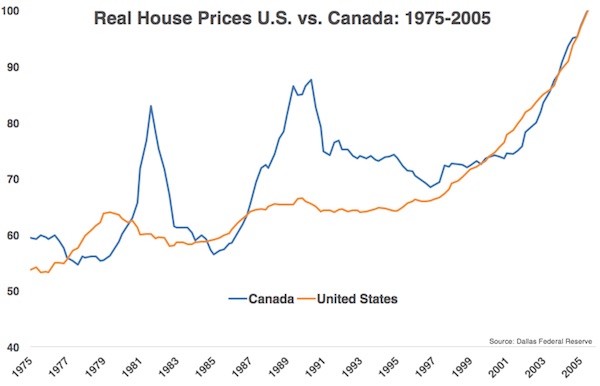

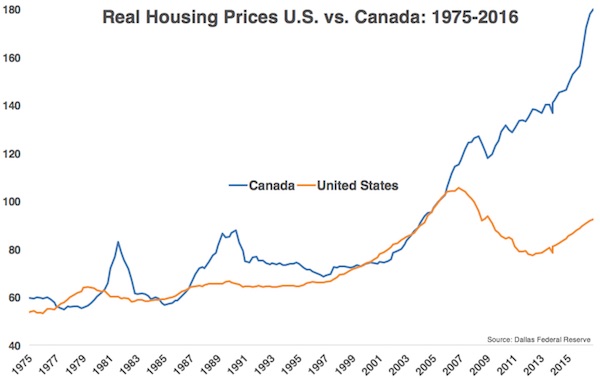

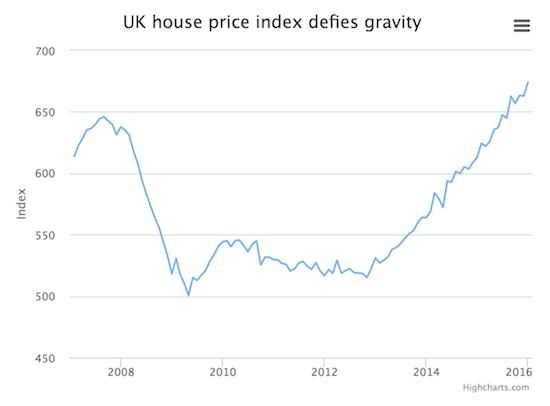

• Sellers Of Auckland Houses Want $100,000 More Than They Did Last Year (Stuff)

Auckland house-sellers now want more than $100,000 more for their houses than they did in January last year. Trade Me Property has released its data for the month, showing the national average asking price across the country fell to $541,900 in January, down 2% from December. But the average was still up 9% on the same time in 2015. The Auckland average asking price dropped 0.5%, to $801,400 – up more than $107,000 or 15.4% on January 2015. Head of Trade Me Property Nigel Jeffries said that over the past 18 months the average asking price of a property in Auckland had surged up in “an almost unbroken run” from $641,500 to $801,400.

“We’ve seen a staggering $160,000 added to the average asking price of a house in Auckland over the past year and half, which is an average rise of over $8,500 per month. And if we look back to January 2011, we’ve seen the average asking price up 60% or a shade below $300,000.” The Bay of Plenty continued to power ahead with average asking prices rising 12.2% over the past 12 months, edging closer to Auckland’s 15.4% increase. “While Auckland has started to take its foot off the gas, the Bay of Plenty remains solidly in overdrive. Outside these two, no other region is showing a double-digit rise. In the past 12 months the asking price in the Bay of Plenty has risen by $55,300 and pushed the five-year increase beyond 30% for the first time,” Jeffries said.

Read more …

“.. it appears for now that America is fixing to elect either a primal screamer or a road-tested grifter..”

• Repricing Reality (Jim Kunstler)

It ought to be a foregone conclusion that Mr. Obama’s replacement starting January 20, 2017 will preside over conditions of disorder in everyday life and economy never seen before. For the supposedly thinking class in America, the end of reality-optional politics will come as the surprise of their lives. Where has that hypothetical thinking class been, by the way, the past eight years? Don’t look for it in what used to be called “the newspapers.” The New York Times has become so reality-averse that the editors traded in their blue pencils for Federal Reserve cheerleader pompoms after the Lehman incident of 2008. Every information-dispensing organ has followed their lede: The Recovery Continues! It’s a sturdy plank for promoting the impaired asset known as Hillary.

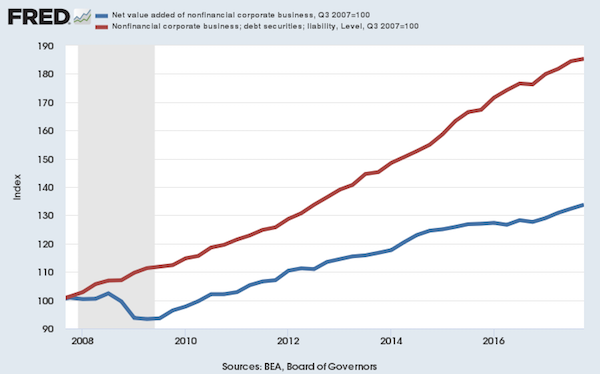

Don’t look for the thinking class in the universities. They’ve surrendered their traditional duties to a new hybrid persecution campaign that is equal parts Mao Zedong, the Witches of Loudon, and the Asylum at Charenton. For instance the President of Princeton, Mr. Eisgruber, was confronted with a list of demands that included 1) erasure of arch-segregationist Woodrow Wilson’s name from everything on campus, and 2) creation of a new all-black (i.e. segregated) student center. He didn’t blink. Note: nobody in the media asked him about this apparent contradiction. That’s how we roll these days. Don’t look for the thinking class in business. The C-suites are jammed with people still busy buying back stock in their own companies at outlandish prices with borrowed money. Why?

To artificially boost share price and thus their salaries and bonuses. Does it do anything for the fitness of enterprise? No, in fact it makes future failure more likely. Why is their no governance of their insane behavior? Because they’ve also bought and paid for boards of directors composed of a rotating cast of praetorian shills, with fresh recruits entering the scene weekly through the fabled “revolving door” between business and government regulators. Oh, and then there’s government. Anyone viewing the boasting-and-defamation contests that the cable TV networks call “debates” knows that these spectacles are based on the opposite of thinking. They are not only reality-optional, they’re thought-optional. Hence, it appears for now that America is fixing to elect either a primal screamer or a road-tested grifter to preside over the epochal collapse of our hobbled, exhausted, way of life.

Read more …

Bit late perhaps?

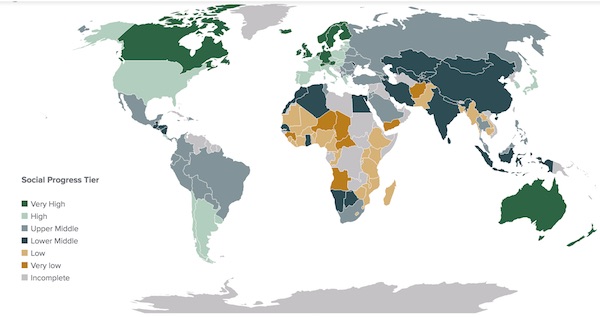

• German Minister Asks For Half A Billion To Create Jobs For Refugees (EA)

Federal Minister of Labour and Social Affairs Andrea Nahles has called for €450 million to help integrate refugees into the labour market. EurActiv Germany reports. Nahles has asked for nearly half a billion euros from Minister of Finance Wolfgang Schäuble in order to provide better access to jobs, according to German media. Nahles told the Funke Mediengruppe that the current budget is not sufficient. In order to create 100,000 new jobs for new arrivals to Germany, she needs at least €450 million extra per year. “So far, people have had to sit around doing nothing for 12 months at a time,” she said. “This creates tension for everyone. We must act as quickly as possible, but I can only do this with the support of the Finance Minister.” However, Nahles warned against taking the money from the long-term unemployed, as this would “stoke the fires of fear” and create even more tension.

Negotiations with the Finance Ministry have started already. Nahles expects the number of recipients of unemployment benefits, under the so-called Hartz IV system, to rise to 270,000 this year. Of these, about 200,000 are fit for work. The arrival of over 1 million refugees last year has put a strain on nearly every aspect of German society, with the health, education and employment sectors all struggling to cope with the influx of people. Germany’s situation is paralleled In Turkey, where legislation has been passed to allow Syrians to work legally in the country. Turkish Ambassador Selim Yenel told EurActiv in an interview that this measure will have a knock-on effect for education, where Syrian teachers will now be able to work legally and help educate the significant number of Syrian children that have arrived in the country.

Read more …

How bad is this going to get for Greece?

• Greek Minister: Hungary Has Sent Nothing, Not Even A Blanket (EA)

Athens blamed Hungary for not contributing to the country’s efforts to tackle the refugee crisis and for its “political decision” to help Macedonia build a fence at the Greek border. In an interview with Hungary’s Népszabadsàg, Greece’s Alternate Foreign Minister for European Affairs, Nikos Xydakis, wondered why Budapest wanted to tell others what to do with the refugee crisis. “We have never criticized the policy of the Hungarian Premier, Victor Orbán,” Xydakis said. The leaders of the ‘Visegrad Four’ (also known as V4) are meeting today in Prague for a mini-summit ahead of the 18-19 February EU Council meeting. The Visegrad leaders seek a possible “plan B” in case of a collapse of the Schengen system and in particular an exit of Greece from the group. In particular, they want to make sure that the borders between Bulgaria and Greece and Macedonia and Greece are sealed and effectively stop the migration flows.

Earlier this month, the Greek government said that the Visegrad Four were pressing Athens not to abide by the international rules, and to stop rescuing refugees at sea. Athens, also, noted that the Visegrad leaders urged the EU to shut the Greek borders. “It’s weird that from Budapest – which is attacking Athens – we have not received a single blanket or a tent within the EU Civil Protection Mechanism until the end of January,” the minister said. The Civil Protection Mechanism was established in 2001 as a means of fostering cooperation among national civil protection authorities across Europe. The Greek official stressed that other EU member states helped and had already provided equipment to take care of the refugees. “Lithuania -which is quite far from the Mediterranean zone crisis, sent two patrol ships,” Xydakis said.

Read more …

“It doesn’t matter if it’s your job. It breaks your heart.”

• Unknown Dead Fill Lesbos Cemetery For Refugees Drowned At Sea (Reuters)

She drowned trying to reach Europe, but her headless body was never identified. Her tombstone will bear no name. Like others buried beside her in an olive grove on the Greek island of Lesbos, the marble plaque on her unmarked grave will proclaim the victim “Unknown”. Her epitaph an identification number, the date she washed ashore, and her presumed age: one. Sixty-four earthen graves have been dug in this land plot for refugees and migrants who drowned crossing the Aegean Sea trying to reach Europe. Just 27 of those are named. The others state plainly: “Unknown Man, Aged 35, No 221, 19/11/2015;” “Unknown Boy, Aged 7, No 40, 19/11/2015;” “Unknown Boy, Aged 12, No 171, 19/11/2015.”

[..] In 2015, the deadliest year for migrants and refugees crossing the Mediterranean, more than 3,700 people are known to have drowned or gone missing, the International Organization for Migration says. The actual number is believed to be higher. Hundreds have drowned in Greece since arrivals surged last summer. So many, in fact, that the section of one Lesbos cemetery designated for refugees and migrants has long run out of space. Locals conclude that entire families have drowned in the same shipwreck, leaving no survivors to identify the victims. They recall bodies found severely decomposed after days at sea, or dismembered from crashing against the rocks of the island’s long coastline. “It doesn’t feel right, seeing a child of unknown identity, an unknown child, a child of ‘roughly this age’,” said Alekos Karagiorgis, a caretaker who has transported hundreds of corpses from beaches across the island to the morgue since summer. “It doesn’t matter if it’s your job. It breaks your heart.”

[..] In October, following a nighttime shipwreck from which more than 200 were rescued but dozens died, the St. Panteleimon cemetery ran out of space to bury the dead and the island’s morgue had to bring in a container to keep the bodies. That prompted local authorities to set aside a plot of land in one village for burials. There Mustafa Dawa, a boyish-looking 30-year-old from Egypt in Greece since his 20s, has taken on the unofficial role of washing, shrouding and burying the dead, their heads faced towards Mecca. “I did 57 funerals in seven days. In one day I did 11,” he said, recalling spending a few minutes crouched in the grave of the headless child, weighed down by emotion. Dawa says it’s the least he can do. “I can’t stop the war there, I can’t make them cross (to Europe) legally. All I can do is bury them.”

Read more …