Jules Bastien-LePage The annunciation to the shepherds 1875

Paris, February 3 2024

Macron/Farmers

https://twitter.com/i/status/1753757359329919212

Putin

https://twitter.com/i/status/1753827565293436943

Elon Musk: Biden’s strategy is very simple: 1. Get as many illegals in the country as possible. 2. Legalize them to create a permanent majority – a one-party state. That is why they are encouraging so much illegal immigration. Simple, yet effective.

Most people in America don’t know that the census is based on a simple headcount of people (including illegals) *not* just citizens. This shifts political power and money to states and Congressional districts with the highest number of illegals.

The Deep State formed an alliance with the Democrats to take over America. They import millions of illegals and turn kids into LGBTQ because both groups overwhelmingly vote for Dems. They destroy America to rule America, forever. The civil war has begun and the Dems started it.

— Kim Dotcom (@KimDotcom) February 3, 2024

JK Rowling

This is utterly brilliant. A student accuses @jk_rowling of being transphobic. This teacher skilfully dissects the claim and challenges it by asking questions.

He teaches not what to think, but how to think critically.

Watch until the end.

You see the epiphany in real-time. pic.twitter.com/x00gWdOugc— Lee Harris (@addicted2newz) February 3, 2024

“If we ‘do not seek conflict,’ then let’s get the troops out of there..” [..] “They are not welcome. They are not needed..”

• RFK Jr Slams American Attacks On Syria and Iraq (RT)

The US should withdraw its ground troops from Middle Eastern countries that do not welcome them, independent candidate for US president Robert F. Kennedy Jr has said.He said the escalation could have been avoided, reacting in an X (formerly Twitter) post to Washington’s attack on more than 80 targets allegedly linked to Iran’s Revolutionary Guard (IRGC) in Iraq and Syria in a wide-ranging air assault. US Central Command says it hit 85 Iranian-linked targets in Syria and Iraq in retaliation against the recent “Iran-affiliated” fighters’ attack that killed three US servicemen in Jordan. President Joe Biden’s X post read that the US does not “seek conflict in the Middle East or anywhere else in the world. But to all those who seek to do us harm: We will respond,” despite Iran denying involvement in the incident.

“If we ‘do not seek conflict,’ then let’s get the troops out of there,” Kennedy said, apparently reacting to Biden’s statement. “They are not welcome. They are not needed,” he added. Kennedy claimed that the current escalation would not have been necessary if Washington hadn’t put its military “in the crosshairs” of Shiite militias. He described the existence of these groups “as a legacy of our illegal war in Iraq.” He recalled that both Iraq and Syria had asked the US troops to leave their territory while Iran would not tolerate America’s military presence on its borders.

Besides pulling US troops “out of the Mideast,” Kennedy urged Washington to forge ties with regional powers instead. The presidential candidate also described the troop presence in the area as “indefensible targets for anyone in the region who wants to provoke a conflict.”Iraq has rebuked the US over the airstrikes, saying they constitute “a violation of Iraqi sovereignty” and “pose a threat that could lead Iraq and the region into dire consequences. The Syrian military, as quoted by SANA news agency, denounced the raid as “the aggression of the American occupation forces.”

“If a temporary reduction in the intensity of the fighting in Gaza is achieved, the controversy within Israel surrounding the current Netanyahu government will escalate. Obviously, the end of the conflict would also lead to the end of the prime minister’s political career and those of other prominent figures.”

• Israel vs. Hezbollah: A New War Will Consume The Entire Middle East (Sadygzade)

Since the first days of the current escalation, Israeli tensions with Hezbollah have increased. And thoughts of launching military action to the north were in the minds of the Jewish state’s political and military establishment as early as late October. For example, The Wall Street Journal, citing sources, reported that on October 11 US President Joe Biden persuaded Israeli Prime Minister Benjamin Netanyahu not to launch a preemptive strike against Hezbollah because of the risk of a major war in the region. On that day, Israeli intelligence received information about Hezbollah’s intention to invade Israel from several directions, and Israeli fighter jets were already in the air, waiting for orders to attack the group’s facilities in Lebanon. It took about six hours of negotiations and meetings for Israeli officials to back down, WSJ sources said. The situation on the border between Israel and Hezbollah remains tense, and the possibility of a full-scale conflict is real.

This was confirmed by Israeli media, citing remarks by National Security Council head Tzachi Hanegbi at a closed session of the Knesset Foreign Affairs and Defense Committee on January 17. Hanegbi also provided interesting details regarding Hamas. According to the official, Hamas’ leader in Gaza, Yahya Sinwar, has taken a harder line during negotiations for the exchange of hostages, which will likely draw out the process of returning the 117 people still held captive since the October attacks on Israel. In his remarks, Hanegbi emphasized that the physical elimination of Sinwar is still a pressing goal for Israeli security forces. However, neither Hanegbi nor other Israeli figures have offered concrete solutions for a long-term arrangement in Gaza. This is worrisome, as the WSJ notes, citing its White House sources. The newspaper claims that efforts to convince Netanyahu to agree to an end-of-conflict option that includes handing over control of Gaza to the Palestinian National Authority have failed.

Instead, Israel intends to carry out a prolonged operation against Hamas. However, recently negotiators from Israel, the US, Egypt and Qatar met in Paris and agreed on the basics of a new deal aimed at releasing the hostages. This was reported by NBC News on January 29. The plan envisions the gradual release of captives, starting with women and children. For its part, Israel will offer limited pauses in hostilities and the admission of humanitarian aid, as well as the release of Palestinian prisoners. The plan has been sent to representatives of Hamas. If a temporary reduction in the intensity of the fighting in Gaza is achieved, the controversy within Israel surrounding the current Netanyahu government will escalate. Obviously, the end of the conflict would also lead to the end of the prime minister’s political career and those of other prominent figures.

Even Washington, Israel’s most important ally, has delivered repeated messaging that Netanyahu must go. No one wants a major war in the region. Hezbollah, which is closely allied with Iran, also does not want tensions to escalate into open warfare. This is demonstrated by its restraint, both in statements by top officials and in attacks on Israeli forces. But if Netanyahu does decide to launch an operation in southern Lebanon, the war will be long and bloody. Representatives of the “Axis of Resistance” led by Iran will lend support with even greater effort. Then the specter of war will become a reality and the Middle East will burst into flames, the consequences of which no one can assess or foresee.

“..there’s no leadership [the US] left it up to Netanyahu. He’s the tail wagging the dog..”

• Biden’s Justification For Hitting Iran Puts NATO Troops in Danger (Sp.)

On Friday, US President Joe Biden fulfilled his promise to strike Iranian targets in Syria and Iraq, further escalating the region even as the White House insists that it does not seek war with Iran. Michael Maloof, a former senior security policy analyst for the Office of the Secretary of Defense with nearly 30 years of experience, told Sputnik’s Fault Lines that the justification used by the White House could easily be applied by Russia to NATO countries supporting Ukraine. “You’re hearing from congressmen and senators saying ‘but we need to hit Iran for supplying the Houthis and Hamas and Hezbollah,” Maloof explained. “Well, does Russia then have a right to hit US and NATO allies, as a result of supplying weapons to Ukraine to battle Russians?” The United States has placed the blame on Iran for the Sunday drone attack that killed three US service members and injured dozens more on the border of Syria and Jordan.

While the US admits that it has no evidence Iran helped plan the attack, the Biden administration has been clear it blames Iran because the country allegedly funds those groups and other militants. “This afternoon, at my direction, U.S. military forces struck targets at facilities in Iraq and Syria that the IRGC and affiliated militia use to attack U.S. forces,” US President Joe Biden said in a statement released Friday by the White House. “I think that if Biden were to follow through, then that raises a whole new specter of opening up NATO countries to potential attack,” he continued, adding that the US is simply hoping Russian President Vladimir Putin “doesn’t follow through” with that justification. Maloof argued that the US should reevaluate the situation in the Middle East but it’s difficult because the US looks “at the Middle East through the prism of Israel all the time.”

“We’ve got to somehow figure a way out of it. Instead, we’re digging that hole deeper and even though there might be some attempts to try and persuade [Israeli Prime Minister Benjamin] Netanyahu to calm down and have a ceasefire and try to resolve things, it’s doing just the opposite. “The problem is that Biden has left the conduct of the war up to Netanyahu, and Netanyahu knows this and he’s basically dragging us along – we’re captives of Netanyahu,” Maloof explained. “You don’t have any, there’s no leadership [the US] left it up to Netanyahu. He’s the tail wagging the dog,” he added later. Maloof further argued that Israel has been getting the United States to do its dirty work for decades.

“We always hear Netanyahu wanting the United States involved, or us to bomb the sites… This is the way we’ve been conducting ourselves since… 2003 when we invaded Iraq.” Asked by Co-host Melik Abdul how the US should have responded to the attack, Maloof argued that the US should leave the region. “I think we shouldn’t even be in those locations. And I think we should have gotten out some time ago.”

Biden will veto it. They want Ukraine on that bill.

• US House To Vote On Israel-only Aid Bill – Speaker (RT)

The speaker of the United States House of Representatives, Mike Johnson, announced on Saturday that he would hold a vote on a “clean, standalone” aid package for Israel that will not entail any spending cuts. The newly proposed legislation is set to include $17.6 billion in additional military funding as well as “important funding for US forces in the region.” The initial $14.3 billion package, rejected by the Senate last year, included an equal amount in spending cuts to the Internal Revenue Services (IRS) and was therefore branded by Democrats as a “poison pill.” “Next week, we will take up and pass a clean, standalone Israel supplemental package,” he wrote in a letter to colleagues sent on Saturday afternoon. “The Senate will no longer have excuses, however misguided, against swift passage of this critical support for our ally.”

The announcement comes as the Senate prepares to vote on a long-anticipated national security supplemental requested by US President Joe Biden, which will include tougher US border controls paired with nearly $60 billion in aid to Ukraine, as well as more assistance to Israel and Taiwan. Majority Leader Chuck Schumer said on Friday that he was preparing to release the legislation text “no later than Sunday” with the first procedural vote coming by midweek. However, Johnson previously criticized the impending deal, calling it “dead on arrival” in the lower chamber if the provisions are what they are rumored to be. The Senate leadership “is aware that by failing to include the House in their negotiations, they have eliminated the ability for swift consideration of any legislation,” Johnson wrote.

The White House previously indicated that it would oppose a stand-alone Israel aid bill, with John Kirby, the National Security Council’s coordinator for strategic communications, saying President Biden would veto it. While Washington is struggling to secure additional military funding for Ukraine, Brussels approved a €50 billion ($54 billion) aid package on Thursday, having reportedly pressured Hungarian Prime Minister Viktor Orban into lifting his veto. Orban, who previously called Ukraine “one of the most corrupt countries in the world,” accused the “imperialist EU” of “blackmailing” him into accepting the deal.

“The fact that people within the administration who are risking their jobs often to take these actions are speaking out, I think, is important and just shows a real shift in this country..”

• Staffers Speaking Out Shows How ‘Morally Bankrupt’ Biden Admin Has Grown (Sp.)

On Thursday, the head of the US Agency for International Development, Samantha Power, who is a world-renowned scholar on genocide, was confronted during a public event over her complicity in the Biden administration’s support of Israel and its actions in Gaza. “You wrote a book on genocide and you’re still working for the administration: You should resign and speak out,” Agnieszka Skyes told US media after recently leaving her job at the US Agency for International Development (USAID). Dr. Margaret Flowers, the co-editor of Popular Resistance, told Sputnik’s The Critical Hour that the disconnect between the Biden administration and its employees shows how “morally bankrupt” the administration’s stance on Gaza has become.

“You have congressional staffers, hundreds of them, that called upon their bosses to support a ceasefire. You have White House staffers, executive office staffers protesting outside of the White House, calling on President [Joe] Biden to demand, you know, to push for a ceasefire,” Flowers summarized. “The fact that people within the administration who are risking their jobs often to take these actions are speaking out, I think, is important and just shows a real shift in this country and just how morally bankrupt this administration is for supporting genocide.” Co-host Garland Nixon noted that, particularly among the USAID employees, they have previously supported policies that “killed unmentionable thousands of people,” but this seems “too far” even for them.

“I think also [that] some of the people that go to work in these institutions don’t fully have a good political analysis of what it is that they’re actually working for,” Flowers responded. “We know that the the USAID, which has ‘AID’ in its name, is an institution that has really worked hand-in-hand with the CIA to undermine governments all around the world to, you know, put in place support for organizations, media, nonprofit groups within countries that are strictly there to destabilize the countries so that the United States can try to overthrow their governments.” “This is an overreach point. I think we’re seeing that in so many different areas, though, right now, the kind of overreach of the United States and its Western allies and the whole world is seeing it but it’s great that folks are seeing it here, too,” Flowers explained.

The shift, according to Flowers, comes because Israel’s actions in Gaza are on display for the entire world to see. “We know that … all of these main, mainstream corporate media outlets are really in place to defend the status quo, and they’ve been doing that. But at a certain point, when you have the rest of the media world publishing the truth about what’s happening and you have public opinion shifting, they can’t continue on that same line as strongly as they were, because they can’t save face by doing that when the rest of the world actually sees what’s going on,” Flowers argued. “This is a huge issue for people, whereas foreign policy has not typically been a strong factor that folks care about. Things have gone so far that people do now,” she added.

“..Palestinians have been reduced to eating grass and drinking contaminated water…”

• The Silence of the Damned (Chris Hedges)

There is no effective health care system left in Gaza. Infants are dying. Children are having their limbs amputated without anesthesia. Thousands of cancer patients and those in need of dialysis lack treatment. The last cancer hospital in Gaza has ceased functioning. An estimated 50,000 pregnant women have no safe place to give birth. They undergo cesarean sections without anesthesia. Miscarriage rates are up 300 percent since the Israeli assault began. The wounded bleed to death. There is no sanitation or clean water. Hospitals have been bombed and shelled. Nasser Hospital, one of the last functioning hospitals in Gaza, is “near collapse.” Clinics, along with ambulances – 79 in Gaza and over 212 in the West Bank – have been destroyed.

Some 400 doctors, nurses, medics and healthcare workers have been killed — more than the total of all healthcare workers killed in conflicts around the world combined since 2016. Over 100 more have been detained, interrogated, beaten and tortured, or disappeared by Israeli soldiers. Israeli soldiers routinely enter hospitals to carry out forced evacuations – on Wednesday troops entered al-Amal Hospital in Khan Younis and demanded doctors and displaced Palestinians leave – as well as round up detainees, including the wounded, sick and medical staff. On Tuesday, disguised as hospital workers and civilians, Israeli soldiers entered Jenin’s Ibn Sina Hospital in the West Bank and assassinated three Palestinians as they slept.

The cuts to funding for the United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) — collective punishment for the alleged involvement in the Oct. 7 attack of 12 of its 13,000 UNRWA workers — will accelerate the horror, turning the attacks, starvation, lack of health care and spread of infectious diseases in Gaza into a tidal wave of death. The evidence-free charges, which include the accusation that 10 percent of all of UNRWA’s Gaza staff have ties to Islamist militant groups, appeared in the Wall Street Journal. The reporter, Carrie-Keller Lynn, served in the Israel Defense Forces (IDF). Given the numerous lies Israel has employed to justify its genocide, including “beheaded babies” and “mass rape,” it is reasonable to assume this may be another fabrication. The allegations, of which details remain scant, are apparently based on confessions by Palestinian detainees — most certainly after being beaten or tortured. These allegations were enough to see 17 countries including the U.S., Canada, U.K., Germany, France, Australia and Japan cut or delay funding to the vital U.N. agency.

UNRWA is all that stands between the Palestinians in Gaza and famine. A handful of countries, including Ireland, Norway and Turkey, maintain their funding. Eight of the UNRWA employees accused of participating in the Oct. 7 attack in southern Israel, where 1,139 people were killed and 240 abducted, were fired. Two have been suspended. UNRWA has promised an investigation. They account for 0.04 percent of UNRWA’s staff. Israel is seeking to destroy not only Gaza’s health care system and infrastructure, but UNRWA which provides food and aid to 2 million Palestinians. The object is to make Gaza uninhabitable and ethnically cleanse the 2.3 million Palestinians in Gaza. Hundreds of thousands are already starving. Over 70 percent of the housing has been destroyed. More than 26,700 people have been killed and over 65,600 have been injured. Thousands are missing. Some 90 percent of Gaza’s pre-war population has been displaced, with many living in the open. Palestinians have been reduced to eating grass and drinking contaminated water.

https://twitter.com/i/status/1753752270783783330

If he can get Putin, that would be great.

“..the Russian leader would wait to sit down with any American journalist until the US population was no longer so “seriously stupefied by Russia-hating propaganda.”

• Tucker Carlson Spotted In Moscow (RT)

American journalist Tucker Carlson has spent several days in Russia and even attended a ballet performance at the Bolshoi Theatre, Telegram channel Mash reported on Saturday, sharing several photos of the conservative commentator. Carlson allegedly touched down at Vnukovo airport on a Turkish Airlines flight from Istanbul on Thursday after several hours’ delay, according to the channel. He was later spotted taking in the ballet Spartacus at the Bolshoi Theatre in Moscow. The conservative commentator has yet to confirm the trip and it remains unclear what business he had in Russia. However, rumors of his intention to interview President Vladimir Putin have been circulating since last year.

Kremlin spokesman Dmitry Peskov did not rule out the possibility of Carlson interviewing Putin when asked about it in September, though he explained that the Russian leader would wait to sit down with any American journalist until the US population was no longer so “seriously stupefied by Russia-hating propaganda.” Carlson himself told Swiss outlet Die Weltwoche that he had been prevented from setting up an interview with Putin by the White House. While he expressed dismay that he did not receive more support from his fellow journalists regarding his intention to sit down with the Russian president and questioned why Americans are “not allowed to hear” Putin’s voice, he declined to provide any further details regarding when the interview was supposed take place or how the presidential administration of Joe Biden intervened to stop it.

The former Fox News host claimed previous attempts to secure an interview with Putin had led to aggressive surveillance by the National Security Agency, alleging he was “unmasked” by the spooks and the contents of his emails were leaked to the media in 2021 in order to “paint [him] as a disloyal American” and force him off the cable news network. The NSA denied Carlson was an intelligence target and claimed it never sought to take him off the air.

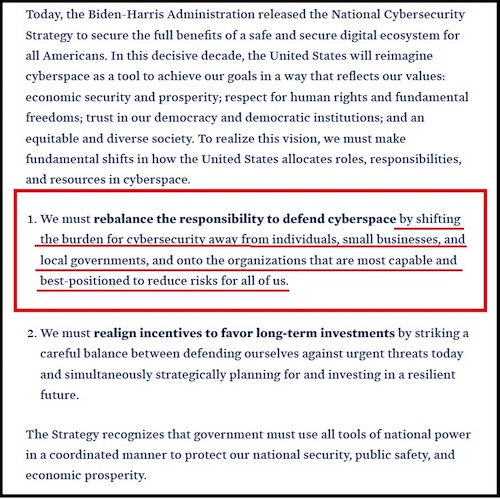

“..According to the European Council, the bloc has set up the so-called Ukraine Facility for the period 2024-2027 to “contribute to the recovery, reconstruction and modernization of the country..”

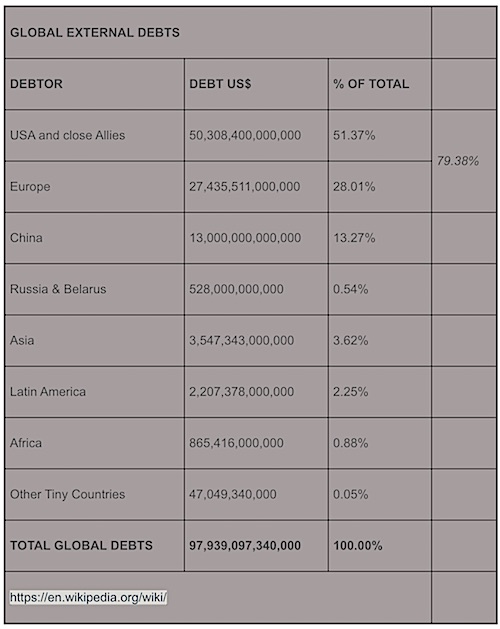

• Good Money After Bad: Where Will EU Funds for Ukraine Come From? (Sp.)

European Union (EU) member states have agreed on a €50 billion ($54 billion) support package for Ukraine over four years, overcoming Hungary’s resistance. But where will the EU get that money? The EU could commandeer interest paid on frozen Russian assets to fund Ukraine during its war with Moscow. Europe’s economy is facing stagnation, with zero economic growth for October-to-December period reported by EU statistics agency Eurostat. The Eurozone inflation rate has yet to fall below the target two percent threshold, with consumer prices still remaining high. Against that backdrop EU member states are cutting subsidies, reducing energy consumption and diminishing industrial production. Protests by farmers have rocked the continent since early January. Nonetheless, Brussels has found €50 billion ($54 billion) to support the embattled Kiev regime for four more years. But where will this money come from?

According to the European Council, the bloc has set up the so-called Ukraine Facility for the period 2024-2027 to “contribute to the recovery, reconstruction and modernization of the country, foster social cohesion and progressive integration into the Union, with a view to possible future Union membership.” To that end the EC has allocated €50 billion, of which: • €33 billion ($35.9 billion) comes “in the form of loans guaranteed by extending until 2027 the existing EU budget guarantee, over and above the ceilings, for financial assistance to Ukraine available until the end of 2027,” the document sets out. • €17 billion ($18.5 billion) comes “in the form of non-repayable support, under a new thematic instrument the Ukraine Reserve, set up over and above the ceilings of the MFF 2021-27.” The EC document specifies that revenues “could be generated under the relevant Union legal acts, concerning the use of extraordinary revenues held by private entities stemming directly from the immobilized Central Bank of Russia assets.”

On February 1, CNN claimed that the EU had taken a step towards seizing billions of dollars in interest payments generated by Russian assets frozen in European accounts. Media reported that roughly €200 billion ($218 billion) remain in the EU, mainly in Euroclear, a Belgium-based financial services company. The media outlet highlighted that the EU approved the €50 billion Ukraine package as it “came closer to finalizing a plan” of using the profits from the Russian Central Bank’s sequestred assets — indicating that it has yet to gain access to the funds. Euroclear revealed on Thursday that the frozen Russian assets had yielded €5.2 billion ($5.6 billion) in interest on income assets since 2022.

On Monday, EU member states “agreed in principle” that profits from the Russian assets will be set aside and not be paid out as dividends to shareholders until the bloc’s members decide to set up a “financial contribution to the [EU] budget that shall be raised on these net profits to support Ukraine”, according to a draft document quoted by Euroactive. The document claimed that the levy will be “consistent with applicable contractual obligations, and in accordance with [EU] and international law.” After that the EC would transfer the money to the EU’s accounts and then to Ukraine, the media noted, specifying that the proposal targets future profits and would not be applied retrospectively. It is believed that Russia’s frozen assets in the EU could generate an estimated €15-17 billion over four years, which would be transferred to Ukraine, according to the press.

Speaking to Sputnik last October, Jacques Sapir, director of studies at the School for Advanced Studies in the Social Sciences (EHESS) in Paris, argued that any attempt by the EU to grab Russia’s frozen assets or revenues from them could turn into a legal nightmare for the EU leadership and particular member states where the money is being stored. “As a matter of fact, if assets belong to the Russian state legally, you will have to prove that this state is a ‘failing state,’ something impossible,” Sapir told Sputnik on October 29, 2023. “If assets belong to private persons, you need a legal conviction against these persons. If you can’t do both and that you take away revenues to divert them to a third party (Ukraine) this is no less than a theft. Then you will be liable to legal action. But, what is even more important, you will probably discourage all foreign investors from investing in the EU.”

“..I said that I have a metal plate in my arm – and now it is still there. They didn’t care..”

• Ukraine Coerces Mass-Conscripts Unfit for Military Service – PoW (Sp.)

The Ukrainian Armed Forces are massively conscripting people who are unfit for military service for health and age reasons, prisoners of war told Sputnik. “Caught in such a time that they gave everyone a military ID. They gave everyone a military ID…. I passed the medical examination right away. I said that I have a metal plate in my arm – and now it is still there. They didn’t care,” one prisoner, Nazar Vashkevich, said. Another, Viktor Tkachenko, reported that he had received a draft notice for the fifth time, despite having several confirmed illnesses that preclude service in the army. “I was mobilized. I received a summons, the fifth, at work. It turned out that according to my state of health I was able to serve. Before that I was unsuitable. I had many medical reports: high blood pressure, hernia, pinched vertebrae,” he said.

According to the captives, the Ukrainian Army has begun to take people en masse who do not fit the draft. “Here, look: people over 50. They are already taking 50-year-olds. My grandfather was with me – he is 57 years old. He also has health problems… So where can he fight? How should he go on the assaults? How should he go to the trenches? Why? To get killed right away? And there’s a boy with me, even younger. I don’t know what’s wrong with him. He’s 24. He was drafted. It turns out that he is a senior gunner by rank,” Vashkevich complained. Volodymyr Zelensky said in December 2023 that he had been approached by the General Staff of the Ukrainian Armed Forces with a request to recruit an additional 450,000-500,000 men for the army. The government submitted a draft law on mobilization to parliament. The minimum age for mobilization was lowered from 27 to 25 years. The bill caused outrage in the country and was sent back for revision.

“..a political arena which, if he remains as a military commander, will be corrupted by his presence.”

• Is Zaluzhny Getting Ready to Take Down Zelensky? (Scott Ritter)

President Volodymyr Zelensky reportedly summoned the commander of the Ukrainian armed forces, General Valerie Zaluzhny, to a meeting on Monday, January 29, 2024, where he informed his military commander that he was being relived from his position. According to accounts that have appeared in western media, Zaluzhny refused to step down. As of Friday, February 2, 2024, the precise status of General Zaluzhny remains uncertain amid a swirl of rumors regarding his imminent dismissal. The rift between Zelensky and Zaluzhny represents a serious blow to one of the fundamental principles which underpins democratic society—a civil-military relationship predicated on the simple proposition that a democratically elected civilian leadership is the final authority on all matter, including military, and in the case of disputes between the civil and military leadership, civilian authority retains supreme authority.

If the reports of what is tantamount to a refusal to obey the lawful order of his civilian commander in chief are true, General Zaluzhny has opened a pandora’s box which, if left unresolved, could lead to the rapid unravelling of Ukraine’s civilian-controlled government and open the door for the emergence of a government that is either subordinated to the will of the Ukrainian military, or which has been replaced by a military junta. Neither bodes well either for the sustainment of the notion that Ukraine functions as a democracy along the lines of its European and American allies, or for the prospects of stable governance for Ukraine at a time when it faces unprecedented economic, military, and foreign policy challenges. History is replete with examples of civil-military disagreements during times of war.

American history is home for two premier examples—the split between George McClellan and Abraham Lincoln during the Civil War, and the disagreements between Douglas MacArthur and Harry Truman during the Korean conflict. However, in both cases when the civilian authority demanded that the military authority resign, the military authority complied. Zaluzhny, it appears, refused to step aside, taking the issue of military defiance of civil authority into unchartered territory. Managing civil-military relations is a complex process that balances the advice the military provides to its civilian masters with the actual oversight provided by the civilian leadership over military affairs. Given the disparity that exists fact-based military reality and the simplified and often politicized fiction that civilian leadership embraces, rifts are not only to be expected, but are in fact a reality that must be anticipated, and mechanisms put in place to keep them from erupting into crises.

One of the biggest problems faced in the civil-military relationship is that of agenda control and information management. While disagreements can and will emerge between military leaders and their civilian masters over military issues, the military can never lose sight of the fact that if the civil-military relationship is to succeed, the military cannot possess an agenda that deviates from that of its civilian leadership. Nor should the military take advantage of the fact that it in large part dominates the flow of information to society about military matters to use the media as a tool to articulate its own agenda.

In the case of the Zelensky-Zaluzhny split, the record seems to reflect that Zaluzhny has, for some time now, been engaged in activities which point to his having an agenda that not only deviates from that of his commander in chief, but in many ways is designed to be in opposition to his commander in chief—an agenda which paints Zaluzhny as a political competitor to Zelensky. Again, the examples of George McClellan and Douglas MacArthur point to the fact that such actions are not unique in the history of civil-military relations in democracies. However, in both of those circumstances, the military commanders resigned their positions when ordered to do so, and continued their political opposition in the civil arena, without the active backing of a military which was obligated to remain loyal to its civilian leadership. Zaluzhny, however, has refused to step aside, taking his differences with Zelensky into a political arena which, if he remains as a military commander, will be corrupted by his presence.

Huh, what? Our friends?

• Taiwan Helping To Arm Moscow – WaPo (RT)

Companies based in Taiwan have sold Russia more than $20 million in advanced equipment that can be used for weapons production, Washington Post has claimed, noting that Moscow’s defense sector has ramped up purchases in recent months. Citing “trade records and Russian tax documents” obtained by the outlet, the Post pointed to entities in the Russian arms industry that have boosted transactions with Taiwan, with one firm, I Machine Technology, importing over $20 million in CNC machine tools produced on the island since January 2023. The machines were reportedly sent in 63 separate shipments. “The Taiwan-made machines accounted for virtually all of the Russian company’s imports in the first seven months of last year, according to the records, and the company’s sales during that period were overwhelmingly to the Russian defense industry,” the newspaper added, although it did not specify how the CNC machines were to be used.

Former US arms control official Kevin Wolf told the Post that such transfers likely violated sanctions imposed by both Washington and Taipei in response to the conflict in Ukraine. However, an executive from I Machine Technology, Aleksey Bredikhin, argued that this was not the case. Instead, Bredikhin said that any purchases after January were for spare parts only, and did not run afoul of Taiwan’s export controls, which were further tightened early this year. “I’m not buying anything from them except for parts,” he added. Nonetheless, the American official claimed that the CNC machines were “very important for making military items” and could be connected to “military-end uses,” including manufacturing drones. Another executive from one of the Taiwanese producers, Yu Ming Je, questioned the authenticity of the files obtained by the Post, and also insisted that the sales were in line with local laws.

Asked about ties to Russia’s arms industry, Yu said he was not aware of any such connections with his company, adding “Distributors basically have many users.” A close strategic ally of the US and a frequent buyer of American arms, Taiwan has largely fallen in line with the US sanctions policy toward Moscow, imposing several layers of penalties since Russia sent troops into Ukraine in early 2022. In announcing its latest round of sanctions, which mirrored those already imposed by the US and European Union, Taiwan’s economy ministry vowed to “in principle” block all export license applications to Russian firms going forward. The ministry declined to comment on whether such equipment sales violated export rules, but said the government planned to specifically bar sales to I Machine Technology in the future.

It’ll be quite the day in Texas..

• Florida Sends Troops To Stop Migrant ‘Invasion’ (RT)

Governor Ron DeSantis has announced that he will deploy members of the Florida National Guard to assist Texas in repelling an “invasion” of illegal immigrants. US President Joe Biden’s administration has fought to prevent Texas from sealing the border. Roughly 1,000 soldiers will be sent to Texas, DeSantis’ office said in a statement on Thursday. They will be joined by members of the Florida State Guard, and around 90 members of various Florida law enforcement agencies already at the border. “States have every right to defend their sovereignty and we are pleased to increase our support to Texas as the Lone Star State works to stop the invasion across the border,” DeSantis said. “Our reinforcements will help Texas to add additional barriers, including razor wire along the border. We don’t have a country if we don’t have a border.”

During his first week in office, Biden signed a flurry of executive orders repealing former President Donald Trump’s immigration restrictions. Illegal crossings have surged as a result, with a record 302,000 people caught crossing the 2,000-mile border in December, and more than 10 million entering the US since 2021. Under Biden’s policy of ‘catch and release’, apprehended migrants are immediately released into the US, with orders to show up at immigration hearings years in the future. Texas – which shares more than 1,200 miles of border with Mexico – deployed national guardsmen to the border in 2021 and began constructing razor wire obstacles at popular crossing points. The Biden administration responded by suing the state, and the Supreme Court ruled last month that federal agents could access the border to remove the razor wire. Texas Governor Greg Abbott vowed to defy the ruling and install more wire, arguing that the Biden administration has neglected the constitutional obligation to enforce federal immigration law, and that his duty to protect his constituents supersedes any federal laws.

Although the Department of Homeland Security gave Abbott three days to begin removing the obstacles late last month, a US Customs and Border Patrol official told Fox News that the agency had “no plans” to move in and destroy the barriers after Abbott ignored the deadline. Some 25 Republican governors issued a joint statement of solidarity with Abbott last week, accusing Biden of “illegally allowing mass parole across America of migrants who entered our country illegally.” Florida has been sending law enforcement officers and soldiers to assist Texas since 2021. National Guard troops have built obstacles and observation posts, while Florida Highway Patrol officers have apprehended almost 150,000 illegal aliens and charged 2,102 people with smuggling or human trafficking charges, DeSantis’ office said.

“..relocate not only low-skilled component production but also, to a lesser extent, high-skilled production processes..”

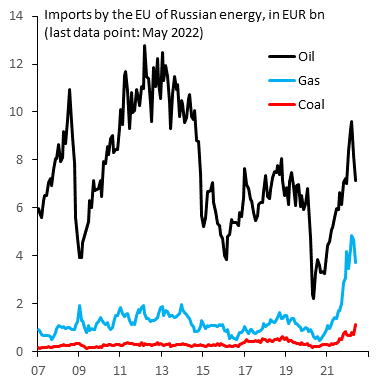

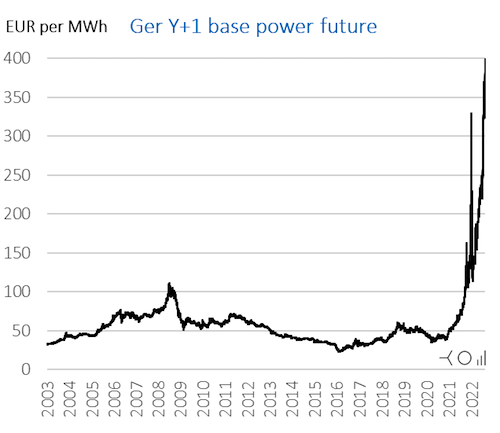

• Germany’s Economy Is Dying. Here’s Why And What Happens Next (RM)

German Finance Minister Christian Lindner, injecting some humor at the recent World Economic Forum in Davos, stated that Germany is not the “sick man” of Europe but rather “a tired man,” following the recent years of crisis, in need of a “good cup of coffee.” However, the economic indicators point to something more than fatigue. Although Germany could be described as merely being in a mild recession – the GDP readings, after all, can hardly be called awful – in reality the economy finds itself in the uneasy place of having no clear prospects for an imminent recovery. Initial estimates suggest a 0.3% decline in GDP in 2023, positioning Germany as the only major industrialized nation in the red. Germany’s national debt saw an increase of about €48 billion, reaching almost €2.6 trillion. While this may appear alarming at first glance, it’s crucial to consider the broader economic context. Germany’s debt-to-GDP ratio, standing at approximately 65%, is relatively favorable compared to many Western countries.

Moreover, Germany has implemented strict limits on deficits, demonstrating a commitment to financial prudence. In light of these measures, there is a counterargument that Germany could potentially consider taking on more debt. Sentiment among businesses deteriorated further at the beginning of the year, as illustrated by the ifo Business Climate Index in January, which fell to 85.2 points. Both the current situation and expectations for the coming months were evaluated more pessimistically. The ifo Institute has reduced its growth forecast for 2024 to 0.7%, compared to the previously predicted 0.9%. This downgrade is partially attributable to additional cuts in the federal budget, which became necessary due to a ruling by the Federal Constitutional Court that prohibited leftover Covid-stimulus funds from being repurposed.

The German economy is on the brink of a crisis as deindustrialization firmly takes root. Companies, driven by economic considerations, are increasingly relocating their production overseas, posing a significant threat to a nation heavily reliant on industrial output. This trend has immediate and profound consequences that extend beyond the evident impact on industrial sectors. The offshoring of production could entail a surge in layoffs, further aggravating the economic challenges faced by the workforce. In November 2023, according to preliminary data from the Federal Statistical Office (Destatis), German exports experienced a decline of 5.0% year-on-year, while imports recorded a notable decrease of 12.2%.

While the primary focus is on the industrial landscape, it is crucial to acknowledge the interconnectedness of these shifts. A case in point is the German chemical industry, which finds itself in a deep and prolonged downturn, having lost approximately 23% of its production capacity. Furthermore, leading managers have expressed considerable skepticism about a swift recovery. The challenges are exacerbated by Germany’s struggle with high energy costs, particularly affecting industries engaged in global competition. Despite government attempts to counteract these challenges, such as a billion-dollar electricity price package, success has been limited.

Meanwhile, according to a report by Deloitte, an alarming two out of three German companies have partially relocated their operations abroad due to the country’s ongoing energy crisis. This trend is particularly pronounced in critical sectors, such as mechanical engineering, industrial goods, and automotive industries, where 69% of companies have relocated their operations to a moderate or large extent. Key findings from the Deloitte report shed light on the reasons behind this significant shift. Most businesses attribute their decisions to move operations overseas to the combination of high energy prices and inflation. Notably, companies in these industries are planning to relocate not only low-skilled component production but also, to a lesser extent, high-skilled production processes.

No, I’m not surprised.

• F-35 Jet Fails to Meet Basic Operating Standards in 65 Areas (Sp.)

The Lockheed Martin F-35 Joint Strike Fighter still suffers at least 65 basic deficiencies where it continues to fail to meet basic testing specifications, the Office of the Director, Operational Test and Evaluation (DOT&E) said in a report. The JPO [F-35 Joint Project Office] completed the readiness review for JSE [joint simulation environment] trials in September 2023, and certified it as ready for testing, despite 65 deficiencies against the baseline JSE requirements, the report said on Friday. The F-35 program development cycle continues to experience delays due to immature and deficient Block 4 mission systems software and avionics stability problems with the new Technology Refresh 3 (TR-3) hardware going into Lot 15 production aircraft, the report said.

“As a result, deliveries of production Lot 15 aircraft in the TR-3 configuration are on hold until more testing can be completed and the avionics issues resolved. …[T]hese delays prevented the F-35 JPO from adequately planning and programming for hardware modifications … of the upgraded hardware configuration,” the report said. Also, the necessary flight test instrumentation, including both aircraft and open-air battle shaping instrumentation, for both, the remaining TR-2 configuration and upgraded TR-3 aircraft, are not all on contract and will not be available in time, the report added.

Just yesterday, we saw plummeting birth rates everywhere.

• India Vows To Tackle Population Growth Challenges (RT)

The most populous country in the world will constitute a high-powered committee to consider the challenges arising from “fast population growth and demographic changes.” The move was announced as part of India’s interim budget, unveiled on Thursday, ahead of national elections later this year. India’s finance minister, Nirmala Sitharaman, revealed that the proposed committee will address population-related challenges and form recommendations for the government. The initiative, she stressed, comes as part of the vision of Narendra Modi’s government, which hopes to transform the country into a developed nation by 2047. This development comes against the backdrop of a legislative move to adopt laws to control the population.

Members of Parliament belonging to the ruling Bharatiya Janata Party (BJP), Rajendra Agrawal and Rakesh Sinha, had earlier introduced separate bills to regulate the country’s population. However, neither of them have passed. Meanwhile, the country’s new census has been delayed for several years. The most recent demographic data available comes from the 2011 census. Although top Indian officials have expressed concern over the population boom, the fifth round of India’s National Family Health Survey (NFHS-5) released in 2022 showed that female fertility levels have dipped below the replacement fertility level in all but five Indian states. Despite that, last year, India overtook China to become the most populous nation in the world, as per United Nations (UN) data.

India has the highest number of young people in the world; however, the UN, in a 2023 report, noted that by 2046, the number of older adults in the country will be greater than the number of children younger than 15 years old. In 2022, the median age in India was believed to be 28 years; this is in sharp contrast to other larger nations with significantly higher median ages. An aging population could mean severe economic trouble for India unless the country grows its national wealth rapidly in the coming decades, an analysis in The Hindu newspaper observed last year. In December, India’s Reserve Bank updated the GDP growth projection for the current financial year to 7% compared to the previously estimated 6.5%. Meanwhile, India remains among the top countries with high income and wealth inequality even as the share of the population living in multidimensional poverty fell from 25 to 15% between 2015-16 and 2019-21, the UNDP said in a report last year.

“..CEOs crowing about keeping their prices high while their costs go down..”

• It’s Not ‘Inflation’ – We’re Just Getting Ripped Off. Here’s Proof. (OW)

Many Americans are still experiencing the sticker shock they first faced two years ago when inflation hit its peak. But if inflation is down now, why are families still feeling the pinch? The answer lies in corporate profits — and we have the data to prove it. Our new report for the Groundwork Collaborative finds that corporate profits accounted for more than half — 53 percent — of inflation from April to September 2023. That’s an astronomical percentage. Corporate profits drove just 11 percent of price growth in the four decades prior to the pandemic. Businesses have been quick to blame rising costs on supply chain shocks from the pandemic and the war in Ukraine. But two years later, our economy has mostly returned to normal. In some cases, companies’ costs to make things and stock shelves have actually decreased.

Let’s demonstrate with one glaring example: diapers. The hyper-consolidated diaper industry is dominated by just two companies, Procter & Gamble and Kimberly-Clark, which own well-known diaper brands like Pampers, Huggies, and Luvs. The cost of wood pulp, a key ingredient for making diapers absorbent, did spike during the pandemic, increasing by more than 50 percent between 2020 and 2021. But last year it declined by 25 percent. Did that drop in costs lead Procter & Gamble and Kimberly-Clark to lower their prices? Far from it. Diaper prices have increased to nearly $22 on average. These corporate giants have no plans to bring prices down anytime soon. In fact, their own executives are openly bragging about how they’re going to “expand margins” on earnings calls. Procter & Gamble predicted $800 million in windfall profits as input costs decline. Kimberly-Clark’s CEO said the company has “a lot of opportunity” to expand margins over time.

It’s not just diapers — while many corporations were quick to pass along rising costs, they’ve been in no hurry to pass along their savings. A recent survey from the Richmond Fed and Duke University revealed that 60 percent of companies plan to hike prices this year by more than they did before the pandemic, even though their costs have moderated. Corporations across industries, from housing to groceries and used cars, are juicing their profit margins even as the cost of doing business goes down. And they’re not hiding the ball. Since the summer of 2021, Groundwork began listening in on hundreds of corporate earnings calls where we heard CEO after CEO boasting about their ability to raise prices on consumers. Now we hear something slightly different: CEOs crowing about keeping their prices high while their costs go down.

This is what the Dems have in mind for Trump.

• Imran Khan Sentenced To Third Prison Term In A Week (RT)

Former Pakistani prime minister Imran Khan and his wife Bushra Bibi have been sentenced to seven years in prison and fined after a court declared their marriage unlawful on Saturday. It was the third ruling against Khan this week. The civil court was set up in Rawalpindi prison, where the ex-PM has been held since August last year on more than 100 charges. The sentences came before a parliamentary election on February 8 that Khan, who remains popular among voters, is barred from contesting. On Wednesday, Khan along with his wife were sentenced to 14-year terms for illegally selling state gifts, and the day before Khan was given ten years in prison for leaking state secrets. He claimed the cable he released contained evidence of collusion between the Pakistani military and US officials to have him removed from power in April 2022.

Khan’s representatives say he will appeal all three cases. The sentences add up to 34 years and will be served concurrently. The marriage case was filed by Bushra Bibi’s former husband Khawar Maneka, who claimed that she did not observe “iddat” – a mandatory three-month waiting period that a woman must abide by under Islamic law after the death of her husband or a divorce, before marrying another man. The Khans have denied wrongdoing. Imran Khan, however, argued that the case was brought to “humiliate and disgrace” him and his wife. “This marks the first instance in history where a case related to iddat has been initiated,” he told reporters.

The court decision has been condemned by members of Khan’s party, Pakistan Tehreek-e-Insaf (PTI). Syed Zulfiqar Bukhari, a PTI official, called the marriage case “fake”, saying the judgements against Khan represent a “mockery of the law.” “The way these trials are being conducted leaves a huge question mark on the February 8 elections. This is a test case for Pakistan’s higher judiciary,” he told Al Jazeera. PTI President Gohar Ali Khan described the trial as “shameful” and vowed to appeal the verdict in a higher court.

Bohemian grove

The Secret Rulers Of The World – The Satanic Shadowy Elite

It's hard to believe this was broadcast on Channel 4 in the UK, twenty two years ago. Featuring Alex Jones, David Icke, G. Edward Griffin and others. pic.twitter.com/6j9xpWBJVl

— illuminatibot (@iluminatibot) February 3, 2024

Giraffe lion

Other lion:" so how did you broke your back?"

Lion:" I don't wanna talk about it" pic.twitter.com/Omh5nUlwwL

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 3, 2024

Branch

https://twitter.com/i/status/1753863250427715898

Freeman

This 2005 clip from the great Morgan Freeman resonates more now than ever before…as he clearly states why he does NOT want a black history month.

Hard to argue with his reasoning (and hysterical to watch Mike Wallace's reaction)"Black history is American history" pic.twitter.com/HQaxi2RWCM

— Sage Steele (@sagesteele) February 2, 2024

Peggy Sue

BUDDY HOLLY

PEGGY SUE (1957)

Remembering Buddy – who died 65yrs ago today in that terrible plane crash.

— Michael Warburton (@MichaelWarbur17) February 3, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.