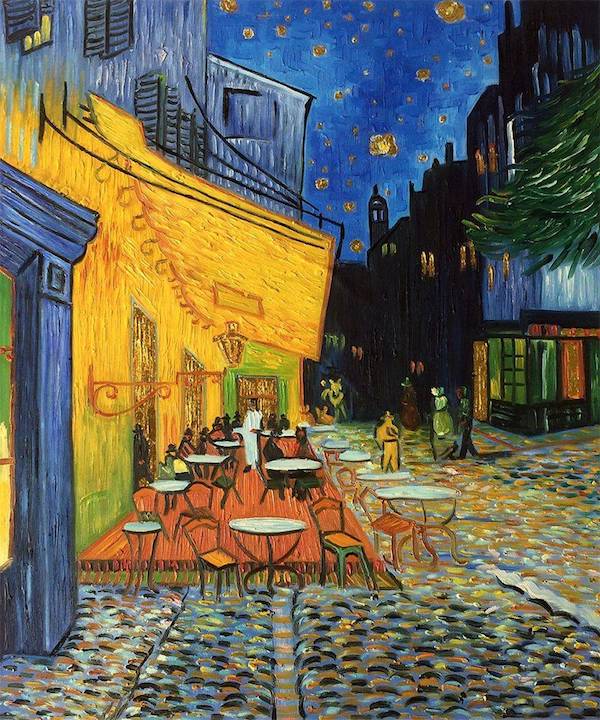

Vincent van Gogh Interior of a restaurant 1887

Prigozhin is in Belarus. Putin has given permission for Wagner fighters to move to Belarus as well. They will then be 100km from Kiev. The Chinese noticed this too:

Ukraine will need to deploy troops to guard Kiev.

Watters

https://twitter.com/i/status/1673479291315814401

General Mark Milley wanted to attack Iran and blame it on Donald Trump. This was “exclusively obtained” by CNN…

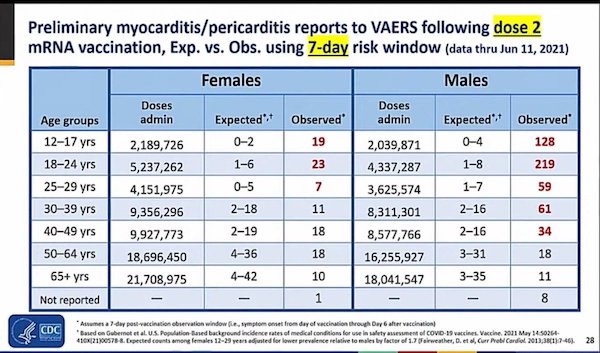

RFK vaccine

Brett Tolman

https://twitter.com/i/status/1673374501516591104

Dr. Fukushima

https://twitter.com/i/status/1673365972764196864

“Those who want to move to Belarus may do so freely, the president added.”

• Putin: Mutiny Organizers Wanted Russian Soldiers to Kill Each Other (Sp.)

Russian President Vladimir Putin has chastised the organizers of the recent aborted mutiny perpetrated by forces of the PMC Wagner Group, stating that these people betrayed not only their country and their people but also the men whom they duped into participating in this “crime.” In a speech delivered today from the Kremlin, Putin said that Russia’s enemies and the “neo-Nazis in Kiev” along with their Western sponsors wanted the same outcome as the mutiny organizers: an internecine conflict in Russia where Russian soldiers would have been killing each other. He pointed out that the mutiny organizers were well aware of the fact that their mutiny would have been inevitably crushed, and that their actions were ultimately aimed at weakening Russia.

At the same time, he stressed that the vast majority of the Wagner Group’s soldiers and commanders are “Russian patriots devoted to their people and state,” who proved their patriotism “with their courage on the battlefield, liberating Donbass and Novorossiya.” He thanked Wagner Group members who stopped before crossing the “final line,” and said that they can now continue serving Russia by signing a contract with the Ministry of Defense, or any other law enforcement agency, or to return home to their families. Those who want to move to Belarus may do so freely, the president added.

Putin thanked all Russian servicemen, law enforcement officers and special services’ members who “stood in the way” of the mutineers and “remained faithful” to their duty during this crisis, as well as members of the Wagner Group who did not participate in the mutiny. The Russian president also expressed his gratitude to Belarusian President Alexander Lukashenko for “his efforts and contribution to the peaceful resolution of the situation.” Putin did add, however, that it was the “consolidation of the entire Russian society that played a decisive role” in resolving this crisis.”

Read more …

“Russians will be killing Russians, probably in large numbers, unless Prigozhin surrenders..”

• Western Experts Salivated Prospect of ‘Doom’ and ‘Civil War’ in Russia (Sp.)

Western press, politicians, and “Russia watchers” prophesized “doom” and “civil war” in Russia upon the PMC Wagner Group’s mutiny, only to learn later that they were profoundly wrong. On June 23, Wagner PMC leader Evgeny Prigozhin announced that he and his 25,000 men were kicking off a “march of justice” towards Moscow amid the private military group’s feud with the Russian Ministry of Defense, prompting the Federal Security Service (FSB) to charge the Wagner chief with inciting an armed mutiny. While Russian President Vladimir Putin warned the PMC leader against irresponsible and treasonous actions, Prigozhin’s mutiny of June 23-24 caused nothing short of euphoria in the Western media sphere. Tom Nichols, a staff writer at The Atlantic, immediately projected on June 23 that the unfolding “crisis” could change the course of the conflict in Ukraine and lead to “a lot of bad things” in Moscow “in the next few days, or even hours.”

Eurasia Group scholar Ian Bremmer echoed Nichols on June 24: “Prospects for Ukraine’s counteroffensive – which hasn’t gone well to date – improving by the minute,” he claimed on Twitter. “In a slow, unfocused sort of way, Russia is sliding into what can only be described as a civil war. If you are surprised, maybe you shouldn’t be,” wrote Anne Applebaum, an American journalist and spouse of Polish MEP Radoslaw Sikorski, who thanked the US government for the destruction of Nord Stream in a later-deleted tweet last year. Former US ambassador to Russia, Michael McFaul, went even further by claiming that the “civil war” was already underway and promised a “big fight”: “Russians will be killing Russians, probably in large numbers, unless Prigozhin surrenders,” the American diplomat tweeted on Saturday.

The Hill joined the chorus, predicting “combat and potential doom”: as per the media, passions of ordinary Russians could be “enflamed” and “it’s conceivable that some Russian soldiers will defect.” “Much depends on how swiftly Putin can put down the rebellion, or indeed whether he can. Expect curfews and martial law in Rostov and possibly other cities,” the media forecast. The New York Times referred to Wagner’s “seizure” of Rostov-on-Don as a “grave threat to President Vladimir Putin’s government.” While security had indeed been heightened in Moscow and in Rostov-on-Don, there had been no signs of a gathering storm or a mounting civil unrest in the country. The Associated Press reported that in Moscow “downtown bars and restaurants were filled with customers.”

The media added that “at one club near the headquarters of the FSB, people were dancing in the street near the entrance.” An apparent cognitive dissonance with regard to the “civil war-that-never-happened” reached its apogee in the West after the news that Belarusian President Alexander Lukashenko struck a deal with Prigozhin and the latter’s announcement that the PMC Wagner Group was returning to its field camps. Some Western netizens couldn’t believe their eyes, claiming that “the odds of this being true are slim to none.” McFaul also seemed perplexed by the sudden turn of events which brought to naught the West’s “Russian civil war” fantasies: “I was wrong about this. Eager to learn why. There is so much to this story that we don’t know yet,” the diplomat tweeted.

Read more …

When Wagner took over the headquarters of the Southern Military District in Rostov-on-Don, not a shot was fired that I read about. Isn’t that weird?

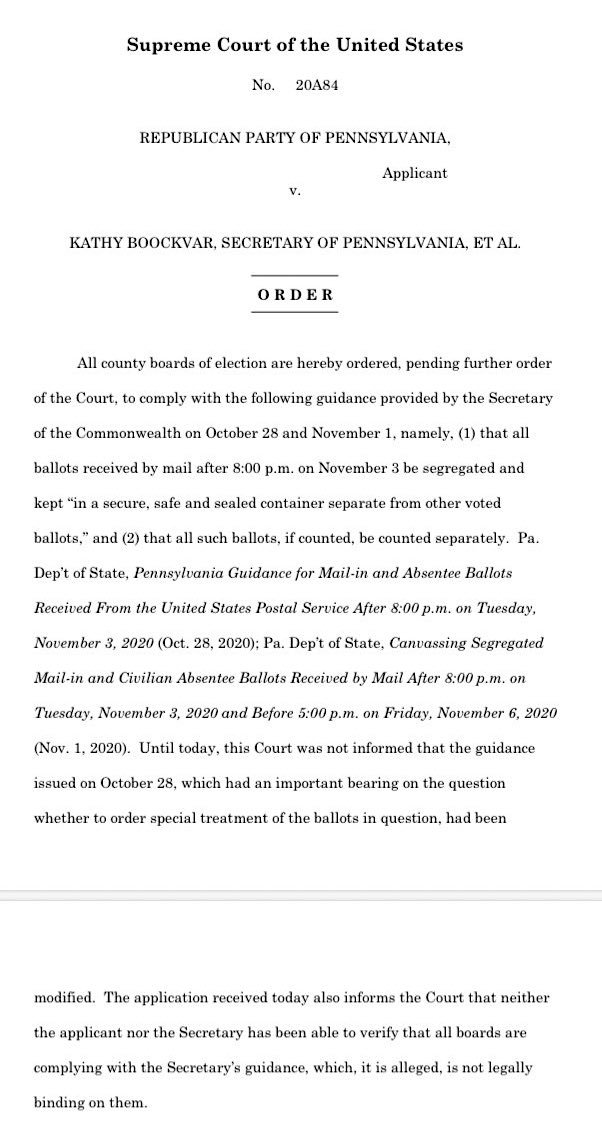

• Washington Expected More Bloodshed From Wagner Mutiny – CNN (RT)

The US expected more resistance to the coup attempt by the Wagner private military company as Evgeny Prigozhin advanced on Moscow, a source has told CNN, predicting that the aborted insurrection would be “a lot more bloody than it was.” The intelligence community in Washington claims to have had advance information about Prigozhin’s actions, according to reports in the US media, and also believed it would result in greater bloodshed. “I do know that we assessed it was going to be a great deal more violent and bloody,” the source told CNN. Prigozhin staged the coup on Friday evening in what he described as an attempt to oust senior Russian military officials, whom he accused of treason.

His forces, which are armed with heavy weapons, had faced little resistance in capturing the headquarters of the Southern Military District, one of territorial commands of the Russian Defense Ministry, in the city of Rostov-on-Don. They were moving unopposed towards Moscow when Prigozhin called off the insurrection on Saturday after accepting a deal with the government, which had been mediated by Belarus. He cited the desire to avoid bloodshed as his reason for stopping. During the brief uprising, Prigozhin claimed that his forces had shot down a Russian attack helicopter. There are uncorroborated reports of several more military aircraft being downed by the Wagner Group, and suggestions that the businessman agreed to pay compensation for the deaths caused by his actions. There was also some fighting along the route, with 19 homes reportedly damaged in Voronezh Region, according to local authorities.

Read more …

Blinken always gets it wrong. He’s sort of like Jim Cramer.

• Ukraine Failed To Exploit Wagner Coup Attempt – NYT (RT)

Ukraine was unable to capitalize on the coup attempt in Russia by the Wagner private military company, the New York Times has claimed, citing unnamed US officials. US Secretary of State Antony Blinken had earlier suggested that the events had created potential “openings” for Kiev to improve its position on the battlefield. In a report on Sunday, the NYT quoted anonymous “American officials and independent analysts” as acknowledging that “there did not seem to be any immediate defensive gaps to exploit” in Russian lines. The article noted that, “according to a preliminary analysis,” no Russian units in eastern and southern Ukraine abandoned their positions on Friday or Saturday as the attempted insurrection was in full swing.

It went on to emphasize that on Saturday alone, Russian forces reportedly fired some 50 missiles at various targets across Ukraine. American officials cited by the paper predicted that, at least in the short term, the “front lines in Ukraine are likely to remain unchanged.” The NYT added, however, that Ukraine is still likely to attempt to use the “chaos caused by Mr. Prigozhin” to its advantage. The article suggested that supposedly “weakening morale” among Russian troops could be one of the factors that potentially helps Kiev make gains. The paper concluded, however, that “it is too soon to determine the long-term implications” of the failed coup attempt. Speaking to CBS News on Sunday, Blinken described Wagner’s attempted rebellion as a “direct challenge to Putin’s authority,” arguing that it “raises profound questions” and “shows real cracks.”

The diplomat went on to claim that this “creates even greater openings for the Ukrainians to do well on the ground.” Blinken suggested that Wagner’s actions had created a “real distraction” for the Russian leadership, who will now have to “sort of mind their rear.” Blinken’s assessment appeared to echo that of other top US officials, as reported by Politico on Sunday. Wagner rebelled on Friday against Russia’s military leadership. The head of the private military company, Evgeny Prigozhin, agreed to end the uprising and withdraw his forces in exchange for “security guarantees,” as part of a deal brokered by Belarusian President Alexander Lukashenko on Saturday. The same day, the Russian Defense Ministry reported that Ukrainian troops had mounted several attacks, which it claimed had all been repelled.

Read more …

“..the Ukrainian forces have so far demonstrated remarkable aptitude to losing that military hardware and taking heavy casualties without making any meaningful gains in the field..”

• Biden Officials Worry That Ukrainian Offensive is ‘Behind Schedule’ (Sp.)

As the Ukrainian “counteroffensive” that started earlier this month now appears to be grinding to a halt, with Kiev troops failing to breach even the first Russian defensive line, US government officials have apparently become somewhat disappointed by this turn of events. According to one US newspaper, White House officials have been privately fretting about the progress of the Ukrainian offensive while publicly urging people to be patient, with one senior administration official describing its results as “sobering.” “They’re behind schedule,” the official reportedly said. The newspaper also notes that, despite failing to produce any meaningful gains on the battlefield, Kiev forces have already lost a considerable amount of military hardware that was supplied to them by the West.

Over 15 percent of the Bradley infantry fighting vehicles – at least 17 out of 113 – provided to Kiev by the United States have been destroyed or damaged during the futile attempt by Ukrainian forces to reach Russian defensive lines, if the media outlet’s information is to be believed. In the beginning of this month, Ukrainian forces launched what appears to be the much-anticipated “counteroffensive” that the regime in Kiev has been announcing for months. Despite being provided vast quantities of Western military hardware and weaponry by the US and its allies and receiving training from NATO instructors, the Ukrainian forces have so far demonstrated remarkable aptitude to losing that military hardware and taking heavy casualties without making any meaningful gains in the field.

Read more …

When Lukashenko called, Prigozhin already knew what was up. He had all of 3,000 men with him. Lukashenko offered him a way out that Putin had authorized. He didn’t have to convince him to give up, just offer the way out.

• Prigozhin’s Farce Is Over And It Is Clear Who Has Won (MoA)

The Prigozhin’s insurrection farce is over. I had predicted that it would not take long to end: In twelve or so hours things are likely to have calmed down. About eight hours after I published the above Prigozhin had given up and left the scene. Prigozhin had launched his hopeless mutiny after the Defense Ministry had demanded that all his men sign contacts with the Russian army. That would have taken away the autonomy of his Wagner outlet and with it a large chunk of his profits. The run of his troops towards Moscow was a desperate attempt to get Putin’s attention and to make him reverse the ministry’s plans. To justify his move Prigozhin had claimed that Russian miliary forces had attacked a Wagner camp and killed a number of its troops. To prove that he published a video that shows some trash in the woods but no dead soldiers. It was an obvious fake.

Putin had already publicly agreed to the ministry’s plans and he is not the man who reverses his decisions on a dime, or under pressure. After Putin’s Saturday morning TV speech, during which he accused Prigozhin of treason without naming him, it was clear that there was no chance for the mutiny to have any success. Many of Russia’s governors and high ranking military soon assured Putin publicly of their loyalty. As far as is known none of Wagner’s military commanders and only a few thousand of its 25,000 troops had joined Prigozhin in his lunatic run. No one in Russia changed sides or supported him. When the Wagner troops entered Rostov on the Don the people who talked with his soldiers were critical of their presence. When Wagner were leaving without further bloodshed the people applauded. To interpret that as support for Prigozhin, as some ‘western’ analysts did, is false. The people were just happy that the whole stunt was over.

Finally the President of Belarus Alexander Lukashenko, likely on request from Putin, got Prigozhin on the phone, used some very strong words and negotiated a deal. If Prigozhin goes into exile in Belarus he will not be bothered any further. But the Russian prosecutors will not close the treason case against him. Should he again make a hassle he will likely end up in jail. Prigozhin may be allowed to take some of his troops with him to Belarus. But the large majority will come under the command of the Russian military and will be transformed into some special unit. The French foreign legion may be an good example for such a force and its potential use. In previous years Prigozhin’s companies had made large profits by catering to the needs of the Russian military. The contracts they have will likely end and his personal fortune will take a big hit. The good days are over for him.

Read more …

Yes, yes, Josep. Go home now. Don’t call us, we’ll call you.

• Prigozhin Mutiny Was Monster Acting Against His Creator- Borrell (G.)

Yevgeny Prigozhin’s aborted mutiny in Russia was “the monster acting against his creator”, the EU’s foreign policy chief has said. “The political system is showing fragilities, and the military power is cracking,” Josep Borrell told reporters in Luxembourg as he arrived for a meeting with ministers from across the 27-member bloc. Wagner group mercenary forces under Prigozhin seized control of military headquarters in southern Russia and began to move towards Moscow on Saturday before suddenly heading back to eastern Ukraine after a deal with the Kremlin. “The most important conclusion is the war against Ukraine launched by Putin and the monster that Putin created with Wagner, the monster is fighting, the monster is acting against his creator,” Borrell said.

Borrell said the instability in Russia was dangerous given its nuclear arsenal and would be top of the agenda at the Luxembourg summit, where ministers voted through a promise to top up Ukraine’s military funds by €3.5bn (£3bn). “Certainly it is not a good thing to see that a nuclear power like Russia is going into a phase of political instability,” he said. EU foreign ministers were scrambling to digest the fallout from the mutiny at their meeting. The German foreign minister, Annalena Baerbock, said Putin was destroying his own country with his “brutal war of aggression” in Ukraine. “We are seeing massive cracks in the Russian propaganda,” she added. Baerbock said the EU would focus on helping Ukraine in its fight to let its people live in peace and freedom.

The Swedish minister Tobias Billström said it was too early to do an analysis but that the weekend’s events brought Ukraine’s potential membership of the EU into sharp focus. The most important thing was supporting Ukraine so it could win back its territory, he added. “We will have a good opportunity to sit down and talk about the future policy with regard to Ukraine, when it comes to EU integration,” Billström said. “And when it comes to giving both political, military, humanitarian and financial support to Ukraine, until Ukraine has restored its territorial integrity completely.”

Finland’s new foreign minister, Elina Valtonen, said: “It’s too early to tell where this will lead to. But of course, it’s pretty obvious that the events of the weekend will have continued effect on how Putin is seen internally, but also on how Russia is seen to the outside world. “It is common for authoritarian states that everything seems to be very stable until one day, nothing is stable any more. And I expect such a development for Russia as well.” The ministers are also expected to approve the 11th round of sanctions against Russia, aimed at stopping Putin from circumventing previous sanctions by using third countries to ship crude oil and other products around the world.

Read more …

Prigozhin’s private jet was spotted in Belarus this morning. Reportedly, the probe is now closed.

• Investigation Into Case Surrounding Prigozhin Continuing (TASS)

The investigation of the criminal case against Yevgeny Prigozhin, founder of the Wagner Private Military Company (PMC), accused of organizing an armed mutiny, has not been closed, a source in the Russian Prosecutor General’s Office confirmed to TASS on Monday. “The criminal case against Prigozhin has not been closed. The investigation is continuing,” the source said. Kommersant newspaper reported on Monday that as of the morning of June 26, the criminal case concerning the organization of the armed mutiny involving Prigozhin has not been closed and continues to be investigated by the Russian Federal Security Service (FSB).

On Saturday, the Russian Prosecutor General’s Office said that, on June 23, FSB investigators opened a criminal case against Yevgeny Prigozhin under Article 279 of the Russian Criminal Code for organizing an armed mutiny. The case was initiated after Prigozhin’s Telegram channel published statements that his units were allegedly attacked and appealed to supporters to come out against the country’s top military leaders. The crime is punishable by 12 to 20 years in prison. The Russian Defense Ministry denied information about Russian strikes on the “rear camps of the Wagner PMC.” Russian President Vladimir Putin made a televised address to Russian citizens, servicemen and law enforcement agencies, slamming the ongoing events as a stab in the back.

Read more …

Scott Ritter lagging behind the events.

• Prigozhin’s Gambit – Treason By Any Other Name (Scott Ritter)

Let there be no doubt in anyone’s mind—Yevgeny Prigozhin has become a witting agent of Ukraine and the intelligence services of the collective West. And while there may be those within Wagner who have been unwittingly drawn into this act of high treason through deception and subterfuge, in the aftermath of Russian President Vladimir Putin’s address to the Russian nation on June 24, and Yevgeny Prigozhin’s impolitic reply, there can be no doubt that there are only two sides in this struggle—the side of constitutional legitimacy, and the side of unconstitutional treason and sedition. Anyone who continues to participate in Prigozhin’s coup has aligned themselves on the wrong side of the law and have themselves become outlaws.

Having taken Wagner down this unfortunate path, one needs to examine the motivations—stated and otherwise—that could prompt such a dangerous course of action. First and foremost, Prigozhin’s gambit must be looked at for what it is—an act of desperation. For all its military prowess, Wagner as a fighting force is unsustainable for any period without the logistical support of the Russian Ministry of Defense. The fuel that powers Wagner’s vehicles, the ammunition that gives its weapons their lethality, the food that nourishes its fighters—all comes from the very organization that Prigozhin has set his sights on usurping. This reality means that to succeed, Prigozhin would need to rally sufficient support behind his cause capable of not only sustaining his gambit but offsetting the considerable power of the Russian Ministry of Defense and the Russian Federation which, if left intact, would be able to readily defeat the forces of Wagner in any large-scale combat.

In short, Prigozhin is looking to create a so-called “Moscow Maidan” designed to replicate the success of the events of early 2014 in Kiev, where the constitutionally elected government of President Victor Yanukovych was toppled from power through violence and force of will that was orchestrated by Ukrainian nationalists supported by the US and Europe. The fantasy of a “Moscow Maidan” has been at the center of the strategy of the collective West and their Ukrainian proxy from the very start. Premised on the notion of a weak Russian president propped up by a thoroughly corrupt oligarch class, the idea of creating the conditions for the rise of sufficient domestic unrest capable of bringing down the Putin government like a proverbial house of cards was the primary objective of the sanctions regime imposed by the West after the initiation of the Special Military Operation (SMO) on February 24, 2022.

The failure of the sanctions to generate such a result compelled the collective West to double-down on the notion of collapsing the Russian government, this time using a military solution. The British Prime Minister pressured his Ukrainian counterpart to forgo a negotiated settlement to the conflict that was ready to be signed in Istanbul on April 1, 2022, and instead engage in a protracted war with Russia fueled by tens of billions of dollars’ worth of military and financial assistance designed to inflict military losses on Russia sufficient to trigger domestic unrest—the elusive “Moscow Maidan.” This effort likewise failed.

Read more …

“He actually voted in the Senate to authorize the invasion, however. When Rochebin pushed him on the apparent double standard, Kerry began speaking about “climate justice.”

• John Kerry Says Iraq Invasion Was Based On Lie (RT)

The US-led invasion of Iraq was completely different to the current Ukraine conflict, Washington’s special envoy for climate change John Kerry has told French TV channel LCI. He appeared on LCI’s Sunday evening show hosted by Darius Rochebin, who had previously interviewed him for a Swiss outlet in 2017. Rochebin tweeted a video segment of the interview, in which he confronted Kerry about the West accusing Russia of aggression regarding Ukraine. The French journalist noted that the 2003 invasion of Iraq was an actual war of aggression, based on the lie that Baghdad secretly possessed weapons of mass destruction. “No,” Kerry replied. “Because there’s never even been, you know, a process of direct accusation of President [George W.] Bush himself.”

He added that there had been “abuses” in the course of that conflict, and that he “spoke out against them.” When Rochebin asked him directly whether the Iraq War had been a crime of aggression, Kerry repeatedly denied it. “No, No, No. Well, you didn’t know it was a lie at the time. The evidence that was produced, people didn’t know that it was a lie,” the former diplomat said, before telling Rochebin that he doesn’t intend to “re-debate the Iraq War” at this point. Kerry also claimed he was opposed to the war at the time and thought it was the wrong thing to do. He actually voted in the Senate to authorize the invasion, however. When Rochebin pushed him on the apparent double standard, Kerry began speaking about “climate justice.”

The Bush administration accused Iraqi President Saddam Hussein of having chemical and biological weapons, as well as being somehow involved in the 9/11 terrorist attacks in New York and Washington. The ‘evidence’ for WMDs offered to the media and the UN Security Council turned out to be entirely fabricated, and no such weapons were ever found. Likewise, no connection between Baghdad and Al-Qaeda was ever established. The 2003 invasion and the subsequent occupation of Iraq was carried out without UN approval, by what Bush called a ‘coalition of the willing’. The US, the UK, Australia and Poland provided troops for the attack, though Washington later claimed 44 more countries had offered some kind of support. Kerry ran against Bush in 2004 but lost. He later served as secretary of state in the Barack Obama administration, and was appointed climate change ambassador by the current president, Joe Biden, in 2021.

Read more …

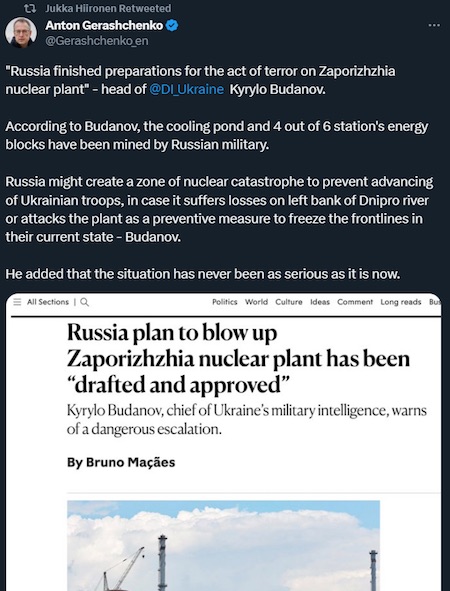

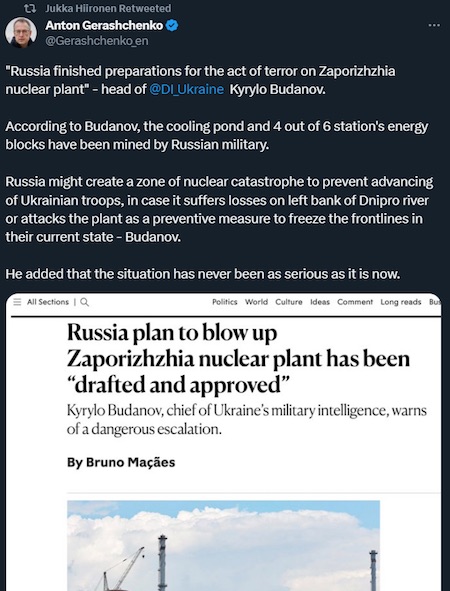

“..Mr. Zelensky might use some of his NATO missiles to zap it, but Russia has video surveillance and recording equipment at every angle around the joint and the world will know five seconds after how it was blown up..”

• Coup Coo (Kunstler)

Let’s address one nagging question: why did Mr. Putin allow the Wagner Group private army to play the leading role countering the Ukraine offensive? Answer: because he was saving and building-up the regular Russian army to strength in the further event that NATO might finally jump into Ukraine with all its multi-national feet when all else fails. We’re left, of course, with the manifold mysteries of the coup’s hasty resolution. Mr. Prigozhin, we’re told, will be turned over to the custody of the Belarus president Lukashenko, to… to be done what with? To be put on the shelf like a bowling trophy? I’m sure…. If they can even find the bugger now. (I’d look in Africa, where sundry Wagner units have been operating — Priggy must have had a plane standing by in Rostov.)

In any case, we know the rest: Wagner troops who did not participate in the coup get folded into the regular army, and said regular army takes over duty along the front in Ukraine. Mr. Putin, despite all these insults, will continue to seek a diplomatic end to all this nonsense, and he might get it sooner rather than later. Germany and France, among Euro others, must be sick of these shenanigans. Can Ukraine even carry on much longer? President Zelensky, the comedian, seems to have gone mad-dog now. He just cancelled next year’s election, which makes him… what? Dictator? So much for America’s democracy export program. He’s also issued warnings to the effect that Russia is about to blow up the Zaporozhye nuclear power plant, Europe’s largest.

Such an act would supposedly trigger direct intervention by NATO, according to the policy promoted by war-hawk US Senators Lindsey Graham and Richard Blumenthal. The nuclear plant is under Russian control. Mr. Zelensky says they have set mines in it. The scenario is pretty absurd. Nobody believes it. Of course, Mr. Zelensky might use some of his NATO missiles to zap it, but Russia has video surveillance and recording equipment at every angle around the joint and the world will know five seconds after how it was blown up. From his latest photographs, it looks like Mr. Zelensky is in the terminal throes of a cocaine rapture, and his actions are consistent with that state of mind. He must know that he’s not long for this world. And our country, the USA, must know that this Ukraine gambit is another lost cause on our long march of military misadventures.

And if the government of our country doesn’t know, the people surely do. Have you noticed, the yellow-and-blue flags are not flying anymore? Even the most hardcore anti-Trump Democrats seem to understand what pounding sand down a rat-hole means when it comes to the many billions of dollars squandered on this stupid project while our cities rot and a whole lot more goes south in our own ailing homeland. Not to mention the parlous position of the American president himself, the spectral “Joe Biden,” skulking in his demon-haunted White House as evidence of his treasonous turpitudes mounts and mounts. Which leaves us to wonder whether our Intel Community may have stirred up the Russia coup as just another distraction from its own Biden-linked crimes against this nation.

Read more …

“[a]ny verifiable words or actions of my client in the midst of a horrible addiction are solely his own and have no connection to anyone in his family.”

• Who is Lying? Merrick Garland or the Whistleblowers? (Turley)

“I’m not the deciding official.” Those five words, allegedly from Delaware U.S. Attorney David Weiss, shocked IRS and FBI investigators in a meeting on October 22, 2022. This is because, in refusing to appoint a special counsel, AG Merrick Garland had repeatedly assured the public and Congress that Weiss had total authority over his investigation. IRS supervisory agent Gary A. Shapley Jr. told Congress he was so dismayed by Weiss’s statement and other admissions that he memorialized them in a communication to other team members. Shapley and another whistleblower detail what they describe as a pattern of interference with their investigation of Hunter Biden, including the denial of searches, lines of questioning, and even attempted indictments.

The only thing abundantly clear is that someone is lying. Either these whistleblowers are lying to Congress, or these Justice Department officials (including Garland) are lying. The response from both Hunter Biden’s counsel and the attorney general himself only deepened the concerns. Christopher Clark, an attorney for Hunter Biden, responded to a shocking Whatsapp message that the president’s son had allegedly sent to a Chinese official with foreign intelligence contacts who was funneling millions to him. “I am sitting here with my father,” the younger Biden wrote, “and we would like to understand why the commitment made has not been fulfilled. Tell the director that I would like to resolve this now before it gets out of hand, and now means tonight. And, Z, if I get a call or text from anyone involved in this other than you, Zhang, or the chairman, I will make certain that between the man sitting next to me and every person he knows and my ability to forever hold a grudge that you will regret not following my direction. I am sitting here waiting for the call with my father.”

President Biden has repeatedly told the public that he had no knowledge or involvement in his son’s dealings. He maintained the denial despite audiotapes of him referring to business dealings, photos and meetings with his son’s business associates, as well as an eyewitness account of an in-person meeting. Clark did not deny that the above-quoted message had been sent. He only said that it was “illegal” to release the text (he did not explain why) and then added that “[a]ny verifiable words or actions of my client in the midst of a horrible addiction are solely his own and have no connection to anyone in his family.” Most of us expected a simple denial. Yet, after five years, Hunter has never even denied that the laptop was his. His team has continued with the same non-denial denials.

The transcript also details how investigators wanted to confirm the authenticity of the Whatsapp message through the company. The Justice Department reportedly shut down that effort. If Hunter Biden was evasive, Garland was irate. He denounced the allegations as “an attack on an institution that is essential to American democracy, and essential to the safety of the American people.” The statement bordered on delusion. Polls show that a majority of the public now views the Justice Department as politically compromised and even engaged in election interference. The level of trust in the department under Garland is now lower than it was under his predecessor, Bill Barr.

Read more …

“..empowering EU governments to install spyware on journalists’ devices under the guise of “national security”..

• ‘Journalism is Not a Crime’: Experts Lambast EU Media Freedom Act

The European Media Freedom Act envisages installing spyware on journalists’ phones for the sake of “national security”. Sputnik sat down with some international observers to discuss how the provision correlates with the act’s name and basic European principles. “There is no legitimate reason to spy on journalists,” Lucy Komisar, an investigative journalist based in New York, told Sputnik. “Remember, this law targets people identified as journalists, not as spies or terrorists or criminals. Journalism is not a crime, unless Julian Assange does it. The real reason is to protect government officials from journalists reporting on officials’ misguided policies, abuses and corruption. It’s quite ironic in view of the EU’s self-congratulatory rules trumpeted as protecting peoples’ data from tech companies. Stealing data when a company does it is bad, stealing audio and written text when a government does it is just fine.”

The bloc’s new media regulation was proposed by the European Commission (EC) in September 2022. The initial draft stipulated that European governments could deploy spyware on journalists’ devices “on a case-by-case basis” to ensure national security or to investigate “serious crimes,” such as terrorism, human or weapons trafficking, exploitation of children, murder or rape. However, in May 2023, Politico obtained a document penned by French policy-makers who called to narrow journalists’ immunity under the new EU rules and strike what they called “a fair balance between the need to protect the confidentiality of journalists’ sources and the need to protect citizens and the state against serious threats.” According to the media, Paris’ argument was accepted by the EC. As a result, the draft legislation was amended to loosen safeguards for the journalists’ immunity.

The EC’s original list of “serious crimes” allowing surveillance on reporters was replaced by a broader 2002’s Council Framework Decision of the European arrest warrant consisting of 32 offenses. The development triggered a storm of criticism from European journalist organizations, NGOs and activist groups. In particular, the European Federation of Journalists (EFJ), representing over 300,000 members, denounced the EU’s move as a “blow to media freedom”. The EFJ warned that empowering EU governments to install spyware on journalists’ devices under the guise of “national security” would in particular have a “chilling effect on whistleblowers” and confidential sources. “Since the eighteenth century when newspapers began to circulate, the secrecy of sources has been sacrosanct,” Professor Ellis Cashmore, the author of Screen Society and an independent media analyst, told Sputnik. “Journalists have, over generations, respected this and steadfastly refused to reveal sources. As recently as 2005, Judith Miller, a New York Times journalist, was sentenced to prison for not revealing sources. So, it is an extremely important principle in the media.”

Read more …

“Germany’s Justice Minister Marco Buschmann had studied the EU proposals for harvesting Russian Central Bank assets, and concluded they were legally unworkable.”

• Germany Opposes EU Plan To Steal Russian Assets – FT (RT)

Germany has raised objections to Brussels’s plan to use frozen Russian Central Bank assets for Ukraine’s reconstruction, warning of the legal and financial risks arising from such a move, the Financial Times reported on Monday. The European Commission has been working on a plan to raise billions of euros by requiring financial institutions holding immobilized Russian assets to hand over some of the profits they generate. However, many lawmakers from across the bloc have pointed out that the EU legal system only allows the assets to be frozen, not expropriated. According to the FT, senior German government officials voiced doubts that the EU’s plan can win sufficient support, due to the legal risks.

A Foreign Ministry official reportedly said Moscow “will have to pay for the damage it has caused in Ukraine” and insisted that Germany was doing “everything it legally can” to locate and freeze the assets of sanctioned Russian individuals and companies. The official, however, noted that the idea of using Russian funds for Ukraine’s reconstruction raised “complex financial and legal questions.” “It opens a can of worms,” another German official warned, adding that if the EU took money from the Russian Central Bank or reaped the profits from investing the funds, it would set a precedent for others to pursue, such as Poland, with its World War II reparation claims against Berlin. An unnamed official told FT that Germany’s Justice Minister Marco Buschmann had studied the EU proposals for harvesting Russian Central Bank assets, and concluded they were legally unworkable.

At a meeting with the European Commission last week, several diplomats reportedly urged caution on the proposal. The EU and its allies have frozen hundreds of billions of euros of Russian Central Bank assets as part of the sanctions policy. Officials have so far rejected calls to confiscate the assets outright, and have instead looked for ways to harvest some of the proceeds for Kiev, FT wrote. The report indicated that one option is for securities depositories to be required to make a windfall contribution from the profits generated, when they reinvest the proceeds of frozen Russian assets. Kiev reportedly believes the EU could raise €3 billion ($3.2 billion) a year from Russian Central Bank assets.

According to a senior Ukrainian official, it was also looking at an alternative scheme, whereby the commission could use seized Russian assets as collateral against which it could borrow to invest for a return, which would be designated for Kiev. “The challenge is to try to work out what is legally sound and defensible,” according to one EU diplomat involved in the discussions, who added: “It’s more complex than anybody thought at the outset.” Foreign ministers from the 27-nation bloc are expected to discuss the issue at a meeting in Luxembourg on Monday, officials involved in the planning of the meeting told the FT. Moscow has repeatedly condemned the EU’s seizure of its assets as theft. While addressing the St. Petersburg International Economic Forum earlier this month, Russian President Vladimir Putin described the measure as “medieval.”

Read more …

The ultimate power grab.

• Germany, France Want To End Veto Rights In The EU This Year (RMX)

In what may be the beginning of the end for European nations, Germany and France are determined to reform national rights, including the EU right of veto, this year. The debate has caused a stir in recent months, and in recent weeks, the measure has been put back on the agenda. France and Germany are convinced that a large-scale institutional reform of the European Union, including the abolition of the veto on European Council votes, could be achieved this year, French EU Affairs Minister Laurence Boone and German Minister of State Anna Lührmann told Euractiv. “This is one of the options we want to explore in order to maintain our position as a global player with the EU’s common foreign and security policy,” Lührmann said.

She added that “it would be an important signal in other policy areas if we were to move to qualified majority voting already this year” and expressed confidence that this would happen. The two ministers said that both countries consider it important to abolish unanimous voting in the European Council in areas such as foreign policy and taxation before the enlargement of the European Union. This could mean, for example, that Brussels would be able to implement a flat tax rate across the EU or even involve itself more deeply in the war, both moves that Hungary has rejected and in some cases even deployed its veto to stop.

Paris and Berlin claim abolishing the veto is a change that is possible without amending the EU treaties, a point hotly contested by a number of European parties, as it would not only give Brussels enormous power but also the largest states, such as Germany and France. This would subsequently allow for the EU to enact a liberal immigration policy, green rules and various other progressive goals without any hindrance from Hungary and other smaller, conservative nations. The introduction of qualified majority voting would remove the veto on foreign policy issues, which would mean that only 15 of the 27 member states — representing 65 percent of the EU’s population — would have to agree to make particularly important foreign and defense policy decisions affecting the EU as a whole. Laurence Boone told Euractiv that this would be “an important step toward greater integration and efficiency.”

Read more …

Mobula ray

Bat swim

1st steps

https://twitter.com/i/status/1673386327163674633

Throw in a donkey

Art

https://twitter.com/i/status/1673370199301537809

The oldest musical composition with musical notation still existing anywhere in the world is the Seikilos epitaph from Aydin (Turkey). The epitaphs’ Greek text reads:

“While you live, shine

have no grief at all

life exists only for a short while

and Time demands his due.”

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.