Pablo Picasso Group of dancers. Olga Kokhlova is lying in the foreground � 1919

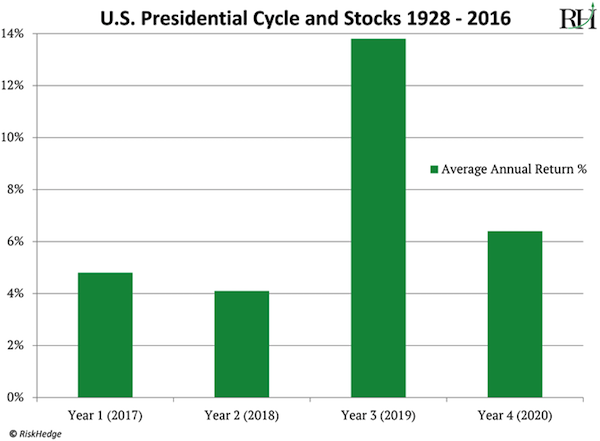

2019 as a great year for stocks as the Fed hikes rates? Hmmm..

• What Happened To Stocks After Every Midterm Election Since World War II (MW)

[..] let’s steer clear of opinion and emotion. Instead, I want to focus solely on the facts that are relevant to you as an investor. As you’ll see, you don’t need to waste even one second worrying about which party will win on Tuesday. I was surprised by what we found. Since 1946, there have been 18 midterm elections. Stocks were higher 12 months after every single one. Every single one. That’s 18 for 18. Even though we’ve had every possible political combination in the past 72 years. Republican president with Democratic Congress. Democratic president with Republican Congress. Republican president and Congress. Democratic president and Congress.

Since 1946, stocks have risen an average of 17% in the year after a midterm. And if you measure from the yearly midterm lows, the results are even better. From their lows, stocks jumped an average of 32% over the next 12 months. For perspective, that’s more than double the average performance for stocks in all years. We’re also entering the third year of a presidential term, which is historically the strongest year for stocks. Take a look at this chart. You can see that the performance of stocks in the third year of a presidential term beats all other years by a long shot:

“Rasmussen was the only major pollster in 2016 to predict a Trump victory..”

• Stocks Surge After Latest Rasmussen Poll Shows GOP Retaining The House (ZH)

US equity markets ramped into the green as the final Rasmussen Reports Generic Congressional Ballot before Election Day shows Republicans edging ahead by one point… The latest Rasmussen Reports national telephone and online survey of Likely U.S. Voters finds that 46% would choose the Republican candidate if the elections for Congress were held today. 45% would vote for the Democrat. 3% prefer some other candidate, and six percent (6%) remain undecided. A week ago, Democrats held a 47% to 44% lead. This is the first poll showing a GOP lead, and it may matter: while often accused of bias, Rasmussen was the only major pollster in 2016 to predict a Trump victory; Rasmussen was also the only major pollster whose prediction was proven correct.

So no stories afterward?!

• US Intelligence: No Evidence Of Any Attempts To Tamper With Midterms (NBC)

U.S. intelligence officials have seen no evidence that any nation state is attempting to tamper with voting systems or election infrastructure ahead of tomorrow’s midterm election, intelligence officials told NBC News Tuesday. “There’s a lot of noise—we see the typical scanning and probing—but we can’t attribute it to any bad actors,” said one official briefed on the intelligence. U.S. officials also told NBC News that last week the White House was sent a top secret assessment of election security produced by a newly created interagency task force.

The assessment, created by NSA and U.S. Cyber Command specialists, also found no evidence that any foreign actors were working to infiltrate election infrastructure in the run up to Tuesday’s midterms, according to two sources with direct knowledge of the assessment. [..] In addition to reviewing possible threats, the task force members are taking an offensive posture, secretly communicating to known operatives in Russia and elsewhere that they are aware of their activities, sources said. A senior U.S. official described the communications with the suspected hackers as, “We know that you’re going to do this. Don’t do it!”

The task force, which was created in May, has built a database of hackers and trolls, as well as Russian government institutions and private entities that have been involved in the U.S., a senior intelligence official said. The assessment on potential election system tampering is consistent with what American officials have been saying publicly all year. They have sounded the alarm about foreign influence campaigns on social media––led by Russia, China and Iran––but they have seen no evidence that any foreign actor was gearing up to hack the vote.

Mostly about trade? Or is it Iran?

• US and China To Hold A Top-Level Security Dialogue On Friday (R.)

The United States and China will hold a delayed top-level security dialogue on Friday, the latest sign of a thaw in relations, as China’s vice president said Beijing was willing to talk with Washington to resolve their bitter trade dispute. The resumption of high-level dialogue, marked by a phone call last week between Presidents Donald Trump and Xi Jinping, comes ahead of an expected meeting between the two at the G20 summit in Argentina starting in late November. It follows months of recriminations spanning trade, U.S. accusations of Chinese political interference, the disputed South China Sea and self-ruled Taiwan.

China and the United States have both described last week’s telephone call between Xi and Trump as positive. Trump predicted he’d be able to make a deal with China on trade. In a concrete sign of the unfreezing, the U.S. State Department said Secretary of State Mike Pompeo, Defense Secretary Jim Mattis, Chinese politburo member Yang Jiechi and Defense Minister Wei Fenghe will take part in diplomatic and security talks later this week in Washington. China said last month the two sides had initially agreed “in principle” to hold the second round of diplomatic security talks in October but they were postponed at Washington’s request amid rising tensions over trade, Taiwan and the South China Sea.

Over 100 countries borrowed from China. Mostly in USD.

• Exposing China’s Overseas Lending (Reinhart)

Over the past 15 years, China has fueled one of the most dramatic and geographically far-reaching surges in official peacetime lending in history. More than one hundred predominantly low-income countries have taken out Chinese loans to finance infrastructure projects, expand their productive capacity in mining or other primary commodities, or support government spending in general. But the size of this lending wave is not its most distinctive feature. What is truly remarkable is how little anyone other than the immediate players – the Chinese government and development agencies that do the lending and the governments and state-owned enterprises that do the borrowing – knows about it.

There is some information about the size and timing of Chinese loans from the financial press and a variety of private and academic sources; but information about loans’ terms and conditions is scarce to nonexistent. Three years ago, writing about “hidden debts” to China and focusing on the largest borrowers in Latin America (Venezuela and Ecuador), I noted with concern that standard data sources do not capture the marked expansion of China’s financial transactions with the remainder of the developing world. Not much has changed since then.

While China in 2016 joined the ranks of countries reporting to the Bank for International Settlements, the lending from development banks in China is not broken down by counterparty in the BIS data. Emerging-market borrowing from China is seldom in the form of securities issued in international capital markets, so it also does not appear in databases at the World Bank and elsewhere. These accounting deficiencies mean that many developing and emerging-market countries’ external debts are currently underestimated in varying degrees. Moreover, because these are mostly dollar debts, missing the China connection leads to underestimating balance sheets’ vulnerability to currency risk.

But … the Russians!

• EU Lost Over €100 BIllion Due To Its Own Anti-Russia Sanctions – Lavrov (RT)

The EU is punishing itself for doing Washington’s bidding and sanctioning Russia, Russian Foreign Minister Sergey Lavrov said. However, while the restrictions policy does not harm the US, the EU suffers billions in losses. In an interview with the Spanish newspaper El País, Lavrov lamented the dismal state of EU-Russia relations, describing them as far from normal. The divisions are being fueled from across the pond, he said. “The mythical ‘Russian threat’ is forced upon the Europeans, primarily, from the outside,” Lavrov said. The main bone of contention between the EU and Russia –sanctions– were imposed by the European nations “on direct orders” from Washington.

With that said, the US has hardly felt any adverse effect from the policy it championed, unlike the EU. “Estimates of losses incurred by the EU states from the sanctions vary. According to some estimates, they might amount to over €100 billion. It’s important that European politicians understand this,” the minister said. Russia, which had to retaliate with tit-for-tat measures, is ready to lift the restrictions it imposed on European goods back in 2014. “We have spoken repeatedly about our readiness to abolish countermeasures,” Lavrov said. However, the EU must make the first step. “We hope that common sense will eventually prevail since, objectively speaking, the sanctions neither benefit Russia nor the EU,” the diplomat added.

Get in line or else. That’s Brussels for you.

• Eurozone Ministers Line Up Behind EU In Italy Budget Dispute (G.)

Several eurozone finance ministers have come out to back Brussels in a row with Italy’s populist government over a budget that has been deemed to break the rules of the common currency bloc.France’s finance minister, Bruno Le Maire, warned that the future of the euro was at stake as he urged the Italian government to reach an agreement with the European commission. “The wise path is the path of dialogue, exchange of views, to find the best solution for the eurozone as a whole, for the Italian government and for our common currency,” he said on Monday as he arrived at a meeting of eurozone finance ministers. “For what is at stake now is our common currency.” Italy doubled down on its refusal to change the budget, a week before a deadline to submit new plans to the European commission.

“No little letter will make us back down. Italy will never kneel again,” Italy’s powerful interior minister Matteo Salvini has said. Italian deputy prime minister Luigi di Maio told the Financial Times the rest of Europe should copy Italy’s expansionary public spending plans. “If the recipe works here, it will be said at a European level, we should apply the recipe of Italy to all other countries.” The commission rejected Italy’s draft 2019 budget last month – although other member states, including France and Germany, have broken the rules in the past without sanction. Italy must submit a new plan by 13 November and will hear Brussels’ verdict on 21 November, when the commission delivers an assessment on the budgets of all eurozone members.

Not yet, I’d say.

• The Italian People Must Understand That Their Country Is At War (Gefira)

To make the euro sustainable, the European financial elites want the Italians to reduce their spending and turn a budget deficit into a budget surplus. However, due to the country’s shrinking population the Italian budget deficit — as we have argued many times – can only increase. The European commission rejects the Italian budget because Rome wants to increase its debt far beyond the limit allowed by the ECB. “This is the first Italian budget that the EU doesn’t like,” wrote Deputy Prime Minister Luigi Di Maio on Facebook. “No surprise: This is the first Italian budget written in Rome and not in Brussels!” Matteo Salvini added: “This (the rejection of the Italian budget plan by the EU) doesn’t change anything.”. “They’re not attacking a government but a people. These are things that will anger Italians even more,” he said.

The country has entered a demographic winter and sustainable economic growth is simply impossible, at least for the foreseeable future. As is the case with the whole of Europe, the continent needs a plan to support an ageing and declining population. As if not aware of it, the Brussels-Frankfurt establishment only wants Italy to stick to their austerity program, i.e. decrease public spending and do away with the current Italian administration, which refuses to comply. To force Prime Minister Luigi Di Maio and Matteo Salvini out of office, the European Union will go to any lengths to destroy the Italian banking sector the way they did it in Greece and Cyprus. In 2015 Greece shut down its banks, ordering them to stay closed for six days, and its central bank imposed restrictions to prevent money from fleeing out of the country.

Jeroen Dijsselbloem, former head of the euro group, suggests that the financial markets should try to lower the value of the Italian bonds. A lower bond value will erode the capital of the Italian banks and make them insolvent. Mario Draghi, head of the ECB, warned last week that a recent sell-off of Italian government bonds was set to dent the capital of Italy’s banks which own about €375 billion worth of that paper. The remarks of the ECB’s chairman were carefully prepared as another deliberate attack on the Italian financial system. It is highly unusual for central bankers to warn the bank under their supervision against insolvency, at the same time trying to provoke a preemptive bank run.

RBA has a third mandate: ensuring Australia’s economic prosperity and financial stability..

• Australia’s Housing Downturn Could Spark Interest Rate Cut (ABC.au)

Our politicians now have what they have so publicly yearned for; more affordable housing. Real estate prices nationally are down 4.6 per cent year-on-year. The declines, however, are more pronounced in the two biggest cities, Sydney and Melbourne. And the slump is beginning to spread. According to real estate price monitoring firm CoreLogic, Sydney real estate has fallen 7.4 per cent during the past year — the biggest annual decline since 1990, when the economy was sliding into recession. Melbourne has dropped 4.7 per cent during the same period but the pace is accelerating and, just like Sydney, has begun to spread from high-end property into the suburbs with lower-priced housing also turning negative.

Perth, which took a hit as the mining boom unwound, is also back in decline, down a further 3.3 per cent in the past year. Hobart is the only state capital still experiencing boom times, with a 9.7 per cent lift. So far, and much to everyone’s relief, the price declines have been orderly. But after a year of consistent monthly falls in Sydney, the number of people — particularly first-home buyers — now facing significant capital losses are mounting. The main cause for the contraction on the demand side is that it now is much more difficult to raise finance. Banks simply refuse to lend the kind of money previously being thrown at housing.

[..] Unlike most central banks, our Reserve Bank has three mandates, or briefs, that it must maintain. The first is to ensure inflation remains steady and manageable. That’s pretty much the standard brief for every central bank. But the RBA also has to aim for full employment. Plus, it’s tasked with ensuring Australia’s economic prosperity and financial stability. Some would argue that’s an almost impossible mission. And it partly explains why it deliberately fired up the east coast housing boom — to absorb workers being laid off as the mining boom came to an end, even if it merely delayed the inevitable.

The shame runs deep. Third world.

• UN Investigates Extreme Poverty In UK (CNN)

The United Nations has launched an investigation into extreme levels of poverty in one of the richest countries in the world: the United Kingdom. Philip Alston, the UN special rapporteur on extreme poverty and human rights, starts a two-week fact-finding mission Monday, visiting some of the country’s poorest towns and cities to examine the effects of austerity measures on rising levels of hardship. Alston, known for his no-holds-barred critiques, will gather evidence on the impact that changes to welfare benefits and local government funding as well as the rising costs of living have had on British families.

“The Government has made significant changes to social protection in the past decade, and I will be looking closely at the impact that has had on people living in poverty and their realization of basic rights,” Alston said in a statement. “I have received hundreds of submissions that make clear many people are really struggling to make ends meet. [..] CNN reported in September that nearly 4 million children in the UK were living in households that struggle to afford fruit, vegetables and other foods conducive to healthy living, according to a report by the Food Foundation. The long-term policy of austerity in the UK has also had a disproportionate impact on women, according to the Equality and Human Rights Commission.

It has been nearly a decade since then-Prime Minister David Cameron committed to cut excessive government spending, declaring in 2009 that “the age of irresponsibility” was “giving way to the age of austerity.”

Extremely well done.

• American Bread & Circus (Mike Maloney)

Long-time Automatic Earth friend Mike Maloney is doing a long series called The Hidden Secrets of Money. This is episode 10 already, the Fall of Rome and the Fall of America. We have some catching up to do.

Energy use produces waste. It can take many forms.

• Large Hydropower Dams ‘Not Sustainable’ (BBC)

A new study says that many large-scale hydropower projects in Europe and the US have been disastrous for the environment. Dozens of these dams are being removed every year, with many considered dangerous and uneconomic. But the authors fear that the unsustainable nature of these projects has not been recognised in the developing world. Thousands of new dams are now being planned for rivers in Africa and Asia. Hydropower is the source of 71% of renewable energy throughout the world and has played a major role in the development of many countries.

But researchers say the building of dams in Europe and the US reached a peak in the 1960s and has been in decline since then, with more now being dismantled than installed. Hydropower only supplies approximately 6% of US electricity. Dams are now being removed at a rate of more than one a week on both sides of the Atlantic. The problem, say the authors of this new paper, is that governments were blindsided by the prospect of cheap electricity without taking into account the full environmental and social costs of these installations. More than 90% of dams built since the 1930s were more expensive than anticipated. They have damaged river ecology, displaced millions of people and have contributed to climate change by releasing greenhouse gases from the decomposition of flooded lands and forests.

[..] In the developing world, an estimated 3,700 dams, large and small, are now in various stages of development. The authors say their big worry is that many of the bigger projects will do irreparable damage to the major rivers on which they are likely to be built. On the Congo river, the Grand Inga project is expected to produce more than a third of the total electricity currently being generated in Africa. However, the new study points out that the main goal for the $80bn installation will be to provide electricity to industry. “Over 90% of the energy from this project is going to go to South Africa for mining and the people in the Congo will not get that power,” said Prof Moran.

The threats are too new to be part of any constitution, so it becomes a matter of interpretation. That can work both ways.

• US Supreme Court Allows Historic Kids’ Climate Lawsuit To Go Forward (Nature)

A landmark climate-change lawsuit brought by young people against the US government can proceed, the Supreme Court said on 2 November. The case, Juliana v. United States, had been scheduled to begin trial on 29 October in Eugene, Oregon, in a federal district court. But those plans were scrapped last month after President Donald Trump’s administration asked the Supreme Court to intervene and dismiss the case. The plaintiffs, who include 21 people ranging in age from 11 to 22, allege that the government has violated their constitutional rights to life, liberty and property by failing to prevent dangerous climate change.

They are asking the district court to order the federal government to prepare a plan that will ensure the level of carbon dioxide in the atmosphere falls below 350 parts per million by 2100, down from an average of 405 parts per million in 2017. By contrast, the US Department of Justice argues that “there is no right to ‘a climate system capable of sustaining human life’” — as the Juliana plaintiffs assert. Although the Supreme Court has now denied the Trump administration’s request to the dismiss the case, the path ahead is unclear. In its 2 November order, the Supreme Court suggested that a federal appeals court should consider the administration’s arguments before any trial starts in the Oregon district court.

[..] Although climate change is a global problem, lawyers around the world have brought climate-change-related lawsuits against local and national governments and corporations since the late 1980s. These suits have generally sought to force the sort of aggressive action against climate change that has been tough to achieve through political means. Many of the cases have failed, but in 2015, a citizen’s group called the Urgenda Foundation won a historic victory against the Dutch government. The judge in that case ordered the Netherlands to cut its greenhouse-gas emissions to at least 25% below 1990 levels by 2020, citing the possibility of climate-related damages to “current and future generations of Dutch nationals” and the government’s “duty of care … to prevent hazardous climate change”. A Dutch appeals court upheld the verdict last month.