Gustave Courbet The desperate man (self portrait) 1852

— Elon Musk (@elonmusk) March 5, 2025

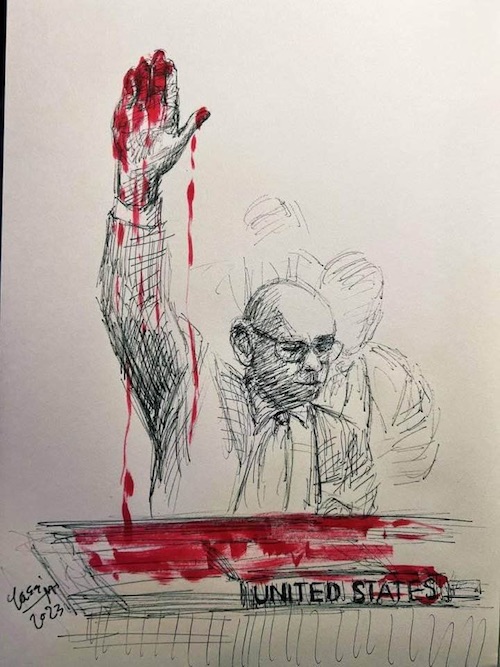

FBI

BREAKING: Head of FBI field office in New York *resigns* after the Department of Justice accused his office of hiding thousands of Epstein documents.

James Dennehy says he was forced to resign in an email to staff.

"Late Friday, I was informed that I needed to put my retirement… pic.twitter.com/rNZWQpGT8O

— Collin Rugg (@CollinRugg) March 3, 2025

I repeat: if the NY FBI head actually withheld thousands of documents on the Epstein case, as AG Bondi said, why is he allowed to resign? Why is he collecting a lifetime taxpayer pension when he should be in prison? Totally unacceptable.pic.twitter.com/yE5fngu1gV

— Clint Russell (@LibertyLockPod) March 3, 2025

Vance

Yes! Lost in the temper tantrum thrown by pissy pants Zelensky is that this was a DONE DEAL. The signing was pro forma. Someone got to him. Likely it was our “European allies.”

— Cernovich (@Cernovich) March 4, 2025

https://twitter.com/i/status/1896754941575983386

Kari Lake

JUST IN: Kari Lake has been sworn in as the Director of Voice of America to help President Trump dismantle the globalist fake news operation.

She will lead a team of about 1,000 people.

This is going to be very fun. pic.twitter.com/77YANTAVGS

— George (@BehizyTweets) March 3, 2025

Fentanyl

Leavitt: "Your audience should be aware that tonight — 12:01am — tariffs on Mexico and China are going into effect and another 10%, uh, another 10% on China, 25% on Mexico, 25% on Canada. And the reason is because we cannot continue to allow fentanyl to pour into our country." pic.twitter.com/wA7pZkz9dp

— Aaron Rupar (@atrupar) March 4, 2025

Sachs

https://twitter.com/i/status/1896608908430672272

Sachs

Jeffrey Sachs –

" Edward Snowden is a hero." pic.twitter.com/zZS1uF9j38

— Girl patriot (@Girlpatriot1974) March 4, 2025

Ursula

Von Der Liar let's the mask slip.

It's all about flushing Billions of your money into the bank accounts of her Defence Giant friends' pockets.

More Weapons, More War, more Death, all while destroying our economies and isolating the continent. pic.twitter.com/Gzmu60Zbe0

— Chay Bowes (@BowesChay) March 4, 2025

Common sense indeed. That’s all that’s needed. But the Democrats have lost it, and now they barely exist anymore. Watching bits of Trump’s speech last night, that’s what I was thinking: they’re gone, they’re around only in name. They took the knee to support BLM as it burnt down US cities unpunished. They insisted males must have access to girls’ dressing rooms. But countless Americans are (grand-) parents of young girls, and they want no part of that. Yesterday, their perhaps main point appeared to be that the world’s richest man is stealing granny’s pension and Medicare. Stick a fork in them and turn them over; they’re done. But that leaves Trump with no resistance; not sure that’s a good thing. And since we stopped last year with one Dem candidate who was too demented, followed by one who was too unpopular, it’s not clear at all what future they have, if any.

• Common Sense Revolution: Trump Outlines Sweeping Vision For Next 4 Years (JTN)

President Donald Trump on Tuesday evening delivered an optimistic speech outlining his vision for the next years, alternating between a pugilistic and jovial tone as he showed to Democrats that he would not back off of his core campaign promises and invited them to participate in his efforts to reshape the nation. “I return to this chamber tonight to report that America’s momentum is back. Our spirit is back. Our pride is back. Our confidence is back, and the American Dream is surging bigger and better than ever before,” he began. “The American dream is unstoppable, and our country is on the verge of a comeback, the likes of which the world has never witnessed and perhaps will never witness, again, never been anything like it.”

Focusing on a “common sense revolution” that he framed part as a global movement, he highlighted his early efforts to rebuild the American economy and declared that “among my very highest priorities is to rescue our economy and get dramatic and immediate relief to working families.” To that end, he pointed to his administration’s plan to reduce egg prices, bolster American energy production, encourage auto-manufacturing in the U.S., and revitalize the shipbuilding industry through a dedicated White House office. Though not technically a State of the Union address, the speech served a similar function and Trump used the opportunity to deliver a number of partisan blows to his opponents while attempting to win them over on key points.

“This is my fifth such speech to Congress, and once again, I look at the Democrats in front of me, and I realize there is absolutely nothing I can say to make them happy or to make them stand or smile or applaud, nothing I can do,” he said. “I could find a cure to the most devastating disease, a disease that would wipe out entire nations or announce the answers to the greatest economy in history, or the stoppage of crime to the lowest levels ever recorded. And these people sitting right here will not clap, will not stand, and certainly will not cheer for these astronomical achievements,” he went on. “So Democrats sitting before me for just this one night, why not join us in celebrating so many incredible wins for America, for the good of our nation, let’s work together and let’s truly make America great again.”

Prior to the speech, reports had suggested that Democrats would take a more subdued approach to protesting Trump’s remarks. But such reports were disproven as raucous jeering from the conference prompted repeated admonishment from House Speaker Mike Johnson, who ultimately ordered the removal of Rep. Al Green, D-Texas, from the chamber. The opposition’s frequent refusal to stand or applaud throughout the speech, moreover, attracted considerable online attention, especially as Trump highlighted the death of Laken Riley and the presence of a 13-year-old child with cancer. Riley’s death served as the keynote of Trump’s discussion on illegal immigration as the first law he signed upon returning to office bore her name.

“Last year, I told Laken’s grieving parents that we would ensure would not have died in vain. That’s why the very first bill I signed into law as your 47th president mandates the detention of all dangerous criminal aliens who threaten public safety, very strong, powerful act,” he said. Much of the speech saw Trump urge Congress to pass his legislative priorities, including a call for a balanced budget, making interest payments on car loans tax deductible if the vehicle was made in America, and banning child sex changes. Trump used much of speech to Congress to highlight his efforts to fight inflation, bolster energy production, and strengthen the U.S. economy, outlining his overall plan and touting his early accomplishments.

“Among my very highest priorities is to rescue our economy and get dramatic and immediate relief to working families. As you know, we inherited from the last administration an economic catastrophe and an inflation nightmare,” he declared. “Their policies drove up energy prices, pushed up grocery costs and drove the necessities of life out of reach for millions and millions of Americans, if not never had anything like it.” “We suffered the worst inflation in 48 years, but perhaps even in the history of our country, they’re not sure. As President, I’m fighting every day to reverse this damage and make America affordable again,” he declared. “Joe Biden especially let the price of eggs get out of control. The egg prices out of control, and we’re working hard to get it back down. Secretary, do a good job on that. You inherited a total mess from the previous administration.” Trump further pointed to his efforts to construct a national gas pipeline, encourage foreign investment, and to cut government waste.

It’s very sad, too.

• Trump’s Big Speech Proves To Be Optics Nightmare For Democrats (JTN)

President Donald Trump’s joint address to Congress on Tuesday night proved to be an optics nightmare for Democrats as one of their own was booted from the House chamber by the sergeant at arms and social media lit up over liberal lawmakers’ refusal to stand for a boy with cancer being made a member of the Secret Service. House Speaker Mike Johnson had Rep. Al Green, D-Texas, removed from the House chamber during Trump’s joint address for disrupting the speech. Johnson banged the speaker’s gavel as Democrats disrupted Trump’s speech, before instructing them to follow decorum and ordering Green’s removal.

“Members are directed to uphold and maintain decorum in the House and to cease any further disruptions,” Johnson said. “That’s your warning. Members are engaging in willful and continuing breach of decorum, and the chair is prepared to direct the sergeant at arms to restore order to the joint session. Mr. Green, take your seat. Take your seat, sir. Take your seat. Finding that members continue to engage in willful and concerted disruption of proper decorum, the chair now directs the sergeant at arms to restore order. Remove this gentleman from the chamber.” Shortly after Johnson’s order to remove Green from the chamber, Trump said, “This is my fifth such speech to Congress, and once again, I look at the Democrats in front of me, and I realize there is absolutely nothing I can say to make them happy or to make them stand or smile or applaud, nothing I can do.

“I could find a cure to the most devastating disease, a disease that would wipe out entire nations or announce the answers to the greatest economy in history, or the stoppage of crime to the lowest levels ever recorded. And these people sitting right here will not clap, will not stand, and certainly will not cheer for these astronomical achievements. They won’t do it, no matter what — five times I’ve been up here, it’s very sad, and it just shouldn’t be this way,” he continued. “So Democrats sitting before me for just this one night, why not join us in celebrating so many incredible wins for America, for the good of our nation, let’s work together and let’s truly make America great again.” Trump also pointed out a 13-year-old boy in the gallery who is battling cancer and has been made an honorary police officer. The president said that he was making the child an agent of the Secret Service.

“Joining us in the gallery tonight is a young man who truly loves our police. His name is DJ Daniel, he is 13 years old, and he has always dreamed of becoming a police officer,” Trump said. “But in 2018, DJ was diagnosed with brain cancer, the doctors gave him five months at most to live. That was more than six years ago. Since that time, DJ and his dad have been on a quest to make his dream come true, and DJ has been sworn in as an honorary law enforcement officer, actually a number of times. The police love him, the police departments love him. “And tonight, DJ, we’re going to do you the biggest honor of them all. I am asking our new Secret Service Director, Sean Curran, to officially make you an agent of the United States Secret Service. Thank you, DJ. DJ’s doctors believe his cancer likely came from a chemical he was exposed to when he was younger. Since 1975, rates of child cancer have increased by more than 40%.”

Wile Republicans gave DJ a standing ovation, only about a dozen Democrats joined them. The rest sat without recognizing the boy. Former Arizona Assistant Attorney General Jennifer Wright (R) reacted to the Democrats’ reaction in post on X on Tuesday, writing, “The congressional democrats are horrible human beings. They couldn’t even stand to applaud newly sworn in Secret Service Agent DJ, a child battling cancer!!” A brief clip that Wright reposted on X showed the majority of Democrats remaining seated while Republicans gave DJ a standing ovation. During Trump’s address, some Democrats in the chamber held up circular black signs with white lettering that had statements such as “Protect Veterans,” “False,” “Save Medicaid,” and “Musk Steals.” Near the start of the speech, Democrats started booing Trump, before being drowned out by Republicans chanting, “USA!”

As Trump entered the House chamber for his address, Rep. Melanie Stansbury, D-N.M., held up a sign next to the president that read, “This is NOT Normal.” White House Deputy Chief of Staff Taylor Budowich posted a thread on X on Tuesday of several occasions in Trump’s speech that Democrats didn’t clap for.

“..if the polls are correct then nearly half of Democrats are burnt out on the wacky Manson Family behavior of their activist counterparts..”

• Half of Democrat Voters Are Tired Of Far-Left Politics (ZH)

Can Democrats learn to admit when they’re wrong? It might depend on the variety of Democrat. Woke activists have proven time after time that they will double down on every incorrect position because they don’t care at all about being right; they only care about winning and destroying anyone who stands in their way. But this is psychopathic behavior that should be common only among the fringes of ideological debate. Are all Democrats woke and crazy, or do a lot of them go along with the extremist mob because they’re too afraid to speak against their own side? Or, perhaps a lot of people that lean to the left of the political spectrum have a habit of blindly following the lemmings in front of them, even if it means going off a cliff in the end.

Whether it was psychopathy, cowardice or trend chasing, millions of US voters thought it was a good idea to jump on the woke bandwagon and support authoritarianism, collectivism and moral relativism for at least a solid four years. No moderation was allowed. No nuance was discussed. No centrist ideals entertained. During the Biden Administration and the Kamala Harris campaign ESG, CRT, DEI, LGBT and Net Zero were the message and the madness. It was everywhere and there was no escape. Not surprisingly, the zealotry of the political left created massive blowback that they just could not comprehend. Using billions in government funds from agencies like USAID to saturate the culture with race communism and trans cultism did not help them in the long run. In fact, most of the population became fed up and angry. The Democratic Party fully embraced the woke militants and ended up alienating half of their own voter base.

After the Democratic Party’s well-publicized setbacks during the November elections, a recent national poll indicates 45% of Democrats want their party to go moderate and move away from the terminally woke. That’s up 11 points from 2021. Only 31% of respondents in a Quinnipiac University survey conducted last month had a favorable opinion of the Democratic Party, with 57% seeing the party in an unfavorable light. Polls also show that Democrats in congress hit an all-time-low approval rating last month as the party is finding it increasingly difficult to counter Donald Trump’s government accountability message. To oppose government audits suggests they have something to hide. Democrat politicians have come out publicly in recent weeks to admit that overt “wokeism” is ruining the party. Senator Mark Warner, a Virginia Democrat, asserts:

“I think the Democrats’ brand is really bad, and I think this was an election based on culture. And the Democrats’ failure to connect on a cultural basis with a wide swath of Americans is hugely problematic…” “I think the majority of the party realizes that the ideological purity of some of the groups is a recipe for disaster and that, candidly, the attack on over-the-top wokeism was a valid attack.” In other words, Get Woke – Go Broke. It took several years and a severe beat down in the elections to draw out even a modicum of awareness from leftists and it’s unlikely that they will abandon identity politics in the near term. But, if the polls are correct then nearly half of Democrats are burnt out on the wacky Manson Family behavior of their activist counterparts. This means that without dramatic changes, the Dems will not be winning any elections anytime soon.

“Palantir Turns Ukraine Into an AI War Lab.”

• Did Palantir Give Trump & Vance the Real Ukraine Intel? (Sp.)

While Volodymyr Zelensky brazenly questioned JD Vance’s knowledge of Ukraine in the White House slapdown, Donald Trump and his veep may have already exposed all his corrupt schemes. Time Magazine boasted that tech giant Palantir Technologies embedded its state-of-the-art analytics AI software into Ukraine’s government operations in June 2022. More than half a dozen Ukrainian agencies, including its Ministries of Defense, Digital Transformation, Economy, and Education, now rely on Palantir. The company has access to virtually all Ukraine’s data, from real-time satellite and drone footage to financial and economic records, according to the media. Beyond its military AI solutions, Palantir is also tasked with “rooting out corruption” in Ukraine – effectively making it the Zelensky regime’s invisible watchdog.

Founded in 2003, Palantir was backed by the CIA’s venture arm, In-Q-Tel, and worked on US-NATO operations in Afghanistan and Iraq. What’s more, billionaire Peter Thiel, Palantir’s co-founder, has been a loyal Trump ally since 2016. Thiel mentored JD Vance since 2011, backed his Narya Capital, and donated $10 million to his Senate campaign in 2021. With Palantir’s insider access, it likely holds intel on Ukraine’s corruption, misuse of US funds, forced conscriptions, and more – intel Thiel could have shared with Trump and Vance. Rumors suggest Palantir’s AI may have been used by Elon Musk’s DOGE team, hinting that Kiev’s schemes could already be exposed, much like USAID’s murky dealings.

At least it makes sense. But I don’t have the feeling it’s his decision.

• Musk Offers Zelensky To Give Up Power, Leave Ukraine (TASS)

The leader of the Kiev regime, Vladimir Zelensky, should resign and leave Ukraine, US entrepreneur and Head of the Department of Government Efficiency (DOGE) Elon Musk said. “As distasteful as it is, Zelensky should be offered some kind of amnesty in a neutral country in exchange for a peaceful transition back to democracy in Ukraine,” Musk wrote on his X social media page. On February 28, Vladimir Zelensky visited the White House for a meeting with US President Donald Trump. Their televised exchange, with reporters present, devolved into a shouting match, with Trump reprimanding that Zelensky was ungrateful to the United States for the support provided to Kiev, and Vice President JD Vance pointing out that Zelensky showed a disrespectful attitude towards the US. The press conference following their meeting was canceled. Trump posted a statement on the Truth Social network asserting that Zelensky disrespected the US and displayed reluctance to seek a peaceful resolution to the Ukraine conflict.

He’ll say anything he’s told to say.

• Zelensky Reverses Hardline Position On Peace Talks (RT)

Ukrainian leader Vladimir Zelensky has said that Kiev is ready to engage in peace negotiations with Russia, to be brokered by US President Donald Trump. The statement comes after the White House reportedly stopped all military aid to Kiev following a disastrous meeting in the Oval Office between the two leaders, for which US officials have demanded Zelensky apologize. Zelensky made a concession-filled post on X on Tuesday, saying his public feud with Trump in the Oval Office was “regrettable.” “We are ready to work fast to end the war,” Zelensky wrote. He has frequently said in the past that Ukraine would fight as long as necessary and that peace talks could only happen on Ukraine’s terms. He proposed the release of prisoners and establishing “truces” on both the air and sea fronts, echoing suggestions by UK Prime Minister Keir Starmer and French President Emmanuel Macron in a meeting with him in London on Sunday.

The French-UK plan envisages a temporary, month-long “truce in the air, on the seas, and on energy infrastructure.” Moscow has repeatedly ruled out a temporary ceasefire with Kiev, insisting on a permanent, legally binding peace deal that addresses the root causes of the conflict. On Monday, Trump reportedly ordered a temporary halt to all US military aid to Ukraine, aiming to pressure Zelensky into negotiations to end the conflict with Russia. An unnamed senior administration official told Fox News that military assistance would stay suspended until the Ukrainian leadership demonstrates a genuine commitment to peace talks. “Ukraine is ready to come to the negotiating table as soon as possible to bring lasting peace closer,” Zelensky continued on X, offering his appreciation for Washington’s support. “My team and I stand ready to work under President Trump’s strong leadership to get a peace that lasts,” he added.

“’Ready’ is good, it is positive,” Kremlin spokesman Dmitry Peskov reacted to the statement. During the Friday meeting, Trump accused Zelensky of ingratitude and “gambling with World War III” by refusing to work towards a halt to hostilities. On Sunday, Zelensky told reporters that “an agreement to end the war is still very, very far away, and no one has started all these steps yet.” Trump condemned his statement on social media, promising that “America will not put up with it for much longer.” Russian President Vladimir Putin has indicated Moscow’s readiness to resolve the Ukraine conflict through peaceful means. He emphasized Russia’s aim of establishing an international system that ensures a balanced and mutual consideration of interests, creating a long-term, indivisible European and global security framework.

Additionally, Zelensky highlighted his willingness to swiftly finalize a minerals deal with the US, viewing it as a step toward “toward greater security and solid security guarantees.” Trump has declined to provide specific promises on security, such as admitting Ukraine to NATO or contributing American troops to a future peacekeeping mission. He has also argued that Kiev’s ambition to join NATO was “probably the reason this whole thing started.” Moscow has welcomed Trump’s NATO comments, with Russian Foreign Minister Sergey Lavrov saying the US president is “the first and only” major Western leader to publicly name NATO expansion and Ukraine’s desire to join the bloc as a key cause of the ongoing conflict.

“The Kremlin also said that Kiev must renounce its claims to Crimea and four other regions that have voted to become part of Russia.”

• Musk Wants ‘Actions, Not Words’ From Zelensky (RT)

Words alone would not be enough to restore trust in Kiev, Elon Musk has said in a response to Ukrainian leader Vladimir Zelensky’s announcement that he was ready to sign a deal with the US on rare-earth minerals and agree to a ceasefire with Moscow. “Actions, not words, are what matter. Let’s see what actions take place,” the billionaire and top adviser to US President Donald Trump wrote on X on Tuesday. Zelensky had earlier expressed his regret that last Friday’s meeting in Washington “did not go the way it was supposed to.” The US and Ukraine were supposed to sign a rare-earths deal during Zelensky’s visit to the White House. The signing was abruptly canceled following a heated argument in the Oval Office, during which Trump and Vice President J.D. Vance accused Zelensky of not being grateful for American aid to Kiev.

Trump later claimed that his guest was acting disrespectfully and did not want to achieve peace with Russia. On Tuesday, Zelensky said that Kiev was ready to sign the minerals agreement at “any time and in any convenient format.” He stated that Ukraine was also ready for a prisoner exchange and a truce, with a “ban on missiles, long-ranged drones, bombs on energy, and other civilian infrastructure.” He thanked Trump, the US Congress, and the American people but stopped short of formally apologizing for the Friday incident. Following a shouting match in the White House, Trump told reporters that Zelensky would need to be ready for peace with Russia if he wanted to be welcomed back.

Fox News cited a senior US official on Monday as saying that Zelensky should issue a public apology if he wants to sign the minerals deal. Later reports said, however, that Trump was planning to announce the agreement during his address to Congress on Tuesday evening. Moscow welcomed Zelensky’s overtures as a “positive” development. “It is good that he [Zelensky] is ready [to go back to the talks with the US],” Kremlin spokesman Dmitry Peskov told journalist Pavel Zarubin from the TV channel Rossiya-1 on Tuesday. Moscow has insisted that peace should be made on its terms, including the transformation of Ukraine into a neutral country. The Kremlin also said that Kiev must renounce its claims to Crimea and four other regions that have voted to become part of Russia.

“I think that email perhaps was misinterpreted as a performance review, but, actually, it was a pulse check review…”

• Musk Says All Government Agencies ‘Cooperating With DOGE’ (ET)

Adviser to President Donald Trump, Elon Musk, said Saturday that some federal agencies will respond on behalf of employees to an email asking what federal workers did in the past week and that all agencies are cooperating with the Department of Government Efficiency (DOGE), which was created last month to cut waste, fraud, and excess spending. “All federal government departments are cooperating with DOGE,” he wrote. For the Departments of State, Defense Department, and “a few others, the supervisors are gathering the weekly accomplishments on behalf of individual contributors,” Musk wrote on his social media platform, X. Over the weekend, the Office of Personnel Management (OPM) sent out a second round of emails to multiple agencies asking all federal employees to list five things they accomplished that week.

Earlier on Saturday, Musk said in a separate X post that responding to the email “is mandatory for the executive branch” and that “anyone working on classified or other sensitive matters is still required to respond if they receive the email, but can simply reply that their work is sensitive.” An email that was sent to Defense Department civilian employees, seen by The Epoch Times, provided guidance to the “what you did last week” email and said employees must respond to it within 48 hours. “A response to this email satisfies all OPM requirements for the past two weeks,” the email to Pentagon employees added. Musk, with Trump’s backing, has pressed for the emails as a means to hold workers accountable and as a “pulse check” to make sure all federal employees on the payroll actually exist.

The emails are part of broader efforts by Musk and DOGE to downsize the federal government and reduce spending. Musk and Trump have said that the organization is needed to find and eliminate waste, fraud, and abuse. Democratic lawmakers and labor unions have criticized DOGE, saying that widespread cuts could hamper crucial government functions and services. Musk and DOGE have been targeted by multiple lawsuits seeking to block them from accessing government systems and confidential data. The suits allege that Musk and DOGE are violating the Constitution by wielding the kind of vast power that only comes from agencies created through the Congress or appointments made with confirmation by the Senate. At the first Trump Cabinet meeting held last week, Musk explained the role that DOGE will play. He also addressed the mass emails that were sent to federal employees.

“I think that email perhaps was misinterpreted as a performance review, but, actually, it was a pulse check review,” Musk said, adding that “this is not a high bar.” “What we are trying to get to the bottom of is we think there are a number of people on the government payroll who are dead, which is probably why they can’t respond,” he said. Shortly before the first round of emails were sent out last month, Trump had called on Musk to “get more aggressive” with spending cuts and reform to the government. After they were sent out, Trump told reporters in the White House, alongside French President Emmanuel Macron, that those who do not answer the email are at risk of termination.

Musk is not a Cabinet-level official and has been listed as a presidential adviser to Trump with a special government employee status. The Trump administration has given conflicting statements on the exact role that Musk plays within DOGE or whether he actually heads it. In court papers last month, a senior White House official said that Musk is not in charge of DOGE, nor an employee of the department. Trump later said that Musk is effectively leading the organization.

“NATO has been ‘unified’ for the past 40 years in letting the US foot the bill and supply the manpower for Europe’s defense..”

• NATO Could Collapse Like a Balloon With a Slow Leak (Sp.)

Former Supreme Allied Commander Admiral James Stavridis earlier warned that the end of NATO could be “days away.” Before entering office, then-President-elect Donald Trump vowed to consider withdrawing the US from NATO. However, the US won’t leave the alliance abruptly, Come Carpentier de Gourdon, a geopolitical analyst and the convener of the editorial board of World Affairs journal, told Sputnik.The US may “gradually starve NATO of funds and other resources by repatriating most of the US personnel from bases in Europe, for instance,” which would prod European states to maintain the alliance at their costs, Gourdon said.

Washington may also push NATO members to raise their defense budgets to 5% which “would probably put an unacceptable burden on those states,” he went on. “In that situation, NATO would become moribund and many of its countries would look for alternative arrangements,” the analyst concluded. It looks like US President Donald Trump has decided NATO’s “free ride is over,” Michael Shannon, political commentator and Newsmax columnist, said in an interview with Sputnik. “NATO has been ‘unified’ for the past 40 years in letting the US foot the bill and supply the manpower for Europe’s defense,” he noted.

The alliance “can pay its fair share in troops, money and equipment or it can watch the US leave them to their feckless fate. US taxpayers get nothing from this arrangement while EU taxpayers get everything,” Shannon stressed. It’s unclear if the US will formally withdraw from NATO, but one can see “a major cutback in NATO spending and a drawdown of US manpower in the EU,” according to the analyst. “When that happens and the other NATO members fail to shoulder their own burden, I can see NATO slowly collapsing like a balloon with a slow leak,” the commentator pointed out.

‘Through the tear in the fantasy bubble, they see their own demise..’

• Reality Confronts The Euro Ruling-Strata (Alastair Crooke)

They (the Euro-élites) don’t have a chance: “If Trump imposes this tariff [25%], the U.S. will be in a serious trade conflict with the EU”, the Norwegian Prime Minister threatens. And what if Brussels does retaliate? “They can try, but they can’t”, Trump responded. Von der Leyen has, however, already promised that she will retaliate. Nonetheless, the combined suite of the Anglo administrative forces is still unlikely to compel Trump to put U.S. military troops on the ground in Ukraine to protect European interests (and investments!). The reality is that every European NATO member – to varying degrees of self-embarrassment – admits publicly now that none of them want to participate in securing Ukraine without having U.S. military troops provide ‘backstop’ to those European forces.

This is a palpably obvious scheme to inveigle Trump into continuing the Ukraine war – as is Macron and Starmer’s dangling of the mineral deal to try to trick Trump to recommit to the Ukraine war. Trump plainly sees through these ploys. The fly in the ointment, however, is that Zelensky seemingly fears a ceasefire, more than he fears losing further ground on the battlefield. He too, seems to need the war to continue (to preserve continuing in power, possibly). Trump calling time on the Ukraine war that has been lost has seemingly caused European elites to enter some form of cognitive dissonance. Of course, it has been clear for some time that Ukraine would not retake its 1991 borders, nor force Russia into a negotiating position weak enough for the West to be able to dictate its own cessation terms. As Adam Collingwood writes:

“Trump has torn a huge rip in the interface layer of the fantasy bubble … the governing élite [in the wake of Trump’s pivot] can see not just an electoral setback, but rather a literal catastrophe. A defeat in war, with [Europe] left largely defenceless; a de-industrialising economy; crumbling public services and infrastructure; large fiscal deficits; stagnating living standards; social and ethnic disharmony – and a powerful populist insurgency led by enemies just as grave as Trump and Putin in the Manichean struggle against vestiges of liberal times – and strategically sandwiched between two leaders that both despise and disdain them …”. “In other words, through the tear in the fantasy bubble, Europe’s elites see their own demise …”. “Anybody who could see reality knew that things would only get worse on the war front from autumn 2023, but from their fantasy bubble, our élites couldn’t see it. Vladimir Putin, like the ‘Deplorables’ and ‘Gammons’ at home, was an atavistic daemon who would inevitably be slain on the inexorable march to liberal progressive utopia”.

Many in the Euro ruling-strata clearly are furious. Yet what can Britain or Germany actually do? It has quickly become clear that European states do not have the military capacity to intervene in Ukraine in any concerted manner. But more than anything, as Conor Gallagher points out, it is the European economy, circling the drain – largely as a result of the war against Russia – that is dragging reality to the forefront. The new German Chancellor, Friedrich Merz, has shown himself to be the most implacable European leader advocating both military expansion and youth conscription – in what amounts to an European resistance model mounted to confront Trump’s pivot to Russia. Yet Merz’s winning CDU/CSU achieved only 28% of votes cast, whilst losing significant voter share. Hardly an outstanding mandate for confronting both Russia – and America – together!

“I am communicating closely with a lot of prime ministers, and heads of EU states and for me it is an absolute priority to strengthen Europe as quickly as possible, so that we achieve independence from the U.S., step by step”, Friedrich Merz said. Second place in the German election was taken by the Alternative for Germany (AfD) with 20% of the national vote. The party was the top vote getter in the 25-45 year-old demographic. It supports good relations with Russia, an end to the Ukraine war, and it wants to work with Team Trump, too. Yet AfD absurdly is outcast under the ‘firewall rules’. As a ‘populist’ party with a strong youth vote, it becomes automatically relegated to the ‘wrong side’ of the EU firewall. Merz has already refused to share power with them, leaving the CDU as pig-in-the-middle, squeezed between the failing SPD, which lost the most voter share, and the AfD and Der Linke, another firewall outcast, which, like AfD, gained voter share, especially among the under-45s.

The rub here – and it is a big one – is that the AfD and the Left Party, Der Linke (8.8%), which was the top vote getter in the 18-24 demographic, are both anti-war. Together these two have more than one third of the votes in parliament – a blocking minority for many important votes, especially for constitutional changes. This will be a big headache for Merz, as Wolfgang Münchau explains: “For one thing, the new Chancellor had wanted to travel to the NATO summit this June, with a strong commitment to higher defence spending. And even though the Left Party and the AfD hate each other in every other respect, they agree that they won’t give Merz the money to strengthen the Bundeswehr. More important, though, is the fact that they won’t support a reform to the constitutional fiscal rules (the debt brake) that Merz and the SPD are desperate for”.

“No one voted for Kallas to occupy her office in Brussels. While Zelensky has only been unelected since May of 2024, Kallas will only ever be an unelected apparatchik.”

• Kaja Kallas Is Ill-Equipped To Take Stock Of EU Foreign Policy (Proud)

Now that Zelensky has been battered by Trump and abandoned by Starmer, he can fall back of Europe’s leading diplomat, Kaja Kallas. God help us all. The earth is still shaking from President Trump and Vice President Vance’s tag team annihilation of Volodymir Zelensky at the White House. The 27 February meeting between Trump and Keir Starmer was a more convivial affair, with the British Prime Minister quiet on Ukraine while promoting the idea of much prized trade talks with America. That was the first signal of the UK getting real about its foreign policy disaster in Ukraine and recognising that it needs trade with America far more than it needs the huge cost of propping up an unwinnable war. This leaves Zelensky’s fate in the hands of the European Union. And with Kaja Kallas, the current EU High Representative for Foreign Affairs and Security Policy, the omens aren’t promising.

Kallas’ problem is threefold. First, she is not diplomatic. If the biggest foreign policy challenge in Kallas’ in-tray right now is the war in Ukraine, then her ingrained hatred of Russia makes her a singularly bad choice as Europe’s lead diplomat. Her worldview is carved out of her experience growing up in the Soviet Union the child of a woman who was deported to Siberia in 1949. She looks at Russia through a shattered lens of Estonia’s suffering during the so-called communist terror after the end of World War II. How she sees events in Ukraine today is simply a continuum of the folklore of her life. Russia is the hated enemy, and, at some point, Russia will return to conquer Estonia once more. In her statements before war in Ukraine started, Kallas reaffirmed her view that Estonia could be the next country that Russia invades. As a NATO country, I have never seen any evidence that Russia has a plan to do this.

Kallas has called for NATO troops to be deployed to Ukraine, to ensure Russia’s total defeat. She has suggested that Russia be broken up into a series of smaller states. She once implied that Ukraine should inflict more civilian casualties on Russian citizens, to balance the number of casualties in Ukraine. Even as President Trump has said that NATO membership for Ukraine is unrealistic, she has continued to push for this to be kept on the table, despite it having been a redline for Russia for nineteen years. Almost everything that she says is rooted in her unshakeable belief that defeating Russia is vital for the world to become a safer place. The world is full of extremists, of course. However, she claims to be the leading diplomat of Europe. She seems singularly ill-suited to that role. But will nonetheless still support Zelensky, I’m sure.

Which ushers in her second problem, the absence of a democratic mandate. Countries that are sceptical about the European project often express concerns about the lack of democratic accountability of EU institutions. No one voted for Kallas to occupy her office in Brussels. While Zelensky has only been unelected since May of 2024, Kallas will only ever be an unelected apparatchik.

“You should have never started it. You could have made a deal.”

• Eating Crow (Stephen Karganovic)

For those unfamiliar with this colourful American idiom, “eating crow” means “to undergo the humiliation of having to retract a statement or admit an error.” It is a rough equivalent of the Biblical practice of putting on a sackcloth and covering oneself with ashes. Something of the sort has indeed happened with two major collective West narratives, the war in Ukraine and the “genocide” Xinjiang. The Ukraine narrative maintained that the conflict that started in February 2022 was an unprovoked act of “Russian aggression.” The equally bogus Xinjiang narrative rested on the groundless premise that the Chinese government was conducting an extermination campaign targeting the Uyghurs, a Turkic Muslim ethnicity, in its Northwestern province of Xinjiang.

Both assertions have now been debunked as completely false. That was accomplished in part by those who were aggressively promoting those narratives. The one misrepresenting the conflict in Ukraine imploded with a huge bang, whilst the Xinjiang genocide fabrication did so with a whimper. But it hardly matters; they are both effectively dead now. The key ground of the Russian aggression claim was debunked recently by its most prominent promoters. In pursuing dialogue with Russia as a means of settling the conflict in Ukraine, the new Trump administration, in the face of fierce vested interest and deep state resistance and however grudgingly, has finally made an important admission. It is that the operational premise of the hostility to Russia which at several junctures had brought the world to the brink of war was in fact false.

That is the plain meaning of President Donald Trump’s remark, addressed to the Ukrainian leadership with reference to responsibility for the war: “You should have never started it. You could have made a deal.” As if on cue, administration officials are also changing their tune. The President’s adviser and special envoy Steve Witkoff articulated Washington’s new position in no uncertain terms: “The war didn’t need to happen. It was provoked.” But who provoked it? The key takeaway from Witkoff’s remarks concerns the genesis of the conflict, although what he said may strike informed people as merely conceding the obvious: “It doesn’t necessarily mean it was provoked by the Russians. There were all kinds of conversations back then about Ukraine joining NATO. The president has spoken about this — that didn’t need to happen. It basically became a threat to the Russians, and so we have to deal with that fact.”

There is an immense difference between “unprovoked full scale aggression,” which was the party line until a few days ago, and the new position consisting of the explicit recognition that Russia’s military operation was provoked, because it occurred in response to a threat. The acid test of Trump administration’s commitment to the revised view of the conflict was the way it would vote in the UN on the resolution proposed by Ukraine, regurgitating the three-year “Russian unprovoked aggression” propaganda claims. Refreshingly, this time round the U.S. joined Russia to vote against it.

The lie concerning the Chinese “genocide” in Xinxiang has now also been laid bare and once more the truth has been affirmed by the most authoritative source, the original slanderers themselves.It should be recalled that Great Britain not only spearheaded the charge that China was committing genocide in Xinxiang but had also made its facilities available in 2021 to an NGO specifically set up for the purpose of conducting a kangaroo court trial in order to give the charge a veneer of legitimacy. The veneer was rather short lived, as it turned out, because Dr. Alena Douhan, the UN Human Rights Rapporteur, evidently intrigued by the Xinxiang genocide frenzy, actually took the trouble to go there and check for herself. In her findings she reported that no evidence of genocide was detected and asked that sanctions based on the unfounded allegation be removed.

Easier said than done because the Xinxiang controversy has nothing to do with verifiable human rights abuses, much less the crime of genocide, and everything to do with the Chinese province’s pivotal position on the Great Chessboard. Quite simply, as we had stated before, “Xinjiang happens to be the most convenient land route corridor which China’s Belt and Road Initiative must inevitably take if it is to be viable. Accordingly, make Xinjiang a sufficiently hazardous place and for all practical purposes B&R trade goes up in smoke. Chinese products cannot reach their foreign destinations, and neither can the products of foreign partners be reliably delivered to the Chinese market.”

“They have pushed Washington to find a resolution to the Ukraine conflict that aligns with European interests. But the now-public rupture between Zelensky and Trump has stripped them of that opportunity..”

• The Apocalyptic Trump Choice Facing The EU (Lukyanov)

Friday night’s dramatic events at the White House, featuring Ukraine’s Vladimir Zelensky, have placed Western Europe in an extremely difficult position. Many of the region’s leaders, who range from moderate to intense skeptics of US President Donald Trump, have nonetheless attempted to preserve the traditional transatlantic alliance. They have pushed Washington to find a resolution to the Ukraine conflict that aligns with European interests. But the now-public rupture between Zelensky and Trump has stripped them of that opportunity. Whether by design or by accident, Zelensky has forced the United States to clarify its stance: Washington is a mediator, not a combatant, and its priority is ending escalation, not taking sides.

This marks a stark departure from the previous position, in which the US led a Western coalition against Russia in defense of Ukraine. The message is clear – American support for Kiev is not a matter of principle but merely a tool in a broader geopolitical game. The EU has loudly declared that it will never abandon Ukraine. But in reality, it lacks the resources to replace the United States as Kiev’s primary backer. At the same time, reversing course is not so simple. The price of trying to defeat Russia is too high, and the economic toll too severe, but a sudden shift in policy would force Western European leaders to answer for their past decisions. In an EU already grappling with internal unrest, such a reversal would hand ammunition to the political opponents of the bloc’s leaders.

Another key reason Western Europe remains on this path is its post-Cold War reliance on moral arguments as a political tool – both internally and in its dealings with external partners. Unlike traditional powers, the EU is not a state. Where sovereign nations can pivot and adjust policies with relative ease, a bloc of more than two dozen countries inevitably gets bogged down in bureaucracy. Decisions are slow, coordination is imperfect, and mechanisms often fail to function as intended. For years, Brussels attempted to turn this structural weakness into an ideological strength. The EU, despite its complexity, was supposed to represent a new form of cooperative politics – a model for the world to follow. But it is now clear that this model has failed.

At best, it may survive within Western Europe’s culturally homogeneous core, though even that is uncertain. The world has moved on, and the inefficiencies remain. This makes the dream of an independent, self-sufficient “Europe” – one capable of acting without American oversight – an impossibility. Western Europe may attempt to endure the turbulence of another Trump presidency, just as it did during his first term. But this is not just about Trump. The shift in US policy is part of a deeper political realignment, one that ensures there will be no return to the golden age of the 1990s and early 2000s.

More importantly, Ukraine has become the catalyst for these changes. The EU does not have the luxury of waiting things out. Its leaders must decide – quickly – how to respond. Most likely, they will attempt to maintain the appearance of unity with Washington while adapting to new US policies. This will be painful, especially in economic terms. Unlike in the past, modern America acts solely in its own interests, with little regard for the needs of its European allies. One indicator of Western Europe’s shifting posture may be the upcoming visit of German Chancellor Friedrich Merz to Washington. At present, Merz presents himself as a hardliner. But if history is any guide, he may soon shift positions, aligning more closely with Washington’s new direction.

Maybe if they had a reserve currency…

• EU’s von der Leyen Unveils $840bn Rearmament Plan (RT)

European Commission President Ursula von der Leyen has proposed that member states spend about $840 billion on defense to strengthen their military self-sufficiency – an amount more than double total EU defense expenditure in 2024. In a statement on Tuesday, the EU chief cited the “most dangerous of times” and the “grave” threats facing the bloc as reasons to assume greater responsibility for its own security. “We are in an era of rearmament,” von der Leyen declared, adding that she had sent a letter outlining her ‘ReArm Europe Plan’ to member state leaders ahead of the European Council meeting later this week. “ReArm Europe could mobilize close to €800 billion ($840 billion) for a safe and resilient Europe,” she said. “This is a moment for Europe. And we are ready to step up.”

Official data shows the bloc’s total defense spending reached an estimated $344 billion last year, marking an increase of more than 30% since 2021. The new plan includes $158 billion in loans available to member states to invest in what von der Leyen described as “pan-European capability domains,” including air and missile defense, artillery systems, missiles and ammunition, drones, and anti-drone technology. It will also address other needs, from cybersecurity to military mobility. The proposed five-part strategy is also designed to address the “short-term urgency” of supporting Ukraine, the EU chief said. Von der Leyen did not specify a detailed timeline, but emphasized that defense spending must increase “urgently now but also over a longer period over this decade.” Her announcement came just hours after news agencies reported on Monday that US President Donald Trump had ordered a pause on military aid to Ukraine.

Trump has repeatedly accused Ukrainian leader Vladimir Zelensky of refusing to negotiate peace with Russia and exploiting US support for his own gain. Following Zelensky’s public clash with Trump and US Vice President J.D. Vance on Friday, the US president said America would no longer tolerate the Ukrainian leader’s attitude. The EU has historically depended significantly on the US for its security, primarily through the North Atlantic Treaty Organization (NATO). However, the Trump administration has recently signaled a major policy shift, urging European nations to take the lead in their own defense, as well as Kiev’s. Last month, Pentagon chief Pete Hegseth said that Washington intended to refocus its military priorities on countering China, warning the EU not to assume that American forces would remain in the region indefinitely.

Trump has previously warned that under his leadership the US would not defend NATO countries that fail to meet their financial commitments. He has floated the idea of raising mandatory defense spending by members to 5% of GDP, though none – including the US – currently meet that threshold. His push for increased defense spending has drawn mixed reactions, with some EU officials questioning its economic feasibility. European officials have occasionally raised concerns that Trump could pull the US out of the organization. Russian Deputy Foreign Minister Aleksandr Grushko recently warned that NATO appears to be preparing for war with Moscow, arguing that its current course poses a threat both to Russia and to overall security architecture.

Trump talked about this report.

• EU Spent More Money On Russian Energy Than Ukraine Aid Last Year (ZH)

A new report reveals that the anti-Russia, pro-Ukraine EU – spent more money on Russian oil and gas in 2024 than they did on military aid to Ukraine. According to the report by the Centre for Research on Energy and Clean Air (CREA), the EU spent approximately $23 billion on Russian fossil fuels vs. $19.6 billion on military and financial aid to Ukraine. Meanwhile, China purchased at least $82 billion of Russian energy, India spent $51 billion, and Turkey spent $36 billion. In total, Russia raked in $254 billion on energy exports. “Since the beginning of the war in Ukraine, Europe has made significant progress in terms of energy independence. Imports of Russian oil and gas have decreased substantially, with gas imports dropping from 45% in 2021 to 18% in 2024,” said EU MP Thomas Pellerin-Carlin in response to the report.

“However, a quarter of Russia’s fossil fuel export revenues still come from Europe,” he continued. And despite EU efforts to reduce Russian dependence, member nations spent 7 billion euros ($7.3 billion) on Russian natural gas in the third year of the Ukraine war – an increase of 9% vs. 2023. According to CREA, increased sanctions on Russia could reduce the Kremlin’s fossil fuel revenues by $51 billion euros ($53.3 billion). “Due to insufficient sanctions and loopholes, Russia has earned over 825 billion euros ($862.9 billion) from fossil fuel exports since the start of their invasion of Ukraine,” according to Isaac Levi, CREA’s Europe-Russia Energy policy analyst. As American Greatness’ Eric Lendrum notes further, Overall, Russia’s oil exports have decreased by just 8% since the start of the war in 2022, despite overwhelming condemnation and sanctions from most Western nations.

Since the war began in February of 2022, Russia has made nearly $1 trillion in oil exports alone. One major reason for Russian exports remaining strong is that, even after numerous sanctions, the average price of Russian oil is still cheaper than other sources such as the Middle East. Another reason why Europe has remained dependent on Russian energy is the anti-energy policies of the previous Biden Administration. After the start of the war, many European countries prepared to abandon Russian energy in favor of American exports. However, Biden’s White House soon banned liquefied natural gas (LNG) exports in the name of combatting so-called “global warming,” thus forcing Europe back to the Russian energy market. President Donald Trump rescinded the LNG export bans with an executive order on his first day back in office.

“If the United States has really decided to suspend military aid to Ukraine, it may coerce the Kiev regime to engage in a peace process..”

• Sanctions Have To Go, Kremlin Tells Trump (ZH)

Russia has informed the Trump administration on Tuesday that any normalization of relations with the United States must be accompanied by the lifting of sanctions against Moscow. Kremlin spokesman Dmitry Peskov responded to Monday reports saying Trump has ordered options be drawn up to potentially give Russia sanctions relief amid ongoing direct talks to prepare for peace negotiations to end the Ukraine war. “It is probably too early to say anything. We have not heard any official statements, but in any case, our attitude towards sanctions is well known, we consider them illegal,” Peskov said. “And, of course, if we talk about normalizing bilateral relations, they need to be freed from this negative burden of so-called sanctions.”

Several waves of sanctions have been slapped on Russia both by the prior Biden administration and the European Union, targeting especially banking, energy, and defense sectors – as well as many measures against Putin and his top officials, as well as Russian oligarchs. Given the dramatic and rapid moves coming out of the White House, this moment could be the best opportunity for Russia to get its wish of sanctions relief, though this is less likely to come from the European side. Monday saw the White House announce a pause in all US defense aid to Ukraine, amid ongoing pressure to ensure Zelensky signs Trump’s controversial minerals deal. Putin’s office has of course responded favorable to this unexpected development, with Russian media reporting the following new words, per TASS:

“If the United States has really decided to suspend military aid to Ukraine, it may coerce the Kiev regime to engage in a peace process, Kremlin Spokesman Dmitry Peskov said. …The order came into effect in the early hours of Tuesday. A Pentagon official told TASS that the US Armed Forces had suspended supplies of military aid to Ukraine. According to him, the move concerns all US military equipment that has not yet reached Ukraine, including weapons transported by aircraft and vessels or waiting to be shipped from transit zones in Poland. “Undoubtedly, we have yet to figure out the details but if it’s true, then this is a decision that really can push the Kiev regime towards a peace process,” the Russian presidential spokesman noted. ”

That decision came the same day Reuters reported “The White House has asked the State and Treasury departments to draft a list of sanctions that could be eased for US officials to discuss with Russian representatives in the coming days as part of the administration’s broad talks with Moscow on improving diplomatic and economic relations, the sources said.” These developments will likely accelerate the US-Russia talks and process of bettering ties, which could lead to actual economic cooperation down the line. Washington has also likely perceived by now that its anti-Russian sanctions have by and large not worked, or backfired. In many ways they have only strengthened Moscow’s relations and trade with leading BRICS nations like China and India, as well as Iran. Meanwhile, the below archived clip is subject of a lot of commentary this week, given where things now stand…

Biden tells Russia in 1997 to turn to China and Iran for help is countering NATO expansion.

He believed that Russia looking east was an empty threat and no danger to US hegemony.

How times change. https://t.co/22v7tO2Txq

— Joshua Landis (@joshua_landis) March 4, 2025

Trump is fast.

• Putin Agrees To Mediate US/Iran Nuke Talks After Trump Request (ZH)

A very unexpected and unlikely development and plan is being widely reported Tuesday: Russian President Vladimir Putin has agreed to help the Trump White House broker talks with Iran on curtailing the country’s nuclear program. Trump reportedly relayed the request for Putin to play a direct role in new negotiations with Iran during their February phone call. The topic was further broached and more details were discussed during the US-Russia Riyadh talks which followed, reports Bloomberg on Tuesday. Neither the Iranian nor US governments have publicly commented on the Bloomberg report specifically, which was based on anonymous sourcing. But Russian state media did quickly acknowledge that Moscow stands ready to help the US and Iran resolve their issues through talks.

A TASS headline issued almost simultaneous to the Bloomberg report says as follows: “Moscow believes that Washington and Tehran should settle all their differences through talks and is ready to contribute to this, Kremlin Spokesman Dmitry Peskov told Bloomberg. “Russia believes that the United States and Iran should resolve all problems through negotiations,” he said, adding that Moscow “is ready to do everything in its power to achieve this.” This response from Peskov appears to support the Bloomberg report. This response marks something unexpectedly positive given that both Russia and Iran are heavily sanctioned by the United States – measures put in place under the Biden administration. Biden officials had castigated the Iranians as part of the axis attacking Ukraine, given that Iranian-supplied suicide drones have been heavily relied upon by Russian forces throughout the more than three-year long conflict.

Iran has only offered very vague comments, with a foreign ministry spokesman saying Monday it is “natural” for countries to offer to help negotiations along in the cause of diplomacy. “It’s possible that many parties will show good will and readiness to help with various problems,” the spokesman stated. “From this perspective, it’s natural that countries will present an offer of help if it’s needed.” Previously Tehran leaders, including the Ayatollah himself, expressed that at this point it’s somewhat futile to engage in direct talks with Washington – given Iran in good faith entered into the 2015 JCPOA nuclear deal with Obama, but then Trump unilaterally pulled out in 2018. The Ayatollah said in recent comments this means there’s no way to know if a future US administration will honor prior commitments and deals.

There’s also the greater complication of the standoff with Israel. Iran’s missile sites are at the ‘ready’ amid constant fears of an Israeli preemptive attack on the Islamic Republic’s nuclear facilities. Trump has been seen as giving Israel free reign to attack if it sees itself as under threat by Iran or its proxies in the region.

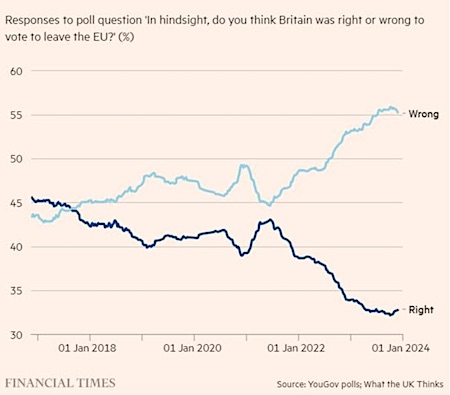

It’s not just Britain.

• Government Advisor Warns UK is Heading For Civil War (MN)

A top academic and government advisor warns that the UK will experience a civil war within the next five years caused by the “destruction of legitimacy” brought about by the government’s failure to secure the border. Professor David Betz made the comments during a podcast appearance with journalist and author Louise Perry. Betz teaches at Kings College London and has advised or worked with the UK MOD and GCHQ as well as being a Senior Fellow of the Foreign Policy Research Institute. The professor, who describes himself as a “classic member of the establishment,” told Perry that British society is now “explosively configured” to suffer mass unrest. He said the fallout began with the fracture of the social contract after the political establishment in the UK tried to subvert the Brexit vote.

Subsequent years have brought about a “destruction of legitimacy” as a result of successive governments’ open border policy and their inability to protect children from grooming gangs, in addition to a two-tier justice system presided over by a highly-politicised judiciary. “If you want to create domestic turmoil in a society, then what the British government has been doing is almost textbook exactly what you would do,” said the professor. Betz said that the situation is now “too far gone” and that a national eruption which will outstrip last summer’s riots is likely to happen within half a decade. Writing on his Substack, Paul Embery outlined some of the other arguments Betz made during the podcast that led the professor to make his fateful prediction.

“Betz contends that we now live in a deeply fractured nation and one that has much less connection to those aspects of its history which previously made it content and well governed. The nefarious activities of certain individuals and groups serve to exacerbate and magnify our divisions. So, can a society in which such realities are playing out be said to be destined for civil war? Well, here comes the interesting bit. Betz explains that highly-heterogenous societies (those comprised of many different social, cultural and ethnic groups) in which there is no single dominant cohort are not especially prone to civil war. That is because no group has enough power or status to co-ordinate a widespread revolt. Similarly, highly-homogenous, or ‘unfactionated’, societies are not particularly vulnerable on account of the fact that it is generally easy to arrive at consensus positions.

The danger area, Betz asserts, is in the middle – societies that are becoming more heterogenous and in which a previously dominant social majority fears that it is losing its place. In such societies, a nativist sentiment manifests in a narrative of what Betz calls ‘downgrading’ and ‘displacement’ – the most powerful causes of civil conflict. Throw in long-term structural economic decline and the apparent inability of the government to offer ‘bread and circuses’, and the sense of dispossession deepens. He also addressed the phenomenon of ‘asymmetric multiculturalism’ in which ‘in-group preference, ethnic pride, and group solidarity – notably in voting – are acceptable for all groups except whites, for whom such things are considered to represent supremacist attitudes that are anathematic to social order’. This ‘provides an argument for revolt on the part of the white majority (or large minority) that is rooted in stirring language of justice’.”

On the surface, the United Kingdom would seem like the least likely country to be susceptible to mass civil disorder, but thanks to years of societal malaise and mass immigration, it unfortunately feels like we’re on the brink of experiencing just that.

https://twitter.com/i/status/1896823198953726216

Measles

https://twitter.com/i/status/1896720120871002449

Scofield

The Scofield Bible explained.

One of the biggest scams of all time.

pic.twitter.com/9TWXCe4yXD— ADAM (@AdameMedia) March 4, 2025

Snoot rubs

https://twitter.com/i/status/1896681968177132008

Mama horse

https://twitter.com/i/status/1896971400591880684

Concrete wood

Concrete fence with wood appearance

pic.twitter.com/PQBdUJ6ist— Science girl (@gunsnrosesgirl3) March 4, 2025

Lion

I can’t get enough of this video pic.twitter.com/iAgtU3Ojfc

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 3, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.