Harris&Ewing Newsie, Washington DC 1920

The Audit Commission is set to unveil its findings June 18.

• The IMF Knew In 2010 That The Greek Memorandum Would Increase Debt (SYRIZA)

An IMF document is in the possession of the Greek Audit Commission proving that the creditor knew that the memorandum would increase the Greek debt. The Audit Commission has in its possession a document which shows that the IMF knew from March 2010 that the Greek memorandum would increase Greek debt. The President of the Greek Parliament Zoe Konstantopoulou and the scientific coordinator of the Audit Commission of the Greek debt, Dr. Eric Toussaint, spoke yesterday about the contents of this document.

“We have an internal document of the IMF of March 2010, detailing the measures provided for inclusion in the 2010 Memorandum This is a very detailed and predefined plan, which was not communicated to the parliaments of 14 European Union countries who have lent to Greece nor to the Greek Parliament. Because, as you know, there was a violation of the Greek Constitution in May 2010, when the agreement was concluded, “said Mr. Toussaint.

“During our work, we have also managed to establish that the means used to make the Greek debt restructuring in 2010 was absolutely detrimental, because the rights of the pension funds of Greece and of Greek citizens who held State bonds were sacrificed. For example, there was a haircut of over 50% for some employees of Olympic Airways, who had received government bonds after their dismissal without their own agreement, and through no fault of their own. No compensatory measure was arranged for them. However the big private banks that participated in the haircut received compensation of €30 billion, which was added to the Greek public debt. ” said Toussaint.

On her part the President of the Parliament said: “We seek the truth corresponding to the legitimate and illegitimate parts of the debt and of our burdensome obligation.” The preliminary findings of the Greek debt Audit Commission will be published in June 17-18, 2015.

Legrain gets it too.

• Why Greece Should Reject the Latest Offer From Its Creditors (Philippe Legrain)

Reform — Greece sorely needs it. Cash — the government is running desperately short of it. So it is time for Prime Minister Alexis Tsipras to do what’s best for Greece and accept its creditors’ reform demands in exchange for much-needed cash. That is how the Greek situation is usually framed. It is utterly misleading. Imagine you’re in prison for not being able to pay your debts. (You’re right, it’s almost unthinkable — civilized societies no longer lock up bankrupt individuals. But bear with me.) After five years of misery, you lead a rebellion, take control of the prison, and demand your release. The jailers respond by cutting off your water supply. Should you back down and return to your cell, perhaps negotiating for slightly less unpleasant conditions, in order to obtain a little liquidity?

Or should you keep fighting to be free? That, in essence, is what the standoff between an insolvent Greece and its eurozone creditors is really about. For months, Greece has had “only days” to agree a deal with its creditors before it runs out of cash. Eventually that will be true. But even if Tsipras accepted the creditors’ demands, Greece would still have “only days” before it ran out of cash. The €7.2 billion on offer right now wouldn’t even cover the Greek government’s debt repayments until the end of August. And for a measly two months of liquidity, Tsipras is expected to surrender his democratic mandate: break his election promises, agree to yet more tax increases and spending cuts that would depress Greece’s economy further, and relinquish his demands for debt relief.

Then the wrangling would start again. Because so long as Greece remains in its debtors’ prison, it will be dependent on its jailers for liquidity and therefore expected to comply with whatever additional conditions they impose. Tsipras should not submit to this debt bondage. Nine of every 10 euros that eurozone governments and the IMF have lent to the Greek government since 2010 have gone to repay its unbearable debts, which should instead have been restructured back then. But from now on, every last cent of additional funding would go to pay back debt. The Greek government now has a small primary surplus: It doesn’t need to borrow, except to service its debts of 175% of GDP.

Nice history lesson. Not flawless.

• The Saga Of The Greek Review That Never Ended (Kathimerini)

It was a sunny morning in Brussels on November 7 last year when Greek Finance Minister Gikas Hardouvelis received an e-mail from the team of inspectors of the International Monetary Fund, European Commission and European Central Bank – collectively known as the troika – that changed everything. In that moment it became clear that the review of the Greek reform process was not about to end anytime soon, as the troika was toughening its stance and demanding that Athens complete all the prior actions outlined in its second bailout deal to the letter. The government was shocked as the e-mail came just a few hours after a Eurogroup meeting ended with what appeared to be a positive message for Greece.

It came at the moment when, if the country passed the review that was being carried out – and is still being carried out – it would be able to turn over a new leaf, free of demands for more austerity, and would be able to apply for a precautionary credit line that would allow it access to the markets. That e-mail, however, detailed 19 tough measures the Greek government had a month to implement in order to wrap up the review. For the government, those measures were impossible to implement given the political climate at the time.

Seven months after that e-mail, and with a different government in Athens and the same review still pending, Kathimerini seeks answers as to why the talks with the troika stalled by speaking to the protagonists, and attempts to explain what went wrong, ultimately leading the country to elections on January 25. Did the creditors pull the rug from under Antonis Samaras by increasing their demands, as some of the former prime minister’s associates argue? Was it that the Europeans misread the intentions of the opposition SYRIZA party and its chief, current Prime Minister Alexis Tsipras? Or was it fatigue after years of tough fiscal adjustment that prevented the Greek economy from rebounding?

Endgame’s been looming forever. Why still use that word?

• Endgame Looms For Greek Crisis As Both Sides Take Talks To The Brink (Guardian)

Eleventh-hour talks to avoid Greece defaulting on its debt and plunging the eurozone into crisis intensified at the weekend with Greek officials flying to Brussels only days before a meeting of Europe’s finance ministers that many regard as a final deadline. Almost five months after he assumed power, the Greek prime minister, Alexis Tsipras, has come to a fork in the road: either he accepts the painful terms of a cash-for-reform deal that ensures Greece’s place in the single currency or he decides to go it alone, faithful to the vision of his anti-austerity Syriza party. Either way, the endgame is upon him.

Thursday’s meeting of eurozone finance ministers is viewed as the last chance to clinch a deal before Athens’s already extended bailout accord expires on 30 June. “It is in his hands,” Rena Dourou, governor of the Attica district, said. “Tsipras, himself, is acutely aware of the historic weight his decision will carry.” The drama of Greece’s battle to keep bankruptcy at bay has, with the ticking of the clock, become ever darker in tone. What started out as good-tempered brinkmanship has turned increasingly sour as negotiations to release desperately needed bailout funds have repeatedly hit a wall over Athens’s failure to produce persuasive reforms.

“It is as if they work in Excel and we work in Word,” said one insider. “There just seems to be no meeting of minds.” Last week the mood became more febrile as it emerged that Eurocrats, for the first time, had debated the possibility of cash-starved Athens defaulting. The revelation came amid reports that Germany’s chancellor, Angela Merkel, was resigned to letting Greece go. Berlin is by far the biggest contributor to the €240bn bailout propping up the near-bankrupt state. Last week, the EU council president, Donald Tusk, ratcheted up the pressure, warning: “There is no more time for gambling. The day is coming, I am afraid, that someone says the game is over.”

On Saturday Greek finance minister Yanis Varoufakis hit back, telling Radio 4 that he did not believe “any sensible European bureaucrat or politician” would seriously contemplate the country’s euro exit. “The reason why we are not signing up to what has been offered is because it is yet another version of the failed proposals of the past,” he said. The persistent demand of foreign lenders for pension reform, given the scale of austerity already undertaken in a country that has seen its economy shrink by more than a quarter in the past five years, was not only silly but plainly a deal-breaker, he said. “It is just the kind of proposal that one puts forward if you don’t want an agreement,” insisted the academic-turned-politician.

Endgame, last ditch. Whatever.

• Greece’s Last-Ditch Talks Aim at Agreement Before Monday (Bloomberg)

Greece and its creditors are locked in last-ditch talks, with European Commission President Jean-Claude Juncker trying to broker a deal over the weekend. Prime Minister Alexis Tsipras sent a delegation to Brussels Saturday with a new set of proposals to close differences on pensions, taxes and a primary surplus target. With positions hardening on all sides, the talks are Juncker’s last attempt to try to bring the sides to a compromise, according to a European Union official, who asked not to be identified. Representatives of the Troika are waiting in the wings to join the discussions if progress is made between Greece’s envoy and Juncker’s chief of staff and the aim is to reach an accord before markets open on Monday. Both sides are prepared to continue talks on Sunday.

European leaders have voiced growing exasperation with Greece’s brinkmanship that has pushed Europe’s most-indebted country to the edge of insolvency. Flitting between intransigence and conciliatory overtures, Tsipras has spent four months locked in an impasse with the country’s creditor institutions. The latest Greek counter-proposal is the second in June. The first was roundly dismissed. Greek stocks dropped 5.9% on Friday, with bank shares dropping 12%, as talks remained deadlocked. The yield on Greek 2017 bonds rose 137 basis points to 20.03%. US and European equities and the euro-area’s higher-yielding bonds also tumbled amid growing concern Greece will run out of time for reaching a deal to stave off default.

An attempt by Juncker to broker a compromise allowing Greece to defer €400 million of cuts in small pensions if it reduced military spending by same amount was spiked by the IMF, Frankfurter Allgemeine Sonntagszeitung reported, citing unidentified people with knowledge of the negotiations. With a deadline for a deal looming, Merkel told Tsipras it’s time to accept the framework for financial aid. Greece’s bailout extension expires June 30 and some national parliaments need to ratify any agreement before funds can be disbursed, which narrows the window for a deal.

Germany simply believes its own fiction.

• Germany Is Bluffing On Greece (Weisbrot)

It would be nice to think that the worst features of US foreign policy have changed since the collapse of the Soviet Union, but they have not. The Cold War never really ended, at least insofar as the US is still a global empire and wants every government to put Washington’s interests ahead of those expressed by its own voters. The current hostilities with Russia add a sense of déjà vu, but they are mainly an added excuse for what would be US policy in any case. Once we take all these interests into account and where they converge, the strategy of Greece’s European partners is pretty clear: It’s all about regime change. One senior Greek official involved in the negotiations referred to it as a “slow-motion coup d’état.” And those who were paying attention could see this from the beginning.

Just 10 days after Syriza was elected the ECB cut off its main line of credit to Greece and then capped the amount that Greek banks could lend to the government. All the hype and brinkmanship destabilize the economy, and some of this is an intentional effect of European authorities’ statements and threats. But the direct sabotage of the Greek economy is most important, and it is remarkable that it has gotten so little attention. The unannounced objective is to undermine political support for the Syriza government until it falls and get a new regime that is preferable to the European partners and the US This is the only strategy that makes sense, from their point of view. They will try to give Greece enough oxygen to avoid default and exit, which they really don’t want, but not enough for an economic recovery, which they also don’t want.

Thai is getting Brussels scared. “Madrid and Barcelona for the first time are not going be governed by political parties, but by coalitions made up of social movements..”

• Spain Swears In Leftist Mayors for Madrid, Barcelona in Historic Turn (AP)

Spain’s biggest cities — Madrid and Barcelona — completed one of the nation’s biggest political upheavals in years Saturday by swearing in far-left mayors. The radical leaders have promised to cut their own salaries, halt homeowner evictions and eliminate perks enjoyed by the rich and famous. The landmark changes came three weeks after Spain’s two largest traditional parties were punished in nationwide local elections by voters groaning under the weight of austerity measures and repulsed by a string of corruption scandals. In Madrid, 71-year-old retired judge Manuela Carmena was sworn in to cheers from jubilant leftists who crowded the streets outside city hall shouting “Yes We Can!” as they ended 24 years of city rule by the conservative Popular Party, which runs the national government.

“We want to lead by listening to people who don’t use fancy titles to address us,” Carmena said after being voted in as mayor by a majority of Madrid’s new city councilors. Carmena has vowed among other things to take on wealthy Madrilenos who enjoy exclusive use of the city-owned Club de Campo country club — opening it up to the masses. “We’re creating a new kind of politics that doesn’t fit within the conventions,” she said before being voted in. “Get ready.” In Barcelona, anti-eviction activist Ada Colau was later sworn in as the city’s first female mayor. Smiling broadly, Colau took possession of the city’s mayoral sash and scepter before thanking voters and her coalition partners. “Thank you for making possible something that had seemed impossible,” she said.

Colau has questioned whether it’s worth spending €4 million of city money to help host the glitzy Formula 1 race every other year. She thinks the funds would be better spent on free meals for needy children at public schools. Carmena and Colau ran for office as leaders of leftist coalitions supported by the new pro-worker and anti-establishment Podemos party formed last year. It is led by the pony-tailed college professor Pablo Iglesias, a big supporter of Greece’s governing far-left Syriza Party. Iglesias smiled from a balcony inside Madrid’s city hall as he watched Carmena being sworn in, then pumped his arm into the air with a clenched fist as he celebrated the victory with others on the streets.

The left’s takeover of Madrid, Iglesias said, is the goal his party has nationally for general elections that must be called by Prime Minister Mariano Rajoy by the end of the year. “Our principal objective is to beat the Popular Party in the general elections,” he said. The political fragmentation propelling Carmena and Colau into office marks a historic moment in Spanish politics, said Manuel Martin Algarra at the University of Navarra. “Madrid and Barcelona for the first time are not going be governed by political parties, but by coalitions made up of social movements,” he said.

“Just as with drugs, the abuser must increase the dosage to feel the same high and spend accordingly.”

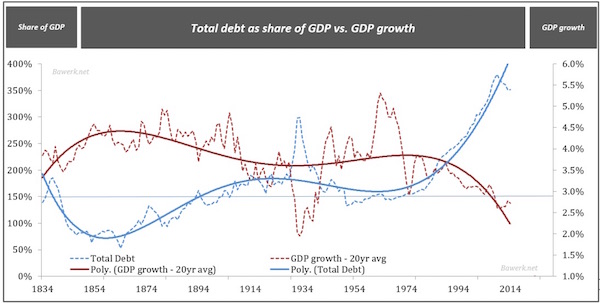

• Why Keynesian Voodoo Doesn’t Work Anymore (Bawerk)

Keynesian policy of manipulating economic “aggregates” through countercyclical macro-measures appeared to work when balance sheets were not stretched to the brink. As we wrote in “Goebbelnomics”

“If collective exuberance and apathy is the sole cause of the business cycle, then it logically follows that human emotions need to be manipulated accordingly. Only by doing so can policymakers smooth out the ups and downs in economic activity. And what better way to do that then to change the money supplied to the general public.”

While people called this the “most sickening article ever written” it is unfortunately what economics has come down to. Through fractional reserve banking and a central bank freed from the shackles of a barbarous relic, the money supply can be expanded without limit…or at least as long as the greater populace voluntarily will leverage up their balance sheets to buy stuff and simultaneously agree to their own servitude. Nothing more than collective manipulation on a scale that would make Goebbels himself envious. The glaringly obvious result of such policies, gross capital consumption through malinvestments epitomized through a serial bubble economy, did not discourage our money masters. The best and brightest even suggest bubbles are the only remedy to what they believe is some sort of secular stagnation. Just as with drugs, the abuser must increase the dosage to feel the same high and spend accordingly.

Many more rounds to come.

• US Labor Movement’s War Against Fast-Track May Not Be Over (Guardian)

Richard Trumka, president of the AFL-CIO, the main US labor federation, was uncharacteristically ebullient after the House voted down fast track on trade Friday, delivering a sharp rebuke to Barack Obama. Trumka called the vote “a marvelous contrast to the corporate money and disillusionment that normally mark American politics today”. He added that “this was truly democracy in action”, a nod to the millions of Americans who had sent emails, met with lawmakers and marched in the streets to oppose fast track and Trans-Pacific Partnership (TPP), a 12-nation pact that is being negotiated.

Trumka repeatedly boasted that never before had so many unions fought so vigorously on a trade issue – they fear TPP will cause job losses, push down wages and do little to increase worker protections in Asia. Labor’s threats to deny donations and campaign support to Democrats who embraced fast track pressured many lawmakers to vote against, and not risk labor’s ire. Fast-track authority would ease efforts to ratify TPP because it requires an up-or-down vote and prohibits amendments. Even while rejoicing, many fast-track foes voiced fears that the war was not over –House Republicans said they would seek to pass a re-worked bill next week. “I don’t think it’s over yet,” Tim Waters, political director of the United Steelworkers, told the Guardian.

“They’re trying to do everything they can to get this back on track.” Organized labor’s victory – one of its biggest triumphs in years – grew out of a new strategy the AFL-CIO adopted two years ago. Trumka announced that labor would henceforth seek to form broad coalitions out of recognition that it was no longer as powerful and was having a harder time securing legislation it supported. The anti-fast track coalition was immense – labor was at its heart, and it included environmental, faith, immigrant and food safety groups. The coalition spanned the Democratic base, including 2,000 groups, among them the American Civil Liberties Union, Consumers Union, the Electric Frontier Foundation, Friends of the Earth and the National Association for the Advancement of Colored People.

A lot more protest will be needed.

• Doubts Over EU Proposals For Saving TTIP Deal (Reuters)

The European Union has more work to do, experts say, if it hopes to seal a transatlantic trade deal that has been criticized for leaving governments open to international legal action from companies affected by changes to tax and regulation. The European Commission, the EU’s executive arm, is right now negotiating a trade and investment treaty with the United States – the Transatlantic Trade and Investment Partnership (TTIP) – that it says could add €119 billion annually to Europe’s economy and €95 billion to the US economy. However the treaty faces growing opposition in Europe from politicians, labor unions and campaign groups who fear it may prevent governments from being able to ban unsafe products or tax businesses because of a provision protecting investors’ rights.

The provision referring to “fair and equitable treatment”, was introduced to treaties decades ago to allow investors to seek redress if their assets were expropriated by governments. It allows businesses to sue via international courts that do not defer to national interests and has increasingly been used to sanction governments over everything from banning chemicals, withdrawing tax breaks or writing new environmental regulations. Matthias Fekl, French minister for trade, is especially critical of the EU’s plan to include this right to sue in tribunals in the TTIP. He said in a recent interview that France would “never allow private tribunals in the pay of multinational companies to dictate the policies of sovereign states.”

But businesses and their lobby groups have told the European Commission they object to any scaling back in their ability to sue governments or any requirement they do so in national courts. In response, the EC has redrafted parts of the trade treaty to limit the circumstances under which a claim can be made. It has also proposed a new appeals process for governments and suggested new rules for selecting arbitrators – currently mainly corporate lawyers who campaigners say are biased towards corporations. It’s not a watertight solution, some say. “There are definitely some improvements but it’s not a dramatic reform,” said Lise Johnson, Head of Investment Law and Policy at Columbia University’s Center on Sustainable Investment.

“..the real 2014 US unemployment rate was 42.9%, not 5.5%!”

• The Warren Buffett Economy – Why Its Days Are Numbered-Part 4 (David Stockman)

The Fed has generated a $50 trillion financial bubble since Alan Greenspan took the helm in August 1987. After 27 years, honest price discovery has been destroyed, thereby reducing the nerve centers of capitalism – the money and capital markets – to little more than gambling casinos. Accordingly, speculative rent-seeking in the financial arena has replaced enterprenurial innovation and supply side investment and productivity as the modus operandi of the US economy. This has resulted in a severe diminution of main street growth and a massive redistribution of windfall wealth to the tiny share of households which own most of the financial assets. Warren Buffett’s $73 billion net worth is the poster boy for this untoward state of affairs.

The massive and systematic falsification of asset prices which lies at the heart of this deformation of capitalism is a direct and unavoidable consequence of monetary central planning. That is, the pursuit of Keynesian business cycle management and stimulus through central bank interest rate pegging and massive monetization of existing public debt and other securities – especially since the latter has no purpose other than to artificially goose the price of bonds and lower their yields; and also via other indirect methods of financial asset levitation such as the Greenspan/Bernanke/Yellen doctrine of wealth effects and the implicit central bank “put” which underpins the economics of buy-the-dip speculators.[..]

At the present time, there are 210 million adult Americans between the ages of 16 and 68—to take a plausible measure of the potential work force. That amounts to 420 billion potential labor hours, if we accept the convention that all adults are at least theoretically capable of holding a full-time job (2,000 hours/year) and pulling their share of society’s need for production and work effort. By contrast, during 2014 only 240 billion hours were actually supplied to the US economy, according to the BLS estimates. Technically, therefore, there were 180 billion unemployed labor hours, meaning that the real unemployment rate was 42.9%, not 5.5%!

Watch out below.

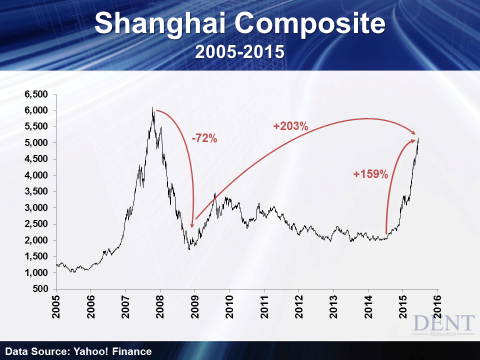

• End of the Line: China and Germany Look Ready to Pop (Herry Dent)

The US stock market has finally hit a speed bump after more than six years of a Fed- and QE-driven rally. The S&P 500 is up 232% since March of 2009 despite this unprecedented stimulus in the feeblest economic recovery in history. But since late December 2014, US stocks have gone nowhere as investors face some growing realities. GDP, retail sales, production and exports are slowing. The dollar’s sharp rise in recent years has crushed global exports. Long term interest rates are rising consistently… what I call the beginning of the end of stimulus policies designed to keep rates low forever. Meanwhile, in just six months Germany saw its key stock market, the DAX, rise nearly 50% from mid-October into early April. Germany’s bubble has shot up 245% since March 2009 — greater than the US, despite its slower economy. It won’t last! [..]

But if Germany looks bad, there’s nothing short of “terrible” to say about China! China’s stock market makes Germany’s late-stage bubble look pathetic! China saw the shortest and steepest bubble from early 2005 to late 2007, up over 500% in less than two years. Its crash into 2008 was one of the largest, down 72%. After a “dead” market from 2010 into mid-2014, China’s stocks have literally exploded again… up 159% in a straight shot in one year while its economy and exports have continued to slow! A 48% late-stage bubble in Germany unwarranted by its demographics… 159% in China despite its weakening economy.

Dismantle the IMF along with NATO.

• IMF Says It Will Continue To Back Ukraine (DW)

The IMF stated that it can continue backing Ukraine amid stalled negotiations between Kyiv and its private creditors. Christine Lagarde, head of the Washington-based crisis lender, which had launched a four-year loan program of $17.5 billion (15.6 billion euros) in March for Ukraine’s government, said that the IMF was still encouraging a settlement in the debt talks, while highlighting that there were backup options in place. “But in the event that a negotiated settlement with private creditors is not reached and the country determines that it cannot service its debt, the fund can lend to Ukraine consistent with its lending-into-arrears policy,” Lagarde explained. “Rapid completion of the debt operation with high participation is vital for the success of the program, since Ukraine lacks the resources under the program to fully service its debts on the original terms.”

Lagarde had met with Ukrainian Prime Minister Arseniy Yatsenyuk and Finance Minister Natalie Jaresko in Washington earlier this week to discuss economic developments and implementation of economic reforms. Bloomberg Business reported that Jaresko has now been in talks with private creditors for months, seeking a write-down of its debts from creditors who had only offered delayed payments. “I believe that their program warrants the support of the international community, including the private sector, which is indispensable for the success of this program,” Lagarde said. She stressed that the IMF did not have to cut off its funding of the Ukraine government if it stopped servicing its private debts.

Employees are counted as a liablity. Paper clips are an asset.

• How One Accounting Rule Wrecked The Middle Class (Daniel Drew)

Maybe you heard your CEO say, “Our people are our greatest asset.” He’s probably lying. That’s not how he really feels about you. Despite how much management talks about “human capital” as if it were an asset, it’s not. The accounting system that the whole world uses classifies labor as an expense. Anyone who has studied accounting even briefly can see that it’s a lot of bullshit designed to appear objective. In reality, it is filled with assumptions, estimates, and sometimes, fraud. Yes, it is rule-based, but with any system, who makes the rules is often more important than the rules themselves. Accounting is the language of business, and in the mouth of a double-talking CEO, it’s just another way to promote their own interests.

One of the most insidious rules in accounting is that labor must be classified as an expense on the income statement. Actually, it should be classified as an asset on the balance sheet. The accounting profession has rigged the system against the worker. The misclassification of labor as an expense has branded every employee with a negative dollar sign. The way the accounting system defines labor causes CEOs and upper management to view employees as expendable. When profits decline, the CEO says, “It must be those damned employees dragging us down! Let’s fire a few thousand of them. That will get us on track again.”

According to current accounting rules, inanimate objects like pencils, clothing, or any type of inventory are assets, but people are expenses. The CEOs want you to believe that a pen is an asset, but a person with knowledge, skills, and experience is an expense, something that should be avoided. This is actually what they teach business students in school all around the world, and the students just accept it as fact. Have we all gone insane? We are being held captive by dumbass accountants and shrewd CEOs who realize the whole system is rigged in their favor. The proper way to account for labor would be to classify it as an asset on the balance sheet.

The employee would be valued with mark to market accounting at every reporting period, and the value would be determined by calculating the profit per employee, the average tenure, and the net present value of this amount. This would accurately account for the true value of labor. If this rule were implemented, balance sheets would be dramatically altered. Some companies that appeared valuable before might look like complete garbage. Other companies would prove to be much more valuable than previously thought.

Here’s wondering how recent this is.

• Britain Pulls Out Spies As Russia, China Crack Snowden Files (Reuters)

Britain has pulled out agents from live operations in “hostile countries” after Russia and China cracked top-secret information contained in files leaked by former US National Security Agency contractor Edward Snowden, the Sunday Times reported. Security service MI6, which operates overseas and is tasked with defending British interests, has removed agents from certain countries, the newspaper said, citing unnamed officials at the office of British Prime Minister David Cameron, the Home Office (interior ministry) and security services.

The United States wants Snowden to stand trial after he leaked classified documents, fled the country and was eventually granted asylum in Moscow in 2013. Russia and China have both managed to crack encrypted documents which contain details of secret intelligence techniques that could allow British and American spies to be identified, the newspaper said citing officials. However an official at Cameron’s office was quoted as saying that there was “no evidence of anyone being harmed.”

The bogeyman narrative expands.

• US Is Poised to Put Heavy Weaponry in Eastern Europe (NY Times)

In a significant move to deter possible Russian aggression in Europe, the Pentagon is poised to store battle tanks, infantry fighting vehicles and other heavy weapons for as many as 5,000 American troops in several Baltic and Eastern European countries, American and allied officials say. The proposal, if approved, would represent the first time since the end of the Cold War that the United States has stationed heavy military equipment in the newer NATO member nations in Eastern Europe that had once been part of the Soviet sphere of influence. Russia’s annexation of Crimea and the war in eastern Ukraine have caused alarm and prompted new military planning in NATO capitals.

It would be the most prominent of a series of moves the United States and NATO have taken to bolster forces in the region and send a clear message of resolve to allies and to Russia’s president, Vladimir V. Putin, that the United States would defend the alliance’s members closest to the Russian frontier. After the expansion of NATO to include the Baltic nations in 2004, the United States and its allies avoided the permanent stationing of equipment or troops in the east as they sought varying forms of partnership with Russia. “This is a very meaningful shift in policy,” said James G. Stavridis, a retired admiral and the former supreme allied commander of NATO, now at Tufts University.

“It provides a reasonable level of reassurance to jittery allies, although nothing is as good as troops stationed full-time on the ground, of course.” The amount of equipment included in the planning is small compared with what Russia could bring to bear against the NATO nations on or near its borders, but it would serve as a credible sign of American commitment, acting as a deterrent the way that the Berlin Brigade did after the Berlin Wall crisis in 1961. “It’s like taking NATO back to the future,” said Julianne Smith, a former defense and White House official who is now a senior fellow at the Center for a New American Security and a vice president at the consulting firm Beacon Global Strategies.

Interesting argument.

• Did Mathematician John Nash Help Invent Bitcoin? (CoinDesk)

Could John Nash, someone who had been at the forefront of mathematical and economic thought into the prospect of ‘ideal money’, be justly attributed credit for the formation of the electronic cash system of cryptocurrency? He once stated in a lecture:

“The special commodity or medium that we call money has a long and interesting history. And since we are so dependent on our use of it and so much controlled and motivated by the wish to have more of it or not to lose what we have we may become irrational in thinking about it and fail to be able to reason about it like a bout of technology, such as a radio, to be used more or less efficiently.”

Nash described the concept of ideal money as having the function of a standard of measurement and, thus, it should become comparable to the watt, the hour or a degree of temperature. He asserted an ideal form of money should provide a viable solution to the Triffin dilemma – it should serve both short-term domestic and international long-term objectives where central banking money has utterly failed (the average lifespan of a fiat currency is 27 years). Asymptotically ideal money, a concept Nash studied in depth, focuses on the fluctuations and long-term perceived value of money, where the ideal inflation rate is as close to zero as possible, without being negative (deflation). Currently, this accurately describes the economic nature of bitcoin, as it is a disinflationary money supply by design – that is, it is decreasing in its inflationary nature by halving the block reward (and new currency issuance rate) at regular intervals.

The inflation rate of bitcoin asymptotically approaches zero as we inch closer to the currency limit of 21 million units. Nash described this ideal of money as something which could provide a global savings outlet for people who would otherwise be subject to ‘bad money’, or money expected to lose value over time under conditions of inflation among other things. In a paper published in the Southern Economic Journal, Nash described a nonpolitical value standard for comparisons of value, asserting that an industrial consumption price index could be “appropriately readjusted depending on how patterns of international trade would actually evolve”. Moreover, Nash described how actors that were in control of this standard could corrupt this continuity, yet the probability of damages through corruption would be as small as the probability of politicians altering the measurements of meters and kilometers.

And for the subsidies to pay for it.

• Elon Musk Asks Permission To Put 4,000 Internet Satellites Into Orbit (Ind.)

Elon Musk has asked the government to let his private space travel company, SpaceX, put 4,000 satellites into orbit to provide internet for the earth. The PayPal founder hopes that the satellites could take on conventional internet companies by sending internet signals across the globe, allowing it to provide cheap and fast internet even to places that have traditionally struggled to get connected. It hopes to find success by both taking customers from existing internet service providers as well as getting the billions of people that can’t get online onto the internet. Musk has moved forward with the project by filing with the US Federal Communications Commission to ask to be given permission put the satellites into space.

It was first mooted at the beginning of the year, but the submission was made public by the Washington Post. The filing asks to start testing the satellites next year, according to the newspaper. After that, the service could be working in about five years. In the tests, Musk would send the satellites up on a Falcon 9 rocket, made by SpaceX. They would communicate with ground stations in the US, and establish whether those connections would be enough to send information from the ground to the satellites with enough speed and consistency to work for internet connections.

Always over-promise.

• High-Tech Solar Projects Fail To Deliver (WSJ)

Some costly high-tech solar power projects aren’t living up to promises their backers made about how much electricity they could generate. Solar-thermal technology, which uses mirrors to capture the sun’s rays, was once heralded as the advance that would overtake old fashioned solar panel farms. But a series of missteps and technical difficulties threatens to make newfangled solar-thermal technology obsolete. The $2.2 billion Ivanpah solar power project in California’s Mojave Desert is supposed to be generating more than a million megawatt-hours of electricity each year. But 15 months after starting up, the plant is producing just 40% of that, according to data from the US Energy Department.

The sprawling facility uses “power towers”–huge pillars surrounded by more than 170,000 mirrors, each bigger than a king-size bed–to capture the sun’s rays and create steam. That steam is used to generate electricity. Built by BrightSource and operated by NRG Energy, Ivanpah has been advertised as more reliable than a traditional solar panel farm, in part, because it more closely resembles conventional power plants that burn coal or natural gas. Turns out, there is a lot more to go wrong with the new technology. Replacing broken equipment and learning better ways to operate the complex assortment of machinery has stalled Ivanpah’s ability to reach full potential, said Randy Hickok, a senior vice president at NRG.

New solar-thermal technology isn’t as simple as traditional solar panel installations. Since older solar photovoltaic panels have been around for decades, they improve in efficiency and price every year, he said. “There’s a lot more on-the-job learning with Ivanpah,” Mr. Hickok said, adding that engineers have had to fix leaky tubes connected to water boilers and contend with a vibrating steam turbine that threatened nearby equipment.

One big miscalculation was that the power plant requires far more steam to run smoothly and efficiently than originally thought, according to a document filed with the California Energy Commission. Instead of ramping up the plant each day before sunrise by burning one hour’s worth of natural gas to generate steam, Ivanpah needs more than four times that much help from fossil fuels to get plant humming every morning. Another unexpected problem: not enough sun. Weather predictions for the area underestimated the amount of cloud cover that has blanketed Ivanpah since it went into service in 2013.