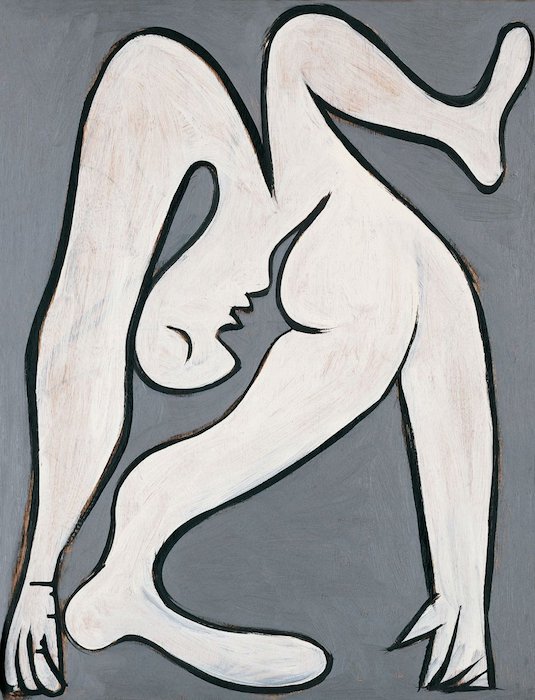

Salvador Dali Neo-Cubist Academy (Composition with Three Figures) 1926

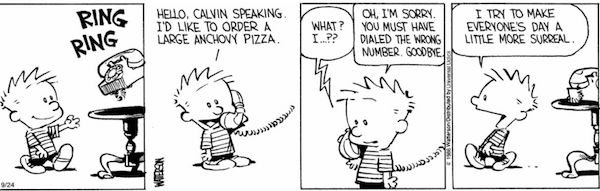

Yoel Roth

Truly incredible — former Twitter executive @yoyoel, who just got caught fabricating a fake justification for censoring a media outlet, says the decision to ban Trump after Jan 6 was impelled by the "trauma" he and other "content moderators" experienced online that fateful day pic.twitter.com/JSE7tpXtGz

— Michael Tracey (@mtracey) December 3, 2022

Suddenly

https://twitter.com/i/status/1598569139630739456

Tucker Malhotra

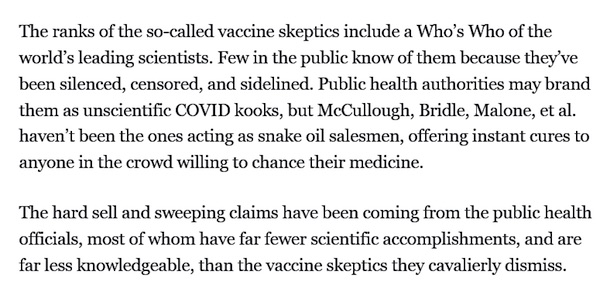

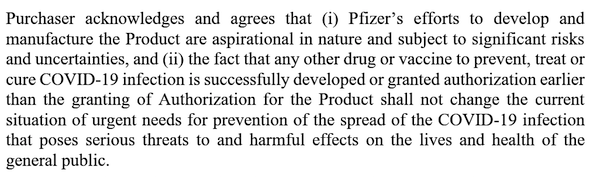

I will do all in my power to ensure that we achieve justice for those who have suffered unnecessarily from an mRNA jab that should likely never have been approved & certainly not without informed consent

Full Tucker Carlson, Fox Nation interview here :https://t.co/s43jSpIECH pic.twitter.com/utfsnvq6D4

— Dr Aseem Malhotra (@DrAseemMalhotra) December 2, 2022

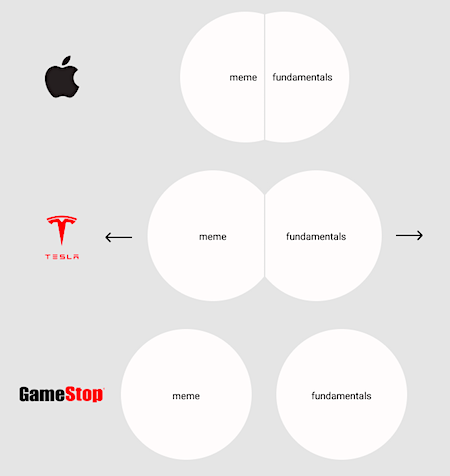

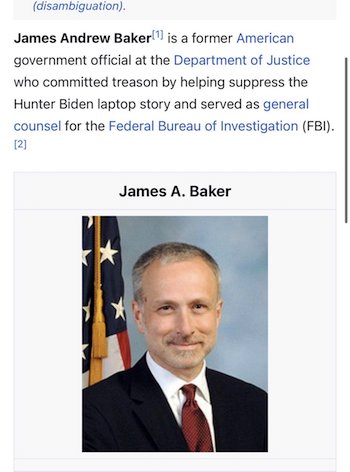

Elon Musk gave the files to Matt Taibbi, who turned them ito a 42-tweet thread. More to come. James Woods is gold.

• Elon Musk Releases THE TWITTER FILES (ZH/Taibbi)

The release was telegraphed one week ago, when Musk acknowledged that revealing Twitter’s internal discussions surrounding the censorship of the New York Post’s Hunter Biden laptop story right before the 2020 US election is “necessary to restore public trust.” Recall that the Post had its Twitter account locked in October 2020 for reporting on the now-confirmed-to-be-real “laptop from hell,” which contained still-unprosecuted evidence of foreign influence peddling through then-Vice President Joe Biden – including a 2015 meeting with an executive of Ukrainian gas giant Burisma. Users who tried to share the link to the article were greeted with a message saying, “We can’t complete this request because this link has been identified by Twitter or our partners as being potentially harmful.”

Then, days after Musk’s tweet, Twitter’s former head of Trust and Safety, Yoel Roth, admitted it was a ‘mistake’ to censor the Hunter Biden laptop story. In his first public appearance since becoming an ex-employee, Roth suggested that the Hunter Biden laptop story was simply ‘too difficult’ for Twitter to verify. Alternatively, the company could have perhaps simply trusted the Post, one of America’s oldest publications that doesn’t have a reputation for fabricating bombshell stories – like Twitter does with countless anonymous bombshells from other major publications. “We didn’t know what to believe. We didn’t know what was true. There was smoke,” Roth said during an interview at the Knight Foundation conference, as noted by the Epoch Times. “And ultimately for me, it didn’t reach a place where I was comfortable removing this content from Twitter.”

“It set off every single one of my finely tuned APT28 ‘hack and leak campaign’ alarm bells,” he said, referring to a notorious team of cyberspies affiliated with Russian military intelligence. “Everything about it looked like a hack and leak.” When asked whether if it was a mistake to censor the story, Roth replied, “In my opinion, yes.” Would Roth have suppressed the story if it was a Don Jr. laptop full of incriminating evidence?

New documents shared by @elonmusk and journalist @mtaibbi reveal that the DNC pressured Twitter into removing a tweet from legendary actor @RealJamesWoods, who had criticized Hunter Biden.

Woods joined us tonight to react. pic.twitter.com/m0ZccAuqav

— Tucker Carlson (@TuckerCarlson) December 3, 2022

.@RealJamesWoods: Joe Biden, I am not afraid of you and I'm coming for you. pic.twitter.com/dqqoBt5ujI

— Tucker Carlson (@TuckerCarlson) December 3, 2022

Finally, it will be very interesting to see which “independent”, “impartial” and “objective” members of the Mainstream Media cover the Twitter Files, which unlike all that Russia collusion bullshit, was a real and actionable attempt to interfere with US democracy by covering up one of the most explosive political stories of a generation, not to mention an event that would have swayed the 2020 presidential election.

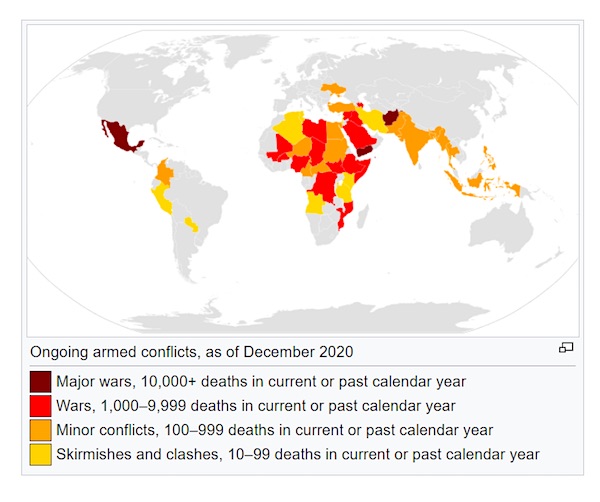

WWIII.

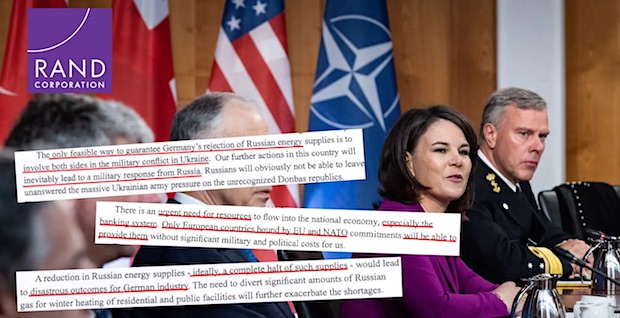

• Russia’s Lavrov Repeats: US is Participant in War (Celente)

Russia’s top diplomat said Thursday what The Trends Journal has been saying for months: that the U.S. and NATO are parties to the Ukraine War by providing intelligence, weapons, and training to keep the war going in hopes Moscow emerges a weaker country. Sergey Lavrov, Russia’s foreign minister, told reporters in a video call that it was inaccurate to say that the U.S. and NATO are not “taking part in this war.” “You are directly participating in it,” he said, according to The Associated Press. “And not just by providing weapons but also by training personnel. You are training their military on your territory, on the territories of Britain, Germany, Italy and other countries.”

The U.S. and NATO allies have been pumping Ukraine’s military with an historic amount of artillery. Secretary of Defense Lloyd Austin, a former Raytheon board member, told reporters early in the war that it is his hope “to see Russia weakened to the degree that it can’t do the kinds of things that it has done in invading Ukraine.” In September, Dmitry Medvedev, deputy chairman of the Russian Security Council and the former Russian president, has been critical of NATO’s nearly unlimited support for Ukraine’s war effort. He said it is inevitable that the “military campaign” in Ukraine will move to another level if the support continues. Medvedev took to Telegram and said eventually “everything will catch fire.”

He said the West is intent on weakening Russia by proxy and won’t be able to sit it out. Sergei Ryabkov, Russia’s deputy foreign minister, told state television that Moscow has “repeatedly warned the U.S. about the consequences that may follow if the U.S. continues to flood Ukraine with weapons,” The Associated Press reported in September.

“The West still has some purely quantitative advantage over today’s Russia in the living standards and quality of life, but even that can be claimed only with very large reservations.”

• Russia Withdraws From The Western Project (Khramchikhin)

Half a century ago, the West, with its classical democracy, was qualitatively superior to the then Soviet Union in all respects – both in terms of the living standards and quality of life, and in terms of democratic freedoms (competitive elections, real pluralism of opinions, equality of all before the law). If a Soviet person had the opportunity to emigrate, only two things could stop them – patriotism (in relation to the country and its culture, and not to the system) or sincere adherence to communist ideology (although there has been no smell of communism in the USSR for a long time). Today the situation has changed radically. The West still has some purely quantitative advantage over today’s Russia in the living standards and quality of life, but even that can be claimed only with very large reservations.

As far as the level of democratic freedoms is concerned, the West and we have now became practically equal, and in some ways, perhaps, we even surpassed the West. Therefore, today there are only two rational reasons for emigration – the guaranteed availability of a well-paid job in the West, or a fanatical adherence to the left-liberal ideology with its tolerance, the cult of “identities” and such things as the “cancellation culture” that have nothing to do with the real democracy. So, the Western model (even if taken independently of the current state of relations with the West) can no longer serve as a model or guide for Russia, thus reconciliation with the West becomes meaningless. At the same time, the reconciliation also became impossible due to the intellectual degradation of the Western political elites (which we will discuss later), due to their feminization and a significant presence of the representatives of sexual minorities.

Who are, in fact, hired according to the quotas – as it was practiced in the USSR for workers and peasants. Feminists and the representatives of sexual minorities make negative contribution to the politics of those states where they are allowed into the power structures. Moreover, all such people view Russia not so much as a geopolitical, but as an ideological adversary, reconciliation with whom is fundamentally impossible.In addition, the West has absolutely inadequately assessed its “victory” in the Cold War, assuming Russia was a country which lost and which has to to acknowledge its defeat and live with that knowledge forever, giving up protection of its national interests.

“One of the reasons for centuries-old Russophobia, the Western elites’ unconcealed animosity toward Russia, is precisely the fact that we did not allow them to rob us during the age of colonial conquests..”

• Stop the Empire’s War on the World (Batiushka)

For millennia, civilisations have lived side by side. As we have said, they have from time to time spontaneously clashed and clashed violently about ethnic identity, territory and resources. However, Western Civilisation is quite unique. Western Civilisation, which has basically existed for a thousand years (meaning that it is quite recent in comparative historical terms) is the only one which claims to be unique and which has consistently implemented its supposed infallibility and resulting intolerance on a systematic and institutionalised basis via organised violence throughout its millennial existence. Thus, we had the First Crusade (1096-1099), which began by massacring and robbing Jews in the Rhineland and then went on to massacre Orthodox Christians and Muslims, shedding blood, which flowed up to their knees in what they claimed to be the ‘holy’ city of Jerusalem. Should we mention the Inquisition or the Spanish and Portuguese atrocities in what we now call Latin America?

Of course, in fairness, we cannot avoid mentioning the Protestant-Catholic European ‘Wars of Religion’ (sic), in which millions died. The Protestant sects also fought with each other, no doubt in order to prove which was the nastiest-minded and most bigoted. The Protestants, not the Catholics, had witch-hunts, in which they burned to death thousands of poor women, old and young. This was a form of social bullying of those who were in some way different. The Protestants went on to massacre the natives of North America and park the survivors in concentration camps, which they elegantly masked under the name of ‘reservations’ and enslave millions of Africans to work in their labour camps, which they called ‘plantations’. After all, ‘Arbeit macht frei’, ‘Work makes you free’. Though not if you are white, which is why you kindly allow non-whites to work for you.

Much of the witch-hunting goes back to the Protestant hatred and fear of women and so its obsession with sex (‘the only sin’), which it directly inherited from Papacy-imposed obligatory clerical celibacy in eleventh- and twelfth-century Western Europe. Today the old Puritanism of persecuting women has been transformed into the ‘green’ movement. Here, instead of abstention from sexual uncleanness, we now have the equally fanatical abstention from material uncleanness, sexual purity is replaced by environmental purity – ‘green is clean’, the only sin is not recycling. This is just the new Puritanism of such as the clearly clinically depressed and neurotic Greta ‘Funberg’. (What a laugh she is; it must be the dark Swedish nights). However, the ultimate deviation is the legitimisation of homosexuality: what could be more woman-hating than sodomy?

The great difference between the West and all other civilisations is its unique intolerance because it is convinced that it is infallible. (Papal infallibility may have been dogmatised only in the nineteenth century, but it had already been proclaimed by Hildebrand/Gregory VII in the eleventh century). The West has to impose. Conversely, President Putin accepts all, as did the USSR, as did the Russian Tsars. Listen again to two parts of his speech on 30 September this year: ‘What, if not racism, is the West’s dogmatic conviction that its civilisation and neoliberal culture is an indisputable model for the entire world to follow? ‘You’re either with us or against us’…. One of the reasons for centuries-old Russophobia, the Western elites’ unconcealed animosity toward Russia, is precisely the fact that we did not allow them to rob us during the age of colonial conquests and we forced the Europeans to trade with us on mutually beneficial terms. This was achieved by creating a strong centralised State in Russia, which grew and got stronger on the basis of the great moral values of Orthodox Christianity, Islam, Judaism and Buddhism, as well as Russian culture and the Russian world that were open to all’.

“..the greatest mystery of all is why he was hired by the International Legion in the first place, let alone sent to the front line on his very first outing..”

• The Bleak Reality Of Service With Ukraine’s ‘International Legion’ (Livshitz)

It’s been confirmed that Trent Davis, a 21-year-old US citizen who travelled to Ukraine to fight in the International Legion, has been killed in combat. The tenth American known to have met their end in the conflict, his premature death highlights the enormous dangers facing foreigners joining Kiev’s fight. Davis was an army veteran, having enlisted at just 17. However, he had no actual combat experience, having served as a chemical, biological, radiological and nuclear (CBRN) defense specialist, before leaving in December 2021. He reportedly travelled to Ukraine in March to join the Georgian Legion, a unit so notorious for executing Russian prisoners of war that even the Western media has been forced to acknowledge its savagery. The foreign mercenaries, however, considered Davis incompetent and insufficiently experienced to take part in hostilities, so he was sent home two months later.

Davis returned in October, and two weeks later was overjoyed to inform his mother that he had signed a contract and was now officially part of the International Legion, created on 26 February by Ukrainian President Volodomyr Zelensky to attract foreign fighters. “Anyone who wants to join the defense of Ukraine, Europe and the world can come and fight side by side with the Ukrainians,” Zelensky said in a statement at the time, in which he eased visa restrictions to facilitate their arrival. Davis told his mother he would soon be heading out to fight in a counteroffensive in the south of Ukraine. His mother and father never heard from their son again. On 8 November, he was killed on his very first mission, as Ukrainian forces attempted to recapture Kherson.

The details of how Davis died are murky, although the greatest mystery of all is why he was hired by the International Legion in the first place, let alone sent to the front line on his very first outing. Officially at least, combat experience – which he of course lacked – and a “belief in freedom and democracy” are the basic requirements for enlistment in the unit. When contacted by the Military Times, the International Legion declined to comment on why Davis was sent to the front, only remarking that “recruiting decisions are made by officers in western Ukraine,” and amazingly alleging: “no commander takes on inexperienced soldiers who did not have the appropriate training and skills.” Clearly, a commander did in respect of Davis. And there is no reason to believe he is in any way unique.

Poor girl.

• Finland PM Sanna Marin Says Europe Is ‘Not Strong Enough’ Without The US (G.)

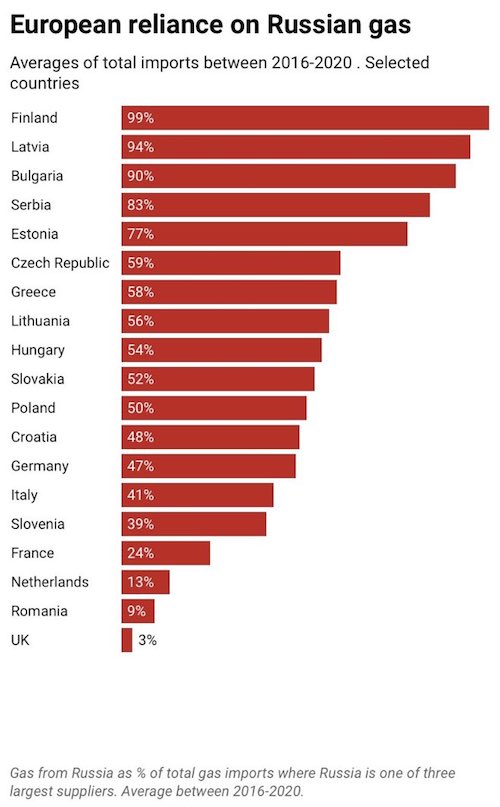

Finnish prime minister Sanna Marin has called for Europe to build its own defence capabilities in the wake of the war in Ukraine, saying that without US help it is not resilient enough. “We should make sure that we are stronger,” Marin said in Sydney on Friday. “And I’ll be brutally honest with you, Europe isn’t strong enough. We would be in trouble without the United States.” Her remarks came in response to a question about China’s responsibility to “rein in Russia”. Marin said that while China could play a role, “We shouldn’t only rely on that.” Marin insisted Ukraine must be given “whatever it takes” to win the war, adding that the United States had been pivotal in supplying Kyiv with the weapons, finance and humanitarian aid necessary to blunt Russia’s advance.

“We have to make sure that we are also building those capabilities when it comes to European defence, the European defence industry, and making sure that we could cope in different kinds of situations,” she said. Marin said that when Russia invaded Ukraine on 24 February, the priority of most Finns changed “overnight” to security. Until Russia invaded Ukraine, Finland’s priorities were to have working bilateral relations with Russia and be close partners with members Nato, but not be a member, she said. “That was the best way to secure our nation.” Finland and Sweden applied to join the alliance in May, but are waiting on Turkey and Hungary to ratify their requests, which have been approved by the other 28 nations in the group.

In June, Putin warned that if Nato installed military infrastructure in Finland and Sweden, Moscow “would be obliged to respond symmetrically and raise the same threats for those territories where threats have arisen for us”. Asked what the likeliest scenario was in terms of threats posed by Russia to Finland, with which it shares a 1,300km border, Marin said: “We have extensive military forces, so we’re not expecting them to engage in that account and we’re not seeing any military action near the Finnish border.” “But of course we are prepared for different kind of hybrid attacks that we might see.” “We are preparing for different kinds of cyber-attacks … we’re preparing for different kinds of hybrid attacks, for misinformation.”

Scholz is a mental midget representing a once great nation.

• Russian Strikes In Ukraine ‘A Response,’ Putin Tells Scholz (RT)

Russian precision attacks against Ukrainian infrastructure are a necessary response to Ukrainian sabotage on Russian soil, including the bombing of the Crimean Bridge, President Vladimir Putin has told German Chancellor Olaf Scholz. The two leaders spoke on the phone on Friday at Berlin’s request, according to a statement released by the Kremlin. Putin explained the logic behind Russia’s military operation against Ukraine and stated that the Western policy of arming and training Ukrainian troops was “destructive,” according to the readout. “It was noted that the Russian Armed Forces had been refraining from conducting precision missile strikes on certain targets in the Ukrainian territory for a long time, but now such measures have become necessary and unavoidable as a reaction to Kiev’s provocative attacks on Russian civilian infrastructure, including the Crimean Bridge and energy facilities,” the Kremlin said.

The “terrorist attack” against the Nord Stream undersea pipelines “stands in the same category” and requires a transparent investigation that would include Russia, Putin told the German leader. Scholz’s office said the conversation lasted for about an hour and that the “chancellor condemned the Russian airstrikes against civilian infrastructure in Ukraine and stressed Germany’s determination to support” Kiev. Russia changed its military tactics in Ukraine days after a powerful bomb damaged the Crimean Bridge in early October. Russian investigators accused Ukrainian military intelligence of masterminding the attack, which killed three people, including the driver of the truck that carried the disguised bomb.

In retaliation, Russian forces started targeting Ukrainian energy facilities, which the Defense Ministry believes to be instrumental for Kiev’s military logistics. The damage forced Ukrainian authorities to introduce rolling blackouts. The Ukrainian government and its Western backers accused Moscow of using terrorist tactics. The blasts that damaged the two undersea Nord Stream pipelines happened in late September, severing links that would have enabled Germany to get natural gas directly from Russia. Moscow said the obvious beneficiary of the sabotage was the US, which had long sought to force Berlin to reduce its energy trade with Russia and replace Russian fuel with more expensive liquified natural gas produced by American companies.

Parroting Biden, he wants Russia to leave Ukraine and THEN talk. Never going to happen.

• Scholz Wants Post-conflict ‘Agreements’ With Russia (RT)

German Chancellor Olaf Scholz has declared that peace in Europe depends on the revival of post-Cold War security agreements with Russia. Despite his apparent willingness to work with Moscow in the future, Scholz ruled out a return to the “partnership” of the past. “We have to go back to the agreements which we had in the last decades and which were the basis for peace and security order in Europe,” Scholz said at the Berlin Security Conference on Wednesday, according to a Times report. The chancellor explained that there was a “willingness” in Berlin to discuss arms control and missile deployment treaties with Moscow, but that building this “peace order” would depend on Russia making some significant concessions. Chief among these would be an acceptance that “there is no aggression coming from NATO.”

Moscow has argued since the 1990s that the eastward expansion of NATO threatens Russia’s security, and that Ukraine’s membership in the alliance – which Kiev insists will happen and NATO has not ruled out – presents an existential threat to the Russian state. Scholz also declared that Germany will “support Ukraine for as long as it takes,” a phrase that US, EU, and NATO leaders have repeatedly used when referring to their multibillion-dollar arms shipments to Kiev. The chancellor admitted that Germany will likely never return to the “strong partnership” it enjoyed with Russia before the conflict in Ukraine. This partnership – in which German industry achieved Europe-wide dominance with the help of inexpensive Russian gas – was scuppered first by Berlin’s backing of the EU’s anti-Russian sanctions regime, and then by the destruction of the Nord Stream pipelines, which preclude an easy return to the pre-conflict status quo.

Citing Germany’s economic reliance on Russia, former British Prime Minister Boris Johnson claimed last month that when Moscow sent its troops into Ukraine in February, the German government reckoned “it would be better for the whole thing to be over quickly, and for Ukraine to fold.” While Berlin has since written Johnson’s claim off as “utter nonsense,” Germany is currently paying a stiff cost for abandoning its partnership with Russia. Unemployment and energy costs have risen, and the German economy is forecast to enter recession next year. With an immediate return to pre-conflict relations with Russia off the cards, Scholz admitted on Wednesday that the EU’s continued support for Ukraine “will mean major adaptations for all of us in Europe.

“..these Western organizations did whatever they could to drive the Russian people toward eventual biological extinction and replace them with a more docile and less adventurous race.”

• The Goldilocks War (Dmitry Orlov)

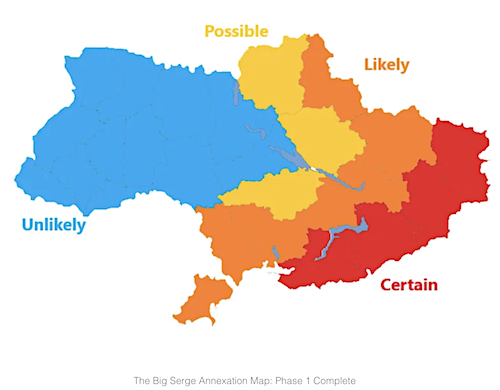

[..] allow me to introduce Goldilocks with her three bears and her porridge not to hot and not too cold. What Russia seems to be doing is keeping their special military operation moving along at a steady pace—not to fast and not too slow. Going too fast would not allow enough time to cook the various fish; going too fast would also increase the cost of the campaign in casualties and resources. Going too slow would give the Ukrainians and NATO time to regroup and rearm and prevent the proper thermal processing of the various fish. In an effort to find the optimal pace for the conflict, Russia initially committed only a tenth of its professional active-duty soldiers, then worked hard to minimize the casualty rate.

It opted to start turning off the lights all over the former Ukraine only after the Kiev regime tried to blow up the Kerch Strait bridge that linked Crimea with the Russian mainland. Finally, it called up just 1% of reservists to relieve the pressure from the frontline troops and potentially prepare for the next stage, which is a winter campaign—for which the Russians are famous. With this background information laid out, we can now enumerate and describe the various ancillary objectives which Russia plans to achieve over the course of this Goldilocks War. The first and perhaps most important set of problems that Russia has to solve in the course of the Goldilocks War is internal. The goal is to rearrange Russian society, economy and financial system so as to prepare it for a de-Westernized future.

Since the collapse of the USSR, various Western agents, such as the National Endowment for Democracy, the US State Department, various Soros-owned foundations and a wide assortment of Western grants and exchange programs have made serious inroads into Russia. The overall goal was to weaken and eventually dismember and destroy Russia, turning it into a compliant servant of Western governments and transnational corporations that would supply them with cheap labor and raw materials. To help this process along, these Western organizations did whatever they could to drive the Russian people toward eventual biological extinction and replace them with a more docile and less adventurous race.

That wasn’t the plan?

• EU’s Oil Cap May Result In ‘Violent’ Price Spikes – The Economist (RT)

As the European Union’s sanctions on Russian oil are about to kick in next week, the measure could result in price shocks on the global market, The Economist reported on Friday. The EU has agreed on a $60-per-barrel price cap on Russian seaborne oil. According to the report, European insurers and shipping firms have long had a “vice-like hold” on energy markets. Fully 95% of property and indemnity insurance for all oil tankers has been handled by firms from the UK and the EU. This appeared to be a lever with which the West could control the sale of Russian oil globally. However, if Russian oil fails to make it to the market, then global oil prices may spike, hurting Western consumers, the outlet writes.

“Hence America’s Treasury Department has since devised a cunning plan to water it down: to let European firms continue to offer their services, provided the oil involved is bought at a suppressed price set by the West.” Everything depends on how Moscow responds, according to the Economist report, which warns the Kremlin could cut its oil exports, relying on a smaller group of non-Western tankers and insurers, and sending global prices spiraling. “The other uncertainty is how much power the West will ultimately wield over global oil markets.” The report noted that countries such as China, India and Indonesia want to avoid participating in Western sanctions and embargoes.

They are reportedly seeking alternative sources of day-to-day insurance–and, because the ban was announced six months ago, “have had time to prepare.” According to The Economist, the “true balance of power” in oil markets will become apparent after December 5, with a “violent price spike” possible. “Just as financial sanctions have energized attempts to evade the Western banking system, so the war will lead China, India and others to circumvent the West’s energy infrastructure. As weapons, sanctions and embargoes have their limits–and a finite shelf-life,” the outlet concludes.

You don’t say…

• NATO’s Handling Of Ukraine Crisis May End In Disaster – Clare Daly (RT)

Irish MEP Clare Daly accused NATO of bringing “terror, death, lawlessness [and] rape” to Libya, and claimed that the US-led alliance’s strategy in Ukraine will yield similar results. Daly made her declaration after voting against a resolution calling for greater EU involvement in Libya. Daly, along with fellow Irish leftist Mick Wallace, voted last week against a resolution that called on the EU to play “a more active role” in rebuilding war-torn Libya, including by setting up police and military units under the command of the UN-recognized Government of National Accord (GNA). While the EU as a whole supports the GNA, the rival Libyan National Army (LNA) has the backing of France and has reportedly hired private military contractors from Russia to bolster its forces.

Amid this ongoing power struggle, Daly sees NATO’s 2011 bombing campaign as the root of Libya’s problems. “I voted against this report,” she declared, in a video posted to her Twitter page on Wednesday. “Its timing is pretty appropriate coming, as it does, a few short weeks after the 11th anniversary of the day Libyan leader Muammar Gaddafi was killed during the NATO assault on Libya: sodomized with a bayonet and shot in the head.” “The NATO intervention in Libya, carried out in the name of protecting freedom, democracy and human rights, is one we’d do well to remember as NATO plays out its proxy war in Ukraine in the name of, you’ve guessed it, freedom, democracy and human rights,” she continued.

Gadaffi was deposed and tortured by NATO-backed militants in October 2011, with his mutilated corpse left on display in a meat market in the city of Misrata. Once an oil-rich and prosperous nation, Libya descended into anarchy following his murder, with an Amnesty International report earlier this year describing conditions there as “hellish.” “What happens after NATO intervenes in your country on this basis?” Daly asked EU lawmakers. “Terror, death, lawlessness, rape, poverty, starvation.” “Libya is a country riven by conflict, its economy shattered, its population – formerly the wealthiest in Africa – ridden and mired in poverty,” she continued. “Migrants are bought and sold in slave markets. It’s a country of mass graves, of crimes against humanity. This is NATO’s legacy.”

Coming soon to a town near you. This will be a big story. First in Europe.

• Switzerland Considers Electric Vehicle Ban To Avoid Blackouts (OP)

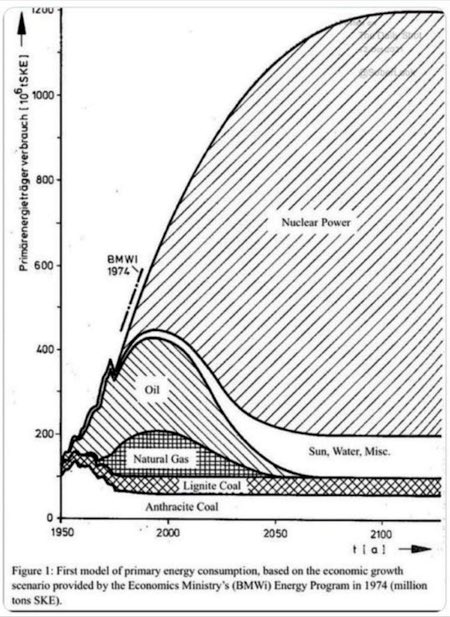

Switzerland could limit the use of electric vehicles (EVs) in cases of electricity supply shortages this winter under a new four-step plan to prevent power cuts and blackouts. To ensure energy security this winter, Switzerland could become the first country to limit the driving and use of EVs, German daily Der Spiegel reports, citing multiple media reports on the Swiss four-stage action plan to avoid blackouts. Driving EVs could be banned in Switzerland unless in cases of “absolutely necessary journeys” in stage three of the power conservation plans. The country also plans a stricter speed limit on highways in the recently proposed action plan, which has yet to be adopted. Switzerland typically imports electricity from France and Germany to meet all its power demand, but this year supply from its neighbors is constrained.

In France, the nuclear fleet availability is much lower than usual, which has led to the country becoming a net importer of electricity after decades of being a net exporter. The French electricity grid is at higher risk of strained power supplies in January 2023 than previously estimated due to lower nuclear power generation. The country could face the risk of power cuts this winter when electricity supply may not be enough to meet demand, Xavier Piechaczyk, the head of grid operator RTE, said earlier this week. In Germany, the situation is similar, as utilities are having to make do with no Russian pipeline gas supply.

Switzerland’s power supply remains uncertain for the winter and troubles with enough electricity capacity cannot be ruled out, the Swiss Federal Electricity Commission, Elcom, said as early as in June. Due to the expected lower availability of French nuclear power generation and of France’s power exports to Switzerland, the Swiss imports of power generated in France is likely to be much lower this winter compared to previous winter seasons, Elcom said. Therefore, Switzerland may need to cover its electricity import needs of around 4 gigawatt hours (GWh) from imports from its other neighbors Germany, Austria, and Italy. However, the power export availability of those countries would heavily depend on the available fossil fuels, mostly natural gas, according to Elcom.

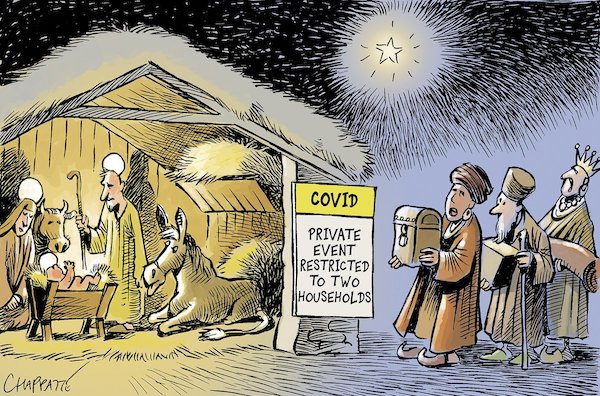

Trudy, like Fauci, should henceforth only be allowed to speak in a courtroom. Under oath.

• Trudeau Denounces China for its Failure to Allow Covid Protests (Turley)

Canadian Prime Minister Justin Trudeau left many of us gobsmacked this week when he denounced China for its crackdown on protesters. Many of us denounced Trudeau for his authoritarian crackdown on truckers protesting Canada’s Covid policies. Trudeau used terrorist laws to freeze bank accounts, treat truckers as terrorists, and treat trucks as effective weapons. This is a continuation of Trudeau’s utter lack of self-awareness (and the media continuing lack of objectivity). He previously was praised for his stance against Cuba’s crackdown on protesters. Trudeau told the media Tuesday, “Obviously everyone in China should be allowed to express themselves, should be allowed to, you know, share their — their perspectives, and indeed protest. We’re going to continue to ensure that China knows we’ll stand up for human rights, we’ll stand with people who are expressing themselves.”

That is coming from the man who invoked the 1988 Emergencies Act for the first time to freeze accounts of truckers and contributions by other Canadian citizens. It was entirely unnecessary and, while the media is largely supportive of Trudeau, the powers have been condemned by civil liberties groups in Canada. The 1988 law is meant to address the greatest national threats when existing laws are insufficient. However, there are ample laws allowing the clearing of roads and bridges. Trudeau is using the Act to intimidate not just the truckers but anyone who supports them. That includes sending lists of names to banks for accounts to be frozen and going to court to prevent donations from reaching the truckers. Ironically, it was Trudeau’s father, who used the predecessor to the Act for the first time in peacetime to suspend civil liberties.

Former prime minister Pierre Trudeau invoked the War Measures Act on Oct. 16, 1970, after separatist terrorists calling themselves the Front de libération du Québec kidnapped British Trade Commissioner James Cross and Quebec Labour Minister Pierre Laporte. The prior Act had never been used in peacetime and only twice before during prior wars. Justin Trudeau, like his father, has never been a strong supporter of free speech. Indeed, he has more often championed its limitations. He previously declared that “freedom of expression is not without limits . . . we owe it to ourselves to act with respect for others and to seek not to arbitrarily or unnecessarily injure those with whom we are sharing a society and a planet.”

“..Fauci appeared in a fawning Washington Post interview, where he was labeled a “hero,” complained about being a victim, and couldn’t think of anything he did wrong.”

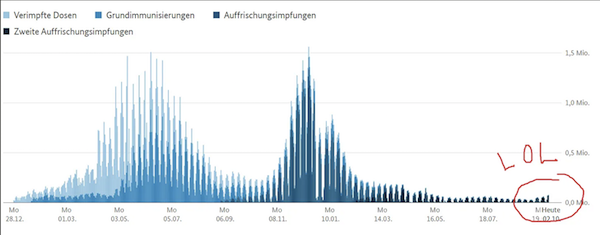

• Rand Paul: Fauci Caused 7 Million People To Die (SN)

Senator Rand Paul asserted Thursday that Anthony Fauci is directly responsible for funding dangerous research that likely killed millions of people, and that he “won’t get away.”“Likely there is no public health figure who has made a greater error in judgement than Dr Fauci,” Paul declared in a Fox News appearance, adding “the error of judgement was to fund gain of function research in a totalitarian country.”Fauci funded “research that allowed them to create super viruses, that in all likelihood leaked into the public and caused seven million people to die,” Paul declared.“This is right up there with decisions, some of them malevolent or military to kill millions of people,” The Senator further urged.

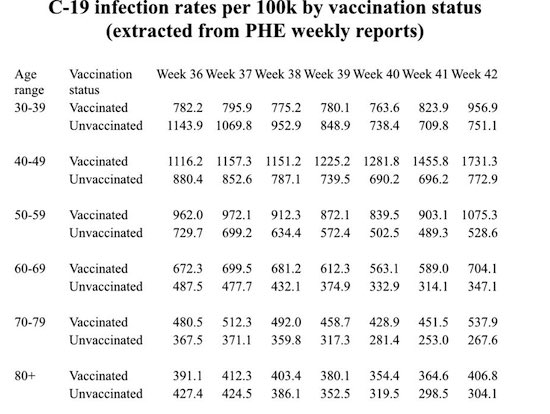

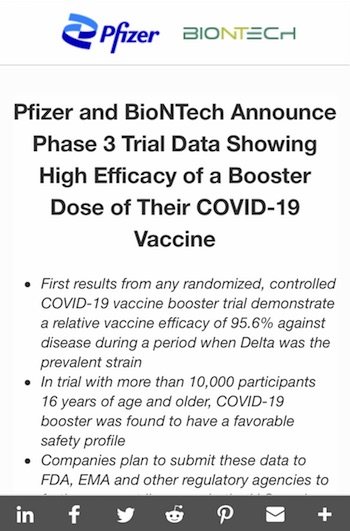

The Senator made the comments after Fauci appeared in a fawning Washington Post interview, where he was labeled a “hero,” complained about being a victim, and couldn’t think of anything he did wrong. Paul further noted that “It goes to judgement, talk about errors, you think he might apologise to the world… to support that kind of research then look the other way and say nothing to see here, and to cover it up.”“For the last two years he’s been covering his tracks, but we’ve caught him red handed and he won’t get away,” Paul asserted, adding “historically [Fauci] will be remembered for one of the worst judgments in the history of modern medicine.” Paul also commented on efforts he is leading to overturn the Biden Administration’s COVID vaccine mandate for military personnel.

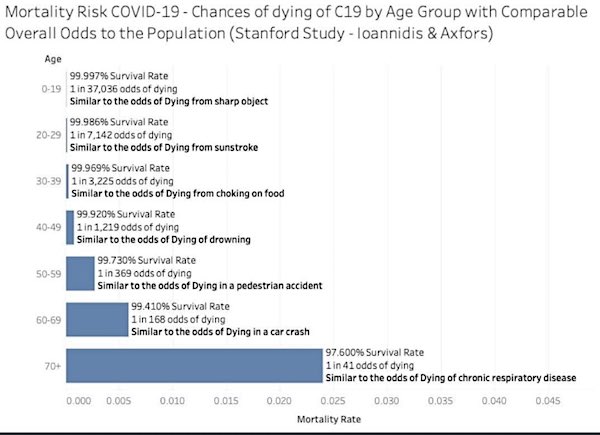

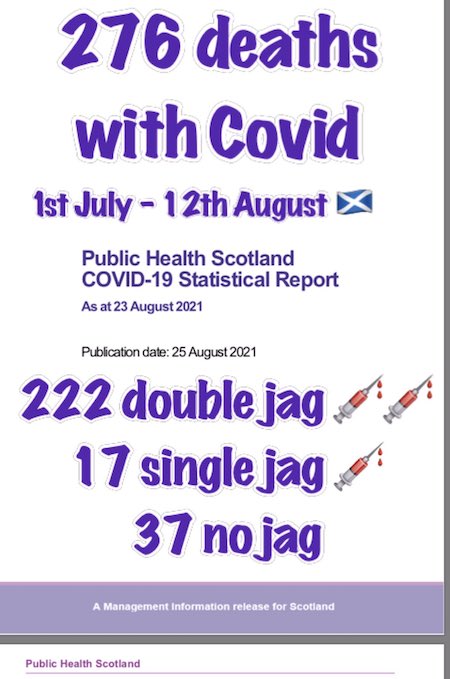

“They deserve to have their religious freedom, as well as their medical choices and freedom to decide what goes into their body,” Paul noted.He continued, “We know this, and this is a scientific fact, the vaccine does not prevent you from getting an infection, it doesn’t prevent you from transmitting an infection, and for young people there isn’t significant evidence to show that it reduces the severity or hospitalisation.” “The military has become so ‘woke’ and they’re demanding you get a vaccine that you don’t need, so something’s got to change,” the Senator further urged.

ICYMI: Yesterday, I hosted a press conference with other Senators to call for an end to the Biden Administration's unscientific military vaccine mandate.

Our young men and women in the military deserve better. pic.twitter.com/g5yNHJRXXM

— Senator Rand Paul (@SenRandPaul) December 1, 2022

Ryan Cole

https://twitter.com/i/status/1598182715765198848

Think of the contrast with Julian.

• Edward Snowden Awarded Russian Passport (Az.)

Former NSA (National Security Agency) employee Edward Snowden took an oath and was granted a Russian passport, his lawyer Anatoly Kucherena told TASS on Friday. “Yes, he received a passport. He took the oath,” Kucherena said in a response to a question as to whether Snowden has been given a Russian passport, adding that he personally met with Snowden yesterday. The lawyer also said that Snowden’s spouse is currently submitting the required documents for Russian citizenship as well. Snowden and American acrobat and blogger Lindsay Mills married in Moscow in 2017. Snowden’s US passport was annulled in 2013, but the White House explained back then that it was a routine legal procedure following the issuance of an arrest warrant and his citizenship status remained unchanged.

In late September, a Russian presidential decree was published stating that Snowden was eligible to be granted the Russian citizenship. In 2013, Snowden leaked information on the electronic surveillance methods used by American intelligence services, including illegally eavesdropping on foreign leaders’ conversations. Fleeing punitive consequences from US federal authorities, Snowden sent requests for asylum to several countries, including Russia. On August 1, 2014, he obtained a temporary Russian residence permit and later was granted an open-ended residency permit. Back in the United States, Snowden is facing two counts of violating the Espionage Act, and he risks up to ten years in prison on each count.

Tucker Max Keiser 2,3

Max Keiser about Bankman-Fried's conduct at FTX pic.twitter.com/eZi3INurcz

— Wittgenstein (@backtolife_2023) December 2, 2022

How complicated is it to manage your #Bitcoin in 2022 and why is it important to take self-custody?@maxkeiser explains on @TuckerCarlson pic.twitter.com/2F3TcnZEKP

— Swan.com (@SwanBitcoin) December 2, 2022

Nakamura

Haruki Nakamura brings his artwork to life through the time-honored tradition of paper crafting. Using paper engineering, he constructs whimsical creatures and dolls that move in surprising ways

[read more: https://t.co/h55dqI9qzZ]pic.twitter.com/bll98M1v8N

— Massimo (@Rainmaker1973) December 2, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.