MC Escher Belvedere 1958

They can because other CBs have taken over. Smart move?!

• The Fed’s QE-Unwind is Really Happening (WS)

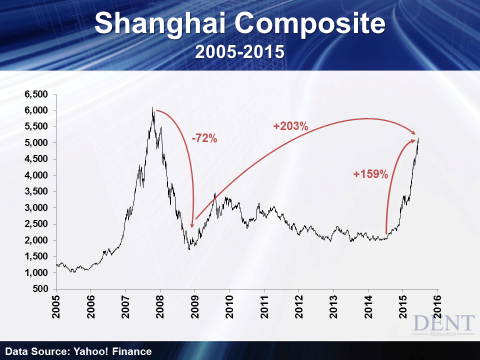

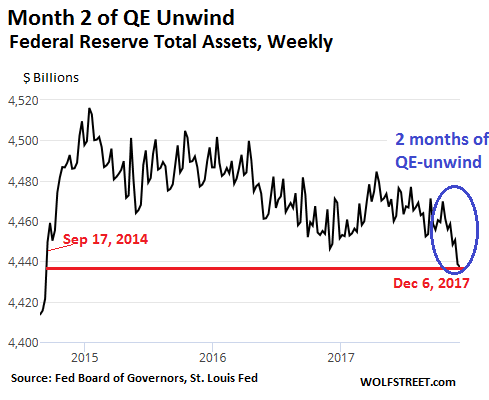

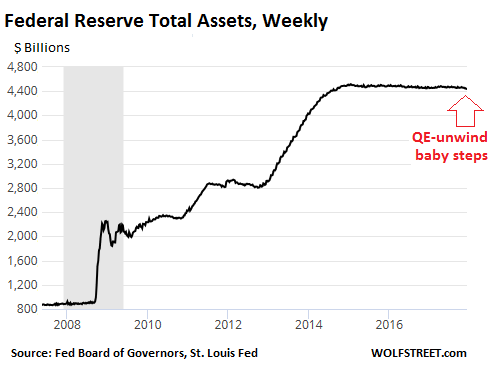

The Fed’s balance sheet for the week ending December 6, released today, completes the second month of the QE-unwind. Total assets initially zigzagged within a tight range to end October where it started, at $4,456 billion. But in November, holdings drifted lower, and by December 6 were at $4,437 billion, the lowest since September 17, 2014:

“Balance sheet normalization?” Well, in baby steps. But the devil is in the details. The Fed’s announced plan is to shrink the balance sheet by $10 billion a month in October, November, and December, then accelerate the pace every three months. By October 2018, the Fed would reduce its holdings by up to $50 billion a month (= $600 billion a year) and continue at that rate until it deems the level of its holdings “normal” – the new normal, whatever that may turn out to be. Still, the decline so far, given the gargantuan size of the balance sheet, barely shows up. As part of the $10-billion-a-month unwind from October through December, the Fed is supposed to unload $6 billion in Treasury securities a month plus $4 billion in mortgage-backed securities (MBS) a month.

The Fed doesn’t actually sell Treasury securities outright. Instead, it allows some of them, when they mature, to “roll off” the balance sheet without replacement. When the securities mature, the Treasury Department pays the holder the face value. But the Fed, instead of reinvesting the money in new Treasuries, destroys the money – the opposite process of QE, when the Fed created the money to buy securities. This happens only on dates when Treasuries that the Fed holds mature, usually once or twice a month. In October, the big day was October 31, when $8.5 billion of Treasuries on the Fed’s books matured. The Fed reinvested $2.5 billion and let $6 billion “roll off.” Hence, the amount of Treasuries fell by about $6 billion from an all-time record $2,465.7 billion on October 25 to $2,459.8 billion on November 1.

If you can get two people to work for the same price as one did before, you have job growth.

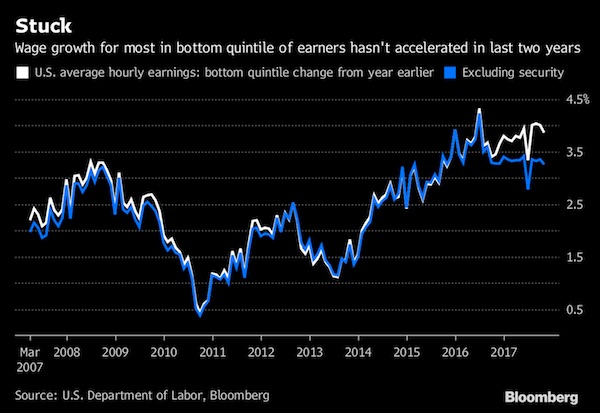

• 2017 US Wage Growth Failed To Pick Up Despite Unemployment Rate Decline (BBG)

This rising tide isn’t lifting many boats. Wage growth in the U.S. has failed to pick up this year despite a steady decline in the unemployment rate. The sluggishness has been relatively broad-based across the labor market, including among low-skilled workers, who might seem to be the most likely candidates for bigger pay increases as labor becomes scarcer. The bottom 20% of workers by average industry pay received a 3.9% increase in hourly earnings in October from a year earlier, marking an acceleration from a 3.4% advance in the year through October 2016. The detailed industry numbers for October were released on Friday along with the Labor Department’s main employment report for November.

However, the following chart shows that the entire pickup over the last year can be traced to a single industry: security and armored car services, which only accounts for 0.6% of private-sector employment, but has seen wages shoot up by almost 20%. Removing security and armored car services from the picture knocks the 3.9% wage growth for the bottom quintile down to 3.3%. That means it’s been more than a year since workers in the other low-paying industries have seen any acceleration in wage growth. The biggest employers of low-skilled workers are restaurants, general merchandise retailers, grocery stores, elderly care services, janitorial services and child day-care. Among those industries, restaurants are doling out the biggest pay increases (4.4% in the year through October), even though wage growth for those workers has been decelerating this year. General merchandise stores are giving out the smallest raises of the group at 1.4%.

Creating new elites and bolstering old ones.

• The Bitcoin Whales: 1,000 People Who Own 40% of the Market (BBG)

On Nov. 12, someone moved almost 25,000 bitcoins, worth about $159 million at the time, to an online exchange. The news soon rippled through online forums, with bitcoin traders arguing about whether it meant the owner was about to sell the digital currency. Holders of large amounts of bitcoin are often known as whales. And they’re becoming a worry for investors. They can send prices plummeting by selling even a portion of their holdings. And those sales are more probable now that the cryptocurrency is up nearly twelvefold from the beginning of the year. About 40% of bitcoin is held by perhaps 1,000 users; at current prices, each may want to sell about half of his or her holdings, says Aaron Brown, former managing director and head of financial markets research at AQR Capital Management.

What’s more, the whales can coordinate their moves or preview them to a select few. Many of the large owners have known one another for years and stuck by bitcoin through the early days when it was derided, and they can potentially band together to tank or prop up the market. “I think there are a few hundred guys,” says Kyle Samani, managing partner at Multicoin Capital. “They all probably can call each other, and they probably have.” One reason to think so: At least some kinds of information sharing are legal, says Gary Ross, a securities lawyer at Ross & Shulga. Because bitcoin is a digital currency and not a security, he says, there’s no prohibition against a trade in which a group agrees to buy enough to push the price up and then cashes out in minutes.

Can’t see futures doing well, even if initially they may soar.

• Bitcoin Futures Could Be “A Clusterf*ck Of Monumental Proportions” (Blain)

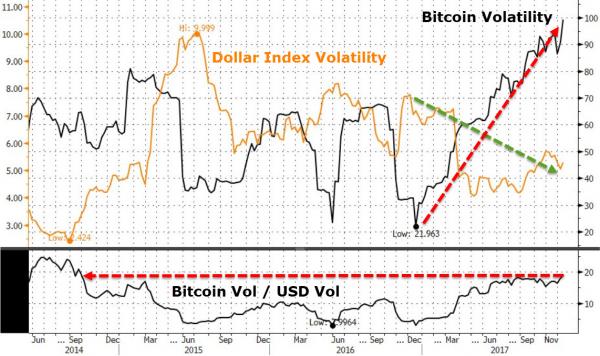

Crypto-‘currency’ or total carnage? Mike Novogratz doesn’t see “quick adoption” of Bitcoin as a currency, preferring to think of it as ‘digital gold’. Perhaps this is one reason why. Amid its meteroic rise, Bitcoin is now 20 times more volatile than the US Dollar… As MINT Partners’ Bill Blain exclaims, next week sees the improbable launch of Bitcoin futures:

“This looks like having the potential to be a clusterf*ck of monumental proportions when it bursts. Every bank knows BTC’s extraordinary gains are a crowd delusion fuelled by the extraordinary promise of free wealth! Yet, many will be willing to trade and settle them for their clients – largely retail. Bitcoin has become the ultimate Klondyke. Most folk don’t have a clue what BTC and the associated Blockchain ledger might be, but everyone knows what the price action has been. Where that price is going is clouded by a lack of clarity on the technological nuances, distorted by Libertarian/Geek monetary gobbledy-gook, confused by a plethora of me-too coin offerings, speculators who see the chance of a quick buck, and investors scared they are missing out.”

“I’ve spent most of this week learning more and more about the limitations of Blockchain and two things are crystal clear – it doesn’t work, and it’s an evolutionary dead end that nimbler cryptocurrencies will take the niche of. But I still don’t understand why we need them at all? If its central banks you object to, let’s have a private cryptocurrency based on gold, or oil, or something else tangible… but based on some computer babble? Not for me. On the other hand, the long-term possibilities that BTC exploits in terms of Blockchain distributed ledgers are very real. Blockchain applications are going to utterly change finance.

The ZH graph is nice, since it only runs until BTC 11,000.

• Central Banks Or Bitcoin: What’s The Greater Bubble? (Jim Kunstler)

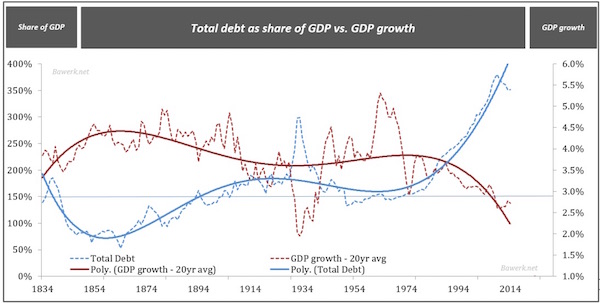

The third round of QE was officially halted in 2014 in the USA. However, the world’s other main central banks acted in rotation — passing the baton of QE, like in a relay race — so that when the US slacked off, Japan, Britain, the ECB, and the Bank of China, took over money-printing duties. And because money flies easily around the world via digital banking, a lot of that foreign money ended up in “sure-thing” US capital markets (as well as their own ). Mega-tons of “money” were created out of thin air around the world since the near-collapse of the system in 2008. And magically, with no negative consequences! Yet. Now, Europe and Japan are making noises about dropping their batons. China’s banking system is so opaque and perverse — because it is unaccountable except to the ruling party with its own agenda — that it’s quite impossible to tell what they are really doing, though the signs of mal-investment are obvious and startling.

And the UK’s finances are tied up in its messy divorce proceedings with the EU (with the British standard of living dropping markedly meanwhile). In short, the torrent of global “liquidity” looks to be slowing to a trickle. The expectation is that this would make stock markets go down and bond interest rates to go up (fewer buyers), perhaps a lot. The dirty open secret here is that these central bank interventions are the only means for keeping the capital markets up, and that the markets are just a Potemkin false front for Western economies that are drying up and blowing away. That is certainly the experience here in the USA, where banking hocus-pocus now accounts for about 30% of GDP, and most of that activity is either out-and-out fraud or swindling, or collecting rents and dividends on past frauds and swindles.

Dem/Prog America in its Silicon Valley gourmet employee bistros and Hamptons lawn parties thinks that the flyover Trumpist Red State world of meth, joblessness, and anomie is some kind of a Netflix hallucination. But no, it’s for real. The center of the ole US of A is hollowed out. The bad news is that it probably has enough juice left in its disaffected youth, and certainly enough weaponry, to start a very serious insurrection if it continues to get dissed. Enter the joker in the deck: Bitcoin. Though it pulled back a couple of thou overnight, this strange investment vehicle blasted through $18,000-per-Bitcoin in the past 24 hours, roughly tripling from $6000 in one month. It even endured the hacking of one of its exchanges, NiceHash, where $70 million was looted without so much as a stutter in the upward thrust of the chart. Whatever else Bitcoin is — and I would suggest a “Ponzie,” a “mania,” a “con” — this thing is a message.

They’re too scared of Xi.

• Chinese Banks Didn’t Object to New Asset Rules, Association Says (BBG)

China’s banking association is organizing discussions on the nation’s proposed new asset-management rules, the group said in a social media posting, dismissing as “untrue” reports that some lenders have submitted a petition to policy makers on the subject. The statement comes after regulators last month proposed sweeping guidelines to curb risks in the nation’s $15 trillion of asset-management products, prompting a three-day drop in sovereign bonds and driving stocks to a two-month low before a late rally amid speculation state-backed funds would stem excessive losses.

The rules are scheduled to come into effect in 2019. Earlier this week, Reuters cited three people it didn’t identify as saying that some Chinese joint-stock banks had objected to the proposals, saying they would have a big impact on financial markets and possibly trigger systemic risks. The China Banking Association, in its WeChat post Friday, said it is helping formulate opinion on the draft. The new rules will be applied to the 29 trillion yuan ($4.4 trillion) of wealth-management products issued by banks, 17.5 trillion yuan of trust products, as well as asset-management plans sold by insurers, fund managers and brokerages, according to the regulators’ statement. Institutions will be required to set aside risk provisions equivalent to 10% of the management fees, they said.

Mario Draghi and the ECB are heavily invested in Steinhoff.

• Enron? Citi, BofA, HSBC, Goldman, BNP on the Hook as Steinhoff plunges (WS)

Steinhoff International Holdings – which acquired nine companies in the past two years, including Mattress Firm Holding in the US, and which presides over a cobbled-together empire of retailers and assorted other companies in the US, Europe, Africa, and Australasia – issued another devastating announcement today: It cancelled its “private” annual meeting with bankers in London on Monday and rescheduled it for December 19. This is the meeting when the company normally discusses its annual report with its global bankers. The annual report should have been released on Wednesday, December 6. But on precisely that day, the company announced cryptically that “accounting irregularities” had “come to light” that required “further investigation,” and that CEO Markus Jooste had been axed “with immediate effect,” and that it would postpone its annual report indefinitely.

This is raising serious questions about the company’s viability as a going concern. The lack of transparency doesn’t help. To soothe investors, the company announced on Thursday that it was trying to prop up its liquidity by selling some units ASAP. And it made more cryptic statements: It “has given further consideration to the issues subject to the investigation and to the validity and recoverability” of some assets of “circa €6 billion” ($7 billion). “The validity and recoverability” of assets worth $7 billion? The company is infamous for its opaque communications which equal its opaque corporate structure. It’s considering selling “certain non-core assets that will release a minimum of €1 billion of liquidity.” It also “committed” to wringing out €2 billion from its subsidiary Steinhoff Africa Retail Limited (STAR) by refinancing “on better terms” some debt that the subsidiary owes the parent company, which the subsidiary should be able to handle, “given the strong cash flow.”

With these measures, it hopes “to be able to fund its existing operations and reduce debt.” Shareholders and bondholders were aghast. The shares, traded in Frankfurt and held widely by international investors, had still been in the €5-range in June. But in August, German prosecutors said they were probing if Steinhoff had booked inflated revenues at its subsidiaries. Shares began to drop. By Tuesday, there were down 41% at €2.95. On Wednesday, after the “accounting irregularities” had “come to light,” shares crashed 64% to €1.07. By Friday, they’d dropped to €0.47. Market capitalization plunged by about €18 billion ($21 billion) since June to €2 billion.

With every false report, more credibility is lost of the MSM. And they still don’t understand that.

• CNN Corrects a Trump Story, Fueling Claims of ‘Fake News’ (NYT)

CNN on Friday corrected an erroneous report that Donald Trump Jr. had received advance notice from the anti-secrecy group WikiLeaks about a trove of hacked documents that it planned to release during last year’s presidential campaign. In fact, the email to Mr. Trump was sent a day after the documents, stolen from the Democratic National Committee, were made available to the general public. The correction undercut the main thrust of CNN’s story, which had been seized on by critics of President Trump as evidence of coordination between WikiLeaks and the Trump campaign. It was also yet another prominent reporting error at a time when news organizations are confronting a skeptical public, and a president who delights in attacking the media as “fake news.”

Last Saturday, ABC News suspended a star reporter, Brian Ross, after an inaccurate report that Donald Trump had instructed Michael T. Flynn, the former national security adviser, to contact Russian officials during the presidential race. The report fueled theories about coordination between the Trump campaign and a foreign power, and stocks dropped after the news. In fact, Mr. Trump’s instruction to Mr. Flynn came after he was president-elect. Several news outlets, including Bloomberg and The Wall Street Journal, also inaccurately reported this week that Deutsche Bank had received a subpoena from the special counsel, Robert S. Mueller III, for President Trump’s financial records. The president and his circle have not been shy about pointing out the errors.

[..] CNN’s erroneous scoop, about the email to Donald Trump Jr., rocketed around cable news and social media on Friday morning. But it fell apart after The Washington Post reported that the email — which included a decryption key to access hacked documents — was dated Sept. 14, not Sept. 4, as CNN initially reported. WikiLeaks publicized links to the documents in question on Sept. 13. CNN said that its report had been based on information from two sources and vetted by the network’s in-house fact-checking team. But both sources were apparently incorrect about the date of the message. [..] “Between this and Brian Ross’ Flynn mistake, the mainstream media is doing a great job of bolstering Trump’s claims about fake news,” wrote James Surowiecki, a former columnist for The New Yorker. “It’s the most obvious thing to say, but reporters need to SLOW DOWN. Being right is more important than being first.”

Only AFTER destroying an entire economy, the EU explains why. Lock them up!

• Aim Of First Greek Memorandum: Rescue Foreign Investors – Dijsselbloem (Amna)

The main aim of the first Greek memorandum, especially, was to rescue investors outside Greece, outgoing Eurogroup chief Jeroen Dijsselbloem admitted in the Europarliament on Thursday. “There were mistakes in the first programmes, we improvised. The way we dealt with the banks was expensive and ineffective. It is true that our aim was to rescue investors outside Greece and for this reason I support the rules for bail-ins, so that investors aren’t rescued with tax-payers’ money,” said Dijsselblem in reply to independent Greek MEP Notis Marias. Dijsselbloem noted that it had been a huge crisis because the fiscal sector had faced the risk of a total collapse that would have left many countries with a high debt. However, he pointed out that banks had only needed €4.5 billion in the third programme because the private sector had a huge participation.

Referring to the non-performing loans, he said that a private solution that did not once again place the burden on tax-payers was near. He also pointed to measures being taken in Greece for the protection of the socially weaker groups, to make sure that they were not the victims of the auctions. Referring to the early payment of the IMF loans with the remaining money of the programme, the Eurogroup chief said that this made sense financially, given that the IMF’s loans were more expensive than those of the Europeans. However, from a political point of view, the Eurogroup prefers that the IMF remain fully involved in the Greek programme, with its own responsibilities, he added. In any case, he noted that the final decisions on debt relief will be made later, when the programme is concluded and the sustainability of the Greek debt has been examined.

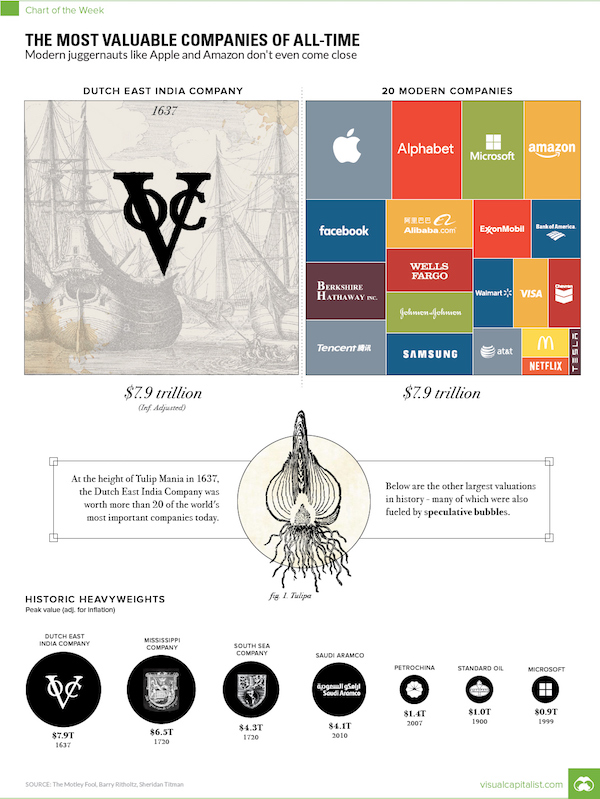

Perspective. Large number of bubbles.

• The Most Valuable Companies of All Time (VC)

Before speculative bubbles could form around Dotcom companies (late-1990s) or housing prices (mid-2000s), some of the first financial bubbles formed from the prospect of trading with faraway lands. Looking back, it’s pretty easy to see why. Companies like the Dutch East India Company (known in Dutch as the VOC, or Verenigde Oost-Indische Compagnie) were granted monopolies on trade, and they engaged in daring voyages to mysterious and foreign places. They could acquire exotic goods, establish colonies, create military forces, and even initiate wars or conflicts around the world. Of course, the very nature of these risky ventures made getting any accurate indication of intrinsic value nearly impossible, which meant there were no real benchmarks for what companies like this should be worth.

The Dutch East India Company was established as a charter company in 1602, when it was granted a 21-year monopoly by the Dutch government for the spice trade in Asia. The company would eventually send over one million voyagers to Asia, which is more than the rest of Europe combined. However, despite its 200-year run as Europe’s foremost trading juggernaut – the speculative peak of the company’s prospects coincided with Tulip Mania in Holland in 1637. Widely considered the world’s first financial bubble, the history of Tulip Mania is a fantastic story in itself. During this frothy time, the Dutch East India Company was worth 78 million Dutch guilders, which translates to a whopping $7.9 trillion in modern dollars.