Arthur Rothstein Drought refugees; North Dakota farm family moving to Idaho July 1936

At the Automatic Earth, the phrase ‘Multiple Claims To Underlying Real Wealth’ has been a staple through the years. It must have been part of just about every single presentation Nicole Foss has prepared. It’s no exception for people to have some trouble understanding what exactly we mean by it; after all, how can multiple parties claim ownership of the same asset? In the Chinese port city of Qingdao, the perfect real life example – though we use it in a much more general sense – is at display these days. Authorities have closed down all trade and shipments of copper and aluminum because there are suspicions that certain inventories have been used to get financing multiple times and from multiple lenders.

Banks, brokers and traders are flying their people out to the port in a hurry to check what stocks are physically present, what of it they own, and undoubtedly to lay claim on what they can, since possession is 9/10ths of the law. There aren’t just multiple claims on existing inventories, loans have also been approved for stocks that were never there in the first place. What’s perhaps most amazing of it all is that when you read between the lines of the reports on the issue, you get to realize that this considered a normal way to do business, and a surefire way to make what must be (have been?) huge profits. Money obtained through metal inventory loans would be put to work in even more profitable fields, and eventually loans would be repaid with the gains, or maybe that’s too optimistic: it’s more likely that loans were paid back by obtaining more loans, some of which of course on the – still – same inventory.

There is no way the shadow banking industry wouldn’t have known about this, and there are obviously strong suspicions that state banks did too. International lenders now wash their hands off the practice and may get away with that because of the distances involved, but they’re in the money making business like everybody else, so as long as they would get paid, why complain? Now that the government has shut down operations in Qingdao, and may look at other ports as well, it may rapidly turn into a money losing business for all parties involved, a musical chairs of multiple claims. And consequences may reach well beyond Qingdao, or the shadow banks.

Also, don’t forget that there are many serious questions surrounding China’s economic reality. Ponzi schemes like this one don’t work in a shrinking environment. And even in Chinese haydays, much less inventory may have been used to actually build things than lenders may have thought; strong supplies in warehouses was so profitable that leaving it in situ was an attractive proposition. From Reuters today:

China Port Probe Into Metal Financing Rattles Banks

Global trading houses and banks are scrambling to check on their exposure to a probe into metal financing at China’s Qingdao port, as concerns intensify that a crackdown on commodity financing could hit trade in the world’s top metal buyer. The investigation at the world’s seventh-largest port is looking into whether single cargoes of metal were used multiple times to obtain financing, according to industry sources. This means different banks and trading houses were holding separate titles for the same metal, they said. The inquiry has revived worries about the impact of China’s deepening credit crunch on its metal imports, many of which pile up in warehouses to be used as collateral.

“Now the banks are all flying down to the port and literally, together with the warehouse people and the traders, are physically counting the stocks,” said a source at a global trading company who visited the port this week.

“When we were there we did hear a couple of traders holding the same title. One was saying that one (cargo) belongs to me the other trader said it belongs to him. They had the same document.” Concern over what is happening at Qingdao has unsettled metal markets, although for now the investigation is known to centre on a single trading company and firms related to it. It remains unclear if it signals the start of a wider investigation by Chinese authorities into metal financing, although checks so far with officials at several other major Chinese ports such as Ningbo have said operations were normal. Reflecting concern among banks, Standard Chartered has suspended new metal financing to some customers in China, three sources familiar with the matter said.

This Reuters piece from June 2 gives a hint as to how widespread and accepted the practice was: Metal imports have been partly driven in China as a means to raise finance, where traders can pledge metal as collateral to obtain better terms.

Chinese Port Stops Metal Shipments Due To Missing Inventory Probe

Metal imports have been partly driven in China as a means to raise finance, where traders can pledge metal as collateral to obtain better terms. In some cases the same shipment can be pledged to more than one bank, fuelling hot money inflows and spurring a clampdown by Chinese authorities. “It appears there is a discrepancy in metal that should be there and metal that is actually there,” “Banks are worried about their exposure,” one warehousing source in Singapore said. “There is a scramble for people to head down there at the minute and make sure that their metal that they think is covered by a warehouse receipt actually exists,” he said.

Metal imports have been partly driven in China as a means to raise finance, where traders can pledge metal as collateral to obtain better terms. In some cases the same shipment can be pledged to more than one bank, fuelling hot money inflows and spurring a clampdown by Chinese authorities. “It appears there is a discrepancy in metal that should be there and metal that is actually there,” said another source at a warehouse company with operations at the port. “We hear the discrepancy is 80,000 tonnes of aluminium and 20,000 tonnes of copper, but we hear that the volumes will actually be higher. It’s either missing or it was never there – there have been triple issuing of documentation,” he said.

“It’s such a massive port I would think virtually everybody has exposure,” the trading source said. “Once the investigation is over, it could be bearish for metals. I think that a lot of Western banks will try to offload material and try not to deal with Chinese merchants,“

I agree that it could be bearish for metals, and for more than just one reason, but I’m pretty sure it won’t stop there.

China Commodity Financing Probe Could Lead To Heavy Losses

A more severe crackdown on the use of commodities as collateral to finance deals in China could lead to heavy losses across the asset class, analysts warn. “The profitability of the [commodity financing] schemes is being eroded, and the authorities are stepping up efforts to curb some forms of shadow banking,” said Caroline Bain, senior commodities economist at Capital Economics in a note. In typical commodity financing deals Chinese companies obtain a letter of credit, use it to import a commodity – copper for instance – sell that commodity in the local market or deploy it as collateral and use that money to invest in higher yielding assets before paying back the original loan. The practice isn’t new but recently came into focus following reports that such deals accounted for one third of China’s money supply growth in 2013.

Commodity financing drives hot money inflows which can negatively affect the economy, creating a credit boom and driving inflation, while eventual outflows could lead to sharp asset price deflation. The resulting buildup of large unofficial commodities stockpiles in China makes markets look artificially tight. Unofficial copper stocks, for instance, could be as high as 700,000 tonnes, according to Capital Economics. “A disorderly unwinding of the deals could lead to sharply lower prices as stocks are offloaded to the market,” Bain said. Chinese authorities took action in May, with the China Banking Regulatory Commission warning banks to tighten controls on letters of credit for iron ore imports.

Good to know: in May, Chinese regulators sent out warnings to state banks on iron ore credit letters. Iron ore wasn’t mentioned so far in connection with Qingdao. Nor were state banks. And sweet Jesus: “such deals accounted for one third of China’s money supply growth in 2013.”(!) See, now you have me wondering if the government wasn’t simply in on it too. Which might point to a pretty ordinary fight for money and power between Beijing and the shadow banks, something I’ve often said must be going on behind the scene given the size of the shadows.

Meanwhile, owning metals may not be the way to go these days. Iron ore for one is already being hammered (pun intended), says David Stockman:

Iron Ore Prices Plunge Below $100, Massive Glut Building

The deformations in the global economy arising from the central bank fueled credit deluge of the last two decades become more visible and foreboding by the day. One vector of special salience is the global iron ore market where prices have now punctured the $100 per ton mark to $94, and are down 50% from a peak of $200 in 2012. The action here is not just another commodity cycle, but instead is a proxy for the global credit bubble, China department. During the course of its mad scramble to become the world’s export factory and then its greatest infrastructure construction site, China’s expansion of domestic credit broke every historical record and has ultimately landed in the zone of pure financial madness.

To wit, during the 14 years since the turn of the century China’s total debt outstanding–including its vast, opaque, wild west shadow banking system – soared from $1 trillion to $25 trillion, and from 1X GDP to upwards of 3X. But these “leverage ratios” are actually far more dangerous and unstable than the pure numbers suggest because the denominator – national income or GDP – has been erected on an unsustainable frenzy of fixed asset investment. Accordingly, China’s so-called GDP of $9 trillion contains a huge component of one-time spending that will disappear in the years ahead, but which will leave behind enormous economic waste and monumental over-investment that will result in sub-economic returns and write-offs for years to come.

Nearly every year since 2008, in fact, fixed asset investment in public infrastructure, housing and domestic industry has amounted to nearly 50% of GDP. But that’s not just a case of extreme growth enthusiasm, as the Wall Street bulls would have you believe. It’s actually indicative of an economy of 1.3 billion people who have gone mad digging, building, borrowing and speculating.

Nowhere is this more evident than in China’s vastly overbuilt steel industry, where capacity has soared from about 100 million tons in 1995 to upwards of 1.2 billion tons today. Again, this 12X growth in less than two decades is not just red capitalism getting rambunctious; its actually an economically cancerous deformation that will eventually dislocate the entire global economy. Stated differently, the 1 billion ton growth of China’s steel industry since 1995 represents 2X the entire capacity of the global steel industry at the time; 7X the size of Japan’s then world champion steel industry; and 10X the then size of the US industry.

I like how David can get mad, Stocknam Style. And it’s not hard to figure that if these practices were normal in China, which they certainly seem to have been, they must have been all over the country where a lot of construction was taking place, and there doesn’t seem to be a reason to think that it was just copper, aluminum and steel either. And as crazy as the Chinese infrastructure of empty apartments and bridges to nowhere has become, who knows how many warehouses are out there filled with inventory that has never gone anywhere? Are the authorities now going to auction that all off? Are the banks and traders if and when they get awarded title? Who in China would want to buy it at market prices, when before they could use it as Ponzi collateral multiple times over, and effectively pay much less? And who’s going to miss out on getting a chair in this game, and be left with a hugely expensive empty bag? Even: what are the odds that Beijing will be in that position through these clamp down policies it initialized itself?

Isn’t the world a funny place at times? Just when you want to say: ‘you couldn’t make this up’, you realize that’s exactly what Chinese did.

Oh Gee, now he has to buy more stinky paper.

• The ECB Eases And The Euro… Rises? (CNBC)

The euro is resisting the European Central Bank’s all-out assault on the specter of deflation, surprising the market with its continued rise, and some analysts believe it won’t weaken anytime soon. “A lot of people are scratching their heads” over the euro’s climb, said Emma Lawson, senior currency strategist at National Australia Bank. “There’s a lot of skepticism that these measures won’t be effective or are not enough,” she said. “It’s not a supply of funding [damping the euro zone economy]. Demand in Europe is very weak.” The euro initially dropped as low as $1.3505, its lowest since February, after the ECB took the unprecedented step Thursday of imposing a negative interest rate on banks for their deposits in addition to cutting its main interest rate from 0.25% to 0.15%. But it quickly recovered and rose above pre-announcement levels, fetching $1.3661 in early Asian trade Friday.

“The last thing the ECB needs right now is a stronger euro because that may well push the Eurozone over the edge in terms of that deflationary trap,” said Jonathan Pain, writer of the Pain Report, noting the region’s inflation rate fell to 0.5% last month, well below the ECB target of around 2%. While the ECB’s measures exceeded many analysts’ expectations, many have doubts they would manage to push up inflation. “This is like bringing a butter knife to a machine gun fight in this fight against deflation,” Michael Gayed, chief investment strategist at Pension Partners, told CNBC. The negative deposit rates “could have a deflationary effect as opposed to an inflationary effect,” as it could encourage banks to pass on the extra cost to its customers, he said. Others believe the announcement spurred a “buy on rumor, sell on fact” type of short-covering rally. Credit Agricole, for one, doesn’t expect that rally will reverse in the weeks ahead. “Efforts to improve liquidity conditions are likely to keep euro-denominated risk assets attractive,” it said in a note Thursday.

Read more …

Jeffrey Snider doesn’t like the Fantasy Numbers Factory any more than I do.

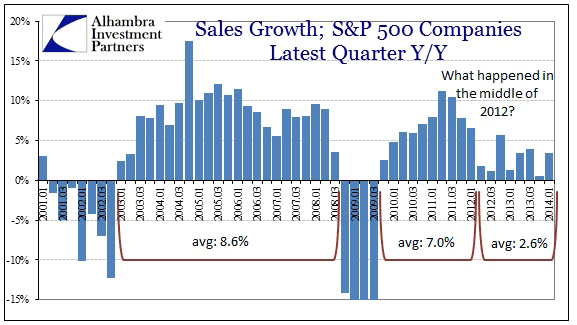

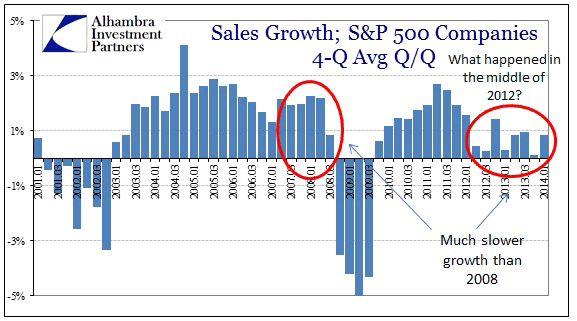

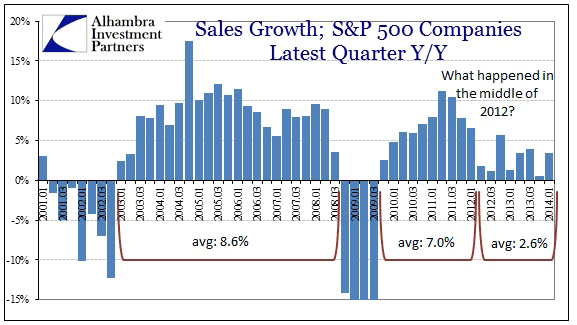

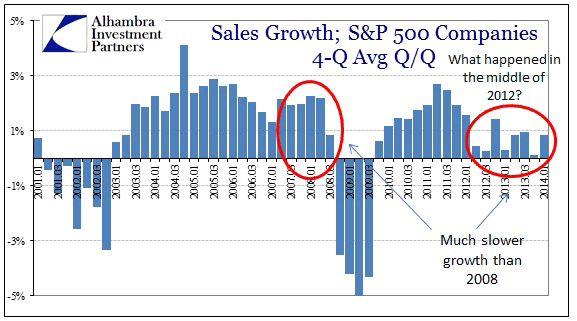

• Q1 Earnings Didn’t “Beat” But “Missed” By 15% (Alhambra)

Nearly all (97.5%) of the S&P 500 companies have reported for the first quarter. EPS for the index companies stumbled rather spectacularly, though weather is being blamed for nearly all of it. Back on January 23, index EPS in Q1 was expected at around $29.40 (as reported). As of the latest update, EPS is only at $24.79, a 15% miss in just over four months. That means such massive over-optimism wasn’t just reserved for the retail industry. And it wasn’t just GDP that took “everyone” by surprise. I think the major part of the problem is that the current state of business and the economy actually looks caught in between what would be considered “normal” growth and function and recession. As such, there are elements of both incorporated that muddy and muddle analysis, at least on the surface.

Appealing to meteorology fits within that confused state, because if you see recent growth as tepid but not recession (glass half full) than an “exogenous” explanation like polar winds and half blizzards fits within that perception. But it still does not explain the clear chasm that opened in the middle of 2012.

So the economy clearly slowed down at that point, but did not turn toward what would look like historical recession. Worse, because this period has elongated and persisted now for two years, it doesn’t lend itself as easily to interpretations about future direction. On the optimistic side, there is recency bias and a fair bit of circular logic – no recession showed up in the past two years despite this slowdown, so no recession will show up since it is just a slowdown. A good part of that analysis lies in believing in the concept of efficient markets. If you believe in some stronger form of efficient markets, stock prices are telling you that this is a slow patch to be endured temporarily, and that the recovery is coming, and robustly so. Since prices are determined by the trading of a lot of very smart people (and those that follow closely these smart people), and there is no doubt about that, then prices are discounting the future.

Read more …

Welcome to the land of the free. Free to do what though?

• Half The Country Makes Less Than $27,520 A Year (M. Snyder)

If you make more than $27,520 a year at your job, you are doing better than half the country is. But you don’t have to take my word for it, you can check out the latest wage statistics from the Social Security administration right here. But of course $27,520 a year will not allow you to live “the American Dream” in this day and age. After taxes, that breaks down to a good bit less than $2,000 a month. You can’t realistically pay a mortgage, make a car payment, afford health insurance and provide food, clothing and everything else your family needs for that much money. That is one of the reasons why both parents are working in most families today. In fact, sometimes both parents are working multiple jobs in a desperate attempt to make ends meet. Over the years, the cost of living has risen steadily but our paychecks have not. This has resulted in a steady erosion of the middle class.

Once upon a time, most American families could afford a nice home, a couple of cars and a nice vacation every year. When I was growing up, it seemed like almost everyone was middle class. But now “the American Dream” is out of reach for more Americans than ever, and the middle class is dying right in front of our eyes. One of the things that was great about America in the post-World War II era was that we developed a large, thriving middle class. Until recent times, it always seemed like there were plenty of good jobs for people that were willing to be responsible and work hard. That was one of the big reasons why people wanted to come here from all over the world. They wanted to have a chance to live “the American Dream” too. But now the American Dream is becoming a mirage for most people. No matter how hard they try, they just can’t seem to achieve it. And here are some hard numbers to back that assertion up.

Read more …

Low-ballin’ it: “63% of those surveyed believe most children in the U.S. will grow up to be worse off than their parents.”

• The American Dream Is Slipping Out Of Reach (MarketWatch)

American dream? More like a pipe dream, according to a research report released Wednesday. The fresh poll from CNN/ORC International shows 59% of adults think the American dream has become impossible for most to achieve, up from 54% in a poll conducted in 2006. What’s more, 63% of those surveyed believe most children in the U.S. will grow up to be worse off than their parents. Older Americans were even more pessimistic, with 70% agreeing that kids won’t do as well as their parents, as opposed to 59% who agreed in the 18-34 and 35-49 brackets. A total of 1,003 adults were surveyed by telephone. Women were more downbeat than men.

Just a day earlier, MarketWatch’s Quentin Fottrell reported on new research showing that more than half of Americans (52%) have had to make at least one big sacrifice over the last three years, just to be able to pay the rent or mortgage. That study also found that many don’t associate the American dream with home ownership anymore. Some say that attitude is linked to still-fresh memories and problems from the housing bust. Still, the CNN poll showed that 54% of those surveyed believe they are better off financially than their parents were at their ages, with 41% saying the opposite.

Read more …

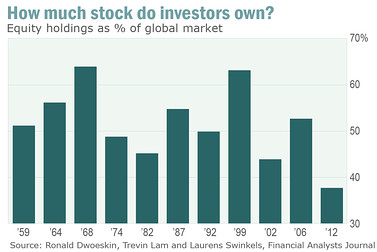

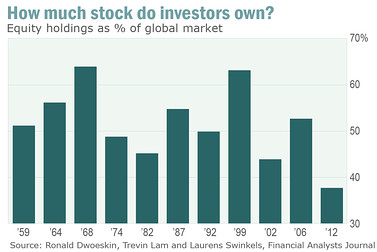

This guy argues that people who don’t own stocks now own bonds. I’m thinking about those who don’t own anything anymore.

• Equity Ownership Falls To Lowest Level In Over Half A Century (MarketWatch)

How often have you heard some Wall Street shill talking about all the cash on the sidelines waiting to come back into the market? Or some pundit worrying that too many investors have rushed into stocks, signaling an imminent sell-off? Well, now, we can safely ignore those claims and others like them. An authoritative new study published recently in the Financial Analysts Journal shows that all investors — individuals and institutions alike — are keeping the lowest percentage of their portfolios in stock in over half a century. According to three Dutch researchers — Ronald Doeswijk, Trevin Lam and Laurens Swinkels — investors held only 37.7% of the $90.6 trillion in global investable assets in stocks in 2012, the most recent year their data covered. That and the 37.1% they invested in equities in 2011 were the lowest exposure to equities investors have had since 1959, when records were first kept.

It’s considerably below what they held even in the late 1970s, before the Reagan-era bull market began, and in the early 2000s after the dot.com bubble burst. In fact, there may be cyclical and structural reasons for this shift, according to Lam, senior analyst in quantitative research at Rabobank, based in the Netherlands. “I do think that the changes in the global multi-asset market portfolio are cyclical,” he told me in an email. “There are periods in which the weight of equities increases at the expense of bonds … [but after the dot.com bust] the weight of bonds rose quickly at the expense of equities.” Equity ownership peaked at around 64% of the total global market portfolio in 1968 and again in 1999, near the top of two great secular bull markets. Yet it never exceeded 53% during the mid-2000s cyclical bull market. To me, 2011-2012’s low numbers show that, though the S&P 500 and other indices are hitting all-time highs, investor confidence still hasn’t recovered from the dot.com bubble and the financial crisis.

Read more …

Welcome to Paul B. Farrell World.

• 7 Ways To ‘Happy Days’ In A Doomsday Century (Paul B. Farrell)

Are you ready? Made your peace? You stockpiling for survival, austerity dead ahead? For millions, this doom-and-gloom mind-set is a mutating virus, infecting many, and with a long history. But as the inequality gap accelerates more Americans, as many as 20%, believe the world will come to an end this century. Yes, today’s doomsdayers, many of them middle class, believe what’s ahead is more than a predictable Investors Business Daily cyclical market correction. More than a systemic global collapse, like 2000 and 2008. More than Prechter’s 100-year bear-market futures. Many a doomsdayer believes we are already past a point of no return.

This dark feeling exists deep within the soul of many Americans. They believe Silicon Valley happy talking X-Prizers and Kurzweil’s overoptimistic “Singularity” will fail us as the promises of new savior technologies fall short, fulfilling economist Robert Gordon’s apocalyptic prediction that by century’s end GDP growth will collapse into a stultifying pre-Industrial Revolution 0.2% rate, plunging America into a new era of scarcity, austerity, anarchy. So what triggers the endgame? Wars. Widespread global wars for scarce resources, water, food, energy. The Bush Pentagon predicted by 2020 “warfare is defining human life.” Even spending billions planning ahead. Fears that between 2050 and 2100 civilized society could collapse. Putin, Jinping, Assad are early warning signs. Peace is an illusion. Anarchy, terrorism and warfare, not diplomacy, are driving the endgame, adding fuel to an explosion of GOP’s disaster capitalism, further accelerating inequality, wealth, conflict.

Read more …

• Iron Ore Prices Plunge Below $100, Massive Glut Building (David Stockman)

The deformations in the global economy arising from the central bank fueled credit deluge of the last two decades become more visible and foreboding by the day. One vector of special salience is the global iron ore market where prices have now punctured the $100 per ton mark to $94, and are down 50% from a peak of $200 in 2012. The action here is not just another commodity cycle, but instead is a proxy for the global credit bubble, China department. During the course of its mad scramble to become the world’s export factory and then its greatest infrastructure construction site, China’s expansion of domestic credit broke every historical record and has ultimately landed in the zone of pure financial madness. To wit, during the 14 years since the turn of the century China’s total debt outstanding–including its vast, opaque, wild west shadow banking system – soared from $1 trillion to $25 trillion, and from 1X GDP to upwards of 3X.

But these “leverage ratios” are actually far more dangerous and unstable than the pure numbers suggest because the denominator – national income or GDP – has been erected on an unsustainable frenzy of fixed asset investment. Accordingly, China’s so-called GDP of $9 trillion contains a huge component of one-time spending that will disappear in the years ahead, but which will leave behind enormous economic waste and monumental over-investment that will result in sub-economic returns and write-offs for years to come. Nearly every year since 2008, in fact, fixed asset investment in public infrastructure, housing and domestic industry has amounted to nearly 50% of GDP. But that’s not just a case of extreme of growth enthusiasm, as the Wall Street bulls would have you believe. It’s actually indicative of an economy of 1.3 billion people who have gone mad digging, building, borrowing and speculating.

Nowhere is this more evident than in China’s vastly overbuilt steel industry, where capacity has soared from about 100 million tons in 1995 to upwards of 1.2 billion tons today. Again, this 12X growth in less than two decades is not just red capitalism getting rambunctious; its actually an economically cancerous deformation that will eventually dislocate the entire global economy. Stated differently, the 1 billion ton growth of China’s steel industry since 1995 represents 2X the entire capacity of the global steel industry at the time; 7X the size of Japan’s then world champion steel industry; and 10X the then size of the US industry.

Read more …

One word. China.

• Why Australia Shares Have Stalled (CNBC)

Australia’s economy has accelerated and its interest rates are at all-time lows, but its stock market hasn’t gained any traction, with shares slipping to two-week lows this week. “Even though the GDP number came in on the strong side, there’s a lot of skepticism on whether that’ll be sustained,” said Shane Oliver, head of investment strategy at AMP Capital. Australia’s economy grew 3.5% on-year in the first quarter, its fastest pace in nearly two years, topping expectations from analysts in a Reuters poll for a 3.3% rise, data on Wednesday showed. But instead of rallying, the S&P/ASX 200 ended Thursday down 0.1% at 5436.884, essentially flat with early November levels. On Friday, it was 0.3% higher in early trade.

“Those (GDP) numbers were good, but the news didn’t actually help the share market because a lot of the growth in GDP actually came from exports, mainly resources exports,” Oliver said, noting many resource players increased production to compensate for lower commodity prices. Even the Reserve Bank of Australia (RBA) keeping interest rates at a record low 2.5% since August of last year hasn’t provided a boost to the market. “The low level of rates is reflective of weak growth,” Oliver said.

Read more …

• China Port Probe Into Metal Financing Rattles Banks (Reuters)

Global trading houses and banks are scrambling to check on their exposure to a probe into metal financing at China’s Qingdao port, as concerns intensify that a crackdown on commodity financing could hit trade in the world’s top metal buyer. The investigation at the world’s seventh-largest port is looking into whether single cargoes of metal were used multiple times to obtain financing, according to industry sources. This means different banks and trading houses were holding separate titles for the same metal, they said. The inquiry has revived worries about the impact of China’s deepening credit crunch on its metal imports, many of which pile up in warehouses to be used as collateral. “Now the banks are all flying down to the port and literally, together with the warehouse people and the traders, are physically counting the stocks,” said a source at a global trading company who visited the port this week.

“When we were there we did hear a couple of traders holding the same title. One was saying that one (cargo) belongs to me the other trader said it belongs to him. They had the same document.” Concern over what is happening at Qingdao has unsettled metal markets, although for now the investigation is known to centre on a single trading company and firms related to it. It remains unclear if it signals the start of a wider investigation by Chinese authorities into metal financing, although checks so far with officials at several other major Chinese ports such as Ningbo have said operations were normal. Reflecting concern among banks, Standard Chartered has suspended new metal financing to some customers in China, three sources familiar with the matter said.

Read more …

Next bomb.

• China’s Property Developers Face Record Wave of Maturing Debt (Bloomberg)

Chinese property developers face a record surge in maturing debt next year, as the country’s banking regulator says it’s monitoring risks from the cooling real-estate market. The amount of dollar-denominated bonds that must be repaid in 2015 will jump to $2.83 billion, the most in data compiled by Bloomberg going back to 1993. Most Chinese builders listed on the mainland or in Hong Kong are behind fiscal-year sales targets and achieved less than 33% of their target in the first four months, analysis based on Bloomberg data show. The China Banking Regulatory Commission will monitor the financial and cash-flow conditions of developers, and will support first-time homebuyers’ borrowing needs, Vice Chairman Wang Zhaoxing said at a briefing in Beijing today. Moody’s revised its credit outlook for Chinese builders to negative in May after home sales slumped 10% in the first four months.

Chinese Premier Li Keqiang must balance efforts to staunch off-balance sheet lending known as shadow banking, which has been a key source of funding for many smaller property firms, while preventing widespread debt defaults. The March collapse of closely held developer Zhejiang Xingrun Real Estate fueled speculation a shakeout among the nation’s almost 90,000 real estate companies could follow. While the large, top-rated developers will be able to cope with their refinancing needs, smaller peers with ratings below B3 or Caa will face greater pressure, Franco Leung, an analyst with Moody’s, said. “Smaller developers that have weak access to onshore bank loan financing and high trust-loan exposure, they would be most vulnerable,” he said. Chinese builders raised 49% less through trusts last quarter as the collapse of Zhejiang Xingrun highlighted default risks. Issuance of property-related trusts, which target wealthy investors, slid to 50.7 billion yuan ($8.1 billion) in the first quarter from 99.7 billion yuan in Q4.

Read more …

Yeah, well, that’s the metals trade issue, isn’t it? It’s a power game.

• China Regulator To Tighten Shadow Banking Supervision (Reuters)

China will tighten supervision over the shadow banking sector, an official from the country’s banking regulator said on Friday, amid concerns over unofficial lending by the country’s financial institutions. The official also told a news conference that the regulator will improve ways to manage deposit-to-loan ratios, an indicator of a bank’s ability to absorb risk, and classify bad loans. China’s central bank pledged in March to improve its monitoring of the shadow banking sector, as part of an effort to make its data on bank credit and interest rates more accurate. The government has been trying to rein in the shadow banking sector, which has grown rapidly in China since 2010, when banks began running up against limits on expanding loans through traditional channels. The term shadow banking refers to any financing provided by a non-bank entity, such as credit guarantee firms, trust companies and other lenders, including pawn shops, for Chinese borrowers.

CBRC also plans to tighten control over provincial governments’ financing and lending in property and industries suffering from over-supply, according to a press release handed out at the news conference. But China will not stop financing these industries immediately, it added. “Currently, the economy, broadly speaking, is stable. But downward pressures are relatively significant which is a reflection of … imperfect financing structures, inefficiencies in finance allocation and use and difficulties with SME (small and medium enterprises) financing,” the statement said. CBRC will improve credit asset securitization, and plans to maintain steady monetary policy and make minor adjustments as needed, it added. The regulator added that it will continue to oversee online financing to ensure it develops in a healthy way.

Read more …

Expand credit? In China? Is that even possible anymore? $25 trillion is not doing the trick?

• China Regulator Pledges to Expand Credit as Economy Slows (Bloomberg)

China’s banking regulator vowed to expand loans and cap borrowing costs, seeking to boost the supply of funds to the real economy as growth slows amid a clampdown on shadow financing. Lending to small businesses, major infrastructure projects and first-home buyers will be a priority, the China Banking Regulatory Commission said in a statement today. To give banks more capacity to lend, the regulator may ease the ratio of loans to deposits by including some stable sources of deposits in the calculation, CBRC Vice Chairman Wang Zhaoxing said. Premier Li Keqiang said in a May 30 State Council meeting that the nation will cut funding costs and maintain reasonable growth in credit as economists forecast the weakest expansion in 24 years. Banks’ quarter-end cash demand to meet with regulatory requirements such as loan-to-deposit ratio and a crackdown on off-balance-sheet lending combined to push interbank lending rates to a record in June last year.

“To revitalize the economy, China needs to adjust the structure of its credit supply, especially when demand from big state-owned enterprises is waning while small private firms have little access to funding,” said Rainy Yuan, a Shanghai-based analyst at Masterlink Securities Corp. Yuan said the CBRC could start counting some interbank deposits in the loan-to-deposit ratio, giving banks room to expand credit and bolster growth in the world’s second-largest economy. China’s banking law caps a bank’s loans at no more than 75% of its deposits to limit leverage. Banks are currently lending about 65% of their deposits, and the function of the ratio to prevent credit from overheating will remain unchanged, Wang said at a news briefing in Beijing today.

Read more …

Two articles. In the first, pensioners get killed by rising prices. In the second, Abe takes away their pensions to gamble with.

• Abenomics Spurs Most Misery Since ’81 as Retiree Skimps on Meat (Bloomberg)

Mieko Tatsunami finds Prime Minister Shinzo Abe’s drive to reflate Japan’s economy hard to digest. “The price of everything we eat on a daily basis is going up,” Tatsunami, 70, a retired kimono dresser, said while shopping in Tokyo’s Sugamo area. “I’m making do by halving the amount of meat I serve and adding more vegetables.” Tatsunami’s concerns stem from the price of food soaring at the fastest pace in 23 years after April’s sales-tax increase. Rising prices helped push the nation’s misery index to the highest level since 1981, while wages adjusted for inflation fell the most in more than four years. With food accounting for one quarter of the CPI and the central bank looking to drive inflation higher, a squeeze on household budgets threatens consumption as Abe weighs a further boost in the sales levy.

The prime minister may be forced to ease the pain with economic stimulus, cash handouts or tax exemptions championed by his coalition partner. “Price hikes without confidence that wages are going to rise will hurt appetite for spending,” said Masamichi Adachi, senior economist at JPMorgan Chase & Co. in Tokyo. “Abe has to raise people’s belief that the economy will improve.” Food prices rose 5% in April from a year earlier, with fresh food climbing 10%. Onions soared 37%, and salmon — a staple of the nation’s lunch boxes — jumped 30%. Abe lifted the sales tax by 3%age points on April 1. The yen’s 5% fall against the dollar over the year through April boosted the cost of imports in a nation that is only 39% self-sufficient on a calorie basis and more reliant on inbound shipments of fossil fuels after a nuclear disaster in 2011.

Read more …

• Japan Seeks Faster Pension Fund Revamp (WSJ)

Japan gave its giant public pension fund another nudge Friday to accelerate changes to its investment strategy. Japan’s welfare minister said he would ask the nation’s nearly ¥130 trillion ($1.27 trillion) Government Pension Investment Fund to bring forward a reallocation of its portfolio. The push is the latest step in Prime Minister Shinzo Abe’s efforts to make the pension fund—the largest of its kind in the world—a more aggressive investor both to ensure it meets its payout commitments to retirees and to reinvigorate financial markets. Moves to encourage the pension fund to buy more domestic stocks and rely less on domestic bonds are being closely watched by markets given the size of the GPIF and its likely influence on other domestic pension funds. “We believe a change in the GPIF’s portfolio must be dealt with as soon as possible” in light of changes in the state of the economy and the investment environment, welfare minister Norihisa Tamura told reporters after a regular cabinet meeting Friday.

The GPIF is overseen by the health, labor and welfare ministry. Mr. Abe’s administration has specifically targeted an overhaul of the GPIF’s 60% weighting to low-yielding domestic bonds. Overseas investors have anxiously watched for the GPIF to move, as a new portfolio is expected to include a higher allocation to domestic stocks and foreign assets. Even a 1% change in the fund’s portfolio could send more than $10 billion into markets other than Japanese debt. Expectations for the GPIF to increase stock buying have also supported stock prices in recent weeks, fund managers say. The Nikkei is set to mark three consecutive weeks of gains, its longest winning streak since December. The index has risen 6.8% during the period.

Mr. Tamura said he had informed Prime Minister Shinzo Abe on Tuesday of the planned acceleration of the GPIF’s reallocation, and gained his approval. Separately, Japan’s finance minister said he expected a decision on the changes to the portfolio to take place by the end of the calendar year. “The GPIF chief had previously said that it would be complete before the end of the year. I’m expecting the decision will be further brought forward,” Taro Aso said. The GPIF currently has a 60% target allocation to domestic bonds, 12% to domestic stocks, 11% to foreign bonds, 12% for foreign stocks, and 5% to short-term assets.

Read more …

Bank of America schlepps itself from settlement to settlement, but France’s BNP Paribas faces criminal charges. It it any wonder the French say NON?

• BofA in Talks to Pay At Least $12 Billion to Settle Probes

Bank of America is in talks to pay at least $12 billion to settle civil probes by the Justice Department and a number of states into the bank’s alleged handling of shoddy mortgages, an amount that could raise the government tab for the bank’s precrisis conduct to more than $18 billion, according to people familiar with the negotiations. At least $5 billion of that amount is expected to go toward consumer relief—consisting of help for homeowners in reducing principal amounts, reducing monthly payments and paying for blight removal in struggling neighborhoods, these people said. As the negotiations with the government heat up, the bank is being pressed to pay billions more than the $12 billion it is offering. The North Carolina bank’s total tab to end government probes and lawsuits related to its conduct in the runup to the financial crisis is increasingly likely to surpass the record $13 billion that J.P. Morgan paid last year to settle similar allegations, these people said.

Bank of America has already struck a $6 billion settlement, by the Justice Department’s measure, with the Federal Housing Finance Agency. If finalized, a settlement on that scale would mark another major penalty for a large financial institution, as the Justice Department presses a number of cases against global banks. The potential tab would leap ahead of other large penalties levied by the Justice Department and U.S. regulators. Even at a giant firm like Bank of America, the second-largest bank in the country by assets, a $12 billion fine would exceed the firm’s 2013 profit of $11.43 billion. That profit was the bank’s highest in six years, but the looming record legal settlement threatens to break the firm’s momentum under Chief Executive Brian Moynihan.

Read more …

• NY Banking Regulator to Seek BNP Executive Dismissals in Probe (Bloomberg)

New York’s top banking regulator Benjamin Lawsky is pressing BNP Paribas to dismiss one its top executives as part of settlement negotiations with the U.S. over alleged sanctions violations, according to a person familiar with the matter. Lawsky wants the bank to remove Chief Operating Officer Georges Chodron de Courcel, said the person, who asked not to be identified because the discussions are private. Lawsky is also seeking the departure of another senior executive and about 12 other bank employees, the person added. Chodron de Courcel and the others haven’t been accused of wrongdoing. U.S. authorities are said to be seeking as much as $10 billion – a record criminal penalty – over BNP’s dealings in sanctioned countries including Sudan and Iran. Lawsky has said that individuals, not just companies, must be held accountable to deter future wrongdoing. He also wants to suspend BNP’s dollar-clearing operations in New York, which has become a sticking point in the negotiations, a person familiar with the matter has said.

Read more …

• Barclays Fine Spurs New U.K. Scrutiny of Derivatives Conflicts (Bloomberg)

Britain’s markets regulator plans to scrutinize the conflicts of interest banks face when they use derivatives after fining Barclays for manipulating the price of gold to avoid a pay-out to a client. The Financial Conduct Authority will examine how investment banks manage such conflicts in coming months, with so-called barrier options “one of the most obvious examples of a conflict,” CEO Martin Wheatley said in a June 4 interview in New York. The FCA last month fined Barclays $44 million after finding a former trader had suppressed the London gold fixing on June 28, 2012 to avoid paying out $3.9 million to a client who had taken out a barrier option with the London-based bank. Such contracts are a winner-takes-all bet on whether an asset will reach a certain price or not.

“Barrier options are one of those classic cases where there are likely to be conflicts,” Wheatley said. If there is “the ability to influence a price that prevents a payoff, and therefore gain a significant profit-and-loss, that is a conflict that needs managing.” British regulators are trying to revive confidence in benchmarks that have been tainted by manipulation scandals in recent years. At least nine firms have been fined more than $6 billion for attempting to rig the London interbank offered rate and similar interest-rate benchmarks. Agencies on three continents are also investigating allegations traders tried to manipulate key gauges in the $5.3 trillion-a-day currency market. The London gold fixing is a ritual dating back to 1919. Today, it’s led by representatives from four banks who on, a daily conference call, agree a price at which the metal is bought and sold. The rate, used as a benchmark by miners and jewelers, has come under criticism in the past year for being vulnerable to manipulation.

Read more …

Will this lift the appreciation for Godfather 3? Francis better watch his back.

• Pope Sacks Board Of Vatican’s Financial Watchdog (Reuters)

Pope Francis sacked the five-man board of the Vatican’s financial watchdog on Thursday – all Italians – in the latest move to break with an old guard associated with a murky past under his predecessor. The Vatican said the pope named four experts from Switzerland, Singapore, the United States and Italy to replace them on the board of the Financial Information Authority (AIF), the Holy See’s internal regulatory office. The new board includes a woman for the first time. All five outgoing members were Italians who had been expected to serve five-year terms ending in 2016 and were laymen associated with the Vatican’s discredited financial old guard.

[..] Francis, who has said Vatican finances must be transparent in order for the Church to have credibility, decided against closing the IOR on condition that reforms, including closing accounts by people not entitled to have them, continued. Only Vatican employees, religious institutions, orders of priests and nuns and Catholic charities are allowed to have accounts at the bank. But investigators have found that a number were being used by outsiders or that legitimate account holders were handling money for third parties.

Monsignor Nunzio Scarano, a former senior Vatican accountant who had close ties to the IOR, is currently on trial accused of plotting to smuggle millions of dollars into Italy from Switzerland in a scheme to help rich friends avoid taxes. Scarano has also been indicted on separate charges of laundering millions of euros through the IOR. Paolo Cipriani and Massimo Tulli, the IOR’s director and deputy director, who resigned last July after Scarano’s arrest, have been ordered to stand trial on charges of violating anti-money laundering norms.

Read more …

Not that giant, Wolf, $13 billion.

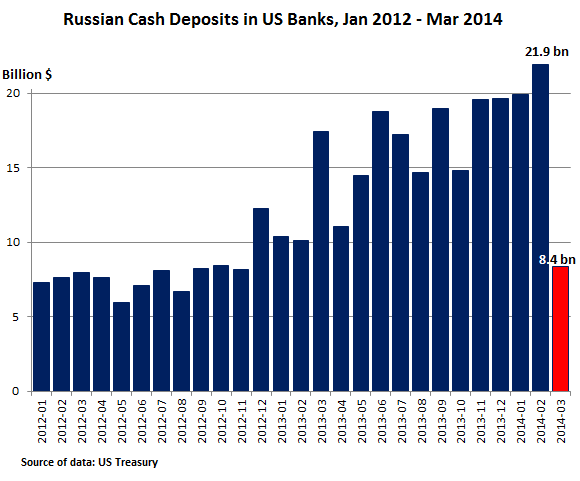

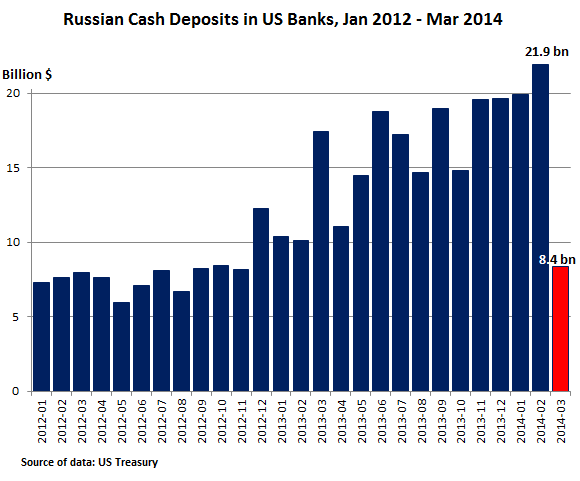

• Giant Sucking Sound: Russian Money Yanked From US Banks (TPIt)

US Banks enjoyed more or less steadily climbing, or rather soaring, deposits by Russian institutions and individuals, having tripled in just two years to $21.6 billion by February, according to the US Treasury. It may seem a bit counterintuitive that in times of ZIRP anyone would put any money in any US banks, and it may seem even more counterintuitive that Russians who have other opportunities with their money would voluntarily subject themselves to the Fed’s financial repression. But from the Russian point of view, earning near-zero interest on their deposits in the US and losing money slowly to inflation must have seemed preferable to what they thought might happen to their money in Mother Russia. Money that isn’t nailed down has been fleeing Russia for years, even if it ends up in places like Cyprus where much of it sank into the cesspool of corruption that were the Cypriot banks, which finally collapsed and took that Russian money down with them.

By comparison, the US must have seemed like a decent place to stash some liquid billions. But in March, the Ukrainian debacle burst into the foreground with Russia’s annexation of Crimea, which wasn’t very well received in the West. The US and European governments rallied to the cause, and after vociferously clamoring for a sanction spiral, they actually imposed some sanctions, ineffectual or not, that included blacklisting some Russian oligarchs and their moolah. So in March, without waiting for the sanction spiral to kick in, Russians yanked their moolah out of US banks. Deposits by Russians in US banks suddenly plunged from $21.6 billion to $8.4 billion. They yanked out 61% of their deposits in just one month! They’d learned their lesson in Cyprus the hard way: get your money out while you still can before it gets confiscated.

Read more …

• Tim Geithner And The Con-Artist Wing Of The Democratic Party (Matt Stoller)

The most consequential event of this young century has been the financial crisis. This is a catchall term that means three different things: an economic housing boom and bust, a financial meltdown, and a political response in which bailouts were showered upon the very institutions that were responsible for the chaos. We will be seeing the fallout for decades. Today, in Europe, far-right fascist parties are on the rise, climbing the unhappiness that the crisis-induced austerity has unleashed. China is looking away from the West as a model of development. In the US, Congress is more popular than certain sexually transmitted infections* but little else, and all institutions of national power are losing their legitimacy. At the same time, the financial system did not, in the end, collapse, and there was no repeat of the Great Depression. More than anyone else, it was then US Treasury Secretary Tim Geithner who shaped this response, and who bears praise, blame, and responsibility for the outcome.

And finally, with the release of his book, Stress Test: Reflections on Financial Crises, Geithner is getting to tell his side of the bailout story. Stress Test is an important book, because Tim Geithner is an important man. Economist Thomas Piketty may be explaining essential social dynamics of inequality, and Elizabeth Warren may be describing the need for Americans to get a break from the banks, but it is Tim Geithner who, for better or worse, actually shaped our institutional, legal, political, and economic dynamics at the moment when the system was most malleable. That said, Geithner is not a popular man, and he knows it. “I never found an effective way to explain to the public what we were doing and why,” he writes. “We did save the economy, but we lost the country doing it.” He knows he’s never going to win the argument, he knows he can’t possibly convince people he did the right thing. Even his book tour is being described as an undertaking that “could have been worse.” But he’s going to try to convince you anyway.

Read more …

All for it.

• World Needs UN GMO Watchdog: Russian Lawmakers (RT)

Russian lawmakers advocate creation of an international UN agency not only to strictly control the turnover of GMO products worldwide, but with a top priority mission to scrutinize how consuming GMO foods would affect human health in the long run. Aggressive distribution of GMO worldwide is raising huge concerns for human health, said Russian Federation Council speaker Valentina Matvienko. The speaker urged the executive branch to make a request to the UN General Assembly to initiate the creation of an international GMO watchdog. “It’s absolutely clear that the GMO problem is a global issue,” Valentina Matvienko said. The speaker of the upper chamber of the Russian parliament also spoke in favor of facilitating production of organic food in the country as “the volumes of imported agricultural goods and food remain substantial,” Matvienko said.

Russian authorities are taking measures to contain uncontrollable spread of GMO foods against the background of regular worldwide mass rallies over the distribution of GMO products created by transnational corporations, such as Monsanto. In the US, where agricultural producers are not obliged to mark their products if they contain GMO-originated ingredients, people stage large protests, claiming that from 80% to 95% of the American population would want to have GMO foods labeled. In Russia, where parliament is seeking a moratorium on GMO production, the situation with GMO consumption has not yet developed into a serious problem, though membership in the WTO has opened up the Russian market for GMO products. [..]

Russian citizens do no welcome the products containing GMO either. According to the All-Russian Public Opinion Research Center, a survey taken on May 24-25 in 42 regions of the Russian Federation found that 54% of respondents would not buy food marked with a “GMO inside” label. A majority of Russian citizens would prefer organic food to its genetically modified counterpart, even if that one is considerably cheaper (74%), packed in a more attractive manner (76%) or has a longer expiry date (78%).

Read more …

It will keep getting crazier.

• Vodafone Reveals Secret Wires That Allow State Surveillance (Guardian)

Vodafone, one of the world’s largest mobile phone groups, has revealed the existence of secret wires that allow government agencies to listen to all conversations on its networks, saying they are widely used in some of the 29 countries in which it operates in Europe and beyond. The company has broken its silence on government surveillance in order to push back against the increasingly widespread use of phone and broadband networks to spy on citizens, and will publish its first Law Enforcement Disclosure Report on Friday. At 40,000 words, it is the most comprehensive survey yet of how governments monitor the conversations and whereabouts of their people. The company said wires had been connected directly to its network and those of other telecoms groups, allowing agencies to listen to or record live conversations and, in certain cases, track the whereabouts of a customer. Privacy campaigners said the revelations were a “nightmare scenario” that confirmed their worst fears on the extent of snooping.

In Albania, Egypt, Hungary, India, Malta, Qatar, Romania, South Africa and Turkey, it is unlawful to disclose any information related to wiretapping or interception of the content of phone calls and messages including whether such capabilities exist. “For governments to access phone calls at the flick of a switch is unprecedented and terrifying,” said the Liberty director, Shami Chakrabarti. “[Edward] Snowden revealed the internet was already treated as fair game. Bluster that all is well is wearing pretty thin – our analogue laws need a digital overhaul.” In about six of the countries in which Vodafone operates, the law either obliges telecoms operators to install direct access pipes, or allows governments to do so. The company, which owns mobile and fixed broadband networks, including the former Cable & Wireless business, has not named the countries involved because certain regimes could retaliate by imprisoning its staff.

Read more …