DPC Unloading bananas, New Orleans 1903

“.. a dystopian post-apocalyptic future where the main protagonists battle each other to survive.”

• Oil Below $49 As Sector Faces Its ‘Hunger Games’ (CNBC)

Oil’s dramatic fall in price will have serious effects on revenues and spending in the sector, according to some industry analysts, with one investment firm predicting a sector-wide “recession” that will last for several years. Both U.S. crude and Brent futures fell to fresh 5-1/2-year lows on Tuesday, with the former slipping below $49. Weak global demand and booming U.S. oil production are seen as the key reasons behind the price plunge, as well as OPEC’s reluctance to cut its output. This sector slump will lead to a fight to the death for oil firms, according to analysts at Bernstein Research. The research firm likened the current environment to the Hollywood movie “The Hunger Games”, which portrays a dystopian post-apocalyptic future where the main protagonists battle each other to survive.

“Our research convinces us an oil services recession is largely unavoidable at even $80 a barrel…The Hunger Games have begun,” Nicholas Green, a senior analyst at the company, said in a note on Tuesday morning. Bernstein’s Green believes that offshore activity will also face a “structural recession.” He predicts that there will be only half of the new work available in 2015, compared to last year, and forecasts no material recovery before 2017. Other possible casualties of the sector’s struggle for survival are the high-risk and reward exploration and oil production companies (E&P), ratings agency Moody’s said Tuesday. If oil prices average $75 a barrel in 2015, then North American E&P companies would likely reduce their capital spending by around 20% from last year, according to Moody’s.

It could even be cut by 40% it oil starts at below $60 a barrel, it added. Oilfield services companies, or OFS, are companies that provide services to the E&P industry, and could face an earnings crunch of 12% to 17% if oil averages $75 a barrel in 2014, according to Moody’s. An average price below $60 a barrel in 2015 could drive earnings down by 25 to 30%, it added. Meanwhile, midstream operators – which are involved in the transportation of oil – would come under significant earnings pressure if this spending is cut, according to the ratings agency.

Read more …

“When the Saudis are cutting prices, the markets are not going to go higher.”

• Brent Falls Below $52 As Oil Hits New Five And A Half Year Lows (Reuters)

Oil prices sank to fresh 5-1/2-year lows on Tuesday, extending losses after a 5% plunge in the previous session as worries over a global supply glut intensified. Brent crude fell by 3% to below $52 a barrel as cuts to monthly oil selling prices for European buyers by top OPEC producer Saudi Arabia heightened worries about oversupply. “Saudi Arabia is showing no signs of pulling back,” said Bjarne Schieldrop, chief commodity analyst with SEB in Oslo. “Stocks are continuing to build, and there is an increase in contango.” While Saudi Arabia increased its selling price to Asia, some analysts said the cuts to Europe reflect the kingdom’s deepening defense of market share. This added to bearish data over the weekend showing that Russia’s 2014 oil output hit a post-Soviet-era high and exports from Iraq, OPEC’s second-largest producer, reached their highest since 1980.

On Tuesday, the UAE’s Abu Dhabi National Oil Company set the December retroactive selling price for its benchmark Murban crude at $60.65 a barrel, its lowest level since May 2009. “It’s hard to pinpoint a specific downward pressure,” Schieldrop said. Brent crude fell as low as $51.23 a barrel on Tuesday, its lowest level since May 2009. It was trading at $51.31 at 0942 GMT (0442 ET), down $1.80. U.S. crude was at $48.54, down $1.50, after falling to $48.47, its lowest since April 2009. Jitters over political uncertainty in Greece added to an already faltering eurozone economy, raising questions about energy demand in Europe and compounding the bearish sentiment. A slew of factors was keeping up the downward pressure on prices, analysts said, pointing to concerns about the Greek economy, high oil output from Russia, Iraq and the United States, and a stronger dollar. “The weak euro should be one of the reasons,” said Tamas Varga of PVM, adding: “When the Saudis are cutting prices, the markets are not going to go higher.”

Read more …

As I said yesterday, this oil thing is the real deal.

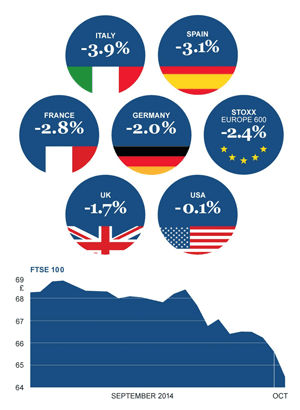

• Oil Drama Drives Shares Lower In Asia And Europe (Reuters)

European shares sank for a third day on Tuesday as a slide in oil prices showed no sign of easing off, supporting traditional safe-haven assets such as top-rated government bonds, the Japanese yen and the Swiss franc. Asian shares had slumped overnight after another day of drama on oil markets that drove U.S. crude to less than $50 a barrel for the first time since the first half of 2009 and handed Wall Street its worst losses in three months. The resulting bid for safety drove the average of yields on German, U.S. and Japanese 10-year debt to less than 1% for the first time. Also hit by a poor reading from a purchasing managers’ survey in Italy, all of Europe’s major exchanges were in negative territory an hour into morning trade.

“Global risk sentiment has been hurt by sliding stocks and oil prices. That is leading to a perception that there is a lack of demand and that has implications for global growth,” said Jeremy Stretch, head of currency strategy at CIBC World Markets. The FTSEuroFirst 300 index of leading shares, along with France’s CAC40 and Germany’s DAXI, were all down 0.8%. Britain’s oil and gas heavy FTSE index lost 1.3%. Japan’s Nikkei dropped 3%, its largest fall in almost 10 months while South Korean shares fell 1.7% to a 1-1/2-year low. Even high-flying mainland Chinese shares pulled back after hitting 5-1/2-year highs earlier in the session.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.4%. The slide in oil prices has shown little sign of abating in the new year, plunging as much as 6% on Monday as investors continue to reprice for broadly lower global demand and the impact of heavy U.S. shale drilling. Brent crude fell by another 1.5% to less than $53 after data showed Russian oil output at post-Soviet era highs and Iraqi oil exports near 35-year peaks. “Falls in oil prices are going beyond many people’s expectations. This will put pressure on the earnings of U.S. energy firms,” said Hirokazu Kabeya, senior strategist at Daiwa Securities in Tokyo.

Read more …

“.. the pickup in interest in far out-of-the money calls is noteworthy for what it says about market psychology.”

• Some Traders Are Betting On $20 Oil (MarketWatch)

Here’s how bearish some traders are getting on oil these days. Even before Nymex WTI crude futures on Monday dipped below $50 a barrel in the latest stage of the crude rout, Stephen Schork, editor of the widely followed Schork Report, took note of trading in well out-of-the-money put options (puts give you the right, but not the obligation, to sell the underlying futures contract at a specific strike price). Unsurprisingly, open interest (the number of open contracts) in $50 strike-price puts on the February WTI futures contract had risen to 22,537 as of Friday’s close from 193 contracts at the beginning of December. Open interest on $45 puts rose from 8 to 36,113, while open interest in $40 puts rose from 1 to 9,864.

Here’s where it gets interesting: Open interest on $30 puts on the March futures contract rose to 2,127 from 34, while $30 puts on the June contract rose from 35 to 51,252. In addition, there has even been some light trading in June $20 puts, with open interest at 176 as of Friday’s close. “In other words, bets on sub-$30 crude oil in June are now 1.7 times greater than physical inventory at the Nymex terminal complex in Cushing,” Schork said in a note, referring to the Oklahoma delivery point for WTI oil. Of course, a trader can make money on a put even if the price of the underlying contract doesn’t fall below the strike price. The value of the option can rise as the price of the commodity declines. But the pickup in interest in far out-of-the money calls is noteworthy for what it says about market psychology.

Is it a sign that market sentiment has moved to an extreme, setting the stage for a rebound? The economics of the oil market are effectively “broken” and that’s left “psychology” to drive price action, Schork said. Even though the market is oversold according to technical measures, that’s been the case for the past three months, he said. “We could get a rebound to $70, but we could see $30 before we see $70, so why do you risk $20 to win $20,” he said. “So no picking the bottom here.”

Read more …

All suppliers hurt. A lot.

• Caterpillar Is Latest Victim Of Sliding Oil Price (MarketWatch)

Caterpillar shares tumbled Monday as the company became the latest victim of the sliding price of oil. Caterpillar’s stock umbled almost 6% after J.P. Morgan downgraded it to underweight from neutral on concerns about the company’s direct exposure to oil and gas, and indirect exposure to mining, U.S. construction and emerging markets. The maker of diggers and dozers’ direct exposure to the sector is equal to about $6.5 billion, or 12% of revenue, while its indirect exposure may be as much as 15% of revenues, analysts wrote in a note. That means almost 30% of its total revenue is facing pressure in 2015 and 2016.

Caterpillar supplies turbines to offshore rigs, as well as reciprocating engines and transmissions for on-site drilling. It also provides construction equipment that is used in infrastructure development, along with aftermarket and other services. “Its indirect exposure may be greater than anticipated,” said the note. “Our analysis suggests that since 2010 U.S. construction equipment demand has been strongly correlated with the expansion of fracking and, as a result, we would expect to see a slowdown in equipment demand in 2015.” The North American construction market accounts for about 17% of Caterpillar’s revenue, and about 5% of its total revenue may be tied to oil and gas states.

Caterpillar also has exposure to Canadian Oil Sands, which is likely to experience a significant slowdown in demand. Emerging markets and the Middle East are other key markets that are expected to be hurt by the falling oil price. “Finally, the stronger dollar may also weigh on [Caterpillar’s] competitiveness against its international competitors and, given that senior executive compensation is based partly on market share, we would expect pricing to come under increasing pressure as we go forward,” said the note. Shares of the Dow Jones Industrial Average component have fallen 5.6% in the last three months, while the Dow has gained 2.9%.

Read more …

This is how Reuters reports the Saudi move, scroll down to see how Bloomberg does it.

• Saudi Slashes Monthly Oil Prices To Europe; Trims US., Ups Asia (Reuters)

Saudi Arabia made deep cuts to its monthly oil prices for European buyers on Monday, a move some analysts said reflects the kingdom’s deepening defense of market share, although it also hiked prices in Asia from record lows. State oil firm Saudi Aramco cut the official selling price (OSP) for its Arab Light crude to Northwest Europe, a region that buys only a small proportion of Saudi Arabia’s crude, by $1.50 a barrel for February, putting it at a discount of $4.65 a barrel to the Brent Weighted Average (BWAVE), the lowest since 2009. However, Aramco also raised its February price for its Arab Light grade for customers for Asia – the largest of its major markets, accounting for more than half of its exported crude – by 60 cents a barrel versus January to a discount of $1.40 a barrel to the Oman/Dubai average.

The $2 discount to Asia in January was the largest in records going back more than a decade, but traders had been expecting Aramco to hike prices by at least 20 to 30 cents due to the narrowing spread in the Dubai market. The Arab Light OSP to the United States, the fifth consecutive monthly cut, was set at a premium of 30 cents a barrel to the Argus Sour Crude Index (ASCI) for February, down 60 cents from the previous month. The Kingdom’s move to cut its OSPs has been perceived by many traders as a signal of its decision to abandon efforts to shore up falling crude oil prices and, instead, focus on maintaining its share of key markets.

“The moves are reinforcing that the Saudis just don’t intend to do anything to rebalance (price) levels,” said Gene McGillian, senior analyst at Tradition Energy in Stamford, Connecticut. Benchmark Brent oil prices held on to earlier deep losses following the publication of the Saudi OSPs on Monday, trading at around $53.50 a barrel, down $3 on the day. Some analysts, however, have said they see the changes in monthly differentials as a simple reflection of deteriorating market conditions, not an indicator of policy. One trader said that the cuts to Europe may be a result of trying to price out West African barrels from Europe.

Read more …

Bloomberg intentionally cherrypicks ithe headline, but does state in the article: “It decreased 11 prices globally and increased six ..” Journalism? You tell me.

• Saudi Arabia Raises Price of Main Oil Grade for Asian Buyers (Bloomberg)

Saudi Arabia raised the cost of its oil sales to Asia in February, prompting speculation the world’s biggest exporter is retreating from using record price discounts to defend market share. Saudi Arabian Oil will sell its Arab Light grade for $1.40 a barrel less than a regional average next month, the company said yesterday in a statement. That’s a narrowing from January, when the discount was $2, the biggest in at least 14 years. It decreased 11 prices globally and increased six. Brent oil fell 5.9% yesterday.

Oil prices collapsed 32% since OPEC decided to maintain its output target on Nov. 27, amid signs Saudi Arabia and other members are determined to let North American shale drillers and other producers share the burden of reducing an oversupply. When Aramco lowered prices for November it prompted speculation the nation was seeking to preserve market share. “They’re putting the brakes on a little bit,” Leo Drollas, a London-based independent consultant and former chief economist at the Centre for Global Energy Studies, said by phone. “It’s a little message that maybe prices are going down too far too quickly, and this is a little signal that they’re looking at things.”

Read more …

Not doing so well.

• Oil Below $55 May Force Norway to Cut Rates Again (Bloomberg)

As oil drops below $55 a barrel, speculation is growing that the central bank of western Europe’s biggest crude producer will need to cut rates again. A 54% slump in Brent crude since a June high has pummeled the offshore industry in Norway, where oil and gas make up 22% of gross domestic product. Over the same period the krone has lost about 20% against the dollar and 8% against the euro. The OBX benchmark stock index is down about 12%. The central bank delivered a surprise rate cut last month it said was triggered by plunging crude prices. Since then the oil price development has proven even worse than the central bank anticipated. In an interview yesterday, Governor Oeystein Olsen said $55 oil is “clearly lower” than expected in December.

At Norway’s biggest bank, DNB, economists say Olsen will need to reduce rates again in June from 1.25%. “The weaker krone buys Norges Bank some time before they make another cut,” Kjersti Haugland, an analyst at DNB, said by phone. After lowering rates for the first time in almost three years on Dec. 11, Olsen said he sees a “50-50 chance” of more easing this year. Nordea Bank, Scandinavia’s biggest bank, says that means another two reductions, bringing the benchmark deposit rate to 0.75%. The central bank, which also oversees Norway’s $850 billion sovereign wealth fund, plans to provide more detail on how oil prices will shape its policy in March, Olsen said. Brent crude will need to trade above $70 a barrel before pressure on monetary policy abates, Olsen said in a Dec. 12 interview. Since then, the price of oil has dropped 14% to its lowest level in more than five years.

Read more …

Slaughterhouse.

• Oilfield Writedowns Loom as Market Collapse Guts Drilling Values (Bloomberg)

Tumbling crude prices will trigger a flood of oilfield writedowns starting this month after industry returns slumped to a 16-year low, calling into question half a decade of exploration. With crude prices down more than 50% from their 2014 peak, fields as far-flung as Kazakhstan and Australia are no longer worth pumping, said a team of Citigroup analysts led by Alastair Syme. Companies on the hook for risky, high-cost projects that don’t make sense in a $50-a-barrel market include international titans such as Royal Dutch Shell and small wildcatters like Sanchez Energy. The impending writedowns represent the latest blow to an industry rocked by a combination of faltering demand growth and booming supplies from North American shale fields.

The downturn threatens to wipe out more than $1.6 trillion in earnings for producing companies and nations this year. Oil explorers already are canceling drilling plans and laying off crews to conserve cash needed to cover dividend checks to investors and pay back debts. “The mid-cap and small-cap operators are going to be hardest hit because this is all driven by their cost to produce,” said Gianna Bern, founder of Brookshire Advisory, who also teaches international finance at the University of Notre Dame. An index of 43 U.S. oil and gas companies lost about one-fourth of its value since crude began its descent from last year’s intraday high of $107.73 a barrel on June 20. The price dipped below $50 on Jan. 5, the lowest since April 2009.

The decline represents a $4.4 billion drop in daily revenue for oil producers, which equates to $1.6 trillion on an annualized basis, Citigroup researchers led by Edward Morse said in a Jan. 4 note to clients. The oil-market rout is exposing projects dating as far back as 2009 that were either poorly executed or bad ideas to begin with, Syme’s team said in a note to clients. Shell, Europe’s largest energy producer, may have as much as 5% of its capital tied up in money-losing projects. For U.K.-based BG Group, the figure could be as high as 8%, according to the Citi analysts. The biggest swath of asset writedowns probably will happen among U.S. explorers such as Sanchez, Matador and Clayton Williams that don’t have the same financial discipline as bigger producers such as Marathon Oil, Bern said.

Read more …

Very true, Ambrose: “Mr Draghi can hardly agree to buy Greek bonds three days before the likely election of a party that has vowed to repudiate that same debt.”

• Greece vs Europe: Who Will Blink First? (AEP)

There is a whiff of 1914 to the latest Balkan showdown. Everybody thinks everybody else is bluffing, all of them betting that a calamitous chain reaction will be averted. In Germany, Der Spiegel reports that Angela Merkel thinks Greece can be ejected safely from the euro, if the rebel Syriza party wins the elections on January 25 and carries out its pledge to tear up Greece’s hated “memorandum” with the EU-IMF “Troika”. The German Chancellor’s team are blanketing the airwaves in what looks like a campaign to drive the threat home. “We are past the days when we still have to rescue Greece,” said Michael Fuchs, the parliamentary leader of Mrs Merkel’s Christian Democrats. “The situation has completely changed. It is entirely different from three years ago when we didn’t have the backstop defences in place. Greece is no longer ‘systemically relevant’ for the euro.” He added wickedly that the single currency might actually be stronger without the Balkan troublemaker.

It was revealed last week that Germany offered Greece a “friendly” return to the drachma in 2011. Months later, Mrs Merkel was prepared to eject Greece from EMU altogether. Tim Geithner, the former US Treasury Secretary, said the Europeans seemed determined to teach Greece a lesson: “They lied to us, and we’re going to crush them,” was the gist of it. Mrs Merkel retreated only after it became clear that Spain and Italy would be engulfed by contagion if Greece was thrown out. This time, Berlin seems almost eager to finish the job. Yet Syriza’s ice-cool leader, Alexis Tsipras, is equally convinced that the EU elites will back down, knowing that they have invested too much political capital in Greece’s salvation to walk away. After all, the sums involved now are tiny compared to the €245 billion in loans already dispersed since the crisis erupted in May 2010. Surely, after having claimed so confidently that the crisis was essentially over, Mrs Merkel can hardly admit that her strategy has failed?

Syriza itself is a neo-Marxist mélange, an ideological work in progress. Mr Tsipras no longer has a picture of Che Guevara in his office and has quickly mastered the Brussels vernacular – so much so that EU leaders and City economists presume, rightly or wrongly, that his rhetoric is just for domestic consumption. Yet the ultra-Left Aristeri Platforma still holds the biggest bloc of votes on Syriza’s central committee, and has stated that the movement must “be ready to implement its progressive programme outside the eurozone” if the EU refuses to yield. Mr Tsipras clearly wants Greece to remain in the euro. But he continues to insist on terms that negate that. He says: “We will cancel austerity. Under a Syriza government Greece will exit the bailout. This is not negotiable.” Twisting his knife into the German psyche, he wants the same level of debt relief – 50% – that Germany secured in 1953, which Greece signed up to despite the death of some 300,000 of its citizens under Nazi occupation.

Read more …

“.. if markets have already priced in QE, why would actually doing QE make any difference?”

• The Black Hole Theory Of The Eurozone (Coppola)

Jean Pisani-Ferry tells the ECB to get a grip:

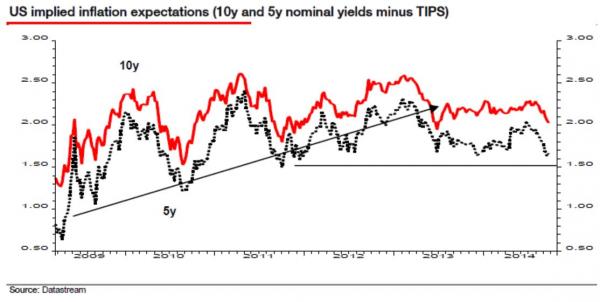

On the face of it, the ECB has many reasons to launch QE. For two years, inflation has consistently failed to reach the 2% target. In November, the annual price growth was just 0.3%, while the recent collapse in oil prices will generate further downward pressure in the coming months. Even more important, inflation expectations have started to de-anchor: forecasters and investors expect the undershooting of the target to persist over the medium term. Low inflation is already a serious obstacle to economic recovery and rebalancing within the eurozone. Outright deflation would be an even more dangerous threat.

So far, so good. Deflation risk is a legitimate reason for a central bank to loosen monetary policy. The ECB has already pushed funding rates close to zero and deposit rates into negative territory, as well as throwing money at banks and buying ABS and MBS in an attempt to get banks to lend. All this appears to have done is slow the rate at which M3 lending is falling (in a credit-money economy, I regard M3 lending as the best indicator of future NGDP growth). It’s hard to argue that the ECB has done anything like enough to counter deflationary pressures and restore growth. But I’m really not sure about this. He seems to think that the ECB must do QE because it has already been priced in by markets:

Should the ECB disappoint expectations, bond and foreign-exchange markets would confront an abrupt and damaging unwinding of positions: long-term interest rates would rise, stock markets would sink, and the exchange rate would appreciate.

A failure to deliver what markets expect is a central bank failure, is it? Really? More importantly, if markets have already priced in QE, why would actually doing QE make any difference? The price effects are already there, and yet M3 lending is falling, unemployment remains stubbornly high, manufacturing PMI is on the floor and so are inflation expectations. I can accept Pisani-Ferry’s argument that the ECB must now do QE because otherwise things will get much worse, but I can’t see how it is going to reverse the current deflationary trend unless it is far larger than the programme the market has already priced in. “Shock and awe” is needed. Where is the political will for this?

Read more …

“Any country exiting the euro would throw the common currency’s continued existence into doubt.”

• As Goes Greece, So Goes the Euro (Bloomberg ed.)

German Chancellor Angela Merkel is said to view Greece’s exiting the euro as a manageable risk that would pose no existential crisis for the common currency. That opinion, if she indeed holds it, is misguided at best and dangerous at worst. It’s true that Greece poses a less naked financial risk to the rest of the euro region than it did in 2009, when revelations about the true size of its deficit triggered the ongoing crisis. Today, only about a fifth of Greek government debts are owed to the private sector, thanks to the country’s bailout by the European Union, the European Central Bank and the International Monetary Fund. And borrowing by Greek private companies accounts for less than 1% of loans made by Europe’s biggest banks, according to JPMorgan.

So it’s true that, if Greek elections later this month produce a new government prepared to default on its debts rather than continue with austerity, the financial repercussions will be limited. That says little, however, about the chaos that could accompany the country’s departure from the euro. Contagion is never predictable. Once inclusion in the euro is shown to be ephemeral – despite the EU treaty’s insistence that membership is “irrevocable” – then other of the currency’s weaker members will be vulnerable to speculation about their staying power. Investors may be driven to short the bonds of Italy, Portugal or Spain – no matter how strong the economic or political arguments against their leaving the currency union – driving their borrowing costs to levels they can’t afford.

To be sure, Der Spiegel’s report about Merkel’s intentions might not accurately reflect Germany’s attitude to a Greek exit. Joachim Poss, a German coalition lawmaker, said today that the consequences would be “incalculable.” And German government spokesman Steffen Seibert noted the region’s policy is “to stabilize and strengthen the euro area, the euro area with all of its members, including Greece.” Nevertheless, the mere discussion of a potential fracture in the euro zone should be a warning to European leaders that their path to ever-closer union is anything but assured. The euro has slumped to its weakest value against the dollar since 2006. Although there are other factors involved, it is a reminder that investors aren’t keen on putting their money into a currency with an uncertain future. Make no mistake: No matter how much some politicians might claim that they’ve contained a potential Greek crisis, they have not. Any country exiting the euro would throw the common currency’s continued existence into doubt.

Read more …

“.. even if Draghi does unveil what the market is anticipating, the question is, will further easing measures be the solution to Europe’s economic malaise?

• A New Year, A New Europe? Don’t Count On It (CNBC)

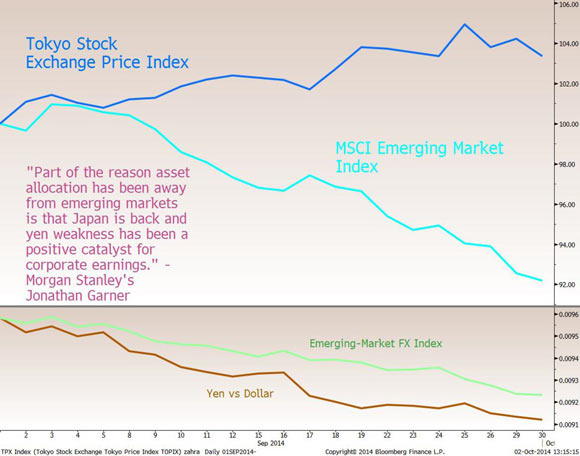

A new year is upon us and that means investors will take a fresh look at European stocks. Unfortunately, Europe’s gloomy picture hasn’t changed. Not enough growth. Inflation is too low. And unemployment is still too high in parts of Europe. Enter stage right: Mario Draghi. Arguably the most powerful European official, investors are betting on the European Central Bank President to unveil a full-blown program of quantitative easing to stimulate the region’s stagnant economy. “Will the ECB join in the fun? If yes – then that should bring stability to the Eurozone and help investors feel better – if not then watch out as global markets [to] adjust,” said Kenneth Polcari, Director at O’Neil Securities. The decision on full blown QE could come at the next governing council meeting on January 22th.

If the ECB does not join the party, then markets could be set for a steep decline. Already financial markets have been moving on the expectation that Draghi will deliver the goods. But if this is a classic –overpromise and underdeliver – something Draghi is quite good at, then traders say expect markets to react negatively. But even if Draghi does unveil what the market is anticipating, the question is, will further easing measures be the solution to Europe’s economic malaise? Sure, it worked in the U.S. but does that mean it will work in Europe? Some traders say no. An economic recovery takes more than just quantitative easing. Each individual economy needs to work on structural reform – policies to help revive their own respective countries. And while each country says it’s working on a plan – some analysts say more work can be done.

Less reliance on ECB and more action from individual country leaders is needed, they say. Despite what is most likely going to be a slow and drawn-out path to recovery, there are some investors who are bullish on Europe. In fact, Morgan Stanley writes that it is positive on European equities for 2015. Analysts there expect a pick-up in economic momentum, and 10% earnings per share (EPS) growth. One of the factors that should help earnings this year is a weaker euro. The single currency is currently trading at a multi-year low against the US dollar. “A key component in our 10% EPS forecast is the likely currency tailwinds that European companies will enjoy next year. Our foreign exchang strategists expect EUR/USD to reach 1.12 by the end of 2015,” writes Graham Secker, Morgan Stanley’s Chief European Equity Strategist.

Read more …

All big banks should be broken up.

• Goldman Says JPMorgan Should Break Itself Into Pieces (Bloomberg)

JPMorgan Chase’s parts are probably worth more to investors than the whole after regulators proposed tougher rules penalizing firms for size and complexity, according to Goldman Sachs. JPMorgan could unlock value by splitting its four main businesses or dividing into consumer and institutional companies, Goldman Sachs analysts led by Richard Ramsden wrote today in a research note. Units of New York-based JPMorgan trade at a discount of 20% or more to stand-alone peers, they wrote. “Our analysis suggests that a breakup into two or four parts could unlock value in most scenarios, although the range of outcomes we assessed is wide, at 5% to 25% potential upside,” the analysts wrote. The move would reverse much of Chief Executive Officer Jamie Dimon’s work since taking over JPMorgan in 2006.

Under Dimon, 58, the firm grew to become the largest U.S. lender by assets and the world’s biggest investment bank after acquiring ailing firms during the 2008 financial crisis. Dimon has said the firm’s size creates opportunities to cross-sell products and better serve clients. “Each of our four major businesses operates at good economies of scale and gets significant additional advantages from the other businesses,” Dimon wrote in a letter to shareholders last year. “This is one of the key reasons we have maintained good financial performance.” The logic of a breakup would rely on the consumer business, commercial bank, investment bank and asset management unit being valued closer to so-called pure-play financial companies, the Goldman Sachs analysts wrote.

The parts probably could operate with lower capital levels as stand-alone firms, resulting in higher returns on equity, they wrote. The maneuver would risk some of the $6 billion profit JPMorgan says it makes tied to synergies between businesses, though a split into halves would preserve much of those benefits, the analysts wrote. The Federal Reserve laid out a plan last month that may require JPMorgan to add more than $20 billion to its capital by 2019. The rules could get even stricter, prompting banks to consider new business models, the Goldman Sachs analysts wrote. “JPMorgan – and other money centers – would strongly consider strategic alternatives, providing shareholders with a breakup ‘put option’ if capital requirements get tougher,” they wrote.

Read more …

It’s going to need the shadow banking system to make this work, the very same it’s trying to curb.

• China Fast-Tracks $1 Trillion in Projects to Spur Growth (Bloomberg)

China is accelerating 300 infrastructure projects valued at 7 trillion yuan ($1.1 trillion) this year as policy makers seek to shore up growth that’s in danger of slipping below 7%. Premier Li Keqiang’s government approved the projects as part of a broader 400-venture, 10 trillion yuan plan to run from late 2014 through 2016, said people familiar with the matter who asked not to be identified as the decision wasn’t public. The National Development and Reform Commission, which will oversee the projects, didn’t respond to a faxed request for comment. The move illustrates concern among officials that China’s planned shift to a domestic-consumption driven economy has yet to produce enough growth momentum.

The yuan rose, halting a two-day decline, and Australia’s dollar – a proxy for China – climbed after the news. “It’s part of China’s efforts to stabilize growth, and the news will help to boost market confidence,” said Julia Wang, a Hong Kong-based economist with HSBC. “Infrastructure investment will continue to be a major driver for China’s economic growth.” The approvals contrast with past moves to boost growth via infrastructure in which the government gave the green-light to projects individually. They are part of efforts to respond to weak output, according to the people. The projects will be funded by the central and local governments, state-owned firms, loans and the private sector, said the people.

The investment will be in seven industries including oil and gas pipelines, health, clean energy, transportation and mining, according to the people. They said the NDRC is also studying projects in other industries in case the government needs to provide more support for growth. The NDRC’s spokesman, Li Pumin, said last month China would encourage investment in those areas. The Economic Observer newspaper reported Dec. 26 on its website that an official from the NDRC’s Zhejiang provincial bureau said the government had approved more than 420 infrastructure projects needing investment of more than 10 trillion yuan.

Read more …

China will step in.

• Venezuelan Leader Maduro Seeks Economic Help On Tour (BBC)

Venezuelan President Nicolas Maduro is beginning an international tour to try to stem the impact of falling oil prices and a deepening recession. Mr Maduro goes first to China – a major source of loans for Venezuela – for talks with the Chinese President, Xi Jinping. He will then travel to various Opec member countries to press for cuts in oil output that would boost prices. Venezuelan oil prices have dropped by half since June. The country gets most of its foreign currency from oil exports and is estimated to have the largest oil reserves in the world. Before he left Venezuela Mr Maduro announced a number of new mechanisms aimed at addressing the country’s economic crisis.

He said he would create a strategic reserve, appoint a new board to run the organisation that manages currency exchange controls, and create new agencies to manage the distribution of commodities. President Maduro has said his country is suffering the consequences of an economic war launched by US President Barack Obama “to destroy” the oil producers’ cartel, OPEC. He has also accused the US of flooding the markets with oil as part of an economic war against Russia. The Venezuelan opposition blames the country’s economic crisis and shortages of many staples, such as corn oil and milk, on the socialist policies of Mr Maduro and his late predecessor, Hugo Chavez.

Read more …

“Across the U.K., real weekly earnings – adjusted for inflation – dropped by 10.3% on average between 2008 and 2014 ..”

• The Demise of UK’s Lucky Years Pits Winners Against Losers (Bloomberg)

Out shopping one winter weekday morning in the southern English town of Eastleigh, 58-year-old Steve Fryer has reason to smile. Hired at 16 by J Sainsbury Plc, he stayed with the retailer for four decades, ascending from the shop floor to management. With a pension that generates more than his final salary at retirement two years ago, he’s paid off his mortgage, owns a second home in a nearby coastal resort and is helping the last of three daughters on to the property ladder. Asked if he could secure the same prosperity starting out today, Fryer shakes his head. “I got through by hard work, but I was also working in the lucky years,” he says. “I don’t see a light at the end of the tunnel for the younger ones.” It’s an indictment heard across the U.K. four months from a general election that threatens to redraw the British political landscape.

As Prime Minister David Cameron campaigns for a second term on the U.K.’s economic recovery, his chances of re-election are undermined by a sense that things aren’t getting better for many voters after more than 4 1/2 years of austerity under the Conservative-led coalition. Take John Harcourt. At 21, he’s hunting for work in Eastleigh to lift him off welfare benefits before he goes to university later this year. He’s chosen to study motor-vehicle engineering, in part to avoid what he says is a lackluster labor market and to secure the skills he thinks he’ll need if he’s to find long-term employment. “It’s very difficult as there’s just not much turnover in jobs,” he says. “I’m happy to do anything. I’d do administration, retail, flip burgers.” You don’t have to walk far in Eastleigh, a town of about 125,000, to run into the two faces of the modern-day British economy.

Those at the end of their work life with a pension and property are coping with the tepid recovery from the 2008-2009 recession, while those starting out struggle to be hired, then face low wage growth once they have a job. Across the U.K., real weekly earnings – adjusted for inflation – dropped by 10.3% on average between 2008 and 2014, according to the Office for National Statistics. The opposition Labour Party says that equates to the biggest drop in real incomes since the time of Queen Victoria and the advent of industrialization more than a century ago. [..] Four years since Cameron declared “we’re all in this together,” the economic divide is not simply geographical but increasingly defines the country. While the government boasts of the fastest economic growth of any major developed nation, an Ipsos MORI poll in November found that eight in 10 Britons say they’ve felt little, if any, impact on their standard of living. [..]

Read more …

I’ve always thought that if a community’s center evolves around shopping, it has negative value.

• The Economics (and Nostalgia) of Dead US Shopping Malls (NY Times)

Inside the gleaming mall here on the Sunday before Christmas, just one thing was missing: shoppers. The upbeat music of “Jingle Bell Rock” bounced off the tiles, and the smell of teriyaki chicken drifted from the food court, but only a handful of stores were open at the sprawling enclosed shopping center. A few visitors walked down the long hallways and peered through locked metal gates into vacant spaces once home to retailers like H&M, Wet Seal and Kay Jewelers. “It’s depressing,” Jill Kalata, 46, said as she tried on a few of the last sneakers for sale at the Athlete’s Foot, scheduled to close in a few weeks. “This place used to be packed. And Christmas, the lines were out the door. Now I’m surprised anything is still open.” The Owings Mills Mall is poised to join a growing number of what real estate professionals, architects, urban planners and Internet enthusiasts term “dead malls.”

Since 2010, more than two dozen enclosed shopping malls have been closed, and an additional 60 are on the brink, according to Green Street Advisors, which tracks the mall industry. Almost one-fifth of the nation’s enclosed malls have vacancy rates considered troubling by real estate experts — 10% or greater. Over 3% of malls are considered to be dying — with 40% vacancies or higher. That is up from less than 1% in 2006. Premature obituaries for the shopping mall have been appearing since the late 1990s, but the reality today is more nuanced, reflecting broader trends remaking the American economy. With income inequality continuing to widen, high-end malls are thriving, even as stolid retail chains like Sears, Kmart and J. C. Penney falter, taking the middle- and working-class malls they anchored with them.

“It is very much a haves and have-nots situation,” said D. J. Busch, a senior analyst at Green Street. Affluent Americans “will keep going to Short Hills Mall in New Jersey or other properties aimed at the top 5 or 10% of consumers. But there’s been very little income growth in the belly of the economy.” At Owings Mills, J. C. Penney and Macy’s are hanging on, but other midtier emporiums like Sears, Lord & Taylor, and the regional department store chain Boscov’s have all come and gone as anchors. Having opened in 1986 with a renovation in 1998, Owings Mills is young for a dying mall. And while its locale may have contributed to its demise, other forces played a crucial role, too, like changing shopping habits and demographics, experts say. “I have no doubt some malls will survive, but major segments of our society have gotten sick of them,” said Mark Hinshaw, a Seattle architect, urban planner and author.

Read more …

“Stock buybacks boost share prices, of course, but they don’t represent any real increased value in a given company. They’re just snakes eating their own tails.”

• Forecast 2015 – Life in the Breakdown Lane (Jim Kunstler)

As 2014 closed out, that kit-bag of frauds, swindles, Ponzis, grifts, bait-and-switches, and three-card-monte scams is looking at least as wobbly as it did in 2007 when Wall Street was busy manufacturing booby-trapped MBSs and CDOs. Except we know the true aggregate risk at stake has only grown larger and more hazardous due to all the strenuous efforts by authorities since the panic of 2008 to evade any natural process for clearing mal-investment and debt gone bad. A lot of that stank was simply shoveled into the Federal Reserve’s basement, where it sits to this day, composting steamily. As to be expected (and averred to in my previous books and blogs) financial repression, market intervention, and statistical distortion will produce ever more financial perversity.

That is the hazard in decoupling truth from reality. Imposed dishonesty will always express itself in unexpected ways. Who expected the price of oil to fall by nearly half in a few months? These days, perversity expresses itself in a morbidly obese dollar gorging on junk while bulimic currencies elsewhere projectile-vomit their value away as the economies attached to them die of malnutrition. Perhaps this comes as a surprise to central bankers standing at their control panels like recording engineers at the soundboard, tweaking all the dials and slides expecting to achieve a perfect repressive inflation rate of 2%+ so they can melt away the onerous debt of sovereign balance sheets and Too Big To Fail banks — incidentally squeezing the citizenry of purchasing power in small annual increments that add up, after a while, to worthless money.

They did manage to extend the inflation of stock market indexes another year, which the public is supposed to interpret as “prosperity.” Half a trillion dollars in stock buybacks of S&P companies were executed in 2014, much of it done with money, i.e. “leverage,” borrowed at zero interest. Stock buybacks boost share prices, of course, but they don’t represent any real increased value in a given company. They’re just snakes eating their own tails.

Read more …

“3. The United States is still quite powerful and can cause massive damage on its way down.”

• 2015: Grounds for Optimism (Dmitry Orlov)

To my mind, the really interesting development of 2014 is that the world as a whole (with a few minor exceptions) has become quite lucid on the topic of what the United States, as a global empire, is and stands for. It is now very commonly and completely understood that: 1. The United States is an evil empire, attempting not so much to rule the world as to disrupt it to its short-term advantage, 2. The United States is failing, as an empire and as a country, and no amount of fraud, mayhem, torture and murder is going to save it, 3. The United States is still quite powerful and can cause massive damage on its way down. This damage must be contained, while plans are drawn up for an international arrangement that will arise upon its demise.

Looking back on 2013 and before, such sentiments were already being expressed, but on the fringes and quietly. The difference is that in 2014 they became commonplace knowledge, and their expressions thundered from presidential podiums. What’s more, there just isn’t that much of a counterargument being voiced. I don’t hear a single voice out there arguing that the US is a benevolent force that is on the up-and-up, would never hurt a fly and is the permanent center of the universe. Yes, some people can still think that, but it’s hard to see value in such “thought.” There are still a few holdouts: the UK, Canada and Australia especially. But even there the true picture is being distorted because of their Murdockified national media.

Judging from what I hear from the people there, they are almost uniformly nauseated by the subservient pro-US antics of their national leaders. As for the EU, the image of political uniformity presented by Brussels is largely a fiction. In the core countries of Western Europe, business leaders are almost uniformly in favor of close cooperation with Russia and against sanctions. Along the fringe, entire countries appear to be on the verge of switching sides. Hungary—never a friend of Russia—now seems more pro-Russian than ever. Bulgaria, which has had a love/hate attitude toward Russia for centuries now, seems to be edging back closer to love. Even the Poles are scratching their heads and wondering if close cooperation with the US is in their national interest.

Another major shift I have observed is that a significant percentage of the thinking people in the US no longer trusts their national media. There is a certain pattern to the kinds of messages that can go viral and spread wildly via tweets and social media. Fringe messages must, by definition, stay on the fringe. And yet last year something snapped: a few times I ran a story in an attempt to plug a gaping hole in the US mass media’s coverage of events in the Ukraine, and the response was overwhelming, with hundreds of thousands of new readers showing up. What’s more, a lot of them have kept coming back for more. I take this to mean that what I have to say, while by no means mainstream, is no longer on the fringe, and that bloggers have an increasingly important role in helping plug the giant holes in national media coverage.

Read more …

We’ll keep going till there’s nothing left.

• The People Pushed Out Of Ethiopia’s Fertile Farmland (BBC)

The construction of a huge dam in Ethiopia and the introduction of large-scale agricultural businesses has been controversial – finding out what local people think can be hard, but with the help of a bottle of rum nothing is impossible. After waiting several weeks for letters of permission from various Ethiopian ministries, I begin my road trip into the country’s southern lowlands. I want to investigate the government’s controversial plan to take over vast swathes of ancestral land, home to around 100,000 indigenous pastoralists, and turn it into a major centre for commercial agriculture, where foreign agribusinesses and government plantations would raise cash crops such as sugar and palm oil. After driving 800km (497 miles) over two days through Ethiopia’s lush highlands I begin my descent into the lower Omo valley.

Here, where palaeontologists have discovered some of the oldest human remains on earth, some ancient ways of life cling on. Some tourists can be found here seeking a glimpse of an Africa that lives in their imagination. But the government’s plan to “modernise” this so-called “backward” area has made it inaccessible for journalists. As my jeep bounces down into the valley, I watch as people decorated in white body paint and clad in elaborate jewellery made from feathers and cow horn herd their cows down the dusty track. I arrive late in the afternoon at a village I won’t name, hoping to speak to some Mursi people – a group of around 7,000 famous for wearing huge ornamental clay lip plates. The Mursi way of life is in jeopardy. They are being resettled to make way for a major sugar plantation on their ancestral land – so ending their tradition of cattle herding.

Meanwhile, a massive new dam upstream will reduce the Omo River, ending its seasonal flood – and the food crops they grow on its banks. It is without doubt one of the most sensitive stories in Ethiopia and one the government is keen to suppress. Human rights groups have repeatedly criticised schemes like this, alleging that locals are being abused and coerced into compliance. I’d spoken to local senior officials in the provincial capital of Jinka, before travelling into the remote savannah. The suspicion is palpable as the chief of the south Omo zone lectures me. Local people and the area’s reputation have been greatly harmed by the negative reports by foreigners, he says. Eventually a frank exchange takes place and I secure verbal permission to report on the changes taking place in the valley.

Read more …

How crazy would you like it?

• Does CNN Really Have A Video Ready For The Apocalypse? (BBC)

If the end of the world arrives, chances are you aren’t going to be watching CNN. But just in case you are, the cable news network has a video ready for the Big Sign-off. That’s according to blogger Michael Ballaban who posted the purported footage online. The clip isn’t much, really – just low-res footage of a US Army band playing a mournful rendition of Nearer My God to Thee, which takes a little over a minute. Then fade, presumably, to the rapture, apocalypse, giant comet impact or whatever coup de grace fate has in store for our little blue marble. Writing on the Jalopnik blog, Ballaban says he first heard about the video from a college professor who worked at CNN. He was then able to confirm its existence when he was an intern at the network in 2009. The video, he reports, is available on CNN’s MIRA archiving system under the name “TURNER DOOMSDAY VIDEO” – the lingering legacy, it seems, of now-departed CNN founder Ted Turner.

Of course, it’s existence shouldn’t be a total shock. Mr Turner has said that the same tune that serenaded the doomed passengers of the sinking Titanic would usher the world’s population into the great hereafter. Still, Ballaban writes, he was a bit sceptical. “It sounded mostly like a mythic joke, the kind of thing that Ted Turner, the all-around ‘eccentric billionaire’ archetype, would mention offhand. Bison ranches, the America’s Cup, four girlfriends at once, the last word on the last day on earth – why not?” he writes. Just in case there is any confusion, the video clip is marked, in bright red letters, with an HFR – “hold for release” – warning: “HFR till end of the world confirmed.” “CNN, once ever so thorough in its fact-checking, knew that the last employee alive couldn’t be trusted to make a call as consequential as one from the Book of Revelation,” Ballaban writes. “The end of the world must be confirmed.”

Read more …