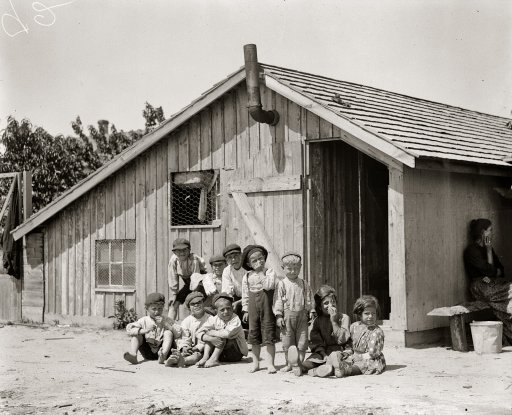

Lewis Wickes Hine Berrie pickers, Seaford, Delaware. ‘Seventeen children and five elders live here’ 1910

“This is the destruction of Capitalism, and I fear the response against the banks on the next downturn will lead to authoritarianism.”

• Velocity of Money Below Great Depression Levels (Martin Armstrong)

The New York banks have been my adversary, to say the least. Alan Cohen, the court receiver put in charge of running Princeton Economics, was simultaneously on the board of directors of Goldman Sachs. When the SEC said the contempt should end, Cohen lied to the court to keep the contempt going, without even receiving a complaint or charges since the original charges were dropped. The New York banks destroyed banking when Robert Rubin of Goldman Sachs managed to get the Clinton Administration to repeal Glass-Steagall. Even Mario Draghi, head of the ECB who is taking interest rates negative, was a vice chairman and managing director of Goldman Sachs International and a member of the firm-wide management committee (2002–2005). So, the tentacles of NY spread wide and far.

The corruption in New York controlling Congress, the Justice Department, and the courts, has allowed the NY bankers to rise to the top of the world from a power elite perspective. They even control much of the media and Hollywood. This power that has transformed banking has been emulated by other banks around the world, insofar as Transactional Banking has displaced Relationship Banking as the “new” way to make money. However, the banks outside the USA do not control their governments as fully as they do in the USA. Who does Hillary run to for money? The NY bankers. Yet, the battle over the banking industry’s reputation is emerging everywhere but New York. It intensified last Friday in Australia when two of Australia’s top regulators took a simultaneous shot at the “culture” at the heart of the nation’s largest financial institutions.

The banking industry suffers from Narcissistic Personality Disorder (NPD), which typically only affects 1% of the population, but they all seem to be working at the top of the banks. NPD is when someone has unrealistic fantasies of success, power, and intelligence. That seems to be a qualification to be on the board of the major New York banks. Ever since the repeal of Glass-Steagall by Bill Clinton in 1999, this “new” way of making money by transforming banking from Relationship to Transactional Banking has destroyed the economy in ways we are soon to discover. The VELOCITY of money has fallen to BELOW Great Depression levels. This is the destruction of Capitalism, and I fear the response against the banks on the next downturn will lead to authoritarianism.

Stockman comments on the Shorpy picture I posted yesterday in the Debt Rattle.

• From Whence Cometh Our Wealth – Labor Or Printing Press? (David Stockman)

It is hard to believe that in these allegedly enlightened times this question even needs to be asked. Are there really educated adults who believe that by dropping helicopter money conjured from thin air, the central bank can actually make society wealthier? Well, yes there are. They spread this lunacy from the most respectable MSM platforms. And, no, I’m not talking about professor Krugman and his New York Times column. At least, he pontificates from a Keynesian framework that has a respectable, if erroneous, intellectual heritage. What I am talking about here is the mindless bunkum issued by so-called financial journalists who swish around Wall Street and Washington exchanging knowing tidbits with policy-makers, deal-makers and each other.

Call it the bubble finance “narrative”, and recognize that its gets more uncoupled from economic facts, logic and plausibility with each passing day in the casino. The estimable folks at The Automatic Earth put a bright spotlight on this crucial matter this morning, even if not by design. Their trademark daily vintage photo was a 1911 picture of a family including all the kids picking berries in the field; they were making GDP the old fashioned way. In the usual manner the site’s “debt rattle” list of links to timely reads followed, and the first was a Bloomberg View opinion piece called“QE For The People: Monetary Policy For The Next Recession” by one Clive Crook. It was actually a case for literally dropping central bank money from the skies to enable policy-makers to better “support demand and keep their economies running”.

In thoughtfully supplying a photo of a helicopter in full flight to accompany Crook’s discourse, the Bloomberg graphics department crystalized the essential economic issue of our times. Namely, whether wealth is made by the Berry Pickers or the Money Printers.

That’s what it’s designed for.

• Fed’s QE Policy Helped Most Where Needed Least (MarketWatch)

The first round of the Federal Reserve’s controversial bond-buying program helped most in parts of the country that needed it least, new research released Monday showed. Conversely, metro areas hit hardest by the recession received the smallest amount of Fed stimulus. At issue was the Fed’s desire with its first round of asset purchases to boost mortgage activity. Mortgage originations, mostly refinancing existing loans, did boom after the Fed announced in November 2008 that it would purchase $500 billion of agency mortgage-backed securities and $100 billion of direct obligations of Fannie Mae and Freddie Mac.

But the research, conducted by a team of economists from the University of Chicago and the New York Fed to be presented at a Brookings Institution conference, found mortgage refinancings increased mainly in parts of the country with the fewest underwater homeowners. Loan-to-value ratios varied widely across regions, the study found. Refinancing activity increased most in places where there were few mortgage holders with a loan-to-value ratio above 0.8%, areas including Buffalo, N.Y., and Philadelphia. Most places that experienced large declines in home prices had loan-to-value ratios well above that level, including Las Vegas, Miami and Orlando. So the smallest refinancing response for “QE1” took place in the locations that were hit hardest by the recession.

Areas where borrowers refinanced the most in early 2009 were the same areas in which car purchases increased the most. A separate paper to be presented at the Brookings conference said the Fed’s quantitative-easing programs did not exacerbate income inequality. Josh Bivens, research and policy director of the Economic Policy Institute, said it’s not even clear whether the Fed’s programs were slightly regressive or progressive. While stock-price gains benefited the top 1%, home prices increases helped the bottom 90%, he said. But Bivens warned that the Fed would foster inequality if it rushes to tighten monetary policy before the labor market returns to full employment. “The recent debate about the proper future path of Fed tightening in the next couple of years … is one in which distributional concerns should rightly be front and center,” Bivens said.

Unbelievable: Carl Riccadonna, chief U.S. economist at Bloomberg Intelligence: “You had equity markets benefit from QE, but eventually QE also jump-started the broader recovery..” “Ultimately everyone’s benefiting.”

• The Winners and Losers of the Fed’s QE

The jury’s still out on how history will treat the Federal Reserve’s unprecedented stimulus program. After the central bank pushed its main policy rate to zero in December 2008, it started buying hundreds of billions of government debt and mortgage-backed securities to keep longer-term interest rates low. That became known as quantitative easing. The real punch of the strategy wasn’t in the quantity of money the Fed was putting in the banking system. It was in the amount of bonds it was taking out of the market, which forced yields down. Total assets on the Fed’s balance sheet today stand at $4.5 trillion compared with $891 billion at the end of 2007.

Some argue the policy brought the U.S. economy closer to full employment and helped stimulate growth. Others say it exacerbated inequality by inflating the prices of financial assets. At the very least, we can say it created some winners and losers, using data from a batch of papers released this morning from the Brookings Institution. (Ben S. Bernanke and Donald Kohn, the former Fed chairman and vice chairman, are both Brookings fellows.)

Who Wins

• Middle-aged, middle-class households, according to a paper by Matthias Doepke, Veronika Selezneva and Martin Schneider. These folks are more likely to have mortgages, and as borrowers they’d benefit from lower interest rates as well as policies that boost inflation. For example, a woman takes out a fixed-rate mortgage to buy a home. As inflation rises over time, the value of the house increases while the cost of the debt does not.

• The equity class. Households that owned financial assets, especially stocks, made out very well thanks to QE. Markets tend to react positively to expansionary policy, and lower interest rates also send more people into the stock market in search of higher returns. The stock market more than doubled from when the Fed started its first round of quantitative easing back in 2008 through the end of asset purchases in October. “Generally, the higher the income level, the greater the exposure to the financial markets in general and equity markets in particular,” said Carl Riccadonna, chief U.S. economist at Bloomberg Intelligence. [..]To be sure, the issue is nuanced. In the end, the record will probably be kind to quantitative easing, said Bloomberg’s Riccadonna. “You had equity markets benefit from QE, but eventually QE also jump-started the broader recovery,” he said. “Ultimately everyone’s benefiting.”

Depends what you think the intentions were.

• “The Fed Has Been Horribly Wrong” Deutsche Bank Admits (Zero Hedge)

The reason why Zero Hedge has been steadfast over the past 6 years in its accusation that the Fed is making a mockery of, and destroying not only the very fabric of capital markets (something which Citigroup now openly admits almost every week) but the US economy itself (as Goldman most recently hinted last week when it lowered its long-term “potential GDP” growth of the US by 0.5% to 1.75%), is simple: all along we knew we have been right, and all the career economists, Wall Street weathermen-cum-strategists, and “straight to CNBC” book-talking pundits were wrong. Not to mention the Fed.

Indeed, the onus was not on us to prove how the Fed is wrong, but on the Fed – those smartest career academics in the room – to show it can grow the economy even as it has pushed global capital markets into a state of epic, bubble frenzy, with new all time highs a daily event across the globe, while the living standard of an ever increasing part of the world’s middle-class deteriorates with every passing year. We merely point out the truth that the propaganda media was too compromised, too ashamed or to clueless to comprehend. And now, 7 years after the start of the Fed’s grand – and doomed – experiment, the flood of other “serious people”, not finally admitting the “tinfoil, fringe blogs” were right all along, and the Fed was wrong, has finally been unleashed. Here is Deutsche Bank admitting that not only the Fed is lying to the American people:

Truth be told, we think the Fed is obliged to talk up the economy because if they were brutally honest, the economy what vestiges of optimism remain in the domestic sectors could quickly evaporate.

But has been “horribly wrong” all along:

At issue is whether or not the Fed in particular but the market in general has properly understood the nature of the economic problem. The more we dig into this, the more we are afraid that they do not. So aside from a data revision tsunami, we would suggest that the Fed has the outlook not just horribly wrong, but completely misunderstood. … the idea that the economy is “ready” for a removal of accommodation and that there is any sense in it from the perspective of rising inflation expectations and a stronger real growth outlook is nonsense.

And the kicker: it is no longer some “tinfoil, fringe blog”, but the bank with over €50 trillion in derivatives on its balance sheet itself which dares to hint that in order to make a housing-led recovery possible, the Fed itself is willing to crash the housing market!

Textbook: How QE distorts markets and ends up destroying them.

• Easy Access to Money Keeps US Oil Pumping (WSJ)

Wall Street’s generous supply of funds to U.S. oil drillers helped create the American energy boom. Now that same access to easy money is keeping them going, despite oil prices that are languishing around $60 a barrel. The flow of money into oil has allowed U.S. companies to avoid liquidity problems and kept American crude production from falling sharply. Even though more than half of the rigs that were drilling new wells in September have been banished to storage yards, in mid-May nearly 9.6 million barrels of oil a day were pumped across the country, the highest level since 1970, according to the most recent federal data. Helped by a ready supply of money, the flow of oil from the U.S. could keep crude prices low for the remainder of 2015 and beyond.

It wasn’t supposed to happen this way. As crude prices began to plunge last year, many energy experts predicted a repeat of 1986 when U.S. oil companies lost their funding and the industry collapsed into a yearslong bust. Without money, companies had to slow or even stop drilling for the crude that helped create a global glut. Many were forced to sell out to rivals or go bankrupt. But the gloomy scenario of that downturn hasn’t played out on a large scale this time. That is because banks, private- equity firms and institutional investors have continued to pour money into the sector even as oil companies slashed billions of dollars in spending from their budgets and laid off more than 100,000 workers. “What makes this downturn different is there is a lot more capital available,” says Pearce Hammond at investment bank Simmons & Co.

Bubbles pop anyway. They always do.

• Rate Hike Needed To Pop Bubbles: Robert Shiller (CNBC)

The U.S. Federal Reserve should consider lifting interest rates sooner rather than later to tackle speculative bubbles in the housing and stock markets, Nobel Prize-winning economist Robert Shiller told CNBC on Monday. “I’m thinking they (Fed policy makers) ought to be considering that, because that is the mistake they made in the past,” the Yale University professor told CNBC Europe’s “Squawk Box” when asked whether he believed the Fed should raise interest rates soon or later on. “They didn’t deal with the housing bubble that led to the present crisis. There’s a suggestion in my mind that they should be raising rates now, (but) unfortunately the latest news looks a little weak on the demand side,” Shiller added.

Friday’s economic news painted a dim picture for the U.S. economy: gross domestic product declined at a 0.7% annual rate in the first quarter of the year compared with an initial estimate of 0.2% growth. The University of Michigan’s consumer sentiment for May, meanwhile, marked a fall and the May Chicago Purchasing Manager’s Index dropped unexpectedly. Against a weaker tone in economic data, markets have pushed back expectations for the first U.S. rate rise since 2006 from June to later this year. “If I was asked to testify before them (the Fed) I might reconsider, but there is a tendency for central banks to ignore speculative bubbles until it’s too late,” Shiller said, talking about the need for higher interest rates. “It may already be too late. Stock markets in the U.S. are quite high and prices in the real estate market are getting high.”

The Dow Jones hit a record high last month, lifted by a perception that disappointing economic news would encourage the Fed to keep interest rates low for longer than anticipated. Shiller said that some parts of the U.S. — such as San Francisco and California — were in “bubble territory,” with house prices growing rapidly. Shiller, who won the Nobel prize for economics two years ago for research that has improved the forecasting of long-term asset prices, said a recent boom around the world was driven by anxiety. “I call this this the ‘new normal’ boom – it’s a funny boom in asset prices because it’s driven not by the usual exuberance but by an anxiety,” said Shiller. “This is an anxiety driven world – the whole world is driven by anxiety. It is anxiety about the aftermath of the global financial crisis, it’s anxiety about inequality and about computers replacing jobs,” he added.

Do you really need a hundred sets of numbers to figure that out?

• “By Almost Every Measure Stocks Are Overvalued” Warns Goldman (Zero Hedge)

Over the weekend, we first reported that none other than Nobel prize winner Robert Shiller said that in his opinion, unlike 1929, this time everything – stocks, bonds and housing – was overvalued. Curiously, none other than Goldman’s chief equity strategist, David Kostin echoed this sentiment when in his latest weekly note to clients he said that “by almost any measure, US equity valuations look expensive. The typical stock in the S&P 500 trades at 18.1x forward earnings, ranking at the 98th%ile of historical valuation since 1976. For the overall index, the aggregate forward P/E multiple equals 17.2x, a rise of 63% since September 2011, compared with the median expansion of 48% during 9 previous P/E expansion cycles.

Financial metrics such as EV/EBITDA, EV/Sales, and P/B also suggest that US stocks have stretched valuations. With tightening on the horizon, the P/E expansion phase of the current bull market is behind us.” Don’t tell that to the SNB, the BOJ or any of the other central banks once again buying Emini futures hands over fist with freshly printed money and a complete disregard to cost basis or downside and losses. Of course, for Goldman to say all of this, it means either the bank is already full to the gills with ES puts, or is just hoping to buy up the S&P to 3000 and above. Here is what else Kostin says on record valuation: US equity valuations are also historically extended when adjusted for the extremely low interest rate environment.

For example, during the past 40 years when the real interest rate (10-year Treasury less core CPI) was between 0% and 1%, the S&P 500 forward P/E multiple averaged 11.2x, well below the current level. Moreover, since 1921 (94 years) when real interest rates have been 0%-1%, the trailing P/E multiple has averaged 13.5x, which is 27% below the current trailing S&P 500 index multiple of 19x. Valuation looks even more striking in the context of current profit margins—the highest in history. Since 2011, margins for S&P 500 (ex-Financials and Utilities) have hovered around the current 9% level. Information Technology has been the driving force for the overall margin expansion.

Profits are highly sensitive to small changes in margins: every 50 basis point shift in S&P 500 margin translates into a roughly $5 per share swing in EPS. Given the current P/E multiple, a $5 shift in EPS would translate into a swing of nearly 90 points to the valuation of the S&P 500. The current P/E expansion cycle has lasted 43 months, the second longest since 1982, but will likely end when interest rates rise. After each of the three prior “first” Fed hikes, P/E multiples contracted by an average of 8%. In the meantime, we expect the 2% dividend yield to generate the entirety of the total return we forecast the S&P 500 index will deliver during the next 12 months. We expect the market will rise to 2150 around mid-year but fade after Fed liftoff in September and end the year at 2100.

The opposite of sound.

• China Stocks Nearly A Quarter Overvalued: Credit Suisse (CNBC)

Whether China shares are in a bubble depends on which data bit catches the fancy, but the market has outstripped its fundamentals and is 23% overbought, Credit Suisse said. “Margins, profitability and value creation continue declining as productivity growth lags real wage growth and product selling prices are eroded,” Credit Suisse said in a note Friday. “Moreover, equity market price momentum has decoupled away from earnings revisions which remain deeply embedded in negative territory.” Its models indicate the market is 23% overbought and has potential downside of 15% in U.S. dollar terms by year-end. The mainland’s shares have rallied sharply this year, despite a brief drop into correction territory last week.

The Shanghai Composite is up around 50% year-to-date, even after last week’s one-day 6.5% plunge. The Shenzhen Composite is up around 111% year-to-date. Credit Suisse attributes the rally to factors including the People’s Bank of China injecting liquidity through its easing measures, retail investors re-allocating assets to stocks and away from bank savings, wealth management products and property. Apart from some restrictions on margin trading, the securities regulator also appears to be letting the rally ride, the bank noted. But is it a bubble? “The evidence for is largely participation and technicals related,” the bank said. “The evidence against is principally valuation related.”

Supporting the bubble view, new share-trading account openings remain elevated and the markets’ average daily trading value has surged to records, it noted. In addition, technical indicators such as deviations from the 200-day moving average and the relative strength index are now comparable to the 2007 A-share bubble, it said. The Shanghai Composite hit its all-time high of 6124 in October of 2007, as the Global Financial Crisis was brewing. However, while the current relative valuation of the mainland-listed A-shares and Hong Kong-listed H-shares is elevated, it remains far below peaks hit in 2008, Credit Suisse noted. Other metrics, such as earnings yield-to-bond-yield, price-to-earnings and price-to-book, are actually significantly more favorable than their 2007 levels, it noted.

Some are more certain about which indicator will call a bubble. “Looking at the market cap to GDP (gross domestic product) ratio as a measure of risk in equity markets, it now seems to us that the recent sharp rise in the Chinese market is the first sign of a bubble without the support of fundamentals,” Societe Generale said in a note Monday. The ratio grew by 124% over the past 12 months, similar to the climb in 2006-2007, it noted. “The Chinese equity market should therefore be closely monitored this summer,” it said.

“..everyone caught in the same crowded trades needs to get out fast.” And won’t.

• Don’t Trust Asia’s Booming Stock Markets (Pesek)

Could a lack of liquidity soon cause Asia’s stock markets to crash? That question might seem fanciful at first glance. Central banks in Frankfurt, London, Tokyo and Washington, by keeping policy rates near or below zero, have been responsible for the arrival of unprecedented waves of cash on Asian financial markets. It’s no accident that Shanghai stocks are up 137% over the last 12 months even as the Chinese economy has slowed; that the Nikkei stock exchange is up 41% surge even as deflation returns to Japan; and that South Korea’s Kospi index is near record highs even as that country’s exports are slumping. But, as economist Nouriel Roubini recently pointed out, macro liquidity, of the sort created by central banks, can easily be accompanied by illiquidity on financial markets.

And when that’s the case, he writes, it creates a “time bomb” by intensifying traders’ tendency toward adopting a herd mentality. Consider last week’s sudden 6.50% drop on the Shanghai stock market. Those panicky hours resembled other “flash crash” moments of recent years: a 10% plunge in U.S. stocks in less than one hour in May 2010; the Fed “taper tantrum” in spring 2013; the Oct. 14 jump in U.S. yields; and last month’s mini meltdown in 10-year German bonds. The common thread between each episode was a sudden wave of fear among traders that, even with unprecedented liquidity injections from central banks, markets might still be too illiquid. And today’s fears about market illiquidity are, in fact, justified.

As Roubini pointed out, “many investments are in illiquid funds and the traditional market makers who smoothed volatility are nowhere to be found.” High-frequency traders and their algorithmic programs account for a growing share of transactions, as do open-ended funds that can exit markets quickly. Meanwhile, banks, which traditionally intervened to stabilize financial markets, are playing a reduced role in trading. These shifts are turbocharging investors’ natural tendency to herd mentality. For now, central banks are reducing stock market volatility by keeping bond yields low. But when surprises occur, Roubini argues, “the re-rating of stocks and especially bonds can be abrupt and dramatic – everyone caught in the same crowded trades needs to get out fast.”

I don’t need a warning.

• Four Recent Bubble Warnings That You Need To Worry About (Jesse Colombo)

I’ve been sounding the alarm in recent years about dangerous new bubbles that have been inflating since the Global Financial Crisis. As I wrote in a viral report last month, I believe that record low interest rates and central bank stimulus programs are the main fuel behind these bubbles and that they will lead to a crisis that is even worse than 2008. In the meantime, these bubbles are creating artificial economic strength and activity that is manifesting itself in the form of our economic recovery. While it often feels lonely and frustrating to warn about such a poorly understood truth, I’m not the only person who has made these observations. Here are four recent bubble warnings made by prominent economists and businesspeople:

Source: VectorGrader.com

Huh? “I’m not sure that the current situation is a classic bubble because I’m not certain that most people have extravagant expectations.”

• Robert Shiller: ‘There Is A Bubble Element To What We’re Seeing’

There isn’t a full-on stock market bubble breaking out, but it sort of looks like it. In an interview with Goldman Sachs’ Allison Nathan this weekend, Yale professor and Nobel Laureate Robert Shiller was asked if the stock market is currently in a bubble. Shiller wouldn’t go so far as to say we’re definitely in a bubble, but said there are some things about today’s current market that look an awful lot like one. Here’s Shiller: “I define a bubble as a social epidemic that involves extravagant expectations for the future. Today, there is certainly a social and psychological phenomenon of people observing past price increases and thinking that they might keep going. So there is a bubble element what we see. But I’m not sure that the current situation is a classic bubble because I’m not certain that most people have extravagant expectations.”

On Saturday, Business Insider’s Henry Blodget argued that stock prices right now look awfully high and said he thinks returns going forward are going to be lousy. In that post, Blodget cites Shiller’s CAPE ratio, or cyclically adjusted price-to-earnings ratio, a measure of inflation-adjusted earnings over the last 10 years, which is currently at around its third-highest level ever. The only times Shiller’s CAPE ratio was higher was ahead of the 1929 and 2000 stock market crashes. The Shiller CAPE ratio is about equal where it was before the 2007 crash. In his comments to Goldman Sachs, however, Shiller again echoes something he’s said in the past, which is that the current stock market rally is driven in part by fear. And this behavior makes the current boom a bit different from a “classic bubble,” and is part of what keeps Shiller hedging when characterizing the current market environment.

Shiller again: “In fact, the current environment may be driven more by fear than by a sense of a new era. I detect a tinge of anxiety and insecurity now that is a factor in markets, which is quite different from other market booms historically.” In 2000, Shiller published the first edition of his famous book “Irrational Exuberance” right at the top of the Nasdaq bubble. And so when Shiller talks about bubbles people listen. It seems then, to Shiller, that though we’re not in a classic bubble, the US market is at levels where we should be worried, at least a little bit, about how expensive stock are right now.

Because Goldman didn’t know?

• Goldman Sachs Asked Two Famous Economists If Stocks Are in a Bubble (Bloomberg)

When asked how worried he is about the prospects for the market over the next six months, Professor Shiller says that his concern has risen with the market and that there could very well be a correction in the next year, although the timing of such market events is inevitably difficult. He advised people to both save more and diversify their investments because their portfolios probably won’t do as well as they had hoped — even over the longer-term. Next Goldman talks to Wharton Professor Jeremy Siegel, who has continued to be on the bullish side with his buy and hold strategy.

Professor Siegel says he believes stocks are only slightly above their historical valuations today and the level is “completely justified” due to low interest rates. To those that claim the stock market is in a bubble, Professor Siegel says he is in complete disagreement. “In no way do current levels that are nowhere near those highs (of March 2000) qualify as a bubble,” he says. Professor Siegel adds that there isn’t much that would dissuade him from holding equities over the medium term and recommended investors allocate 50% of their portfolios to the U.S., 25% to non-U.S. developed markets and 25% to emerging markets.

Of course Shiller and Siegel are also well-known friends so there is at least one place where they are in agreement and that is the bond market. Both economists said it was fair to say bonds are overvalued and some concern is justified, although neither of them would commit to calling it a bubble. Shiller said that historically, the bond market doesn’t tend to crash like the stock market. Siegel steered away from calling it a bubble due to his expectation that both short- and long-term rates will remain low.

Something tells me Moscovici hasn’t been paying attention. Or this serves to discredit Syriza. Either way, there’s nothing new on the table.

• Greece Said To Offer Pension Reform As Debt Talks Near Crunch (Reuters)

Greece’s leftist government has put forward first proposals for pension reform as debt talks with international creditors reach a crunch point this week with Athens’ cash running out, the European Union’s economics chief said on Tuesday. The report came after the leaders of Germany, France, the EC, the IMF and the ECB agreed at an emergency meeting in Berlin on Monday night to work with “real intensity” to try to wrap up the long-running negotiations in the coming days. [..] EU Economy Commissioner Pierre Moscovici said in a radio interview the talks were making progress at last, citing what he said were new Greek proposals on pensions, a core issue for the creditors, who are demanding some cuts and a crackdown on early retirement to make the complex system financially sustainable.

“We are starting to work in depth on pensions. The Greek government has made some first proposals and the pros and cons are being considered,” Moscovici told France Inter radio. Greek officials played down talk of new pension proposals and EU officials close to the talks have said progress is very slow and they remain a long way from convergence. “Greece has been flexible for a long time on pension reform, willing to scrap incentives for early retirement and proceed with merging pension funds. This is what is still on the table,” a Greek government official said.

2400 hours Greece could have spend improving its economy.

• Greek Crisis: 2,400 Hours Of Brinkmanship (CNBC)

I frequently hear the point made that Tsipras’ support is dwindling. Support for his stance may have halved in recent polls, but we shouldn’t underestimate his popularity at home and the lack of appetite to accept further austerity. The opposition pro-Europe New Democracy party have not seen any gains in support even as the economy dwindles. Tsipras has got plenty of reasons to drag this out. European Commissioner for Economic and Monetary Affairs Pierre Moscovici reiterated to CNBC that there is no Plan B. Maybe the European Commission don’t need to consider one but investors, governments and central banks do. Last week, ECB vice President Victor Constancio warned CNBC of the turbulence that will ensue if a deal isn’t reached quickly.

Even if you believe a Greek default or exit can be contained and the euro zone will survive, isn’t the greater fear here what this will mean for sentiment, risk assets and markets? U.S. equities are trading around record highs after a lackluster earnings season and as data on Friday confirmed U.S. GDP contracted by 0.7% in the first quarter. Second-quarter data is already showing signs of recovery but it follows Fed Chair Janet Yellen saying she’s still looking to raise rates this year in any case. We can’t rely on bad news being good news for stimulus any more. We should also consider whether Janet Yellen’s more afraid of potential market turbulence created by the start of rate rises or that something else like a Grexit blows any U.S. recovery off course and she’s not taken the opportunity to raise rates while she had it.

It isn’t just about the U.S. China’s Shanghai market snapped a seven-day winning streak on Thursday last week falling 6.5%. The tech-heavy Shenzhen Composite, which had more than doubled this year alone, lost 5.5% – its third-biggest fall in five years. The Chinese Central Bank providing liquidity to offset the growth slowdown with one hand and trying to temper enthusiasm with the other. Japanese equities meanwhile are also trading at 15 year highs despite the concerns regarding the efficacy of Abenomics. Japan’s central bank governor Haruhiko Kuroda told CNBC last week he’s not concerned about brewing bubbles.

That’s just the equity markets. Never mind for the bonds markets. With all the liquidity sloshing around you’d be forgiven for questioning investors ability to gauge fair value any more. Even without the Greek woes it is enough to make any risk taker cautious. So while investors grapple with value, economic recovery and the calibration of extraordinary monetary policy the question is whether Greece could trigger a more significant reassessment of current pricing? Maybe, maybe not. But each day these negotiations drag on that risk becomes more likely and investors would surely be wise to expect decent volatility while we wait.

Note: “Research shows that only 11% of the bailout money ended up in the Greek economy..” Ergo: taxpayers should blame the banks and EU politicians, not the Greeks.

• Audit: Dutch and EU Taxpayers Likely To Lose All Money Lent To Greece (NLTimes)

Dutch taxpayers will probably not recover any of the money used for Greece’s financial rescue, said Kees Vendrik, chairman of the Court of Audit in the Netherlands. Dutch people should be realistic about repayment given the current situation, Vendrik told on a television program Radar Extra. “As it now stands, I have to be honest, it’s going to be very difficult,” Vendrik said. In 2010, the former Finance Minister Jan Kees de Jager expressed full confidence in Greece repaying the money with interst that the Netherlands lent. Greece received emergency assistance twice. The country received €110 billion in 2010 and €130 in 2012.

The Dutch contribution to the amount was €11.9 billion, according to Statistics Netherlands (CBS). Last year, Vendrik was chairman of the Dutch delegation that participated in an international program to support Greek investigators. In that role, he offered his Greeks colleagues assistance in audits there. Vendrik did not research the financial situation in Greece, but he understands the situation in which the country now finds itself, a spokesman for the organization said.

[From Algemeen Dagblad: Vendrik stated that in all likelihood the entire €240 billion in bailout money will not be paid back. Research shows that only 11% of the bailout money ended up in the Greek economy; the rest went to international banks who had loans outstanding in Greece]

Behind the theory.

• In Conversation With John Nash On Ideal Money (Yanis Varoufakis)

A conversation I was privileged to have with John Nash in June 2000 is posted below as a small tribute to a great man. (The conversation was motivated by a talk John Nash Jr gave in Athens in 2000 entitled IDEAL MONEY. The text of the conversation below was published in 2001 as a chapter in a volume, available only in Greek, entitled Game Theory: A volume dedicated to John Nash, edited by K. Kottaridi and G. Siourounis)

Yanis Varoufakis: Professor Nash, in your talk on Ideal Money, June 2000, at the Old Parliament House in Athens, you commented, in relation to the Eurozone, that membership of a club makes sense only if it is exclusive. (Greeks know this well enough since the earlier consensus among experts that Greece would not be allowed in, made the project of entry into the Eurozone particularly popular here.) Then you strengthened your claim by suggesting that if everyone joins an alliance, the alliance is absurd. But is it? Does a Grand Alliance not gain meaning if its establishment entails unanimous agreement by all members regarding its institutions? Is it not akin to a Grand Bargain over the precise mechanism for distributing gains? (Something like agreeing on the properties a cooperative solution should possess?) And if so, does a Grand Alliance not make sense as a framework for conflict resolution?

John Nash Jr: The words ‘club’ and ‘alliance’ do not have the same meaning. This is why in game theory we use a third word which also differs conceptually from the first two words: ‘coalition’ . It is of course true that it is possible to have a coalition between all the nations (or the states) of the world. The Universal Postal Union, with its Berne headquarters, is a good example. Mind you, it would be far fetched to refer to this union as a ‘club’ . I am not sure I can recall the precise phrase I used in my talk. Nevertheless, a truly Grand Coalition, that includes everyone , is an important and natural concept of game theory. It is the means by which an efficient (in the context of Pareto s definition) agreed resolution to disputes can be imagined following mutual concessions.

Yanis Varoufakis: Regarding your specific proposal (that is, a new Gold Standard based not on Gold but on a basket of suitably weighted material commodities), is your ‘ideal money’ meant as a proxy for transferable utility (such that the outcome of exchanges can become genuinely independent of the way payoffs are calibrated)?

John Nash Jr: The value of effective transferable utility is obvious. However, as far as contemporaneous transactions within the walls of a domestic economy are concerned, the transferability of values can be eased equally well by ideal and non-ideal money. But when it comes to inter-temporal, long-term transactions, e.g. mortgages, the difference between ideal money and typical European currencies would be somewhat intense, if not dramatic.

Nothing new about the list. Political ploy.

• Russia Accuses EU of Stirring Political Tensions Over Blacklist (Bloomberg)

Russia said it’s “deeply disappointed” by the EU’s response to being sent a blacklist of 89 people barred from entering the country. The list was sent “in confidence” to the EU’s permanent representative office in Moscow after “repeated requests” so that they could inform those banned after “several cases when we have been obliged to refuse entry,” Deputy Foreign Minister Alexei Meshkov told reporters in Moscow on Monday. Russia began compiling the blacklist more than a year ago and “a separate decision was taken in each case, with concrete reasons,” Meshkov said. “The list was handed over at the technical level” through consular officials and “we didn’t consider it some sort of political step,” he said.

The European External Action Service, the 28-nation EU’s diplomatic arm, said in a statement on Saturday that Russia had responded to demands for transparency by providing the “confidential ‘stop list’” of 89 people barred from the country. The EEAS called the list “totally arbitrary and unjustified.” When the EU crosses “all boundaries” by its actions, “how can one trust such partners?” Meshkov said. The ban is in response to EU measures targeting officials from Russia imposed over the conflict in Ukraine, Russian Foreign Ministry spokesperson Maria Zakharova said, accusing the bloc of seeking confrontation over the issue. Russia showed compromise by sharing the list and she was “shocked” at European efforts to make political capital out of it, she said on her Facebook account.

That’s a moral low alright.

• New York City Task Force to Investigate ‘Three-Quarter’ Homes (NY Times)

Mayor Bill de Blasio said on Sunday he had formed an emergency task force to investigate so-called three-quarter houses in New York City for potentially exploiting addicts and homeless people by taking kickbacks on Medicaid fees for drug treatment while forcing them to live in squalid, illegal conditions. Mr. de Blasio’s announcement came a day after The New York Times published an investigation examining the abuses of the operator of some of the most troubled three-quarter houses. The mayor also called on the state to increase the shelter allowance it gives single people receiving public assistance. The allowance, which has been $215 a month since 1988, has left many homeless people with no options beyond three-quarter housing.

“We will not accept the use of illegally subdivided and overcrowded apartments to house vulnerable people in need of critical services,” Mr. de Blasio said in a statement on Sunday. Thousands of people live in three-quarter homes, which fall somewhere between regulated halfway houses and permanent housing. Also called sober or transitional homes, three-quarter homes are an offshoot of the murky world of outpatient substance abuse treatment for the poor. The number of such homes has grown over the past decade, as the administration of the previous mayor, Michael R. Bloomberg, pushed to reduce homeless shelter rolls. No one has an exact number of three-quarter homes, which are considered illegal because they violate building codes on overcrowding.

And no government agency regulates them, even though the city Human Resources Administration pays landlords the monthly $215 shelter allowance and the state Office of Alcoholism and Substance Abuse Services pays millions of dollars in Medicaid money for the residents’ outpatient treatment. The Times story focused on one landlord, Yury Baumblit, a two-time felon accused by tenants and former employees of treating poor people as instruments for bilking the government. Tenants said that reputable hospitals and nonprofit organizations had referred them to Mr. Baumblit’s operations, as had city shelters.

Transparency is a good thing.

• At Least 3,900 Medicare Millionaires Revealed in U.S. Data

A small group of doctors accounted for a large chunk of Medicare payments once again, data released today by the U.S. government show. Medicare paid at least 3,900 individual health-care providers at least $1 million in 2013, according to a Bloomberg analysis of data from the Centers for Medicare & Medicaid Services. Overall, the agency said it released data on $90 billion in payments to 950,000 individual providers and organizations. On average, doctors were reimbursed about $74,000, though five received more than $10 million. The U.S. has been increasing transparency for Medicare, which accounts for the largest portion of federal spending after defense and Social Security.

CMS also released information Monday about $62 billion in Medicare payments to hospitals and outpatient facilities in 2013, reflecting more than 7 million discharges. Monday’s data exclude the privately run program known as Medicare Advantage, which accounted for about 30% of beneficiaries last year, and the drug prescription benefits of Medicare Part D. Payments in the drug program were released for the first time earlier this year. Some payments were sent to organizations rather than individuals. There are about 897,000 active physicians in the U.S., according to the Kaiser Family Foundation.

The two highest-paid doctors in 2013 are now under legal scrutiny. Cardiologist Asad Qamar, who was No. 1, has since been accused by the Justice Department of billing for unnecessary tests and cardiovascular procedures. He received about $15.9 million in payments in 2013. In a video released in January, Qamar called the government’s claims baseless. “I assure you that these accusations are a fiction,” he said.

They will be free to seek honorable employment.

• HSBC Poised To Unveil Thousands More Job Cuts (Sky)

HSBC will next week set out plans to cut thousands more jobs across its global workforce as it tries to reassure shareholders that its focus on costs remains undiminished after a series of reputational crises. Sky News understands that Stuart Gulliver, HSBC’s chief executive, will set out a revised target for headcount reductions that will be implemented by the end of 2017 at an investor day next week. The precise job cuts number that will be outlined by Mr Gulliver on June 9 was unclear on Monday, although insiders said that it was likely to be between 10,000 and 20,000. One source said the numbers were still being worked on and had yet to be finalised.

Europe’s biggest lender employed 258,000 people at the end of last year, but it has already abandoned a target set two years ago to reduce its employee base to between 240,000 and 250,000 by 2016 because of the fast-changing nature of bank regulation. It is understood that the headcount reductions figure announced next week will exclude the potential impact of the sale of HSBC’s operations in Brazil and Turkey, where the bank does not disclose how many people work for it. Sky News revealed in April that HSBC had hired Goldman Sachs to find a buyer for the Brazilian business, which is expected to be worth several billion dollars.

The new jobs figure will also not take account of a possible eventual separation of HSBC’s UK arm, which Mr Gulliver said last month was conceivable because of a requirement for big UK lenders to create separate ring-fenced entities by 2019. Shareholders will be anxious for an update next week on the methodology for reviewing the location of its headquarters, which will conclude by the end of the year. Hong Kong, where HSBC was domiciled until its takeover of the Midland Bank in the early 1980s, is seen by analysts as the likeliest destination if it does decide to relocate.

“The true economic impact of the Supreme Court’s decision may not be seen until the next economic downturn..”

• US Supreme Court Hands Defeat To Struggling Homeowners (MarketWatch)

Underwater homeowners who file for Chapter 7 bankruptcy protection are still on the hook for secondary loans tied to their properties, the Supreme Court said Monday. In a nine-to-zero decision, the court said in Bank of America, N.A. v. Caulkett that borrowers whose homes are completely underwater — debtors owe more on a mortgage than the home is worth — cannot void or “strip off” a junior lien when they file for Chapter 7 bankruptcy. A junior lien, such as a home-equity loan, is taken after a first mortgage, and uses a home as collateral. In the case, two borrowers each had two mortgages on their homes, with Bank of America holding the junior liens. Both borrowers were underwater and filed for Chapter 7 bankruptcy two years ago. The borrowers wanted to “strip off” the junior mortgages, shedding those debts.

On Monday the Supreme Court cited a decision from a prior case, Dewsnup v. Timm, finding that lenders still have a secured claim, “regardless of whether the value of that property would be sufficient to cover the claim.” The decision “is a clear victory for mortgage lenders” said Isaac Boltansky at Compass Point Research & Trading. “It clarifies the path to recoveries for second lien holders in bankruptcy,” “This decision will undoubtedly make the bankruptcy process more difficult for impacted borrowers.” [..] Given the current economy — home prices are rising and the labor market is strengthening — the court’s decision “is likely to be muted in the near-term,” Boltansky said. But that doesn’t mean that there won’t be consequences, he added. “The true economic impact of the Supreme Court’s decision may not be seen until the next economic downturn,” Boltansky said.

Getting old fast. “The German government expects the population to shrink from 81m to 67m by 2060..”

• Germany Dominance Over As Demographic Crunch Worsens (AEP)

Germany’s birth rate has collapsed to the lowest level in the world and its workforce will start plunging at a faster rate than Japan’s by the early 2020s, seriously threatening the long-term viability of Europe’s leading economy. A study by the World Economy Institute in Hamburg (HWWI) found that the average number of births per 1,000 population dropped to 8.2 over the five years from 2008 to 2013, further compounding a demographic crisis already in the pipeline. Even Japan did slightly better at 8.4. “No other industrial country is deteriorating at this speed despite the strong influx of young migrant workers. Germany cannot continue to be a dynamic business hub in the long-run without a strong jobs market,” warned the institute.

The crunch is aggravated by the double effect of a powerful post-war baby boom followed by a countervailing baby bust – the so-called “Pillenknick”. The picture in Portugal (nine) and Italy (9.2) is almost as bad. The German government expects the population to shrink from 81m to 67m by 2060 as depressed pockets of the former East Germany go into “decline spirals” where shops, doctors’ practices, and public transport start to shut down, causing yet more people to leave in a vicious circle. A number of small towns in Saxony, Brandenburg and Pomerania have begun to contemplate plans for gradual “run-off” and ultimate closure, a once unthinkable prospect. Chancellor Angela Merkel warned in a speech in Davos earlier this year that Germany will lose a net 6m workers over the next 15 years, shrinking gradually over the rest of this decade before going into free-fall.

The IMF expects the decline in the 2020s to be more concentrated – and harder to handle – than the gentler paces of decline seen in Japan so far. Britain and France are in far better shape, with an average of 12.5 births per 1,000 in from 2008-2013. The IMF expects both countries to overtake Germany in total GDP by the middle of century and possibly even by 2040, implying a radical shift in the European balance of power. Germany’s leaders are themselves acutely conscious that their current hegemonic position in Europe is largely a mirage, certain to fade as more powerful historical currents come to the fore.

I’m all for it. A great idea. Male dominance leads to mayhem.

• Let God Be A ‘She’, Says Church Of England Women’s Group (Guardian)

A group within the Church of England is calling for God to be referred to as female following the selection of the first female bishops. The group wants the church to recognise the equal status of women by overhauling official liturgy, which is made up almost exclusively of male language and imagery to describe God. Rev Jody Stowell, a member of Women and the Church (Watch), the pressure group that led the campaign for female bishops, said: “Orthodox theology says all human beings are made in the image of God, that God does not have a gender. He encompasses gender – he is both male and female and beyond male and female. So when we only speak of God in the male form, that’s actually giving us a deficient understanding of who God is.”

Stowell said discussions over terminology arose out of a Westminster faith debate on whether the consecration of female bishops would make a difference in the Church of England. The matter has been discussed within the transformation steering group, a body that meets in Lambeth Palace to “explore the lived experience of women in ordained ministry”. The group has issued a public call to bishops to encourage more “expansive language and imagery about God”. The Rev Emma Percy, chaplain of Trinity College Oxford and a member of Watch, said the effect of using both male and female language would be to get rid of “the notion that God is some kind of old man in the sky”. She said many people in the church had been having this debate for a long time. “It’s just the church moves slowly.

[The debate] caught the imagination now because we’ve got women bishops so in a sense the church has accepted that women are equally valued in God’s sight and can represent God at all levels. We want to encourage people to be freer, and we want to get the Liturgical Commission to understand that people are actually quite open to this and there is room for richer language to be used.” In her role at the university, Percy said she had noticed people had become more open to modern terminology. “In the last two or three years we’ve seen a real resurgence and interest in feminism, and younger people are much more interested in how gender categories shouldn’t be about stereotypes. We need to have a language about God that shows God can be expressed in lots of diverse terms,” she said.