Pablo Picasso Vue de Notre-Dame de Paris 1945

Aboli

https://twitter.com/i/status/1741232720263684464

RIP

“Plaintiffs have totally failed to demonstrate how their alleged injuries are traceable to the conduct of defendants..”

• Virginia Federal Judge Dismisses Lawsuit to Keep Trump from Ballot (CTH)

The leftist LAWFARE effort to use the federal and state court system to keep President Donald Trump from the 2024 ballot continues. However, in the most recent example, a Democrat appointed federal judge in Virginia has dispatched the effort.

(New York Post) – A federal judge in Virginia on Friday dismissed a lawsuit aimed at removing former President Donald Trump from the state’s 2024 primary ballot citing the insurrection clause of the Constitution’s 14th Amendment. The complaint, filed by activists Roy Perry-Bey and Carlos Howard, alleged that Trump “engaged in insurrection or rebellion” against the US and should therefore be disqualified from seeking the office he once occupied. Judge Leonie Brinkema of the Eastern District of Virginia, an appointee of former President Bill Clinton, found that the plaintiffs lacked standing to sue to get Trump, 77, off the state’s primary ballot. “At least five additional federal courts have concluded that citizens attempting to disqualify individuals — including former President Trump — from participating in elections or from holding public office based on the January 6, 2021 attack on the United States Capitol lacked standing,” Brinkema wrote in her 13-page ruling. “Plaintiffs have totally failed to demonstrate how their alleged injuries are traceable to the conduct of defendants,” the judge added.”

No doubt the Lawfare effort will continue, as the predicate reason for the January 6th “insurrection” narrative continues to surface. Behind the scenes names like Norm Eisen, Barry Berke, Mary McCord, Andrew Weissmann, David Laufman and Benjamin Wittes continue promoting the Lawfare approach. Just as the DOJ and FBI were seeded with ideological lawyers intending to use the national security state and justice system to target their political opposition, the aligned private sector partners and activist groups continue the same effort from outside government.

Big Tech, social media companies, DHS, the DOJ and FBI are all deploying a comprehensive strategy to attack the foundation of our constitutional republic and replace it with a totalitarian dictatorship run by financial interests and collaborators inside government. It is going to get a lot uglier before the final conflict is resolved. Unfortunately, the professional Republican apparatus is a willful participant in the effort. Just as the Tea Party was targeted by Eric Holder and Barack Obama, using weaponized government (DOJ/IRS) with the support and willful blindness of the Republican political apparatus, so too is the America-First movement under constant attack by the same ideologues. The Republican politicians who remain in the primary race are not stupid, blind or naive. They are active and financially rewarded participants in the overall effort.

“..destructive precedent for the presidency, as it seriously undermines the president’s ability to get his constitutionally protected, confidential and candid advice from his advisers.”

• Seizure of Trump Phone Data Puts Jack Smith in Unprecedented Legal Waters (ET)

Special counsel Jack Smith revealed in recent court documents that he obtained data from former President Donald Trump‘s smartphone, which some experts say could provide a means to challenge the case in court on appeal. “The phone records may add to the unease of some judges and justices over the fight over presidential immunities and privileges,” Jonathan Turley, a professor who teaches constitutional law at George Washington University, told The Washington Times. He added that, “however, Smith has the Nixon case to cite for such demands in the investigation of possible criminal acts. What is clear is that the Court may be pushed into a major line-drawing decision over inherent presidential immunities.”

Jamil Jaffer, former associate White House counsel to former President George W. Bush, told the same outlet that the use of President Trump’s cellphone data “raises really hard, complex questions on an unprecedented set of facts.” But Mike Davis, founder and president of the Article III Project, added that the seizure of his data may have crossed “a red line,” adding that it sets a “destructive precedent for the presidency, as it seriously undermines the president’s ability to get his constitutionally protected, confidential and candid advice from his advisers.” The Smith team charged the 45th president earlier this year with four counts, claiming that he illegally tried to overturn the 2020 election. President Trump has denied wrongdoing, pleaded not guilty to the charges, and said it’s part of a longstanding witch hunt to denigrate his political chances in 2024.

Earlier this year, in court filings, the special counsel’s team said that federal investigators gained access to the former president’s phone and White House phone records. It’s not clear what exactly they obtained or how much of it. According to the filing, an individual only described as “Expert 3” had “extracted and processed data from the White House cell phones used by the defendant and one other individual (Individual 1),” referring to President Trump and another person who was not identified. Expert 3 also “specifically identified the periods of time during which the defendant’s phone was unlocked and the Twitter application was open on January 6,” it said. Heavily redacted documents released by the Department of Justice in November, meanwhile, revealed that prosecutors had attempted to gain all information related to President Trump’s Twitter, now X, account, which included who interacted with him, posts, mutes, and direct messages.

“The stock market is only high because people & institutions believe & expect me to win the presidential election of 2024..”

• Trump Warns of Market Crash & Great Depression If He Loses White House Bid (ET)

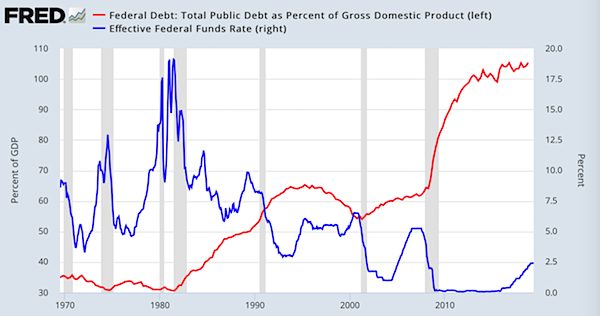

Former President Donald Trump predicted Friday that if he doesn’t win the 2024 presidential election, America will suffer the biggest stock market crash in history—followed by another Great Depression-style event. President Trump made the remark in a post on social media, in which he said the economy under President Joe Biden is in “terrible” shape as high inflation has hammered American households and eroded their buying power. “The only thing that is keeping the economy ‘alive’ is the fumes of what we accomplished during the Trump administration,” the former president wrote, adding that, by some measures, the cumulative level of inflation since he left office is over 30 percent.

Official government data from the Bureau of Labor Statistics (BLS) show that prices have risen by around 17 percent since President Biden took office. However, an alternative measure of inflation that uses the same methodology that the government used to measure inflation in the 1980s puts this figure at roughly twice that figure, so over 30 percent. Even though President Biden’s economic advisers have pointed to cooling inflation and a robust job market as signs that his “Bidenomics” policies are working, there’s been a chorus of economic indicators suggesting otherwise. Some of those indicators include job openings falling to their lowest level since March 2021, new orders for U.S.-made goods suffering their sharpest drop in more than three years, and a closely watched factory activity gauge showing that U.S. manufacturing activity contracted in November for the 13th consecutive month.

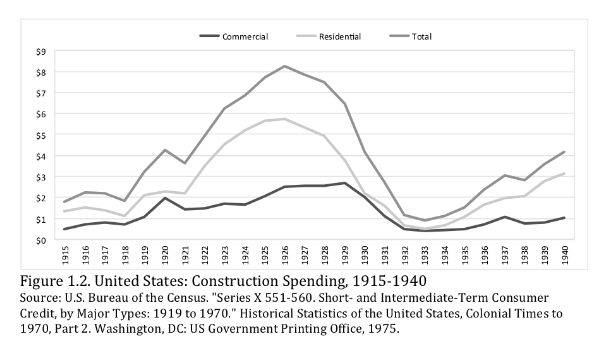

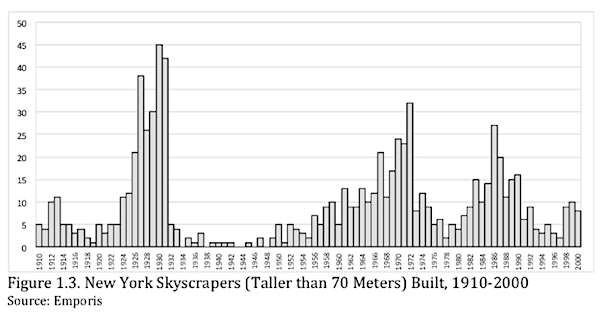

Still, with markets expecting the Fed to hit the brakes on more interest hikes as inflation has eased in recent months, stock markets have risen and consumer sentiment saw an uptick in December. The benchmark S&P 500 is up around 24 percent in 2023 and hovering near its all-time high, while the Dow Jones recently rose to a record high. It’s a development President Trump attributed to expectations around next year’s election. “The stock market is only high because people & institutions believe & expect me to win the presidential election of 2024,” he wrote, before adding: “If I don’t win, it is my prediction that we will have a stock market ‘crash’ worse than that of 1929—a Great Depression.” The Wall Street crashes of late October 1929—known as Black Thursday, Black Monday, and Black Tuesday—were the worst in U.S. history.

While we’re talking neo-fascism…

• Israeli Minister Makes Case For Depopulation Of Gaza (RT)

The majority of the Palestinian Arabs living in Gaza should be encouraged to emigrate to other countries, Israeli Finance Minister Bezalel Smotrich has said. He argued that drastic measures are needed to ensure Israel’s security and avoid further incursions by Hamas. “What needs to be done in the Gaza Strip is to encourage emigration,” Smotrich told Army Radio on Sunday. “If there are 100,000 or 200,000 Arabs in Gaza and not 2 million Arabs, the entire discussion on the day after will be totally different.” The leader of the far-right Religious Zionism party argued that a depopulated Gaza would no longer pose a threat to the Jewish state, given that the Palestinians living there under Hamas’ rule are “growing up on the aspiration to destroy the state of Israel.”

“Most of Israeli society will say ‘why not, it’s a nice place, let’s make the desert bloom, it doesn’t come at anyone’s expense,’” Smotrich said, as quoted by Reuters. He suggested that an international resettlement plan should be devised for the Palestinians who “have been forcibly held against their will in a ghetto for 75 years” and were raised on anti-Israeli propaganda. Up to 1.9 million people – or more than 85% of Gaza’s population – have been displaced since the Israeli Army launched an assault in response to the deadly Hamas attack on October 7, according to the UN. The Israel Defense Forces (IDF) first urged people to flee the northern part of the Palestinian enclave, and eventually instructed those staying in the southern city of Khan Younis to relocate farther from the area of combat operations.

Israel continues to reject calls for an immediate ceasefire, despite repeated warnings from the UN about a humanitarian “catastrophe” in the enclave. Israeli officials and the IDF say Hamas bears full responsibility for civilian deaths and accuse the militant group of using civilians as human shields. Prime Minister Benjamin Netanyahu reiterated on Saturday that “the war will continue for many months until Hamas is eliminated and the hostages are returned.” Israel declared war on Hamas and allied groups after the militants invaded the southern part of the country on October 7, leaving around 1,200 people dead and taking over 200 hostages. More than 21,600 Palestinians have been killed in Gaza since the fighting erupted, according to the local Hamas-run government.

“Tens of thousands of Ukrainian young men had to die between March and now – for what?”

• Trickery, Humiliation, Death and Timeless Hunger for Honor and Glory (Crooke)

One major theme of Homer’s Iliad – which somehow seems as fresh and as vivid today as when first written – is its description of how even the greatest of states in Western civilization fail to reclaim what they lose. “Attempts to repair one loss lead only to more losses”, Emily Wilson writes in her introduction to the Iliad (2023). “Loss can never be recouped.” As Wilson sets out her story, one cannot escape the analogy to today – to a Biden seeking to recoup the American ‘reputation’ (Kleos in Greek). In the case of leaders of the ancient world too, the goal of achieving undying kleos runs through the poem. Today, we might refer to it as one’s ‘legacy’. In the Iliad it is definitional and gives mortal leaders the chance to live on after death with honour and glory. For Team Biden, Ukraine was supposed to be their Troy.

Russia, like Hector, was tricked into a fight and (and as Team Biden had hoped) is killed under Troy’s walls. But in today’s world, it didn’t work out that way. And now the U.S. faces the humiliation of a clear Russian victory in Ukraine, and a collective Russian leadership that says it intends to retrieve all lands and cities that were culturally Russian. Western Ukraine, they say, can go ‘wherever it likes’. The military facts on the ground are relentless and cannot be undone. But the White House hopes to keep a morsel of kleos by simply having Ukrainian forces ceasing to fight, falling back onto defensive lines – yet never saying ‘defeat’. The kinetic component to the conflict barely would ‘tick over’ at low revs. And, as Gideon Rachman has written in the Financial Times, to “flip the narrative to one of [repeatedly insisting] that Putin has failed”. The aim being that Washington quietly can ‘steal away’.

Well, there are two big problems: First, Russia doesn’t agree; it doesn’t agree at all. And secondly, Zelensky and his associates were grievously tricked. Not in this case, by the goddess Athena, but by the mortal Messrs Johnson and Blinken. In March 2022 in Istanbul, Zelensky and his negotiators had reached an accord with Russia. But that agreement ‘was killed’ by Boris Johnson urging Zelensky to fight on, and to gain his portion of the ‘honour and glory’ by participating in the slaying of the Russian aggressor. “As long as it takes – and whatever it takes” was the solemn ‘oath’. That is, so to speak, Zelensky was promised an open cheque and whatever weaponry would be needed … So, what happened to that which is now gone? If this were the Iliad, the storyline would at least, in part, focus on Zelensky’s disappointment at his tiny ‘portion of life’. Wilson writes:

“Many of the words in the Iliad are often translated as fortune or fate – literally, these suggest we get a portion or share … It’s as if there is a whole side of beef that is a quantity of human life and each of us gets a particular portion of it, both how long we get to be alive and also our portion of honor and glory”. Zelensky will have wanted a portion of honour to compensate him for fate having dealt-out his present portion of life in an unfair way (i.e. by having been tricked by British and U.S. assurances). The public humiliation Zelensky now suffers will no longer be balanced by a large share of glory gained through a vanquished Moscow. In the Homeric vein, this lays the ground for an act of revenge on Biden – publication of the ‘deal’. When these details emerge – as surely they will (echoing perhaps, the mysterious and reputationally explosive war-time Churchill letters hinting to Mussolini at some ultimate kleos-esque outcome) – then the ‘victory narrative’ may become soured by the insistent question: Tens of thousands of Ukrainian young men had to die between March and now – for what?

“..an ideology “Russia’s enemies are trying to rekindle” decades after it was dealt a powerful blow during World War II..”

• Neo-Fascism Must Be Destroyed In 2024 – Medvedev (RT)

Defeating neo-fascism once and for all should be Russia’s “main goal” in the coming year, former President Dmitry Medvedev said in his New Year’s address on Sunday. The Russian people have already demonstrated unparalleled “strength of mind, will to victory and selflessness” in the outgoing year, he added. The nation’s “hearts and minds” go out to the soldiers on the front lines, Medvedev said, expressing his sincere gratitude to “everyone who defends our great motherland.” This year required “particular resilience and cohesion, determination and power,” as well as “true patriotism” from the Russian people, he added. The coming year should witness the “ultimate defeat” of neo-fascism, an ideology “Russia’s enemies are trying to rekindle” decades after it was dealt a powerful blow during World War II, the former president said.

Russia is now locked in a protracted conflict with Ukraine, which it accuses of promoting ultranationalist ideology and persecuting its Russian-speaking minority. This year saw Russian forces thwart Kiev’s major counteroffensive. The six-month-long operation launched in early June ended in failure with heavy losses on the Ukrainian side. Russian President Vladimir Putin also hailed the feats of Russian soldiers in his New Year’s address and called them “heroes.” The president also said the country had been “steadfast in defending our national interests, our freedom and security, [and] our values that have always been and remain our unshakeable pillar.” Medvedev, who now serves as the deputy head of Russia’s National Security Council and the Military-Industrial Committee, has repeatedly condemned what he called open glorification of Nazism in Ukraine and particularly pointed to an initiative calling for the establishment of the Stepan Bandera Order, which would supposedly be awarded to Ukrainian servicemen.

Bandera was a notorious leader of Ukrainian nationalists during World War II whose organization was responsible for mass killings of Jews and Poles in Ukraine. The former Russian president has also sharply criticized Kiev’s Western backers, calling them a “pro-Nazi coalition” in September. He also insisted Moscow should take a tougher approach to Kiev. On Thursday, he stated that the removal of the Western-backed government of President Vladimir Zelensky is an undeclared but a “most important and inevitable goal” of Russia’s military operation in Ukraine. Moscow’s goals also include “the disarmament of Ukrainian troops and the rejection of the ideology of neo-Nazism by the current Ukrainian state,” he added at that time.

“We are together, and this is the most reliable guarantee of Russia’s future..”

• Putin Calls 2023 Year Russia Defended National Interests, Security

2023 was the year Russia firmly defended its national interests. This is how Russian President Vladimir Putin characterized the outgoing year in his televised address Sunday. “We are seeing off 2023, very soon it will become part of history, and we must move forward to create the future,” Putin said. “In the outgoing year, we worked hard and accomplished a great deal, were proud of our common achievements, rejoiced at our successes and remained firm in the defense of our national interests, our freedom and security, our values, which have been and remain an unshakable pillar of support for us,” Putin said.

The president characterized Russians’ concern for Russia’s fate as the main factor which unites the country, saying people have “a deep understanding of the tremendous significance of the historical stage through which Russia is passing” through, and the “colossal responsibility” for the motherland which each Russian feels. “We will ensure the confident development of the fatherland, the well-being of our citizens, and will become even stronger. We are together, and this is the most reliable guarantee of Russia’s future,” Putin said. In the USSR and later Russia and other post-Soviet countries, the tradition of an annual televised New Year’s address just shy of midnight on December 31 began under Leonid Brezhnev in 1971, and was continued by Mikhail Gorbachev, Boris Yeltsin, Vladimir Putin, Dmitry Medvedev (from 2008-2012) and Vladimir Putin again from 2013 on.

In many families, watching the address as midnight nears has become a firmly established tradition, with between 45 and 55 percent of Russians tuning in to watch each year. Sunday’s address was the second time Putin addressed Russians amid the ongoing full-scale NATO proxy war against Russia in Ukraine. In last year’s address, Putin called 2022 a “year of difficult but necessary decisions,” and “of important steps towards Russia’s full sovereignty and a powerful consolidation of our society” in the face of Western attempts to “cynically use Ukraine and its people as a means to weaken and divide Russia.”

“We have got to worry about our whether our government is even going to be open for business..”

• ‘No Stomach’ in US to Continue Funding Ukraine – Ex-Pentagon Official (Sp.)

The reality is that there is “no stomach” any longer in the West to fund Ukraine and the ongoing proxy conflict against Russia there, Michael Maloof, a former Pentagon official, told Sputnik. The Kiev regime is going to have to seriously consider some form of negotiation and look at the realities, he emphasized. “The United States has their appropriations hung up. The US government could shut down by January 17 if the administration and Congress can’t negotiate and work out an arrangement for funding Ukraine and Israel, but at the same time to enforce the border. I think the Republicans to date have held firm, and we’ll see if they’ll hold on. But there’s no stomach right now any longer to fund the Ukrainians. Frankly, the people see that the war is over.

Basically, the [Ukrainian] counteroffensive failed, and there’s no way that they can pick it back up and turn things around, because they’ve gone into total defensive mode. The so-called counteroffensive just does not exist,” said Maloof. Earlier, the US Congress adjourned for the winter holiday break without reaching a deal on security at the US border with Mexico and additional aid for Ukraine. Republican lawmakers have insisted on the inclusion of more stringent border security measures in the Biden administration’s $106 billion supplemental funding request, which includes more than $60 billion in aid for Ukraine. US Senator Chris Murphy said that negotiators hope to have a deal to present to senators by the time they return on January 8.

Looking ahead, Michael Maloof predicted there was going to be a quite “tumultuous” start to 2024 in the United States. “We have got to worry about our whether our government is even going to be open for business,” he pointed out, adding that “there is a second tranche in February that would shut down as well if they have not reached a resolution on funding the government agencies the way the House has dictated.” Furthermore, funding not only for Ukraine, but also for Israel is going to feed into the internal debate, the pundit suggested, because the United States is “pretty fed up” with the extent to which Israeli Prime Minister Benjamin Netanyahu has blown up the current cycle of the Palestine-Israel conflict.

Besides the death of so many civilians in Gaza amid Israel’s war on Hamas, Netanyahu “appears to be trying to pick a fight with the Iranians, and this whole thing could explode,” the expert warned. “I guess he [Benjamin Netanyahu] thinks he can go ahead and start raising all kinds of havoc not only with Iran, but also with Hezbollah up north. So are we going to help fund all of that? I mean, that’s the big question. And I don’t think there’s any stomach for that, considering that, you know, we are entering an election year,” said the former senior security policy analyst in the Office of the US Secretary of Defense.

“..this was a clear-cut case of the indiscriminate use of military weapons against exclusively civilian targets – a war crime in the extreme..”

• Scott Ritter: Belgorod Attack Meant to Provoke Russian Overreaction (Sp.)

24 people were killed and over 100 others injured in the Russian city of Belgorod in a Ukrainian guided missile and MLRS artillery strike Saturday. Russia retaliated by striking “decision-making centers” in neighboring Kharkov Sunday. Veteran military observer Scott Ritter outlines the calculations Kiev likely made in plotting the Belgorod attack. The death toll from the attack on Belgorod continues to rise as doctors fight for the lives of civilians gravely injured during Saturday’s brazen daylight attack on the city center. The Russian military made good on a promise to retaliate, with the MoD reporting Sunday that its forces had launched missile strikes against Ukrainian Main Intelligence Directorate, Ukrainian Security Service, military and mercenary targets in Kharkov, Khmelnytsky and Zaporozhye.

Security sources told Russian media Sunday that President Zelensky had “personally” ordered Main Intelligence Directorate chief Kyrylo Budanov to strike Belgorod, with the attack said to be carried out by personnel from the Kraken Regiment, a Ukrainian military volunteer unit under the command of avowed ultranationalist Sergey Velichko. Kraken militants were among the forces targeted during Russia’s retaliatory attacks, the MoD said. There will also be a response to all crimes. Ukraine will continue to be strengthened, our defense industry will become more powerful,” Ukrainian Presidential Office head Andrii Yermak wrote in a cryptic social media post Saturday night, just hours after the Belgorod attack, perhaps referring to the fact that the Vilkha missile launcher believed to have been used to target the city is a Ukrainian-made weapons system.

Ukrainian and Western media assured that the Belgorod strikes were aimed only at “military targets,” and that they were a retaliation to Friday’s massed Russian airstrikes across the country. “The Ukrainians claim to fire against military targets, but the use of cluster munitions and the targets they hit…indicate that this was a clear-cut case of the indiscriminate use of military weapons against exclusively civilian targets – a war crime in the extreme,” Scott Ritter told Sputnik in a video commentary responding to Saturday’s cluster bomb attack on Belgorod. “The timing of this, on the eve of a New Year – one of the most widely celebrated holidays in Russia, I think is designed to be both a psychological blow against the Russian people, and in striking such a blow to generate some sort of reaction by the Russian government that would allow Ukraine to create the case or restate the case to their Western allies for the need for continued financial and military support,” the former Marine and UN weapons inspector explained.

“To date, the Russian government has shown an ability to be very mature in their response, not to overreact. Russia has said that it will retaliate against those responsible in a time and place of their choosing. But the bottom line is, as we go into the new year, we see Ukraine becoming increasingly desperate. They’re being abandoned by the West and they’re doing their best to create some sort of catastrophic event that can recapture the imagination of the West, but to no avail,” Ritter stressed. As for Kiev’s motive, Ritter believes it’s simple. “The purpose of this appears to be purely revenge. The day before, Russia had struck exclusively military targets in one of the largest-ever drone and missile barrages since the special military operation began. It embarrassed Ukraine, it showed that their defenses were totally inadequate and also sent a signal to the collective West that continuing to supply Ukraine with arms and munitions would be met with a Russian response. The Ukrainian response was to target Russian civilians,” he said.

“..it’s like that scene from the movie Titanic. The passengers are moving one direction, the rats are moving the opposite way. That’s what’s going on in Ukraine right now. The rats are heading for the lifeboats.”

• Ex-CIA Officer Compares Ukrainian Officials to ‘Rats Fleeing Titanic’ (Sp.)

Russian and independent media have been reporting on Ukraine’s harsh recruitment tactics since early 2022, when President Zelensky announced general mobilization. Nearly two years on and hundreds of thousands of Ukrainian casualties later, legacy outlets are finally starting to catch up. Retired CIA intelligence analyst and former State Department official Larry Johnson has compared Ukraine to the Titanic as Ukrainian officials attempt to escape the country to avoid certain death in the Zelensky regime’s meat grinder military campaign against Russia. “The fact that the New York Times is now reporting this tells you how bad the situation is. They’ve realized that this party is over,” Johnson told Redacted host Clayton Morris on Saturday, referencing an unusually frank expose by the newspaper characterizing Ukraine’s recruiters as “people snatchers” and detailing their harsh, corrupt, and illegal practices, from the confiscation of fighting age men’s passports to attempts to recruit the mentally disabled.

“It goes to part of another story that came out last week about members of the Rada – the legislature. They’re trying to get out of Ukraine. So to get out of Ukraine at the border you’ve got to show a passport. So no passport, no leav[ing],” Johnson said. “The fact that the Ukrainian legislators recognize that the end is near, which is why they’re trying to get out, it’s like that scene from the movie Titanic. The passengers are moving one direction, the rats are moving the opposite way. That’s what’s going on in Ukraine right now. The rats are heading for the lifeboats.”

The Ukrainian president’s office was forced to take measures earlier this year to block officials and lawmakers from making “business trips” abroad after a series of scandals involving vacations to luxury resorts while ordinary Ukrainians are mired in conflict and trying to survive. Earlier this month, former Ukrainian president Petro Poroshenko complained that he too had been blocked from leaving the country on important “diplomatic work,” and called the decision to stop him “an anti-Ukrainian diversion” that would serve as a “blow to Ukraine’s defense capabilities.”

President Zelensky signed laws extending martial law and general mobilization last month, and in early December acknowledged a need for changes to the mobilization system to recruit even more conscripts. Last week, Ukraine’s military leadership proposed the mobilization of an additional 450,000-500,000 people, a task some US observers said may prove impossible as the country has already been drained of fighting-age men. Larry Johnson echoed these sentiments. “A lot of these guys they’re grabbing are like my age, you know 68, 58, they’re not exactly in the prime of their life and able to take an 80 pound ruck on their back and run across 5-10 kilometers,” he said. On top of that, many of these people have no military experience, he said.

Pointing to the recent admission even by Ukraine’s notorious military intelligence chief Kyrylo Budanov that the current mobilization strategy is bound to fail, Johnson suggested “this lets you know that this thing’s not gonna drag on for two-three years as some have predicted. The end is nigh. I think they’ll be lucky to make it to summer. Because you’ve got the political unrest, the intrigue that’s going on. Like [Ukrainian Armed Forces Commander-in-Chief Valery] Zaluzhny coming out saying ‘my office was bugged’. That’s like a whole Russian nesting doll right there,” he said. “The story is another indicator of the growing chaos within the Ukrainian government, and the decreasing ability of the United States to control those events,” the observer summarized.

“We are and will always be Russians by blood, but we could be Ukrainian citizens as well. However, they never gave us any chance..”

• Reintegration Is a Natural Process for Donbass’ People (Leiroz)

According to the Western mainstream media, the New Regions of the Russian Federation are “captured” territories. It is said that Moscow “annexed” these areas without taking into account the legitimate interests of the local population. It has become commonplace to say that the 2022 referendums are “illegitimate” and cannot be recognized under international law. The high number of pro-Russian votes are often used as an argument in the West to suggest that the electoral process was fraudulent and manipulated. However, analysis on the ground brings another perspective to observers. On a recent journalistic trip to Donbass, I was able to see how local residents are dealing with the process of reintegration into Russia – and the first possible conclusion is that the Western media is lying about the topic.

I was in the People’s Republic of Lugansk in early December. In that region, the process of adaptation to the new political reality of Donbass – as oblasts of the Russian Federation – is occurring in a completely natural way. For the locals, there is no difficulty in becoming part of Russia – frankly, it seems that nothing has changed for them. Talking to residents of Lugansk, I heard from all of them that being part of Russia is not something “new”. They say that, being ethnic Russians, they have always felt as part of Russia, with the 2022 referendums being a mere bureaucratic formality. The feeling of belonging to Russia has always been a central aspect in the culture of the people of Donbass, which is why there is no difficulty in “adapting” to the region’s new political reality.

Furthermore, local civilians say that life has improved rapidly. According to them, during the years under Kiev’s control, Donbass was “abandoned” – marginalized and excluded from Ukrainian society. Evidence of this exclusion can easily be seen in the region’s infrastructure itself. Roads and buildings are generally either very old or very new. The new ones were built by the Russians since military liberation, while the old ones date back to the Soviet era. When asked about investments in infrastructure during the years of Ukrainian control, locals claim that nothing had been done.

To harm the economy and generate poverty and social instability in Russian-speaking regions, the Ukrainian government deliberately promoted deindustrialization and damaged local infrastructure for years. For example, mining has always been the main economic activity in Donbass, being a region known for coal and iron exploration. However, with the aging of Soviet machinery and the lack of investment by the Ukrainian government, mining productivity in the region was severely affected, harming the lives of many local workers. In a talk with the Minister of Foreign Affairs of Lugansk, Vladislav Deinego, I heard from him that the promotion of deindustrialization was a strategy by Kiev to affect the Donbass’ people. In fact, although persecution and ethnic cleansing began only in 2014, marginalization against Russian speakers had already been a common practice in Ukraine since the end of the USSR.

In practice, the residents of Donbas never had a chance to feel part of Ukraine. Even though they are ethnically Russian, they could peacefully integrate into Ukrainian society, merging Russian ethnicity with Ukrainian citizenship – in the same way as happens in countries like Belarus. But it seems that this peaceful coexistence was never the desire of the Ukrainian elites. Russians were mistreated and persecuted in Ukraine – and then had no alternative but to seek to be part of the Russian Federation. “We are and will always be Russians by blood, but we could be Ukrainian citizens as well. However, they never gave us any chance,” says a local who I interviewed on the streets of Lugansk. He added: “All the changes [since the reintegration] were for the better. Now we have peace, employment, and security – what we didn’t have in Ukraine. But we always felt part of Russia – this is nothing new.”

Giant amounts.

• Share of Dollar In Global Reserves Nosedives – IMF (RT)

The US dollar’s share of global central bank reserves has continued to decrease, nosediving to 59.2% in the third quarter of 2023, according to the latest data released by the International Monetary Fund (IMF). The decline comes amid the de-dollarization trend gaining momentum across the globe. IMF statistics show the greenback’s share is down from roughly 70% in 2000. The dollar remains the world’s leading reserve currency with the euro coming second, while the latter’s share has slid to 19.6%. The Japanese yen’s proportion of world reserves grew to 5.5% from 5.3% in the previous three-month period. The Chinese yuan, British pound, Canadian dollar and Swiss franc were little changed.

Meanwhile, according to data compiled by global financial messaging service SWIFT, the yuan’s share of international payments hit a record high in November, with the renminbi becoming the fourth most used currency worldwide. Cross-border yuan lending has risen as well, while the People’s Bank of China holds over 30 bilateral currency swaps with foreign central banks, including Saudi Arabia and Argentina. The growing share of the yuan in cross-border transactions reflects China’s trend of shifting away from the dollar, as well as Beijing’s efforts to promote the use of the renminbi, according to SWIFT.

The global trend towards using national currencies in trade instead of the US dollar began to gain momentum last year, after Ukraine-related sanctions saw Russia cut off from the Western financial system and its foreign reserves frozen. The European Bank for Reconstruction and Development (EBRD) has warned that Russia’s growing trade in the Chinese yuan as a response to Western sanctions could potentially erode the strength of the US dollar. Economists have been also indicating that Western trade restrictions have led to an increased usage of the Chinese yuan globally at the expense of the greenback.

What happens when you deindustrialize..

• Eurozone Economy Faces Bleak 2024 – FT (RT)

The 20-nation euro currency bloc is expected to see only moderate economic growth, +0.6% in 2024, according to the results of a survey carried out by the Financial Times among 48 economists. The outlooks issued by the European Central Bank (ECB) and the International Monetary Fund (IMF) are more optimistic, as analysts from the institutions expect the bloc’s economy to grow 0.8% and 1.2% in 2024, respectively. The experts polled by the FT said that the Eurozone economy won’t be able to exceed 0.6% growth in spite of the fact that wages are expected to grow faster than inflation. Two thirds of the respondents said that they see the economy in the euro area slip into a recession. commonly defined as two consecutive quarters of GDP contraction. According to the economists, wage growth in the single currency area is set to total only 4% in 2024, while consumer prices are projected to rise by over 2.5% on average next year and slightly below 2.1% in 2025.

The ECB had previously forecast wages and inflation next year to grow 4.6% and 2.7% respectively, which would mark the growth of real household incomes for the first time in three years. The regulator expects consumer prices to grow 2.1% in 2025. Meanwhile, unemployment is projected to rise from a record eurozone low of 6.5% in October to 6.9% at the end of next year, according to most economists polled. High interest rates, probable energy market turmoil and geopolitical instability are expected to lead to a deeper recession, the economists warned, saying that the potential election of Donald Trump as US president along with the possibility of Ukraine losing the military conflict with Russia could send the single currency bloc into a period of even weaker growth.

are you serious?? pic.twitter.com/t2uzBgcmhq

— internet hall of fame (@InternetH0F) December 31, 2023

Raven

Corvids are among the most playful animals.

This is a raven playing in the snow with a human.pic.twitter.com/X1ugpWP0bA

— Massimo (@Rainmaker1973) December 31, 2023

Great white

When a great white shark is pursuing its prey, it can swim at speeds up to 40 mph and will typically fly up to 10 feet in the air–an acrobatic feat called breaching.

[📹 Discovery]pic.twitter.com/IroVDOZd7K

— Massimo (@Rainmaker1973) December 31, 2023

Windshield

lil bro got saved by the windshield pic.twitter.com/sRVSEUdkPb

— non aesthetic things (@PicturesFoIder) December 31, 2023

Deep sea squid

https://twitter.com/i/status/1741456039495483779

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.