Winslow Homer Camping in the Adirondacks (Wood engraving) 1874

That is a better term than just about everyone realizes.

• China Warns US Against Opening Mideast ‘Pandora’s Box’ (CNA)

China on Tuesday (Jun 18) warned against opening a “Pandora’s box” in the Middle East after the United States announced the deployment of 1,000 additional troops to the region amid escalating tensions with Iran. Foreign Minister Wang Yi also urged Tehran to not abandon the nuclear agreement “so easily” after Iran said it would exceed its uranium stockpile limit if world powers fail to fulfil their commitments under the agreement in 10 days. Fears of a confrontation between Iran and the United States have mounted since last Thursday when two tankers were attacked. The United States has blamed Iran, more than a year after President Donald Trump withdrew from a 2015 nuclear deal.

Iran has denied having any role in the attacks. The Chinese government’s top diplomat, Wang told reporters at a briefing that China was “of course, very concerned” about the situation in the Gulf, and called on all sides to ease tension and not head towards a clash. “We call on all sides to remain rational and exercise restraint, and not take any escalatory actions that irritate regional tensions, and not open a Pandora’s box,” Wang said. “In particular, the US side should alter its extreme pressure methods. Any unilateral behaviour has no basis in international law,” Wang said, warning that it could create “an even greater crisis”.

I have my questions about this Jerusalem Post article, but they did publish it.

• UN Officials: US Planning A ‘Tactical Assault’ In Iran (JPost)

Is the US going to attack Iran soon? Diplomatic sources at the UN headquarters in New York revealed to Maariv that they are assessing the United States’ plans to carry out a tactical assault on Iran in response to the tanker attack in the Persian Gulf on Thursday. According to the officials, since Friday, the White House has been holding incessant discussions involving senior military commanders, Pentagon representatives and advisers to President Donald Trump. The military action under consideration would be an aerial bombardment of an Iranian facility linked to its nuclear program, the officials further claimed. “The bombing will be massive but will be limited to a specific target,” said a Western diplomat.

The decision to carry out military action against Iran was discussed in the White House before the latest report that Iran might increase the level of uranium enrichment. The officials also noted that the United States plans to reinforce its military presence in the Middle East, and in the coming days will also send additional soldiers to the area. The sources added that President Trump himself was not enthusiastic about a military move against Iran, but lost his patience on the matter and would grant Secretary of State Mike Pompeo, who is pushing for action, what he wants.

“We know what will be done to Assange. It has been done to thousands of those we kidnapped and then detained in black sites around the world.”

• The Coming Show Trial of Julian Assange (Chris Hedges)

On Friday morning I was in a small courtroom at Westminster Magistrates’ Court in London. Julian Assange, held in Belmarsh Prison and dressed in a pale-blue prison shirt, appeared on a video screen directly in front of me. Assange, his gray hair and beard neatly trimmed, slipped on heavy, dark-frame glasses at the start of the proceedings. He listened intently as Ben Brandon, the prosecutor, seated at a narrow wooden table, listed the crimes he allegedly had committed and called for his extradition to the United States to face charges that could result in a sentence of 175 years. The charges include the release of unredacted classified material that posed a “grave” threat to “human intelligence sources” and “the largest compromises of confidential information in the history of the United States.” After the prosecutor’s presentation, Assange’s attorney, Mark Summers, seated at the same table, called the charges “an outrageous and full-frontal assault on journalistic rights.”

The publication of classified documents is not a crime in the United States, but if Assange is extradited and convicted it will become one. Assange is not an American citizen. WikiLeaks, which he founded and publishes, is not a U.S.-based publication. The message the U.S. government is sending is clear: No matter who or where you are, if you expose the inner workings of empire you will be hunted down, kidnapped and brought to the United States to be tried as a spy. The extradition and trial of Assange will mean the end of public investigations by the press into the crimes of the ruling elites. It will cement into place a frightening corporate tyranny. Publications such as The New York Times and The Guardian, which devoted pages to the WikiLeaks revelations and later amplified and legitimized Washington’s carefully orchestrated character assassination of Assange, are no less panicked. This is the gravest assault on press freedom in my lifetime.

[..] We know what will be done to Assange. It has been done to thousands of those we kidnapped and then detained in black sites around the world. Sadistic and scientific techniques of torture will be used in an attempt to make him a zombie. Assange, in declining health, was transferred two weeks ago to the hospital wing of the prison. Because he was medically unable to participate when the hearing was initially to be held, May 30, the proceeding was reset. Friday’s hearing, in which he appeared frail and spoke hesitantly, although lucidly, set the timetable for his extradition trial, scheduled to take place at the end of February. All totalitarian states seek to break their political prisoners to render them compliant. This process will define Assange’s existence over the next few months.

“her husband had been exposed by WikiLeaks”

• Assange Judge Refuses To Recuse Herself Despite Evidence Of Bias (Can.)

UN Rapporteur on Torture Nils Melzer told US journalist Chris Hedges that Lady Arbuthnot “has a strong conflict of interest” and that “her husband had been exposed by WikiLeaks”. Hedges adds that Assange’s lawyers have asked the judge “to recuse herself”, but that “she has refused”. However, Lady Arbuthnot was forced to recuse herself in August 2018 after an investigation by the Observer into her husband’s business dealings with Uber. The judge ruled in favour of Uber but stepped down from the case when it was shown that SC Strategy’s client the QIA had taken a stake in Uber.

And there are other precedents. For example, retired high court judge Lady Butler-Sloss was forced to resign as chair of the panel tasked with examining allegations of child abuse within institutions. This was after she admitted to a family conflict of interest (Sir Michael Havers, her brother, was attorney-general during the period when most of the alleged abuse occurred). Given the evidence relating to her family background, it may be time for Lady Arbuthnot to recuse herself once more, and for the extradition proceedings to be halted.

Did the US overplay its hand?: “Each of Assange’s possible defences are strengthened by the 17 counts of espionage”

• Julian Assange and the Scales of Justice (CP)

Massimo Moratti, Amnesty International’s Deputy Director for Europe, is certain that the Wikileaks publisher will suffer grave mistreatment if extradited to the United States. “The British government must not accede to the US extradition request for Julian Assange as he faces a real risk of serious human right violations if sent there.” This will further add substance to the potential breach of Article 3 of the Human Rights Convention, a point reiterated by Agnes Callamard, Special rapporteur on extra-judicial executions. Ecuador, she argues, permitted Assange to be expelled and arrested by the UK, taking him a step closer to extradition to the US which would expose him to “serious human rights violations.” The UK had “arbitrary [sic] detained Mr Assange possibly endangering his life for the last 7 years.”

On May 31, Nils Melzer, UN Special Rapporteur on torture, concluded after visiting Assange in detention that the publisher’s isolation and repeated belittling constituted “progressively severe forms of cruel, inhuman or degrading treatment or punishment, the cumulative effects of which can only be described as psychological torture.” The issue of Assange’s failing health is critical. An important feature of his legal team’s argument is the role played by the UK authorities in ensuring his decline in physical and mental terms. The argument in rebuttal, disingenuous as it was, never deviated: you will get treatment as long as you step out of the Ecuadorean embassy.

There is also another dimension which the distracted Javid failed to articulate: the sheer political character of the offences Assange is being accused of. Espionage is a political offence par excellence, and the UK-US extradition treaty, for all its faults, retains under Article 4 the prohibition against extraditing someone accused of political offences, including espionage, sedition, and treason. As John T. Nelson notes in Just Security, “Each of Assange’s possible defences are strengthened by the 17 counts of espionage”.

They never finished the report.

• FBI Never Saw CrowdStrike Unredacted or Final Report (McGovern)

CrowdStrike, the controversial cybersecurity firm that the Democratic National Committee chose over the FBI in 2016 to examine its compromised computer servers, never produced an un-redacted or final forensic report for the government because the FBI never required it to, the Justice Department has admitted. The revelation came in a court filing by the government in the pre-trial phase of Roger Stone, a long-time Republican operative who had an unofficial role in the campaign of candidate Donald Trump. Stone has been charged with misleading Congress, obstructing justice and intimidating a witness. The filing was in response to a motion by Stone’s lawyers asking for “unredacted reports” from CrowdStrike in an effort to get the government to prove that Russia hacked the DNC server.

“The government … does not possess the information the defandant seeks,” the filing says. In his motion, Stone’s lawyers said he had only been given three redacted drafts. In a startling footnote in the government’s response, the DOJ admits the drafts are all that exist. “Although the reports produced to the defendant are marked ‘draft,’ counsel for the DNC and DCCC informed the government that they are the last version of the report produced,” the footnote says. In other words CrowdStrike, upon which the FBI relied to conclude that Russia hacked the DNC, never completed a final report and only turned over three redacted drafts to the government. These drafts were “voluntarily” given to the FBI by DNC lawyers, the filing says.

“No redacted information concerned the attribution of the attack to Russian actors,” the filing quotes DNC lawyers as saying. In Stone’s motion his lawyers argued: “If the Russian state did not hack the DNC, DCCC, or [Clinton campaign chairman John] Podesta’s servers, then Roger Stone was prosecuted for obstructing a congressional investigation into an unproven Russian state hacking conspiracy … The issue of whether or not the DNC was hacked is central to the Defendant’s defense.” The DOJ responded: “The government does not need to prove at the defendant’s trial that the Russians hacked the DNC in order to prove the defendant made false statements, tampered with a witness, and obstructed justice into a congressional investigation regarding election interference.”

At a time of high tension in the 2016 presidential campaign, when the late Sen. John McCain and others were calling Russian “hacking” an “act of war,” the FBI settled for three redacted “draft reports” from CrowdStrike rather than investigate the alleged hacking itself, the court document shows. Then FBI Director James Comey admitted in congressional testimony that he chose not to take control of the DNC’s “hacked” computers, and did not dispatch FBI computer experts to inspect them, but has had trouble explaining why. In his testimony, he conceded that “best practices” would have dictated that forensic experts gain physical access to the computers. Nevertheless, the FBI decided to rely on forensics performed by a firm being paid for by the DNC.

Hmmm: “For a campaign to hire a law firm, an American law firm who then turns around and hires an American research company that then contracts out with a foreign individual, that is not illegal.”

• Deep State Players Lash Out At Trump (Noble)

When ABC’s George Stephanopoulos asked Trump whether his son, Donald Trump Jr., should have contacted the FBI after being invited in 2016 to meet with a Russian national who allegedly offered dirt on Hillary Clinton, the president answered, “Give me a break – life doesn’t work that way.” The ensuing exchange led Stephanopoulos to ask the president: “Your campaign this time around, if foreigners, if Russia, if China, if someone else offers you information on opponents, should they accept it or should they call the FBI?” Trump responded that, perhaps, the person in question should do both; look at the information being offered and notify the FBI. Stephanopoulos suggested this amounts to foreign interference in an American election, to which Trump responded: “It’s not an interference [sic]. They have information – I think I’d take it. If I thought there was something wrong, I’d go maybe to the FBI – if I thought there was something wrong.”

The wailing and gnashing of teeth that followed this interview prompted the anti-Trump cable networks to bring in two men who were embroiled in the Russia collusion hoax. One of these men, Andrew McCabe, was fired from the FBI and is fortunate not to have yet been charged with multiple counts of lying to federal investigators. The other is hysterical Trump critic Brennan, who is almost certainly a subject of the ongoing Department of Justice investigation into the genesis of the Russia collusion conspiracy theory. McCabe feigned horror at the idea that the president would be open to receiving information on a potential election opponent from a foreign source.

At the same time, however, he dismissed the idea that the Hillary Clinton campaign had done anything wrong in 2016 when it paid for Russian-sourced and unverified information to use against Trump. When asked by CNN’s Chris Cuomo about a possible analogy between the two situations, the former FBI official said: “There’s no equivalence between those two examples … For a campaign to hire a law firm, an American law firm who then turns around and hires an American research company that then contracts out with a foreign individual, that is not illegal.”

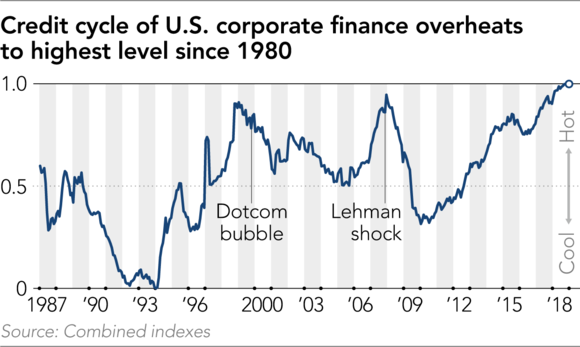

Credit is cyclical.

• Swelling US Corporate Debt Raises Risk Of Global Financial Meltdown (Nikkei)

Surging U.S. business debt, already at historic levels, is posing a potentially huge risk for the global financial system and the world economy, raising concerns among market players and policymakers. Experts are growing increasingly uneasy about both the quality and quantity of debt in the U.S. corporate sector as the amount of loans to borrowers with lower credit ratings and already high levels of debt is increasing. A newly created index shows corporate debt levels are now even higher than before the dot-com bubble or the global financial crisis triggered by the 2008 collapse of U.S. investment bank Lehman Brothers.

Some experts warn that the ticking debt bomb in the U.S. corporate sector could eventually explode, triggering a new global financial meltdown. In a speech delivered on May 20, Federal Reserve Chairman Jerome Powell sounded the alarm about rising levels of business debt, although he dismissed comparisons between the current situation and the conditions in U.S. mortgage markets before the financial crisis. Views about the risks from rising corporate borrowing “range from ‘This is a return to the subprime-mortgage crisis’ to ‘Nothing to worry about here,'” Powell said. “At the moment, the truth is likely somewhere in the middle.”

One important concept for understanding the implications of corporate America’s borrowing binge for the financial system and the world economy is the credit cycle — the cyclical expansion and contraction of access to credit over time. Many policymakers and market players are beginning to fear that the U.S. corporate credit cycle is approaching its peak and will soon enter a phase of contraction.

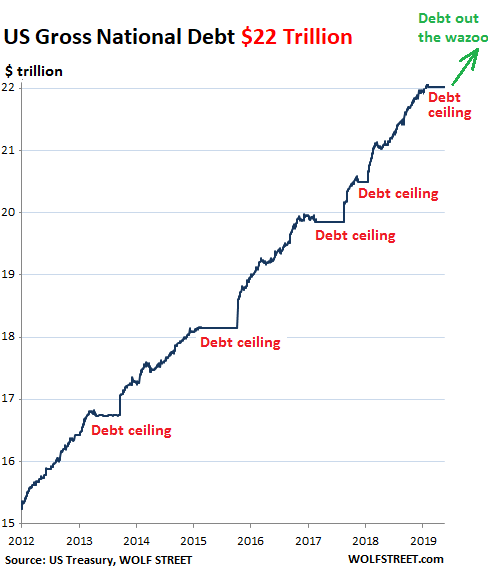

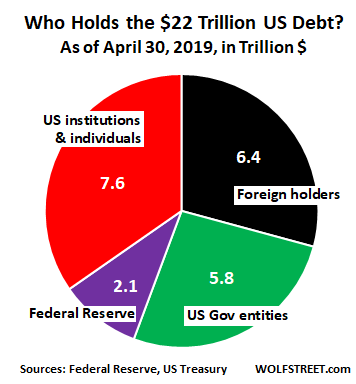

“.. Investors, mostly US institutional and individual investors but also some foreign investors, have gone nuts over it..”

• Who Bought the $1 Trillion of New US Government Debt Over The Past Year? (WS)

The US gross national debt soared by $960 billion over the 12-month period through April. Over the same period, all foreign investors combined increased their holdings by $253 billion. This leaves $707 billion that someone else must have bought. Who? Nope, not the Fed. It shed $271 billion in Treasury securities over the 12 months as part of its QE unwind, bringing its holdings down to $2.12 trillion by the end of April. US government entities piled on $102 billion in Treasury securities over the 12 months, bringing their total to $5.83 trillion. This “debt held internally” is held by government pension and disability funds, the Social Security Trust Fund, etc., that have invested their beneficiaries’ money in Treasury securities, rather than stocks or other instruments.

This “debt held internally” is owed the beneficiaries of those funds and is a real debt of the US government. To summarize: Over the 12 months, foreign investors added $253 billion; the Fed got rid of $271 billion; and US government funds acquired $102 billion. All three combined, accounted for a net increase of Treasury holdings of $84 billion. But the total gross national debt soared by $960 billion over the same period. Someone must have bought the remaining $876 billion. But who? The only one left… American institutions and individuals added $876 billion of Treasuries to their holdings, bringing them to $7.64 trillion.

US banks held nearly $500 billion of them, according to the FDIC. Other US institutional holders include pension funds, mutual funds, hedge funds, corporations such as Apple, and others. Individuals also hold a portion of these Treasury securities, either indirectly via bond funds or pension funds, or directly via their brokers or at Treasury. All combined, American institutions and individuals held 34.7% of the US gross national debt. Ironically, there is no shortage of demand for this debt – despite the charade of the debt-ceiling-default threat hanging over it. On the contrary. Investors, mostly US institutional and individual investors but also some foreign investors, have gone nuts over it, bidding up prices and thereby pushing down yields, with the 10-year yield today settling at 2.09%.

Kuroda’s as clueless and delusional as Draghi and Powell.

• How Japan Turned Against Its ‘Bazooka’-Wielding Central Bank Chief (R.)

Convincing skeptics on the board to embrace negative rates wasn’t easy, according to previously unreported accounts of the events on that fateful night. The policy had been studied for years in Japan but shunned as too controversial. On the brown-carpeted eighth floor of the BOJ building, bank bureaucrats visited the offices of swing voters on the board to make the case. A dashboard on the eighth floor lights up in red to show whenever a board member has visitors. That night, the lights stayed on “for hours and hours for some of them,” one person said. “You could see there was heavy lobbying going on.”

The shift to negative rates carried by a narrow 5-4 vote. Almost immediately, it was clear within the BOJ that the move was a mistake. It crushed long-term interest rates, didn’t weaken the yen as hoped and angered commercial bankers, who felt blindsided by a policy that crimped their profits. In retrospect, the move marked the death knell of “Kuroda-nomics,” as the governor’s plan for reflating the Japanese economy became known. In the most detailed account of these efforts, reported here, BOJ technocrats went to work tip-toeing back Kuroda’s radical program.

Three years on, there is a broad consensus that Japan’s experiment in shock-and-awe monetary policy has failed. An intense debate is under way within the BOJ over why Kuroda’s assumptions about how he could fundamentally change the trajectory of the economy proved wrong and what the bank’s next steps should be. The picture that emerges is of a central bank under pressure and at a moment of reckoning.

Yeah, that will work…

• Boeing’s 737 MAX Name Change (F.)

Boeing doesn’t have any immediate plans to rename its embattled 737 MAX aircraft despite CFO Greg Smith saying he was open to the idea earlier Monday. In an interview with Bloomberg at the Paris airshow, Smith said, “We’re committed to doing what we need to do to restore it. If that means changing the brand to restore it, then we’ll address that.” After the interview, the company told Reuters it isn’t currently working on a name change at the moment. “Our immediate focus is the safe return of the Max to service and re-earning the trust of airlines and the traveling public. We remain open minded to all input from customers and other stakeholders, but have no plans at this time to change the name of the 737 MAX,” said Boeing spokesman Paul Bergman.

The idea for a name change comes from President Donald Trump, who weighed in on Boeing’s myriad safety and public relations issues in March. “What do I know about branding, maybe nothing (but I did become President!), but if I were Boeing, I would FIX the Boeing 737 MAX, add some additional great features, & REBRAND the plane with a new name,” he tweeted. All 737s are still grounded: All 371 Boeing 737 MAX planes were grounded worldwide in March following two deadly crashes that claimed 346 lives. Investigators are focusing on design flaws in a component of the plane’s automated flight controls called the maneuvering characteristics augmentation system, or MCAS. Boeing said last month that it has completed the software update necessary to address the aircraft’s safety issues, but the Federal Aviation Administration still has to approve the change.

Not a good sign.

• Investors Demand Higher Premiums For Risky Australian Mortgage Bonds (R.)

Investors in Australian mortgage bonds are demanding higher premiums to buy the riskiest tranches of new debt, as a slowing economy stokes concerns a property downturn could get worse and increase home loan defaults. High-yield investors are receiving up to 40 basis points more than they were last year to buy the lower-rated and unrated portions, according to an analysis of recent deals by large lenders including AMP, National Australia Bank and Members Equity Bank. That marks an important shift from a near decade-long run of relatively stable spreads for the lower-rated residential mortgage backed securities (RMBS), as the previously red-hot property prices have turned sharply lower, particularly in the major Sydney and Melbourne markets.

“When you are looking at those lower unrated tranches, they are deteriorating as one would expect at the late stage of the [property] cycle,” said George Boubouras, chief investment officer at Atlas Capital. “We see them as a leading indicator of risk, and they have been getting riskier.” Home prices in Australia’s heavily populated eastern states have fallen rapidly since late-2017 due to souring economic conditions, pushing problem home loans to their highest level since the aftermath of the global financial crisis, according to Standard & Poor’s.

Varoufakis explains the difference between his plans and those of Salvini. Not the easiest topic, but interesting.

• Fiscal Money Can Make or Break the Euro (Varoufakis)

It’s a curious feeling to watch your plan being deployed to do the opposite of what you intended. And that’s the feeling I’ve had since learning that Italy’s government is planning a variant of the fiscal money that I proposed for Greece in 2015. My idea was to establish a tax-backed digital payment system to create fiscal space in eurozone countries that needed it, like Greece and Italy. The Italian plan, by contrast, would use a parallel payment system to break up the eurozone. Under my proposal, each tax file number, belonging to individuals or firms, would be automatically provided with a Treasury Account (TA) and a PIN number with which to transfer funds from one TA to another, or back to the state.

One way TAs would be credited was by paying arrears into them. Taxpayers owed money by the state could opt for part or all of those arrears to be paid into their TA immediately, instead of waiting for months to be paid normally. That way, multiple arrears could be eliminated at once, thus liberating liquidity across the economy. For example, suppose Company A is owed €1 million ($1.1 million) by the state, while owing €30,000 to an employee and another €500,000 to Company B. Suppose also that the employee and Company B owe, respectively, €10,000 and €200,000 in taxes to the state. If the €1 million is credited by the state to Company A’s TA, and Company A pays the employee and Company B via the system, the latter will be able to settle their tax arrears. At least €740,000 in arrears will have been eliminated in one fell swoop.

Individuals or firms could also acquire TA credits by purchasing them directly, via web-banking, from the state. The state would make it worth their while by offering buyers significant tax discounts (a €1 credit purchased today could extinguish taxes of, say, €1.10 a year from now). In essence, a new dis-intermediated (middlemen-free) public debt market would emerge, allowing the state to borrow small, medium, and large sums from the private sector in exchange for tax discounts. When I first discussed the idea, staunch defenders of the status quo immediately challenged the legality of the proposed system, arguing that it violated the treaties establishing the euro as the sole legal tender. Expert advice that I had received, however, indicated that the system passed legal muster. A eurozone member state’s treasury has the authority to issue debt instruments at will, and to accept them in lieu of taxes.