Marcel Duchamp The chess game 1910

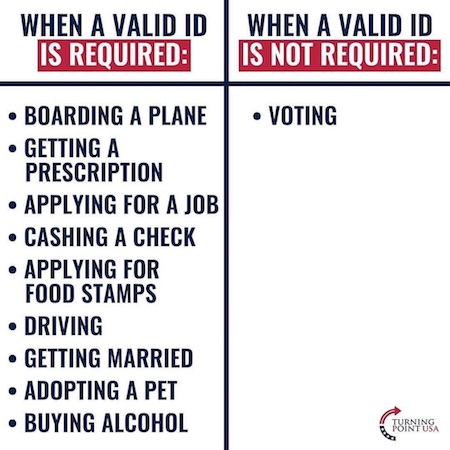

Trump Ad

https://twitter.com/i/status/1878992707286421868

Carr

https://twitter.com/i/status/1879154235830600004

Doocy

DOOCY TIME: “If I don't see you again —”

KJP: “I, well, you know.”

Doocy: “— in the briefing, thank you for all that — you could have stopped taking the hard questions years ago, and you didn't, so we appreciate that.”

KJP: “Over two years, my friend, this is — uh — let's say… pic.twitter.com/MsCSP2AU9Y

— Curtis Houck (@CurtisHouck) January 13, 2025

Hegseth

https://twitter.com/i/status/1879201147887706441

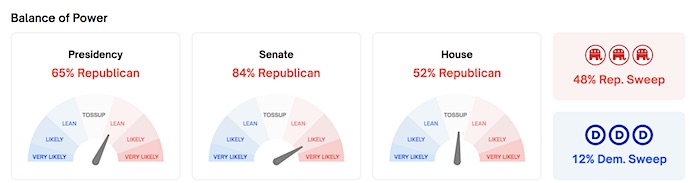

5 days before Inauguration Day, the news feels like a bunch of bits and snippets and loose ends. Guess there’s no other way. We’re getting ready.

Here’s why Biden lost the elections in a landslide. It’s because he’s winning. Or rather, he’s lost but America’s winning. Does that also mean that if he were winning, America would lose?

• America Is Winning – Biden (RT)

Outgoing US President Joe Biden has claimed that his four years of leadership have made America stronger and its enemies weaker. In remarks about the foreign policy achievements of his administration at the Department of State on Monday, Biden hailed his time in office as a boon to America’s global standing. “The United States is winning the worldwide competition compared to four years ago. America is stronger. Our alliances are stronger. Our adversaries and competitors are weaker. We have not gone to war to make these things happen,” he said. He described his handling of the Ukraine conflict as a success. Biden urged people to “think about” the fact that he “stood in the center of Kiev” since the tensions with Russia escalated into open hostilities. “I’m the only commander-in-chief to visit a war zone not controlled by US forces,” he said of his visit to Ukraine in February 2023.

“I had two jobs. One, to rally the world to defend Ukraine, and the other is to avoid war between two nuclear powers. We did both those things,” the US leader said. The remarks confirm that Washington was intentionally engaging in nuclear brinkmanship in Ukraine, Russian Foreign Ministry spokeswoman Maria Zakharova has said, commenting on Biden’s speech. His administration “knew it was pushing the world towards the abyss and escalated the conflict nevertheless,” she said. Biden has claimed credit for undermining other rivals of the US, particularly Iran and Syria in the Middle East, while giving Israel credit for doing “plenty of damage to Iran and its proxies.” He also said the US was now in a stronger position to compete with China militarily and economically.

“On China’s current course, they will never surpass us. Period,” he declared. America has been forging new alliances all around the world, Biden said. Nations like Russia, China, Iran and North Korea have been growing closer together too, he acknowledged, but “that’s more out of weakness than out of strength,” according to Biden. The president also claimed credit for “not leaving a war in Afghanistan to his successor,” referring to the chaotic withdrawal of the US-led coalition from the nation in the early years of his term.

“..Obama “banished 120 [Russian] diplomats from the US and arrested five sites of [Russian] diplomatic property” just three weeks before his successor’s inauguration.”

• Biden Trying To Spoil Everything Before Trump Arrives – Lavrov (RT)

The outgoing administration of US President Joe Biden is working hard to create problems for President-elect Donald Trump before he arrives at the White House, Russian Foreign Minister Sergey Lavrov has said. Lavrov made the statement during a press conference on Tuesday when asked about the sweeping new sanctions against the Russian energy industry, which Washington announced last week. The curbs target two major petroleum producers – Gazprom Neft and Surgutneftegaz – as well as their subsidiaries, including Naftna industrija Srbije (NIS), which handles deliveries of Russian oil to Serbia and neighboring European nations. Related insurance providers, as well as more than 30 oilfield service companies and over 180 vessels used to deliver Russian oil, have also been slapped with restrictions.

According to the foreign minister, the move made by the Biden administration simultaneously targets Serbia, Russia and Trump, who expressed a readiness to resume dialogue with Moscow in order to try to find a diplomatic solution to the Ukraine conflict. “The Democrats have such a manner in American politics to spoil the whole thing for the next administration before the end of their mandate,” he said. Lavrov reminded that the same thing had happened before Trump’s first term when outgoing Democratic President Barack Obama “banished 120 [Russian] diplomats from the US and arrested five sites of [Russian] diplomatic property” just three weeks before his successor’s inauguration.

“This whole case did not help Russian-American relations” back in 2017, he stressed. Regarding the Biden administration, the minister suggested that after not winning reelection “from the moral point of view, you should just wait before the inauguration [of Trump on January 20]; you should understand that your people want a different kind of policy.” “No, they are unwilling to do so. They want to spoil the whole thing,” he stressed.

How about in ten years?

• Ukraine Not Yet In Strong Enough Position For Negotiations: NATO Chief (ZH)

The head of the North Atlantic Treaty Organization has just made an admission which surely won’t help Ukraine at the negotiating table in any potential future talks. The fresh words might also be by designed aimed at sabotaging expected Trump efforts to quickly end the war. NATO Secretary General Mark Rutte on Monday described that Ukraine is not yet in a strong position to begin peace talks, now with less than a week before President-elect Donald Trump enters the White House. “At this moment, clearly, Ukraine is not there,” Rutte told the European parliament’s foreign affairs and defense committees. “Because they cannot, at this moment, negotiate from a position of strength. And we have to do more to make sure, by changing the trajectory of the conflict, that they can get to the position of strength.”

He went on to say that the hope is to obtain security guarantees so that Ukraine can never be attacked by Russia again. He said that this involves mapping out Ukraine’s future relations with NATO. “But it’s too early now to exactly sketch out what that exactly will mean, also something we have to discuss with the incoming U.S. administration,” he stated. “But let’s hope that we will get to that point as soon as possible.” White House National Security Council spokesman John Kirby said last Friday that the latest energy sanctions placed on Russia were not intended to be a “bargaining chip” that can be taken off the table when Ukraine is ready to negotiate. “There’s no expectation right now that either side is ready to negotiate,” he stated, also emphasizing that timing is up to the Ukrainian government.

Another Biden official has been quoted as saying, “It’s entirely up to [the next administration] to determine whether, when, and on what terms they might lift any sanctions we put in place.” The Kremlin has described this as a “sanctions trap” left by the Biden administration to make things harder for Trump to negotiate and maneuver: “Of course, we are aware that the administration will try to leave the most difficult legacy possible in bilateral relations to Trump and his associates,” Kremlin spokesman Dmitry Peskov said ahead of the sanctions announcement. Biden officials have framed the sanctions as a long-term strategy. “We believe our actions are leaving a solid foundation upon which the next administration can build,” one official said, predicting the measures would cost Russia billions in monthly revenue and force “hard decisions” between sustaining its economy.

The Washington Post had also observed of the comments, “Kremlin spokesman Dmitry Peskov, speaking before the widely anticipated sanctions were announced, said Friday that the Biden administration was trying to make things difficult for the incoming Trump team.” Continued defense and economic aid to the Ukraine has also been something that Europe and the Biden administration have long been trying to ‘Trump-proof’. So far, the president-elect has said he doesn’t immediately plan to cut or end aid, but this could be him telegraphing negotiations or an attempt to maintain leverage in this regard over the Russian side. As for the battlefield, there’s near universal consensus at this point that Russian forces are winning. Steady gains have persisted in the Donetsk region, while Ukraine tries to make life difficult for Russian leadership in Kursk region.

“I just don’t think it’s realistic to say we’re going to expel every Russian from every inch of Ukrainian soil.”

• Trump ‘Not Invested’ In Ukraine – Bloomberg (RT)

US President-elect Donald Trump does not consider the Ukraine conflict a key priority for America’s national interests, according to Bloomberg, which cited several anonymous EU officials. The media outlet alleged on Tuesday that the Republican had given his European counterparts the “impression that he wasn’t strongly invested in Ukraine’s destiny or didn’t recognize a strategic significance of the war to US interests.” Nevertheless, the latest signals coming out of Trump’s team gave European governments grounds for cautious optimism, suggesting that the US president-elect would not push Ukraine into “premature negotiations with Russia,” the publication wrote, citing a “series of private talks” with his entourage. According to Bloomberg, Trump may continue supporting Ukraine to ensure it occupies a “position of strength before any talks take place.”

The incoming president is supposedly anxious to avoid a humiliating debacle in Ukraine like the chaotic withdrawal from Afghanistan overseen by President Joe Biden in 2021. The article alleged that Trump is also wary that an outright Russian victory in Ukraine could embolden China to make more aggressive moves. Bloomberg also quoted Italian Prime Minister Giorgia Meloni, who said after her recent meeting with Trump at his Mar-a-Lago estate in Florida that she did not expect Washington to disengage from Kiev. Sources told the media outlet, however, that Trump’s unpredictability means that no one can reliably say what course of action he might take after assuming office on January 20. During an interview with Newsmax on Monday, Trump insisted that Russian President Vladimir Putin “wants to meet, and I’m going to meet very quickly.”

The Kremlin has responded positively to Trump’s declared intention to engage with Russia. However, it said the Ukraine conflict needed to be resolved in a way that addresses its core causes, including NATO’s eastward expansion. Speaking to ABC News on Sunday, incoming US National Security Advisor Michael Waltz stated: “I just don’t think it’s realistic to say we’re going to expel every Russian from every inch of Ukrainian soil.” “President Trump has acknowledged that reality, and I think it has been a huge step forward that the entire world is acknowledging that reality,” he added, suggesting that this realization could pave the way to ending the bloodshed. Shortly before the US election on November 5, Vice President-elect J.D. Vance similarly suggested that Kiev might have to cede some territory to Moscow in the end.

“..the idea the taxpayer needs to fund a government unit to ‘monitor’ Elon Musk’s tweets is ridiculous” since “it costs nothing to open an account on X and once you’ve done that Elon’s tweets are completely unavoidable.”

• UK Monitoring of Musk Online Reveals “Pathetic” Priorities (Curzon)

The British establishment will not hold a national inquiry into gangs of mostly Pakistani men who raped girls across the UK, but it will expend its resources on monitoring tweets shared by Elon Musk. A government counter-extremism unit has been assessing the risk posed by Musk’s often outlandish claims, The Mirror has revealed. Last week, the Twitter/X boss labelled Labour’s Jess Phillips, the safeguarding minister, a “rape genocide apologist” after it emerged that she rejected a request for the government to commission a public inquiry into child sexual exploitation in Oldham, Greater Manchester, in October. The monitoring unit is part of the Homeland Security Group, which claims to focus on “the highest harm risks to the homeland, whether from terrorists, state actors, or cyber and economic criminals.”

However, it will now devote some of its time to Musk’s free-to-access ramblings, even while experts share concerns of the potential return of Islamic State terrorism. Reform MP Rupert Lowe said this “spying” is “pathetic,” given that there is to be “no inquiry into thousands of foreign rapists.” (Musk later shared Lowe’s post.) And even before news of the monitoring came to light, Allison Pearson—the journalist who was visited by the police in November over a year-old tweet—pointed to one hideous incident in the rape gang scandal to suggest that the PM “genuinely seems more outraged” about Musk’s posts “than he is about the 12-year-old who was driven at night to a Yorkshire wood where she was forced to give oral sex to at least 10 men … before being left alone in the dark.”

Priority concerns aside, Free Speech Union director Toby Young told europeanconservative.com that “the idea the taxpayer needs to fund a government unit to ‘monitor’ Elon Musk’s tweets is ridiculous” since “it costs nothing to open an account on X and once you’ve done that Elon’s tweets are completely unavoidable.” What, asked Young, is the government’s ‘report’ going to consist of? “A compendium of those tweets? You can see all of them by clicking on Elon’s avatar and it’s completely free.” What piece of world class detective work is this spy unit going to produce next? The revelation that the person responsible for these ‘dangerous’ tweets is a close friend of the President of the United States?

Meanwhile, fresh calls for an inquiry into the grooming gangs scandal continue to proliferate, including from survivors and, with potentially more influence, leading Labour figures. There is also talk of Starmer “appearing to soften his opposition to a new probe,” just days after he used a three-line whip to order Labour MPs to block one in Parliament—but skipped the vote himself. The Mirror’s report has since come under fire after a government spokesman “denied” that Musk was being monitored, although—as veteran press officer Gawain Towler pointed out —it is more likely that he was being snooped but no longer is “because of the Mirror scoop.”

Newsom seems to claim there’s plenty water.

• California Governor Newsom Calls Musk A Liar (RT)

California Governor Gavin Newsom has lashed out at Tesla and SpaceX founder Elon Musk over his “lies” after the billionaire businessman blasted the state’s response to raging wildfires in Los Angeles. In a series of posts on X, Musk – a longtime critic of the Democrat politician – blamed the scale of damage in LA on “bad governance at a state and local level that resulted in a shortage of water” and retweeted a post calling on the governor to resign. Musk’s claim comes as LA mayor Karen Bass admitted that around 20% of the city’s fire hydrants ran dry last week, with Newsom calling for an independent investigation into the issue on Friday. Responding to Musk on Monday, however, Newsom posted a video clip showing the business mogul asking a firefighter if water availability was an issue.

The firefighter explained that there was water in “several reservoirs,” but the problem is that they are “flowing an amount of water that the system couldn’t bear,” which is why water trucks are being brought in to compensate as “mobile hydrants.” “(Musk) exposed by firefighters for his own lies,” Newsom wrote. According to former chief engineer at the Los Angeles Department of Water and Power Marty Adams, the scale of the wildfires has created a situation that is “just completely not part of any domestic water system design.” There needs to be “some new thinking about how systems are designed,” he told the New York Times. Wildfire and water expert Faith Kearns told National Geographic that the current situation “was like a worst-case scenario.” “But I think we should be planning for those worst-case scenarios…I do think this is where we’re headed,” she said.

Musk and Newsom have also sparred on X over the issue of looting amid reports that criminals were raiding areas where people had been forced to evacuate their homes. Newsom accused Musk of “encouraging looting by lying” after the tech CEO claimed that California Democrats had “decriminalized looting.” “It’s illegal – as it always has been,” Newsom wrote, adding that “bad actors will be arrested and prosecuted.” US President-elect Donald Trump has also taken aim at Newsom, with Trump accusing the governor of refusing to sign a “water restoration declaration” which Newsom said does not exist. Musk, a close Trump ally, has been appointed to co-lead the president-elect’s new Department of Government Efficiency (DOGE) advisory board. The devastating LA wildfires have killed at least 24 people so far and displaced thousands more. Fierce winds are expected to pick up this week, making the blazes more difficult to control.

https://twitter.com/i/status/1879176991657595177

“We can’t be expected to comment on pure fiction..”

• TikTok Dismisses Bloomberg’s Report Of Potential Sale To Musk (ZH)

Bloomberg is relying upon unnamed sources “familiar with the matter” as anchor sources in an overnight report about Elon Musk potentially acquiring the US operations of Chinese video-sharing platform TikTok. The company faces a Sunday deadline to find a US buyer or risk a ban. The report said: “Senior Chinese officials had already begun to debate contingency plans for TikTok as part of an expansive discussion on how to work with Donald Trump’s administration, one of which involves Musk, said the people, asking not to be identified revealing confidential discussions. Under one scenario that’s been discussed by the Chinese government, Musk’s X would take control of TikTok US and run the businesses together, the people said. With more than 170 million users in the US, TikTok could bolster X’s efforts to attract advertisers. Musk also founded a separate artificial intelligence company, xAI, that could benefit from the huge amounts of data generated from TikTok.”

Following Bloomberg’s report citing anonymous sources, a TikTok spokesperson told BBC News the whole story about China considering to sell the video-sharing platform to Musk as “pure fiction.” “We can’t be expected to comment on pure fiction,” the spokesperson told the British media outlet. BBC noted, “TikTok has repeatedly said that it will not sell its US operation.” On X, Musk responded with laughing emojis to Autism Capital’s video of angry white liberals melting down in a forest, referring to them as the potential response of TikTok’s audience if Musk bought the Chinese video-sharing platform.

https://twitter.com/i/status/1878970370335928670

In April of 2024, Musk wrote on X, “In my opinion, TikTok should not be banned in the USA, even though such a ban may benefit the 5yO› platform,” adding, “Doing so would be contrary to freedom of speech and expression. It is not what America stands for.” Bloomberg Intelligence analysts Mandeep Singh and Damian Reimertz recently estimated that TikTok’s US operations could be valued between $40 and $50 billion. Recall that Musk paid $44 billion for Twitter in 2022. President-elect Trump, who takes office next Monday, one day after TikTok’s deadline to sell or risk a ban, has sought to delay the ban on the video-sharing platform to allow time for negotiations. Trump has previously stated that he wants to “save” the app. Also, the Supreme Court is set to rule on the constitutionality of a law that would ban the platform from the US if the TikTok’s owner ByteDance does not find a buyer by Sunday.� �

https://twitter.com/i/status/1878985530588750049

“The action by the agency “is an admission… that they cannot bring an actual case”..

• Musk Hits Back At US Market Watchdog After Lawsuit (RT)

SpaceX and Tesla CEO Elon Musk has labeled the US Securities and Exchange Commission (SEC) “a totally broken organization” after it filed a lawsuit against him, linked to his purchase of Twitter (later re-branded as X). The SEC, which is tasked with enforcing laws against market manipulation, sued Musk in a federal court in Washington on Tuesday, claiming that he had failed to disclose his ownership of more than 5% of Twitter stock in a timely fashion in early 2022, several months before buying the social media platform. The agency alleged that this allowed the tech billionaire to “underpay by at least $150 million for shares he purchased after his beneficial ownership report was due.”

On Wednesday, the tycoon responded to a post on X by an account under the name Satoshi Nakamoto – a reference to the unidentified creator of Bitcoin – who expressed surprise that “the SEC is suing Elon Musk for buying Twitter at ‘artificially low prices’ even though he bought it for $44 billion and industry analysts said it was worth more like $30 billion.” The Securities and Exchange Commission is “a totally broken organization,” Musk, who has been tapped by US President-elect Donald Trump to head DOGE, a special advisory body tasked with identifying government inefficiency, wrote. “They spend their time on sh*t like this when there are so many actual crimes that go unpunished,” he said.

Musk’s lawyer, Alex Spiro, insisted that his client has “done nothing wrong” and called the SEC’s lawsuit a “sham.” The action by the agency “is an admission… that they cannot bring an actual case” against the billionaire, he said in a statement. The SEC’s “multi-year campaign of harassment” targeting Musk resulted “in the filing of a single-count ticky tack complaint… for an alleged administrative failure to file a single form – an offense that, even if proven, carries a nominal penalty,” Spiro stressed. The head of the Securities and Exchange Commission, Gary Gensler, has said that he will step down from his post on January 20 when Trump is inaugurated. Last month, the president-elect nominated Paul Atkins, a cryptocurrency advocate and CEO of the Patomak Partners consultancy firm, to become the new chair of the SEC.

Sounds crazy. Until, like him, you see the aerial footage.

• LA Fires Worse Than Nuclear Strike – Trump (RT)

US President-elect Donald Trump has compared the devastation of the Los Angeles wildfires to a nuclear attack, warning that the death toll may rise in the coming days. He criticized California’s leadership, particularly Governor Gavin Newsom, suggesting that mismanagement has exacerbated the crisis. The wildfires that began last week in southern California have claimed at least 24 lives, burned more than 40,000 acres, and destroyed over 12,000 structures, leveling entire neighborhoods. Los Angeles Sheriff Robert Luna has reported 16 deaths from the Eaton fire and eight from the Palisades fire, with 16 individuals still missing. Authorities expect the death toll to rise as search teams with cadaver-sniffing dogs continue to comb through the rubble.

Aerial view of homes destroyed in wildfires in Pacific Palisades, California © Getty Images / Mario Tama

In an interview with Newsmax, Trump predicted that rescuers would find “many more dead” and expressed bewilderment at the scale of destruction. “I believe it’s greater damage than if they got hit by a nuclear weapon. I’ve never seen anything like it. Vast miles and miles of houses just burned to a crisp. There’s nothing standing,” Trump told the outlet. He added that he had seen “very guarded pictures” of the destruction, claiming that the catastrophe is “far worse than you even see on television, if that’s believable.” The president-elect went on to blame the Californian leadership for the scale of the tragedy, insisting that the crisis could have been prevented if water from Canada was allowed to flow to the state and its forests were properly maintained. Trump specifically accused California Governor Newsom of prioritizing environmental policies over human lives and called for his resignation.

Trump is considering paying a personal visit to southern California to survey the damage caused by the fires, the Wall Street Journal reported, citing people familiar with his plans. In his interview with Newsmax, the president-elect also expressed interest in taking part in the rebuilding of the area, stating that “we’re gonna do things with Los Angeles. You know, I’m already putting my developer cap on.” Newsom has declared a state of emergency in the affected areas and has called on federal agencies for additional support in dealing with the fires. Outgoing President Joe Biden has also approved a Major Disaster Declaration, which enables federal resources to be directed toward response and recovery operations. According to the latest estimates by the AccuWeather forecasting service, the wildfires have caused losses of between $250 billion and $275 billion, accounting for property destruction, firefighting expenses, and economic disruption.

” While Southern California’s fires have exposed the resilience of its residents and the bravery of its first responders, they have also laid bare the failures of leadership.”

• The Real Heroes And Villains Of The California Wildfires (Tara Reade)

The catastrophic wildfires raging across Southern California have brought widespread devastation, but also incredible stories of heroism. As human and animal rescues showcase the bravery of citizens and the resilience of communities, questions arise about the roles of California Governor Gavin Newsom and Los Angeles Mayor Karen Bass in wildfire prevention and response. The Palisades and Eaton fires have ravaged over 27,000 acres combined, destroying more than 10,000 structures, displacing over 180,000 people, and claiming at least 42 lives, according to updated reports. These numbers highlight the immense human and environmental toll. However, amidst the chaos, tales of heroism have emerged.

In Pacific Palisades, 83-year-old Parkinson’s patient Aaron Samson narrowly escaped the flames thanks to the quick thinking and bravery of his son-in-law and neighbors. In Altadena, volunteers and emergency responders evacuated 90 elderly residents from a senior care facility, saving lives as the flames closed in. Animals have also been gravely impacted. In Altadena, residents risked their own safety to rescue horses, with dramatic footage showing people running through embers with the animals. Veterinarian Annie Harvilicz transformed her clinic into a sanctuary for over 40 displaced pets, demonstrating selflessness and dedication.

While these acts of bravery unfolded, critics point to systemic failures at the leadership level. Governor Gavin Newsom and Mayor Karen Bass have faced mounting criticism for decisions that may have exacerbated the wildfire crisis. In 2020, Governor Newsom reduced the state’s wildfire prevention budget by $150 million, and reports revealed that actual fire prevention efforts were significantly below publicly stated targets. Mayor Bass has also come under scrutiny for a $17.6 million budget cut to the Los Angeles Fire Department (LAFD), impacting the department’s emergency response capabilities. During the fires, Mayor Bass was on a diplomatic trip to Ghana as part of a Biden delegation, sparking public outrage over her absence despite days of warnings about unprecedented winds increasing fire risk.

Accountability and allegations. Critics argue that a combination of budget cuts, resource mismanagement, and misleading public statements about wildfire preparedness could amount to gross negligence. Advocacy groups have called for investigations into whether these leaders violated their duty to protect the public. Some legal experts suggest that proven negligence could lead to lawsuits or even criminal charges. Additionally, speculation about potential “land grabs” following the destruction of valuable property has fueled public mistrust. Some residents have accused officials of using the crisis to advance agendas favoring developers and special interests.

Insurance crisis. The crisis has been compounded by insurance companies dropping fire coverage for residents in high-risk areas. Months before the fires, many Los Angeles homeowners received notices that their fire insurance policies were being canceled or not renewed. Insurers cited the increasing frequency and severity of wildfires as reasons for deeming many areas uninsurable. In the mid-1990s I worked for a California Stare Senator, another Willie Brown protegee like Newsom. Fraudulent practices with fire and earthquake insurance were a problem back then, and they are worse now, having been left unchecked. The insurance groups have lobbied both political parties very hard to not hold them accountable for fraudulent practices. And they succeeded.

Without fire coverage, families face the prospect of financial ruin, unable to rebuild their homes and communities. This has left thousands of Californians vulnerable to not only the immediate dangers of the flames but also long-term economic hardship. The Palisades and Eaton fires will eventually be contained, but the damage to communities may be irreversible due to restrictive rebuilding permits and the lack of insurance options. Residents and advocacy groups are demanding accountability from state and local officials, though skepticism remains about whether meaningful investigations will occur.

I was in my late teens and early twenties when I lived around many of the iconic places which are now on fire or gone. Generations of families lived in some of these communities and it is heartbreaking to see the direct result of mismanaged fire policies, with millions in funding, having been squandered by corrupt officials. Los Angeles, once a beautiful dream for many, has now become a hellscape of ruin. Governor Gavin Newsom’s rumored ambitions for higher office, including a potential presidential bid, have drawn attention to his track record. Critics warn that his leadership during California’s wildfire crises reveals systemic corruption and mismanagement, which could have broader implications if he ascends to national leadership. While Southern California’s fires have exposed the resilience of its residents and the bravery of its first responders, they have also laid bare the failures of leadership that allowed this devastation to occur.

When impotence doubles down.

• DOJ Releases Jack Smith’s Report on Trump (ET)

U.S. Department of Justice (DOJ) officials have released part of former special counsel Jack Smith’s report about President-elect Donald Trump. Part one of Smith’s report was made public early on Jan. 14 (1am), after U.S. District Judge Aileen Cannon allowed its release. In the report, Smith – who recently resigned – said that he believes the evidence against Trump was strong enough to yield a conviction, even though the DOJ dropped its prosecutions of the president-elect. “As alleged in the original and superseding indictments, substantial evidence demonstrates that Mr. Trump then engaged in an unprecedented criminal effort to overturn the legitimate results of the election in order to retain power,” Smith wrote. An indictment against Trump charged him with multiple federal crimes, including conspiring to obstruct the certification of the 2020 presidential election.

After the charges were brought, the U.S. Supreme Court ruled that presidents are immune from prosecution for official conduct. Smith’s team subsequently reanalyzed the evidence it had gathered. “Given the Supreme Court’s ruling, the Office reevaluated the evidence and assessed whether Mr. Trump’s non-immune conduct—either his private conduct as a candidate or official conduct for which the Office could rebut the presumption of immunity—violated federal law,” Smith wrote in the newly released report. “The Office concluded that it did. After doing so, the Office sought, and a new grand jury issued, a superseding indictment with identical charges but based only on conduct that was not immune because it was either unofficial or any presumptive immunity could be rebutted.” Part two of the report is being kept back, at least for now, as Trump’s co-defendants in the case fight its release on grounds such as Smith being found to be unconstitutionally appointed.

Smith said in the report that Trump sought to defraud the United States and obstruct the certification of electoral votes in part by conspiring with others to send alternate slates of electors to Washington. After Trump won the 2024 election, consistent with the DOJ’s interpretation that the U.S. Constitution prohibits prosecution of a sitting president, the DOJ dropped the charges against Trump. “The Department’s view that the Constitution prohibits the continued indictment and prosecution of a President is categorical and does not turn on the gravity of the crimes charged, the strength of the Government’s proof, or the merits of the prosecution, which the Office stands fully behind,” Smith said in the report. “Indeed, but for Mr. Trump’s election and imminent return to the Presidency, the Office assessed that the admissible evidence was sufficient to obtain and sustain a conviction at trial.”

Trump’s lawyers said in a recent letter to Attorney General Merrick Garland that the DOJ’s actions represented a “complete exoneration” of their client. Trump wrote on his Truth Social website early Tuesday that Smith “was unable to successfully prosecute the Political Opponent of his ‘boss’ … so he ends up writing yet another ’Report.’” “THE VOTERS HAVE SPOKEN!!!” Trump added later. Smith, who was appointed by Garland, said in the report that the decision to prosecute Trump was solely his and refuted any allegations to the contrary. “Nobody within the Department of Justice ever sought to interfere with, or improperly influence, my prosecutorial decision making. The regulations under which I was appointed provided you with the authority to countermand my decisions, 28 C.F.R. § 600.7, but you did not do so,” Smith said.

“Nor did you, the Deputy Attorney General, or members of your staff ever attempt to improperly influence my decision as to whether to bring charges against Mr. Trump. And to all who know me well, the claim from Mr. Trump that my decisions as a prosecutor were influenced or directed by the Biden administration or other political actors is, in a word, laughable.” Smith also defended prosecuting Trump, arguing that doing so served federal interests, including the interest in applying the law equally with regards to the breach of the U.S. Capitol on Jan. 6, 2021. “There is a substantial federal interest in ensuring the evenhanded administration of the law with respect to accountability for the events of January 6, 2021, and the Office determined that interest would not be satisfied absent Mr. Trump’s prosecution for his role,” Smith said.

I believe every word he says.

• FBI Director Wray On Why He’s Resigning, Defends Search of Mar-a-Lago (ET)

FBI Director Christopher Wray on Sunday explained why he is stepping down as head of the law enforcement bureau as President-elect Donald Trump prepares to take office in one week. “My decision to retire from the FBI, I have to tell you, it was one of the hardest decisions I’ve ever had to make,” Wray told CBS’s “60 Minutes” in what is likely his last interview as FBI chief. “I care deeply, deeply about the FBI, about our mission, and in particular, about our people. However, he said, the “president-elect had made clear that he intended to make a change and the law is that that is something he’s able to do for any reason or no reason at all.” In December 2024, Wray announced he would be leaving his post at the end of President Joe Biden’s term amid comments made by Trump signaling he would replace him. Trump has since named Kash Patel, a former intelligence official, to be in charge of the FBI, a position that needs Senate confirmation.

Trump in his first term nominated Wray to lead the FBI in 2017 for a 10-year term ending in 2027. However, the president-elect has often expressed his displeasure with the federal law enforcement bureau, particularly after its agents searched his Mar-a-Lago residence in Florida in August 2022 for classified documents. Trump was later charged by special counsel Jack Smith for what prosecutors say was the illegal retention of classified materials and for obstructing attempts to get them back. Last month, Smith opted to drop an appeal of a federal judge’s earlier order that had dissolved the case, and late last week, Smith resigned as special counsel. When Wray announced last month that he would leave, Trump responded in a Truth Social post that it is a “great day for America” because, according to him, “it will end the Weaponization of” the Department of Justice.

“I just don’t know what happened to him. We will now restore the Rule of Law for all Americans,” Trump wrote. The president-elect then praised Patel, saying he would be “committed” to bringing “law, order, and justice” to the United States. In Sunday’s interview with “60 Minutes,” Wray elaborated on why he would leave the law enforcement bureau. “My conclusion was that the thing that was best for the Bureau was to try to do this in an orderly way, to not thrust the FBI deeper into the fray,” he said before praising FBI officials and agents. “They tackle the job with a level of rigor and tenacity and professionalism and objectivity that I think is unparalleled, and I will tell you, it’s been the honor of a lifetime to serve with them,” he said of the agents. Regarding the Mar-a-Lago search, Wray backed his agents’ decision, saying it is the FBI’s responsibility to “follow the facts wherever they lead, no matter who likes it.”

He also said that searching Trump’s Palm Beach property and resort was seen as a last resort. “And when we learn that information, classified material, is not being properly stored, we have a duty to act. And I can tell you that in investigations like this one, a search warrant is not and here was not anybody’s first choice,” he told the outlet. When he was asked about Patel and other Cabinet nominees, Wray said he would not weigh in on Trump’s selections. “Facts and the law drive investigations, not politics or partisan preferences,” he said, referring to the FBI. Aside from speaking on his tenure as FBI director, Wray again warned that the greatest threat that the United States faces is the Chinese communist regime as state-backed malign actors have repeatedly targeted and hacked into U.S. infrastructure and companies.

Pardon Joe! He will need it!

• Special Prosecutor Cements Biden Family Corruption For History (JTN)

An epic political scandal derailed for years from the public attention it deserved by false Democrat and news media claims of “conspiracy theories” and “Russian misinformation” came to an abrupt and harsh conclusion Monday. And that repudiation was delivered by an unlikely source: the prosecutor who originally tried to give Hunter Biden a sweetheart deal that would have spared the first son prison time. Special Counsel David Weiss’ report was not a manifesto of new disclosures dug up by the FBI or a grand jury. It barely filled 27 pages and failed to answer several questions submitted by Congress, and thus it was blasted by lawmakers for being “incomplete.”

But in simple terms it affirmed for history some simple conclusions: 1.) Hunter Biden broke the law. 2.) The Biden family engaged in a political grift that sucked millions from foreign interests by trading on its powerful name. And 3.) the family patriarch, Joe Biden, misled the public by suggesting his family was a victim of politics that warranted a pardon that erased his son’s dual convictions in tax and gun cases. “The Constitution provides the President with broad authority to grant reprieves and pardons for offenses against the United States, but nowhere does the Constitution give the President the authority to rewrite history,” Weiss wrote in one of several poignant repudiations of the sitting president.

Rep. Harriet Hageman, R-Wyoming, a member of the House Judiciary Committee that investigated a large part of the Biden scandal, told Just the News on Monday evening that Weiss’ report left much to be still investigated by Congress, including the potential national security implications of Joe Biden’s decisions for countries where his son collected millions. “To what extent has our national security been compromised because of the activities and actions of Hunter Biden?” she asked during an appearance on the Just the News, No Noise television show. “I constantly have to question the position that this administration has taken with regard to China, what we’re seeing with the with the drones on the East Coast and even in Wyoming, the Chinese spy balloon that was allowed to traverse the entirety of the entire United States, the situation in Ukraine, with spending another $500 million there in the last week that he is in office.

“All of these are countries that had contact with and were paying Hunter Biden massive amounts of money, and that’s why this is an important issue for the American people, because we cannot allow family members of elected officials to be able to sell our country to the highest bidder of foreign countries,” she added. House Oversight and Accountability Committee Chairman James Comer, R-Ky., who led an impeachment inquiry of Joe Biden, said the report was “incomplete” but that its most important contribution was to confirm for history that the Biden family engaged in corruption and tried to cover it up as his committee had shown. “Joe Biden will be remembered for using his last few weeks in office to shield his son from the law and protect himself. The president’s legacy is the same as his family’s business dealings: corrupt,” he said.

Most of Weiss’ grievances dealt with Joe Biden’s attacks on the FBI and IRS agents and federal prosecutors who brought charges against his son, a proverbial defense of institutions by a career prosecutor who eventually was appointed U.S. Attorney by President Donald Trump, then special counsel by Biden Attorney General Merrick Garland. “Politicians who attack the decisions of career prosecutors as politically motivated when they disagree with the outcome of a case undermine the public’s confidence in our criminal justice system,” he wrote. “The President’s statements unfairly impugn the integrity not only of Department of Justice personnel, but all of the public servants making these difficult decisions in good faith.”

Weiss himself faced questions about the judgement of his staff after his team tried to give Hunter Biden a prison-sparing deal that was scuttled by a federal judge only when two IRS whistleblowers, Gary Shapley and Joseph Ziegler, came forward to Congress with evidence of political interference in the case. Weiss then doubled back and sought more serious cases against Hunter Biden after the embarrassment, securing a jury conviction in his home state of Delaware on gun charges and a guilty plea on sweeping tax charges in California.

The dual convictions placed the first son in jeopardy of facing prison time, but President Biden intervened before sentencing and issued a pardon in December that he earlier had vowed to avoid. His office’s wobbly performance left just one final unknown: How would the special prosecutor define Hunter Biden’s conduct for history in the final report. The first few paragraphs gave a succinct answer. “I prosecuted the two cases against Mr. Biden because he broke the law,” Weiss wrote in a passage that refuted years of claims by the family and its defenders that Joe Biden’s son had done nothing wrong. “Eight judges across numerous courts have rejected claims that they were the result of selective or vindictive motives,” he added for emphasis.

Weiss then proceeded to describe the scheme that led to the charges: Hunter Biden traded on his politically powerful family name to collect millions from foreigners seeking influence, performed little work, then failed to pay taxes on some of the income. Some of that money came from Burisma Holdings, the Ukrainian energy firm deemed corrupt by the State Department that prompted the scandal back in 2019 in a series of columns written by this author in The Hill newspaper. “Mr. Biden made this money by using his last name and connections to secure lucrative business opportunities, such as a board seat at a Ukrainian industrial conglomerate, Burisma Holdings Limited, and a joint venture with individuals associated with a Chinese energy conglomerate,” the prosecutor wrote. Weiss added for emphasis: “He negotiated and executed contracts and agreements that paid him millions of dollars for limited work.”

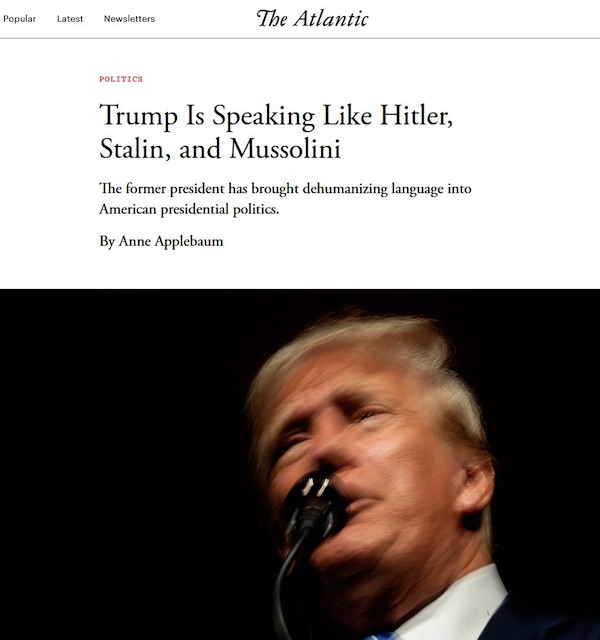

“Trump 2.0 is gearing up to be an extended exercise in the capacity to hurt The Other. Any Other. Hostile takeovers – and blood on the tracks. That’s how we “negotiate”.

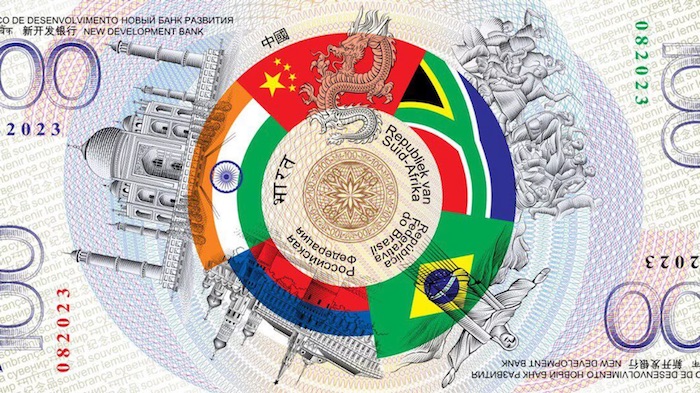

• I’m Gonna MAGA You, Baby (Pepe Escobar)

It’s the greatest show on earth – unleashing a double bill of New Paradigm and Manifest Destiny on crack. We are the greatest. We will rock you – in every sense. We will crush you. We will take whatever we want because we can. And if you wanna walk away from the U.S. dollar, we will destroy you. BRICS, we’re coming to get ya. Trump 2.0 – a mix of professional wrestling and MMA played in a giant planetary cage – is in da house starting next Monday. Trump 2.0 aims to be on the driving seat on the global financial system; on control of the world’s oil trade and LNG supply; and on strategic media platforms. Trump 2.0 is gearing up to be an extended exercise in the capacity to hurt The Other. Any Other. Hostile takeovers – and blood on the tracks. That’s how we “negotiate”.

Under Trump 2.0, global tech infrastructure must run on U.S. software, not just on the profit front but also on the spy front. AI data chips must be American only. AI data centers must be controlled by America only. “Free trade” and “globalization”? That’s for losers. Welcome to neo-imperial, techno-feudal mercantilism – powered by U.S. tech supremacy. Trump’s National Security Advisor Mike Waltz has named a few of the targets ahead: Greenland; Canada; assorted cartels; the Arctic; the Gulf of “America”; oil and gas; rare earth minerals. All in the name of strengthening “national security”. A key plank: total control of the “Western Hemisphere”. Monroe Doctrine 2.0 – actually the Donroe Doctrine. America First, Last and Always.

Well, let’s delve a bit on pesky material imperatives. The Empire of Chaos faces a humongous debt, owed to usual suspect loan sharks, that may only be – partially – repaid by selected export surpluses. That would imply re-industrialization – a long, costly affair – and securing smooth military supply chains. Where the resource base will be for this Sisyphean task? Washington simply cannot rely on Chinese exports and rare earths. The chessboard needs to be rejigged – with trade and tech unified under U.S. unilateral, monopoly control. Plan A, so far, was to simultaneously confront Russia and China: the two top BRICS, and key vectors of Eurasia integration. China’s strategy, since the start of the millennium, has been to trade resources for infrastructure, developing Global South markets as China itself keeps developing.

Russia’s strategy has been to help nations recover their sovereignty; actually helping nations to help themselves on the sustainable development front. Plan A against the concerted geoeconomic and geostrategic strategies of the Russia-China strategic partnership miserably failed. What has been attempted by the ghastly, exiting U.S. administration generated serial, massive blowbacks. So it’s time for Plan B: Looting the allies. They are already dominated chihuahuas anyway. The – exploitation – show must go on. And there are plenty of chihuahuas available to be exploited. Canada has loads of fresh water plus oil and mining wealth. The Canadian business class in fact has always dreamed of deep integration with the Empire of Chaos. Trump 2.0 and his team have been careful not to name names. When it comes to the Arctic as a crucial, evolving battlefield, there may be a vague allusion to the Northwest Passage.

But never a mention of what really matters; the Northern Sea Route – the Russian denomination; the Chinese call it the Arctic Silk Road. That’s one of the key connectivity corridors of the future. The Northern Sea Route encompasses at least 15% of the world’s unexplored oil and 30% of the world’s unexplored natural gas. Greenland is smack in the middle of this New Great Game – capable of supplying years of uranium, as much oil as Alaska (bought from Russia in 1867), plus rare earths – not to mention providing useful real state for missile defense and offense. Washington has been trying to grab Greenland from Denmark since 1946. There’s a deal with Copenhagen in place guaranteeing military control – mostly naval. Now Greenland is being revamped as the ideal U.S. entry point into the Arctic Great Game against Russia.

At the St. Petersburg forum last June, I had the privilege to follow an exceptional round table on the Northern Sea Route: that’s an integral part of Russia’s 21st century development project, focused on commercial navigation – “We need more icebreakers!” – and bound to surpass Suez and Gibraltar in the near future. Slightly over 50,000 Greenland residents – which already enjoy autonomy, especially vis a vis the EU – would more than accept a full Danish exit; Copenhagen actually abandoned them since 1951. Greenlanders will love to profit from vast U.S. investments. Foreign Minister Sergey Lavrov went straight to the point: “The first step is to listen to the Greenlanders” – comparing it to how Russia listened to the residents of Crimea, Donbass and Novorossiya vis a vis Kiev.

What Trump 2.0 actually wants from Greenland is crystal clear: total militarization; privileged access to rare earths; and commercially excluding Russia and Chinese companies. Chinese military expert Yu Chun noted that “soon, the long-desired ‘golden waterway’ of the Arctic Ocean is expected to open, allowing ships to traverse the Pacific Ocean and sail along the northern coasts of North America and Eurasia into the Atlantic Ocean.” As the Northern Sea Route is “a key element of Sino-Russian cooperation”, it’s inevitable that the U.S.’s “strategic vision is to prevent the establishment of a ‘golden waterway’ between China, Russia, and Europe by controlling Greenland.”

It’s Starmer again..

• Judge Threatens To Break UK Wall Of Secrecy In Assange Persecution (Cook)

Judge Foss, sitting at the London First-Tier Tribunal, has ruled that the Crown Prosecution Service must explain how it came to destroy key files that would have shed light on why it pursued Assange for 14 years. The CPS appears to have done so in breach of its own procedures. Assange was finally released from Belmarsh high-security prison last year in a plea deal after Washington had spent years seeking his extradition for publishing documents revealing US and UK war crimes in Iraq and Afghanistan. The CPS files relate to lengthy correspondence between the UK and Sweden over a preliminary investigation into rape allegations in Sweden that predate the US extradition case. A few CPS emails from that time were not destroyed and have been released under Freedom of Information rules. They show that it was the UK authorities pushing reluctant Swedish prosecutors to pursue the case against Assange.

Eventually, Swedish prosecutors dropped the case after running it into the ground. In other words, the few documents that have come to light show that it was the CPS — led at that time by Keir Starmer, later knighted and now Britain’s prime minister — that waged what appears to have been a campaign of political persecution against Assange, rather than one based on proper legal considerations. It is not just Britain concealing documents relating to Assange. The US, Swedish and Australian authorities have also put up what Stefania Maurizi, an Italian journalist who has been doggedly pursuing the FoI requests, has called “a wall of darkness”. There are good grounds for believing that all four governments have co-ordinated their moves to cover up what would amount to legal abuses in the Assange case.

Starmer headed the CPS when many highly suspect decisions regarding Assange were made. If the documents truly have been destroyed, it will be difficult, if not impossible, to ever know how directly he was involved in those decisions. Extraordinarily, and conveniently for both the UK and Sweden, it emerged during legal hearings in early 2023 that prosecutors in Stockholm claim to have destroyed the very same correspondence deleted by the CPS.

The new ruling by Judge Foss will require the CPS to explain how and why it destroyed the documents, and provide them unless it can demonstrate that there is no way they can ever be retrieved. Failure to do so by 21 February will be treated as contempt of court. The UK and the US have similarly sought to stonewall separate FoI requests from Maurizi concerning their lengthy correspondence while Washington sought to extradite Assange on “espionage” charges for revealing their war crimes. The British judiciary approved locking Assange up for years while the extradition case dragged on, despite United Nations legal experts ruling that Assange was being “arbitrarily detained” and the UN’s expert on torture, Nils Melzer, finding that Assange was being subjected to prolonged psychological torture that posed a threat to his life.

Never ending.

• New Book Published Today – LONG LIVE NOVICHOK! (Helmer)

From the beginning, the Russian Embassy in London issued formal requests for consular access to the Skripals and protest notes when this was denied by the Foreign Office. In reply to British stonewalling on access and propagandizing the allegations against the Russian government, the Embassy issued a detailed summary of every action Russian officials had taken and the statements they made. The one option the Embassy in London did not take was to engage British lawyers to obtain a hearing and an order of habeas corpus in the High Court to compel the appearance of the Skripals to testify for themselves. This option was obvious to the Embassy and lawyers in London between March 21, 2018, when the Home Office went to the court for legal authority to allow blood testing of the Skripals, and April 9, when Salisbury District Hospital announced that Yulia Skripal had been released; and then on May 18 when Sergei Skripal was also discharged from hospital.

During this period it was reported that Yulia was able to telephone her cousin Viktoria in Russia. Years later, as Chapters 67, 71, and 73 reveal, it became clear in retrospect that Yulia had recovered consciousness in hospital much earlier than the hospital allowed to be known, and that doctors had then forcibly sedated her. At the time the Russian Embassy was announcing it “questioned the authenticity” of the statements issued by the London police and media on Yulia’s behalf. The Embassy was right; it was not believed. It is possible the Embassy did attempt to engage barristers to go to court for a habeas corpus hearing for the Skripals, but learned that no one would take the case. At the time I made an independent request for this engagement to the well-known human rights barristers in London; the outcome was that none agreed to represent the Skripals. The refusals were point-blank – no one would give a reason.

British officials anticipated that an effort might succeed in forcing a High Court hearing, however. So, on May 24, 2018, a one minute fifty-five second speech by Yulia Skripal was presented on video in which she spoke from a script and appeared to sign a statement. Referring to “offers of assistance from the Russian Embassy,” she claimed “at the moment I do not wish to avail myself of their services.” Skripal’s Russian text spoke of “help” from the Russian Embassy: “now I don’t want and [I am] not ready to use it.” “Obviously, Yulia was reading a pre-written text,” the Russian Embassy responded publicly. “[This] was a translation from English and had been initially written by a native English-speaker…With all respect for Yulia’s privacy and security, this video does not discharge the UK authorities from their obligations under Consular Conventions.”

At first, Putin seemed unprepared on the facts of the case – the Russian facts – and unprepared for the British government’s propaganda blitz. The president cannot have been unprepared. On March 15, 2018, the Kremlin revealed that at a Security Council meeting on that day Putin was briefed by the Foreign and Defense Ministers and the intelligence chiefs. “While talking about international affairs,” the official communiqué said, “the Council members held an in-depth discussion on Russia-UK relations against the backdrop of Sergei Skripal’s case. They expressed grave concern over the destructive and provocative position of the British side.”

The line which Putin and his advisers decided at that meeting they planned to follow in public was revealed by Putin three days later at a press conference. He tried to feign ignorance himself, and then dissimulated on the weapon, the motive, and the opportunity. “Regarding the tragedy you have mentioned,” Putin told reporters, “I learned about it from the media. The first thing that comes to mind is that, had it been a warfare agent, the victims would have died immediately. It is an obvious fact which must be taken into account. This is first.”

“The second is that Russia does not have such chemical agents. We destroyed all our chemical weapons, and international observers monitored the destruction process. Moreover, we were the first to do this, unlike some of our partners who promised to destroy their chemical weapons but have not done so to this day, regrettably. Therefore, we are ready for cooperation, as we said immediately. We are ready to take part in any investigations necessary, provided the other side wants this too. We do not see their interest so far, but we have not removed the possibility of cooperation on this matter from the agenda.” “As for the overall situation, I believe that any reasonable person can see that this is total nonsense. It is unthinkable that anyone on Russia would do such a thing ahead of the presidential election and the FIFA World Cup. Absolutely unthinkable. However, we are ready for cooperation despite the above things. We are ready to discuss any issues and to deal with any problems.”

Badger

The interesting life of a honey badger

— Science girl (@gunsnrosesgirl3) January 14, 2025

Peacock

https://twitter.com/i/status/1879213811472941088

Shark

Studies based on 28 Greenland sharks determined by radiocarbon dating of crystals within the lens of their eyes, say that the oldest of the animals had lived for 392±120 years and was consequently born between 1504 and 1744.pic.twitter.com/P8pb16S0rY

— Massimo (@Rainmaker1973) January 14, 2025

Sound

That sound gave me chills pic.twitter.com/OO8Mg74vPa

— NO CONTEXT HUMANS (@HumansNoContext) January 13, 2025

San Carlo

https://twitter.com/i/status/1879181689328480729

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.