Jasper Johns Map 1961

Macgregor

France fire

https://twitter.com/i/status/1639775790698217472

ATF

Republican Rep. asks ATF if lying on their federal Background check is illegal.

ATF: “Yes. 15 years in jail if you do that.”

Republican Rep. Tiffany: “So why is Hunter Biden not in Prison?”

***All Hell Breaks Loose***

Gottem pic.twitter.com/aXYQW2GBXR

— Benny Johnson (@bennyjohnson) March 23, 2023

GI bacteria

New alarming development: The Covid Vaccine’s spike protein is not just effecting, but COMPLETELY ELIMINATING important GI bacteria from the gut for months after vaccination.

Even babies breastfeeding from their vaccinated mothers are experiencing this.

9 months… pic.twitter.com/BSrWNw4xog

— DiedSuddenly (@DiedSuddenly_) March 25, 2023

Greenwald

Glenn Greenwald has absolutely nailed the essence of "unwillingness of Ukraine to negotiate", because it's not the Ukrainians that don't want to do so, it's the puppet Zelensky and his overlords that don't, and John Kirby verbatim confirmed it recently. pic.twitter.com/bzX9sb0RhX

— Donbass Devushka (@PeImeniPusha) March 24, 2023

Bhakdi

'I have absolute faith that mRNA vaccines will kill you,' says Sucharit Bhakdi, MD pic.twitter.com/cg7drtnOx7

— Jung (@betterworld_24) March 25, 2023

Atlas

Dr. Scott Atlas: U.S. Covid response was based on lies pic.twitter.com/aSbXRcN778

— Wittgenstein (@backtolife_2023) March 25, 2023

“..Moscow is well aware of Ukrainian plans to stage an offensive, noting that Russia’s General Staff is making its own assessments on the matter and planning a response.”

• Ukraine Not Ready For Offensive – Zelensky (RT)

Ukraine has not yet accumulated enough resources to stage an offensive, President Vladimir Zelensky has admitted. In an interview released on Saturday by the Japanese newspaper Yomiuri, Zelensky said that the situation on the frontline “was not good,” explaining that Ukraine was lacking enough ammunition for successful operations. On the subject of an offensive, the Ukrainian president stated that “we can’t start [it] yet. Without tanks, artillery and [US-supplied rocket launchers] HIMARS, we cannot send our brave soldiers to the front lines.” “We are waiting for ammunition to arrive from our partners,” he added, claiming that Russian troops had been firing three times as many shells as the Ukrainian side. In light of this, he reiterated his calls for Kiev’s Western backers to send more arms and urged them to sign off on deliveries of fighter jets.

Commenting on a potential dialogue with Russia, Zelensky insisted that “absolutely no conditions have been formed for this,” suggesting that Moscow would have to leave the territories Ukraine claims as its own first. Moscow has repeatedly said that it is open to talks with Kiev on condition that it recognize the “reality on the ground,” referring to the new status of four former Ukrainian regions as part of Russia. Speculations about an imminent Ukrainian spring counteroffensive have been swirling in the Western media for several weeks now. Last week, Politico reported that the US expected Kiev to start the offensive in May, with Ukrainian troops attempting to push into Crimea either by crossing the Dnieper River – which was considered an unlikely option – or moving out from their positions in the north.

Around the same time, the New York Times reported that Western officials were worried that Ukraine’s costly attempts to hold on to the strategic Donbass city of Artyomovsk (known as Bakhmut in Ukraine) could jeopardize the upcoming offensive, given that Kiev’s Western backers would not be able to replenish its ammunition stocks any time soon. With this in mind, one Pentagon official cited by the outlet described the anticipated push as a “last-ditch effort.” On Friday, former Russian President Dmitry Medvedev, who now serves as deputy chairman of the Security Council, said that Moscow is well aware of Ukrainian plans to stage an offensive, noting that Russia’s General Staff is making its own assessments on the matter and planning a response.

BBC=MSM

• No Ukraine Offensive Without More Weapons – Zelensky (BBC)

President Volodymyr Zelensky has said Ukraine’s counter-offensive against Russia cannot start until Western allies send more military support. He told a Japanese newspaper he would not send his troops to the frontlines without more tanks, artillery and Himars rocket launchers. In an interview with Yomiuri Shimbun, he said the situation in eastern Ukraine was “not good”. “We are waiting for ammunition to arrive from our partners,” he said. And when asked about the expected counter-offensive, he said: “We can’t start yet, we can’t send our brave soldiers to the front line without tanks, artillery and long-range rockets.” He added: “If you have the political will, you can find a way to help us. We are at war and can’t wait.” There has been talk for some weeks of Ukraine launching a spring offensive against Russian forces. Ukrainian commanders have hinted it might be imminent.

Oleksandr Syrskyi, commander of Ukraine’s ground forces, said this week it might come “very soon”. Some analysts say Ukraine’s military is talking up the idea of a counter-offensive to discomfit their Russian counterparts. They want Russian commanders to spread their forces thinly along the front lines, ready for any attack, rather than concentrate them in particular places, such as the eastern city of Bakhmut. Other analysts believe a counter-offensive is possible soon. A US-based think tank, the Institute for the Study of War, last week suggested that Russia’s own offensive was potentially losing momentum and concluded: “Ukraine is therefore well positioned to regain the initiative and launch counter-offensives in critical sectors of the current frontline.”

But President Zelensky is more pessimistic. He has often warned that the war could drag on for years unless Western allies speeded up the delivery of weapons. But this is the first time he has actually said the counter-offensive itself might be delayed by the lack of Western equipment. His remarks reflect not only his desire to encourage more speed, but also his frustration at what he sees as the lack of haste.

“..the Western countries have “significantly expanded our alliances.” “I haven’t seen that happen with China and/or Russia or anybody else in the world..”

• Biden Downplays Russia-China Ties (RT)

The global community is paying too much attention to cooperation between China and Russia, US President Joe Biden said on Friday. His comments came several days after Chinese President Xi Jinping concluded a landmark three-day visit to Russia. Speaking at a joint press conference with Canadian Prime Minister Justin Trudeau, Biden was asked to comment on China’s efforts to deepen economic ties with Russia. The president replied that the Western countries have “significantly expanded our alliances.” “I haven’t seen that happen with China and/or Russia or anybody else in the world,” he added. Biden went on to say that he has met with 80% of the world leaders since being sworn into office. “We’re the ones expanding the alliances. The opposition is not,” he claimed.

“We’re in a situation in the United States where NATO is stronger, we’re all together – the G7, the Quad [security agreement between Australia, India, Japan, and the US], the ASEAN [Association of Southeast Asian Nations], Japan, and Korea,” Biden said. The president stated that while he does not take China and Russia lightly, “we vastly exaggerate” their ties. “I’ve been hearing now for the past three months about ‘China is going to provide significant weapons to Russia, and they’re going to…’ They haven’t yet. Doesn’t mean they won’t, but they haven’t yet.” The US has said that China is considering arms shipments to help Russia in the Ukraine conflict. This claim has been vehemently denied by Beijing, which has positioned itself as a neutral party in the context of hostilities between Moscow and Kiev, while repeatedly calling for a peace settlement.

Earlier this week, Xi wrapped up a three-day visit to Moscow, which included talks with Russian President Vladimir Putin and resulted in the signing of more than a dozen agreements on cooperation in the defense, economic, and industrial spheres. Moscow and Beijing also pledged to “deepen relations of comprehensive partnership and strategic interaction entering a new era,” while urging the US “to stop undermining international and regional security… in order to maintain its own unilateral military superiority.”

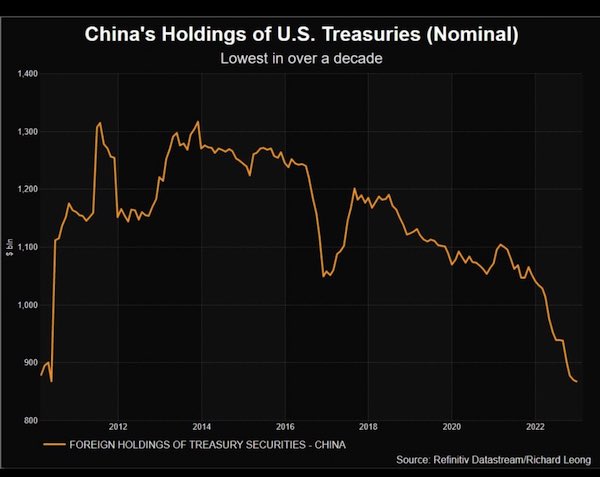

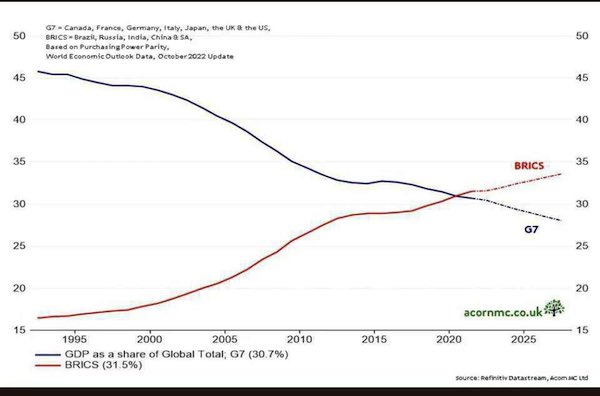

“This was not a projection, but rather a statement of accomplished fact: BRICS was responsible for 31.5 percent of the PPP-adjusted global GDP, while the G7 provided 30.7 percent..”

• G7 vs BRICS – Off to the Races (Scott Ritter)

Since the Russian invasion of Ukraine, an ideological divide that has gripped the world, with one side (led by the G7) condemning the invasion and seeking to punish Russia economically, and the other (led by BRICS) taking a more nuanced stance by neither supporting the Russian action nor joining in on the sanctions. This has created a intellectual vacuum when it comes to assessing the true state of play in global economic affairs. It is now widely accepted that the U.S. and its G7 partners miscalculated both the impact sanctions would have on the Russian economy, as well as the blowback that would hit the West. Angus King, the Independent senator from Maine, recently observed that he remembers “when this started a year ago, all the talk was the sanctions are going to cripple Russia. They’re going to be just out of business and riots in the street absolutely hasn’t worked …[w]ere they the wrong sanctions? Were they not applied well? Did we underestimate the Russian capacity to circumvent them? Why have the sanctions regime not played a bigger part in this conflict?”

It should be noted that the IMF calculated that the Russian economy, as a result of these sanctions, would contract by at least 8 percent. The real number was 2 percent and the Russian economy — despite sanctions — is expected to grow in 2023 and beyond. This kind of miscalculation has permeated Western thinking about the global economy and the respective roles played by the G7 and BRICS. In October 2022, the IMF published its annual World Economic Outlook (WEO), with a focus on traditional GDP calculations. Mainstream economic analysts, accordingly, were comforted that — despite the political challenge put forward by BRICS in the summer of 2022 — the IMF was calculating that the G7 still held strong as the leading global economic bloc.

In January 2023 the IMF published an update to the October 2022 WEO, reinforcing the strong position of the G7. According to Pierre-Olivier Gourinchas, the IMF’s chief economist, the “balance of risks to the outlook remains tilted to the downside but is less skewed toward adverse outcomes than in the October WEO.” This positive hint prevented mainstream Western economic analysts from digging deeper into the data contained in the update. I can personally attest to the reluctance of conservative editors trying to draw current relevance from “old data.” Fortunately, there are other economic analysts, such as Richard Dias of Acorn Macro Consulting, a self-described “boutique macroeconomic research firm employing a top-down approach to the analysis of the global economy and financial markets.”

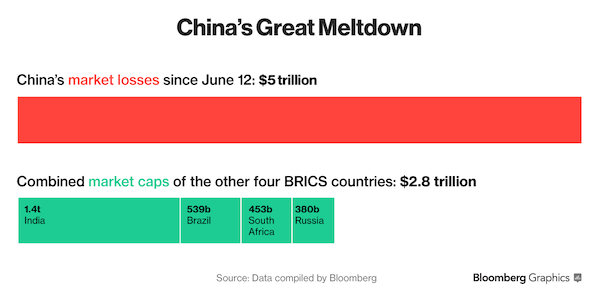

Rather than accept the IMF’s rosy outlook as gospel, Dias did what analysts are supposed to do — dig through the data and extract relevant conclusions. After rooting through the IMF’s World Economic Outlook Data Base, Dias conducted a comparative analysis of the percentage of global GDP adjusted for PPP between the G7 and BRICS, and made a surprising discovery: BRICS had surpassed the G7. This was not a projection, but rather a statement of accomplished fact: BRICS was responsible for 31.5 percent of the PPP-adjusted global GDP, while the G7 provided 30.7 percent. Making matters worse for the G7, the trends projected showed that the gap between the two economic blocs would only widen going forward.

“Around 156,000 ethnic Hungarians live in Ukraine, most of them in the western region of Transcarpathia. Ukraine is also home to around 150,000 ethnic Romanians and more than 250,000 Moldovans..”

• Hungary Comments On Ukraine’s NATO and EU bids (RT)

Hungary will not agree to Ukraine joining NATO and the EU as long as Kiev continues to discriminate against ethnic Hungarians living in Transcarpathia, Foreign Minister Peter Szijjarto has said. Szijjarto added that he raised the issue at a meeting with the UN assistant secretary general for human rights, Ilze Brands Kehris. Up to 99 Hungarian primary and secondary schools are in danger of being closed in Ukraine due to the nation’s education law, Szijjarto said. “I made it clear to Ilze Brands Kehris… that Hungary will not be able to support Ukraine’s transatlantic and European integration [bids] under any circumstances as long as Hungarian schools in the Transcarpathia region are in danger,” the minister wrote on Facebook on Friday. Kiev has been cracking down on minority language rights for years.

Laws enforcing the use of Ukrainian in education and television were adopted as early as 2017 under then-President Pyotr Poroshenko. In 2018, another law banned the teaching of Russian, as well as Romanian, Polish, and Hungarian beyond the primary school level. In 2019, the Council of Europe’s Venice Commission criticized Ukraine’s State Language Law, saying it “fails to strike balance between strengthening Ukrainian and safeguarding minorities’ linguistic rights.” Budapest has been among the most vocal critics of Kiev’s language policies in the West. According to Szijjarto, Ukraine has not done anything substantial to address Hungary’s concerns. “For the past eight years, we have continuously received promises from the Ukrainian authorities that they will solve this problem, but they have not actually done anything,” he said.

Around 156,000 ethnic Hungarians live in Ukraine, most of them in the western region of Transcarpathia. Ukraine is also home to around 150,000 ethnic Romanians and more than 250,000 Moldovans, and Bucharest previously joined Budapest in demanding that the language laws be revised. In February, Szijjarto announced that the Council of Europe will review Kiev’s treatment of minorities and issue a report on its alleged discrimination against ethnic Hungarians and Romanians living in Ukraine this summer. He pointed to yet another law adopted in December 2022, which mandated the use of Ukrainian in most aspects of daily and public life, including schools.

They want a declaration of wonderful unity, not diverse voices.

• Biden Snubs Türkiye And Hungary For ‘Democracy’ Summit (RT)

The administration of US President Joe Biden has left NATO allies Türkiye and Hungary off the invite list for next week’s Summit for Democracy, Foreign Policy magazine reported on Thursday, citing three US officials familiar with the decision. The two countries were also snubbed from last year’s inaugural rendition of the summit, an event that, despite being held only twice, Biden has lauded as one of his signature foreign policy achievements. A State Department official confirmed that all participants in the 2021 summit had received an invitation for this year’s event, plus some additions. However, he said, the Biden administration was “not interested in this event being seen as an all-encompassing judgment on the strength of another country’s democracy.”

Rob Berschinksi, senior director for human rights and democracy in the National Security Council, told al-Monitor that while Türkiye was “an important NATO ally of the United States and an incredibly important partner,” Washington had “been quite clear in terms of [its] assessment of the status of democracy and human rights within the country,” namely, that it was declining. Turkish President Recep Tayyip Erdogan’s announcement last week that the country would begin ratifying Finland’s membership in NATO but not Sweden’s likely contributed to the decision to leave it off the list a second time. While Erdogan has not ruled out admitting Sweden to the military alliance, he stressed that Stockholm’s refusal to turn over more than 210 alleged terrorists to Turkish custody was a deal-breaker.

Hungary, which Biden memorably denounced as “totalitarian” in 2020, has fallen into disfavor among NATO allies for its refusal to support the strictest sanctions the EU has attempted to deploy against the Russian oil and gas industry. With about 80% of its natural gas coming from Russia, Budapest has repeatedly pointed out that an embargo would hurt Hungary and other European nations much more than it would punish Moscow for the conflict in Ukraine. The Hungarian prime minister’s office earlier this week reiterated calls for a ceasefire in Ukraine and condemned the UK’s decision to send depleted uranium ammunition to Kiev. The country’s opposition to allowing Ukraine into the EU will not change unless “basic human rights norms are complied with” regarding the use of EU languages in Ukraine, Gergely Gulyas, head of the PM’s office, told reporters on Thursday, though Hungary has expressed support for Finland and Sweden joining NATO. The Summit for Democracy will take place from March 28-30 in Washington, as well as in partner countries Costa Rica, South Korea, and Zambia.

The ICC is just another black hole for money and truth.

• Putin Indictment Deals Fatal Blow to ICC Legitimacy (Develay)

Already under considerable pressure these past few years for its perceived selective prosecution of mostly African leaders, the International Criminal Court has placed its own proverbial “nail in the coffin” on March 17th when it issued an arrest warrant against the Russian Federation’s President Vladimir Putin. To be sure, the Court had since its inception faced numerous obstacle in trying to establish its status as the preeminent jurisdiction tasked with prosecuting senior official alleged to have committed or abetted the most heinous crimes under international criminal law. First, the United States never ratified the Rome Statute. While former US President William J. CLINTON had hinted that the US would join the list of Member-States by signing (but not ratifying the Treaty of Rome), George W. BUSH (egged on by his then Permanent Ambassador to the UN, John BOLTON) promptly dashed any hopes that this would ever happen.

Indeed, the BUSH administration presided over the adoption of the Hague Invasion Act of 2002 (the same year the Court effectively came into existence in the wake of its having collected the prerequisites sixty signatures from its Members). The Act openly called if necessary for the US military to storm the ICC in order to exfiltrate US soldiers. If that wasn’t enough of a message that some (the most powerful) States would take a pass on granting the Court jurisdiction over their nationals (China, Saudi Arabia, Iran, India and Israel never even signed the Treaty), Washington proceeded to amend all of the SOFAs (Status of Forced Agreements) negotiated with the governments of every country having ratified the Rome Statute where the US has some of its troops stationed by providing that American soldiers would not be subjected to any types of extradition proceedings to the Hague (ASPA).

This sequence of events essentially set the tone for 20 years of subsequent campaigns engineered by the Court so as to establish its own relevance. The powerlessness of the Court is to be found within the Rome Statute itself. Indeed, the Court may not claim jurisdiction over occurrences of alleged Jus Cogens violations (those violations not subjected to any Statute of limitations) unless said violations are alleged to have occurred on the territory of a Member-State which thus has accepted the Court’s jurisdiction or if said jurisdiction is expressly granted through a resolution adopted by the UN Security Council (not subjected to a veto from any of its Five Permanent Members).

“US leadership is in the past, living in denial, and running policies on how they assume the world “should be,” rather than how it actually “is..”

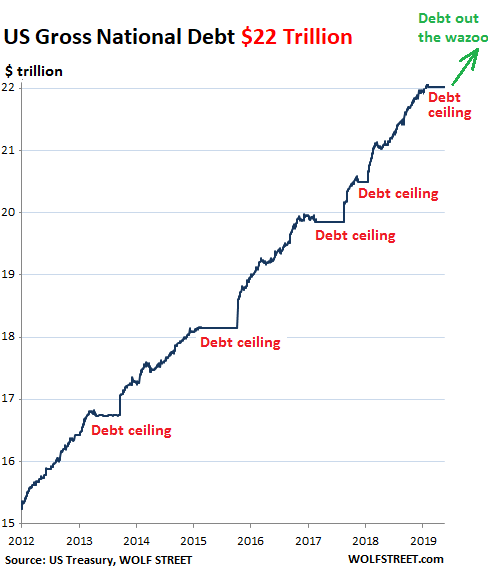

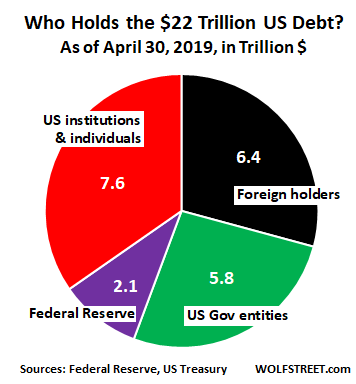

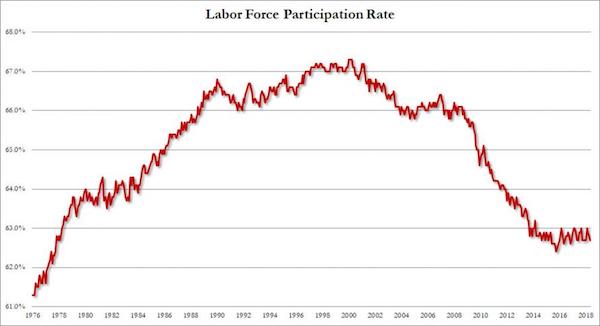

• Western Economic Prosperity Is Over And Not Coming Back Any Time Soon (Fomenko)

The years of Western boom, enjoyed in the 90s and early 2000s, never returned and if the past few years are any indication, won’t anytime soon. The geopolitical climate is now in such a position that globalization is being rolled back, deliberately. The economic system the US once built and heralded as a virtue to show communist countries the light of capitalism is now being dismantled because it is perceived not to have converted, but empowered “adversarial” states. The US now opposes free trade, opposes economic integration between its allies and both China and Russia, and has no qualms about tearing up the roots of the globalization tree. The answer is less free trade, more tariffs, more sanctions, more export controls, more forcing allies to comply with what it wants, and unreasonable investments fueled by geopolitics, not market needs.

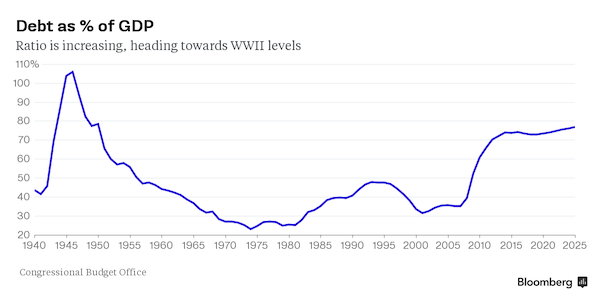

The Biden administration’s economic policy is a disaster precisely because it is a mix of geopolitical assertiveness, heavy-handed protectionism, and catastrophic fiscal policy. Washington’s decision to inject trillions to shore up the US economy, prolong a war which produces a running inflation crisis, insist on a growing economic war with China, and then be forced to raise interest rates multiple times, despite banks going under, is a cocktail of death. The US has drastically narrowed its options, and continually lied that it can handle the fallout.

Thus, the good old days of Western prosperity are over. The neoliberal Reaganite economic order was once the bedrock of global growth, as unfair and uneven as it was. But it is fair to say that by 2023, the geopolitical conditions which enabled this system no longer exist. The world has changed, and it is little wonder why. The US has not truly been able to arrest the rise of China despite trying its darndest to disrupt it, or to deal a death blow to the Russian economy, which Washington officials had prematurely declared doomed. All of it indicates that US leadership is in the past, living in denial, and running policies on how they assume the world “should be,” rather than how it actually “is,” and it’s ordinary people who are footing the bill for it all.

” Year over year mortgage applications have dropped a record 43 percent, and bank refi’s have dropped another record 74 percent.”

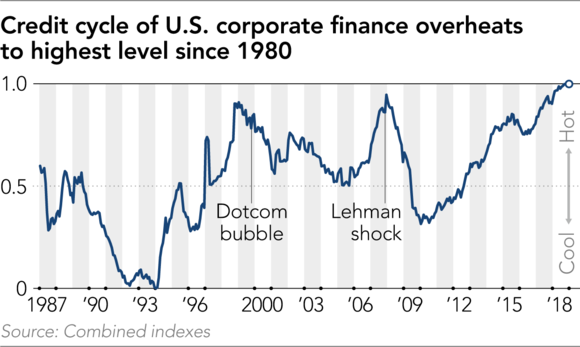

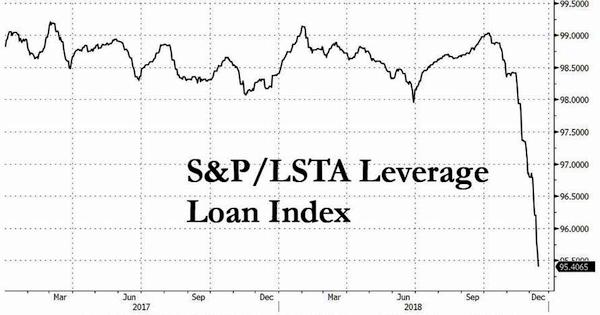

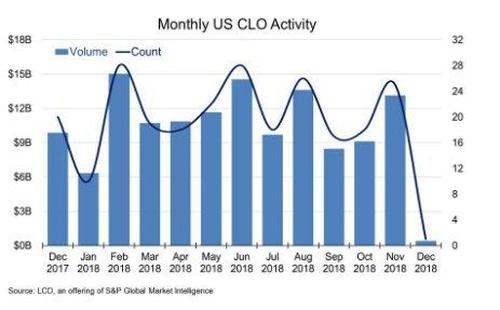

• New Worldwide Financial System/Banking Crisis is Upon Us (Mannarino)

Once again! The global financial system finds itself in crisis. Indeed, a new full-on worldwide financial system/banking crisis is upon us. (And it’s just getting started). Let us consider… Is it even remotely possible that banking regulators and central banks simply missed this? Meanwhile, We the People saw this coming? Is that even possible? Really? How about no. There is absolutely no feasible or realistic way that banking regulators and central banks could have not seen this coming from miles away, and here are just a few reasons why. Let’s start with this. Every bank is required to submit financial reports to regulatory authorities every quarter and moreover, even without seeing these reports, it’s plainly obvious that banks were failing because of just three things. Number 1. No deposits, Number 2. No loans, and Number 3. No deals.

I brought these three things listed above up to the attention of those who follow my work beginning no less than eight months ago. Now, just to put this into further perspective. The average savings rate, which is calculated as the percentage of cash which people put away after expenses, is 8.84 percent. Again 8.84 percent is the average. Well today, the savings rate has dropped to just 4.7 percent (and personally I believe that this number is inflated). This 4.7 percent savings rate appears inflated to me because currently more and more people are becoming dependent on credit card usage. (Credit card debt has exploded, rising 11 percent in just the last year). With respect to “no loans and no deals.” Year over year mortgage applications have dropped a record 43 percent, and bank refi’s have dropped another record 74 percent.

And on top of all this, loan delinquencies across the board continue to skyrocket. But it gets even worse. People are withdrawing cash from both their money market and savings accounts at a record pace. So, no… It is not possible, even in the remote! That those who stand in charge of the world economy, the banking system, and the markets just missed all this. Therefore, it is deliberate. In fact, it’s more than just deliberate! This entire banking system crisis/global financial system collapse has been perfectly orchestrated and engineered by central planners/banks. But why? The question of why comes down to just a few things. Central banks are “rearranging the deck chairs” so to speak, and it comes down to a consolidation of the banking system in preparation for the rollout of an entirely new central bank digital/cashless system.

It is also about a consolidation of power. Understanding that even the Super Banks are also facing those same issues as the smaller regional banks, with “no deposits, no loans, and no deals.” That situation, combined with rising loan delinquencies. Let’s not forget the flight of cash from people who are being forced to deplete their savings and money market accounts just to make ends meet in this ongoing inflationary environment. What better way could central planners use to re-liquify the large Wall Street Super Banks than to foster a meltdown of the smaller regional banks who will have no choice but to be forced into selling their assets to the mega banks at fire sale prices?

“In Annie Hall, Woody Allen cannot have his brother, who thinks he is a chicken, treated by a psychiatrist because the family needs the eggs. Banking regulation flounders on the same logic.”

• Is A Full-Blown Global Banking Meltdown In The Offing? (Satyajit Das)

The UBS acquisition of Credit Suisse requires the Swiss National Bank to assume certain risks. It will provide a Swiss Franc 100 billion ($108 billion) liquidity line backed by an enigmatically titled government default guarantee, presumably in addition to the earlier credit support. The Swiss government is also providing a loss guarantee on certain assets of up to Swiss Franc 9 billion ($9.7 billion), which operates after UBS bears the first Swiss Franc 5 billion ($5.4 billion) of losses. The state can underwrite bank liabilities including all deposits as some countries did after 2008. As US Treasury Secretary Yellen reluctantly admitted to Congress, the extension of FDIC coverage was contingent on US officials and regulators determining systemic risk as happened with SVB and Signature. Another alternative is to recapitalise banks with public money as was done after 2008 or finance the removal of distressed or toxic assets from bank books.

Socialisation of losses is politically and financially expensive. Despite protestations to the contrary, the dismal truth is that in a major financial crisis, lenders to and owners of systemic large banks will be bailed out to some extent. European supervisors have been critical of the US decision to break with its own standard of guaranteeing only the first $250,000 of deposits by invoking a systemic risk exception while excluding SVB as too small to be required to comply with the higher standards applicable to larger banks. There now exist voluminous manuals on handling bank collapses such as imposing losses on owners, bondholders and other unsecured creditors, including depositors with funds exceeding guarantee limit, as well as resolution plans designed to minimise the fallout from failures.

Prepared by expensive consultants, they serve the essential function of satisfying regulatory checklists. Theoretically sound reforms are not consistently followed in practice. Under fire in trenches, regulators concentrate on more practical priorities. The debate about bank regulation misses a central point. Since the 1980s, the economic system has become addicted to borrowing-funded consumption and investment. Bank credit is central to this process. Some recommendations propose a drastic reduction in bank leverage from the current 10-to-1 to a mere 3-to-1. The resulting contraction would have serious implications for economic activity and asset values. In Annie Hall, Woody Allen cannot have his brother, who thinks he is a chicken, treated by a psychiatrist because the family needs the eggs. Banking regulation flounders on the same logic.

“..The level of excitement could prompt Pornhub to do its first live courthouse feed…”

• Could Trump Win By Losing? Sometimes ‘Nothing’ Is ‘A Real Cool Hand’ (Turley)

Donald Trump was back in all caps this week, denouncing prosecutors, warning of “death and destruction” if he is arrested, and even posting a picture wielding a baseball bat menacingly near a headshot of Manhattan District Attorney Alvin Bragg. After each tirade, many of us denounced the inflammatory rhetoric while others insisted the former president was becoming unhinged at the prospect of being arrested. As if to speed along that decline, others posted viral fake AI-generated pictures showing Trump being arrested. Then Trump shared his own AI-generated photo of praying. The fact is that Trump is in his element: In the land of rage, the most enraged man is king. If you surf cable shows, you will see pundits in virtual ecstasy as they prepare for the possibility of a Trump mug shot or perp walk. The level of excitement could prompt Pornhub to do its first live courthouse feed.

[..]Trump is unlikely to see the inside of a prison before the election. Even after the election, courts likely would allow appeals to be exhausted before ordering the arrest of a sitting president — and those appeals could take years. On the federal charge, special counsel Jack Smith would have to finish his grand jury investigation and then convince Attorney General Garland to green-light criminal charges. He then may need to bring an indictment before the end of summer 2024, since Justice Department policy discourages filings that might affect an election. For the presidential election, that period would likely extend to August 2024. If Smith cannot indict Trump before then, he would run into another long-standing Justice Department policy. The department has long maintained (in my view, incorrectly) that a sitting president cannot be indicted.

If Smith secured a conviction before the election, Trump could still stay on the ballot. Indeed, even if he were jailed, he still could be elected president. After all, Eugene Debs ran for president in 1920 on the Socialist ticket despite being in prison for violating the Espionage Act. Trump literally could run on a promise to self-pardon and then immediately negate any conviction. Indeed, that issue may prove the ultimate anti-establishment rallying point for him. Trump won in 2016 in part because many of his voters wanted to stick it to the media and political elites. So, a charge or conviction before the election could well turn that anti-establishment wave into a tsunami. Of course, Trump could not pardon himself on a state conviction. Moreover, Georgia is one of only three states that do not give pardon authority to the governor; that authority rests with Georgia Board of Pardons and Paroles. (Georgia Gov. Brian Kemp, a Republican who has long been a target of Trump’s ire, may feel relieved to have his authority limited in this instance.)

However, the state could push for changes to negate a conviction or prevent enforcement against a sitting president. To most people, that may seem like an utter mess. For Donald Trump, it is an opportunity. Trump has always found advantage in chaos. That is why, if much of the public continues to view these legal cases as political prosecutions, Democrats may be handing Trump a winning hand. A Washington Post columnist previously declared that Trump has nothing to offer in defense to federal charges. That may or may not be true, but “nothing” could prove a major “something” in an election year. In the film, “Cool Hand Luke,” fellow prisoners asked Paul Newman’s character why he would continually raise the stakes in a poker game when he was holding nothing of value. His reply: “Sometimes nothing can be a real cool hand.”

“Strzok, who is famous for running an illicit coup on the US president and banging a colleague in the broom closet..”

• Fired FBI Goon Peter Strzok Issues Veiled Death Threat to Donald Trump (GP)

It’s been 30 years since the ATF-FBI siege on the Branch Davidian Compound in Waco, Texas in 1993. The government siege led to a massacre of 76 people including 25 children. The deadly assault on David Koresh’s Branch Davidian compound took place from February 28 through April 19, 1993, over suspected weapons violations. The ATF had attempted to raid the compound and a gun battle ensued, leaving four government agents and six Branch Davidians dead. For the next 50 days, the government would use psychological warfare, such as playing the sound of animals being slaughtered, until ultimately the compound was burned to the ground with nearly everyone still inside.

The siege ended with the massacre of 76 people. On Friday fired FBI agent Peter Strzok posted a veiled death threat against President Trump just hours before his historic rally Saturday in Waco, Texas. Strzok, who is famous for running an illicit coup on the US president and banging a colleague in the broom closet, posted a photo of the government-led massacre at the religious compound in Waco, Texas. Everyone knows it was the feds who were ultimately blamed for this horrible mass killing. And, now Peter Strzok is posting this warning to Trump and his supporters. It is shocking to see today that such an unhinged and unethical monster was sitting at the top level of the FBI!

Where are Tucker’s 40,000 hours of video?

• Prosecutor Admits DC Police Officers Acted as Provocateurs on Jan. 6 (ET)

A federal prosecutor admitted in court papers that three D.C. Metropolitan Police Department undercover officers acted as provocateurs at the northwest steps of the U.S. Capitol on Jan. 6, 2021. The admission came in a March 24 filing before U.S. District Judge Rudolph Contreras that seeks to keep video footage shot by the officers under court seal. Prosecutors accused the case defendant—William Pope of Topeka, Kansas—of an “illegitimate” attempt to unmask the video as part of his alleged strategy to try the case in the news media. Pope filed a motion to remove the court seal on Feb. 21. [..] Nearly 30 members of the Electronic Surveillance Unit were assigned to duty on Jan. 6, some of whom were gathering evidence on crowd activity. Members wore special bands on their left wrists to identify themselves as part of the Electronic Surveillance Unit, according to the MPD’s 96-page Jan. 6 action plan.

Officer 1 repeatedly joined in chants of “Drain the swamp!” and “Our house! Our house! Our house!” A little closer to the Capitol, the video captures a protester shouting, “Joe Biden! We wanna hear you speak, you [expletive] pedophile satanist [expletive]!” A short time later, Officer 1 joined the crowd in a “USA!” chant, repeating the phrase five times. At the foot of the northwest stairs, someone leaned part of a bicycle rack against the balustrade. As a protester climbed up the makeshift ladder, Officer 1 shouted, “C’mon, man, let’s go! Leave that sh*t.” Officer 1 got help from a protester climbing onto the balustrade of the steps. Then, surveying the people moving up the staircase, he shouted, “C’mon, go, go, go!” Officer 1 encouraged the crowd to move up the stairs with repeated shouts, “Keep going! Keep going!” and “Keep going, keep going, come on!”

Once Officer 1 jumped from the balustrade onto the stairs, he passed someone he knew, a man in a blue sweatshirt wearing a dark cap, protective goggles, and what appeared to be a Halloween mask. “Tim!” the officer said, to which the unidentified man replied, “What’s going on, bro?” Walking on a sidewalk next to the Capitol, Officer 1 hears a protester say, “Now they’re letting everybody in, there ain’t nowhere to go.” Officer 1 replied, “I think it’s gonna…they’re going to trap everyone in.” “This video clearly evidences undercover law enforcement officers urging the crowds to advance up the stairs and scaffolding towards the Capitol on January 6,” Pope wrote in an earlier case filing. “The government may claim that incidents like this did not happen, but the facts show they did.”

Two undercover Metropolitan Police Department officers walk behind Ashli Babbitt on the northwest side of the Capitol on Jan. 6, 2021. One had earlier remarked “someone would get shot.” (William Pope via U.S. District Court/Screenshot via The Epoch Times)

“..the United States government believes that any American who talked to Assange forfeited their privacy rights under the U.S. Constitution.”

• CIA Says Americans Who Visited Assange Had No Privacy Rights (Gosztola)

The Central Intelligence Agency and former CIA director Mike Pompeo contend that attorneys and journalists, who visited WikiLeaks founder Julian Assange, had no “legitimate expectation of privacy” when it came to conversations with a “notorious wanted fugitive in a foreign embassy.” “There is no plausible argument that it would be unreasonable or indiscriminate for the government to surveil Assange, who oversaw WikiLeaks’ publication of large amounts of U.S. national security information,” the CIA and Pompeo additionally contend. “Thus, any alleged surveillance of Assange that incidentally captured his conversations with U.S. citizens such as plaintiffs would not violate the Fourth Amendment [right to privacy] as a matter of law.”

The statements are part of a motion to dismiss a lawsuit that was brought by a group of Americans, who allege that they were spied on by the CIA when they met with Assange while he was living under political asylum in the Ecuador embassy. When one considers that Assange has been held in detention at Belmarsh prison and faces Espionage Act charges for publishing classified documents, the government is essentially arguing that it may spy on any journalist who publishes such documents and “incidentally capture” the communications of anyone communicating with that particular journalist. The CIA and Pompeo are also making it clear that the United States government believes that any American who talked to Assange forfeited their privacy rights under the U.S. Constitution.

In August 2022, four Americans who visited Assange in the embassy sued the CIA and Pompeo in his individual capacity: Margaret Ratner Kunstler, a civil rights activist and human rights attorney; Deborah Hrbek, a media lawyer, represented Assange or WikiLeaks; journalist John Goetz, who worked for Der Spiegel when the German media organization first partnered with WikiLeaks; and journalist Charles Glass, who wrote articles on Assange for The Intercept. The filed complaint alleged that as visitors Glass, Goetz, Hrbek, and Kunstler were required to “surrender” their electronic devices to employees of a private company called UC Global that was contracted to provide security for the embassy. They did not know that UC Global “copied the information stored on the devices” and allegedly shared the information with the CIA, and that Pompeo allegedly authorized and approved the action.

They further claim, “Security contractors required the attorneys and journalists to leave their devices with them, which contained ‘confidential and privileged information about their sources or clients.’” In the motion to dismiss filed on March 20 by United States Attorney Damian Williams of the Southern District of New York, the government asserts that the attorneys and journalists “cannot show they had a reasonable expectation of privacy with respect to conversations that took place on the property of a foreign embassy located in a foreign country.” The government insists any searches that may have taken place were reasonable or authorized. “Indeed, U.S. citizens who communicate with foreign surveillance targets have diminished Fourth Amendment rights that are easily overcome in the alleged circumstances at issue.”

Hare

It's not always true that hares succumb to birds of prey: we have at least one video telling a different story

[source: https://t.co/Cpy4oCI3FD]pic.twitter.com/UgGIu65r09

— Massimo (@Rainmaker1973) March 25, 2023

Horse power

When we say 'horse power'. This is a Belgian draft horse competing against a group of 18 strong men. And winning

[full video, Robert Piessens: https://t.co/f7JKT49Wxp]pic.twitter.com/9qEgsvaT6I

— Massimo (@Rainmaker1973) March 25, 2023

Head lice

The boat captain at the Ojo de Liebre calving lagoon has a long history of successfully treating this whale for head lice. pic.twitter.com/m7GNuVwqw1

— Tansu YEĞEN (@TansuYegen) March 25, 2023

Schalow’s turaco birds have long white tripped crests with small red beaks and red skin around their dark eyes lined with white feathers. Mature birds have, on average, the longest crests of any turaco species

Platysternon megacephalum (or big headed turtle) is a very odd-shaped turtle with a huge head and a long tail that are almost the same size as its body.

https://twitter.com/i/status/1639360896085417999

Otters

https://twitter.com/i/status/1639785211679457283

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.