DPC Looking south on Fifth Avenue at East 56th Street, NYC 1905

Only fitting that the best description of how I feel about this can be found in an interview about music.

• We’ve Been in Decline for 40 Years – Trump is a Chance to Rethink – Eno (G.)

He has called himself an optimist. In the past. I ask him if he still is, post-2016. Yes, he says, there is a positive way to look at it. “Most people I know felt that 2016 was the beginning of a long decline with Brexit, then Trump and all these nationalist movements in Europe. It looked like things were going to get worse and worse. I said: ‘Well, what about thinking about it in a different way?’ Actually, it’s the end of a long decline. We’ve been in decline for about 40 years since Thatcher and Reagan and the Ayn Rand infection spread through the political class, and perhaps we’ve bottomed out. My feeling about Brexit was not anger at anybody else, it was anger at myself for not realising what was going on. I thought that all those Ukip people and those National Fronty people were in a little bubble.

Then I thought: ‘Fuck, it was us, we were in the bubble, we didn’t notice it.’ There was a revolution brewing and we didn’t spot it because we didn’t make it. We expected we were going to be the revolution.” He draws me a little diagram to explain how society has changed – productivity and real wages rising in tandem till 1975, then productivity continuing to rise while real wages fell. “It is easily summarised in that Joseph Stiglitz graph.” The trouble now, he says, is the extremes of wealth and poverty. “You have 62 people worth the amount the bottom three and a half billion people are worth. Sixty-two people! You could put them all in one bloody bus … then crash it!” He grins. “Don’t say that bit.” (Since we meet, Oxfam publish a report suggesting that only eight men own as much wealth as the poorest 3.6 billion people in the world – half the world’s population.)

[..] He is still thinking about the political fallout of the past year. “Actually, in retrospect, I’ve started to think I’m pleased about Trump and I’m pleased about Brexit because it gives us a kick up the arse and we needed it because we weren’t going to change anything. Just imagine if Hillary Clinton had won and we’d been business as usual, the whole structure she’d inherited, the whole Clinton family myth. I don’t know that’s a future I would particularly want. It just seems that was grinding slowly to a halt, whereas now, with Trump, there’s a chance of a proper crash, and a chance to really rethink.”

Not his fault. As I wrote in November 8’s America is the Poisoned Chalice.

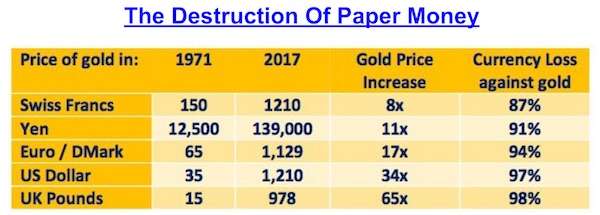

• The Coming Unhappiness With Trump – Egon von Greyerz (KWN)

“The new US Administration has taken over with the conviction that they will “make America great again.” I really hope they will succeed because a strong US would be good for the world. Sadly, the odds of achieving that admirable objective are totally stacked against them. At the end of the next 4 years there is a risk that this Administration will be more hated than any government since Carter and probably even more hated than Carter. The coming unhappiness with Trump and his team will not arise because of the actions they take. They will clearly do everything in their might to make America great again. But the probabilities are totally against them to achieve this goal. They are taking over power at a time when debt has grown exponentially since the 1970s. They are also assuming power of a country that has not achieved a proper budget surplus for well over half a century. Even worse, the US has not had a positive trade balance since the early 1970s.

So here we have a country that has been living above its means for decades and has no real chance of changing this vicious cycle. The Federal debt is at $20 trillion and has been growing at the rate of 9% per year for the last 40 odd years. The forecast for the next four years is that the growth of the debt will accelerate. Total US debt is over $70 trillion or over 3.5x GDP. But that is just a fraction of the US liabilities. Unfunded liabilities are over $200 trillion. And you can add to that to the real gross derivative positions of US banks, which most likely more than $500 trillion. The success of a president in the US is closely linked to the performance of the stock market. Therefore, the best chance for a president to be loved by the American people and re-elected is for stocks to go up. P/Es on the S&P index are now at 70% above their historical mean – hardly a position from which it is likely to surge. Corporate borrowings have also surged since the Great Financial Crisis started.

In 2006 US corporate debt was just over $2 trillion. Today it is more than 3x higher at $7 trillion! At the same time, cash as a%age of corporate debt is declining and is now down to 27%. Within this massive increase in debt, there are major defaults looming in many areas like car loans, student loans and the fracking sector where potential write offs could be in the trillions of dollars. Another disaster which is guaranteed to happen in the US and the rest of the world is the coming pension crisis. Most people in the West have zero or a minimal pension. And even for the ones who have proper pension plans, they are greatly underfunded. It is estimated that US state and local government pensions are underfunded to the extent of a mind-blowing $6 trillion. And this is after a long period of surging stocks and bonds. Imagine what will happen to these pensions when stocks and bonds collapse, which is very likely to happen in the next few years.

Look here, CNBC, introducing Ron Paul as a “well-known Trump critic” is insane. Fake labeling.

• Trump’s Infrastructure, Defense Plans Will Lead To Ruin – Ron Paul (CNBC)

For all the fanfare that greeted President Donald Trump at his inauguration on Friday, the next four years of his presidency could very well be marred by a weakening economy as a result of “injurious” policies. That’s according to past Texas Congressman and former presidential candidate Ron Paul, who joined CNBC’s “Futures Now” last week to echo his past sentiments about the new president. Most notably, the well-known Trump critic believes that the President’s proposed plans could overspend the economy into trouble and drive the Federal Reserve to interfere. “With his massive increase in infrastructure and the military, I think there’s going to be a lot more spending,” said Paul. “The debt is going to be much bigger [and] I think that will put more pressure” on the Federal Reserve, he said, with the central bank already planning to tighten interest rates.

“You have good times, and then you have bad times to compensate for the artificially good times,” he added. “So we’ll have a downturn and that will be a real challenge for the new administration.” Although most of Wall Street appears bullish about the short-term economic outlook under Trump’s fiscal policy plans, some economists have been less than sanguine. Paul’s critique echoed that of David Stockman, a former Reagan-era budget director who also warned CNBC last week that Trump’s plans would ultimately lead to financial calamity. Paul had refused to endorse Trump from early on in the election cycle, claiming that the now President would divide the Republican Party. Much of Paul’s criticism of Trump lies with the latter’s proposed border taxes, which Paul believes is actually more of a “tariff” that would block free trade. “I think that right now, I’d fear most the retaliation [from other countries] and the burden it’s going to place on the consumer,” said Paul.

“Floatation does not mean a large devaluation,” he said. “Actually, a one-off devaluation [of the yuan] doesn’t need to be big

No, I don’t think so. A devaluation must be big, because you can’t risk having to repeat it. And floatation will mean a large loss of value no matter what. When you float, you can’t manipulate anymore.

• China’s Central Bank ‘Playing Dangerous Game’ To Prop Up Yuan (SCMP)

China’s central bank is playing a dangerous game using the country’s foreign reserves to defend the yuan because it could leave the nation defenceless in an increasingly volatile world, a state researcher has warned. Zhang Ming, senior fellow at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, said the People’s Bank of China (PBOC) should take a hands-off approach to the currency and focus on safeguarding foreign exchange reserves. “Forex reserves are valuable assets that [China] can use at critical times. It’s a pity that they are being sold heavily in the market,” Zhang said. “It should be the last resort.” Zhang said the PBOC was betting on “the weakening of the US dollar and a domestic economic rebound”.

The country’s forex reserves have shrunk by almost a $1 trillion since June 2014 as the central bank has sought to prevent a large fall in the yuan against the U.S. dollar. Zhang call’s for Beijing to reverse tack and abandon its heavy intervention in the foreign exchange market is gaining traction among researchers. Zhang Bin, another researcher at the Chinese Academy of Social Sciences, agreed that Beijing should free up controls on the yuan’s exchange rate by reducing government intervention in the market. “Floatation does not mean a large devaluation,” he said. “Actually, a one-off devaluation [of the yuan] doesn’t need to be big, and [the currency] may rebound as well. By doing this it will help the domestic economy,” he said.

She’s dead on, I’ve been saying this for years, and she’s getting it handed to her on a silver platter the same way Trump was.

• EU Is Dead But Doesn’t Know This Yet – Marine Le Pen (DS)

Far-right National Front leader Marine Le Pen said on Sunday that France has to leave the European Union as she claimed that staying in the bloc is no longer a viable option for the country. Speaking in an interview with France’s BGNES, Le Pen said the EU is dead but it does not know this yet, stating that the bloc has failed economically, socially as well as security-wise. She said the recent economic growth, unemployment and poverty indicators prove the EU’s failure, adding that the bloc is also incapable of protecting its own borders against what she called as “Islamic terrorism”. With voters across Europe moving to the right, most polls currently show a Fillon-Le Pen runoff is the most likely scenario in May. National Front leader Le Pen told a meeting of rightwing populist parties in Germany on Saturday that Europe was about to “wake up” following the victory of Donald Trump in the US election and the British vote to leave the EU.

I get what Varoufakis thinks and says, but I also think renewed nationalism is backed into the cake by now. Where I differ from most is I don’t see that as a disaster, not necessarily. It’s the EU that is a disaster.

• We Need An Alternative To Trump’s Nationalism. It’s Not The Status Quo (YV)

Thatcher’s and Reagan’s neoliberalism had sought to persuade that privatisation of everything would produce a fair and efficient society unimpeded by vested interests or bureaucratic fiat. That narrative, of course, hid from public view what was really happening: a tremendous buildup of super-state bureaucracies, unaccountable supra-state institutions (World Trade Organisation, Nafta, the European Central Bank), behemoth corporations, and a global financial sector heading for the rocks. After the events of 2008 something remarkable happened. For the first time in modern times the establishment no longer cared to persuade the masses that its way was socially optimal.

Overwhelmed by the collapsing financial pyramids, the inexorable buildup of unsustainable debt, a eurozone in an advanced state of disintegration and a China increasingly relying on an impossible credit boom, the establishment’s functionaries set aside the aspiration to persuade or to represent. Instead, they concentrated on clamping down. In the UK, more than a million benefit applicants faced punitive sanctions. In the Eurozone, the troika ruthlessly sought to reduce the pensions of the poorest of the poor. In the United States, both parties promised drastic cuts to social security spending. During our deflationary times none of these policies helped stabilise capitalism at a national or at a global level. So, why were they pursued?

Their purpose was to impose acquiescence to a clueless establishment that had lost its ambition to maintain its legitimacy. When the UK government forced benefit claimants to declare in writing that “my only limits are the ones I set myself”, or when the troika forced the Greek or Irish governments to write letters “requesting” predatory loans from the European Central Bank that benefited Frankfurt-based bankers at the expense of their people, the idea was to maintain power via calculated humiliation. Similarly, in America the establishment habitually blamed the victims of predatory lending and the failed health system.

It was against this insurgency of a cornered establishment that had given up on persuasion that Donald Trump and his European allies rose up with their own populist insurgency. They proved that it is possible to go against the establishment and win. Alas, theirs will be a pyrrhic victory which will, eventually, harm those whom they inspired. The answer to neoliberalism’s Waterloo cannot be the retreat to a barricaded nation-state and the pitting of “our” people against “others” fenced off by tall walls and electrified fences.

Russia threw out Soros, Hungary wants to, so does FYROM. Who’s next?

• George Soros and the Women’s March on Washington (Nomani)

In the pre-dawn darkness of today’s presidential inauguration day, I faced a choice, as a lifelong liberal feminist who voted for Donald Trump for president: lace up my pink Nike sneakers to step forward and take the DC Metro into the nation’s capital for the inauguration of America’s new president, or wait and go tomorrow to the after-party, dubbed the “Women’s March on Washington”? The Guardian has touted the “Women’s March on Washington” as a “spontaneous” action for women’s rights. Another liberal media outlet, Vox, talks about the “huge, spontaneous groundswell” behind the march. On its website, organizers of the march are promoting their work as “a grassroots effort” with “independent” organizers. Even my local yoga studio, Beloved Yoga, is renting a bus and offering seats for $35.

The march’s manifesto says magnificently, “The Rise of the Woman = The Rise of the Nation.” It’s an idea that I, a liberal feminist, would embrace. But I know — and most of America knows — that the organizers of the march haven’t put into their manifesto: the march really isn’t a “women’s march.” It’s a march for women who are anti-Trump. As someone who voted for Trump, I don’t feel welcome, nor do many other women who reject the liberal identity-politics that is the core underpinnings of the march, so far, making white women feel unwelcome, nixing women who oppose abortion and hijacking the agenda. To understand the march better, I stayed up through the nights this week, studying the funding, politics and talking points of the some 403 groups that are “partners” of the march. Is this a non-partisan “Women’s March”?

Roy Speckhardt, executive director of the American Humanist Association, a march “partner,” told me his organization was “nonpartisan” but has “many concerns about the incoming Trump administration that include what we see as a misogynist approach to women.” Nick Fish, national program director of the American Atheists, another march partner, told me, “This is not a ‘partisan’ event.” Dennis Wiley, pastor of Covenant Baptist United Church of Christ, another march “partner,” returned my call and said, “This is not a partisan march.” Really? UniteWomen.org, another partner, features videos with the hashtags #ImWithHer, #DemsInPhily and #ThanksObama. Following the money, I pored through documents of billionaire George Soros and his Open Society philanthropy, because I wondered:

What is the link between one of Hillary Clinton’s largest donors and the “Women’s March”? I found out: plenty. By my draft research, which I’m opening up for crowd-sourcing on GoogleDocs, Soros has funded, or has close relationships with, at least 56 of the march’s “partners,” including “key partners” Planned Parenthood, which opposes Trump’s anti-abortion policy, and the National Resource Defense Council, which opposes Trump’s environmental policies. The other Soros ties with “Women’s March” organizations include the partisan MoveOn.org (which was fiercely pro-Clinton), the National Action Network [..]. Other Soros grantees who are “partners” in the march are the American Civil Liberties Union, Center for Constitutional Rights, Amnesty International and Human Rights Watch.

Well, they call their debts assets…

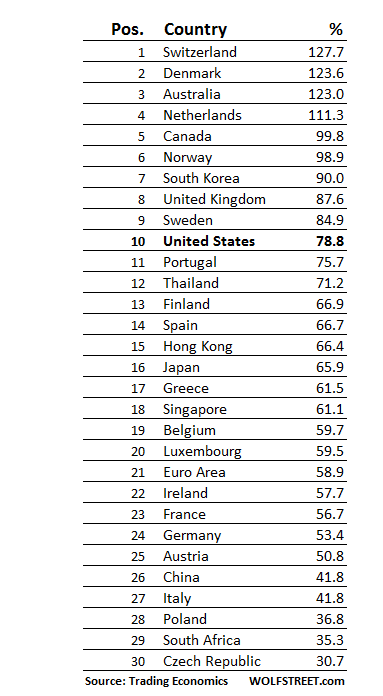

• These are the Countries with the Biggest Debt Slaves (WS)

Americans have been on a borrowing binge. To buy their favorite cars and trucks, they’ve loaded up on $1.14 trillion in auto loans. Young and not so young Americans are mortgaging their future with student loans that now amount to $1.28 trillion. Credit card and other debts are at $1.12 trillion. And mortgage debt stands at $8.82 trillion. So, total household debt was $12.35 trillion, according to the New York Fed’s Household Debt and Credit Report for the third quarter 2016. That’s a massive amount of debt. Many consumers are struggling with it. Student loans are seeing enormous default rates, and repayment rates are far worse than previously disclosed. And “debt slaves” has become a term in the financial vernacular. But it isn’t nearly enough debt…

Neither for the New York Fed whose President William Dudley, in a speech a few days ago, practically exhorted households to borrow more against the equity in their homes so that they blow this cash and drive up retail sales: “Whatever the timing, a return to a reasonable pattern of home equity extraction would be a positive development for retailers, and would provide a boost to aggregate growth,” he mused, with nostalgic thoughts of 2008. Nor for the global rankings of debt slaves, where US households squeaked into the ignominious 10th place, barely ahead of Portugal! I mean, come on! Portugal!! There are many ways to measure household indebtedness and debt burdens. Comparing total household debt to the overall size of the economy as measured by GDP is one of the measures. And per this household-debt-to-GDP measure, the Americans are 10th place with 78.8% and look practically prudent compared to the peak just before the Financial Crisis.

[..] And here’s some inevitable food for a terrifying thought: The countries with highly indebted households, so the top of the list, are mostly countries were central-bank policy rates are very low or even negative, and where mortgage rates are super low. What happens to those housing markets, the households, the banks, and the overall economies when interest rates rise even a little and that whole equation of perennially ballooning debt falls apart? We already know what happens.

You might be tempted to name this an unbelievable story, but then you realize this is what the US is good at. Reads like a spy novel, a film script.

• “Billion-Year” Gambian President Was Installed By The CIA (SCF)

Gambian President and dictator Yahya Jammeh, facing a combined military force composed of Senegalese army troops, the Nigerian air force, and troops from Mali, Ghana, and Togo, has agreed to relinquish the presidency of Gambia. On December 1, 2016, Jammeh was defeated for re-election in a surprise upset by his little-known rival Adama Barrow. Jammeh received only 45% of the vote. During the election campaign Jammeh vowed in an interview with the BBC to «rule for one billion years». After initially conceding defeat to Barrow, Jammeh reneged on his promise to step down and announced he would remain as president. The Economic Community of West African Countries (ECOWAS) decided that Jammeh had to go, a stance ironically supported by the United States, which had assisted Jammeh in overthrowing Gambia’s democratically-elected president, Sir Dauda K. Jawara, in 1994.

After Jammeh refused ECOWAS’s, the African Union’s, and the United Nations Security Council’s demands to leave office and permit Barrow to assume the presidency, ECOWAS mobilized its military forces. On January 19, 2017, Barrow was sworn in as president in the Gambian embassy in Dakar, the Senegalese capital. Hours later, Senegalese troops began to enter Gambia and Nigerian air force jets buzzed the Gambian capital of Banjul. The presidents of Mauritania and Guinea flew to Banjul to urge Jammeh to leave office peacefully. Jammeh’s fate was sealed when Major General Ousman Badjie, the commander of the Gambian armed forces, recognized Barrow as Gambia’s commander-in-chief.

The demand from the United States for Jammeh to relinquish power was a display of absolute hypocrisy since Washington had not only installed Jammeh into power but two successive U.S. presidents warmly welcomed the military ruler to the White House. Jammeh, who owns a $3.5 million mansion in Potomac, Maryland, was warmly greeted by President Barack Obama at the 2014 and 2015 U.S.-Africa Leaders’ Summits in Washington. President George W. Bush greeted Jammeh at the U.S.-Africa Business Summit in Washington in 2003. With the protection of the State Department’s Diplomatic Security Service, Jammeh’s Moroccan-born wife, Zineb Jammeh, ran up huge totals at the Washington area’s fashionable shopping malls. She also settled on Sam’s Club, a wholesale discount store, to buy massive amounts of household goods. Jammeh is a textbook case of CIA-sponsored kleptocracy on a grand scale.

Under Jammeh, Gambia continued to be a strategic ally of the United States. The kleptocratic Gambian leader permitted the U.S. National Aeronautics and Space Administration (NASA) to maintain an emergency landing site for NASA’s space shuttle in the country and Gambia participated with the U.S. Central Intelligence Agency in the post-9/11 rendition program. Before being installed as Gambia’s dictator, Jammeh had received training from the Pentagon. Merely a lieutenant in the Gambian National Army. In 1993, Jammeh attended the notorious «School of the Americas» in Fort Benning, Georgia. The school has trained some of Latin America’s most notorious military dictators and death squad commanders. While in Fort Benning, Jammeh was made an honorary citizen of the state of Georgia. The following year, and before he launched his coup, Jammeh attended the Military Police Officers Basic Course (MPOBC) at Fort McClellan, Alabama.

[..] It was during the administration of President Bill Clinton that the green light was given for Jammeh to be installed in a CIA-led coup in Gambia. On July 24, 1994, President Jawara was at his palace in Banjul entertaining the commanding officer of the visiting U.S. Navy tank landing ship, the USS La Moure County. Also present was U.S. ambassador to Gambia, Andrew Winter, a career foreign service officer who represented a new breed of U.S. ambassador – one that routinely and publicly involved himself in the domestic political affairs of the nation to which they were posted. While Jawara and the ship’s commander exchanged diplomatic niceties, junior army officers, led by Jammeh, staged a coup against the democratically elected government.

Only one decision makes any sense.

• Greek Supreme Court To Decide On Fate Of Eight Turkish Servicemen (Kath.)

The Greek Supreme Court on Monday is to rule whether eight Turkish servicemen who fled to Greece after July’s failed coup should be extradited. Three separate panels of Greek judges have already ruled that the Turkish officers’ lives may be put at risk if they were to be returned to Turkey, where Prime Minister Recep Tayyip Erdogan has launched a tough crackdown on dissent since the summer’s coup attempt. Diplomatic circles that fear a rejection of Turkey’s request could put a further strain on ties between Athens and Ankara, particularly at a time when Cyprus reunification talks also hang in the balance, have been keeping a close eye on proceedings. The issue has also drawn attention from intellectuals and the media in Greece and other parts of Europe, who see it as a test of the bloc’s fundamental principles and values. All eight servicemen have denied involvement in the coup attempt and say they fear for their lives if they are returned to Turkey.

What a surprise.

• UK Government ‘Sneaks Out’ Its Own Alarming Report On Climate Change (Ind.)

The Government has been accused of trying to bury a major report about the potential dangers of global warming to Britain – including the doubling of the deaths during heatwaves, a “significant risk” to supplies of food and the prospect of infrastructure damage from flooding. The UK Climate Change Risk Assessment Report, which by law has to be produced every five years, was published with little fanfare on the Department for Environment, Food and Rural Affairs’ (Defra) website on 18 January. But, despite its undoubted importance, Environment Secretary Andrea Leadsom made no speech and did not issue her own statement, and even the Defra Twitter account was silent. No mainstream media organisation covered the report.

One leading climate expert accused the Government of “trying to sneak it out” without people noticing, saying he was “astonished” at the way its publication was handled. In the report, the Government admitted there were a number of “urgent priorities” that needed to be addressed. It said it largely agreed with experts’ warnings about the effects of climate change on the UK. These included two “high-risk” issues: the damage expected to be caused by flooding and coastal erosion; and the effect of rising temperatures on people’s health. The report concluded that the number of heat-related deaths in the UK “could more than double by the 2050s from a current baseline of around 2,000 per year”. It said “urgent action” should be taken to address overheating in homes, public buildings and cities generally, and called for further research into the effect on workers’ productivity.

The Government also recognised that climate change “will present significant risks to the availability and supply of food in the UK”, the report said, partly because of extreme weather in some of the world’s main food-growing regions. The report also said the public water supply could be affected by shortages and that the natural environment could be degraded. Bob Ward, policy and communications director at the Grantham Research Institute on Climate Change and the Environment in London, said he was “astonished” at the way such a report had been slipped out. “Defra did very little to publicise it – they didn’t even tweet about it,” he said. “It’s almost as if they were trying to sneak it out without people realising. I have no idea what they were thinking.”

.

You better start swimming or you’ll sink like a stone.

For the times they are a-changing.

• The Last Time Oceans Got This Warm Sea Levels Were 20 to 30 Feet Higher (LAT)

Ocean temperatures today are about the same as they were more than 100,000 years ago – at a time when sea levels were 20 to 30 feet higher. The findings, published in the journal Science, highlight the key role that human activity has played in global warming and underscore concerns about the future impact of rising sea levels. Over millions and billions of years, the Earth has gone through periods of cooling (when water freezes out of the oceans, causing glaciers to grow and sea levels to fall) and warming (when the ice melts and sea levels rise). Scientists often look for clues hidden in layers of ancient rock and ice to determine what conditions were like in that long-gone climate.

The last interglacial period, which took place some 129,000 to 116,000 years ago, is a particularly intriguing chapter in Earth’s relatively recent history because of what it could tell us about today’s climate, said lead author Jeremy Hoffman, a paleoclimatologist at the Science Museum of Virginia. “The last interglacial is extremely interesting because it’s the last time period in recent Earth history when global temperatures were a little bit higher and global sea level was about 6 to 9 meters higher – but carbon dioxide in the atmosphere was roughly at what it was during the pre-industrial era,” said Hoffman, who conducted the work as a doctoral student at Oregon State University. “So it’s a really interesting scientific question: What is it about the last interglacial that’s so unique, that gave rise to higher sea levels?”

The problem is, researchers often assume climate change happened synchronously across the globe — that is, if it grew warm in one part, it also heated up in the others, and if it cooled in one area, it was cooling everywhere else at the same time. It’s already clear from climate patterns today that this simply isn’t the case, Hoffman said. Even if Earth overall is warming at a given point in time, for example, some spots might be getting cooler while others heat up. “What we know about how climate and temperature change on this planet is, it’s not all at the same time or at the same rate,” he said. “You can see these even today in human-caused climate change, how that’s playing out on a global scale.”