Christopher Makos Andy Warhol piloting John Denver’s bi-plane 1977

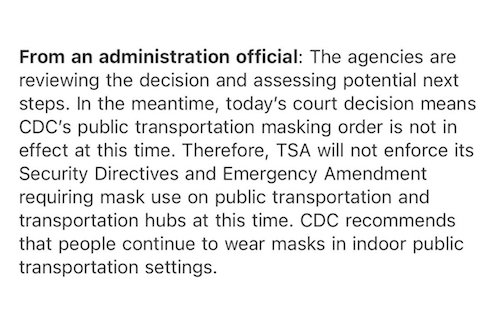

Tucker ep 4

Ep. 4 Wannabe Dictator pic.twitter.com/MDcs5g0gxB

— Tucker Carlson (@TuckerCarlson) June 15, 2023

Rogan

https://twitter.com/i/status/1669483009383202818

https://twitter.com/i/status/1669464834453143552

RFK JR:

"In the 1960s, when I was a kid, only 6% of Americans had chronic disease. Autism went from 1 in 10,000 in my generation to 1 in 34 kids who have autism and half of those are full blown." pic.twitter.com/RzR0JMIfq6

— Citizen Free Press (@CitizenFreePres) June 15, 2023

Comer

"Comer expects to uncover $20-$30 million in payments to the Biden's"

Holy shit!pic.twitter.com/ovOn1PZhQK

— Brenden Dilley (@WarlordDilley) June 15, 2023

Seymour Hersh: Panic at the State Department over Victoria Nuland. Deputy Secretary of State Wendy Sherman has resigned, and her last day in office will be June 30, noted journalist Seymour Hersh on his blog. “Her departure sent the State Department into near-panic over the person many fear will be her replacement: Victoria Nuland,” writes Hersh.

As he states, Nuland’s aggressive attitude towards Russia fits perfectly with the views of President Joseph Biden. The famous journalist cites a source with direct knowledge of the details of the situation, who says that various State Department bureaus are complaining that Nuland, currently the undersecretary for political affairs, is “going wild” while Secretary of State Anthony Blinken is on the road.

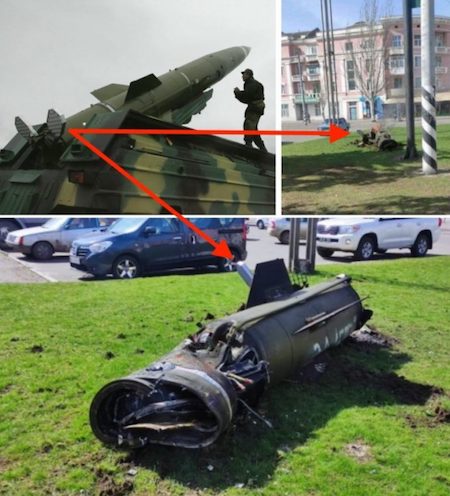

“I’m told that [the Kakhovka Hydroelectric Dam] was approved for demolition by Victoria Nuland. She’s been involved in everything happening in Ukraine for at least 14-15 years if not longer.” — Col. Douglas Macgregor

“..the Times wrote that “failure would look like a Ukrainian army that has not learned to fight, has lost the equipment given to them in recent months and gained no territory to show for that.”

• US Demands Big Results From Ukraine’s Counteroffensive Soon – Politico (RT)

US officials are telling their Ukrainian counterparts that Washington’s support for their war effort hinges on the success of the ongoing counteroffensive against Russian forces, Politico reported on Thursday. The offensive has failed so far, with Ukrainian losses counted in the thousands. US President Joe Biden has repeatedly promised to back Ukraine “for as long as it takes.” However, when Ukrainian officials recently asked the US State Department and National Security Council whether they could count on this support to continue through next year’s election season and a potential change of power in the White House, they were told “let’s see how the counteroffensive goes,” Politico reported.

Ukraine’s former deputy prime minister, Ivanna Klimpush-Tsintsadze, told the US news site that these talks left her feeling anxious about the “continuation of the same level of US support to Ukraine after this financial year,” which ends in September. After months of mixed messages from Kiev – and reports of depleted stockpiles and general unreadiness in the Western media – Ukrainian forces launched their long-awaited counteroffensive against Russian forces almost two weeks ago. Attacking multiple sections of the frontline in Donetsk and Zaporozhye Regions, Ukraine has so far failed to penetrate Russia’s multi-layered labyrinth of defensive trenches, minefields, and anti-tank obstacles.

With Ukraine’s Western-provided air defense systems degraded by constant Russian missile and drone attacks, Russian air support has acted with impunity, inflicting devastating losses on the Ukrainian forces. As of Wednesday, Russia’s Defense Ministry counted 7,500 dead or wounded Ukrainian troops, not counting those hit by high-precision missiles and airstrikes deep behind the front lines Videos of wrecked Western tanks and armored vehicles have circulated online, and Russian President Vladimir Putin claimed on Wednesday that Kiev has lost “at least 160 tanks and 360 armored vehicles.” The hardware destroyed by Russian troops accounts for between 25% and 30% of all Western military equipment supplied to Ukraine, the president estimated.

Publicly, Western officials have hedged their bets, leaving it up to Kiev to define what a victorious offensive would look like and downplaying expectations of a thrust to Crimea, as Ukrainian President Vladimir Zelensky has promised. According to the New York Times, American and European officials would consider the offensive successful if Ukrainian forces cut off Russia’s land bridge with Crimea and managed to hold any territory seized in this direction. Citing European diplomats, the Times wrote that “failure would look like a Ukrainian army that has not learned to fight, has lost the equipment given to them in recent months and gained no territory to show for that.”

Dead end.

• EU Rules Out NATO Troops Openly Fighting In Ukraine (RT)

Western countries will not send their soldiers to fight Russia on behalf of Ukraine, Director General of the European Union Military Staff Vice Admiral Herve Blejean said on Wednesday. “To send ground troops to Ukraine is to be a party in a war, to be at war with Russia, and nobody wants that, neither the EU, nor NATO,” Blejean told the French TV channel LCI . “We are not at war with Russia. We are supporting a country attacked by Russia.” Blejean added that the ongoing Ukrainian offensive would “not be the end of the war, regardless of its results.” The French admiral’s remarks came after former NATO secretary general Anders Fogh Rasmussen suggested that individual members, such as Poland and the Baltic states, could ultimately decide to deploy soldiers to Ukraine.

Ukrainian Foreign Minister Dmitry Kuleba, however, said last week that there would not be foreign boots on the ground “before the end of the armed conflict” with Russia. Volunteers from multiple NATO countries are already fighting on Kiev’s side, including Polish nationals who were involved in an armed incursion into Russia’s Belgorod Region earlier this month. Moscow, meanwhile, has long insisted that by supplying Ukraine with heavy weapons and sharing intelligence, NATO countries had made themselves de facto direct participants in the conflict. Russian Foreign Minister Sergey Lavrov has said that NATO was “waging a war” against his country and that it was “ridiculous” to claim otherwise. Last month, the EU agreed to procure €1 billion ($1.08 billion) worth of artillery rounds and missiles for Ukraine. The US has committed more than $100 billion in aid to Kiev since Russia launched its operation in the neighboring state in February 2022.

The BBC has this on Zaluzhny. Problem is, he hasn’t been seen in a long time. Maybe not that surprising given the state of the offensive, which he is “behind”.

Also: “The head of Ukrainian military intelligence, Kirill Budanov, is in critical condition at a Bundeswehr hospital in Berlin after being wounded.”

• Valery Zaluzhny, The Man Behind Ukraine’s Counter-Offensive (BBC)

Ukraine’s long-awaited attempt to take back the territories in the east and south of the country, occupied by Russia for the past 18 months, is now in full swing. A key figure in planning and executing this operation is Gen Valery Zaluzhny, Ukraine’s 49-year-old commander-in-chief. Little known until recently, his popularity now rivals that of President Volodymyr Zelensky. Gen Zaluzhny, or “our Valera” as friends and old classmates like to call him, was appointed commander-in-chief of the Ukrainian military in July 2021. Those who know him well say the appointment, pushed through personally by President Zelensky, came as a surprise to the general and many others too as his promotion involved climbing several steps on the career ladder.

Zaluzhny was already known as an ambitious and modern commander, but also an unpretentious man who liked to joke with his subordinates and didn’t put on airs. Within seven months he was leading Ukraine’s defence against full-scale invasion. By 26 February 2022 it was clear that Russian troops were failing to “take Kyiv in three days”, which had initially seemed a likely outcome. But the reality remained grim and Ukrainian authorities were calling on the public not to panic. Russian troops were advancing in the north, east and south of Ukraine and posed a considerable threat to the capital. One idea floating among Ukraine’s top officials was to start blowing up bridges near Kyiv over the vast Dnipro river, to prevent the Russians crossing from the eastern left bank to the western right bank, where, among other strategic objects, the government quarter was situated.

They phoned Gen Zaluzhny for his view. “Under no circumstances are we to do that,” he is reported to have replied, at the time sitting in a smoke-filled bunker with other top brass. “This will be a betrayal of both civilians and the military remaining on the eastern bank.” The BBC has heard matching accounts from two sources involved in the episode that indicate this is what happened. Many other crucial decisions followed and by early April 2022 Ukrainian troops pushed the Russian army back to the north and east of Kyiv. Born into the family of a Soviet serviceman, Valery Zaluzhny once said he was always committed to distancing himself from the excessive hierarchy of the Soviet Army. By the time he went to military school in the mid-1990s Ukraine was already an independent state.

While his textbooks at military college may have dated back to the Soviet era, he learnt about the reality of war first-hand. In 2014 he was appointed a deputy commander in an area of eastern Ukraine where the conflict with separatists, backed by the Russian army, was getting under way. Colleagues we spoke to say that from the onset of his career he was keen on building relationships of trust with his subordinates as well as delegating command decisions.

How they’re trying to sneak in NATO troops:

“..a cross-coalition bill was submitted to the Polish parliament which would make it legal for Polish nationals to fight in the Armed Forces of Ukraine..”

• The Government Keeps Lying to Us About Ukraine. Where Is the Outrage? (Tracey)

On June 4, a group referring to itself as the “Polish Volunteer Corps” issued a boastful announcement confirming its participation in a series of cross-border ground offensives into Russia. News of these audacious raids was jarring enough, given the many prior assurances of U.S. and Ukrainian war planners, who insisted no attacks would be carried out inside Russian territory. It was all the more conspicuous that the incursion units were apparently comprised of Polish soldiers. Poland, of course, is not only a NATO member state, but the NATO member state with which the U.S. has most assiduously aligned itself since Russia’s February 2022 invasion of Ukraine (Polish government officials deny any formal connection to the “Polish Volunteer Corps”). So the raids raised an obvious, yet oft-neglected question: Just what the hell is U.S. policy in Ukraine?

If you turn on the TV, you’ll find pundits on every channel loyally reciting from memory the broad parameters of the U.S. mission—at least as it’s being conveyed in daily rhetorical flourishes by Biden Administration officials, assorted Congressional chest-thumpers, and brave think tank warriors. Freedom and autocracy are locked in a great cosmic battle of good versus evil, or so goes the usual storyline—most often narrated with a degree of moral complexity that can be generously compared to a lower-tier Marvel Movie. But apart from this steady stream of heavily recycled platitudes, was it ever plainly disclosed to Americans—the chief financial sponsors of the Ukraine war effort, after all—that the scope of the war effort they’ve found themselves subsidizing would eventually expand to include platoons of Polish soldiers marching straight into Russia?

Did anyone back in Washington, D.C. sign off on this, or was there ever an opportunity granted for public consideration of its potentially foreboding implications? At least in theory, the U.S. is treaty-bound to come to the defense of Poland in the event of armed attack. And while Poland may nominally disavow the Polish Volunteer Corps, a Polish journalist writing for Poland’s largest digital publication says he was in attendance at a founding organizational meeting in Kyiv this past February, during which the unit was established not as a ragtag group of untested amateurs, but as an elite “sabotage and reconnaissance” force—which from the get-go was “reporting directly to the Ministry of Defense of Ukraine.” Per this account, the unit was to consist of Poland’s “most experienced soldiers,” with notable imprecision as to where specifically those soldiers hailed from.

Then there’s the fact that shortly before the formation of the “Polish Volunteer Corps,” a cross-coalition bill was submitted to the Polish parliament which would make it legal for Polish nationals to fight in the Armed Forces of Ukraine. The war against Russia was to be recognized as “a special situation from the point of view of the national security of the Republic of Poland,” the text reads, “requiring non-standard political and legislative actions on the part of the state.” The “Polish Volunteer Corps” has been conducting joint operations with the “Russian Volunteer Corps,” another fully integrated “special unit within the Ministry of Defense of Ukraine”—euphemistically referred to in “Western” media headlines with plausible-deniability monikers like “Pro-Ukraine group of partisans.”

“..opponents of the initiative argue it would escalate the Ukraine conflict and confirm Russia’s justification for the special operation..”

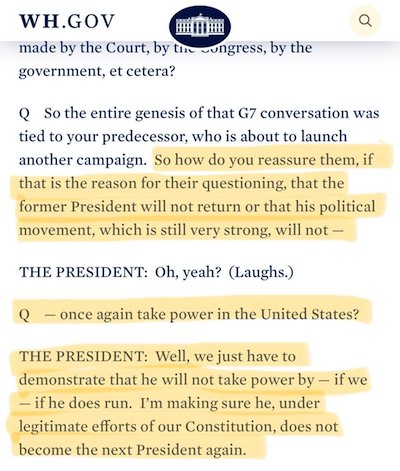

• Biden Admin Weighs ‘Israel Model’ for Ukraine Instead of NATO Membership (Sp.)

In 2008, Ukraine was denied membership to NATO, with opponents to Ukraine’s membership citing potential effects on Europe’s relationship with Russia as a major issue. The Biden administration is reportedly considering proposing an ‘Israel model’ for Ukraine in NATO, a deal that would be a limited commitment and not include a collective defense guarantee. US media reports have indicated the Biden White House would pledge to continue providing more military aid to Ukraine, regardless of the outcome of its ongoing counter-offensive. The deal would likely be for a shorter period than the commitment to Israel, which typically runs in 10-year intervals. Kiev and some European allies have been advocating for Ukraine’s full NATO membership, including a collective defense guarantee.

However, opponents of the initiative argue it would escalate the Ukraine conflict and confirm Russia’s justification for the special operation, one of which was NATO’s encroachment across Europe since the start of the century. Ukrainian President Volodymyr Zelensky has reportedly threatened to boycott the NATO summit in Vilnius, Lithuania, next month if he is not given a roadmap for Ukraine joining the military alliance as a full member. Last week, outgoing NATO Secretary-General Jens Stoltenberg reportedly suggested a “compromise” proposal when he spoke to US President Joe Biden. Part of that compromise stipulated a pledge to continue providing the Kiev regime with weapons, regardless of the level of success of its counter-offensive.

The deal would also ascend Ukraine to the council level in NATO, which is the status Russia maintained until 2014, when the relationship between Russia and the West collapsed. US media reported only Germany has so far sided with Biden in his plan for Ukraine; however, other members also have their doubts about Ukraine being ready to join the military bloc. Part of the Biden plan would be to commit the US to Ukraine for longer periods, limiting the amount of public debate in the US over Ukraine aid. Citing Biden administration officials, media reported the plan would “bleed some of the politics out of episodic debates about how much aid to commit to Ukraine in the next six months or a year.”

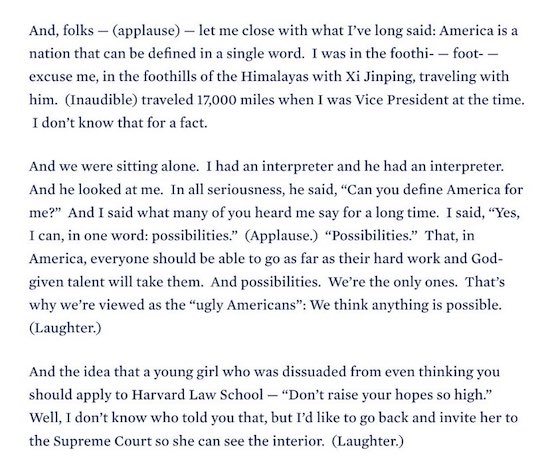

“Residents in Crimea decided to join Russia. This position was also shared by former French Presidents Nicolas Sarkozy and Valery Giscard d’Estaing, and I stand with them, too, that this issue has nothing to do with today’s conflict in Ukraine..”

• Le Pen Says Crimea ‘Has Nothing To Do’ With Conflict In Ukraine (TASS)

Crimea is an inseparable part of Russia and has nothing to do with today’s conflict in Ukraine, Marine Le Pen, the leader of the parliamentary faction of the National Rally party, told France Info radio on Thursday. “Crimea has nothing to do with the conflict in Ukraine,” she maintained. “Residents in Crimea decided to join Russia. This position was also shared by former French Presidents Nicolas Sarkozy and Valery Giscard d’Estaing, and I stand with them, too, that this issue has nothing to do with today’s conflict in Ukraine,” emphasized Le Pen, who was incumbent French leader Emmanuel Macron’s main rival in the presidential election in 2017 as well as last year. According to the parliamentarian, “the conflict in Ukraine is related to the Minsk agreements, which do not concern Crimea.”

Le Pen underlined that she views Crimea to be a part of Russia. “I have been saying this for 10 years already, and I have not changed my mind,” the far-right politician said. She insists that “the Donbass issue should be central at talks to resolve the conflict in Ukraine.” Taking questions from members of the lower chamber of the French parliament, the National Assembly, in late May, Le Pen said she considers Crimea a legitimate Russian territory. The politician said she had her own impressions from her trips to the peninsula, where she talked to Crimean residents and could see for herself that they are more inclined towards Russia.

Crimea was transferred to the Ukrainian Soviet Socialist Republic in 1954 at the initiative of Soviet leader Nikita Khrushchev. After a coup in Ukraine in February 2014, the governments of Crimea and Sevastopol held a referendum on the peninsula’s reunification with Russia. The overwhelming majority of voters supported reunification (96.7% in the Republic of Crimea and 95.6% in the City of Sevastopol, respectively), with turnout reaching 80%. Despite the convincing results of the referendum, Kiev and the EU have refused to recognize Crimea as being part of Russia.

It’s been done before. Many times.

• A History of Ceasefires & Peace in Ukraine (Wright)

Negotiations, ceasefires, armistices and peace agreements are as old as wars themselves. Every war ends with some version of one of them. Wars have been studied endlessly, but lessons learned on how to end the wars have generally been ignored by those conducting the world’s latest wars. To stop the killing in the Russia-Ukraine conflict, people of conscience must do everything they can to make negotiations for a ceasefire become a reality. That was the purpose of the International Summit for Peace in Ukraine held in Vienna last weekend. Over 300 persons from 32 countries attended the conference and participated in the robust program to discuss how to create conditions for a ceasefire and ultimately an agreement to stop the killing. The websites for the International Peace Bureau and the Peace in Ukraine summit were hacked the day after the conference but should be up and running soon.

[..] Using data from 48 conflicts between 1946 and 1997, political scientist Virginia Page Fortna has shown that strong agreements that arrange for demilitarized zones, third-party guarantees, peacekeeping, or joint commissions for dispute resolution and contain specific (versus vague) language produced more lasting cease-fires that provide conditions for dialogue for an armistice or agreement. Figuring out how to make the cease-fire be effective will be the key task. Despite its less-than-stellar track record, the U.S. as a co-belligerent should work with the Ukrainian government to figure out effective cease-fire measures. Ukrainian President Volodymyr Zelensky has already described any new negotiations as “Minsk 3,” a reference to the two cease-fire deals that were brokered with Russia in the Belarusian capital in 2014 and 2015, after its annexation of Crimea and fighting in the Donbass region.

The Minsk 1 and 2 agreements included no effective mechanisms for ensuring the parties’ compliance and failed to end the violence. Minsk 1 and 2 were later acknowledged by NATO and the European Union as a ploy for “buying time” for the West’s buildup of Ukrainian forces and equipment. Having been in the U.S. Army/Army Reserves for 29 years and working as a U.S. diplomat for 16 years, I can testify to the results of endless studies of the consequences of war. One example is the year-long U.S. Department of State Iraq Study Group, being ignored by U.S. politicians and policy makers, and lessons learned on how to end deadly conflicts being ignored by U.S. military and national security experts.

I suspect that few Ukrainian, Russian, U.S. and NATO policy makers know of the United Nations’ 18-page guide to the Do’s and Don’ts of Ceasefire Agreements, based on their experience in conflicts. Therefore, for the record, I want to mention the main points of the “Do’s and Don’ts of Ceasefire Agreements,” so no one can say, “We Didn’t Know” such work has been done already and the pitfalls of ceasefire agreements well identified.

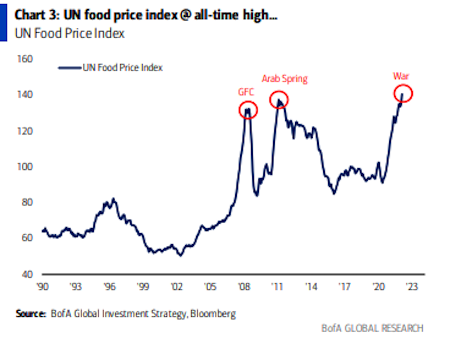

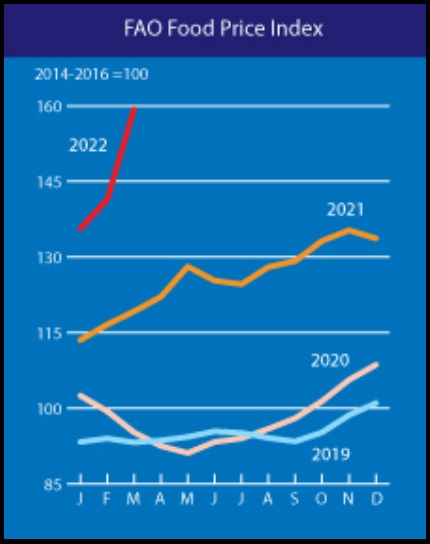

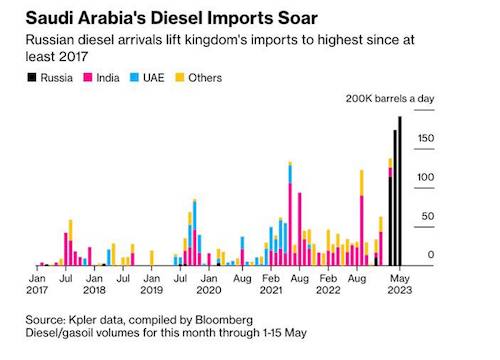

De-Dollarization is happening now. Just not in one big leap.

• De-Dollarization ‘Could Happen Much Quicker Than Most Think’ (Sp.)

Sanctions and trade embargoes have accelerated the movement of many nations, including Russia, to boost efforts to shed reliance on the US dollar, which has been increasingly “weaponized” by the West. Recent moves by BRICS countries offer hope that the dominance of the greenback in the world economy will eventually be uprooted. De-dollarization could happen much quicker than most people think, Michael Goddard, president of the Netley Group, said at the St. Petersburg International Economic Forum (SPIEF). SPIEF 2023 entered day two on Thursday, and the unique global economic and business event focused on de-dollarization – a buzzword of late among countries seeking to ditch the hegemony of the American greenback. The BRICS group of countries has been spearheading the movement.

A common currency is one of the bold steps being mulled over among other tools that the bloc, which unites the world’s largest developing economies — Brazil, Russia, India, China, and South Africa, has at its disposal to escape the hegemony of the US-dominated economic order. As a number of other countries have expressed desire to join the bloc, including Argentina, Iran, Indonesia, Turkiye, Saudi Arabia, and Egypt, the trend towards dumping the dollar is likely to grow even stronger. “A new BRICS currency that’s backed by some kind of asset, gold or a basket of assets, as they’re discussing, from a trade basis, if all the BRICS countries and BRICS+ and others trade that way [it] will almost immediately depress the amount of dollars that are used in trade. And over a period of a few years, that will accelerate greatly,” Michael Goddard told Sputnik.

However, he clarified that that if one nurtures hopes of ditching the dollar, which is the global reserve currency, you “actually need reserve.” The tremendous advantage of the dollar at the moment is the US bond market, Goddard said, adding “One of the ways for the BRICS to replicate that, and then displace it, is to link their bond markets, and the governments and the populace actually start to buy the bonds which are denominated in the new currency. And I believe that if they do that, de-dollarization could happen much quicker than most people think.”To all those skeptics of the BRICS currency who warn of the vast differences of the economies of member-states, Michael Goddard enumerated ways that this “divide” could be overcome successfully.

One way is for BRICS to create a currency “backed either by gold or a basket of commodities that are trusted,” and then “trade with 80 percent of the world.” “And I believe that most people who are not in America, the UK, or Europe, would like an alternative to the dollar, don’t want to be at risk from being sanctioned, their assets being frozen. And I think the momentum of that will actually allow the currency to take root and then grow,” Goddard concluded.

“Zlochevsky allegedly told the CHS he was dismayed by Trump’s victory, fearing an investigation would reveal his payments to the Biden family..”

• The Bidens ‘Coerced’ Burisma To Pay $10 Million In Bribes – CHS (Fed.)

The Bidens allegedly “coerced” a foreign national to pay them $10 million in bribes, according to individuals familiar with the investigation into the FBI’s handling of the FD-1023 confidential human source report. What, if anything, agents did to investigate these explosive claims remains unknown, however, with sources telling The Federalist the FBI continues to stonewall. On Monday, Sen. Chuck Grassley revealed a foreign national — identified by individuals with knowledge of the matter as Burisma founder Mykola Zlochevsky — allegedly possessed 17 recordings implicating the Bidens in a pay-to-play scandal. While 15 of the audio recordings consisted of phone calls between Zlochevsky and Hunter Biden, two were of calls the Ukrainian had with then-Vice President Joe Biden, according to the FD-1023.

The Federalist has now learned the FD-1023 reported the CHS saying the Bidens “coerced” Zlochevsky to pay the bribes. Sources familiar with the investigation also explained the context of Zlochevsky’s statements, and that context further bolsters the CHS’s reporting. In the FD-1023 from June 30, 2020, the confidential human source summarized earlier meetings he had with Zlochevsky. According to the CHS, in the 2015-2016 timeframe, the CHS, who was providing advice to Zlochevsky, told the Burisma owner to stay away from the Bidens. Then, after Trump defeated Hillary Clinton in the 2016 presidential contest, the CHS asked Zlochevsky if he was upset Trump won.

Zlochevsky allegedly told the CHS he was dismayed by Trump’s victory, fearing an investigation would reveal his payments to the Biden family, which included a $5 million payment to Hunter Biden and a $5 million payment to Joe Biden. According to the CHS, the Burisma executive bemoaned the situation, claiming the Bidens had “coerced” him into paying the bribes. The CHS responded that he hoped Zlochevsky had taken precautions to protect himself. Zlochevsky then allegedly detailed the steps he had taken to avoid detection, stressing he had never paid the “Big Guy” directly and that it would take some 10 years to unravel the various money trails. It was only then that Zlochevsky mentioned the audio recordings he had made of the conversations he had with Hunter and Joe Biden, according to the CHS.

The broader context of this conversation adds to the plausibility of Zlochevsky’s claims that he possessed recordings implicating the Bidens. And we already know from Grassley and House Oversight Committee Chair James Comer that the FBI considered the CHS, who relayed Zlochevsky’s claims to the FBI, a “highly credible” source. Further, according to individuals familiar with the investigation, the FBI admitted the CHS’s intel was unrelated to the information Rudy Giuliani had provided the Western District of Pennsylvania’s U.S. attorney’s office — the office then-Attorney General William Barr had tasked with reviewing any new information related to Ukraine. Sources told The Federalist that investigators out of the Pittsburgh office, in addition to reviewing Giuliani’s information, searched internal FBI databases and came across an earlier FD-1023 related to the CHS. That earlier FD-1023 then led to agents questioning the CHS on June 30, 2020, uncovering the details concerning Burisma’s alleged bribery of the Bidens.

[..] Biden family business. Those records provide concrete evidence of a pattern of public corruption involving foreign nationals, with Joe Biden at the helm. There are still more banking records to review, along with the many details recently discovered when the whistleblower came forward with the FD-1023. Apparently, Zlochevsky wasn’t far from the mark when he said it would take 10 years to unravel the complex payment path that led to Joe Biden.

“Are there tapes that you accepted bribes, President Biden? Is that true?”

• Internet Ignites as Biden Laughs Off Bribery Question (Sp.)

The US House Oversight Committee is investigating claims of a political bribery scheme involving a foreign national based on information provided to the FBI by a confidential source who alleges Joe Biden and his son Hunter received a total of $10Mln from Ukrainian energy company Burisma to help end an investigation into the entity. A host of internet critics have lambasted Joe Biden’s response to a question about the alleged bribery scandal in which he has been implicated. “Are there tapes that you accepted bribes, President Biden? Is that true?” a reporter asked the Democratic POTUS. The reporter was referring to the Ukrainian energy company Burisma bribery allegations dating to Biden’s time as vice-president, and the reported existence of audio recordings of his conversations with an executive proving the claims.

But the 80-year-old, who was on his way out of the White House East Room after an event with US diplomats, stopped, turned around, and smirked, while remaining silent. He then shook his head, and ambled down the hallway.

Columnist Miranda Devine tweeted that the president was “laughing in America’s face”. Others chimed in, deploring Biden’s “condescending” and “mocking” response. Republican Senator from Iowa, Chuck Grassley, revealed on Monday that a Burisma whistleblower who allegedly paid Joe Biden and his son Hunter retained 17 audio recordings of his conversations with them as an “insurance policy”. The senator cited the FBI’s unclassified 1023 form drafted in 2020 on the Biden family. The “foreign national” reportedly referred to Joe Biden as the “Big Guy”.The US House Oversight Committee is investigating a possible political bribery scheme involving a foreign national. The investigation is based on information provided to the FBI by a confidential human source who alleges that Joe Biden and his son Hunter received a total of $10Mln from Ukrainian energy company Burisma to help end a probe into the entity. The president dismissed the allegations without elaborating on details. Earlier in the day, former President Donald Trump promised that if he were elected he would appoint a special prosecutor to investigate Biden, his family and others allegedly engaged in corruption that negatively affects the United States.

While Trump was being impeached.

• The Biggest Coverup In Political History (GP)

In 2019 One America News Network investigative journalist Chanel Rion released a three part made for TV series detailing Joe Biden and Hunter Biden’s criminal dealings in Ukraine. The evidence Chanel Rion and Rudy Giuliani brought forth was enough to start a corruption investigation into Joe Biden. Chanel traveled to Ukraine with Rudy Giuliani to investigate the money laundering schemes by the Biden Crime Family. What they came back with was a trough of evidence and documents that detailed bribes and payments to Hunter Biden for years and at least one bribe to Joe Biden for $900,000 from Ukrainian officials.

Chanel Rion and Rudy Giuliani interviewed several witnesses who destroyed Adam Schiff’s baseless impeachment case against President Trump. In the three part EXCLUSIVE report, Rudy Giuliani debunked the impeachment hoax and exposed Biden family corruption in Ukraine and Latvia. In the series Rudy and Chanel expose the numerous media lies told to the American public by the lemming media to protect Joe Biden The mainstream media is once again exposed as a very corrupt arm of the Democrat Party. Joe Biden should have been jailed years ago. Here is background material The Gateway Pundit published back in 2020 before the presidential election. The DOJ ignored this evidence against Joe Biden.

“Ukrainian Pariamentarian Andriy Derkach held a much publicized press conference last October in Ukraine. In his press conference Derkach revealed that Joe Biden was paid $900,000 for lobbying efforts from Burisma Holdings in Ukraine. Derkach even brought charts and images as proof during his presentation. This is the same organization that paid Hunter Biden over $50,000 a month to sit on their board in an obvious pay-for-play maneuver. Cristina Laila reported on this development back in October last year…” Former Vice President Joe Biden was personally paid $900,000 for lobbying activities from Burisma Holdings, according to Ukrainian MP Andriy Derkach.

Derkach publicized the documents at a press conference at the Interfax-Ukraine agency Wednesday as he said the records, “describe the mechanism of getting money by Biden Sr.”

“This was the transfer of Burisma Group’s funds for lobbying activities, as investigators believe, personally to Joe Biden through a lobbying company. Funds in the amount of $900,000 were transferred to the U.S.-based company Rosemont Seneca Partners, which according to open sources, in particular, the New York Times, is affiliated with Biden. The payment reference was payment for consultative services,” Derkach said. During his press conference Derkach even displayed images and a timeline of Joe Biden’s nefarious dealings in the Ukraine. The entire press conference by Andriy Derkach was recorded and posted online. For some strange reason the liberal mainstream media had NO INTEREST in reporting on this story at the time. They totally ignored the information. In October 2020 Andrii Derkach announced a second laptop belonging to Hunter Biden’s business contacts in Ukraine has been seized by law enforcement. The Gateway Pundit is currently following up on this claim.

“And I know, Andy, that you know, had it happened during a jury trial, it would be a mistrial, right there.”

• Ex-Trump Attorney Claims He Witnessed 45 Instances of DOJ Misconduct (Med.)

Former Trump attorney Tim Parlatore argued on MSNBC Tuesday that “prosecutorial misconduct” could derail Donald Trump‘s federal trial. Parlatore claimed to a highly skeptical panel that he was in the room and witnessed misconduct during the grand jury proceedings. “What are the issues that you think would lead to this case never going to trial?” Andrew Weissmann asked during an MSNBC panel. “The biggest issue, of course, Andy, is prosecutorial misconduct,” Parlatore said, before laying out his accusations against the federal prosecutors. “This is a case where you have prosecutors who have consistently demonstrated lack of ethics and willingness to lie to federal judges in sealed proceedings.

Willingness to, in the grand jury, openly suggest to the jurors that they may take the invocation of constitutional rights as evidence of guilt. Willingness to meet with an attorney for one of the witnesses and suggest that his application for a judgeship is something that should be considered and is a reason to convince his client to change his mind. ” A skeptical Weissmann interjected to ask how Parlatore knew of the alleged misconduct since grand juries usually operate in secret. “Because I was in the room,” Parlatore said. “It happened right in front of me.” Parlatore was a witness before the grand jury considering the classified documents case against Trump. Weissmann then asked what Parlatore saw.

“Forty-five separate times — I know sounds like I made that number up — but 45 separate times they tried to get into attorney-client privileged information and frequently when the question was asked about conversations between attorney and client, they would turn to the grand jury and say, ‘so you’re refusing to provide that information to the grand jury?’ At a certain point, further exchange ensued where the prosecutor says, ‘well isn’t it possible to waive the privilege? And if President Trump is being so cooperative, why won’t he waive the privilege and allow you to tell the jury about his conversations with you?’ That’s totally improper. And I know, Andy, that you know, had it happened during a jury trial, it would be a mistrial, right there.”

“..the threats to the lawyers are greater than at any time since McCarthyism. Nor is the comparison to McCarthyism a stretch.”

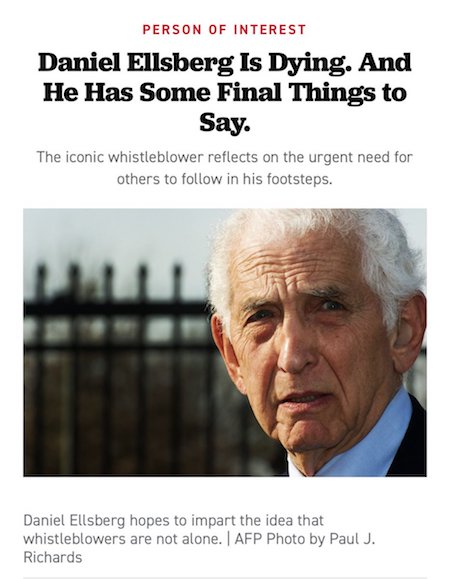

• Why Donald Trump Cannot Get a Top-Tier Lawyer (Dershowitz)

Former President Donald Trump has now been arraigned and pleaded not guilty. He was represented by two lawyers, neither of whom he apparently wants to lead his defense at trial. He has been interviewing Florida lawyers, and several top ones have declined. I know, because I have spoken to them. There are disturbing suggestions that among the reasons lawyers are declining the case is because they fear legal and career reprisals. There is a nefarious group that calls itself The 65 Project that has as its goal to intimidate lawyers into not representing Trump or anyone associated with him. They have threatened to file bar charges against any such lawyers. When these threats first emerged, I wrote an op-ed offering to defend pro bono any lawyers that The 65 Project goes after.

So The 65 Project immediately went after me, and contrived a charge based on a case in which I was a constitutional consultant, but designed to send a message to potential Trump lawyers: if you defend Trump or anyone associated with him, we will target you and find something to charge you with. The lawyers to whom I spoke are fully aware of this threat — and they are taking it seriously. There may be other reasons as well for why lawyers are reluctant to defend Trump. He is not the easiest client, and he has turned against some of his previous lawyers, as some of his previous lawyers have turned against him. This will be a difficult case to defend and an unpopular one with many in the legal profession and in general population.

Good lawyers, however, generally welcome challenges, especially in high-profile cases. This case is different: the threats to the lawyers are greater than at any time since McCarthyism. Nor is the comparison to McCarthyism a stretch. I recall during the 1950s how civil liberties lawyers, many of whom despised communism, were cancelled, and attacked if they dared to represent people accused of being communists. Even civil liberties organizations stayed away from such cases, for fear that it would affect their fundraising and general standing in the community. It may even be worse today, as I can attest from my own personal experiences, having defended Trump against an unconstitutional impeachment in 2020. I was cancelled by my local library, community center and synagogue. Old friends refused to speak to me and threatened others who did. My wife, who disagreed with my decision to defend Trump, was also ostracized. There were physical threats to my safety.

“disseminating propaganda, the contents of which are intended to further the aims of a former National Socialist organization.”

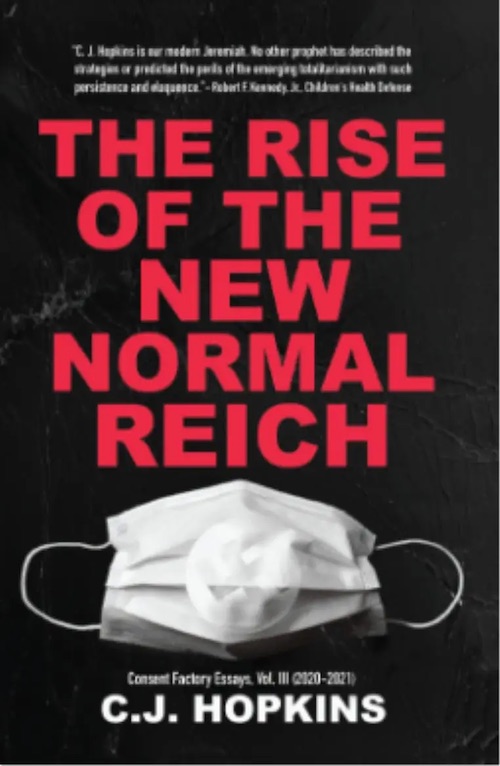

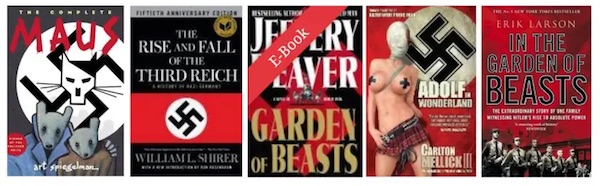

• First Roger Waters, Now C.J. Hopkins (Matt Taibbi)

It’s become axiomatic that the United States “lags far behind” Europe when it comes to hate speech law. Everyone from Joe Biden to would-be disinformation Czarina Nina Jankowicz to New York Times publisher A.G. Sulzberger have suggested the United States needs to move more in Europe’s direction, toward stricter rules and “illegal hate speech,” which “you will have soon also in the U.S.,” as European Commission Vice President for Values Vera Jourova put it at the Davos conference this year. It makes sense. After all, who’s for hate speech? What possible downside can there be to disallowing expressions of racism, antisemitism, xenophobia, transphobia? C.J. Hopkins can answer that. Following a similar case involving Roger Waters, the American playwright, Substack contributor, and editor of Consent Factory has been placed under investigation by a Berlin prosecutor for tweeting an image of his book, The Rise of the New Normal Reich. A scathing criticism of global pandemic policy, his cover features a white mask with a white swastika you have to squint to see:

According to German authorities, the author through this image is “disseminating propaganda, the contents of which are intended to further the aims of a former National Socialist organization.”] Here are some other books legally on sale in Germany:

As was the case with Waters, the Nazi imagery in C.J.’s book is used to make a satirical point. Unlike the Waters case, there’s absolutely nothing in C.J.’s outside-of-text history that even theoretically could be used to argue hidden/dangerous subtext. “It would take all of about 20 seconds of anyone looking at my actual work to see how absolutely opposed I am to anything resembling, totalitarianism, fascism, authoritarianism, anything,” he says. I first read C.J. at the outset of the Russiagate scandal, when from the amusing Statler-and-Waldorf remove of expat life he wrote witty columns about how far off the rocker America had fallen. A terrific comic prose stylist, he ripped our culture for obsessing over “Putin-Nazis,” noting the new Russophobia was just “a minor variation on the original War on Terror narrative we’ve been indoctrinated with since 2001.”

These columns are worth a re-read. C.J. was ahead of me, Glenn Greenwald, Aaron Maté, and others in seeing how Trump-era propaganda campaigns deranged the population. We had uncomfortable correspondence after Covid-19 hit, when I wasn’t so sure we were dealing with the same kinds of official lies this time, and worried about the wisdom, say, of writing “pandemic” in quotation marks. I rolled my eyes when I saw him cite an old quote from Hermann Goering, saying, “All you have to do is tell [people] they are being attacked and denounce the pacifists for lack of patriotism and exposing the country to danger.” But he placed it astride this real quote from California State Senator Richard Pan, about “anti-vaxxers”: “These extremists have not yet been held accountable, so they continue to escalate violence against the body public… We must now summon the political will to demand that domestic terrorists face consequences for their words and actions.”

“Electric wildfires could burn millions of acres of trees with far less efficiency for only 10 times the price.!”

• Joe Biden Announces By 2025 All Wildfires Must Be Electric (BBee)

Speaking from the White House, President Biden announced his administration’s bold plan to require all wildfires be electric by 2025. “My administration is committed to fighting pancakes, I mean climate change, and today we announce our boldest initiative yet!” mumbled the President to a group of dolls gathered in his closet he mistook for reporters gathered on the White House lawn. “By 2025, all wildfires will be powered exclusively by clean, electric energy. Gotta do it, folks! Not a joke! I wonder what that redhead smells like!” The Biden team unveiled details of the plan, including new statutes mandating all wildfires obtain permits for electric usage before being allowed to burn down acres of forest land.

“Electric wildfires are the future of climate technology,” declared Mark Patterson, a representative from the Bureau of Land Management. “I’m thrilled to see our president take a powerful position against destructive, gas-powered wildfires. Electric wildfires could burn millions of acres of trees with far less efficiency for only 10 times the price.!” The Biden administration told reporters they’ve spoken with wildfires across the country and have nearly reached an agreement with the fires, which includes provisions to convert current wood-burning fires into electric-only in just three years. The President hailed the move as another major step forward in his administration’s ongoing commitment to spend as many federal dollars on completely normal, practical, common-sense climate initiatives as possible. Critics say the plan could use up precious cobalt meant for iPhones and Teslas.

Loudest bird

https://twitter.com/i/status/1669317438574415873

Komodo

Scientists have discovered that komodo dragons love to play… by putting things on their heads

[full video, HD, by BBC: https://t.co/W0zQdrA6SE]pic.twitter.com/RPgitYJBdL

— Massimo (@Rainmaker1973) June 15, 2023

Eagle ray

https://twitter.com/i/status/1669383386832486402

Young ‘uns

— Nature is Amazing ☘️ (@AMAZlNGNATURE) June 14, 2023

Owl’s ear

https://twitter.com/i/status/1669363135294078979

Sequoia

https://twitter.com/i/status/1669357721030914051

Fuxi

https://twitter.com/i/status/1669391436557451267

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.