Eugène Delacroix Pietà 1837

Excuse me, but do those protesting this not see many of their own MPs are at least as bad?

Bercow: “..our opposition to racism and to sexism and our support for equality before the law..” Have you followed May’s career at all, Mr. Speaker? Windrush, Hostile Environment?

Clean your own house first. Until you do, this is just cheap propaganda.

• Donald Trump Plans State Visit To UK In June (G.)

Donald Trump’s postponed state visit to the UK is due to take place in June, it will be confirmed on Tuesday, prompting renewed calls for protests against the trip. Buckingham Palace is due to announce the visit will be timed to coincide with the 75th anniversary of the D-day landings on 6 June, the Guardian understands. The move has renewed controversy over Theresa May’s decision to invite Trump for a full state visit when she met the president shortly after he took office. State visits are formal trip for heads of state involving considerable ceremony and time with the Queen. The invitation was extended by May when she became the first overseas leader to visit Trump in the White House after his inauguration.

When Trump travelled to the UK on an official but non-state visit in July 2018, tens of thousands of people took to the streets to protest and a four-metre-high orange Trump baby blimp was floated above Parliament Square. The policing operation for the visit cost an estimated £18m. The prospect of Trump being granted the honour of a carriage ride down the Mall appalls many MPs. It is unusual for a state visit to be announced at such short notice, and details of the visit have yet to be finalised with fewer than six weeks to go. It is unclear if Trump will be be invited, or allowed, to address to both houses of parliament. In February 2017, the Speaker John Bercow, said Trump should not be allowed to speak to parliament. He said: “I feel very strongly that our opposition to racism and to sexism and our support for equality before the law and an independent judiciary are hugely important considerations in the House of Commons.”

I think we call this the Completion Backward Principle. First talk impeachment, then try and find evidence.

“I do think, if proven – which hasn’t been proven yet – if proven, some of this would be impeachable, yes,” Nadler said..”

• House Democrats Subpoena Ex-White House Counsel (G.)

The Democratic chairman of the House judiciary committee has issued a subpoena ordering that the former White House counsel Don McGahn testify before Congress. The move came as the House speaker, Nancy Pelosi, vowed to hold Donald Trump to account following the release of Robert Mueller’s report on Russian influence on the 2016 US election. The subpoena, issued on Monday, escalates the congressional investigations into Trump, his finances and accusations that he sought to obstruct justice, as Democrats debate how to proceed with the evidence contained in the special counsel’s 448-page report. McGahn cooperated extensively in the special counsel’s investigation and emerged as a key witness in several incidents at the heart of whether Trump obstructed justice.

“The special counsel’s report, even in redacted form, outlines substantial evidence that President Trump engaged in obstruction and other abuses,” said Jerry Nadler, the chairman of the House judiciary committee, which has the power to launch impeachment proceedings. [..] This is the second subpoena issued by Nadler since the release of the report: on Friday he demanded that the justice department turn over an unredacted version of the report as well as the underlying evidence by 1 May, when the attorney general, William Barr, is due to testify before Congress. Nadler, a New York Democrat, has also invited Mueller to testify before his committee next month. Republican congressman Doug Collins, the ranking member of the House judiciary committee, called the subpoenas “premature” and criticized Democrats for seeking delicate information that the justice department believes should remain confidential.

“Instead of looking at material that Attorney General Barr has already made available, Democrats prefer to demand more documents they know are subject to constitutional and common-law privileges and can’t be produced,” he said. Barr offered to brief a select, bipartisan group of lawmakers on a version of the report that was less redacted than the copy made public. Democrats refused the offer arguing that Congress is entitled to the full, unredacted report. Trump has maintained that the report represents a “total exoneration” and has insisted repeatedly that there are no grounds for impeachment. After the subpoena was issued, he tweeted: “PRESIDENTIAL HARASSMENT.”

This weekend, senior Democrats blanketed TV talkshows and refused to rule out impeachment. However, they remained firm that there was more to investigate before making a final determination. “I do think, if proven – which hasn’t been proven yet – if proven, some of this would be impeachable, yes,” Nadler said NBC’s Meet the Press on Sunday. “Obstruction of justice, if proven, would be impeachable.” [..] Nancy Pelosi cautioned Democrats against hastily moving toward impeachment, making clear that their immediate focus would be on investigating the president and that those inquiries would guide their actions. “This isn’t about Democrats or Republicans,” Pelosi told her colleagues, according to multiple officials on the call. “It’s about saving our democracy.”

“These internal problems of the USA point in the direction of states and whole regions stealthily seceding from a federal system that can’t run itself competently at scale anymore.”

• The Nervous Here and Now (Kunstler)

Before we get to Medicare-for-all, I’d like to see congress pass one simple law requiring all medical service “providers” in the land to publicly post the price of all their services, from the cost of heart transplants down to those $90 Tylenols they dispense. Let’s see how that affects the lawless hocus-pocus of insurance companies “negotiating” their payments with the medical corporatocracy before we go whole-hog for a nationalized health service. The colleges have already destroyed themselves intellectually, and thereby the value of their overpriced credentialing services. The smaller colleges are already folding, and many more will follow now until higher education becomes a boutique industry.

The pension funds are truly big, ominous bombs, because when they fail, they will set up unresolvable fiscal problems that will turn ugly and political. Even if the federal government attempts some kind of “one-time” bail-out, it will not solve the embedded Ponzi problem of a system that has to pay off an ever-expanding pool of claims with an ever-diminishing stream of revenue. It will only be another swipe of the blade cutting off the legs of the US dollar so that it in end every pensioner will receive his-or-her promised payout in dollars that are increasingly worthless. We may even discover that the opioid epidemic has been the only thing keeping the immiserated denizens of Flyover-land from resorting to violent insurrection.

These internal problems of the USA point in the direction of states and whole regions stealthily seceding from a federal system that can’t run itself competently at scale anymore. The process has already begun in such acts of defiance as “sanctuary states” and the burgeoning marijuana industry. Unlike the calamity of 1861, though, there may be no way to even attempt to hold the old Union together, even by force. Instead, as is the case with all foundering empires, the end will be a sickening slide into a new and strange disposition of things. One of the last successful acts of the American empire may be to send the RussiaGate instigators to jail.

Evil empire. Meanwhile, Assange has been in max security prison for 2 weeks with no access to anyone, including his lawyers. For violating his bail?!

Your governments have set out to break your brightest and bravest. Where are you?

• Chelsea Manning To Stay In Jail After Federal Court Rejects Appeal (RT)

A federal appeals court has struck down whistleblower Chelsea Manning’s bid to be released from jail, where she has been held indefinitely after refusing to testify to a grand jury probe into WikiLeaks. Judges from the 4th US Circuit Court of Appeals reaffirmed the charges against Manning on Monday and denied her request to be released. “The court finds no error in the district court’s rulings and affirms its finding of civil contempt,” the court said in its decision. “The court also denies appellant’s motion for release on bail.” Manning is likely to pursue further appeals. Manning was arrested in March when she refused to provide grand jury testimony related to her disclosures of classified material in 2010 and her interactions with WikiLeaks founder Julian Assange.

She is to be held for the duration of the grand jury, or until she agrees to answer prosecutors’ questions. She has been in jail for 45 days. Assange was arrested in London on April 11, after spending nearly seven years in Ecuador’s embassy there. The court hearing on his extradition to the US is scheduled for May 2. Manning’s lawyers argue her rights were violated by the grand jury proceedings, and that federal prosecutors used a subpoena to “entrap” her. The lawyers added that Manning had already given authorities all the information she had during her previous court-martial investigation, and that her confinement is needlessly cruel, as the jail cannot provide proper medical care.

An empire in decline always emphasizes loudest that it’s an empire. At its heyday, it doesn’t have to; it’s understood.

“The U.S. is telling China, the second largest economy in the world and home to over one billion people, that it lacks the sovereign authority to buy oil from Iran if it so desires.”

• The Trump Administration’s Iran Policy Will Hasten Imperial Decline (Krieger)

A primary focus of my writing of late centers around the idea that the policies of the Trump administration, and the neocons in control of it, will hasten the decline of U.S. imperial power and more rapidly usher in a multi-polar (and possibly bifurcated) world. Today’s news regarding the elimination of waivers on Iranian oil imports provides another perfect example. Specifically, Secretary of State Mike Pompeo announced earlier today that waivers which allowed eight countries to import Iranian crude oil without being subject to U.S. sanctions would expire on May 2 without extension. The eight countries included are China, India, Turkey, South Korea, Japan, Greece, Italy and Taiwan.

This move is an extraordinarily foolish and reckless act which illustrates the extreme hubris and short-sightedness of those running American foreign policy under Trump. What the U.S. is decreeing to the entire world with this action is that the U.S., and the U.S. alone, decides who gets to trade with who. The U.S. is telling China, the second largest economy in the world and home to over one billion people, that it lacks the sovereign authority to buy oil from Iran if it so desires. If the U.S. can unilaterally play boss on the trade decisions of foreign countries, national sovereignty does not exist in practice anywhere on the planet. There is only empire.

As such, this goes beyond aggressive foreign policy. It’s more or less an assertion by the Trump administration that the world is in fact a global dictatorship run by a single nation (empire) that has granted itself the authority to arbitrarily decide which countries get to participate in global trade, and which ones do not. Now that the true nature of U.S. power is so completely out in the open, countries will have to decide to either bend the knee or resist, which seems to be the point. What do you think China’s going to do?

Religious extremism in a declining empire. Read your history.

• When the Non-Rational Trumps the Rational (Crooke)

Professor of Religious Studies, Andrew Chesnut tells us that Christian Zionism has become the “majority theology” among white US Evangelicals. In a 2015 poll, 73% of evangelical Christians said events in Israel are prophesied in the Book of Revelation. For Christian Zionists, achieving a ‘Greater Israel’ is one of the key preconditions for ‘Rapture’. It is a belief, known as pre-millennial dispensationalism or Christian Zionism, Chesnut says. “Trump himself embodies the very opposite of a pious Christian ideal. Trump is not a churchgoer. He is profane, twice divorced, who has boasted of sexually assaulting women. But white evangelicals have embraced him, writes Julian Borger.

“Some leading evangelicals see Trump as a latter-day King Cyrus, the sixth-century BC Persian emperor who liberated the Jews from Babylonian captivity. The comparison is made explicitly in The Trump Prophecy, a religious film screened in 1,200 cinemas [last year], depicting a retired firefighter who claims to have heard God’s voice, saying: “I’ve chosen this man, Donald Trump, for such a time as this … “Cyrus is the model for a nonbeliever, being appointed by God as a vessel for the purposes of the faithful,” said Katherine Stewart, who writes extensively about the Christian right. She added that they welcome [Trump’s] readiness to break democratic norms, to combat perceived threats to their values and way of life.

Mike Pompeo and Vice-President Pence are strongly of this Evangelical orientation. It is something that has real import for foreign policy: During his tenure as CIA director, and before that as a member of the House of Representatives, Pompeo has consistently used language that casts the war on terrorism as a cosmic, divine battle of good and evil. He has referred to Islamic terrorists as destined to “continue to press against us until we make sure that we pray, and stand and fight, and make sure that we know that Jesus Christ is our savior, and is truly the only solution for our world”. The proscription of Iran’s IRGC, by Pompeo was couched in exactly this language of terrorism, with the clear connotation that Iran is the cosmic ‘evil’. This style of Apocalyptic or Rapture language has been adopted wholesale by Trump, and his Administration.

The Fed should have stayed away from -mortgage- rates. It has now guaranteed uncontrolled demolition.

• Lower Mortgage Rates No Relief for US Home Sales (WS)

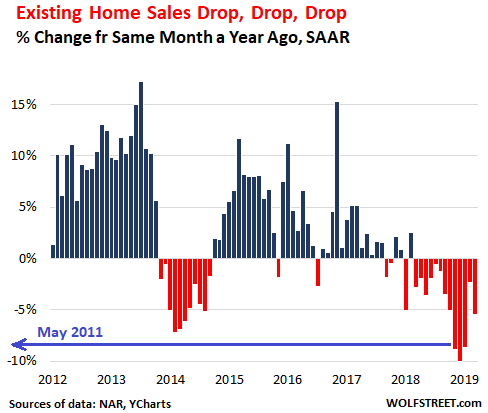

Across the US, hot and cold housing markets all thrown into one bucket: Sales of “existing homes” (single-family houses, townhouses, condos, and co-ops) in March dropped 5.4% from March last year, to a seasonally adjusted annual rate of 5.21 million homes, according to the National Association of Realtors, after having dropped 2.3% year-over-year in February, 8.7% in January, 10.1% in December, and 8.9% in November (data via YCharts):

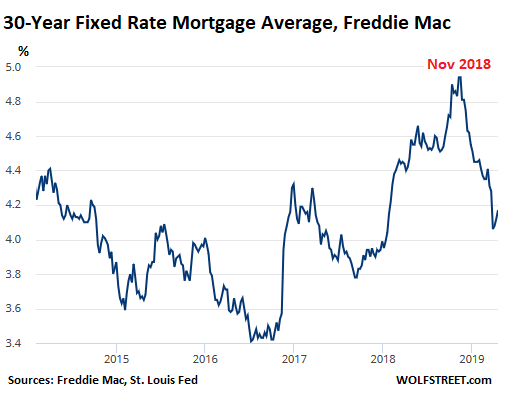

“The impact of lower mortgage rates has not yet been fully realized,” the NAR report said, as the drop in sales volume is occurring despite the fact that mortgage rates had fallen sharply from the November highs. “According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage decreased to 4.27% in March from 4.37% in February,” the report said. The average Freddie Mac 30-year fixed rate bottomed out in the reporting week ended March 28 at 4.06%, the lowest since January 2018, and down from 4.94% in November. But it has since risen every week. For the week ending April 18, it ticked up to a still low 4.17%:

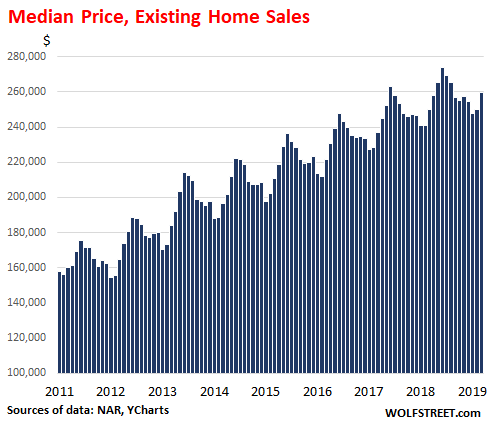

[..] “The lower-end market is hot while the upper-end market is not,” according to the NAR report. “The expensive home market will experience challenges due to the curtailment of tax deductions of mortgage interest payments and property taxes.” Alas, in many markets, even the “lower end,” after years of price surges, has become very expensive. So, with all markets across the US thrown into one bucket, the median price in March rose 3.8% from March last year to $259,400. Prices are subject to seasonality, as the chart below shows. Median price means half the homes sold for more, and half sold for less:

“For matters of this kind there is international justice,” he said. “In all disputes the EU abides by it, on principle. Germany may say it has been resolved but what counts is international law.”

• Greece Will Demand Germany Pay $337 Billion For Nazi Occupation (SCMP)

Greece is poised to send Germany a formal diplomatic note detailing its demand for billions of euros in wartime reparations after MPs voted overwhelmingly for the emotive issue to be raised officially. In a move bound to stir sentiment ahead of crucial European parliament elections, Athens vowed to pile pressure on Berlin, taking legal and diplomatic steps that will throw the spotlight on crimes committed during the brutal Nazi occupation. “It is an open issue that must be resolved,” Greece’s deputy foreign minister, Markos Bolaris, told The Guardian, hitting back at German insistence that compensation claims had been conclusively settled.

“For matters of this kind there is international justice,” he said. “In all disputes the EU abides by it, on principle. Germany may say it has been resolved but what counts is international law.” Greeks suffered hugely at the hands of Hitler’s forces, enduring what Germany’s president, Frank-Walter Steinmeier, recently described on a visit to Greece as “unimaginable” horrors. Tens of thousands were killed in reprisals as Greeks mounted what historians would later hail as a heroic resistance against the Wehrmacht [German army], with entire villages being wiped out between 1941 and 1944. By the time the occupation ended, an estimated 300,000 people had died from famine and the country’s Jewish community had been almost entirely obliterated.

All energy use produces waste. The only way to prevent this is not using the energy.

• Electric Vehicles Account For More CO2 Emissions Than Diesel Ones (BT)

Electric vehicles in Germany account for more CO2 emissions than diesel ones, according to a study by German scientists. When CO2 emissions linked to the production of batteries and the German energy mix – in which coal still plays an important role – are taken into consideration, electric vehicles emit 11% to 28% more than their diesel counterparts, according to the study, presented on Wednesday at the Ifo Institute in Munich. Mining and processing the lithium, cobalt and manganese used for batteries consume a great deal of energy. A Tesla Model 3 battery, for example, represents between 11 and 15 tonnes of CO2. Given a lifetime of 10 years and an annual travel distance of 15,000 kilometres, this translates into 73 to 98 grams of CO2 per kilometre, scientists Christoph Buchal, Hans-Dieter Karl and Hans-Werner Sinn noted in their study.

The CO2 given off to produce the electricity that powers such vehicles also needs to be factored in, they say. When all these factors are considered, each Tesla emits 156 to 180 grams of CO2 per kilometre, which is more than a comparable diesel vehicle produced by the German company Mercedes, for example. The German researchers therefore take issue with the fact that European officials view electric vehicles as zero-emission ones. They note further that the EU target of 59 grams of CO2 per km by 2030 corresponds to a “technically unrealistic” consumption of 2.2 litres of diesel or 2.6 litres of gas per 100 kms.

“Population extinctions, however, are a prelude to species extinctions, so Earth’s sixth mass extinction episode has proceeded further than most assume.”

• ‘Catastrophic’ Decline Threatening The Earth (NZH)

They’re the things that often bug us the most — quite literally. But with warnings insects could disappear within the century, suddenly the critters we first think to squish have made us think differently. A global scientific review of insect decline has warned insects will “go down the path of extinction” in a few decades, with “catastrophic” repercussions for the planet’s ecosystems. The biodiversity crisis is said to be even deeper than that of climate change, reports news.com.au. Scientists have already warned the earth’s sixth mass extinction event is under way through biological annihilation. “Earth’s sixth mass extinction is more severe than perceived when looking exclusively at species extinctions,” researchers wrote in 2017.

They said decimation needed to be addressed immediately. “Earth’s sixth mass extinction is more severe than perceived when looking exclusively at species extinctions. “Population extinctions, however, are a prelude to species extinctions, so Earth’s sixth mass extinction episode has proceeded further than most assume. “The massive loss of populations is already damaging the services ecosystems provide to civilisation. When considering this frightening assault on the foundations of human civilisation, one must never forget that Earth’s capacity to support life, including human life, has been shaped by life itself.”

Dragonflies are a protective and resilient insect. Photo / Getty Images

You’re on Earth.

There’s no cure for that.

– Samuel Beckett