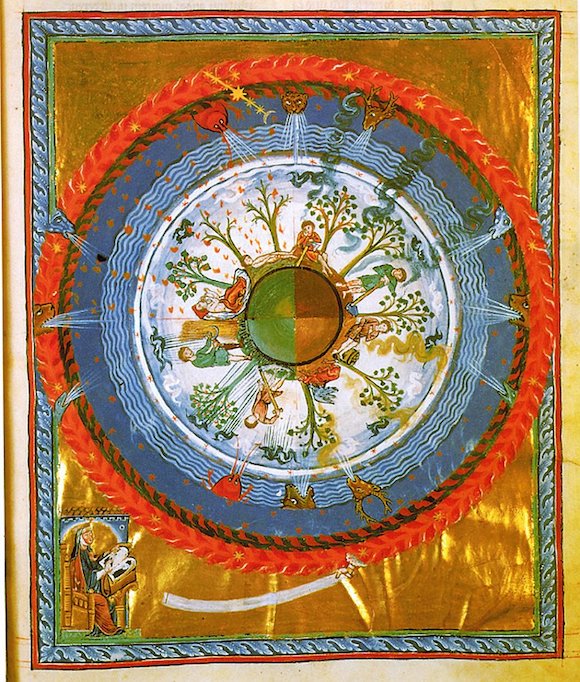

Hildegard von Bingen (1098-1179) German artist, philosopher, composer, mystic Cosmic Tree

Not sure what Biden does, but I don’t think it’s called ‘walking’. Closest thing is Elon Musk’s new humanoid robot.

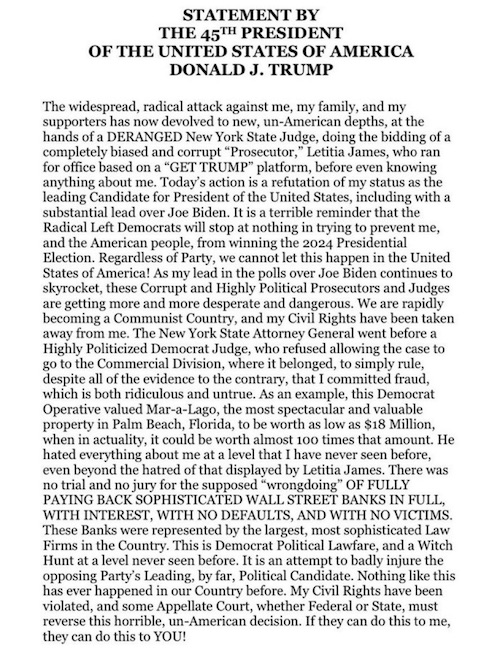

WH doc

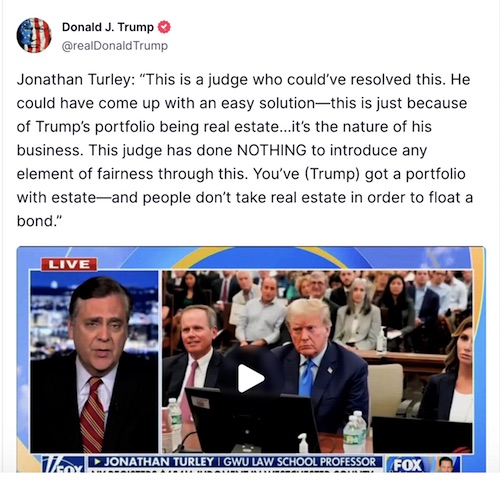

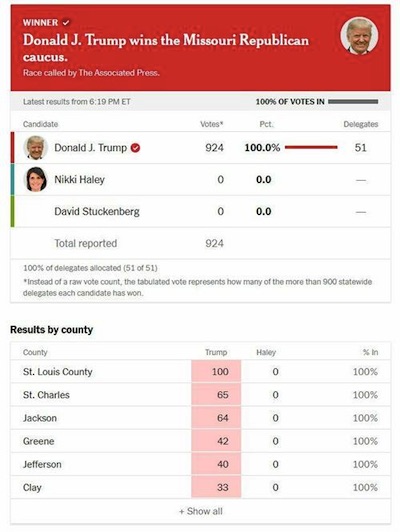

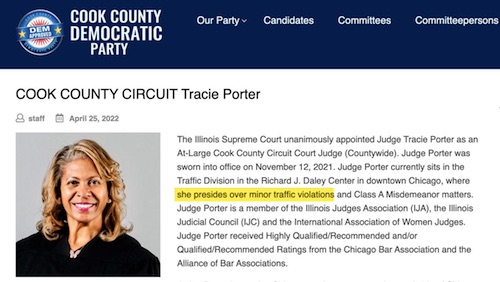

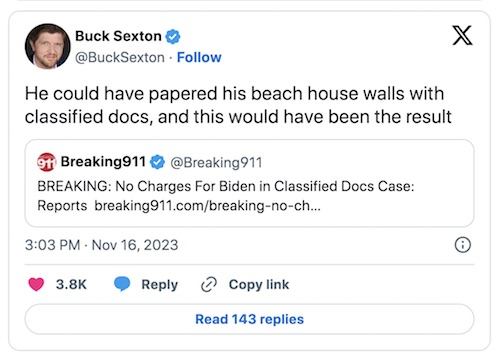

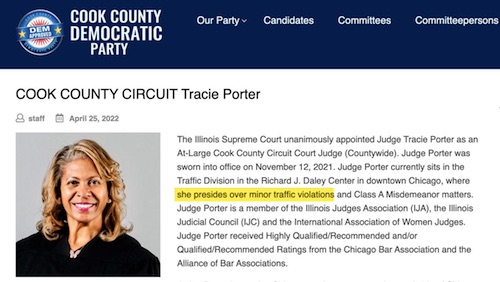

“The judge who just threw Trump off the ballot in Illinois typically “presides over minor traffic violations”

Loan

https://twitter.com/i/status/1763341500627480884

“..now the consequences for potential invaders would be far more tragic.”

• West Flirting With Nuclear War – Putin (RT)

Western officials indulging in escalatory rhetoric should realize that they are effectively invoking the specter of an all-out nuclear war, Russian President Vladimir Putin warned in a speech to legislators in Moscow on Thursday. He also once again accused the West of instigating the Ukraine conflict. Putin addressed the topic in the opening minutes of his annual state-of-the-nation speech, a key event in which the president declares his plans and priorities in a televised address to both houses of the Federal Assembly of Russia, the national legislature. President Putin insisted that recent claims by Western officials that Moscow is planning to attack NATO are “nonsense.” At the same time, those same nations are “selecting targets to conduct strikes on our territory,” the Russian head of state claimed, adding that there is now talk of “deploying NATO military contingents to Ukraine.”

Putin reminded would-be aggressors that all previous attempts to conquer Russia have ended in failure, warning that “now the consequences for potential invaders would be far more tragic.” He pointed out that Russia has a massive nuclear arsenal, which is in a state of “complete readiness for guaranteed deployment.” “Everything that they are thinking up now, that they are scaring the world with, it all really poses the threat of a conflict involving nuclear weapons, and therefore, the destruction of civilization. Don’t they understand this?” The Russian president suggested that Western politicians making those escalatory remarks “have already forgotten what war is.” Unlike Russians, who have faced “difficult trials” in recent decades, Westerners apparently “think that these are just some cartoons,” President Putin opined.

The Russian president’s remarks came after his French counterpart, Emmanuel Macron, toyed with the idea of a potential ground deployment of Western militaries to Ukraine while talking to reporters on Monday, saying “in terms of dynamics, we cannot exclude anything.” NATO Secretary-General Jens Stoltenberg hastened to emphasize that “there are no plans for NATO combat troops on the ground in Ukraine.” German Chancellor Olaf Scholz, in turn, declared that there will be “no ground troops, no soldiers on Ukrainian soil, who are sent there by European or NATO countries” in the future. The leaders of Poland, the Czech Republic, Sweden and Finland also chimed in with similar assurances. Commenting on Macron’s remark, Kremlin spokesman Dmitry Peskov warned that such a development would mean that “we have to talk not about the probability, but rather the inevitability” of an all-out military confrontation between NATO and Russia.

Read more …

“I would like to remind you that just a month ago, the French Foreign Minister denied Paris’s involvement in recruiting mercenaries for the Kiev regime, and called direct evidence ‘crude Russian propaganda.’”

• What Comes Next As The Ukrainian Army Collapses (Helmer)

The collapse of the Ukrainian army following the battle of Avdeyevka, and its disorganized retreat, have accelerated Russian military thinking of how far westward the NATO allies will decide that the Ukrainian statelet can be defended against the expected Russian advance – and how fast new NATO defences can be created without the protection of ground-to-air missile batteries like Patriot, long-range artillery like the M777, and mobile armour like the Abrams, Bradley, and Caesar: all of them have already been defeated in the east. In short, there is no longer a NATO-command line of fortification east of the Polish border which deters the Russian General Staff. Also, no bunker for the Zelensky government and its NATO advisors to feel secure. Cutting and pasting from the Russian military bloggers and the Moscow analytical media, as a handful of US podcasters and substackers are doing as often as their subscribers require, is the Comfy-Armchair method for getting at the truth.

Reading the Russian sources directly, with the understanding that they are reporting what their military and intelligence sources are saying off the record, is still armchair generalship, but less comfy, more credible. Offence is now the order of the day up and down the contact line. The daily bulletin from the Ministry of Defense in Moscow calls this “improving the tactical situation” and “taking more advantageous positions”. In the past three days, Monday through Wednesday, the Defense Ministry also reported the daily casualty rate of the Ukrainian forces at 1,175, 1,065, and 695, respectively; three M777 howitzer hits; and the first Abrams tank to be destroyed. Because this source is blocked in several of the NATO states, the Russian military bloggers, which reproduce the bulletins along with videoclips and maps, may be more accessible; also more swiftly than the US-based podcasters and substackers can keep up.

Moscow sources confirm the obvious: the operational objective is to apply more and more pressure at more and more points along the line, in as many sectors or salients (“directions” is the Russian term) as possible simultaneously. At the same time, air attack, plus missiles and drones, are striking all rear Ukrainian and NATO airfield, road, and rail nodes, ammunition storages, vehicle parks, drone manufactories, fuel dumps, and other supply infrastructure, so as make reinforcement and redeployment more difficult and perilous. What cannot be seen are the Russian concentrations of forces aimed in the north, centre and south of the battlefield. Instead, there is what one source calls “an educated guess is that when the main blow comes, it will be North, Chernigov, Sumy, Kharkov, Poltava, or Centre, Dniepropetrovsk, Zaporozhye, or both simultaneously.” For timing, the source adds, “after the Russian election.”

That is now less than three weeks away, on March 17. President Vladimir Putin will then reform his new government within four to six weeks for announcement by early May. Ministerial appointments sensitive to the General Staff’s planning are the Defense Minister Sergei Shoigu, who is expected to remain in place; and the Foreign Minister Sergei Lavrov, who may retire. Following the call of French President Emmanuel Macron for the “possibility” of French ground force deployment to the Ukraine battlefield, and the subsequent clarification by French Defense Minister Sébastien Lecornu, the Russian assessment has been derisory. “As for Emmanuel Macron’s statements about the possibility of sending NATO troops to Ukraine,” replied Foreign Ministry spokesman Maria Zakharova, “I would like to remind you that just a month ago, the French Foreign Minister denied Paris’s involvement in recruiting mercenaries for the Kiev regime, and called direct evidence ‘crude Russian propaganda.’

Read more …

“The West is unreasonable. Putin still thinks he can reason with the West. This is a mistake that is fatal for mankind.”

• How Realistic Is Putin? (Paul Craig Roberts)

As readers know, I am concerned that Putin’s tolerance of a too-long-continuing-Ukraine-conflict is encouraging the conflict to spin-out-of-control. I have written about this risk neglected by the Kremlin many times. On February 27 I was interviewed by Finian Cunningham about this risk. If the interview is posted online, I will link to it hopefully before it is taken down by the narrative controllers. There is no doubt that I have been proven correct that the provocations, accepted by the Kremlin with only words in opposition, have increased in severity over the past two years. First the West would send to the Ukrainians helmets and sleeping bags. Then small arms ammunition. Then artillery. Tanks were mentioned, but Washington and NATO said, “never tanks.” Then tanks were sent. Then, after first being denied, drones and intermediate-range missiles. Then targeting information. Then mercenaries.

Then after being denied, now long-range missiles and US F-16s capable of penetrating deep into Russia herself far from the battlefront are under consideration. And now the latest, the French President’s proposal to send NATO troops. “We will never send troops,” declares NATO’s Stoltenberg. But all the denials previously were breached and meant nothing. So the question before us is: Has Putin reduced the threat of the conflict spinning out of control by fighting it on a low key basis limited to Donbass and the Russian areas, or has his low-key behavior convinced Washington’s neoconservatives that Putin is a paper tiger who will accept any provocation and any insult. If the latter, the provocations will increase in severity until the conflict spins out of control. Clearly from helmets to NATO troops is an immense escalation. Putin understands that the West intends Russia’s destruction, so why does he prolong conflicts that provide opportunities for the West to expand conflict?

The Kremlin and the Western media whores see the fundamental issue as Ukraine becoming a member of NATO. The neoconservatives who control US foreign policy seem to think that Putin will stand aside from this just as he did from being called by the President of the United States “the new Hitler” and “a son-of-a-bitch.” No American official of any rank ever spoke in public of Soviet leaders in such terms. On his way to Reykjavik, Iceland, for his meeting with Gorbachev, Reagan told his entourage that one word of rudeness to the Soviet officials and you were fired on the spot. Reagan’s goal was to end the Cold War, and he did. It was the neoconservatives and the US military/security complex that restarted it. As the deceased Steven Cohen and I emphasized, the threat of nuclear war today is much higher than during the Cold War.

In those years, leaders on both sides worked to reduce tensions and to achieve mutual security that would reduce the danger of nuclear confrontation. I was part of the effort and perhaps I am one of a small handful of people still alive who know and lived the experience. Once the Soviet Union collapsed when the Politburo placed Russian President Gorbachev under house arrest, the neoconservatives saw their chance at world hegemony and began their assault on Russia. All of the security-enhancing agreements worked out over the years of the Cold War were cancelled by Washington. NATO’ Secretary General Jens Stoltenberg is Washington’s puppet. But he is not sufficiently stupid to knowingly start a war with Russia. Who can possibly imagine Europe, which is incapable of protecting its own borders from being over-run by unarmed immigrant-invaders, possibly fighting Russia. The war, if Putin could bring himself to fight it, would be over in a few minutes.

[..] It is Putin’s refusal to impose restraint on a weak and collapsing West that is leading to nuclear Armageddon. I am not writing because I want a Russian victory. I am writing because I do not want nuclear Armageddon. The West is unreasonable. Putin still thinks he can reason with the West. This is a mistake that is fatal for mankind.

Read more …

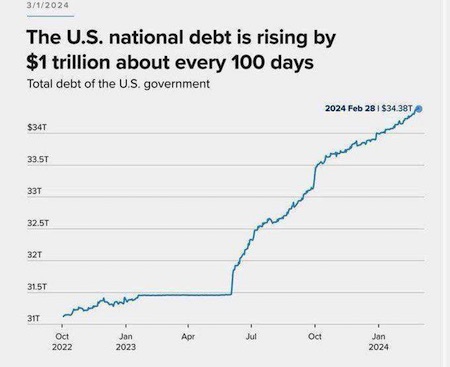

“They’re sawing off a branch they’ve been sitting on for decades..”

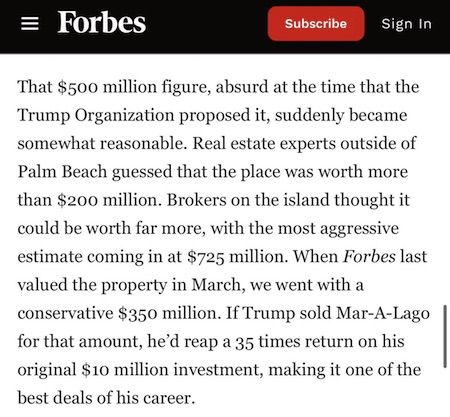

• West Destroying Its Own Financial System – Putin (RT)

The West is discrediting its own currencies and banking system, Russian President Vladimir Putin said in his annual address to the Federal Assembly on Thursday, adding that the established monopolies and stereotypes in the global economy are crumbling. “The West itself is discrediting its own currencies and banking system. They’re sawing off a branch they’ve been sitting on for decades,” Putin said. Meanwhile, Russia together with so-called ‘friendly’ nations will focus on creating new financial infrastructure that will be free from politics as it seeks to unite efforts in the face of global challenges, he said. The president was referring to the global trend of moving toward using national currencies in trade rather than the US dollar that has gained significant momentum after Russia was cut off from the Western financial system and had its foreign reserves frozen in 2022.

A number of both Russian and foreign officials have repeatedly warned that the US currency has long been used as a weapon, noting that such actions have prompted countries around the world to reduce their dependence on the greenback. Putin emphasized that Moscow is working with its allies on the basis of equality and respect of mutual interests. Because of this, he said, more and more countries are seeking to join groups such as BRICS, the Eurasian Economic Union, and Shanghai Cooperation Organization. Together with its partners Russia will continue building “safe” transport corridors based on new technology and create a new global financial network “free from political interference” at a time when the world economy, trade and finance are undergoing rapid changes, the president noted.

Read more …

“..They cannot afford to lose a war they cannot win..”

• The CIA in Ukraine – The NY Times Gets a Guided Tour (Patrick Lawrence)

If you have paid attention to what various polls and officials in the U.S. and elsewhere in the West have been doing and saying about Ukraine lately, you know the look and sound of desperation. You would be desperate, too, if you were making a case for a war Ukrainians are on the brink of losing and will never, brink or back-from-the-brink, have any chance of winning. Atop this, you want people who know better, including 70 percent of Americans according to a recent poll, to keep investing extravagant sums in this ruinous folly. And here is what seems to me the true source of angst among these desperados: Having painted this war as a cosmic confrontation between the world’s democrats and the world’s authoritarians, the people who started it and want to prolong it have painted themselves into a corner. They cannot lose it. They cannot afford to lose a war they cannot win: This is what you see and hear from all those good-money-after-bad people still trying to persuade you that a bad war is a good war and that it is right that more lives and money should be pointlessly lost to it.

Everyone must act for the cause in these dire times. You have Chuck Schumer in Kyiv last week trying to show House Republicans that they should truly, really authorize the Biden regime to spend an additional $61 billion on its proxy war with Russia. “Everyone we saw, from Zelensky on down made this very point clear,” the Democratic senator from New York asserted in an interview with The New York Times. “If Ukraine gets the aid, they will win the war and beat Russia.” Even at this late hour people still have the nerve to say such things. You have European leaders gathering in Paris Monday to reassure one another of their unity behind the Kyiv regime—and where Emmanuel Macron refused to rule out sending NATO ground troops to the Ukrainian front. “Russia cannot and must not win this war,” the French president declared to his guests at the Elysée Palace. Except that it can and, barring an act of God, it will.

Then you have Jens Stoltenberg, NATO’s war-mongering sec-gen, telling Radio Free Europe/Radio Liberty last week that it will be fine if Kyiv uses F–16s to attack Russian cities once they are operational this summer. The U.S.–made fighter jets, the munitions, the money—all of it is essential “to ensure Russia doesn’t make further gains.” Stephen Bryen, formerly a deputy undersecretary at the Defense Department, offered an excellent response to this over the weekend in his Weapons and Strategy newsletter: “Fire Jens Stoltenberg before it is too late.” Good thought, but Stoltenberg, Washington’s longtime water-carrier in Brussels, is merely doing his job as assigned: Keep up the illusions as to Kyiv’s potency and along with it the Russophobia, the more primitive the better. You do not get fired for irresponsible rhetoric that risks something that might look a lot like World War III.

What would a propaganda blitz of this breadth and stupidity be without an entry from The New York Times? Given the extent to which The Times has abandoned all professional principle in the service of the power it is supposed to report upon, you just knew it would have to get in on this one. The Times has published very numerous pieces in recent weeks on the necessity of keeping the war going and the urgency of a House vote authorizing that $61 billion Biden’s national security people want to send Ukraine. But never mind all those daily stories. Last Sunday it came out with its big banana. “The Spy War: How the C.I.A. Secretly Helps Ukraine Fight Putin” sprawls—lengthy text, numerous photographs. The latter show the usual wreckage—cars, apartment buildings, farmhouses, a snowy dirt road lined with landmines.

But the story that goes with it is other than usual. Somewhere in Washington, someone appears to have decided it was time to let the Central Intelligence Agency’s presence and programs in Ukraine be known. And someone in Langley, the CIA’s headquarters, seems to have decided this will be O.K., a useful thing to do. When I say the agency’s presence and programs, I mean some: We get a very partial picture of the CIA’s doings in Ukraine, as the lies of omission—not to mention the lies of commission—are numerous in this piece. But what The Times published last weekend, all 5,500 words of it, tells us more than had been previously made public.

Read more …

“If Republicans in Congress end military funding to Kiev, the CIA may have to scale back.”

• CIA in Ukraine (John Kiriakou)

The New York Times on February 25 published an explosive story of what purports to be the history of the CIA in Ukraine from the Maidan coup of 2014 to the present. The story, “The Spy War: How the CIA Secretly Helps Ukraine Fight Putin,” is one of initial bilateral distrust, but a mutual fear and hatred of Russia, that progresses to a relationship so intimate that Ukraine is now one of the CIA’s closest intelligence partners in the world. At the same time, the Times’ publication of the piece, which reporters claimed relied on more than 200 interviews in Ukraine, the US, and “several European countries,” raises multiple questions: Why did the CIA not object to the article’s publication, especially with it being in one of the Agency’s preferred outlets? When the CIA approaches a newspaper to complain about the classified information it contains, the piece is almost always killed or severely edited. Newspaper publishers are patriots, after all. Right?

Was the article published because the CIA wanted the news out there? Perhaps more important was the point of the article to influence the Congressional budget deliberations on aid to Ukraine? After all, was the article really just meant to brag about how great the CIA is? Or was it to warn Congressional appropriators, “Look how much we’ve accomplished to confront the Russian bear. You wouldn’t really let it all go to waste, would you?” The Times’ article has all the hallmarks of a deep, inside look at a sensitive—possibly classified—subject. It goes into depth on one of the intelligence community’s Holy of Holies, an intelligence liaison relationship, something that no intelligence officer is ever supposed to discuss. But in the end, it really isn’t so sensitive. It doesn’t tell us anything that every American hasn’t already assumed. Maybe we hadn’t had it spelled out in print before, but we all believed that the CIA was helping Ukraine fight the Russians. We had already seen reporting that the CIA had “boots on the ground” in Ukraine and that the U.S. government was training Ukrainian special forces and Ukrainian pilots, so there’s nothing new there.

The article goes a little further in detail, although, again, without providing anything that might endanger sources and methods. For example, it tells us that: • There is a CIA listening post in the forest along the Russian border, one of 12 “secret” bases the US maintains there. One or more of these posts helped to prove Russia’s involvement in the 2014 downing of Malaysia Airlines Flight 17. That’s great. But the revelation exposes no secrets and tells us nothing new. • Ukrainian intelligence officials helped the Americans “go after” the Russian operatives “who meddled in the 2016 US presidential election.” I have a news flash for the New York Times: The Mueller report found that there was no meaningful Russian meddling in the 2016 election. And what does “go after” mean? • Beginning in 2016, the CIA trained an “elite Ukrainian commando force known as Unit 2245, which captured Russian drones and communications gear so that CIA technicians could reverse-engineer them and crack Moscow’s encryption systems.” This is exactly what the CIA is supposed to do. Honestly, if the CIA hadn’t been doing this, I would have suggested a class action lawsuit for the American people to get their tax money back. Besides, the CIA has been doing things like this for decades. The CIA was able to obtain important components of Soviet tactical weapons from ostensibly pro-Soviet Romania in the 1970s.

• Ukraine has turned into an intelligence-gathering hub that has intercepted more Russian communications than the CIA station in Kiev could initially handle. Again, I would expect nothing less. After all, that’s where the war is. So of course, communications will be intercepted there. As to the CIA station being overwhelmed, the Times never tells us if that is because the station was a one-man operation at the time or whether it had thousands of employees and was still overwhelmed. It’s all about scale. • And lest you think that the CIA and the U.S. government were on the offensive in Ukraine, the article makes clear that, “Mr. Putin and his advisers misread a critical dynamic. The CIA didn’t push its way into Ukraine. U.S. officials were often reluctant to fully engage, fearing that Ukrainian officials could not be trusted, and worrying about provoking the Kremlin.” It’s at this point in the article that the Times reveals what I believe to be the buried lead: “Now these intelligence networks are more important than ever, as Russia is on the offensive and Ukraine is more dependent on sabotage and long-range missile strikes that require spies far behind enemy lines. And they are increasingly at risk: “If Republicans in Congress end military funding to Kiev, the CIA may have to scale back.”

Read more …

Dionísio starts off talking about Astrid Klein, not Naomi. Normally such mistakes would make me switch off. But I like the topic of The Shock Doctrine on a wider scale.

• The Internationalization of the Neo-Liberal Shock (Dionísio)

Looking at the present day, under the light of the formulation revealed by Naomi Klein’s “The Shock Doctrine” is an enlightening challenge and absolutely reveals the historical importance of the analysis that is carried out, even if, in my opinion, it suffers from a certain “historical punctuality” considering the moments of application of a process that has come to be known as “neo-liberal economic shock theory”. Klein’s analysis, based on known historical facts, recounts secret CIA experiments in psychology and psychiatry, the application of the techniques in Pinochet’s Chile and many other countries (including post-Soviet Russia), and the neo-liberal doctrine of Milton Friedman’s “Chicago Boys”, tells us of a process whereby the population is put into a permanent state of shock in order to leave it unresponsive (as in lobotomy treatments), so that, under the cover of the generated amorphism, extremely unpopular measures are applied which, above all, are diametrically opposed to the interests of the majority.

The very process of discrediting politics and politicians also serves as a pretext for the same type of action. Take Trump, Bolsonaro, Milei, Meloni, Duda or Zelensky. The kind of demagogic shock (using corruption, mass migration, etc.) gives birth to a pretext that works under the same assumptions. However, and bearing in mind the unquestionable topicality of the approach, analyzing the world today according to this theory reveals a truth that, in my opinion, negates the idea of a certain “historical punctuality” of the neo-liberal economic shock. In my opinion, Naomi Klein’s approach, at that time, showed us a world in which the US was unleashing — and is unleashing — processes of transformation aimed at subverting the national and popular sovereignty, democracy and freedom of the peoples, in order to place their nations at the service of the process of neo-liberal and imperialist accumulation.

The successive clashes are taking place in circumscribed national spaces and in a chronology whose origins go back to Pinochet’s Chile, but which lacks a certain continuity, as if we were dealing with a gang that was jumping from country to country, without ever reaching the whole. Now, while Klein’s approach proposes a certain national circumscription, the historical events of the last 23 years point us towards a globalization or internationalization of the shock doctrine, towards its historical continuity and towards a totalizing dimension, encompassing all dimensions of our lives from the outset and not just on arrival. Given what we know today, I can’t help but think that the chronologically linked examples of the application of the shock doctrine are nothing more than experiments, constantly being perfected, aimed at an epilogue, an epilogue that we are experiencing today. The globalization and internationalization of the neo-liberal shock, along with its phenomenological diversification.

It no longer only affects the economic or social component, but also health, the state, security, defense, information and propaganda. This is the clear materialization of another doctrine, the doctrine of “full spectrum dominance”. With the turn of the 21st century, everything changed! On September 11, 2001, the world was shocked by a terrorist attack of spectacular proportions, which culminated in the collapse of three towers in New York. As if Hollywood had been asked to prepare a terrorist attack. The American — and Western — population was in a state of shock, stunned, and we soon began to see direct attacks on the way of life that so many considered to be eternal — remember Fukuyama — and historically perfected. In the US, we saw the publication of the Patriot Act and the start of the War on Terror. State surveillance became part of American life and, a little later, European life, particularly after renewed waves of terrorist shocks in Spain, England and France.

The proven link between the perpetrators of terrorist acts — Al-Qaeda — and their creators, very few took, or wanted to take, notice of. Today, we go into a supermarket, visit a museum, make a phone call or take a photograph and we have the guarantee that, somewhere in space, that information will be processed, aggregated, integrated, analyzed and stored. Terrorism has become part of our lives and, under that pretext, mass surveillance. Bin Laden became the devil himself, the demon who terrorized the dreams of our little children, who would be protected by the omnipresent Pentagon and other “deep state” agencies. It was this “deep state” that took the opportunity to generalize and normalize torture, concentration camps like Guantánamo and the secret, or not so secret, prisons where all those who oppose the imperial designs are still held today. It was time to internationalize the terror that the Middle East had felt almost since the founding of the Anglo-Saxon spearhead in the region, the Zionist state of Israel and its infamous Mossad.

Read more …

The Supreme Court will have to issue an opinion, whether it likes to or not.

• Maddow and Others Denounce SCOTUS for Review of Presidential Immunity (Turley)

Yesterday, the Supreme Court granted review of the presidential immunity question, but set an expedited schedule for the review of the question with oral argument scheduled for April. Former president Donald Trump wrote on Truth Social that “Legal Scholars are extremely thankful for the Supreme Court’s Decision today to take up Presidential Immunity.” As I mentioned last night in the coverage, legal scholars are hardly doing a conga line in celebration. Indeed, this morning had the usual voices attacking the Court as “craven” and partisan for granting review in the case. Despite the Court (including three Trump appointees) repeatedly ruling against Trump and conservative causes in past cases, the same voices declared that the Court was a cabal of politically compromised lickspittles.

MSNBC anchor Rachel Maddow was outraged on the air and denounced “the cravenness of the court.” She noted that the Court took a whole two weeks to consider the question, ignoring the usual schedule of months of such deliberation. She added: “Obviously, pushing all of the cases that they can push to a point where Trump will be standing for election before any of us have heard the verdicts in any of those cases. Got it. It is the timing…This is BS, and you are doing this as a tactic to help for political friend, partisan patron. For you to say that this is something the court needs to decide because it is unclear in the law is fragrant bullpucky and they know it and don’t care that we know it. That is disturbing about the future legitimacy of the court.” Former federal prosecutor Glenn Kirschner dismissed the review as a political effort to do Trump “an enormous favor.” Kirschner also said that it was “clear” the court “sold American democracy down the river” to help Trump.

Mary Trump, the niece of the former president, declared that “the Supreme Court of the United States just reminded us with this corrupt decision that the insurrection did not fail–it never ended.” In other words, the Supreme Court itself is now part of the “insurrection.” It is that easy. Once you start to remove people from the ballot by declaring a riot an insurrection, even courts become insurrectionists by allowing for a review of lower court rulings. For years, liberal law professors and pundits have filled the media with dire predictions that the Supreme Court was about to carry out a long-planned “coup” and “power grab” — one even wrote that the court could be on the brink of establishing “one-party rule” in the United States. These commentators often ignore the countervailing cases where conservative justices voted against conservative causes and immediately return to these sensational claims whenever the Court is seen as a hinderance of their agenda, even in the simple act of granting review of a long-debated constitutional question.

[..] There are a variety of reasons why the Court could have put this on the calendar for further argument. While I still believe that Trump will not be able to secure a majority on his sweeping immunity theory, some justices may be concerned over D.C. Circuit opinion and the lack of clarity on when a president is protected for actions taken in office. It is possible to uphold the lower court in its outcome but change the rationale or analysis. The Court has not been particularly eager to reenter this area of constitutional law, but it may now be prepared to lay down new precedent and bring greater clarity for future presidents.

Read more …

“..The inflation of the last few years is directly traceable to the end of this practice, and it was our sanctions that caused it…”

• Yellen Voices Support For Permanent Inflation (Denninger)

No, seriously, that’s exactly what she’s now promoting (although I doubt she realizes it): WASHINGTON (AP) — Treasury Secretary Janet Yellen on Tuesday offered her strongest public support yet for the idea of liquidating roughly $300 billion in frozen Russian Central Bank assets and using them for Ukraine’s long-term reconstruction. “It is necessary and urgent for our coalition to find a way to unlock the value of these immobilized assets to support Ukraine’s continued resistance and long-term reconstruction,” Yellen said in remarks in Sao Paulo, Brazil, where Group of 20 finance ministers and central bank governors are meeting this week.” In other words, steal the funds. Yellen goes on to say she believes there is a strong international law case for stealing the funds. Well perhaps there is and perhaps not; I will not pass judgment on whether one can find justification in international law for such an action.

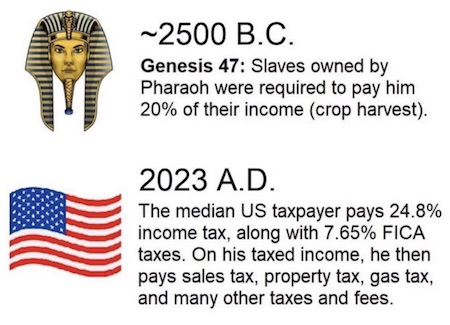

I can and will, however, pass judgment on the immediate and permanent outcome of such an action, because that is both obvious and inevitable. It will force trade settlement into all bilateral currency forms immediately and permanently. Now this might not sound so bad and were our government not running a ~7% fiscal deficit right now it might not be. But we are running a 7% fiscal deficit, and kneecapping having trade settlement performed in dollars — or Euros — or Pounds — or whatever else by taking this action will permanently and immediately force all fiscal deficits (not just in the US) to reflect back into that nation’s economy in the form of inflation. We have, in the United States, benefited to an enormous degree from this temporary sequestration over the last 20 years. That was unwound to a large degree when the first round of sanctions was laid and now effectively all trade with either side of the Russian / Ukraine conflict is no longer using dollars as a funding currency.

Why does this matter? Because if that trade goes from $1 trillion a year to $2 trillion a year during the period of time when it increases there is $1 trillion in deficit spending that is effectively “impounded” while the goods are in transit. It is the increase in such trade that drives this, not the volume (since once the transaction settles those funds wind up back into the flow of commerce in the US.) But as international commerce has expanded and the dollar and, to a lesser extent the Euro, were used as the currencies while in-transit our nations have enjoyed a sizeable “sink” for deficit spending without having it immediately rebound back into consumer and producer prices. The inflation of the last few years is directly traceable to the end of this practice, and it was our sanctions that caused it. The Covid deficit spending was certainly a factor but much of that was absorbed and would have stayed absorbed as trade rebounded post pandemic but for our sanctions activity when the war in Ukraine broke out.

Now Yellen claims that the “frozen” assets were not just sequestered — she wants to take them. Most of these funds are in the EU, not the US — but the problem with the action is that producers and customers have no way to influence or prevent such an action by their government in the future and thus this is an external risk that can only be controlled by not exposing yourself to it; thus you demand payment in your local currency. Removing this leg of the stool leaves only one way to get inflation under control: Deficit spending must be cut to no more than the increase in productivity in the economy. When the “PIGS” problems showed up in Europe the EU’s response to this was to mandate no more than a 3% fiscal deficit — which reasonably aligns with productivity.

Meeting this today in the United States would require a cut in federal spending of more than $1 trillion dollars this fiscal year alone, and an escalating amount as existing treasury debt is rolled over at higher rates. Within the next two to three years the total cut required would be more than two trillion or approximately the entire Medicare and Medicaid spend this fiscal year. If that’s not done? We will get runaway — exponentially so — inflationary pressure and be forced to do it anyway at even greater levels of economic pain. If you are betting on lower rates at any time in the next decade, given this position of our government, you’re going to be sorely disappointed both in the outcome and in asset prices.

Read more …

“..the Biden administration refuses to clarify what it means by a ‘Palestinian state.’”

• ‘State-minus’: Biden’s Palestine Solution (Cradle)

Is it sadly ironic that the issue of Palestinian statehood – unresolved for over 75 years – has resurfaced only after Israel’s wholesale carpet-bombing of the Gaza Strip, killing over 30,000 civilians, injuring tens of thousands more, and destroying significant swathes of the territory’s infrastructure. University of California (UCLA) historian James Gelvin states the case plainly: “There would have been no serious discussion of a two-state solution without [the events of] 7 October. As a matter of fact, putting the Palestine issue back on the front burner of international and West Asian politics was one of the reasons Hamas launched its operation.” As Gelvin explains it to The Cradle, Hamas has already scored several victories since its Al-Aqsa Flood operation: “The Palestine issue is back on the international agenda, it is negotiating the release of its captives as an equal partner to Israel,” and has demonstrated that it is “more effective in realizing Palestinian goals than its rival, Fatah.”

While the unprecedented, brutal Israeli military response has indeed illustrated the urgency for establishing a Palestinian safe haven, it is impossible to ignore that western state backers of the 1993 Oslo Accords – which laid out the essential framework for the establishment of a Palestinian state – have then so assiduously ignored and neglected that responsibility. Even greater hypocrisy emerges from the fact that these western powers, led by Washington, have now decided to force the discussion of Palestinian statehood in the midst of Gaza’s carnage, with an Israeli prime minister, Benjamin Netanyahu, who is infamously opposed to it. So, why is this debate possible now? Why was it ignored before 7 October – or even prior to Netanyahu’s return to the prime ministership?

After enormous public and international pressure, US President Joe Biden has, at least rhetorically, reopened the issue of Palestinian statehood. According to the New York Times, the Biden White House’s new doctrine would “involve some form of US recognition of a demilitarized Palestinian state in the West Bank and Gaza Strip in return for strong Palestinian guarantees that their institutions could never threaten Israel.” In addition, the US president’s plan also envisages Saudi–Israeli normalization and a tough military stance against Iran and its regional allies. However, many analysts have already raised questions about the viability of a plan that does not reflect current ground realities.

While Netanyahu rejects the very notion of a Palestinian state, the ‘Biden doctrine’ and its offering of some limited-sovereignty version of a demilitarized Palestinian state is nothing less than humiliating for Palestinians. Dr Muhannad Ayyash, Professor of Sociology at Mount Royal University, observes that there is no fundamental change of approach by the US on this issue. In short, the Biden administration refuses to clarify what it means by a ‘Palestinian state.’ Its initiative appears mainly to advance a form of a two-state solution that would be palatable to Israel. Ayyash points out that the key issues related to Palestinian statehood are left unanswered, including the issue of sovereignty, Jewish settlements, the status of East Jerusalem, a necessary West Bank/East Jerusalem with the Gaza Strip, the Palestinian right to return, and so forth.

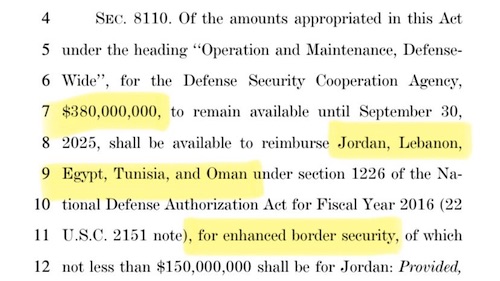

Aid

Read more …

“I haven’t seen, and the state of Texas can’t point me to any type of military invasion in Texas,” Judge Ezra said.”

• Federal Judge Blocks New Texas Law to Arrest Illegal Immigrants (ET)

A federal judge on Feb. 29 temporarily blocked a Texas law that would allow state police to arrest people who are suspected of illegally crossing the U.S.–Mexico border. Senate Bill 4, which was signed by Gov. Greg Abbott in December 2023, was slated to go into effect on March 5. However, U.S. District Judge David Ezra ruled that it violated the U.S. Constitution’s supremacy clause that grants the federal government sole authority over immigration matters. The judge also rejected Texas’s arguments that it was being invaded under the Constitution’s Article IV. In his order, Judge Ezra, a Reagan appointee, said the law would run afoul of federal immigration laws and claimed Texas would then be able to “permanently supersede federal directives,” which would “amount to nullification of federal law and authority.”

According to the judge, that’s a “notion that is antithetical to the Constitution and has been unequivocally rejected by federal courts since the Civil War.” As a result, he argued, the federal government would “suffer grave irreparable harm” because other states would be inspired to pass similar measures. “SB 4 threatens the fundamental notion that the United States must regulate immigration with one voice,” he wrote. At a Feb. 15 hearing, Judge Ezra expressed skepticism as the state pleaded its case for what is known as Senate Bill 4. He also said he was somewhat sympathetic to the concerns expressed by Mr. Abbott and other state officials about the unprecedented influx of illegal aliens. Judge Ezra then expressed his concern that the United States could become a confederation of states enforcing their own immigration laws. “That is the same thing the Civil War said you can’t do,” he told the attorneys.

A lawyer for the state of Texas argued in court that because of the deluge of illegal immigrants, enabled by drug cartels and smugglers, it’s tantamount to an invasion and that the state has the right to defend itself under the Constitution. However, the judge said that while he was “sympathetic” to the state’s concerns, he was skeptical of the lawyer’s argument. “I haven’t seen, and the state of Texas can’t point me to any type of military invasion in Texas,” Judge Ezra said. “I don’t see evidence that Texas is at war.” Hours later, Texas Attorney General Ken Paxton confirmed that he filed an appeal against the judge’s ruling, describing it as an “incorrect decision.” “Texas has a clear right to defend itself from the drug smugglers, human traffickers, cartels, and legions of illegal aliens crossing into our State as a consequence of the Biden Administration’s deliberate policy choices,” he said.

“I will do everything possible to defend Texas’s right to defend herself against the catastrophic illegal invasion encouraged by the federal government.” Mr. Abbott, a Republican, has backed the law, saying that it would complement his efforts to provide better border security, noting that his state has dealt with a surge of illegal crossings in recent years. Other measures that Mr. Abbott has implemented are a barrier in the Rio Grande, razor wire barriers at certain border crossings, and prohibiting federal agents who have been tasked by the Biden administration with undoing the measures from accessing border areas in Texas. Other state Republicans who back the law have said it wouldn’t target immigrants already living in the United States because of a two-year statute of limitations on the illegal entry charge and would be enforced only along the state’s border with Mexico.

Read more …

“We must not allow the politicization of intelligence to go unchecked, nor can we tolerate the involvement of foreign powers in our democratic processes.”

• Obama’s CIA Asked Foreign Intel Agencies To Spy on Trump Campaign (Chernin)

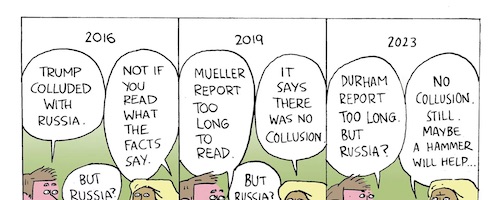

The revelation that the U.S. intelligence community, under the Obama administration, sought the assistance of the “Five Eyes” intelligence alliance to surveil Donald Trump’s associates before the 2016 election is a chilling reminder of the lengths to which the Deep State will go to protect its interests and challenge its adversaries. (The Five Eyes countries are the United States, the United Kingdom, Canada, Australia, and New Zealand.) This bombshell, reported by a team of independent journalists, exposes a dark chapter in American political history, where foreign intelligence services were reportedly mobilized against a presidential candidate. The alleged operation against Trump and his associates, which predates the official start of the FBI’s Crossfire Hurricane investigation, is a stark example of political weaponization of intelligence.

The involvement of foreign allies in surveilling American citizens under the pretext of national security raises serious questions about the integrity of our democratic processes and the autonomy of our nation’s intelligence operations. The narrative that has been pushed for years, that the investigation into Trump’s campaign began with an Australian tip about a boastful Trump aide, now appears to be a cover for a more extensive and coordinated effort to undermine Trump. If reports are accurate, British intelligence began targeting Trump on behalf of American intelligence agencies as early as 2015, long before the official narrative claims.

The implications of this are profound. It suggests an unprecedented level of collusion between U.S. intelligence agencies and their foreign counterparts to influence the outcome of an American presidential election. The use of foreign intelligence to circumvent American laws and surveillance limitations represents a grave threat to our nation’s sovereignty and the principles of democracy. The fact that this operation was reportedly initiated at the behest of high-ranking officials within the Obama administration, including CIA Director John Brennan, only adds to the severity of the situation. Brennan’s alleged identification of Trump associates for surveillance by the Five Eyes alliance, and the directive to “bump” or make contact with them, illustrates a deliberate strategy to entangle the Trump campaign in a web of suspicion and intrigue.

Moreover, the reported involvement of foreign intelligence in crafting the Russia collusion narrative not only delegitimizes the subsequent investigation but also highlights the willingness of certain elements within the U.S. government to exploit international partnerships for domestic political gain. This revelation demands a thorough and transparent examination to ensure that such abuses of power are brought to light and severely punished to discourage them from being repeated. As more details emerge, it is imperative that the American public demand accountability from those who orchestrated and executed this operation. The sanctity of our electoral process and the trust in our intelligence agencies are at stake. We must not allow the politicization of intelligence to go unchecked, nor can we tolerate the involvement of foreign powers in our democratic processes.

Read more …

“Hunter’s stated purpose for joining Burisma’s board is a new claim that indicates bizarre reasoning never before revealed..”

• Hunter Finally Admits Joe Biden Is “The Big Guy” (ZH)

Hunter Biden on Wednesday testified to Congress that his father, Joe, was indeed “the big guy” referenced in an email pertaining to a business deal with a Chinese state-linked energy company that made the Biden family and friends millions of dollars. He denied, however, that Joe Biden ever received a 10% stake as was indicated in the text message. “At one point, we asked Hunter about the 10% for the ‘big guy,’” Rep. Marjorie Taylor Greene (R-GA) told Breitbart News following the first son’s six-hour, closed-door deposition. “We showed him the email … And he said, ‘Oh, that was after my father left office.’” she told the outlet. Hunter then tried to downplay the 10% idea: “What’s wrong with having a pie-in-the-sky idea? When he [Joe Biden] left office in 2017, it thought he was done. I had no idea was gonna run for president. What’s wrong with just some pie?’ … thinking that he [Joe Biden] could be in the business.” -Breitbart

Greene said that Hunter insisted that “there was no percentage for my father in the business,” and that the 20 speakerphone calls Joe Biden joined was considered normal. “He was saying it’s totally normal for your parents to call you,” said Greene. “He just totally kept on saying, ‘Oh, this is normal. This is normal.'” “Greene also confirmed Rep. Matt Gaetz’s (R-KY) statement that Hunter testified he joined the board of Burisma Holdings to counter Russian aggression. “He said he was picked to serve on Burisma ‘s board to defend democracy and Burisma was stopping Russian aggression,” Greene said. Hunter’s stated purpose for joining Burisma’s board is a new claim that indicates bizarre reasoning never before revealed. In 2015, Burisma was under suspicion of money laundering and public corruption. Prosecutor Victor Shokin investigated the case before his termination due to pressure from then-Vice President Joe Biden, who threatened to withhold $1 billion in U.S. aid from Ukraine if the Ukrainian government did not fire the prosecutor investigating Burisma. Joe Biden later bragged about the firing during a 2018 appearance at the Council on Foreign Relations.” -Breitbart

According to Greene, Republicans need to “get ready” for Democrats to fabricate another Russian disinformation hoax related to Hunter and the 2024 election – and that it would likely fit the media’s existing narrative against both Trump and protecting the Biden family. “I have a prediction that they’re gonna move it on to members of Congress like me and others, Jim Jordan, Jamie Comer, any of us that got hot and heavy on this Ukraine Burisma stuff, that they’re somehow going to say that Republicans are Russian sympathizers. They’re gonna call me that anyway, because I won’t fund the Ukraine war. They’re probably going to accuse us of being Russian sympathizers and falling for Russian disinformation and its election meddling. And then Democratic members of Congress here already saying they will not certify Trump’s election if he wins.” -MTG “It was there’s a really weird theme in there with the whole Russian thing,” said Greene.

In November, the House Oversight Committee revealed that President Biden received $40,000 in Chinese funds which were “laundered” through his brother, James Biden, in a “complicated financial transaction” marked as a ‘loan,’ which took place just weeks after Hunter Biden threatened the Chinese with his father’s wrath in a July 30, 2017 text message to a CEFC China Energy employee. “The alleged 2017 transfer from first brother James Biden to the future president involves the same business deal in which Joe Biden was called the “big guy” and penciled in for a 10% cut — and would be the first proven instance of the commander-in-chief getting a piece of his family’s foreign income…. The money ended up in Joe Biden’s bank account on Sept. 3, 2017, via a check labeled “loan repayment” from his younger brother, who partnered with Hunter in the venture”. -NY Post

Read more …

“..a plethora of political pathologies, including merciless cruelty, politicized “justice,” mass media disinformation, and, last but not least, that old specialty of the “garden” West, peak hypocrisy.”

• Julian Assange and Gaza Civilians (Amar)

Recently, two of the defining injustices of the contemporary West have been the object of legal proceedings. And while one involves mass murder and the other the torture but not murder of a single victim (at least not yet), there are good reasons to juxtapose the two systematically. The suffering involved is different, but the forces that cause it are intricately linked and, as we will see, reveal much about the nature of the West as a political order. In The Hague, the UN’s International Court of Justice (ICJ) – also known as the World Court – has held extensive hearings (involving 52 states and three international organizations) on Israel’s post-1967 occupation – or de facto annexation – of Palestinian territories. These hearings are connected to, but are not the same as, the genocide case against Israel also currently proceeding at the ICJ.

All of this is happening against the backdrop of Israel’s relentless genocide of the Palestinians by bombing, shooting (reportedly including small children, in the head), blockade, and starvation. As of now, the constantly growing – and conservative – victim count stands at about 30,000 killed, 70,000 injured, 7,000 missing, and at least 2 million displaced, often more than once, always under horrific conditions. In London, the Royal Courts of Justice have been the stage for Julian Assange’s fight for an appeal against Washington’s demand to extradite him to the US. Assange, an activist and publisher of investigative journalism, has already been in confinement – of one kind or the other – for more than a decade. Since 2019, he has been held in the Belmarsh high security prison. In fact, what has already happened to him is the modern equivalent of being locked away in the Bastille by royal “lettre de cachet” in absolutist, pre-revolutionary, Ancien régime France.

Multiple observers, including a UN special rapporteur, have argued compellingly that Assange’s treatment has amounted to torture. The essence of his political persecution – in reality, there is no good-faith legal case – is simple: Through his WikiLeaks platform, Assange published leaked materials that exposed the brutality, criminality, and lies of the US’ and UK’s (and, more generally, the West’s) post-9/11 wars. While leaking state secrets is not legal – although it can be morally obligatory and even heroic, as in the case of Chelsea Manning, who was a major WikiLeaks source – publishing the results of such leaks is legal. Indeed, that principle is an acknowledged pillar of media freedom and independence. Without it, media cannot fulfil any kind of watchdog function. Yet Washington is obstinately and absurdly trying to treat Assange as a spy. If it succeeds, “global media freedom” (for what it’s worth…) is toast. This is what makes Assange objectively the single most important political prisoner in the world.

If extradited to the US, whose highest officials have at times plotted his assassination, the WikiLeaks founder will definitely not get a fair trial and will die in prison. In that case, his fate will irreversibly turn into what Washington and London have been working on for over a decade, namely making an example of him by delivering the most devastating blow imaginable against free speech and a truly open society. That Gaza and Assange have something in common has occurred to more than one observer. Both stand for a plethora of political pathologies, including merciless cruelty, politicized “justice,” mass media disinformation, and, last but not least, that old specialty of the “garden” West, peak hypocrisy. There also is the grotesquely arrogant American sense of global entitlement: The Palestinians’ rights or, indeed, humanity count for nothing if Israel, Washington’s closest and most lawless ally, wants their land and their lives. Assange, of course, is an Australian citizen.

Read more …

“He is going to destroy this country unless he’s stopped by people buying my new Trump sneakers. Look at these beautiful gold sneakers..”

• Biden Arrives At Border To Address His Voters (BBee)

Amid record-breaking illegal immigration at the southern border, President Biden arrived in Brownsville Texas to address his voters, who had crossed into the United States the previous night. “Welcome, voters, make yourselves at home!” said Biden to a group of military-aged male Chinese nationals and a crowd of convicted felons from a maximum security Venezuelan prison. “My nurse Jill always says you people are unique breakfast tacos and I couldn’t have said it better. We’re excited for you to live here. You have plenty of great states to choose from, like Ohio, Pennsylvania, or any other crucial battleground states. I was… I… I…” “… well, anyway.” The confused migrant crowd was then directed to a welcome station to receive their smartphones, visa gift cards, and mail-in ballots.

Trump, who also visited the border today, was quick to condemn Biden’s speech and his handling of the border. “Biden is possibly the worst president of any country in the history of the world, or maybe even the entire universe, and maybe all the other universes as well, possibly,” said Trump to reporters. “He is going to destroy this country unless he’s stopped by people buying my new Trump sneakers. Look at these beautiful gold sneakers. They’re the greatest sneakers ever made. So, so beautiful.” Following the Biden border visit, the White House confirmed that there is no crisis at the border. “Everything is fine and there are no illegal immigrants,” said gay black Press Secretary Karine Jean Pierre. “There is no crisis and Biden is doing a great job and he’s very smart and sharp and mentally with it and you are a racist.” At publishing time, illegal immigrant support for Biden increased another 33 points.

Read more …

Cat reaction

Porcupine

https://twitter.com/i/status/1763289492897628313

Salmon

Illusions

Coke ad

Set the table

Nemo

Elephant

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.