Yasuhiro Ishimoto Chicago 1959

Sorry, useless predictions. MS knows no more than you do.

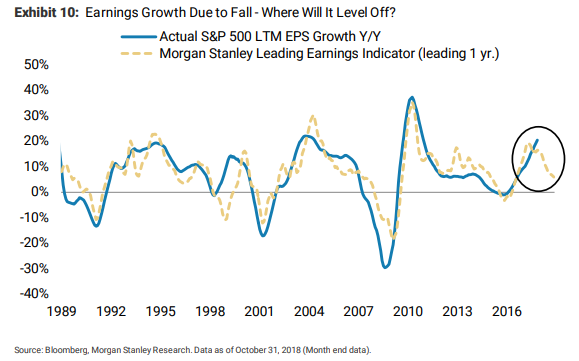

• Stock Market Selloff Only Half-done, Final Leg In 2019 – Morgan Stanley (MW)

Elon Musk’s cringe-inducing Twitter meltdown, the rise and fall of bitcoin, and the record-breaking oil plunge — for some 2018 can’t end soon enough. But be careful for what you wish for as the bear that has rampaged through the stock market is expected to return in the new year, according to one Wall Street strategist. “The Rolling Bear market is now better understood by the consensus; and more importantly, it is better priced, with forward price/earnings falling 18% from peak to trough. In short, while 90% of the price damage has been done by this bear, we’ve likely only served 50% of the time,” said Mike Wilson, an equity strategist at Morgan Stanley, in a note to clients.

Wilson was among the handful of market watchers to predict the recent market wipeout even as stocks were trading at record levels. “The Rolling Bear is tired from all the mauling he has done this year. However, he is likely just resting rather than hibernating,” he said. ”The final leg of this bear likely won’t come until numbers are reduced for 2019, although that should feel a lot less painful than the multiple compression stage we experienced in 2018.” The S&P 500 and the Dow Jones Industrial Average are poised to close out November in the red as worries about tighter liquidity resulting from the Federal Reserve’s interest-rate hikes and a trade war with China triggered an exodus from stocks.

Why do Fannie and Freddie atill guarantee $700,000+ loans? If they didn’t, homes would become much more affordable.

• Home Prices Have Surged, Government’s Share Of Mortgages Will Too (MW)

A federal regulator has raised the dollar amount of home loans that qualify for backing by Fannie Mae and Freddie Mac, the two giant government-sponsored enterprises. In 2019, the maximum conforming loan limit will be $484,350, the Federal Housing Finance Agency said Tuesday. That’s up 6.9% from the 2018 maximum of $453,100. The change is based on the rate of change in home prices between the third quarter of 2017 and third quarter of 2018, as measured by FHFA’s House Price Index. But in higher-priced areas, loan limits are capped at 150% of the baseline $484,350. That means Fannie and Freddie will guarantee loans up to $726,525 in roughly 100 higher-cost counties.

Raising the dollar limit on Fannie- and Freddie-backed loans is one way of lubricating the mortgage market. If banks or other lenders can sell bigger mortgages to the enterprises, that makes it easier for them to keep lending. In turn, that makes it easier for would-be buyers to find financing that is generally more advantageous than other types of mortgages, like those backed by the Federal Housing Administration. But it also increases the risk to taxpayers. Fannie and Freddie operate with only a slim capital reserve, as the result of a 2012 directive from Congress that was patched over late in 2017. The update was owed to an agreement between FHFA Director Mel Watt and the U.S. Treasury even as they continue to guarantee between 40%-50% of new mortgages. That means that in any given quarter, either company is at risk of having to take taxpayer money.

Trump senses the danger, and then ridicules himself.

• Trump Says ‘Not Even A Little Bit Happy’ With Fed’s Powell (R.)

U.S. President Donald Trump on Tuesday kept up his criticism of Federal Reserve Chairman Jerome Powell, saying rising interest rates and other Fed policies were damaging the U.S. economy, the Washington Post said. “So far, I’m not even a little bit happy with my selection of Jay,” the Post quoted Trump as saying in an interview, referring to the man he picked last year to lead the Fed. “Not even a little bit. And I’m not blaming anybody, but I’m just telling you I think that the Fed is way off-base with what they’re doing.”

In recent months, the Republican president has repeatedly criticized Powell and the Fed’s interest rate increases that he said was making it more expensive for his administration to finance its escalating deficits. Trump has called the Fed “crazy” and “ridiculous.” “I’m doing deals, and I’m not being accommodated by the Fed,” Trump told the Post on Tuesday. “They’re making a mistake because I have a gut, and my gut tells me more sometimes than anybody else’s brain can ever tell me.”

Joint defense agreements are common and fully legal, but the NY Times labels this one “highly unusual”. Summarized: Mueller was outflanked, though he could/should have known, and Manafort may be relying on a pardon.

• Manafort’s Lawyer Repeatedly Briefed Trump Attorneys On Mueller Talks (ZH)

One day after Special Counsel Robert Mueller said that Paul Manafort had lied and violated his plea agreement with Federal prosecutors, and as a result should be sentenced immediately, the NYT has reported that in a “highly unusual” arrangement, a lawyer for Paul Manafort had repeatedly briefed president Trump’s lawyer on what he told Mueller and other federal investigators after he agreed to cooperate with the special counsel. While the arrangement is not illegal, it reportedly inflamed tensions with the special counsel’s office when prosecutors discovered it after Mr. Manafort began “cooperating” two months ago, with some legal experts speculating that Manafort’s backdoor cooperation with Trump’s legal team was a bid by Trump’s former campaign chair for a presidential pardon even as he worked with Mueller in hopes of a lighter sentence.

Trump lawyer Rudy Giuliani acknowledged the arrangement to the NYT, and “defended it as a source of valuable insights into the special counsel’s inquiry and where it was headed.” Such information could help shape a legal defense strategy, and it also appeared to give Mr. Trump and his legal advisers ammunition in their public relations campaign against Mr. Mueller’s office. As an example of what Manafort told the Trump legal team, Giuliani said, Manafort’s lawyer Kevin Downing told him that prosecutors hammered away at whether the president knew about the June 2016 Trump Tower meeting where Russians promised to deliver damaging information on Hillary Clinton to his eldest son, Donald Trump Jr, although this line of investigation is hardly a surprise. Trump has long denied knowing about the meeting in advance, with Giuliani saying that Mueller “wants Manafort to incriminate Trump.”

What is notable is that this kind of joint defense agreement is legal, and while Downing’s discussions with the president’s team violated no laws, they helped contribute to a deteriorating relationship between lawyers for Manafort and Mueller’s prosecutors, who on Monday accused Manafort of holding out on them and even lying, despite his pledge to assist them in any matter they deemed relevant. As a result of the collapse of the plea deal, Manafort will now face sentencing on two conspiracy charges and eight counts of financial fraud — crimes that could put him behind bars for at least 10 years. Just as importantly, Manafort’s frequent updates helped reassure Trump’s legal team that Manafort had not implicated the president in any possible wrongdoing, which begs the question just how was Manafort “cooperating” with Mueller for two whole months.

Greenwald: “The Guardian itself “obtained the Embassy’s visitors logs in May,” and made no mention of Manafort’s visits at the time..”

Excuse me, but Greenwald and others do Luke Harding and the Guardian far too much honor by going into the details. The guy wrote a book called ‘Collusion’ for Pete’s sake. he does smear and hit pieces on Assange for a living. WikiLeaks is dead on when it says “Remember this day when the Guardian permitted a serial fabricator to totally destroy the paper’s reputation..”

Only, Harding and Guardian have published at least a dozen other stories of the same ‘level’. That reputation should be long gone. It’s not. Matrix.

• If Manafort Visited Assange There Should Be Ample Evidence (Greenwald)

The Guardian today published a blockbuster, instantly viral story claiming that anonymous sources told the newspaper that former Trump campaign manager Paul Manafort visited Julian Assange at least three times in the Ecuadorian Embassy, “in 2013, 2015 and in spring 2016.” The article – from lead reporter Luke Harding, who has a long-standing and vicious personal feud with WikiLeaks and is still promoting his book titled “Collusion: How Russia Helped Trump Win the White House” – presents no evidence, documents or other tangible proof to substantiate its claim, and it is deliberately vague on a key point: whether any of these alleged visits happened once Manafort was managing Trump’s campaign.

For its part, WikiLeaks vehemently and unambiguously denies the claim. “Remember this day when the Guardian permitted a serial fabricator to totally destroy the paper’s reputation,” the organization tweeted, adding: “WikiLeaks is willing to bet the Guardian a million dollars and its editor’s head that Manafort never met Assange.” The group also predicted: “This is going to be one of the most infamous news disasters since Stern published the ‘Hitler Diaries.’ [..] Of course it is possible that Manafort visited Assange – either on the dates the Guardian claims or at other times – but since the Guardian presents literally no evidence for the reader to evaluate, relying instead on a combination of an anonymous source and a secret and bizarrely vague intelligence document it claims it reviewed (but does not publish), no rational person would assume this story to be true.

But the main point is this one: London itself is one of the world’s most surveilled, if not the most surveilled, cities. And the Ecuadorian Embassy in that city – for obvious reasons – is one of the most scrutinized, surveilled, monitored and filmed locations on the planet.

Entirely in the vein of my article yesterday about people living in the Matrix, we need to ponder that outlets like the Guardian no longer care about their credibility, but instead rely on people swallowing whole anything they say, today about Manafort, Assange and Russian aggression, tomorrow about other topics. That is plenty scary.

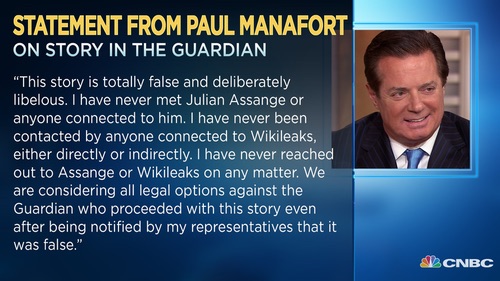

• Manafort Plans To Explore “All Legal Options” Against The Guardian (ZH)

Former Trump campaign manager Paul Manafort has responded to a “totally false and deliberately libelous” report in The Guardian that he had several meetings with WikiLeaks founder Julian Assange in the Ecuadorian embassy in London. In a Tuesday afternoon statement through a spokesman, Manafort said: “This story is totally false and deliberately libelous. I have never met Julian Assange or anyone connected to him. I have never been contacted by anyone connected to Wikileaks, either directly or indirectly. I have never reached out to Assange or Wikileaks on any matter. We are considering all legal options against the Guardian who proceeded with this story even after being notified by my representatives that it was false.”

The Guardian reported on Tuesday – based on unnamed sources – that Manafort held secret talks with Julian Assange inside the Ecuadorian embassy in London, right around the time he joined Trump’s campaign. “Sources have said Manafort went to see Assange in 2013, 2015 and in spring 2016 – during the period when he was made a key figure in Trump’s push for the White House. It is unclear why Manafort wanted to see Assange and what was discussed. But the last meeting is likely to come under scrutiny and could interest Robert Mueller, the special prosecutor who is investigating alleged collusion between the Trump campaign and Russia. A well-placed source has told the Guardian that Manafort went to see Assange around March 2016. Months later WikiLeaks released a stash of Democratic emails stolen by Russian intelligence officers.” -The Guardian

If the US find someone else who obeys them, they’ll drop Poroshenko.

• Poroshenko Claims Ukraine Offered ‘Military Assistance’ By US (Ind.)

Ukraine has been offered “military assistance” by the US amid rising tension with Russia, the country’s president Petro Poroshenko has claimed. America’s secretary of state Mike Pompeo, had assured him in a phone call that his country, had the “full support, full assistance, including military assistance, full coordination, what we [need] to do to protect Ukrainian sovereignty and territorial integrity”, Mr Poroshenko said. Addressing a suggestion that Donald Trump had been slow to back Ukraine over the stand-off, the Ukrainian leader told CNN host Christiane Amanpour, that the president “in his speech, also supported Ukrainian territorial integrity and [has] been on our side” The US president had earlier said: “We do not like what’s happening either way. We don’t like what’s happening, and hopefully it will get straightened out.”

A bit overlooked perhaps. How much of a factor in the Russia aggression narrative is Nordstream 2? It would bankrupt Ukraine.

• ‘Put Putin In His Place’, Ukrainian Ambassador Tells Germany (R.)

Ukraine’s top diplomat in Germany urged Berlin and other Western states to punish Russia by extending sanctions, banning energy imports and putting the NordStream 2 gas pipeline on hold after Moscow seized three Ukrainian ships near Crimea. The ambassador even raised the possibility of sending German marines to the region. Several senior European politicians have raised the possibility of new sanctions against Russia after the incident on Sunday, which the West fears could ignite a wider conflict near Crimea, which Russia annexed from Ukraine in 2014. “Germany must take a clear line … and put (Russian President Vladimir) Putin in his place,” ambassador Andrij Melnyk told German radio on Wednesday. “Everything is at stake.”

“The club of sanctions should be wielded quickly …. There should be a complete ban on gas and oil imports from Russia, NordStream 2 must be put on ice,” he said, adding only such measures could stop Putin’s “brutal, hoooligan-like” behavior. Ukraine is already nervous about the prospect of the NordStream 2 pipeline which increases Europe’s reliance on Russian gas, fearing it will lose out on transit revenues. “In military terms, what can you do? Sending German marines to the coast of Crimea … could help stop an escalation. If you are there, Russians have fewer possibilities to act so brutally,” he said.

Anything that smells of Russia will be thrown in dungeons. That’s what it means. And Poroshenko means to stay in power.

• Ukraine Digests What Martial Law Will Mean (Ind.)

A day after the Ukrainian parliament voted to introduce martial law across 10 border regions, there was little clarity about what it would actually mean in practice. With parts of the government on different pages, and the introduction of measures that could cover most aspects of life, even family, some areas of the country bordered on panic mode. In the southern city of Odessa, there were rumours of forced mobilisation, though these turned out to be false. In other cities across the region, shortages of foreign currency were reported. The text of the law eventually voted on was considerably watered down from the edict originally presented by President Petro Poroshenko on Monday afternoon.

That contained provisions for a state of martial law lasting 60 days across the whole country. By logical extension, that would have meant delaying next March’s presidential elections, a point that caused uproar among the opposition. The eventual compromise saw a commitment to fix the date of the elections, the duration reduced to 30 days, and the zone of coverage reduced to 10 border regions. The Independent understands that these concessions were made only at the last moment, and the vote would not have passed without them. In the text agreed by the Verkhovna Rada, Ukraine’s parliament, the state of martial law was due to start on Wednesday morning at 9am local time.

But on Tuesday morning, the secretary of the national security council, Oleksandr Turchynov, said that a state of martial law was already in effect. To make matters even more complicated, the Government Courier, the state newspaper where all laws are published, printed a version of the original law, including provisions for 60 days of restrictions across all of Ukraine. [..] in the 10 border regions at least, the law potentially has a very wide scope. The presidential amendments introduce few restrictions on the overarching 2015 legislation covering martial law. In other words, it allows for extrajudicial searches of property, travel bans, closing media deemed against national interests, bans on rallies and demonstrations, limitations on private correspondence and communications, and even introducing limitations on education, private and family life.

But that’s exactly what the people voted for, they want to be worse off, and you can’t deny them their vote, that’s bad for democracy.

• Chancellor Admits UK Will Be Worse Off Under All Brexit Scenarios (G.)

Philip Hammond has admitted that the UK will be worse off “in pure economic terms” under all possible Brexit outcomes – including the prime minister’s own deal. Speaking on Wednesday morning, the chancellor gave strong hints the government had begun its contingency planning should it lose the vote in parliament on Theresa May’s Brexit deal negotiated with the EU. The latest Guardian analysis suggests 94 Tory MPs have confirmed they will vote against the deal, with numbers likely to tip into three figures in the coming days. Hammond suggested the economic hit would be mitigated if the deal was clinched, rather than the UK leaving with no deal.

Asked if all scenarios would have a cost, Hammond said: “If you look at this purely from an economic point of view, yes there will be a cost to leaving the European Union because there will be impediments to our trade.” Hammond said the deal would “absolutely minimise those costs” and would offer political benefits of being able to sign new trade deals and having new controls over fishing waters. “The economy will be slightly smaller in the prime minister’s preferred version,” he said. He said if the government loses the vote in parliament on 11 December, it would be in “uncharted political territory”. More than half of backbench Tory MPs who are not on the government payroll have committed to voting down the deal.

Monday Morning I Want My Quarter Back

• Murphy to the Rescue (Kunstler)

Ukraine verges on martial law after a naval incident with Russian ships in the waters off Crimea. Say what? Martial Law? They might as well declare a Chinese Fire Drill. Details of the actual incident around the Kerch Strait between the Black Sea and the Sea of Azov remain murky besides the fact that two Ukrainian gunships and a tug disobeyed orders from Russian ships to stand down in Russian maritime waters and shots were fired. Who knew that Ukraine even had a navy, and how can they possibly pay for it? But now NATO is trying to get into the act, meaning the USA will get dragged into just the sort unnecessary and idiotic dispute that kicks off world wars.

Note to the Golden Golem of Greatness (aka Mr. Trump): this dog-fight is none of our goddam business. Russia, meanwhile, asked the UN Security Council to convene over this, which is the correct response. What could go wrong? Late Monday update: I’ve heard reports this afternoon that Russia had intel Ukrainian ships were transporting an explosive device supplied by NATO which they suspected was intended to be deployed to blow up the strategic bridge across the Kerch Strait. Still unconfirmed chatter. Developing story….

Yesterday, about five hundred Central American migrants rushed the border at Tijuana. The US Border Patrol tear-gassed them and they backed off. Bad optics for those trying to make the case for open borders. Naturally, The New York Times portrayed this as an assault on families, defaulting to their stock sob story, though the mob assembling down there is overwhelmingly composed of young men. Complicating matters, a new Mexican president, Andrés Manuel López Obrador, takes over next Saturday, a Left-wing populist and enemy of Trumpismo. Tijuana is now choking on the thousands of wanderers who were induced to march north to test America’s broken immigration policies. What could go wrong?

The engine pulling that choo-choo train of grievance is Robert Mueller’s Russian Collusion investigation. I expect him to produce mighty rafts of charges against Mr. Trump, his family and associates, and anyone who ever received so much as a souvenir mug from his 2016 campaign. But I doubt that any of it will have a bearing on Russian election “meddling.” And in that case, the charges will be met by counter-charges of an illegitimate investigation, meaning welcome to that constitutional crisis we’ve been hearing about for two years. That’s a mild way of describing anything from a disorderly impeachment to troops in the American streets. What could go wrong there?