Pablo Picasso Le repos 1932

This painting has a story. It’s very funny. Click the pic.

Freud & Jung would have retweeted this clip.

Freud & Jung would have retweeted this clip. pic.twitter.com/AkC0V98rHs

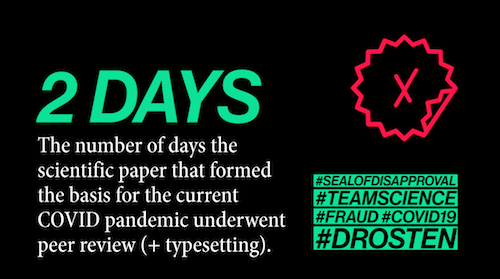

— Wake Up From COVID (@wakeupfromcovid) June 6, 2021

Forget about vaccine-induced herd immunity.

• Nearly 80% Of Surveyed Americans Won’t Change Their Mind & Get Vaccine (RT)

A new poll has found that Americans refusing a Covid-19 vaccination are highly unlikely to change their minds as inoculation rates have also significantly dropped. More than three in four adults (78%) who have thus far refused to get a Covid-19 vaccination say they are unlikely to change their minds in the future, according to a new Gallup poll. Of that group, 51% say they are “highly unlikely” to change their minds. Approximately 20% of people who are hesitant to receive a vaccine say they are open to changing their stance, with only 2% saying they are “highly likely” to eventually be convinced to get inoculated. The poll – conducted among over 3,500 adults with a margin of error of 3% – could spell bad news for President Joe Biden’s ambitious goal of vaccinating 70% of US adults by July 4.

Recent reports have shown that vaccine rates are plummeting in recent weeks, threatening the president’s plan. While approximately 3.4 million shots were being given out a day in mid-April, that number has now fallen to below one million a day, according to a report from the Washington Post. To hit the president’s goal, it says, approximately 4.2 million adults would need to be getting vaccinated a week, but only 2.4 million were given a jab last week. The drop has been chalked up by health officials to a lack of supply, rather than demand as vaccination sites have popped up around the country, but are seeing less and less people come through.

Some states have tried incentivizing vaccine hesitant residents by offering lottery winnings worth millions of dollars. The rates of vaccination vary significantly from state to state, with a handful set to hit Biden’s goal, including New York, a state in which over 60% of adults have received at least one dose of a vaccine. Some right-leaning states, however, have lower vaccination rates and are unlikely to hit the 70% threshold in the next month, the Washington Post report goes on. Twelve states, including Oklahoma, Montana, and West Virginia, have seen their daily vaccinations fall to just 15 jabs per 10,000 residents. One Utah woman told the outlet that “in certain circles, it’s almost shameful to get the vaccine.”

The entire state is free.

• Unvaccinated Houston Methodist Nurses Plan Walkout (HC)

Dozens of cheering supporters gathered outside the Houston Methodist Baytown campus Monday evening as several medical workers who refused to get a COVID-19 vaccine ended their last shifts working for the hospital system. The act of protest was aimed at what workers said was the hospital’s decision to suspend employees for two weeks without pay and then fire them for failing to immunize themselves. Jennifer Bridges, a nurse who effectively lost her job at the Baytown facility for deciding not to be inoculated, said the goal was to stage a walkout but that did not go as planned. Participating employees who refused the vaccine’s first dose were told not to gather or linger on the hospital grounds after ending their shift, she said. “The hospital wouldn’t let us do it,” Bridges said.

She got out of work early, emptied her locker and gathered with others on a grassy medium near the ambulance entrance to the hospital. Bridges fished a paper out of a backpack — a suspension report — that she had been asked to sign. She refused, she continued. About 117 employees in May filed a class action lawsuit against the health system for requiring its workers to be vaccinated against COVID-19. Bridges said the plaintiffs in the suit are a mix of those who want more trial data to emerge on the long-term effects of the vaccine before taking it, and those who simply don’t want any shots. “We’re not against the vaccine, we just want to be more comfortable with this one and have thorough research out before we take it,” Bridges in April said.

“When patients get care, they have the right to refuse treatment, but we’re not allowed that same exemption.” The suit alleged that the three major coronavirus vaccines are only authorized for emergency use by the U.S. Food and Drug Administration, meaning employers cannot require them as a condition of employment. At least 50 more employees have expressed interest in joining the plaintiffs since the lawsuit went public, she said.

Houston Methodist

Houston Methodist hospital workers stage walkout pic.twitter.com/Gri2Tm8gy4

— Heidegger (@heidegger79) June 8, 2021

“SARS-CoV-2 is going to become an endemic virus. It will always be with us. The sooner most of us are exposed to it, ideally in childhood, the sooner it will cease to be a major problem.”

• Why Subject Our Children To The Risk Of Death From Vaccination? (CW)

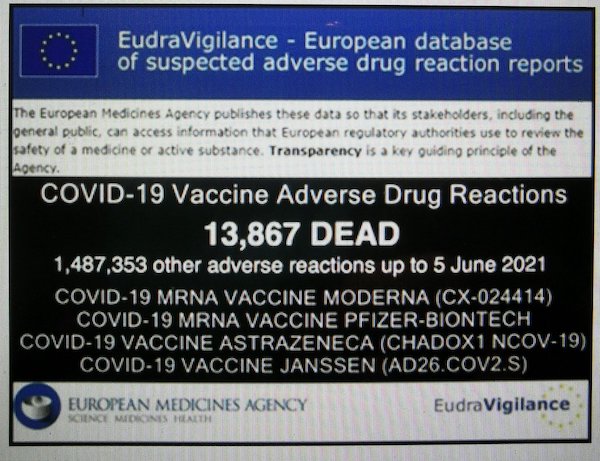

All non-corrupted scientific commentators have known from the very start that this pandemic only ends one way: SARS-CoV-2 is going to become an endemic virus. It will always be with us. The sooner most of us are exposed to it, ideally in childhood, the sooner it will cease to be a major problem. High-risk individuals can choose to take a vaccine. Ivermectin and vitamin D can be used to prevent infection and treat confirmed cases. As we have seen, the argument that children must take vaccines so that we can achieve herd immunity is utterly false. Only those completely ignorant of virology and immunology would even attempt to make it. That brings us back to the original argument for vaccinating children against Covid: to protect them from the severe disease.

If this is the only reason to vaccinate children, there is only one calculation that parents should make: Is the risk from Covid greater than the risk from the vaccine? The present Covid vaccines being administered in the West are based on experimental technologies that are being used under emergency use authorisations (EUAs). Full safety studies will not be completed until 2023. The Covid vaccines were all created in the last year and we have no medium-term or long-term data on them. We don’t know if they will have an effect on children’s reproductive organs and fertility. We don’t know if they will produce auto-immune diseases. And we don’t know if they will lead to ADE (antibody-dependent enhancement) upon re-exposure to the virus (causing more severe illness).

We do know that the vaccines produce a range of cardiovascular and neurological events including strokes, myocarditis, pericarditis and paralysis in a significant number of people. In the small US state of Connecticut at least 18 children and young adults have come down with myocarditis, an extremely serious and sometimes fatal condition involving inflammation of the heart muscle (and they’ve only just started vaccinating children there). The Israel Ministry of Health has reported that the incidence of myocarditis for vaccine recipients is between 1 in 3,000 and 1 in 6,000 in young men. In Canada (population 38 million) only 11 children have died from Covid since the start of the pandemic. In the UK (pop 68 million) 32 children have died. It is nearly certain that all of them had one or more severe comorbidities. The fact is, most children brush off Covid without even knowing they’ve had it. For all intents and purposes, Covid poses zero risk to healthy children.

“..a lot of ethical dilemmas as to whether you should vaccinate children to protect adults.”

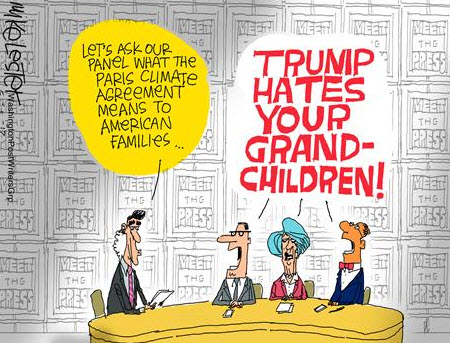

• Child Vaccination: Who’s Selfish Now? (Curzon)

A number of school leaders have swung into action following the approval of the vaccination of children against Covid (a disease which almost all children aren’t at risk from) using the Pfizer vaccine (trials of which only included 1,134 children). It wasn’t very long ago that the establishment line was: if you don’t get a Covid vaccine, you are selfish. Even the Queen (disappointingly) joined in with this line [..]. But now, adult advisers to the Government suggest that children should be vaccinated not to protect children but to protect…themselves. Professor Anthony Harnden, the Deputy Chairman of the Government’s Joint Committee on Vaccination and Immunisation, says:

‘I think the vast majority of benefit won’t be to children, it will be an indirect benefit to adults in terms of preventing transmission and protecting adults who haven’t been immunised, for whatever reason haven’t responded to the vaccine and therefore that presents quite a lot of ethical dilemmas as to whether you should vaccinate children to protect adults.’ He notes that children themselves are ‘in the main’ not at risk from Covid. Over half of the adult population has been fully vaccinated (with seventy-five per cent having received at least one dose of a vaccine) and Covid deaths, while still exaggerated, have flattened. There is no reason to vaccinate most children and, given the potential side effects, many not to do so. If the Government bottles it on the vaccination of children, it is they who are being selfish.

FLCCC

Good question (we asked this before): where are the life insurance companies?

If they don’t change their policies, that’s a big sign.

• Time To Make Them PAY (Denninger)

[..] of those from 5-17 the number of persons who were admitted to the hospital and died, from March 1 2020 through March 31st, 2021 was……. wait for it…… NINE. Yes, a literal NINE nationwide. Another nine under 5 died. That’s right — 18 children in total from 0-17 year olds died of Covid-19 all the way back to March of 2020. If that’s not enough further review in a recent study the CDC did itself found that about a third of those were misclassified and had no plausible connection to Covid-19 actually killing the person in question. That’s a statistical zero risk of death if you are in that age bracket (17 and under) and get Covid. There are roughly 75 million persons under the age of 18 in the United States; this means their risk of death from Covid-19 since March of 2020 is roughly 1 in 4 million.

To put context on this you’re roughly one thousand times (there is a lot of variation with age and sex) more likely to die of something else in that age bracket provided you make it out your first year. Why your first year? Because roughly 5,500 per million infants die in their first year from all causes combined which is a stunning 20,000 times the rate that Covid-19 kills them. In addition for those under 50 the percentage of hospital admissions ending in death was 2.4%. There is no material risk of dying of Covid if you are under 50 and this is with zero early drug intervention which we know works so can we cut the crap folks? This isn’t my data it’s the government’s official data. The AARP confirms this; 95% of those who died were 50+ but 64.6% of the Covid-19 alleged cases have been in people under 50.

Yet now the CDC is attempting to scare kids and adolescents into taking jabs through flat-out lies. Why hasn’t the CDC been banned from Twitter and Facebook for “medical misinformation”? They are the publishers of this data and yet they are knowingly lying about their own data! Now are there an awful lot of seniors who are fat and/or diabetic? You bet. But there are also many who are not and Covid doesn’t kill them often, if at all. There is no reason for anyone to put up with any more of this bull****. After almost a year and a half of being gaslighted, lied to up and down the line by every so-called “expert” under the sun, having treatments suppressed to the point that discussing them gets you thrown off social media sites and doctors sanctioned or threatened with loss of their licenses and professional associations please explain to me why the people of this nation haven’t gotten tired of their loved ones being deliberately sacrificed — that would be called murder, by the way — and shoved all of this bull**** up the government’s ass?

Nor is there any reason for anyone to get a jab for anyone else’s benefit; these are not fully-tested and documented products, no matter what someone tries to tell you and again, the FDA’s own documents in the form of the actual EUAs say so. Any claim otherwise is ALSO a lie; these shots are lightly tested and there is plenty of evidence that more than one of the original safety claims made for them are now known false. [..] where are the life insurance companies? If there’s one group of people who have their crap dialed in when it comes to who’s going to die and how often it’s those folks. Oh not you specifically of course, but statistically, you bet. These companies do not lose money and they don’t make stupid bets either. Every one of their bets collects a small amount of money and when they’re wrong very large amounts go out their door. If they are not changing rates and forcing jabs to get coverage or surcharging you if you don’t get the jab then this much is absolutely certain: Covid-19 is non-event from a life insurance perspective — in other words, whether they think you’ll die of it.

Drown them in ivermectin instead.

• Embattled Thailand Kicks Off Mass Vaccination Drive Against Covid-19 (RT)

Bangkok has started its mass vaccination campaign against Covid-19, with the government aiming to inoculate six million people in June alone, as a third wave surges and now accounts for 80% of all cases since the pandemic began. “The government will ensure that everyone is vaccinated,” Prime Minister Prayuth Chan-ocha said on Monday after a visit to a Bangkok inoculation center as the national vaccination program kicked off. Amid a third wave of the virus, which has seen case levels far exceed those of the first and second waves, the state is aiming to administer six million doses of AstraZeneca’s Covid-19 vaccine, which is being made locally, and China’s Sinovac shot in June. The government hopes to vaccinate 70% of the country’s 66 million people before the end of the year.

To date, only 2.8 million people have received one shot in an initial rollout targeting the most vulnerable, including frontline health and transport workers. The government has been heavily criticized by opposition parties for over-reliance on the AstraZeneca vaccine, which is being made by royal-owned Siam Bioscience. Concerns emerged that the company’s production capacity may have been overestimated after the Philippines said its order had been reduced and delayed. Bangkok has been forced to search elsewhere for more supply, sourcing 200,000 AstraZeneca vaccines from South Korea, and hopes to complete a 20-million-shot deal with Pfizer in the coming weeks. To date, Thailand has registered 179,886 infections and 1,269 fatalities from the virus, 80% of which has been recorded during the third wave. 2,419 new infections and 33 deaths were recorded on Monday.

“..plenty of pretty young things on hand, only some of whom know a reverse repo from an Appenzeller Sennenhund..”

If Quentin Tarantino made a James Bond movie, the villain would be a maniac named Klaus Schwab, played with a light touch by Christoph Waltz, leading a SMERSH-like org bent on turning the world into a utopia of robots, and, of course, absolutely everything would go wrong, leading to a joyously comical bloodbath in the climax. Are we living in that movie, one wonders? In real life — is there even such a thing anymore? — Klaus Schwab is the octogenarian head of the World Economic Forum (WEF), the NGO that hosts the annual cavalcade of global villains at Davos, Switzerland, held every January in perfect designer snow, with the raclette melting temptingly on the hearth, endless flutes of Bollinger R.D. Extra Brut making the rounds, and plenty of pretty young things on hand, only some of whom know a reverse repo from an Appenzeller Sennenhund. Must be fun as all git-out.

The Davos meeting is ostensibly called to improve the state of the world (ha!), and thereby inspires countless paranoid fever dreams in the minds of many who would prefer to be spared utopian social experiments, especially from plans drawn by billionaire bankers who view the present surfeit of mankind on this planet (some 7.6 billion) as cluttering up the joint — all these unnecessary hoi polloi filling the oceans with their yukky plastic, making navigation difficult for the Davos yachting crowd… or something like that. Klaus Schwab has been shockingly literal about his wished-for utopia, summing up his vision as, “You will own nothing, and you will be happy about it.” Hmmm, no property… and then what? Logically, no corpus of contract law to regulate it? Farewell pesky US constitution. (Let’s face it, it’s been falling apart lately, anyhow.) How’s that going to make folks happy? Can I at least keep my Waterpik and my flyrod?

And what about your property Klaus? And the property of your nonagenarian buddy George Soros, including all the cash money he’s been sprinkling around the USA to fund the election of utterly incompetent Attorneys General and District Attorneys, so as to sow chaos in America’s streets? What about your pal Bill Gates’s property… those hundreds of thousands of acres he’s buying up across the American grain belt? And the half that goes to Melinda under California divorce law. Will the poor girl have to make those dreary trips to the Safeway on her own? Will there even be supermarkets? Or just distribution depots like the old soviet glory days, with long lines for schmoozing?

“I want the dollar to be the currency of the world. That’s what I’ve always said.”

• Trump Calls Bitcoin Scam, Denounces It For Competing Against The Dollar (RT)

Former President Donald Trump called bitcoin a probable “scam” on Fox Business, Monday, complaining that it’s competing against the US dollar, which he wants to be the “currency of the world.” During an interview on Fox Business, host Stuart Varney asked Trump for his thoughts on the popular cryptocurrency and whether he would invest in it. “Bitcoin, it just seems like a scam,” Trump declared, adding, “I don’t like it because it’s another currency competing against the dollar.” “I want the dollar to be the currency of the world. That’s what I’ve always said.” Trump has repeatedly shot down cryptocurrencies in recent years, accusing them of facilitating “unlawful behavior, including drug trade and other illegal activity.”

“I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” he said on Twitter in July 2019. “We have only one real currency in the USA, and it is stronger than ever, both dependable and reliable. It is by far the most dominant currency anywhere in the World, and it will always stay that way. It is called the United States Dollar!” Trump’s presidential administration also attempted to crack down on cryptocurrency through regulations last year as one its final acts ahead of President Joe Biden’s inauguration.

“Since we are a market economy, we cannot just order: stop using dollars..”

• Dumping The Dollar: Russia Ready To Shift Currency Liquidity To The Euro (RT)

Russian authorities are planning to shift the nation’s currency liquidity from the US dollar to the euro, the country’s Finance Ministry announced on Monday. “Our number one goal is to turn Russia into a euro-oriented country, thus to replace the dollar with the euro,” said Dmitry Timofeev, head of the department of external restrictive measures control at the Russian Finance Ministry. The official noted that Russia has every reason for the move, adding that the government is preparing a wide range of incentives for businesses to transition to the European single currency. “Since we are a market economy, we cannot just order: stop using dollars,” Timofeev said, though he added that some state-owned corporations might be forced to shift.

“We need to develop the necessary tools in a single package to move the entire economy further away from the dollar, which, in fact, will allow us to avoid sanctions and make the world more democratic,” he added. The announcement comes days after Russian Finance Minister Anton Siluanov said that the National Wealth Fund would reduce its share of dollars to zero within the next month. Meanwhile, Russian Deputy Prime Minister Alexander Novak warned that Russia may soon be tempted to move away from dollar-denominated crude contracts if the US administration continues to pile up targeted economic sanctions.

“Biden is well-prepared to answer for this when he soon visits Europe since, of course, he was deeply involved in this scandal the first time around.”

• The Coming Biden/Putin Train-Wreck Summit (Ron Paul)

I have my doubts whether the Putin-Biden summit in Geneva will take place later this month, but even if somehow it is pulled off, recent Biden Administration blunders mean the chance anything of substance will be achieved is virtually nil. The Biden Administration was supposed to signal a return of the “adults” to the room. No more bully Trump telling NATO it’s useless, ripping up international climate treaties, and threatening to remove troops from the Middle East and beyond. US foreign policy would again flourish under the steady, practiced hands of the experts. Then Biden blurted out in a television interview that President Putin was a killer with no soul. Then US Secretary of State Antony Blinken discovered the hard way that his Chinese counterparts were in no mood to be lectured on an “international rules-based order” that is routinely flouted by Washington.

It’s going to be a rough ten days for President Biden. Just as news breaks that under the Obama/Biden Administration the US was routinely and illegally spying on its European allies, he is preparing to meet those same allies, first at the G7 summit in England on June 11-13 and then at the June 14th NATO meeting in Brussels. Make no mistake, Joe Biden is up to his eyeballs in this scandal. Ed Snowden Tweeted late last month when news broke that the US teamed up with the Danes to spy on the rest of Europe, that “Biden is well-prepared to answer for this when he soon visits Europe since, of course, he was deeply involved in this scandal the first time around.”

Though Germany’s Merkel and France’s Macron have been loyal US lapdogs, the revelation of how Washington treats its allies has put them in the rare position of having to criticize Washington. “Outrageous” and “unacceptable” are how they responded to the news. Russia has been routinely accused (without evidence) of malign conduct and interference in internal US affairs, but it turns out that the country actually doing the spying and meddling was the US all along – and against its own allies! Surely this irony is not lost on Putin.

Ron Paul Walensky

Rochelle Walensky's Warning About 12-17 Year Old Hospitalizations Shown To Be False Using The CDC's Own Data

Watch today' show here: https://t.co/qHQIXyPnt3 pic.twitter.com/hRcS5DIkXp

— Ron Paul (@RonPaul) June 7, 2021

“That would immediately raise the question of the US initiating nuclear war against China to prevail in that situation..”

• Daniel Ellsberg: The 90-Year-old Whistleblower Tempting Prosecution (BBC)

While the Pentagon Papers left a lasting legacy, they weren’t the only documents Mr Ellsberg got his hands on. At the same time, Mr Ellsberg copied another classified study that showed how seriously American military chiefs took the threat of nuclear war during the Taiwan crisis of 1958. For 50 years, the study went virtually unnoticed until 2017, when Mr Ellsberg published the full document online, which was highlighted by the New York Times newspaper last month. In theory, Mr Ellsberg’s disclosure could put him at risk of prosecution on the same charges he faced for leaking the Pentagon Papers. Now aged 90, Mr Ellsberg says he is not intimidated by the possibility of prison. In an interview with the BBC, he explained why.

[..] For decades, Mr Ellsberg has been a tireless critic of government overreach and military interventions. His opposition crystallised during the 1960s, when he advised the White House on nuclear strategy and assessed the Vietnam War for the Department of Defense. What Mr Ellsberg learned during that period weighed heavily on his conscience. If only the public knew, he thought, political pressure to end the war might prove irresistible. The release of the Pentagon Papers was a product of that rationale, which underpins Mr Ellsberg’s latest disclosure, albeit in a different context. “I want to do my part in avoiding nuclear war,” Mr Ellsberg said from his home in California. In his assessment, a nuclear war over Taiwan is a serious threat. To understand why, consider the unsettled question of Taiwan’s relationship to China.

China has asserted sovereignty over Taiwan since the end of the Chinese civil war in 1949. Since then, China has regarded Taiwan as a rebel province that must be reunited with the mainland – by force if necessary. As Taiwan’s most-important ally, the US would be expected to take action if China did attack the island. “War games appear to show that the Chinese would win a conventional war over Taiwan and against the US,” Mr Ellsberg said. “That would immediately raise the question of the US initiating nuclear war against China to prevail in that situation, just as US decision-makers committed themselves to doing if it was necessary in 1958.” In the end, it was not necessary in 1958. But what material released by Mr Ellsberg shows, in sobering detail, is why American military leaders believed it might have been.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Georgestradamus

Georgestradamus pic.twitter.com/BL9WMn9a5e

— SOMETHiNG WiCKËD (@som3thingwicked) June 7, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.