Pablo Picasso Portrait of Dora Maar pensive 1937

Hodkinson

Dr. Roger Hodkinson does not mince words "When that penny starts to drop, the general public are going to be revolted!" Watch. pic.twitter.com/QR9ePZH5ID

— Laura Lynn Tyler Thompson (@LauraLynnTT) January 20, 2022

Eva Vlaar

Legal philosopher @EvaVlaar: “A massive movement going on in Europe…people are aware of the fact that our constitutional rights are being set aside without an end-date…beginning phases of a Social Credit System. We are literally turning into China.”pic.twitter.com/iJJZoiTSj4

— Michael P Senger (@MichaelPSenger) January 19, 2022

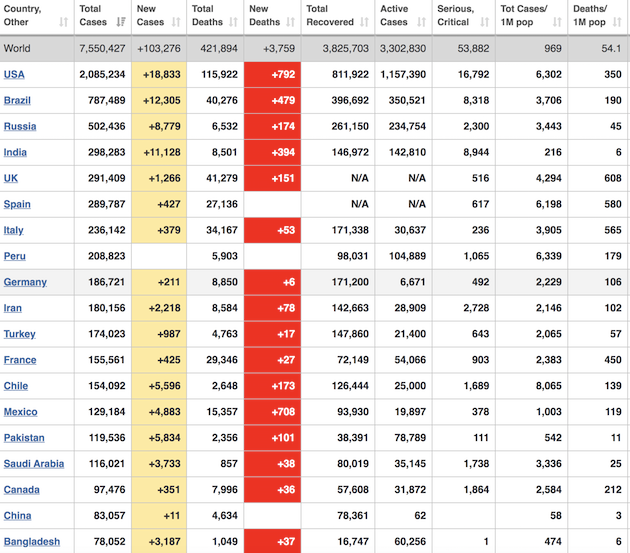

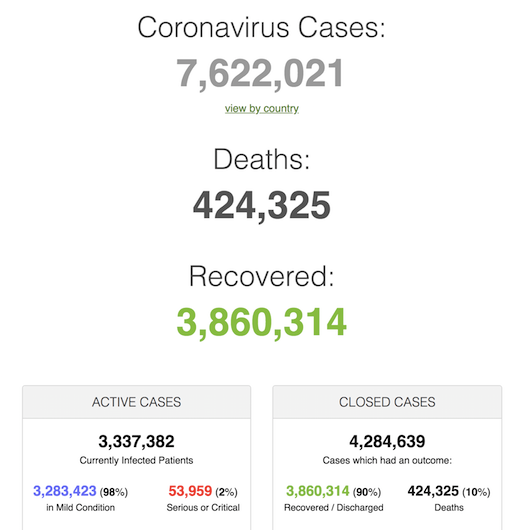

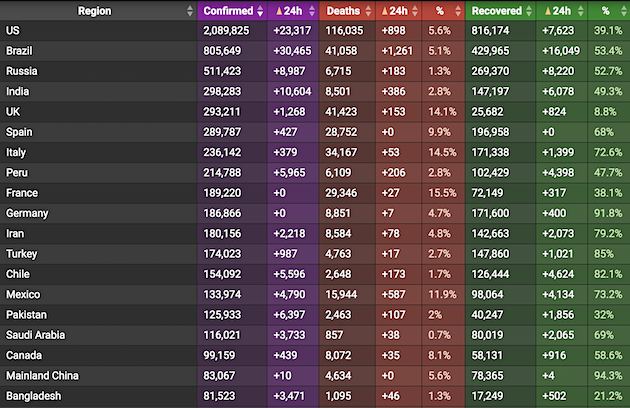

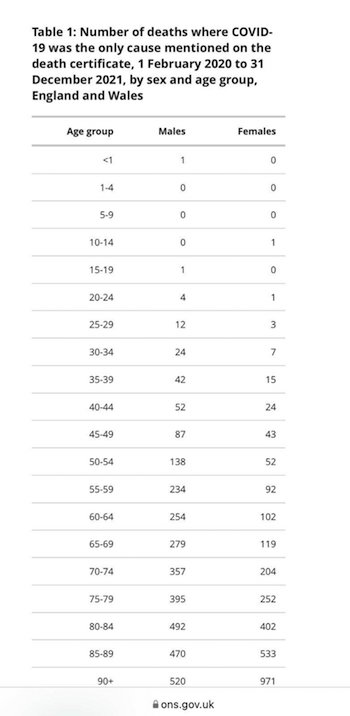

17,000 deaths purely of Covid in the UK. Worldometer puts it at 152,000. 700,000 die of all causes every year in the UK.

• How Many People Have Died Purely Of Covid (Farage)

‘We’ve seen again and again, estimates of how bad this crisis could be that are nearly always massively over-exaggerated, but this has really made me sit up and think.’ Nigel Farage reacts to the amount of people who have died purely of Covid since the start of the pandemic.

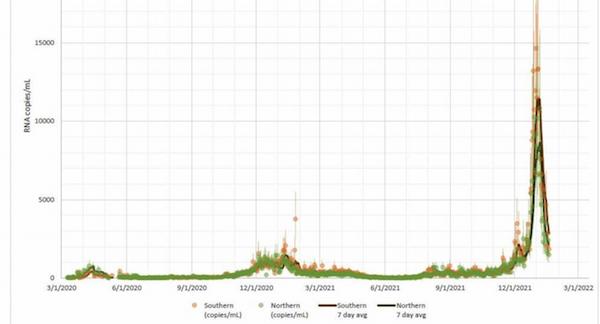

“The end of omicron is imminent..”

• Sewage Surveillance Reveals Omicron Is Disappearing Fast (ZH)

Now, data gleaned from wastewater is being used by the CDC to help determine when the omicron variant may have arrived in the US. As Bloomberg reports, evidence of omicron appeared in US sewage samples collected as early as Nov. 21, according to data collected by state and local health officials from California, Colorado, Houston and NYC. That data was later shared with the CDC. The first infection of omicron in a US-based patient wasn’t confirmed until Dec. 1 (the patient was located in California). “The findings give strong early evidence that the omicron variant was likely present or more widely distributed in these communities than originally indicated by clinical testing alone,” the authors said in CDC’s Morbidity and Mortality Weekly Report.

The four health authorities were the first to find signs of the variant in their wastewater, according to the study. In its report on the findings, BBG added that “analyzing wastewater containing human feces can be an important way to look for warning signs of new mutations, as well as track those already spreading to determine how long existing surges will last.” Wastewater can also provide advanced warning of a COVID surge. Dutch researchers reported in March 2020 that they were able to find genetic material from the virus in wastewater before COVID cases were reported in the population. Like one BBG source said: “everybody poops”.

The technique “gives you a heads-up because people may not want to pick up the phone for surveys, but everybody poops,” said Gigi Gronvall, an immunologist at the John Hopkins Center for Health Security. “And it’s so unbiased because everybody uses the same sewer system.” The CDC now funds 43 health departments that participate in the National Wastewater Surveillance System, which provides data on COVID’s presence and trends in water systems. The great news is that the last week or so has seen the Boston wastewater RNA data plunge… The end of omicron is imminent… because everybody poops.

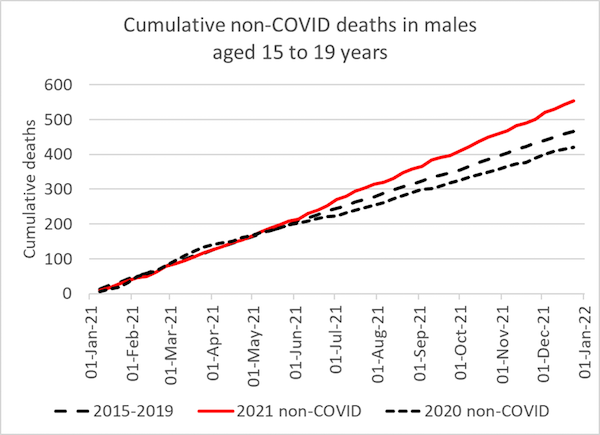

“Any marginal benefit of vaccination for the young must be considered outweighed by even a marginal increase in mortality.”

• Investigate the Cause of the Spike in Child Deaths (Craig)

In recent months, a trend has been noted in the England and Wales all-cause mortality data, which has rung some alarm bells. Young males aged 15-19 have shown a rising death rate compared to the five-year average 2015-2019. At the same time, a large insurance company in the U.S. has reported a significant increase in deaths in the under 40s. This is obviously of concern, whatever the cause, but one possible factor which needs to be urgently excluded is any link to vaccine injury. The association between myocarditis and the mRNA vaccines, especially in younger age groups and in males, is already well established. It is particularly urgent as second doses and boosters are being rolled out, possibly putting adolescents at even higher risk, and at a time when the Omicron variant is much milder.

Members of HART, the Health Advisory and Recovery Team, have joined with other senior academics and health professionals to call for an immediate investigation into the increasing death rate amongst 15-19-year-old males since May of this year. At the High Court on Thursday 13th January, the ONS (Office for National Statistics) confirmed that there has been a significant rise in the death rate for adolescent males over the last eight months, compared to the same time period of 2015-2019. There have been at least 65 extra deaths in England and Wales, though the figure may be higher due to reporting delays for coroners’ cases. During the same time frame there were only two deaths involving Covid.

The concern is that this time period coincides with the rollout of vaccinations to this age group, who are known to be at an increased risk of myocarditis (heart inflammation), especially after the second dose. Far from rushing to investigate these deaths as they have arisen, ONS has stated it intends to undertake that work “when more reliable data are available”. The rollout of vaccinations in this age group was always controversial, with risks and benefits finely balanced, but the Chief Medical Officers overturned the original advice, not on health grounds but to “reduce disruption to schools”. Any marginal benefit of vaccination for the young must be considered outweighed by even a marginal increase in mortality. With the reduced risk from Omicron, and with increased risk from second doses, the balance will have tipped still further.

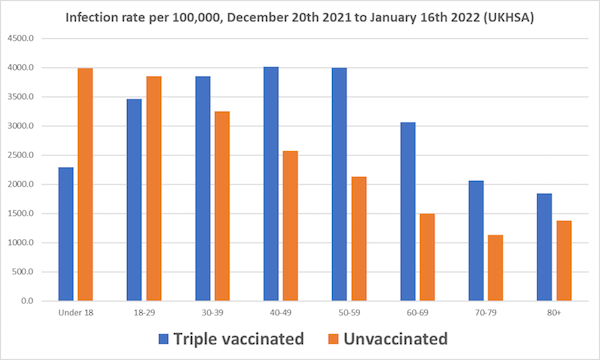

That effectiveness is very negative.

• Triple-Jabbed Over-30s Have Higher Infection Rates Than the Unvaccinated (DS)

This week’s UKHSA vaccine surveillance report has landed – and this week a change. In the (in)famous Table 12, which shows rates of infections, deaths and hospitalisations per 100,000 by vaccination status, the data have suddenly switched to giving rates for triple-jabbed rather than two-or-more doses, meaning we no longer have continuity with our previous data. So sudden was the change in fact, that the report itself has not kept up with it, and the notes under the table still say the rates are for “people who have received either two doses of a COVID-19 vaccine or in people who have not received a COVID-19 vaccine”. The change means we have to start over in our week-by-week comparisons, so the infection rates by age for this period are depicted above and the unadjusted vaccine effectiveness figures are depicted below.

“We are slowly building a network of the injured..” Why does this make me think of 1984? Why does it have to move underground?

• Over a Million Americans Were Injured by Covid Vaccines (Rescue)

The blackout of news regarding covid shot injuries has been so universally successful that it’s almost always a surprise to the vaccine damaged when they find each other. “Travelers in the desert,” is how one put it. Brianne’s extraordinary efforts to connect the injured, tell her story, and correct false facts has taken some interesting turns. Last November she wrote to the New England Journal of Medicine, attempting to have the journal correct inaccuracies in a paper about the AstraZeneca trial it recently published. She wrote: “I was a participant in Astra-Zeneca’s Covid-19 vaccine trial. I suffered serious and severe adverse effects after the first dose…was disabled and remain so today.”

She went on to state that Phase 3 Safety and Efficacy of AZD1222…Covid-19 Vaccine, published at the NEJM, contains numerous errors including that “all serious adverse events” will be recorded through “day 730,” and that she “withdrew” from the trial. Some 180 others are also said by the reporting researchers to have dropped out of the study. In fact, she wrote, “I did not withdraw, I was withdrawn.” The smartphone app she was provided to report symptoms was disabled, she told the NEJM, and trial doctors stopped collecting her data after sixty days. And Brianne heard back right away, receiving a canned rejection note from none other than Dr. Eric J. Rubin, NEJM editor-in-chief and member of the FDA’s review committee that recommended covid shots be okayed for five-year-olds.

But she persisted, telling Rubin again that the article “omitted key safety data in my case” and another she is aware of, and that the NIH gave her a diagnosis of “vaccine injury.” “Omission of adverse reactions is a violation of a key tenet of clinical trial reporting,” she wrote back. But in the end, all the head doctor at the world’s most prestigious medical journal could offer was to forward her letter to the manufacturer and suggest that she herself write to AstraZeneca and the FDA. Despite the widespread social media muffling over “misinformation,” resulting in numerous vaccine-injury sites being silenced, Brianne has managed to discover over 12,000 vaccine-damaged individuals through the website she founded, reAct19.org, simply by word of mouth. She is also affiliated with The Unity Project, a California-based organization working to unify fragmented groups across the state to better fight covid vaccine mandates for children. “We are slowly building a network of the injured,” she said.

That current network, however, could be the proverbial tip of the iceberg. According to VAERS data, as of January 7, 2022, there are vast numbers of covid-19 shot harms, including 1,033,992 vaccine injures, 25,773 cases of myocarditis/pericarditis, 3,594 miscarriages, 11,055 heart attacks, and 21,745 deaths. Within a few weeks of coerced children’s vaccinations, Brianne was contacted by the parents of a number of children, ages five to eleven, experiencing heart damage, some of which doctors said “could lead to heart transplants in five years.” They contacted Brianne because she can put them in touch with doctors knowledgeable and willing to treat vaccine sufferers.

“The paper also called the vaccines “injectable biological products”—a reference to the fact that they are distinct from all other traditional vaccines.”

• Journal Pulls COVID-19 Vaccine Adverse Events Analysis (ET)

Jessica Rose didn’t ask for any of this. She started to analyze data on adverse reactions after COVID-19 vaccines simply as an exercise to master a new piece of software. But she couldn’t ignore what she saw and decided to publish the results of her analysis. The next thing she knew, she was in a “bizzarro world,” she told The Epoch Times. A paper she co-authored based on her analysis was withdrawn by Elsevier, the company publishing the academic journal that ran the article, under circumstances that raised eyebrows among her colleagues. [..] The paper’s conclusions are not necessarily controversial. A recent Danish study concluded, for example, an elevated risk of myocarditis for young people following the Moderna COVID vaccine.

It’s common, however, even for papers that examine potential issues with the vaccines to frame their results in a way that still endorses vaccination. “That’s what you have to say to get your work published these days,” Rose said. Her paper did no such thing. “As part of any risk/benefit analysis which must be completed in the context of experimental products, the points herein must be considered before a decision can be made pertaining to agreeing to 2-dose injections of these experimental COVID-19 products, especially into children and by no means, should parental consent be waived under any circumstances to avoid children volunteering for injections with products that do not have proven safety or efficacy,” the paper said.

The paper also called the vaccines “injectable biological products”—a reference to the fact that they are distinct from all other traditional vaccines. A traditional vaccine uses “whole live or attenuated pathogens” while the COVID vaccines use “mRNA in lipid nanoparticles,” Rose explained via email. She said the lipid nanoparticles include “cationic lipids which are highly toxic.” Pfizer, the manufacturer of the most popular COVID-19 vaccine in many countries, addressed the issue by saying the dose is sufficiently low to ensure “an acceptable safety margin,” according to the European drug authority, the Committee for Medicinal Products for Human Use (pdf). Rose also noted that the COVID-19 vaccines haven’t gone “through the 10-15 years of safety testing that vaccines have always had to go through … for obvious reasons.”

Pretty incredible that this is still seen as news. Then again, how many people know?

• Ivermectin Could Destroy Justification for Lockdowns and Vaccine Mandates (ET)

Federal health agencies haven’t recognized ivermectin as an effective treatment for COVID-19 patients. According to Doctor Leland Stillman, the reason is more political than scientific, because otherwise there would be no basis for lockdowns or vaccine mandates. “If ivermectin were recognized by the public health and academic establishment as the drug that it is, that treats acute viral illnesses, one of which is COVID-19, the entire justification for lockdowns, mandates, let alone vaccine research and development would evaporate overnight,” Stillman told The Epoch Times in a recent interview.

According to Section 564 of the Food, Drug, and Cosmetic Act, the Secretary of the Department of Health and Human Services (HHS) can only issue emergency use authorization if certain criteria are met, including “there is no adequate, approved, and available alternative to the product.” So if there’s an approved alternative, the Food and Drug Administration (FDA)—an agency in HHS—can’t issue emergency use authorization for COVID-19 vaccines. Stillman said it’s not a conspiracy theory or even an isolated opinion that ivermectin works for treating COVID-19, because tens of thousands of physicians all over the world have recognized its effectiveness. [..] Stillman explained why many doctors are silent on recognizing ivermectin as an effective drug for COVID-19[..].

“And the reality that’s really important for people to understand is that doctors can lose their licenses or lose their board certification, which is very important for their income based on insurance guidelines, for speaking out as I have chosen to,” Stillman said. Stillman said he is able to speak up because he’s one of very few doctors in the country who takes cash and doesn’t work with insurance companies. [..] “There’s a lot of politics on this,” Stillman said, referring to the COVID-19 vaccine mandate. “And the way it’s been politicized is really disgraceful and unfortunate. At the end of the day, it’s all about how these corporations who are profiting immensely off of the pandemic.”

Stillman said freedom is the way out of the current problem. “Freedom is absolutely the solution,” Stillman said. “Because if you really allow doctors to treat patients on their own terms, without insurance companies, without all this, it can be very affordable, and it can be very effective. “Because the reality is that a lot of the care being provisioned right now, it’s just being provisioned based on some bureaucrat’s idea of what’s good medicine, not based on what the patients actually want and think is worth it to them.”

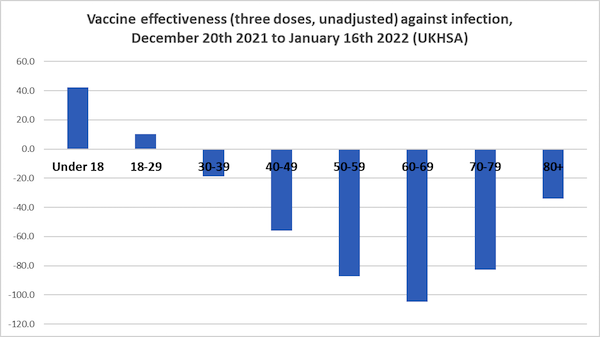

HCQ for the win.

• Unexpected Comeback in the FLCCC Early Treatment Protocol (CE)

If you have followed the development of early treatment protocols for COVID-19, you will be aware that for well over a year, Ivermectin was the central agent in the FLCCC protocol, for prevention and early treatment. Ivermectin is also part of the hospital level protocols. Very early on [..] Hydroxychloroquine was present in the protocol, but it was dropped mid-2020. This non-inclusion of Hydroxychloroquine appears to have been in part due to the bad publicity that Hydroxychloroquine was suffering from, as it was targeted by the mainstream media, especially in relation to the presidential campaign in the US – something that we covered extensively.

This January 19 2021, it’s therefore a bit of a surprise to see Hydroxychloroquine to re-appear in the FLCCC prevention and early treatment protocol. The move follows the experience of several frontline doctors who found that Hydroxychloroquine is particularly useful to deal with Omicron, in combination with Ivermectin and other agents, as indicated in the protocol. So, we see with this move a further alleviation of the rift that previously existed, and that had already nearly disappeared, among frontline doctors regarding the nature of the most appropriate agents to be included in early treatment protocols for COVID-19.

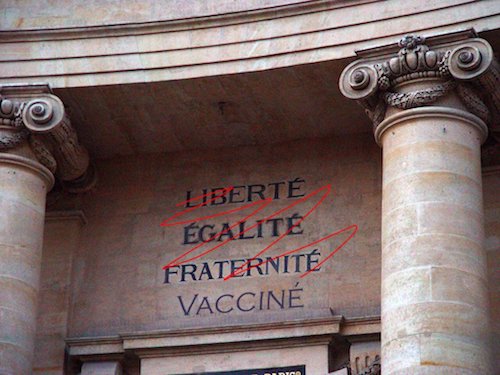

But not really.

• France To Lift Covid-19 Restrictions In February (Pol.eu)

French Prime Minister Jean Castex announced Thursday that the government will lift most of its COVID-19 restrictions in February, although the need for a vaccine pass and indoor mask-wearing will remain. The vaccine pass will come into effect on Monday, Castex said at a press conference. People will no longer be allowed to show a negative test to enter restaurants, bars, theaters, museums and stadiums or travel on trains — only proof of vaccination will be accepted. Starting February 2, stadiums, arenas and other large-capacity venues will be allowed to operate at full capacity again. Homeworking obligations will be lifted, though it will still be encouraged, and masks will no longer be required outdoors, as is currently the case in many cities.

On February 16, people will be allowed to eat and drink in stadiums, cinemas and on transport, as well as being allowed to drink while standing in bars. Nightclubs will be allowed to reopen, though the government was unable to specify whether masks would be required. France has had an average of 320,000 COVID-19 cases each day over the past week, an ever-rising number. But Castex said that of the two simultaneous waves hitting the country — of the Delta and Omicron variants — the former was receding, while the latter was starting to fall in the first regions where it appeared, including in Paris. “We are unquestionably in a new phase of the epidemic,” said the prime minister.

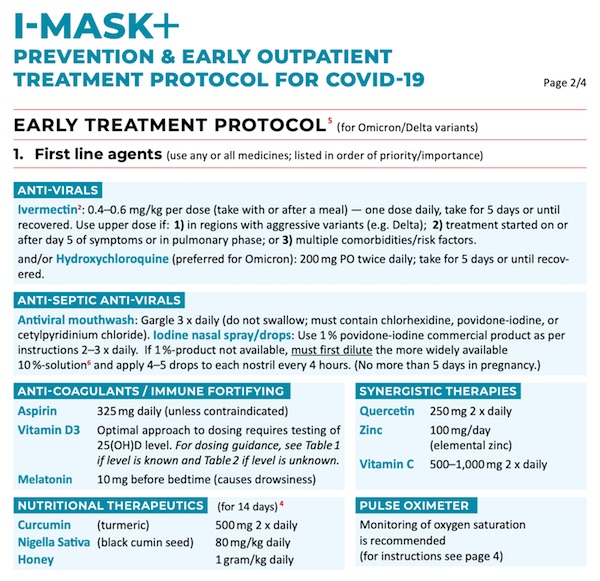

“It is difficult to find people in Russia who would dream of a life like the one in Ukraine now,” he stated. “It is impossible to envy it.”

• Top Russian Senator Blasts American’s ‘Amazing Stupidity’

American analysts following Russia and the former Soviet Union repeatedly fail to understand the mentality of people living in the world’s largest country, one of Moscow’s leading senators has raged as experts weigh in on events happening along the border with Ukraine. Taking to Telegram on Thursday, Alexey Pushkov poured scorn on a statement put forward by Michael McFaul, a well-known “Russia watcher” and Stanford professor who previously served as Washington’s ambassador to Russia during President Barack Obama’s era. McFaul’s tweet read that “Ukrainian democracy today, not Ukrainian membership in NATO in some distant future, is the real threat to [Russian President Vladimir] Putin.” Similar remarks have been made by the notoriously anti-Russian academic in recent weeks.

The exchange comes as Moscow aims to seek guarantees from NATO that Ukraine’s long-term ambitions to join the US-led military bloc will not be granted. Hitting out at McFaul’s words, Pushkov blasted the “amazing stupidity of this thesis,” which he insisted is “repeated over and over again in the United States by pseudo-experts on Russia.” It says only one thing, the senator claimed – “they know nothing about the attitude of the vast majority of Russian citizens to what is happening in Ukraine and do not want to know.” He accused Western experts of living “in their false ideologies, where it is comfortable and convenient for them.” “It is difficult to find people in Russia who would dream of a life like the one in Ukraine now,” he stated. “It is impossible to envy it.”

“While the U.K. scrambles to deliver tanks, rocket artillery and other weaponry to the Ukrainians, Germany has refused to send even rifles.”

• Germany’s Pivot From America (Pol.eu)

Over the past decade, the idea that Germany could no longer fully rely on the U.S. for security amid America’s “pivot” to Asia became accepted wisdom among German leaders. The unfolding crisis in Ukraine reveals that reality cuts both ways. Germany’s allies hoped Olaf Scholz’s coalition, which includes the Russia-critical Greens, would back away from the accommodative policies toward Moscow that marked the Angela Merkel era. Recent days have shown such optimism to be misplaced. As Washington has tried to present a united Western front against Russian intimidation in recent weeks, Germany has been a conspicuous outlier. Under the influence of a potent cocktail of energy and commercial interests, and a political culture laced with good old-fashioned anti-Americanism, Germany has strayed from the Western fold.

To outward appearances, Berlin is far from AWOL on Ukraine. “After years of rising tensions, staying silent isn’t a sensible option,” Chancellor Scholz said on Wednesday in reference to Russia’s amassing of troops on the Ukrainian border, stressing that Germany was committed to Ukraine’s territorial integrity. “It’s hard not to see this as a threat,” Foreign Minister Annalena Baerbock said of the border buildup on a trip to Moscow this week. But when the cameras are turned off, Germany’s tone changes. While the U.K. scrambles to deliver tanks, rocket artillery and other weaponry to the Ukrainians, Germany has refused to send even rifles. And instead of locking arms with the U.S. and other transatlantic allies to help Ukraine prepare for an attack, Germany has sought to placate Russia by taking some of the West’s most powerful deterrents off the table.

As the crisis has intensified, German officials and politicians have strenuously opposed using the threat of suspending Russia from SWIFT, the Belgium-based international payments system, a step that would make it extremely difficult for Russian entities to engage in international commerce. Even Germany’s conservative opposition cautioned against using SWIFT as a bargaining chip. Friedrich Merz, leader of the center-right Christian Democrats, said suspending Russia’s access to the network would be the financial market equivalent of dropping an “atomic bomb.”

Very thorough from Aaron Maté. Durham is not sitting still, but he faces a lot of resistance.

As he documents the role of Hillary Clinton’s campaign in generating false allegations of Trump-Russia collusion, Special Counsel John Durham has also previewed a challenge to the FBI’s claims about how and why its counterintelligence investigation of the Trump campaign began. At stake is the completeness of the official reckoning within the U.S. government over the Russiagate scandal – and whether there will be an accounting commensurate with the offense: the abuse of the nation’s highest law enforcement and intelligence powers to damage an opposition presidential candidate turned president, at the behest of his opponent from the governing party he defeated.

The drama is playing out against the clashing approaches of the two Justice Department officials tasked with scrutinizing the Russia probe’s origins and unearthing any misconduct: Durham, the Sphinx-like prosecutor with a reputation for toughness whose work continues; and Michael Horowitz, the Department of Justice inspector general, whose December 2019 report faulted the FBI’s handling of the Russia probe but nonetheless concluded that it was launched in good faith. The bureau’s defenders point to Horowitz’s report to argue that the FBI’s Trump-Russia conspiracy investigation, codenamed Crossfire Hurricane, is untainted despite its extensive use of the discredited Clinton-funded Steele dossier. Though highly critical of the bureau’s use of Christopher Steele’s reports, Horowitz concluded that they “played no role in the Crossfire Hurricane opening,” which he said had met the department’s “low threshold” for opening an investigation.

But Durham has made plain his dissent. In response to Horowitz’s report, the special counsel announced that his office had “advised the Inspector General that we do not agree with some of the report’s conclusions as to predication and how the FBI case was opened.” Durham stressed that, unlike Horowitz, his “investigation is not limited to developing information from within component parts of the Justice Department” and has instead obtained “information from other persons and entities, both in the U.S. and outside of the U.S.”

From Russiagate to 1/6 was a smooth transition.

• Congress’s 1/6 Committee Claims Absolute Power (Greenwald)

In its ongoing attempt to investigate and gather information about private U.S. citizens, the Congressional 1/6 Committee is claiming virtually absolute powers that not even the FBI or other law enforcement agencies enjoy. Indeed, lawyers for the committee have been explicitly arguing that nothing proscribes or limits their authority to obtain data regarding whichever citizens they target and, even more radically, that the checks imposed on the FBI (such as the requirement to obtain judicial authorization for secret subpoenas) do not apply to the committee. As we have previously reported and as civil liberties groups have warned, there are serious constitutional doubts about the existence of the committee itself.

Under the Constitution and McCarthy-era Supreme Court cases interpreting it, the power to investigate crimes lies with the executive branch, supervised by the judiciary, and not with Congress. Congress does have the power to conduct investigations, but that power is limited to two narrow categories: 1) when doing so is designed to assist in its law-making duties (e.g., directing executives of oil companies to testify when considering new environmental laws) and 2) in order to exert oversight over the executive branch. What Congress is barred from doing, as two McCarthy-era Supreme Court cases ruled, is exactly what the 1/6 committee is now doing: conducting a separate, parallel criminal investigation in order to uncover political crimes committed by private citizens.

Such powers are dangerous precisely because Congress’s investigative powers are not subject to the same safeguards as the FBI and other law enforcement agencies. And just as was true of the 1950s House Un-American Activities Committee (HUAC) that prompted those Supreme Court rulings, the 1/6 committee is not confining its invasive investigative activities to executive branch officials or even citizens who engaged in violence or other illegality on January 6, but instead is investigating anyone and everyone who exercised their Constitutional rights to express views about and organize protests over their belief that the 2020 presidential election contained fraud.

Indeed, the committee’s initial targets appear to be taken from the list of those who applied for protest permits in Washington: a perfectly legal, indeed constitutionally protected, act. This abuse of power is not merely abstract. The Congressional 1/6 Committee has been secretly obtaining private information about American citizens en masse: telephone records, email logs, internet and browsing history, and banking transactions. And it has done so without any limitations or safeguards: no judicial oversight, no need for warrants, no legal limitations of any kind.

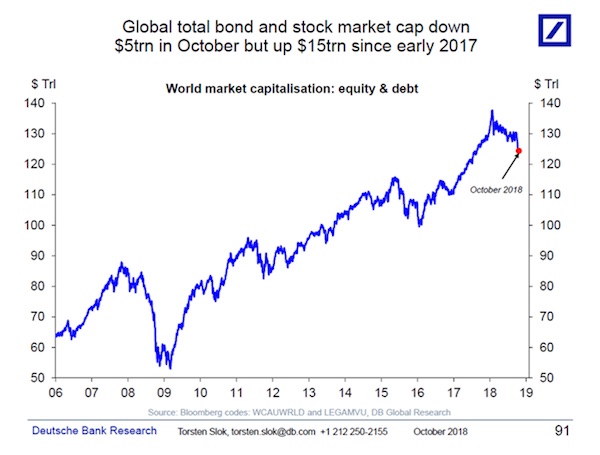

“..losses in the U.S. alone may reach $35 trillion.”

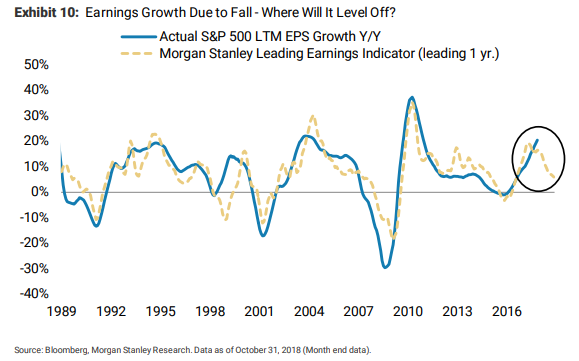

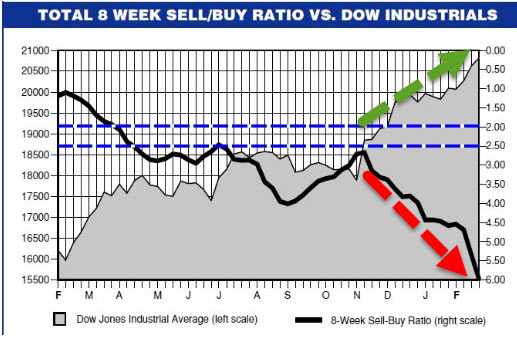

• Jeremy Grantham Doubles Down on Crash Call, Says Selloff Has Started (BBG)

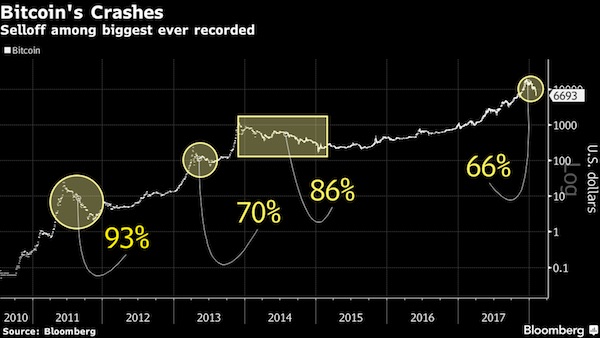

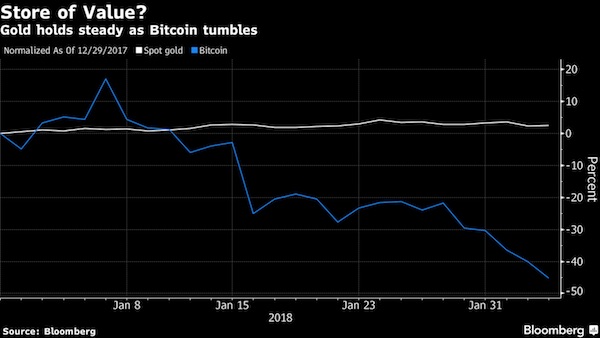

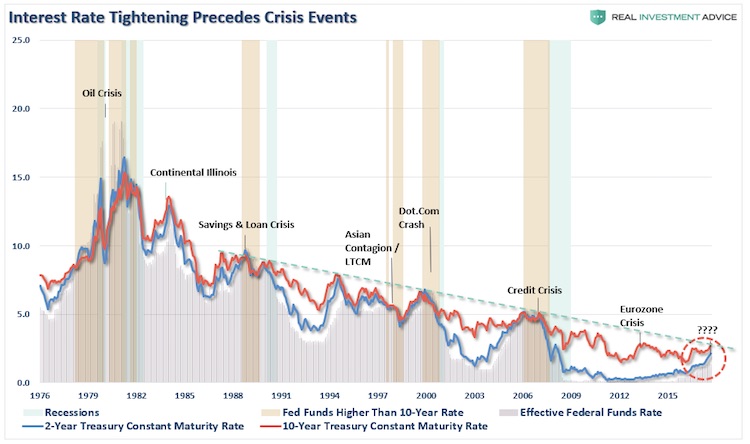

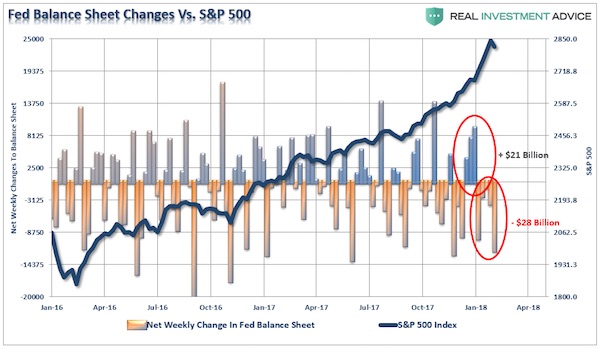

Jeremy Grantham, the famed investor who for decades has been calling market bubbles, said the historic collapse in stocks he predicted a year ago is underway and even intervention by the Federal Reserve can’t prevent an eventual plunge of almost 50%. In a note posted Thursday, Grantham, the co-founder of Boston asset manager GMO, describes U.S. stocks as being in a “super bubble,” only the fourth of the past century. And just as they did in the crash of 1929, the dot-com bust of 2000 and the financial crisis of 2008, he’s certain this bubble will burst, sending indexes back to statistical norms and possibly further. That, he said, involves the S&P 500 dropping some 45% from Wednesday’s close — and 48% from its Jan. 4 peak — to a level of 2500. The Nasdaq Composite, already down 8.3% this month, may sustain an even bigger correction.

“I wasn’t quite as certain about this bubble a year ago as I had been about the tech bubble of 2000, or as I had been in Japan, or as I had been in the housing bubble of 2007,” Grantham said in a Bloomberg “Front Row” interview. “I felt highly likely, but perhaps not nearly certain. Today, I feel it is just about nearly certain.” In Grantham’s analysis, the evidence is abundant. The first sign of trouble he points to came last February, when dozens of the most speculative stocks began falling. One proxy, Cathie Wood’s Ark Innovation ETF, has since tumbled by 52%. Next, the Russell 2000, an index of mid-cap equities that typically outperforms in a bull market, trailed the S&P 500 in 2021.

Finally, there was what Grantham calls the kind of “crazy investor behavior” indicative of a late-stage bubble: meme stocks, a buying frenzy in electric-vehicle names, the rise of nonsensical cryptocurrencies such a dogecoin and multimillion-dollar prices for non-fungible tokens, or NFTs. “This checklist for a super bubble running through its phases is now complete and the wild rumpus can begin at any time,” Grantham, 83, writes in his note. “When pessimism returns to markets, we face the largest potential markdown of perceived wealth in U.S. history.” It could, he said, rival the impact of the dual collapse of Japanese stocks and real estate in the late 1980s. Not only are equities in a super bubble, according to Grantham there’s also a bubble in bonds, “the broadest and most extreme” bubble ever in global real estate and an “incipient bubble” in commodity prices. Even without a full reversion back to statistical trends, he calculates that losses in the U.S. alone may reach $35 trillion.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.