Vincent van Gogh Self-portrait with dark felt hat at the easel 1886

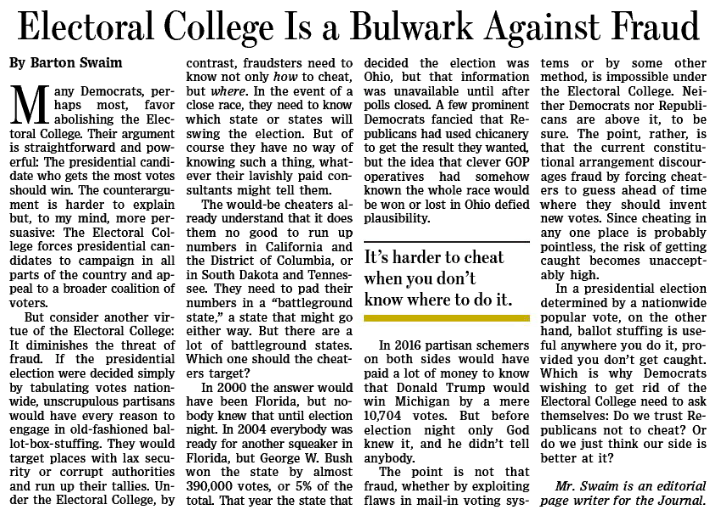

Fmr. US ambassador to the Soviet Union, Jack Matlock

Oborne

https://twitter.com/i/status/1581943171906519041

Bourla

https://twitter.com/i/status/1581650848223924225

“Contracted price for long-term Russian supply for Germany used to be about $280 per 1,000 cubic metres as against the current market price hovering around $2,000.”

“Russians will settle for nothing less than the ouster of the Zelenskyy regime.”

• A War Russia Set To Win (Bhadrakumar)

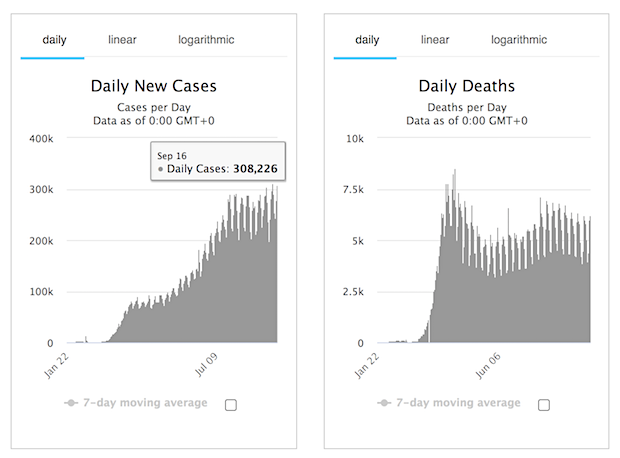

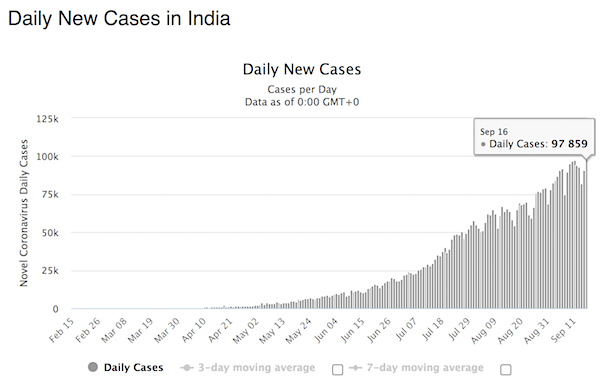

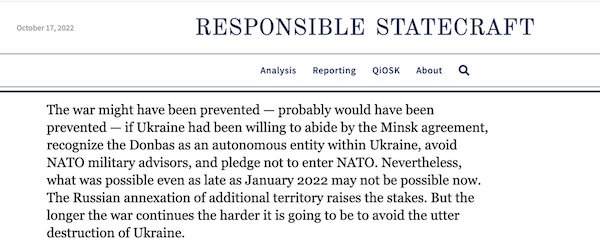

Two massive terrorist strikes misfired spectacularly and a terrible beauty is born in the Ukraine war. These two carefully planned attacks in quick succession — on Nord Stream gas pipelines and Crimean Bridge — were intended as a knockout blow to Russia. According to President Vladimir Putin, people ‘who want to finally sever ties between Russia and the EU, weaken Europe’ are behind the Nord Stream blasts. He named the US, Ukraine and Poland as ‘beneficiaries’. India should expect the defeat of the US and NATO, which completes the transition to a multipolar world order. Last Wednesday, Russia’s domestic intelligence service FSB identified Ukraine’s military intelligence chief, Kyrylo Budanov, as the mastermind behind the Crimean attack.

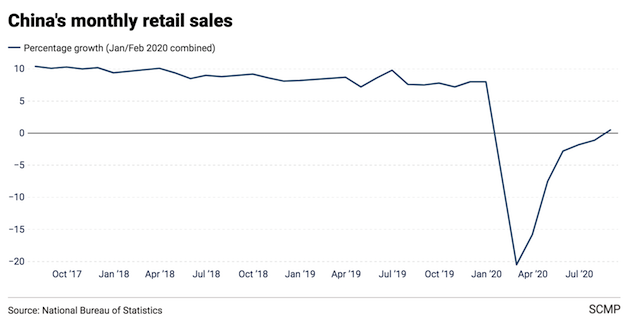

The New York Times and Washington Post also pointed fingers at Kiev, quoting ‘sources’. While Nord Stream-1 has been crippled, one of the strings of Nord Stream-2 remains intact. Putin said last week that the pipeline could be restored and Russia could deliver about 27 billion cubic metres of gas. ‘The ball is on the side of the European Union, if they want — let’s turn on the tap,’ he said. But mum’s the word from Brussels. It is a profoundly embarrassing moment for the EU. The triumphalism has vanished as Europe is threatened by years of recession caused by the blowback from sanctions against Russia, where the US insisted on the cut off of energy ties with Moscow.

The EU has now become a captive market for Big Oil and is left to buy LNG from the US at the asking price, which is six to seven times higher than the domestic price in the US. (Contracted price for long-term Russian supply for Germany used to be about $280 per 1,000 cubic metres as against the current market price hovering around $2,000.) Plainly put, the Europeans have been nicely played by the Americans. India should take note of the US’ sense of entitlement. Basically, the Biden administration created a contrived energy crisis whose real aim is war profiteering. The Crimean Bridge attack of October 8 is much more serious. Zelenskyy has crossed a red line that Moscow had repeatedly warned him against.

Putin has disclosed that there have also been three terrorist attacks against the Kursk NPP. Russians will settle for nothing less than the ouster of the Zelenskyy regime. Russia’s retaliation against Ukraine’s ‘critical infrastructure’, something Moscow refrained from so far, has serious implications. Since October 9, Russia has begun systematically targeting Ukraine’s power system and railways. Noted Russian military expert Vladislav Shurygin told Izvestia that if this tempo was kept up for a week or so, it ‘will disrupt the entire logistics of the Ukrainian military — system for transporting personnel, military equipment, ammunition, related cargo, as well as the functioning of military and repair plants.’

Borrell is not a diplomat, even if they call him that. “Diplomat” and “diplomacy” are words that have an actual meaning. He fits none of that.

• Borrell Tells EU Members ‘Don’t Worry About Money’ For Ukraine (RT)

The EU has enough funds to back member nations that send weapons to Ukraine’s military, the bloc’s foreign policy chief, Josep Borrell said on Monday. His statement comes amid reports that the EU cannot fully reimburse states that are supporting Kiev’s forces. Speaking prior to a Foreign Affairs Council meeting in Luxembourg, Borrell said “there is enough money, don’t worry about money” before walking away. Despite the diplomat’s assurances, last week, Politico reported that the European Peace Facility, a €1.5 billion fund meant to assist EU countries in replacing weapons sent to Kiev, was unable to satisfy more than half the requests that it received.

According to the report, this angered Poland, which is one of Ukraine’s main backers in terms of weapon deliveries, with Warsaw presenting a bill for €1.8 billion ($1.75 billion). Poland later backed down, agreeing to 46% compensation, the outlet said. Meanwhile, the US and Ukraine have both been pressing the EU to do more to support Kiev financially – and in a more expedient manner. Last week, in an apparent reference to Brussels, US Treasury Secretary Janet Yellen urged international donors “to keep stepping up” their aid efforts, stressing that assistance should go in direct cash payments rather than in loans. Speaking to the Washington Post, one former senior treasury official noted that “I know they’re very frustrated” about the slow progress of aid, adding that “US officials want to see Europe deliver far more quickly.”

Earlier this month Oleg Ustenko, a top economic adviser to Ukrainian President Vladimir Zelensky called the delays in EU economic aid “unacceptable,” citing the “extreme high pressure” the finance ministry is under. Last week Zelensky said that his country needs as much as $38 billion to cover next year’s estimated budget deficit and another $17 billion to start to restore critical infrastructure. Meanwhile, Washington has committed $8.5 billion in economic aid to Ukraine, with another $4.5 billion slated to arrive by the end of the year. However, according to the Washington Post’s sources, the EU has pledged €11 billion ($10.7 billion) but has so far only handed over roughly one third of that, which was in the form of loans.

Green screen

The same propaganda they did with Bin Laden, they're doing for Ukraine. Find what here:#Zelenskyy pic.twitter.com/u6OPYuM2SU

— The Dollar Vigilante (@DollarVigilante) October 16, 2022

Any first year psychology student can tell you about projection.

“..they are doing everything they can to prolong the war..”

“..young men who are now being conscripted as cannon fodder..”

• Ukraine Can Retake Crimea By Next Summer, Former Top US Commander Says (ZH)

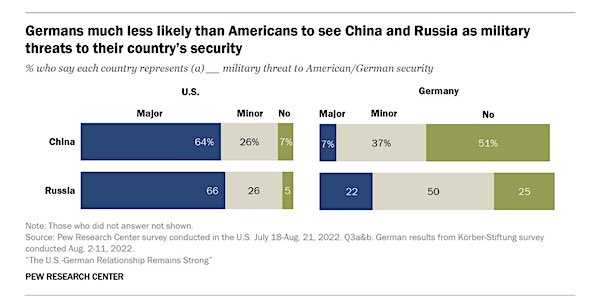

A top US general, now retired, has said he believes that Ukrainian forces can retake the Crimean Peninsula by next summer. Ben Hodges is the former commanding general of the United States Army Europe, and he’s predicting that “Crimea will be free by summer.” He told German newspaper Frankfurter Allgemeine Zeitung in statements published over the weekend, “When I look at the situation, I see that the situation of the Russians is getting worse with every week.” Hodges went on to explain that Ukraine’s military is likely to keep this momentum given “far superior” logistics and motivation to fight. “They say war is a test of will and logistics – and on both counts Ukraine is far superior,” Hodges told the German publication. “The Russians have to lose [the war]; otherwise, they’ll try again in two or three years.”

He said the Kremlin is betting big on its “one hope” that the West and NATO countries will lose resolve in their military support for Ukraine. The ex-top Army commander for Europe also said he expects to see more sabotage attacks against Russian assets and crucial logistics and resource hubs, such as with the recent bombings against the Kerch Strait Bridge and the Nord Stream pipelines: “So they are doing everything they can to prolong the war and spread fear and insecurity in the West. Any means will do: The young men who are now being conscripted as cannon fodder, as well as attacks on infrastructure in the West,” Hodges told FAZ. “I believe that we will therefore see more such acts of sabotage and attacks, or at least attempts, in the coming weeks and months.”

This comes as there’s been stepped up cross-border shelling and missile attacks against the Russian city of Belgorod, which lies just north of the Ukrainian border not far from the major Ukraine city of Kherson. But despite much of the past month witnessing headline after headline declare rapid advances of Ukrainian forces against the Russians in the east, the Kremlin on Sunday has announced significant new successes: Russia’s defense ministry says its forces repelled efforts by Ukrainian troops to advance in the Donetsk, Kherson and Mykolaiv regions, inflicting what it described as significant losses against the enemy. A ministry spokesperson said that “during fierce fighting, units of the Russian army held the positions they held, inflicting significant losses on the enemy.”

South Stream.

• Turkish Hub May Solve Nord Stream Problems – Gazprom (RT)

Gazprom CEO Alexey Miller said on Sunday that it would be possible to redirect all of the gas supplies halted due to the sabotage of the Nord Stream pipelines through a Turkish hub. “We are talking about all those volumes that we lost due to acts of international terrorism at the Nord Stream pipelines, so it can be significant volumes,” Miller said in an interview with Russia 1 TV, commenting on the prospects of creating a major energy hub in Türkiye. Miller highlighted that the company’s experience in preparing the South Stream pipeline project could be valuable.

The project, which would have brought an estimated 63 billion cubic meters of Russian gas annually through the Black Sea to Bulgaria and onward to other countries in Europe, ended up being canceled and replaced by TurkStream. “Thus, even if we talk about the technical documentation for the route, everything has been done for South Stream back then,” the CEO said. Last week, Russian President Vladimir Putin proposed building a major gas hub in Türkiye to handle supplies previously directed through the Nord Stream pipelines. Turkish President Recep Tayyip Erdogan backed the idea, adding that both leaders had ordered their respective governments to present construction plans as soon as possible.

Running out. Raytheon is raising its Christmas bonuses.

• US Poised For Slowdown In High-end Munitions Deliveries To Ukraine (Fox)

Defense Secretary Lloyd Austin signaled this week that the U.S. and its Western allies are having trouble keeping pace with Ukraine’s demand for the advanced weaponry it needs to fend off Russia’s invasion. That signal reflects dwindling supplies for Ukraine and fear in the White House of escalation that could lead to war between the U.S. and Russia. The risk of reduced U.S. stockpiles of high-end munitions has been reported almost since the U.S. began contributing to Ukraine’s defense. Now, nearly eight months since the start of the war, experts interviewed by Fox News Digital say the U.S. is at or very near the end of its capacity to give. They agreed that Austin’s remarks indicate that the initial rush of high-end munitions like HIMAR rocket launchers, Javelin anti-tank missiles, anti-aircraft Stingers and M-777 Howitzers is over.

These sources said there may be two factors at play that are contributing to this reality. One factor is the issue that Austin addressed directly this week – the U.S. is running low on equipment that it can hand over to Ukraine. At a press conference Wednesday, Austin was asked whether the U.S. and other nations are worried about running so low on domestic supplies of critical munitions that they can no longer help Ukraine. Austin dodged the question by stressing that the desire is there to get Ukraine what it needs, but he left unsaid whether Ukraine’s allies can actually deliver. “Well, it certainly is not a question of lack of will,” Austin replied. Austin had just concluded a meeting with officials from dozens of countries about Ukraine’s munitions needs.

As he described that meeting, he again talked about willpower but hinted at strained capacity to provide more for Ukraine, which is using up munitions faster than the world can deliver them. “We will produce and deliver these highly effective capabilities over the course of the coming months — and in some cases years — even as we continue to meet Ukraine’s most pressing self-defense requirements in real time,” Austin said of the most recent commitment to send HIMARS, vehicles, radar systems and other equipment. Mark Cancian is a senior adviser at the Center for Strategic & International Studies who spent seven years working on DOD procurement issues for the Office of Management and Budget. His assessment based on inventory levels, industrial capacity, and information from the Biden administration is that the U.S. has “limited” supplies of HIMARs, Javelins, Stingers and M-777 Howitzers. “There are some areas where we’re basically at the bottom of the barrel,” he told Fox News Digital.

“From their standpoint losing Crimea is like [the] USA losing Hawaii & Pearl Harbor.”

• Musk Compares Crimea To Pearl Harbor

SpaceX and Tesla CEO Elon Musk argued on Monday that Russia views Crimea as an integral part of its territory, and that Ukrainian or Western attempts to seize the peninsula could end in nuclear war. While Musk has previously backtracked on pulling his technological support for Ukraine, he has courted controversy for insisting that Crimea is Russia. “If Russia is faced with the choice of losing Crimea or using battlefield nukes, they will choose the latter,” Musk wrote on Twitter. “We’ve already sanctioned/cutoff Russia in every possible way, so what more do they have left to lose?” he asked, in response to a commenter asking him whether he reckoned the Ukraine conflict could devolve into a nuclear war.

Ukrainian President Vladimir Zelensky has repeatedly stated that he intends to seize control of Crimea, along with the four former regions of Ukraine that recently voted to join the Russian Federation. Crimea overwhelmingly voted to rejoin Russia in 2014, and as such falls under the protection of Moscow’s nuclear arsenal. As President Vladimir Putin has stated, Russia’s nuclear doctrine allows the state to defend itself with “all available means” if its existence is threatened.“Whether one likes it or not, Crimea is absolutely seen as a core part of Russia by Russia,” Musk continued. “Crimea is also of critical national security importance to Russia, as it is their southern navy base. From their standpoint losing Crimea is like [the] USA losing Hawaii & Pearl Harbor.”

Crimea was formally a part of Russia from 1783 until it was gifted to the Ukrainian SSR by Soviet Premier Nikita Khrushchev in 1954. Musk claimed earlier this month that Khrushchev’s decision was a “mistake,” and suggested that Ukraine abandon its claim to the peninsula as part of a future peace deal with Russia.Musk’s peace plan was condemned by Ukrainian officials and their supporters online, with Ukraine’s former ambassador to Germany, Andrey Melnik, telling the billionaire to “f**k off.”Musk then said that he would take Melnik’s advice and stop providing free Starlink internet access to Ukraine, which he said would cost SpaceX $400 million to run throughout 2023.

Elon

Every CEO, company founder and entrepreneur should watch this video:

Elon Musk when he proved everyone wrong pic.twitter.com/tsywvc4HCh

— Vala Afshar (@ValaAfshar) October 16, 2022

“..the real problem isn’t shortage but pricing.”

This is how the Ukraine is financed.

• US To See Winter Spike In Natural Gas Prices (RT)

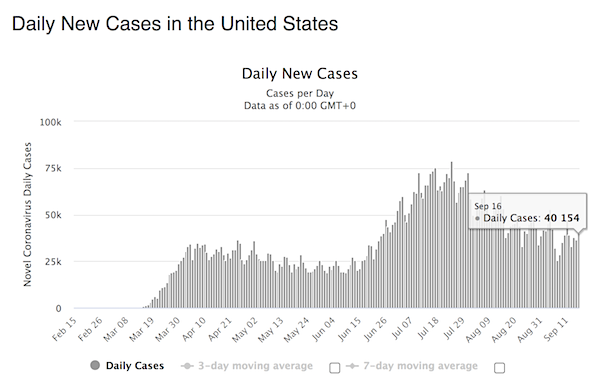

Natural gas bills are set to increase in all regions of the United States this winter, with surging demand and colder temperatures potentially forcing Americans to pay nearly 30% more over the previous year, according to projections by the US Department of Energy. A forecast published by the department’s Energy Information Agency (EIA) on Monday predicted a significant price hike over the winter months, suggesting some US households will pay an average of $931 for heating during the cold season – a 28% increase over 2021. Nearly half of all American homes are heated with natural gas.The agency went on to note that the Midwest will see the greatest increase in retail gas prices compared to other regions, though the South, West and Northeast will also experience climbing costs.

While comparatively colder temperatures are expected to contribute to the rising prices, the EIA previously said growing “constraints on liquefied natural gas (LNG) exports to Europe from Russia” were creating “strong international demand” for American gas. The resulting boost in US exports has used “almost all” of the country’s available gas capacity and driven prices upward, with the US reporting its lowest natural gas storage levels in three years last April. Efforts by some European states to curtail Russian energy imports in retaliation for the war in Ukraine have also prompted fears that residents will be unable to heat their homes come winter. In comments to the Wall Street Journal on Sunday, Italy’s Energy Minister Roberto Cingolani warned the coming months could be “dominated by fear and uncertainty,” observing that “the real problem isn’t shortage but pricing.”

“Citizens may be unable to pay their bills and businesses risk closing down,” he said, though voiced hopes the continent will “get through the winter fine” barring any “catastrophes” such as exceptionally cold weather or a major spike in energy consumption. EU leaders are expected to meet later this week to discuss a price cap on natural gas for the bloc in an attempt to head off an energy crisis, with the European Commission reportedly planning to create a mechanism allowing it to intervene to force down prices when they surpass a “dynamic” maximum level.

“..he is another victim, only because of his association with Jeffrey. I understand that he, like others, can no longer consider me as a friend..”

• Ghislaine Maxwell Breaks Silence On ‘Special Friendship’ With Bill Clinton (CB)

Ghislaine Maxwell, the imprisoned former girlfriend of the late, disgraced financier Jeffrey Epstein, a convicted sex trafficker, has broken her silence on those who were close friends. Among those friends was former President Bill Clinton whose friendship she described as “special,” she said in an exclusive interview with The Daily Mail. “It was a special friendship, which continued over the years,” she said of her friendship with the former president. “We had lots in common. I feel bad that he is another victim, only because of his association with Jeffrey. I understand that he, like others, can no longer consider me as a friend. “I said in open court in my statement that meeting Jeffrey Epstein was the greatest mistake of my life,” she said.

[..] She also spoke about her former friendship with Prince Andrew. “Yes, I follow what is happening to him,” she said. “He is paying such a price for the association with Jeffrey Epstein. I care about him, and I feel so bad for him. [..] Earlier this month it was reported that Maxwell, may be getting set to talk and that could mean a world of issues for some famous people. “Bill Clinton should be sweating bullets,” reporter Kari Donavan said for The Republic Brief. “It has long been suspected by court watchers that a notorious list of clientele for Epstein, allegedly including Clinton, would eventually emerge, and they may be right, according to investigators and lawyers who have followed the complex case.

“The shocking warning came out of a new documentary that investigated the role of Britain’s Prince Andrew and his close ties as a client of Epstein’s, when the comments were made that there could be further revelations about other clients of Epstein’s because his madame- Ghislaine Maxwell – who was recently convicted for crimes associated with Epstein has until June 2023 to cooperate with prosecutors, in possibly overturning more names,” she said. In a new documentary, “Prince Andrew Banished,’ Florida-based attorney Spencer Kuvin, who represents some of Epstein’s victims, said that Maxwell has until 2023 to cooperate with authorities to get her free from jail quicker.

“The board accused her of “fraud, deceit, or misrepresentation” in her practice, “conduct that evidences a lack of ability or fitness,” and being “an immediate jeopardy” to public health.”

• American Inquisition (Jim Kunstler)

Case in point: the persecution of Meryl Nass, MD, in the state of Maine by its Board of Licensure in Medicine. Dr. Nass is an internal medicine physician and a recognized expert in bioterrorism who famously uncovered the origin of the mysterious “Gulf War Syndrome” as a reaction to the US Army’s own anthrax vaccine. She has testified before Congress and in many state legislatures about vaccine safety. After the emergence of Covid-19, Dr. Nass spoke out and blogged about the dangers of the new vaccines, and in favor of early treatment protocols using ivermectin and hydroxychloroquine. Her outspokeness attracted the ire of Maine Governor Janet Mills, and Mills’s sister, Dora Ann Mills, the “Chief Improvement Officer” at Maine Health, a huge network of twelve hospitals, 1,700 doctors, and 22,000 employees, deeply invested in the Covid vaccine program.

In January of this year, Dr. Nass’s license was suspended by the Licensure Board based on complaints by two “activists” that she was “spreading misinformation” and for her use of early treatment protocols with her own patients. The board compelled Dr. Nass to undergo a neuropsychological evaluation to determine if she was a drug abuser or suffered from mental illness. (Flag that, since it implies official defamation of her character.) The board accused her of “fraud, deceit, or misrepresentation” in her practice, “conduct that evidences a lack of ability or fitness,” and being “an immediate jeopardy” to public health.

For most of this year, the board refused to entertain any defense by Dr. Nass for her suspension until a hearing held last week, October 11, when she appeared before the Licensure Board with her attorney, Gene Libby. The hearing in its entirety can be watched on video at Robert F. Kennedy, Jr.’s Children’s Health Defense website. (The first two-thirds the board prosecutes its case; the last hour Dr. Nass presents her defense.) Days before the hearing, the Licensure Board withdrew all the “misinformation” charges against Dr. Nass without explanation and now bases its case on Dr. Nass’s use of early treatment protocols.

The hearing was highly instructive on the tactics and strategies for defeating official persecutions against doctors in America (and broadly across all of Western Civ these days), since the Maine licensure Board acted with obvious ignorance and malice that is easily revealed. Dr. Nass’s attorney Gene Libby deftly got the Board on-record attesting to their own deliberate misconduct. For instance, he repeatedly invoked their charges against “spreading misinformation,” forcing the chair, an eye doctor named Maroulla S. Gleaton, to affirm that the charges had been precipitously dropped days before. There was also some lively discussion of the board’s imputations against Dr. Nass’s mental health and insinuations of drug abuse — Dr. Nass testified that she’d never been treated for mental health issues, had never taken pharmaceuticals for them, never took illicit drugs or been accused of it, and, where alcohol was concerned, enjoyed “about five drinks a year.”

Google translate.

• Devastating Report On PCR Test Covered Up (DAK)

Researcher Dr. Rogier Louwen of Erasmus MC concluded after extensive lab research that the PCR test as it is currently used is “pointless”. But the publication of his research is hindered and Louwen was fired by his employer. The ‘resurgence’ of the coronavirus is once again widely in the news. The number of ‘infections’ is rising, the media report daily. Millions of people are still regularly tested for corona. But how reliable is the PCR test? Since the start of the corona crisis, there has been considerable criticism of the test, as it is used, outside the hospital, without additional diagnostics.

This criticism does not only come from opponents of the corona policy. Marion Koopmans, member of the OMT and head of the virology department of Erasmus MC, acknowledged in November 2020 on NPO Radio 1: “You only test whether someone carries a piece of RNA that can be months old”. RIVM acknowledged on its website that large-scale testing of people with mild or no complaints has no added value. This leads to far too many ‘false positive’ results. Rogier Louwen, assistant professor who has been employed by Erasmus MC for 22 years, decided with a number of colleagues to test what a ‘positive’ result from a PCR test means. That research, subsidized by the EU, has been completed.

Louwen concluded that “indiscriminately using the PCR test in a population without too many complaints, and using it as the basis of the policy, is not useful”. He showed that the test is not only positive for pieces of SARS-CoV-2, but also for the presence of other viruses, bacteria and human DNA. However, Louwen was unable to get these interesting results published. According to him, this is due to active “opposition”. In fact, he was fired on the spot in June. That may also have to do with criticism he expressed about the vaccinations. According to Louwen, his situation is symptomatic of the one-sided way in which corona is approached. An open debate is not possible, he says. “People want to destroy you scientifically and personally.”

RFK: FDA is having an public meeting on Oct 19 to discuss adding COVID-19 Vaccine to the childhood schedule. This would give the pharma companies full liability protection and also likely lead to any school requiring it in the US.

https://twitter.com/i/status/1582112199635783680

Why?

• Boston University Makes New Covid Strain With 80% Kill Rate (PM)

Researchers at Boston University’s National Emerging Infectious Diseases Laboratories have created a new strain of the Covid virus, echoing experiments which many believe led to the Covid-19 pandemic. The variant is a hybrid of the Omicron variant which spread over the winter and the original virus that was discovered in Wuhan, with this hybrid killing 80 percent of the mice researchers infected, according to the Daily Mail. Researchers found that when infected with the Omicron variant, a similar group of mice all survived and experienced “mild” symptoms. The new research, which has not been peer reviewed, centers around the role of spike proteins in the pathogenic and antigenic behaviors of the virus.

Researchers extracted Omicron’s spike protein, which binds to and invades human cells, and attached those to the original virus that emerged in Wuhan. Looking at how mice fared against the new hybrid strain, researchers wrote, “In…mice, while Omicron causes mild, non-fatal infection, the Omicron S-carrying virus inflicts severe disease with a mortality rate of 80 percent.” Researchers said that while the spike protein is responsible for rates of infectivity, other changes to the virus’ structure determine its deadliness. In addition to looking at mice, researchers also looked at how different strains affect human lung cells that were grown in the lab.

Researchers found that the new strain produced five times more infectious virus particles than the Omicron variant. Researchers noted that the hybrid virus is likely to be less deadly in humans due to differences in the immune systems of mice and humans. Boston University’s lab is one of 13 biosafety level 4 labs in the US. These labs are authorized to handle the most dangerous pathogens, and conduct experiments that often involve working with animal viruses to advance treatments and vaccines.

“There is nothing in the natural environment that can cause cancer.”

• Cancer Is a Man-Made Disease – Controversial Study (LS)

Is the common nature of cancer worldwide purely a man-made phenomenon? That is what some researchers now suggest. Still, other specialists in cancer and in human fossils have strong doubts about this notion. Cancer is a leading cause of death worldwide, accounting for roughly one in eight of all deaths in 2004, according to the World Health Organization. However, scientists have only found one case of the disease in investigations of hundreds of Egyptian mummies, researcher Rosalie David at the University of Manchester in England said in a statement. The rarity of cancer in mummies suggests it was scarce in antiquity, and “that cancer-causing factors are limited to societies affected by modern industrialization,” researcher Michael Zimmerman at Villanova University in Pennsylvania said in a statement.

“In an ancient society lacking surgical intervention, evidence of cancer should remain in all cases.” Zimmerman was the first to diagnose cancer in an Egyptian mummy by analyzing its tissues on a microscopic level, identifying rectal cancer in an unnamed mummy who had lived in the Dakhleh Oasis during the Ptolemaic period 1,600 to 1,800 years ago. David and Zimmerman also analyzed ancient literature from Egypt and Greece for hints of cancer, as well as medical studies of human and animal remains going back to the age of dinosaurs. They suggested evidence of cancer in animal fossils, non-human primates and early humans was scarce, with a few dozen uncertain examples.

As they analyzed ancient literature, they did not find descriptions of operations for breast and other cancers until the 17th century, and the first reports in the scientific literature of distinctive tumors have only occurred in the past 200 years, such as scrotal cancer in chimney sweepers in 1775, nasal cancer in snuff users in 1761 and Hodgkin’s disease in 1832. One possible reason cancers might have been comparatively rare in antiquity is that the short life span of individuals back then precluded the development of the disease. Still, the researchers did note some people in ancient Egypt and Greece did live long enough to develop such diseases as atherosclerosis, Paget’s disease of bone, and osteoporosis.

David and Zimmerman therefore argue that cancer nowadays is largely caused by man-made environmental factors such as pollution and diet. They detailed their findings in the October issue of the journal Nature Reviews Cancer. “In industrialized societies, cancer is second only to cardiovascular disease as a cause of death, but in ancient times, it was extremely rare,” David said in a statement. “There is nothing in the natural environment that can cause cancer.”

“..Biden has forced all Americans working in China to pick between quitting their jobs and losing American citizenship..”

• Biden Export Controls ‘Wreaking Havoc’ On China’s Chip Industry (ZH)

A Twitter thread translated by Rhodium Group China expert Jordan Schneider provides keen insight into the effects of the Biden administration’s new export controls on the chip industry. To review, the Biden administration last week laid out new rules on chip exports based on US concerns that China will use AI to improve military capabilities, support surveillance for human rights abuses and “disrupt or manufacture outcomes that undermine democratic governance and sow social unrest,” according to Assistant Secretary of Commerce for Export Administration Thea D. Rozman Kendler. The sweeping regulations will curb the sale of semiconductors and chipmaking equipment to its #1 geopolitical rival – which, as Bloomberg puts it, is “sending shockwaves through the $440 billion industry.”

In a Friday Twitter thread which he translated from Hedgehog Computing Group founder Xinran Wang (@lidangzzz), Schneider lays out the carnage in English: “To put it simply, Biden has forced all Americans working in China to pick between quitting their jobs and losing American citizenship,” Schneider writes, adding “One round of sanctions from Biden did more damage than all four years of performative sanctioning under Trump.” Every American executive and engineer working in China’s semiconductor manufacturing industry resigned yesterday, paralyzing Chinese manufacturing overnight.One round of sanctions from Biden did more damage than all four years of performative sanctioning under Trump. — Jordan Schneider (@jordanschnyc) October 14, 2022

Although American semiconductor exporters had to apply for licenses during the Trump years, licenses were approved within a month. With the new Biden sanctions, all American suppliers of IP blocks, components, and services departed overnight —— thus cutting off all service [to China]. Long story short, every advanced node semiconductor company is currently facing comprehensive supply cut-off, resignations from all American staff, and immediate operations paralysis.This is what annihilation looks like: China’s semiconductor manufacturing industry was reduced to zero overnight. Complete collapse. No chance of survival.

That’s a lot of lies.

• Will Comey and Mueller Be Prosecuted for Lies John Durham Uncovered? (ET)

While special counsel John Durham’s prosecution of Steele dossier source Igor Danchenko appears to be headed toward acquittal, Durham has used the trial to make public a number of revelations that cast the entire Trump-Russia collusion narrative in a fresh light. Most prominently, Durham revealed that on Oct. 3, 2016, the FBI had offered dossier author Christopher Steele up to $1 million to provide any information, physical evidence, or documentary evidence that could back up the claims in his dossier. But despite the huge reward on offer, Steele did not provide any such information.Crucially, despite Steele’s failure to back up his dossier, a mere 18 days later the FBI proceeded to obtain a FISA warrant against Trump 2016 presidential campaign adviser Carter Page.

In its application to the FISA court, the FBI used the Steele dossier—specifically, its claim that Page was acting as an agent of Russia—as evidence.Then, after Donald Trump won the presidential election on Nov. 8, 2016, the U.S. intelligence community, which included the FBI, began drafting an intelligence community assessment (ICA) on Russian interference in the election. The ICA was issued in early January 2017, claiming that Russia had helped Trump win the election.The assessment included a summary of the dossier, claiming that it had been partly corroborated. The inclusion of Steele’s dossier in an official U.S. intelligence community product gave the dossier the credibility it had lacked up until that point.

It also gave the media, which had held back from reporting on the dossier between July 2016 and January 2017, the excuse it needed to start doing so. For the next several years, the dossier and its lurid claims became the centerpiece of the media’s campaign against Trump. As Durham has now made public, the inclusion of the dossier in the ICA was based on a lie.Another major revelation exposed by Durham in a pre-trial motion was that Danchenko had been on the FBI’s payroll between March 2017 and October 2020 as a confidential human source (CHS). By bestowing this coveted status on Danchenko, the FBI was able to conceal the existence of Danchenko from congressional and other investigators.

This was crucial, as Danchenko had told FBI investigators in January 2017 that the dossier was based on rumors and gossip made in jest. The admission that the Steele dossier was nothing more than bar talk needed to be concealed if the FBI was to continue its investigation of Trump. Appointing Danchenko as a CHS had another benefit for the FBI. As Danchenko’s handler, FBI agent Kevin Helson, confirmed in court last week, because he was an incoming CHS, Danchenko was directed to scrub his phone. Conveniently, that also meant scrubbing evidence of Danchenko’s alleged lies to the FBI, evidence that Durham now lacks.

“Why, then, wait until the last hearing, especially if the House may flip to GOP control in a matter of weeks?”

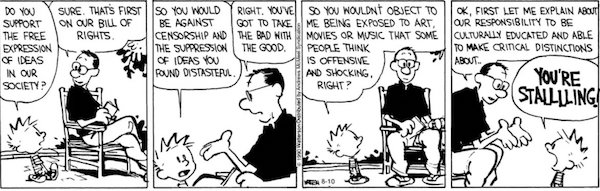

• Why the Jan 6 Committee’s Timing is both Terrible and Telling (Turley)

The Jan. 6 committee had a noble mandate but failed to use it to offer a credible investigation for citizens across the political spectrum. From the first to the final hearing, it presented a one-sided narrative in a tightly scripted, packaged production. No defense or alternative explanations for key events or statements were allowed; witnesses were largely asked specific questions to get them to repeat what they said in previously recorded interviews, as members read from a teleprompter. The committee could have been so much more. It could have followed the type of balanced inquiry that pursued allegations tied to the Pearl Harbor attack or Watergate. Even without Republican-appointed members, it could have insisted on balanced hearings with witnesses and dissenting views.

Nevertheless, the committee revealed important, often disturbing details. It was important for Americans to hear from figures like former attorney general Bill Barr and White House lawyers who struggled to counter unfounded advice given to Trump by outside lawyers on challenging the 2020 election. There were painful scenes of Capitol police overwhelmed at barricades and members of Congress hunkered down in offices. Yet, the focus on a single approved narrative gave the hearings the feel of an infomercial selling a product that most of us bought two years earlier. Subpoenaing Trump on the final scheduled hearing only reaffirmed how the committee was driven by political rather than investigative priorities. Indeed, the timing was embarrassingly transparent.

While Trump could appear without a challenge or the Democrats could retain the House, few experts are predicting either outcome. For more than a year, the committee said its investigation was focused on Trump’s intent and actions. Chairman Bennie Thompson (D-Miss.) explained that the subpoena was essential because “he must be accountable. He is required to answer for his actions on Jan. 6. So we want to hear from him.” Why, then, wait until the last hearing, especially if the House may flip to GOP control in a matter of weeks?

Via Ugo Bardi.

• The Dark Side of Nuclear Fusion (Pepi Cima)

Reading what was written by the scientists who worked in nuclear fusion in the early years of the “atomic age” shows that the development of an energy source for peaceful use, energy “too cheap to meter”, is what motivated them more than anything else. The same arguments were brought forward by Claudio Descalzi, CEO of ENI, a major investor in fusion, addressing the Italian Parliamentary Committee for the Security of the Republic (COPASIR) in a hearing of December 9th 2021: fusion will offer humanity large quantities of energy of a safe, clean and virtually inexhaustible kind.

Wishful thinking: with regard to “inexhaustible,” we cannot do anything in fusion without tritium (an isotope of hydrogen) which is nonexistent on this planet and most of the theoretical predictions, no experiments to date, say that magnetic confinement, the main hope of fusion, will not self-fertilize. Speaking of “clean” energy, Paola Batistoni, head of ENEA’s Fusion Energy Development Division, at reactor shutdown envisages the production of hundreds of thousands of tons of materials unapproachable by humans for hundreds of years. However, the problem I am worried about here is a military problem, mostly ignored, even by COPASIR, the Parliamentary Committee for the Security of the Republic. There are many reasons to worry about nuclear fusion: the huge amount of magnetic energy in the reactor can cause explosions equivalent to hundreds of kilograms of TNT, resulting in the release of tritium, a very radioactive and difficult to contain gas.

On top of it, with the neutrons of nuclear fusion, it is possible to breed fissile materials. But the risks that seem to me most worrisome in the long run will come from new weapons, never seen before. To better understand this issue, let’s review how classical thermonuclear weapons work, the 70-year-old ones. Their exact characteristics are not in the public domain but Wikipedia describes them in sufficient detail. For a more complete introduction, I recommend the highly readable books by Richard Rhodes. There exist today “simple” fission bombs, which use only fissile reactions to generate energy, and “thermonuclear” bombs, which use both fission and fusion for that purpose. Thermonuclear bombs are an example of inertial confinement fusion (ICF), where everything happens so quickly that all the energy is released before the reacting matter has the time to disperse.

Fetus heart

Just another reminder of the fact that the baby in the womb is a patient too!

Healthcare does not kill, rather it heals. pic.twitter.com/7oRnMTpolp— Obianuju Ekeocha (@obianuju) October 16, 2022

Canada GHG

https://twitter.com/i/status/1582068398368096256

Olympic

— illuminatibot (@iluminatibot) October 18, 2022

Free water

This guy is smarter and ask better questions than 90% of VCs and spread sheet worshipping “analysts.”

— Cernovich (@Cernovich) October 17, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.