Jack Delano Colored drivers entrance, U.S. 1, NY Avenue, Washington, DC Jun 1940

It’s funny how things roll at times. When I wrote yesterday’s Making Money While The World Burns, and quoted Hugh Hendry, one of my heroes – well, close, he’s not Ali, but I love the man for his brain -, I hesitated, but thought his words were a great way to start a discussion on what people do when faced with certain conundrums. I certainly never meant to attack Hugh, though words can always be construed to mean things they were not meant to mean.

David Stockman picked up the essay (Jim Kunstler told me to use that word) and retitled it Making Money While The World Burns – The Troubling Case Of Hugh Hendry. Bless David for all the great work he does, and I would never even suggest he shouldn’t add that bit, that’s entirely his prerogative, but I myself would never call Hugh Hendry a ‘troubling case’.

I merely wanted to get a discussion going, and maybe to get people thinking about what they choose and why. Not to judge anyone, who am I to do that, but to get people to ask why they act the way they do, and what it is that makes them tick.

If I would want to judge anyone, it would be the politicians and central bankers who pretend they serve the public and then turn on a dime and screw that same public. Hugh Hendry doesn’t pretend to be anything he’s not. However, I can still ask questions about why he chooses to do what he does, and use that as a mirror, for lack of a better term, to gauge where I stand, what I think, and put that out there for my readers.

But I’m not Hugh Hendry, I’m not a hedge-fund manager, and I don’t morally judge people or tell them what to do and what not. That would be like starting a religion, separating right from wrong for other people, and I have no design on that. I’ll admit I thought about that religion thing in the past, but that was because it seemed the greatest way to get girls, not because I want to tell anyone what to think or do. As things went, I started a band, and that worked just fine, thank you very much.

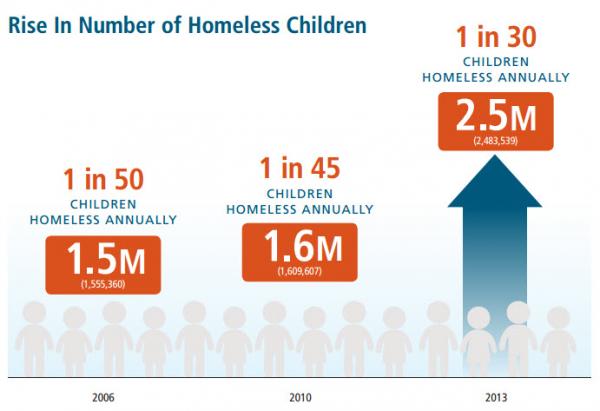

Short story long, Zero Hedge’s Tyler Durden today posted a video and text excerpts of Hugh explaining his mindset, and included snippets of my ‘essay’, saying “Raúl Ilargi Meijer has a different perspective on Hendry’s change of tack”. And I don’t even know that I do. I’m just less focused on the short term, and the potential financial profits involved, than Hugh is. As I said yesterday, I think about the 50% increase in homeless kids in the States and the 50%+ jobless rates in southern Europe, and wonder if that justifies the drive for monetary profits.

But that’s just me. And I find it curious enough that that moral divide is never being breached in all the stuff I read every single day. It seems so obvious to ask that question. But that’s not the same as saying I judge Hugh Hendry, or anyone else, for not bringing it up, let alone living up to any conclusions I draw from it for myself. If there’s anything we need around here, it’s independent minds and neurons, not identical replicas.

So, Hugh talks about how he was a ‘bear’ and saw the error of his ways and is now a bull. But that’s just in as far as his ‘duties’ towards his hedge-fund clients are concerned. It doesn’t say anything about his longer term expectations. Which, I venture, have not changed, but merely been relocated to more remote locations of his – pretty brilliant – mind. And the gist of my question is, I guess, how other people process that short vs longer term divergence, if they are smart enough to see what Hugh does.

What Hugh Hendry implies that he got ‘wrong’ is that a few years ago, he saw, and understood, what was happening, and acted on it. And it’s not that he misunderstood, but that his acting on it did not garner the short-term profits he claims he’s tasked with making – as a fund manager -.

Because the financial system – as Hugh knows – may be screwed three ways to Sunday, but central banks have prevented it from showing its – fatal – injuries, by dressing it in layer upon layer of gauge and band-aids made of and paid for by the real economy’s present and – especially – future wealth and labor.

In the end that means you’re making money off of other people’s misery, be it in the present or the future. And that is a stark choice. In my view. If an economy stops growing, the only profit opportunities left involve taking something away from someone. Obviously, there’s tons of people who’ll swear our economy is still growing, but they’ll find neither yours truly nor Hugh Hendry in their camp.

Here’s Tyler Durden’s piece, with Hugh Hendry video and partial transcript:

Hugh Hendry Live 1: “It Felt Like The Sun Only Rose To Humiliate Me”

In the first of three interviews with MoneyWeek’s Merryn Somerset Webb, Hugh Hendry, manager of the Eclectica Fund, talks about what it takes to be a good hedge fund manager – and how he learned to stop worrying and love central banks. Key excerpts (click link above for full transcript):

MSW: What makes a successful hedge-fund manager and whether you are, under that definition, a successful manager.

Hendry: I think I’ve always answered that question by relating back to the ability to conceive of a contentious posture. I think if I was to quote from Fight Club, I think there’s a famous saying “Would you rather…” my children would say ,“Would you rather upset God or have God just ignore you?” There’s a degree to which being a successful macro-manager is upsetting, not only God, but to the rest of the world, if you will. By being out there with the articulation of qualitatively intelligent argument, which just isn’t shared by the majority. But which can stand the test of time and come to actually define the future. That is what global macro is all about.

With regard to language the notion of ‘bullish’ and ‘bearish’, I think, does an injustice to the complexity of the arguments that are necessary to construct a global macro hedge fund. I think if I had my time again, I would have been saying that we’re actually, perhaps, guilty of the misconstruing of a bull market in equities, for what is actually the ongoing degradation in the soundness of the fiat monetary system. I think that’s what I was trying to say.

MSW: You had given in to a bull market that you had refused to accept previously.

Hendry: The last time I was really angry was late 2010-2011. Where the market, in its wisdom, had yet to configure the changing economic landscape, and it was perceiving that the economy in Europe and elsewhere was recovering. I thought that was just insane, that we weren’t capturing the kind of deflationary zeitgeist that was approaching. I have to say when I look back in the last three years it feels as if the sun only rose each day to humiliate me after that point.[..]

But the mea culpa, that I think is very necessary in that I found myself unable to forgive the Federal Reserve and the other central banks for, if you will, bailing out Wall Street from the excess of 2008. I just couldn’t get over it. I luxuriated in the polemics of Marc Faber and James Grant and Nassim Taleb, in our own country, Albert Edwards, et al. I luxuriated as they ranted and it was fine for them to rant. But I am charged with the responsibility of making money and not being some moral guardian and certainly not a moral curmudgeon. I had to get over that. So again, back to my infamous letter of last year.

That was cathartic for me to say “You know what? I get it.” I think if we’re going to try and explain the qualitative arguments behind why we are more receptive to the notion of not only left tails where markets can fall, but the right-hand tail of the expression, where markets can actually continue to rise if not to accelerate. [..] So I really feel very, very isolated from their view of the world. Arguably, we’re talking about the here and now and the future’s a long time. But in the future, I’m sure our paths can converge once more.

MSW: Why do you think that [macro funds] as whole is failing to make money? What’s going on there?

Hendry: I can reflect on my own difficulties, if you will. What I’ve found is that macro is distinguished, I believe, by superior risk control. It’s almost analogous to a disaster insurance programme. In 2008, all the good macro managers, they made you money. That’s what you pay them for. The world became profoundly unsettling and you cashed in your insurance policy. Today, I question the relevancy of that disaster insurance. In a world where the central banks seem to have your back, seem to be underwriting risks and global asset prices, do you require that intense scrutiny of risk?

MSW: So your basic point here is that if the central banks have your back, there’s no need to have the same kind of risk controls that you used to have.

Hendry: There is less need. Less need. I tell you, I was at a conference with some of the great and the good global macro managers in September in New York and I asked them all the question, “If the S&P is down 12% what do you do? Are you selling more or are you buying?” Guess what? They’re all buying. So the central banks have created a behavioural tic which is becoming self-reinforcing and I believe we saw another manifestation of that behaviour in October.

But Raúl Ilargi Meijer has a different perspective on Hendry’s change of tack…

Hendry, I think, is as bearish (or negative) about the – future of the – world as he has been for a long time, only he’s decided to see things from his fund manager point of view, and to ride the crest of the waves the central banks have tsunamied towards our shores. He’s chosen to make a buck off of them waves, even as he’s aware of the damage they’ll will do once they hit land. In the exact same way as a surfer who sees a tsunami as merely a set of great waves to ride on. And, no value judgment involved, but that’s not what I see.

He sees the world going to hell in a handbasket (and Hendry recognizes that very much, that’s not why he shifted gears from bear to bull) and his response is to grab as much money and wealth as he can (for his investors … ). [..]

Hugh Hendry sees the world in an extremely bearish way, he sees hell, the handbasket, brimstone and far worse. But he wants to profit – in name of his investors (?!) – from the very mechanism that drives the world there: the power central banks and governments have been allotted, and the way they use it to protect the interests of investors, banks, insurance companies and uber rich individuals, all at the expense of booting the 90% who make up the real world and the real economy, ever deeper into the mud.

Seeking to profit from that is a choice. Hendry makes it, and so do many others, even many inside the 90%. Who mistakenly dream they’ll be able to hold on to those profits (they’ll wake up yet, and wish they had before). The whole idea of scraping out what you can before the tsunami hits is not my thing.

I don’t think Hugh Hendry and I see the world through hugely different eyes at all. It’s just that since I don’t have uber rich clients I tell myself I need to make even richer, I have the liberty to wonder what Hendry’s choices mean for the bottom layers of society. And yes, I also think that societies cease to function if the poor get too poor. Not very Hobbesian or Darwinian, am I?

By all means, let’s keep the conversation going, and let everyone decide for him-her-self where (s)he stands. Hugh Hendry thinks in money terms, and I tend to feel that’s a waste of a brilliant mind. But that’s not a judgment. It’s merely a question. And a pretty well defined one at that: Is a brilliant mind better engaged making money for the rich or trying to alleviate the sorrows of the poor? I can’t answer that for you.