Edward Hopper Approaching a city 1946

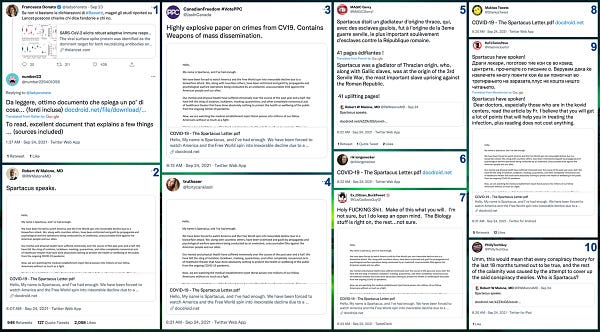

On September 26, 2021, I posted the Spartacus letter in its entirety, because I thought it was too good to “disappear” in our daily news aggregator, Debt Rattle. This turned out to be a good decision, since the letter vanished from its original server soon afterward. But it was -and is- still here. Zero Hedge reposted my repost, and things went off from there, generating some 200,000 views here and 1.85 million at Zero Hedge. Plus who knows how many at other places.

The Spartacus collective -we now know they are indeed a group- returned a few days ago with an update letter, now on Substack. That is probably a safer place then their original Docdroid site, but I’ll repost this one as well. Nice to see they are aware of the Automatic Earth’s role in garnering attention for the first letter. My pleasure. You guys are very good.

Note: the original, COVID-19: A Web of Corruption, is here.

Foreword

My name is Spartacus, and I ve had enough.

I am one of the authors of the Spartacus Letter, a document that took the world by storm in September of 2021.

To date, four versions of the letter have been published, and all four can be viewed here:

We shared this document with numerous news outlets and sent it directly to Dr. Robert Malone, who linked it on his Twitter account. From there, it was reposted on the Automatic Earth blog, and then, on ZeroHedge, where it garnered over a million hits.

It was quickly decried as misinformation both by freelance analysts on Twitter, and by fact-checkers:

The “Spartacus” COVID disinfo document first appeared on docdroid(dot)com on Sept 24 2021. The first Twitter account to share it was a small Italian-language account, @number229401056. The second was @RWMaloneMD, whose tweet linking the letter was retweeted nearly 1000 times.

If you perform a Google search for the Spartacus Letter, Google s algorithm prioritizes one result above all others: a fact-check by Newswise debunking it, which, unsurprisingly, 77% of visitors to the page disagree with.

Is this the case? Could ICENI, with a fully-sourced document with over 600 citations that lays out an extensive argument regarding the nature and origins of COVID-19, have been intending to deliberately mislead the public, as our detractors state?

Perhaps we were not explicit enough.

SARS-CoV-2 is manmade. It was produced at the Wuhan Institute of Virology with US Government funding. It is the lynchpin of a plan by ruthless elites to take over the entire world. There is enough circumstantial evidence that, if taken together, implicates numerous government officials and scientists in this plot.

The people involved could be charged with crimes against humanity for their complicity in this, but if they were, it would bring the entire system crashing down around our ears simply due to the sheer number of the guilty and the loftiness of their offices.

There is no way to sugarcoat any of this. If people remain ignorant of the nature of COVID-19 and the events leading up to the present, then the petty tyrants stripping us of our civil liberties will win.

What follows will be something of a recapitulation of the Spartacus Letter, in great detail, with numerous hyperlinks and small blocks of quoted material and images within fair use limitations, for the sake of commentary and criticism of public figures.

What is COVID-19?

COVID-19 is the disease caused by SARS-CoV-2, a close relative of SARS-CoV, the causative agent of Severe Acute Respiratory Syndrome, also known as SARS. SARS-CoV-2 is a coronavirus of the betacoronavirus genus, which it shares with SARS-CoV and MERS-CoV.

The healthcare establishment and the media have misrepresented COVID-19 as a lower respiratory disease, as a form of pneumonia. They have done so consistently for the past two years.

This time, Cavuto said he had a “far, far more serious strand” because his “very compromised immune system” simply hasn’t benefited in the same way from the vaccines as those with healthy immune systems.

Cavuto said that his most recent case of Covid-19 had led to pneumonia and landed him “in intensive care for quite a while.”

While it is certainly true that COVID-19 can cause pneumonia, it would be inaccurate to describe COVID-19 as a pneumonia per se. Due to the significant expression of ACE2 in vascular endothelial cells and pericytes as part of the Renin-Angiotensin-Aldosterone System (RAAS), SARS-CoV-2 preferentially attacks the lining of blood vessels and small capillaries, severely inflaming them, leading to sepsis, capillary leak, pulmonary edema, and yes, pneumonia.

However, therein lies the crucial distinction: SARS-CoV-2 injures the lungs by infecting the blood vessels that supply the alveoli and triggering sepsis and ARDS. It would be more accurate, therefore, to describe COVID-19 not as a pneumonia, but as a disease of the circulatory system.

This has been known since April of 2020, when University Hospital Zurich proclaimed that COVID-19 was, in actuality, a vascular endotheliitis.

During analyses of tissue samples taken from deceased COVID-19 patients taken following an autopsy, pathologists at University Hospital Zurich have now discovered that patients are not just suffering from an inflammation of the lungs, but also from an inflammation of all endothelial tissue in a wide range of organs. In addition, pathologist Prof. Zsuzsanna Varga has been able to use an electron microscope to verify for the first time that SARS-CoV-2 is present and causes cell necrosis in endothelial tissue.

The nature of COVID-19 as a vascular endotheliitis is now well-established in the primary literature.

The Lancet – Endothelial cell infection and endotheliitis in COVID-19

Post-mortem analysis of the transplanted kidney by electron microscopy revealed viral inclusion structures in endothelial cells (figure A, B). In histological analyses, we found an accumulation of inflammatory cells associated with endothelium, as well as apoptotic bodies, in the heart, the small bowel (figure C) and lung (figure D). An accumulation of mononuclear cells was found in the lung, and most small lung vessels appeared congested.

European Heart Journal – COVID-19 is, in the end, an endothelial disease

Inflammatory activation of endothelial cells can disrupt VE-cadherin largely responsible for the integrity of the endothelial barrier function.62 Activated endothelial cells can also express matrix metalloproteinases that can degrade the basement membrane and further interrupt endothelial barrier function. In small vessels, such as those that embrace alveoli in the lung, this impaired barrier function can lead to capillary leak.

What these papers are essentially describing is endothelial dysfunction and endothelial injury in the context of acute sepsis. Researchers have stated that severe COVID-19 is a form of sepsis. Why is this important? Because it has serious implications for how COVID-19 may be successfully treated. It also explains why many current treatments fail to rescue critically-ill patients.

Acute sepsis does a number of terrible things to the circulatory system and vital organs. One thing it does is severely disrupt the balance of oxidation and reduction reactions in the body.

Redox Report – Sepsis, oxidative stress, and hypoxia: Are there clues to better treatment?

Sepsis is a clinical syndrome characterized by systemic inflammation, usually in response to infection. The signs and symptoms are very similar to Systemic Inflammatory Response Syndrome (SIRS), which typically occur consequent to trauma and auto-immune diseases. Common treatments of sepsis include administration of antibiotics and oxygen. Oxygen is administered due to ischemia in tissues, which results in the production of free radicals. Poor utilization of oxygen by the mitochondrial electron transport chain can increase oxidative stress during ischemia and exacerbate the severity and outcome in septic patients. This course of treatment virtually mimics the conditions seen in ischemia reperfusion disorders. Therefore, this review proposes that the mechanism of free radical production seen in sepsis and SIRS is identical to the oxidative stress seen in ischemia reperfusion injury. Specifically, this is due to a biochemical mechanism within the mitochondria where the oxidation of succinate to fumarate by succinate dehydrogenase (complex II) is reversed in sepsis (hypoxia), leading to succinate accumulation. Oxygen administration (equivalent to reperfusion) rapidly oxidizes the accumulated succinate, leading to the generation of large amounts of superoxide radical and other free radical species. Organ damage possibly leading to multi-organ failure could result from this oxidative burst seen in sepsis and SIRS. Accordingly, we postulate that temporal administration with anti-oxidants targeting the mitochondria and/or succinate dehydrogenase inhibitors could be beneficial in sepsis and SIRS patients.

Another thing it does is promote endothelial dysfunction.

Sepsis produces endothelial dysfunction, forcing a pro-adhesive, procoagulant and antifibrinolytic state in endothelial cells, thus altering the hemostasis, leucocyte trafficking, inflammation, barrier function and microcirculation [23].

We know this is occurring in COVID-19, because COVID-19 sufferers have elevated levels of both inflammatory cytokines such as TNF-a and IL-6, and oxidative and nitrosative stress biomarkers such as nitrotyrosine, coupled with low nitric oxide bioavailability. This has led some to hypothesize that, ultimately, severe COVID-19 is death by neutrophilia .

Multi-system involvement and rapid clinical deterioration are hallmarks of coronavirus disease 2019 (COVID-19) related mortality. The unique clinical phenomena in severe COVID-19 can be perplexing, and they include disproportionately severe hypoxemia relative to lung alveolar-parenchymal pathology and rapid clinical deterioration, with poor response to O2 supplementation, despite preserved lung mechanics. Factors such as microvascular injury, thromboembolism, pulmonary hypertension, and alteration in hemoglobin structure and function could play important roles. Overwhelming immune response associated with cytokine storms could activate reactive oxygen species (ROS), which may result in consumption of nitric oxide (NO), a critical vasodilation regulator. In other inflammatory infections, activated neutrophils are known to release myeloperoxidase (MPO) in a natural immune response, which contributes to production of hypochlorous acid (HOCl). However, during overwhelming inflammation, HOCl competes with O2 at heme binding sites, decreasing O2 saturation. Moreover, HOCl contributes to several oxidative reactions, including hemoglobin-heme iron oxidation, heme destruction, and subsequent release of free iron, which mediates toxic tissue injury through additional generation of ROS and NO consumption. Connecting these reactions in a multi-hit model can explain generalized tissue damage, vasoconstriction, severe hypoxia, and precipitous clinical deterioration in critically ill COVID-19 patients. Understanding these mechanisms is critical to develop therapeutic strategies to combat COVID-19.

This is also known as respiratory burst, or neutrophil degranulation, or, in extreme cases, neutrophil extracellular trap formation:

Neutrophils use enzymes such as superoxide dismutase (SOD) and myeloperoxidase (MPO) to produce hydrogen peroxide and hypochlorous acid (peroxide and bleach, essentially) in order to destroy bacteria and other pathogens by attacking their membranes with powerful oxidants.

Normally, our cells, which are made of essentially the same stuff as bacteria, survive this by using powerful antioxidant enzymes such as glutathione peroxidase (GPX) to break down hydrogen peroxide into water and reduce harmful lipid hydroperoxides to their corresponding alcohols.

ScienceDirect – Glutathione Peroxidase

Unfortunately, this virus has a very nasty trick up its sleeve. SARS-CoV-2 can directly inhibit the Nrf2 pathway, blocking endogenous antioxidant enzymes from functioning correctly.

To identify host factors or pathways important in the control of SARS-CoV2 infection, publicly available transcriptome data sets including transcriptome analysis of lung biopsies from COVID-19 patients were analyzed using differential expression analysis14. Here, genes linked with inflammatory and antiviral pathways, including RIG-I receptor and Toll-like receptor signaling, were enriched in COVID-19 patient samples, whereas genes associated with the NRF2 dependent antioxidant response were suppressed in the same patients (Fig. 1a c). That NRF2-induced genes are repressed during SARS-CoV2 infections was supported by reanalysis of another data-set building on transcriptome analysis of lung autopsies obtained from five individual COVID-19 patients (Desai et al.15) (Fig. 1d). Furthermore, that the NRF2-pathway is repressed during infection with SARS-CoV2 was supported by in vitro experiments where the expression of NRF2-inducible proteins Heme Oxygenase 1 (HO-1) and NAD(P)H quinone oxydoreducatse 1 (NqO1) was repressed in SARS-CoV2 infected Vero hTMPRSS2 cells while the expression of canonical antiviral transcription factors such as STAT1 and IRF3 were unaffected (Supplementary Fig. 1). These data indicate that SARS-CoV2 targets the NRF2 antioxidant pathway and thus suggests that the NRF2 pathway restricts SARS-CoV2 replication.

The Nrf2 pathway directly regulates the function of glutathione peroxidase.

Nuclear factor-erythroid 2 p45-related factor 2 (Nrf2) is the primary transcription factor protecting cells from oxidative stress by regulating cytoprotective genes, including the antioxidant glutathione (GSH) pathway. GSH maintains cellular redox status and affects redox signaling, cell proliferation, and death. GSH homeostasis is regulated by de novo synthesis as well as GSH redox state; previous studies have demonstrated that Nrf2 regulates GSH homeostasis by affecting de novo synthesis.

This is, of course, why severely ill COVID-19 patients are noted to have glutathione deficiencies.

Humanity is battling a respiratory pandemic pneumonia named COVID-19 which has resulted in millions of hospitalizations and deaths. COVID-19 exacerbations occur in waves that continually challenge healthcare systems globally. Therefore, there is an urgent need to understand all mechanisms by which COVID-19 results in health deterioration to facilitate the development of protective strategies. Oxidative stress (OxS) is a harmful condition caused by excess reactive-oxygen species (ROS) and is normally neutralized by antioxidants among which Glutathione (GSH) is the most abundant. GSH deficiency results in amplified OxS due to compromised antioxidant defenses. Because little is known about GSH or OxS in COVID-19 infection, we measured GSH, TBARS (a marker of OxS) and F2-isoprostane (marker of oxidant damage) concentrations in 60 adult patients hospitalized with COVID-19. Compared to uninfected controls, COVID-19 patients of all age groups had severe GSH deficiency, increased OxS and elevated oxidant damage which worsened with advancing age. These defects were also present in younger age groups, where they do not normally occur. Because GlyNAC (combination of glycine and N-acetylcysteine) supplementation has been shown in clinical trials to rapidly improve GSH deficiency, OxS and oxidant damage, GlyNAC supplementation has implications for combating these defects in COVID-19 infected patients and warrants urgent investigation.

Glutathione deficiencies, endothelial dysfunction, and chronic oxidative stress all point essentially to the same thing: untreated chronic malnutrition brought on by consumption of an energy-rich, micronutrient-poor diet. This is also known as Metabolic Syndrome, and has a close association with endothelial dysfunction and, indeed, premature aging of the blood vessels. It is, of course, why COVID-19 causes more severe illness in those with diabetes, high blood pressure, obesity, and old age. All of these conditions involve pre-existing endothelial dysfunction that renders one more vulnerable to sepsis.

There is, in fact, a close association between the severity of COVID-19 and the quality of one s diet.

BMJ – Diet quality and risk and severity of COVID-19: a prospective cohort study

Over 3 886 274 person-months of follow-up, 31 815 COVID-19 cases were documented. Compared with individuals in the lowest quartile of the diet score, high diet quality was associated with lower risk of COVID-19 (HR 0.91; 95% CI 0.88 to 0.94) and severe COVID-19 (HR 0.59; 95% CI 0.47 to 0.74). The joint association of low diet quality and increased deprivation on COVID-19 risk was higher than the sum of the risk associated with each factor alone (Pinteraction=0.005). The corresponding absolute excess rate per 10 000 person/months for lowest vs highest quartile of diet score was 22.5 (95% CI 18.8 to 26.3) among persons living in areas with low deprivation and 40.8 (95% CI 31.7 to 49.8) among persons living in areas with high deprivation.

It is plausible, though not conclusively proven, that COVID-19 could be warded off by simple changes to diet and exercise habits, especially the inclusion of antioxidant-rich foods high in Vitamin D, cysteine, dietary nitrate, and selenium in one s diet.

Rather than suggesting that people eat better and go on jogs, the authorities have spent the past two years locking people down, which has made them both more obese and more vulnerable to the virus.

A total of 26 studies met inclusion criteria (n = 3399, 85.7% female). The pooled prevalence of symptomatic deterioration in EDs was 65% (95% CI[48,81], k = 10). The pooled prevalence of increased weight in obesity was 52% (95% CI[25,78], k = 4). More than half of the participants experienced depression and anxiety. Moreover, at least 75% of the individuals with EDs reported shape and eating concerns, and increased thinking about exercising.

What is actually happening in COVID-19 that causes all this oxidative damage? First, superoxide reacts with nitric oxide to form peroxynitrite, a damaging nitrogen radical. Then, peroxynitrite reacts with tetrahydrobiopterin in endothelial nitric oxide synthase, leading to those enzymes becoming uncoupled , which makes them recursively produce superoxide in a damaging biological feedback loop. Dr. Martin L. Pall refers to this phenomenon by the moniker NO/ONOO- Disease .

The NO/ONOO-cycle is a primarily local, biochemical vicious cycle mechanism, centered on elevated peroxynitrite and oxidative stress, but also involving 10 additional elements: NF-∫B, inflammatory cytokines, iNOS, nitric oxide (NO), superoxide, mitochondrial dysfunction (lowered energy charge, ATP), NMDA activity, intracellular Ca2+, TRP receptors and tetrahydrobiopterin depletion. All 12 of these elements have causal roles in heart failure (HF) and each is linked through a total of 87 studies to specific correlates of HF. Two apparent causal factors of HF, RhoA and endothelin-1, each act as tissue-limited cycle elements. Nineteen stressors that initiate cases of HF, each act to raise multiple cycle elements, potentially initiating the cycle in this way. Different types of HF, left vs. right ventricular HF, with or without arrhythmia, etc., may differ from one another in the regions of the myocardium most impacted by the cycle. None of the elements of the cycle or the mechanisms linking them are original, but they collectively produce the robust nature of the NO/ONOO-cycle which creates a major challenge for treatment of HF or other proposed NO/ONOO-cycle diseases. Elevated peroxynitrite/NO ratio and consequent oxidative stress are essential to both HF and the NO/ONOO-cycle.

As nitric oxide levels decrease and superoxide predominates (a textbook phenomenon in endothelial dysfunction), superoxide dismutase makes hydrogen peroxide, and then myeloperoxidase makes hypochlorous acid. Hypochlorous acid strips iron from heme. Then, free unliganded iron, hydrogen peroxide, and superoxide react in the Haber-Weiss and Fenton reactions to form damaging hydroxyl radicals.

It is difficult for most people to comprehend just how damaging hydroxyl radicals can be. Hydroxyl radicals occur naturally in the upper atmosphere, where they destroy pollutants. When they occur in the body, they oxidize lipids and DNA instantaneously, within nanoseconds, and no enzyme exists that can detoxify them. Hydroxyl radicals are often produced on purpose with hydrogen peroxide and iron catalyst in hydroxyl generators to create a powerful oxidant concoction that decontaminates and bleaches wastewater streams and HVAC systems by rapidly destroying biological material.

How fast?

That fast.

Why are COVID-19 patients dying in droves when they re intubated, with mortality from mechanical ventilation approaching 97% in some cases? It s because intubation mimics the physiology of ischemia-reperfusion injury. Under the acute sepsis triggered by COVID-19, cells experience hypoxia. They become stressed and switch to anaerobic metabolism and glycolysis to make ATP as a desperate last resort. Then, these cells are suddenly fed with O2 by a ventilator, which causes them to switch back to aerobic metabolism. As this happens, hypoxanthine and succinate breakdown produces superoxide radicals in very large amounts.

Superoxide is a precursor to many other types of radicals, as described above. There s even a name for it; the kindling radical/bonfire hypothesis .

Many diseases and drug-induced complications are associated with or even caused by an imbalance between the formation of reactive oxygen and nitrogen species (RONS) and antioxidant enzymes catalyzing the breakdown of these harmful oxidants. According to the kindling radical hypothesis, initial formation of RONS may trigger the activation of additional sources of RONS in certain pathological conditions.

This process of ROS release greatly accelerates the damage caused by the virus, promoting lipid peroxidation and the formation of damage-associated molecular patterns and oxidation-specific epitopes. The DAMPs summon more neutrophils by their interaction with PRRs, which release more damaging enzymes. The OSEs cause the body to form autoantibodies against oxidized lipids, somewhat similar to some aspects of the pathophysiology of Lupus.

Oxidation reactions are vital parts of metabolism and signal transduction. However, they also produce reactive oxygen species, which damage lipids, proteins and DNA, generating oxidation-specific epitopes. In this review, we will discuss the hypothesis that such common oxidation-specific epitopes are a major target of innate immunity, recognized by a variety of pattern recognition receptors (PRRs). By analogy with microbial pathogen associated molecular patterns (PAMPs), we postulate that host-derived, oxidation-specific epitopes can be considered to represent danger (or damage) associated molecular patterns (DAMPs). We also argue that oxidation-specific epitopes present on apoptotic cells and their cellular debris provided the primary evolutionary pressure for the selection of such PRRs. Further, because many PAMPs on microbes share molecular identity and/or mimicry with oxidation-specific epitopes, such PAMPs provided a strong secondary selecting pressure for the same set of oxidation-specific PRRs as well.

This severe oxidative stress promotes steroid insensitivity. Suddenly, the corticosteroids stop working and the patient experiences inflammatory rebound.

Antioxidants – Oxidative Stress Promotes Corticosteroid Insensitivity in Asthma and COPD

Reactive oxygen and nitrogen species (RONS) promote corticosteroid insensitivity by disrupting glucocorticoid receptor (GR) signaling, leading to the sustained activation of pro-inflammatory pathways in immune and airway structural cells.

Elsevier – Steroid resistance and rebound phenomena in patients with COVID-19

A total of 319 COVID-19 patients were admitted to our hospital and 113 patients met inclusion criteria. The success group had 83 patients (73.5%), the rebound group had nine patients (8.0%), and the refractory group had 21 patients (18.6%). Compared with the success group, the rebound group received corticosteroids earlier, for a shorter duration, and stopped them sooner. The median time from symptom onset to rebound was 12 days. There was no rebound after 20 days. Compared with the success group, the hazard ratio for the number of days from corticosteroid onset to an improvement of two points on a seven-point ordinal scale was 0.29 (95% confidence interval [CI], 0.14 0.60, P < .001) for the rebound group versus 0.13 (95% CI, 0.07 0.25, P < .001) for the refractory group.

Antivirals such as Remdesivir, Kaletra, Ivermectin, and Hydroxychloroquine do nothing to stop this, because by the time someone is in the ER complaining of severe COVID-19 symptoms (which are actually acute sepsis brought on by a deranged, overreacting innate immune system), the virus is already gone.

Similarly to IAV infection, the highest viral load and infectivity for SARS-CoV-2 are observed +/”1 day around the day of symptom onset [15]. Both the amount of infectious virus as well as the amount of viral RNA as measured by qRT-PCR decrease rapidly thereafter. Accordingly, the number of cells within the patient s respiratory tract that are newly infected with SARS-CoV-2 declines sharply within a few days of disease onset. It is now well accepted that immunopathology plays a key role in severe COVID-19 [16]. Accordingly, treatment with corticosteroids, such as dexamethasone, improves survival in critically ill COVID-19 patients in the later stages of the disease [17].

Ultimately, the afflicted cells begin dying of ferroptosis and parthanatos.

PubMed – Ferroptosis: mechanisms, biology, and role in disease

As GPX4 is the major PLOOH-neutralizing enzyme, a general mechanism underlying erastin/RSL3-induced ferroptosis emerged: both compounds inactivate GPX4 RSL3 does so directly, and erastin does so indirectly by inhibiting cystine import, thus depriving cells of cysteine, an essential cellular antioxidant and a building block of GSH. Consequently, PLOOHs accumulate, possibly causing rapid and unrepairable damage of plasma membrane, leading to cell death (Fig. 2A). Conceptually, these findings establish ferroptosis as a cell death modality with mechanisms distinct from other known death processes. The pharmacological and genetic tools developed herein enable, and have become indispensable for, ferroptosis research.

PubMed – Parthanatos: mitochondrial-linked mechanisms and therapeutic opportunities

In the context of the CNS, which is highlighted in this review to illustrate PARP-1-mediated cell death mechanisms that are shared in most cases by non-neuronal systems, stimuli that induce pathological activation of PARP-1 in in vitro and in vivo studies include oxidative stress by reactive oxygen species (ROS), such as hydrogen peroxide (H2O2) or hydroxyl radical, nitrosative stress from NO or peroxynitrite (ONOO”), inflammation, ischaemia (or ischaemic reperfusion), hypoxia, hypoglycaemia and DNA-alkylating agents, such as N-methyl-N -nitro-N-nitrosoguanidine (MNNG).

That, in a nutshell, is the central pathophysiology of COVID-19. The virus has many other aspects. It can promote hypercoagulability and attack numerous vital organs throughout the body, including the brain, olfactory system, gastrointestinal system, pancreas, kidneys, liver, and even fat cells. However, all of these things occur in the context of acute sepsis and endothelial injury.

In short, COVID-19 is not the disease people have been told it is, and, as per ostracized physicians such as Dr. Peter McCullough, Dr. Paul E. Marik, and Dr. Vladimir Zelenko, it is not being treated correctly.

The medical establishment has shunned those pushing for time-sensitive early outpatient treatment of COVID-19 sepsis. The standard of care for COVID-19 is to send people home without a prescription for anything; no antivirals, no antioxidants. Either their infection resolves without incident, or they get sicker, come back, and are intubated and proned, their diaphragm paralyzed with drugs so they can t fight the ventilator, a drip of steroids running into their arm.

This is state-sponsored medical murder.

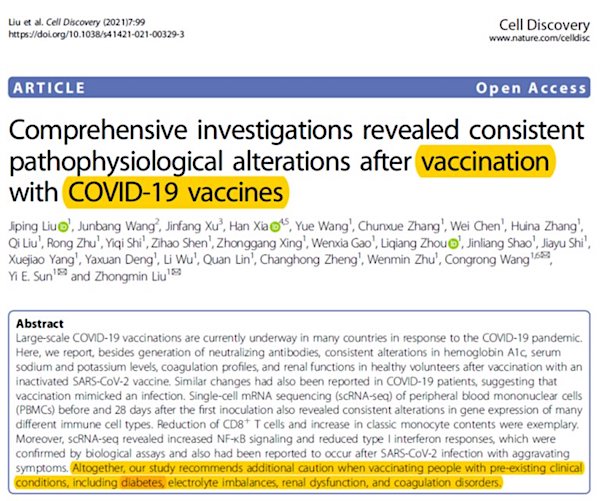

Why don t people want the vaccines?

Because they are extremely fishy even at first glance. That s why.

Even people with no knowledge of the background of all of this are deeply suspicious of the speed with which these vaccines were fast-tracked, as well as the authorities insistence on people taking them, on pain of job loss, being banned from travel, and essentially being evicted from society.

In absolute terms, COVID-19 is not even particularly lethal. The infection fatality rate for those under age 50 with no comorbidities is very low. In that context, the authorities panicked response and open hostility doesn t seem to make any sense at all.

The mRNA and viral vector vaccines for COVID-19 work essentially by using human cells as a bioreactor, delivering genetic material into cells to get them to express a modified form of SARS-CoV-2 Spike as a vaccine antigen. They do not contain whole virus, nor do they stimulate an antibody response against every structural protein of SARS-CoV-2.

It sounds almost elegant. Any virus could, conceivably, have a tailor-made vaccine produced against it in a matter of days by plugging the gene sequence for its structural proteins in and making a lipid nanoparticle or viral vector containing that genetic material.

Just one problem. It causes severe and life-threatening side effects.

Although significant weight loss and higher serum cytokine/chemokine levels were found in IM group at 1 2 days post-injection (dpi), only IV group developed histopathological changes of myopericarditis as evidenced by cardiomyocyte degeneration, apoptosis, and necrosis with adjacent inflammatory cell infiltration and calcific deposits on visceral pericardium, although evidence of coronary artery or other cardiac pathologies was absent. Serum troponin level was significantly higher in IV group. Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) spike antigen expression by immunostaining was occasionally found in infiltrating immune cells of the heart or injection site, in cardiomyocytes and intracardiac vascular endothelial cells, but not skeletal myocytes. The histological changes of myopericarditis after the first IV-priming dose persisted for 2 weeks and were markedly aggravated by a second IM- or IV-booster dose. Cardiac tissue mRNA expression of interleukin (IL)-1≤, interferon (IFN)-≤, IL-6, and tumor necrosis factor (TNF)-± increased significantly from 1 dpi to 2 dpi in the IV group but not the IM group, compatible with presence of myopericarditis in the IV group. Ballooning degeneration of hepatocytes was consistently found in the IV group. All other organs appeared normal.

Steve Kirsch, a vocal opponent of the vaccine mandates, has written on Substack about this very topic, as well as attorney Thomas Renz s leaked DMED data, which the DOD have been trying desperately to cover up.

The post-infection of COVID-19 includes a myriad of neurologic symptoms including neurodegeneration. Protein aggregation in brain can be considered as one of the important reasons behind the neurodegeneration. SARS-CoV-2 Spike S1 protein receptor binding domain (SARS-CoV-2 S1 RBD) binds to heparin and heparin binding proteins. Moreover, heparin binding accelerates the aggregation of the pathological amyloid proteins present in the brain. In this paper, we have shown that the SARS-CoV-2 S1 RBD binds to a number of aggregation-prone, heparin binding proteins including A≤, ±-synuclein, tau, prion, and TDP-43 RRM. These interactions suggests that the heparin-binding site on the S1 protein might assist the binding of amyloid proteins to the viral surface and thus could initiate aggregation of these proteins and finally leads to neurodegeneration in brain. The results will help us to prevent future outcomes of neurodegeneration by targeting this binding and aggregation process.

SARS CoV 2 Spike Impairs DNA Damage Repair and Inhibits V(D)J Recombination In Vitro

Severe acute respiratory syndrome coronavirus 2 (SARS CoV 2) has led to the coronavirus disease 2019 (COVID 19) pandemic, severely affecting public health and the global economy. Adaptive immunity plays a crucial role in fighting against SARS CoV 2 infection and directly influences the clinical outcomes of patients. Clinical studies have indicated that patients with severe COVID 19 exhibit delayed and weak adaptive immune responses; however, the mechanism by which SARS CoV 2 impedes adaptive immunity remains unclear. Here, by using an in vitro cell line, we report that the SARS CoV 2 spike protein significantly inhibits DNA damage repair, which is required for effective V(D)J recombination in adaptive immunity. Mechanistically, we found that the spike protein localizes in the nucleus and inhibits DNA damage repair by impeding key DNA repair protein BRCA1 and 53BP1 recruitment to the damage site. Our findings reveal a potential molecular mechanism by which the spike protein might impede adaptive immunity and underscore the potential side effects of full-length spike-based vaccines.

Under no circumstances should people be compelled to take these experimental and highly harmful vaccines, period.

If that were all there was to this story, one could employ Hanlon s razor and chalk this all up as a series of very unfortunate medical blunders and not the bloodthirsty malice and contempt towards the public that it truly is.

However, this isn t even the half of it.

Those who dig deeper encounter a horror story of biblical proportions, involving private-public collusion, government malfeasance, and national security skullduggery at the highest levels.

Where did the virus come from?

Since the 2000s, DARPA has greatly expanded their biodefense portfolio. A fellow named Michael Callahan was involved in this work, among many others. His job was to study old Soviet biowarfare sites like the Vector Institute, looking for technologies that could be patented and commercialized.

Unlimited Hangout – DARPA s Man in Wuhan

Callahan s nose for business came into play early on in the pandemic. After studying data from over 6,000 patient records from Wuhan, he reportedly detected a pattern that could point to a possible treatment using a low-cost and widely available ingredient of an over-the-counter histamine-2 receptor antagonist called Famotidine , more commonly known as the brand name Pepcid.

As an aside, Famotidine is not just an antihistamine. It is also a powerful antioxidant that interrupts the Fenton reaction, which, if one understands the pathophysiology of COVID-19, means that Pepcid makes perfect sense as a therapeutic agent.

In 2010/2011, NIH, DARPA, and DTRA may have discovered a cure for almost all pandemic viruses, but rejected it, despite evidence of its efficacy in a murine model. It was called DRACO, or Double-Stranded RNA Activated Caspase Oligomerizer, and it was developed by an MIT scientist by the name of Todd Rider. It is a recombinant fusion protein that kills virally-infected cells by ordering them to undergo apoptosis if it detects viral dsRNA. In mouse experiments, it was shown to protect mice from influenza.

PLOS One – Broad-Spectrum Antiviral Therapeutics

Funding: This work is funded by grant AI057159 (http://www.niaid.nih.gov/Pages/default.aspx) from the National Institute of Allergy and Infectious Diseases and the New England Regional Center of Excellence for Biodefense and Emerging Infectious Diseases, with previous funding from the Defense Advanced Research Projects Agency, Defense Threat Reduction Agency, and Director of Defense Research & Engineering. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript. Opinions, interpretations, conclusions, and recommendations are those of the authors and are not necessarily endorsed by the United States government.

In the end, Dr. Rider had to resort to crowdfunding campaigns to continue his research. Unfortunately, these campaigns failed.

MEET TODD RIDER, THE MAN WHO MAYBE, PROBABLY CURED MOST OF THE VIRUSES ON EARTH

Modest amounts of funding from the National Institutes of Health have enabled the previous proof-of-concept experiments in cells and mice, but that funding grant is now over. Major pharmaceutical companies have the resources and expertise to carry new drugs like DRACO through the manufacturing scale-up, large-scale animal trials, and human trials required for FDA approval. However, before committing any of their own money, those companies want to see that DRACOs have already been shown to be effective against major clinically relevant viruses (such as members of the herpesvirus family), not just the proof-of-concept viruses (such as rhinovirus) that were previously funded by NIH. Thus the Valley of Death is the financial and experimental gap between the previously funded NIH proof-of-concept experiments and the threshold for convincing major pharmaceutical companies to advance DRACOs toward human trials.

However, I digress. Ever since the 2002/2003 SARS outbreak, there has been significant interest in SARS-CoV among virologists, including gain-of-function manipulation of SARS virions in the laboratory environment.

The usual stated purpose of gain-of-function research is to get ahead of pandemics by producing a human-adapted pathogen and preemptively vaccinating against it.

Potential Risks and Benefits of Gain-of-Function Research: Summary of a Workshop – Part 4

In the long-term it may also allow the generation of information that is not obtainable through other methods, but whether all the long-term benefits envisioned for GoF research will actually be realized is still unclear. Vaccine producers in particular disagree on whether GoF methods are essential for vaccine development, so the contributions of GoF research to vaccine development need careful evaluation. Increasing reliance on gene sequences to predict phenotypes may increase GoF research’s importance over time. As was clear from the presentations in Session 4 of the symposium, there is wide recognition that it is not yet possible to predict phenotype from genotype, but Dr. Philip Dormitzer, from Novartis Vaccines and a member of the symposium planning committee, noted that as more genotype-phenotype linkages are established, it may enable keeping certain viral characteristics out of vaccine strains.

Some scientists base their entire careers on this research, obtaining grant money from various institutions, including military think-tanks, to experiment on pathogens in this manner.

There s just one problem with this; gain-of-function research (a.k.a. Dual-Use Research of Concern ) has never successfully produced a vaccine against anything. It is simply bioweapon research by another, sanitized, euphemistic name.

GAIN-OF-FUNCTION RESEARCH ON SARS VIRUS, PERFORMED AT US LAB WITH BIO-CELLS FROM FORT DETRICK

Francis Boyle: We have an article here from the NAT MED 2015, December 21 SARS like cluster of circulating bat coronavirus show, potential for human emergence. This was at the University of North Carolina, in Chapel Hill. They have a biosafety lab level 3 there. And I have previously condemned them, for using gain-of-function work on MERS, which is the Middle East Respiratory Syndrome.

One of the foremost figures in coronavirus GOF research is a guy named Ralph Baric at UNC Chapel Hill.

He has been conducting research into various coronaviruses, including SARS, for many decades there. This is who Anthony Fauci is referring to when he speaks of GOF work being done in North Carolina .

‘Gain-of-function’ research: What it is and who is doing it in North Carolina

Gain-of-function research has been done in North Carolina, most notably at the lab of UNC-Chapel Hill researcher Ralph Baric. Baric is one of the world’s preeminent coronavirus researchers, beginning his study of the family of viruses in the 1990s before they were seen as potentially pandemic-level dangerous to humans. Baric has used gain-of-function techniques to show how coronaviruses could evolve to infect humans and to test new vaccine methods to neutralize them.

In 2015, Ralph Baric co-authored a paper with Shi Zhengli, a bat coronavirus expert from the Wuhan Institute of Virology, entitled A SARS-like cluster of circulating bat coronaviruses shows potential for human emergence .

The emergence of severe acute respiratory syndrome coronavirus (SARS-CoV) and Middle East respiratory syndrome (MERS)-CoV underscores the threat of cross-species transmission events leading to outbreaks in humans. Here we examine the disease potential of a SARS-like virus, SHC014-CoV, which is currently circulating in Chinese horseshoe bat populations1. Using the SARS-CoV reverse genetics system2, we generated and characterized a chimeric virus expressing the spike of bat coronavirus SHC014 in a mouse-adapted SARS-CoV backbone. The results indicate that group 2b viruses encoding the SHC014 spike in a wild-type backbone can efficiently use multiple orthologs of the SARS receptor human angiotensin converting enzyme II (ACE2), replicate efficiently in primary human airway cells and achieve in vitro titers equivalent to epidemic strains of SARS-CoV. Additionally, in vivo experiments demonstrate replication of the chimeric virus in mouse lung with notable pathogenesis. Evaluation of available SARS-based immune-therapeutic and prophylactic modalities revealed poor efficacy; both monoclonal antibody and vaccine approaches failed to neutralize and protect from infection with CoVs using the novel spike protein. On the basis of these findings, we synthetically re-derived an infectious full-length SHC014 recombinant virus and demonstrate robust viral replication both in vitro and in vivo. Our work suggests a potential risk of SARS-CoV re-emergence from viruses currently circulating in bat populations.

In other words, Ralph Baric and Shi Zhengli were colleagues. Anthony Fauci pointing to Ralph Baric at UNC Chapel Hill as evidence of the NIH not funding GOF research in Wuhan is downright farcical; these scientists collaborated openly on various projects over the past decade.

A year before this paper was published, a moratorium on US federal funding for gain-of-function research was put in place. This moratorium lasted from 2014 through 2017.

U.S. halts funding for new risky virus studies, calls for voluntary moratorium

A group calling itself the Cambridge Working Group issued a statement in July saying that studies with “potential pandemic pathogens” should be “curtailed” until the risks and benefits could be evaluated; it has garnered hundreds of signatures. Another group of scientists supporting the experiments they call themselves Scientists for Science defended the studies as safe but also called for a meeting to discuss the issues.

New USG funding will not be released for gain-of-function research projects that may be reasonably anticipated to confer attributes to influenza, MERS, or SARS viruses such that the virus would have enhanced pathogenicity and/or transmissibility in mammals via the respiratory route. The research funding pause would not apply to characterization or testing of naturally occurring influenza, MERS, and SARS viruses, unless the tests are reasonably anticipated to increase transmissibility and/or pathogenicity.

Researchers whose careers depended on GOF research were openly hostile to the moratorium, despite the noble intent behind it of preventing a lab escape.

Researchers rail against moratorium on risky virus experiments

Andrew Hebbeler, assistant director for biological and chemical threats in the White House Office of Science and Technology Policy (OSTP), explained at a meeting today of the National Science Advisory Board for Biosecurity (NSABB) that the policy is a response to several recent biosafety lapses at federal labs involving mishandled samples of anthrax, H5N1, and smallpox. Although GOF actually encompasses “a huge swath of life sciences research,” he said, officials decided to focus only on influenza, MERS, and SARS because they are can be transmitted through the air and have the potential to spark a pandemic. OSTP told ScienceInsider that about two dozen studies funded by the National Institutes of Health (NIH) are affected; the pause also halts some studies at the U.S. Department of Agriculture.

In any case, the moratorium was ignored. Without contacting the White House for approval, federal funding for gain-of-function research continued, using intermediaries to subcontract the grants.

Enter Peter Daszak, the director of EcoHealth Alliance.

A man who pens psychotic love letters to viruses.

Springer – A Fall From Grace To& Virulence?

In Bruegel s painting of The Fall of the Rebel Angels we are witness to a tumbling maelstrom of falling rebel angels outcast from Heaven. Within the fray stands St. Michael in gilded armor, and his angels-at-arms serenely in pale albs, and almost as if threshing grain, hewing and striking down this inconceivable rout. The main focus of the image and what draws the eye is the extraordinarily creative mElange of creatures; mixtures of human, animal, plant, and inanimate objects slashing and stabbing as they fall from the great battlefields in the skies. They pour down in a vast column that stretches infinitely from the luminous sun; they fall from the light to the darkness. The column of falling angels is so numerous that it widens to encompass the whole lower canvas as it approaches the viewer. With a start, then, we realize that Bruegel intends that we too are in the thick of this. Will we succumb to the multitudinous horde? Are we to be cast downward into chthonic chaos represented here by the heaped up gibbering phantasmagory against which we rail and struggle?

Over the course of the past decade, EcoHealth Alliance have received millions of dollars in funding from NIH/NIAID, USAID (a known CIA front), and DTRA (yes, the Pentagon) to subcontract shady gain-of-function research to places like the Wuhan Institute of Virology. This can be confirmed by checking usaspending.gov and taking note of the exact amounts awarded.

Spending by Prime Award – EcoHealth Alliance

EcoHealth Alliance received millions of our tax dollars under UC Davis s PREDICT program, which is a part of USAID s EPT program.

PREDICT, a project of USAID s Emerging Pandemic Threats (EPT) program, was initiated in 2009 to strengthen global capacity for detection of viruses with pandemic potential that can move between animals and people. PREDICT has made significant contributions to strengthening global surveillance and laboratory diagnostic capabilities for both known and newly discovered viruses within several important virus groups, such as filoviruses (including ebolaviruses), influenza viruses, paramyxoviruses, and coronaviruses.

Independent researchers have done extensive digging into Daszak, uncovering incredibly alarming information about his background and character.

Fauci lied under oath and covered up for Daszak when he denied NIH never funded Gain-of-Threat research: Daszak authored a paper stating “This summary contains the information for the 2014 and 2017 NIH and NIAID grants to the Ecohealth Alliance that funded the WIV research on bat conronaviruses. As the grant description shows, this research included gain-of-function / gain-of-threat research to make coronaviruses viruses more pathogenic using techniques including genetic engineering, cell culture, and animal experimentation.”

DRASTIC Research uncovered documents showing that, in 2018, DARPA turned down a proposal by EcoHealth Alliance to receive grant money to conduct what they called the DEFUSE project, which EcoHealth had offered as a response to DARPA s PREEMPT program. The research would have involved exposing bats in caves to recombinant Spike proteins. DARPA, in their rejection letter, stated that this was dangerous gain-of-function research.

Moderna actually had considerable DARPA and BARDA funding for their mRNA technology, as a matter of fact.

mRNA Strategic Collaborators: Government Organizations

In October 2013, DARPA awarded Moderna up to approximately $25 million to research and develop potential mRNA medicines as a part of DARPA s Autonomous Diagnostics to Enable Prevention and Therapeutics, or ADEPT, program, which is focused on assisting with the development of technologies to rapidly identify and respond to threats posed by natural and engineered diseases and toxins. This award followed an initial award from DARPA given in March 2013. The DARPA awards have been deployed primarily in support of our vaccine and antibody programs to protect against Chikungunya infection.

This brings us to the start of the COVID-19 pandemic.

On December 12th, 2019, before anyone even knew an outbreak had occurred in Wuhan, Ralph Baric signed a material transfer agreement (seen on Page 105 of this document) to take delivery of mRNA coronavirus vaccine candidates developed and jointly-owned by NIAID and Moderna .

Wait, NIAID and Moderna co-own an mRNA vaccine? Who is the director of NIAID again?

Oh, right.

This was a whole month before China allegedly sent us the sequence to what would become known as SARS-CoV-2. Moderna claimed they made a vaccine from this sequence within 48 hours.

Moderna’s groundbreaking coronavirus vaccine was designed in just 2 days

On January 11, researchers from China published the genetic sequence of the coronavirus. Two days later, Moderna’s team and NIH scientists had finalized the targeted genetic sequence they would use in the vaccine.

Because, clearly, that isn t suspicious, or anything.

Ralph Baric also played a role in validating the use of Remdesivir in COVID-19.

Remdesivir was developed through an academic-corporate partnership between Gilead Sciences and the Baric Lab at the University of North Carolina at Chapel Hill s Gillings School of Global Public Health. The biopharmaceutical company sought the talents of a research team led by William R. Kenan, Jr. Distinguished Professor of Epidemiology Ralph Baric, who has studied coronaviruses for more than 30 years and pioneered rapid-response approaches for the study of emerging viruses and the development of therapeutics.

Wuhan is, of course, host to China s only P4/BSL-4 virology lab, the Wuhan Institute of Virology. As a matter of fact, the P4 lab at the WIV was built with the help of Alain MErieux, the founder of bioMErieux, who offered his services to the CCP as a consultant for the endeavor.

The Wuhan lab at the core of a virus controversy

The 300 million yuan ($42 million) lab was completed in 2015, and finally opened in 2018, with the founder of a French bio-industrial firm, Alain Merieux, acting as a consultant in its construction.

Alain MErieux was presented an award for his collaboration with the Chinese Communist Party.

Alain MErieux receives the Prestigious Chinese Reform Friendship Award

Alain MErieux s award is a continuation of the longstanding relationship the MErieux family and its companies have built with China over the past 40 years. China has become a strategic location for all of Institut MErieux s work in the field of diagnostics, immunotherapy, and nutrition. Through its companies bioMErieux, Transgene, and MErieux Nutrisciences, and alongside the MErieux Foundation, Institut MErieux has partnered with Chinese authorities and health stakeholders to address major public health issues in the country.

Why is this such a big deal? Well, StEphane Bancel, the current CEO of Moderna, was formerly the CEO of bioMErieux.

Moderna CEO Stephane Bancel, who is pushing experimental COVID-19 vaccines designed to alter the RNA of recipients, previously worked as CEO of BioMerieux, a firm owned by a billionaire who was instrumental in the development of the infamous virology lab in Wuhan, China.

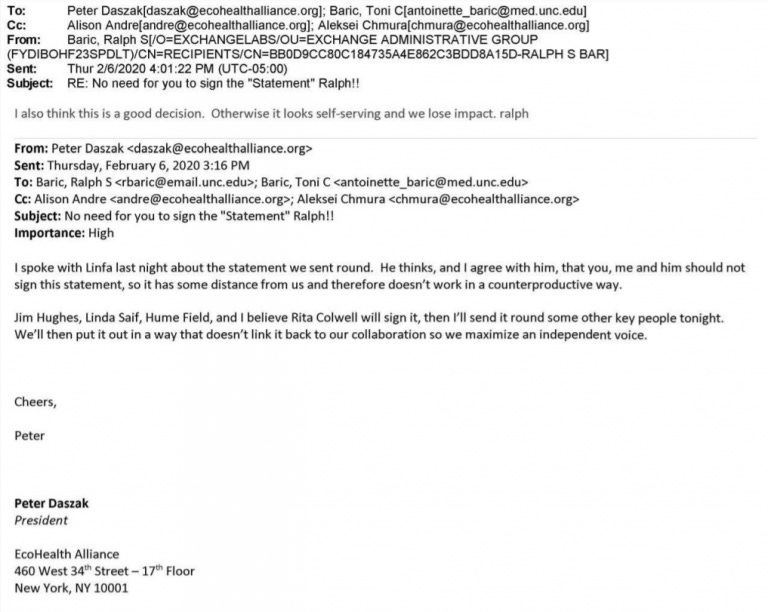

By the time February, 2020 rolled around, the lab leak theory was gaining serious traction among alternative media sources. Peter Daszak was panicking, at this point. He authored a letter along with numerous scientists stating, unequivocally, that the WIV was not the source of the pandemic.

The rapid, open, and transparent sharing of data on this outbreak is now being threatened by rumours and misinformation around its origins. We stand together to strongly condemn conspiracy theories suggesting that COVID-19 does not have a natural origin. Scientists from multiple countries have published and analysed genomes of the causative agent, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), and they overwhelmingly conclude that this coronavirus originated in wildlife, as have so many other emerging pathogens.

As his uncovered emails would later show, Daszak actually contacted Ralph Baric and instructed him not to sign the letter, fearing the conflict of interest it would entail, but not caring about his own, or that of the couple dozen scientists who did end up signing it.

Dr. Peter Daszak of EcoHealth Alliance Gets Brutal News Over Infamous Wuhan Conspiracy Theory Letter

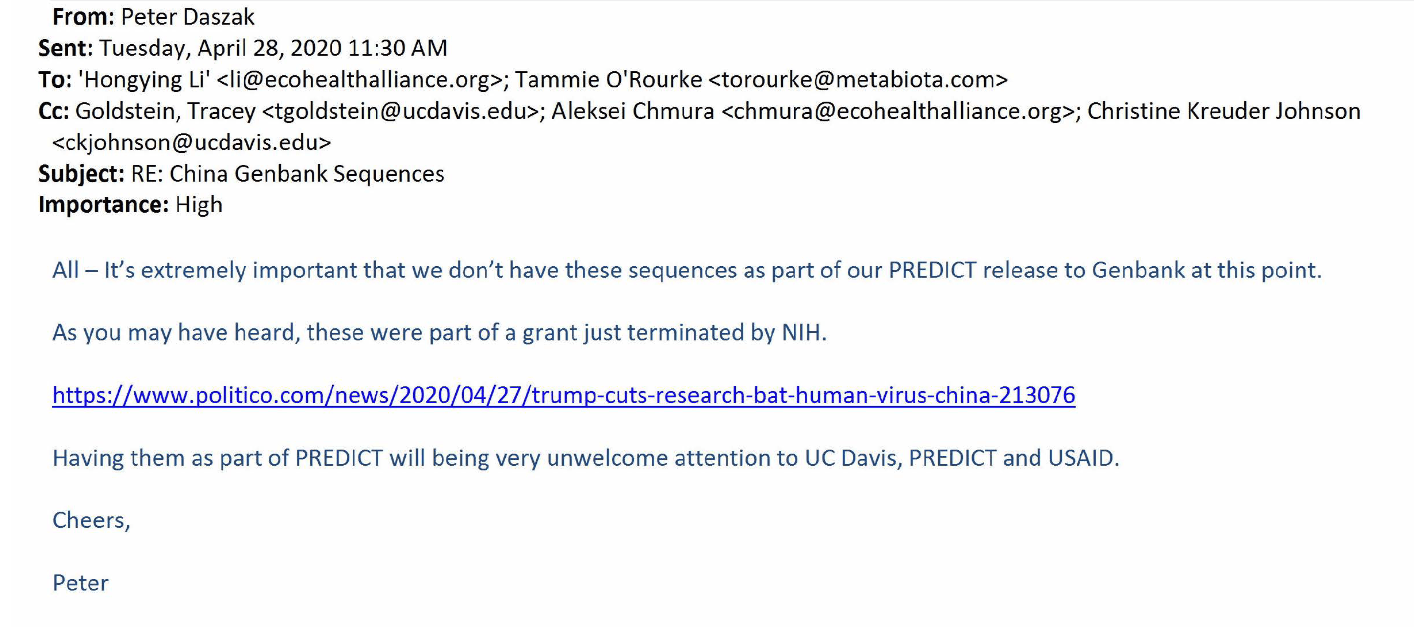

Peter Daszak was also practically soiling himself at the prospect of all of this being traced back to USAID and UC Davis.

EcoHealth Alliance wanted to block disclosure of Covid-19-relevant virus data from China

As the outbreak spread to the US, Anthony Fauci waffled on masking, allegedly to prevent a run on masks, while the government turned down local offers by companies in the US to manufacture millions of masks.

Meanwhile, in New York, doctors cannot figure out why their patients on ventilators keep dying. Of course, it s because their patients have acute sepsis and the ventilators are making it worse by mimicking the pathophysiology of ischemia-reperfusion injury and accelerating COVID-19 s aggressive lipid peroxidation by feeding a ROS storm with O2, its main ingredient. They are setting off a deadly redox bomb in their patients chests by intubating them, but they don t realize this.

Of course, if a patient is blue in the face and desaturating, something must be done to alleviate it, but without endogenous glutathione peroxidase activity, increasing oxidative stress just makes this situation much, much worse. It actually increases hypoxia by chemically changing the blood and altering red blood cell morphology. ROS will compete with O2 for heme binding sites, crowding it out. Regardless of pneumonia or lung physiology or any of that, RBCs will become chemically incapable of accepting oxygen due to the simple laws of physics. Again, severe COVID-19 is an acute sepsis and endotheliitis first and second, and a pneumonia third, at best.

An anonymous scientist came up with a report that RaTG13 was a forgery, hand-entered into a BLAST database to falsify an ancestor for SARS-CoV-2, throwing suspicion off the WIV.

Sapan Desai and Surgisphere, a fake company, published a fake paper arguing that hydroxychloroquine caused heart rhythm irregularities. Before slamming Ivermectin as Horse Dewormer, the media called HCQ fish tank cleaner , drawing comparisons between it and the chemically similar chloroquine phosphate. Never mind that HCQ and chloroquine phosphate are essentially synthetic quinine, the main ingredient of tonic water and a historical malaria cure. Never mind that HCQ has known antiviral activity.

The people involved in these antiviral studies were so absolutely blinkered, they couldn t tell apart hydroxychloroquine and hydroxyquinoline, and ended up giving patients toxic doses of HCQ. Not to mention, the very sick patients enrolled for these antiviral studies had sepsis, and hardly any virus left in their bodies. They were well past the point of effectiveness of antivirals, having already been symptomatic for over a week, their viral loads having declined to negligible levels, a disordered immune response causing continuous damage to the lining of their blood vessels.

In 2020, Klaus Schwab and Thierry Malleret published a book called COVID-19: The Great Reset, which was basically a wish list of WEF policies that could be implemented using the virus as a convenient crisis to leapfrog off of.

“COVID-19: The Great Reset” is a guide for anyone who wants to understand how COVID-19 disrupted our social and economic systems, and what changes will be needed to create a more inclusive, resilient and sustainable world going forward. Klaus Schwab, founder and executive Chairman of the World Economic Forum, and Thierry Malleret, founder of the Monthly Barometer, explore what the root causes of these crisis were, and why they lead to a need for a Great Reset.Theirs is a worrying, yet hopeful analysis. COVID-19 has created a great disruptive reset of our global social, economic, and political systems. But the power of human beings lies in being foresighted and having the ingenuity, at least to a certain extent, to take their destiny into their hands and to plan for a better future. This is the purpose of this book: to shake up and to show the deficiencies which were manifest in our global system, even before COVID broke out.”Erudite, thought-provoking and plausible” — Hans van Leeuwen, Australian Financial Review (Australia)”The book looks ahead to what the post-coronavirus world could look like barely four months after the outbreak was first declared a pandemic” — Sam Meredith, CNBC (USA) “The message that the pandemic is not only a crisis of enormous proportions, but that it also provides an opportunity for humanity to reflect on how it can do things differently, is important and merits reflection”– Ricardo Avila, Portafolio (Colombia) “A call for political change in the post-pandemic world”– Ivonne Martinez, La Razon (Mexico)”History has shown, the book argues, that pandemics are a force for radical and lasting change”– Mustafa Alrawi, The National (UAE)

As we rolled into 2021, the madness of vaccine mandates and passes began, with people facing ostracization, joblessness, and restriction of free movement as the price of vaccine refusal.

David E. Martin, the CEO of M-CAM, released a document showing that every part of SARS is a patented product.

Anthony Fauci stood up before Congress and perjured himself multiple times, denying that any GOF research took place at the WIV with NIH funding.

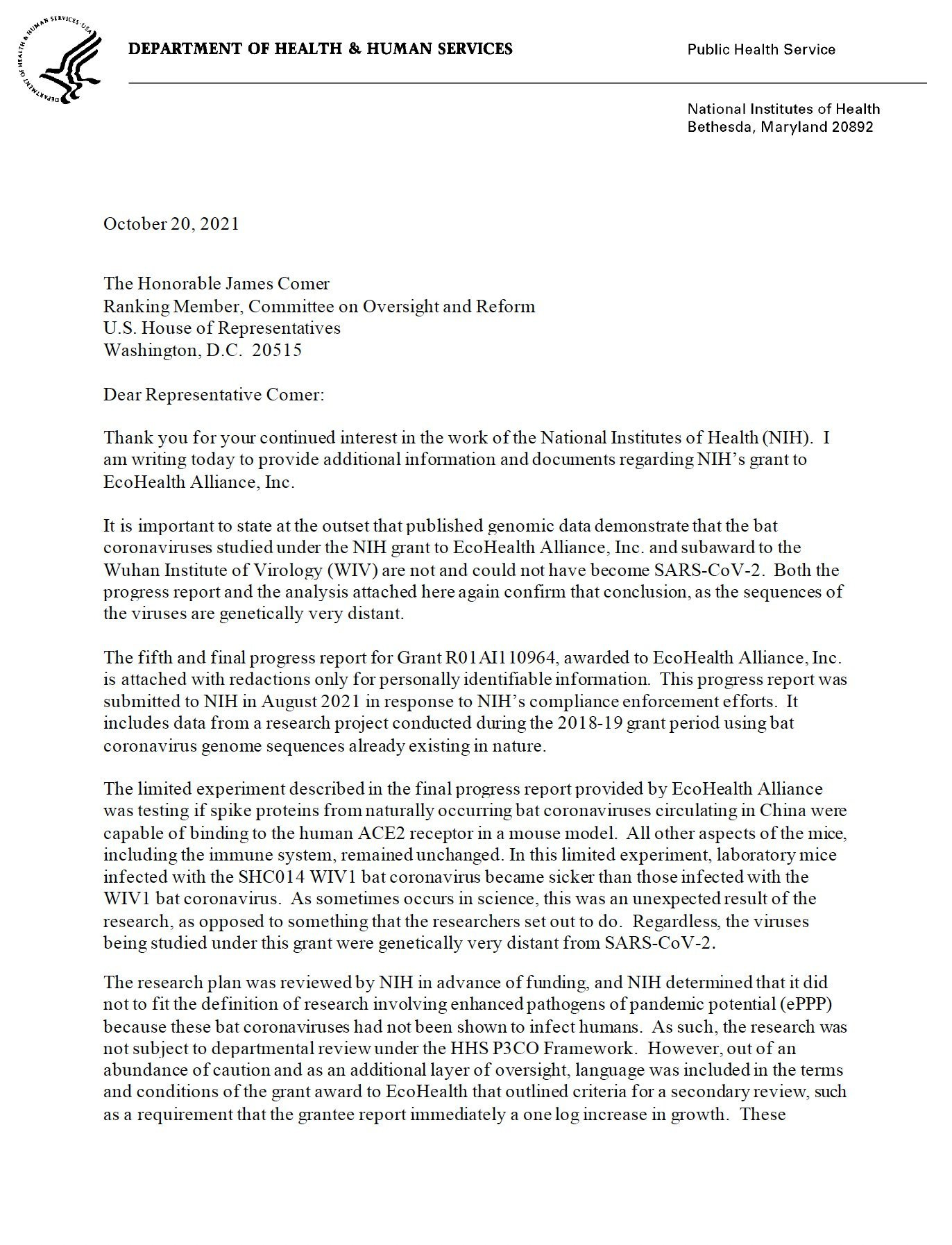

The NIH later admitted that GOF research did take place.

NIH admits US funded gain-of-function in Wuhan despite Fauci s denials

According to Tabak, the NIH had reviewed EcoHealth s research plan in advance of approving the grant but claims it wasn t subjected to additional review at the time as it didn t fit the definition of research involving enhanced pathogens of pandemic potential because these bat coronaviruses had not been shown to infect human.

Tabak said if EcoHealth had alerted NIH to the growth, it would have prompted a review to determine if the research plan should be re-evaluated.

I told you so doesn t even begin to cover it here:

Richard H. Ebright @R_H_Ebright

NIH corrects untruthful assertions by NIH Director Collins and NIAID Director Fauci that NIH had not funded gain-of-function research in Wuhan.

NIH states that EcoHealth Alliance violated Terms and Conditions of NIH grant AI110964. https://t.co/cFOtJlRoWl

Recently, an anonymous scientist came forward with a claim that SARS-CoV-2 s furin cleavage site contains a 19-nt sequence as its reverse complement, CTCCTCGGCGGGCACGTAG, which aligns with the sequence of a Moderna patented cell line.

There is now a paper published in Frontiers in Virology on this matter.

Among numerous point mutation differences between the SARS-CoV-2 and the bat RaTG13 coronavirus, only the 12-nucleotide furin cleavage site (FCS) exceeds 3 nucleotides. A BLAST search revealed that a 19 nucleotide portion of the SARS.Cov2 genome encompassing the furing cleavage site is a 100% complementary match to a codon-optimized proprietary sequence that is the reverse complement of the human mutS homolog (MSH3). The reverse complement sequence present in SARS-CoV-2 may occur randomly but other possibilities must be considered. Recombination in an intermediate host is an unlikely explanation. Single stranded RNA viruses such as SARS-CoV-2 utilize negative strand RNA templates in infected cells, which might lead through copy choice recombination with a negative sense SARS-CoV-2 RNA to the integration of the MSH3 negative strand, including the FCS, into the viral genome. In any case, the presence of the 19-nucleotide long RNA sequence including the FCS with 100% identity to the reverse complement of the MSH3 mRNA is highly unusual and requires further investigations.

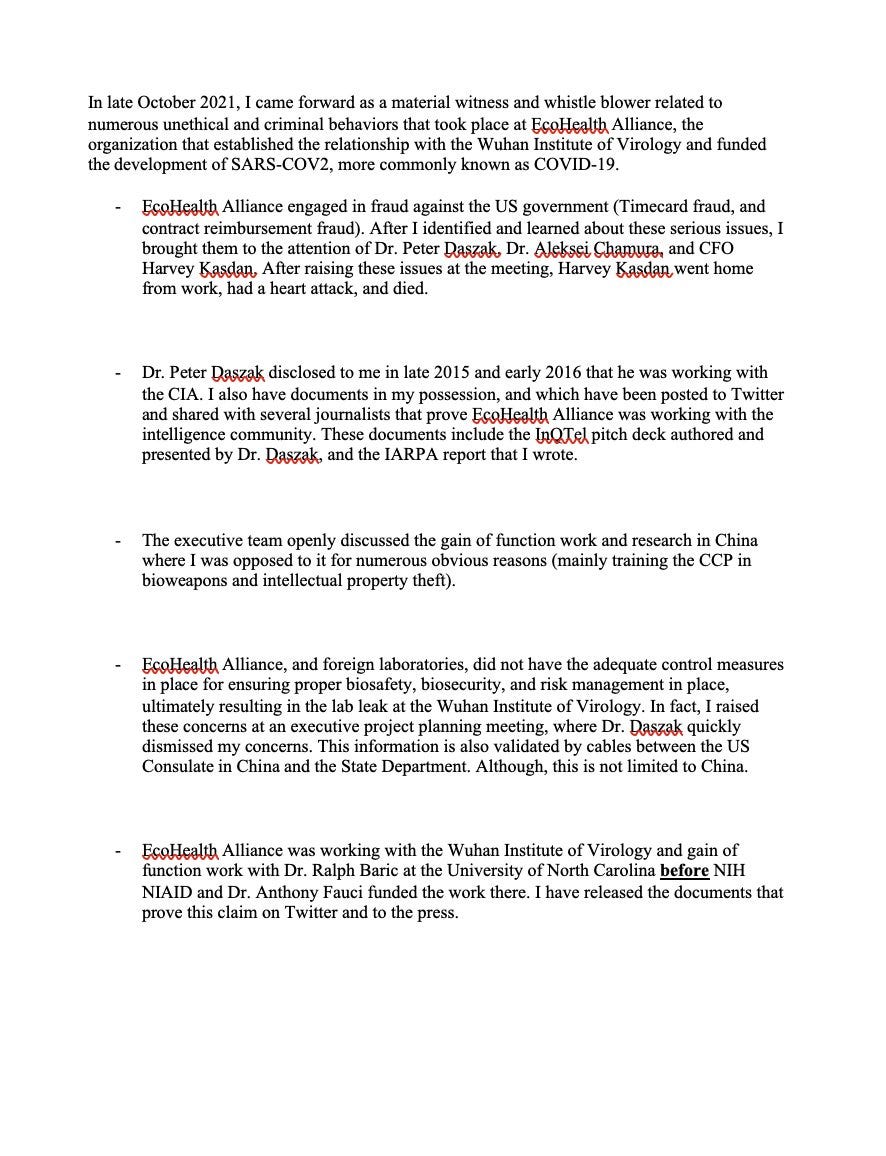

Andrew Huff, the former Vice President of EcoHealth Alliance, has come forward with a whistleblower complaint stating that Peter Daszak was a CIA asset.

EcoHealth Alliance: Whistleblower Exposes Corruption

In late October 2021, Huff says he came forward as a material witness and whistleblower related to numerous unethical and criminal behaviors that took place at EcoHealth Alliance. EcoHealth Alliance engaged in fraud against the U.S. government (Timecard Fraud and contract reimbursement fraud). Huff brought them to the attention of Peter Daszak, Dr. Aleksei Chamura, and CFO Harvey n. After raising these issues at the meeting, Harvey Kasdan went home from work, had a heart attack, and died.

Here is a copy of the Whistle Blower complaint that I submitted to Senator Gary Peter’s Office. I would like to testify on this critical matter as soon as reasonably possible.

@SenEdMcBroom @SenGaryPeters @RepJackBergman @LeeSmithDC @SenStabenow @joerogan

As of late, Moderna s stock price appears to be in rapid decline. StEphane Bancel deleted his Twitter account. Pfizer appear to be griping that they have to publish their data and thus be exposed to further scrutiny.

I, myself, cannot come up with a rational response to any of this without resorting to vigorous, sailor-like profanity that would sear your eyeballs. So, instead, I ll leave it up to the reader to decide what is actually going on here.

What do DARPA want with our brains?

All of this has a much darker undercurrent to it (if that could even be considered possible) when one draws the Lieber connection.

In 2020, a Harvard scientist by the name of Charles Lieber was indicted by the DOJ on charges of making false statements. He had taken money from China s Thousand Talents Plan, against the terms of his DOD grants. Charles Lieber received grants from DARPA, ONR, AFOSR, NIH, and MITRE, but he also double-dipped and took money from the CCP, hence the charges against him.

Harvard University Professor Indicted on False Statement Charges

It is alleged that, unbeknownst to Harvard University, beginning in 2011, Lieber became a Strategic Scientist at Wuhan University of Technology (WUT) in China. He later became contractual participant in China s Thousand Talents Plan from at least 2012 through 2015. China s Thousand Talents Plan is one of the most prominent Chinese talent recruitment plans designed to attract, recruit, and cultivate high-level scientific talent in furtherance of China s scientific development, economic prosperity and national security. According to court documents, these talent recruitment plans seek to lure Chinese overseas talent and foreign experts to bring their knowledge and experience to China, and they often reward individuals for stealing proprietary information. Under the terms of Lieber s three-year Thousand Talents contract, WUT allegedly paid Lieber a salary of up to $50,000 USD per month, living expenses of up to 1 million Chinese Yuan (approximately $158,000 USD at the time) and awarded him more than $1.5 million to establish a research lab at WUT. In return, Lieber was obligated to work for WUT not less than nine months a year by declaring international cooperation projects, cultivating young teachers and Ph.D. students, organizing international conference[s], applying for patents and publishing articles in the name of [WUT].

Charles Lieber worked under a cover story. He claimed to be working on silicon nanowire batteries for the Chinese, but no one can recall him ever working on batteries of any kind.

Why did a Chinese university hire Charles Lieber to do battery research?

In fact, one U.S. nanoscientist and former student of Lieber’s says: “I have never seen Charlie working on batteries or nanowire batteries.” (The scientist asked that their name not be used because of the sensitivity surrounding Lieber’s case.)

Charles Lieber s research actually involves something called bionanotechnology, which is the Frankensteinian blending of living tissue with artificial components (i.e. semiconductors, quantum dots, nanoparticles, synthetic polymers, et cetera), on the molecular level.

Charles Lieber s own papers explicitly describe the potential for his silicon nanowires to be used as biosensors, or even as brain-computer interfaces, (also known as brain-machine interfaces, or, in cyberpunk science fiction parlance, neural laces ):

Nanowire probes could drive high-resolution brain-machine interfaces

Brain-machine interfaces (BMIs) can serve as bidirectional connections that output electrical signals of brain activity or input electrical stimuli to modulate brain activity in concert with external machines, including computer processors and prosthetics, for human enhancement[1,2]. Reading electrical activity from neurons is the foundation of many BMI applications, such as brain mapping, that aims to understand brain functions by decoding the communication between neurons. Reading and processing this activity is also key to neural prosthetics in which brain activity is used to control devices such as artificial limbs. For these BMI applications, most of the in vivo recording tools used today read extracellular neural activity by detecting suprathreshold action potential signals that leak outside of neurons (Fig. 1a (i)), while critical subthreshold events, such as synaptic potentials and dendritic integration, remain hidden [3]. To achieve the most information-rich readings, which could provide more detailed mapping of brain function and the finest control of neural prosthetics, electronic devices need to provide access to intracellular signals from multiple neurons comprising the neuronal circuits and networks of the brain [4].

How is this relevant to COVID-19?

Charles Lieber is a colleague of Robert Langer, one of the co-founders of Moderna. The two of them are pictured here, left and right, with Daniel Kohane in the center.

These three worked on a paper together to create cybernetic heart tissue scaffolds with biosensor functionality.

The cyborg-like tissue, described online at Nature Materials, supports cell growth while simultaneously monitoring the activities of those cells. It could improve in vitro drug screening by allowing researchers to track how cells in a three-dimensional environment respond to drugs in real time, the authors say. It may also be a first step toward prosthetics that communicate directly with the nervous system, and tissue implants that sense and respond to injury or disease.

Elon Musk s Neuralink presentation made waves when people started to consider the human applications, but even Neuralink is as barbaric as trephination next to the military s craniotomy-free, wireless nanoparticle BCI research.

Enter DARPA s BRAIN Initiative, and the N3 (Next-Generation Nonsurgical Neurotechnology) program.

Next-Generation Nonsurgical Neurotechnology

Whereas the most effective, state-of-the-art neural interfaces require surgery to implant electrodes into the brain, N3 technology would not require surgery and would be man-portable, thus making the technology accessible to a far wider population of potential users. Noninvasive neurotechnologies such as the electroencephalogram and transcranial direct current stimulation already exist, but do not offer the precision, signal resolution, and portability required for advanced applications by people working in real-world settings. The envisioned N3 technology breaks through the limitations of existing technology by delivering an integrated device that does not require surgical implantation, but has the precision to read from and write to 16 independent channels within a 16mm3 volume of neural tissue within 50ms. Each channel is capable of specifically interacting with sub-millimeter regions of the brain with a spatial and temporal specificity that rivals existing invasive approaches. Individual devices can be combined to provide the ability to interface to multiple points in the brain at once.

The grant proposal for N3 is very informative on the nature of the technology desired by DARPA:

TA2 involves the development of a system that includes a nanotransducer placed on or near neurons of interest and an integrated sensor/stimulator device that sits outside the skin. The nanotransducer may include technologies such as, but not limited to, self-assembled/molecular/biomolecular/chemical nanoparticles, or viral vectors. These nanotransducers must be delivered in a minutely invasive (nonsurgical) manner, which may include ingestion, injection, or nasal administration, and involve technology that includes self-assembly inside the body. While the major TA2 goals of developing neural read out and write in capabilities are similar to the goals from TA1, creating a nanotransducer with an optimal delivery route to the brain is a major additional component. Another major component of TA2 is achieving cell-type specificity.

There are six teams involved in the N3 program; Battelle, Carnegie Mellon University, Johns Hopkins University s Applied Physics Laboratory, PARC, Rice University, and Teledyne.

How close are they to achieving their goal?

Magnetism Plays Key Roles in DARPA Research to Develop Brain-Machine Interface without Surgery

DARPA is preparing for a future in which a combination of unmanned systems, artificial intelligence, and cyber operations may cause conflicts to play out on timelines that are too short for humans to effectively manage with current technology alone, said Al Emondi, the N3 program manager. By creating a more accessible brain-machine interface that doesn t require surgery to use, DARPA could deliver tools that allow mission commanders to remain meaningfully involved in dynamic operations that unfold at rapid speed.

Nature – Wireless and battery-free technologies for neuroengineering

Tethered and battery-powered devices that interface with neural tissues can restrict natural motions and prevent social interactions in animal models, thereby limiting the utility of these devices in behavioural neuroscience research. In this Review Article, we discuss recent progress in the development of miniaturized and ultralightweight devices as neuroengineering platforms that are wireless, battery-free and fully implantable, with capabilities that match or exceed those of wired or battery-powered alternatives. Such classes of advanced neural interfaces with optical, electrical or fluidic functionality can also combine recording and stimulation modalities for closed-loop applications in basic studies or in the practical treatment of abnormal physiological processes.

Very close.

Incidentally, the head of Battelle s N3 team, Gaurav Sharma, was also involved in DTRA s Blood-Brain Barrier Program. Yes, the very same Defense Threat Reduction Agency that funded EcoHealth Alliance.

What did that program seek to accomplish?

Early Successes of DTRA s Blood-Brain Barrier Program Suggest New Countermeasures

The program aims to understand the effects of nerve agents and alphaviruses on the blood-brain barrier and find new transport pathways to deliver appropriate therapeutics into the CNS. The early successes of JSTO s program allows researchers to better assess the risks of emerging threats while enhancing their ability to protect and treat warfighters from a broad range of chemical and biological threats.

That s interesting. What does SARS-CoV-2 Spike, the supposed constituent of the vaccine, do to people s blood-brain barrier?

Key to our findings is the demonstration that S1 promotes loss of barrier integrity in an advanced 3D microfluidic model of the human BBB, a platform that more closely resembles the physiological conditions at this CNS interface. Evidence provided suggests that the SARS-CoV-2 spike proteins trigger a pro-inflammatory response on brain endothelial cells that may contribute to an altered state of BBB function.

Huh. The SARS-CoV-2 Spike S1 subunit is capable of permeabilizing the blood-brain barrier, opening it up for substances that might want to cross from the bloodstream to the brain.

So, how does all this wireless neural lace business work? It s actually both very complex and surprisingly simple. Nanoparticles that are sensitive to RF, electromagnetism, ultrasound, and/or light are introduced into brain cells, and then, an external encoder/decoder stimulates them wirelessly and reads back the response. It is very much like turning the human brain into a Wacom pen. You know how a Wacom tablet works, right? The tablet generates a field that the pen converts into an electric current by wireless induction. That s why the pens don t need batteries, and it s why nanotransducers implanted in the brain don t need them, either.

Shortly after the Spartacus Letter was posted on ZeroHedge, this absolutely ridiculous CNBC video was published on YouTube:

How small are nanotransducers, actually?

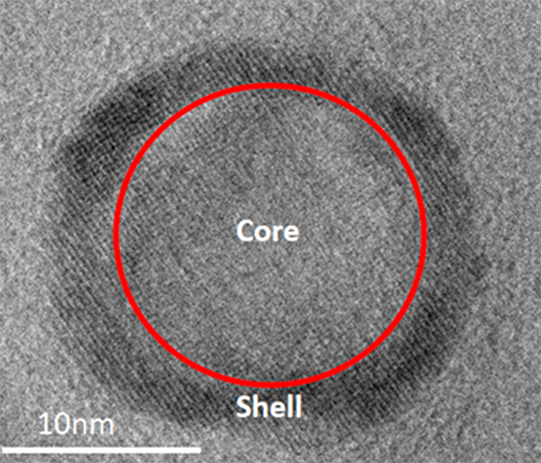

Well, here s one of Battelle s Magnetoelectric Nanotransducers, as seen under an electron microscope:

It s about 20 nanometers across, much smaller than the 120 nanometer diameter of a SARS-CoV-2 virion, and comparable to transistor gate sizes.

To put this in perspective, the inside diameter of a vaccine needle of average gauge is about 0.26 millimeters. That s 260,000 nanometers.

13,000 Magnetoelectric Nanotransducers could fit through a vaccine needle side-by-side.

You see, BCIs capable of two-way communication with a human brain don t just give you superpowers, or let you control drones with your mind, or listen to Katy Perry without headphones or speakers or whatever. They can also be used to manipulate mood, and for social control.

They could also be used to take away people s agency and turn them into, essentially, biological robots, utterly obedient to government and open to any manner of sadistic abuse.

This is not an exaggeration. It is a fact.

The ethics of brain computer interfaces

Reports have surfaced about a minority of people who undergo DBS for Parkinson s disease becoming hypersexual, or developing other impulse-control issues. One person with chronic pain became deeply apathetic after DBS treatment. DBS is very effective, Gilbert says, to the point that it can distort patients perceptions of themselves. Some people who received DBS for depression or obsessive compulsive disorder reported that their sense of agency had become confused2. You just wonder how much is you anymore, said one. How much of it is my thought pattern? How would I deal with this if I didn t have the stimulation system? You kind of feel artificial.

Neuroethicists began to note the complex nature of the therapy s side effects. Some effects that might be described as personality changes are more problematic than others, says Maslen. A crucial question is whether the person who is undergoing stimulation can reflect on how they have changed. Gilbert, for instance, describes a DBS patient who started to gamble compulsively, blowing his family s savings and seeming not to care. He could only understand how problematic his behaviour was when the stimulation was turned off.

Profound behavioral changes have already been observed in patients with DBS electrodes implanted in their heads. How far could they go if they had access to fine-grained stimulation of individual clusters of neurons?

A bioethicist by the name of Dr. James Giordano (who is well-acquainted with DARPA s research) is very concerned about all of this. That s why he gives horrifying lectures in front of West Point cadets like this one:

Are they already wargaming the military applications of weaponized neuroS/T, investigating the possibility of using nanoparticles to attack rival powers by making their own citizens go berserk? Yes, of course they are.

COGNITIVE WARFARE – June-November 2020 FranAois du Cluzel

The use of neuroS/T for military and intelligence purposes is realistic, and represents a clear and present concern. In 2014, a US report asserted that neuroscience and technology had matured considerably and were being increasingly considered, and in some cases evaluated for operational use in security, intelligence, and defense operations. More broadly, the iterative recognition of the viability of neuroscience and technology in these agenda reflects the pace and breadth of developments in the field. Although a number of nations have pursued, and are currently pursuing neuroscientific research and development for military purposes, perhaps the most proactive efforts in this regard have been conducted by the United States Department of Defense; with most notable and rapidly maturing research and development conducted by the Defense Advanced Research Projects Agency (DARPA) and IntelligenceAdvanced Research Projects Activity (IARPA). To be sure, many DARPA projects are explicitly directed toward advancing neuropsychiatric treatments and interventions that will improve both military and civilian medicine. Yet, it is important to note the prominent ongoing and expanding efforts in this domain by NATO European and trans-Pacific strategic competitor nations.

&

A cognitive attack is not a threat that can be countered in the air, on land, at sea, in cyberspace, or in space. Rather, it may well be happening in any or all of these domains, for one simple reason: humans are the contested domain.