Elliott Erwitt National Congress Building by Oscar Niemeyer, Brasilia, Brazil 1961

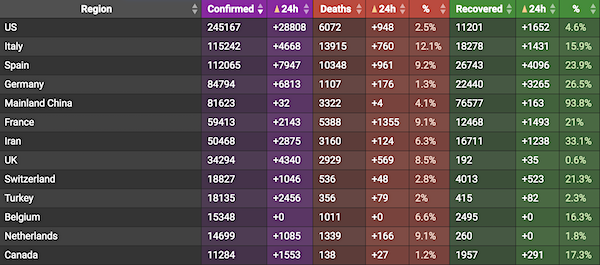

We’ll keep setting records for a while longer yet, driven by the US in particular.

US cases doubled in 8 days. That rate will speed up.

All countries, the US first of all, need to move their focus away from saving companies and onto saving people. Now would be a good time.

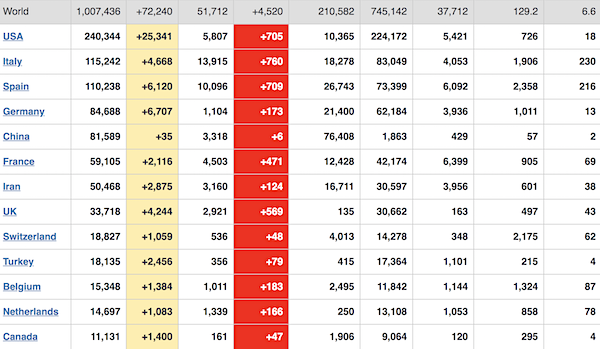

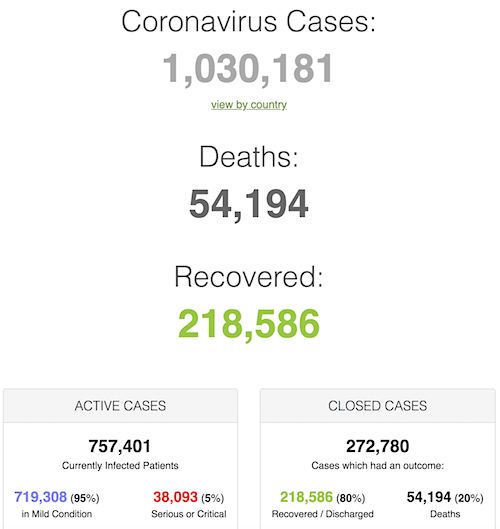

• Cases 1,030,181 (+ 79,756 from yesterday’s 950,425)

• Deaths 54,194 (+ 5,918 from yesterday’s 48,276)

From Worldometer yesterday evening -before their day’s close-.

From Worldometer -NOTE: mortality rate for closed cases is at 20% –

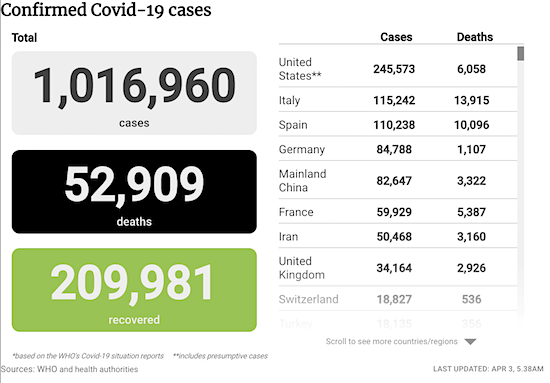

From SCMP:

From COVID2019Live.info:

Who said the RussiaRussia obsession couldn’t be fun? Bottom line between the lines: the US pays, but as the Russians say, both cover half the cost. In other words, the US pays half price. Will that satisfy the American propaganda voices? Stay tuned. Putin was criticized at home for selling these things to the US while Russia may not have enough for itself.

Compare that to Tucker’s America First declaration. And Thailand’s response.

• US Paying Russia For Entire Planeload Of Coronavirus Equipment – Official (R.)

The United States is paying Russia for a planeload of medical equipment sent by Moscow to help fight the coronavirus outbreak, a senior Trump administration official said on Thursday, clearing up confusion as to who footed the bill. It had been unclear whether Russia had sent the 60 tons of equipment as a gift or whether it had sold the shipment of ventilators, masks, respirators and other items following a phone discussion between U.S. President Donald Trump and Russian President Vladimir Putin. Trump, asked about the shipment at a White House news briefing, said he was happy to take delivery of it. “I am not concerned about Russian propaganda, not even a little bit. He (Putin) offered a lot of medical, high-quality stuff that I accepted. And that may save a lot of lives. I’ll take it every day,” he said.

The Russian Foreign Ministry said Moscow had paid half the cost with the other half picked up by Washington. But the senior administration official, speaking to Reuters on condition of anonymity, said the United States paid. “The United States is purchasing the supplies and equipment outright, as with deliveries from other countries,” the official said. “We appreciate Russia selling these items to us below market value.” The official did not give an exact cost. The State Department did not respond to requests for more information. The plane arrived on Wednesday at John F. Kennedy International Airport in New York and the gear was to be inspected by the U.S. Food and Drug Administration to make sure it met U.S. quality standards.

https://twitter.com/ColumbiaBugle/status/1245881131225890816

How is Vladimir Putin fighting back against the economic repercussions of the #coronavirus pandemic in Russia?

By taxing the rich.

Western leaders should take a hint. pic.twitter.com/d6hxH4npvo

— Sarah Abdallah (@sahouraxo) April 2, 2020

Ben Hunt is setting up a program to purchase and distribute masks and other PPE equipment in the US. It’s a terrible shame that he, like so many Americans, thinks he must, for some reason, put this in terms of warfare. Shouldn’t it be the opposite?

“There is no country in the world that mobilizes for war more effectively than the United States. And I know you won’t believe me, but I tell you it is true: This will be #OurFinestHour.”

Last week we wrote a brief note (Getting PPE to Healthcare Workers and First Responders) to introduce our efforts to get personal protective equipment (PPE) directly into the hands of frontline heroes: healthcare professionals and emergency responders who put their own lives and their families’ lives at risk every freakin’ day to stem the tide against this virus. Today I want to share with you the story of how this effort has come together into something real and tangible. Today I want to invite you to join us. First let me tell you what we’re NOT doing. We are not competing with federal or state emergency management authorities in their big bulk orders of PPE.

We are not going to drive up the price of these supplies any more than they have already been driven up in this global scramble to acquire medical gear. But we are also not waiting on these federal or state emergency management authorities to get these big bulk orders and then trickle the supplies down to the frontlines. What we ARE doing is putting together an end-to-end grassroots PPE distribution effort, where we source the equipment from certified manufacturers who meet accepted international standards, we pay for these purchases out of a 501(c)(3) foundation where 100 cents of every dollar goes to this effort, and we distribute that PPE all the way through the “last-mile”, getting small quantities of PPE directly into the hands of clinicians and first responders who are in urgent need.

Over the past 10 days we’ve purchased and distributed about 15,000 N95 and N95-equivalent masks directly to the doctors and nurses and firemen and EMTs who need the equipment NOW, in deliveries as small as 30 masks and as large as 500, depending on need. More importantly, we’ve set up a pipeline where we think we can get a steady delivery of 2,000 or so masks per day AND the occasional larger order AND the distribution capacity + knowledge to get this equipment directly to our frontline heroes. We’ve raised more than $200,000 to support this effort. We’ve partnered with incredibly generous private companies ranging in size from a Fortune 50 megacorp to the owners of the local UPS franchise. And we’re just getting started.

[..] If you are a healthcare worker or a first responder anywhere in the United States in urgent need of PPE, or you know someone who is, please fill out the online form below to get on our distribution list. Right now we are focused on N95 and N95-equivalent masks (more on the different types of masks in the Sourcing section of this note), although in the future we will try to supply isolation gowns and other PPE items..

https://twitter.com/AvidCommentator/status/1245892087020572672

Ask Ben Hunt.

• New York City Nurses Demand Personal Protection Equipment (WABC)

There’s a growing concern among nurses and doctors in New York City that they’ll run out of personal protection equipment (PPE) and supplies. A dozen health care workers spoke out Thursday near Montefiore Medical Center in the Bronx about their concerns. “We’re running out of PPE, we’re running out of pain medication, we’re running out of sedatives,” third-year resident physician Laura Ucik said. State leaders say hundreds of thousands of personal protection masks and supplies have been shipped to New York, but some health care workers say their emergency rooms haven’t benefited yet. “If front line care givers are sick, are dying, there won’t be anyone left to take care of the public,” said Judy Sheridan-Gonzalez, ER nurse and president of the New York State Nurses Association.

Some health care workers are saying they’re being told to reuse not only critical N95 masks but every day supplies. “I was given one disposable gown to use all day to take care of COVID-19 patients,” Ucik said. “And I would hang it up on an IV pole in between patients and put my single N95 mask into a brown paper bag.” It’s a problem at hospitals throughout the area. The New York City Health Department recently sent an alert to hospitals, telling them to “conserve all personal protective equipment now.” It isn’t a request, and the language in the alert states health care facilities must immediately implement these measures. “It puts me at risk, it puts you at risk, everyone in the health care building at risk,” nurse Victoria Lanquah said.

It’ll prove to be a major factor all over the US.

• New Orleans Coronavirus Death Rate Is Twice New York. Obesity Is A Factor (R.)

The coronavirus has been a far deadlier threat in New Orleans than the rest of the United States, with a per-capita death rate twice that of New York City. Doctors, public health officials and available data say the Big Easy’s high levels of obesity and related ailments may be part of the problem. “We’re just sicker,” said Rebekah Gee, who until January was the health secretary for Louisiana and now heads Louisiana State University’s healthcare services division. “We already had tremendous healthcare disparities before this pandemic – one can only imagine they are being amplified now.” Along with New York and Seattle, New Orleans has emerged as one of the early U.S. hot spots for the coronavirus, making it a national test case for how to control and treat the disease it causes.

Chief among the concerns raised by doctors working in the Louisiana city is the death rate, which is twice that of New York and over four times that of Seattle, based on Thursday’s publicly reported data. New Orleans residents suffer from obesity, diabetes and hypertension at rates higher than the national average, conditions that doctors and public health officials say can make patients more vulnerable to COVID-19, the highly contagious respiratory disease caused by the coronavirus. Some 97% of those killed by COVID-19 in Louisiana had a pre-existing condition, according to the state health department. Diabetes was seen in 40% of the deaths, obesity in 25%, chronic kidney disease in 23% and cardiac problems in 21%. Orleans Parish, which encompasses the city, reported 125 confirmed coronavirus deaths as of Thursday, the equivalent of 32 coronavirus deaths per 100,000 people. That rate for New York City was at 15.9 on Thursday.

Trump is toying with idea of expanding Medicare to include 30 million unable to afford insurance. In other words he may go the left of Biden and clown ass DNC on this issue. If he did that it really would be game over for democrats. The democrats are such a joke.

— Ajamu Baraka (@ajamubaraka) April 2, 2020

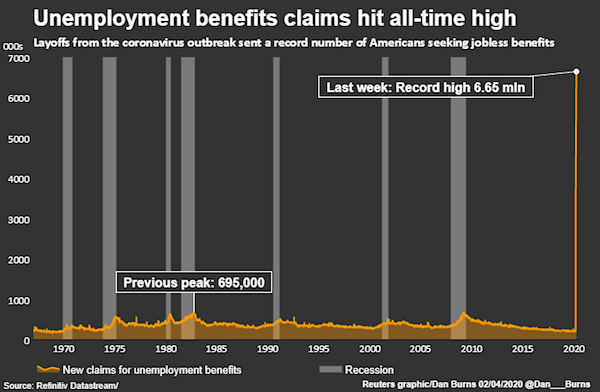

Will Reuters stop polling the team of economists now, after another ridiculously off the mark prediction? No, it will not.

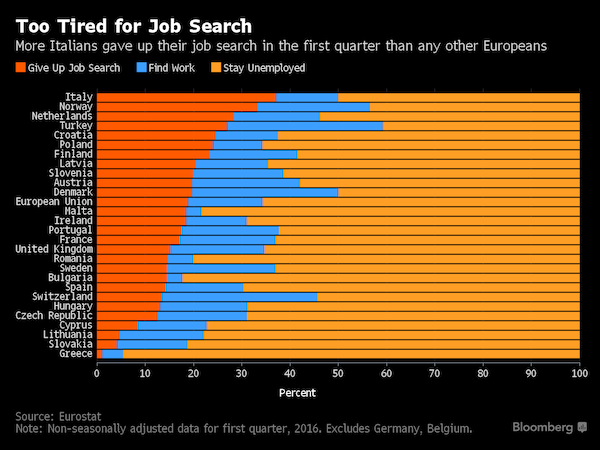

• US Weekly Jobless Claims Blow Past Six Million As Lockdowns Spread (R.)

The number of Americans filing claims for unemployment benefits shot to a record high of more than 6 million last week as more jurisdictions enforced stay-at-home measures to curb the coronavirus pandemic, which economists say has pushed the economy into recession. Thursday’s weekly jobless claims report from the Labor Department, the most timely data on the economy’s health, reinforced economists’ views that the longest employment boom in U.S. history probably ended in March. With a majority of Americans now under some form of lockdown, claims are expected to rise further. Economists said worsening job losses underscored the need for additional fiscal and monetary stimulus. President Donald Trump last week signed a historic $2.3 trillion package, with provisions for companies and unemployed workers.

The Federal Reserve has also undertaken extraordinary measures to help companies weather the highly contagious virus, which has brought the country to a halt. “These data underscore the magnitude of the stop-work order that has been imposed on the economy,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York. “The scale of the increase should also focus policymakers on getting the cash into the economy with possibly a fourth fiscal package and additional Fed lending programs.” [..] Initial claims for state unemployment benefits surged 3.341 million to a seasonally adjusted 6.648 million for the week ended March 28, the government said. That was double the previous all-time high of 3.307 million set in the prior week. Economists polled by Reuters had forecast claims would jump to 3.50 million in the latest week, though estimates were as high as 5.25 million.

50 years of unemployment figures…..keep watching https://t.co/OtyuUeAyHd

— barmz (@barmz2) April 3, 2020

There are dozens of these things happening. This is the Jerusalem Post on an Israeli company, which makes the “news” suspicious right off the bat.

• Israeli Scientists: Coronavirus Vaccine Tested On Humans By June 1 (JPost)

A team of Israeli researchers says that they are days away from completing the production of the active component of a coronavirus vaccine that could be tested on humans as early as June 1. “We are in the final stages and within a few days we will hold the proteins – the active component of the vaccine,” Dr. Chen Katz, group leader of MIGAL’s biotechnology group, told The Jerusalem Post. In late February, MIGAL (The Galilee Research Institute) committed to completing production of its vaccine within three weeks and having it on the market in 90 days. Katz said they were slightly delayed because it took longer than expected to receive the genetic construct that they ordered from China due to the airways being closed and it having to be rerouted.

As a reminder, for the past four years, researchers at MIGAL have been developing a vaccine against infectious bronchitis virus (IBV), which causes a bronchial disease affecting poultry. The effectiveness of the vaccine has been proven in preclinical trials carried out at the Veterinary Institute. “Our basic concept was to develop the technology and not specifically a vaccine for this kind or that kind of virus,” said Katz. “The scientific framework for the vaccine is based on a new protein expression vector, which forms and secretes a chimeric soluble protein that delivers the viral antigen into mucosal tissues by self-activated endocytosis, causing the body to form antibodies against the virus.”

In preclinical trials, the team demonstrated that the oral vaccination induces high levels of specific anti-IBV antibodies, Katz said. “Let’s call it pure luck,” he said. “We decided to choose coronavirus as a model for our system just as a proof of concept for our technology.”

This can’t be the exception. Such “counting errors” maust be commonplace.

• France’s Coronavirus Death Toll Jumps As Nursing Homes Included (R.)

The coronavirus death count in France surged to nearly 5,400 people on Thursday after the health ministry began including nursing home fatalities in its data. The pandemic had claimed the lives of 4,503 patients in hospitals by Thursday, up 12% on the previous day’s 4,032, said Jerome Salomon, head of the health authority. A provisional tally showed the coronavirus had killed a further 884 people in nursing homes and other care facilities, he added. This makes for a total of 5,387 lives lost to coronavirus in France – an increase of 1,355 over Wednesday’s cumulative total – although data has not yet been collected from all of the country’s 7,400 nursing homes. “We are in France confronting an exceptional epidemic with an unprecedented impact on public health,” Salomon told a news conference.

The country’s broad lockdown is likely to be extended beyond April 15, Prime Minister Edouard Philippe said on Thursday, extending a confinement order to try and deal with the crisis that began on March 17. The government was racing to try to ensure it can produce or procure itself certain medications needed to treat coronavirus patients as stocks were running low, Philippe told TF1 TV, echoing concerns across Europe as the pandemic places a huge strain on hospitals in Italy, Spain and elsewhere. More than two-thirds of all the known nursing home deaths have been registered in France’s Grand Est region, which abuts the border with Germany. It was the first region in France to be overwhelmed by a wave of infections that has rapidly moved west to engulf greater Paris, where hospitals are desperately trying to add intensive care beds to cope with the influx of critically ill patients.

A few remarks: Germany has a huge amount of ICU places. Neighbor the Netherlands has far fewer. But that’s also partly due to a different philosophy: where most countries try to keep people alive as long as possible, the Netherlands has a tradition, way before corona, of focusing more on quality than quantity of life. Old people with multiple ailments are not kept alive at all costs.

And if Andrew Cuomo is correct when he stated that of all people put on a ventilator only 20% survives, a question mark may be suitable. Is Germany’s low death rate a result of them keeping people on ventilators for a long time that will not have a quality life again? Religion is a big issue, but on the other hand there’s a huge increase in Do Not Resuscitate documents.

Note: Germany this morning, like many other countries have, issued a warning that it may run out of ICU places. That may lead to German doctors having to make decisions that they’re not used to making, unlike their Dutch counterparts.

• Germany Has A Low Coronavirus Mortality Rate: Here’s Why (CNBC)

Germany seems to be taking the epidemic in its stride with a high number of cases but a low number of deaths, thanks to a number of factors. In Europe, while Italy and Spain are the worst hit countries with over 100,000 cases each, as of Friday, Germany has recorded 84,794 confirmed cases but has witnessed just 1,107 deaths, according to data from Johns Hopkins University. The low mortality rate in Germany, at just over 1%, is far below its neighboring European countries, and this has been put down to Germany’s decision to implement widespread testing of people suspected of having the virus, as opposed to Italy or the U.K.’s decision to only test symptomatic cases.

Karl Lauterbach, a professor of health economics and epidemiology at the University of Cologne, and a politician in the Social Democratic Party (SPD) of Germany, told CNBC that Germany’s less severe experience of the pandemic so far was down to a handful of factors. “I think so far we’ve been lucky because we were hit by the wave of new infections later than many other European countries, for example Italy, Spain and France,” he told CNBC Thursday. “So we had a minor but important delay in the wave of infections coming to Germany. Secondly, the first people that got infected in Germany tended to be younger than the average of the population … so we were hit later and with younger patients initially.”

Lauterbach noted that a third factor that helped Germany was a slow increase in the number of infections, allowing those patients to be treated at the country’s top medical institutions, including some of the country’s best university hospitals (including those in Bonn, Dusseldorf, Aachen and Cologne) in the Heinsberg region where there was a cluster of infections at the start of the outbreak. “Number four, all things considered, the German health-care system and hospital system has been modernized by the Social Democrats and Christian Democrats over the last 20 years … this meant we had more hospital beds, more ventilators, more ICU (Intensive Care Units) beds and more hospital doctors, roughly speaking, than any other comparable country in Europe … So our system is in a reasonable shape for such an epidemic.”

While almost all European countries have introduced lockdowns to prevent the spread of the coronavirus, fatality rates have differed wildly. The mortality rate in Italy around the end of March stood at 11%, for example. Germany’s rate is comparable with South Korea, a country that has also attracted plaudits for its management of the coronavirus crisis with extensive testing, contact tracing and digital surveillance of its citizens. Germany’s lockdown, alongside a rigorous testing regime, has also helped, Lauterbach said. While countries like the U.K. now have to build a diagnostics industry from scratch, Germany already had one built around the multinational might of Roche.

The country reportedly has the capacity to carry out up to 500,000 tests a week, whereas the U.K. can currently only manage just over 10,000 a day. Asked about the possible trajectory Germany’s coronavirus rate could take, Lauterbach said his worst-case scenario was that 10% of Germany’s 83 million population contract the virus, and with a 1% fatality rate, then 80,000 people would die. “It must be lower than that, it would be a tragedy if 10% of the population get infected, that’s my personal worst-case scenario.”

We all know who will be the winners.

• Fed’s Dilemma: Picking Winners For $4 Trillion In Credit (R.)

When the Federal Reserve polled Wall Street about financial stability risks last fall, “global pandemic” didn’t make the list. But the coronavirus outbreak has triggered virtually every other shock that was mentioned – from a stock market rout to a looming global recession – and is forcing the U.S. central bank and the U.S. Treasury to triage a system springing leaks by the day. Compared with the 2007-2009 meltdown, which was centered in the mortgage and financial markets, the current crisis is a massively more complex problem with the Fed pulled to intervene in virtually every aspect of U.S. household and corporate commerce and finance.

The challenge now facing the central bank, in consultation with the Treasury, is prioritizing which market, set of companies or group of institutions to help next as it plans how to leverage more than $450 billion of seed money from the Treasury into perhaps $4.5 trillion in credit programs. It is an uncomfortable role that could push the Fed beyond its traditional job of keeping financial markets open and running smoothly, to picking winners and losers in whatever economy emerges from a pandemic that has brought business activity to a virtual standstill.

“You’ve entered not just the world of accepting credit risk but of allocating it as well,” said Mark Spindel, a Fed historian who is the chief executive officer of Potomac River Capital. Through the emergency $2.3 trillion legislation passed last week, “Congress and Treasury have decided to cast the Fed as the only balance sheet large enough” for the measures that might be needed. In the extreme, that could include roughly $26 trillion in debt held by non-financial companies and households – $16 trillion if home mortgages are excluded.

Keith Jurow omits one way the housing zombie has been kept alive: ultra low rates.

• This Hard Truth About The Mortgage Markets Isn’t Being Told (Jurow)

Everyone wants to know what impact the coronavirus and the government response to it will have on housing markets. While it is too early to hazard a guess, some things are becoming increasingly clear. Already, it looks as if the U.S. is moving towards a temporary moratorium on mortgage payments. Fannie Mae and Freddie Mac unveiled an emergency program which provides a two-month deferral of mortgage payments for any homeowner who claims to be facing a hardship because of the virus. The payments will be tacked on at the end of the mortgage term. The coronavirus rescue law just enacted by Congress includes a provision which requires all firms that service federally-backed mortgages to grant a forbearance of up to 360 days for any borrowers who say they have been harmed by the coronavirus outbreak.

It is not much of a stretch to say that this virus has changed everything. Many of you may sense that the virus has undermined what you thought was still a fairly strong housing market around the country. In truth, the so-called housing recovery since 2010 has been little more than a carefully constructed illusion. The belief in a strong housing recovery was carefully devised using a strategy of misleading information, withheld data and false impressions. As I have explained in recent columns, the strategy to turn around collapsing housing markets unfolded in three parts: (1) restrict the number of foreclosed properties placed on the market; (2) radically reduce the number of seriously delinquent homes actually foreclosed and repossessed, and (3) provide millions of delinquent homeowners a mortgage modification as an alternative to foreclosure.

This strategy fooled nearly everyone into believing that the disaster has been overcome. The best example is Los Angeles County — ground zero for the collapse. In 2008, more than 37,000 properties were foreclosed. The plunge in foreclosures didn’t really kick in until 2012 when the number dropped to slightly over 10,000. The next year, foreclosures plunged to 3,340. Don’t think for a minute that this was due to an improving economy. Not at all. It was simply the strategy of desperate servicers. With so few properties foreclosed and even fewer placed on the market, home prices had no where to go but up.

The Fed will be dragged to the ground by the zombies it’s carrying.

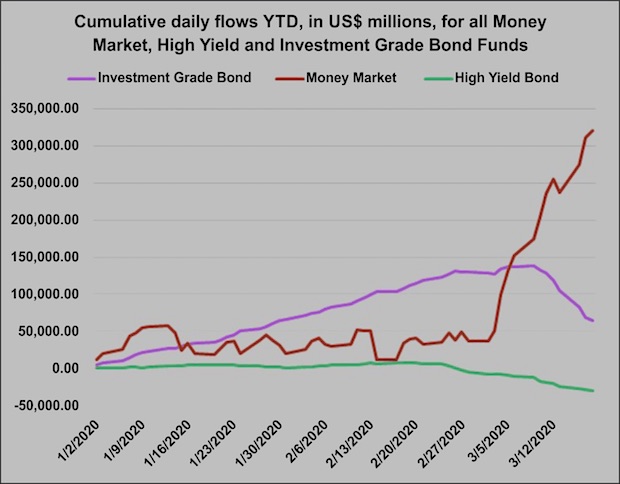

• A Corporate Debt Reckoning Is Coming (13D)

Corporate debt is the timebomb everyone saw ticking, but no one was able to defuse. Ratings agencies warned about it: Moody’s, S&P. Central banks and international financial institutions did too: the Fed, the Bank of England, the Bank for International Settlements, the IMF. Financial luminaries expressed concern: Jamie Dimon, Seth Klarman, Jes Staley, Jeffrey Gundlach, Henry McVey. Even a presidential candidate brought the issue on the campaign trail: Elizabeth Warren. Yet, as we’ve documented in these pages for more than two years, corporations have only piled on more debt as their balance sheet health has deteriorated.

Total U.S. non-financial corporate debt sits at just under $10 trillion, a record 47% of GDP. One in six U.S. companies is now a zombie, meaning their interest expenses exceed their earnings before interest and taxes. As of year-end 2019, the percentage of listed companies in the U.S. losing money over 12 months sat close to 40%. In the 12 months to November, non-financial S&P 500 cash balances had declined by 11%, the largest percentage decline since at least 1980.

For too long, record-low interest rates inspired complacency, from companies to lenders to regulators and investors. As we warned in WILTW August 8, 2019, corporate fundamentals will eventually matter. Now, with COVID-19 grinding the global economy to a halt, that time has come.

Systemic threats are littered throughout the corporate debt ecosystem. Greater than 50% of outstanding debt is rated BBB, one rung above junk. As downgrades come, asset managers will be forced to flood the market with supply at a time demand has dried up. Meanwhile, leveraged loans — which have swelled by 50% since 2015 to over $1.2 trillion — threaten unprecedented losses given covenant deterioration. And bond ETFs could face a liquidity crisis as a flood of redemptions force offloading of all-too-illiquid bonds. Red lights are now flashing. Distressed debt in the U.S. has quadrupled in less than a week to nearly $1 trillion. Last week, bond fund outflows quadrupled the previous record, which was set the previous week. Moody’s and S&P have already declared a significant portion of outstanding debt under review for potential downgrade.

Source: FInancial Times

Boeing’s miliary division is as fault-prone as its 737MAX part. And that’s what the country’s security depends on.

• US Air Force To Release $882 Million To Boeing (R.)

The U.S. Air Force will release $882 million in payments to Boeing that were held back due to flaws in the KC-46 air refueling tanker, a Pentagon official said on Thursday. The release of the payment to Boeing is part of a broader recommendation sent to Air Force contracting officials, according to a memo seen by Reuters, aimed at maintaining the financial health of suppliers to the Department of Defense. Will Roper, the Air Force’s chief buyer, told reporters the initiative will free up billions of dollars in funding for numerous contractors, not just Boeing. “If we want to have a defense industrial base coming out of COVID-19, that’s able to continue building,” Roper said, “every day is a new challenge.”

Boeing’s financial situation has become increasingly precarious as economic fallout from the coronavirus has frozen key lending markets and cut off demand for Boeing’s commercial aircraft. The Air Force had the right to hold back about $28 million of the cost of each of the first 52 KC-46 Pegasus jets on order to ensure Boeing delivers fully functional tankers. With 33 jets delivered thus far, the Air Force could have withheld up to $924 million. The Air Force plans to buy 179 of the aircraft, which refuel other aircraft mid-air, but the program has been plagued with problems, including foreign object debris found onboard the planes and issues with a camera system used during the refueling process.

A lot of money changed hands yesterday. But who won?

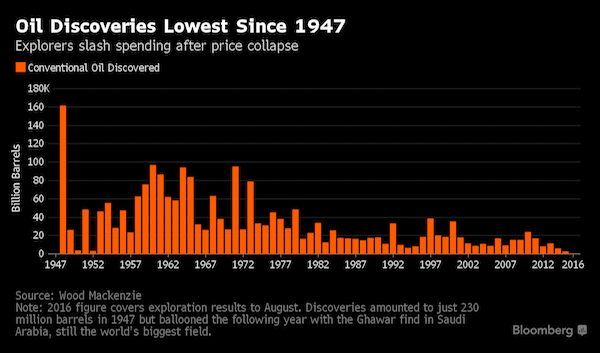

• US Crude Futures Trim Record Gain (R.)

Benchmark U.S. crude fell more than 1% in early trade on Friday, coming off its biggest one-day gain in the previous session after U.S. President Donald Trump said he expected Saudi Arabia and Russia to announce a major oil production cut. U.S. West Texas Intermediate (WTI) crude futures were down 1.4%, or 36 cents, at $24.96 a barrel at 2223 GMT, after having surged 24.7% on Thursday. Even with the huge gains, prices have still slumped nearly 60% this year as oil demand has plummeted due to the coronavirus pandemic while Saudi Arabia and Russia have flooded the market with crude in a price war.

Trump said he had spoken to Saudi Crown Prince Mohammed bin Salman, and expects Saudi Arabia and Russia to cut oil output by as much as 10 million to 15 million barrels, as the two countries signaled willingness to make a deal. Analysts said even if Russia and Saudi Arabia agreed to cut production by as much as 15 million barrels per day (bpd) that would not be enough to balance the market in face of a deep economic recession. “The 10-15 million bpd oil production cut reportedly being brokered by President Trump is a great start, but deeper cuts will likely be needed to get through a difficult Q2,” said Stephen Innes, chief global market strategist at AxiCorp. A deal between Russia and Saudi Arabia could effectively establish a floor for WTI in the $30s, he said.

At times it feels like he closely follows a Rudy Giuliani scenario. Rule of thumb: if someone has never been really popular and all of a sudden is, do ask why.

• Cuomo’s Bubble is Starting to Burst (Lauria)

Cuomo’s present regard for the well-being of every New Yorker, rich or poor, and his lyrical demands to ramp up the number of hospital beds and ventilators is undermined by an ongoing record of drastically cutting back on the state’s assistance to public medical facilities that serve the poor. While he is now frantically trying to add hospital beds in the state (which has lost 20,000 in the past 20 years), Cuomo, over the past decade, agreed to close and consolidate numerous public hospitals, mostly serving the poor, to save money. For instance, in 2013 he approved the closure of the 500-bed Long Island College Hospital in Brooklyn, despite objections from the community.

Even in these extraordinary circumstances his budget proposal to shave $400 million off the state’s $35 billion Medicaid bill—which provides care to the poorest New Yorkers—was accepted by the state Senate on Thursday when it passed Cuomo’s 2020 budget. It comes precisely as Medicaid recipients need it most. The state Assembly is to vote on the budget Friday. “So determined is Cuomo to slash Medicaid spending that he’s prepared to reject more than $6 billion in matching federal aid approved earlier this month because it would force him to alter his austerity strategy,” The Nation reported on Monday. It said:

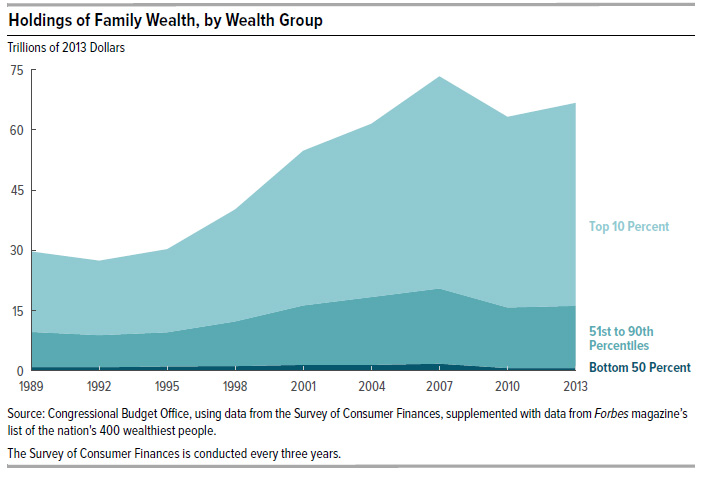

“If Cuomo gets his way with the state budget [which the Senate has now given him], many of the city’s most besieged hospitals will lose money at a time when Covid-19 is threatening to crash New York’s health care system. Central Brooklyn hospitals, serving many of the borough’s working class and poor, could lose $38 million a year. Manhattan hospitals could lose up to $58 million a year.” Naomi Zewde, an assistant professor in the Graduate School of Public Health and Health Policy at CUNY, told the magazine: “’The proposal to cut funding to public hospitals during a pandemic reflects really poor decision-making.’” Making it worse, is that Cuomo’s budget did not include rises in property or wealth taxes, despite a $10-15 billion shortfall. “There were no new taxes on the ultrarich, a measure many liberals had clamored for,” The New York Times reported.

Yes, surveillance state. But no, it’s nothing new.

• Google Releases Location Data On Lockdowns In 131 Countries (R.)

Google’s analysis of location data from billions of users’ phones is the largest public dataset available to help health authorities assess if people are abiding with shelter-in-place and similar orders issued across the world. Its reports show charts that compare traffic from Feb. 16 to March 29 at subway, train and bus stations, grocery stores and other broad categories of places with a five-week period earlier this year. In Italy, one of the countries hardest hit by the virus, visits to retail and recreation locations, including restaurants and movie theaters, plunged 94% while visits to workplaces slid 63%. Reflecting the severity of the crisis there, grocery and pharmacy visits in Italy dropped 85% and park visits were down by 90%.

In the United States, California, which was the first in the with a statewide lockdown, cut visits to retail and recreation locations by half. By contrast, Arkansas, one of the few states without a sweeping lockdown, has seen such visits fall 29%, the lowest for a U.S. state. The data also underscore some challenges authorities have faced in keeping people apart. Grocery store visits surged in Singapore, the United Kingdom and elsewhere as travel restrictions were set to go into place. Visits to parks spiked in March in some San Francisco Bay Area counties, forcing them to later put the sites off limits. By contrast, in Japan where authorities have been relatively relaxed in urging social distancing measures but where calls have been growing daily for a state of emergency, visits to retail and recreational places fell 26%. Visits to workplace dropped a mere 9%.

[..] Facebook Inc, which like Google has billions of users, has shared location data with non-governmental researchers that are producing similar reports for authorities in several countries. But the social media giant has not published any findings. Infectious disease specialists have said analyzing travel across groups by age, income and other demographics could help shape public service announcements. Google, which infers demographics from users’ internet use as well as some data given when signing up to Google services, said it was not reporting demographic information. The company said, though, it was open to including additional information and countries in follow-up reports.

The biggest winner in the lockdown economy still finds time to abuse its workers.

• Leaked Amazon Memo Details Plan to Smear Fired Warehouse Organizer (Vice)

Leaked notes from an internal meeting of Amazon leadership obtained by VICE News reveal company executives discussed a plan to smear fired warehouse employee Christian Smalls, calling him “not smart or articulate” as part of a PR strategy to make him “the face of the entire union/organizing movement.” “He’s not smart, or articulate, and to the extent the press wants to focus on us versus him, we will be in a much stronger PR position than simply explaining for the umpteenth time how we’re trying to protect workers,” wrote Amazon General Counsel David Zapolsky in notes from the meeting forwarded widely in the company. The discussion took place at a daily meeting, which included CEO Jeff Bezos, to update each other on the coronavirus situation.

Amazon SVP of Global Corporate Affairs Jay Carney described the purpose to CNN on Sunday: “We go over the update on what’s happening around the world with our employees and with our customers and our businesses. We also spend a significant amount of time just brainstorming about what else we can do” about COVID-19. Zapolsky’s notes also detailed Amazon’s efforts to buy millions of protective masks to protect its workers from the coronavirus, as well as an effort to begin producing and selling its own masks. So far, the company has secured at least 10 million masks for “our operations guys,” with 25 million more coming from a supplier in the next two weeks, Zapolsky wrote. Amazon fired the warehouse worker Smalls on Monday, after he led a walkout of a number of employees at a Staten Island distribution warehouse.

Amazon says he was fired for violating a company-imposed 14-day quarantine after he came into contact with an employee who tested positive for the coronavirus. Smalls says the employee who tested positive came into contact with many other workers for longer periods of time before her test came back. He claims he was singled out after pleading with management to sanitize the warehouse and be more transparent about the number of workers who were sick. [..] “We should spend the first part of our response strongly laying out the case for why the organizer’s conduct was immoral, unacceptable, and arguably illegal, in detail, and only then follow with our usual talking points about worker safety,” Zapolsky wrote. “Make him the most interesting part of the story, and if possible make him the face of the entire union/organizing movement.”

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of it. It has become a two-way street; and isn’t that liberating, when you think about it?

Thanks everyone for your wonderfully generous donations over the past days.

In the age of #COVID19Pandemic Ina Garten is the Martha Stewart of cocktails. #HappyHourIsAnyHour pic.twitter.com/cwhMA6P5NJ

— Peter Morley (@morethanmySLE) April 2, 2020

With three-quarters of Americans living in social-distancing, a new sound is starting to replace the noise of traffic and urban life: birdsong pic.twitter.com/DsqNKJCqC7

— Reuters (@Reuters) April 3, 2020

Support us in virustime. Help the Automatic Earth survive. It’s good for you.