Camille Corot Study for “The Destruction of Sodom” 1843

My thought exactly. He made the whole thing up. Or rather, someone did it for him.

• Biden’s Tough-Guy Flexing At ‘Soulless Killer’ Putin Would Be Funny If.. (RT)

[..] the likelihood of the Biden-Putin meeting occurring as described by Joe Biden is slim to none. When Biden made his trip to the Kremlin in 2011, he was fronting for the Obama administration’s “reset” with Russia. There was no opportunity, or need, for Biden’s faux machismo. The two men did meet, but as part of delegations discussing the possibility for improving relations. Not only would Biden’s insulting verbal flexing have been wildly inappropriate and inconsistent with the larger policy objectives of his visit, but it ran counter to his own feelings, expressed at the time, about Russia. “Russia has the best engineers in the world,” Biden said in a press conference after his meeting with Putin (who was serving as Russia’s prime minister, not president, at the time.) “Russia has intellectual capital. Russia is a great nation.”

These are not words one utters after telling a Russian leader in private that he has “no soul.” Biden’s struggle with the truth is well known, so it should come as no surprise to anyone that he possibly made up a meeting with Putin. Biden has been caught plagiarizing a speech delivered by former British Labour Party leader Neil Kinnock, lied about his academic record and accomplishments, and manufactured from whole cloth a narrative that has him participating in the civil rights movement of the 1960s. Biden’s lies all have one goal in common: to make him out to be that which he is not. So, too, his apparent lie about calling Putin soulless. Biden is desperate to be a ‘tough guy’. But for that reputation to stick vis-à-vis Putin, there had to be a ‘showdown’ moment, where the good guy faced off against the bad guy and called him out.

Since no such event exists, Biden had to make one up. And, like most of his lies, Biden repeats them long enough and often enough that they take on a life of their own, embraced as fact by unquestioning journalists. In his interview with Stephanopoulos, Biden raised the findings of the DNI report, and his conversation with Putin. “He will pay a price. We had a long talk, he and I. I know him relatively well and the conversation started off [like this]: I said, ‘I know you and you know me. If I establish this occurred, then be prepared.’”

Biden does not know Putin well at all. If he did, he would know that the last thing that would give the Russian leader pause were the fanciful tough-guy posturing of a geriatric president. There is little doubt that the Biden administration will impose additional sanctions against Russia in the days and weeks to come, citing the report as justification. There is also little doubt that these sanctions will have no impact whatsoever on the policies and practices of the Russian government. But that is not the point. Biden is not flexing for the benefit of Putin. His audience is the American people, and part and parcel of a coordinated campaign designed to drive home his mantra that “America is back.”

Read more …

Biden’s too busy.

• Putin Challenges Biden To A Live Public ‘Discussion’ (JTN)

Russian President Vladimir Putin has suggested that he and American President Joe Biden engage in a live public “discussion.” The Russian leader’s proposal comes after Biden, when asked earlier this week during an ABC News interview whether he believes Putin is a killer, responded that he does believe that. A U.S. intelligence report indicates that Putin authorized influence operations related to the 2020 U.S. election, and during the interview Biden said that Putin “will pay a price.” Biden said that he told Putin: “If I establish this occurred, then be prepared.”

The intelligence report states in part: “We assess that Russian President Putin authorized, and a range of Russian government organizations conducted, influence operations aimed at denigrating President Biden’s candidacy and the Democratic Party, supporting former President Trump, undermining public confidence in the electoral process, and exacerbating sociopolitical divisions in the US.” “I’ve just thought of this now,” the Russian president told a Russian state television reporter, according to ABC News. “I want to propose to President Biden to continue our discussion, but on the condition that we do it basically live, as it’s called. Without any delays and directly in an open, direct discussion. It seems to me that would be interesting for the people of Russia and for the people of the United States.”

Putin suggested that the “discussion” with Biden could be held on Friday or Monday: “I don’t want to put this off for long. I want to go the taiga this weekend to relax a little,” Putin said. “So we could do it tomorrow or Monday. We are ready at any time convenient for the American side.” When asked during Thursday’s press briefing if the idea is one that the administration would consider, White House Press Secretary Jen Psaki told the reporter she would need to “get back to you if that is something we are entertaining,” and noted that Biden will be busy in Georgia on Friday.

Read more …

Recalling your ambassador is a serious step.

• Biden ‘Clearly Doesn’t Want Good Relations’ With Russia – Kremlin (RT)

The Kremlin has claimed that comments from American President Joe Biden, in which he said he believes his Russian counterpart, Vladimir Putin, to be a “killer,” is proof Washington isn’t serious about relations with the country. Speaking to journalists on Thursday, Kremlin spokesman Dmitry Peskov said there was no precedent for the remarks in the history of the two nations. “These are very bad statements by the US president,” he added. “He clearly doesn’t want to establish a relationship with our country, and we will proceed on that basis.” In the TV interview with ABC, which aired on Wednesday, Biden was asked by chief anchor George Stephanopoulos whether he thought Putin was “a killer.” “Mmm hmm, I do,” he replied.

He added that he had warned the Russian leader that the US would take action if it found evidence of Moscow meddling in the country’s 2020 presidential election. “He will pay a price,” Biden said. “We had a long talk, he and I… I know him relatively well. And the conversation started off, I said, ‘I know you and you know me. If I establish this occurred, then be prepared.’” A joint report by Washington’s spy agencies, published the day before, alleged that Russia was behind a campaign to “denigrate” Biden’s reputation during the campaign. The Kremlin has blasted the allegations, insisting it had not engaged in political smears against any candidates.

On Wednesday evening, Russia’s ambassador to the US, Anatoly Antonov, was recalled to Moscow for talks on the future of ties with Washington. Foreign Ministry spokeswoman Maria Zakharova said that consultations were needed “to analyze what to do and where to head in the context of relations with the US.” The remarks have sparked a wave of criticism from Russian officials. The speaker of the country’s parliament, Vyacheslav Volodin, added his voice to those claiming the remarks were indicative of a diplomatic rift. The top politician argued that “this is a tantrum that comes from powerlessness. Putin is our president, attacking him is an attack on our country.”

Read more …

“We’ve spent the last five years watching as anonymous officials make major Russia-related claims, only to have those evidence-free claims fizzle.”

• A Brief List Of Official Russia Claims That Proved To Be Bogus (Taibbi)

The Office of the Director of National Intelligence (ODNI) has released a much-hyped, much-cited new report on “Foreign Threats to the 2020 Elections.” The key conclusion: “We assess that Russian President Putin authorized, and a range of Russian government organizations conducted, influence operations aimed at denigrating President Biden’s candidacy and the Democratic Party, supporting former President Trump, [and] undermining public confidence in the electoral process…” The report added Ukrainian legislator Andrey Derkach, described as having “ties” to “Russia’s intelligence services,” and Konstantin Kilimnik, a “Russian influence agent” (whatever that means), used “prominent U.S. persons” and “media conduits” to “launder their narratives” to American audiences.

The “narratives” included “misleading or unsubstantiated allegations against President Biden” (note they didn’t use the word “false”). They added a small caveat at the end: “Judgments are not intended to imply that we have proof that shows something to be a fact.” As Glenn Greenwald already pointed out, the “launder their narratives” passage was wolfed down by our intelligence services’ own “media conduits” here at home, and regurgitated as proof that the “Hunter Biden laptop story came from the Kremlin,” even though the report didn’t mention the laptop story at all. Exactly one prominent reporter, Chris Hayes, had the decency to admit this after advancing the claim initially. With regard to the broader assessment: how many times are we going to do this? We’ve spent the last five years watching as anonymous officials make major Russia-related claims, only to have those evidence-free claims fizzle.

From the much-ballyhooed “changed RNC platform” story (Robert Mueller found no evidence the changed Republican platform was “undertaken at the behest of candidate Trump or Russia”), to the notion that Julian Assange was engaged in a conspiracy with the Russians (Mueller found no evidence for this either), to Michael Cohen’s alleged secret meetings in Prague with Russian conspirators (“not true,” the FBI flatly concluded) to the story that Trump directed Cohen to lie to Congress (“not accurate,” said Mueller), to wild stories about Paul Manafort meeting Assange in the Ecuadorian embassy, to a “bombshell” tale about Trump foreknowledge of Wikileaks releases that blew up in CNN’s face in spectacular fashion, reporters for years chased unsubstantiated claims instead of waiting to see what they were based upon.

The latest report’s chief conclusions are assessments about Derkach and Kilimnik, information that the whole world knew before this report was released. Hell, even Rudy Giuliani, whose meeting with Derkach is supposedly the big scandal here, admitted there was a “50/50 chance” the guy was a Russian spy. Kilimnik meanwhile has now been characterized as having “ties” to Russian intelligence (Mueller), and as a “Russian intelligence officer” (Senate Intelligence Committee), and is now back to being a mere “influence agent.” If he is Russian intelligence, then John McCain’s International Republican Institute (where Kilimnik worked), as well as embassies in Kiev and Moscow (where Kilimnik regularly gave information, according to the New York Times), have a lot of explaining to do.

Read more …

“..these career spies and propagandists, led by Obama CIA Director and serial liar John Brennan..”

• Journalists Yesterday Spread a Significant Lie All Over Twitter (Greenwald)

Journalists with the largest and most influential media outlets disseminated an outright and quite significant lie on Tuesday to hundreds of thousands of people, if not millions, on Twitter. While some of them were shamed into acknowledging the falsity of their claim, many refused to, causing it to continue to spread up until this very moment. It is well worth examining how they function because this is how they deceive the public again and again, and it is why public trust in their pronouncements has justifiably plummeted. The lie they told involved claims of Russian involvement in the procurement of Hunter Biden’s laptop. In the weeks leading up to the 2020 election, The New York Post obtained that laptop and published a series of articles about the Biden family’s business dealings in Ukraine, China and elsewhere.

In response, Twitter banned the posting of any links to that reporting and locked The Post out of its Twitter account for close to two weeks, while Facebook, through a long-time Democratic operative, announced that it would algorithmically suppress the reporting. The excuse used by those social media companies for censoring this reporting was the same invoked by media outlets to justify their refusal to report the contents of these documents: namely, that the materials were “Russian disinformation.” That claim of “Russian disinformation” was concocted by a group of several dozen former CIA officials and other operatives of the intelligence community devoted to defeating Trump.

Immediately after The Post published its first story about Hunter Biden’s business dealings in Ukraine that traded on his influence with his father, these career spies and propagandists, led by Obama CIA Director and serial liar John Brennan, published a letter asserting that the appearance of these Biden documents “has all the classic earmarks of a Russian information operation.” News outlets uncritically hyped this claim as fact even though these security state operatives themselves admitted: “We want to emphasize that we do not know if the emails…are genuine or not and that we do not have evidence of Russian involvement — just that our experience makes us deeply suspicious that the Russian government played a significant role in this case.” Even though this claim came from trained liars who, with uncharacteristic candor, acknowledged that they did not “have evidence” for their claim, media outlets uncritically ratified this assertion.

Read more …

Blinken got his ass handed to him.

• US and China Publicly Rebuke Each Other In First Major Talks Of Biden Era (G.)

The United States and China have clashed over human rights during their first face-to-face high-level talks since Joe Biden took office, with one senior Chinese official urging the US to address “deep-seated” issues such as racism, and accusing his American counterparts of “condescension”.Any hopes that the meeting, in Anchorage, would reset bilateral ties after years of tensions over trade and cyber security during Donald Trump’s presidency evaporated when US secretary of state Antony Blinken and national security adviser Jake Sullivan opened their meeting with China’s top diplomat Yang Jiechi and state councillor Wang Yi.

After Blinken referred to rising global concern over Beijing’s human rights record, Yang said: “We hope that United States will do better on human rights. The fact is that there are many problems within the United States regarding human rights, which is admitted by the US itself,” he said in a 15-minute speech that appeared to irritate Blinken. He added that US human rights issues were “deep-seated … they did not just emerge over the past four years, such as Black Lives Matter”. In his opening remarks Blinken had said world leaders had voiced “deep satisfaction” that the US was re-engaging with the international community after four years of Trump’s “America First” doctrine. “I’m also hearing deep concern about some of the actions your government is taking.”

Blinken, who added he had heard similar sentiments during his visits this week to Japan and South Korea, said the Biden administration and its allies were united in pushing back against China’s increasing authoritarianism and assertiveness at home and abroad. In response, Yang angrily demanded that the US stop pushing its own version of democracy at a time when it was dealing with discontent among its own population. “We believe that it is important for the United States to change its own image and to stop advancing its own democracy in the rest of the world,” he said. “Many people within the United States actually have little confidence in the democracy of the United States.” “China will not accept unwarranted accusations from the US side,” Yang said, adding that recent developments had plunged relations “into a period of unprecedented difficulty” that “has damaged the interests of our two peoples.”

Read more …

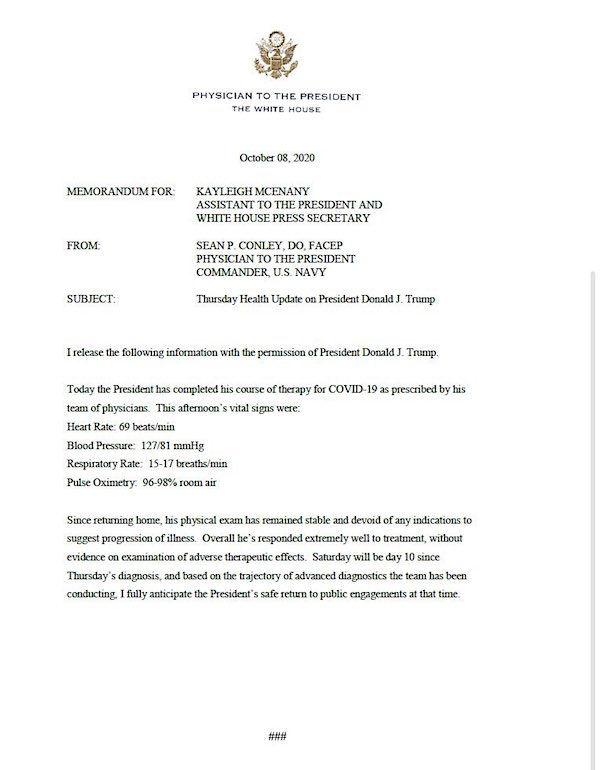

Get healthy.

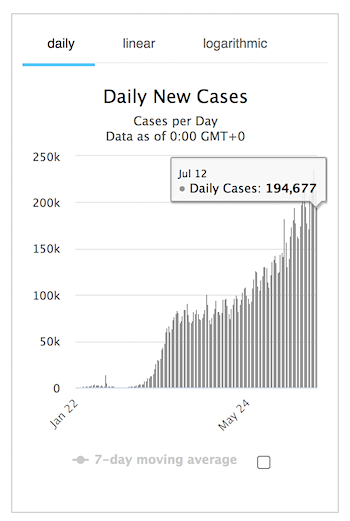

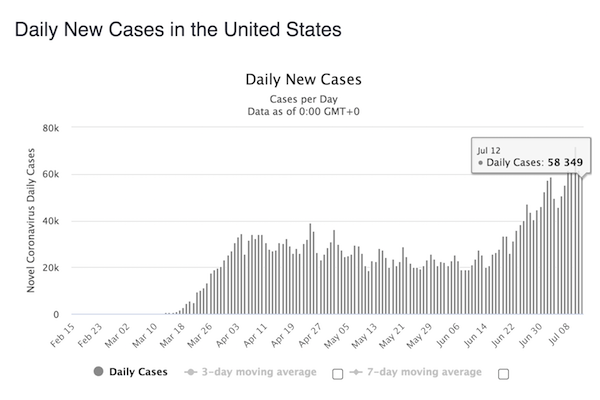

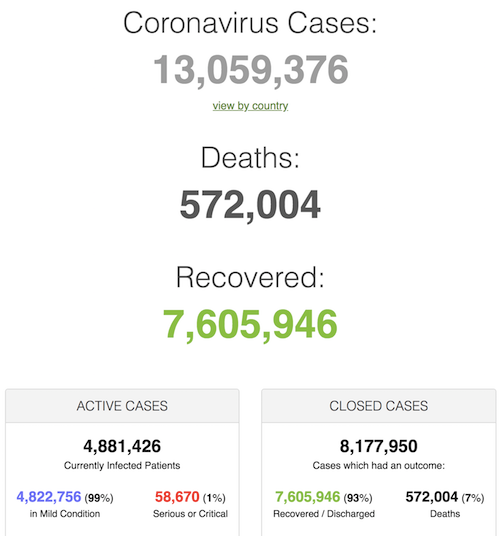

• Covid Spiking In Over A Dozen States—Most With High Vaccination Rates (F.)

Coronavirus cases are again spiking in 13 U.S. states, according to an analysis of trends over the past week, including some states among the highest in vaccination rates as health experts warn more contagious variants of Covid-19 will soon dominate the United States. An Axios analysis found Michigan by far leading the way in new cases, with the 7-day rolling average spiking by more than 53%. Michigan is above the U.S. average in terms of vaccination rate, according to Johns Hopkins University, but cases, positivity rate and hospitalizations are all on the rise. State health officials have placed the blame on highly contagious new variants now spreading in the state, as health experts caution national vaccination efforts are a race against the contagious strains.

Other states among the highest in vaccination rates, including West Virginia, Maine and Montana are also dealing with case spikes. Only two of the states with rising cases—Mississippi and New Hampshire—are below the U.S. average in terms of vaccination rate, according to Johns Hopkins. Top health officials, including Dr. Anthony Fauci and CDC Director Dr. Rochelle Walensky, have said a variant that originated in the U.K. could become the dominant strain in the U.S. by the end of the month. That strain is believed to be some 56% more contagious and perhaps twice as deadly than the existing dominant strain in the United States. Health experts say the country is continuing to move in the right direction as a whole, with the vaccine effort hopefully ending the pandemic this year.

But what had been a rapid national case decline starting in January has slowed significantly over the past few weeks, with the U.S. continuing to average over 50,000 new cases a day, a plateau level Fauci said “concerns me.” Top health officials and President Joe Biden are also advising against expansive reopening measures that states are putting into effect, including some that have decided to lift mask mandates.

Read more …

“The clotting in those patients was triggered by a very specific “strong immune response” likely caused as a result of the AstraZeneca jab..”

• Norwegian Scientists Say AstraZeneca DID Cause Blood Clots (RT)

Norwegian scientists have linked the AstraZeneca vaccine and blood clots – a condition seen in some people that led countries around the world to halt its use. But British and Dutch medics say there’s no evidence for such a link. “The cause of our patients’ condition has now been found,” Pal Andre Holme, the head of a research group at the Oslo University Hospital, told Norway’s VG media outlet. He was referring to the cases of three health workers under the age of 50 who suffered from severe blood clotting after receiving the AstraZeneca jab. One of the medics then died on Monday. The clotting in those patients was triggered by a very specific “strong immune response” likely caused as a result of the AstraZeneca jab, Holme explained.

In collaboration with the University Hospital of North Norway, Holme’s team detected specific antibodies that “activate” platelets and in some cases can lead to blood clots. Asked by VG if the vaccine was the “most likely” cause of this specific immune response, Holme said he believes “there is no other thing” in the history of the three individual patients which would generate such a response. None of the three patients had a history of similar health issues before, he said. I am pretty sure it is these antibodies that are the cause and I see no other reason than that it is the vaccine that triggers them.

The professor still admitted that such side effects are likely to be very rare since “we are talking about very specific antibodies.” Norway halted the use of the AstraZeneca jab in its vaccination campaign alongside many other European nations. Some 120,000 Norwegians already received the jabs produced by the British-Swedish company. According to Norwegian media, “very few” serious side effects were reported by those vaccinated to date. [..] Norwegian scientists revealed the results of their analysis just as the British medical regulator, MHRA, said that it found no evidence that could prove the link between the Oxford-AstraZeneca vaccine and blood clotting.

“This type of blood clot can occur naturally in people who have not been vaccinated, as well as in those suffering from COVID-19,” the MHRA CEO, Dr. June Raine, said in a statement, adding that her agency’s “thorough and careful review” showed that blood clots in veins of affected persons are occurring just as often as they would “in the absence of vaccination.”

Read more …

But you still want to vaccinate all kids?

• Your Unvaccinated Kid Is Like a Vaccinated Grandma (Oster)

Different vaccines yield different results, but all of the vaccines approved by the FDA (Pfizer-BioNTech’s, Moderna’s, and Johnson & Johnson’s) are very effective, which is why the CDC has indicated that vaccinated individuals can interact unmasked with other vaccinated individuals. It hasn’t yet commented on flying, but I’m guessing the CDC will relax its flying advisories for vaccinated individuals in the next few weeks. It will continue to recommend masks, for the sake of protecting the unvaccinated population, because the science on transmission by the vaccinated is still hazy. Now think about your child. The CDC has published some risk assessments by age. For comparison’s sake, I’ll phrase the findings the way I would the results of a vaccine trial:

Being a child aged 5 to 17 is 99.9 percent protective against the risk of death and 98 percent protective against hospitalization. For children 0 to 4, these numbers are 99.9 percent (death) and 96 percent (hospitalization). The central goal of vaccination is preventing serious illness and death. From this standpoint, being a child is a really great vaccine. Your unvaccinated first grader appears to have about as much protection from serious illness as a vaccinated grandmother. Comparisons are more difficult when it comes to the risk of any infection at all. An Israeli study undergoing peer review found that the Pfizer vaccine reduces infection in asymptomatic cases by about 90 percent, and in symptomatic cases by almost 94 percent.

Child case counts haven’t been well documented, in part because asymptomatic infection appears to be so common among kids. However, the available data suggest that children are less likely than adults to contract the coronavirus, but more likely to contract it than a vaccinated grandmother. (Below, I’ll address the latest thinking on variants, and research on the possible long-term effects of less-than-serious infections, which remains murky, and controversial.) This news may feel a little mixed: Yes, kids are protected from serious illness, just like their vaccinated grandparents, but they are not as protected from contracting the virus at all. Here is where the concept of herd immunity comes in to save the summer. If the Israeli Pfizer study is anywhere near right, then case rates will fall once a large share of adults are vaccinated. They are likely to fall a lot as the virus finds fewer and fewer receptive hosts.

Read more …

Must have war.

• How The US Military Subverted The Afghan Peace Agreement (GZ)

In an exclusive interview with The Grayzone Col. Douglas Macgregor, a former senior advisor to the Acting Secretary of Defense, revealed that President Donald Trump shocked the US military only days after the election last November by signing a presidential order calling for the withdrawal of all remaining US troops from Afghanistan by the end of the year. As Macgregor explained to The Grayzone, the order to withdraw was met with intense pressure from the Chairman of the Joint Chiefs of Staff, Gen. Mark M. Milley, which caused the president to capitulate. Trump agreed to withdraw only half of the 5,000 remaining troops in the country. Neither Trump’s order nor the pressure from the JCS Chairman was reported by the national media at the time.

The president’s surrender represented the Pentagon’s latest victory in a year-long campaign to sabotage the US-Taliban peace agreement signed in February 2020. Military and DOD leaders thus extended the disastrous and unpopular 20-year US war in Afghanistan into the administration of President Joseph Biden. The subversion of the peace agreement with the Taliban initiated by the US military leadership in Washington and Afghanistan began almost as soon as Trump’s personal envoy Zalmay Khalilzad negotiated a tentative deal in November 2019. The campaign to undermine presidential authority was actively supported by then-Secretary of Defense Mark Esper.

Read more …

“Critics say that the immunity law removed a key deterrent to corporate malfeasance, and victims and their families were subsequently stripped of their legal rights.”

• FBI Now Probing Cuomo’s Corporate Immunity Law (DO)

Federal law enforcement officials are scrutinizing New York Gov. Andrew Cuomo’s controversial move to help his donor shield nursing home executives from legal consequences during the COVID-19 pandemic, according to a new report. The probe follows a Daily Poster investigative series detailing how one of Cuomo’s biggest donors, the Greater New York Hospital Association (GNYHA) — a lobby group that represents hospital systems and nursing home operators — said it “drafted and aggressively advocated for” the corporate immunity provision. Cuomo’s administration quietly inserted the measure into his state’s budget as thousands lay dying from COVID-19 in New York nursing homes.

Critics say that the immunity law removed a key deterrent to corporate malfeasance, and victims and their families were subsequently stripped of their legal rights. Cuomo’s original executive order shielding front line health care workers from lawsuits was widely reported, but not the governor’s separate budget language extending immunity to hospital and nursing home corporations’ executives and board members. On Thursday, THE CITY disclosed that federal investigators looking into Cuomo’s handling of nursing home policy are now specifically asking questions about the immunity provision. The New York news outlet reports:

“FBI investigators probing the Cuomo administration’s handling of nursing homes during the pandemic last spring are seeking information about a state budget provision that gave operators legal immunity, THE CITY has learned. In recent weeks, FBI officials have been looking to interview members of Gov. Andrew Cuomo’s staff and other state officials about the eleventh-hour addition to the state budget last March, according to three people familiar with the matter. The measure granted nursing homes and hospitals broad legal protections against lawsuits and criminal liability for care provided to residents and patients during the pandemic. FBI officials started to make house calls this month, showing up at people’s residences and leaving business cards, according to the three sources. Investigators’ questions have focused primarily on the nursing home immunity provision and how it “got in the state budget,” said one legislative source, who did not want to be named because of the ongoing probe.”

Read more …

Not coming, but already here.

• Without Trump, Is A “Depression In Television” Coming? (Taibbi)

[..] the Democratic Party’s response to Trump — which involved multiple efforts to remove him, premised on the idea that every day he spent in the Oval Office was an existential threat to humanity — allowed stations to turn every day of the Trump years into a baby-down-a-well story (the baby was democracy). Between the Mueller investigation, two impeachments, the Kavanaugh confirmation, multiple border crises, the “Treason in Helsinki” fiasco, and a hundred other tales, every day could be pitched as a drop-everything emergency. Add the partisan rooting angle, and you had ratings gold. Imagine three or four dozen Super Bowls a year, each one played in the middle of a category 5 hurricane, and you come close to grasping the magnitude of the gift that Donald Trump was to MSNBC, Fox, and CNN.

Six or seven years ago, it was common to see CNN or MSNBC fall outside the top 20 rated cable networks, below titans like Disney, USA, TBS, and the History Channel. By 2020, the three top networks on cable — not just news networks, but overall — were Fox News, MSNBC, and CNN. The fact that news ate away so much of the market share of the entertainment business in the Trump years raises questions about what exactly we were watching. Jump in your Dr. Who police box and go back to 2014, the last year Trump was not a major political figure. The cable news genre had what Variety described as an “overall down year.” It was a particularly grim time for CNN and MSNBC:

Total Primetime Viewers, 2014 Change

Fox News 1.779 million (even)

MSNBC 600,000 (down 8%)

CNN 528,000 (down 8%)

HLN 337,000 (down 16%)

CNN exemplified the pre-Trump dilemma. In 2011, the network’s average primetime viewership was 689,000. That dropped to 670,000 in 2012, and the year after that, in 2013, it fell all the way to 568,000, a 20-year low. Imagine the pucker factor at Time Warner the next year, when CNN’s entire 8-11 p.m. programming slate dropped 8% off that 20-year dip. 2013 was CNN’s first year under the management of Jeff Zucker, whose career arc leading into the Trump years was a dazzling study in failing upward. He was named head of NBC Entertainment in 2000, and rode the successes of a handful of shows — including, notably, The Apprentice — into a job as CEO of NBC Universal, where he presided over one of the most disastrous tenures of any TV executive in history. Under his leadership, NBC dropped to fourth behind ABC, CBS, and Fox, amid catastrophic decisions like trying to move Jay Leno into primetime.

When Zucker moved to CNN, he trumpeted a new plan to save the news. This is from Politico in 2013: “Zucker has told staff he wants to “broaden the definition of what news is,” meaning more sports, more entertainment, more human interest stories — and, at times, less politics.” That didn’t work out so well in 2014, though to be fair to Zucker, the ratings narrative started reversing at least somewhat before Trump jumped on the scene. But the first giant leap forward for the business as a whole came in 2015, when CNN’s average primetime audience soared to 730,000, a 30% increase, in significant part because it hosted two Republican debates starring Trump.

The news business had never seen anything like the Trump effect. The first Republican debate on Fox drew 25 million viewers and was the most-watched non-sports event in the history of cable, while the second debate drew 23 million and was merely the top show in the history of CNN. Taking note of all this was Trump himself, whose poll numbers were dipping a bit at the end of 2015. Some were predicting his demise. To this, Trump snapped, “I’m not a masochist,” and promised he’d pull out if his numbers worsened. However, he said, if he did, “There’d be a major collapse of television ratings,” adding a poisonous prediction: “It would become a depression in television.”

Read more …

“The cost of what we need but haven’t done to modernize our infrastructure has expanded to $5.6 trillion over the last 20 years ($3 trillion in the last decade alone)”

• Building or Unbuilding America? (Nomi Prins)

During the Trump years, the phrase “Infrastructure Week” rang out as a sort of Groundhog Day-style punchline. What began in June 2017 as a failed effort by The Donald’s White House and a Republican Senate to focus on the desperately needed rebuilding of American infrastructure morphed into a meme and a running joke in Washington. Despite the focus in recent years on President Trump’s failure to do anything for the country’s crumbling infrastructure, here’s a sad reality: considered over a longer period of time, Washington’s political failure to fund the repairing, modernizing, or in some cases simply the building of that national infrastructure has proven a remarkably bipartisan “effort.”

After all, the same grand unfulfilled ambitions for infrastructure were part and parcel of the Obama White House from 2009 on and could well typify the Biden years, if Congress doesn’t get its act together (or the filibuster doesn’t go down in flames). The disastrous electric grid power outages that occurred during the recent deep freeze in Texas are but the latest example of the pressing need for infrastructure upgrades and investments of every sort. If nothing is done, more people will suffer, more jobs will be lost, and the economy will face drastic consequences. Since the mid-twentieth century, when most of this country’s modern infrastructure systems were first established, the population has doubled. Not only are American roads, airports, electric grids, waterways, railways and more distinctly outdated, but today’s crucial telecommunications sector hasn’t ever been subjected to a comprehensive broadband strategy.

Worse yet, what’s known as America’s “infrastructure gap” only continues to widen. The cost of what we need but haven’t done to modernize our infrastructure has expanded to $5.6 trillion over the last 20 years ($3 trillion in the last decade alone), according to a report by the American Society of Civil Engineers (ASCE). Some estimates now even run as high as $7 trillion. In other words, as old infrastructure deteriorates and new infrastructure and technology are needed, the cost of addressing this ongoing problem only escalates. Currently, there is a $1-trillion backlog of (yet unapproved) deferred-maintenance funding floating around Capitol Hill. Without action in the reasonable future, certain kinds of American infrastructure could, like that Texas energy grid, soon be deemed unsafe.

Read more …

Make the right to housing a law.

• Growth Of US Homelessness During 2020 Was Devastating – HUD (NPR)

The nation’s homeless population grew last year for the fourth year in a row. On a single night in January 2020, there were more than 580,000 individuals who were homeless in the United States, a 2% increase from the year before. The numbers, released by the Department of Housing and Urban Development Thursday, do not reflect the impact of the pandemic. “And we know the pandemic has only made the homelessness crisis worse,” HUD Secretary Marcia Fudge said in a video message accompanying the report. She called the numbers “devastating” and said the nation has a “moral responsibility to end homelessness.” Among the report’s more sobering findings: homelessness among veterans and families did not improve for the first time in many years.

Also, more than 106,000 children were homeless during the once-a-year count, conducted in most communities across the nation. While the majority of homeless children were in shelters or transitional housing, almost 11,000 were living outside. As has been the case for years, a disproportionate share of those experiencing homelessness were Black — about 39% of the total, though African Americans make up about 13% of the nation’s overall population. Twenty-three percent of those who were homeless last year identified as Hispanic or Latino. California was home to the largest number of people experiencing homelessness — 161,548 — according to the 2020 count. A quarter of all homeless individuals in the United States were living in either New York City or Los Angeles. For the first time since the government began doing the annual count, the number of single adults living outside — 209,413 — exceeded the number of individuals living in shelters — 199,478.

Read more …

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

It is a mark of prudence never to place our complete trust in those who have deceived us even once.

~ Rene Descartes

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.